Aggregate more than 129 us gift tax limit

Share images of us gift tax limit by website toyotabienhoa.edu.vn compilation. Gifting Wisely. Income tax on gifts: Know when your gift is tax-free – BusinessToday. Are Business Gifts Tax Deductible? 7 Rules for Clients and Employees Gifts. What You Need to Know Before Gifting Money to Family | Savant Wealth Management

Generation-Skipping Transfer Taxes – #1

Generation-Skipping Transfer Taxes – #1

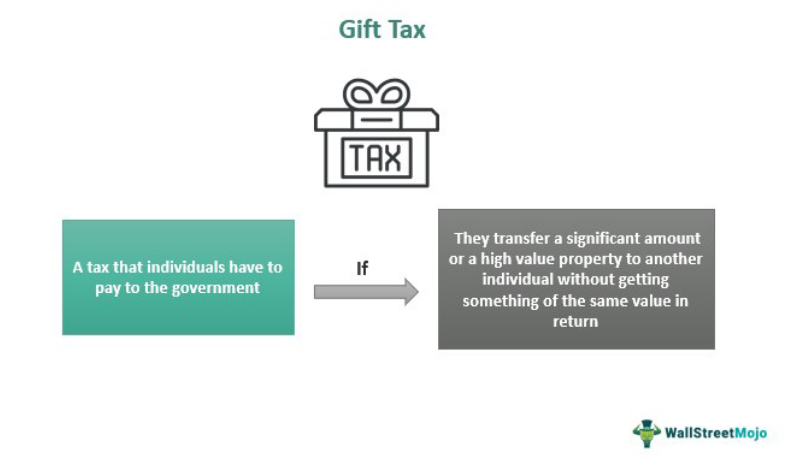

- gift tax definition economics

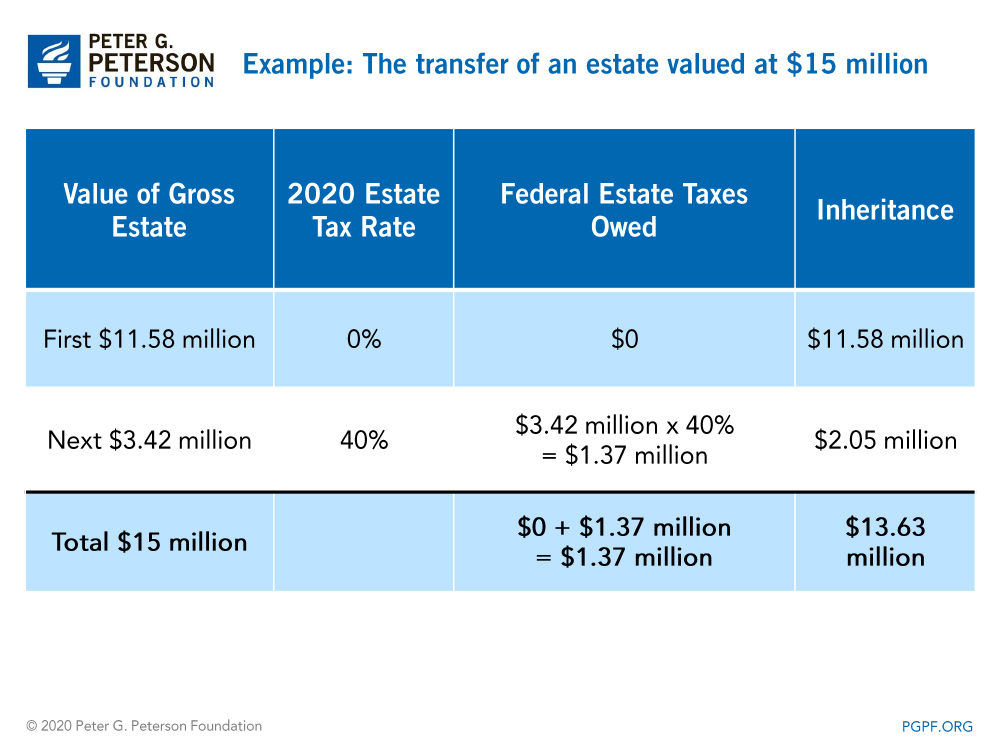

- estate tax

- gift tax exemption relatives list

A Guide to Gifting Money to Your Children | City National Bank – #2

A Guide to Gifting Money to Your Children | City National Bank – #2

Renouncing U.S. citizenship: What is the process? | 1040 Abroad – #4

Renouncing U.S. citizenship: What is the process? | 1040 Abroad – #4

How Are Bonuses Taxed? – Ramsey – #5

How Are Bonuses Taxed? – Ramsey – #5

![Guide to Crypto Tax in India [Updated 2024] Guide to Crypto Tax in India [Updated 2024]](https://upload.wikimedia.org/wikipedia/commons/thumb/7/7b/Payroll_tax_history.jpg/800px-Payroll_tax_history.jpg) Guide to Crypto Tax in India [Updated 2024] – #6

