Update more than 187 is gift taxable in india best

Update images of is gift taxable in india by website toyotabienhoa.edu.vn compilation. Gift to wife is taxable or not – How to earn money through small savings. GIFT TAX – UPSC Current Affairs – IAS GYAN. A Step-By-Step Guide For Remitting Gift Money To UK From India. Gifts received from ‘relatives’ are exempt from tax in India – News | Khaleej Times

All about Income Tax on Gift Received From Parents. – #1

All about Income Tax on Gift Received From Parents. – #1

Corporate Income Tax in India – India Guide | Doing Business in India – #2

Corporate Income Tax in India – India Guide | Doing Business in India – #2

Tax On Gifts In India: Exemption & Criteria | E-StartupIndia | ITR Filing – #4

Tax On Gifts In India: Exemption & Criteria | E-StartupIndia | ITR Filing – #4

Gifts received in professional capacity are taxable – #5

Gifts received in professional capacity are taxable – #5

Taxation of Loans Gifts & Cash Credits by Taxmann’s Editorial Board | Taxmann Books – #6

Taxation of Loans Gifts & Cash Credits by Taxmann’s Editorial Board | Taxmann Books – #6

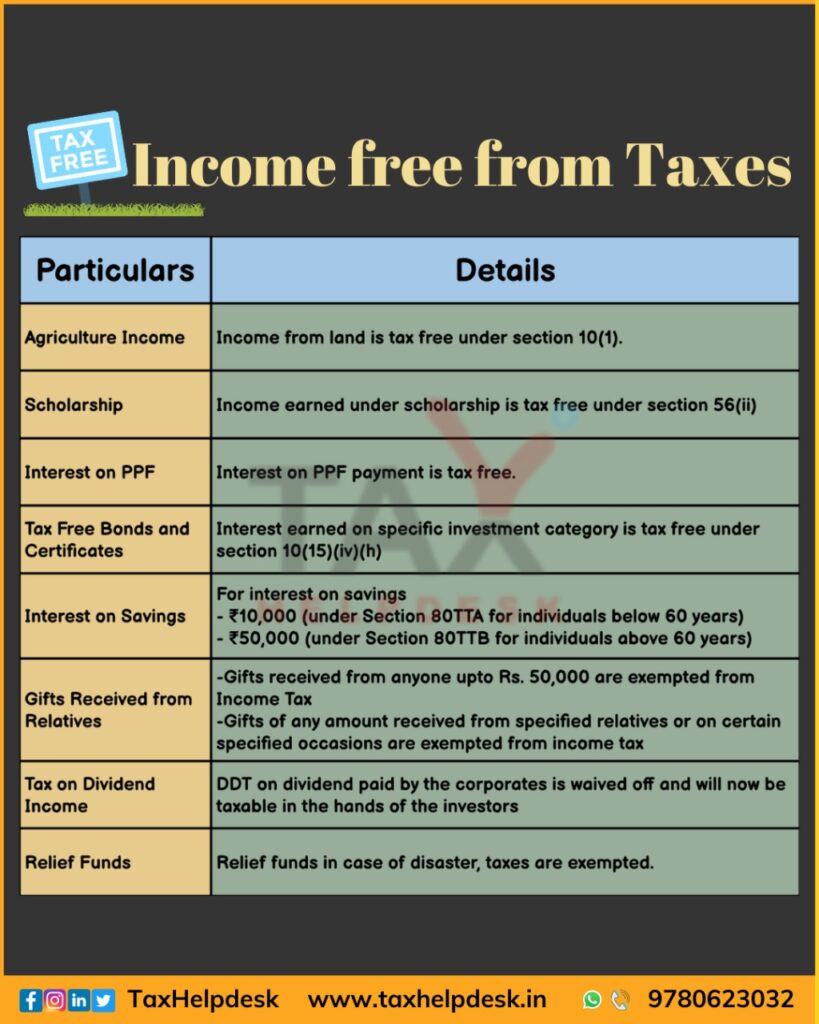

Tax-Free Income Sources in India 2024 – #7

Tax-Free Income Sources in India 2024 – #7

What is a gift tax in India? – Quora – #8

What is a gift tax in India? – Quora – #8

Tax Talk: Diwali gift from a business associate could be taxable – Income Tax News | The Financial Express – #10

Tax Talk: Diwali gift from a business associate could be taxable – Income Tax News | The Financial Express – #10

