Share 160+ gst on gift to employees super hot

Update images of gst on gift to employees by website toyotabienhoa.edu.vn compilation. Section Review-2023-May/June 2023. Practical Case Studies on Input Tax Credit (ITC). Diwali Gifts For Employees Under 1000 at Rs 700/pack | Diwali Gifts in New Delhi | ID: 21482073848. Tax implications of Christmas party – KMT Partners. The Tax Implication of Giving Gifts | Entrepreneurs | Blog

GST on legal services: Applicability and GST Rates – Corpbiz – #1

GST on legal services: Applicability and GST Rates – Corpbiz – #1

GST Implications on Gift by Employer to Employee (Taxability & ITC) – #2

GST Implications on Gift by Employer to Employee (Taxability & ITC) – #2

- diwali gifts for employees

- diwali gift for employees under 500

- qtip trust diagram

FAQs on India’s GST Regime, GST Applicability on Overseas Transactions – #4

FAQs on India’s GST Regime, GST Applicability on Overseas Transactions – #4

How will GST impact the Indian economy – #5

How will GST impact the Indian economy – #5

Memorable Corporate gifts for women’s day with Pla-nt with Pot, Mixed fruits, milk chocolate and more | women’s day corporate gifts | womens day gift hamper | womens day gift for employees : – #6

Memorable Corporate gifts for women’s day with Pla-nt with Pot, Mixed fruits, milk chocolate and more | women’s day corporate gifts | womens day gift hamper | womens day gift for employees : – #6

Transfer of moveable assets by Employer to Employee – Taxability of Pe – #7

Transfer of moveable assets by Employer to Employee – Taxability of Pe – #7

CRA Gift Tax Rules for Employers – SRJ Chartered Accountants Professional Corporation – #8

CRA Gift Tax Rules for Employers – SRJ Chartered Accountants Professional Corporation – #8

2024 Estate, Gift and GST Tax Changes | Shipman & Goodwin LLP™ – #10

2024 Estate, Gift and GST Tax Changes | Shipman & Goodwin LLP™ – #10

Employee Gift Set – Wallet and Pen with Keychain – Corporate Gift Items | JucyGifts – #11

Employee Gift Set – Wallet and Pen with Keychain – Corporate Gift Items | JucyGifts – #11

Diverse nature of director’s remuneration and GST applicability – #12

Diverse nature of director’s remuneration and GST applicability – #12

Buy PRINTABLE Employee Appreciation Candy Tag Bundle 32 Candy Gift Tags Designs Employee Appreciation Gift Ideas Easy to Print & Cut Online in India – Etsy – #13

Buy PRINTABLE Employee Appreciation Candy Tag Bundle 32 Candy Gift Tags Designs Employee Appreciation Gift Ideas Easy to Print & Cut Online in India – Etsy – #13

Women’s day gift ideas for colleagues with Temperature water bottle, Greeting card, Chocolates and more | women’s day gift hampers | womens day gift for employees | women’s day corporate gifts : – #14

Women’s day gift ideas for colleagues with Temperature water bottle, Greeting card, Chocolates and more | women’s day gift hampers | womens day gift for employees | women’s day corporate gifts : – #14

