Top more than 177 historical gift tax rates super hot

Update images of historical gift tax rates by website toyotabienhoa.edu.vn compilation. The Distribution of Household Income, 2019 | Congressional Budget Office. Estate Gift Tax | Estate and Gift Dynamics in the Era of the Big Exemption… New 2024 Tax Rates and Thresholds – U of I Tax School. How Do Millionaires And Billionaires Avoid Estate Taxes?. When You Make Cash Gifts To Your Children, Who Pays The Tax? | Greenbush Financial Group

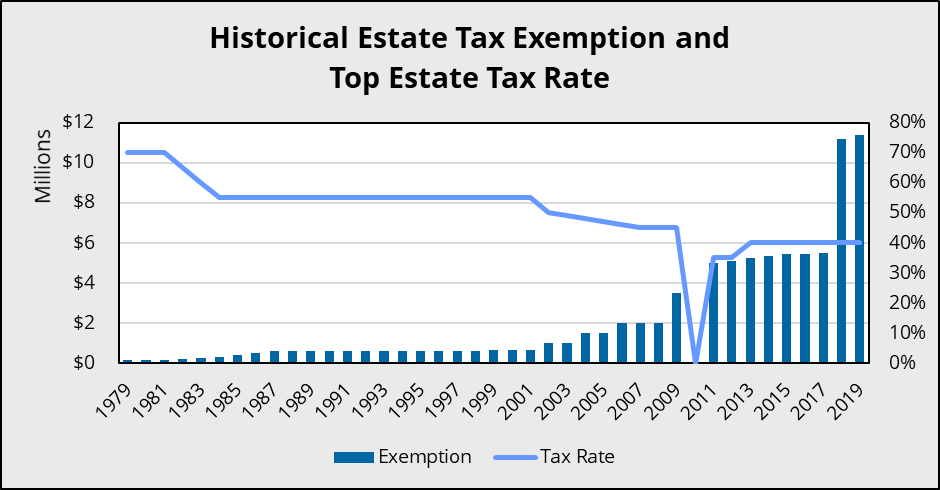

Estate Tax Exemption: How Much It Is and How to Calculate It – #1

Estate Tax Exemption: How Much It Is and How to Calculate It – #1

Federal implications of passthrough entity tax elections – #2

Federal implications of passthrough entity tax elections – #2

The top tax rate has been cut six times since 1980 — usually with Democrats’ help – The Washington Post – #4

The top tax rate has been cut six times since 1980 — usually with Democrats’ help – The Washington Post – #4

Who Pays Taxes on a Gift? – #5

Who Pays Taxes on a Gift? – #5

Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver – #6

Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver – #6

Sales taxes in the United States – Wikipedia – #7

Sales taxes in the United States – Wikipedia – #7

Stamp Duty on Gift Deed: Rates and Regulations – #8

Stamp Duty on Gift Deed: Rates and Regulations – #8

A Guide to the Federal Estate Tax for 2024 | SmartAsset – #10

A Guide to the Federal Estate Tax for 2024 | SmartAsset – #10

5 things to know about the White House’s tax reform plan – #11

5 things to know about the White House’s tax reform plan – #11

When Should I Use My Estate and Gift Tax Exemption? – #12

When Should I Use My Estate and Gift Tax Exemption? – #12

Tax revenue statistics – Statistics Explained – #13

Tax revenue statistics – Statistics Explained – #13

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #14

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #14

United Kingdom corporation tax – Wikipedia – #15

United Kingdom corporation tax – Wikipedia – #15

Taxes Definition: Types, Who Pays, and Why – #16

Taxes Definition: Types, Who Pays, and Why – #16

![PDF] The Federal Estate Tax: History, Law, and Economics | Semantic Scholar PDF] The Federal Estate Tax: History, Law, and Economics | Semantic Scholar](https://images.news18.com/ibnkhabar/uploads/2023/09/Gift-Tax.jpg) PDF] The Federal Estate Tax: History, Law, and Economics | Semantic Scholar – #17

PDF] The Federal Estate Tax: History, Law, and Economics | Semantic Scholar – #17

In Connecticut, the top 2 percent of residents pay most of the state’s bills. Here’s how the proposed cut would affect taxpayers. – Hartford Courant – #18

In Connecticut, the top 2 percent of residents pay most of the state’s bills. Here’s how the proposed cut would affect taxpayers. – Hartford Courant – #18

Corporate Income Tax Revenue as a Share of GDP, 1934-2020 | Tax Policy Center – #19

Corporate Income Tax Revenue as a Share of GDP, 1934-2020 | Tax Policy Center – #19

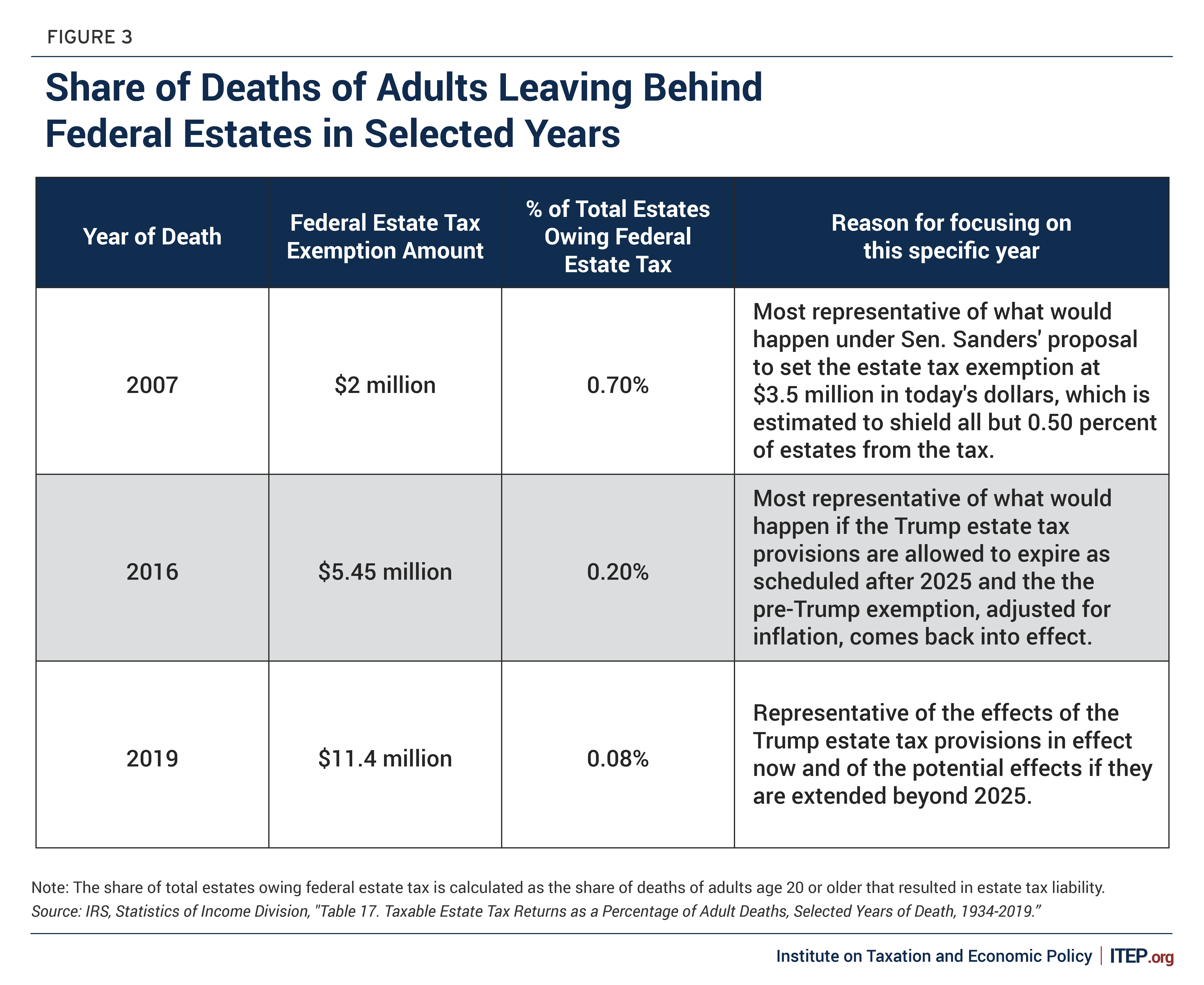

How many people pay the estate tax? | Tax Policy Center – #20

How many people pay the estate tax? | Tax Policy Center – #20

![Biden tax plan & estate / trust planning election 2020 [New Guide] Biden tax plan & estate / trust planning election 2020 [New Guide]](https://image.slidesharecdn.com/historyofthetaxpayersparty-231119142216-9c184d0d/85/history-of-the-taxpayers-party-16-320.jpg?cb\u003d1700430451) Biden tax plan & estate / trust planning election 2020 [New Guide] – #21

