Aggregate more than 138 money gift tax limit super hot

Top images of money gift tax limit by website toyotabienhoa.edu.vn compilation. Income Tax Declared Cash Deposit Limit in Saving & Current Bank Accounts – AWBI. How much money can NRIs gift to parents in India? | Arthgyaan. Gift Tax 101: What You Need to Know — Connecticut Estate Planning Attorneys Blog

Form 709: What It Is and Who Must File It – #1

Form 709: What It Is and Who Must File It – #1

Income Tax on Gift – #2

Income Tax on Gift – #2

Gifting Money to Children Without Paying Tax (Annual Gift Tax Exclusion 2023) – YouTube – #4

Gifting Money to Children Without Paying Tax (Annual Gift Tax Exclusion 2023) – YouTube – #4

Gifts from specified relatives are not taxed | Mint – #5

Gifts from specified relatives are not taxed | Mint – #5

A Data-Driven Analysis of the Laffer Curve | by Andrew Oliver | The Startup | Medium – #6

A Data-Driven Analysis of the Laffer Curve | by Andrew Oliver | The Startup | Medium – #6

Is There Gift Tax If I Give My Niece Money for Her IRA? | Money – #7

Is There Gift Tax If I Give My Niece Money for Her IRA? | Money – #7

How to Gift Money – Experian – #8

How to Gift Money – Experian – #8

- gift tax example

- gift tax return

- gift tax 2023

How Are Foreign Inward Remittance Taxed In India – #10

How Are Foreign Inward Remittance Taxed In India – #10

Gift Tax Limit 2024: How Much Can You Give Tax-Free? | Kiplinger – #11

Gift Tax Limit 2024: How Much Can You Give Tax-Free? | Kiplinger – #11

Lottery Tax in India: Tax Levied on Winning Game Shows & Lottery – #12

Lottery Tax in India: Tax Levied on Winning Game Shows & Lottery – #12

How to calculate income tax on gifts from relatives? – #13

How to calculate income tax on gifts from relatives? – #13

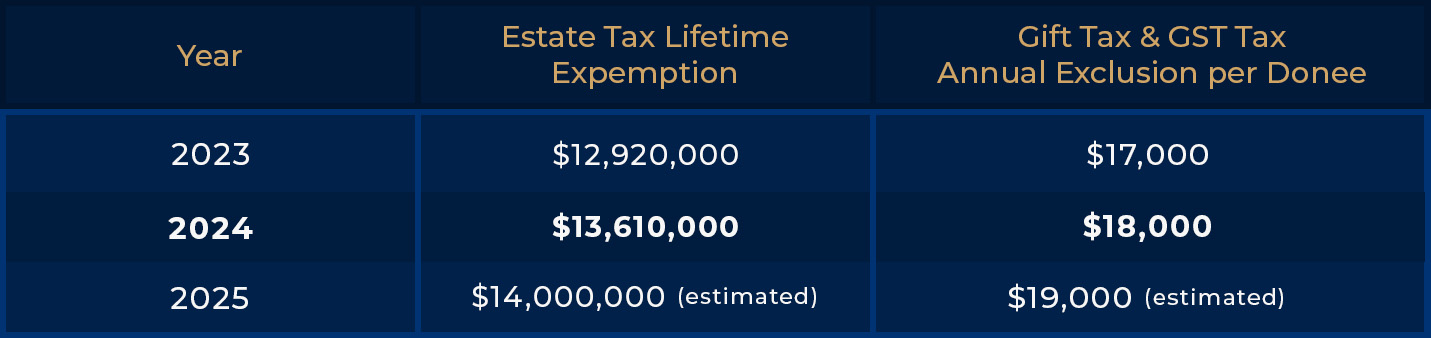

2023 Annual Estate Planning Limits | Money Education – #14

2023 Annual Estate Planning Limits | Money Education – #14

PPF: How you can double your income through clubbing your life partner’s PPF account; know the trick | Zee Business – #15

PPF: How you can double your income through clubbing your life partner’s PPF account; know the trick | Zee Business – #15

