Discover more than 188 income tax on gifted money latest

Update images of income tax on gifted money by website toyotabienhoa.edu.vn compilation. Meaning of relative under different act | CA Rajput Jain. Receiving a Foreign Gift? You May Need to Tell the IRS – The Wolf Group. GIft Tax Act 1958 – very elobarative – THE GIFT-TAX ACT, 1958 ACT NO. 18 OF 1958 1 [15th May, 1958.] – Studocu. Gift Tax Limit Cartoons and Comics – funny pictures from CartoonStock

i.ytimg.com/vi/4YCXzYbzFVE/maxresdefault.jpg – #1

i.ytimg.com/vi/4YCXzYbzFVE/maxresdefault.jpg – #1

Biden Administration Releases Green Book on FY 2022 Tax Proposals | Marcum LLP | Accountants and Advisors – #2

Biden Administration Releases Green Book on FY 2022 Tax Proposals | Marcum LLP | Accountants and Advisors – #2

Income Tax Readings Outline – Vocabulary a. Head Tax : even tax levied on every person of age – Studocu – #4

Income Tax Readings Outline – Vocabulary a. Head Tax : even tax levied on every person of age – Studocu – #4

) The First Income Tax | American Battlefield Trust – #5

The First Income Tax | American Battlefield Trust – #5

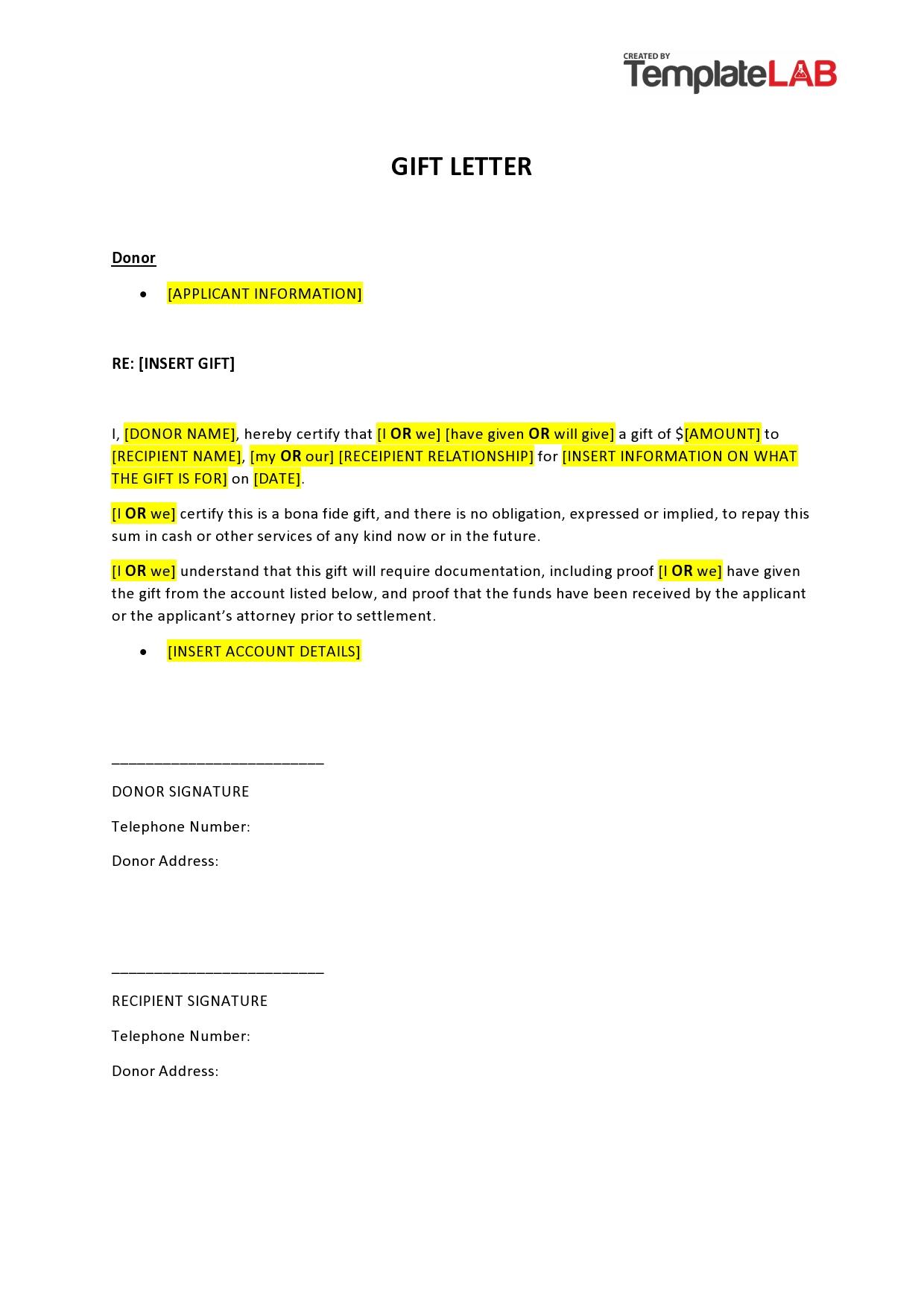

Gift Letter ≡ Fill Out Printable PDF Forms Online – #6

Gift Letter ≡ Fill Out Printable PDF Forms Online – #6

For Calculating Capital Gains, Sale Will Be Considered When Sale Deed Is Executed – #7

For Calculating Capital Gains, Sale Will Be Considered When Sale Deed Is Executed – #7

Do You Pay Taxes on Gifts From Parents? (2023 and 2024) | SmartAsset – #8

Do You Pay Taxes on Gifts From Parents? (2023 and 2024) | SmartAsset – #8

)

- gift tax rate in india 2020

- money gift deed format

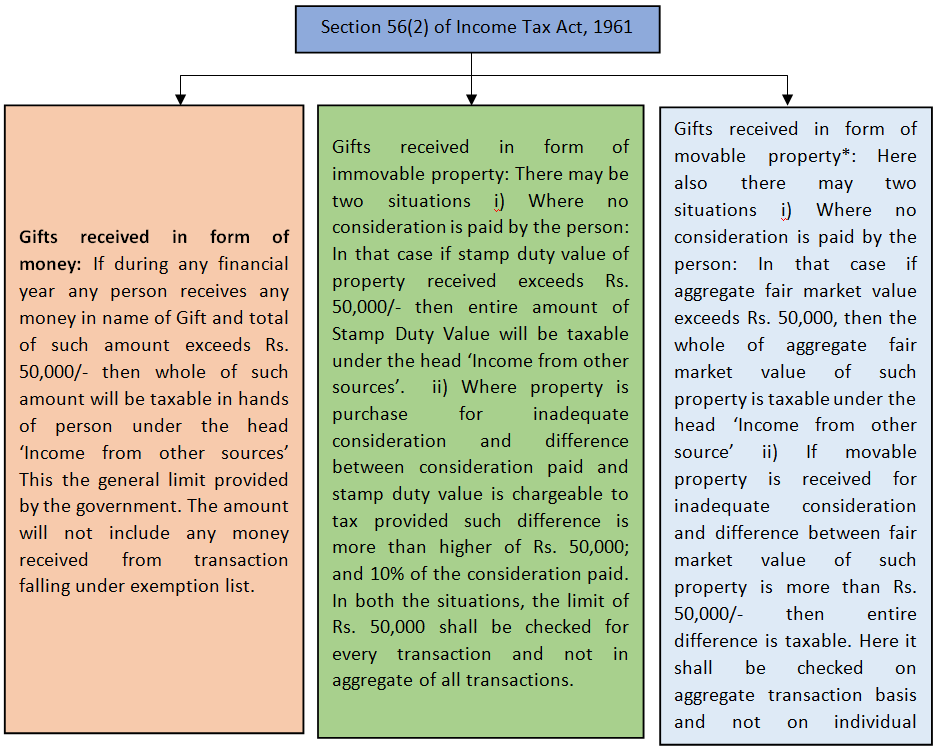

- section 56(2) of income tax act

Income Tax receipt of refunds update received from Income Tax Department TAXCONCEPT – #10

Income Tax receipt of refunds update received from Income Tax Department TAXCONCEPT – #10

