Discover more than 111 tax basis of gifted stock best

Top images of tax basis of gifted stock by website toyotabienhoa.edu.vn compilation. Best Ways To Give Stock As A Holiday Gift | Bankrate. CFP® Practice Question – Online CFP Program. Cost Basis – What Is It, How To Calculate, Methods, Advantages

Donating Equity Compensation Awards | Schwab Charitable Donor-Advised Fund | Schwab Charitable – #1

Donating Equity Compensation Awards | Schwab Charitable Donor-Advised Fund | Schwab Charitable – #1

Gifting Stock – FasterCapital – #2

Gifting Stock – FasterCapital – #2

Gifting Stock to Family: What You Need to Know – #4

Gifting Stock to Family: What You Need to Know – #4

Guide to donating stocks and mutual funds | GiveDirectly – #5

Guide to donating stocks and mutual funds | GiveDirectly – #5

What is a Tax-Free Acquisition? – #6

What is a Tax-Free Acquisition? – #6

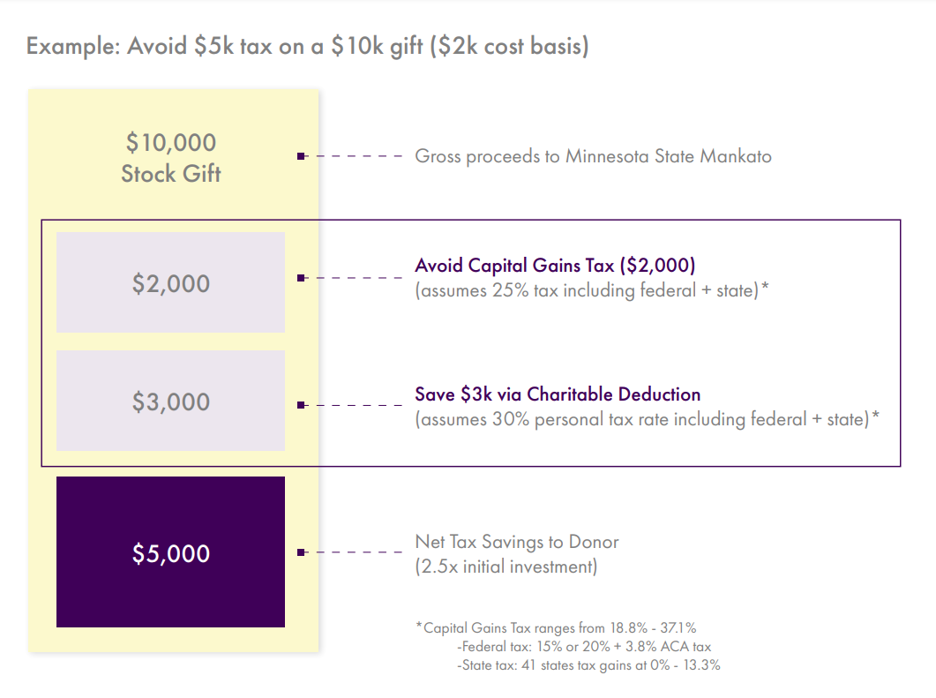

Gifts of Stock | Minnesota State University, Mankato – #7

Gifts of Stock | Minnesota State University, Mankato – #7

Inherited Stock: Definition, How It Works, and Example – #8

Inherited Stock: Definition, How It Works, and Example – #8

5 Ways to Define Cost Basis – wikiHow Life – #10

5 Ways to Define Cost Basis – wikiHow Life – #10

Taxes on Selling Stock: What You Pay & How to Pay Less | The Motley Fool – #11

Taxes on Selling Stock: What You Pay & How to Pay Less | The Motley Fool – #11

Selling your company? Stock swap might avoid a taxable gain – Sol Schwartz – #12

Selling your company? Stock swap might avoid a taxable gain – Sol Schwartz – #12

Appreciated Stock | Jewish Community Foundation | Overland Park, KS – #13

Appreciated Stock | Jewish Community Foundation | Overland Park, KS – #13

- donate stock image

- adjusted basis formula

- inheritance tax document

Solved A donor gives their child a gift of publicly traded | Chegg.com – #14

Solved A donor gives their child a gift of publicly traded | Chegg.com – #14

Section 1202 Planning: When Might the Assignment of Income Doctrine Apply to a Gift of QSBS? – Frost Brown Todd | Full-Service Law Firm – #15

Section 1202 Planning: When Might the Assignment of Income Doctrine Apply to a Gift of QSBS? – Frost Brown Todd | Full-Service Law Firm – #15

