Details more than 100 stock gift tax

Details images of stock gift tax by website toyotabienhoa.edu.vn compilation. Gifting Appreciated Stock: 2021 Year-End Charitable Giving Opportunity. Giving Stock Saves on Taxes and Increases Your Giving Power – Bozeman Public Library Foundation. Stock or Security Gifts — Genesee Valley Conservancy

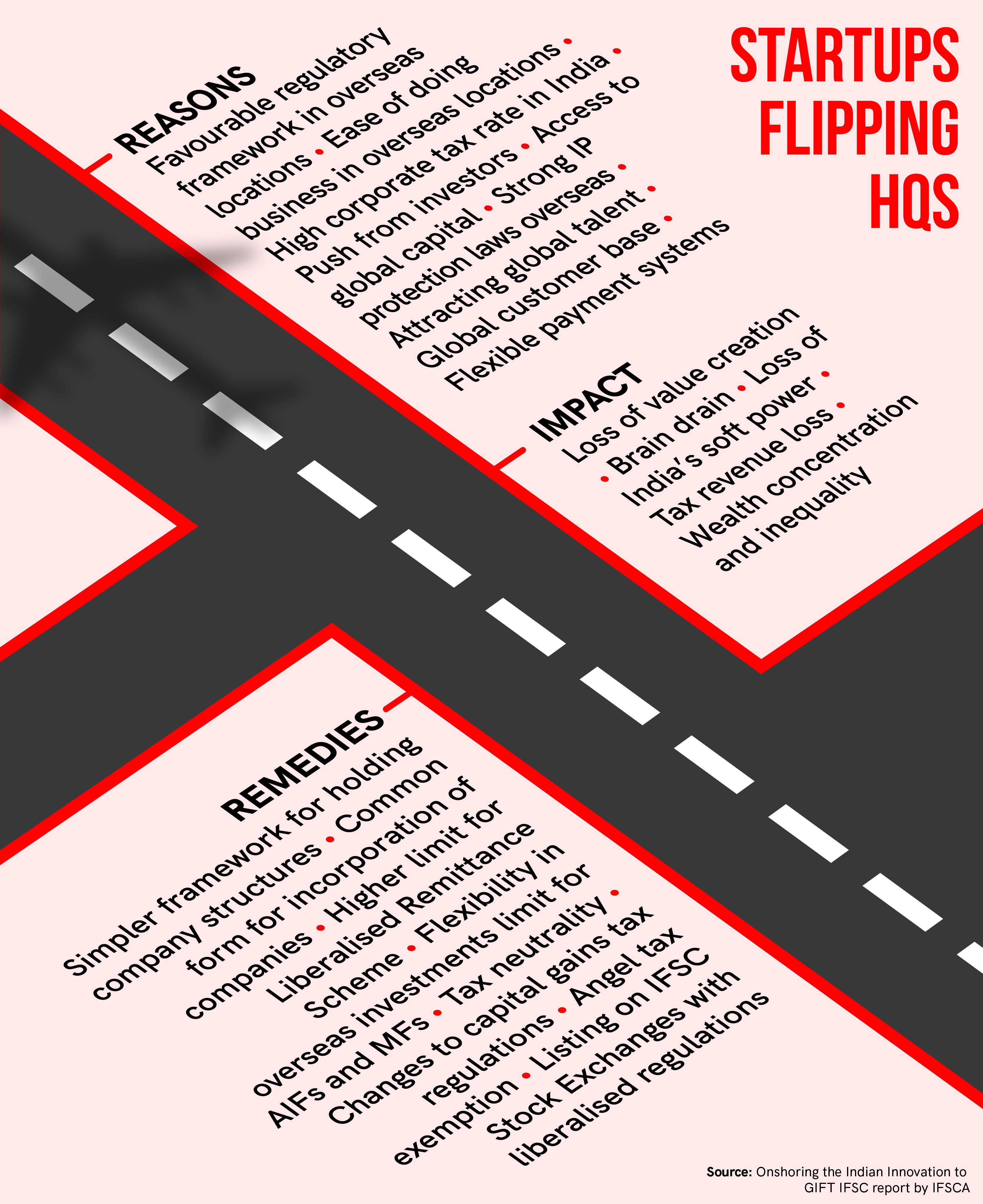

Govt exempts investment trusts, ETFs from capital gains tax in GIFT City | Business Insider India – #1

Govt exempts investment trusts, ETFs from capital gains tax in GIFT City | Business Insider India – #1

Gift Tax In 2024: What Is It And How Does It Work? – #2

Gift Tax In 2024: What Is It And How Does It Work? – #2

)

- sample form 709 completed 2019

- sales tax

- 709 2020 gift tax sample completed irs form 709

SOLVED: Ralph gives his daughter Angela stock basis of 600 fair market value of10,000. No gift tax results. If Angela subsequently sells the stock for 4,000, what is her recognized loss? a.2,000 – #4

SOLVED: Ralph gives his daughter Angela stock basis of 600 fair market value of10,000. No gift tax results. If Angela subsequently sells the stock for 4,000, what is her recognized loss? a.2,000 – #4

In 2018, Joshua gave $15,000 worth of XYZ stock to | Chegg.com – #5

In 2018, Joshua gave $15,000 worth of XYZ stock to | Chegg.com – #5

![]() 04.10.2019 Stakeholders Consultation on GST and The Kerala Economy: Implications on Tax Compliance, Revenue and the Sectoral Performance Workshop | GIFT – #6

04.10.2019 Stakeholders Consultation on GST and The Kerala Economy: Implications on Tax Compliance, Revenue and the Sectoral Performance Workshop | GIFT – #6

![Solved Problem 19-3 Calculating the Gift Tax [LO19-5] In | Chegg.com Solved Problem 19-3 Calculating the Gift Tax [LO19-5] In | Chegg.com](https://img.etimg.com/thumb/width-640,height-480,imgsize-51241,resizemode-75,msid-18641323/wealth/personal-finance-news/tax-deductions-exemptions-you-can-avail-on-stock-investments.jpg) Solved Problem 19-3 Calculating the Gift Tax [LO19-5] In | Chegg.com – #7

