Update 213+ income tax gift rules

Update images of income tax gift rules by website toyotabienhoa.edu.vn compilation. Estate Tax Exemption for 2023 | Kiplinger. YOUR QUERIES: INCOME TAX : No income tax on money received as gift from your grandmother – Income Tax News | The Financial Express. What is Other Income in Income Tax & FAQs | EZTax® Help Center. You Take a Friend on Your Yacht. Is It a Taxable Gift? – WSJ

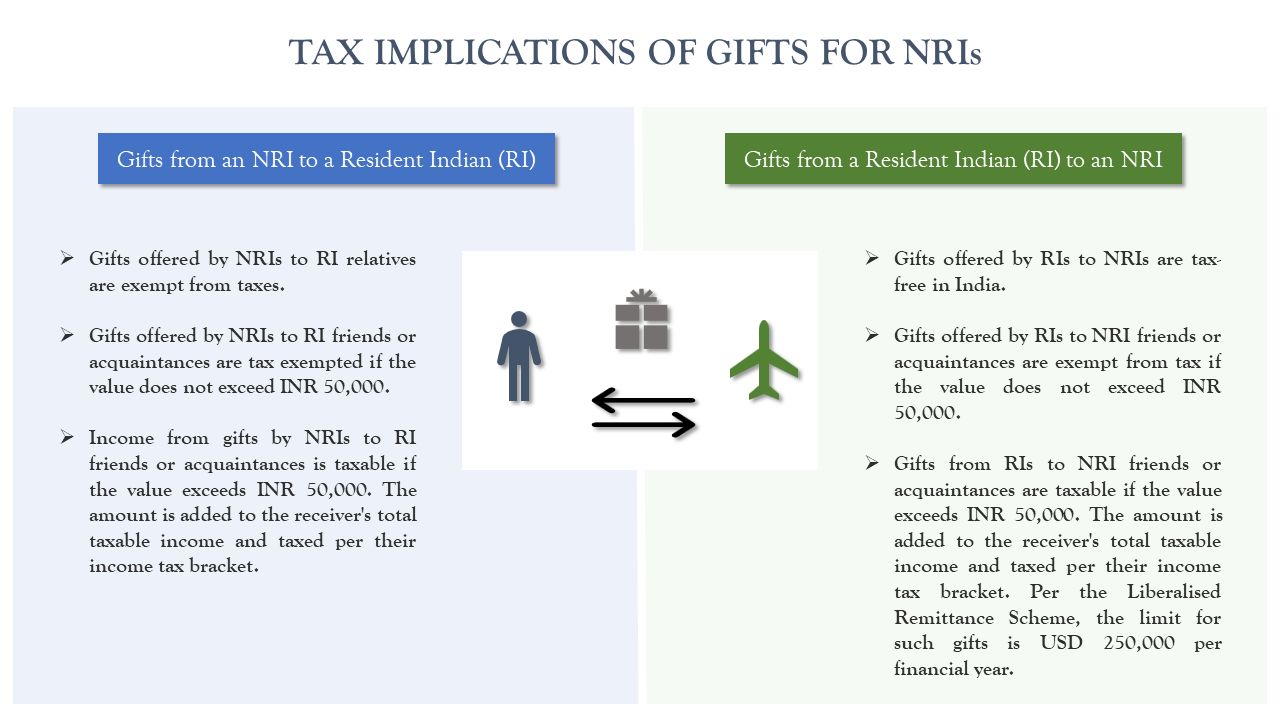

How to File ITR – IT for NRI Tax rebates, Limits and Eligibility | IDFC FIRST Bank – #1

How to File ITR – IT for NRI Tax rebates, Limits and Eligibility | IDFC FIRST Bank – #1

Important Cash Transaction Limits and Penalties Under Income Tax That You Need to Know About – #2

Important Cash Transaction Limits and Penalties Under Income Tax That You Need to Know About – #2

Tax Advantages for Donor-Advised Funds | NPTrust – #4

Tax Advantages for Donor-Advised Funds | NPTrust – #4

Rules For Giving And Receiving Home Down Payment Gifts – Experian – #5

Rules For Giving And Receiving Home Down Payment Gifts – Experian – #5

Income Tax on Gifts| All About Gift Tax Rules & Exemptions| List of relatives – YouTube – #6

Income Tax on Gifts| All About Gift Tax Rules & Exemptions| List of relatives – YouTube – #6

Income Tax on Diwali Gift: How Cash, Gold, Car and Property Gifts are Taxed – Income Tax News | The Financial Express – #7

Income Tax on Diwali Gift: How Cash, Gold, Car and Property Gifts are Taxed – Income Tax News | The Financial Express – #7

Supreme Court Rules Bitumen Not Covered Under ‘Other Valuable Article’ as per Section 69A of Income – #8

Supreme Court Rules Bitumen Not Covered Under ‘Other Valuable Article’ as per Section 69A of Income – #8

Gift Tax Limit 2024: How Much Money Can You Gift? | SmartAsset – #10

Gift Tax Limit 2024: How Much Money Can You Gift? | SmartAsset – #10

Exploring the estate tax: Part 2 – Journal of Accountancy – #11

Exploring the estate tax: Part 2 – Journal of Accountancy – #11

Why Your Church Shouldn’t Take Pass-Through Gifts | The Charity CFO – #12

Why Your Church Shouldn’t Take Pass-Through Gifts | The Charity CFO – #12

Tax Changes Likely to Fuel More M&A Tax Cuts and Jobs Act – #13

Tax Changes Likely to Fuel More M&A Tax Cuts and Jobs Act – #13

Solved Elizabeth makes the following interest-free loans | Chegg.com – #14

Solved Elizabeth makes the following interest-free loans | Chegg.com – #14

Understanding Income Tax on Gifts Received in India: Rules, Exceptions, and Valuation” – #15

Understanding Income Tax on Gifts Received in India: Rules, Exceptions, and Valuation” – #15

Gift Planning and the New Tax Law PG Calc Featured Article, February 2013 The American Taxpayer Relief Act (ATRA) passed by Cong – #16

Gift Planning and the New Tax Law PG Calc Featured Article, February 2013 The American Taxpayer Relief Act (ATRA) passed by Cong – #16