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #16

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #16

Cost Basis: What It Means, Examples and Calculation – #17

Cost Basis: What It Means, Examples and Calculation – #17

What Is Cost Basis and How Do You Prove It? – #18

What Is Cost Basis and How Do You Prove It? – #18

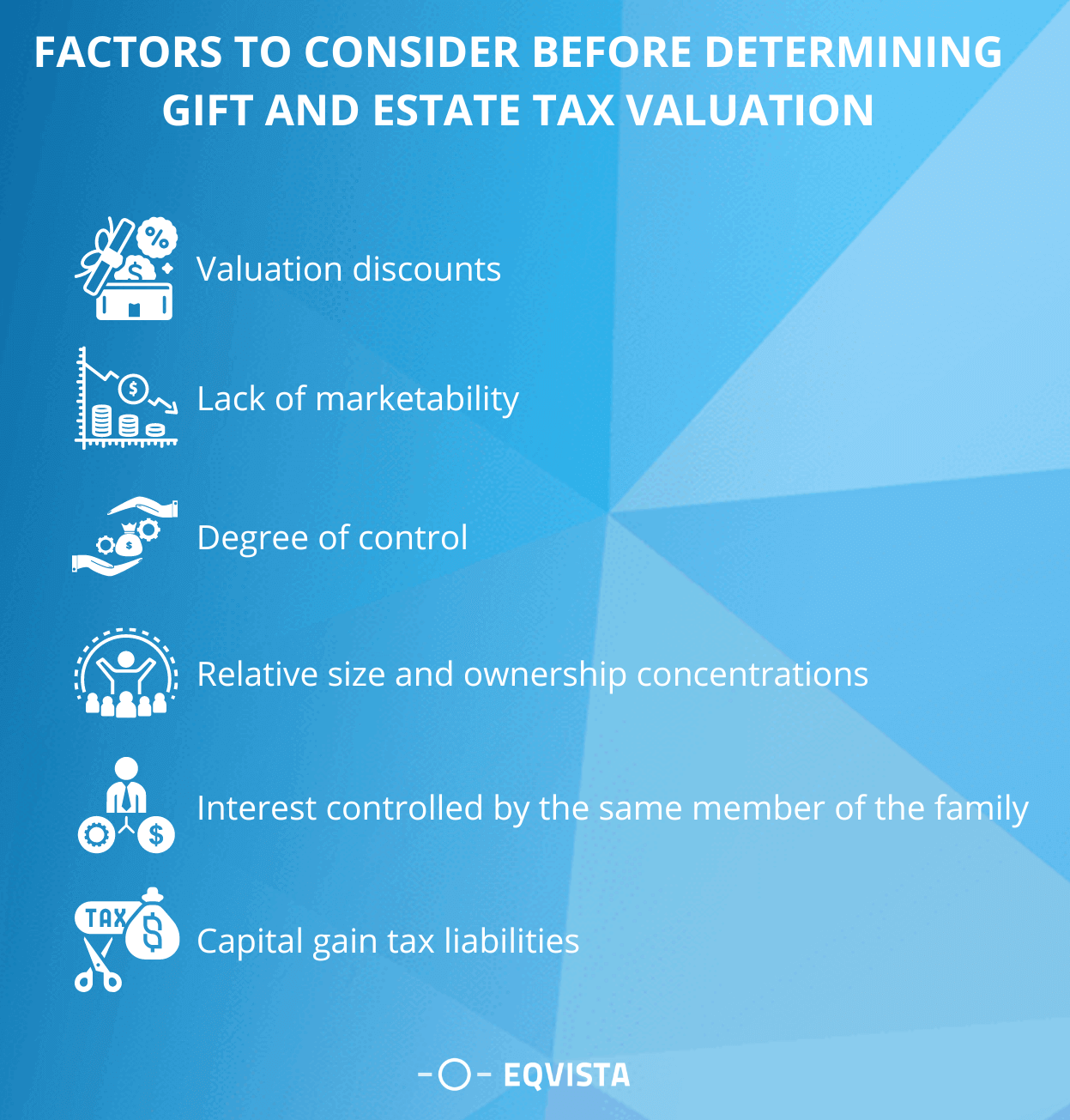

Gift & Estate Tax Valuation – Everything you should know | Eqvista – #19

Gift & Estate Tax Valuation – Everything you should know | Eqvista – #19

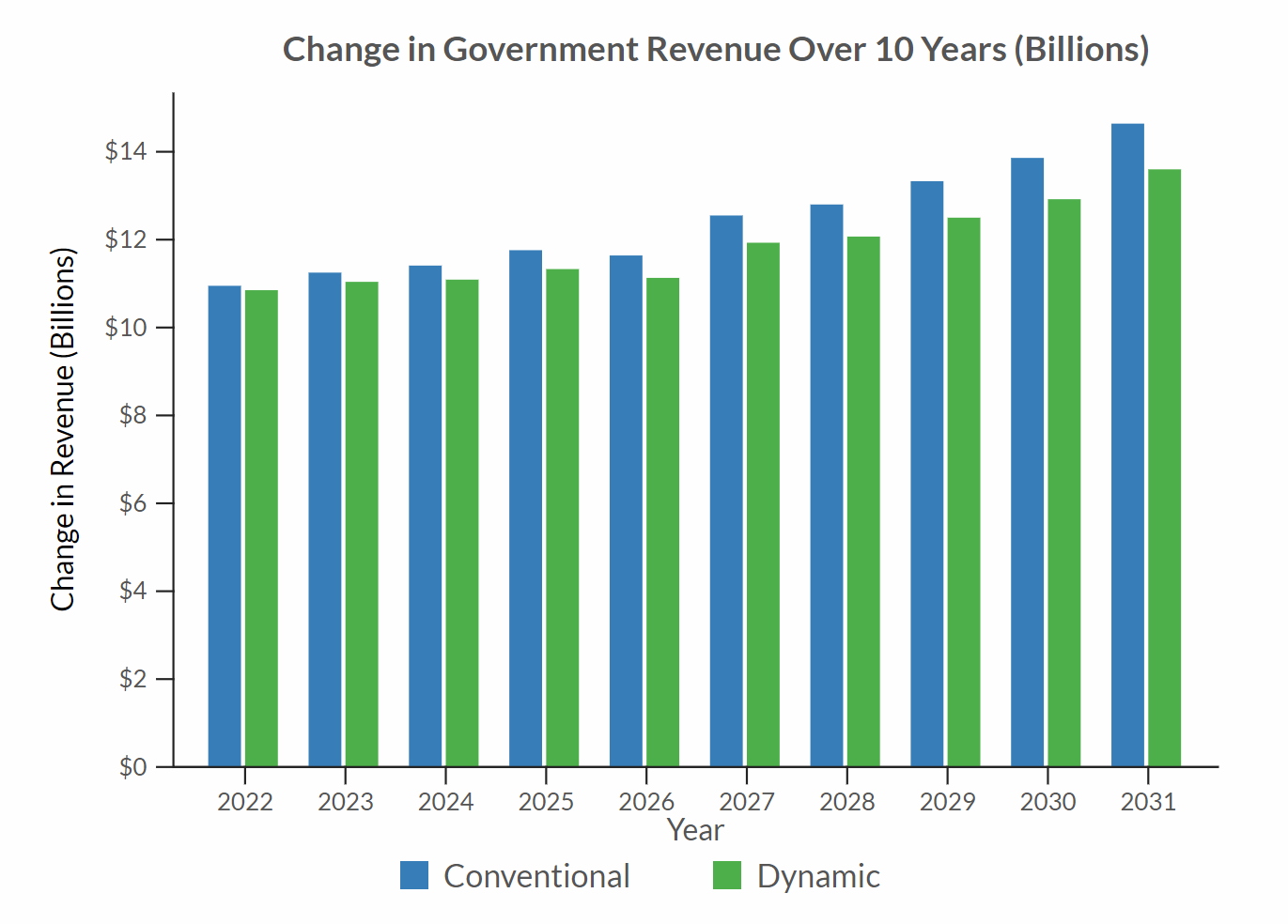

Deferring Capital Gains: Potential Benefits | Russell Investments – #20

Deferring Capital Gains: Potential Benefits | Russell Investments – #20

- cost basis formula

- step up basis

- cost basis calculator

Best Ways To Give Stock As A Holiday Gift | Bankrate – #21

Best Ways To Give Stock As A Holiday Gift | Bankrate – #21

Cost basis on gifted (matched) stock from my employer? : r/tax – #22

Cost basis on gifted (matched) stock from my employer? : r/tax – #22

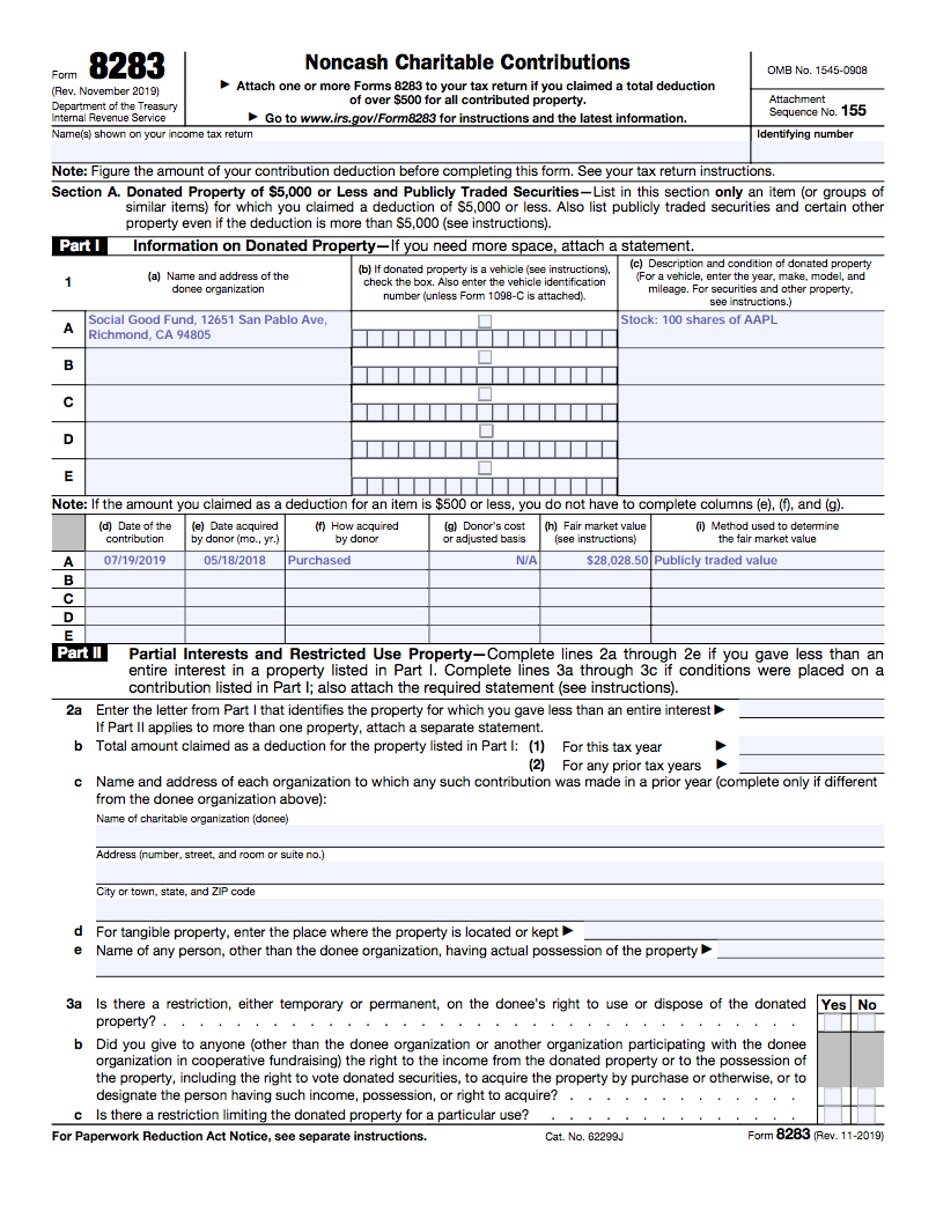

How to Report Donations to a Donor Advised Fund (DAF) | White Coat Investor – #23

How to Report Donations to a Donor Advised Fund (DAF) | White Coat Investor – #23