Historical Estate Tax Exemption Amounts And Tax Rates – #16

Historical Estate Tax Exemption Amounts And Tax Rates – #16

The Tax Implications of Employee Gifts – Hourly, Inc. – #17

The Tax Implications of Employee Gifts – Hourly, Inc. – #17

Gift Tax Limit 2024: How Much Money Can You Gift? | SmartAsset – #18

Gift Tax Limit 2024: How Much Money Can You Gift? | SmartAsset – #18

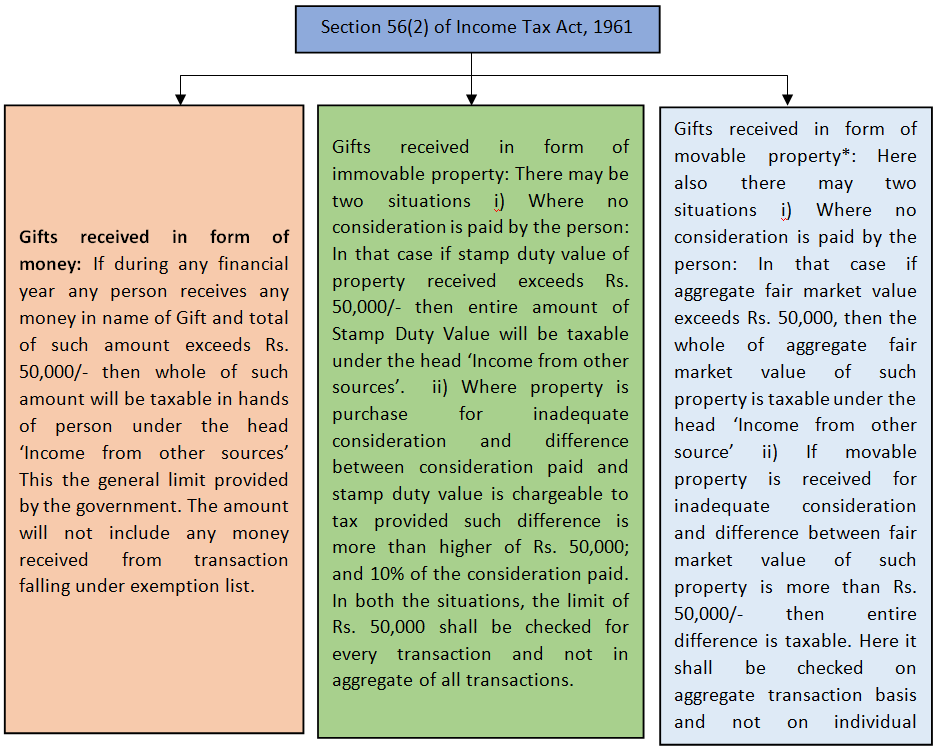

Section 56(2)(vii) : Cash / Non-Cash Gifts – #19

Section 56(2)(vii) : Cash / Non-Cash Gifts – #19

- gift tax rate table

- gift tax exemption 2022

Gift Tax: 3 Easy Ways to Avoid Paying the Gift Tax | TaxAct – #20

Gift Tax: 3 Easy Ways to Avoid Paying the Gift Tax | TaxAct – #20

IRS Announces Higher 2019 Estate And Gift Tax Limits – #21

IRS Announces Higher 2019 Estate And Gift Tax Limits – #21

What are the tax implications of gifting shares to your grandson? | Mint – #22

What are the tax implications of gifting shares to your grandson? | Mint – #22

Irrevocable Trusts for Estate Tax Planning, Gift Tax and Gifting Strategies Explained – #23

Irrevocable Trusts for Estate Tax Planning, Gift Tax and Gifting Strategies Explained – #23

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™ – #24

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™ – #24

Tax | What is Tax | Taxation in India : Tax Calculation – #25

Tax | What is Tax | Taxation in India : Tax Calculation – #25

Gift Tax Planning and Compliance – #26

Gift Tax Planning and Compliance – #26

Gift Tax in India | Save tax on Gift | Income Tax on property gift | will vs gift deed – YouTube – #27

Gift Tax in India | Save tax on Gift | Income Tax on property gift | will vs gift deed – YouTube – #27