Solved Problem 19-3 Calculating the Gift Tax [LO19-5] In | Chegg.com – #7

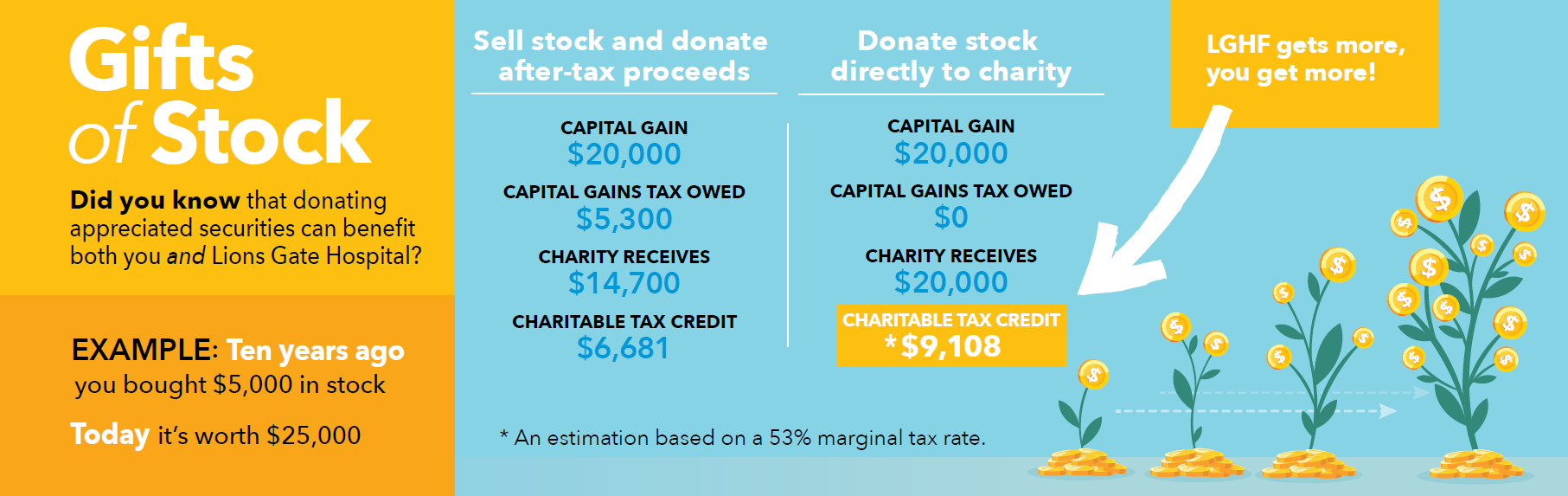

Gifts of Stock & Mutual Funds – LGS Foundation – #8

Gifts of Stock & Mutual Funds – LGS Foundation – #8

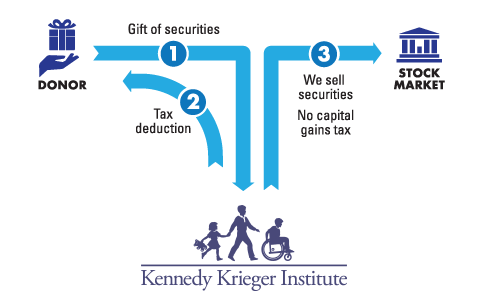

Gifts of Securities – Anglican Foundation of Canada – #10

Gifts of Securities – Anglican Foundation of Canada – #10

Meals for Seniors – #11

Meals for Seniors – #11

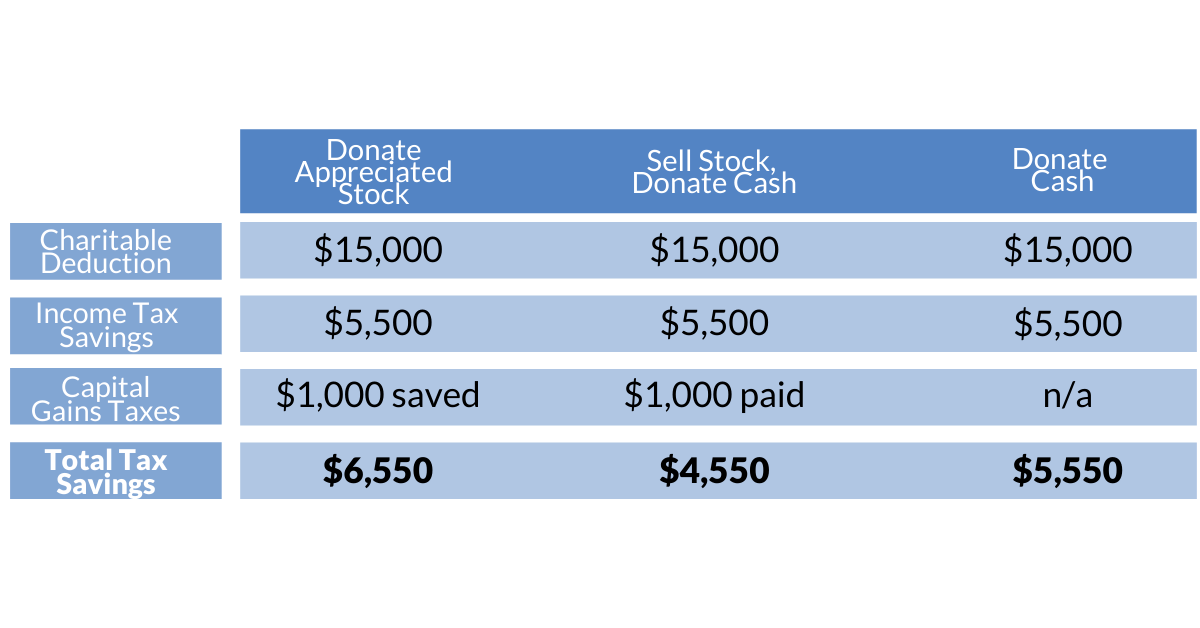

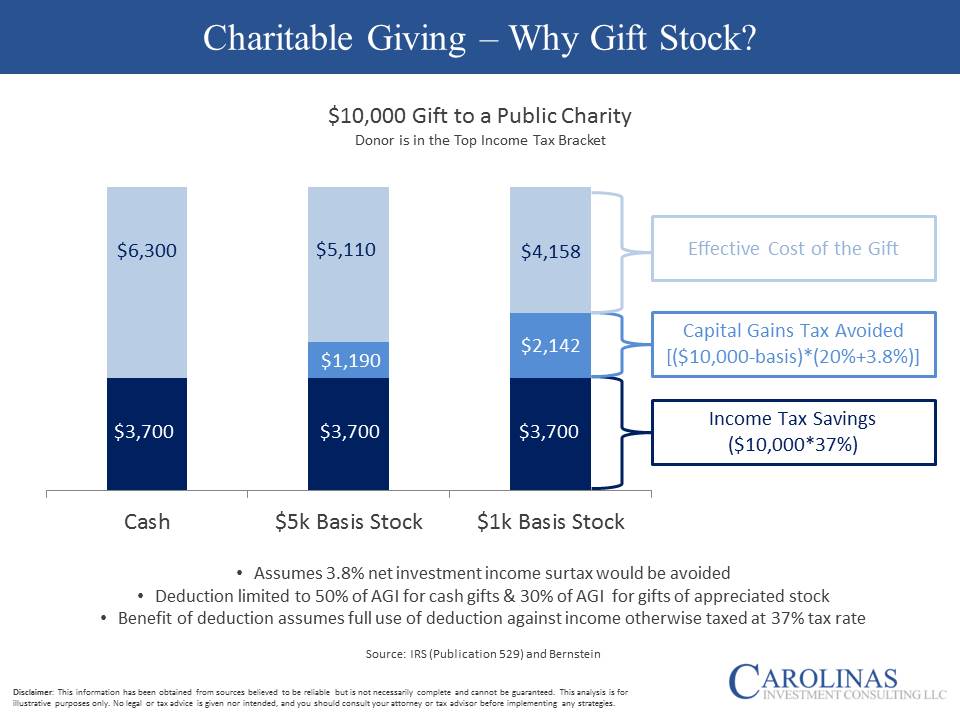

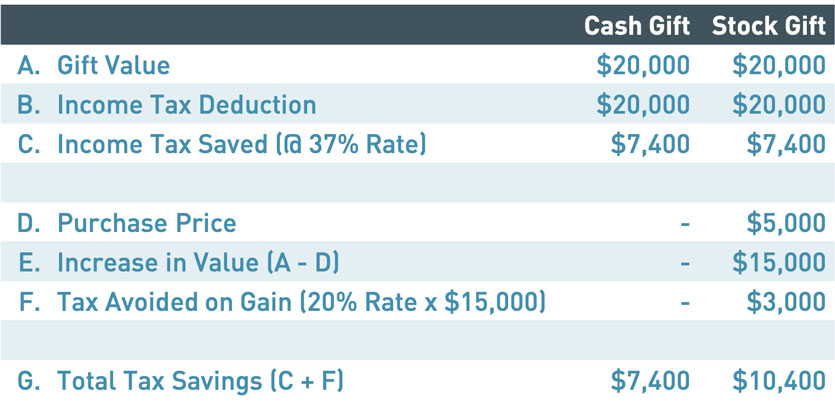

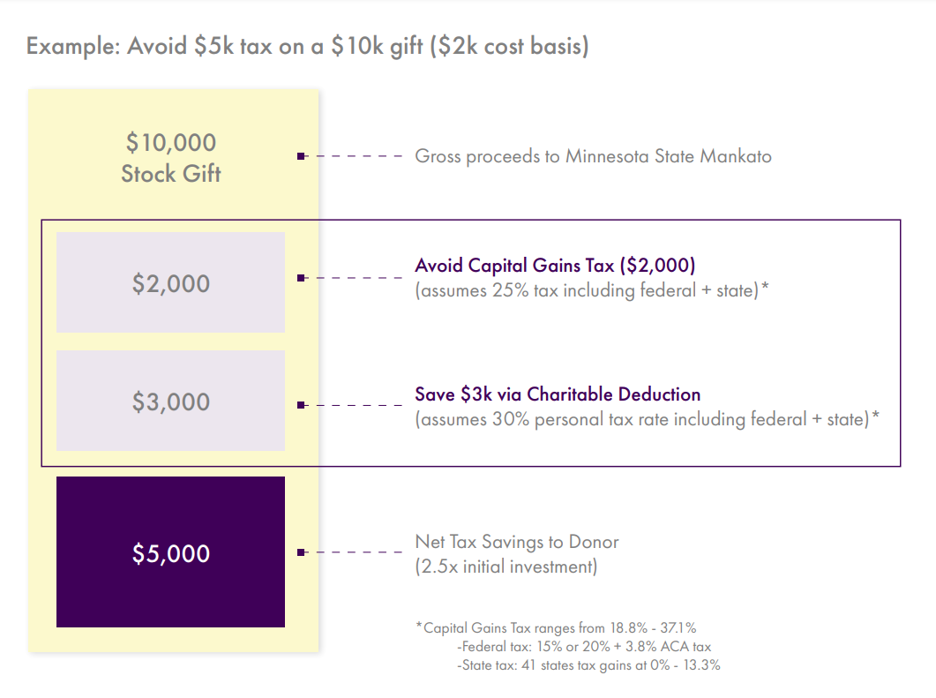

Three Better Methods (than cash) to Fulfill Your Charitable Intentions – Summa Global Advisors, LLC – #12

Three Better Methods (than cash) to Fulfill Your Charitable Intentions – Summa Global Advisors, LLC – #12

What is Portability for Estate and Gift Tax? – #13

What is Portability for Estate and Gift Tax? – #13

Tax Implications of Investing in US Stocks for Indian Residents | 5paisa – #14

Tax Implications of Investing in US Stocks for Indian Residents | 5paisa – #14

Download Present, Gift, Ribbon. Royalty-Free Vector Graphic – Pixabay – #15

Download Present, Gift, Ribbon. Royalty-Free Vector Graphic – Pixabay – #15

Gifts of Appreciated Stock – The Guelph Community Foundation – #16

Gifts of Appreciated Stock – The Guelph Community Foundation – #16

What You Need to Know About Stock Gift Tax – #17

What You Need to Know About Stock Gift Tax – #17

Stock Transfer Instructions – The Wardlaw + Hartridge School – #18

Stock Transfer Instructions – The Wardlaw + Hartridge School – #18

How Much Is the Annual Gift Tax Exclusion? – #19

How Much Is the Annual Gift Tax Exclusion? – #19

Care For the Homeless Taking Stock and Donating It | Care For the Homeless – #20