Biden tax plan & estate / trust planning election 2020 [New Guide] – #21

Historical Highest Marginal Income Tax Rates | Tax Policy Center – #22

Historical Highest Marginal Income Tax Rates | Tax Policy Center – #22

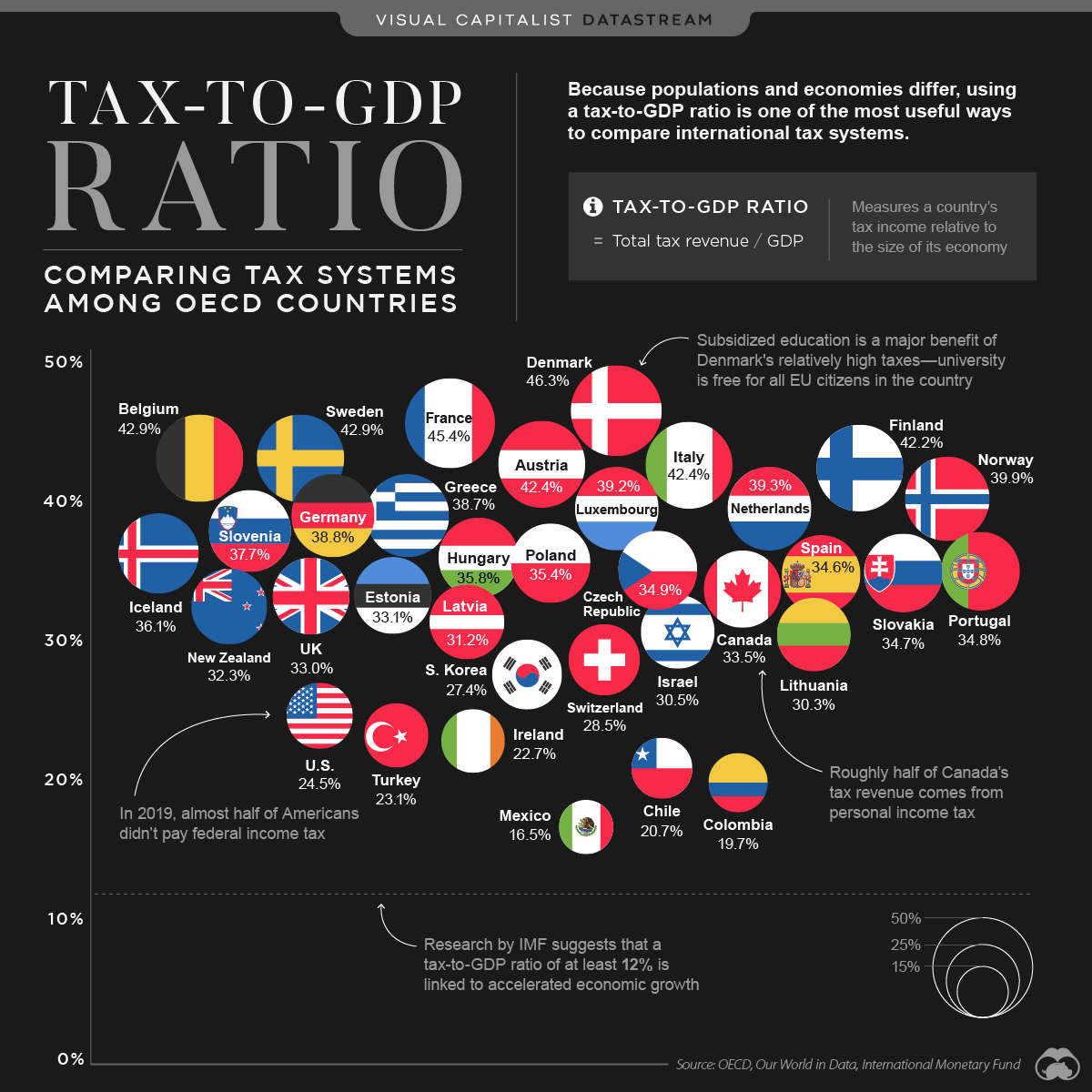

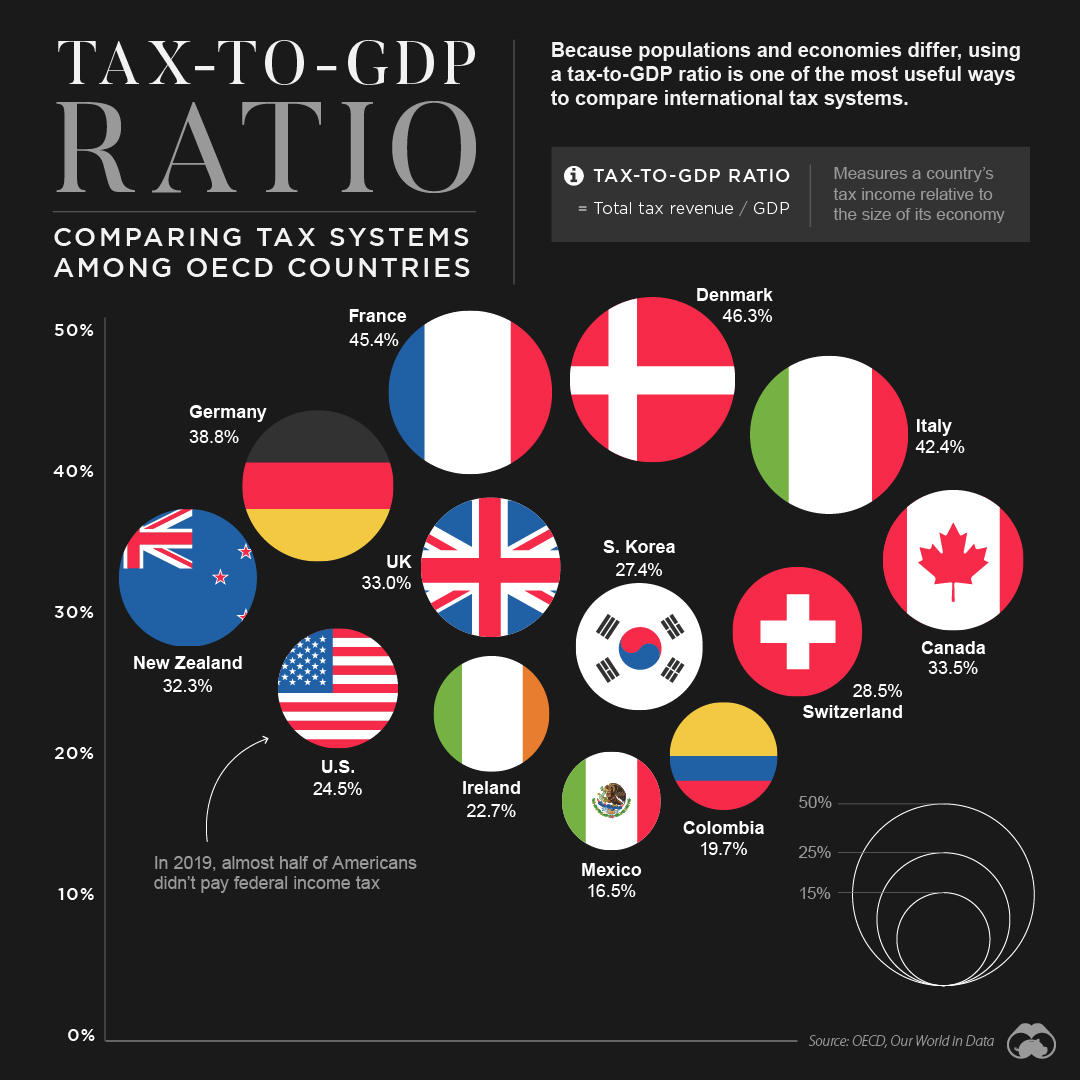

Tax-to-GDP Ratio: Comparing Tax Systems Around the World – #23

Tax-to-GDP Ratio: Comparing Tax Systems Around the World – #23

Taxable Income: What It Is, What Counts, and How To Calculate – #24

Taxable Income: What It Is, What Counts, and How To Calculate – #24

History Of The Taxpayers Party | PDF – #25

History Of The Taxpayers Party | PDF – #25

India’s economic growth – what history tells us in each decade – Scripbox – #26

India’s economic growth – what history tells us in each decade – Scripbox – #26

1960-61 | This budget gave out estimates of an import scheme that later snowballed into a controversy and remained part of India’s political lexicon for many years. Which scheme is this? <strong>Ans:</strong> – #27

1960-61 | This budget gave out estimates of an import scheme that later snowballed into a controversy and remained part of India’s political lexicon for many years. Which scheme is this? <strong>Ans:</strong> – #27

