Share 153+ tax on gifts in india

Details images of tax on gifts in india by website toyotabienhoa.edu.vn compilation. Tax Free Gifts – Blog | PKC Management Consulting. Taxation of Gifts in India – DVS Advisory Group. Tax exemptions for non resident indians | PDF. GIFT TAX | How gift tax in india | Gifts from Relative | Save tax on Gift – YouTube. Gift Tax in India Archives – Taxmann Blog

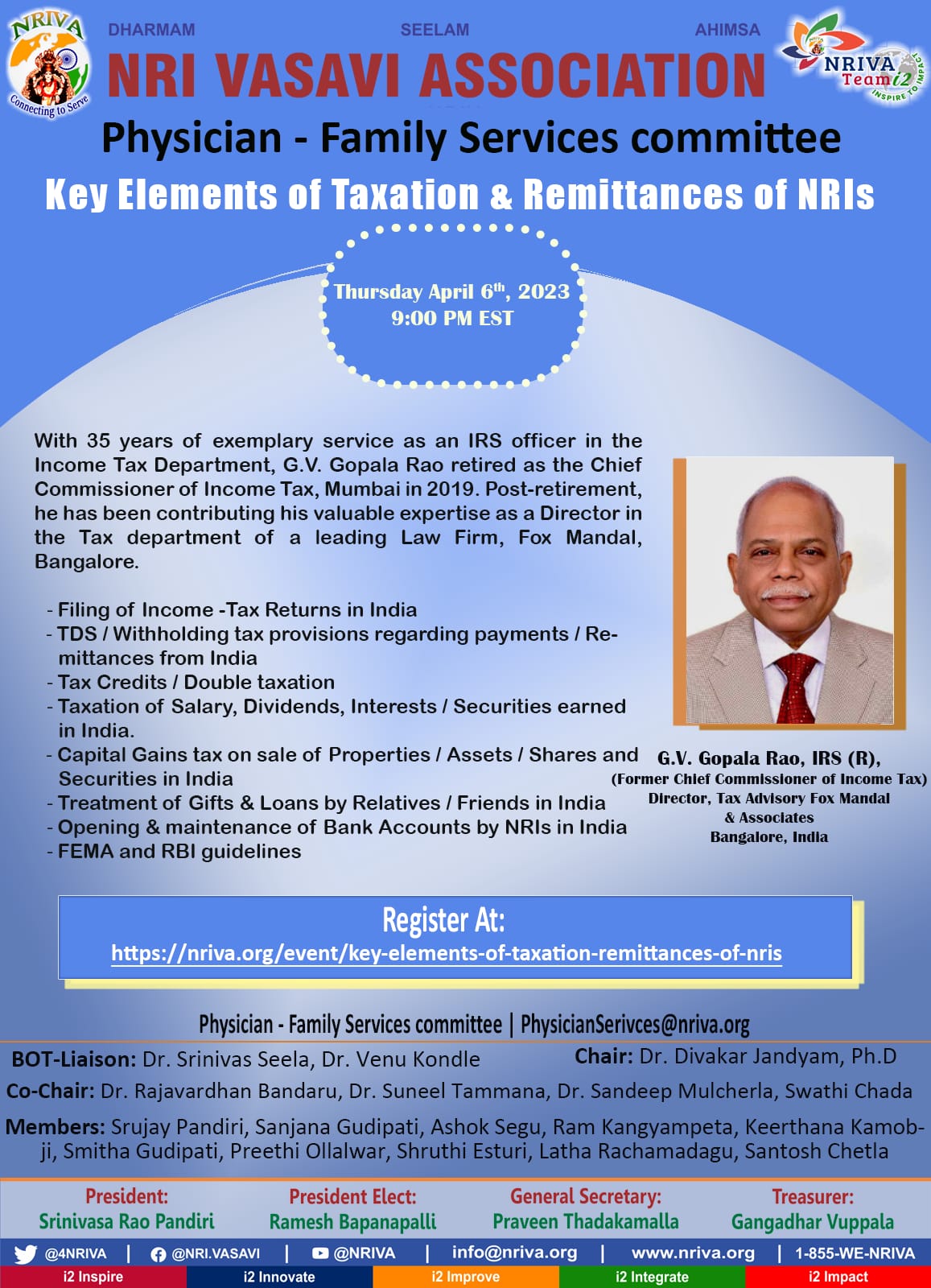

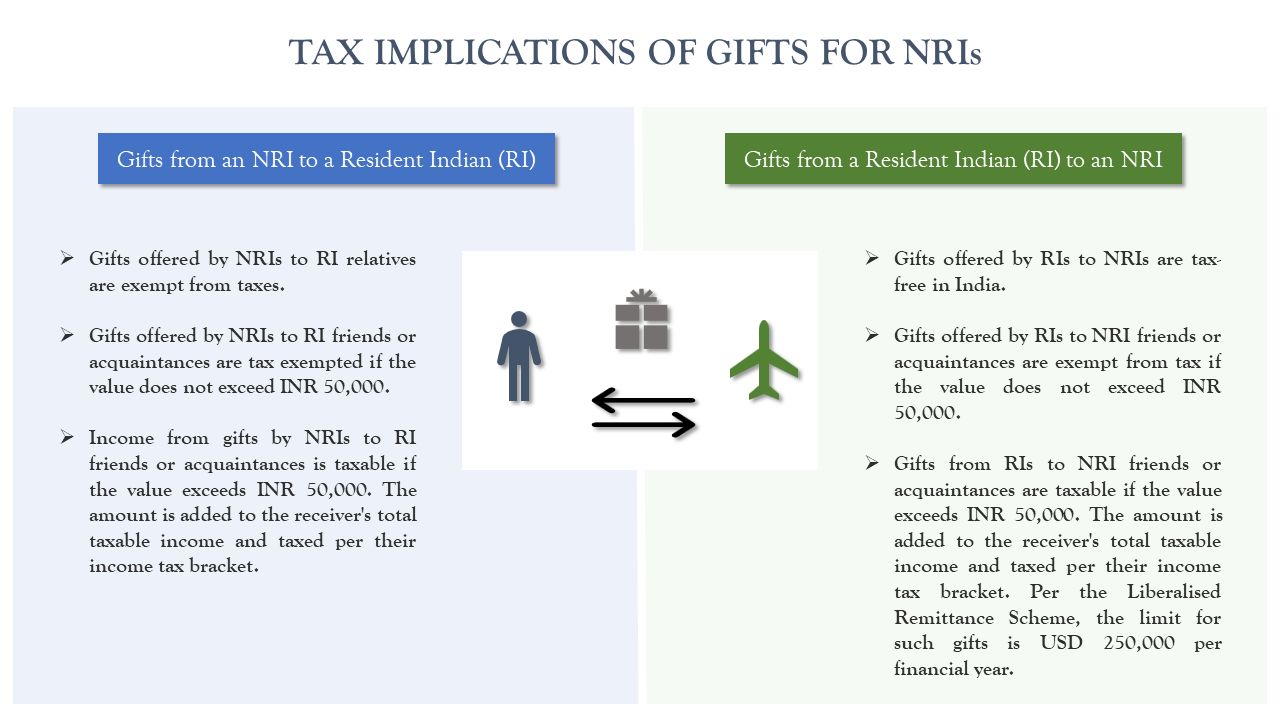

Nri Gift Tax In India – #1

Nri Gift Tax In India – #1

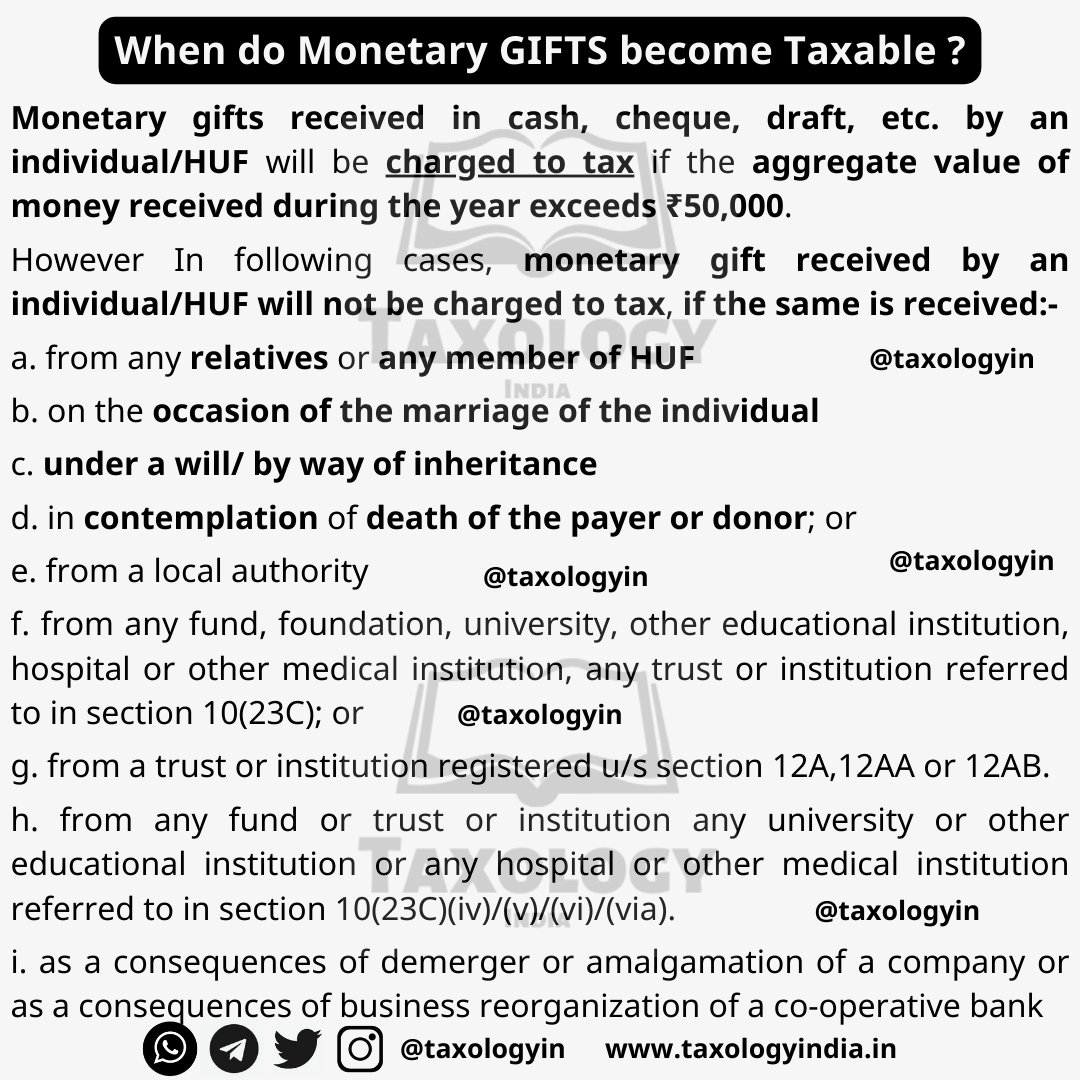

- gift from relative exempt from income tax

- gift tax example

- property gift deed

How to Make Gift Deed in Gujarat? – Property lawyers in India – #2

How to Make Gift Deed in Gujarat? – Property lawyers in India – #2

Taxation Updates (Mayur J Sondagar) on X: “TAX TREATMENT OF GIFTS RECEIVED BY AN INDIVIDUAL OR HUF Source @IncomeTaxIndia Thread 🧵 https://t.co/zBJyS1poKg” / X – #4

Taxation Updates (Mayur J Sondagar) on X: “TAX TREATMENT OF GIFTS RECEIVED BY AN INDIVIDUAL OR HUF Source @IncomeTaxIndia Thread 🧵 https://t.co/zBJyS1poKg” / X – #4

The Gift Tax Act 1958 | 1st Edition 2022: Buy The Gift Tax Act 1958 | 1st Edition 2022 by Tax Sarthi at Low Price in India | Flipkart.com – #5

The Gift Tax Act 1958 | 1st Edition 2022: Buy The Gift Tax Act 1958 | 1st Edition 2022 by Tax Sarthi at Low Price in India | Flipkart.com – #5