The Gift Tax Made Simple – TurboTax Tax Tips & Videos – #17

The Gift Tax Made Simple – TurboTax Tax Tips & Videos – #17

Publication 17 (2023), Your Federal Income Tax | Internal Revenue Service – #18

Publication 17 (2023), Your Federal Income Tax | Internal Revenue Service – #18

Stretch the Gift Tax Limit with Education or Health Care – #19

Stretch the Gift Tax Limit with Education or Health Care – #19

8 Tips For Tax-Free Gifting In 2023 – #20

8 Tips For Tax-Free Gifting In 2023 – #20

Is Egg Donation IVF Tax-Deductible? – #21

Is Egg Donation IVF Tax-Deductible? – #21

How to Gift Educational Expenses: Tax Advantages and Pitfalls – #22

How to Gift Educational Expenses: Tax Advantages and Pitfalls – #22

Modes of Recovery of Income Tax under the Second Schedule of Income Tax rules and How they are different from Order 21 of the Civil Procedure Code – #23

Modes of Recovery of Income Tax under the Second Schedule of Income Tax rules and How they are different from Order 21 of the Civil Procedure Code – #23

Are Cash Gifts from relatives exempt from Income tax? – #24

Are Cash Gifts from relatives exempt from Income tax? – #24

Tax Rules for Holiday Parties and Gifts – GRF CPAs & Advisors – #25

Tax Rules for Holiday Parties and Gifts – GRF CPAs & Advisors – #25

Section 56(2)(vii) : Cash / Non-Cash Gifts – #26

Section 56(2)(vii) : Cash / Non-Cash Gifts – #26

Understanding the Tax Treatment of Gifts: A Comprehensive Guide for Em – Table Matters – #27

Understanding the Tax Treatment of Gifts: A Comprehensive Guide for Em – Table Matters – #27

Rules you should know pertaining to gift taxation – BusinessToday – Issue Date: Dec 01, 2014 – #28

Rules you should know pertaining to gift taxation – BusinessToday – Issue Date: Dec 01, 2014 – #28

What Are the Legal and Tax Implications of Using Gift Cards in India? – #29

What Are the Legal and Tax Implications of Using Gift Cards in India? – #29

eCFR :: 26 CFR Part 25 — Gift Tax; Gifts Made After December 31, 1954 – #30

eCFR :: 26 CFR Part 25 — Gift Tax; Gifts Made After December 31, 1954 – #30

How the Limit on State and Local Tax Deductions Affects Homeowners – Perkins & Zayed, PC – #31

How the Limit on State and Local Tax Deductions Affects Homeowners – Perkins & Zayed, PC – #31

Income Tax Declared Cash Deposit Limit in Saving & Current Bank Accounts – AWBI – #32

Income Tax Declared Cash Deposit Limit in Saving & Current Bank Accounts – AWBI – #32

Roundtable on Tax Strategies | Crain’s Chicago Business – #33

Roundtable on Tax Strategies | Crain’s Chicago Business – #33

Chapter 18: GIFT and ESTATE TAX – ppt download – #34

Chapter 18: GIFT and ESTATE TAX – ppt download – #34

income tax rules for gifts received by taxpayer- किसी से मिला हुआ गिफ्ट भी भारत में आयकर के दायरे में आता है। – #35

income tax rules for gifts received by taxpayer- किसी से मिला हुआ गिफ्ट भी भारत में आयकर के दायरे में आता है। – #35

Navigating Indian Tax Rules for NRI Gift Money: Key Considerations and Compliance Guidelines – #36

Navigating Indian Tax Rules for NRI Gift Money: Key Considerations and Compliance Guidelines – #36

Gift of Immovable property under Income Tax Act – #37

Gift of Immovable property under Income Tax Act – #37

How to fill out a donation tax receipt – Goodwill NNE – #38

How to fill out a donation tax receipt – Goodwill NNE – #38

Top IRS Audit Triggers | Bloomberg Tax – #39

Top IRS Audit Triggers | Bloomberg Tax – #39

How are capital gains taxed? | Tax Policy Center – #40

How are capital gains taxed? | Tax Policy Center – #40

Everything you need to know about NRI Income Tax | Pravasitax Blog – #41

Everything you need to know about NRI Income Tax | Pravasitax Blog – #41

Awarded Money In Lawsuit Only Tax-free In Certain Instances – #42

Awarded Money In Lawsuit Only Tax-free In Certain Instances – #42

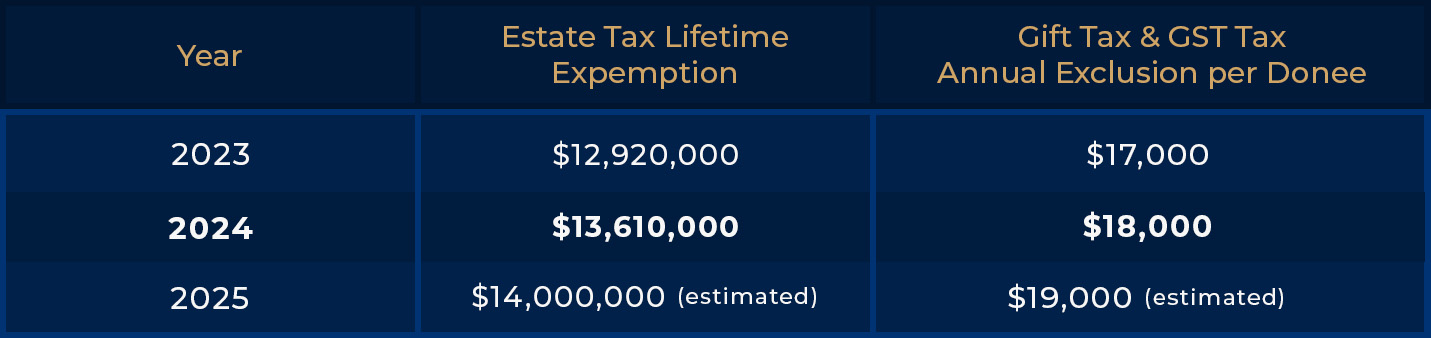

Estate Tax Exemption for 2023 | Kiplinger – #43

Estate Tax Exemption for 2023 | Kiplinger – #43

Lifetime Gifts Tax Exemption: Is Now the Time to Act? | PNC Insights – #44

Lifetime Gifts Tax Exemption: Is Now the Time to Act? | PNC Insights – #44

Want to give a gift to a loved one without gifting the IRS? 👉 Read our blog for all you need to know about gift splitting! 👉 | Consilio Wealth Advisors posted – #45

Want to give a gift to a loved one without gifting the IRS? 👉 Read our blog for all you need to know about gift splitting! 👉 | Consilio Wealth Advisors posted – #45

NEW 2023 Estate and Gift Tax Rules | When Will Taxes Apply? – YouTube – #46

NEW 2023 Estate and Gift Tax Rules | When Will Taxes Apply? – YouTube – #46

Income tax and GST implication for Perquisites or benefit under section 194R of Income tax Act – Tax Today – #47