Explaining The Federal Estate Tax Exemption 2023-24 – #11

Explaining The Federal Estate Tax Exemption 2023-24 – #11

PPF: How you can double your income through clubbing your life partner’s PPF account; know the trick | Zee Business – #12

PPF: How you can double your income through clubbing your life partner’s PPF account; know the trick | Zee Business – #12

- federal gift tax

- gift chart as per income tax

- gift from relative exempt from income tax

Is There a New York Gift Tax? | Long Island Estate Planning – #13

Is There a New York Gift Tax? | Long Island Estate Planning – #13

PLR Articles & Blog Posts – Taxes And Your Inheritance – PLR.me – #14

PLR Articles & Blog Posts – Taxes And Your Inheritance – PLR.me – #14

Diwali Bonus-Gifts Tax Rules: দীপাবলির বোনাস বা ভাইফোঁটার উপহারেও এবার কর? জানুন কত টাকা খসবে – income tax rules diwali gifts and bonuses taxable know the details and tax slabs sbm – – #15

Diwali Bonus-Gifts Tax Rules: দীপাবলির বোনাস বা ভাইফোঁটার উপহারেও এবার কর? জানুন কত টাকা খসবে – income tax rules diwali gifts and bonuses taxable know the details and tax slabs sbm – – #15

Income tax on gifts: Gift received from relatives is tax free | Mint – #16

Income tax on gifts: Gift received from relatives is tax free | Mint – #16

The IRS’s Christmas Gift to Airbnb and PayPal Is a Loss for Law-Abiding Taxpayers | Tax Policy Center – #17

The IRS’s Christmas Gift to Airbnb and PayPal Is a Loss for Law-Abiding Taxpayers | Tax Policy Center – #17

Legislators introduce bills to eliminate Ohio state income tax | 10tv.com – #18

Legislators introduce bills to eliminate Ohio state income tax | 10tv.com – #18

Nabhi’s Income Tax Guidelines & mini Ready Reckoner 2021-22 & 2022-23 Along with Tax Planning – 50th Revised Edition 2021. – – #19

Nabhi’s Income Tax Guidelines & mini Ready Reckoner 2021-22 & 2022-23 Along with Tax Planning – 50th Revised Edition 2021. – – #19

Amendments in Income Tax Act effected by the Finance Act 2023 – #20

Amendments in Income Tax Act effected by the Finance Act 2023 – #20

) Tax Revenue: What It Is, How It Works, Types – #21

Tax Revenue: What It Is, How It Works, Types – #21

What Are the Legal and Tax Implications of Using Gift Cards in India? – #22

What Are the Legal and Tax Implications of Using Gift Cards in India? – #22

IRS Raising Annual Gift Tax and Estate Tax Exclusions in 2023 — Leitner Law PLC – #23

IRS Raising Annual Gift Tax and Estate Tax Exclusions in 2023 — Leitner Law PLC – #23

Tax tribunal rules in favour of actor who got Rs 30 lakh as ‘gift’ from father – #24

Tax tribunal rules in favour of actor who got Rs 30 lakh as ‘gift’ from father – #24

- gift tax in india

- estate/gift tax

- estate tax

What is a gift deed and tax implications | Tax Hack – #25

What is a gift deed and tax implications | Tax Hack – #25

Budget 2024 – Old vs New Income Tax Regime, Which is Better to Opt in 2024? – #26

Budget 2024 – Old vs New Income Tax Regime, Which is Better to Opt in 2024? – #26

Party Background Ribbon, Gift Card, Tax, Money, Christmas Gift, Gift Tax, 401k, Income transparent background PNG clipart | HiClipart – #27

Party Background Ribbon, Gift Card, Tax, Money, Christmas Gift, Gift Tax, 401k, Income transparent background PNG clipart | HiClipart – #27

Know About Income Tax on Intraday Trading | 5paisa – #28

Know About Income Tax on Intraday Trading | 5paisa – #28

![Buy Taxmann's Taxation of Loans Gifts & Cash Credits – Comprehensive analysis on undisclosed income, gifts of money & movable/immovable property along with Case Laws [Finance Act 2023] Book Online at Low Buy Taxmann's Taxation of Loans Gifts & Cash Credits – Comprehensive analysis on undisclosed income, gifts of money & movable/immovable property along with Case Laws [Finance Act 2023] Book Online at Low](https://images.livemint.com/img/2022/02/07/600x338/g1_1644254640327_1644254657230.jpg) Buy Taxmann’s Taxation of Loans Gifts & Cash Credits – Comprehensive analysis on undisclosed income, gifts of money & movable/immovable property along with Case Laws [Finance Act 2023] Book Online at Low – #29

Buy Taxmann’s Taxation of Loans Gifts & Cash Credits – Comprehensive analysis on undisclosed income, gifts of money & movable/immovable property along with Case Laws [Finance Act 2023] Book Online at Low – #29

1099-K IRS Delay: What PayPal, Venmo and Cash App Users Need to Know This Tax Season – CNET – #30

1099-K IRS Delay: What PayPal, Venmo and Cash App Users Need to Know This Tax Season – CNET – #30

Donor-advised Funds: A Smart Way to Make a Lasting Impact – Edward Jones – #31

Donor-advised Funds: A Smart Way to Make a Lasting Impact – Edward Jones – #31

Which Gifts from relatives are exempted from Income Tax? – #32

Which Gifts from relatives are exempted from Income Tax? – #32

Neil Borate on X: “Gifts received on the occasion of marriage are tax-exempt. Normally such gifts above 50k are taxable. Note, gifts from immediate family members are tax exempt in any case – #33

Neil Borate on X: “Gifts received on the occasion of marriage are tax-exempt. Normally such gifts above 50k are taxable. Note, gifts from immediate family members are tax exempt in any case – #33

Income Tax relief to cheap insurance: Top money gifts expected from new Modi government | Zee Business – #34

Income Tax relief to cheap insurance: Top money gifts expected from new Modi government | Zee Business – #34

Income tax, Charitable, and Estate Planning for Digital Assets – #35

Income tax, Charitable, and Estate Planning for Digital Assets – #35

Let’s set the record straight about tax refunds. They’re not gifts from the government! They’re your own hard-earned money coming back to… | Instagram – #36

Let’s set the record straight about tax refunds. They’re not gifts from the government! They’re your own hard-earned money coming back to… | Instagram – #36

Gift are taxable income or exempted income & how are gift taxed? – Tax Knowledges – #37

Gift are taxable income or exempted income & how are gift taxed? – Tax Knowledges – #37