Care For the Homeless Taking Stock and Donating It | Care For the Homeless – #20

- gift tax act 1958

- gift tax example

- personal exemption

Long Term Capital Gain Tax on Shares – Tax Rates & Exemption – #21

Long Term Capital Gain Tax on Shares – Tax Rates & Exemption – #21

Best Ways To Give Stock As A Holiday Gift | Bankrate – #22

Best Ways To Give Stock As A Holiday Gift | Bankrate – #22

) New Jersey Gift Tax: All You Need to Know | SmartAsset – #23

New Jersey Gift Tax: All You Need to Know | SmartAsset – #23

Gift of Securities – Liberty Hospital Foundation – #24

Gift of Securities – Liberty Hospital Foundation – #24

- tax base

- consumption tax

- tax gif

Gift Tax: Over 9,684 Royalty-Free Licensable Stock Photos | Shutterstock – #25

Gift Tax: Over 9,684 Royalty-Free Licensable Stock Photos | Shutterstock – #25

Vanderbilt University Planned Giving :: Gift of Securities – #26

Vanderbilt University Planned Giving :: Gift of Securities – #26

- gift chart as per income tax

- gift from relative exempt from income tax

- gift tax in india

How Does a Uniform Gifts to Minors Act (UGMA) Account Work? – #27

How Does a Uniform Gifts to Minors Act (UGMA) Account Work? – #27

Gifts of Stock or Appreciated Securities | Drexel University – #28

Gifts of Stock or Appreciated Securities | Drexel University – #28

Inheritance Tax Gift Cliparts, Stock Vector and Royalty Free Inheritance Tax Gift Illustrations – #29

Inheritance Tax Gift Cliparts, Stock Vector and Royalty Free Inheritance Tax Gift Illustrations – #29

Donate Stock, Bonds or Mutual Funds | Fred Hutchinson Cancer Center – #30

Donate Stock, Bonds or Mutual Funds | Fred Hutchinson Cancer Center – #30

Word Gift Tax Composed Wooden Letters Stock Photo 1072390610 | Shutterstock – #31

Word Gift Tax Composed Wooden Letters Stock Photo 1072390610 | Shutterstock – #31