Income tax and GST implication for Perquisites or benefit under section 194R of Income tax Act – Tax Today – #47

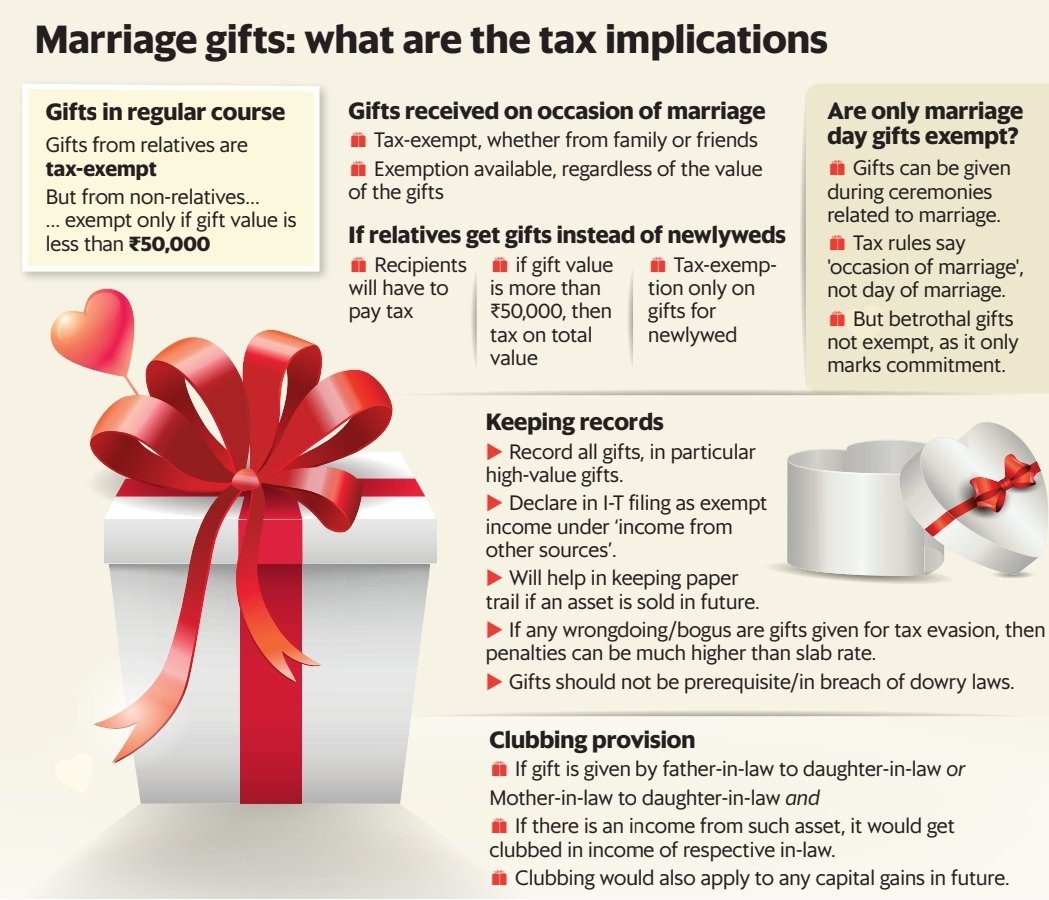

Gift and income tax rules is know tax rules on marriage gifts | शादी के समय मिलने वाले गिफ्ट और रिलेटिव से मिलने वाले Gift को लेकर जानिए क्या है टैक्स संबंधी – #48

Gift and income tax rules is know tax rules on marriage gifts | शादी के समय मिलने वाले गिफ्ट और रिलेटिव से मिलने वाले Gift को लेकर जानिए क्या है टैक्स संबंधी – #48

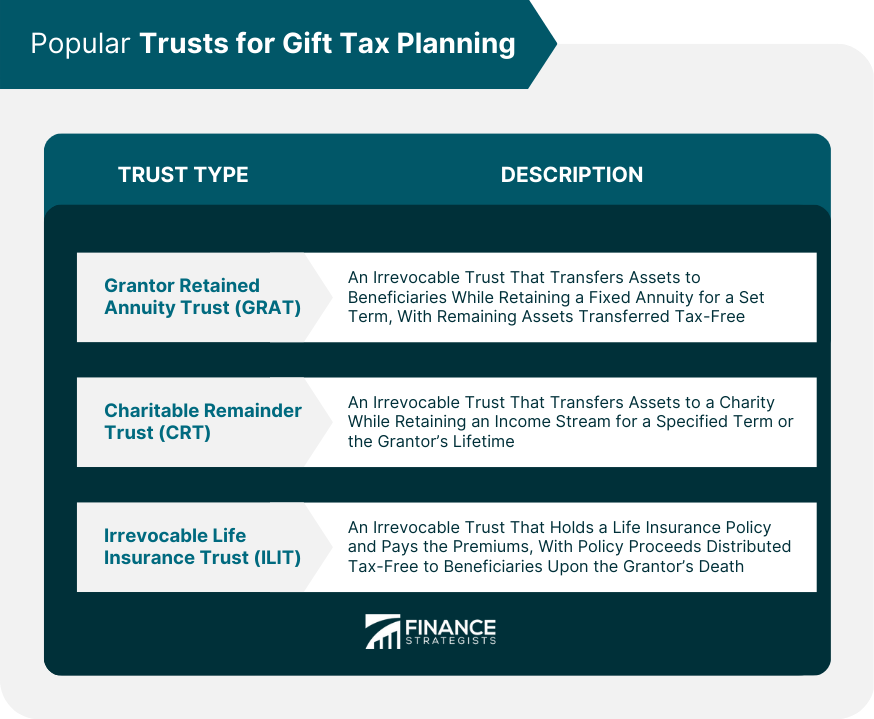

Medicaid Planning Trusts, Gift Tax, and Estate Tax – #49

Medicaid Planning Trusts, Gift Tax, and Estate Tax – #49

Section 49 of the Income Tax Act: Rules for Determining Cost of Acquisition of Capital Assets – Marg ERP Blog – #50

Section 49 of the Income Tax Act: Rules for Determining Cost of Acquisition of Capital Assets – Marg ERP Blog – #50

Employee Gifts – Tax Implications of Giving Gifts to Staff | Blog | Avalon Accounting – #51

Employee Gifts – Tax Implications of Giving Gifts to Staff | Blog | Avalon Accounting – #51