Guide to Crypto Tax in India [Updated 2024] – #6

The Estate Tax is Irrelevant to More Than 99 Percent of Americans – ITEP – #7

The Estate Tax is Irrelevant to More Than 99 Percent of Americans – ITEP – #7

Budget 2023: What is Gift Tax and why govt should abolish this? | Zee Business – #8

Budget 2023: What is Gift Tax and why govt should abolish this? | Zee Business – #8

- gift tax rate

- gift tax 2023

- gift chart as per income tax

Sales taxes in the United States – Wikipedia – #10

Sales taxes in the United States – Wikipedia – #10

My father wants to gift cash to me. Should I pay income tax on money received from my father? | Mint – #11

My father wants to gift cash to me. Should I pay income tax on money received from my father? | Mint – #11

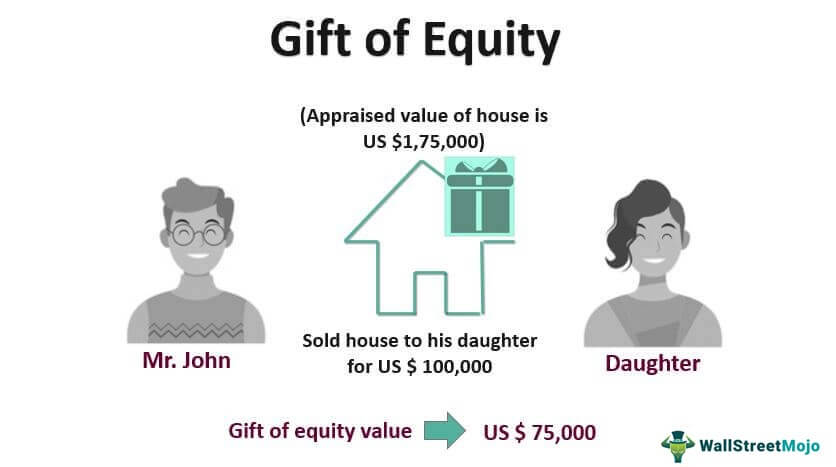

Gift of Equity – What Is It, How Does It Work, Template & Tax – #12

Gift of Equity – What Is It, How Does It Work, Template & Tax – #12

Gifting a Car: 5 Steps You Should Know | Farm Bureau Financial Services – #13

Gifting a Car: 5 Steps You Should Know | Farm Bureau Financial Services – #13

How is the gifting of money or property to a relative taxed? | Mint – #14

How is the gifting of money or property to a relative taxed? | Mint – #14

US Customs Tariff & Duty: All You Need To Know – #15

US Customs Tariff & Duty: All You Need To Know – #15

COATS TAX Service, LLC – #16

COATS TAX Service, LLC – #16

What is a gift deed and tax implications | Tax Hack – #17

What is a gift deed and tax implications | Tax Hack – #17

Generation-Skipping Trust (GST): What It Is and How It Works – #18

Generation-Skipping Trust (GST): What It Is and How It Works – #18

Amazon.com: Google Play gift card – give the gift of games, apps and more ( US Only) : Gift Cards – #19

Amazon.com: Google Play gift card – give the gift of games, apps and more ( US Only) : Gift Cards – #19

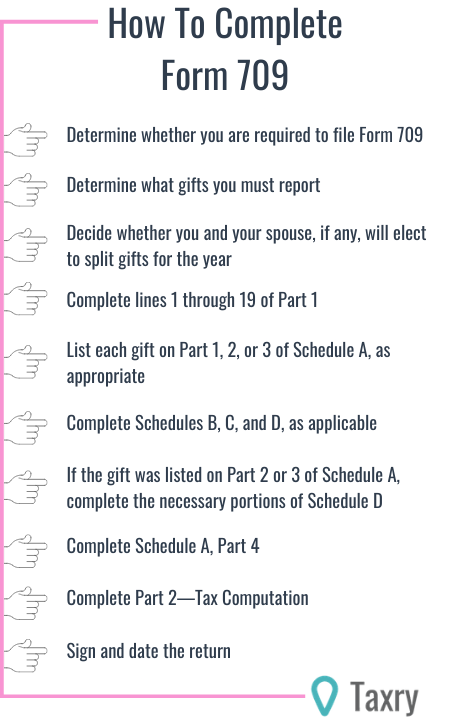

How Does the IRS Know If You Give a Gift? — Taxry – #20

How Does the IRS Know If You Give a Gift? — Taxry – #20

Your acts of generosity could unintentionally use your gift tax exemption – #21

Your acts of generosity could unintentionally use your gift tax exemption – #21

Historical Look at Estate and Gift Tax Rates | Wolters Kluwer – #22

Historical Look at Estate and Gift Tax Rates | Wolters Kluwer – #22

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #23

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #23

IRS Announces 2023 Estate & Gift Tax Exemption Amounts – Texas Agriculture Law – #24