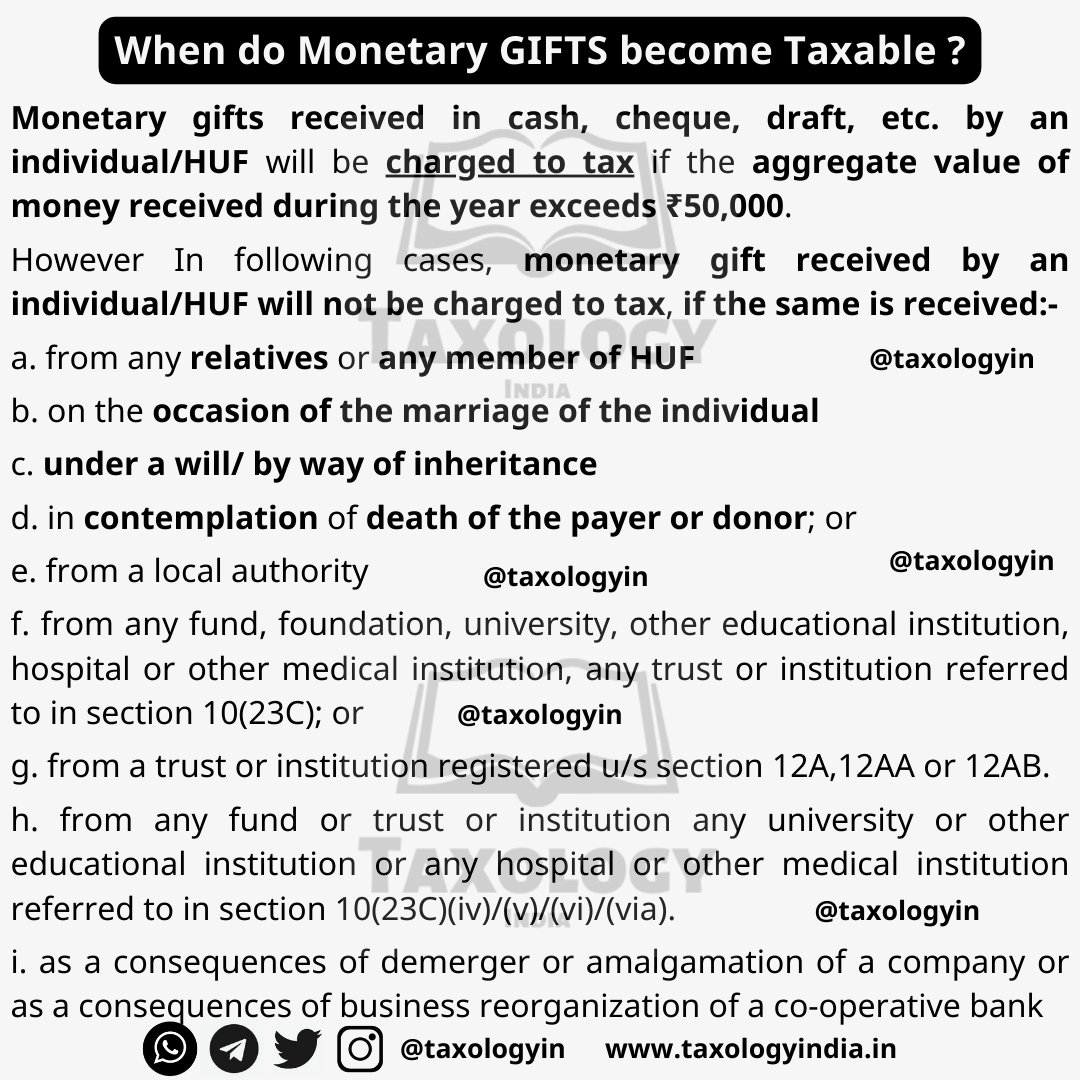

Monetary Gifts & its taxability in India. Did you know cash gifts received from friends is taxable? – YouTube – #11

Monetary Gifts & its taxability in India. Did you know cash gifts received from friends is taxable? – YouTube – #11

Transfer by Gift deed is not taxable – Property lawyers in India – #12

Transfer by Gift deed is not taxable – Property lawyers in India – #12

According to the income tax laws of India, who can be gifted property without incurring tax? – Quora – #13

According to the income tax laws of India, who can be gifted property without incurring tax? – Quora – #13

Zero Tax On Wedding Gifts: A Loophole For The Rich To Amass Wealth? – #14

Zero Tax On Wedding Gifts: A Loophole For The Rich To Amass Wealth? – #14

Getting married? Ask for blessings in presents only and save taxes – #15

Getting married? Ask for blessings in presents only and save taxes – #15

Understanding Income Tax on Marriage Gifts: Important Facts You Need to Know | Ebizfiling – #16

Understanding Income Tax on Marriage Gifts: Important Facts You Need to Know | Ebizfiling – #16

Income tax on Gifts: Money gifts to NRIs are taxable from July 5, 2019, property gift tax rules unchanged – #17

Income tax on Gifts: Money gifts to NRIs are taxable from July 5, 2019, property gift tax rules unchanged – #17

![Opinion] Taxability of Gift Coupons under GST Opinion] Taxability of Gift Coupons under GST](https://images.livemint.com/rf/Image-920x613/LiveMint/Period2/2018/07/24/Photos/Processed/gift-k0sG--621x414@LiveMint.jpg) Opinion] Taxability of Gift Coupons under GST – #18

Opinion] Taxability of Gift Coupons under GST – #18

Unwrapping the Legal Aspects of Gift-Giving in India: What You Need to Know – #19

Unwrapping the Legal Aspects of Gift-Giving in India: What You Need to Know – #19

What is a gift deed and tax implications | Tax Hack – #20

What is a gift deed and tax implications | Tax Hack – #20

How to Transfer Inheritance to US From India? | Unimoni.in – #21

How to Transfer Inheritance to US From India? | Unimoni.in – #21

Income Tax FAQs: Received monetary gift from family or friends? How it will be taxed | etnownews – #22

Income Tax FAQs: Received monetary gift from family or friends? How it will be taxed | etnownews – #22