UPI Transaction Charges and Fees 2024: Limits Per Day & Guidelines – #28

UPI Transaction Charges and Fees 2024: Limits Per Day & Guidelines – #28

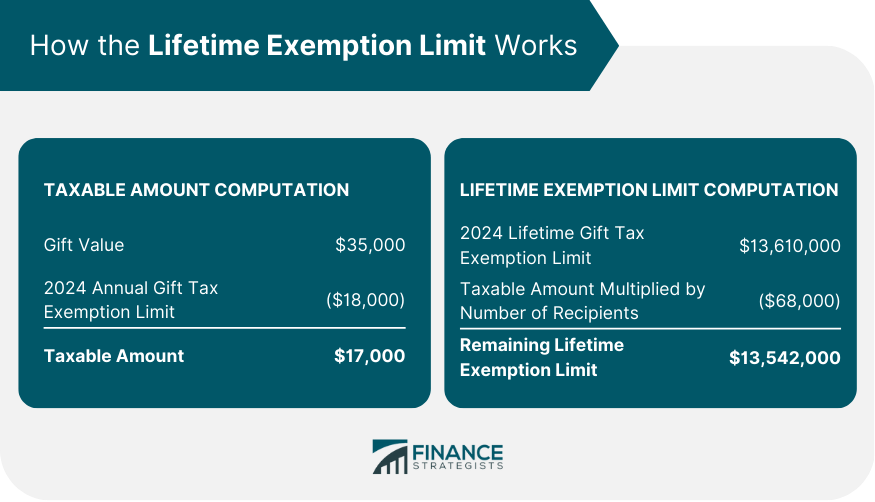

Gift Tax 2023 | What It Is, Annual Limit, Lifetime Exemption, & Gift Tax Rate – #29

Gift Tax 2023 | What It Is, Annual Limit, Lifetime Exemption, & Gift Tax Rate – #29

-Gifts.jpg) How Much Money Can You Gift Tax-Free? | The Motley Fool – #30

How Much Money Can You Gift Tax-Free? | The Motley Fool – #30

Gift Tax Rules – A Simple Guide to Claiming Gifts | www.GkaplanCPA.com – #31

Gift Tax Rules – A Simple Guide to Claiming Gifts | www.GkaplanCPA.com – #31

Taxation of Minor Children in India: How Does It Work? – #32

Taxation of Minor Children in India: How Does It Work? – #32

Property Gift Deed Registration – Sample Format, Charges & Rules – #33

Property Gift Deed Registration – Sample Format, Charges & Rules – #33

Do You Have to Pay Tax on Gifts? – #34

Do You Have to Pay Tax on Gifts? – #34

New Limits on Estate Taxes & Gift Tax exemptions | Ashok Sanghavi – #35

New Limits on Estate Taxes & Gift Tax exemptions | Ashok Sanghavi – #35

- gift chart as per income tax

- gift tax

- gift tax definition

6 Ways To Give Money As A Gift | Bankrate – #36

6 Ways To Give Money As A Gift | Bankrate – #36

![Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will](https://media.assettype.com/outlookbusiness%2Fimport%2Fimgnew.outlookindia.com%2Fuploadimage%2Flibrary%2F16_9%2F16_9_5%2FTax_1642486649.jpg) Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will – #37

Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will – #37

How does the gift tax work? – Personal Finance Club – #38

How does the gift tax work? – Personal Finance Club – #38

) Gift Tax Limits and Exceptions: Advice From an Expert | Money – #39

Gift Tax Limits and Exceptions: Advice From an Expert | Money – #39

Need to file I-T Returns? Know the steps, benefits of doing it online | Economy & Policy News – Business Standard – #40

Need to file I-T Returns? Know the steps, benefits of doing it online | Economy & Policy News – Business Standard – #40

Gift Tax: 6 Ways to Avoid Paying the IRS | The Motley Fool – #41

Gift Tax: 6 Ways to Avoid Paying the IRS | The Motley Fool – #41

Are Gift Cards Taxable? | Taxation, Examples, & More – #42

Are Gift Cards Taxable? | Taxation, Examples, & More – #42

Narayana Murthy gifts Infosys shares worth Rs 240 cr to his 4-month-old grandson: How are gifts taxed in India? – #43

Narayana Murthy gifts Infosys shares worth Rs 240 cr to his 4-month-old grandson: How are gifts taxed in India? – #43

Taxation in the United States – Wikipedia – #44

Taxation in the United States – Wikipedia – #44

What You Need to Know About Stock Gift Tax – #45

What You Need to Know About Stock Gift Tax – #45

40 Years Ago… and now: From 70% to 30% peak I-T rate | Markets and Investing – Business Standard – #46

40 Years Ago… and now: From 70% to 30% peak I-T rate | Markets and Investing – Business Standard – #46

Learn About Estate and Gift Taxes- The Hayes Law Firm – #47

Learn About Estate and Gift Taxes- The Hayes Law Firm – #47

![Guide to Crypto Tax in India [Updated 2024] Guide to Crypto Tax in India [Updated 2024]](https://www.livemint.com/lm-img/img/2023/11/30/1600x900/query_1701362156315_1701362163960.jpg) Guide to Crypto Tax in India [Updated 2024] – #48