IRS Announces 2023 Estate & Gift Tax Exemption Amounts – Texas Agriculture Law – #24

Estate tax and inheritance tax: what’s the difference? – #25

Estate tax and inheritance tax: what’s the difference? – #25

When Should I Use My Estate and Gift Tax Exemption? – #26

When Should I Use My Estate and Gift Tax Exemption? – #26

Taxation of gifts to NRIs and changes in Budget 2023-24 – #27

Taxation of gifts to NRIs and changes in Budget 2023-24 – #27

Taxability of Gifts – #28

Taxability of Gifts – #28

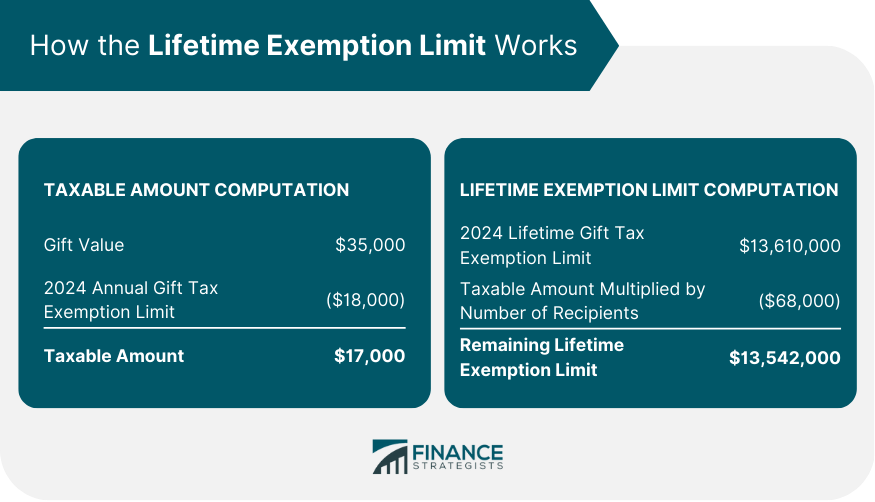

Gift Tax Limit 2024: How Much Money Can You Gift? | SmartAsset – #29

Gift Tax Limit 2024: How Much Money Can You Gift? | SmartAsset – #29

Estate Taxes: Who Pays, How Much and When | U.S. Bank – #30

Estate Taxes: Who Pays, How Much and When | U.S. Bank – #30

Gift Tax 2023 | What It Is, Annual Limit, Lifetime Exemption, & Gift Tax Rate – #31

Gift Tax 2023 | What It Is, Annual Limit, Lifetime Exemption, & Gift Tax Rate – #31