Rules For Taxation Of Gift In India – Labour Law Advisor – #23

Rules For Taxation Of Gift In India – Labour Law Advisor – #23

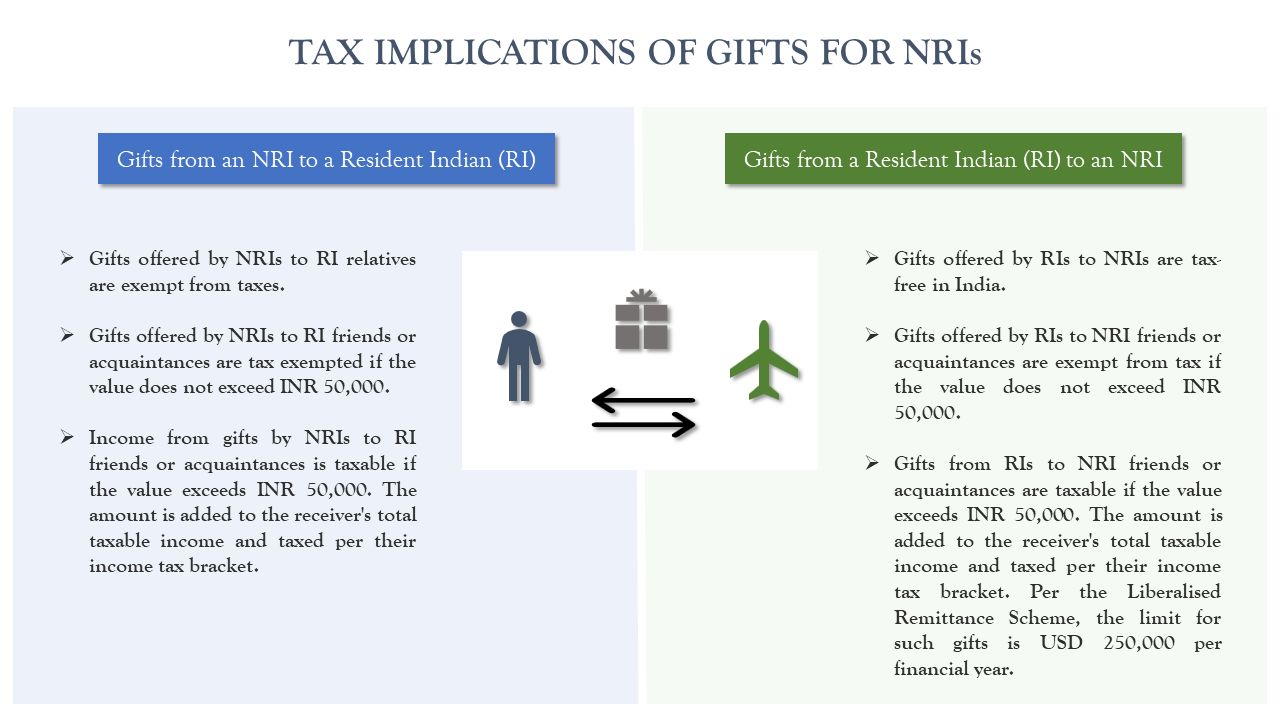

Taxation of gifts to NRIs and changes in Budget 2023-24 – #24

Taxation of gifts to NRIs and changes in Budget 2023-24 – #24

Weddings and tax implications of cash gifts | Mint – #25

Weddings and tax implications of cash gifts | Mint – #25

How much money can NRIs gift to parents in India? | Arthgyaan – #26

How much money can NRIs gift to parents in India? | Arthgyaan – #26

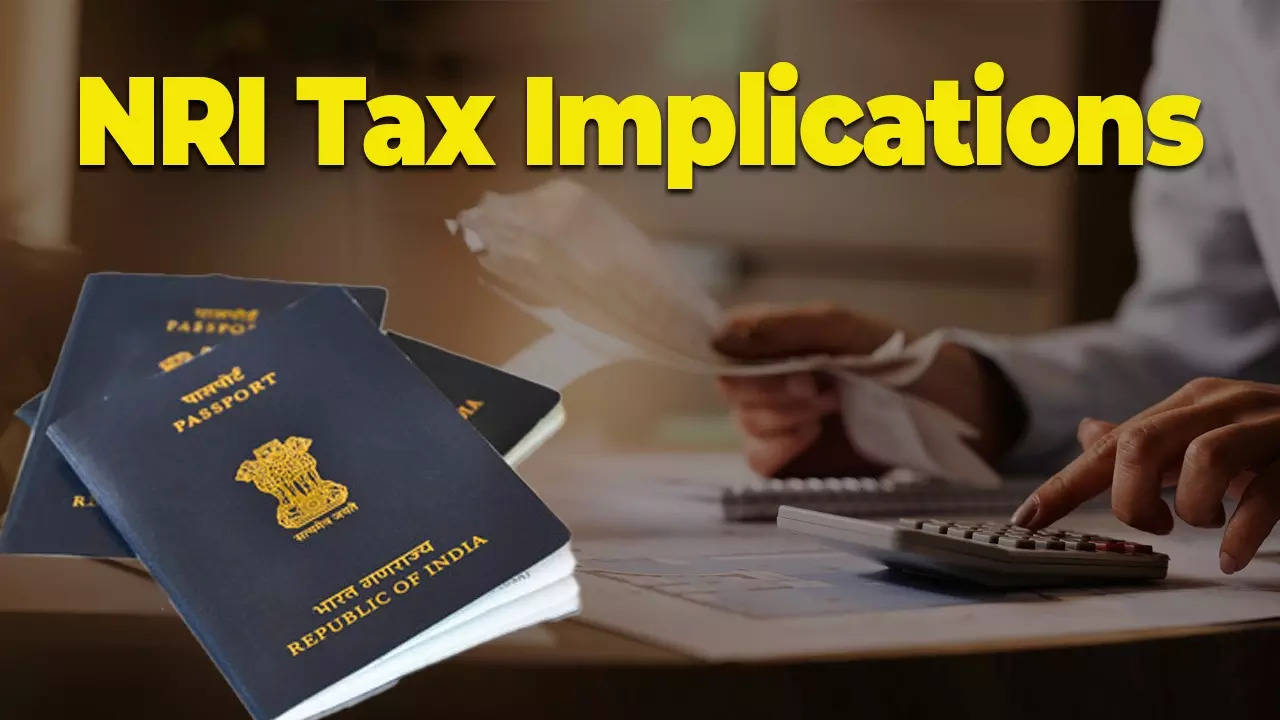

NRI Selling Inherited Property in India: Tax Implications 2023 – SBNRI – #27

NRI Selling Inherited Property in India: Tax Implications 2023 – SBNRI – #27

Taxability on Gifts, Rewards & Rewards Given to Sportsperson – #28

Taxability on Gifts, Rewards & Rewards Given to Sportsperson – #28

Transfer money from India to the USA: tax implications – Wise – #29

Transfer money from India to the USA: tax implications – Wise – #29

Gift Tax: शादी में मिले गिफ्ट टैक्स फ्री, पर जन्मदिन व ऑफिस से मिले तोहफे पर लगता है कर, जानिए ऐसा क्यों? – What is gift tax which gifts are non taxable and which is not know details – News18 हिंदी – #30

Gift Tax: शादी में मिले गिफ्ट टैक्स फ्री, पर जन्मदिन व ऑफिस से मिले तोहफे पर लगता है कर, जानिए ऐसा क्यों? – What is gift tax which gifts are non taxable and which is not know details – News18 हिंदी – #30

Is transferring crypto between wallets taxable? | CoinLedger – #31

Is transferring crypto between wallets taxable? | CoinLedger – #31

Taxation in India: Classification, Types, Direct tax, Indirect tax – Civilsdaily – #32

Taxation in India: Classification, Types, Direct tax, Indirect tax – Civilsdaily – #32

Gift from Non-Relatives – A tool for tax planning – TaxReturnWala – #33

Gift from Non-Relatives – A tool for tax planning – TaxReturnWala – #33

Income Tax Exemption On Gifts | Are The Gifts Above Rs 50,000 Taxable? | Personal Finance – YouTube – #34

Income Tax Exemption On Gifts | Are The Gifts Above Rs 50,000 Taxable? | Personal Finance – YouTube – #34

బహుమతులు తీసుకుంటున్నారా.. అయితే మీ మీద ఐటీ కన్నుంటుంది.. ఎందుకో తెలుసుకోండి | Gift tax rules and exemptions of gift tax in india know when your gift is tax free | TV9 Telugu – #35