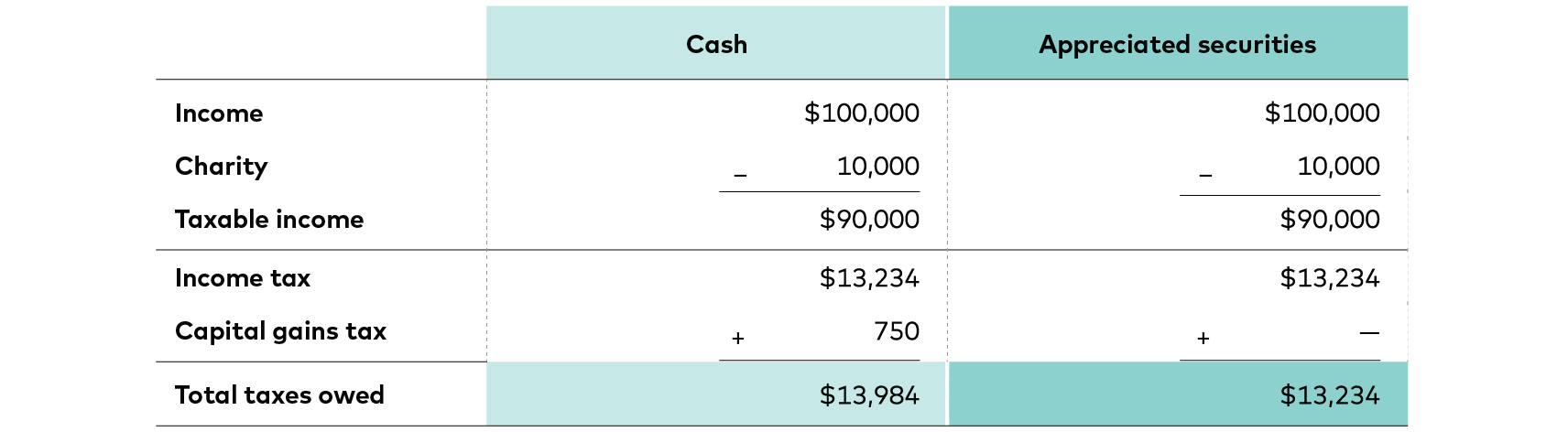

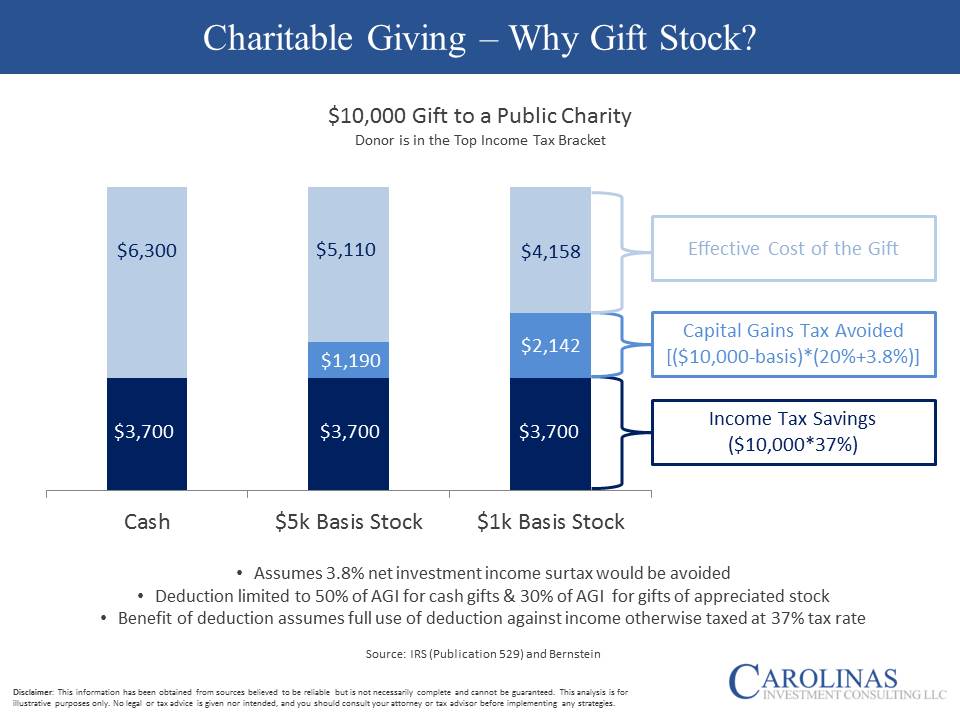

Giving After Tax Reform | Sharpe Group – #24

Giving After Tax Reform | Sharpe Group – #24

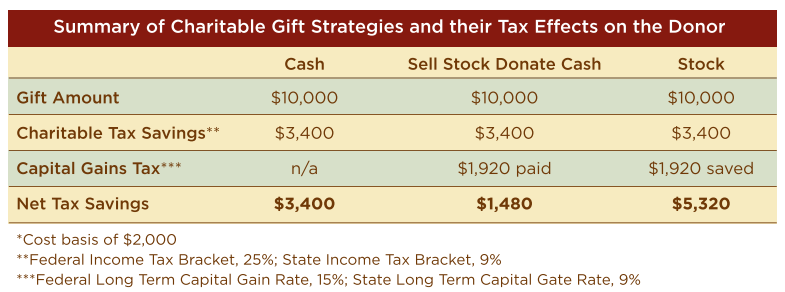

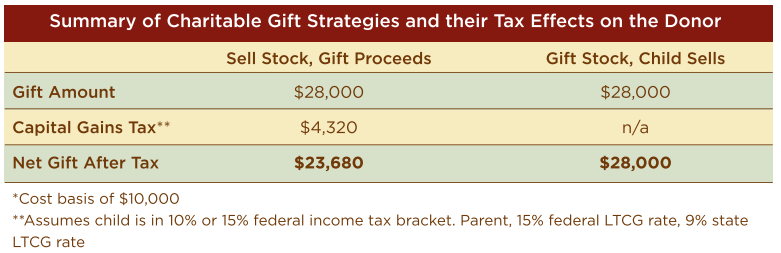

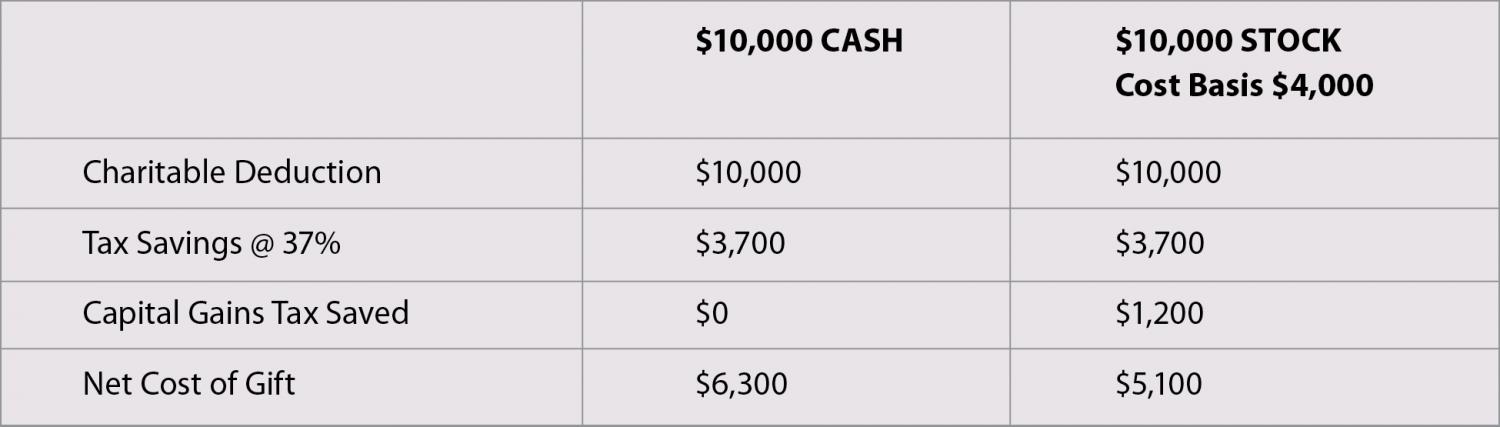

Charitable Donations: Stock vs. Cash – HCR Wealth Advisors – #25

Charitable Donations: Stock vs. Cash – HCR Wealth Advisors – #25

How Much Money Can I Gift Without Owing Taxes? – #26

How Much Money Can I Gift Without Owing Taxes? – #26

The Gift Tax Made Simple – TurboTax Tax Tips & Videos – #27

The Gift Tax Made Simple – TurboTax Tax Tips & Videos – #27

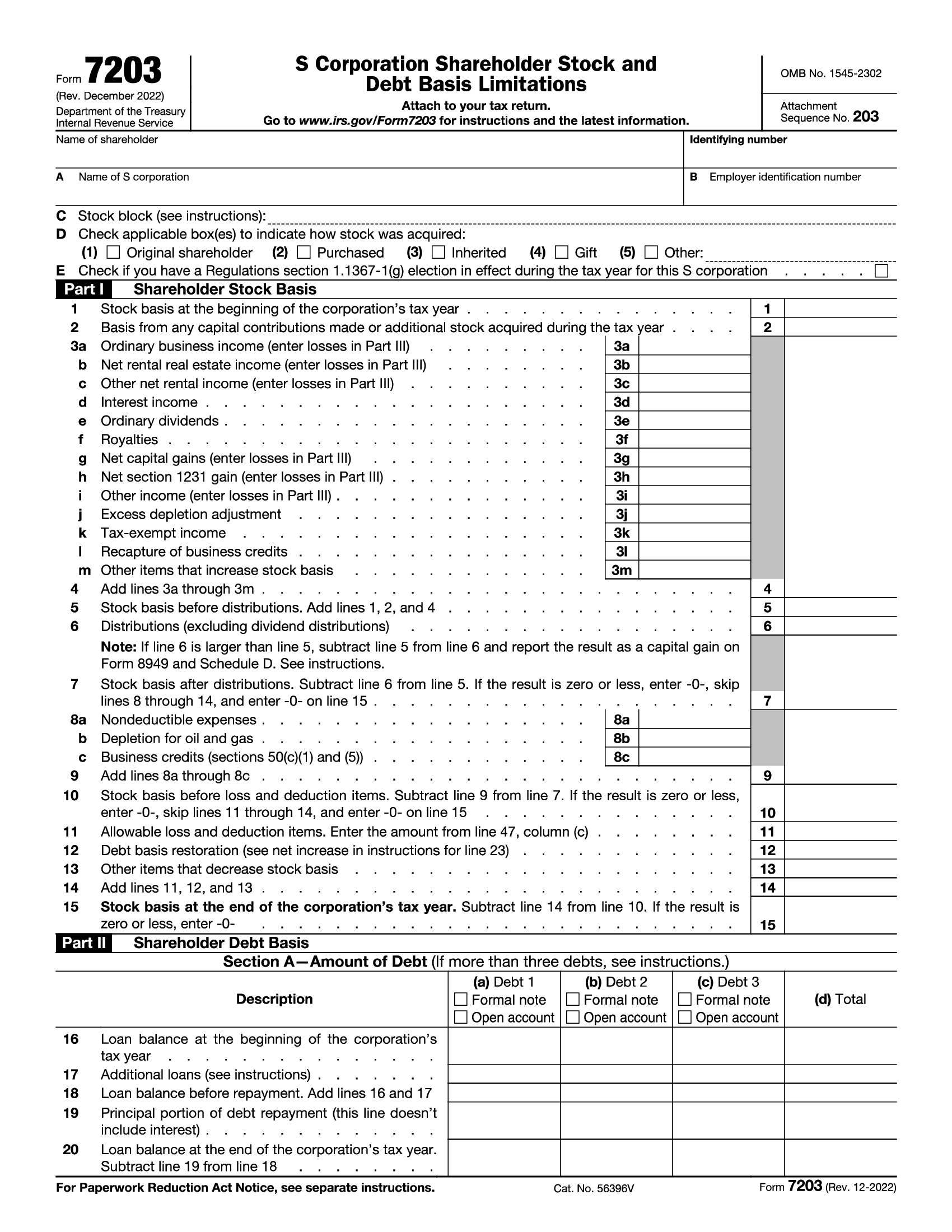

IRS Form 7203. S Corporation Shareholder Stock and Debt Basis Limitations | Forms – Docs – 2023 – #28

IRS Form 7203. S Corporation Shareholder Stock and Debt Basis Limitations | Forms – Docs – 2023 – #28

Can I Give Stock As a Gift? – #29

Can I Give Stock As a Gift? – #29

How to accept stock donations: What nonprofits need to know | Blog | Resources | FreeWill – #30

How to accept stock donations: What nonprofits need to know | Blog | Resources | FreeWill – #30

Gifted Stock: Definition, Process, and Tax Implications – #31

Gifted Stock: Definition, Process, and Tax Implications – #31

Almost too good to be true: The Section 1202 qualified small business stock gain exclusion | Our Insights | Plante Moran – #32