No additions towards gifts if assessee duly produced declarations of donors confirming gifts: ITAT – #6

No additions towards gifts if assessee duly produced declarations of donors confirming gifts: ITAT – #6

What is Previous Year in Income Tax under Section 3? – #7

What is Previous Year in Income Tax under Section 3? – #7

- gift deed format on stamp paper

- capital gains tax

- indian traditional gifts online

Income tax on gifts: Know when your gift is tax-free – BusinessToday – #8

Income tax on gifts: Know when your gift is tax-free – BusinessToday – #8

- section 56(2) of income tax act

- estate duty tax

- gift tax rate

income tax rules for gifts received by taxpayer- किसी से मिला हुआ गिफ्ट भी भारत में आयकर के दायरे में आता है। – #10

income tax rules for gifts received by taxpayer- किसी से मिला हुआ गिफ्ट भी भारत में आयकर के दायरे में आता है। – #10

My grandmother wants to gift cash to me. What are the income tax implications? | Mint – #11

My grandmother wants to gift cash to me. What are the income tax implications? | Mint – #11

Income Tax on Gift | Relative से पैसा लेने से पहले यह video ज़रूर देखना | Cash Gift Tax Rule 2023 | – YouTube – #12

Income Tax on Gift | Relative से पैसा लेने से पहले यह video ज़रूर देखना | Cash Gift Tax Rule 2023 | – YouTube – #12

According to the income tax laws of India, who can be gifted property without incurring tax? – Quora – #13

According to the income tax laws of India, who can be gifted property without incurring tax? – Quora – #13

Are Diwali gifts from employer, relatives, friends taxable? Here’s a look at the norms | Mint – #14

Are Diwali gifts from employer, relatives, friends taxable? Here’s a look at the norms | Mint – #14

) PPT – BY CA NAVEEN KHARIWAL .G Email id: h.c.khincha@gmail PowerPoint Presentation – ID:3225085 – #15

PPT – BY CA NAVEEN KHARIWAL .G Email id: h.c.khincha@gmail PowerPoint Presentation – ID:3225085 – #15

Buy Best Fucking Tax Advisor Ever-gift for Him-gift for Tax Advisor-tax Advisor Coffee Mug-tax Advisor Gift Idea-funny Tax Advisor Gifts Online in India – Etsy – #16

Buy Best Fucking Tax Advisor Ever-gift for Him-gift for Tax Advisor-tax Advisor Coffee Mug-tax Advisor Gift Idea-funny Tax Advisor Gifts Online in India – Etsy – #16

Rebate Of Rs 12,500 Only Available To Individuals With Taxable Income Not Exceeding Rs 5 Lakh – #17

Rebate Of Rs 12,500 Only Available To Individuals With Taxable Income Not Exceeding Rs 5 Lakh – #17

ITR : Disclosure and taxation of gifts received from brother? | Mint – #18

ITR : Disclosure and taxation of gifts received from brother? | Mint – #18

Buy CPA Gift Accountant Clock I’ll Sleep After Tax Season Bookkeeper Gifts for Women Funny Quote Gift 15-oz Coffee Mug Tea Cup 15 oz White Online at Low Prices in India – – #19

Buy CPA Gift Accountant Clock I’ll Sleep After Tax Season Bookkeeper Gifts for Women Funny Quote Gift 15-oz Coffee Mug Tea Cup 15 oz White Online at Low Prices in India – – #19

COMPANY SECRETARY CUM FINANCE MANAGER KSDC FOR SC AND ST LTD : page 5 – Kerala PSC Question Paper – #20

COMPANY SECRETARY CUM FINANCE MANAGER KSDC FOR SC AND ST LTD : page 5 – Kerala PSC Question Paper – #20

Bal Raksha Bharat (@balrakshabharat) • Instagram photos and videos – #21

Bal Raksha Bharat (@balrakshabharat) • Instagram photos and videos – #21

How money received via Will or Inheritance from abroad is taxed in India – Income Tax News | The Financial Express – #22

How money received via Will or Inheritance from abroad is taxed in India – Income Tax News | The Financial Express – #22

CBDT CIRCULATES GUIDELINES ON APPLICABILITY OF NEW TDS PROVISION REGARDING GIFTS, BENEFITS RECEIVED BY INFLUENCERS| DETAILS HERE – Vavo Digital – #23

CBDT CIRCULATES GUIDELINES ON APPLICABILITY OF NEW TDS PROVISION REGARDING GIFTS, BENEFITS RECEIVED BY INFLUENCERS| DETAILS HERE – Vavo Digital – #23

- gift tax

- simple deed of gift template

- interest tax

Perquisites: Meaning, Types, Calculation & Examples – Razorpay Payroll – #24

Perquisites: Meaning, Types, Calculation & Examples – Razorpay Payroll – #24

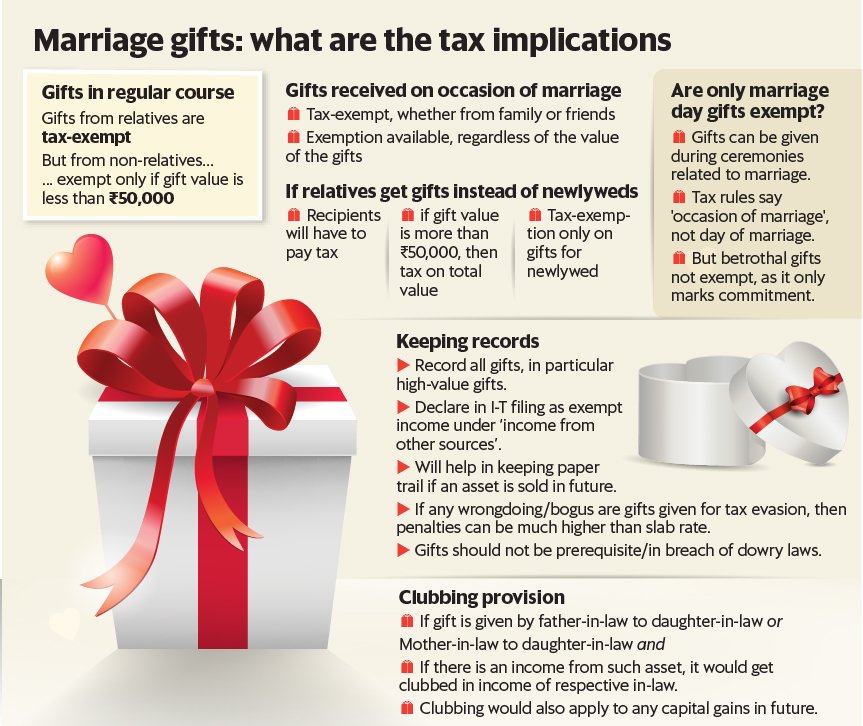

Income Tax on Marriage Gift: Taxation of Wedding Gifts Received – Section 56 – Tax2win – #25