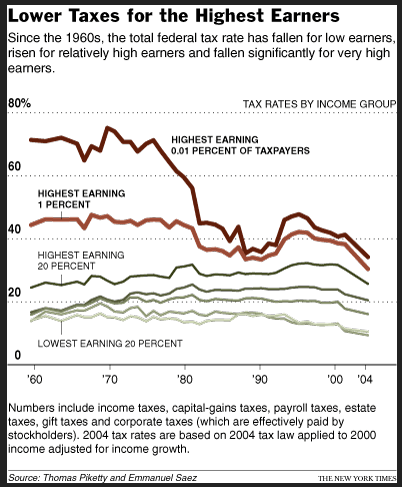

Historical Tax Rates from the New York Times | UrbanHumanist – #28

Historical Tax Rates from the New York Times | UrbanHumanist – #28

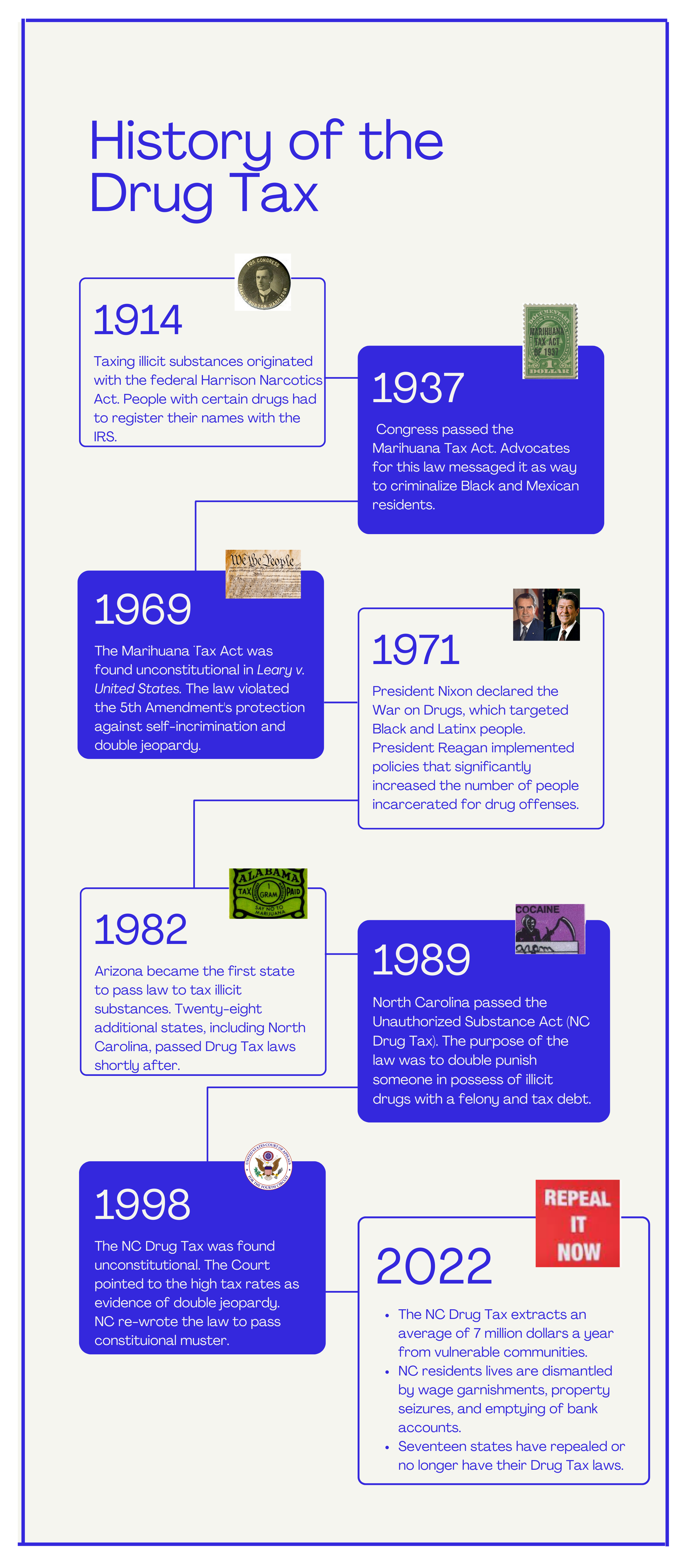

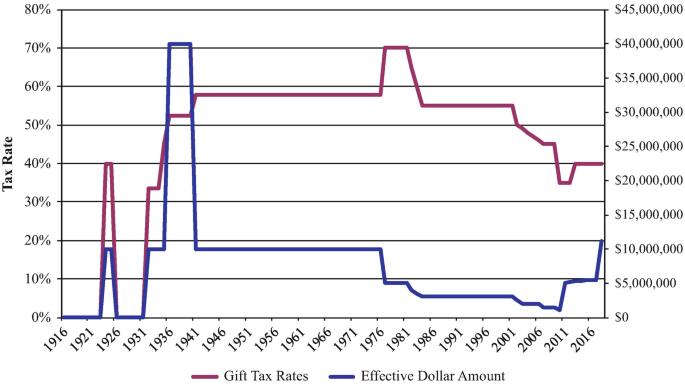

Historical Look at Estate and Gift Tax Rates – #29

Historical Look at Estate and Gift Tax Rates – #29

Federal Estate and Gift Tax Rates, Exemptions, and Exclusions, 1916-2014 – #30

Federal Estate and Gift Tax Rates, Exemptions, and Exclusions, 1916-2014 – #30

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #31

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #31

How Do Millionaires And Billionaires Avoid Estate Taxes? – #32

How Do Millionaires And Billionaires Avoid Estate Taxes? – #32

Do I Need to Worry About the Gift Tax If I Pay $60,000 Toward My Daughter’s Wedding? | Nasdaq – #33

Do I Need to Worry About the Gift Tax If I Pay $60,000 Toward My Daughter’s Wedding? | Nasdaq – #33

State Individual Income Tax Rates | Tax Policy Center – #34

State Individual Income Tax Rates | Tax Policy Center – #34

P5-53. Revenue Recognition and Sales Allowances | Chegg.com – #35

P5-53. Revenue Recognition and Sales Allowances | Chegg.com – #35

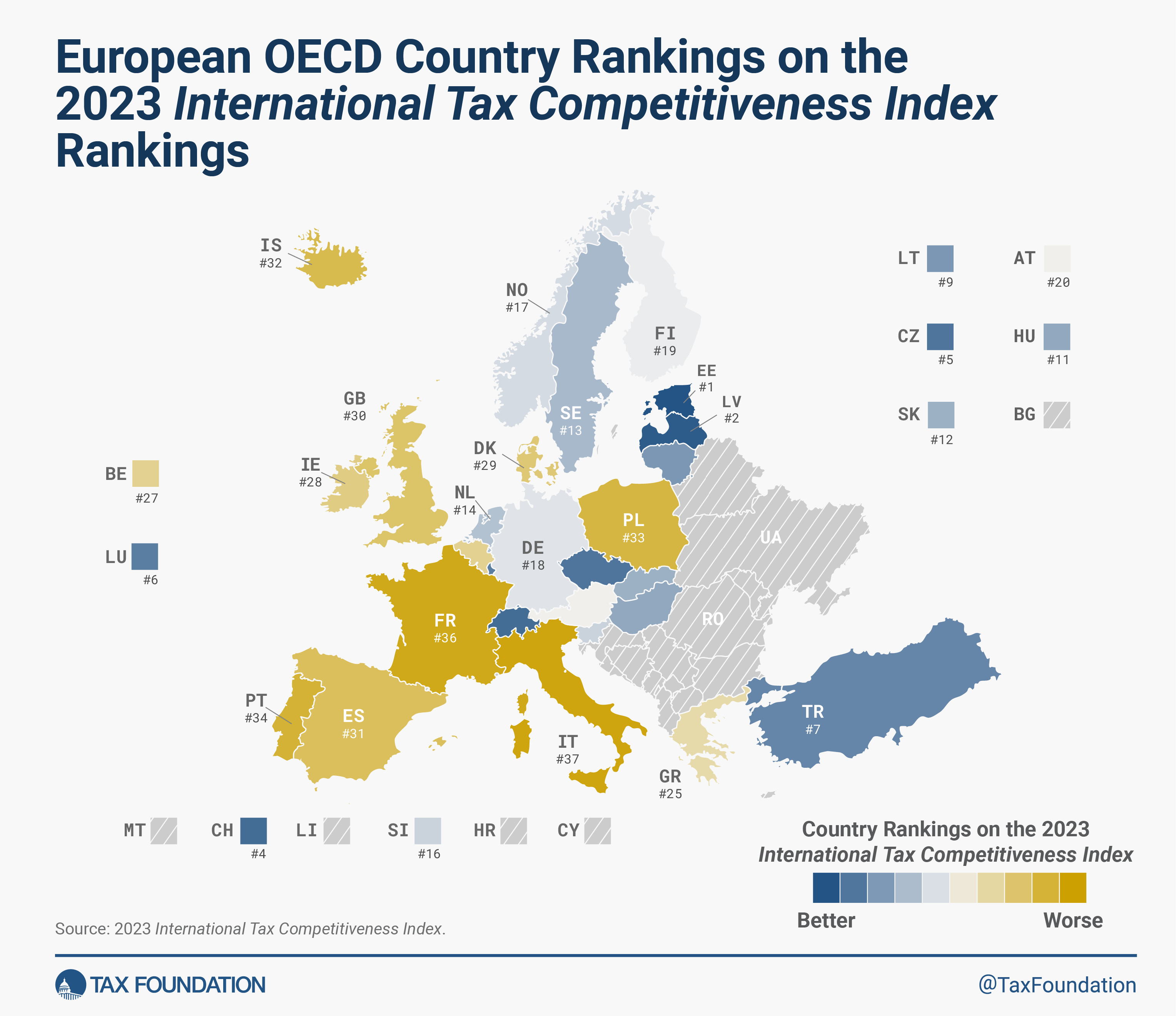

2023 International Tax Competitiveness Index | Tax Foundation – #36

2023 International Tax Competitiveness Index | Tax Foundation – #36

What Are the Tax Brackets for 2023? – Buy Side from WSJ – #37

What Are the Tax Brackets for 2023? – Buy Side from WSJ – #37

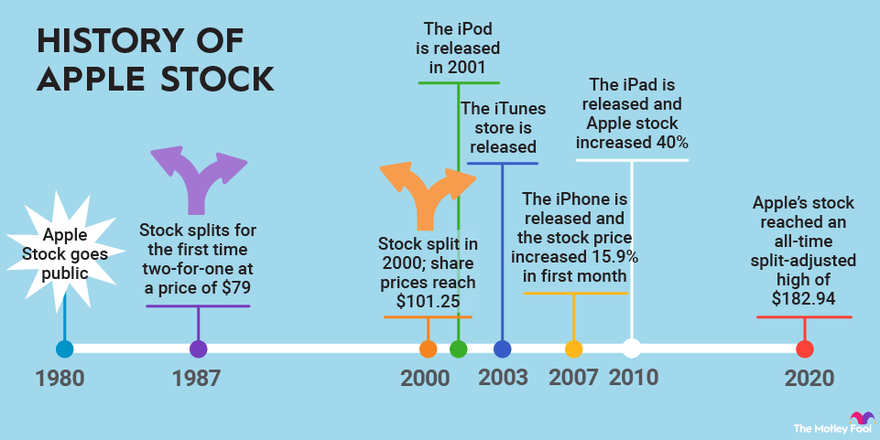

- inheritance tax document

- history of taxes timeline

- federal estate tax exemption 2023

Cross-border M&As post-TCJA: Three things advisers should know – #38

Cross-border M&As post-TCJA: Three things advisers should know – #38

Gift Deed in Maharashtra: A Comprehensive Guide – #39

Gift Deed in Maharashtra: A Comprehensive Guide – #39

Income Tax: How to claim a deduction under Section 80G for donations made to Ayodhya Ram Mandir Trust? | Mint – #40

Income Tax: How to claim a deduction under Section 80G for donations made to Ayodhya Ram Mandir Trust? | Mint – #40

Federal Gift Tax vs. California Inheritance Tax – #41

Federal Gift Tax vs. California Inheritance Tax – #41

Direct Payment of Medical Expenses and Tuition as an Exception to the Gift Tax – #42

Direct Payment of Medical Expenses and Tuition as an Exception to the Gift Tax – #42