బహుమతులు తీసుకుంటున్నారా.. అయితే మీ మీద ఐటీ కన్నుంటుంది.. ఎందుకో తెలుసుకోండి | Gift tax rules and exemptions of gift tax in india know when your gift is tax free | TV9 Telugu – #35

Your Diwali gift and bonus can be taxable: Know ways to avoid it – #36

Your Diwali gift and bonus can be taxable: Know ways to avoid it – #36

Income Tax on Bitcoin in India – PKC Management Consulting – #37

Income Tax on Bitcoin in India – PKC Management Consulting – #37

GIFT City’s Role In Elevating India’s Startup Ecosystem – #38

GIFT City’s Role In Elevating India’s Startup Ecosystem – #38

How to Donate to Charity, Get a Tax Break and Have Income for Life – WSJ – #39

How to Donate to Charity, Get a Tax Break and Have Income for Life – WSJ – #39

Gift tax – A guide – Online Demat, Trading, and Mutual Fund Investment in India – Fisdom – #40

Gift tax – A guide – Online Demat, Trading, and Mutual Fund Investment in India – Fisdom – #40

Monetary gift tax: Income tax on gift received from parents | Value Research – #41

Monetary gift tax: Income tax on gift received from parents | Value Research – #41

income tax rules for gifts received by taxpayer- किसी से मिला हुआ गिफ्ट भी भारत में आयकर के दायरे में आता है। – #42

income tax rules for gifts received by taxpayer- किसी से मिला हुआ गिफ्ट भी भारत में आयकर के दायरे में आता है। – #42

How money received via Will or Inheritance from abroad is taxed in India – Income Tax News | The Financial Express – #43

How money received via Will or Inheritance from abroad is taxed in India – Income Tax News | The Financial Express – #43

- gift tax definition

- gift tax exemption relatives list

- gift tax act 1958

What is covered under Income from other sources? – #44

What is covered under Income from other sources? – #44

- gift chart as per income tax

- gift from relative exempt from income tax

- estate tax

Gift Tax in India and USA – #45

Gift Tax in India and USA – #45

Is it necessary to pay taxes on Diwali gifts received from employers, relatives, and friends? – #46

Is it necessary to pay taxes on Diwali gifts received from employers, relatives, and friends? – #46

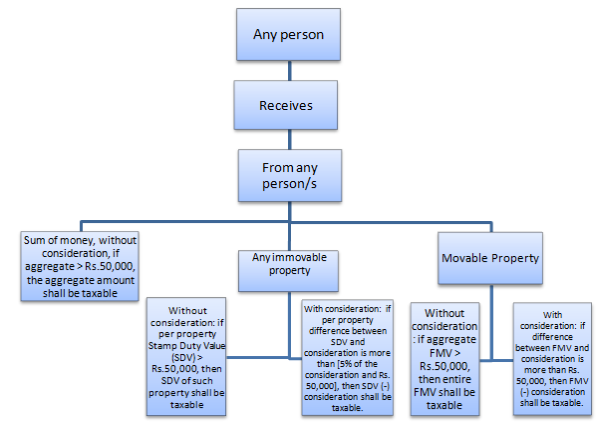

Section 56(2)(X): Taxation of Gift – #47

Section 56(2)(X): Taxation of Gift – #47

Sales taxes in the United States – Wikipedia – #48

Sales taxes in the United States – Wikipedia – #48

Gifts by NRIs to Relatives and Friends can be made fully Exempt from Gift Tax – #49

Gifts by NRIs to Relatives and Friends can be made fully Exempt from Gift Tax – #49

Know how your Diwali gifts from different sources will be taxed | Mint – #50

Know how your Diwali gifts from different sources will be taxed | Mint – #50

tax on diwali gifts: Will you be taxed on Diwali gifts received? Check how various sources of gifts will be taxed – The Economic Times – #51

tax on diwali gifts: Will you be taxed on Diwali gifts received? Check how various sources of gifts will be taxed – The Economic Times – #51

Latest NRI Gift Tax Rules 2019-20 | Are Gifts received by NRIs Taxable? – #52

Latest NRI Gift Tax Rules 2019-20 | Are Gifts received by NRIs Taxable? – #52

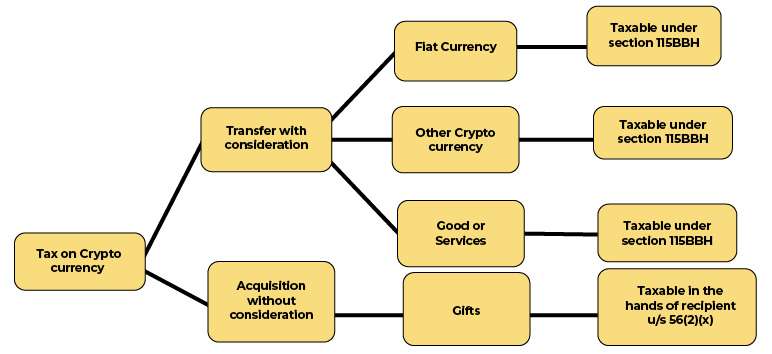

How Are Cryptocurrencies Taxed? How To Report Crypto Income In ITR? – #53

How Are Cryptocurrencies Taxed? How To Report Crypto Income In ITR? – #53

Before giving Diwali gifts this festive season, know about their tax implications here – BusinessToday – #54

Before giving Diwali gifts this festive season, know about their tax implications here – BusinessToday – #54

- indian traditional gifts online

- gift tax rate in india 2020

- wealth tax

) Relatives u/s 56(2)(vii) from whom Gift is permissible…… – Income Tax | Tax planning – #55

Relatives u/s 56(2)(vii) from whom Gift is permissible…… – Income Tax | Tax planning – #55

11 Tax-Free Income Sources In India (2023 Update) – #56

11 Tax-Free Income Sources In India (2023 Update) – #56

Union Budget 2023: What Is Gift Tax And When Is It Exempted? – News18 – #57

Union Budget 2023: What Is Gift Tax And When Is It Exempted? – News18 – #57

Section 56 of the Income Tax Act: Understanding Taxation on Gifts and Other Incomes – Marg ERP Blog – #58

Section 56 of the Income Tax Act: Understanding Taxation on Gifts and Other Incomes – Marg ERP Blog – #58