Income Tax on Marriage Gift: Taxation of Wedding Gifts Received – Section 56 – Tax2win – #25

18. Tax treatment of gifts – TAX TREATMENT OF GIFTS RECEIVED BY AN INDIVIDUAL OR HUF A very common – Studocu – #26

18. Tax treatment of gifts – TAX TREATMENT OF GIFTS RECEIVED BY AN INDIVIDUAL OR HUF A very common – Studocu – #26

Direct vs Indirect Tax System in India – YouTube – #27

Direct vs Indirect Tax System in India – YouTube – #27

But what about the railways …?’ The myth of Britain’s gifts to India | Colonialism | The Guardian – #28

But what about the railways …?’ The myth of Britain’s gifts to India | Colonialism | The Guardian – #28

ITAT Restricts Sec. 69A Additions as It Was Impossible for NRI to Furnish Evidence for Cash Gifts Received on Marriage – Vinay Vohra & Co. – Chartered Accountants – #29

ITAT Restricts Sec. 69A Additions as It Was Impossible for NRI to Furnish Evidence for Cash Gifts Received on Marriage – Vinay Vohra & Co. – Chartered Accountants – #29

Pay Zero Tax for 12 Lakhs Income Tax Slab in FY 2023-24 – #30

Pay Zero Tax for 12 Lakhs Income Tax Slab in FY 2023-24 – #30

Addition u/s 69A deleted as receipt of gifts in cash on various occasions is common – #31

Addition u/s 69A deleted as receipt of gifts in cash on various occasions is common – #31

A taxing situation – India Today – #32

A taxing situation – India Today – #32

What Is Gift Deed: Tax Liabilities, Formalities, Format – #33

What Is Gift Deed: Tax Liabilities, Formalities, Format – #33

Knowledge Tank – Accounting and Goods & Service Tax – #34

Knowledge Tank – Accounting and Goods & Service Tax – #34

CA Arjit Agarwal – Article on the definition of Relatives for purpose of Gift under Income Tax Act 1961 published in Eastern India Regional Council (EIRC) of Institute of Chartered Accountants of – #35

CA Arjit Agarwal – Article on the definition of Relatives for purpose of Gift under Income Tax Act 1961 published in Eastern India Regional Council (EIRC) of Institute of Chartered Accountants of – #35

What do you understand by GIFT TAX? – Consult CA Online – #36

What do you understand by GIFT TAX? – Consult CA Online – #36

- service tax

- gift chart as per income tax

- gift tax act 1958

Income Tax on Gift – #37

Income Tax on Gift – #37

Arun Jaitley: Gifts to trusts for benefit of kin exempted from tax – The Economic Times – #38

Arun Jaitley: Gifts to trusts for benefit of kin exempted from tax – The Economic Times – #38

If my brother transfers money in my account, say 50 lakhs, will it be taxable in India? – Quora – #39

If my brother transfers money in my account, say 50 lakhs, will it be taxable in India? – Quora – #39

- gift tax meaning

- money gift deed format

- gift tax exemption

When is money gifted not taxable? All your tax queries on gifts answered | Personal Finance – Business Standard – #40

When is money gifted not taxable? All your tax queries on gifts answered | Personal Finance – Business Standard – #40

Income Tax on Diwali Gifts & Other Gifts – Live TV Show – YouTube – #41

Income Tax on Diwali Gifts & Other Gifts – Live TV Show – YouTube – #41

How to Ensure Cash Gifts from Parents and Relatives Won’t Land you in Tax Trouble – #42

How to Ensure Cash Gifts from Parents and Relatives Won’t Land you in Tax Trouble – #42

IRS Form 709 | H&R Block – #43

IRS Form 709 | H&R Block – #43

Best Gift for Friend’s Marriage – Between Boxes Gifts – #44

Best Gift for Friend’s Marriage – Between Boxes Gifts – #44

Amount received as gift by any blood relative living in US is not taxable in India – Scripbox – #45

Amount received as gift by any blood relative living in US is not taxable in India – Scripbox – #45

Taxability of Gifts to NRIs from Resident Indians – TaxReturnWala – #46

Taxability of Gifts to NRIs from Resident Indians – TaxReturnWala – #46

Inheriting Property: India-US tax impact on gifts received by Indian Americans – Times of India – #47

Inheriting Property: India-US tax impact on gifts received by Indian Americans – Times of India – #47

Gift Tax In India – New 2020 Rules of Income Tax on Gifts – #48

Gift Tax In India – New 2020 Rules of Income Tax on Gifts – #48

- gift tax rate in india 2022-23

- gift tax exemption 2022

- gift tax rate in india 2020

Do You Pay Taxes on Gifts From Parents? (2023 and 2024) | SmartAsset – #49

Do You Pay Taxes on Gifts From Parents? (2023 and 2024) | SmartAsset – #49

Gift Deed Vs Will: Which is a better option for property transfer – #50

Gift Deed Vs Will: Which is a better option for property transfer – #50

- gift tax exemption relatives list

- estate tax

- gift tax definition

What are the legal provisions for gifting a share of Indian business to an NRI s | Mint – #51

What are the legal provisions for gifting a share of Indian business to an NRI s | Mint – #51

