Aggregate 144+ tax on gift from relatives latest

Share images of tax on gift from relatives by website toyotabienhoa.edu.vn compilation. Stretch the Gift Tax Limit with Education or Health Care. 11 Charts on Taxing the Wealthy and Corporations – Institute for Policy Studies. A relative wants to gift cash to me. What are the income tax implications? | Mint. Your queries: Income Tax; You have to pay tax when you sell a gift received from a relative – Income Tax News | The Financial Express

Income tax on gift received | Gift deed | Gift tax | CA Neha Gupta – YouTube – #1

Income tax on gift received | Gift deed | Gift tax | CA Neha Gupta – YouTube – #1

Family Gifting Made Easy: The Gift Letter Explained – FasterCapital – #2

Family Gifting Made Easy: The Gift Letter Explained – FasterCapital – #2

How to Ensure Cash Gifts from Parents and Relatives Won’t Land you in Tax Trouble – #4

How to Ensure Cash Gifts from Parents and Relatives Won’t Land you in Tax Trouble – #4

The Generation-Skipping Transfer Tax: A Quick Guide – #5

The Generation-Skipping Transfer Tax: A Quick Guide – #5

Gifts are tax exempt in the hands of relatives | Mint – #6

Gifts are tax exempt in the hands of relatives | Mint – #6

What Income Tax Rules Says On Gifts Received From Family Members And Relatives Know Details | Income Tax: సొంత కుటుంబ సభ్యుల నుంచి బహుమతి తీసుకున్నా పన్ను కట్టాలా, రూల్స్ ఏం … – #7

What Income Tax Rules Says On Gifts Received From Family Members And Relatives Know Details | Income Tax: సొంత కుటుంబ సభ్యుల నుంచి బహుమతి తీసుకున్నా పన్ను కట్టాలా, రూల్స్ ఏం … – #7

REG: Becker asking me question that’s not covered in their book/lecture? This is NOT anywhere. WTF is gift-splitting. : r/CPA – #8

REG: Becker asking me question that’s not covered in their book/lecture? This is NOT anywhere. WTF is gift-splitting. : r/CPA – #8

![How to gift money to parents in India: Tax, Limits [2020] - Wise How to gift money to parents in India: Tax, Limits [2020] - Wise](https://corpbiz.io/learning/wp-content/uploads/2020/11/Exempted-Gifts-1024x768.png) How to gift money to parents in India: Tax, Limits [2020] – Wise – #10

How to gift money to parents in India: Tax, Limits [2020] – Wise – #10

Equity Shares: How to gift equity shares to relatives, what are the tax implications – The Economic Times – #11

Equity Shares: How to gift equity shares to relatives, what are the tax implications – The Economic Times – #11

- gift tax act 1958

- gift tax example

- gift tax exemption 2022

If I am gifted a land worth Rs. 35 lakh by non-blood relative, will I have to pay any tax on it after paying the duties? What is the complete process? – – #12

If I am gifted a land worth Rs. 35 lakh by non-blood relative, will I have to pay any tax on it after paying the duties? What is the complete process? – – #12

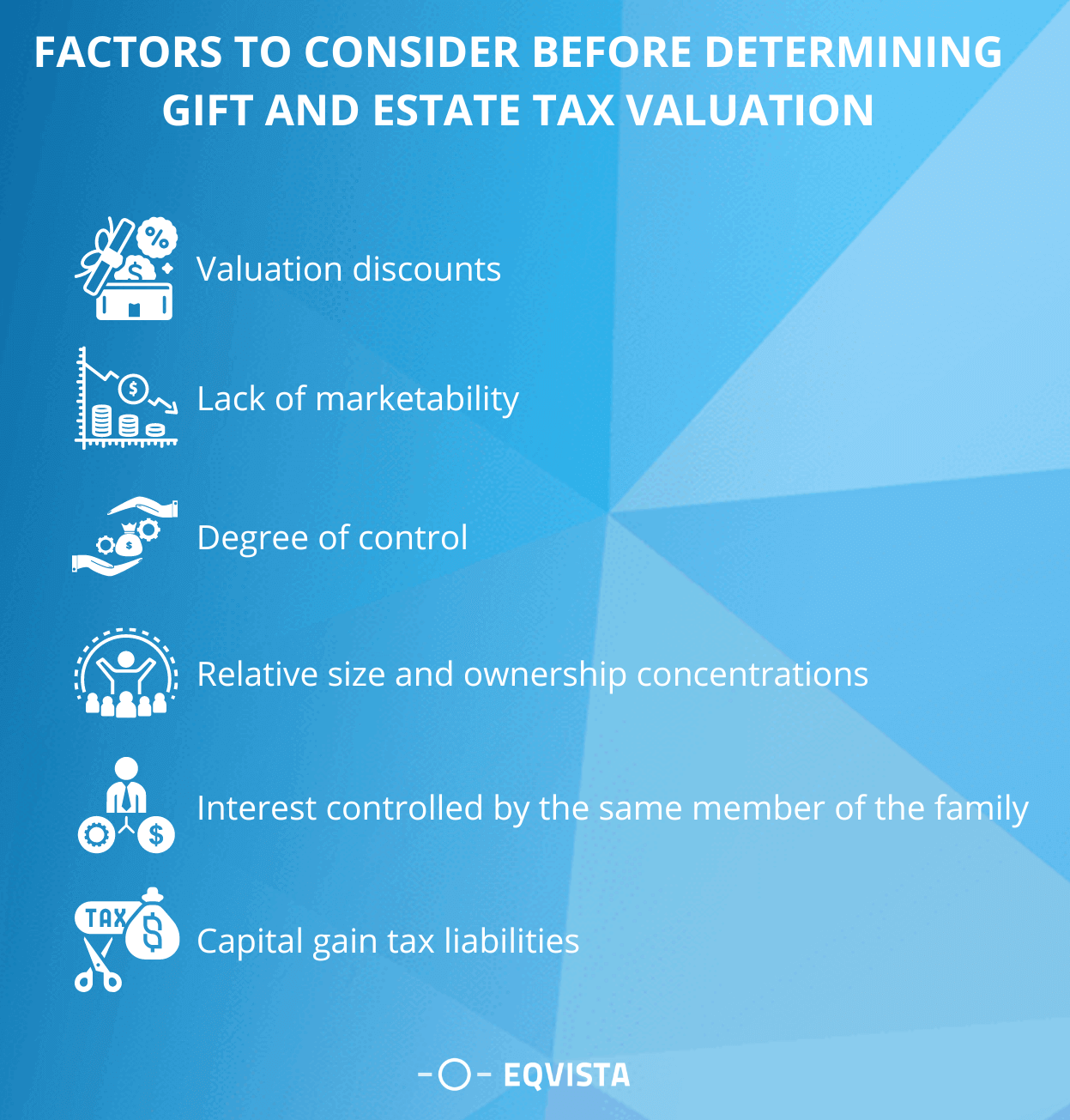

What Do You Need to Know Before Gifting Real Estate? – House of Wealth – #13

What Do You Need to Know Before Gifting Real Estate? – House of Wealth – #13

Estate Planning: Part One of a Lifelong Journey – RDG+Partners – #14

Estate Planning: Part One of a Lifelong Journey – RDG+Partners – #14

- money gift deed format

- section 56(2) of income tax act

- property gift deed

Money gifted by relative in bank account is not liable to tax – Chirag Nangia – Nangia Andersen India Pvt. Ltd. – #15

Money gifted by relative in bank account is not liable to tax – Chirag Nangia – Nangia Andersen India Pvt. Ltd. – #15