Why we pay taxes to the government? | 5paisa – #43

Why we pay taxes to the government? | 5paisa – #43

Tax Rates | Congressional Budget Office – #44

Tax Rates | Congressional Budget Office – #44

Generation-Skipping Transfer Taxes – #45

Generation-Skipping Transfer Taxes – #45

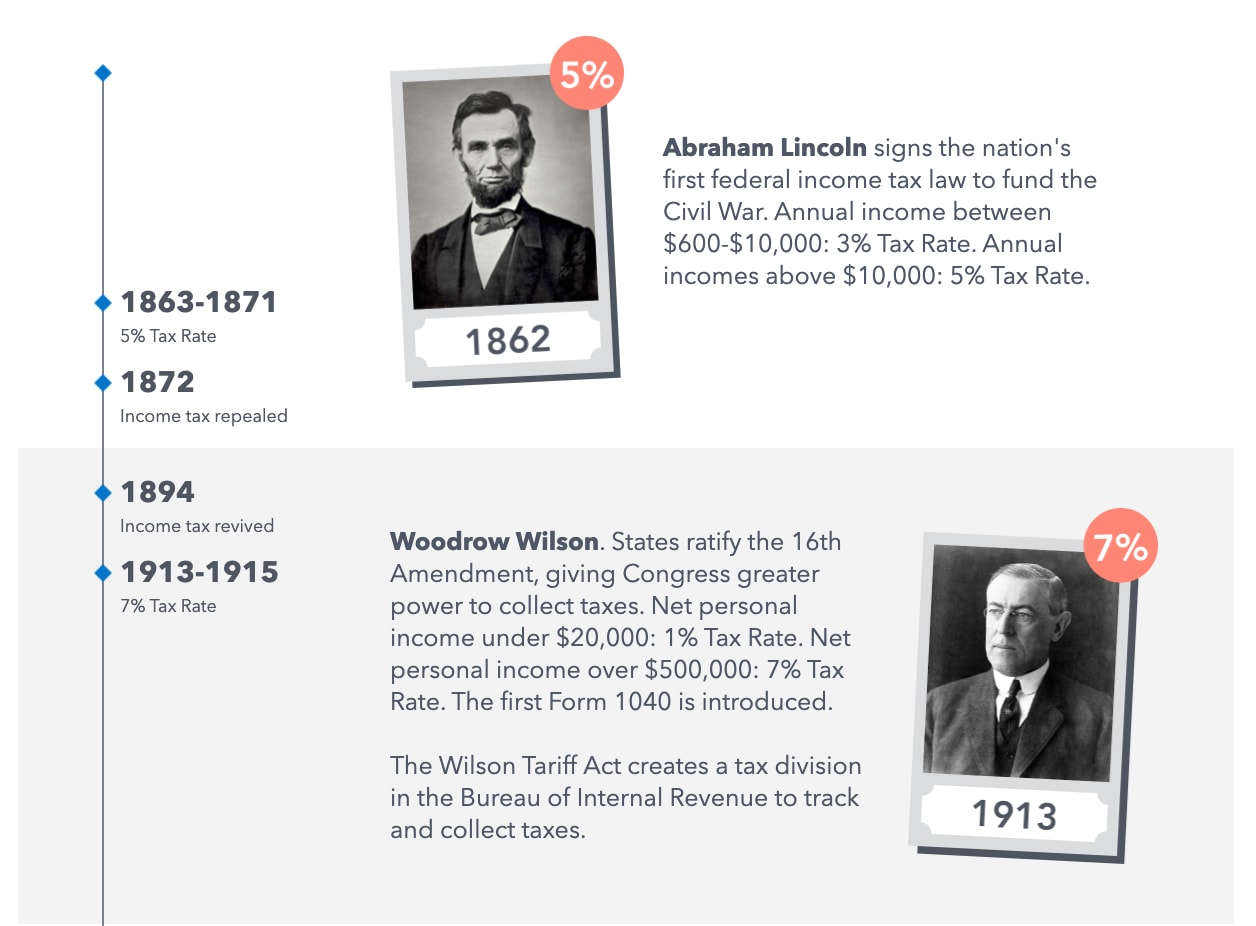

A Brief History of Income Taxes – TurboTax Tax Tips & Videos – #46

A Brief History of Income Taxes – TurboTax Tax Tips & Videos – #46

The taxation of collectibles – #47

The taxation of collectibles – #47

How Does a Uniform Gifts to Minors Act (UGMA) Account Work? – #48

How Does a Uniform Gifts to Minors Act (UGMA) Account Work? – #48

Tata Group: History, Business, Timeline & Subsidiary | 5paisa – #49

Tata Group: History, Business, Timeline & Subsidiary | 5paisa – #49

How the Government Spends Your Tax Dollars | Tax Foundation – #50

How the Government Spends Your Tax Dollars | Tax Foundation – #50

Income tax in the United States – Wikipedia – #51

Income tax in the United States – Wikipedia – #51

Historical Federal Tax Rates by Income Group — My Money Blog – #52

Historical Federal Tax Rates by Income Group — My Money Blog – #52

Income tax on gifts: Know when your gift is tax-free – BusinessToday – #53

Income tax on gifts: Know when your gift is tax-free – BusinessToday – #53

Jason won the lottery 10 years ago. He completed | Chegg.com – #54

Jason won the lottery 10 years ago. He completed | Chegg.com – #54

The history of income taxation in the United States | Fox Business – #55

The history of income taxation in the United States | Fox Business – #55

![Guide to Crypto Tax in India [Updated 2024] Guide to Crypto Tax in India [Updated 2024]](https://www.taxpolicycenter.org/sites/default/files/styles/original_optimized/public/3.2.1_tab1.png?itok\u003dpW7MR7hI) Guide to Crypto Tax in India [Updated 2024] – #56

Guide to Crypto Tax in India [Updated 2024] – #56

How the expiring TCJA may impact taxes in the future – Putnam Wealth Management – #57

How the expiring TCJA may impact taxes in the future – Putnam Wealth Management – #57

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #58

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #58

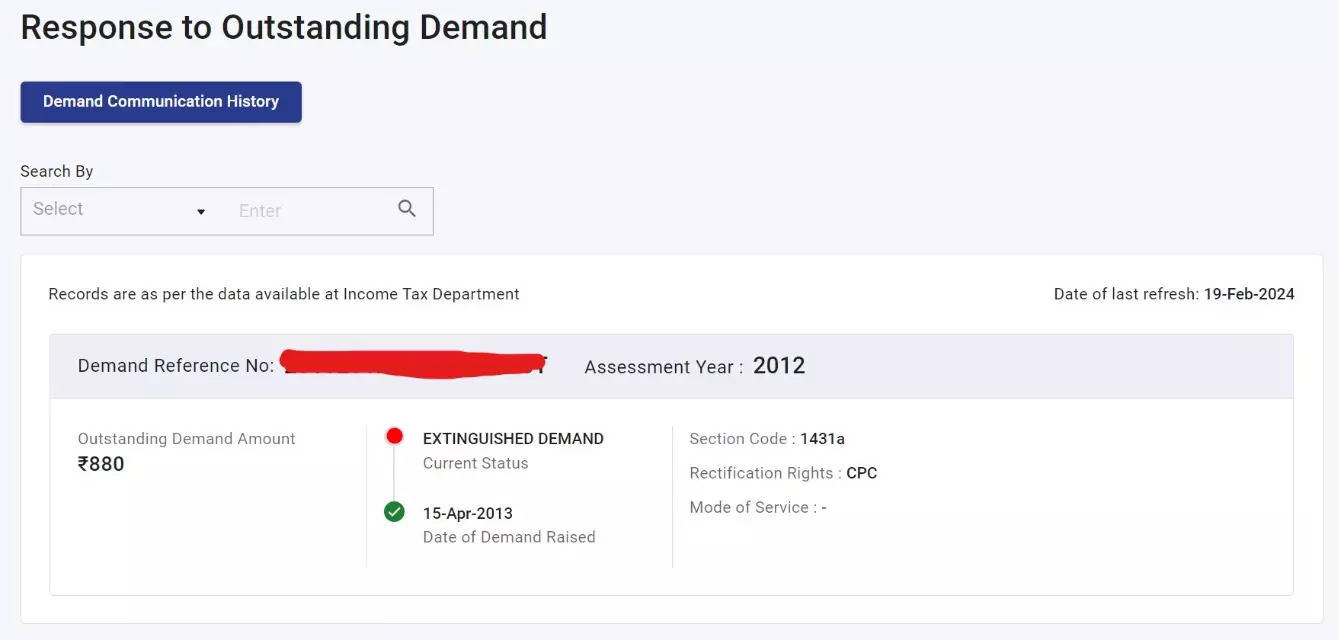

Income tax: Taxpayers, check ITR portal NOW: Pending tax demand of up to Rs 1 lakh per individual waived by govt – The Economic Times – #59

Income tax: Taxpayers, check ITR portal NOW: Pending tax demand of up to Rs 1 lakh per individual waived by govt – The Economic Times – #59

What is the difference between marginal and average tax rates? | Tax Policy Center – #60

What is the difference between marginal and average tax rates? | Tax Policy Center – #60

How Trump Wants to Change Your Tax Deductions – WSJ – #61

How Trump Wants to Change Your Tax Deductions – WSJ – #61

- gift tax exemption

- effective tax rate by income

- us corporate tax rate history

Understanding Federal Estate and Gift Taxes | Congressional Budget Office – #62

Understanding Federal Estate and Gift Taxes | Congressional Budget Office – #62

![Ryotwari & Mahalwari Systems Of Land Revenue In British India [NCERT Notes for Modern Indian History For UPSC] Ryotwari & Mahalwari Systems Of Land Revenue In British India [NCERT Notes for Modern Indian History For UPSC]](https://www.thetaxadviser.com/content/tta-home/issues/2023/aug/passthrough-entity-treatment-of-foreign-subsidiary-income/_jcr_content/contentSectionArticlePage/article/articleparsys/image.img.png/1693335217605.png) Ryotwari & Mahalwari Systems Of Land Revenue In British India [NCERT Notes for Modern Indian History For UPSC] – #63

Ryotwari & Mahalwari Systems Of Land Revenue In British India [NCERT Notes for Modern Indian History For UPSC] – #63

Business Taxesmartinsidwell.com – #64

Business Taxesmartinsidwell.com – #64

Counselor’s Corner: Preparing For Potential Estate & Gift Tax Law Changes – Nebraska CPA Magazine – #65

Counselor’s Corner: Preparing For Potential Estate & Gift Tax Law Changes – Nebraska CPA Magazine – #65

Crypto Taxes: The Complete Guide (2024) – #66

Crypto Taxes: The Complete Guide (2024) – #66

What the Income Tax rate was 40 years ago – Rediff.com – #67

What the Income Tax rate was 40 years ago – Rediff.com – #67

2023 State Estate Taxes and State Inheritance Taxes – #68

2023 State Estate Taxes and State Inheritance Taxes – #68

Tax Brackets in the US: Examples, Pros, and Cons – #69

Tax Brackets in the US: Examples, Pros, and Cons – #69

Benefits of Spousal Lifetime Access Trusts (SLATs) – AMG National Trust – #70

Benefits of Spousal Lifetime Access Trusts (SLATs) – AMG National Trust – #70

When You Make Cash Gifts To Your Children, Who Pays The Tax? | Greenbush Financial Group – #71

When You Make Cash Gifts To Your Children, Who Pays The Tax? | Greenbush Financial Group – #71