Almost too good to be true: The Section 1202 qualified small business stock gain exclusion | Our Insights | Plante Moran – #32

Inherited Stocks – FasterCapital – #33

Inherited Stocks – FasterCapital – #33

- gift tax example

- step up or step out quotes

- step cost examples

How To Calculate Cost Basis For Real Estate | Rocket Mortgage – #34

How To Calculate Cost Basis For Real Estate | Rocket Mortgage – #34

When Should I Use My Estate and Gift Tax Exemption? – #35

When Should I Use My Estate and Gift Tax Exemption? – #35

How To Gift Real Estate | Rocket Mortgage – #36

How To Gift Real Estate | Rocket Mortgage – #36

Save on Taxes: Know Your Cost Basis | Charles Schwab – #37

Save on Taxes: Know Your Cost Basis | Charles Schwab – #37

Using Capital Gains to Pay for College | Resilient Asset Management – #38

Using Capital Gains to Pay for College | Resilient Asset Management – #38

- tax basis formula

A Guide to Employee Stock Options and Tax Reporting Forms | TaxAct – #39

A Guide to Employee Stock Options and Tax Reporting Forms | TaxAct – #39

Capital Gains Tax Calculator: Put Investments To Work This Tax Season- Intuit TurboTax Blog – #40

Capital Gains Tax Calculator: Put Investments To Work This Tax Season- Intuit TurboTax Blog – #40

Schwab Gift Stock Form – Fill Online, Printable, Fillable, Blank | pdfFiller – #41

Schwab Gift Stock Form – Fill Online, Printable, Fillable, Blank | pdfFiller – #41

- revocable living trust flowchart

- partnership basis calculation worksheet excel

- donation stock image

Giving Appreciated Securities | Grand Canyon Trust – #42

Giving Appreciated Securities | Grand Canyon Trust – #42

Donating Restricted and Control Stock to Charity | Fidelity Charitable – #43

Donating Restricted and Control Stock to Charity | Fidelity Charitable – #43

Tax considerations when gifting stock – InvestmentNews – #44

Tax considerations when gifting stock – InvestmentNews – #44

Gifted stock for retirement planning: Securing a comfortable future – FasterCapital – #45

Gifted stock for retirement planning: Securing a comfortable future – FasterCapital – #45

Stock-based compensation: Back to basics – #46

Stock-based compensation: Back to basics – #46

- cost basis real estate

- 754 election example

- shareholder basis worksheet

How to Figure Out Cost Basis on a Stock Investment – #47

How to Figure Out Cost Basis on a Stock Investment – #47

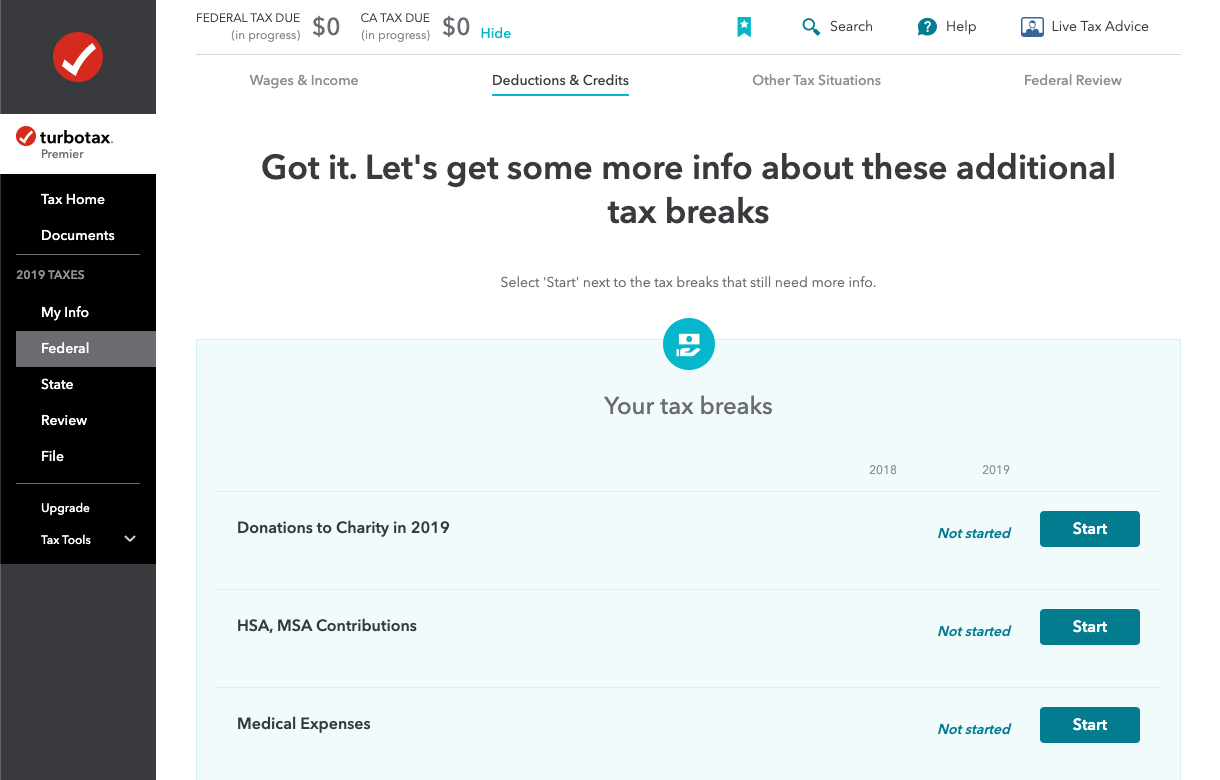

How do you enter information into TT Premier for a charitable gift annuity where the gift is appreciated stock? – #48

How do you enter information into TT Premier for a charitable gift annuity where the gift is appreciated stock? – #48

Avoiding Basis Step-Down At Death By Gifting Capital Losses – #49

Avoiding Basis Step-Down At Death By Gifting Capital Losses – #49

Solved Question 2: The Basis of Transferred Property In | Chegg.com – #50

Solved Question 2: The Basis of Transferred Property In | Chegg.com – #50

Qualified Small Business Stock (QSBS) Revisited | Bessemer Trust – #51

Qualified Small Business Stock (QSBS) Revisited | Bessemer Trust – #51

Are There Tax Benefits to Living in Puerto Rico? – Retirement Daily on TheStreet: Finance and Retirement Advice, Analysis, and More – #52

Are There Tax Benefits to Living in Puerto Rico? – Retirement Daily on TheStreet: Finance and Retirement Advice, Analysis, and More – #52

CFP® Practice Question – Online CFP Program – #53

CFP® Practice Question – Online CFP Program – #53

What Is Tax Basis? A 101 Guide | NetSuite – #54

What Is Tax Basis? A 101 Guide | NetSuite – #54

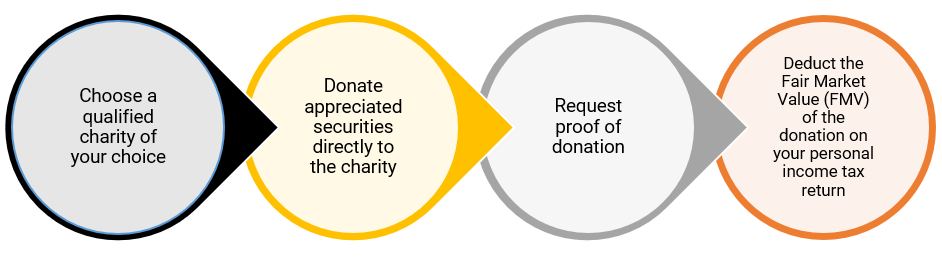

Donate securities | Heart and Stroke Foundation – #55

Donate securities | Heart and Stroke Foundation – #55

Donating Privately Held S-Corp Stock to Charity | Fidelity Charitable – #56

Donating Privately Held S-Corp Stock to Charity | Fidelity Charitable – #56

How Is Crypto Taxed? (2024) IRS Rules and How to File | Gordon Law Group – #57

How Is Crypto Taxed? (2024) IRS Rules and How to File | Gordon Law Group – #57

Donating Restricted Stock | Schwab Charitable Donor-Advised Fund | Schwab Charitable – #58

