Aggregate 160+ taxability of gift from relative super hot

Share images of taxability of gift from relative by website toyotabienhoa.edu.vn compilation. How Are Foreign Inward Remittance Taxed In India. Are federal taxes progressive? | Tax Policy Center. How to Gift Money – Experian. Nephew and Niece are not “Relative” under Income Tax act 1961

Understanding Section 56(2)(viib) of the Income Tax Act – Marg ERP Blog – #1

Understanding Section 56(2)(viib) of the Income Tax Act – Marg ERP Blog – #1

Here’s what you need to know about different forms of gold you can buy and their tax treatment – BusinessToday – #2

Here’s what you need to know about different forms of gold you can buy and their tax treatment – BusinessToday – #2

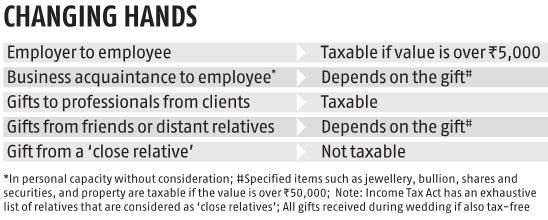

Christmas and New Year gifts could be taxable | Mint – #4

Christmas and New Year gifts could be taxable | Mint – #4

Taxancy – Gifts from Relatives is fully tax Free Who is… | Facebook – #5

Taxancy – Gifts from Relatives is fully tax Free Who is… | Facebook – #5

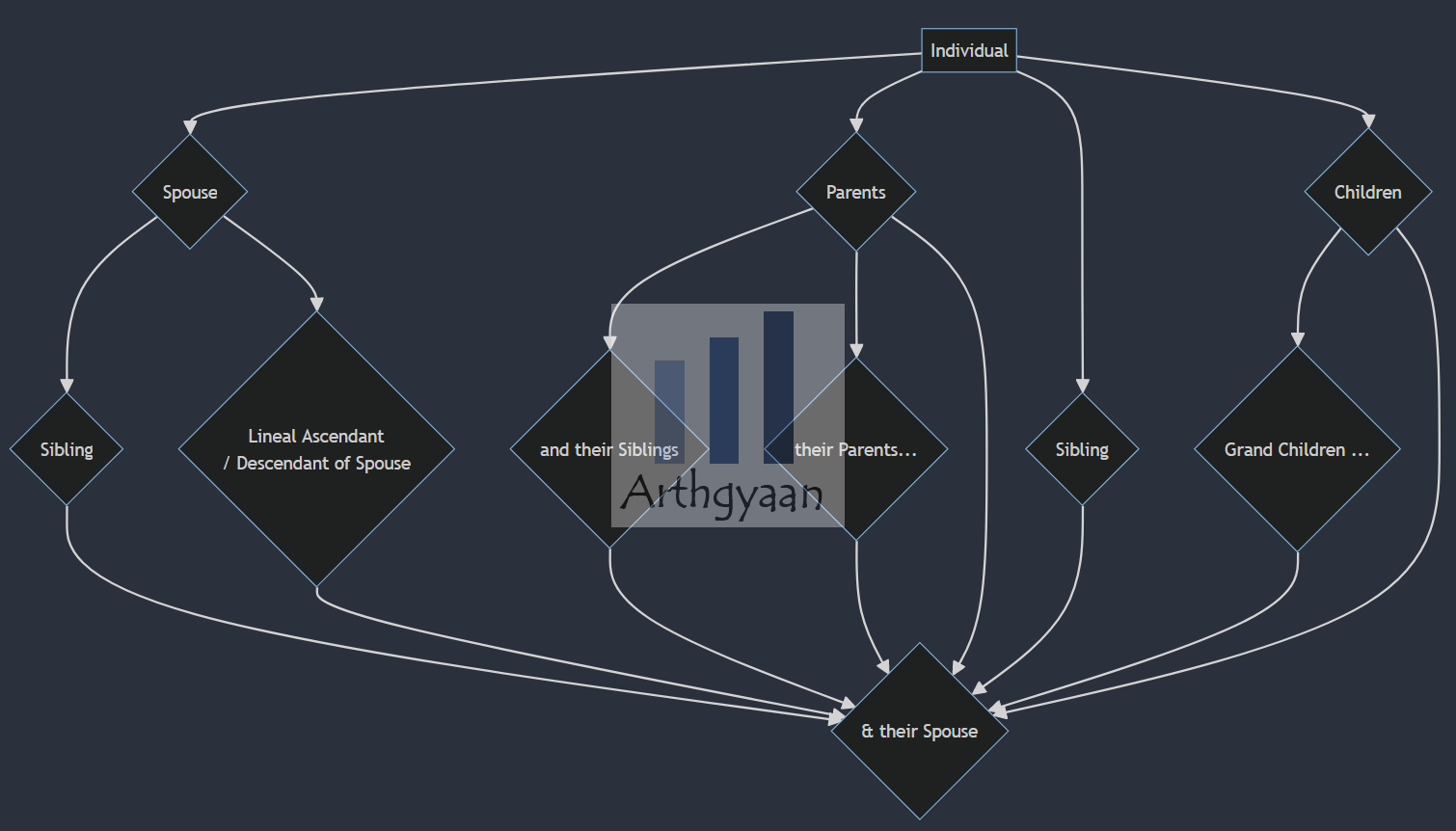

- lineal ascendant gift from relative exempt from income tax

- wealth tax

- expenditure tax act

SHIVANJAL PAWAR – The Institute of Chartered Accountants of India – Ahmedabad, Gujarat, India | LinkedIn – #6

SHIVANJAL PAWAR – The Institute of Chartered Accountants of India – Ahmedabad, Gujarat, India | LinkedIn – #6

Income Tax on Digital, Physical, and Paper Gold in India | IIFL Finance – #7

Income Tax on Digital, Physical, and Paper Gold in India | IIFL Finance – #7

Tax queries: Gifts received from a relative are tax-exempt – The Economic Times – #8

Tax queries: Gifts received from a relative are tax-exempt – The Economic Times – #8

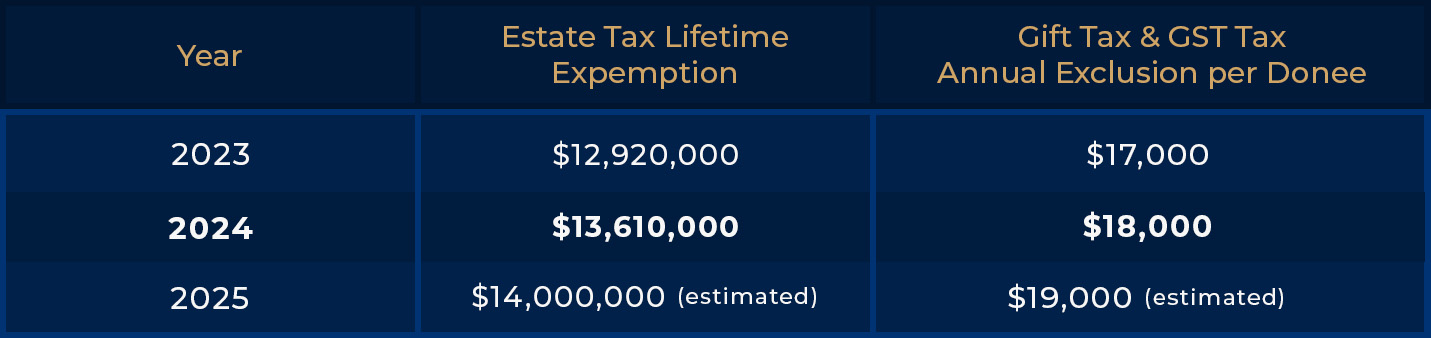

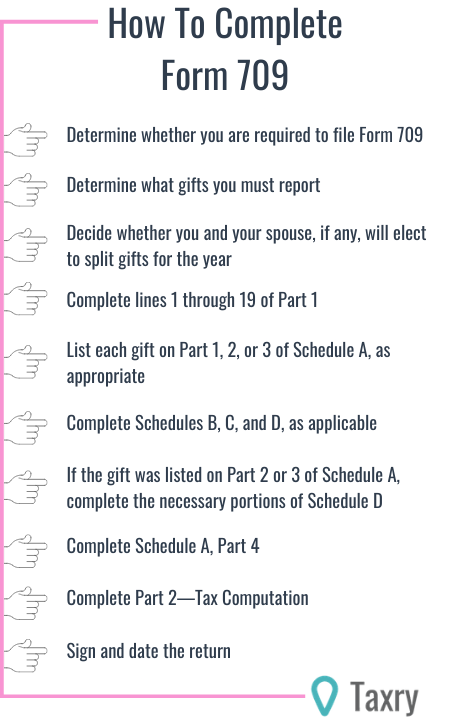

Gift Tax 101: What You Need to Know — Connecticut Estate Planning Attorneys Blog – #10

Gift Tax 101: What You Need to Know — Connecticut Estate Planning Attorneys Blog – #10

Inheritance Tax France – Ultimate Guide | Cameron James Expat Financial Advice – #11

Inheritance Tax France – Ultimate Guide | Cameron James Expat Financial Advice – #11