Govt exempts ETFs from capital gains at GIFT | Mint – #32

Govt exempts ETFs from capital gains at GIFT | Mint – #32

Tax take increases as stocks traded and property sold and gifted – #33

Tax take increases as stocks traded and property sold and gifted – #33

- gift tax rate in india 2022-23

- property tax

- form 709 gift splitting example

Dentons – The Rise Before the Fall: The Temporary “Big” Estate and Gift Tax Exemption Gets Bigger, But Is Scheduled to Drop Dramatically – Use It or Lose It – #34

Dentons – The Rise Before the Fall: The Temporary “Big” Estate and Gift Tax Exemption Gets Bigger, But Is Scheduled to Drop Dramatically – Use It or Lose It – #34

ELSSs help you save tax and invest in stock market at one go, go-for-elsss-to-enjoy-dual-benefits-of-tax-saving-and-investment – #35

ELSSs help you save tax and invest in stock market at one go, go-for-elsss-to-enjoy-dual-benefits-of-tax-saving-and-investment – #35

Stock Donations: 7 Essentials To Maximize Charitable Giving And Your Tax Deduction – #36

Stock Donations: 7 Essentials To Maximize Charitable Giving And Your Tax Deduction – #36

What is Gift Tax? – Exemption and Limits on Gifts for FY 2023-24 – #37

What is Gift Tax? – Exemption and Limits on Gifts for FY 2023-24 – #37

Donate Stock – #38

Donate Stock – #38

- estate tax

- gift tax rate in india 2020

- business income tax slab

Gift/Inheritance Tax Savings Plans for Children in Ireland | Inheritance Tax Advice Ireland – #39

Gift/Inheritance Tax Savings Plans for Children in Ireland | Inheritance Tax Advice Ireland – #39

- import tax

- gift tax rate

- excise tax

Gift taxes red concept icon. Goods taxation idea thin line illustration. Interest rate on present. Tax on transferring wealth. Paying fee for gift box. Vector isolated outline drawing Stock Vector | Adobe – #40

Gift taxes red concept icon. Goods taxation idea thin line illustration. Interest rate on present. Tax on transferring wealth. Paying fee for gift box. Vector isolated outline drawing Stock Vector | Adobe – #40

A complicated gift | Tax Adviser – #41

A complicated gift | Tax Adviser – #41

Donate Stock | Winnipeg Humane Society – #42

Donate Stock | Winnipeg Humane Society – #42

GIFT City route to international equities promises greater security | pf news investments – Business Standard – #43

GIFT City route to international equities promises greater security | pf news investments – Business Standard – #43

Schwab Stock Slices™ – Give the Gift of Ownership | Charles Schwab – #44

Schwab Stock Slices™ – Give the Gift of Ownership | Charles Schwab – #44

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #45

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #45

Income Tax on Digital, Physical, and Paper Gold in India | IIFL Finance – #46

Income Tax on Digital, Physical, and Paper Gold in India | IIFL Finance – #46

Gift of Securities or Stock – United Way Halton & Hamilton – #47

Gift of Securities or Stock – United Way Halton & Hamilton – #47

- gift tag

- gift tax definition

- gift tax exemption relatives list

Equity Shares: How to gift equity shares to relatives, what are the tax implications – The Economic Times – #48

Equity Shares: How to gift equity shares to relatives, what are the tax implications – The Economic Times – #48

A Primer on the Complexities of Gift Tax and Estate Tax | Cray Kaiser Ltd. – #49

A Primer on the Complexities of Gift Tax and Estate Tax | Cray Kaiser Ltd. – #49

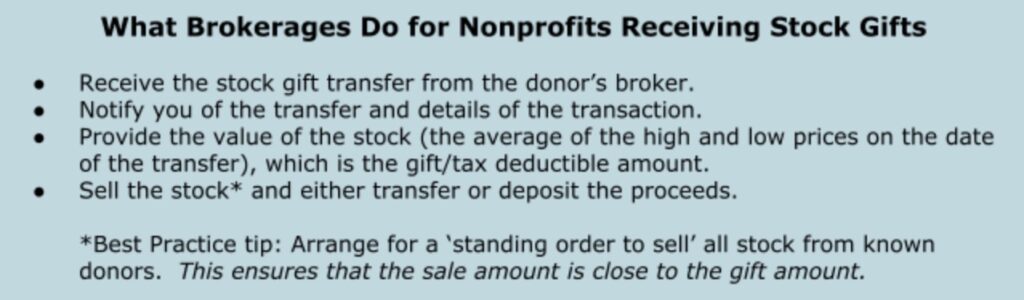

Steve Latham on LinkedIn: #nonprofits – #50

Steve Latham on LinkedIn: #nonprofits – #50

Rules for direct listing of securities by Indian companies on international exchanges of GIFT IFSC notified – The Hindu BusinessLine – #51

Rules for direct listing of securities by Indian companies on international exchanges of GIFT IFSC notified – The Hindu BusinessLine – #51