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #38

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #38

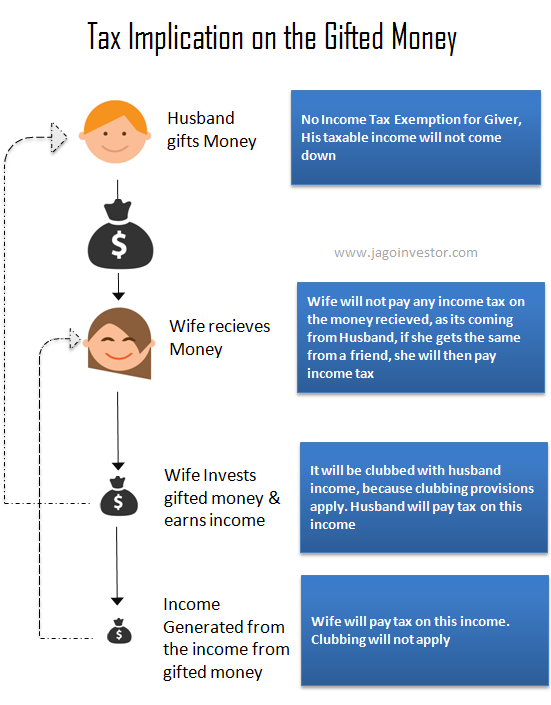

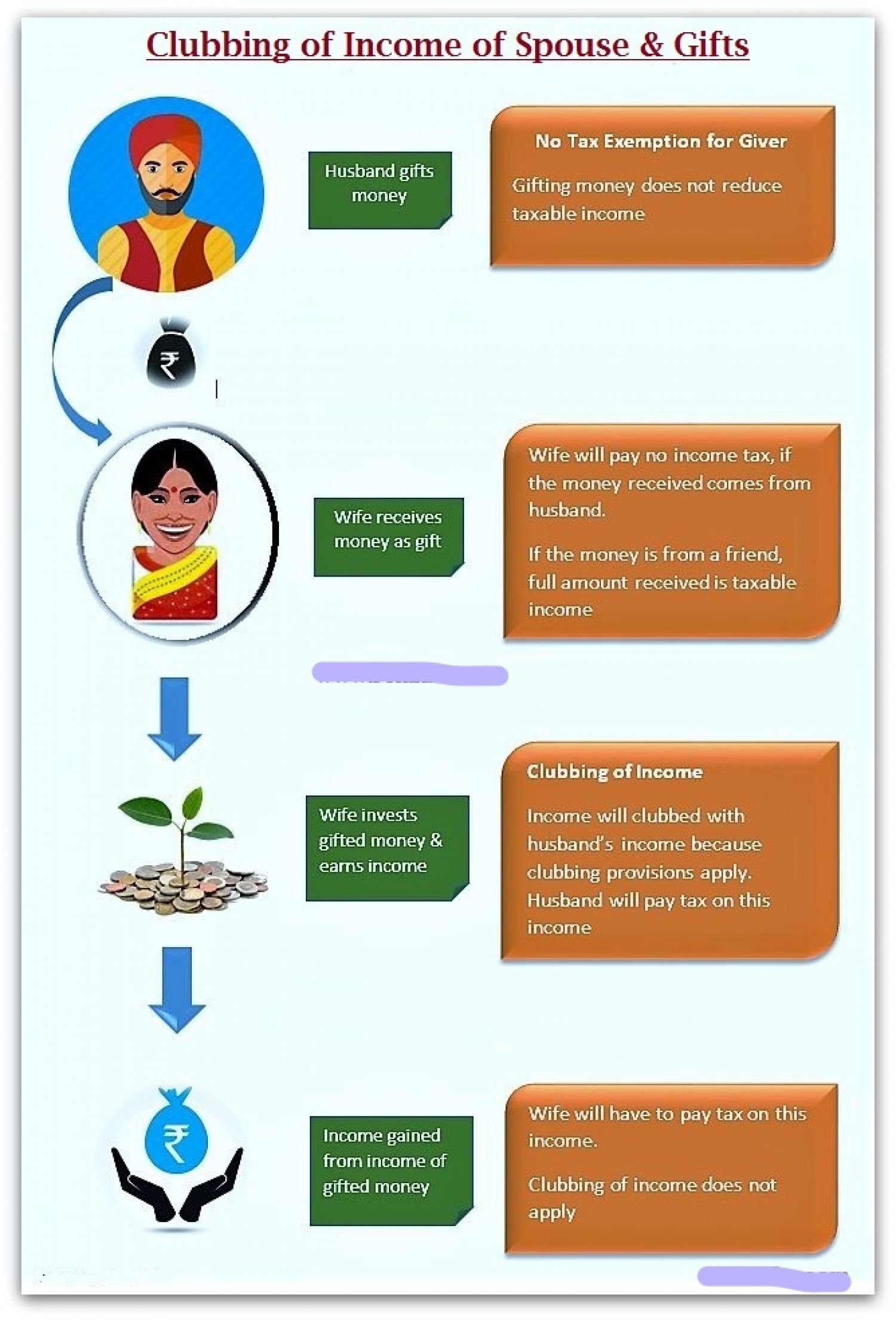

Forums | Clubbing of Income – #39

Forums | Clubbing of Income – #39

Tax Preparer – KLEK Business Directory – #40

Tax Preparer – KLEK Business Directory – #40

Gifts to and from HUF – MN & Associates CS-India – #41

Gifts to and from HUF – MN & Associates CS-India – #41

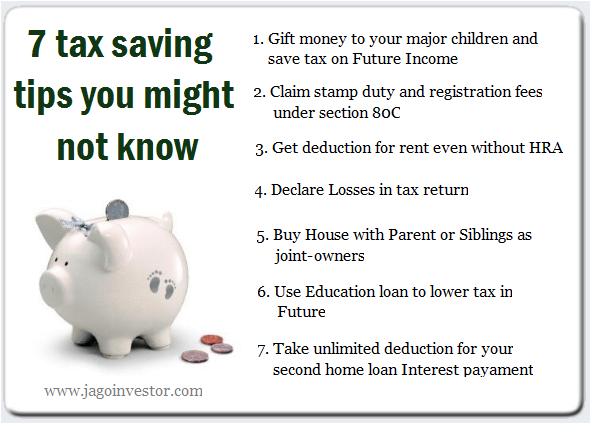

Gift Tax planning – 3 awesome tips to save income tax legally – #42

Gift Tax planning – 3 awesome tips to save income tax legally – #42

Are Cash Gifts from relatives exempt from Income tax? – #43

Are Cash Gifts from relatives exempt from Income tax? – #43

9 Reasons You Might Owe Money to the IRS This Tax Season – CNET – #44

9 Reasons You Might Owe Money to the IRS This Tax Season – CNET – #44

Gift Tax – Do I Have to Pay Taxes on a Gift | Gift Tax Calculator – #45

Gift Tax – Do I Have to Pay Taxes on a Gift | Gift Tax Calculator – #45

Your queries: Income Tax: Show gift from relative in Schedule EI of ITR – Money News | The Financial Express – #46

Your queries: Income Tax: Show gift from relative in Schedule EI of ITR – Money News | The Financial Express – #46

Planned Giving – Feed My People – #47

Planned Giving – Feed My People – #47

Charitable Gift Annuities | American Heart Association – #48

Charitable Gift Annuities | American Heart Association – #48

Fake IRS calls solicit payments via iTunes and Google Play cards – #49

Fake IRS calls solicit payments via iTunes and Google Play cards – #49

Top Tax Planning Tips for 2019 Infographic | Income tax, Audit services, Irs taxes – #50

Top Tax Planning Tips for 2019 Infographic | Income tax, Audit services, Irs taxes – #50