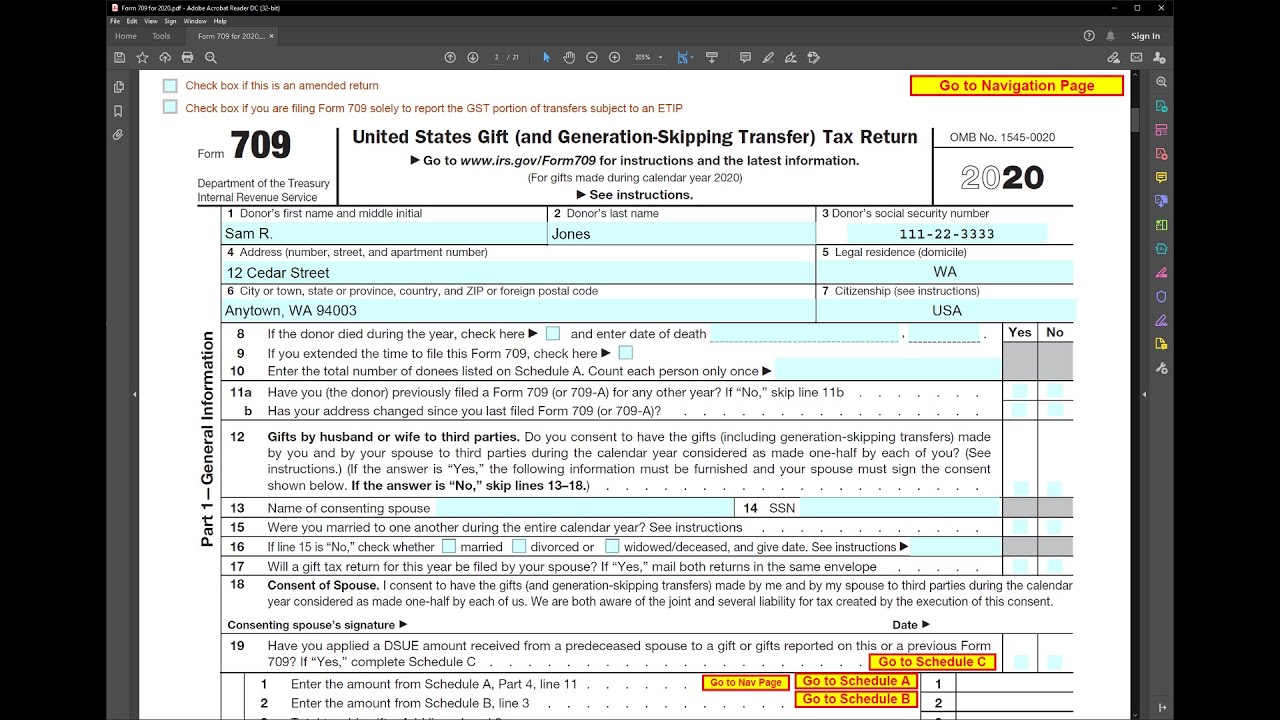

What Is Form 709? – #32

What Is Form 709? – #32

Income Tax on Cash Gift to Wife: How Much You Can Gift on Women’s Day Without Tax Implications – Income Tax News | The Financial Express – #33

Income Tax on Cash Gift to Wife: How Much You Can Gift on Women’s Day Without Tax Implications – Income Tax News | The Financial Express – #33

Holiday Employee Gift Giving and Tax Deductions – Intuit TurboTax Blog – #34

Holiday Employee Gift Giving and Tax Deductions – Intuit TurboTax Blog – #34

legaltemplates.net/wp-content/uploads/Affidavit-of… – #35

legaltemplates.net/wp-content/uploads/Affidavit-of… – #35

- generation skipping tax

Things an NRI must know about gift tax rules in India | IDFC FIRST Bank – #36

Things an NRI must know about gift tax rules in India | IDFC FIRST Bank – #36

Do You Have to Pay Gift Taxes on 529 Plan Contributions? – #37

Do You Have to Pay Gift Taxes on 529 Plan Contributions? – #37

What Are Estate and Gift Taxes and How Do They Work? – #38

What Are Estate and Gift Taxes and How Do They Work? – #38

The Limits of Taxing the Rich | Manhattan Institute – #39

The Limits of Taxing the Rich | Manhattan Institute – #39

3 Ways to Make Sure Your Cash Gifting Is Legal – wikiHow – #40

3 Ways to Make Sure Your Cash Gifting Is Legal – wikiHow – #40

) Income tax: Can a member make gift to the HUF without any tax liability? | Mint – #41

Income tax: Can a member make gift to the HUF without any tax liability? | Mint – #41

What’s Gift Tax Exclusion For Tuition? | Chase – #42

What’s Gift Tax Exclusion For Tuition? | Chase – #42

What is French Gift Tax (“Droits de Donation”)? | Beacon Global Wealth Management – #43

What is French Gift Tax (“Droits de Donation”)? | Beacon Global Wealth Management – #43

Key takeaways from six years of Donald Trump’s federal tax returns | CNN Politics – #44

Key takeaways from six years of Donald Trump’s federal tax returns | CNN Politics – #44

- gift tax definition

- estate tax formula

- federal gift tax

Monetary gift tax: Income tax on gift received from parents | Value Research – #45

Monetary gift tax: Income tax on gift received from parents | Value Research – #45

Form 709: What It Is and Who Must File It – #46

Form 709: What It Is and Who Must File It – #46

Gifting money in Ireland explained | Raisin Bank – #47

Gifting money in Ireland explained | Raisin Bank – #47

- gift tax in india

- excise tax

- gift tax

Water and Shark | LinkedIn – #48

Water and Shark | LinkedIn – #48

Irrevocable Trusts for Estate Tax Planning, Gift Tax and Gifting Strategies Explained – #49

Irrevocable Trusts for Estate Tax Planning, Gift Tax and Gifting Strategies Explained – #49

All you need to know about taxes on gifts and the exceptions | Mint – #50

All you need to know about taxes on gifts and the exceptions | Mint – #50

How do federal income tax rates work? | Tax Policy Center – #51

How do federal income tax rates work? | Tax Policy Center – #51

Gift tax changes stir charges of welfare for the rich – #52

Gift tax changes stir charges of welfare for the rich – #52

Do I Need to Worry About the Gift Tax If I Pay $30,000 Toward My Child’s Wedding? – #53

Do I Need to Worry About the Gift Tax If I Pay $30,000 Toward My Child’s Wedding? – #53