Donating Restricted Stock | Schwab Charitable Donor-Advised Fund | Schwab Charitable – #58

Vig Accounting Inc – #59

Vig Accounting Inc – #59

New Cost Basis Information – #60

New Cost Basis Information – #60

Basic Rules On Gifting – U of I Tax School – #61

Basic Rules On Gifting – U of I Tax School – #61

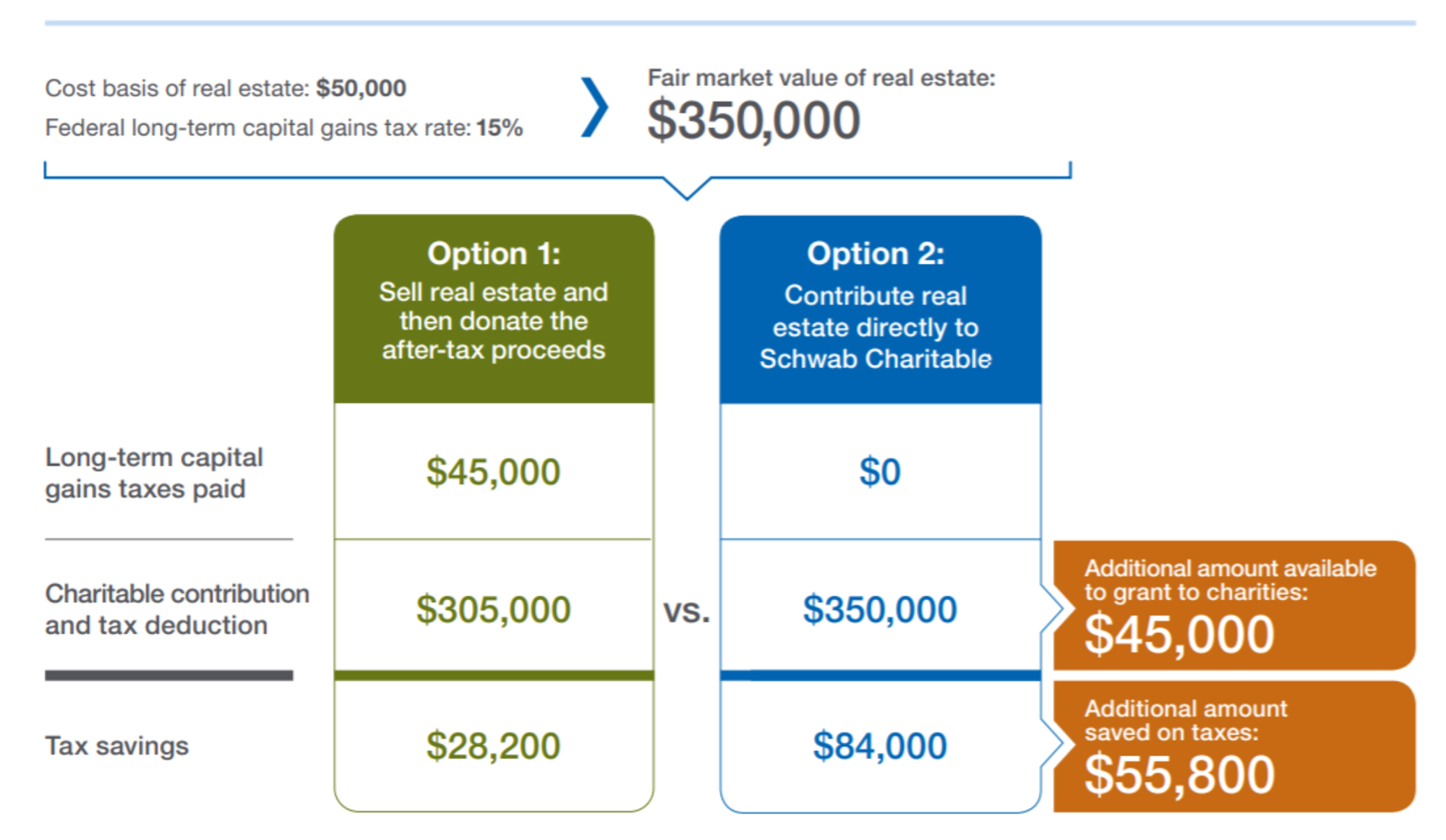

The Benefits of Donating Real Estate to Charity | Wealth Management – #62

The Benefits of Donating Real Estate to Charity | Wealth Management – #62

Tax Geek Tuesday: Determining A Shareholder’s Basis In S Corporation Stock and Debt – #63

Tax Geek Tuesday: Determining A Shareholder’s Basis In S Corporation Stock and Debt – #63

How to gift stock | Vanguard – #64

How to gift stock | Vanguard – #64

9 Ways to Reduce Your Taxable Income | Fidelity Charitable – #65

9 Ways to Reduce Your Taxable Income | Fidelity Charitable – #65

Calculating Cost Basis In Real Estate | Quicken Loans – #66

Calculating Cost Basis In Real Estate | Quicken Loans – #66

Solved QUESTION 13 Sid gave Rob a gift of stock in 2021. | Chegg.com – #67

Solved QUESTION 13 Sid gave Rob a gift of stock in 2021. | Chegg.com – #67

What Is a Step-Up in Basis? – #68

What Is a Step-Up in Basis? – #68

Appreciated Securities | Christian Union – #69

Appreciated Securities | Christian Union – #69

Is Trading One Cryptocurrency For Another A Taxable Event? – #70

Is Trading One Cryptocurrency For Another A Taxable Event? – #70

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #71

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #71

401(k) Net Unrealized Appreciation (NUA) Rules And Caveats – #72

401(k) Net Unrealized Appreciation (NUA) Rules And Caveats – #72

Taxes on Sale of Gifted Property: What you need to know – Smith Patrick CPAs – #73

Taxes on Sale of Gifted Property: What you need to know – Smith Patrick CPAs – #73

How to Find Cost Basis of Old Stock – SmartAsset | SmartAsset – #74

How to Find Cost Basis of Old Stock – SmartAsset | SmartAsset – #74

![]() gift deed: Is gift deed a tax-efficient way to transfer assets to legal heirs? – The Economic Times – #75

gift deed: Is gift deed a tax-efficient way to transfer assets to legal heirs? – The Economic Times – #75