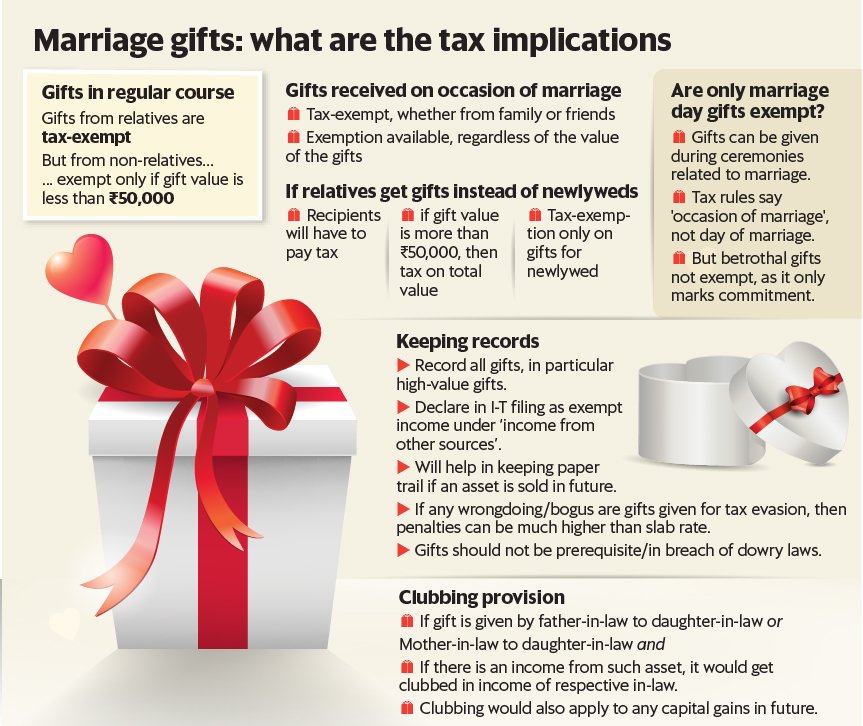

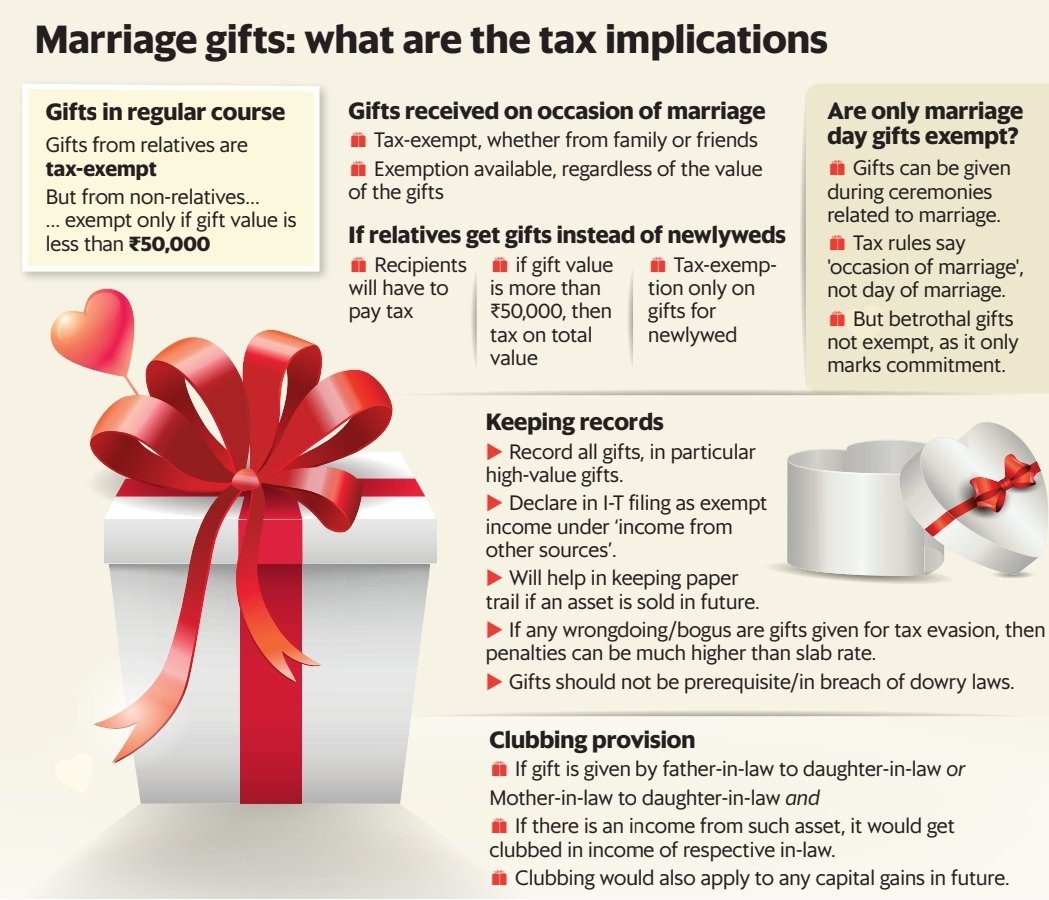

Stridhan: Income Tax Laws For Wedding Gifts That Every Indian Woman Must Know | HerZindagi – #16

Stridhan: Income Tax Laws For Wedding Gifts That Every Indian Woman Must Know | HerZindagi – #16

Solved or each of the following questions, assume you are in | Chegg.com – #17

Solved or each of the following questions, assume you are in | Chegg.com – #17

Income and Gift Tax Implications of Interest-Free Loans Between Relatives – #18

Income and Gift Tax Implications of Interest-Free Loans Between Relatives – #18

Cash received as gift from some relatives is tax exempt | Mint – #19

Cash received as gift from some relatives is tax exempt | Mint – #19

Income from other sources: Definition, types and applicable tax rates – #20

Income from other sources: Definition, types and applicable tax rates – #20

Will I have to pay Inheritance Tax on gifts & money given in my lifetime? – Total Legacy Care – #21

Will I have to pay Inheritance Tax on gifts & money given in my lifetime? – Total Legacy Care – #21

Gift Tax Limits and Exceptions: Advice From an Expert | Money – #22

Gift Tax Limits and Exceptions: Advice From an Expert | Money – #22

Income from Other Sources – CS Executive Tax Laws MCQs – GST Guntur – #23

Income from Other Sources – CS Executive Tax Laws MCQs – GST Guntur – #23

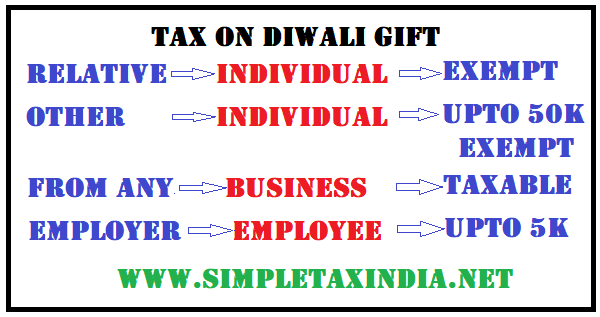

Your Diwali gift and bonus can be taxable: Know ways to avoid it – #24

Your Diwali gift and bonus can be taxable: Know ways to avoid it – #24

- gift tax rate in india 2022-23

If my brother transfers money in my account, say 50 lakhs, will it be taxable in India? – Quora – #25

If my brother transfers money in my account, say 50 lakhs, will it be taxable in India? – Quora – #25

TAX TREATMENT OF GIFTS RECEIVED BY AN INDIVIDUAL OR HUF Source @IncomeTaxIndia Thread 🧵 – Thread from Taxation Updates (Mayur J Sondagar) @TaxationUpdates – Rattibha – #26

TAX TREATMENT OF GIFTS RECEIVED BY AN INDIVIDUAL OR HUF Source @IncomeTaxIndia Thread 🧵 – Thread from Taxation Updates (Mayur J Sondagar) @TaxationUpdates – Rattibha – #26

Modal verb English as a second or foreign language Relative clause, Tax Bracket, english, text, divorce png | PNGWing – #27

Modal verb English as a second or foreign language Relative clause, Tax Bracket, english, text, divorce png | PNGWing – #27