Withholding Tax Explained: Types and How It’s Calculated – #72

Withholding Tax Explained: Types and How It’s Calculated – #72

Corporate Taxes in India – India Briefing News – #73

Corporate Taxes in India – India Briefing News – #73

Tax Advantages for Donor-Advised Funds | NPTrust – #74

Tax Advantages for Donor-Advised Funds | NPTrust – #74

Wassim Zhani Federal Taxation Chapter 1 An Overview of Federal Taxation.pdf – #75

Wassim Zhani Federal Taxation Chapter 1 An Overview of Federal Taxation.pdf – #75

Progressivity in United States income tax – Wikipedia – #76

Progressivity in United States income tax – Wikipedia – #76

Gift Tax, the Annual Exclusion and Estate Planning – #77

Gift Tax, the Annual Exclusion and Estate Planning – #77

The Distribution of Household Income, 2018 | Congressional Budget Office – #78

The Distribution of Household Income, 2018 | Congressional Budget Office – #78

The Generation-Skipping Transfer Tax: A Quick Guide – #79

The Generation-Skipping Transfer Tax: A Quick Guide – #79

Ten Facts You Should Know About the Federal Estate Tax | Center on Budget and Policy Priorities – #80

Ten Facts You Should Know About the Federal Estate Tax | Center on Budget and Policy Priorities – #80

Crypto Taxes India: Expert Guide 2024 | CPA Reviewed | Koinly – #81

Crypto Taxes India: Expert Guide 2024 | CPA Reviewed | Koinly – #81

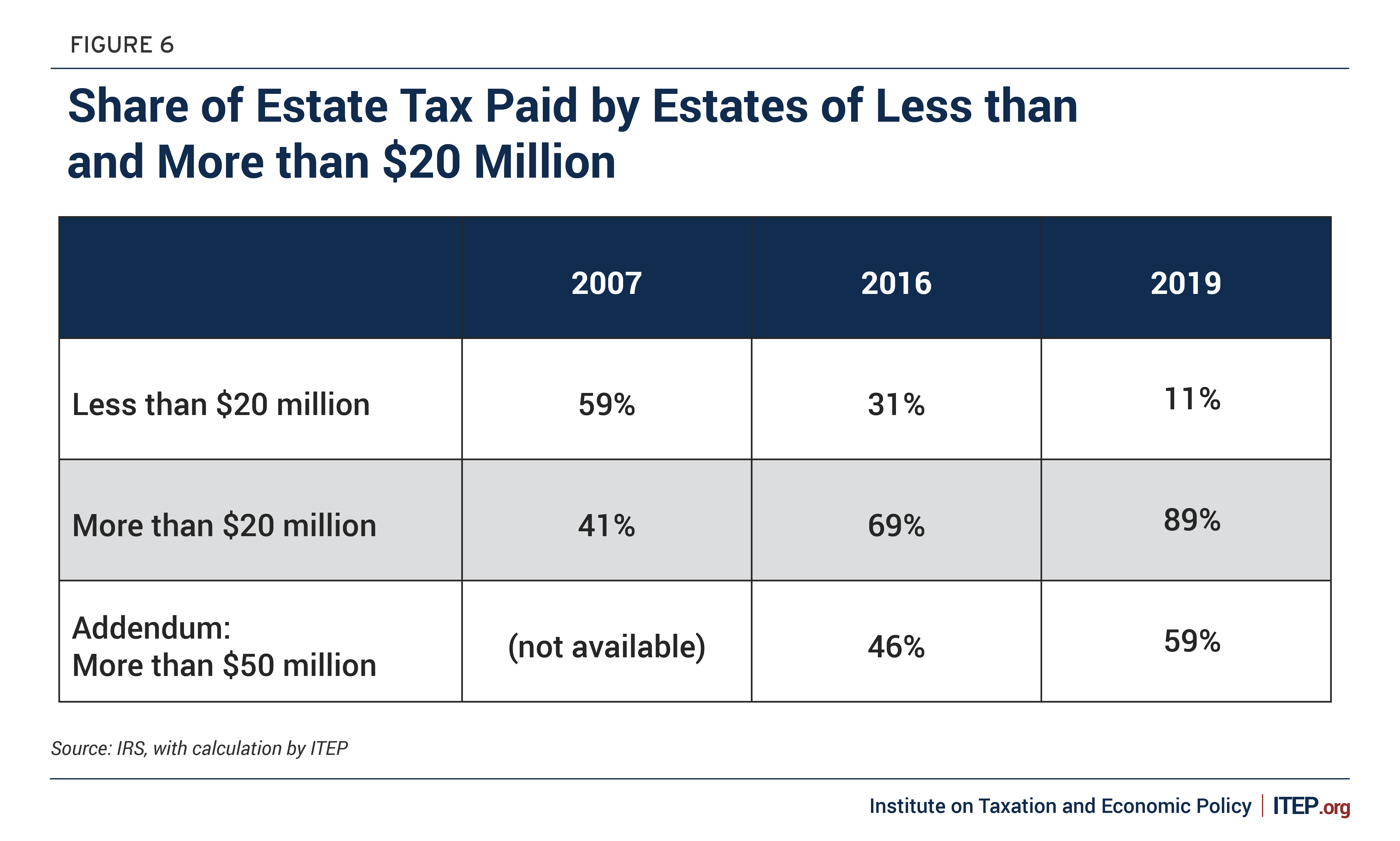

Estate Gift Tax | Estate and Gift Dynamics in the Era of the Big Exemption.. – #82

Estate Gift Tax | Estate and Gift Dynamics in the Era of the Big Exemption.. – #82