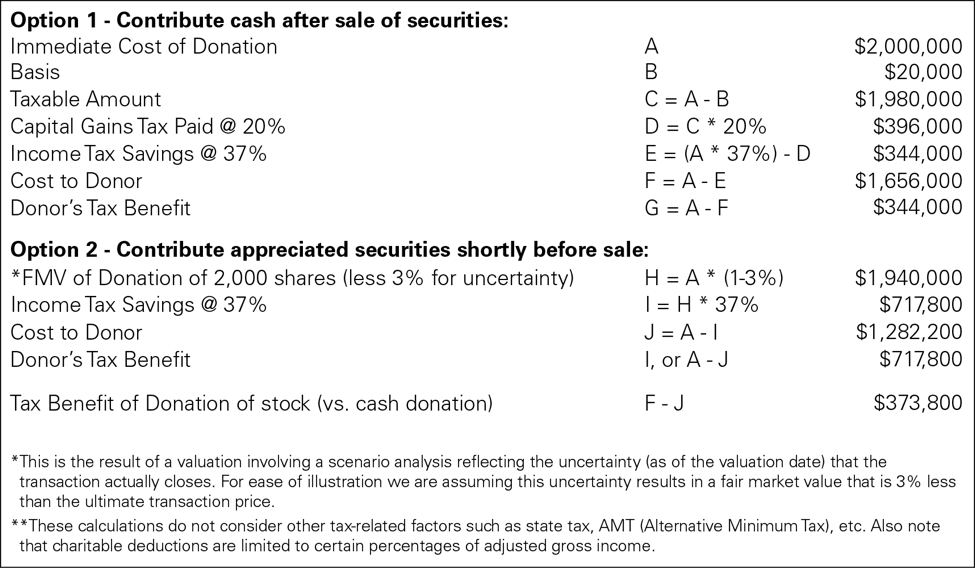

Charitable Gift Valuations Before a Business Sale | Wealth Management – #76

Charitable Gift Valuations Before a Business Sale | Wealth Management – #76

Step-Up in Basis can help Avoid or Reduce Taxes – Texas Trust Law – #77

Step-Up in Basis can help Avoid or Reduce Taxes – Texas Trust Law – #77

Solved Problem 12-34 (LO. 7, 8, 9) At the beginning of the | Chegg.com – #78

Solved Problem 12-34 (LO. 7, 8, 9) At the beginning of the | Chegg.com – #78

How to gift stocks, bonds and ETFs and the tax implications – Z-Connect by Zerodha – #79

How to gift stocks, bonds and ETFs and the tax implications – Z-Connect by Zerodha – #79

Solved Merle gives stock to her daughter Lucy. The stock has | Chegg.com – #80

Solved Merle gives stock to her daughter Lucy. The stock has | Chegg.com – #80

What is the Stepped-Up Basis, and Why Does the Biden Administration Want to Eliminate It? – #81

What is the Stepped-Up Basis, and Why Does the Biden Administration Want to Eliminate It? – #81