Guide to Crypto Tax in India [Updated 2024] – #48

To File Or Not To File A Gift Tax Return, That Is The Question – #49

To File Or Not To File A Gift Tax Return, That Is The Question – #49

- estate/gift tax

- form 709

- gift tax act 1958

What is a gift deed and tax implications | Tax Hack – #50

What is a gift deed and tax implications | Tax Hack – #50

Will I Be Taxed When Gifting Money? – #51

Will I Be Taxed When Gifting Money? – #51

Gifting money in the US: all you need to know | WorldRemit – #52

Gifting money in the US: all you need to know | WorldRemit – #52

How to Gift MORE than the Gift Limit in 2022 | TAX FREE – YouTube – #53

How to Gift MORE than the Gift Limit in 2022 | TAX FREE – YouTube – #53

Estate Tax Exemption and Annual Gift Tax Exclusion for 2023 – Montana Estate Lawyers – #54

Estate Tax Exemption and Annual Gift Tax Exclusion for 2023 – Montana Estate Lawyers – #54

Taxes Definition: Types, Who Pays, and Why – #55

Taxes Definition: Types, Who Pays, and Why – #55

EbixCash -Get Corporate Gift Cards & Prepaid Cards | Meal Cards – #56

EbixCash -Get Corporate Gift Cards & Prepaid Cards | Meal Cards – #56

Annual Gift Tax Exclusion Will Increase to $18,000 to Any Person in 2024 – #57

Annual Gift Tax Exclusion Will Increase to $18,000 to Any Person in 2024 – #57

Taxes Archives – Yardley Estate Planning – #58

Taxes Archives – Yardley Estate Planning – #58

Taxes On Gifts From Overseas – #59

Taxes On Gifts From Overseas – #59

VERIFY on X: “In 2024, a parent is allowed to give their child this much without having to report it to the IRS: https://t.co/tINyQbCDTF https://t.co/WRKCj874Vo” / X – #60

VERIFY on X: “In 2024, a parent is allowed to give their child this much without having to report it to the IRS: https://t.co/tINyQbCDTF https://t.co/WRKCj874Vo” / X – #60