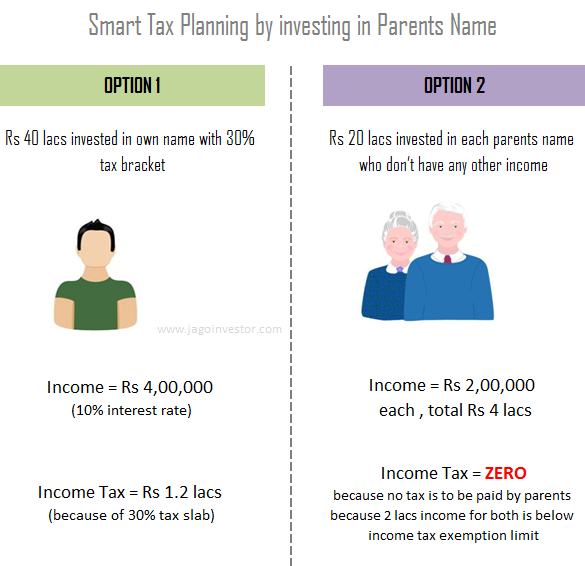

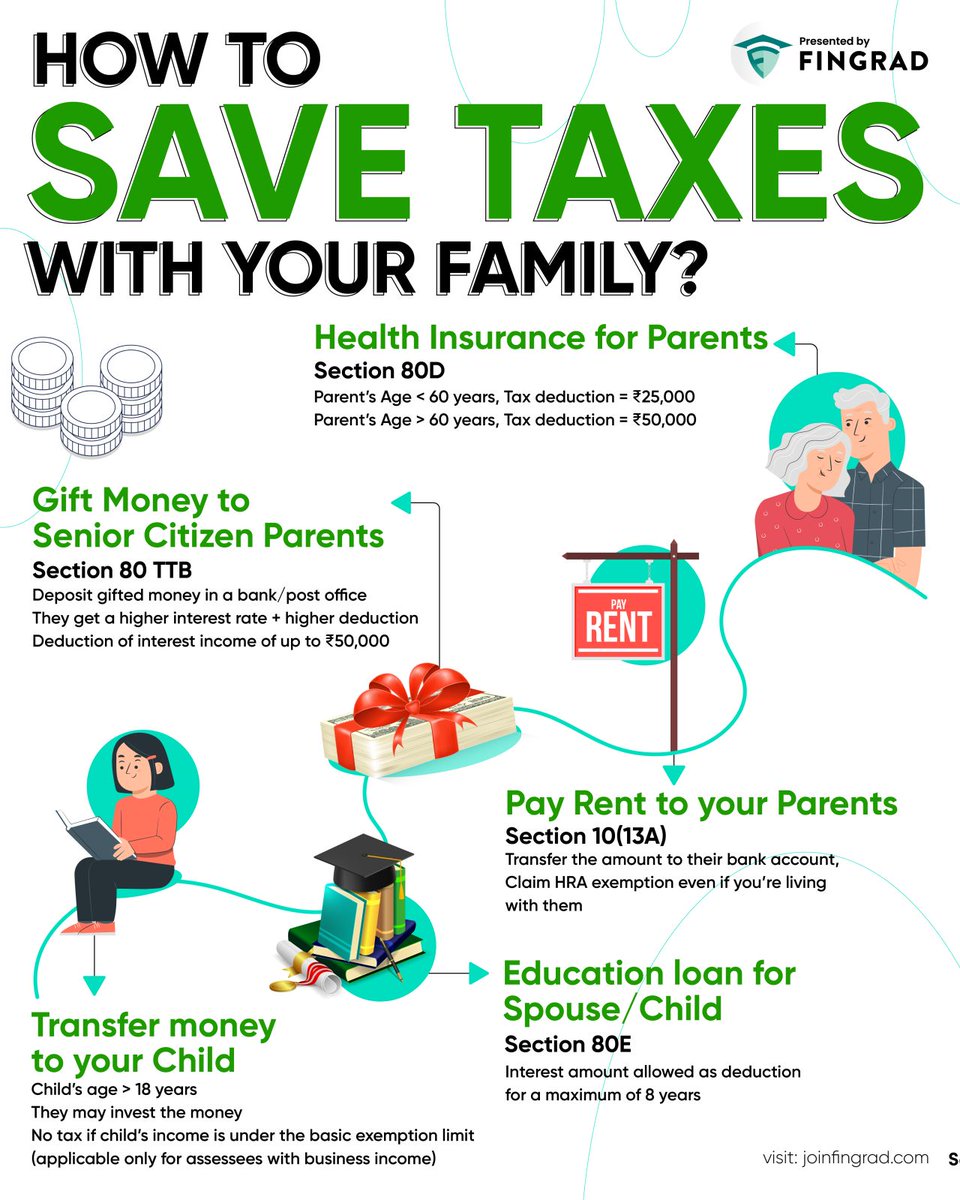

Kritesh Abhishek on X: “How to Save Taxes with your family? – Health Insurance for Parents – Gift Money to Senior Citizen Parents – Pay rent to parents – Transfer money to – #51

Kritesh Abhishek on X: “How to Save Taxes with your family? – Health Insurance for Parents – Gift Money to Senior Citizen Parents – Pay rent to parents – Transfer money to – #51

Income Tax – Penalty proceedings u/s. 270A – Additions made u/s 43CA r.w.s. 56 (2) (x) i.e. deeming sections – There is not even a whisper as to which limb of… – #52

Income Tax – Penalty proceedings u/s. 270A – Additions made u/s 43CA r.w.s. 56 (2) (x) i.e. deeming sections – There is not even a whisper as to which limb of… – #52

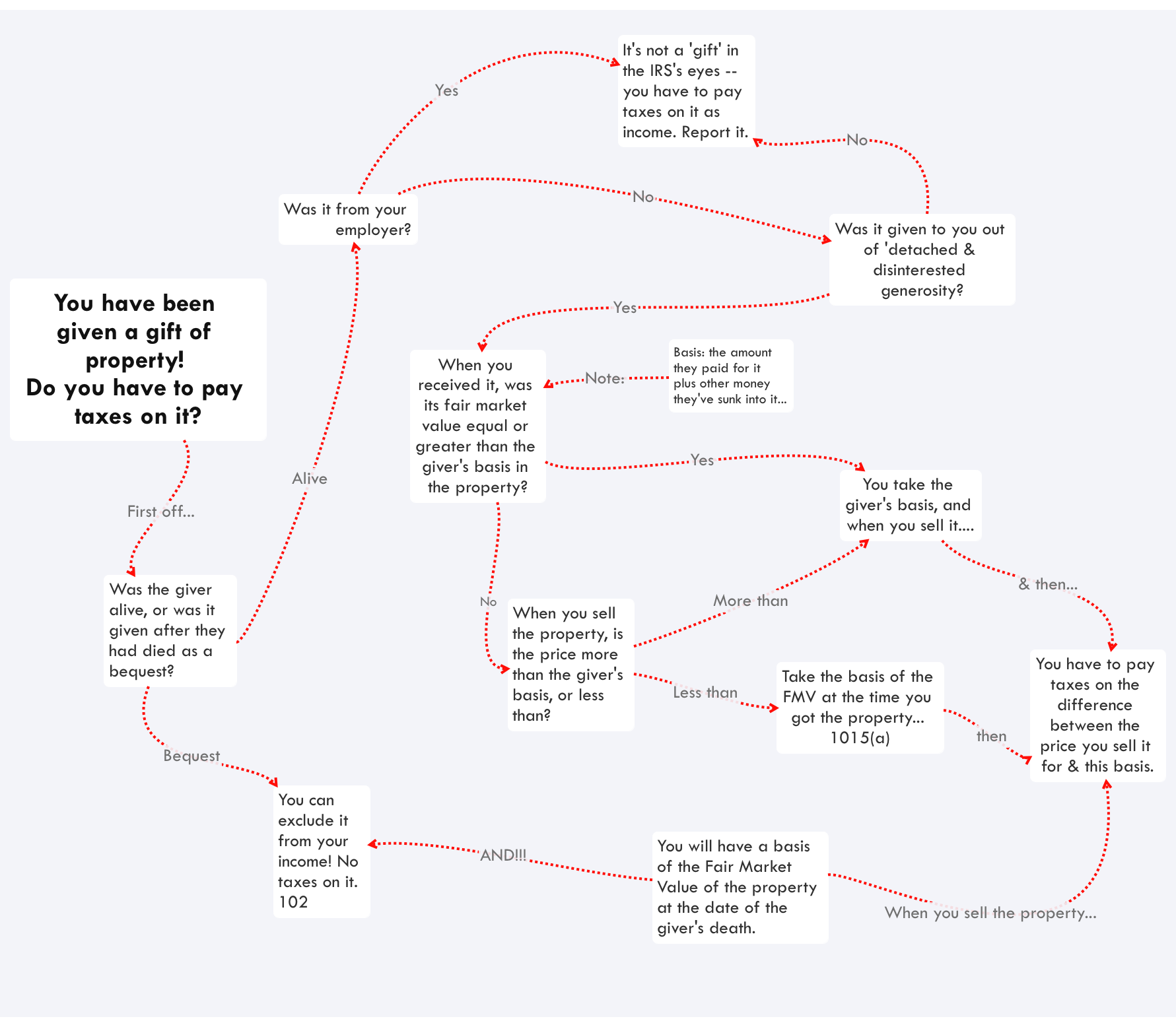

How Can I Avoid Paying Capital Gains Tax on Gifted Property? – #53

How Can I Avoid Paying Capital Gains Tax on Gifted Property? – #53

Tax | What is Tax | Taxation in India : Tax Calculation – #54

Tax | What is Tax | Taxation in India : Tax Calculation – #54

Tax Relief – Just for Them Gift Baskets – #55

Tax Relief – Just for Them Gift Baskets – #55

Pay Zero Tax for 12 Lakhs Income Tax Slab in FY 2023-24 – #56

Pay Zero Tax for 12 Lakhs Income Tax Slab in FY 2023-24 – #56

Will I Be Taxed When Gifting Money? – #57

Will I Be Taxed When Gifting Money? – #57

IRS Announces 2018 Estate And Gift Tax Limits: $11.2 Million – #58

IRS Announces 2018 Estate And Gift Tax Limits: $11.2 Million – #58

MSU Alumni Foundation – How to use the Montana Endowment Tax Credit – #59

MSU Alumni Foundation – How to use the Montana Endowment Tax Credit – #59

- form 709 gift splitting example

![How to Prepare Gift Deed for Income Tax Purposes [Hindi] | गिफ्ट डीड कैसे बनायें - YouTube How to Prepare Gift Deed for Income Tax Purposes [Hindi] | गिफ्ट डीड कैसे बनायें - YouTube](https://digiaccounto.com/wp-content/uploads/2023/03/gt3.jpg) How to Prepare Gift Deed for Income Tax Purposes [Hindi] | गिफ्ट डीड कैसे बनायें – YouTube – #60