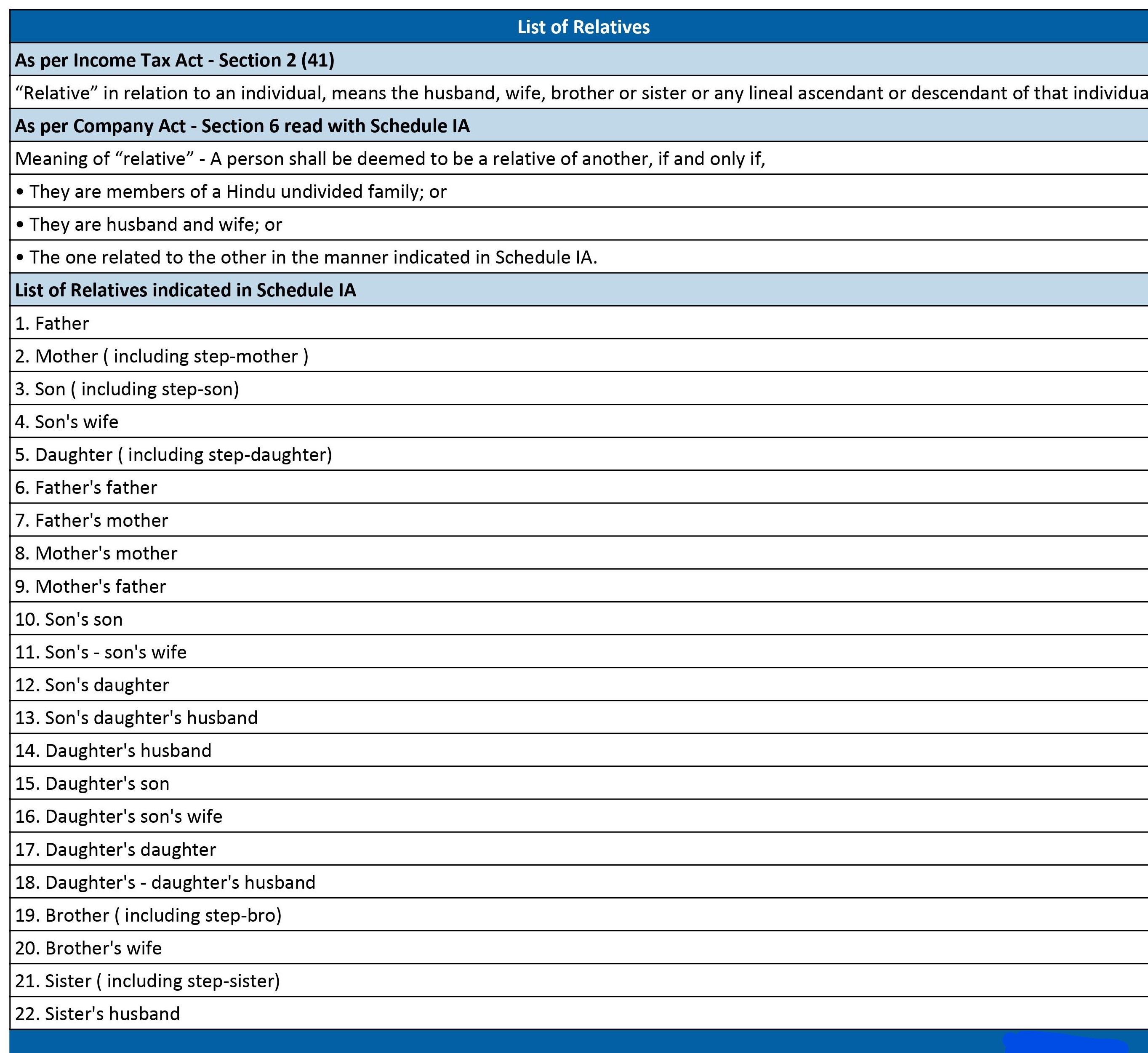

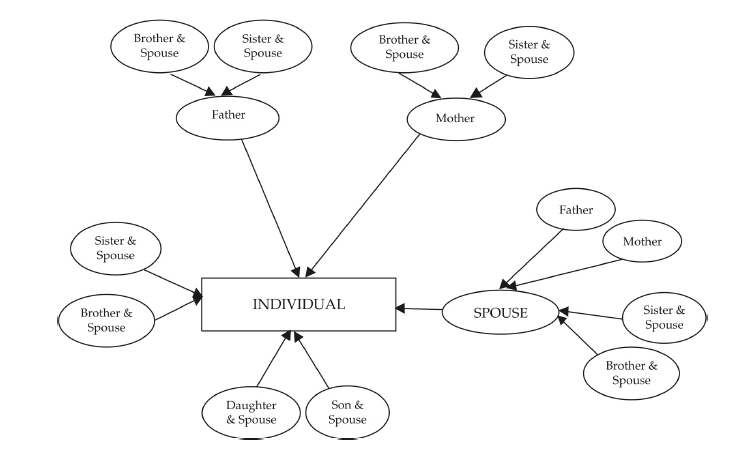

Meaning of relative under different act | CA Rajput Jain – #28

Meaning of relative under different act | CA Rajput Jain – #28

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Using Gift Money for a Down Payment in Kentucky For A Mortgage Loan – #29

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Using Gift Money for a Down Payment in Kentucky For A Mortgage Loan – #29

Now, Gift Received by NRI Non-Relative will be Taxable in India – #30

Now, Gift Received by NRI Non-Relative will be Taxable in India – #30

How are stocks gifted to your spouse taxed? | Mint – #31

How are stocks gifted to your spouse taxed? | Mint – #31

GIFT TAX | How gift tax in india | Gifts from Relative | Save tax on Gift – YouTube – #32

GIFT TAX | How gift tax in india | Gifts from Relative | Save tax on Gift – YouTube – #32

Gift from certain relatives is tax free in India | Mint – #33

Gift from certain relatives is tax free in India | Mint – #33

- list of relatives

- expenditure tax act

- service tax

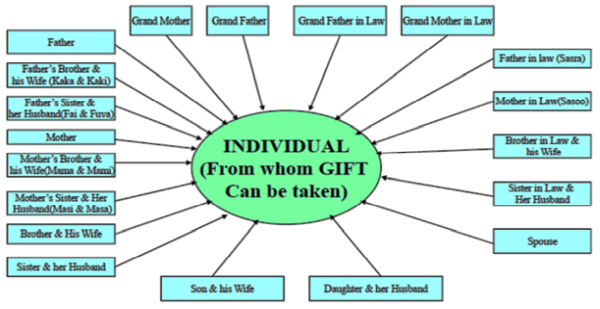

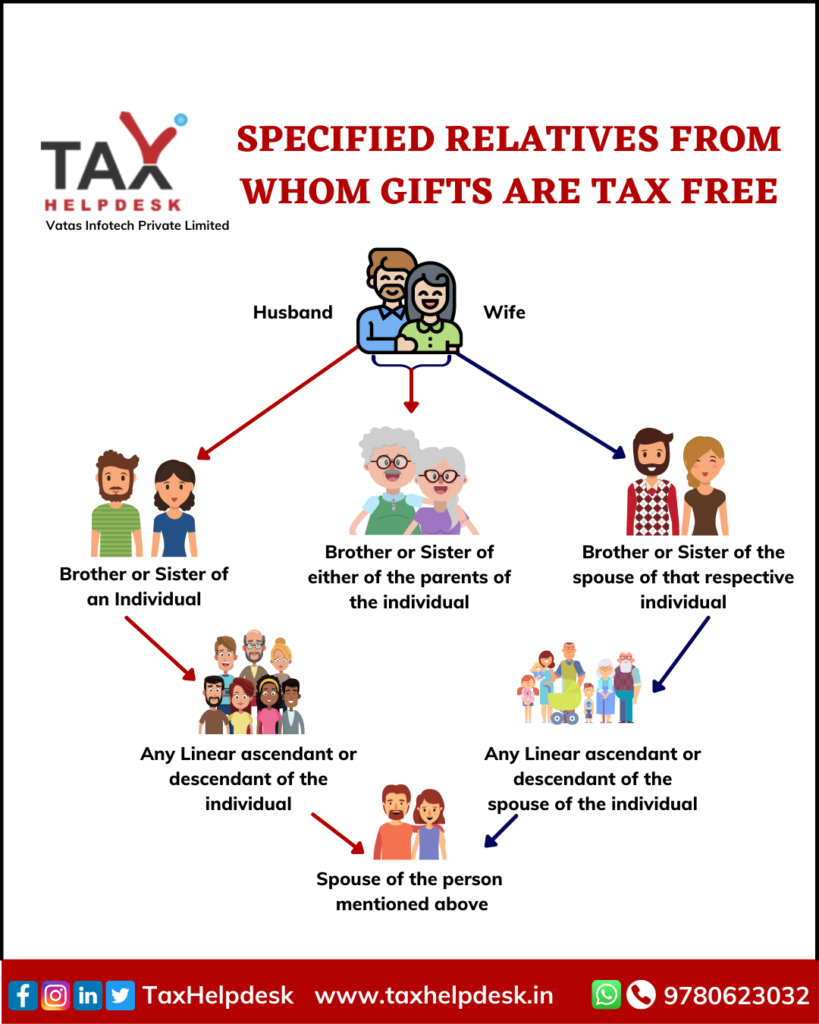

Relatives u/s 56(2)(vii) from whom Gift is permissible…… – Income Tax | Tax planning – #34