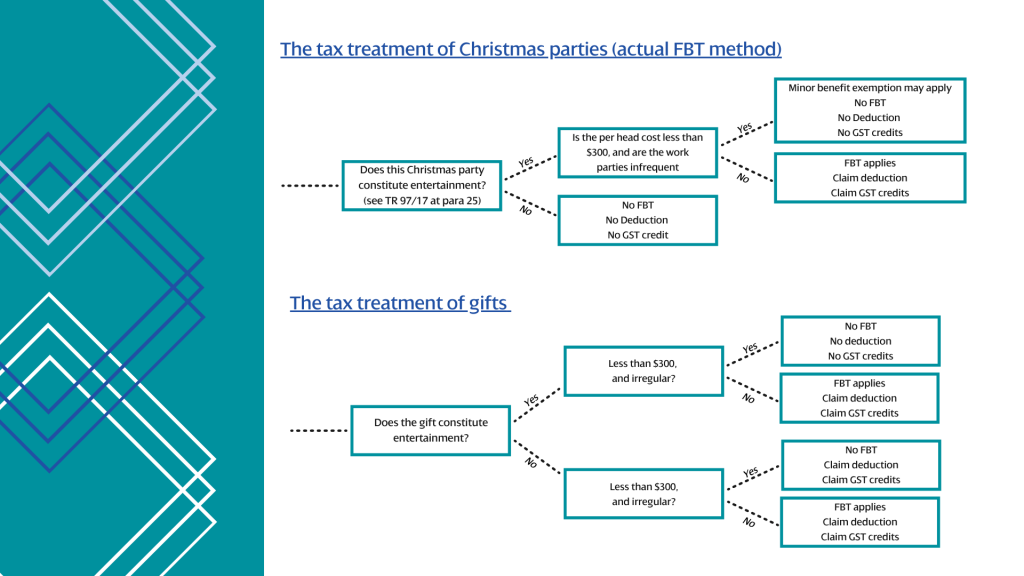

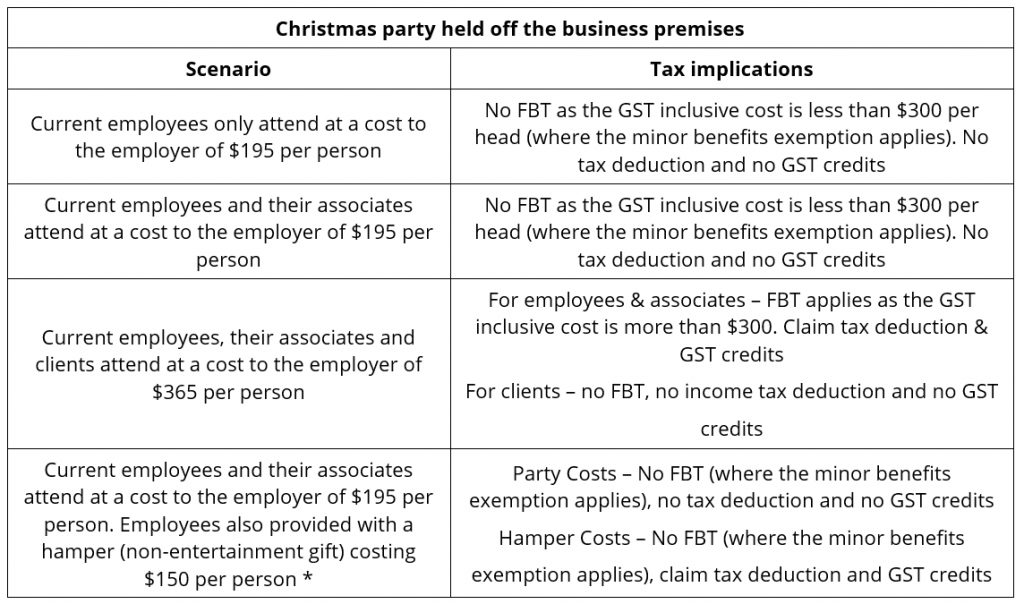

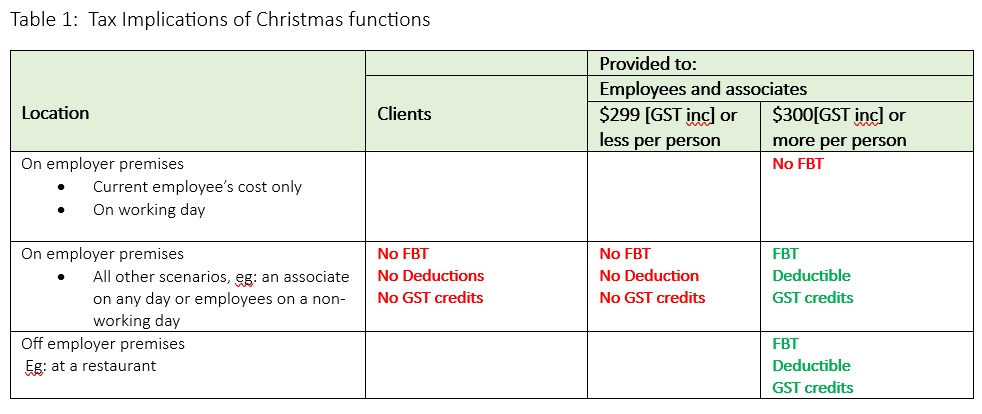

CHRISTMAS PARTIES – TAX TIPS FOR EMPLOYERS – PTAS – #15

CHRISTMAS PARTIES – TAX TIPS FOR EMPLOYERS – PTAS – #15

Gifts For Staff: 20 Thoughtful Gestures To Show Your Gratitude – Sow ʼn Sow – #16

Gifts For Staff: 20 Thoughtful Gestures To Show Your Gratitude – Sow ʼn Sow – #16

) Avoiding the FBT Christmas Grinch — JPR Business Group – #17

Avoiding the FBT Christmas Grinch — JPR Business Group – #17

How is “gift to employees” treated under GST? – #18

How is “gift to employees” treated under GST? – #18

GST on rent: Govt clarifies on the new rule on residential properties | Mint – #19

GST on rent: Govt clarifies on the new rule on residential properties | Mint – #19