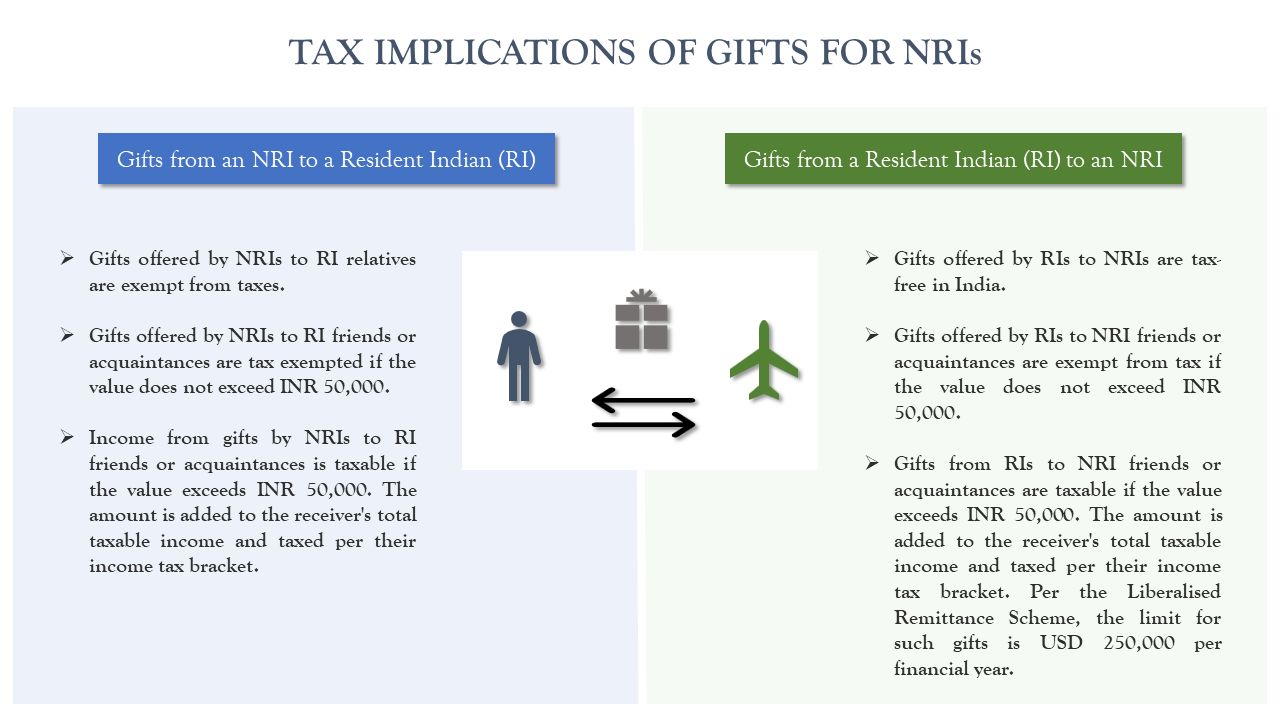

NRI Gift Tax Guide: Understanding Tax Implications in India – #12

NRI Gift Tax Guide: Understanding Tax Implications in India – #12

Looking for a Cannabis tax stamp from Nunavut for a collection. I’m putting together a stamp collection of the Cannabis tax stamps as a gift for a stamp collecting relative. Here is – #13

Looking for a Cannabis tax stamp from Nunavut for a collection. I’m putting together a stamp collection of the Cannabis tax stamps as a gift for a stamp collecting relative. Here is – #13

Political Calculations: What If the Death Tax Were an Income Tax? – #14

Political Calculations: What If the Death Tax Were an Income Tax? – #14

Can NRI gift property to parents? – Quora – #15

Can NRI gift property to parents? – Quora – #15

![Opinion] Gifts | A Comprehensive Analysis of an Everlasting Tax Planning Tool Opinion] Gifts | A Comprehensive Analysis of an Everlasting Tax Planning Tool](https://i.ytimg.com/vi/90oBj8KDv0k/hq720.jpg?sqp\u003d-oaymwEhCK4FEIIDSFryq4qpAxMIARUAAAAAGAElAADIQj0AgKJD\u0026rs\u003dAOn4CLDRAn5C-2uD5hrigkYmPmd-uiIoCA) Opinion] Gifts | A Comprehensive Analysis of an Everlasting Tax Planning Tool – #16

Opinion] Gifts | A Comprehensive Analysis of an Everlasting Tax Planning Tool – #16

What Are the Implications of a Loan Versus a Financial Gift to a Family Member – #17

What Are the Implications of a Loan Versus a Financial Gift to a Family Member – #17

TCS on Tax Foreign Remittance Transactions under LRS – #18

TCS on Tax Foreign Remittance Transactions under LRS – #18

TAX TREATMENT OF GIFTS RECEIVED BY AN INDIVIDUAL OR HUF Source @IncomeTaxIndia Thread 🧵 – Thread from Taxation Updates (Mayur J Sondagar) @TaxationUpdates – Rattibha – #19

TAX TREATMENT OF GIFTS RECEIVED BY AN INDIVIDUAL OR HUF Source @IncomeTaxIndia Thread 🧵 – Thread from Taxation Updates (Mayur J Sondagar) @TaxationUpdates – Rattibha – #19

Prateek Mehta, Author at Scripbox – #20

Prateek Mehta, Author at Scripbox – #20

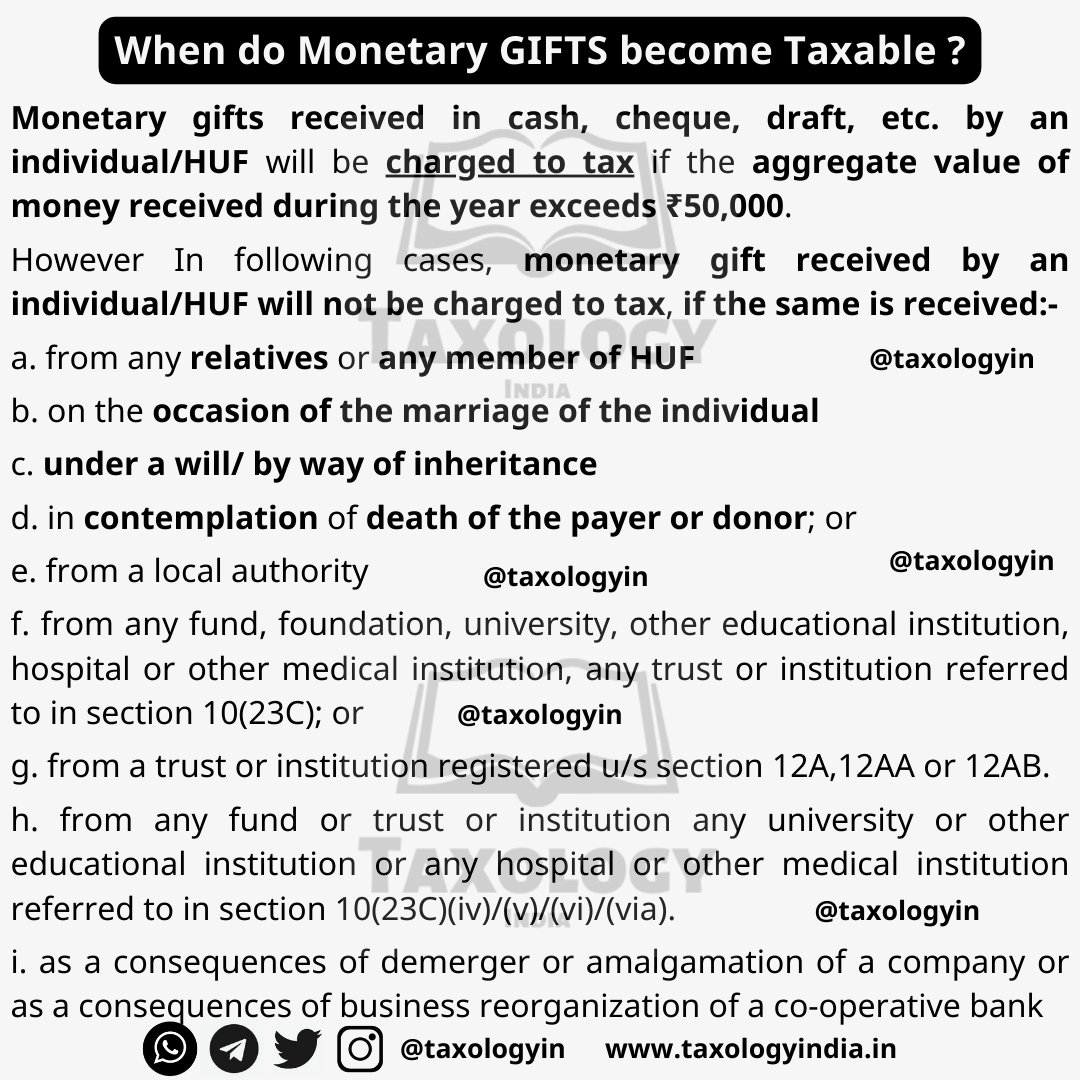

Taxology India on X: “Did you know cash gifts received from friends (other than in wedding) is taxable? Lets learn about Monetary Gifts & its taxability in a simple way. https://t.co/yZFVP17Qu4” / – #21

Taxology India on X: “Did you know cash gifts received from friends (other than in wedding) is taxable? Lets learn about Monetary Gifts & its taxability in a simple way. https://t.co/yZFVP17Qu4” / – #21