GIFT City on the way to becoming an international financial hub – The Week – #59

GIFT City on the way to becoming an international financial hub – The Week – #59

What is gift, is it taxable, who are relatives, which gift to be shown in Income Tax Return and what is clubbing of income. – upload form-16 – #60

What is gift, is it taxable, who are relatives, which gift to be shown in Income Tax Return and what is clubbing of income. – upload form-16 – #60

Explained: How Money Sent From India To Relatives Abroad Is Taxed? – #61

Explained: How Money Sent From India To Relatives Abroad Is Taxed? – #61

- gift tax example

- taxation in india

- gift tax exemption 2022

Giving to India? Compliance with the Newly Amended FCRA – CAF America – #62

Giving to India? Compliance with the Newly Amended FCRA – CAF America – #62

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #63

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #63

Tax Laws on Cash Gifts: Is Gifted Money Taxable? | Axis Bank – #64

Tax Laws on Cash Gifts: Is Gifted Money Taxable? | Axis Bank – #64

Gift पर कब और कैसे टैक्स देनदारी बनती है? जानिए गिफ्ट पर Income Tax का गणित – how are gifts taxed income tax on gifts gift received from relatives is tax free – #65

Gift पर कब और कैसे टैक्स देनदारी बनती है? जानिए गिफ्ट पर Income Tax का गणित – how are gifts taxed income tax on gifts gift received from relatives is tax free – #65

Amount received as gift by any blood relative living in US is not taxable in India | Mint – #66

Amount received as gift by any blood relative living in US is not taxable in India | Mint – #66

If I buy a gift card for myself, is it included in income tax in India? – Quora – #67

If I buy a gift card for myself, is it included in income tax in India? – Quora – #67

How Are Gifts Taxed in India? – Kanakkupillai – #68

How Are Gifts Taxed in India? – Kanakkupillai – #68

- gift tax upsc

- tax free income

- gift tax rate in india 2022-23

Gourmet Pantry Gift Box – The Meadow – #69

Gourmet Pantry Gift Box – The Meadow – #69

What Are the GST Implications for Gift Cards in India? – #70

What Are the GST Implications for Gift Cards in India? – #70

Received gold jewellery in a gift? Will it be taxable | Business News – #71

Received gold jewellery in a gift? Will it be taxable | Business News – #71

Is Startup Funding Taxable in India? Startup Fundraising – #72

Is Startup Funding Taxable in India? Startup Fundraising – #72

Raksha Bandhan 2023: Is gifting cash to your sister taxable? Income tax rules explained here | Mint – #73

Raksha Bandhan 2023: Is gifting cash to your sister taxable? Income tax rules explained here | Mint – #73

Send iPhone USA to India, Custom Duty, GST Tax Calculator – USA – #74

Send iPhone USA to India, Custom Duty, GST Tax Calculator – USA – #74

![Guide to Crypto Tax in India [Updated 2024] Guide to Crypto Tax in India [Updated 2024]](https://www.e-startupindia.com/learn/wp-content/uploads/2022/04/Which-of-the-gifts-exempted-from-income-tax.png) Guide to Crypto Tax in India [Updated 2024] – #75

Guide to Crypto Tax in India [Updated 2024] – #75

What is the taxation on any gift via cash transfer to a relative? | Mint – #76

What is the taxation on any gift via cash transfer to a relative? | Mint – #76

When You Make Cash Gifts To Your Children, Who Pays The Tax? – YouTube – #77

When You Make Cash Gifts To Your Children, Who Pays The Tax? – YouTube – #77

How to ensure your Gifts are exempted from Gift Tax in India? – #78

How to ensure your Gifts are exempted from Gift Tax in India? – #78

- gift tax meaning

- gift tax exemption

- estate duty

- lineal ascendant gift from relative exempt from income tax

- capital gains tax

- list of relatives

TAXATION OF GIFTS RECEIVED – Here Are The Things You Need To Know – YouTube – #79

TAXATION OF GIFTS RECEIVED – Here Are The Things You Need To Know – YouTube – #79

India’s GIFT City IFSC: Legal Framework Under Development – #80

India’s GIFT City IFSC: Legal Framework Under Development – #80

All you need to know about taxes on gifts and the exceptions | Mint – #81

All you need to know about taxes on gifts and the exceptions | Mint – #81

Types of Taxes in India: Direct Tax and Indirect Tax – #82

Types of Taxes in India: Direct Tax and Indirect Tax – #82

Section 56 – Exemption from Taxation on Wedding Gifts | Fincash – #83

Section 56 – Exemption from Taxation on Wedding Gifts | Fincash – #83

Direct Tax: Definition, Types & Rates Of Taxation In 2024 – Forbes Advisor INDIA – #84

Direct Tax: Definition, Types & Rates Of Taxation In 2024 – Forbes Advisor INDIA – #84

Gifts from relatives are always tax-free – The Economic Times – #85

Gifts from relatives are always tax-free – The Economic Times – #85

2021: NRI Taxation on Gifts Received | SBNRI – YouTube – #86

2021: NRI Taxation on Gifts Received | SBNRI – YouTube – #86

- interest tax

- expenditure tax

- gift deed format father to son

- section 56(2) of income tax act

Gift from employer, exceeding Rs5,000, is taxable and tax is to be withheld from salary | Mint – #87

Gift from employer, exceeding Rs5,000, is taxable and tax is to be withheld from salary | Mint – #87

Will your ‘gift’ be taxed? – The Economic Times – #88

Will your ‘gift’ be taxed? – The Economic Times – #88

Does Cryptocurrency Attract Tax in India? Here’s What We Know – #89

Does Cryptocurrency Attract Tax in India? Here’s What We Know – #89

media.assettype.com/outlookbusiness%2Fimport%2Fout… – #90

media.assettype.com/outlookbusiness%2Fimport%2Fout… – #90

Save Tax Through Gifts Se Tax Planning Income Tax Rules, Gift Deed Create # gift #gifttax #taxongift – YouTube – #91

Save Tax Through Gifts Se Tax Planning Income Tax Rules, Gift Deed Create # gift #gifttax #taxongift – YouTube – #91

Amount received as gift by any blood relative living in US is not taxable in India – Scripbox – #92

Amount received as gift by any blood relative living in US is not taxable in India – Scripbox – #92

FAQ / Draft of gift deed, List of Relatives for Tax free Gift – #93

FAQ / Draft of gift deed, List of Relatives for Tax free Gift – #93

Diwali season: Do you have to pay tax on gifts received ? | Personal Finance – Business Standard – #94