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #52

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #52

Gift Deed Stamp Duty and Registration Fee Calculator – #53

Gift Deed Stamp Duty and Registration Fee Calculator – #53

GIFT DEED REGISTRATION » Shreeyansh Legal – #54

GIFT DEED REGISTRATION » Shreeyansh Legal – #54

Small Business Expenses & Tax Deductions (2023) | QuickBooks – #55

Small Business Expenses & Tax Deductions (2023) | QuickBooks – #55

Tax Deducted at Source (TDS) | TDS clarity on business gifts, vouchers – Telegraph India – #56

Tax Deducted at Source (TDS) | TDS clarity on business gifts, vouchers – Telegraph India – #56

How are gifts taxed in India? – #57

How are gifts taxed in India? – #57

What is a Gift Tax and What are its Rates and Exemptions? | Fi Money – #58

What is a Gift Tax and What are its Rates and Exemptions? | Fi Money – #58

Regulations Related to Gift Tax in India – #59

Regulations Related to Gift Tax in India – #59

I received gifts during my wedding, are they taxable? – #60

I received gifts during my wedding, are they taxable? – #60

Corporate Taxes in Germany in 2023: Types, Filing Tax Return & Benefits – #61

Corporate Taxes in Germany in 2023: Types, Filing Tax Return & Benefits – #61

Fortune India: Business News, Strategy, Finance and Corporate Insight – #62

Fortune India: Business News, Strategy, Finance and Corporate Insight – #62

Income Tax Compliance – Ashutosh Financial Services Pvt. Ltd. – #63

Income Tax Compliance – Ashutosh Financial Services Pvt. Ltd. – #63

Union Bank Gift Cards: Convenient and Versatile Gifting Options – #64

Union Bank Gift Cards: Convenient and Versatile Gifting Options – #64

In Japan, People Choose Where to Pay Taxes Based on Thank-You Gifts – WSJ – #65

In Japan, People Choose Where to Pay Taxes Based on Thank-You Gifts – WSJ – #65

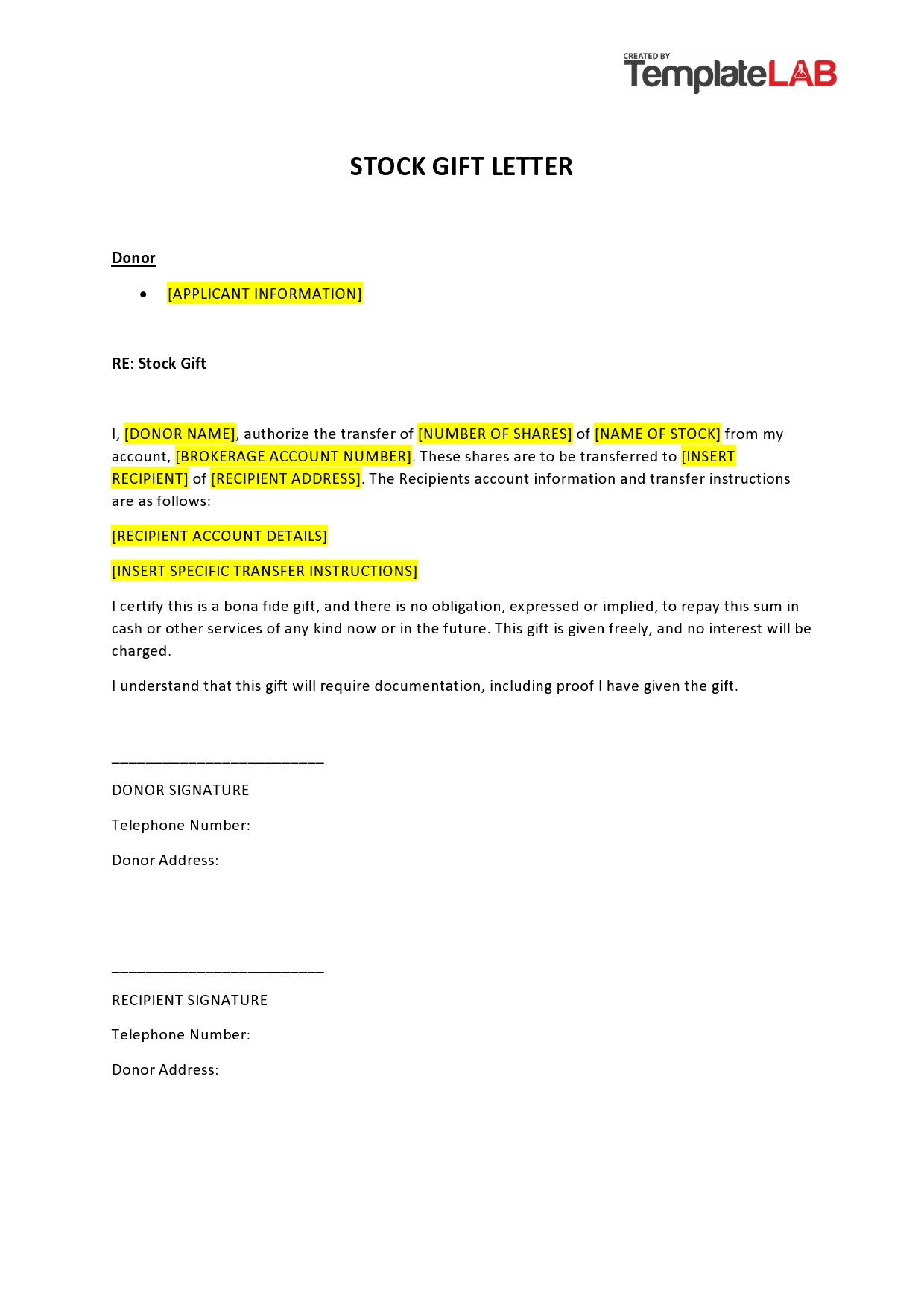

35 Best Gift Letter Templates (Word & PDF) ᐅ TemplateLab – #66

35 Best Gift Letter Templates (Word & PDF) ᐅ TemplateLab – #66

All You Need To Know About Gifting Property And Gift Deed Rules – #67

All You Need To Know About Gifting Property And Gift Deed Rules – #67

What is the limit up to which a father can gift to his son under income tax laws | Mint – #68