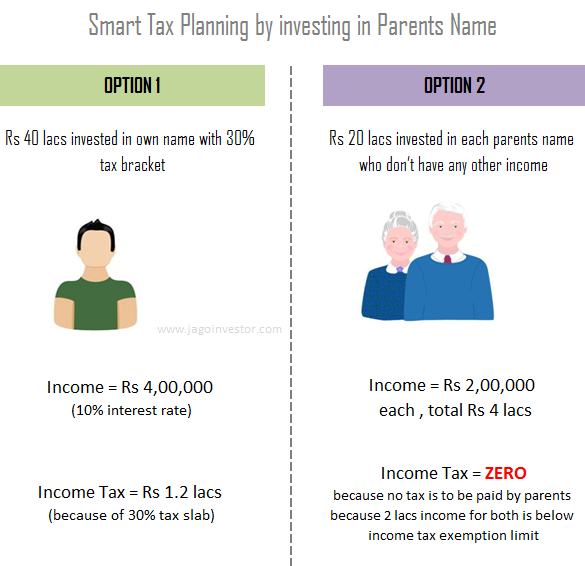

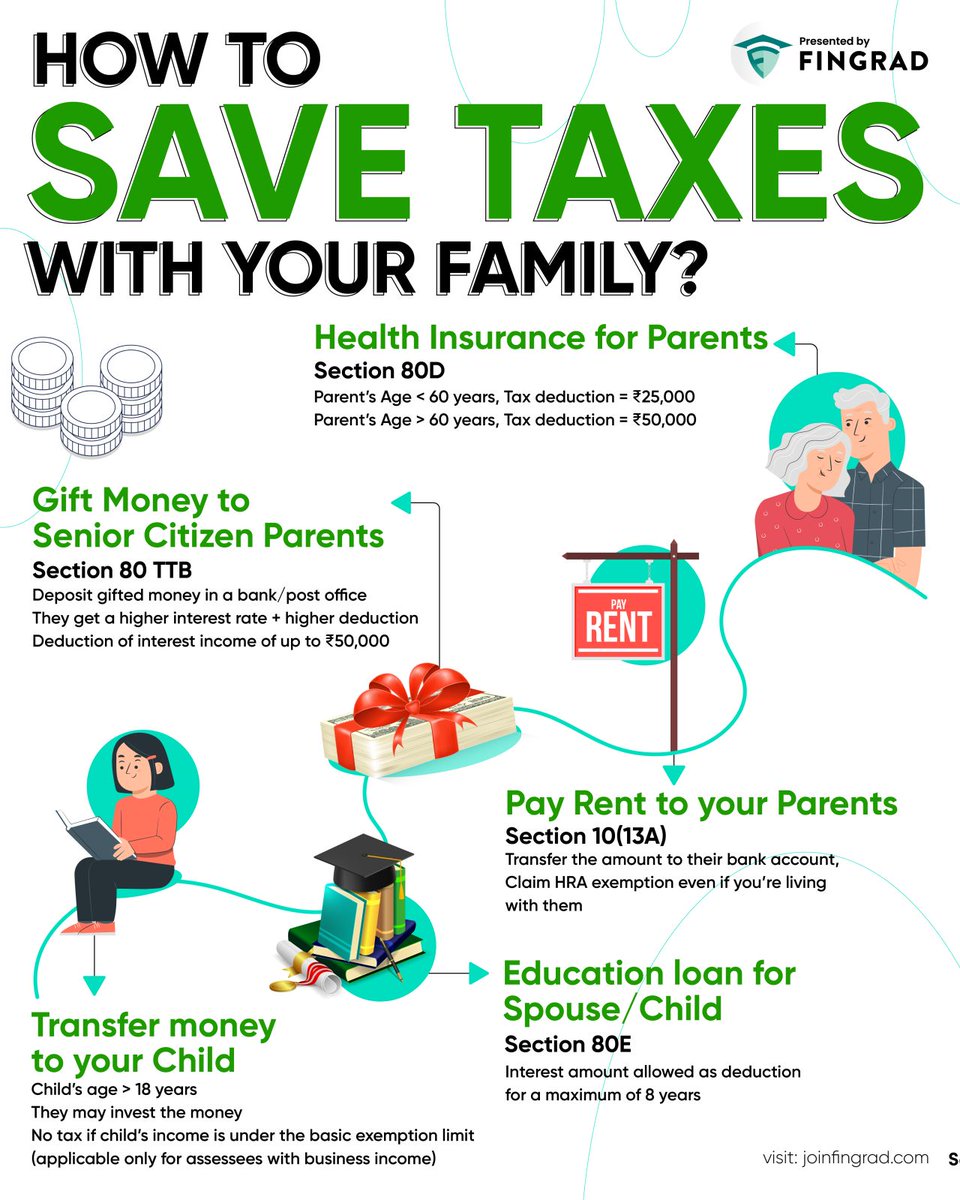

Kritesh Abhishek on X: “How to Save Taxes with your family? – Health Insurance for Parents – Gift Money to Senior Citizen Parents – Pay rent to parents – Transfer money to – #61

Kritesh Abhishek on X: “How to Save Taxes with your family? – Health Insurance for Parents – Gift Money to Senior Citizen Parents – Pay rent to parents – Transfer money to – #61