Diwali season: Do you have to pay tax on gifts received ? | Personal Finance – Business Standard – #94

Taxability of Gifts – Some Interesting Issues – #95

Taxability of Gifts – Some Interesting Issues – #95

taxes – How gifting money to Parents helps in Tax saving in India? – Personal Finance & Money Stack Exchange – #96

taxes – How gifting money to Parents helps in Tax saving in India? – Personal Finance & Money Stack Exchange – #96

Will you be taxed if you get Diwali gifts? – The Economic Times – #97

Will you be taxed if you get Diwali gifts? – The Economic Times – #97

- expenditure tax act

- service tax

- gift tax

Gift taxation | ITR: Gifts have to be declared in ITR: Here’s how they are taxed – #98

Gift taxation | ITR: Gifts have to be declared in ITR: Here’s how they are taxed – #98

Foreign Remittance: Sending Gift Money To The USA From India In 2024 – #99

Foreign Remittance: Sending Gift Money To The USA From India In 2024 – #99

Gift Tax | Gift Tax In India | Gift Tax under Income Tax | Tax on – #100

Gift Tax | Gift Tax In India | Gift Tax under Income Tax | Tax on – #100

Taxes on Gift – #101

Taxes on Gift – #101

Taxation of Gifts received in Cash or Kind – #102

Taxation of Gifts received in Cash or Kind – #102

- money gift deed format

- property gift deed

- gift tax rate

Gifts with Tax Benefits: Guide to Employer Gift Tax Laws – #103

Gifts with Tax Benefits: Guide to Employer Gift Tax Laws – #103

How to Make a Gift Deed – A Complete guide | Law House – #104

How to Make a Gift Deed – A Complete guide | Law House – #104

What are the latest rules for NRI taxation in India? | Mint – #105

What are the latest rules for NRI taxation in India? | Mint – #105

Indian Income Tax: Online Casino, Betting and Casual Skill Gaming – ENV Media – #106

Indian Income Tax: Online Casino, Betting and Casual Skill Gaming – ENV Media – #106

Scheme of Taxation of Undisclosed Income | Taxmann – #107

Scheme of Taxation of Undisclosed Income | Taxmann – #107

Optimize for your 401K/ IRA in India – #108

Optimize for your 401K/ IRA in India – #108

How to Incorporate AIF in IFSC Gift City? – InCorp Advisory – #109

How to Incorporate AIF in IFSC Gift City? – InCorp Advisory – #109

Gift Tax in India: Implications & Exemptions – myMoneySage Blog – #110

Gift Tax in India: Implications & Exemptions – myMoneySage Blog – #110

All You Need To Know About Gifting Property And Gift Deed Rules – #111

All You Need To Know About Gifting Property And Gift Deed Rules – #111

Taxmann Daily – #112

Taxmann Daily – #112

NRIs who invest in India through AIFs set up in Gift City get tax exemption | Personal Finance – Business Standard – #113

NRIs who invest in India through AIFs set up in Gift City get tax exemption | Personal Finance – Business Standard – #113

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #114

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #114

Income Tax Return Filing: Are wedding gifts really tax free? All hidden clauses, conditions explained | Zee Business – #115

Income Tax Return Filing: Are wedding gifts really tax free? All hidden clauses, conditions explained | Zee Business – #115

If an NRI gives a gift to his Indian brother, is it taxable in India? – Quora – #116

If an NRI gives a gift to his Indian brother, is it taxable in India? – Quora – #116

) Gifting Stock: 4 Ways to Gift Stocks to Friends, Family, and Charities – #117

Gifting Stock: 4 Ways to Gift Stocks to Friends, Family, and Charities – #117

TaxManntri Consultancy Private Limited – Tax-free! In India, gifts received during a wedding are generally exempt from income tax. Visit our website: www.taxmanntri.com Contact Us: 9519533133 | 9890358772 #TaxMantri #Indiantax #taxconsultant #taxation # – #118

TaxManntri Consultancy Private Limited – Tax-free! In India, gifts received during a wedding are generally exempt from income tax. Visit our website: www.taxmanntri.com Contact Us: 9519533133 | 9890358772 #TaxMantri #Indiantax #taxconsultant #taxation # – #118

Understanding the Tax Implications of Gold Gifts in India | My Gold Guide – #119

Understanding the Tax Implications of Gold Gifts in India | My Gold Guide – #119

How are Cryptocurrency Gifts Taxed? | CoinLedger – #120

How are Cryptocurrency Gifts Taxed? | CoinLedger – #120

How to Ensure Cash Gifts from Parents and Relatives Won’t Land you in Tax Trouble – #121

How to Ensure Cash Gifts from Parents and Relatives Won’t Land you in Tax Trouble – #121

What is the Easiest way to transfer money from us bank to NRE account in India? – Quora – #122

What is the Easiest way to transfer money from us bank to NRE account in India? – Quora – #122

Here’s what you need to know about different forms of gold you can buy and their tax treatment – BusinessToday – #123

Here’s what you need to know about different forms of gold you can buy and their tax treatment – BusinessToday – #123

Tax matters: Uncle’s gift is tax free | Tax matters: Uncle’s gift is tax free – #124

Tax matters: Uncle’s gift is tax free | Tax matters: Uncle’s gift is tax free – #124

Which Gifts from relatives are exempted from Income Tax? – #125

Which Gifts from relatives are exempted from Income Tax? – #125

Gift by NRI to Resident Indian or Vice-Versa | Tax Exemptions – YouTube – #126

Gift by NRI to Resident Indian or Vice-Versa | Tax Exemptions – YouTube – #126

Gift Deed: Drafting, Registration, Stamp duty, Tax Implication, FAQ – #127

Gift Deed: Drafting, Registration, Stamp duty, Tax Implication, FAQ – #127

Understand the Taxation of Virtual Digital Assets – Taxmann – #128

Understand the Taxation of Virtual Digital Assets – Taxmann – #128

![Opinion] Gifts | A Comprehensive Analysis of an Everlasting Tax Planning Tool Opinion] Gifts | A Comprehensive Analysis of an Everlasting Tax Planning Tool](https://images.livemint.com/img/2023/02/14/original/gift_1676358107458.jpg) Opinion] Gifts | A Comprehensive Analysis of an Everlasting Tax Planning Tool – #129