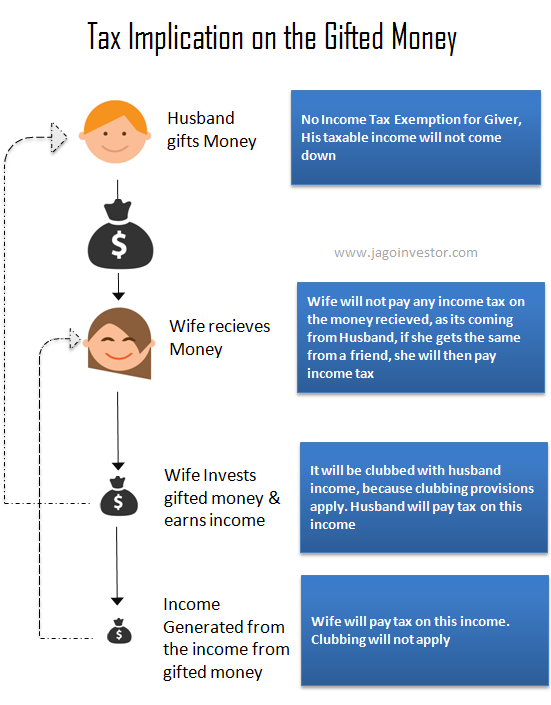

Gift Tax planning – 3 awesome tips to save income tax legally – #22

Gift Tax planning – 3 awesome tips to save income tax legally – #22

Do You Have to Pay Gift Taxes on 529 Plan Contributions? – #23

Do You Have to Pay Gift Taxes on 529 Plan Contributions? – #23

Income Tax Return Filing – Alritz Consultancy – These are the situations where money without consideration, i.e., monetary gift received by an individual or HUF is not charged to tax | Facebook – #24

Income Tax Return Filing – Alritz Consultancy – These are the situations where money without consideration, i.e., monetary gift received by an individual or HUF is not charged to tax | Facebook – #24

Understanding Income Tax on Gifts Received in India: Rules, Exceptions, and Valuation” – #25

Understanding Income Tax on Gifts Received in India: Rules, Exceptions, and Valuation” – #25

What is the taxability for inherited assets? | Mint – #26

What is the taxability for inherited assets? | Mint – #26

Our Benefactors – WELCOME TO SAN DIEGO LIONS SCHOLARSHIP FOUNDATION, Inc. (Lions District 4-L6 Endorsed Project*) – #27

Our Benefactors – WELCOME TO SAN DIEGO LIONS SCHOLARSHIP FOUNDATION, Inc. (Lions District 4-L6 Endorsed Project*) – #27

Money gifted by relative in bank account is not liable to tax – Chirag Nangia – Nangia Andersen India Pvt. Ltd. – #28

Money gifted by relative in bank account is not liable to tax – Chirag Nangia – Nangia Andersen India Pvt. Ltd. – #28

Understanding the Gift Tax in New York – Littman Krooks LLP – #29

Understanding the Gift Tax in New York – Littman Krooks LLP – #29

Format of Gift Deed for gift of amount through cash or Cheque – You can gift cash or amount in bank – Studocu – #30

Format of Gift Deed for gift of amount through cash or Cheque – You can gift cash or amount in bank – Studocu – #30

6:50 voli 4GΔ△A <111ae611−66c6−4c35−8c8 b-fa685e91e4a3 b⋮ Dr. Sateesh ku.. - #31

6:50 voli 4GΔ△A <111ae611−66c6−4c35−8c8 b-fa685e91e4a3 b⋮ Dr. Sateesh ku.. - #31

A relative is asking me to send them a signed W-9 form after sending me a cash wedding gift. Is this normal? : r/tax – #32

A relative is asking me to send them a signed W-9 form after sending me a cash wedding gift. Is this normal? : r/tax – #32

Understanding Section 56(2)(x) of Income Tax Act 1961: Taxation of Gifts Received – Marg ERP Blog – #33

Understanding Section 56(2)(x) of Income Tax Act 1961: Taxation of Gifts Received – Marg ERP Blog – #33

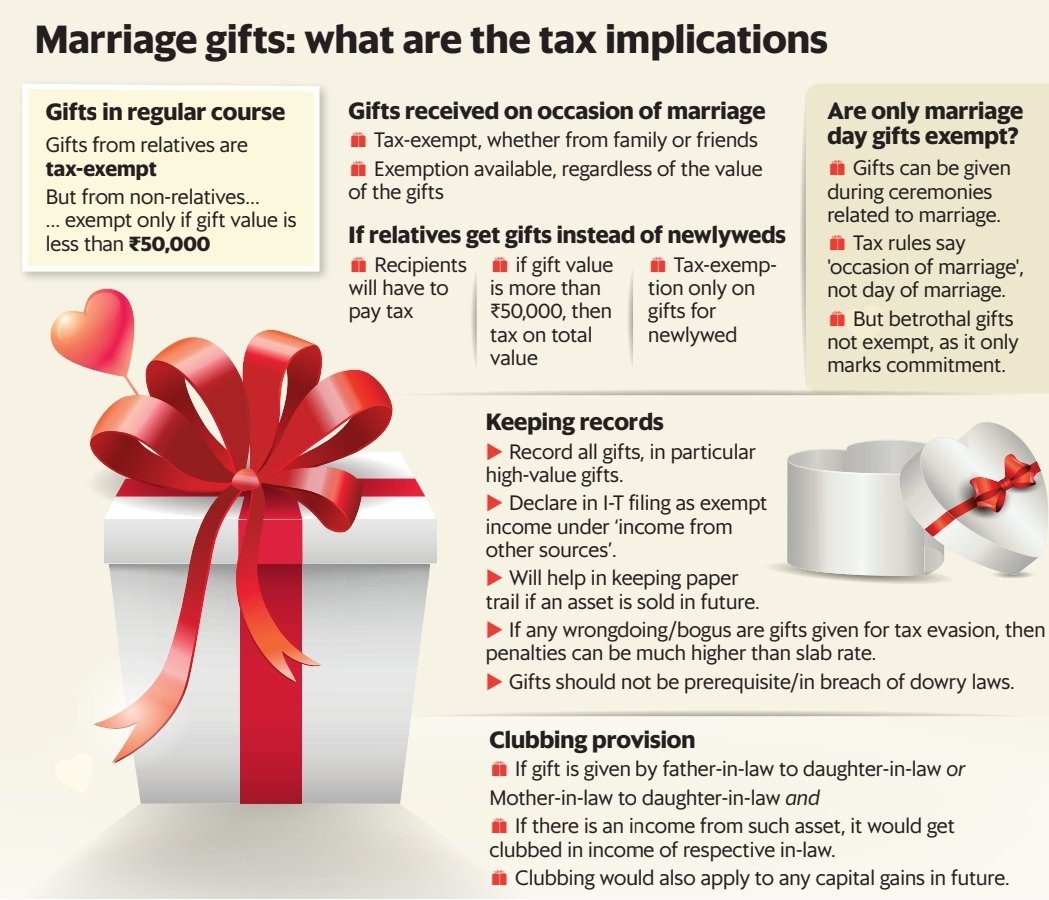

Decoding wedding gift taxation in India: Know ways to exempt it – #34

Decoding wedding gift taxation in India: Know ways to exempt it – #34

I received gifts during my wedding, are they taxable? – #35

I received gifts during my wedding, are they taxable? – #35

How Much Money Can I Gift Without Owing Taxes? – #36

How Much Money Can I Gift Without Owing Taxes? – #36

What are different Types of Gold Investment and How are they Taxed – #37

What are different Types of Gold Investment and How are they Taxed – #37

Section 56(2) of Income Tax Act: All You Need to Know – Marg ERP Blog – #38

Section 56(2) of Income Tax Act: All You Need to Know – Marg ERP Blog – #38

The Estate Tax Provides Less than One Percent of Federal Revenue – #39

The Estate Tax Provides Less than One Percent of Federal Revenue – #39

Taxability of gift received in cash or in kind by HUF without consideration – #40

Taxability of gift received in cash or in kind by HUF without consideration – #40

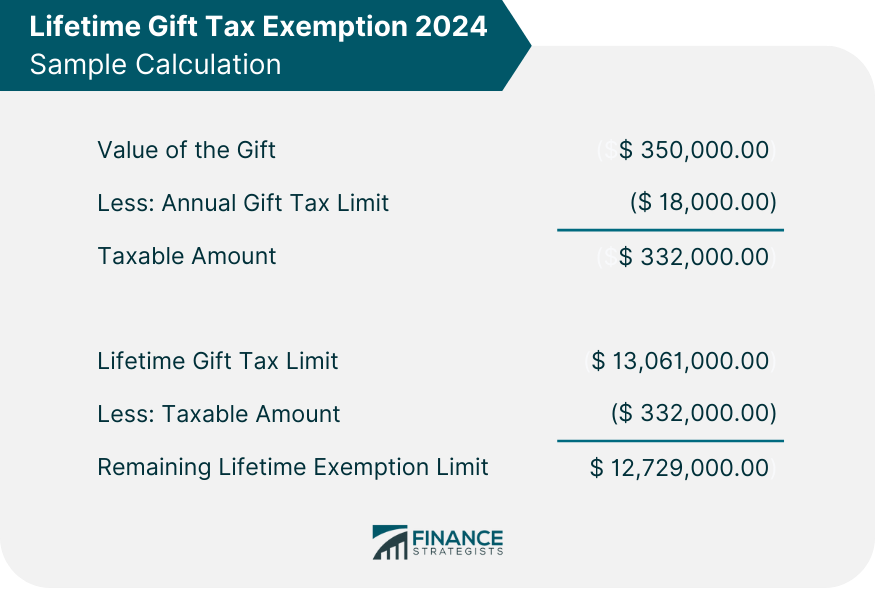

What Is the Lifetime Gift Tax Exemption for 2024? | SmartAsset – #41

What Is the Lifetime Gift Tax Exemption for 2024? | SmartAsset – #41

Rules For Taxation Of Gift In India – Labour Law Advisor – #42

Rules For Taxation Of Gift In India – Labour Law Advisor – #42

Taxability of Gift received by an individual or HUF with FAQs – #43

Taxability of Gift received by an individual or HUF with FAQs – #43

Solved or each of the following questions, assume you are in | Chegg.com – #44

Solved or each of the following questions, assume you are in | Chegg.com – #44

What is a gift deed and tax implications | Tax Hack – #45

What is a gift deed and tax implications | Tax Hack – #45

Income Tax on Cash Gift to Wife: How Much You Can Gift on Women’s Day Without Tax Implications – Income Tax News | The Financial Express – #46