Tax-Free Income Sources in India 2024 – #62

Tax-Free Income Sources in India 2024 – #62

Quiz & Worksheet – Estate Tax Planning | Study.com – #63

Quiz & Worksheet – Estate Tax Planning | Study.com – #63

What Is the Lifetime Gift Tax Exemption for 2024? | SmartAsset – #64

What Is the Lifetime Gift Tax Exemption for 2024? | SmartAsset – #64

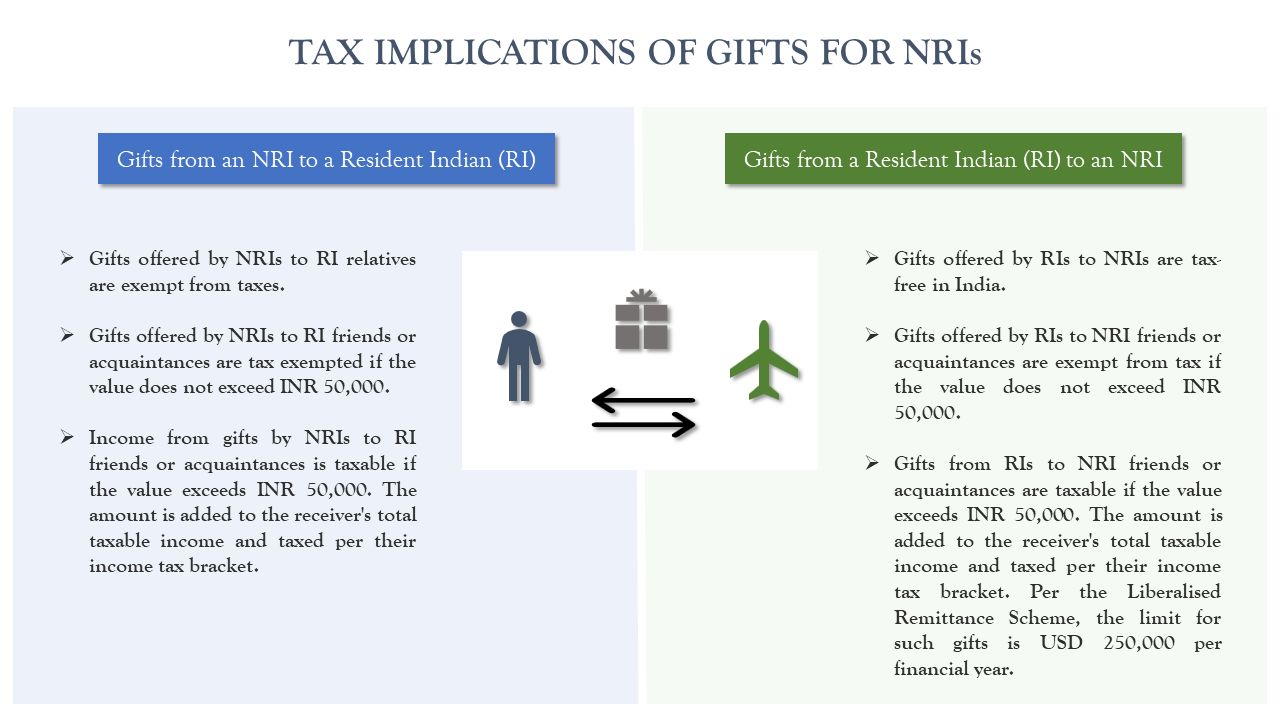

When are gifts received by NRIs subject to tax, TDS in India? – The Economic Times – #65

When are gifts received by NRIs subject to tax, TDS in India? – The Economic Times – #65

Taxes in Russia: the complete guide for expats | Expatica – #66

Taxes in Russia: the complete guide for expats | Expatica – #66

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #67

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #67

How to Make the Most of the Annual Gift Tax Exclusion – CPA Firm Tampa – #68

How to Make the Most of the Annual Gift Tax Exclusion – CPA Firm Tampa – #68

Gift Tax: Tax on gifts: Documents that you should have while filing ITR – The Economic Times – #69

Gift Tax: Tax on gifts: Documents that you should have while filing ITR – The Economic Times – #69

IRS Gift Limit Check 2023 | Gifts Up To A Certain Amount Are Tax-free! – #70

IRS Gift Limit Check 2023 | Gifts Up To A Certain Amount Are Tax-free! – #70

Income tax on gifts: Know when your gift is tax-free – BusinessToday – #71

Income tax on gifts: Know when your gift is tax-free – BusinessToday – #71

Gift Tax Exemption – FasterCapital – #72

Gift Tax Exemption – FasterCapital – #72

Do I have to pay taxes if I receive money from my parents to pay rent? All money I get from them I put in bank then write check – Quora – #73

Do I have to pay taxes if I receive money from my parents to pay rent? All money I get from them I put in bank then write check – Quora – #73

The Estate Tax is Irrelevant to More Than 99 Percent of Americans – ITEP – #74

The Estate Tax is Irrelevant to More Than 99 Percent of Americans – ITEP – #74

What is the taxation on any gift via cash transfer to a relative? | Mint – #75

What is the taxation on any gift via cash transfer to a relative? | Mint – #75

Take advantage of the gift tax exclusion rules – KraftCPAs – #76

Take advantage of the gift tax exclusion rules – KraftCPAs – #76

Avoid the 2021 $15K Gift Tax Limit by Gifting Healthcare and Education – #77

Avoid the 2021 $15K Gift Tax Limit by Gifting Healthcare and Education – #77

Cadence Bank – If gifting is part of your estate planning strategy, it’s helpful to note that the IRS has raised the annual exclusion for gifts to $18,000 for calendar year 2024, – #78

Cadence Bank – If gifting is part of your estate planning strategy, it’s helpful to note that the IRS has raised the annual exclusion for gifts to $18,000 for calendar year 2024, – #78