How to Prepare Gift Deed for Income Tax Purposes [Hindi] | गिफ्ट डीड कैसे बनायें – YouTube – #60

Cutting IRS funding is a gift to America’s wealthiest tax evaders | Brookings – #61

Cutting IRS funding is a gift to America’s wealthiest tax evaders | Brookings – #61

Tax-Free Income Sources in India 2024 – #62

Tax-Free Income Sources in India 2024 – #62

If somebody wants to gift rs 10 lakh or more to his non working mother then how the income tax will be calculated for that amount? – Quora – #63

If somebody wants to gift rs 10 lakh or more to his non working mother then how the income tax will be calculated for that amount? – Quora – #63

How Are Trust Fund Earnings Taxed? – #64

How Are Trust Fund Earnings Taxed? – #64

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation – #65

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation – #65

पतीकडून पत्नीला मिळणाऱ्या गिफ्टवर कर लागतो का? जाणून घ्या गिफ्टवरील कराबाबतचे महत्त्वपूर्ण नियम – Marathi News | Is there a tax on a gift from a husband to his wife know … – #66

पतीकडून पत्नीला मिळणाऱ्या गिफ्टवर कर लागतो का? जाणून घ्या गिफ्टवरील कराबाबतचे महत्त्वपूर्ण नियम – Marathi News | Is there a tax on a gift from a husband to his wife know … – #66

How to calculate income tax on gifts from relatives? – #67

How to calculate income tax on gifts from relatives? – #67

A Step-By-Step Guide For Remitting Gift Money To UK From India – #68

A Step-By-Step Guide For Remitting Gift Money To UK From India – #68

Honey, I Forgot About the Income Tax! – ppt download – #69

Honey, I Forgot About the Income Tax! – ppt download – #69

Top 10 tax credits to claim on your 2015 return | wltx.com – #70

Top 10 tax credits to claim on your 2015 return | wltx.com – #70

What will the estate and gift tax exclusions be in 2024, 2025? – #71

What will the estate and gift tax exclusions be in 2024, 2025? – #71

-Gifts.jpg) New Jersey Gift Tax: All You Need to Know | SmartAsset – #72

New Jersey Gift Tax: All You Need to Know | SmartAsset – #72

nonresident alien – Virginia – US TAX TALK – #73

nonresident alien – Virginia – US TAX TALK – #73

The Limits of Taxing the Rich | Manhattan Institute – #74

The Limits of Taxing the Rich | Manhattan Institute – #74

- simple deed of gift template

- gift tax exclusion 2023

- 2023 gift

Close Relatives” include Uncle and Aunt: ITAT deletes Addition for Cash Gift from Close Relatives during Emergency – #75

Close Relatives” include Uncle and Aunt: ITAT deletes Addition for Cash Gift from Close Relatives during Emergency – #75

The Tax Implications of Employee Gifts: An Easy Guide for U.S. Employers | Goody – #76

The Tax Implications of Employee Gifts: An Easy Guide for U.S. Employers | Goody – #76

2023-2024 Taxes: Federal Income Tax Brackets and Rates – #77

2023-2024 Taxes: Federal Income Tax Brackets and Rates – #77

IRS Alert Update! New 2020 Federal Estate & Gift Tax Limits Announced by the IRS | David M. Frees III – #78

IRS Alert Update! New 2020 Federal Estate & Gift Tax Limits Announced by the IRS | David M. Frees III – #78

Tax on the gift from father to daughter – #79

Tax on the gift from father to daughter – #79

आधार लिंक करें – उपयोगकर्ता पुस्तिका | Income Tax Department – #80

आधार लिंक करें – उपयोगकर्ता पुस्तिका | Income Tax Department – #80

New Higher Tax on UTMA Accounts – Beware the “Kiddie Tax” – Law Offices of Joel A. Harris – #81

New Higher Tax on UTMA Accounts – Beware the “Kiddie Tax” – Law Offices of Joel A. Harris – #81

Income Tax : राखी पर बहन को गिफ्ट में दिया है कैश? जानें- अब सरकार लेगी Tax ….. – #82

Income Tax : राखी पर बहन को गिफ्ट में दिया है कैश? जानें- अब सरकार लेगी Tax ….. – #82

Receiving a Foreign Gift? You May Need to Tell the IRS – The Wolf Group – #83

Receiving a Foreign Gift? You May Need to Tell the IRS – The Wolf Group – #83

Gifting Appreciated Securities | Definition, Process, Pros & Cons – #84

Gifting Appreciated Securities | Definition, Process, Pros & Cons – #84

Charitable Donations: What’s Tax-Deductible, What’s Not – NerdWallet – #85

Charitable Donations: What’s Tax-Deductible, What’s Not – NerdWallet – #85

Direct Taxes Circulars 1922-2015 – Relating to the Law of Income, Wealth and Gift Tax, Black – #86

Direct Taxes Circulars 1922-2015 – Relating to the Law of Income, Wealth and Gift Tax, Black – #86

Money Remitted As Gift To Parent In India Not Taxable As Income – #87

Money Remitted As Gift To Parent In India Not Taxable As Income – #87

Capital Gain on Sale of Property & Land – Learn by Quicko – #88

Capital Gain on Sale of Property & Land – Learn by Quicko – #88

Gift Deed: Registration, Format and All You Need to Know – #89

Gift Deed: Registration, Format and All You Need to Know – #89

Income Tax Slab FY 2023-24 and AY 2024-25 – New and Old Regime Tax Rates | HDFC Life – #90

Income Tax Slab FY 2023-24 and AY 2024-25 – New and Old Regime Tax Rates | HDFC Life – #90

Estate and Gift Tax Outline – TRU1 – Studocu – #91

Estate and Gift Tax Outline – TRU1 – Studocu – #91

8 Tips For Tax-Free Gifting In 2023 – #92

8 Tips For Tax-Free Gifting In 2023 – #92

3 Ways to Make Sure Your Cash Gifting Is Legal – wikiHow – #93

3 Ways to Make Sure Your Cash Gifting Is Legal – wikiHow – #93

Income Tax Calculator: Calculate Income Tax Online for FY 2023-24 and FY 2024-25 | Max Life Insurance – #94

Income Tax Calculator: Calculate Income Tax Online for FY 2023-24 and FY 2024-25 | Max Life Insurance – #94

Step-son falls within the ambit of relative for Gift – Section 56(2) – #95

Step-son falls within the ambit of relative for Gift – Section 56(2) – #95

Drake Tax Services | Tax Season Tips For Holiday Gifts And Bonuses – #96

Drake Tax Services | Tax Season Tips For Holiday Gifts And Bonuses – #96

How Crypto Gifts and Donations are Taxed | CoinTracker – #97

How Crypto Gifts and Donations are Taxed | CoinTracker – #97

Taxmann’s Taxation of Loans Gifts & Cash Credits by Taxmann – Issuu – #98

Taxmann’s Taxation of Loans Gifts & Cash Credits by Taxmann – Issuu – #98

- gift tax definition

- gift tax exemption relatives list

- gift deed format in hindi pdf

If We Can Print Our Own Money Why Do We Have to Pay Taxes? – A Wealth of Common Sense – #99

If We Can Print Our Own Money Why Do We Have to Pay Taxes? – A Wealth of Common Sense – #99