Income Tax on Cash Gift to Wife: How Much You Can Gift on Women’s Day Without Tax Implications – Income Tax News | The Financial Express – #46

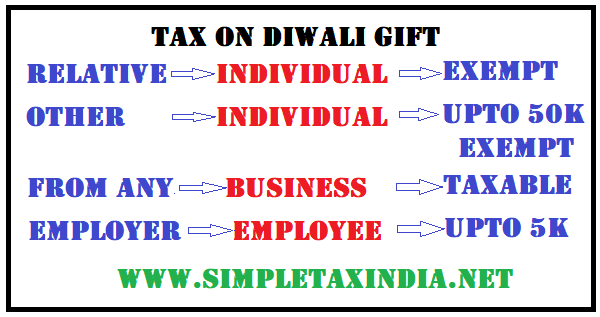

Income Tax Return: Do You Have Pay Tax For Diwali Gifts? Here’s What Rules Say – #47

Income Tax Return: Do You Have Pay Tax For Diwali Gifts? Here’s What Rules Say – #47

tax treatment of gifts | PDF – #48

tax treatment of gifts | PDF – #48

Taxation of Gifts received in Cash or Kind – #49

Taxation of Gifts received in Cash or Kind – #49

Expecting an NFT, crypto, or VDA gift this Diwali? Here are the tax implications – #50

Expecting an NFT, crypto, or VDA gift this Diwali? Here are the tax implications – #50

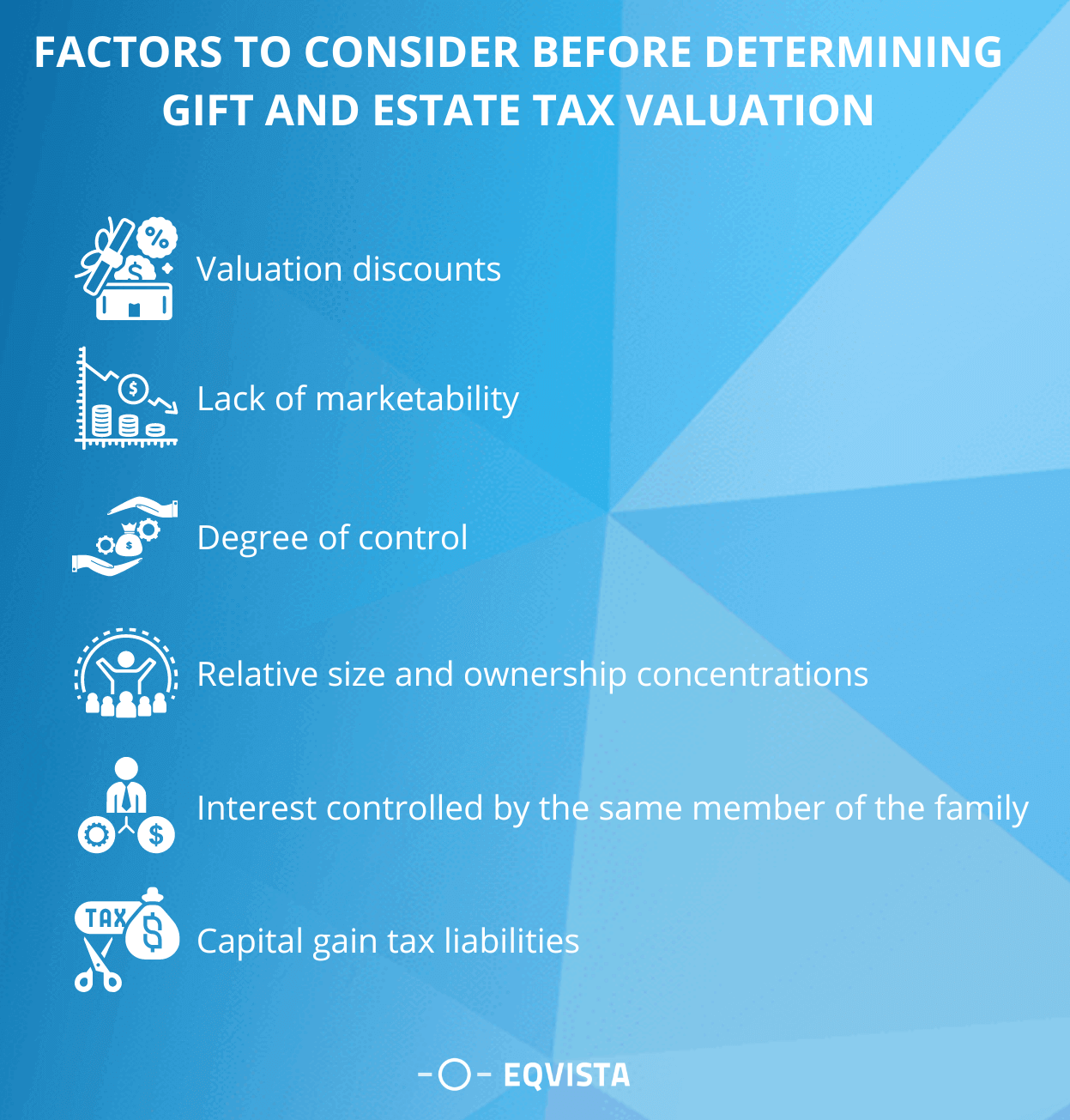

Gift & Estate Tax Valuation – Everything you should know | Eqvista – #51

Gift & Estate Tax Valuation – Everything you should know | Eqvista – #51

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #52

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #52

If I Gift 1cr to my mother is it exempt or taxable? – Quora – #53

If I Gift 1cr to my mother is it exempt or taxable? – Quora – #53

Tax Collected at Source (TCS) for Foreign Tour Package under Liberalised Remittance Scheme from October, 2023 – #54

Tax Collected at Source (TCS) for Foreign Tour Package under Liberalised Remittance Scheme from October, 2023 – #54

Income tax – “GIFT” Taxability under Income Tax Act, 1961-In Very Short | Facebook – #55

Income tax – “GIFT” Taxability under Income Tax Act, 1961-In Very Short | Facebook – #55

Relative से पैसा लेने से पहले यह video ज़रूर देखना, Gift Rule 2022,आपके गिफ्ट पर इनकम टैक्स की नज़र – YouTube – #56

Relative से पैसा लेने से पहले यह video ज़रूर देखना, Gift Rule 2022,आपके गिफ्ट पर इनकम टैक्स की नज़र – YouTube – #56

Gifting a House to a Relative | ThinkGlink | Real Estate – #57

Gifting a House to a Relative | ThinkGlink | Real Estate – #57

साली गिफ्ट दे तो नहीं लगता टैक्स, फिर दोस्त से मिले उपहार पर क्यों? ऐसे हैं Gift पर Tax के रूल – income tax on gift received which gifts are exempted from – #58

साली गिफ्ट दे तो नहीं लगता टैक्स, फिर दोस्त से मिले उपहार पर क्यों? ऐसे हैं Gift पर Tax के रूल – income tax on gift received which gifts are exempted from – #58

Gift Deed: Registration, Format and All You Need to Know – #59

Gift Deed: Registration, Format and All You Need to Know – #59

GIFT DEED REGISTRATION » Shreeyansh Legal – #60

GIFT DEED REGISTRATION » Shreeyansh Legal – #60

Inheritance Tax – Definition, How It Works, Estate Tax – #61

Inheritance Tax – Definition, How It Works, Estate Tax – #61

- gift tax in india

- death tax

- service tax

Essentials of Cash Gift Deed in Blood Relation – #62

Essentials of Cash Gift Deed in Blood Relation – #62

Narayana Murthy gifts Infosys shares worth Rs 240 cr to his 4-month-old grandson: How are gifts taxed in India? – #63

Narayana Murthy gifts Infosys shares worth Rs 240 cr to his 4-month-old grandson: How are gifts taxed in India? – #63

Property Received As Gift From A Relative Is Exempt From Tax – #64

Property Received As Gift From A Relative Is Exempt From Tax – #64

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #65

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #65

GIFT FROM RELATIVE IS TAX FREE NOT COMPLIANCE FREE – #66

GIFT FROM RELATIVE IS TAX FREE NOT COMPLIANCE FREE – #66

What are the tax implications of gifting shares to your grandson? | Mint – #67

What are the tax implications of gifting shares to your grandson? | Mint – #67

Money Remitted As Gift To Parent In India Not Taxable As Income – #68

Money Remitted As Gift To Parent In India Not Taxable As Income – #68

Stamp duty on gift deed in blood relatives – #69

Stamp duty on gift deed in blood relatives – #69

Behavioral responses to inheritance and gift taxation: Evidence from Germany – ScienceDirect – #70

Behavioral responses to inheritance and gift taxation: Evidence from Germany – ScienceDirect – #70

5 rules about Income Tax on Gifts received in India & Exemptions – #71

5 rules about Income Tax on Gifts received in India & Exemptions – #71

Tax Implications of Supporting Adult Children | TaxAct Blog – #72

Tax Implications of Supporting Adult Children | TaxAct Blog – #72

Do Cash Gifts Count as Income? • 1040.com Blog – #73

Do Cash Gifts Count as Income? • 1040.com Blog – #73

Section-56-of-Income-Tax-Act-1961 – Dividend distribution tax-Fair market-Consideration | PubHTML5 – #74

Section-56-of-Income-Tax-Act-1961 – Dividend distribution tax-Fair market-Consideration | PubHTML5 – #74