Foreign cos without PAN can open bank a/cs in IFSC-Gift City – #52

Foreign cos without PAN can open bank a/cs in IFSC-Gift City – #52

-Gifts.jpg) Are Wedding Gifts Taxable? (Explanation + Examples) – #53

Are Wedding Gifts Taxable? (Explanation + Examples) – #53

Who does and doesn’t pay federal income tax in the U.S. | Pew Research Center – #54

Who does and doesn’t pay federal income tax in the U.S. | Pew Research Center – #54

New Tax Regime – Complete list of exemptions and deductions disallowed – BasuNivesh – #55

New Tax Regime – Complete list of exemptions and deductions disallowed – BasuNivesh – #55

Taxation on Cryptocurrency: Guide To Crypto Taxes in India 2024 – #56

Taxation on Cryptocurrency: Guide To Crypto Taxes in India 2024 – #56

IRS Increases Gift and Estate Tax Exempt Limits — Here’s How Much You Can Give Without Paying – #57

IRS Increases Gift and Estate Tax Exempt Limits — Here’s How Much You Can Give Without Paying – #57

Gift of Equity Tax Implications | H&R Block – #58

Gift of Equity Tax Implications | H&R Block – #58

) How did the Tax Cuts and Jobs Act change personal taxes? | Tax Policy Center – #59

How did the Tax Cuts and Jobs Act change personal taxes? | Tax Policy Center – #59

Notes on The Federal Gift and Estate Taxes | ACCT 431 | Apuntes Gestión Tributaria | Docsity – #60

Notes on The Federal Gift and Estate Taxes | ACCT 431 | Apuntes Gestión Tributaria | Docsity – #60

A Guide to Gifting Money to Your Children | City National Bank – #61

A Guide to Gifting Money to Your Children | City National Bank – #61

Federal implications of passthrough entity tax elections – #62

Federal implications of passthrough entity tax elections – #62

About Income Tax | PDF – #63

About Income Tax | PDF – #63

Gift Tax In India – New 2020 Rules of Income Tax on Gifts – #64

Gift Tax In India – New 2020 Rules of Income Tax on Gifts – #64

Income Definition: Types, Examples, and Taxes – #65

Income Definition: Types, Examples, and Taxes – #65

Gifts Tax: Know which gifts are taxable this festive season | TAX SAVING | Zee Business – #66

Gifts Tax: Know which gifts are taxable this festive season | TAX SAVING | Zee Business – #66

What will be my inhand salary? HR have asked me to check and If I need flexipay then inform them. Can anyone help to understand? | Glassdoor – #67

What will be my inhand salary? HR have asked me to check and If I need flexipay then inform them. Can anyone help to understand? | Glassdoor – #67

Countdown for Gift and Estate Tax Exemptions | Charles Schwab – #68

Countdown for Gift and Estate Tax Exemptions | Charles Schwab – #68

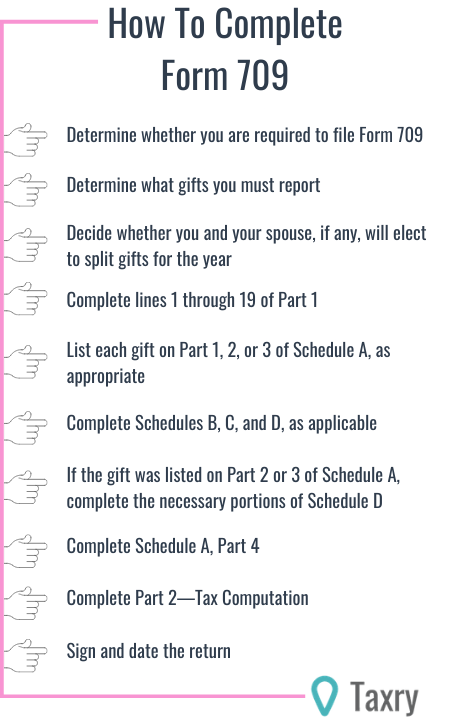

Filing Amended Gift Tax Return | Sapling – #69

Filing Amended Gift Tax Return | Sapling – #69

Navigating tax rules for employee incentive trips | TravelPerk – #70

Navigating tax rules for employee incentive trips | TravelPerk – #70

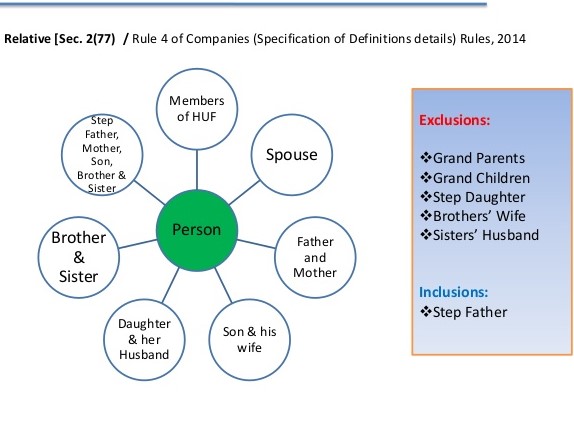

Meaning of relative under different act | CA Rajput Jain – #71

Meaning of relative under different act | CA Rajput Jain – #71

- gift tax meaning

- gift tax exemption

- gift tax rate in india 2022-23

Diwali season: Do you have to pay tax on gifts received ? | Personal Finance – Business Standard – #72

Diwali season: Do you have to pay tax on gifts received ? | Personal Finance – Business Standard – #72

Perquisites: Meaning, Types, Calculation & Examples – Razorpay Payroll – #73

Perquisites: Meaning, Types, Calculation & Examples – Razorpay Payroll – #73

Gift Tax Limit 2024: How Much Can You Give Tax-Free? | Kiplinger – #74

Gift Tax Limit 2024: How Much Can You Give Tax-Free? | Kiplinger – #74

The Fine Print Cost a Widow a $464,000 Tax Deduction – WSJ – #75

The Fine Print Cost a Widow a $464,000 Tax Deduction – WSJ – #75

Gift में मिली प्रॉपर्टी बेचने पर भरना पड़ता है टैक्स? जानिए क्या कहता है नियम – How Gifted property taxed in india know the rules long term capital gain tax – #76

Gift में मिली प्रॉपर्टी बेचने पर भरना पड़ता है टैक्स? जानिए क्या कहता है नियम – How Gifted property taxed in india know the rules long term capital gain tax – #76

I just inherited money, do I have to pay taxes on it? – #77

I just inherited money, do I have to pay taxes on it? – #77

गिफ्ट पर टैक्स छूट के नियम 2023 | Income tax on Gift rules in Hindi » PlanMoneyTax – #78