What is the limit up to which a father can gift to his son under income tax laws | Mint – #68

LawStreet Journal – The gifts received by newly-wed couples from their immediate family are not taxable in India. Be it cash, stock, jewelry, house, or property, regardless of its value such wedding – #69

LawStreet Journal – The gifts received by newly-wed couples from their immediate family are not taxable in India. Be it cash, stock, jewelry, house, or property, regardless of its value such wedding – #69

Weddings and money: Gifts of gold are not taxed, but… – #70

Weddings and money: Gifts of gold are not taxed, but… – #70

What is Tax? Tax Meaning and Types of Taxation in India – #71

What is Tax? Tax Meaning and Types of Taxation in India – #71

Diwali season: Do you have to pay tax on gifts received ? | Personal Finance – Business Standard – #72

Diwali season: Do you have to pay tax on gifts received ? | Personal Finance – Business Standard – #72

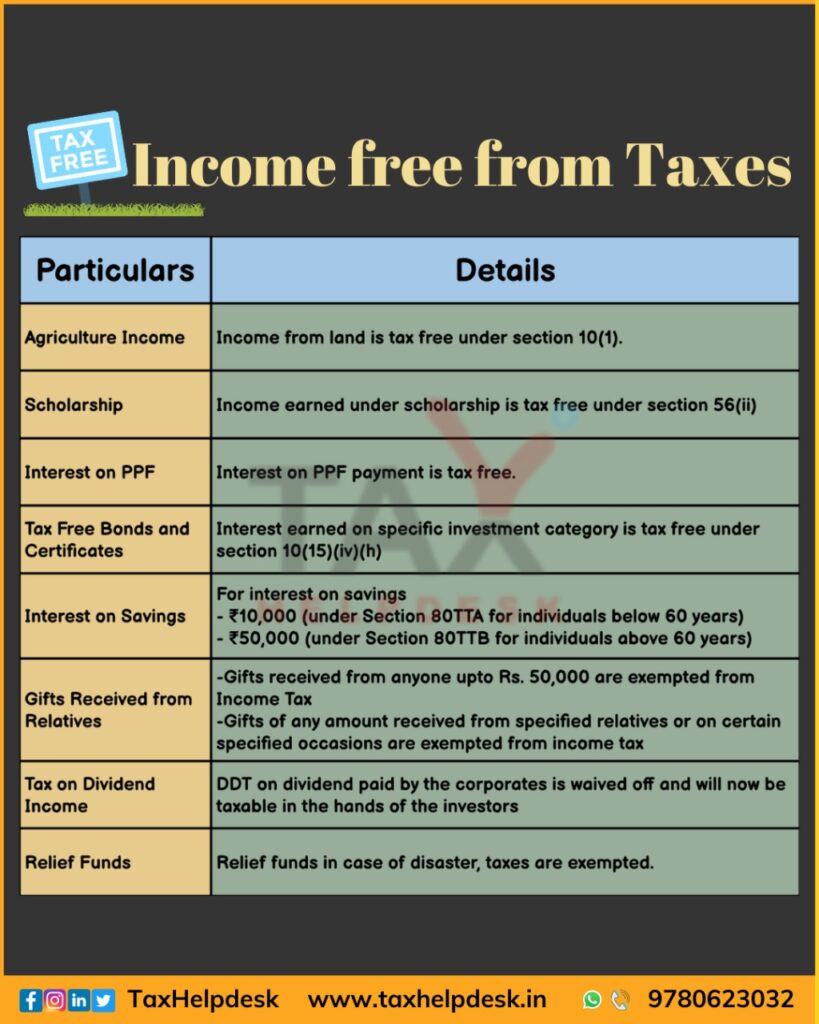

11 Tax-Free Income Sources In India (2023 Update) – #73

11 Tax-Free Income Sources In India (2023 Update) – #73

15 Tax Saving Options Other Than Section 80C – #74

15 Tax Saving Options Other Than Section 80C – #74

What is gift tax? – Quora – #75

What is gift tax? – Quora – #75

Gift Tax: Types, Rules, Exemptions, and more. – #76

Gift Tax: Types, Rules, Exemptions, and more. – #76

What is Wealth Tax in India? – #77

What is Wealth Tax in India? – #77

About Income Tax | PDF – #78

About Income Tax | PDF – #78

Office of Shree Tax Chambers on X: “Hot Off the Press!! May check today’s Deccan Herald’s National Edition Pg 9 | Shree’s ‘Got Deepavali Gifts? Know their tax implications’ appeared. Truly a – #79

Office of Shree Tax Chambers on X: “Hot Off the Press!! May check today’s Deccan Herald’s National Edition Pg 9 | Shree’s ‘Got Deepavali Gifts? Know their tax implications’ appeared. Truly a – #79

Buy I Became a Tax Controller Shot Glass Tax Controller Gifts Funny Novelty Birthday Present Idea Online in India – Etsy – #80

Buy I Became a Tax Controller Shot Glass Tax Controller Gifts Funny Novelty Birthday Present Idea Online in India – Etsy – #80

Types of Taxes in India 2024 – Fincash – #81

Types of Taxes in India 2024 – Fincash – #81

Dealer incentives like foreign trips, gifts to get taxed now – The Hindu BusinessLine – #82

Dealer incentives like foreign trips, gifts to get taxed now – The Hindu BusinessLine – #82

What Is The Tax Liability On Gifts Received? – #83

What Is The Tax Liability On Gifts Received? – #83

Can a Gift Deed be challenged in India? – NRI Legal Services – #84

Can a Gift Deed be challenged in India? – NRI Legal Services – #84

Taxation on Gifts – by Jia – JJ Tax Blog – #85

Taxation on Gifts – by Jia – JJ Tax Blog – #85

Tax Reform in India – #86

Tax Reform in India – #86

Tax on gifts India I Received high-value gifts from friends & family? Know how they are taxed | Business News – #87

Tax on gifts India I Received high-value gifts from friends & family? Know how they are taxed | Business News – #87

) Sec. 68 additions justified as donors confirmed that they arranged gifts on receipt of commission: Madras HC – #88