Gift Tax: Does this Exist at the State Level in New York? – – #75

Gift Tax: Does this Exist at the State Level in New York? – – #75

Showered with gifts at your wedding? Here’s how they will be taxed (or not) – #76

Showered with gifts at your wedding? Here’s how they will be taxed (or not) – #76

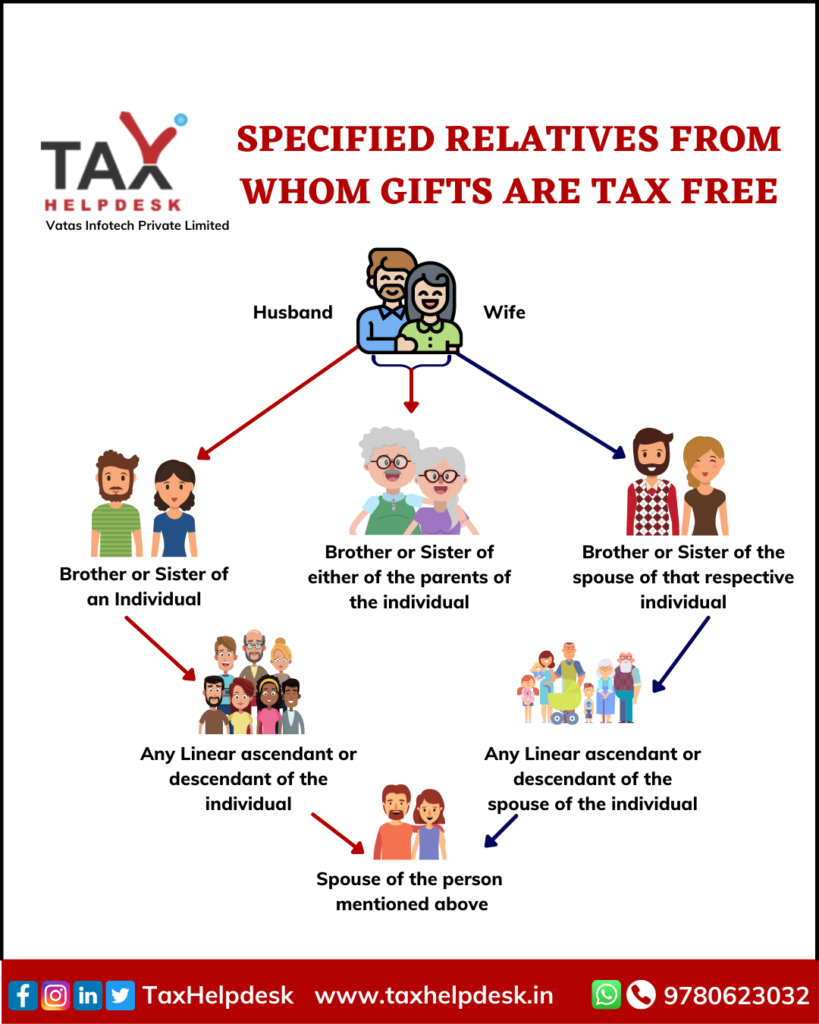

Gifts from relatives are always tax-free – The Economic Times – #77

Gifts from relatives are always tax-free – The Economic Times – #77

Are Cash Gifts from relatives exempt from Income tax? – #78

Are Cash Gifts from relatives exempt from Income tax? – #78

What You Need to Know About Stock Gift Tax – #79

What You Need to Know About Stock Gift Tax – #79

Gift Tax: 3 Easy Ways to Avoid Paying the Gift Tax | TaxAct – #80

Gift Tax: 3 Easy Ways to Avoid Paying the Gift Tax | TaxAct – #80

The Benefits of Gifting: A Tool for Estate Planning and Tax Savings – #81

The Benefits of Gifting: A Tool for Estate Planning and Tax Savings – #81

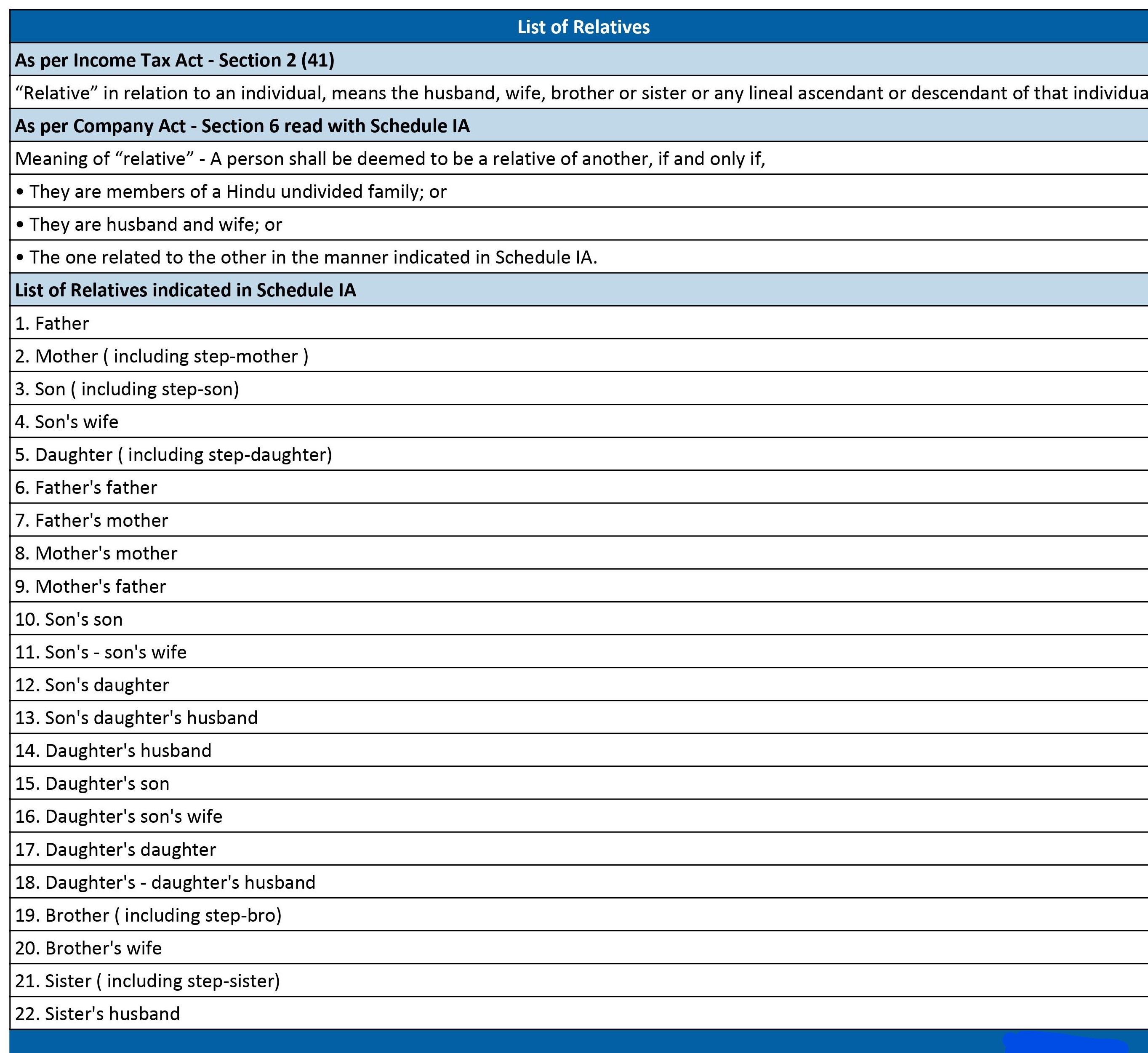

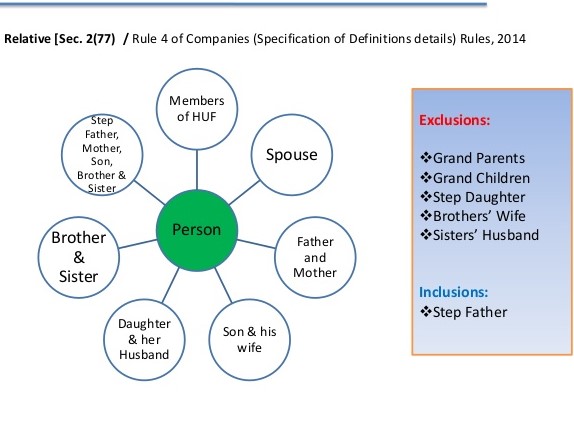

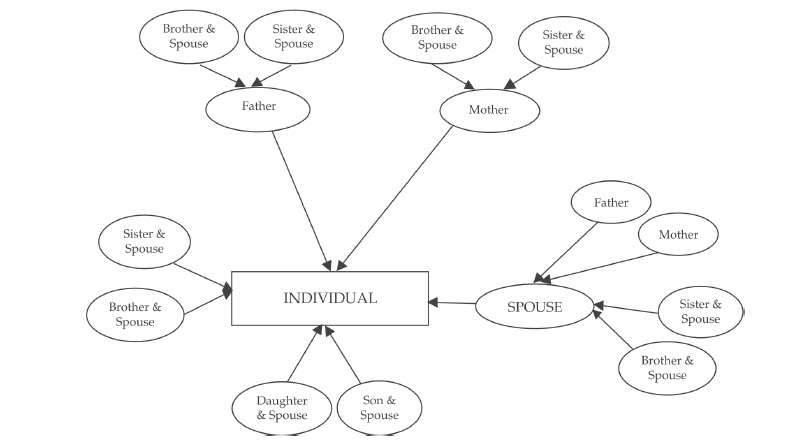

- section 56(2) of income tax act

- list of relatives

- gift tax rate in india 2022-23

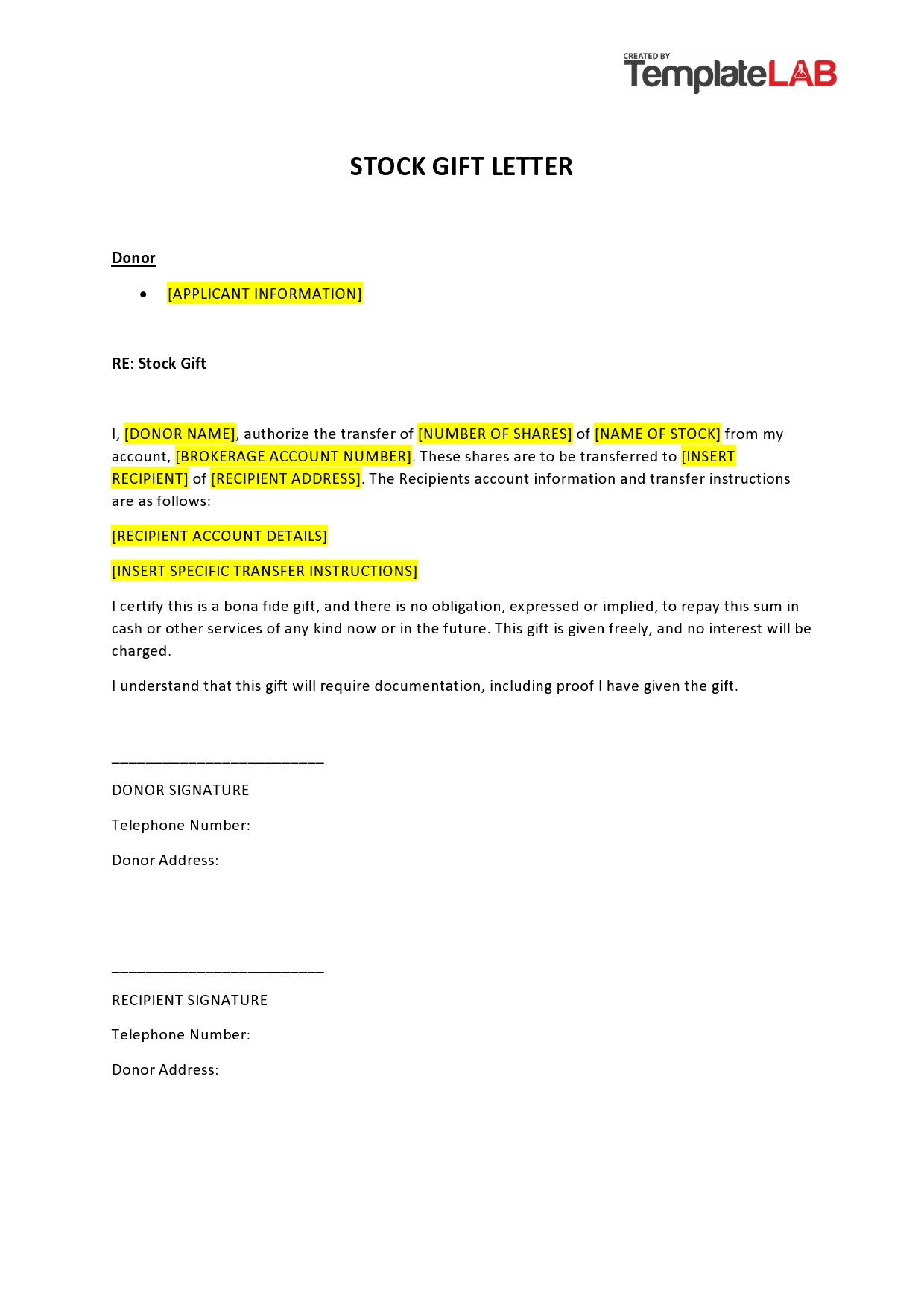

Family Gifting Made Easy: The Gift Letter Explained – FasterCapital – #82

Family Gifting Made Easy: The Gift Letter Explained – FasterCapital – #82

How to gift stocks, bonds and ETFs and the tax implications – Z-Connect by Zerodha – #83

How to gift stocks, bonds and ETFs and the tax implications – Z-Connect by Zerodha – #83