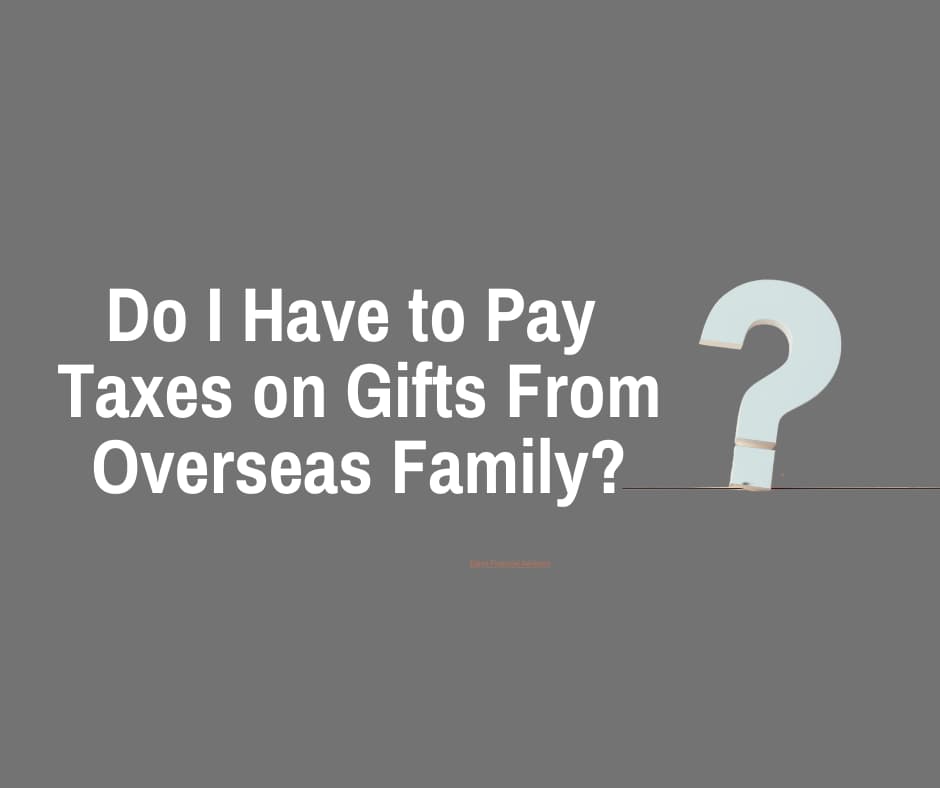

Taxes On Gifts From Overseas – #54

Taxes On Gifts From Overseas – #54

7 Tax Rules to Know if You Give or Receive Cash | Taxes | U.S. News – #55

7 Tax Rules to Know if You Give or Receive Cash | Taxes | U.S. News – #55

15 Tax Saving Options Other Than Section 80C – #56

15 Tax Saving Options Other Than Section 80C – #56

Tax Considerations for Foreign Nationals Purchasing US Real Estate – #57

Tax Considerations for Foreign Nationals Purchasing US Real Estate – #57

IRS Increases Gift and Estate Tax Exempt Limits — Here’s How Much You Can Give Without Paying | GOBankingRates – #58

IRS Increases Gift and Estate Tax Exempt Limits — Here’s How Much You Can Give Without Paying | GOBankingRates – #58

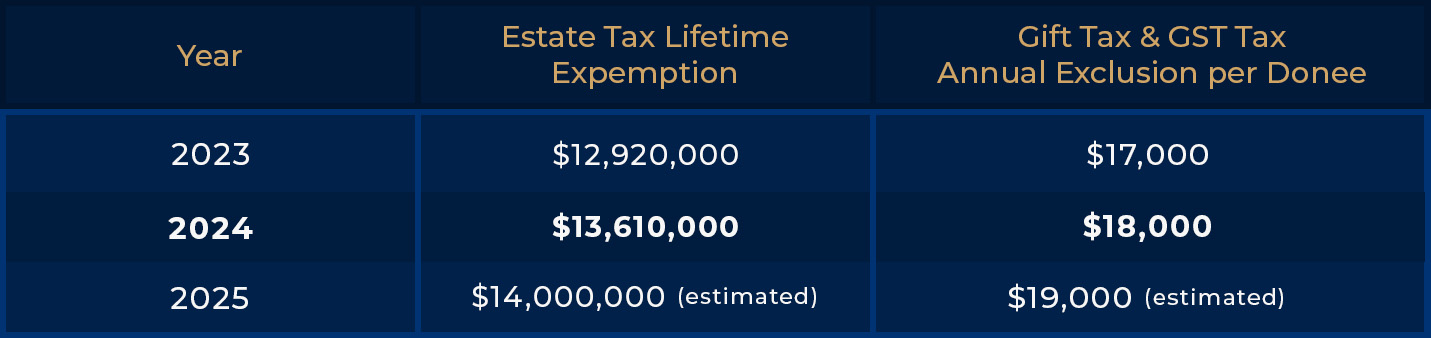

What will the estate and gift tax exclusions be in 2024, 2025? – #59

What will the estate and gift tax exclusions be in 2024, 2025? – #59

Sean Pierpont on LinkedIn: Interesting info about gift taxes…ask me about. – #60

Sean Pierpont on LinkedIn: Interesting info about gift taxes…ask me about. – #60

Discover The Latest Federal Estate Tax Exemption Increase For 2024 – Are You Ready? | Opelon LLP- A Trust, Estate Planning And Probate Law Firm – #61