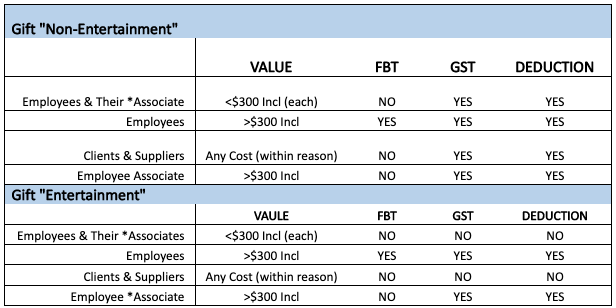

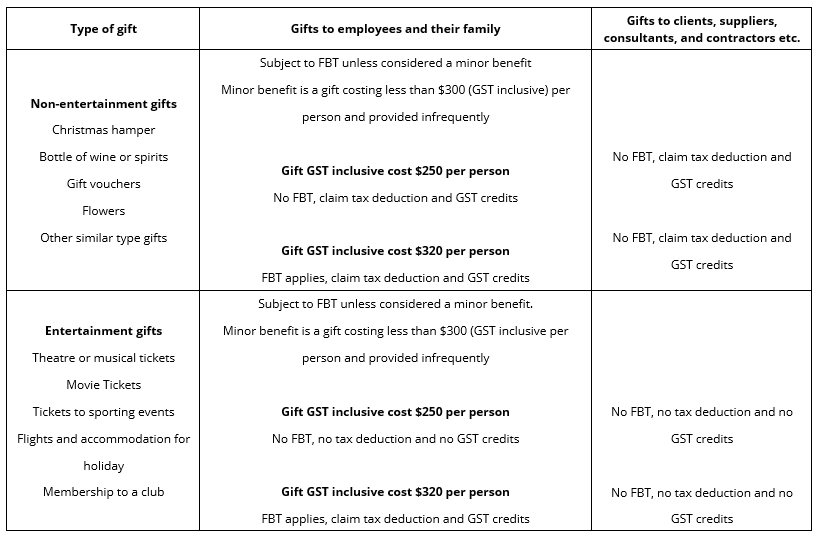

Are Gifts Given to Employees and Non-Employees Claimable? – #20

Are Gifts Given to Employees and Non-Employees Claimable? – #20

Treatment of Gifts & Donations under GST – #21

Treatment of Gifts & Donations under GST – #21

Buy Soda Pop Gift Tags, Soda-lightful Printable, Thank You, Appreciation, Teachers, Staff, Clients, Customers, Employees, Volunteer Appreciation Online in India – Etsy – #22

Buy Soda Pop Gift Tags, Soda-lightful Printable, Thank You, Appreciation, Teachers, Staff, Clients, Customers, Employees, Volunteer Appreciation Online in India – Etsy – #22

How to treat Gifts and Entertainment expenses in your business – MJJ Accounting and Business Solutions – #23

How to treat Gifts and Entertainment expenses in your business – MJJ Accounting and Business Solutions – #23

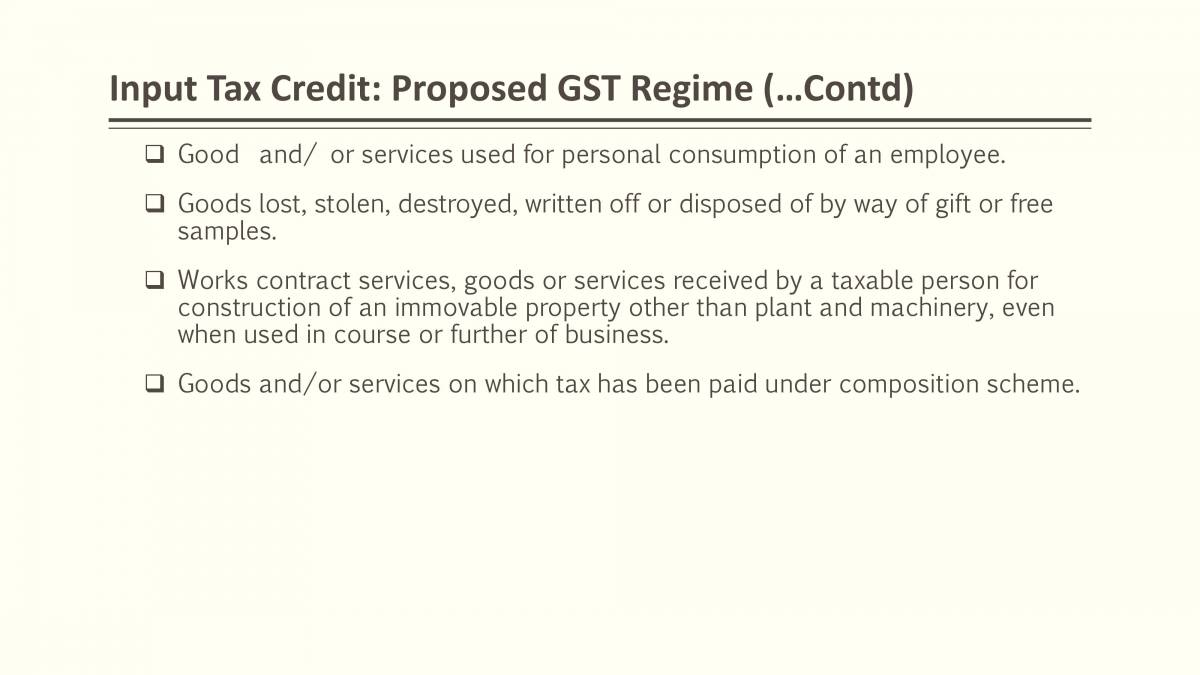

Blocked input tax credit under GST – #24

Blocked input tax credit under GST – #24

List of Goods Services Not Eligible for Input Tax Credit – #25

List of Goods Services Not Eligible for Input Tax Credit – #25

Question 2 AB Pte Ltd (“ABPL”) is a Singapore | Chegg.com – #26

Question 2 AB Pte Ltd (“ABPL”) is a Singapore | Chegg.com – #26

- gst applicable

- generation-skipping trust diagram

- innovative diwali gift hampers

Trends and Innovations to Expect in the Future of GST Payments – #27

Trends and Innovations to Expect in the Future of GST Payments – #27

- no gst logo

- diwali gift for employees under 2000

- transfer tax formula

Plastic Multicolor Corporate Diwali Gifts For Employees Under 300, For Every Occassion at Rs 299/piece in New Delhi – #28

Plastic Multicolor Corporate Diwali Gifts For Employees Under 300, For Every Occassion at Rs 299/piece in New Delhi – #28