What Is The Tax Liability On Gifts Received? – #84

What Is The Tax Liability On Gifts Received? – #84

Gift Under The Income Tax Act In India – Especia – #85

Gift Under The Income Tax Act In India – Especia – #85

Income Tax on Gift in India – Rules and tips to save tax – BasuNivesh – #86

Income Tax on Gift in India – Rules and tips to save tax – BasuNivesh – #86

Income tax on gifts: Gift received from relatives is tax free | Mint – #87

Income tax on gifts: Gift received from relatives is tax free | Mint – #87

Down Payment Gifts: What You Need to Know – AmeriSave – #88

Down Payment Gifts: What You Need to Know – AmeriSave – #88

Understanding Taxes – Assessment: Why Pay Taxes – #89

Understanding Taxes – Assessment: Why Pay Taxes – #89

A taxing situation – India Today – #90

A taxing situation – India Today – #90

Solved Elfrieda Roth, who died in 2017, made lifetime | Chegg.com – #91

Solved Elfrieda Roth, who died in 2017, made lifetime | Chegg.com – #91

Our expert @the_unconventional_ca for @herzindagi ✨ Check out the article to get specialist insights around Income Tax must knows for… | Instagram – #92

Our expert @the_unconventional_ca for @herzindagi ✨ Check out the article to get specialist insights around Income Tax must knows for… | Instagram – #92

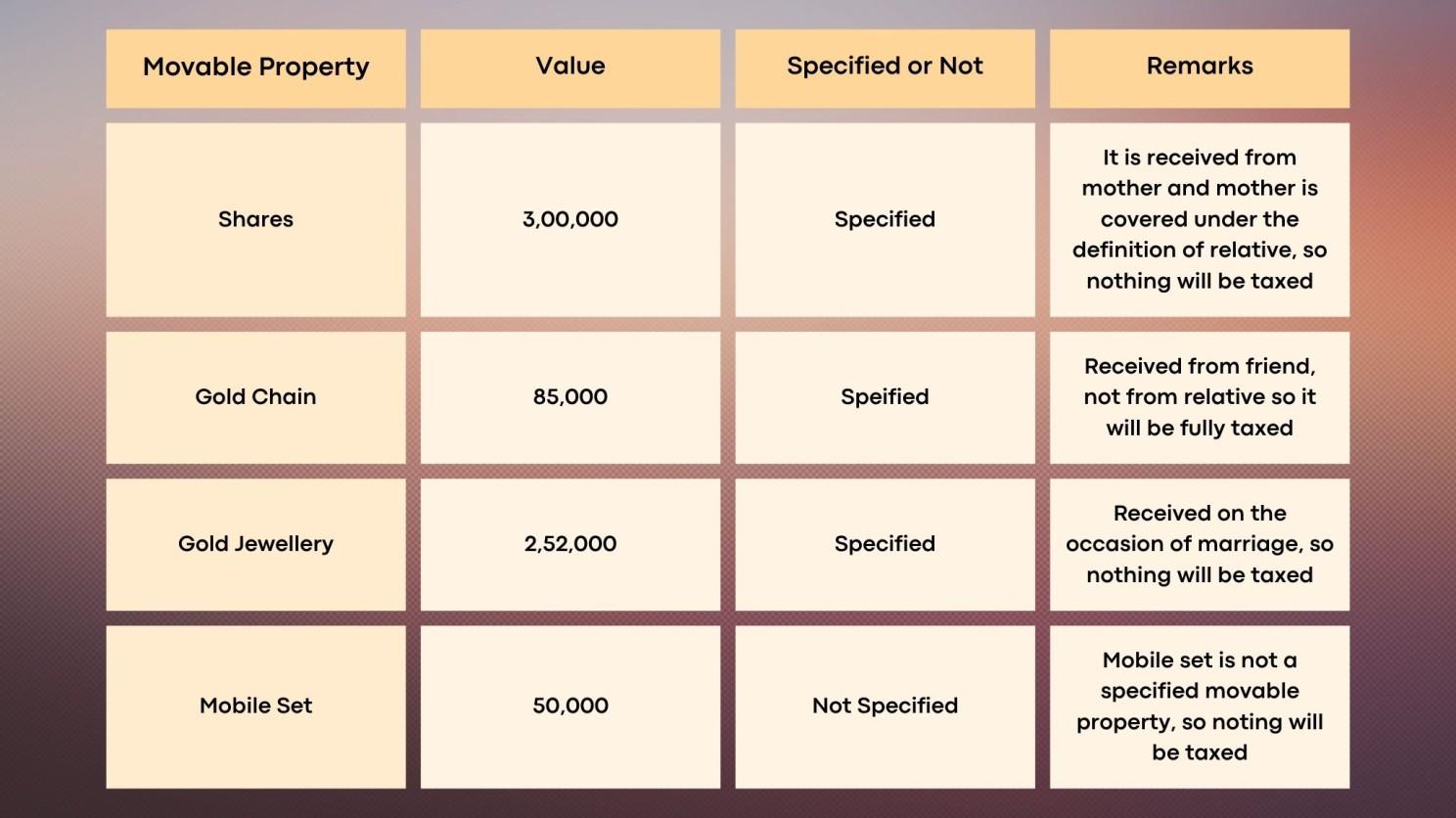

Other sources-tax – 888 888 0402 support@escholars Income Under Head Other Sources Assignment Q. No. – Studocu – #93

Other sources-tax – 888 888 0402 support@escholars Income Under Head Other Sources Assignment Q. No. – Studocu – #93