Discover The Latest Federal Estate Tax Exemption Increase For 2024 – Are You Ready? | Opelon LLP- A Trust, Estate Planning And Probate Law Firm – #61

FPIs’ flight to GIFT City hits air pocket; IFSCA seeks clarity on tax | News on Markets – Business Standard – #62

FPIs’ flight to GIFT City hits air pocket; IFSCA seeks clarity on tax | News on Markets – Business Standard – #62

Frequently Asked Questions on Gift Taxes | Internal Revenue Service – #63

Frequently Asked Questions on Gift Taxes | Internal Revenue Service – #63

Are Corporate Gifts Tax Deductible? – #64

Are Corporate Gifts Tax Deductible? – #64

Using trusts to shift income to children – #65

Using trusts to shift income to children – #65

-Gifts.jpg) Understanding Qualified Domestic Trusts and Portability – #66

Understanding Qualified Domestic Trusts and Portability – #66

What Are the Tax Implications of Gifting Money to Family Members? – #67

What Are the Tax Implications of Gifting Money to Family Members? – #67

A primer on how the IRS gift-tax law pertains to parents and their children – The Washington Post – #68

A primer on how the IRS gift-tax law pertains to parents and their children – The Washington Post – #68

Indian stock market: 10 key things that changed for market over weekend – Gift Nifty, US factory output to oil prices | Mint – #69

Indian stock market: 10 key things that changed for market over weekend – Gift Nifty, US factory output to oil prices | Mint – #69

Excel Tax Calculator for New Personal Tax Regime AY 2024-25 – #70

Excel Tax Calculator for New Personal Tax Regime AY 2024-25 – #70

Is there a limit in income tax laws up to which a father can gift to his son – #71

Is there a limit in income tax laws up to which a father can gift to his son – #71

Received a Foreign Gift in 2023? Learn About Taxes on Gifts and IRS Form 3520 — – #72

Received a Foreign Gift in 2023? Learn About Taxes on Gifts and IRS Form 3520 — – #72

Administration unveils plan to cut taxes and simplify tax code – Putnam Investments – #73

Administration unveils plan to cut taxes and simplify tax code – Putnam Investments – #73

Income tax demand of up to Rs 1 lakh/person to be withdrawn – Times of India – #74

Income tax demand of up to Rs 1 lakh/person to be withdrawn – Times of India – #74

Which Gifts from relatives are exempted from Income Tax? – #75

Which Gifts from relatives are exempted from Income Tax? – #75

Piazza Sorrento – Come and join Us in the New Year with a nice quiet dinner at Piazza Sorrento. Wish You the very Best for the Upcoming Holidays. ~ Piazza Sorrento Team ~ – #76

Piazza Sorrento – Come and join Us in the New Year with a nice quiet dinner at Piazza Sorrento. Wish You the very Best for the Upcoming Holidays. ~ Piazza Sorrento Team ~ – #76

IRS Raises Gifting Limits: Know How Much You Can Gift Tax-Free – #77

IRS Raises Gifting Limits: Know How Much You Can Gift Tax-Free – #77

Yes, there is a limit on how much tax-free money a parent can gift their child each year – #78

Yes, there is a limit on how much tax-free money a parent can gift their child each year – #78

Understand the Taxation of Virtual Digital Assets – Taxmann – #79

Understand the Taxation of Virtual Digital Assets – Taxmann – #79

What Is Estate, Gift and Inheritance Tax – Kotak Bank – #80

What Is Estate, Gift and Inheritance Tax – Kotak Bank – #80

How to Fill Form 709: U.S. Gift Tax Return Procedures – #81

How to Fill Form 709: U.S. Gift Tax Return Procedures – #81

What Is the IRS Gift Limit for Spouses and Minors for 2024? – #82

What Is the IRS Gift Limit for Spouses and Minors for 2024? – #82

Income tax in the United States – Wikipedia – #83

Income tax in the United States – Wikipedia – #83

- gift tax example

- gift tax rate table

- estate tax exemption history

State and Local Tax Treatment of Charitable Contributions | US Charitable Gift Trust – #84

State and Local Tax Treatment of Charitable Contributions | US Charitable Gift Trust – #84

IRS Announces 2024 Tax Brackets, Standard Deductions And Other Inflation Adjustments – #85

IRS Announces 2024 Tax Brackets, Standard Deductions And Other Inflation Adjustments – #85