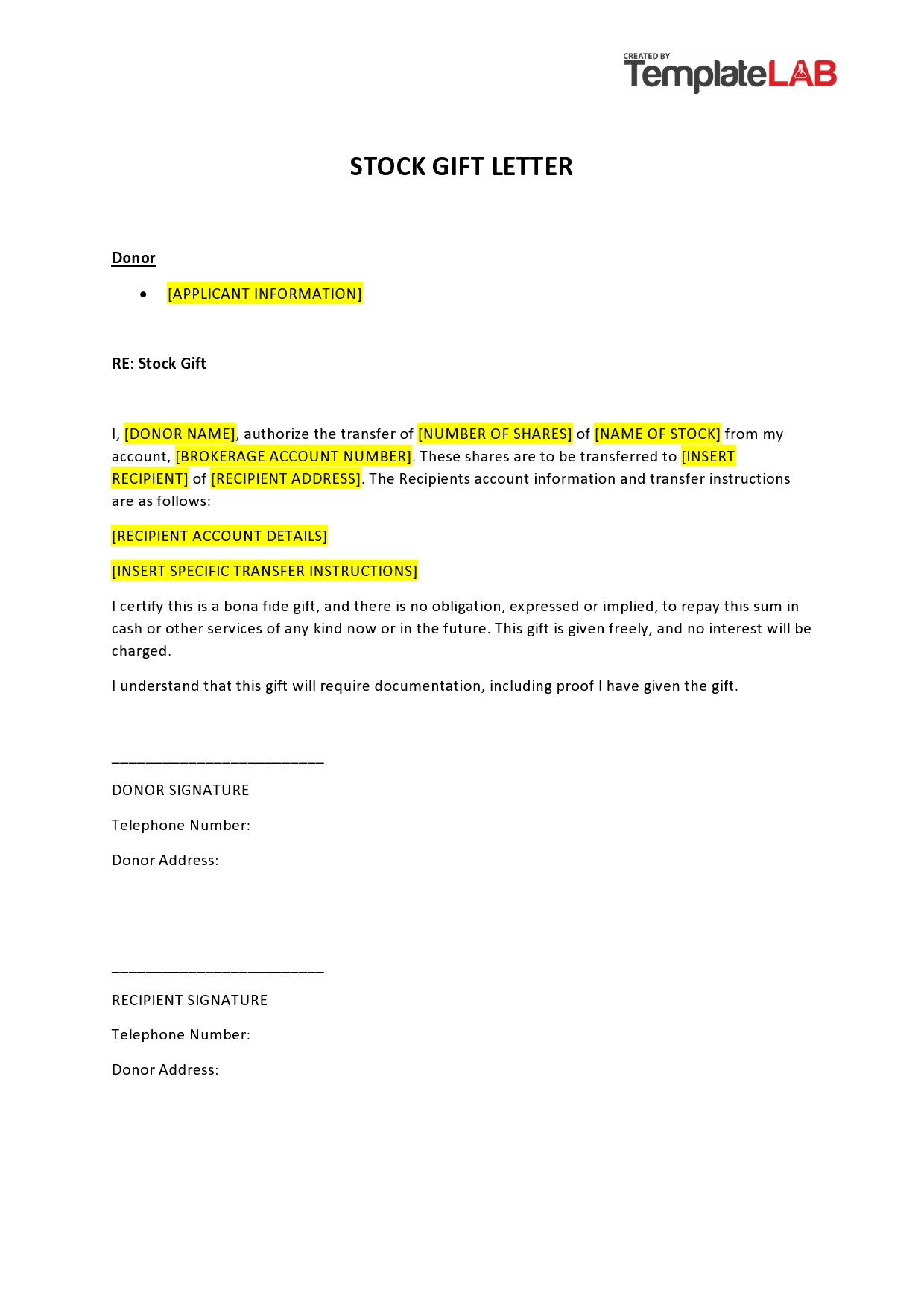

FY19 INSTRUCTIONS FOR ELECTRONIC STOCK GIFT TRANSFER – #52

FY19 INSTRUCTIONS FOR ELECTRONIC STOCK GIFT TRANSFER – #52

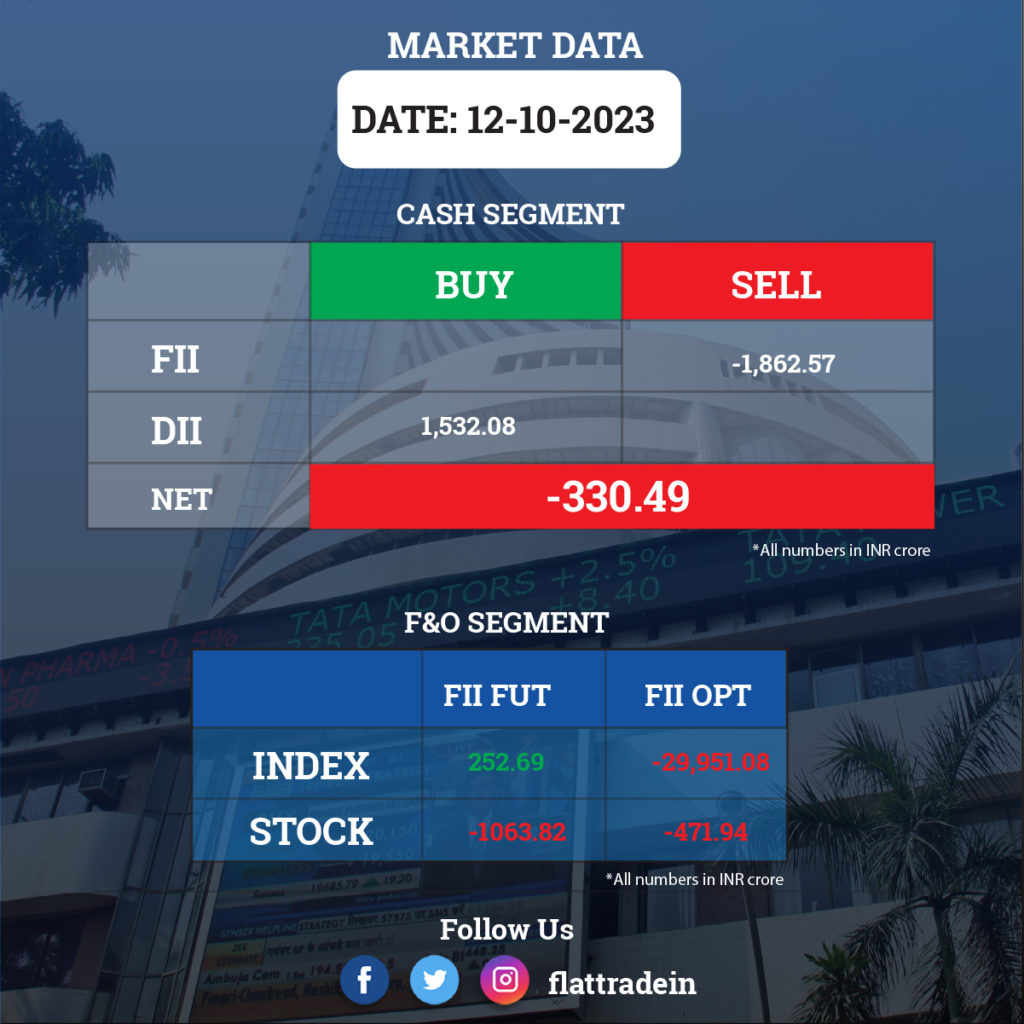

Pre Market Report: GIFT Nifty indicates higher opening; Infosys, HCLTech, Mphasis in focus – Flattrade Kosh – #53

Pre Market Report: GIFT Nifty indicates higher opening; Infosys, HCLTech, Mphasis in focus – Flattrade Kosh – #53

GIFT City explained: History & tax incentives of India’s first ‘Smart City’ – The Hindu – #54

GIFT City explained: History & tax incentives of India’s first ‘Smart City’ – The Hindu – #54

Valuation of Shares, AC – (HAPTER 9 introductiorn Aos an accountant may be called upon to place a – Studocu – #55

Valuation of Shares, AC – (HAPTER 9 introductiorn Aos an accountant may be called upon to place a – Studocu – #55

Gifting Company Stock: A Step-by-Step Guide | Eqvista – #56

Gifting Company Stock: A Step-by-Step Guide | Eqvista – #56

What is a Step-up in Basis? Cost Basis of Inherited Assets – #57

What is a Step-up in Basis? Cost Basis of Inherited Assets – #57

![]() Five Ways to Make a Year-end Gift to FINCA | FINCA – #58

Five Ways to Make a Year-end Gift to FINCA | FINCA – #58

Gift and Estate Tax Limits for 2023 for US and Non-US Citizens – #59

Gift and Estate Tax Limits for 2023 for US and Non-US Citizens – #59

NRIs who invest in India through AIFs set up in Gift City get tax exemption | Personal Finance – Business Standard – #60

NRIs who invest in India through AIFs set up in Gift City get tax exemption | Personal Finance – Business Standard – #60

What is Gift Nifty? Check key changes, impact on traders and investors – India Today – #61

What is Gift Nifty? Check key changes, impact on traders and investors – India Today – #61