A Guide to Gifts for your Clients and Employees – #29

A Guide to Gifts for your Clients and Employees – #29

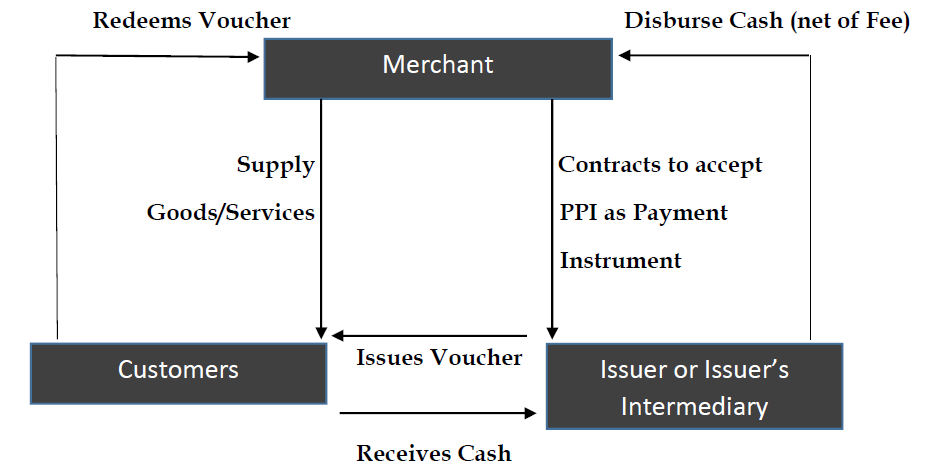

Vouchers – GST Implication – #30

Vouchers – GST Implication – #30

GST | Promotional Scheme: Gift or not? The confusion over GST on promotional schemes run by businesses – #31

GST | Promotional Scheme: Gift or not? The confusion over GST on promotional schemes run by businesses – #31

GST: Is input tax credit available for tax paid on mobiles given to staff? – #32

GST: Is input tax credit available for tax paid on mobiles given to staff? – #32

Diwali gift hampers box/Diwali gifts for corporate employees-1 designer tray+Handmade chocolate box+4 decorated diya for Diwali decoration+figurine showpiece+rangoli colours+Diwali greeting card : Amazon.in: Grocery & Gourmet Foods – #33

Diwali gift hampers box/Diwali gifts for corporate employees-1 designer tray+Handmade chocolate box+4 decorated diya for Diwali decoration+figurine showpiece+rangoli colours+Diwali greeting card : Amazon.in: Grocery & Gourmet Foods – #33

- service tax example

Ineligible ITC under GST: Complete list with example. – #34

Ineligible ITC under GST: Complete list with example. – #34

Gift Under GST: What Is And Isn’t Taxable – #35

Gift Under GST: What Is And Isn’t Taxable – #35

Ways to give an Employee Christmas Bonus – #36

Ways to give an Employee Christmas Bonus – #36

![Opinion] Taxability of Gift Coupons under GST Opinion] Taxability of Gift Coupons under GST](https://img.etimg.com/thumb/width-1200,height-1200,imgsize-149709,resizemode-75,msid-81884612/news/economy/finance/confusion-over-when-to-levy-gst-on-gift-vouchers-and-gift-cards-finally-gets-cleared.jpg) Opinion] Taxability of Gift Coupons under GST – #37

Opinion] Taxability of Gift Coupons under GST – #37

Place of Supply of Goods – #38

Place of Supply of Goods – #38

Work Lady Women’s Day Corporate Gift Hamper in bulk for corporate gifting | Promotional Curated Gift Hampers wholesale distributor & supplier in Mumbai India – #39

Work Lady Women’s Day Corporate Gift Hamper in bulk for corporate gifting | Promotional Curated Gift Hampers wholesale distributor & supplier in Mumbai India – #39