गिफ्ट पर टैक्स छूट के नियम 2023 | Income tax on Gift rules in Hindi » PlanMoneyTax – #78

Estates, Trusts & Gift Taxes Flashcards | Quizlet – #79

Estates, Trusts & Gift Taxes Flashcards | Quizlet – #79

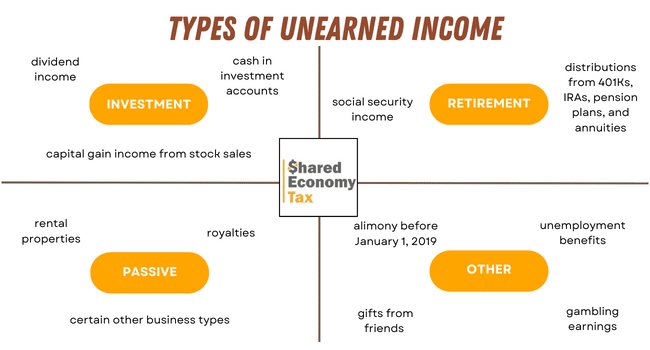

Unearned Income Bookkeeping Rules – Shared Economy Tax – #80

Unearned Income Bookkeeping Rules – Shared Economy Tax – #80

Understanding the 65-Day Rule: Tax Implications for Trusts – #81

Understanding the 65-Day Rule: Tax Implications for Trusts – #81

7 Tax Rules to Know if You Give or Receive Cash | Taxes | U.S. News – #82

7 Tax Rules to Know if You Give or Receive Cash | Taxes | U.S. News – #82

New Tax Rules for Gifting – #83

New Tax Rules for Gifting – #83

Taxscan | Simplifying Tax Laws – #84

Taxscan | Simplifying Tax Laws – #84

Annual Gift Tax Exclusions | First Republic now part of JPMorgan Chase – #85

Annual Gift Tax Exclusions | First Republic now part of JPMorgan Chase – #85

शादी से पहले जान लें टैक्स का नियम, नहीं तो घर आ सकता है नोटिस – #86

शादी से पहले जान लें टैक्स का नियम, नहीं तो घर आ सकता है नोटिस – #86

Gift of Money to Family – Is There a Gift Tax UK? – YouTube – #87

Gift of Money to Family – Is There a Gift Tax UK? – YouTube – #87

Income Tax on Gift: टैक्स के मामले में मायने रखते हैं रिश्ते, पत्नी की बहन का गिफ्ट Tax Free, लेकिन दोस्त का नहीं | Zee Business Hindi – #88

Income Tax on Gift: टैक्स के मामले में मायने रखते हैं रिश्ते, पत्नी की बहन का गिफ्ट Tax Free, लेकिन दोस्त का नहीं | Zee Business Hindi – #88

State Regulations – #89

State Regulations – #89

CRA Gift Tax Rules for Employers – #90

CRA Gift Tax Rules for Employers – #90

) Avoiding Basis Step-Down At Death By Gifting Capital Losses – #91

Avoiding Basis Step-Down At Death By Gifting Capital Losses – #91

Starter Guide to Crypto Tax and Who Needs to Pay It – #92

Starter Guide to Crypto Tax and Who Needs to Pay It – #92

Your Federal Income Tax For Individuals, IRS Publication 17, 2022 | U.S. Government Bookstore – #93

Your Federal Income Tax For Individuals, IRS Publication 17, 2022 | U.S. Government Bookstore – #93

Tax News & Comment — April 2011 | Law Offices of David L. Silverman – #94

Tax News & Comment — April 2011 | Law Offices of David L. Silverman – #94

Give the gift of crypto? Here’s what to expect from your next tax return | Coinbase – #95

Give the gift of crypto? Here’s what to expect from your next tax return | Coinbase – #95

Gift received or given to relatives. How income tax is calculated? | Mint – #96

Gift received or given to relatives. How income tax is calculated? | Mint – #96

Income Tax Purposes – FasterCapital – #97

Income Tax Purposes – FasterCapital – #97

Section 64 Of The Income Tax Act: Clubbing Of Income And Eligibility – #98

Section 64 Of The Income Tax Act: Clubbing Of Income And Eligibility – #98

Section 10 of Income Tax Act – Allowance and Deductions – #99

Section 10 of Income Tax Act – Allowance and Deductions – #99

10 Rules of Thumb for Trust Income Taxation – GWA Blog – #100

10 Rules of Thumb for Trust Income Taxation – GWA Blog – #100

Income tax filing: Are gifts taxable? Frequently asked questions on gift taxes | Zee Business – #101

Income tax filing: Are gifts taxable? Frequently asked questions on gift taxes | Zee Business – #101

Section 281 of Income Tax Act: Guidelines and Details – #102

Section 281 of Income Tax Act: Guidelines and Details – #102

Amazon.com: The Oxford Introductions to U.S. Law: Income Tax Law: 9780195376715: McCaffery, Edward: Books – #103

Amazon.com: The Oxford Introductions to U.S. Law: Income Tax Law: 9780195376715: McCaffery, Edward: Books – #103

Raksha Bandhan 2023: Is gifting cash to your sister taxable? Income tax rules explained here | Mint – #104

Raksha Bandhan 2023: Is gifting cash to your sister taxable? Income tax rules explained here | Mint – #104

Tax matters: Uncle’s gift is tax free | Tax matters: Uncle’s gift is tax free – #105

Tax matters: Uncle’s gift is tax free | Tax matters: Uncle’s gift is tax free – #105

529 plan contribution deadlines | Invesco US – #106

529 plan contribution deadlines | Invesco US – #106

IRS Gift Limit 2024: What is the Gift Limit for Spouse and minors? Tax rates & Tax Free Gifts – #107

IRS Gift Limit 2024: What is the Gift Limit for Spouse and minors? Tax rates & Tax Free Gifts – #107

ICAI’s Treatise on Report on Income Tax Dues: Section 281 | CA Club – #108

ICAI’s Treatise on Report on Income Tax Dues: Section 281 | CA Club – #108

What is Portability for Estate and Gift Tax? – #109

What is Portability for Estate and Gift Tax? – #109

Income From Other Sources: Get the Notes, List and Tax Rates in 2024 – #110

Income From Other Sources: Get the Notes, List and Tax Rates in 2024 – #110

- 709 2020 gift tax sample completed irs form 709

- list of relatives

- gift tax

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #111

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #111

Fair Market Value Of Property under Income Tax Laws – #112

Fair Market Value Of Property under Income Tax Laws – #112

Charitable Remainder Trusts | Fidelity Charitable – #113

Charitable Remainder Trusts | Fidelity Charitable – #113

Audits of Gift & Estate Tax Returns | MPI – #114

Audits of Gift & Estate Tax Returns | MPI – #114

- gift tax rate in india 2020

- lineal ascendant

- gift deed format father to son

Taxation on gifts: Everything you need to know | Tax Hacks – #115

Taxation on gifts: Everything you need to know | Tax Hacks – #115

What’s the “origin of the claim” doctrine and why should trusts and estates litigators care? | Florida Probate & Trust Litigation Blog – #116