Relatives u/s 56(2)(vii) from whom Gift is permissible…… – Income Tax | Tax planning – #34

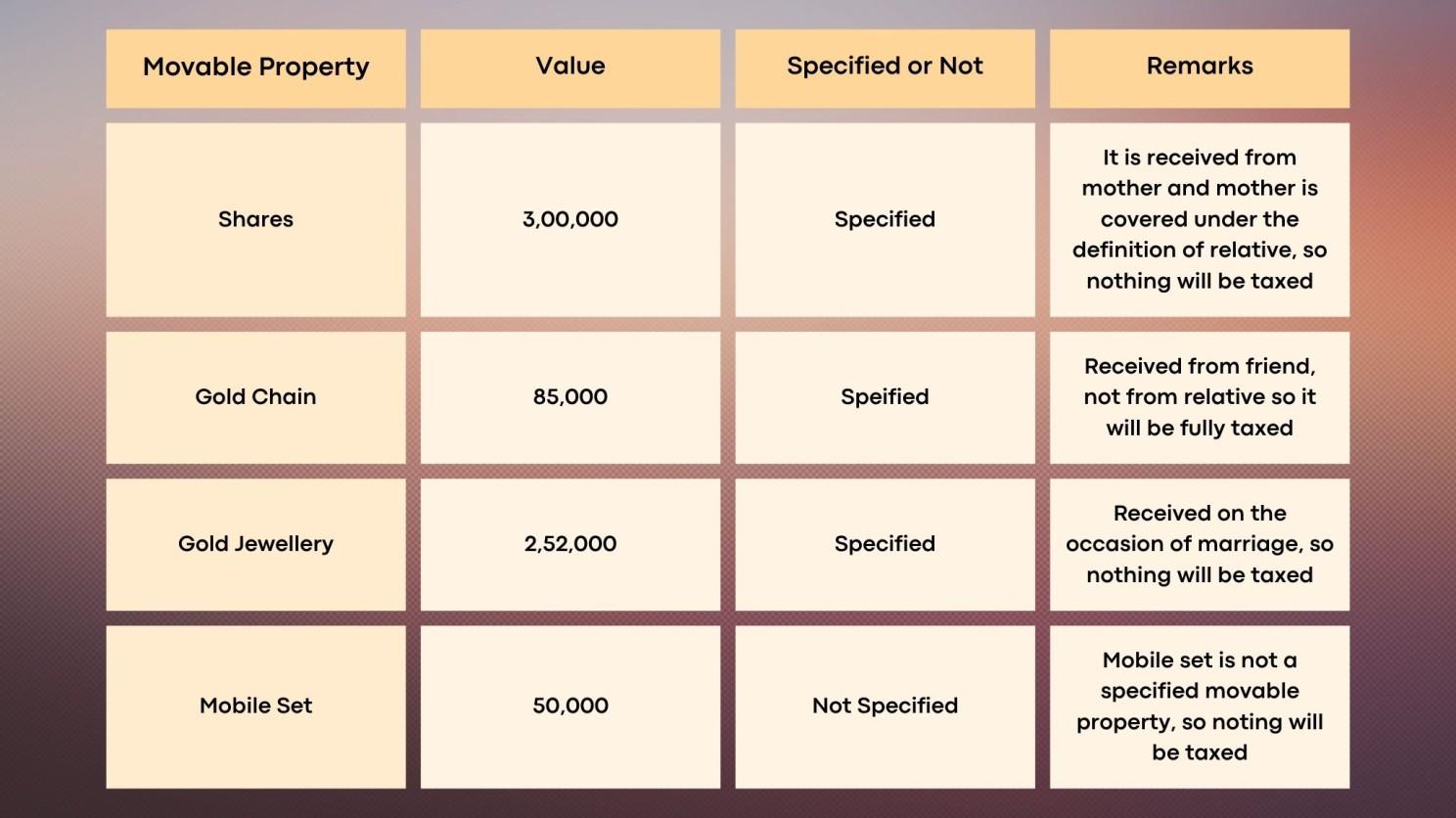

Understanding Section 56(2)(x) of the Income Tax Act: Taxation of Gifts Received Without Consideration or for Inadequate Consideration – Marg ERP Blog – #35

Understanding Section 56(2)(x) of the Income Tax Act: Taxation of Gifts Received Without Consideration or for Inadequate Consideration – Marg ERP Blog – #35

The Gift Tax Made Simple – TurboTax Tax Tips & Videos | PDF | Gift Tax In The United States | Estate Tax In The United States – #36

The Gift Tax Made Simple – TurboTax Tax Tips & Videos | PDF | Gift Tax In The United States | Estate Tax In The United States – #36

Farming Law & Tax Update ppt download – #37

Farming Law & Tax Update ppt download – #37

What’s The Limit On Cash Gifts From A Nonresident Alien? – #38

What’s The Limit On Cash Gifts From A Nonresident Alien? – #38

Want To Gift Ancestral Gold To Your Kin Or Sell It For Cash? Know The Taxation – #39

Want To Gift Ancestral Gold To Your Kin Or Sell It For Cash? Know The Taxation – #39