Christmas Gift Ideas Without Falling Into Tax Traps | Chan & Naylor – #40

Christmas Gift Ideas Without Falling Into Tax Traps | Chan & Naylor – #40

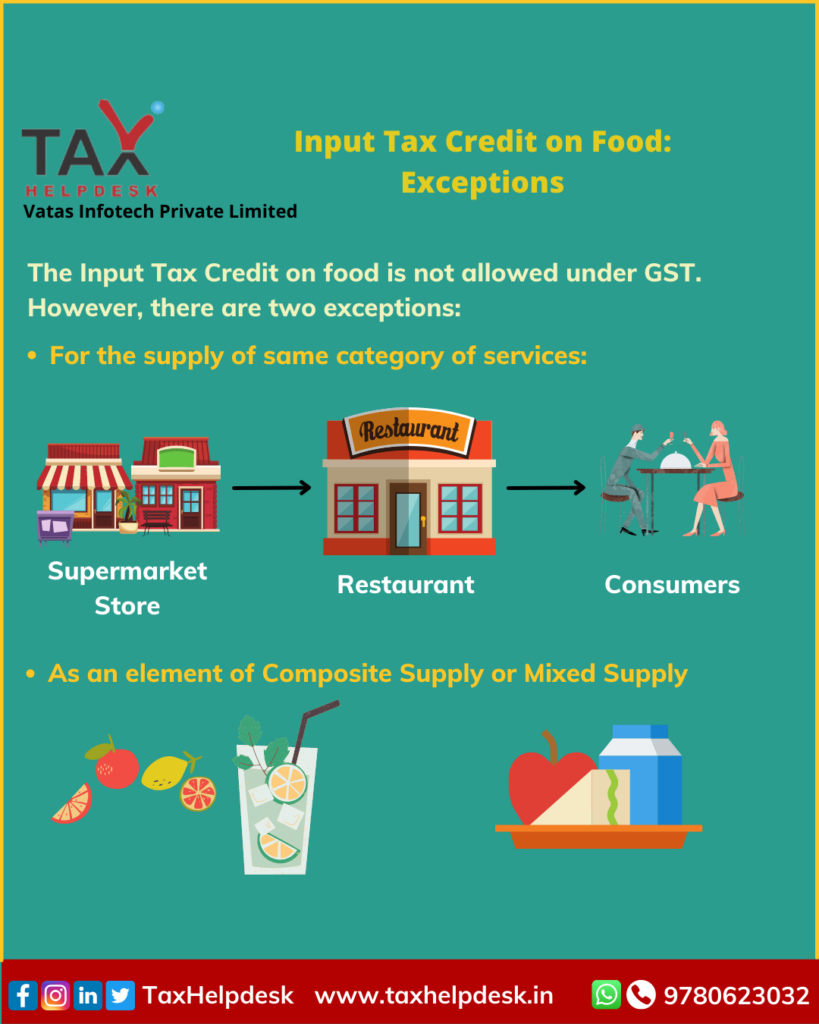

GST on Supply of food to employees and contract workers – #41

GST on Supply of food to employees and contract workers – #41

Vouchers – Whether Goods or Services, leviable to GST and corresponding GST Credit on same | A2Z Taxcorp LLP – #42

Vouchers – Whether Goods or Services, leviable to GST and corresponding GST Credit on same | A2Z Taxcorp LLP – #42

Tax Update: Trust 1041 & Gift Tax | Marcum LLP | Accountants and Advisors – #43

Tax Update: Trust 1041 & Gift Tax | Marcum LLP | Accountants and Advisors – #43

Can I claim the GST input credit on the GST that we pay for a luxury car that I buy in a company’s name? – Quora – #44

Can I claim the GST input credit on the GST that we pay for a luxury car that I buy in a company’s name? – Quora – #44

Common Mistakes in Life Insurance Arrangements – #45

Common Mistakes in Life Insurance Arrangements – #45

Solved Imagine you are working as a graduate tax accountant | Chegg.com – #46

Solved Imagine you are working as a graduate tax accountant | Chegg.com – #46

Bulwark Technologies (@bulwarkllc) / X – #47

Bulwark Technologies (@bulwarkllc) / X – #47

Rudd Mantell Accountants – #48

Rudd Mantell Accountants – #48

INELIGIBLE INPUT TAX CREDIT (ITC) UNDER GST – Msa – #49

INELIGIBLE INPUT TAX CREDIT (ITC) UNDER GST – Msa – #49

Input Tax Credit under Goods and Services Tax Act | RJA – #50

Input Tax Credit under Goods and Services Tax Act | RJA – #50

Is GST applicable on gifts by Employer to Employee? – #51

Is GST applicable on gifts by Employer to Employee? – #51

Northland Perfect Diwali Gift Hamper for Employee Diwali Corporate Gift Hampers Corporate Diwali Gifts for Clients Diwali Gifts for Employees : Amazon.in: Office Products – #52

Northland Perfect Diwali Gift Hamper for Employee Diwali Corporate Gift Hampers Corporate Diwali Gifts for Clients Diwali Gifts for Employees : Amazon.in: Office Products – #52

How to report GST on gift vouchers | Small Business Development Corporation – #53

How to report GST on gift vouchers | Small Business Development Corporation – #53

) CBIC on X: “Gifts upto a value of Rs.50,000/- per year by an employer to his employee are exempted. https://t.co/scZnMPE5Mw” / X – #54

CBIC on X: “Gifts upto a value of Rs.50,000/- per year by an employer to his employee are exempted. https://t.co/scZnMPE5Mw” / X – #54

GST in Transaction between Employer and Employee – #55

GST in Transaction between Employer and Employee – #55

No GST leviable on service of display of donor’s name in the premises of charitable organisations receiving donation or gifts | A2Z Taxcorp LLP – #56

No GST leviable on service of display of donor’s name in the premises of charitable organisations receiving donation or gifts | A2Z Taxcorp LLP – #56

GST: Perks, gifts to employees may come under GST – #57

GST: Perks, gifts to employees may come under GST – #57

Empire Accountants – Can I claim it? Christmas Parties and Client Gifts – #58

Empire Accountants – Can I claim it? Christmas Parties and Client Gifts – #58

2023 Tax Rates And Deduction Amounts – Sales Taxes: VAT, GST – United States – #59

2023 Tax Rates And Deduction Amounts – Sales Taxes: VAT, GST – United States – #59

Calculate GST on Flat Purchase | GST On Under Construction Property – Kotak Bank – #60

Calculate GST on Flat Purchase | GST On Under Construction Property – Kotak Bank – #60

What is a GST Invoice: Components, Formats & Rules | 5paisa – #61

What is a GST Invoice: Components, Formats & Rules | 5paisa – #61

India: Gifting this festive period – with some GST | Rödl & Partner – #62

India: Gifting this festive period – with some GST | Rödl & Partner – #62

Printed Diwali Gift for Employees Under 500, Size: 11×7.5x2inch at Rs 605/piece in Mumbai – #63

Printed Diwali Gift for Employees Under 500, Size: 11×7.5x2inch at Rs 605/piece in Mumbai – #63