What’s the “origin of the claim” doctrine and why should trusts and estates litigators care? | Florida Probate & Trust Litigation Blog – #116

How To Save Tax On Rental Income: Deductions, Calculations – #117

How To Save Tax On Rental Income: Deductions, Calculations – #117

Old Tax Regime Vs New Tax Regime – Which is Better For You? – #118

Old Tax Regime Vs New Tax Regime – Which is Better For You? – #118

Federal Estate Tax and Gift Tax Limits Announced For 2023 | University of Maryland Extension – #119

Federal Estate Tax and Gift Tax Limits Announced For 2023 | University of Maryland Extension – #119

NMS Certified Public Accountants – #120

NMS Certified Public Accountants – #120

How to Reduce Your Taxes as a Working Musician – #121

How to Reduce Your Taxes as a Working Musician – #121

- indirect tax

- gift tax definition

- gift tax exemption relatives list

5 rules about Income Tax on Gifts received in India & Exemptions – #122

5 rules about Income Tax on Gifts received in India & Exemptions – #122

Gift tax: what is it & how does it work? | Empower – #123

Gift tax: what is it & how does it work? | Empower – #123

Publication 929 (2021), Tax Rules for Children and Dependents | Internal Revenue Service – #124

Publication 929 (2021), Tax Rules for Children and Dependents | Internal Revenue Service – #124

Property Gift Deed Registration – Sample Format, Charges & Rules – #125

Property Gift Deed Registration – Sample Format, Charges & Rules – #125

- gift tax in india

- estate/gift tax

- estate tax

- gift tax rate

- estate tax exemption 2022

- lineal ascendant gift from relative exempt from income tax

Amendments in Income Tax Act effected by the Finance Act 2023 – #126

Amendments in Income Tax Act effected by the Finance Act 2023 – #126

Are Kickstarter Funds Taxable? Here’s What You Need To Know. – Fulfillrite – #127

Are Kickstarter Funds Taxable? Here’s What You Need To Know. – Fulfillrite – #127

Does the Standard Deduction or Itemizing Make Sense for Your Taxes? – #128

Does the Standard Deduction or Itemizing Make Sense for Your Taxes? – #128

) Will your ‘gift’ be taxed? – The Economic Times – #129

Will your ‘gift’ be taxed? – The Economic Times – #129

Corporate Gifts Association seeks amendment in Income Tax Act that adversely impacts the industry – The Economic Times – #130

Corporate Gifts Association seeks amendment in Income Tax Act that adversely impacts the industry – The Economic Times – #130

Tax on Gifts in India: know taxation rules on gifts according to Income Tax Act 1961 | Business – #131

Tax on Gifts in India: know taxation rules on gifts according to Income Tax Act 1961 | Business – #131

Current Income Tax Return Filing Due Dates for FY 2023-24 – #132

Current Income Tax Return Filing Due Dates for FY 2023-24 – #132

Stridhan: Income Tax Laws For Wedding Gifts That Every Indian Woman Must Know | HerZindagi – #133

Stridhan: Income Tax Laws For Wedding Gifts That Every Indian Woman Must Know | HerZindagi – #133

StartCHURCH Blog – 3 Ways to Give Your Pastor a Tax-Free Gift – #134

StartCHURCH Blog – 3 Ways to Give Your Pastor a Tax-Free Gift – #134

2017.09.05.0825 – Joseph Dugan – Indiana University – #135

2017.09.05.0825 – Joseph Dugan – Indiana University – #135

Tax Implications of Transfers on Death – FindLaw – #136

Tax Implications of Transfers on Death – FindLaw – #136

trust level – FasterCapital – #137

trust level – FasterCapital – #137

YOUR QUERIES: INCOME TAX : No income tax on money received as gift from your grandmother – Income Tax News | The Financial Express – #138

YOUR QUERIES: INCOME TAX : No income tax on money received as gift from your grandmother – Income Tax News | The Financial Express – #138

Gift Tax In 2024: What Is It And How Does It Work? – #139

Gift Tax In 2024: What Is It And How Does It Work? – #139

Changes to Massachusetts Tax Law – Charitable Contributions New for 2023 – Don’t Tax Yourself – #140

Changes to Massachusetts Tax Law – Charitable Contributions New for 2023 – Don’t Tax Yourself – #140

Uniform Transfers to Minors Act (UTMA): What It Is and How It Works – #141

Uniform Transfers to Minors Act (UTMA): What It Is and How It Works – #141

ITR filing: Are gifts taxable in India? Salient clauses all income taxpayers must know | Zee Business – #142

ITR filing: Are gifts taxable in India? Salient clauses all income taxpayers must know | Zee Business – #142

CRA Gift Tax Rules for Employers – SRJ Chartered Accountants Professional Corporation – #143

CRA Gift Tax Rules for Employers – SRJ Chartered Accountants Professional Corporation – #143

Charitable Gift Annuities – Uses, Selling & Regulations – #144

Charitable Gift Annuities – Uses, Selling & Regulations – #144

How to gift stocks to your friends and relatives? – BusinessToday – #145

How to gift stocks to your friends and relatives? – BusinessToday – #145

Untitled – #146

Untitled – #146

The Taxation of a Gift or Inheritance from an Employer. – #147

The Taxation of a Gift or Inheritance from an Employer. – #147

Frequently asked questions on Section 54F: the complete guide | Arthgyaan – #148

Frequently asked questions on Section 54F: the complete guide | Arthgyaan – #148

Diwali 2020: If you get expensive gift on Diwali, you may have to pay income tax, know what are the rules | Diwali 2020: दिवाली पर मिले गिफ्ट पर भरना पड़ सकता – #149

Diwali 2020: If you get expensive gift on Diwali, you may have to pay income tax, know what are the rules | Diwali 2020: दिवाली पर मिले गिफ्ट पर भरना पड़ सकता – #149

Your Diwali gift and bonus can be taxable: Know ways to avoid it – #150

Your Diwali gift and bonus can be taxable: Know ways to avoid it – #150

When Should I Use My Estate and Gift Tax Exemption? – #151

When Should I Use My Estate and Gift Tax Exemption? – #151

- form 709 gift splitting example

- estate tax example

My grandmother wants to gift cash to me. What are the income tax implications? | Mint – #152