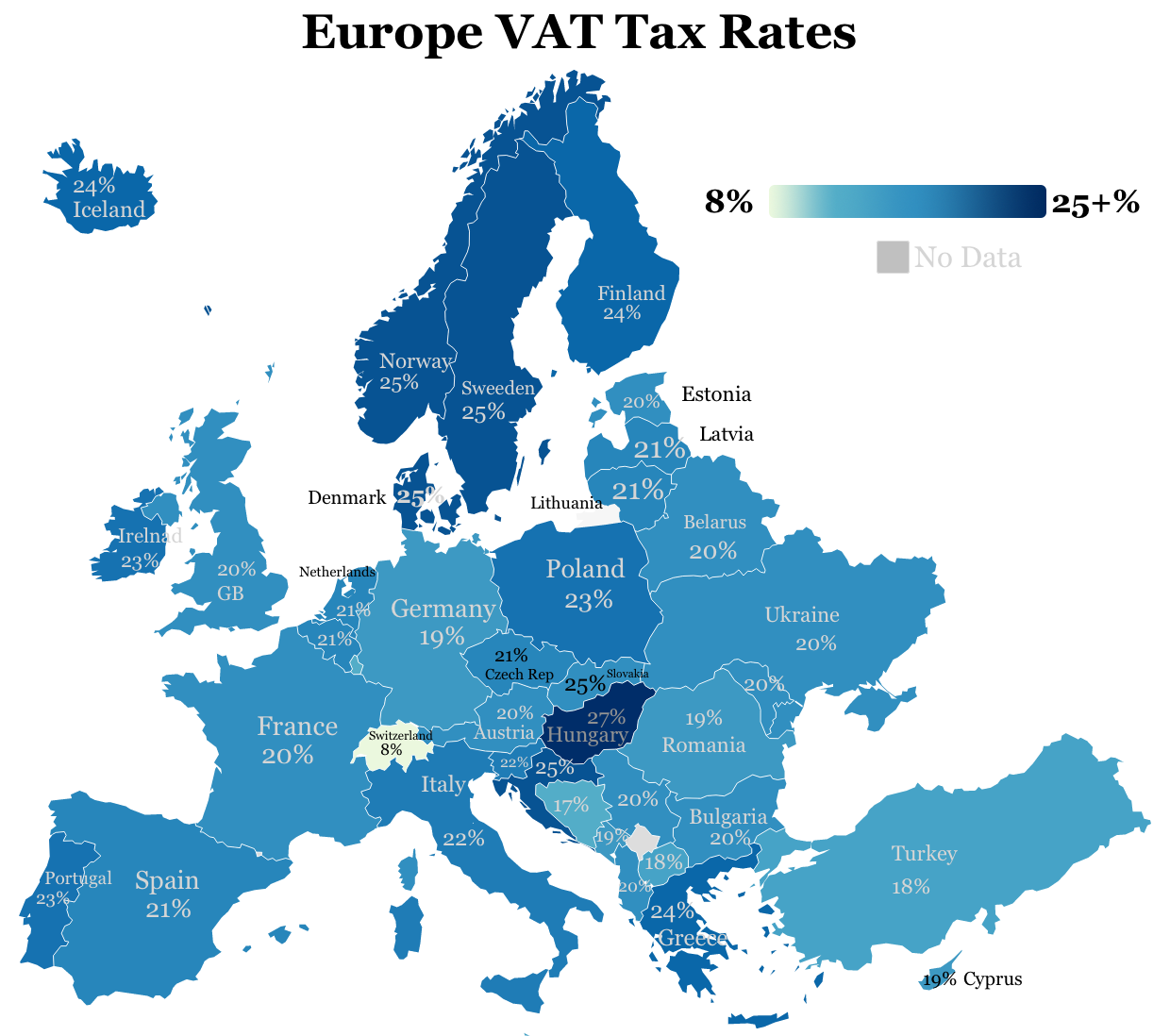

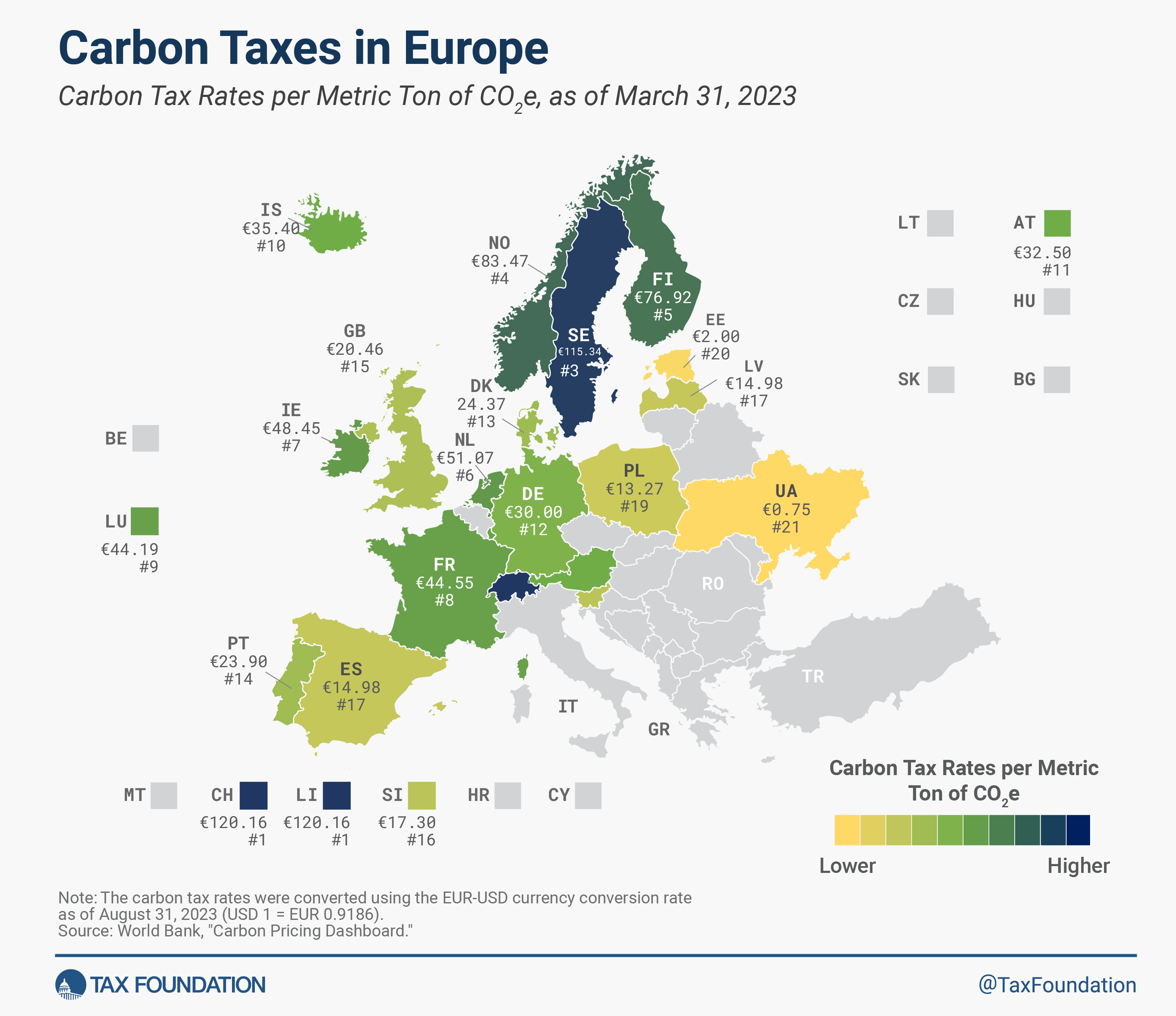

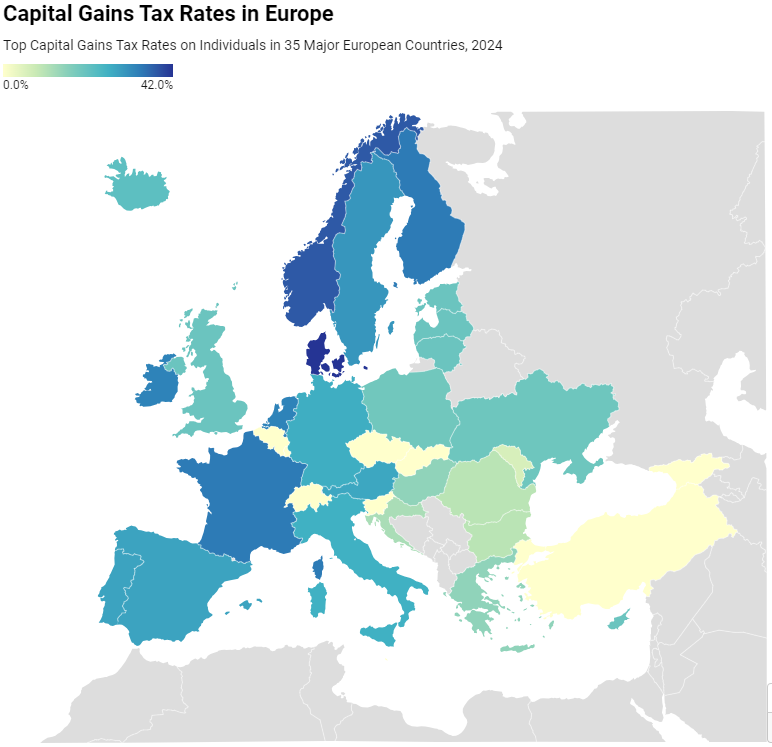

2023 Carbon Taxes in Europe | Carbon Tax Rates in Europe – #83

2023 Carbon Taxes in Europe | Carbon Tax Rates in Europe – #83

Historical Average Federal Tax Rates for All Households | Tax Policy Center – #84

Historical Average Federal Tax Rates for All Households | Tax Policy Center – #84

European Tax Maps Archives | Tax Foundation – #85

European Tax Maps Archives | Tax Foundation – #85

The Estate Tax is Irrelevant to More Than 99 Percent of Americans – ITEP – #86

The Estate Tax is Irrelevant to More Than 99 Percent of Americans – ITEP – #86

Gift Tax: शादी में मिले गिफ्ट टैक्स फ्री, पर जन्मदिन व ऑफिस से मिले तोहफे पर लगता है कर, जानिए ऐसा क्यों? – What is gift tax which gifts are non taxable – #87

Gift Tax: शादी में मिले गिफ्ट टैक्स फ्री, पर जन्मदिन व ऑफिस से मिले तोहफे पर लगता है कर, जानिए ऐसा क्यों? – What is gift tax which gifts are non taxable – #87

2019 Tax Reference Tables | Marcum LLP | Accountants and Advisors – #88

2019 Tax Reference Tables | Marcum LLP | Accountants and Advisors – #88

Revisit the History of I-T Slab Rates (1944-45 to 2021-22) – #89

Revisit the History of I-T Slab Rates (1944-45 to 2021-22) – #89

New York’s “Death Tax:” The Case for Killing It – Empire Center for Public Policy – #90

New York’s “Death Tax:” The Case for Killing It – Empire Center for Public Policy – #90

How Progressive is the US Tax System? | Tax Foundation – #91

How Progressive is the US Tax System? | Tax Foundation – #91

- estate tax exemption 2022

- estate tax exemption 2026

- gift tax example

Direct Tax Definition, History, and Examples – #92

Direct Tax Definition, History, and Examples – #92

North Carolina Gift Tax: All You Need to Know | SmartAsset – #93

North Carolina Gift Tax: All You Need to Know | SmartAsset – #93

US Tax Revenue: % of GDP, 1968 – 2024 | CEIC Data – #94

US Tax Revenue: % of GDP, 1968 – 2024 | CEIC Data – #94

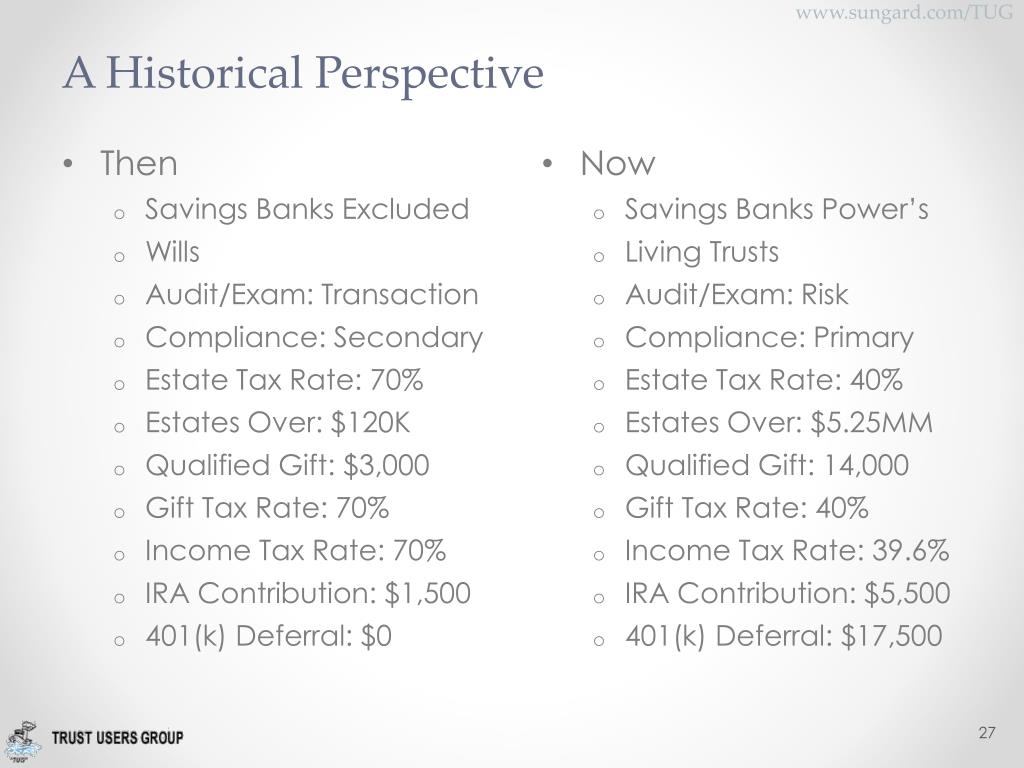

PPT – Industry Challenges PowerPoint Presentation, free download – ID:2599992 – #95

PPT – Industry Challenges PowerPoint Presentation, free download – ID:2599992 – #95

Historical Look at Estate and Gift Tax Rates | Wolters Kluwer – #96

Historical Look at Estate and Gift Tax Rates | Wolters Kluwer – #96

Property tax | Definition, History, Administration, & Rates | Britannica Money – #97

Property tax | Definition, History, Administration, & Rates | Britannica Money – #97