Stock Gifts – Sixteenth Street – #62

Stock Gifts – Sixteenth Street – #62

Income Tax Implications of Transactions in Crypto Currency – #63

Income Tax Implications of Transactions in Crypto Currency – #63

Changes To The Estate And Gift Tax Regulations – Tsamutalis & Company – #64

Changes To The Estate And Gift Tax Regulations – Tsamutalis & Company – #64

How to Make a Stock Gift to Christian Community Service Center – #65

How to Make a Stock Gift to Christian Community Service Center – #65

University of Wisconsin-Platteville Foundation Planned Giving :: Gift of Securities – #66

University of Wisconsin-Platteville Foundation Planned Giving :: Gift of Securities – #66

Gift Tax 101: What You Need to Know — Connecticut Estate Planning Attorneys Blog – #67

Gift Tax 101: What You Need to Know — Connecticut Estate Planning Attorneys Blog – #67

What are different Types of Gold Investment and How are they Taxed – #68

What are different Types of Gold Investment and How are they Taxed – #68

You can build the kingdom of God by gifting stocks or bonds! – #69

You can build the kingdom of God by gifting stocks or bonds! – #69

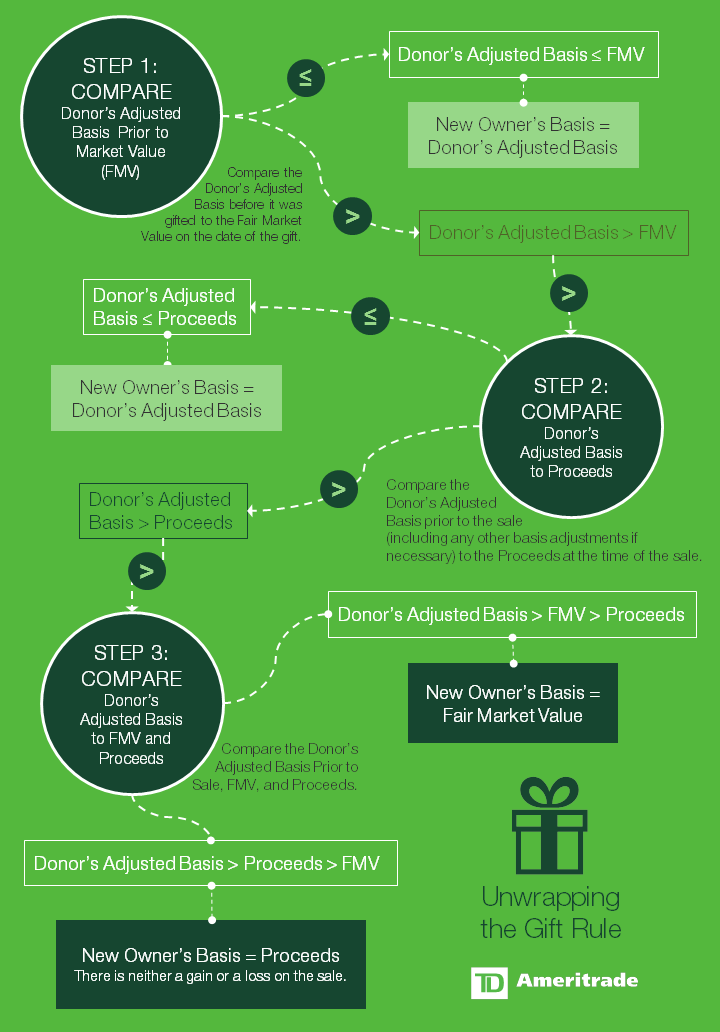

Gift Tax Rules Simplified – Cost Basis of Gifted Stock – Ticker Tape – #70

Gift Tax Rules Simplified – Cost Basis of Gifted Stock – Ticker Tape – #70

Is There a Gift Tax Between Spouses? It Depends – #71

Is There a Gift Tax Between Spouses? It Depends – #71

Does stock x send your shoes back or give credits / gift cards if you successfully sold a shoe and they sent payout, but can’t verify tax details? : r/stockx – #72

Does stock x send your shoes back or give credits / gift cards if you successfully sold a shoe and they sent payout, but can’t verify tax details? : r/stockx – #72

How to Gift Stocks Guide | The Motley Fool – #73

How to Gift Stocks Guide | The Motley Fool – #73

Luxurious Return Gift Of Hometown Tax Stock Illustration – Download Image Now – Taxpayer, Alcohol – Drink, Application Form – iStock – #74

Luxurious Return Gift Of Hometown Tax Stock Illustration – Download Image Now – Taxpayer, Alcohol – Drink, Application Form – iStock – #74

How to Invest in FAANG Stocks from India? – #75

How to Invest in FAANG Stocks from India? – #75

Gifts of Stock or Appreciated Securities | Rochester Regional Health Foundations – #76

Gifts of Stock or Appreciated Securities | Rochester Regional Health Foundations – #76