- gift chart as per income tax

- gift from relative exempt from income tax

- gift tax in india

FAQ: Is Tuition Exempt From The Gift Tax? – Estate and Probate Legal Group – #40

FAQ: Is Tuition Exempt From The Gift Tax? – Estate and Probate Legal Group – #40

The (Foreign) Gift That Keeps On Giving – IRS Penalties – #41

The (Foreign) Gift That Keeps On Giving – IRS Penalties – #41

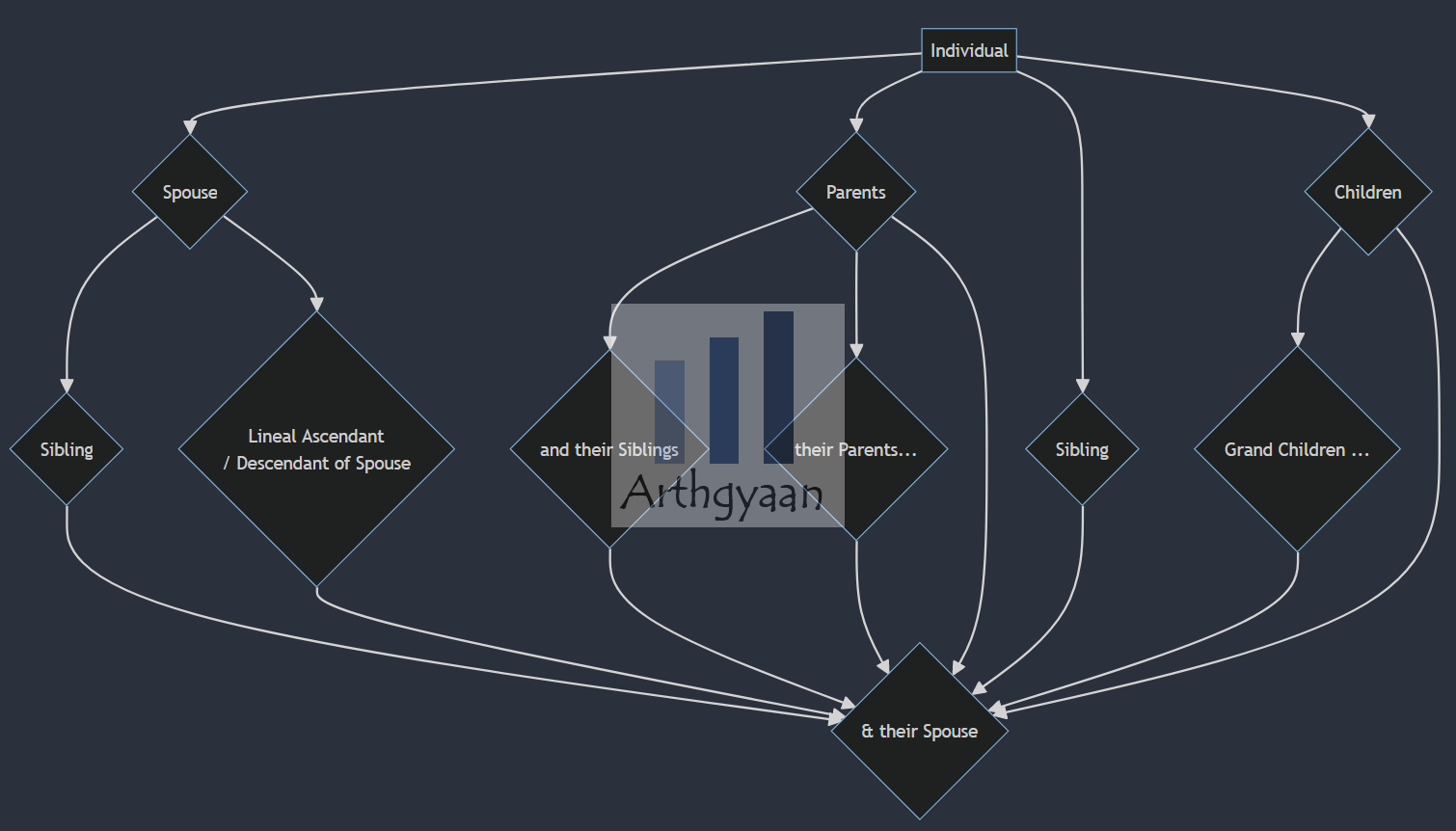

Who should invest in the name of parents to save tax? Who should not? | Arthgyaan – #42

Who should invest in the name of parents to save tax? Who should not? | Arthgyaan – #42

IT Rules On Gifts Income Tax On Gifts Received From Family Members And Relatives | Income Tax: ఎలాంటి బహుమతులపై ఇన్కం టాక్స్ కట్టక్కర్లేదు? – #43

IT Rules On Gifts Income Tax On Gifts Received From Family Members And Relatives | Income Tax: ఎలాంటి బహుమతులపై ఇన్కం టాక్స్ కట్టక్కర్లేదు? – #43

How to calculate income tax on gifts from relatives? – #44

How to calculate income tax on gifts from relatives? – #44

All about Income Tax on Gift Received From Parents. – #45

All about Income Tax on Gift Received From Parents. – #45

6114F4 – Acknowledgement Form For Acceptance Of Any Gift – Issaquah School District 411 – #46

6114F4 – Acknowledgement Form For Acceptance Of Any Gift – Issaquah School District 411 – #46

TCS on Foreign Remittances towards LRS Foreign Travel Overseas Tour Packages – #47

TCS on Foreign Remittances towards LRS Foreign Travel Overseas Tour Packages – #47

Gift Tax Limit 2024: How Much Money Can You Gift? | SmartAsset – #48

Gift Tax Limit 2024: How Much Money Can You Gift? | SmartAsset – #48

When are gifts received by NRIs subject to tax, TDS in India? – The Economic Times – #49

When are gifts received by NRIs subject to tax, TDS in India? – The Economic Times – #49

Inheritance Tax France – Ultimate Guide | Cameron James Expat Financial Advice – #50

Inheritance Tax France – Ultimate Guide | Cameron James Expat Financial Advice – #50

-Gifts.jpg) Income tax filing: Are gifts taxable? Frequently asked questions on gift taxes | Zee Business – #51

Income tax filing: Are gifts taxable? Frequently asked questions on gift taxes | Zee Business – #51

Gift Deed Registration: Tax Implications, Clauses & Format – #52

Gift Deed Registration: Tax Implications, Clauses & Format – #52

Taxes On Gifts From Overseas – #53

Taxes On Gifts From Overseas – #53

Inheritance Tax – Definition, How It Works, Estate Tax – #54

Inheritance Tax – Definition, How It Works, Estate Tax – #54

Tax queries: Gifts received from a relative are tax-exempt – The Economic Times – #55

Tax queries: Gifts received from a relative are tax-exempt – The Economic Times – #55

The Tax Consequences of a Down Payment Gift for a Mortgage – #56

The Tax Consequences of a Down Payment Gift for a Mortgage – #56

Gift To Huf By Member – File Taxes Online | Online Tax Services in India | Online E-tax Filing – #57

Gift To Huf By Member – File Taxes Online | Online Tax Services in India | Online E-tax Filing – #57

How to send money to my daughter in the USA without her having to pay tax – Quora – #58

How to send money to my daughter in the USA without her having to pay tax – Quora – #58

How IRS Can Tax ‘Gifts’ and Impose Big Penalties – #59

How IRS Can Tax ‘Gifts’ and Impose Big Penalties – #59

Is cashback on mobile wallets taxable? – #60

Is cashback on mobile wallets taxable? – #60

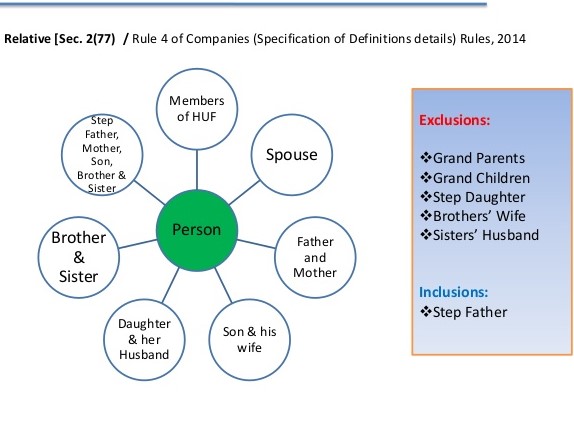

Analysis of definition of “Relative” under different Act – #61

Analysis of definition of “Relative” under different Act – #61

You Take a Friend on Your Yacht. Is It a Taxable Gift? – WSJ – #62

You Take a Friend on Your Yacht. Is It a Taxable Gift? – WSJ – #62

) Tax On Inherited Jewlery: What You Need To Know – #63

Tax On Inherited Jewlery: What You Need To Know – #63

Property Gift Deed Registration – Sample Format, Charges & Rules – #64

Property Gift Deed Registration – Sample Format, Charges & Rules – #64

Decoding wedding gift taxation in India: Know ways to exempt it – #65

Decoding wedding gift taxation in India: Know ways to exempt it – #65

Which ITR Form To Choose For Filing Income Tax Return? – #66

Which ITR Form To Choose For Filing Income Tax Return? – #66

Income Tax Return Filing – Alritz Consultancy – These are the situations where money without consideration, i.e., monetary gift received by an individual or HUF is not charged to tax | Facebook – #67

Income Tax Return Filing – Alritz Consultancy – These are the situations where money without consideration, i.e., monetary gift received by an individual or HUF is not charged to tax | Facebook – #67