Gift Tax In India – All about Gift Tax – Digiaccounto – #94

Gift Tax In India – All about Gift Tax – Digiaccounto – #94

3 Taxes That Can Affect Your Inheritance – #95

3 Taxes That Can Affect Your Inheritance – #95

![PDF] Estate and gift taxes and incentives for inter vivos giving in the US | Semantic Scholar PDF] Estate and gift taxes and incentives for inter vivos giving in the US | Semantic Scholar](https://www.financestrategists.com/uploads/Determining-the-Capital-Gains-on-a-Gifted-Property.png) PDF] Estate and gift taxes and incentives for inter vivos giving in the US | Semantic Scholar – #96

PDF] Estate and gift taxes and incentives for inter vivos giving in the US | Semantic Scholar – #96

Acc… – Berkshire Hathaway HomeServices Northwest Real Estate | Facebook – #97

Acc… – Berkshire Hathaway HomeServices Northwest Real Estate | Facebook – #97

How are stocks gifted to your spouse taxed? | Mint – #98

How are stocks gifted to your spouse taxed? | Mint – #98

New Jersey Gift Tax: All You Need to Know | SmartAsset – #99

New Jersey Gift Tax: All You Need to Know | SmartAsset – #99

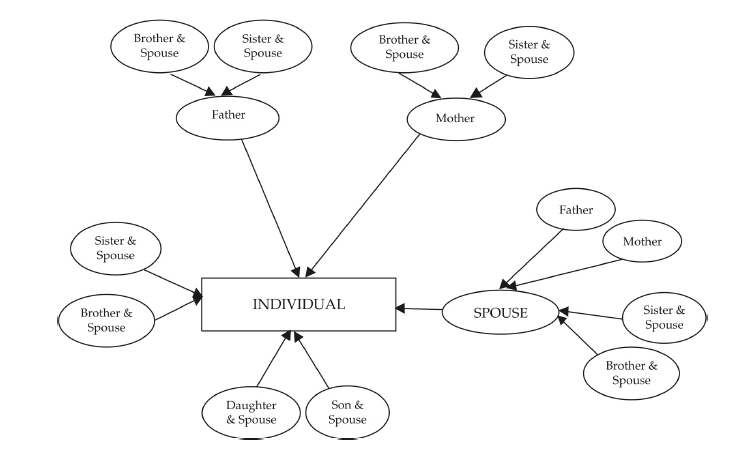

Taxguru.In – FAQ / Performa of gift deed, List of Relatives for Tax free Gift Performa of gift deed, List of Relatives from whom Gift can be received without any tax liability.. – #100

Taxguru.In – FAQ / Performa of gift deed, List of Relatives for Tax free Gift Performa of gift deed, List of Relatives from whom Gift can be received without any tax liability.. – #100

TAXABILITY OF GIFTS—SOME INTERESTING ISSUES – #101

TAXABILITY OF GIFTS—SOME INTERESTING ISSUES – #101

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #102

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #102

Capital Gains on a Gifted Property | Impact, Tax Considerations – #103

Capital Gains on a Gifted Property | Impact, Tax Considerations – #103

How to Sell your Home to a Family Member Off-Market – Blog – #104

How to Sell your Home to a Family Member Off-Market – Blog – #104

How to Avoid the Gift Tax – SmartAsset | SmartAsset – #105

How to Avoid the Gift Tax – SmartAsset | SmartAsset – #105

3. Inheritance, estate, and gift tax design in OECD countries | Inheritance Taxation in OECD Countries | OECD iLibrary – #106

3. Inheritance, estate, and gift tax design in OECD countries | Inheritance Taxation in OECD Countries | OECD iLibrary – #106

Free Gift Affidavit Templates (How to Create) – Word Layouts – #107

Free Gift Affidavit Templates (How to Create) – Word Layouts – #107

Altman Client Letter 2022 | Altman & Associates – #108

Altman Client Letter 2022 | Altman & Associates – #108

Liberalised Foreign Remittances Scheme (LRS) | Law & Procedure – #109

Liberalised Foreign Remittances Scheme (LRS) | Law & Procedure – #109

NRIs: India-US tax impact on gifts received by Indian Americans – The Economic Times – #110

NRIs: India-US tax impact on gifts received by Indian Americans – The Economic Times – #110

How to Transfer Stock to a Family Member Guide – #111

How to Transfer Stock to a Family Member Guide – #111

- gift tax exemption

- gift tax rate

- gift chart as per income tax

The unique benefits of 529 college savings plans – #112

The unique benefits of 529 college savings plans – #112

Stridhan: Income Tax Laws For Wedding Gifts That Every Indian Woman Must Know | HerZindagi – #113

Stridhan: Income Tax Laws For Wedding Gifts That Every Indian Woman Must Know | HerZindagi – #113

LiveMint on LinkedIn: #personalfinance – #114

LiveMint on LinkedIn: #personalfinance – #114

Who should invest in the name of parents to save tax? Who should not? | Arthgyaan – #115

Who should invest in the name of parents to save tax? Who should not? | Arthgyaan – #115

Renting to Relatives? Beware of the Tax Pitfalls of Family Member Rentals – #116

Renting to Relatives? Beware of the Tax Pitfalls of Family Member Rentals – #116

Gift Tax In 2024: What Is It And How Does It Work? – #117

Gift Tax In 2024: What Is It And How Does It Work? – #117

Tax Implications of Loans to Family Members – #118

Tax Implications of Loans to Family Members – #118

- gift tax definition

- gift tax act 1958

- federal gift tax

Rules For Giving And Receiving Home Down Payment Gifts – Experian – #119

Rules For Giving And Receiving Home Down Payment Gifts – Experian – #119

Section 56 – Exemption from Taxation on Wedding Gifts | Fincash – #120

Section 56 – Exemption from Taxation on Wedding Gifts | Fincash – #120

No prohibition on NRI from accepting gifts from the relatives under the – #121

No prohibition on NRI from accepting gifts from the relatives under the – #121

Gift Tax Implications – FasterCapital – #122

Gift Tax Implications – FasterCapital – #122

Gajapriya Annadurai on LinkedIn: Will your gift be taxed??? Under current tax laws, not all gifts received… – #123

Gajapriya Annadurai on LinkedIn: Will your gift be taxed??? Under current tax laws, not all gifts received… – #123

- lineal ascendant meaning

- gift tax meaning

- gift tax return

Gift Tax in India: Implications & Exemptions – myMoneySage Blog – #124

Gift Tax in India: Implications & Exemptions – myMoneySage Blog – #124

Tax Implications When Making an International Money Transfer – #125

Tax Implications When Making an International Money Transfer – #125

- gift tax exclusion 2023

- gift tax rate in india 2020

- gift tax exemption 2022

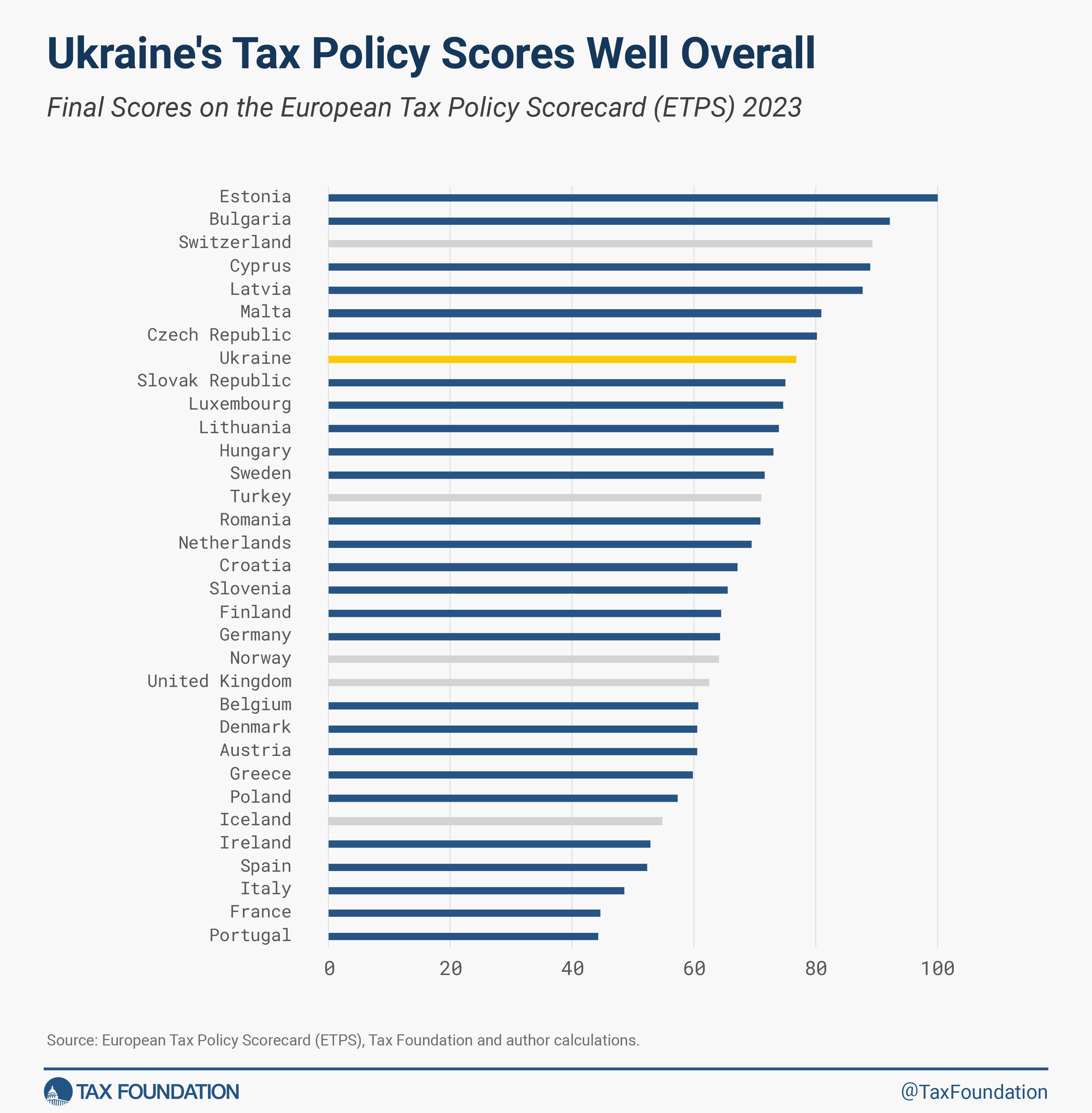

Estate Taxes in Europe | Estate, Inheritance, Gift Taxes | Tax Foundation – #126

Estate Taxes in Europe | Estate, Inheritance, Gift Taxes | Tax Foundation – #126

SOLVED: Problem 3: Mr. Porontong made the following gifts to his relatives: Philippines: P750,000 USA: P500,000 Italy: P500,000 Gross gift Deductions Tax paid P250,000 P150,000 P12,000 The gift tax due after credit – #127