Foreign Remittance: Sending Gift Money To The USA From India In 2024 – #100

Foreign Remittance: Sending Gift Money To The USA From India In 2024 – #100

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #101

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #101

Income tax – “GIFT” Taxability under Income Tax Act,… | Facebook – #102

Income tax – “GIFT” Taxability under Income Tax Act,… | Facebook – #102

Who Pays Taxes on a Gift? – #103

Who Pays Taxes on a Gift? – #103

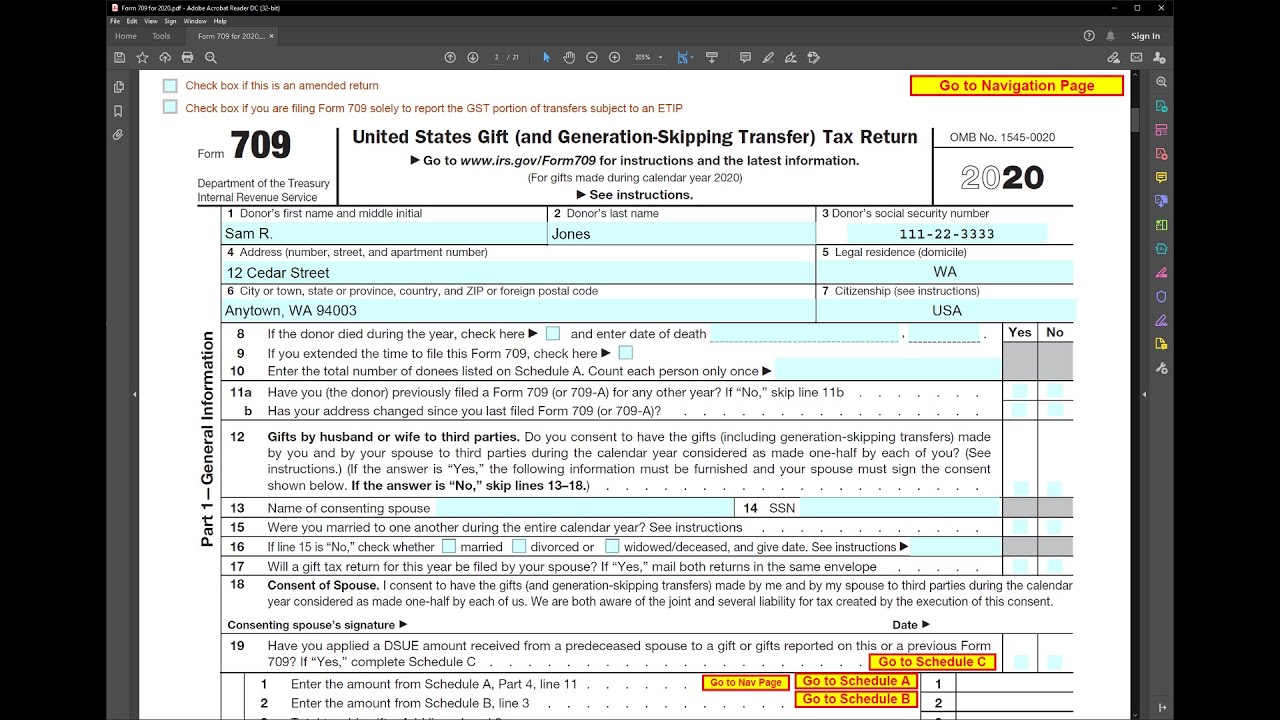

- sample form 709 completed 2019

- gift tax rate table

- list of relatives

Top 10 Benefits Of Paying Taxes In India | 5paisa – #104

Top 10 Benefits Of Paying Taxes In India | 5paisa – #104

What is gift tax? – Quora – #105

What is gift tax? – Quora – #105

All about Income Tax on Gift Received From Parents. – #106

All about Income Tax on Gift Received From Parents. – #106

Expecting an NFT, crypto, or VDA gift this Diwali? Here are the tax implications – #107

Expecting an NFT, crypto, or VDA gift this Diwali? Here are the tax implications – #107

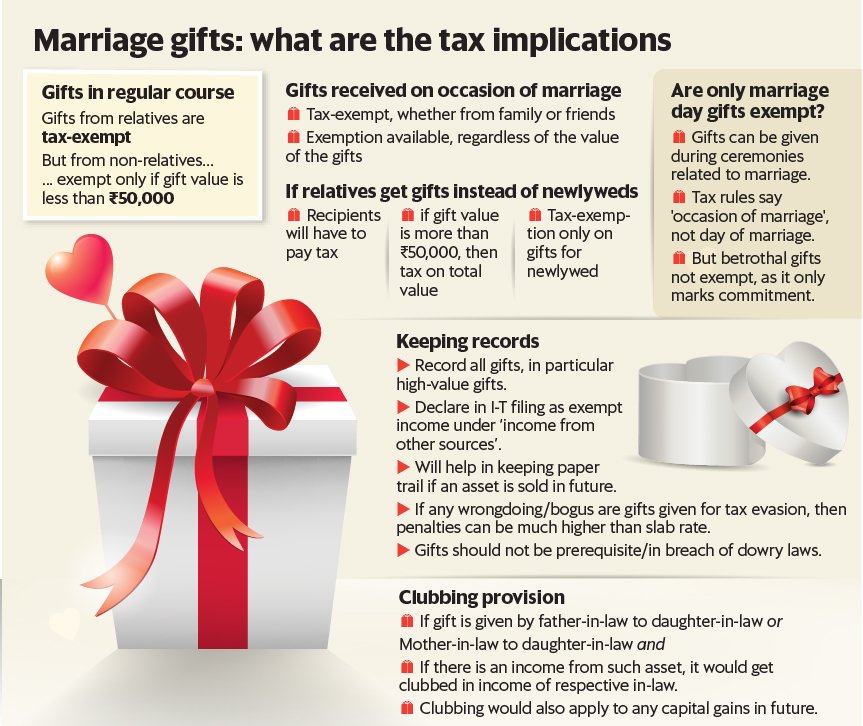

Akshit Bansal on LinkedIn: #marriage #gifts #taxation – #108

Akshit Bansal on LinkedIn: #marriage #gifts #taxation – #108

The Moves Wealthy Families Are Making to Skirt Estate Taxes – WSJ – #109

The Moves Wealthy Families Are Making to Skirt Estate Taxes – WSJ – #109

Gift Tax: Tax on gifts: Documents that you should have while filing ITR – The Economic Times – #110

Gift Tax: Tax on gifts: Documents that you should have while filing ITR – The Economic Times – #110

- gift tax returns irs completed sample form 709 sample

- gift tax act 1958

- gift tax example

How To Avoid Gift Tax in Real Estate – MoneyTips – #111

How To Avoid Gift Tax in Real Estate – MoneyTips – #111

Do I Need to Worry About the Gift Tax If I Pay $30,000 Toward My Child’s Wedding? – #112

Do I Need to Worry About the Gift Tax If I Pay $30,000 Toward My Child’s Wedding? – #112

When You Make Cash Gifts To Your Children, Who Pays The Tax? | Greenbush Financial Group – #113

When You Make Cash Gifts To Your Children, Who Pays The Tax? | Greenbush Financial Group – #113

3 Taxes That Can Affect Your Inheritance – #114

3 Taxes That Can Affect Your Inheritance – #114

12 Types of Passive Income That Aren’t Taxable – #115

12 Types of Passive Income That Aren’t Taxable – #115

How to Make TDS Payment Online? – #116

How to Make TDS Payment Online? – #116

Are gifts to clients and employees tax-deductible? – Financial Solution Advisors – #117

Are gifts to clients and employees tax-deductible? – Financial Solution Advisors – #117

Rules For Giving And Receiving Home Down Payment Gifts – Experian – #118

Rules For Giving And Receiving Home Down Payment Gifts – Experian – #118

- sample completed irs form 709

- property gift deed

- form 709 schedule a example

How to File ITR-1 (SAHAJ) Online? | ITR Filing FY 2022-23 (AY 2023-24) – #119

How to File ITR-1 (SAHAJ) Online? | ITR Filing FY 2022-23 (AY 2023-24) – #119

- gift tax exemption 2022

- gift tax meaning

- gift tax exemption

5 rules about Income Tax on Gifts received in India & Exemptions – #120

5 rules about Income Tax on Gifts received in India & Exemptions – #120

🌟 Tax Refund Giveaway! 🤑 Secure a chance to win a $50 gift card from Citi Trends. Check the rules listed in the comments to enter and make… | Instagram – #121

🌟 Tax Refund Giveaway! 🤑 Secure a chance to win a $50 gift card from Citi Trends. Check the rules listed in the comments to enter and make… | Instagram – #121

Gift and income tax rules is know tax rules on marriage gifts | शादी के समय मिलने वाले गिफ्ट और रिलेटिव से मिलने वाले Gift को लेकर जानिए क्या है टैक्स संबंधी – #122