Opinion] Gifts | A Comprehensive Analysis of an Everlasting Tax Planning Tool – #129

Understanding Taxable Benefits In A Quick and Easy Way – #130

Understanding Taxable Benefits In A Quick and Easy Way – #130

How Much Is Gift Tax? Rates Range From 18% to 40% – #131

How Much Is Gift Tax? Rates Range From 18% to 40% – #131

I received gifts during my wedding, are they taxable? – #132

I received gifts during my wedding, are they taxable? – #132

Gifts to and from HUF – MN & Associates CS-India – #133

Gifts to and from HUF – MN & Associates CS-India – #133

Whether gift received from HUF to any member of HUF is exempt from taxable income? ITAT Explains | SCC Times – #134

Whether gift received from HUF to any member of HUF is exempt from taxable income? ITAT Explains | SCC Times – #134

Understanding Gift Tax in India: Rules, Rates, and Regulations – Marg ERP Blog – #135

Understanding Gift Tax in India: Rules, Rates, and Regulations – Marg ERP Blog – #135

Income Tax: Will Gifting Of Shares To Spouse Be Taxable? – News18 – #136

Income Tax: Will Gifting Of Shares To Spouse Be Taxable? – News18 – #136

) Tax Implications on Gifting of Shares – #137

Tax Implications on Gifting of Shares – #137

Exploring GIFT City: India’s Pioneer in Financial Innovation – #138

Exploring GIFT City: India’s Pioneer in Financial Innovation – #138

Gifts & Income Tax Implications : Scenarios & Examples – #139

Gifts & Income Tax Implications : Scenarios & Examples – #139

Now, Gift Received by NRI Non-Relative will be Taxable in India – #140

Now, Gift Received by NRI Non-Relative will be Taxable in India – #140

Divorce, Alimony, and Taxability in India | EZTax® – #141

Divorce, Alimony, and Taxability in India | EZTax® – #141

Income Tax on Winning Lottery, Game Shows, Awards, and Prizes – #142

Income Tax on Winning Lottery, Game Shows, Awards, and Prizes – #142

Rules you should know pertaining to gift taxation – BusinessToday – Issue Date: Dec 01, 2014 – #143

Rules you should know pertaining to gift taxation – BusinessToday – Issue Date: Dec 01, 2014 – #143

Things an NRI must know about gift tax rules in India | IDFC FIRST Bank – #144

Things an NRI must know about gift tax rules in India | IDFC FIRST Bank – #144

Cryptocurrency Tax In India – Forbes Advisor INDIA – #145

Cryptocurrency Tax In India – Forbes Advisor INDIA – #145

Gift Tax | Galactic Advisors – #146

Gift Tax | Galactic Advisors – #146

How are gifts taxed in India? – #147

How are gifts taxed in India? – #147

Reminder: Holiday Gifts, Prizes or Parties Can Be Taxable Wages – #148

Reminder: Holiday Gifts, Prizes or Parties Can Be Taxable Wages – #148

India Online Gambling Tax: Understanding the Latest Regulations – GadgetMates – #149

India Online Gambling Tax: Understanding the Latest Regulations – GadgetMates – #149

ITR filing: Are gifts taxable in India? Salient clauses all income taxpayers must know | Zee Business – #150

ITR filing: Are gifts taxable in India? Salient clauses all income taxpayers must know | Zee Business – #150

How Are Gains On Foreign Stock Investments Taxed? – Forbes Advisor INDIA – #151

How Are Gains On Foreign Stock Investments Taxed? – Forbes Advisor INDIA – #151

How Are Foreign Inward Remittance Taxed In India – #152

How Are Foreign Inward Remittance Taxed In India – #152

-Gifts.jpg) Form 709 – Guide 2023 | US Expat Tax Service – #153

Form 709 – Guide 2023 | US Expat Tax Service – #153

Benefits of Setting up a Business Entity at GIFT City – #154

Benefits of Setting up a Business Entity at GIFT City – #154

Did you receive Gift? Tax Implications on Gifts | Examples, Limits & Rules – #155

Did you receive Gift? Tax Implications on Gifts | Examples, Limits & Rules – #155

Can a company gift a vehicle to an employee in India without tax? – Quora – #156

Can a company gift a vehicle to an employee in India without tax? – Quora – #156

Did you receive gift cash? It is taxable, but not for these individuals | Zee Business – #157

Did you receive gift cash? It is taxable, but not for these individuals | Zee Business – #157

Tax Implications When Making an International Money Transfer – #158

Tax Implications When Making an International Money Transfer – #158

Tax on Wedding Gifts – Explained | EZTax® – #159

Tax on Wedding Gifts – Explained | EZTax® – #159

Income tax and other related financial information 2019-20 INDIA uploaded by T james joseph Adhikarathil | PDF – #160

Income tax and other related financial information 2019-20 INDIA uploaded by T james joseph Adhikarathil | PDF – #160

Taxation and Accounting – India Guide | Doing Business in India – #161

Taxation and Accounting – India Guide | Doing Business in India – #161

What is the Gift Tax in India and How Does it Affect NRIs? – #162

What is the Gift Tax in India and How Does it Affect NRIs? – #162

Gift Tax: What it is and How Gifts are taxed in India – #163

Gift Tax: What it is and How Gifts are taxed in India – #163

Gifts of Partnership Interests – #164

Gifts of Partnership Interests – #164

gift taxation: Which gifts are taxable for the recipient and which ones can increase tax liability of giver – The Economic Times – #165

gift taxation: Which gifts are taxable for the recipient and which ones can increase tax liability of giver – The Economic Times – #165

Indian Taxes Explained: Income Tax, GST, TDS, and More. Ask Us – #166

Indian Taxes Explained: Income Tax, GST, TDS, and More. Ask Us – #166

Investing in AIFs in Gift City: What You Need to Know – #167

Investing in AIFs in Gift City: What You Need to Know – #167

Taxation on Film Production – #168

Taxation on Film Production – #168

Gift received from HUF is not taxable – #169

Gift received from HUF is not taxable – #169

Income Tax Implications of Wedding Gifts in India – #170

Income Tax Implications of Wedding Gifts in India – #170

Tax on Gifts in India | Exemption and Rules | EZTax® – #171

Tax on Gifts in India | Exemption and Rules | EZTax® – #171

Tax Structure in India – Apna Gyaan – #172

Tax Structure in India – Apna Gyaan – #172

Income tax on a gift from father to daughter – #173

Income tax on a gift from father to daughter – #173

Gift tax in India – Income tax rules on gifts and exemption available – #174

Gift tax in India – Income tax rules on gifts and exemption available – #174

Taxation of Gifts: An In Depth Analysis – #175

Taxation of Gifts: An In Depth Analysis – #175

Holiday Gifts May Be Taxable – #176

Holiday Gifts May Be Taxable – #176

Section 56(ii) of Income Tax Act: Understanding the Taxation of Gifts – Marg ERP Blog – #177