How to Maximize OPC Savings before Filing Income Tax? – #79

How to Maximize OPC Savings before Filing Income Tax? – #79

Receiving a gift from abroad – The TaxSavers – #80

Receiving a gift from abroad – The TaxSavers – #80

When Should I Use My Estate and Gift Tax Exemption? – #81

When Should I Use My Estate and Gift Tax Exemption? – #81

Crypto Gift Tax | Your Guide | Koinly – #82

Crypto Gift Tax | Your Guide | Koinly – #82

Gifts to and from HUF – MN & Associates CS-India – #83

Gifts to and from HUF – MN & Associates CS-India – #83

15 Tax Saving Options Other Than Section 80C – #84

15 Tax Saving Options Other Than Section 80C – #84

Gift tax: what is it & how does it work? | Empower – #85

Gift tax: what is it & how does it work? | Empower – #85

5 Ways to Give Tax-Free Gifts | Pat Clifford – #86

5 Ways to Give Tax-Free Gifts | Pat Clifford – #86

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #87

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #87

Know the tax impact on the gifts you receive – Goal Bridge – #88

Know the tax impact on the gifts you receive – Goal Bridge – #88

Gift Tax In Denmark – When And How Much? | Family Matters On Line – #89

Gift Tax In Denmark – When And How Much? | Family Matters On Line – #89

35 Best Gift Letter Templates (Word & PDF) ᐅ TemplateLab – #90

35 Best Gift Letter Templates (Word & PDF) ᐅ TemplateLab – #90

Giving Gifts to Employees: Best Practices – #91

Giving Gifts to Employees: Best Practices – #91

IT Department Sets Rs 1 Lakh Ceiling Per Taxpayer For Small Tax Demands – #92

IT Department Sets Rs 1 Lakh Ceiling Per Taxpayer For Small Tax Demands – #92

![Tax on money received from abroad to India [Oct 2020] - Wise Tax on money received from abroad to India [Oct 2020] - Wise](https://images.moneycontrol.com/static-mcnews/2024/03/Taxation-of-gifts.jpg) Tax on money received from abroad to India [Oct 2020] – Wise – #93

Tax on money received from abroad to India [Oct 2020] – Wise – #93

Jeanne on X: “A misleading headline. The “annual exclusion” ($18,000 for 2024) is the amount you can gift to someone without using any of your lifetime gift & estate exclusion or filing – #94

Jeanne on X: “A misleading headline. The “annual exclusion” ($18,000 for 2024) is the amount you can gift to someone without using any of your lifetime gift & estate exclusion or filing – #94

Tips to Save Tax on Sale of Residential Property 2024 – #95

Tips to Save Tax on Sale of Residential Property 2024 – #95

Gift tax: Unwrapping the Hidden Tax on Gifts: What You Should Know – FasterCapital – #96

Gift tax: Unwrapping the Hidden Tax on Gifts: What You Should Know – FasterCapital – #96

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #97

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #97

How much gold can an NRI bring into India? | Pravasitax Blog – #98

How much gold can an NRI bring into India? | Pravasitax Blog – #98

Is there a limit in income tax laws up to which a father can gift to his son – #99

Is there a limit in income tax laws up to which a father can gift to his son – #99

GIFT TAX EXCLUSION AMOUNTS IN 2019 – #100

GIFT TAX EXCLUSION AMOUNTS IN 2019 – #100

Is a gift to NRI by a resident Indian who is a relative taxable? – Quora – #101

Is a gift to NRI by a resident Indian who is a relative taxable? – Quora – #101

Tax on Foreign Remittance in India: Sending & Receiving Money – #102

Tax on Foreign Remittance in India: Sending & Receiving Money – #102

- gift tax rate

- gift tax in india

- gift tax exemption relatives list

Changes for estate and gift tax under the new Tax Cuts and Jobs Act – Tarleton Law Firm – #103

Changes for estate and gift tax under the new Tax Cuts and Jobs Act – Tarleton Law Firm – #103

How do Gift Taxes and Annual Exclusion Gifts Work? – Anderson O’Brien Law Firm – #104

How do Gift Taxes and Annual Exclusion Gifts Work? – Anderson O’Brien Law Firm – #104