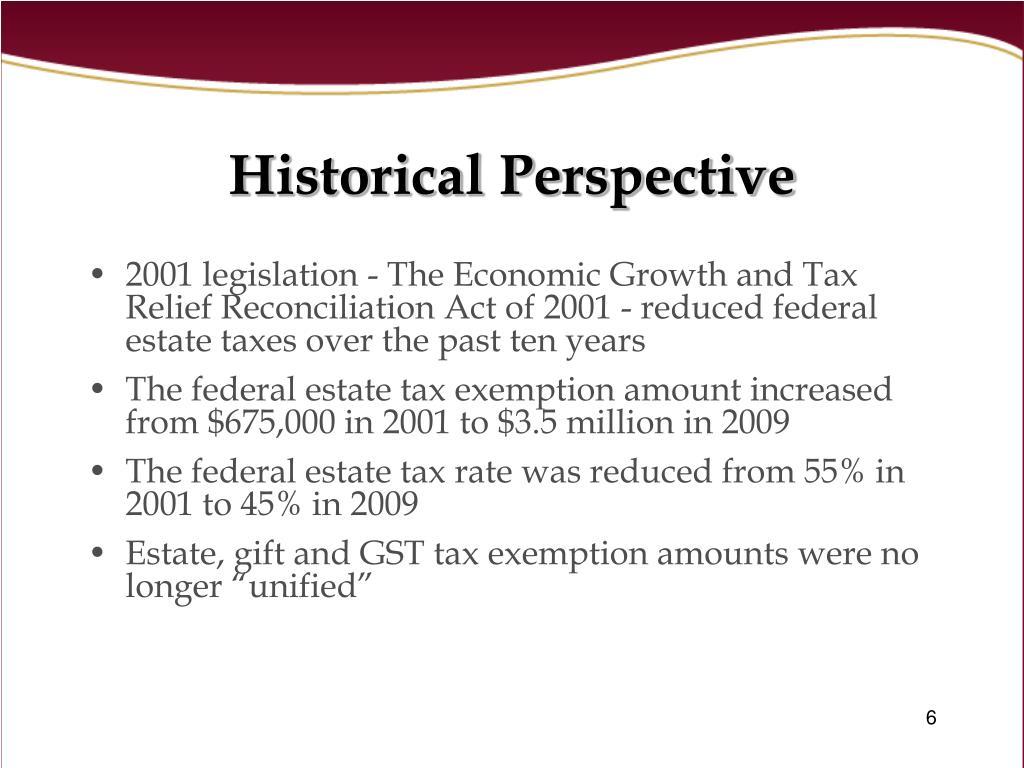

Chapter 12 Wealth Transfer Taxes. – ppt download – #98

Chapter 12 Wealth Transfer Taxes. – ppt download – #98

PBS NewsHour | How Trump’s tax plan could exacerbate inequality | Season 2017 | PBS – #99

PBS NewsHour | How Trump’s tax plan could exacerbate inequality | Season 2017 | PBS – #99

Sandra K Pridemore, CPA, PA – #100

Sandra K Pridemore, CPA, PA – #100

What is Portability for Estate and Gift Tax? – #101

What is Portability for Estate and Gift Tax? – #101

Taxation at the Top: Its Long-Term Effect on the Assets | SpringerLink – #102

Taxation at the Top: Its Long-Term Effect on the Assets | SpringerLink – #102

Newsletters – Slaton Schauer Law Firm, PLLC – #103

Newsletters – Slaton Schauer Law Firm, PLLC – #103

11 Charts on Taxing the Wealthy and Corporations – Institute for Policy Studies – #104

11 Charts on Taxing the Wealthy and Corporations – Institute for Policy Studies – #104

Gold Rate Today in Chennai: Live 22 & 24 Carat Gold Rates | 5paisa – #105

Gold Rate Today in Chennai: Live 22 & 24 Carat Gold Rates | 5paisa – #105

Smart tax strategies for lottery winners – Tax Insider – #106

Smart tax strategies for lottery winners – Tax Insider – #106

The Three Basic Tax Types | TaxEDU Resources – #107

The Three Basic Tax Types | TaxEDU Resources – #107

Gift tax: what is it & how does it work? | Empower – #108

Gift tax: what is it & how does it work? | Empower – #108

You May Be Paying a Higher Tax Rate Than a Billionaire — ProPublica – #109

You May Be Paying a Higher Tax Rate Than a Billionaire — ProPublica – #109

Estate Tax Exemption for 2023 | Kiplinger – #110

Estate Tax Exemption for 2023 | Kiplinger – #110

How do US corporate income tax rates and revenues compare with other countries’? | Tax Policy Center – #111

How do US corporate income tax rates and revenues compare with other countries’? | Tax Policy Center – #111

Historical Estate Tax Exemption Amounts And Tax Rates – #112

Historical Estate Tax Exemption Amounts And Tax Rates – #112

Taxation in the United States – Wikipedia – #113

Taxation in the United States – Wikipedia – #113

- estate tax rates 2023

- us income tax rates

- estate tax exemption history

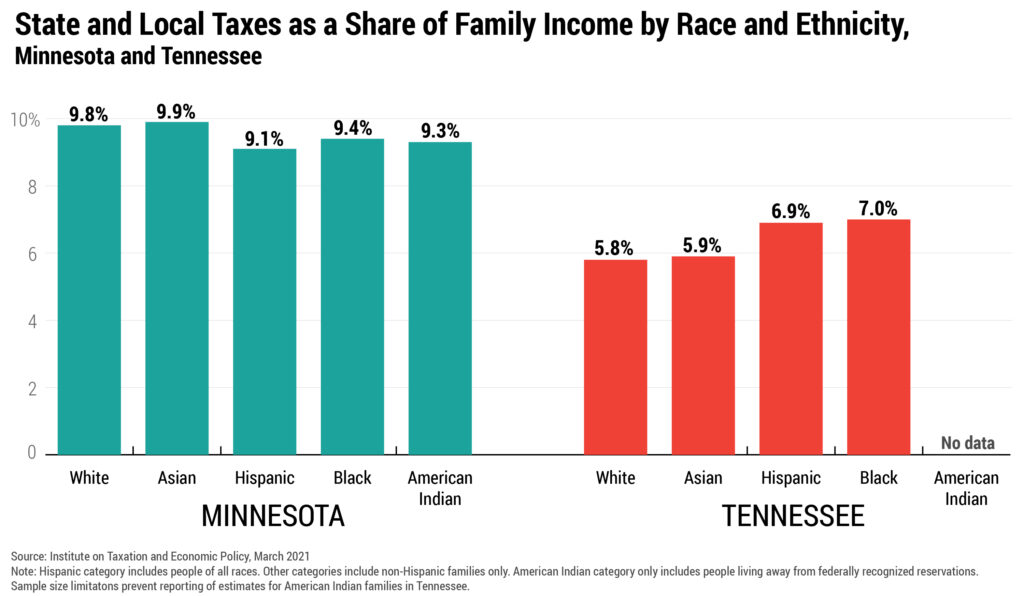

Taxes and Racial Equity: An Overview of State and Local Policy Impacts – ITEP – #114

Taxes and Racial Equity: An Overview of State and Local Policy Impacts – ITEP – #114

Ayodhya Ram Mandir Inauguration: Wishes, images, quotes to share with loved ones – Hindustan Times – #115

Ayodhya Ram Mandir Inauguration: Wishes, images, quotes to share with loved ones – Hindustan Times – #115

Countdown for Gift and Estate Tax Exemptions | Charles Schwab – #116

Countdown for Gift and Estate Tax Exemptions | Charles Schwab – #116

Income Tax Budget 2024 Highlights: Modi Govt gives no relief to middle-class taxpayers. Details of slabs, regimes here | Mint – #117

Income Tax Budget 2024 Highlights: Modi Govt gives no relief to middle-class taxpayers. Details of slabs, regimes here | Mint – #117

Returns Filed Taxes Collected and Refunds Issued | Internal Revenue Service – #118

Returns Filed Taxes Collected and Refunds Issued | Internal Revenue Service – #118

8 Reasons Why Banks Own So Much Life Insurance – #119

8 Reasons Why Banks Own So Much Life Insurance – #119

The Distribution of Household Income, 2019 | Congressional Budget Office – #120

The Distribution of Household Income, 2019 | Congressional Budget Office – #120

How did the Tax Cuts and Jobs Act change business taxes? | Tax Policy Center – #121

How did the Tax Cuts and Jobs Act change business taxes? | Tax Policy Center – #121

Estate Planning Key Numbers | Brian Nydegger – #122

Estate Planning Key Numbers | Brian Nydegger – #122

2024 Sales Tax Rates: State & Local Sales Tax by State – #123

2024 Sales Tax Rates: State & Local Sales Tax by State – #123

Compliance Presence | Internal Revenue Service – #124

Compliance Presence | Internal Revenue Service – #124

A Brief History of Taxes in the U.S. – #125

A Brief History of Taxes in the U.S. – #125

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation – #126

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation – #126

How the Federal Estate Tax Exemption Changed from 1997 to Today – #127

How the Federal Estate Tax Exemption Changed from 1997 to Today – #127

Income tax on a gift from father to daughter – #128

Income tax on a gift from father to daughter – #128

Checkpoint Product Training Tips Newsletter – #129

Checkpoint Product Training Tips Newsletter – #129

How families are skirting estate taxes: Wealthy Americans have doubled the amount they’re gifting each year as the end of Trump-era tax breaks looms | Daily Mail Online – #130

How families are skirting estate taxes: Wealthy Americans have doubled the amount they’re gifting each year as the end of Trump-era tax breaks looms | Daily Mail Online – #130

EGTRRA and Inheritance Tax: Preserving Wealth for Future Generations – FasterCapital – #131

EGTRRA and Inheritance Tax: Preserving Wealth for Future Generations – FasterCapital – #131

A Guide to Statistics on Historical Trends in Income Inequality | Center on Budget and Policy Priorities – #132

A Guide to Statistics on Historical Trends in Income Inequality | Center on Budget and Policy Priorities – #132