Gift and income tax rules is know tax rules on marriage gifts | शादी के समय मिलने वाले गिफ्ट और रिलेटिव से मिलने वाले Gift को लेकर जानिए क्या है टैक्स संबंधी – #122

Crypto Gift Tax | Your Guide | Koinly – #123

Crypto Gift Tax | Your Guide | Koinly – #123

Understanding Section 56(2)(x) of the Income Tax Act: Taxation of Gifts Received Without Consideration or for Inadequate Consideration – Marg ERP Blog – #124

Understanding Section 56(2)(x) of the Income Tax Act: Taxation of Gifts Received Without Consideration or for Inadequate Consideration – Marg ERP Blog – #124

New Estate and Gift Tax Laws for 2022 – Fee Based Guardians of Wealth – #125

New Estate and Gift Tax Laws for 2022 – Fee Based Guardians of Wealth – #125

Crypto Taxes India: Expert Guide 2024 | CPA Reviewed | Koinly – #126

Crypto Taxes India: Expert Guide 2024 | CPA Reviewed | Koinly – #126

Gift Tax Limit 2024: How Much Can You Give Tax-Free? | Kiplinger – #127

Gift Tax Limit 2024: How Much Can You Give Tax-Free? | Kiplinger – #127

What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #128

What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #128

Raksha Bandhan 2023: Is gifting cash to your sister taxable? Income tax rules explained here | Mint – #129

Raksha Bandhan 2023: Is gifting cash to your sister taxable? Income tax rules explained here | Mint – #129

15 Tax Saving Options Other Than Section 80C – #130

15 Tax Saving Options Other Than Section 80C – #130

Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to Avoid It – #131

Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to Avoid It – #131

List of Top 7 Tax-Free Countries in the World 2023 – #132

List of Top 7 Tax-Free Countries in the World 2023 – #132

A relative wants to gift cash to me. What are the income tax implications? | Mint – #133

A relative wants to gift cash to me. What are the income tax implications? | Mint – #133

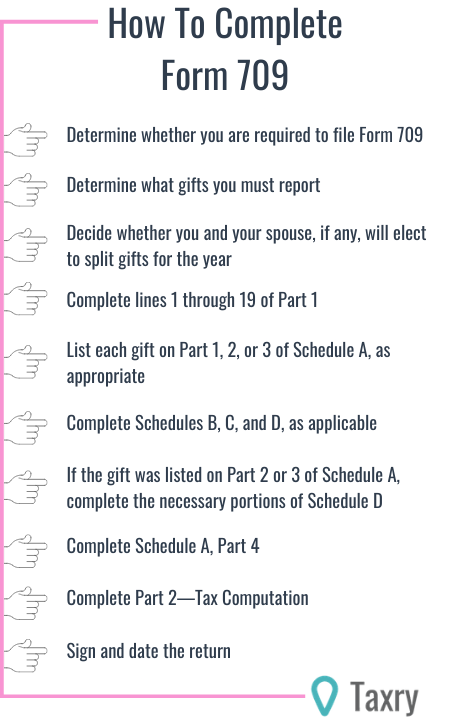

How to Accurately Prepare the 709 Gift Tax Return: NEW Update for 2023 – Ultimate Estate Planner – #134

How to Accurately Prepare the 709 Gift Tax Return: NEW Update for 2023 – Ultimate Estate Planner – #134

Tax receipts. Large taxes. Bag of money and coins is divided in half for taxes and income Stock Photo – Alamy – #135

Tax receipts. Large taxes. Bag of money and coins is divided in half for taxes and income Stock Photo – Alamy – #135

How to calculate taxes and discounts | Basic Concept, Formulas and Examples – Cuemath – #136

How to calculate taxes and discounts | Basic Concept, Formulas and Examples – Cuemath – #136

gift tax Archives – Tax, Litigation, Immigration Law Blog – #137

gift tax Archives – Tax, Litigation, Immigration Law Blog – #137

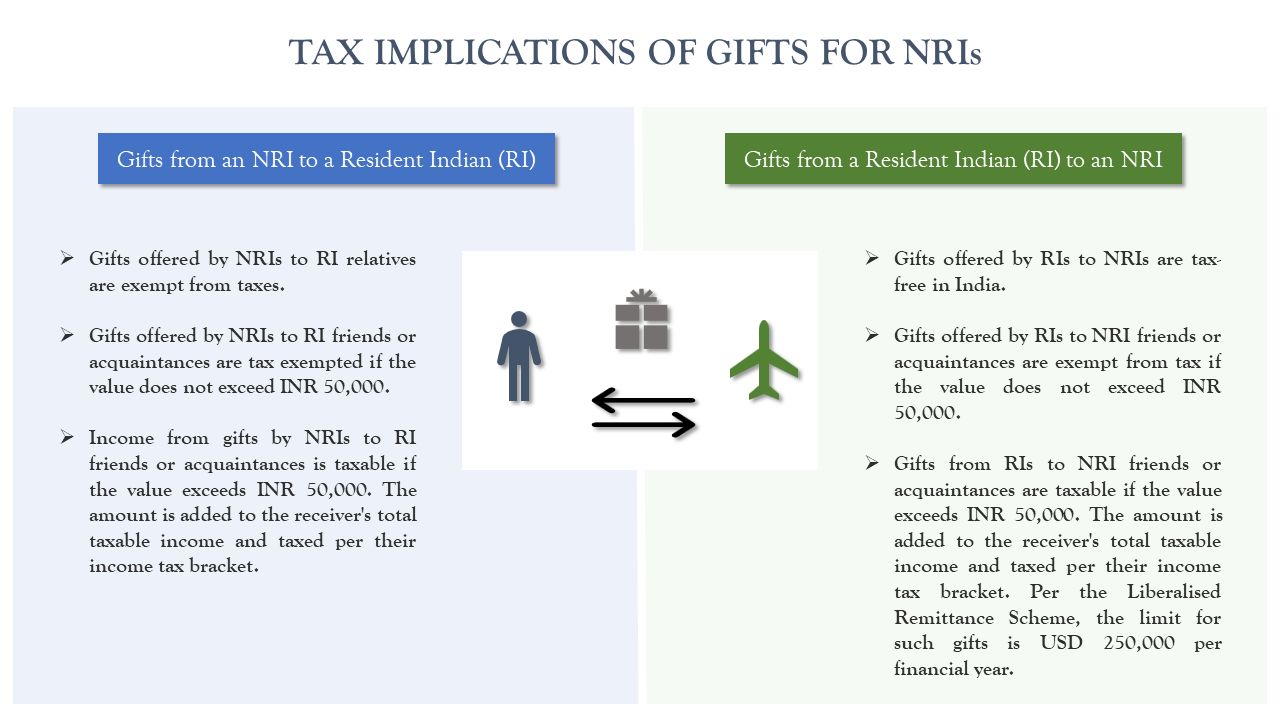

NRI Gift Tax India: Rules for Tax On Gift Money In India | DBS Treasures – #138

NRI Gift Tax India: Rules for Tax On Gift Money In India | DBS Treasures – #138

Basic Concepts of Income Tax | Exemptions & Deductions – #139

Basic Concepts of Income Tax | Exemptions & Deductions – #139

Taxation of Gifts to Ministers and Church Employees – Provident Lawyers – #140

Taxation of Gifts to Ministers and Church Employees – Provident Lawyers – #140

- clubbing of income

- gift deed stamp paper

- gift tax rate in india 2022-23

How bank bonuses and interest payouts affect your tax bill – Los Angeles Times – #141

How bank bonuses and interest payouts affect your tax bill – Los Angeles Times – #141

Are Gift Cards Taxable? | Taxation, Examples, & More – #142

Are Gift Cards Taxable? | Taxation, Examples, & More – #142

Estate and Gift Tax Exemption Sunset 2025: How to Prepare : Cherry Bekaert – #143

Estate and Gift Tax Exemption Sunset 2025: How to Prepare : Cherry Bekaert – #143

IFSC at GIFT City: unpacking key factors driving investor attraction – #144

IFSC at GIFT City: unpacking key factors driving investor attraction – #144

Income Tax: What is Gift Tax? Exemption and limits explained | Economy News – News9live – #145