My grandmother wants to gift cash to me. What are the income tax implications? | Mint – #152

- form 709

- estate tax exemption

- gift tax rate table

Taxation in the United States – Wikipedia – #153

Taxation in the United States – Wikipedia – #153

Tax Impact of ₹2,000 Note:: What are the tax implications of depositing Rs 2,000 notes? | Personal Finance – Business Standard – #154

Tax Impact of ₹2,000 Note:: What are the tax implications of depositing Rs 2,000 notes? | Personal Finance – Business Standard – #154

Self-reporting of income estimates and advance tax liability | Business Law & Taxation Articles – Business Standard – #155

Self-reporting of income estimates and advance tax liability | Business Law & Taxation Articles – Business Standard – #155

Trust Gift Taxation | Definition, Types, Exclusions, & Strategies – #156

Trust Gift Taxation | Definition, Types, Exclusions, & Strategies – #156

Got Property As Gift? Know Stamp Duty, Tax Implications – #157

Got Property As Gift? Know Stamp Duty, Tax Implications – #157

FAQ: Is Tuition Exempt From The Gift Tax? – Estate and Probate Legal Group – #158

FAQ: Is Tuition Exempt From The Gift Tax? – Estate and Probate Legal Group – #158

Rules for Gifting Money to Family for a Down Payment in 2024 – #159

Rules for Gifting Money to Family for a Down Payment in 2024 – #159

Gift Tax 101: Gift Tax Limits (+ Rules for Gifting Stocks) – #160

Gift Tax 101: Gift Tax Limits (+ Rules for Gifting Stocks) – #160

How To Deduct Client Gifts – The $25 Rule — Bastian Accounting for Photographers – #161

How To Deduct Client Gifts – The $25 Rule — Bastian Accounting for Photographers – #161

Guide to Income under the Head Salaries and Its Computation – #162

Guide to Income under the Head Salaries and Its Computation – #162

Annual Gift Tax Exclusion vs. Medicaid Look Back Period | Cornetet, Meyer, Rush & Stapleton – #163

Annual Gift Tax Exclusion vs. Medicaid Look Back Period | Cornetet, Meyer, Rush & Stapleton – #163

Income Tax Expert Guidelines; Income Tax Rules for Gifts Received | बर्थडे-एनिवर्सरी पर मिले गिफ्ट्स पर भी देना होता है इनकम-टैक्स: रिटर्न भरते समय इनकी जानकारी देना … – #164

Income Tax Expert Guidelines; Income Tax Rules for Gifts Received | बर्थडे-एनिवर्सरी पर मिले गिफ्ट्स पर भी देना होता है इनकम-टैक्स: रिटर्न भरते समय इनकी जानकारी देना … – #164

Gift Tax – Do I Have to Pay Taxes on a Gift | Gift Tax Calculator – #165

Gift Tax – Do I Have to Pay Taxes on a Gift | Gift Tax Calculator – #165

Sales taxes in the United States – Wikipedia – #166

Sales taxes in the United States – Wikipedia – #166

The taxation of collectibles – #167

The taxation of collectibles – #167

Jairam Ramesh on X: “Participatory Notes ( P-Notes) are mechanisms through which foreign funds invest in our stock markets without registering themselves. Over the years SEBI has discouraged them in the belief – #168

Jairam Ramesh on X: “Participatory Notes ( P-Notes) are mechanisms through which foreign funds invest in our stock markets without registering themselves. Over the years SEBI has discouraged them in the belief – #168

Examples of Inadmissible Expenses and Admissible Expenses | PDF | Expense | Taxes – #169

Examples of Inadmissible Expenses and Admissible Expenses | PDF | Expense | Taxes – #169

Buy ICAI Study Material – CA Exam Books – PW Store – #170

Buy ICAI Study Material – CA Exam Books – PW Store – #170

Income Tax on Cash Gift to Wife: How Much You Can Gift on Women’s Day Without Tax Implications – Income Tax News | The Financial Express – #171

Income Tax on Cash Gift to Wife: How Much You Can Gift on Women’s Day Without Tax Implications – Income Tax News | The Financial Express – #171

- gift deed format on stamp paper

- gift tax 2023

- gift tax exemption 2022

Taxes Definition: Types, Who Pays, and Why – #172

Taxes Definition: Types, Who Pays, and Why – #172

Elder Law: How Gifts Can Affect Medicaid Eligibility – #173

Elder Law: How Gifts Can Affect Medicaid Eligibility – #173

Do You Need To Pay Taxes on Free Stuff You Get As An Influencer? – Paragon Accountants – #174

Do You Need To Pay Taxes on Free Stuff You Get As An Influencer? – Paragon Accountants – #174

एक पिता अपने बेटे को किस सीमा तक दे सकता है उपहार? जानें क्या कहता है कानून – income tax news can a father gift his property to son or flat what – #175

एक पिता अपने बेटे को किस सीमा तक दे सकता है उपहार? जानें क्या कहता है कानून – income tax news can a father gift his property to son or flat what – #175

Tax Rules for Rental Income | Access Wealth – #176

Tax Rules for Rental Income | Access Wealth – #176

- section 56(2) of income tax act

- money gift deed format

- property gift deed

Is Trading One Cryptocurrency For Another A Taxable Event? – #177

Is Trading One Cryptocurrency For Another A Taxable Event? – #177

Guide to Tax on Incentives in India | Xoxoday – #178

Guide to Tax on Incentives in India | Xoxoday – #178

) Do Cash Gifts Count as Income? • 1040.com Blog – #179

Do Cash Gifts Count as Income? • 1040.com Blog – #179

What Is a Crummey Trust and How Does It Work? – #180

What Is a Crummey Trust and How Does It Work? – #180

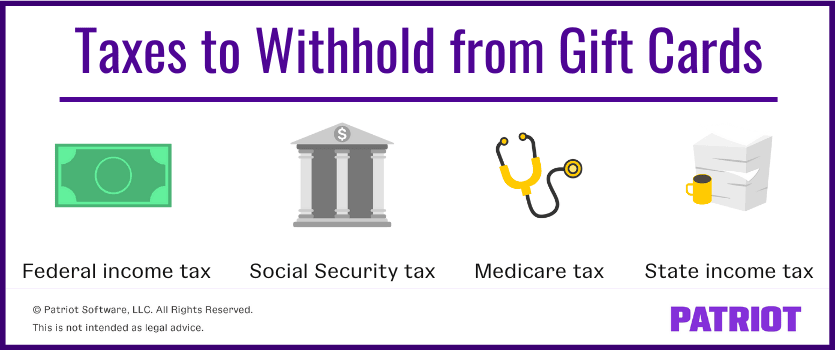

Can I Give My Employee a Gift Card Without Being Taxed? – #181

Can I Give My Employee a Gift Card Without Being Taxed? – #181

Gifting money in the US: all you need to know | WorldRemit – #182

Gifting money in the US: all you need to know | WorldRemit – #182

Grantor Trust Rules: Income Tax Considerations for Grantor Trusts – FasterCapital – #183