Section 56(ii) of Income Tax Act: Understanding the Taxation of Gifts – Marg ERP Blog – #177

How to Show Gift in Income Tax Return 2023 – #178

How to Show Gift in Income Tax Return 2023 – #178

Income Tax on Cash Gift to Wife: How Much You Can Gift on Women’s Day Without Tax Implications – Income Tax News | The Financial Express – #179

Income Tax on Cash Gift to Wife: How Much You Can Gift on Women’s Day Without Tax Implications – Income Tax News | The Financial Express – #179

You Take a Friend on Your Yacht. Is It a Taxable Gift? – WSJ – #180

You Take a Friend on Your Yacht. Is It a Taxable Gift? – WSJ – #180

Taxability of Gift received by an individual or HUF with FAQs – #181

Taxability of Gift received by an individual or HUF with FAQs – #181

Everything You Need To Know About Mutual Fund Taxation – #182

Everything You Need To Know About Mutual Fund Taxation – #182

Unravel The Red Ribbon On Spouse Property Transfers – Gift Tax | US Expat Tax Service – #183

Unravel The Red Ribbon On Spouse Property Transfers – Gift Tax | US Expat Tax Service – #183

Types of Allowances in India: Taxable and Non Taxable Allowance 2022-23 – #184

Types of Allowances in India: Taxable and Non Taxable Allowance 2022-23 – #184

Gift Under GST: What Is And Isn’t Taxable – #185

Gift Under GST: What Is And Isn’t Taxable – #185

Funds in GIFT City – FAQs & Structuring Insights | India Corporate Law – #186

Funds in GIFT City – FAQs & Structuring Insights | India Corporate Law – #186

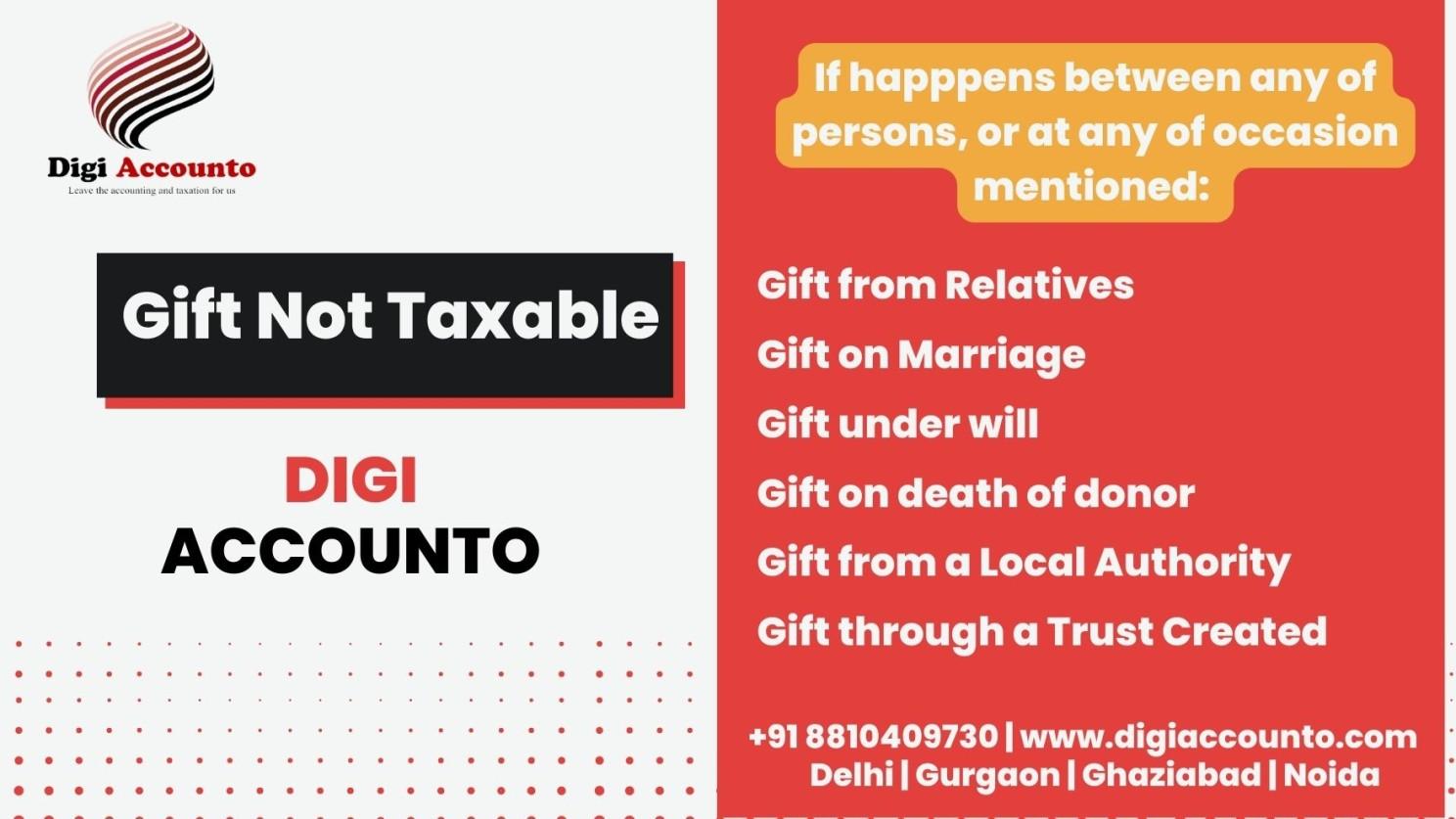

Gifts received from non-relatives of above Rs 50,000 a year are taxable – #187

Gifts received from non-relatives of above Rs 50,000 a year are taxable – #187

Posts: is gift taxable in india

Categories: Gifts

Author: toyotabienhoa.edu.vn