Income Tax: What is Gift Tax? Exemption and limits explained | Economy News – News9live – #145

Free Gift Affidavit: Make & Download – Rocket Lawyer – #146

Free Gift Affidavit: Make & Download – Rocket Lawyer – #146

Understanding crypto taxes | Coinbase – #147

Understanding crypto taxes | Coinbase – #147

Real Estate Articles, Property Market Updates, Insights – #148

Real Estate Articles, Property Market Updates, Insights – #148

Schedule A (Form 1040): A Guide to the Itemized Deduction – #149

Schedule A (Form 1040): A Guide to the Itemized Deduction – #149

How Family Can Help You Save Taxes – Rediff.com – #150

How Family Can Help You Save Taxes – Rediff.com – #150

Solved Question 3 Unsaved Question 3 options: For tax | Chegg.com – #151

Solved Question 3 Unsaved Question 3 options: For tax | Chegg.com – #151

- gift tax rate

- form 709

- lineal ascendant gift from relative exempt from income tax

Hometown tax, property Tax, tax Deduction, Income tax, Income, donation, Tax, saving, Payment, Gift | Anyrgb – #152

Hometown tax, property Tax, tax Deduction, Income tax, Income, donation, Tax, saving, Payment, Gift | Anyrgb – #152

ઘરમાં કેટલી રોકડ રકમ રાખી શકાય ઇન્કમ ટેક્સનો નિયમ જાણો, income tax limit cash Transaction and gift payment it rules – #153

ઘરમાં કેટલી રોકડ રકમ રાખી શકાય ઇન્કમ ટેક્સનો નિયમ જાણો, income tax limit cash Transaction and gift payment it rules – #153

Tax Queries: What are the tax implications on a gift deed? – The Economic Times – #154

Tax Queries: What are the tax implications on a gift deed? – The Economic Times – #154

Income Tax on Cash Gift to Wife: How Much You Can Gift on Women’s Day Without Tax Implications – Income Tax News | The Financial Express – #155

Income Tax on Cash Gift to Wife: How Much You Can Gift on Women’s Day Without Tax Implications – Income Tax News | The Financial Express – #155

Budget 2023: What is Gift Tax and why govt should abolish this? | Zee Business – #156

Budget 2023: What is Gift Tax and why govt should abolish this? | Zee Business – #156

Capital Gains on a Gifted Property | Impact, Tax Considerations – #157

Capital Gains on a Gifted Property | Impact, Tax Considerations – #157

- gift tax return

- gift deed format on stamp paper

- gift tax 2023

Gifts in excess of Rs50,000 per annum are taxable – News | Khaleej Times – #158

Gifts in excess of Rs50,000 per annum are taxable – News | Khaleej Times – #158

Gifting Money to Family Members: 5 Strategies to Understand – Kindness Financial Planning – #159

Gifting Money to Family Members: 5 Strategies to Understand – Kindness Financial Planning – #159

Gifting Stock: 4 Ways to Gift Stocks to Friends, Family, and Charities – #160

Gifting Stock: 4 Ways to Gift Stocks to Friends, Family, and Charities – #160

My grandmother wants to gift cash to me. What are the income tax implications? | Mint – #161

My grandmother wants to gift cash to me. What are the income tax implications? | Mint – #161

Taxation on gifts: Everything you need to know | Tax Hacks – #162

Taxation on gifts: Everything you need to know | Tax Hacks – #162

Should i pay Income tax on money recieved from my father?? – #163

Should i pay Income tax on money recieved from my father?? – #163

Income Tax FAQs: Received monetary gift from family or friends? How it will be taxed | etnownews – #164

Income Tax FAQs: Received monetary gift from family or friends? How it will be taxed | etnownews – #164

Gift from Non-Relatives – A tool for tax planning – TaxReturnWala – #165

Gift from Non-Relatives – A tool for tax planning – TaxReturnWala – #165

Income Tax Guidelines and Mini Ready Reckoner along with Tax Planning | LAWRELS – #166

Income Tax Guidelines and Mini Ready Reckoner along with Tax Planning | LAWRELS – #166

Capital Gains Tax | Redevelopment | CA | TDS on Property | NIL Certifi – #167

Capital Gains Tax | Redevelopment | CA | TDS on Property | NIL Certifi – #167

State Estate and Inheritance Taxes: Does Your State Have Them, What Are They, and How Should You Plan for Them | Georgia Estate Plan: Worrall Law LLC – #168

State Estate and Inheritance Taxes: Does Your State Have Them, What Are They, and How Should You Plan for Them | Georgia Estate Plan: Worrall Law LLC – #168

Section 10 of Income Tax Act – Deductions and Allowances – #169

Section 10 of Income Tax Act – Deductions and Allowances – #169

What You Need to Know About Gift & Estate Taxation – KEB – #170

What You Need to Know About Gift & Estate Taxation – KEB – #170

Online Tax payment – How to Pay Income Tax Online – #171

Online Tax payment – How to Pay Income Tax Online – #171

Free: Gift tax Money Estate, Dollar transparent background PNG clipart – nohat.cc – #172

Free: Gift tax Money Estate, Dollar transparent background PNG clipart – nohat.cc – #172

Will your ‘gift’ be taxed? – The Economic Times – #173

Will your ‘gift’ be taxed? – The Economic Times – #173

Tax Implications of Loans to Family Members – #174

Tax Implications of Loans to Family Members – #174

What is the tax treatment for share transfers? | Value Research – #175

What is the tax treatment for share transfers? | Value Research – #175

) Transferring Large Sums of Money Internationally | Bright!Tax Expat Tax Services – #176

Transferring Large Sums of Money Internationally | Bright!Tax Expat Tax Services – #176

In Pictures: Gift Taxes–The Other April 18 Return – #177

In Pictures: Gift Taxes–The Other April 18 Return – #177

Irrevocable Trusts for Estate Tax Planning, Gift Tax and Gifting Strategies Explained – #178

Irrevocable Trusts for Estate Tax Planning, Gift Tax and Gifting Strategies Explained – #178

PSL Advocates & Solicitors – #179

PSL Advocates & Solicitors – #179

Are Gift Cards Taxable to Employees? – #180

Are Gift Cards Taxable to Employees? – #180

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #181

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #181

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™ – #182

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™ – #182

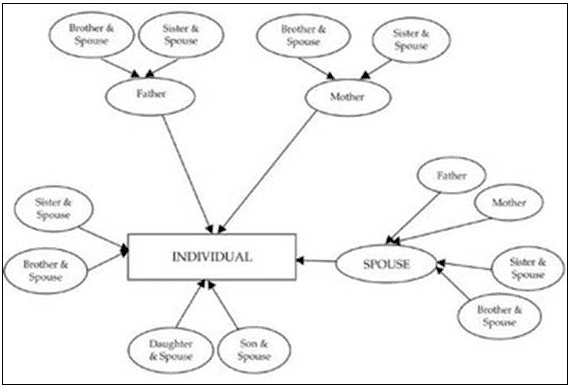

List of relatives covered under Section 56(2) of Income Tax Act,1961 – #183

List of relatives covered under Section 56(2) of Income Tax Act,1961 – #183

Chapter 2: Tax Planning: Gift Tax and Wealth Tax – #184

Chapter 2: Tax Planning: Gift Tax and Wealth Tax – #184

Crypto currency As per Income Tax Provisions U/S 115BBH – #185

Crypto currency As per Income Tax Provisions U/S 115BBH – #185

Birthday, Marriage पर मिले गिफ्ट पर भी देना होता है टैक्स, जानें क्या है Income Tax का नियम – Income Tax What are the Taxation rules on wedding or birthday gifts know – #186

Birthday, Marriage पर मिले गिफ्ट पर भी देना होता है टैक्स, जानें क्या है Income Tax का नियम – Income Tax What are the Taxation rules on wedding or birthday gifts know – #186

How Does the IRS Know If You Give a Gift? — Taxry – #187

How Does the IRS Know If You Give a Gift? — Taxry – #187

When are gifts received by NRIs subject to tax, TDS in India? – The Economic Times – #188

When are gifts received by NRIs subject to tax, TDS in India? – The Economic Times – #188

Posts: income tax on gifted money

Categories: Gifts

Author: toyotabienhoa.edu.vn