Practical Case Studies on Input Tax Credit (ITC) – #64

Practical Case Studies on Input Tax Credit (ITC) – #64

Diwali Gifts For Employees Under 1000 at Rs 700/pack | Diwali Gifts in New Delhi | ID: 21482073848 – #65

Diwali Gifts For Employees Under 1000 at Rs 700/pack | Diwali Gifts in New Delhi | ID: 21482073848 – #65

Decoding GST: Impact of Free Gifts on Input Tax Credit – #66

Decoding GST: Impact of Free Gifts on Input Tax Credit – #66

Buy Gift Ideas for Women’s Day Celebration in Office Including Temperature Water Bottle, Ceramic Mug | Women’s Day Corporate Gifts | Women’s Day Gift for Ladies | Womens Day Gift for Employees – #67

Buy Gift Ideas for Women’s Day Celebration in Office Including Temperature Water Bottle, Ceramic Mug | Women’s Day Corporate Gifts | Women’s Day Gift for Ladies | Womens Day Gift for Employees – #67

Diwali bonuses to gift hampers: How companies are rewarding employees – PANORAMA BusinessToday – #68

Diwali bonuses to gift hampers: How companies are rewarding employees – PANORAMA BusinessToday – #68

What Are the GST Implications for Gift Cards in India? – #69

What Are the GST Implications for Gift Cards in India? – #69

What are the tax implications of giving gifts to staff? – #70

What are the tax implications of giving gifts to staff? – #70

No GST on sanitary napkins shows shift in government’s priorities | Latest News India – Hindustan Times – #71

No GST on sanitary napkins shows shift in government’s priorities | Latest News India – Hindustan Times – #71

Black New Employee Welcome Gift Set Kit, For Gifting at Rs 850/set in Mumbai – #72

Black New Employee Welcome Gift Set Kit, For Gifting at Rs 850/set in Mumbai – #72

3.11.106 Estate and Gift Tax Returns | Internal Revenue Service – #73

3.11.106 Estate and Gift Tax Returns | Internal Revenue Service – #73

Due on or before October 2,2022@11:55PM Homework One | Chegg.com – #74

Due on or before October 2,2022@11:55PM Homework One | Chegg.com – #74

What You Should Know About Tax Treatment of Gifts to Employee? – #75

What You Should Know About Tax Treatment of Gifts to Employee? – #75

Black Leather Employee Gift Hamper, For Promotional Gifting at Rs 1799/piece in Pune – #76

Black Leather Employee Gift Hamper, For Promotional Gifting at Rs 1799/piece in Pune – #76

GST on Freelancers – Applicability & Rates – #77

GST on Freelancers – Applicability & Rates – #77

Are gifts to your employees, clients, and suppliers claimable as a business expense? – #78

Are gifts to your employees, clients, and suppliers claimable as a business expense? – #78

Impact Of GST On India’s IT Sector – #79

Impact Of GST On India’s IT Sector – #79

Countdown for Gift and Estate Tax Exemptions | Charles Schwab – #80

Countdown for Gift and Estate Tax Exemptions | Charles Schwab – #80

End of Year Gifts / Christmas Gifts + Accounting — OAK Business Services – #81

End of Year Gifts / Christmas Gifts + Accounting — OAK Business Services – #81

Giving away goods for free? GST may be accountable even if it’s for your business purpose – #82

Giving away goods for free? GST may be accountable even if it’s for your business purpose – #82

GST won’t apply on gifts worth up to Rs50,000 from employer: Government | Mint – #83

GST won’t apply on gifts worth up to Rs50,000 from employer: Government | Mint – #83

Top 5 GST rules that retailers must know! – Indian Retailer – #84

Top 5 GST rules that retailers must know! – Indian Retailer – #84

News: GST Rules: No GST on gifts to employees up to ₹50,000 | SoOLEGAL – #85

News: GST Rules: No GST on gifts to employees up to ₹50,000 | SoOLEGAL – #85

Know all about Taxable Event under GST – #86

Know all about Taxable Event under GST – #86

FBT & tax rules: gifting to employees and clients | Beany Australia | Online Accounting | Xero | Tax Advice – #87

FBT & tax rules: gifting to employees and clients | Beany Australia | Online Accounting | Xero | Tax Advice – #87

GST Rates in India 2024 – List of Goods and Service Tax Rates, Slab and Revision – #88

GST Rates in India 2024 – List of Goods and Service Tax Rates, Slab and Revision – #88

Why You Should File Non-Taxable Gifts with Your 2021 Taxes – #89

Why You Should File Non-Taxable Gifts with Your 2021 Taxes – #89

Business Tax Tips – Are staff and client gifts tax-deductible and when does FBT apply? – #90

Business Tax Tips – Are staff and client gifts tax-deductible and when does FBT apply? – #90

Gifts to Dealers and “Shagun” during Marriage of Dealers and Staff are Effective Tools for Business Promotion and Social Welfare, Deductible: ITAT – #91

Gifts to Dealers and “Shagun” during Marriage of Dealers and Staff are Effective Tools for Business Promotion and Social Welfare, Deductible: ITAT – #91

Diwali Gift for Office Employees GDH603 at Rs 1499/box | Diwali Gifts in Mumbai | ID: 26737547048 – #92

Diwali Gift for Office Employees GDH603 at Rs 1499/box | Diwali Gifts in Mumbai | ID: 26737547048 – #92