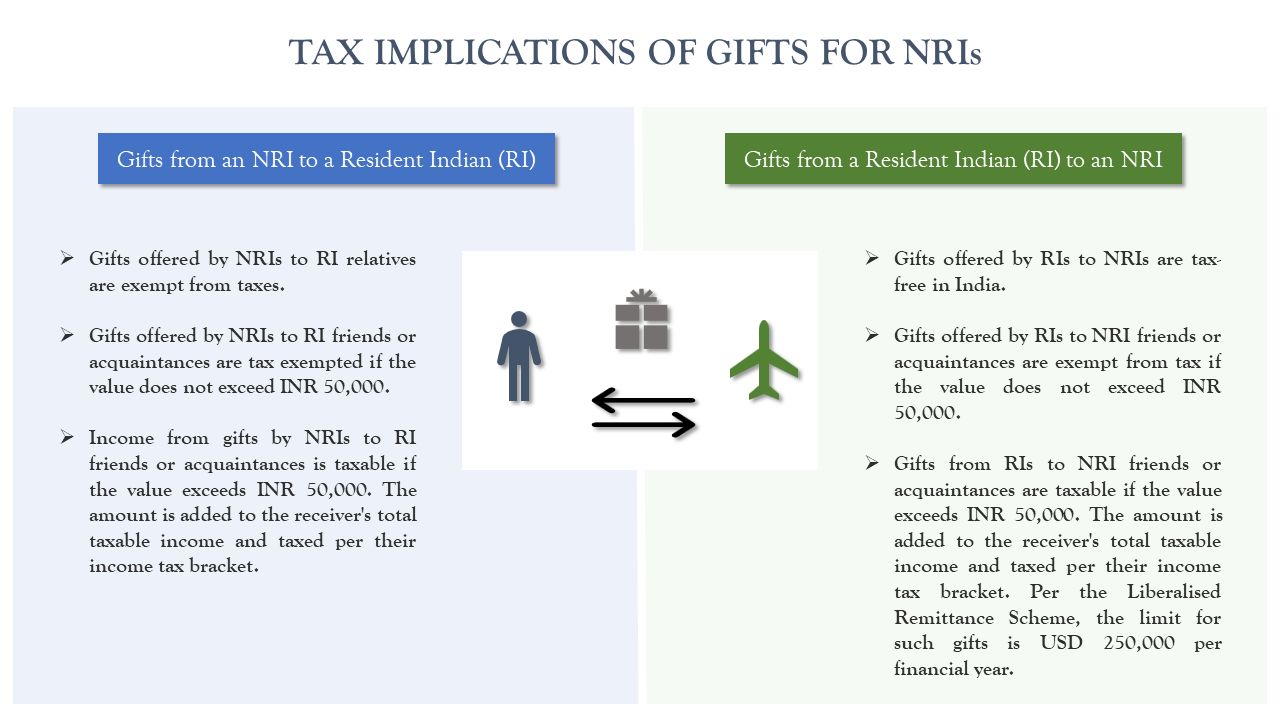

Gift by NRI to Resident Indian or Vice-Versa — NRI Gift Tax In India – Wisenri – Medium – #68

Gift by NRI to Resident Indian or Vice-Versa — NRI Gift Tax In India – Wisenri – Medium – #68

M.K. GUPTA CA EDUCATION INCOME TAX – #69

M.K. GUPTA CA EDUCATION INCOME TAX – #69

Tax Effects on X: “All About Taxation of Gifts [Section 56(2)(x)] https://t.co/Uepayz5jFf” / X – #70

Tax Effects on X: “All About Taxation of Gifts [Section 56(2)(x)] https://t.co/Uepayz5jFf” / X – #70

Taxability of Gifts – #71

Taxability of Gifts – #71

GIFT FROM RELATIVE IS TAX FREE NOT COMPLIANCE FREE – #72

GIFT FROM RELATIVE IS TAX FREE NOT COMPLIANCE FREE – #72

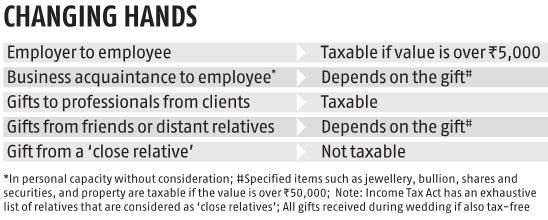

Gifts from relatives – Got Diwali gifts? Know tax implications | The Economic Times – #73

Gifts from relatives – Got Diwali gifts? Know tax implications | The Economic Times – #73

Taxability of Gifts – Some Interesting Issues – #74

Taxability of Gifts – Some Interesting Issues – #74

5 Guidelines for Homebuyers Using Gift Money for Down Payments – #75

5 Guidelines for Homebuyers Using Gift Money for Down Payments – #75

Will your ‘gift’ be taxed? – The Economic Times – #76

Will your ‘gift’ be taxed? – The Economic Times – #76

How single folks should handle estate-tax planning under the new tax law – MarketWatch – #77

How single folks should handle estate-tax planning under the new tax law – MarketWatch – #77

Gifts Treated as Income – #78

Gifts Treated as Income – #78

Tax-Free Income Sources in India 2024 – #79

Tax-Free Income Sources in India 2024 – #79

- gift tax meaning

- gift tax exemption

- gift for boys

Kshitij Patel on LinkedIn: #taxconsultant #taxation #taxadvice #gifttax #ca #accounting #incometax – #80

Kshitij Patel on LinkedIn: #taxconsultant #taxation #taxadvice #gifttax #ca #accounting #incometax – #80

Income tax – “GIFT” Taxability under Income Tax Act, 1961-In Very Short | Facebook – #81

Income tax – “GIFT” Taxability under Income Tax Act, 1961-In Very Short | Facebook – #81

- gift tax definition

- gift tax exemption relatives list

- income tax gif

- gift tax rate

- lineal ascendant gift from relative exempt from income tax

- lineal ascendant meaning

Are Wedding Gifts Taxable? (Explanation + Examples) – #82

Are Wedding Gifts Taxable? (Explanation + Examples) – #82

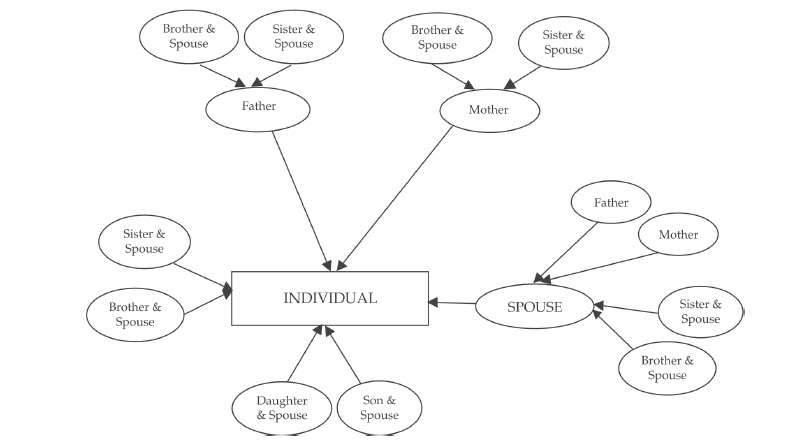

Definition of Relatives for the purpose of Income Tax Act, 1961- Taxwink – #83

Definition of Relatives for the purpose of Income Tax Act, 1961- Taxwink – #83

Close Relatives” include Uncle and Aunt: ITAT deletes Addition for Cash Gift from Close Relatives during Emergency – #84

Close Relatives” include Uncle and Aunt: ITAT deletes Addition for Cash Gift from Close Relatives during Emergency – #84

Tax Mantra by Mukesh Patel at ETNow Swadesh – #85

Tax Mantra by Mukesh Patel at ETNow Swadesh – #85

Income Tax Exemption On Gifts | Are The Gifts Above Rs 50,000 Taxable? | Personal Finance – YouTube – #86

Income Tax Exemption On Gifts | Are The Gifts Above Rs 50,000 Taxable? | Personal Finance – YouTube – #86

Gift Tax, Explained: 2024 Exemptions and Rates | SmartAsset – #87

Gift Tax, Explained: 2024 Exemptions and Rates | SmartAsset – #87

Monetary gift tax: Income tax on gift received from parents | Value Research – #88

Monetary gift tax: Income tax on gift received from parents | Value Research – #88

RELATIVE definition under various laws – KL Aggarwal Associates – #89

RELATIVE definition under various laws – KL Aggarwal Associates – #89

Income Tax for AY 2019-20: Got an expensive gift? Keep a documentary proof; here’s why | Zee Business – #90

Income Tax for AY 2019-20: Got an expensive gift? Keep a documentary proof; here’s why | Zee Business – #90

Gift from Relatives is Taxable in India? I Gift is Tax Free? II Gift Tax Treatment under Income Tax – YouTube – #91