What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #86

What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #86

NRI Gift Tax Guide: Understanding Tax Implications in India – #87

NRI Gift Tax Guide: Understanding Tax Implications in India – #87

Gift Tax – Do I Have to Pay Taxes on a Gift | Gift Tax Calculator – #88

Gift Tax – Do I Have to Pay Taxes on a Gift | Gift Tax Calculator – #88

Louis Fister on LinkedIn: May want to think small… – #89

Louis Fister on LinkedIn: May want to think small… – #89

IRS Releases Annual Inflation Adjustments for Tax Year 2022 – #90

IRS Releases Annual Inflation Adjustments for Tax Year 2022 – #90

Elder Law: How Gifts Can Affect Medicaid Eligibility – #91

Elder Law: How Gifts Can Affect Medicaid Eligibility – #91

6 Ways To Give Money As A Gift | Bankrate – #92

6 Ways To Give Money As A Gift | Bankrate – #92

S.A. Five Diamonds – Tax-free weekend is upon us! What’s better than that? 20% off! 💵 Once again, DICK’S Sporting Goods has provided a discount for 5 Diamonds LL! The offer is – #93

S.A. Five Diamonds – Tax-free weekend is upon us! What’s better than that? 20% off! 💵 Once again, DICK’S Sporting Goods has provided a discount for 5 Diamonds LL! The offer is – #93

Income Tax on Gift – #94

Income Tax on Gift – #94

- gift tax meaning

- gift tax return

- gift from relative exempt from income tax

New Tax Collected at Source (TCS) on Forex Transactions – FAQs – #95

New Tax Collected at Source (TCS) on Forex Transactions – FAQs – #95

Tax considerations when gifting stock – InvestmentNews – #96

Tax considerations when gifting stock – InvestmentNews – #96

2018 Business Gift Tax Deduction – TDHCD – Minneapolis-based full service accounting, tax planning and consulting CPAs. – #97

2018 Business Gift Tax Deduction – TDHCD – Minneapolis-based full service accounting, tax planning and consulting CPAs. – #97

What You Need to Know Before Gifting Money to Family | Savant Wealth Management – #98

What You Need to Know Before Gifting Money to Family | Savant Wealth Management – #98

Tax Implication on Gifts Under Section 56(2)(x)(b) of Income Tax Act, 1961 – #99

Tax Implication on Gifts Under Section 56(2)(x)(b) of Income Tax Act, 1961 – #99

List of relatives covered under Section 56(2) of Income Tax Act,1961 – #100

List of relatives covered under Section 56(2) of Income Tax Act,1961 – #100

What is the limit up to which a father can gift to his son under income tax laws | Mint – #101

What is the limit up to which a father can gift to his son under income tax laws | Mint – #101

- estate tax picture

- estate tax example

- gift tax exemption 2022

- gift tax exemption

- gift tax rate 2023

- federal estate tax exemption 2023

Estate Tax Exemption Sunset | U.S. Bank – #102

Estate Tax Exemption Sunset | U.S. Bank – #102

2023 2024 Tax Brackets, Standard Deduction, Capital Gains, etc. – #103

2023 2024 Tax Brackets, Standard Deduction, Capital Gains, etc. – #103

5 tax planning actions to take before year-end | J.P. Morgan Private Bank U.S. – #104

5 tax planning actions to take before year-end | J.P. Morgan Private Bank U.S. – #104

Gifting Stock: 4 Ways to Gift Stocks to Friends, Family, and Charities – #105

Gifting Stock: 4 Ways to Gift Stocks to Friends, Family, and Charities – #105

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #106

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #106

Giving Gifts to Employees: Best Practices – #107

Giving Gifts to Employees: Best Practices – #107

Who benefits from the deduction for charitable contributions? | Tax Policy Center – #108

Who benefits from the deduction for charitable contributions? | Tax Policy Center – #108

- gift tax picture

- gift of equity

- property tax

Definition of Relatives for the purpose of Income Tax Act, 1961- Taxwink – #109

Definition of Relatives for the purpose of Income Tax Act, 1961- Taxwink – #109

Income Tax Implications of Wedding Gifts in India – #110

Income Tax Implications of Wedding Gifts in India – #110

What Is Unified Tax Credit & How Does It Work? – #111

What Is Unified Tax Credit & How Does It Work? – #111

) TAS Tax Tip: Use caution when paying or receiving payments from friends or family members using cash payment apps – TAS – #112

TAS Tax Tip: Use caution when paying or receiving payments from friends or family members using cash payment apps – TAS – #112

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #113

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #113

Preview of 2023 Estate Tax Exemptions and What to do Now – Fafinski Mark & Johnson, P.A. – #114

Preview of 2023 Estate Tax Exemptions and What to do Now – Fafinski Mark & Johnson, P.A. – #114