.jpeg) TimeDock™ Swipe Cards – Employee time clock badges (Barcode & NFC) – #93

TimeDock™ Swipe Cards – Employee time clock badges (Barcode & NFC) – #93

- diwali gifts for employees home appliances

- vouchers

- gift tax

Gift Tax Australia – Employee gifts and parties | DPM – #94

Gift Tax Australia – Employee gifts and parties | DPM – #94

GST on Diwali Gifts|Input Tax Credit Reversal Gift to Employee &Customer|Schedule1|Related Parties – YouTube – #95

GST on Diwali Gifts|Input Tax Credit Reversal Gift to Employee &Customer|Schedule1|Related Parties – YouTube – #95

Angroos The Classic Corporate Gift Box With Office Supplies corporate gifts | corporate gifts for employees | corporate gifts for men | corporate gifts for women : Amazon.in: Grocery & Gourmet Foods – #96

Angroos The Classic Corporate Gift Box With Office Supplies corporate gifts | corporate gifts for employees | corporate gifts for men | corporate gifts for women : Amazon.in: Grocery & Gourmet Foods – #96

Northland Diwali Ganesha Gift Hamper for Employee Diwali Corporate Gift Hampers Diwali Gift Items Diwali Corporate Gifts Diwali Gifts for Clients Diwali Gifts for Employees : Amazon.in: Home & Kitchen – #97

Northland Diwali Ganesha Gift Hamper for Employee Diwali Corporate Gift Hampers Diwali Gift Items Diwali Corporate Gifts Diwali Gifts for Clients Diwali Gifts for Employees : Amazon.in: Home & Kitchen – #97

Confusion over when to levy GST on gift vouchers and gift cards finally gets cleared – The Economic Times – #98

Confusion over when to levy GST on gift vouchers and gift cards finally gets cleared – The Economic Times – #98

Tax Impact of sale of Fixed Assets by Company to its employees – #99

Tax Impact of sale of Fixed Assets by Company to its employees – #99

Understanding Income Tax on Gifts Received in India: Rules, Exceptions, and Valuation” – #100

Understanding Income Tax on Gifts Received in India: Rules, Exceptions, and Valuation” – #100

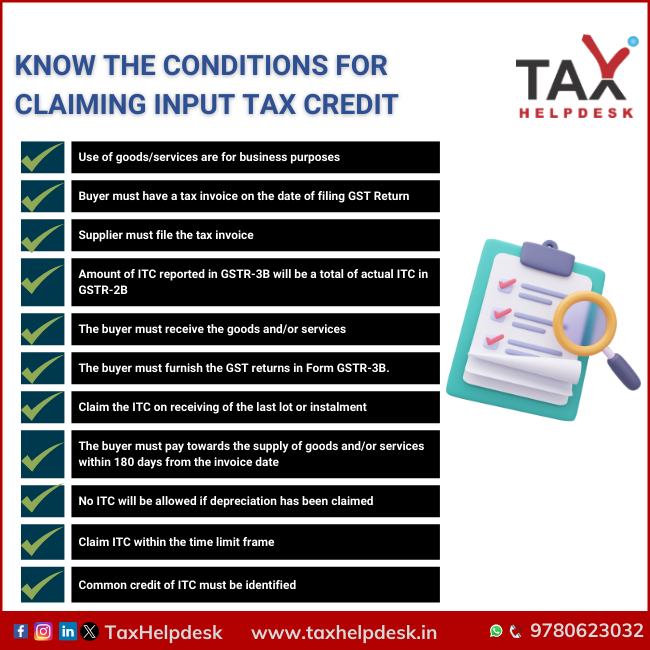

) Input Tax Credit Under GST – How To Claim & Calculation Method – #101

Input Tax Credit Under GST – How To Claim & Calculation Method – #101

EMPLOYER-EMPLOYEE & GST – #102

EMPLOYER-EMPLOYEE & GST – #102

- generation skipping tax example

- no gst png

- generation skipping transfer tax

Gifts with Tax Benefits: Guide to Employer Gift Tax Laws – #103

Gifts with Tax Benefits: Guide to Employer Gift Tax Laws – #103

Guide to GST – Basic Concepts that you Need to Know – #104

Guide to GST – Basic Concepts that you Need to Know – #104

Travel, meals, gifts and entertainment – #105

Travel, meals, gifts and entertainment – #105

GST: Gifts above Rs 50,000 per year by an employer subject to GST: Government – The Economic Times – #106

GST: Gifts above Rs 50,000 per year by an employer subject to GST: Government – The Economic Times – #106

Taxmann Virtual Books – #107

Taxmann Virtual Books – #107

NDR Associates-Yogesh | Bangalore – #108

NDR Associates-Yogesh | Bangalore – #108

GST Rates 2020 – Complete List of Goods and Services Tax Slabs – #109

GST Rates 2020 – Complete List of Goods and Services Tax Slabs – #109

Buy Editable Employee of the Quarter, Printable Employee Gift Award, Gift Certificate Template, Custom Award, Personalized Gifts Download Jet123 Online in India – Etsy – #110

Buy Editable Employee of the Quarter, Printable Employee Gift Award, Gift Certificate Template, Custom Award, Personalized Gifts Download Jet123 Online in India – Etsy – #110