Historical Capital Gains and Taxes | Tax Policy Center – #133

Historical Capital Gains and Taxes | Tax Policy Center – #133

Corporate Top Tax Rate and Bracket | Tax Policy Center – #134

Corporate Top Tax Rate and Bracket | Tax Policy Center – #134

Taxation Defined, With Justifications and Types of Taxes – #135

Taxation Defined, With Justifications and Types of Taxes – #135

We’re Paying for Our Daughter’s Wedding. Is It a Taxable Gift? – WSJ – #136

We’re Paying for Our Daughter’s Wedding. Is It a Taxable Gift? – WSJ – #136

WGU – C237 – TAXATION 1 EXAM PACK – Stuvia US – #137

WGU – C237 – TAXATION 1 EXAM PACK – Stuvia US – #137

- us income tax rate history

- federal historical tax rates graph

- estate tax example

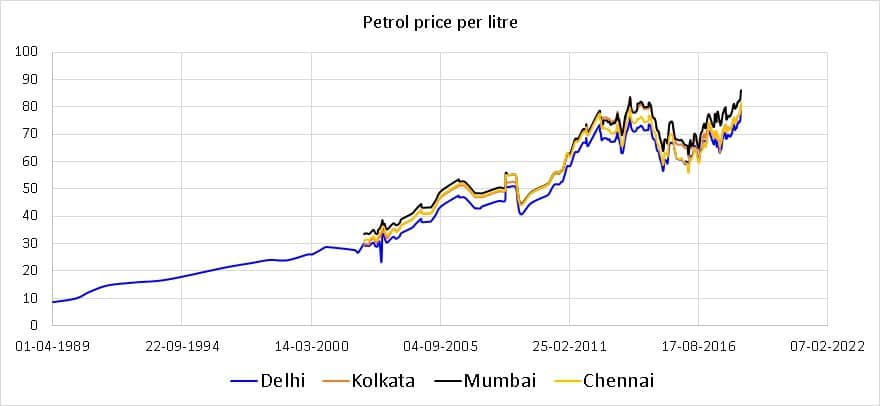

What we can learn from Petrol, Diesel historical price inflation data – #138

What we can learn from Petrol, Diesel historical price inflation data – #138

Are Federal Taxes Progressive? | Taxes & Transfers | Tax Foundation – #139

Are Federal Taxes Progressive? | Taxes & Transfers | Tax Foundation – #139

History of taxation in the United States – Wikipedia – #140

History of taxation in the United States – Wikipedia – #140

Taxation in Hungary – Wikipedia – #141

Taxation in Hungary – Wikipedia – #141

From multiple layered taxes to ‘1 Nation, 1 Tax’ – the journey of Indian Tax Structure. #IndianTaxation #History #1Nation1Ta… | Journey, India latest news, National – #142

From multiple layered taxes to ‘1 Nation, 1 Tax’ – the journey of Indian Tax Structure. #IndianTaxation #History #1Nation1Ta… | Journey, India latest news, National – #142

Gold Price History in India – Unlocking Trends in the Past – #143

Gold Price History in India – Unlocking Trends in the Past – #143

Amazon.com: MG Global Historical Poster of 1912 Panoramic map of Houston Texas | 11×17 12×18 16×24 24×36 Print Wall Art for Gift | Vintage Antique Rustic Home Office Decor: Posters & Prints – #144

Amazon.com: MG Global Historical Poster of 1912 Panoramic map of Houston Texas | 11×17 12×18 16×24 24×36 Print Wall Art for Gift | Vintage Antique Rustic Home Office Decor: Posters & Prints – #144

New 2024 Tax Rates and Thresholds – U of I Tax School – #145

New 2024 Tax Rates and Thresholds – U of I Tax School – #145

The Evolution of Taxation, History, Principles, and Forms – The Evolution of Taxation: History, – Studocu – #146

The Evolution of Taxation, History, Principles, and Forms – The Evolution of Taxation: History, – Studocu – #146

Gift and estate tax planning – interest rates matter, should you act now? – #147

Gift and estate tax planning – interest rates matter, should you act now? – #147

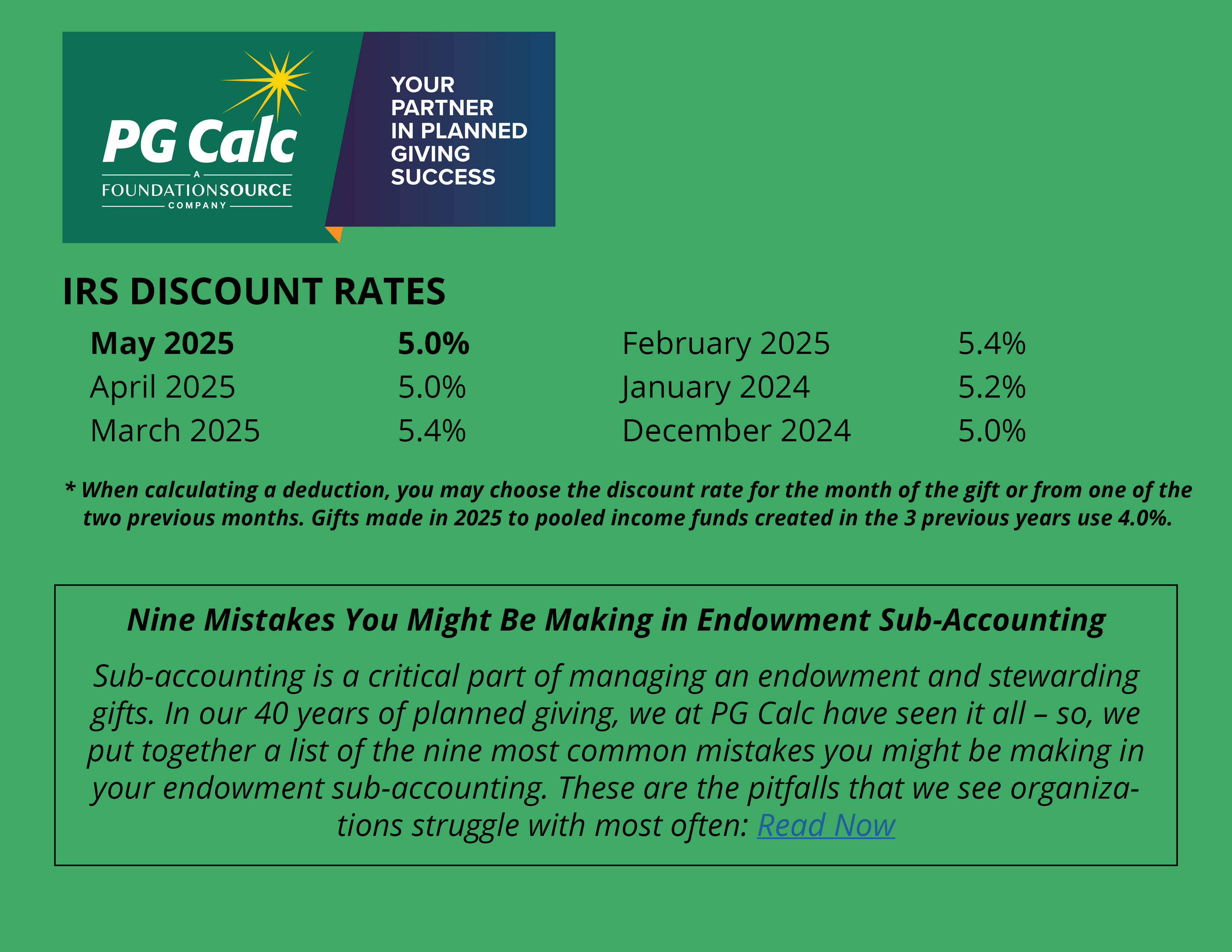

IRS Discount Rate | PG Calc – #148

IRS Discount Rate | PG Calc – #148

Everything You Need to Know About Your Expat Taxes in India – #149

Everything You Need to Know About Your Expat Taxes in India – #149

For the first time in history, U.S. billionaires paid a lower tax rate than the working class – The Washington Post – #150

For the first time in history, U.S. billionaires paid a lower tax rate than the working class – The Washington Post – #150

SOI Tax Stats – IRS Data Book | Internal Revenue Service – #151

SOI Tax Stats – IRS Data Book | Internal Revenue Service – #151

NRI Gift Tax Guide: Understanding Tax Implications in India – #152

NRI Gift Tax Guide: Understanding Tax Implications in India – #152

GIFT City explained: History & tax incentives of India’s first ‘Smart City’ – The Hindu – #153

GIFT City explained: History & tax incentives of India’s first ‘Smart City’ – The Hindu – #153

Discover The Latest Federal Estate Tax Exemption Increase For 2024 – Are You Ready? | Opelon LLP- A Trust, Estate Planning And Probate Law Firm – #154

Discover The Latest Federal Estate Tax Exemption Increase For 2024 – Are You Ready? | Opelon LLP- A Trust, Estate Planning And Probate Law Firm – #154

Received a Foreign Gift in 2023? Learn About Taxes on Gifts and IRS Form 3520 — – #155

Received a Foreign Gift in 2023? Learn About Taxes on Gifts and IRS Form 3520 — – #155

Marginal Corporate Tax Rates | Tax Policy Center – #156

Marginal Corporate Tax Rates | Tax Policy Center – #156

GST Rates in India 2024 – List of Goods and Service Tax Rates, Slab and Revision – #157

GST Rates in India 2024 – List of Goods and Service Tax Rates, Slab and Revision – #157

A Historical Look at Giving Season | J.P. Morgan – #158

A Historical Look at Giving Season | J.P. Morgan – #158

New Viz – #159

New Viz – #159

Passthrough-entity treatment of foreign subsidiary income – #160

Passthrough-entity treatment of foreign subsidiary income – #160

The United Arab Emirates UAE Tax Regime:From No Tax to Low Tax – #161

The United Arab Emirates UAE Tax Regime:From No Tax to Low Tax – #161

PPT – Sunrise, Sunset: The Federal Estate Tax is Back PowerPoint Presentation – ID:475080 – #162

PPT – Sunrise, Sunset: The Federal Estate Tax is Back PowerPoint Presentation – ID:475080 – #162

TaxProf Blog – #163

TaxProf Blog – #163

Latest Income Tax Slab Rates for FY 2022-23 / AY 2023-24 | Budget 2022 Key Highlights – BasuNivesh – #164

Latest Income Tax Slab Rates for FY 2022-23 / AY 2023-24 | Budget 2022 Key Highlights – BasuNivesh – #164

Taxation: Income and Corporation Tax in UK – 3838 Words | Report Example – #165

Taxation: Income and Corporation Tax in UK – 3838 Words | Report Example – #165

– #166

– #166

- federal estate tax

- historical effective tax rates

- historical income tax rates graph

– #167

– #167

– #168

– #168

– #169

– #169

– #170

– #170

– #171

– #171

– #172

– #172

– #173

– #173

– #174

– #174

– #175

– #175

– #176

– #176

– #177

– #177

Posts: historical gift tax rates

Categories: Gifts

Author: toyotabienhoa.edu.vn