Gift from Relatives is Taxable in India? I Gift is Tax Free? II Gift Tax Treatment under Income Tax – YouTube – #91

Annual Gift Tax Exclusion Explained | PNC Insights – #92

Annual Gift Tax Exclusion Explained | PNC Insights – #92

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #93

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #93

Do you have to pay tax on gifts received? – #94

Do you have to pay tax on gifts received? – #94

) FAQ / Draft of gift deed, List of Relatives for Tax free Gift – #95

FAQ / Draft of gift deed, List of Relatives for Tax free Gift – #95

FAQ on Estate Planning for Non-Citizens – DK Rus Law – #96

FAQ on Estate Planning for Non-Citizens – DK Rus Law – #96

SOLVED: Problem 3: Mr. Porontong made the following gifts to his relatives: Philippines: P750,000 USA: P500,000 Italy: P500,000 Gross gift Deductions Tax paid P250,000 P150,000 P12,000 The gift tax due after credit – #97

SOLVED: Problem 3: Mr. Porontong made the following gifts to his relatives: Philippines: P750,000 USA: P500,000 Italy: P500,000 Gross gift Deductions Tax paid P250,000 P150,000 P12,000 The gift tax due after credit – #97

What is a Gift Tax and What are its Rates and Exemptions? | Fi Money – #98

What is a Gift Tax and What are its Rates and Exemptions? | Fi Money – #98

Gift from USA to India: Taxation and Exemptions – SBNRI – #99

Gift from USA to India: Taxation and Exemptions – SBNRI – #99

Relatives from whom Gift is permissible |TAXVANI – #100

Relatives from whom Gift is permissible |TAXVANI – #100

Income tax rules on gifts received from relatives, employers and friends: Key points – #101

Income tax rules on gifts received from relatives, employers and friends: Key points – #101

Gift Deed Registration: Stamp Duty, Registry Fee, Tax, Procedure – #102

Gift Deed Registration: Stamp Duty, Registry Fee, Tax, Procedure – #102

Money Remitted As Gift To Parent In India Not Taxable As Income – #103

Money Remitted As Gift To Parent In India Not Taxable As Income – #103

New Jersey Gift Tax: All You Need to Know | SmartAsset – #104

New Jersey Gift Tax: All You Need to Know | SmartAsset – #104

Other sources-tax – 888 888 0402 support@escholars Income Under Head Other Sources Assignment Q. No. – Studocu – #105

Other sources-tax – 888 888 0402 support@escholars Income Under Head Other Sources Assignment Q. No. – Studocu – #105

When Gifts Become Taxing – #106

When Gifts Become Taxing – #106

Gift Deed in India – Registration Process, Documents & Tax Exemption – #107

Gift Deed in India – Registration Process, Documents & Tax Exemption – #107

Getting a Gift from Relatives When Buying a Home – #108

Getting a Gift from Relatives When Buying a Home – #108

Money received as gift from relative is not taxed | Mint – #109

Money received as gift from relative is not taxed | Mint – #109

- gift tax rate in india 2020

- lineal ascendant

- wealth tax

Receive A Gift From Relati | PDF | Charitable Organization | Tax Exemption – #110

Receive A Gift From Relati | PDF | Charitable Organization | Tax Exemption – #110

Deepavali 2023: ಸಂಬಂಧಿಕರಿಂದ ಗಿಫ್ಡ್ ಪಡೆದರೆ ತೆರಿಗೆಯಿಲ್ಲ, ಆದರೆ ಇತರರಿಂದ ಈ ವಸ್ತುಗಳ ಪಡೆದರೆ ತೆರಿಗೆಯಿದೆ ನೋಡಿ | Gifts from Relatives Are Tax-Free, but These Gifts from Others May Be Taxed … – #111

Deepavali 2023: ಸಂಬಂಧಿಕರಿಂದ ಗಿಫ್ಡ್ ಪಡೆದರೆ ತೆರಿಗೆಯಿಲ್ಲ, ಆದರೆ ಇತರರಿಂದ ಈ ವಸ್ತುಗಳ ಪಡೆದರೆ ತೆರಿಗೆಯಿದೆ ನೋಡಿ | Gifts from Relatives Are Tax-Free, but These Gifts from Others May Be Taxed … – #111

Income Tax on Diwali Gift: How Cash, Gold, Car and Property Gifts are Taxed – Income Tax News | The Financial Express – #112

Income Tax on Diwali Gift: How Cash, Gold, Car and Property Gifts are Taxed – Income Tax News | The Financial Express – #112

NRI Gift Tax Guide: Understanding Tax Implications in India – #113

NRI Gift Tax Guide: Understanding Tax Implications in India – #113

Gift of Equity: What It Is, How It Works, Taxes, and Pros & Cons – #114

Gift of Equity: What It Is, How It Works, Taxes, and Pros & Cons – #114

How to Show Gift in Income Tax Return 2023 – #115

How to Show Gift in Income Tax Return 2023 – #115

Gift of Property & Tax Obligation: A Comprehensive Guide – #116

Gift of Property & Tax Obligation: A Comprehensive Guide – #116

Format of Gift Deed for gift of amount through cash or Cheque – You can gift cash or amount in bank – Studocu – #117

Format of Gift Deed for gift of amount through cash or Cheque – You can gift cash or amount in bank – Studocu – #117

Taxation of Gifts: An In Depth Analysis – #118

Taxation of Gifts: An In Depth Analysis – #118

How to Fill Out Gift Tax Form 709 | SoFi – #119

How to Fill Out Gift Tax Form 709 | SoFi – #119

Article on the definition of Relatives… – CA Arjit Agarwal | Facebook – #120

Article on the definition of Relatives… – CA Arjit Agarwal | Facebook – #120

Income tax on gifts – US Tax Filing – #121

Income tax on gifts – US Tax Filing – #121

PSL Advocates & Solicitors on LinkedIn: #knowledgesharing #lawfirm #legaladvice #legalupdates #taxation #taxlaw – #122

PSL Advocates & Solicitors on LinkedIn: #knowledgesharing #lawfirm #legaladvice #legalupdates #taxation #taxlaw – #122

How much money can my husband’s uncle (in Singapore) gift him (Canada)? Money will be wired and is all legal. All the accountants give different statements. – Quora – #123

How much money can my husband’s uncle (in Singapore) gift him (Canada)? Money will be wired and is all legal. All the accountants give different statements. – Quora – #123

CA #proposal #commerce #Gift #relative #study #random #yqbaba – #124

CA #proposal #commerce #Gift #relative #study #random #yqbaba – #124

) Do I need to pay tax on that birthday gift? – HLB Mann Judd – #125

Do I need to pay tax on that birthday gift? – HLB Mann Judd – #125

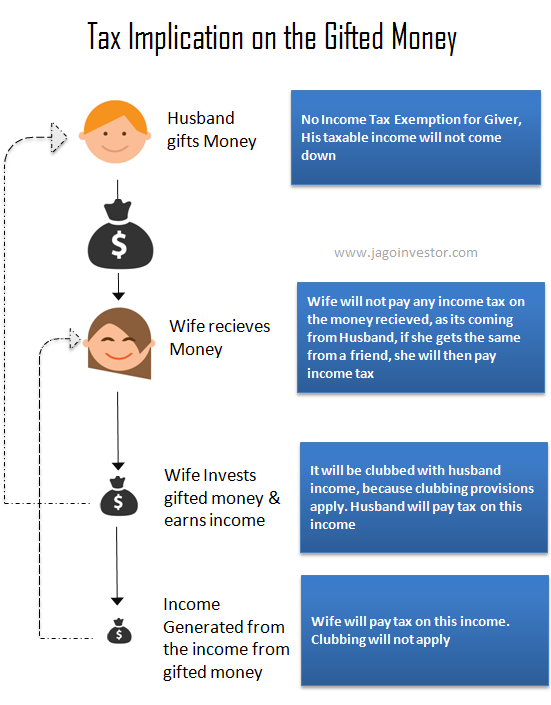

What is gift, is it taxable, who are relatives, which gift to be shown in Income Tax Return and what is clubbing of income. – upload form-16 – #126