Chapter 18: GIFT and ESTATE TAX – ppt download – #77

Chapter 18: GIFT and ESTATE TAX – ppt download – #77

Making a Gift of Securities – #78

Making a Gift of Securities – #78

Make a Stock Gift | ACLU of Rhode Island – #79

Make a Stock Gift | ACLU of Rhode Island – #79

- irs form 709 examples of completed 709s

- form 709 example

- income tax

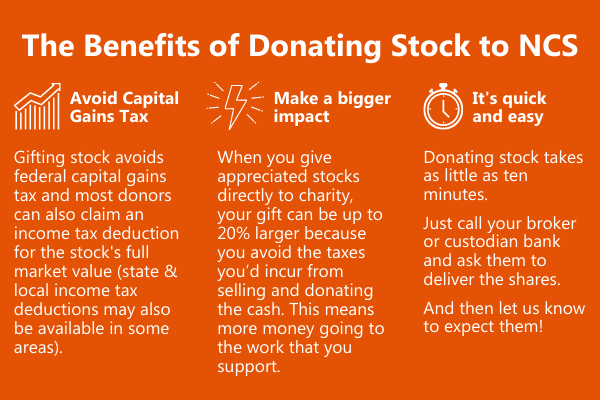

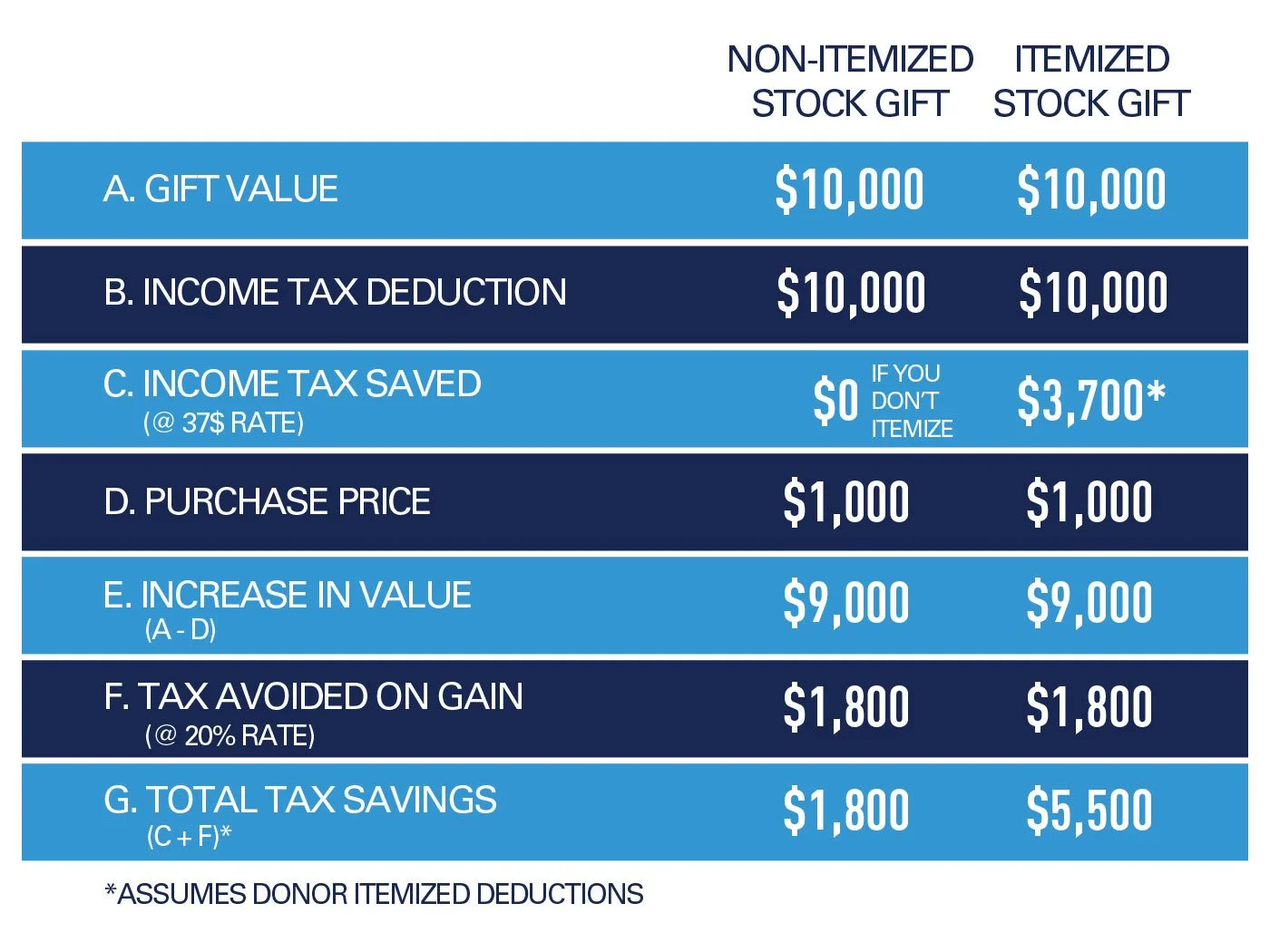

MAKE A GIFT OF STOCK TODAY! – #80

MAKE A GIFT OF STOCK TODAY! – #80

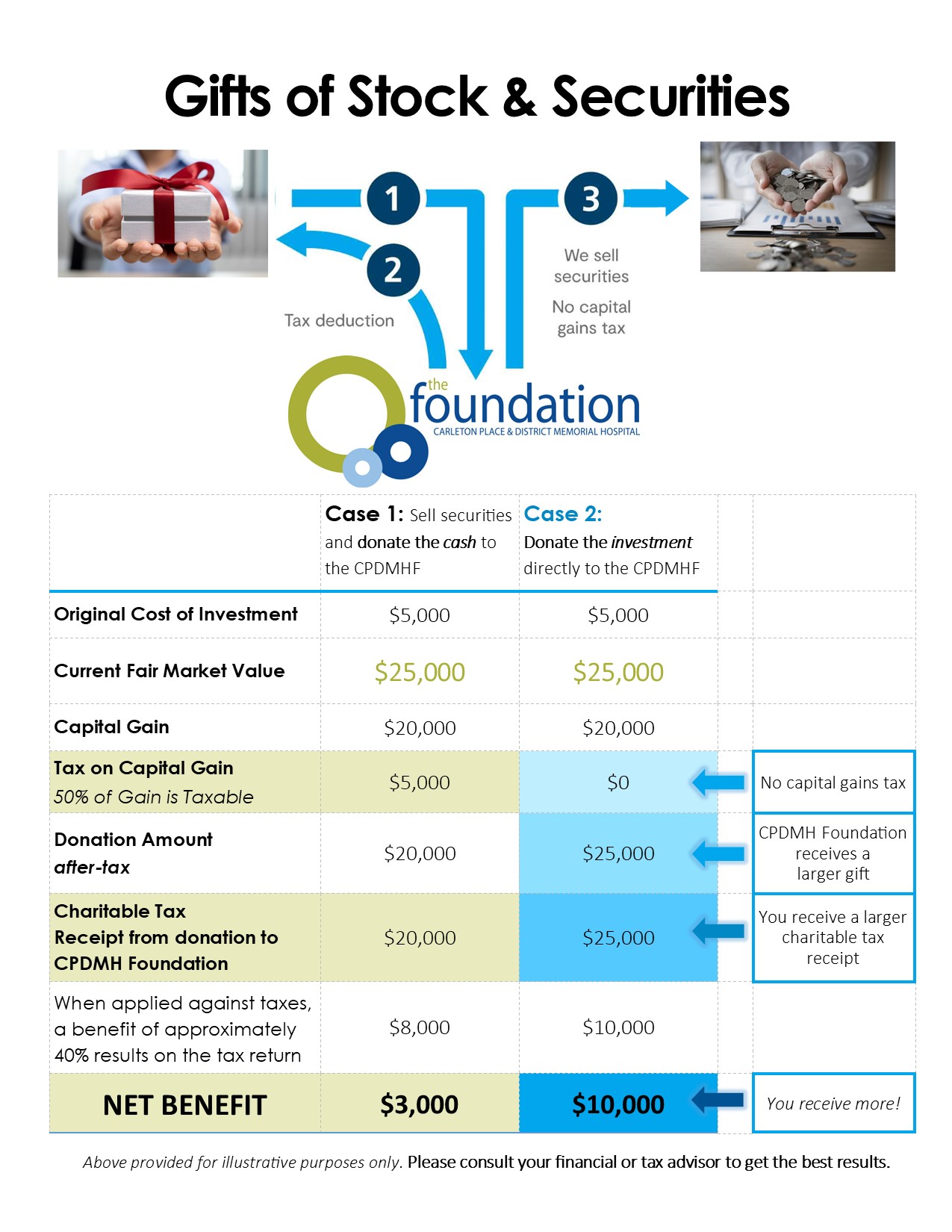

Gifts of Appreciated Stock – West Lafayette Schools Education Foundation – #81

Gifts of Appreciated Stock – West Lafayette Schools Education Foundation – #81

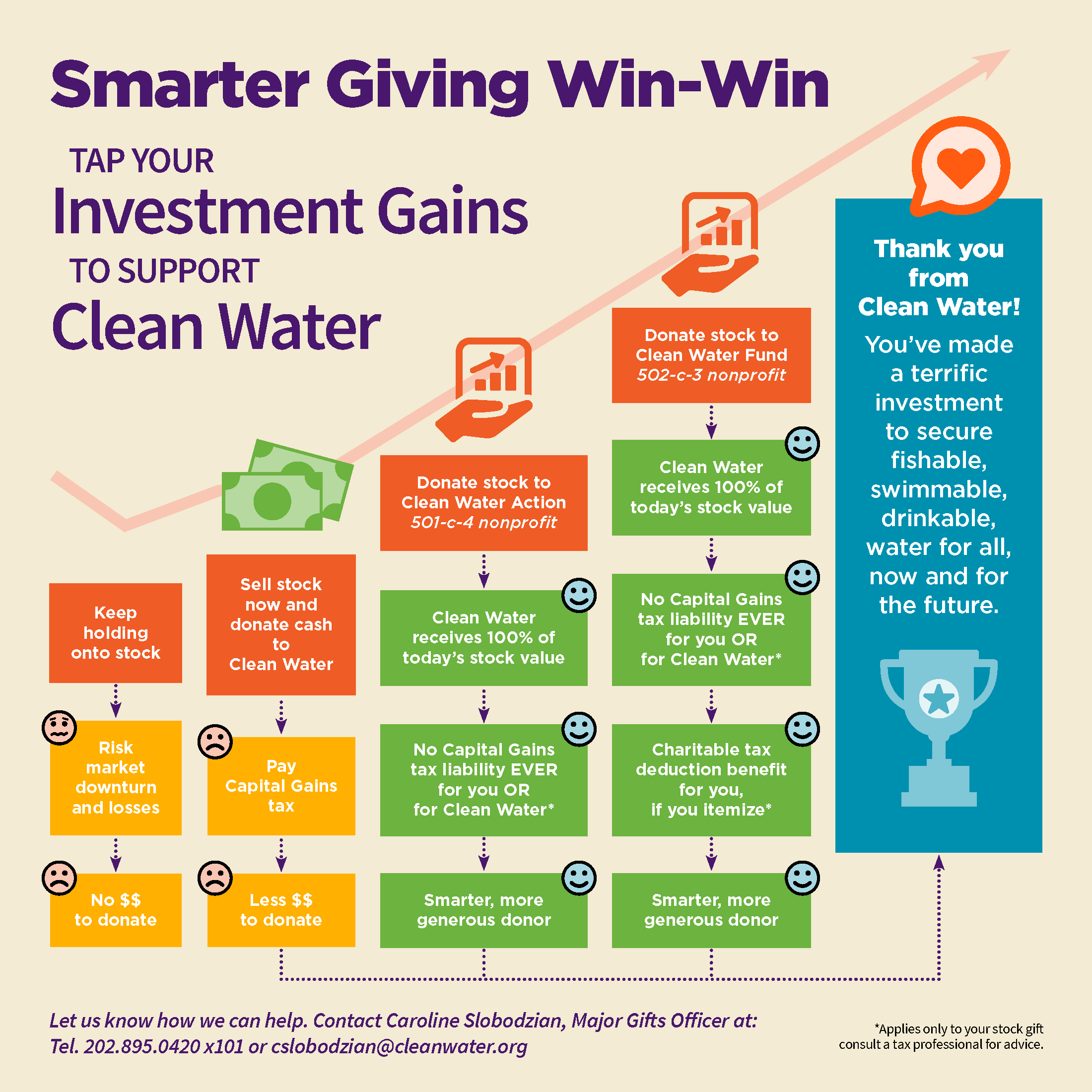

Give Appreciated Stock – #82

Give Appreciated Stock – #82

Best Gifting Strategy for Tax Benefits | Inspired Financial – #83

Best Gifting Strategy for Tax Benefits | Inspired Financial – #83

Disabled American Veterans (DAV) on X: “When you make a gift with stock or appreciated securities, you avoid paying capital gain taxes and get a full income tax deduction for the value – #84

Disabled American Veterans (DAV) on X: “When you make a gift with stock or appreciated securities, you avoid paying capital gain taxes and get a full income tax deduction for the value – #84

Donate with Stocks or Appreciated Securities | Hospice of San Luis Obispo County – #85

Donate with Stocks or Appreciated Securities | Hospice of San Luis Obispo County – #85

Appreciated Securities | Christian Union – #86

Appreciated Securities | Christian Union – #86

Small Business Employee Gifts: Tax Rules and Other Considerations – #87

Small Business Employee Gifts: Tax Rules and Other Considerations – #87

Year End Is Gift-giving Time: Use The Annual Gift Tax Exclusion To The Max – Theus Law Offices – #88

Year End Is Gift-giving Time: Use The Annual Gift Tax Exclusion To The Max – Theus Law Offices – #88

Tax considerations when gifting stock – InvestmentNews – #89

Tax considerations when gifting stock – InvestmentNews – #89