Sec. 68 additions justified as donors confirmed that they arranged gifts on receipt of commission: Madras HC – #88

Income Tax News: Hurray, Zero Tax Zone! Check Out 5 Incomes Exempt from Income Tax, Details – #89

Income Tax News: Hurray, Zero Tax Zone! Check Out 5 Incomes Exempt from Income Tax, Details – #89

HC asks Yunus to pay Tk 12cr tax on gifts to 3 charitable trusts – #90

HC asks Yunus to pay Tk 12cr tax on gifts to 3 charitable trusts – #90

) Gifts & Income Tax Implications : Scenarios & Examples – #91

Gifts & Income Tax Implications : Scenarios & Examples – #91

- expenditure tax act

- wealth tax

- lineal ascendant gift from relative exempt from income tax

How can NRIs in the US gift money to their parents in India in 2023? | Arthgyaan – #92

How can NRIs in the US gift money to their parents in India in 2023? | Arthgyaan – #92

Giving Or Receiving A Down Payment Gift? Here’s What You Need To Know – #93

Giving Or Receiving A Down Payment Gift? Here’s What You Need To Know – #93

Inheritance and gift tax rates – #94

Inheritance and gift tax rates – #94

- gift tax upsc

- list of relatives

- gift deed format father to son

Giving to India? Compliance with the Newly Amended FCRA – CAF America – #95

Giving to India? Compliance with the Newly Amended FCRA – CAF America – #95

Understanding Section 2(24) of the Income Tax Act: Definition of Income for Taxation Purposes – Marg ERP Blog – #96

Understanding Section 2(24) of the Income Tax Act: Definition of Income for Taxation Purposes – Marg ERP Blog – #96

) GIFT TAX – UPSC Current Affairs – IAS GYAN – #97

GIFT TAX – UPSC Current Affairs – IAS GYAN – #97

Case Digest on Demonetization and Deposits – #98

Case Digest on Demonetization and Deposits – #98

How to calculate income tax on gifts from relatives? – #99

How to calculate income tax on gifts from relatives? – #99

Gifting movable, immovable properties or cash through Gift Deed this Diwali? Know how they will be taxed – Money News | The Financial Express – #100

Gifting movable, immovable properties or cash through Gift Deed this Diwali? Know how they will be taxed – Money News | The Financial Express – #100

How Do You Report Crypto Taxes in India? | 8 Easy Steps – #101

How Do You Report Crypto Taxes in India? | 8 Easy Steps – #101

What is the tax on gifts in India? – #102

What is the tax on gifts in India? – #102

Income Tax for NRIs in India – Rules, Exemptions & Deductions – Tax2win – #103

Income Tax for NRIs in India – Rules, Exemptions & Deductions – Tax2win – #103

Re-Ment Miniature Hometown Tax Return Gifts Japan India | Ubuy – #104

Re-Ment Miniature Hometown Tax Return Gifts Japan India | Ubuy – #104

Achiever Spot – #105

Achiever Spot – #105

TCS on Foreign Remittances towards LRS Foreign Travel Overseas Tour Packages – #106

TCS on Foreign Remittances towards LRS Foreign Travel Overseas Tour Packages – #106

Navigating Income Tax & Taxation on Gifts Received in India – 1 Finance Blog – #107

Navigating Income Tax & Taxation on Gifts Received in India – 1 Finance Blog – #107

- expenditure tax

The Best Ways to Give Money for the Holidays, at Any Age – WSJ – #108

The Best Ways to Give Money for the Holidays, at Any Age – WSJ – #108

-Gifts.jpg) Income from other sources: Definition, types and applicable tax rates – #109

Income from other sources: Definition, types and applicable tax rates – #109

Wealth Tax India: Who needs to pay and its history – #110

Wealth Tax India: Who needs to pay and its history – #110

Gifting Money to Family Members: 5 Strategies to Understand – Kindness Financial Planning – #111

Gifting Money to Family Members: 5 Strategies to Understand – Kindness Financial Planning – #111

NRI Tax Services in India, Non Resident Indian – NRI Income Tax Return – #112

NRI Tax Services in India, Non Resident Indian – NRI Income Tax Return – #112

Income Tax Slab FY 2023-24 and AY 2024-25 – New and Old Regime Tax Rates | HDFC Life – #113

Income Tax Slab FY 2023-24 and AY 2024-25 – New and Old Regime Tax Rates | HDFC Life – #113

When Should I Use My Estate and Gift Tax Exemption? – #114

When Should I Use My Estate and Gift Tax Exemption? – #114

Did you give gifts? Know the IRS regulations and Tax Implications – #115

Did you give gifts? Know the IRS regulations and Tax Implications – #115

The Future Consulties – #116

The Future Consulties – #116

All about Income Tax on Gift Received From Parents. – #117

All about Income Tax on Gift Received From Parents. – #117

Buy Delicate Tales Gift Box Online in India | Zariin – #118

Buy Delicate Tales Gift Box Online in India | Zariin – #118

Maximize Your Income: Tax Implications on Earnings Over 12 Lakh – #119

Maximize Your Income: Tax Implications on Earnings Over 12 Lakh – #119

A Mini-Guide for Handling Holiday Bonuses and Gifts | SPARK Blog | ADP – #120

A Mini-Guide for Handling Holiday Bonuses and Gifts | SPARK Blog | ADP – #120

Inherited Gold Jewellery Of Reasonable Value Will Not Fall Under Tax Scrutiny – #121

Inherited Gold Jewellery Of Reasonable Value Will Not Fall Under Tax Scrutiny – #121

Gift Tax: Tax on gifts: Documents that you should have while filing ITR – The Economic Times – #122

Gift Tax: Tax on gifts: Documents that you should have while filing ITR – The Economic Times – #122

Income tax filing: Are gifts taxable? Frequently asked questions on gift taxes | Zee Business – #123

Income tax filing: Are gifts taxable? Frequently asked questions on gift taxes | Zee Business – #123

Transfer by Gift deed is not taxable – Property lawyers in India | Gifts, Place card holders, Legal services – #124

Transfer by Gift deed is not taxable – Property lawyers in India | Gifts, Place card holders, Legal services – #124