Tax Implications of Supporting Adult Children | TaxAct Blog – #115

Tax Implications of Supporting Adult Children | TaxAct Blog – #115

A Guide To Gifts Of Equity | Rocket Mortgage – #116

A Guide To Gifts Of Equity | Rocket Mortgage – #116

What is HUF (Hindu Undivided Family)? and HUF Tax Benefits | HDFC Life – #117

What is HUF (Hindu Undivided Family)? and HUF Tax Benefits | HDFC Life – #117

Federal Estate Tax Exemption to “Sunset” | Savant Wealth Management – #118

Federal Estate Tax Exemption to “Sunset” | Savant Wealth Management – #118

Gift Tax – Meaning, Explained, Limit, Exemptions, Vs Estate Tax – #119

Gift Tax – Meaning, Explained, Limit, Exemptions, Vs Estate Tax – #119

When You Make Cash Gifts To Your Children, Who Pays The Tax? | Greenbush Financial Group – #120

When You Make Cash Gifts To Your Children, Who Pays The Tax? | Greenbush Financial Group – #120

Stamp Duty on Gift Deed: Rates and Regulations – #121

Stamp Duty on Gift Deed: Rates and Regulations – #121

Are Business Gifts Tax Deductible? 7 Rules for Clients and Employees Gifts – #122

Are Business Gifts Tax Deductible? 7 Rules for Clients and Employees Gifts – #122

Canadian residents who own U.S. assets may need to pay U.S. estate tax | Manulife Investment Management – #123

Canadian residents who own U.S. assets may need to pay U.S. estate tax | Manulife Investment Management – #123

IRS Form 709 | H&R Block – #124

IRS Form 709 | H&R Block – #124

Executive Tax Reference Guide | Northern Trust – #125

Executive Tax Reference Guide | Northern Trust – #125

Gift Tax Explained – Do You Pay Taxes On Gifted Money? – YouTube – #126

Gift Tax Explained – Do You Pay Taxes On Gifted Money? – YouTube – #126

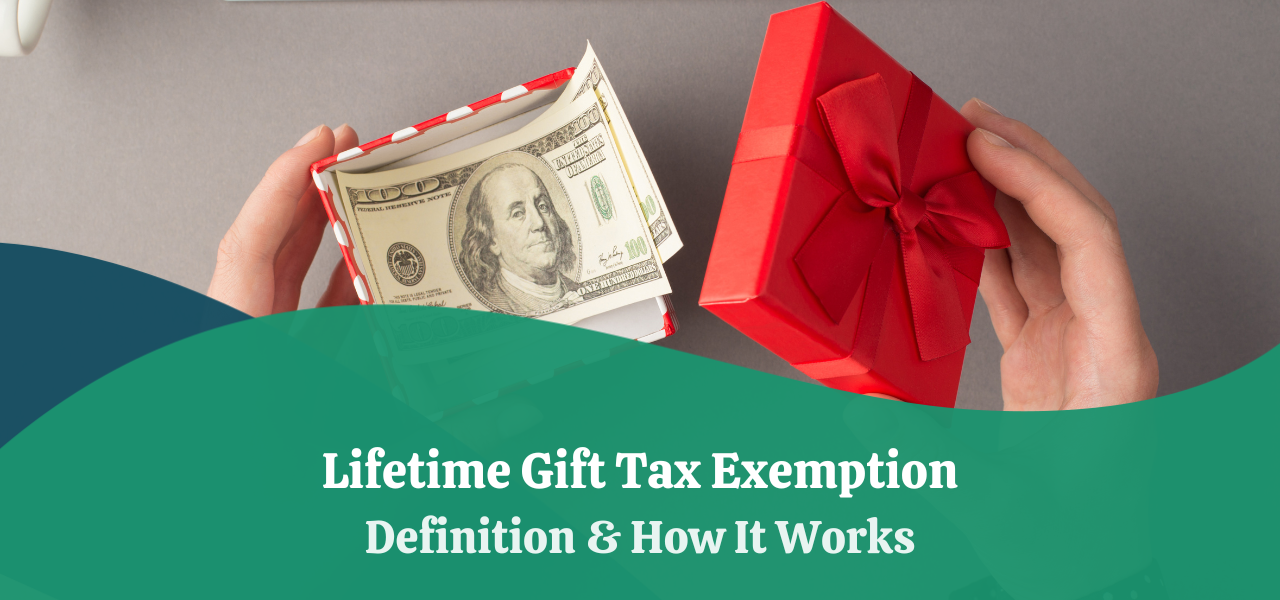

What Is the Lifetime Gift Tax Exemption for 2024? | SmartAsset – #127

What Is the Lifetime Gift Tax Exemption for 2024? | SmartAsset – #127

Legal Alert | Common Gift Tax Return Mistakes and Ways to Avoid Them | Husch Blackwell – #128

Legal Alert | Common Gift Tax Return Mistakes and Ways to Avoid Them | Husch Blackwell – #128

Gift Money for Down Payment | Free Gift Letter Template – #129

Gift Money for Down Payment | Free Gift Letter Template – #129

Posts: us gift tax limit

Categories: Gifts

Author: toyotabienhoa.edu.vn