Free Gift Affidavit Form | PDF & Word – #105

Free Gift Affidavit Form | PDF & Word – #105

Will your ‘gift’ be taxed? – The Economic Times – #106

Will your ‘gift’ be taxed? – The Economic Times – #106

Gift Tax Limit 2024 | Calculation, Filing, and How to Avoid Gift Tax – #107

Gift Tax Limit 2024 | Calculation, Filing, and How to Avoid Gift Tax – #107

NRI Gift Tax India: Rules for Tax On Gift Money In India | DBS Treasures – #108

NRI Gift Tax India: Rules for Tax On Gift Money In India | DBS Treasures – #108

The Gift Tax (2022): US Expat Exclusions & Exemptions Explained! – #109

The Gift Tax (2022): US Expat Exclusions & Exemptions Explained! – #109

Estate and Gift Tax – #110

Estate and Gift Tax – #110

Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to Avoid It – #111

Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to Avoid It – #111

IRS Announces 2018 Estate And Gift Tax Limits: $11.2 Million – #112

IRS Announces 2018 Estate And Gift Tax Limits: $11.2 Million – #112

When is money gifted not taxable? All your tax queries on gifts answered | Personal Finance – Business Standard – #113

When is money gifted not taxable? All your tax queries on gifts answered | Personal Finance – Business Standard – #113

Section 281 of Income Tax Act: Guidelines and Details – #114

Section 281 of Income Tax Act: Guidelines and Details – #114

Gift Tax, the Annual Exclusion and Estate Planning – #115

Gift Tax, the Annual Exclusion and Estate Planning – #115

Making a Charitable Donation? Maximize your gift—Limit your tax liability – RBT CPAs, LLP – #116

Making a Charitable Donation? Maximize your gift—Limit your tax liability – RBT CPAs, LLP – #116

Annual Gift Tax Exclusion Increases in 2022 – #117

Annual Gift Tax Exclusion Increases in 2022 – #117

Gift and Estate Tax Exemption Limits Increase for 2024 – Texas Trust Law – #118

Gift and Estate Tax Exemption Limits Increase for 2024 – Texas Trust Law – #118

Section 56(2)(x): Taxability of Gifts – Pioneer One Consulting LLP – #119

Section 56(2)(x): Taxability of Gifts – Pioneer One Consulting LLP – #119

What Is the 2023 and 2024 Gift Tax Limit? – Ramsey – #120

What Is the 2023 and 2024 Gift Tax Limit? – Ramsey – #120

Taxation on gifts: Everything you need to know | Tax Hacks – #121

Taxation on gifts: Everything you need to know | Tax Hacks – #121

Gift Splitting and Gift Taxes – FasterCapital – #122

Gift Splitting and Gift Taxes – FasterCapital – #122

GRATs: A Planning Tool for Business Succession – #123

GRATs: A Planning Tool for Business Succession – #123

Case Digest on Demonetization and Deposits – #124

Case Digest on Demonetization and Deposits – #124

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #125

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #125

- gift tax meaning

- gift tax exemption

- gift from relative exempt from income tax

Do Beneficiaries Pay Taxes on Life Insurance? – #126

Do Beneficiaries Pay Taxes on Life Insurance? – #126

What is the difference between marginal and average tax rates? | Tax Policy Center – #127

What is the difference between marginal and average tax rates? | Tax Policy Center – #127

Tax Advantages for Donor-Advised Funds | NPTrust – #128

Tax Advantages for Donor-Advised Funds | NPTrust – #128

Gifts & Income Tax Implications : Scenarios & Examples – #129

Gifts & Income Tax Implications : Scenarios & Examples – #129

Taxability of Gifts in India – #130

Taxability of Gifts in India – #130

Are Client Gifts Tax Deductable? How to Write off more this year than – Retention Gifts – #131

Are Client Gifts Tax Deductable? How to Write off more this year than – Retention Gifts – #131

Gift tax limit 2022: What is it and who can benefit? | Marca – #132

Gift tax limit 2022: What is it and who can benefit? | Marca – #132

SuperCA – #133

SuperCA – #133

How are Cryptocurrency Gifts Taxed? | CoinLedger – #134

How are Cryptocurrency Gifts Taxed? | CoinLedger – #134

Gift Tax planning – 3 awesome tips to save income tax legally – #135

Gift Tax planning – 3 awesome tips to save income tax legally – #135

Generation-Skipping Transfer Taxes – #136

Generation-Skipping Transfer Taxes – #136

Income Tax Declared Cash Deposit Limit in Saving & Current Bank Accounts – AWBI – #137

Income Tax Declared Cash Deposit Limit in Saving & Current Bank Accounts – AWBI – #137

How is the gifting of money or property to a relative taxed? | Mint – #138

How is the gifting of money or property to a relative taxed? | Mint – #138

Posts: money gift tax limit

Categories: Gifts

Author: toyotabienhoa.edu.vn