- gift tax exemption 2022

- gift tax meaning

- gift tax exemption

A Lavish Tax Dodge for the Ultrawealthy Is Easily Multiplied – The New York Times – #90

A Lavish Tax Dodge for the Ultrawealthy Is Easily Multiplied – The New York Times – #90

How Are Gains On Foreign Stock Investments Taxed? – Forbes Advisor INDIA – #91

How Are Gains On Foreign Stock Investments Taxed? – Forbes Advisor INDIA – #91

Estate Planning: Consider the Tax Basis of Gifted or Inherited Property – #92

Estate Planning: Consider the Tax Basis of Gifted or Inherited Property – #92

Taxation on Cryptocurrency: Guide To Crypto Taxes in India 2024 – #93

Taxation on Cryptocurrency: Guide To Crypto Taxes in India 2024 – #93

Gift Tax in India: Implications & Exemptions – myMoneySage Blog – #94

Gift Tax in India: Implications & Exemptions – myMoneySage Blog – #94

How To Avoid The Gift Tax In Real Estate | Rocket Mortgage – #95

How To Avoid The Gift Tax In Real Estate | Rocket Mortgage – #95

Abbreviated Stock Transfer Instructions (10/28/99) – #96

Abbreviated Stock Transfer Instructions (10/28/99) – #96

- family member money gift letter from parents

- gift tax upsc

- stock market tax

HOW TO: Easily Accept Stock Donations on Your Nonprofit’s Website – and Why You Should | Nonprofit Tech for Good – #97

HOW TO: Easily Accept Stock Donations on Your Nonprofit’s Website – and Why You Should | Nonprofit Tech for Good – #97

Stocks and Bonds | University of La Verne – #98

Stocks and Bonds | University of La Verne – #98

How Do You Value a Gift of Stock for Taxes? – Marotta On Money – #99

How Do You Value a Gift of Stock for Taxes? – Marotta On Money – #99

Outstanding Tax Savings! How a Gift of Appreciated Publicly Traded Securities Can Benefit You and Others – The Salvation Army in Canada – #100

Outstanding Tax Savings! How a Gift of Appreciated Publicly Traded Securities Can Benefit You and Others – The Salvation Army in Canada – #100

Posts: stock gift tax

Categories: Gifts

Author: toyotabienhoa.edu.vn