SOLVED: Problem 3: Mr. Porontong made the following gifts to his relatives: Philippines: P750,000 USA: P500,000 Italy: P500,000 Gross gift Deductions Tax paid P250,000 P150,000 P12,000 The gift tax due after credit – #127

- lineal ascendant

- gift from relative exempt from income tax

- income tax gif

Is there a limit in income tax laws up to which a father can gift to his son – #128

Is there a limit in income tax laws up to which a father can gift to his son – #128

Receive A Gift From Relati | PDF | Charitable Organization | Tax Exemption – #129

Receive A Gift From Relati | PDF | Charitable Organization | Tax Exemption – #129

Tax on Gifts in India | Exemption and Rules | EZTax® – #130

Tax on Gifts in India | Exemption and Rules | EZTax® – #130

Have a Current/Savings Bank Account? Know the Cash Deposit Limits under Income Tax Act to avoid Penalties and Notices – #131

Have a Current/Savings Bank Account? Know the Cash Deposit Limits under Income Tax Act to avoid Penalties and Notices – #131

Generation-Skipping Trust (GST): What It Is and How It Works – #132

Generation-Skipping Trust (GST): What It Is and How It Works – #132

Legal Alert | Common Gift Tax Return Mistakes and Ways to Avoid Them | Husch Blackwell – #133

Legal Alert | Common Gift Tax Return Mistakes and Ways to Avoid Them | Husch Blackwell – #133

Tax considerations when gifting stock – InvestmentNews – #134

Tax considerations when gifting stock – InvestmentNews – #134

How are Cryptocurrency Gifts Taxed? | CoinLedger – #135

How are Cryptocurrency Gifts Taxed? | CoinLedger – #135

Gift of Equity: What It Is, How It Works, Taxes, and Pros & Cons – #136

Gift of Equity: What It Is, How It Works, Taxes, and Pros & Cons – #136

Crypto Taxes India: Expert Guide 2024 | CPA Reviewed | Koinly – #137

Crypto Taxes India: Expert Guide 2024 | CPA Reviewed | Koinly – #137

Gift from Relatives is Taxable in India? I Gift is Tax Free? II Gift Tax Treatment under Income Tax – YouTube – #138

Gift from Relatives is Taxable in India? I Gift is Tax Free? II Gift Tax Treatment under Income Tax – YouTube – #138

- gift tax definition economics

- gift tax exemption relatives list

- estate tax

Annual Gift Tax Exclusion Explained | PNC Insights – #139

Annual Gift Tax Exclusion Explained | PNC Insights – #139

Women’s Day 2022: Income Tax on Investment by Husband in Wife’s Name – Income Tax News | The Financial Express – #140

Women’s Day 2022: Income Tax on Investment by Husband in Wife’s Name – Income Tax News | The Financial Express – #140

OECD Tax on X: “Inheritance, estate and gift taxes could play a stronger role in addressing #inequality and improving public finances 📈 📘🔍 See our recent #inheritancetax report for the latest analysis – #141

OECD Tax on X: “Inheritance, estate and gift taxes could play a stronger role in addressing #inequality and improving public finances 📈 📘🔍 See our recent #inheritancetax report for the latest analysis – #141

3 Ways to Make Sure Your Cash Gifting Is Legal – wikiHow – #142

3 Ways to Make Sure Your Cash Gifting Is Legal – wikiHow – #142

Weddings & Tax Implications of Cash Gifts | by CA Tanuja Gupta -YourTaxAdvisor& EquityFundManager | Feb, 2024 | Medium – #143

Weddings & Tax Implications of Cash Gifts | by CA Tanuja Gupta -YourTaxAdvisor& EquityFundManager | Feb, 2024 | Medium – #143

Module 1 – Lesson 2 – Taxable Net Gift and Computation of Donor’s Tax Due – MODULE 1: DONOR’S – Studocu – #144

Module 1 – Lesson 2 – Taxable Net Gift and Computation of Donor’s Tax Due – MODULE 1: DONOR’S – Studocu – #144

) YOUR QUERIES: INCOME TAX : No income tax on money received as gift from your grandmother – Income Tax News | The Financial Express – #145

YOUR QUERIES: INCOME TAX : No income tax on money received as gift from your grandmother – Income Tax News | The Financial Express – #145

Diwali gifts from relatives are taxable or not? – #146

Diwali gifts from relatives are taxable or not? – #146

Gift tax exemption rules: who can receive gifts that are tax-free? | Arthgyaan – #147

Gift tax exemption rules: who can receive gifts that are tax-free? | Arthgyaan – #147

Income from other sources: Definition, types and applicable tax rates – #148

Income from other sources: Definition, types and applicable tax rates – #148

Things to keep in mind when lending money – BusinessToday – Issue Date: Jan 31, 2013 – #149

Things to keep in mind when lending money – BusinessToday – Issue Date: Jan 31, 2013 – #149

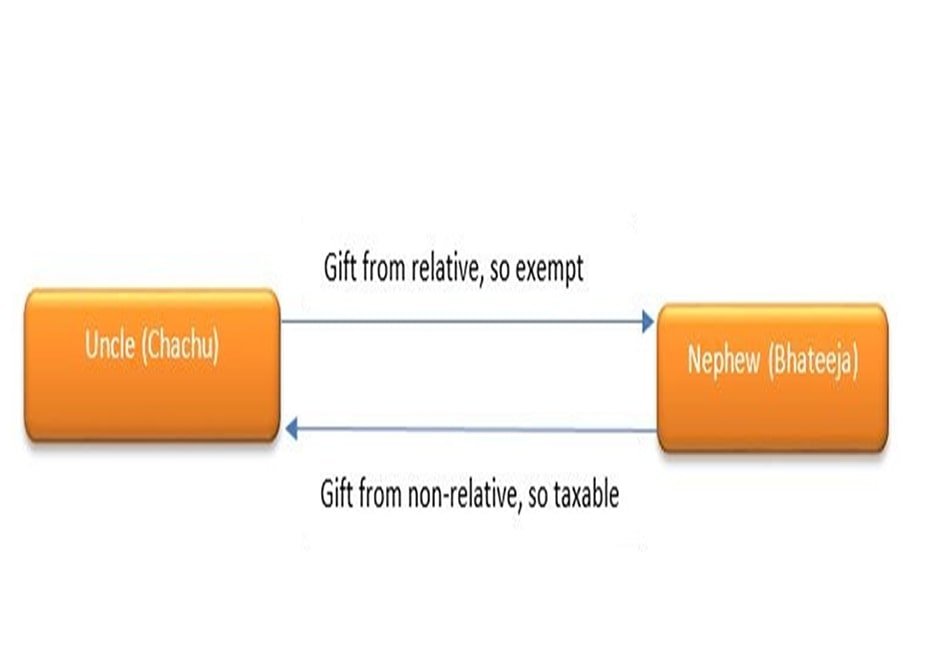

-Gifts.jpg) Gift Tax: Relative Transactions – #150

Gift Tax: Relative Transactions – #150

Tax on Gifts to Children: What You Need to Know – #151

Tax on Gifts to Children: What You Need to Know – #151

Qualified Personal Residence Trusts – #152

Qualified Personal Residence Trusts – #152

- estate/gift tax

- gift for boys

- gift tax example

FHA Gift Funds Guidelines 2024 – FHA Lenders – #153

FHA Gift Funds Guidelines 2024 – FHA Lenders – #153

There is bad news for you if your boss showered you with expensive gifts – #154

There is bad news for you if your boss showered you with expensive gifts – #154

Employers on the Auto-Inclusion Scheme (AIS): Steer clear of these common filing errors when submitting your employees’ income information… | Instagram – #155

Employers on the Auto-Inclusion Scheme (AIS): Steer clear of these common filing errors when submitting your employees’ income information… | Instagram – #155

Your acts of generosity could unintentionally use your gift tax exemption – #156

Your acts of generosity could unintentionally use your gift tax exemption – #156

Is a gift from your cousin taxable? – #157

Is a gift from your cousin taxable? – #157

Things an NRI must know about gift tax rules in India | IDFC FIRST Bank – #158

Things an NRI must know about gift tax rules in India | IDFC FIRST Bank – #158

12 Common Types of Non Taxable Income You Write Off – #159

12 Common Types of Non Taxable Income You Write Off – #159

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #160

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #160

Posts: taxability of gift from relative

Categories: Gifts

Author: toyotabienhoa.edu.vn