Grantor Trust Rules: Income Tax Considerations for Grantor Trusts – FasterCapital – #183

12 Tax-Smart Charitable Giving Tips for 2023 | Charles Schwab – #184

12 Tax-Smart Charitable Giving Tips for 2023 | Charles Schwab – #184

Are Massages Tax Deductible? Things to Know — Spa Theory – #185

Are Massages Tax Deductible? Things to Know — Spa Theory – #185

Spread the Wealth, Carefully, with Tax-Free Gifts – TurboTax Tax Tips & Videos – #186

Spread the Wealth, Carefully, with Tax-Free Gifts – TurboTax Tax Tips & Videos – #186

Implications and Strategies – FasterCapital – #187

Implications and Strategies – FasterCapital – #187

Keyword:gift tax exclusions – FasterCapital – #188

Keyword:gift tax exclusions – FasterCapital – #188

Giving Gifts to Employees: Best Practices – #189

Giving Gifts to Employees: Best Practices – #189

- inheritance estate tax

- gift tax returns irs completed sample form 709 sample

- gift tax act 1958

Common mistakes to avoid while filing your Income Tax Returns – #190

Common mistakes to avoid while filing your Income Tax Returns – #190

Income Tax Projections – Lessen Your Liability – Wrobel Accounting – #191

Income Tax Projections – Lessen Your Liability – Wrobel Accounting – #191

1. 2 INVESTMENT & PERSONAL FINANCIAL PLANNING (1 of 2) Business vs. investment activities Investments in financial assets Interest income Tax deferral: – ppt download – #192

1. 2 INVESTMENT & PERSONAL FINANCIAL PLANNING (1 of 2) Business vs. investment activities Investments in financial assets Interest income Tax deferral: – ppt download – #192

Know All About Gift under Property Law – #193

Know All About Gift under Property Law – #193

- federal gift tax

- gift chart as per income tax

- gift from relative exempt from income tax

- gift tax example

- federal estate tax

- gift tax return

Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver – #194

Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver – #194

NISA – “CA FINAL_ Income Tax Amendments for May 2020 -… | Facebook – #195

NISA – “CA FINAL_ Income Tax Amendments for May 2020 -… | Facebook – #195

Estate Planning: Increased Transfer Limits for Gift and Estate Tax for 2023 – Young Moore Attorneys – #196

Estate Planning: Increased Transfer Limits for Gift and Estate Tax for 2023 – Young Moore Attorneys – #196

WY LLC Taxes | How are Wyoming LLCs Taxed? – #197

WY LLC Taxes | How are Wyoming LLCs Taxed? – #197

Japan Gift Tax; All Expats Need to Know – #198

Japan Gift Tax; All Expats Need to Know – #198

Areas Of Significant Differences in Perception of Complexity by… | Download Table – #199

Areas Of Significant Differences in Perception of Complexity by… | Download Table – #199

Capital Gains Tax Brackets For 2024 – #200

Capital Gains Tax Brackets For 2024 – #200

wiseNRI.com on X: “Gifts from NRI Relative are exempted from tax – When an NRI gives gifts in the form of cash, cheque, items, or property to a Resident Indian who is – #201

wiseNRI.com on X: “Gifts from NRI Relative are exempted from tax – When an NRI gives gifts in the form of cash, cheque, items, or property to a Resident Indian who is – #201

Crypto Gift Tax | Your Guide | Koinly – #202

Crypto Gift Tax | Your Guide | Koinly – #202

Irina S. Shea, Attorney At Law, LLC – With 2017 coming to an end, it’s important that everyone learns about the new estate tax, inheritance tax, and gift tax rules that will – #203

Irina S. Shea, Attorney At Law, LLC – With 2017 coming to an end, it’s important that everyone learns about the new estate tax, inheritance tax, and gift tax rules that will – #203

Income tax rules on gifts as tax on gifts in india over a certain limit with exceptions | किसी से गिफ्ट ले रहे तो आपको देना होगा टैक्स, जान लीजिए क्या है – #204

Income tax rules on gifts as tax on gifts in india over a certain limit with exceptions | किसी से गिफ्ट ले रहे तो आपको देना होगा टैक्स, जान लीजिए क्या है – #204

![Crypto Tax: Step-by-Step Guide + Easy Instructions [2024] Crypto Tax: Step-by-Step Guide + Easy Instructions [2024]](https://www.kitces.com/wp-content/uploads/2023/03/01-Income-and-Estate-Tax-Mechanics-of-IDGT-Trust-1024x640.png) Crypto Tax: Step-by-Step Guide + Easy Instructions [2024] – #205

Crypto Tax: Step-by-Step Guide + Easy Instructions [2024] – #205

Know Income tax rules on gifts received on marriage | Mint – #206

Know Income tax rules on gifts received on marriage | Mint – #206

IRS Announces Higher Estate and Gift Tax Limits for 2020 | Senior Law – #207

IRS Announces Higher Estate and Gift Tax Limits for 2020 | Senior Law – #207

IFSC at GIFT City: unpacking key factors driving investor attraction – #208

IFSC at GIFT City: unpacking key factors driving investor attraction – #208

Annuities can come with a tax surprise – Los Angeles Times – #209

Annuities can come with a tax surprise – Los Angeles Times – #209

Everything You Need To Know About Tax-Free Family Gifting | Private Wealth Management – #210

Everything You Need To Know About Tax-Free Family Gifting | Private Wealth Management – #210

Gifts to Employees – Taxable Income or Nontaxable Gift – #211

Gifts to Employees – Taxable Income or Nontaxable Gift – #211

New NRI Taxation Rules in India: Exemptions, Deductions & Benefits – #212

New NRI Taxation Rules in India: Exemptions, Deductions & Benefits – #212

Gift from USA to India: Taxation and Exemptions – SBNRI – #213

Gift from USA to India: Taxation and Exemptions – SBNRI – #213

Posts: income tax gift rules

Categories: Gifts

Author: toyotabienhoa.edu.vn