Want to Avoid Capital Gains? Gift or Die. – #82

Want to Avoid Capital Gains? Gift or Die. – #82

Solved TAX FORM /RETURN PREPARATION PROBLEMS Use the | Chegg.com – #83

Solved TAX FORM /RETURN PREPARATION PROBLEMS Use the | Chegg.com – #83

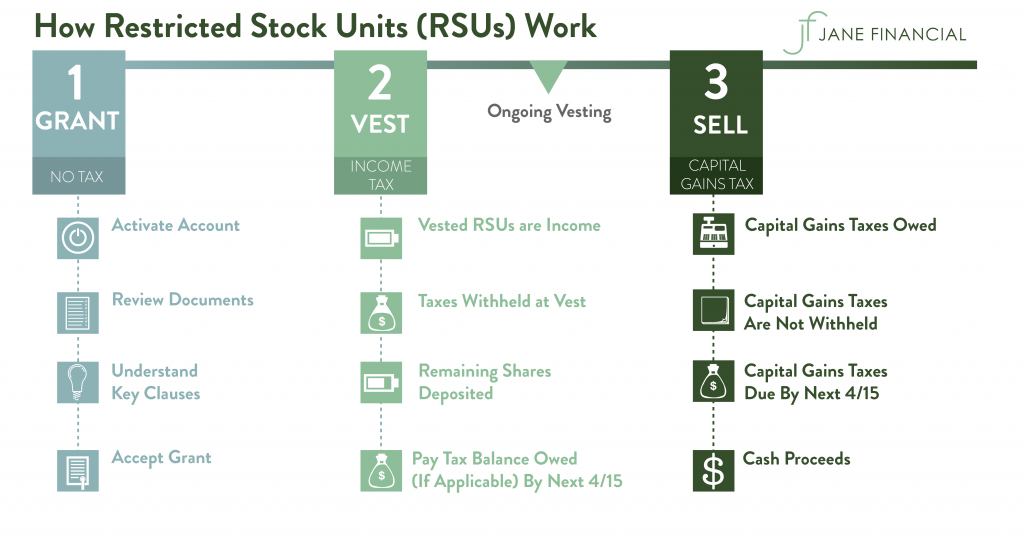

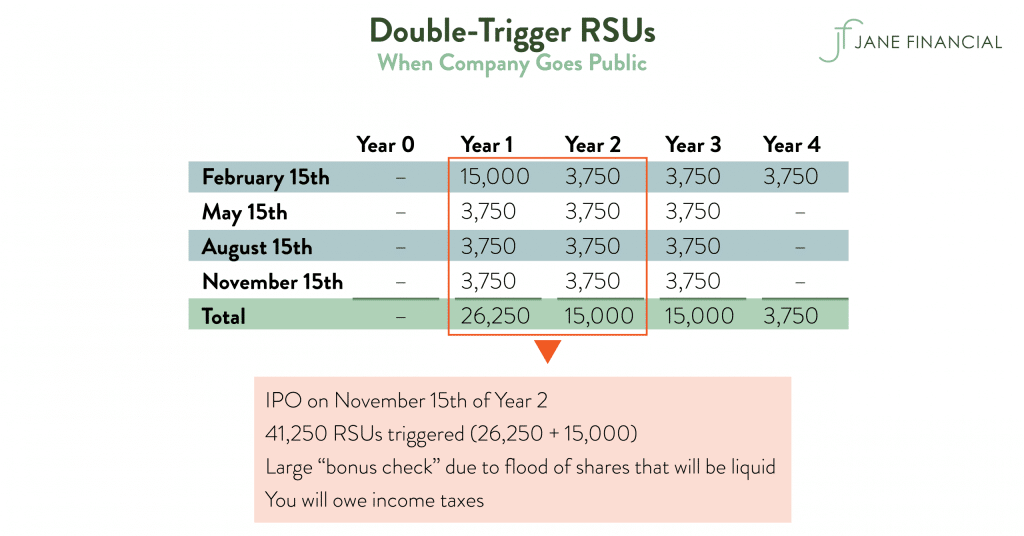

Restricted Stock Units – RSU Taxation, Vesting, Calculator & More – #84

Restricted Stock Units – RSU Taxation, Vesting, Calculator & More – #84

Giving Shares of Stocks as a Gift | Finance Strategists – #85

Giving Shares of Stocks as a Gift | Finance Strategists – #85

What is a gift deed and tax implications | Tax Hack – #86

What is a gift deed and tax implications | Tax Hack – #86

Gifts of Partnership Interests – #87

Gifts of Partnership Interests – #87

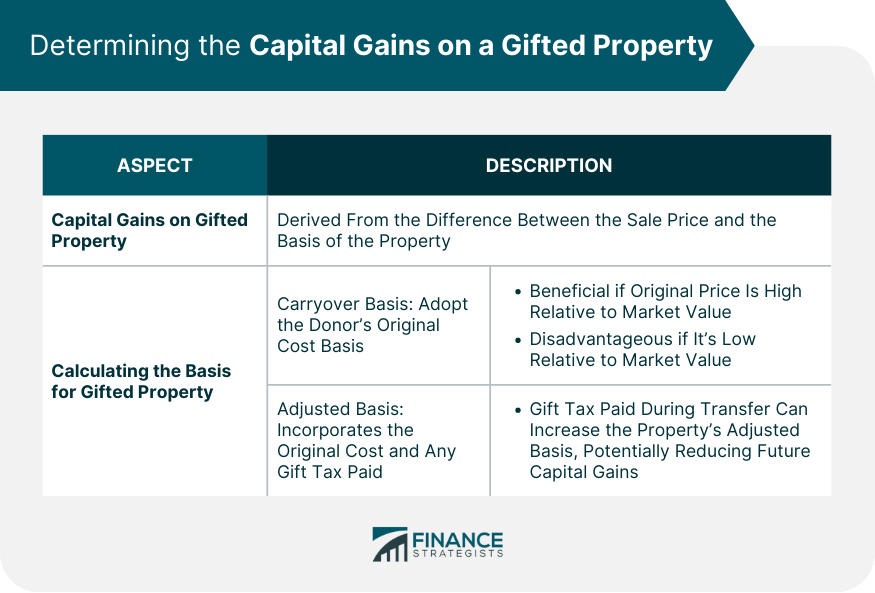

Capital Gains on a Gifted Property | Impact, Tax Considerations – #88

Capital Gains on a Gifted Property | Impact, Tax Considerations – #88

Should I Gift A Stock To My Kids Or Just Let Them Inherit It? | Greenbush Financial Group – #89

Should I Gift A Stock To My Kids Or Just Let Them Inherit It? | Greenbush Financial Group – #89

Donate stock to charity for bigger tax savings | BlackRock – #90

Donate stock to charity for bigger tax savings | BlackRock – #90

Upward Gifting – A Strategy to Help Achieve a Step-Up in Tax Basis | FORVIS – #91

Upward Gifting – A Strategy to Help Achieve a Step-Up in Tax Basis | FORVIS – #91

What Is Cost Basis And How Do You Calculate It? | Seeking Alpha – #92

What Is Cost Basis And How Do You Calculate It? | Seeking Alpha – #92

Looking to gift or invest in gold this festive season? Beware of the tax implications | Mint – #93

Looking to gift or invest in gold this festive season? Beware of the tax implications | Mint – #93

Cost Basis – What Is It, How To Calculate, Methods, Advantages – #94

Cost Basis – What Is It, How To Calculate, Methods, Advantages – #94

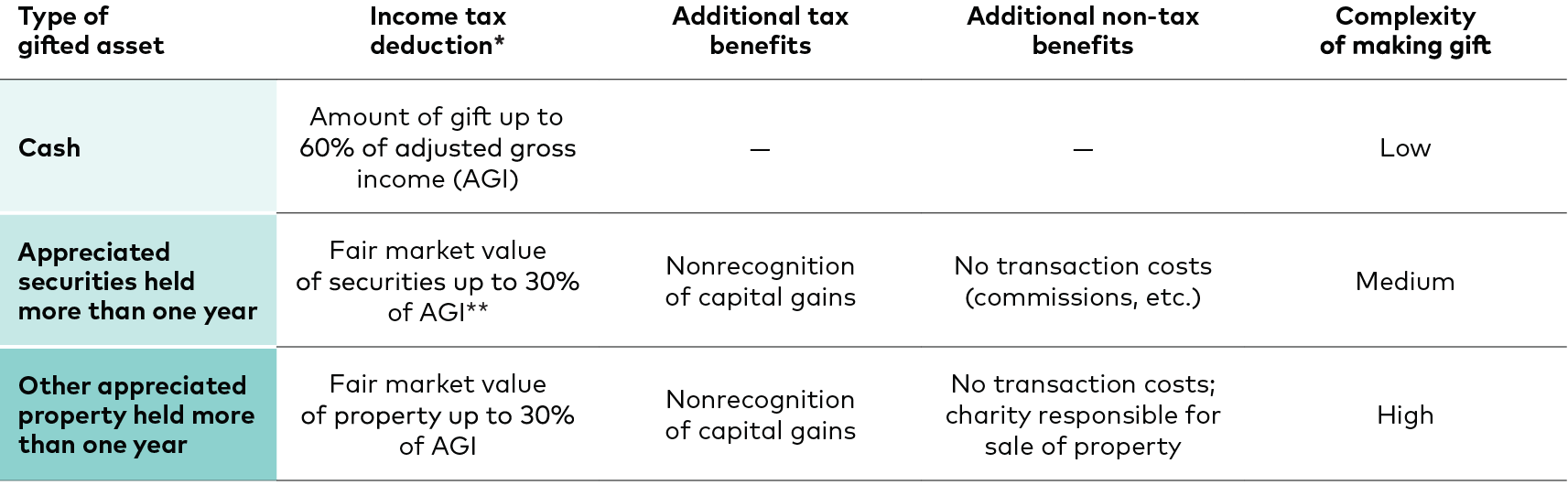

Charitable giving | Gifting appreciated assets | Fidelity – #95

Charitable giving | Gifting appreciated assets | Fidelity – #95

Making a Gift of Stock – #96

Making a Gift of Stock – #96

ITR filing: How income from stock market is taxed — explained | Mint – #97

ITR filing: How income from stock market is taxed — explained | Mint – #97

Tax Codes and IRA’s – Brownlee Wealth Management – #98

Tax Codes and IRA’s – Brownlee Wealth Management – #98

Cost Basis Basics: What It Is, How to Calculate, and Examples – #99

Cost Basis Basics: What It Is, How to Calculate, and Examples – #99

Assets You Can Give | Harvard Alumni – #100

Assets You Can Give | Harvard Alumni – #100

Fair Market Value (FMV): Definition and How to Calculate It – #101

Fair Market Value (FMV): Definition and How to Calculate It – #101

What Is Cost Basis? How It Works, Calculation, Taxation, and Example – #102

What Is Cost Basis? How It Works, Calculation, Taxation, and Example – #102

Tax “basis” and stock-based compensation—don’t get taxed twice! – #103

Tax “basis” and stock-based compensation—don’t get taxed twice! – #103

Understanding The Step-Up In Basis Rule – #104

Understanding The Step-Up In Basis Rule – #104

Donating Stock to Charity | Fidelity Charitable – #105

Donating Stock to Charity | Fidelity Charitable – #105

How to reduce your risk from low-basis stock | Pitcairn – #106

How to reduce your risk from low-basis stock | Pitcairn – #106

Cash and Non-Cash Gifts – National Boy Scouts of America Foundation – #107

Cash and Non-Cash Gifts – National Boy Scouts of America Foundation – #107

![Gifting Stocks to family & friends in 2022? [How-to] Guide - Public.com Gifting Stocks to family & friends in 2022? [How-to] Guide - Public.com](https://www.wallstreetmojo.com/wp-content/uploads/2019/12/Cost-Basis-1.jpg) Gifting Stocks to family & friends in 2022? [How-to] Guide – Public.com – #108

Gifting Stocks to family & friends in 2022? [How-to] Guide – Public.com – #108

Capital Gains Tax Explained: What It Is and How Much You Pay | Kiplinger – #109

Capital Gains Tax Explained: What It Is and How Much You Pay | Kiplinger – #109

Income tax on gifts: Gift received from relatives is tax free | Mint – #110

Income tax on gifts: Gift received from relatives is tax free | Mint – #110

3 tax reform charitable giving strategies: donating appreciated assets – Giving To Duke – #111

3 tax reform charitable giving strategies: donating appreciated assets – Giving To Duke – #111

Posts: tax basis of gifted stock

Categories: Gifts

Author: toyotabienhoa.edu.vn