What is gift, is it taxable, who are relatives, which gift to be shown in Income Tax Return and what is clubbing of income. – upload form-16 – #126

Taxation of Gift- Under Income Tax – #127

Taxation of Gift- Under Income Tax – #127

Your queries: Income Tax; You have to pay tax when you sell a gift received from a relative – Income Tax News | The Financial Express – #128

Your queries: Income Tax; You have to pay tax when you sell a gift received from a relative – Income Tax News | The Financial Express – #128

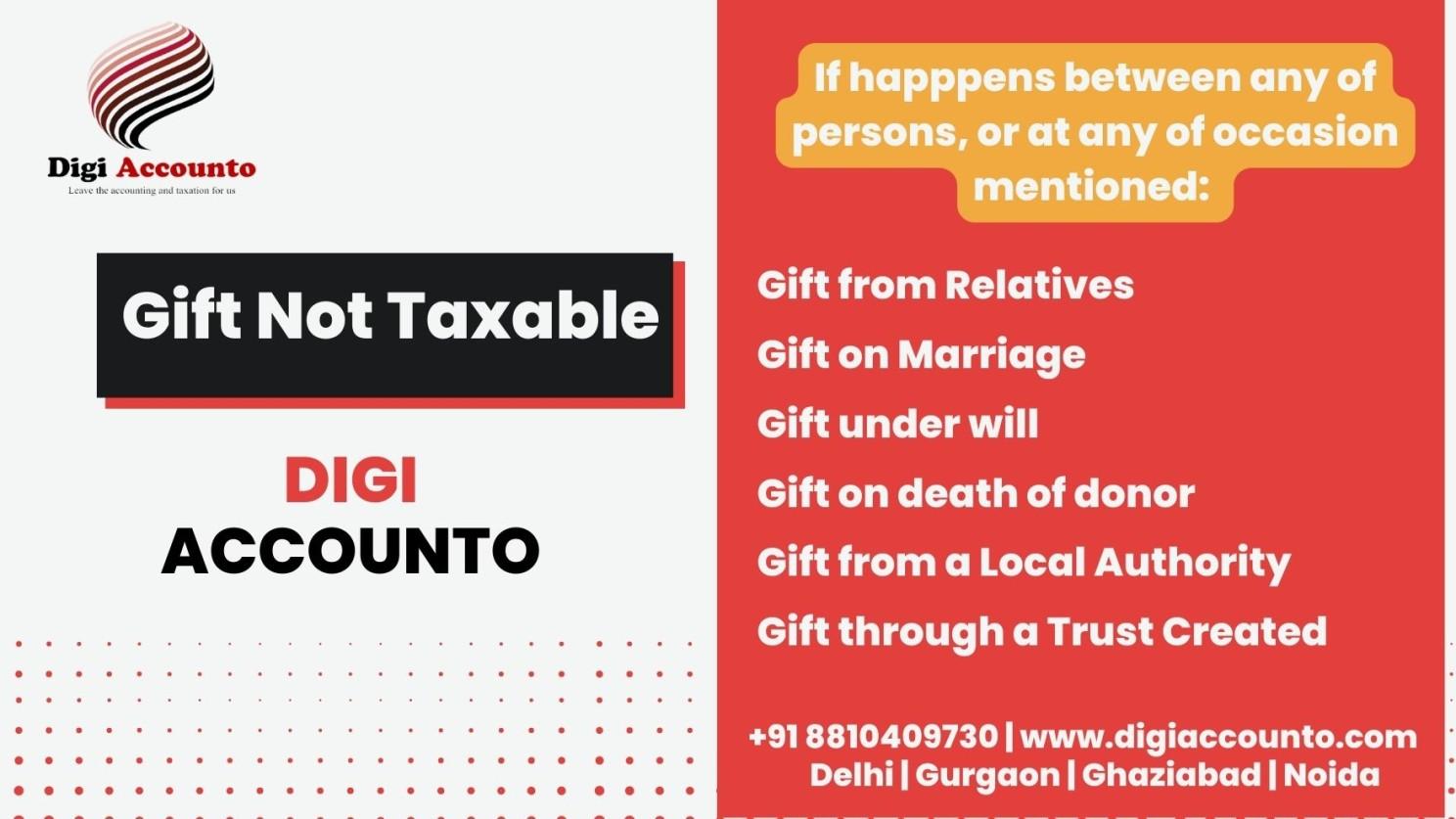

Gift Tax In India – All about Gift Tax – Digiaccounto – #129

Gift Tax In India – All about Gift Tax – Digiaccounto – #129

Use a Gift of Equity When Buying A Home From A Relative – #130

Use a Gift of Equity When Buying A Home From A Relative – #130

Income Tax on Gift and Definition of Relative – YouTube – #131

Income Tax on Gift and Definition of Relative – YouTube – #131

SOLVED: A single individual earned wages of 50,000 working at a bank. The individual received a6,000 gift from a parent to go to Europe, inherited 10,000 from a relative, and received500 interest – #132

SOLVED: A single individual earned wages of 50,000 working at a bank. The individual received a6,000 gift from a parent to go to Europe, inherited 10,000 from a relative, and received500 interest – #132

Income tax and other related financial information 2019-20 INDIA uploaded by T james joseph Adhikarathil | PDF – #133

Income tax and other related financial information 2019-20 INDIA uploaded by T james joseph Adhikarathil | PDF – #133

Gifting Money to Family Members: 5 Strategies to Understand – Kindness Financial Planning – #134

Gifting Money to Family Members: 5 Strategies to Understand – Kindness Financial Planning – #134

Whether gift received from HUF to any member of HUF is exempt from taxable income? ITAT Explains | SCC Times – #135

Whether gift received from HUF to any member of HUF is exempt from taxable income? ITAT Explains | SCC Times – #135

How cross-border clients can utilize the U.S. gift tax lifetime exemption before rules change – The Globe and Mail – #136

How cross-border clients can utilize the U.S. gift tax lifetime exemption before rules change – The Globe and Mail – #136

Gift tax exemption rules: who can receive gifts that are tax-free? | Arthgyaan – #137

Gift tax exemption rules: who can receive gifts that are tax-free? | Arthgyaan – #137

Gift Deed: Registration, property gift deed format, stamp duty – #138

Gift Deed: Registration, property gift deed format, stamp duty – #138

Taxability of Gifts in the Hands of Recipients Simplified – #139

Taxability of Gifts in the Hands of Recipients Simplified – #139

Are Diwali gifts from employer, relatives, friends taxable? Here’s a look at the norms | Mint – #140

Are Diwali gifts from employer, relatives, friends taxable? Here’s a look at the norms | Mint – #140

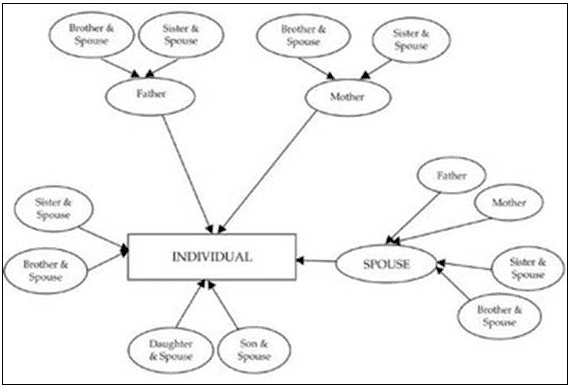

List of relatives covered under Section 56(2) of Income Tax Act,1961 – #141

List of relatives covered under Section 56(2) of Income Tax Act,1961 – #141

Tax News in Kannada: Latest Tax Kannada News Updates, Videos, Photos – Kannada Goodreturns – #142

Tax News in Kannada: Latest Tax Kannada News Updates, Videos, Photos – Kannada Goodreturns – #142

Taxation on gifts: Everything you need to know | Tax Hacks – #143

Taxation on gifts: Everything you need to know | Tax Hacks – #143

How To Gift Real Estate | Rocket Mortgage – #144

How To Gift Real Estate | Rocket Mortgage – #144

Posts: tax on gift from relatives

Categories: Gifts

Author: toyotabienhoa.edu.vn