Indian Customs Guide – How to Avoid Customs Duty in India? – #125

Indian Customs Guide – How to Avoid Customs Duty in India? – #125

A Step-By-Step Guide For Remitting Gift Money To UK From India – #126

A Step-By-Step Guide For Remitting Gift Money To UK From India – #126

Gift Tax: What it is and How Gifts are taxed in India – #127

Gift Tax: What it is and How Gifts are taxed in India – #127

Amaram By Ghasitaram Kaju Katli Sweets Gift, 1000G – Walmart.com – #128

Amaram By Ghasitaram Kaju Katli Sweets Gift, 1000G – Walmart.com – #128

Tax Treatment for gifts received from relatives – MN & Associates – #129

Tax Treatment for gifts received from relatives – MN & Associates – #129

India’s new budget closes NRI tax loophole: Gifts from residents now taxable | India – Gulf News – #130

India’s new budget closes NRI tax loophole: Gifts from residents now taxable | India – Gulf News – #130

Outstanding Tax Demands Up To Rs 1 lakh Waived; Wealth, Gift Tax Exempted; Know Full Details – #131

Outstanding Tax Demands Up To Rs 1 lakh Waived; Wealth, Gift Tax Exempted; Know Full Details – #131

What the Income Tax rate was 40 years ago – Rediff.com – #132

What the Income Tax rate was 40 years ago – Rediff.com – #132

Is there a limit in income tax laws up to which a father can gift to his son – #133

Is there a limit in income tax laws up to which a father can gift to his son – #133

Gifts given to some relatives are tax-exempt | Mint – #134

Gifts given to some relatives are tax-exempt | Mint – #134

Budget 2022 Live Updates: Big Gifts You Can Get in Income Tax From Budget TAXCONCEPT – #135

Budget 2022 Live Updates: Big Gifts You Can Get in Income Tax From Budget TAXCONCEPT – #135

-thumbnailImg-7442ea6c-8ccf-41c8-9626-008ebee2a92d.png) Buy I Became a Tax Administrator Mug Coffee Cup Tax Administrator Gifts Funny Novelty Birthday Present Idea Online in India – Etsy – #136

Buy I Became a Tax Administrator Mug Coffee Cup Tax Administrator Gifts Funny Novelty Birthday Present Idea Online in India – Etsy – #136

Vinayak Khattar, Author at Ourtaxpartner.com – #137

Vinayak Khattar, Author at Ourtaxpartner.com – #137

Be Less Scrooge this Christmas – Tax Free Gifts – #138

Be Less Scrooge this Christmas – Tax Free Gifts – #138

tax on diwali gifts: Will you be taxed on Diwali gifts received? Check how various sources of gifts will be taxed – The Economic Times – #139

tax on diwali gifts: Will you be taxed on Diwali gifts received? Check how various sources of gifts will be taxed – The Economic Times – #139

How to ensure your Gifts are exempted from Gift Tax in India? – #140

How to ensure your Gifts are exempted from Gift Tax in India? – #140

Tax Court details gift tax return adequate disclosure requirement: PwC – #141

Tax Court details gift tax return adequate disclosure requirement: PwC – #141

Know about the Income Tax Laws in India Regarding gifts in Cash | Income Tax Laws: पिता की ओर से बेटे को दिए गए गिफ्ट पर क्या है IT नियम, जानिए कितना – #142

Know about the Income Tax Laws in India Regarding gifts in Cash | Income Tax Laws: पिता की ओर से बेटे को दिए गए गिफ्ट पर क्या है IT नियम, जानिए कितना – #142

How to File ITR (Income Tax Returns) on ClearTax? – Income Tax e-Filing Guide For FY 2022-23 – #143

How to File ITR (Income Tax Returns) on ClearTax? – Income Tax e-Filing Guide For FY 2022-23 – #143

Taxation on Cryptocurrency: Guide To Crypto Taxes in India 2024 – #144

Taxation on Cryptocurrency: Guide To Crypto Taxes in India 2024 – #144

How to Transfer Inheritance to US From India? | Unimoni.in – #145

How to Transfer Inheritance to US From India? | Unimoni.in – #145

Are the income tax slabs justified in our country? – Quora – #146

Are the income tax slabs justified in our country? – Quora – #146

Buy Taxation of Estates, Gifts and Trusts (American Casebook Series) Book Online at Low Prices in India | Taxation of Estates, Gifts and Trusts (American Casebook Series) Reviews & Ratings – Amazon.in – #147

Buy Taxation of Estates, Gifts and Trusts (American Casebook Series) Book Online at Low Prices in India | Taxation of Estates, Gifts and Trusts (American Casebook Series) Reviews & Ratings – Amazon.in – #147

How to file taxes in 2024 | CNN Underscored Money – #148

How to file taxes in 2024 | CNN Underscored Money – #148

Charging Low Fee, Offering or Accepting Gifts would amount to Breach of Ethics by CA, says ICAI’s Proposed Code of Ethics | Taxscan – #149

Charging Low Fee, Offering or Accepting Gifts would amount to Breach of Ethics by CA, says ICAI’s Proposed Code of Ethics | Taxscan – #149

Small Business Tax Planning, Courtyard by Marriott Pigeon Forge, TN, 13 February – #150

Small Business Tax Planning, Courtyard by Marriott Pigeon Forge, TN, 13 February – #150

Buy Tax Season Mug, Tax Season Gift, Tax Preparer Gift, Tax Accountant Gift, Funny Tax Gifts, No Crying Tax, Tax Accountant Mug Online in India – Etsy – #151

Buy Tax Season Mug, Tax Season Gift, Tax Preparer Gift, Tax Accountant Gift, Funny Tax Gifts, No Crying Tax, Tax Accountant Mug Online in India – Etsy – #151

Nitika Khiwani Sood on LinkedIn: #taxation #taxcompliance #marriagetips # gifts – #152

Nitika Khiwani Sood on LinkedIn: #taxation #taxcompliance #marriagetips # gifts – #152

Tax on gifts and inheritances | ATO Community – #153

Tax on gifts and inheritances | ATO Community – #153

Posts: tax on gifts in india

Categories: Gifts

Author: toyotabienhoa.edu.vn