Goods and Service Tax: Meaning and Its Impact on Diwali Gifts – #111

Goods and Service Tax: Meaning and Its Impact on Diwali Gifts – #111

Christmas Party & Gift Deductions Made Easy | TSP Accountants – #112

Christmas Party & Gift Deductions Made Easy | TSP Accountants – #112

Women’s day gift ideas for colleagues with Temperature water bottle, Greeting card, Chocolates and more | women’s day gift hampers | womens day gift for employees | women’s day corporate gifts : Amazon.in: Grocery & Gourmet Foods – #113

Women’s day gift ideas for colleagues with Temperature water bottle, Greeting card, Chocolates and more | women’s day gift hampers | womens day gift for employees | women’s day corporate gifts : Amazon.in: Grocery & Gourmet Foods – #113

Totally Solved! GST Taxability on Vouchers with Current Rate – #114

Totally Solved! GST Taxability on Vouchers with Current Rate – #114

Do I need GST for a trademark? – Vakilsearch – #115

Do I need GST for a trademark? – Vakilsearch – #115

GST Complete Summaries – PowerPoint Slides – LearnPick India – #116

GST Complete Summaries – PowerPoint Slides – LearnPick India – #116

No GST on issuance of Prepaid Payment Instrument vouchers | A2Z Taxcorp LLP – #117

No GST on issuance of Prepaid Payment Instrument vouchers | A2Z Taxcorp LLP – #117

During this festive season: consider your FBT obligations – #118

During this festive season: consider your FBT obligations – #118

Christmas parties, gifts and FBT – Marsh & Partners | Brisbane Accountants – #119

Christmas parties, gifts and FBT – Marsh & Partners | Brisbane Accountants – #119

New GST rule on house rent: Do you have to pay 18% tax? | Mint – #120

New GST rule on house rent: Do you have to pay 18% tax? | Mint – #120

- electronic diwali gifts for employees

- diwali gift ideas for corporates

- gst rates

LED BY CM, PUNJAB CABINET GIVES DIWALI GIFT TO TRADERS BY INTRODUCING OTS OF PRE-GST ARREARS | The Voice of Chandigarh – #121

LED BY CM, PUNJAB CABINET GIVES DIWALI GIFT TO TRADERS BY INTRODUCING OTS OF PRE-GST ARREARS | The Voice of Chandigarh – #121

GST Treatment on Fringe Benefits Provided to Employees | Crowe Singapore – #122

GST Treatment on Fringe Benefits Provided to Employees | Crowe Singapore – #122

Employee Reimbursement under GST – #123

Employee Reimbursement under GST – #123

Diwali gift for govt employees and pensioners: Cabinet hikes DA by 5% | Economy & Policy News – Business Standard – #124

Diwali gift for govt employees and pensioners: Cabinet hikes DA by 5% | Economy & Policy News – Business Standard – #124

Solved (Commission assignment Problem Three – 11 mmission | Chegg.com – #125

Solved (Commission assignment Problem Three – 11 mmission | Chegg.com – #125

Employee Joining Kit Welcome Kit Combo Executive Gift Set at Rs 499/piece | Employee Joining Kits in New Delhi | ID: 24018756155 – #126

Employee Joining Kit Welcome Kit Combo Executive Gift Set at Rs 499/piece | Employee Joining Kits in New Delhi | ID: 24018756155 – #126

Imagine you are working as a graduate tax accountant | Chegg.com – #127

Imagine you are working as a graduate tax accountant | Chegg.com – #127

ITC – Sales promotion vs gifts under GST – #128

ITC – Sales promotion vs gifts under GST – #128

Question 3 10 marks Safe Plus Solution (SPS) is an | Chegg.com – #129

Question 3 10 marks Safe Plus Solution (SPS) is an | Chegg.com – #129

Goods and Services Tax Applicability on Employees Structure | SAG Infotech – #130

Goods and Services Tax Applicability on Employees Structure | SAG Infotech – #130

What Are the Legal and Tax Implications of Using Gift Cards in India? – #131

What Are the Legal and Tax Implications of Using Gift Cards in India? – #131

GST on Handicraft Products – Legal Suvidha Providers – #132

GST on Handicraft Products – Legal Suvidha Providers – #132

How will GST impact the Indian economy | Mint – #133

How will GST impact the Indian economy | Mint – #133

Can a company gift a vehicle to an employee in India without tax? – Quora – #134

Can a company gift a vehicle to an employee in India without tax? – Quora – #134

Articles – #135

Articles – #135

GST On Employees & Employee Benefits – #136

GST On Employees & Employee Benefits – #136

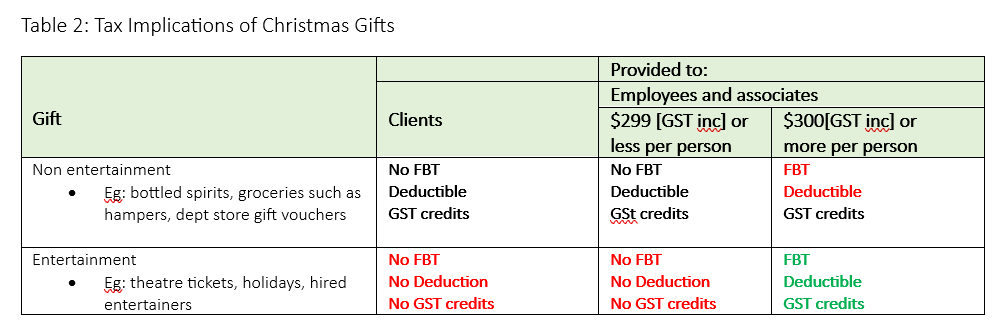

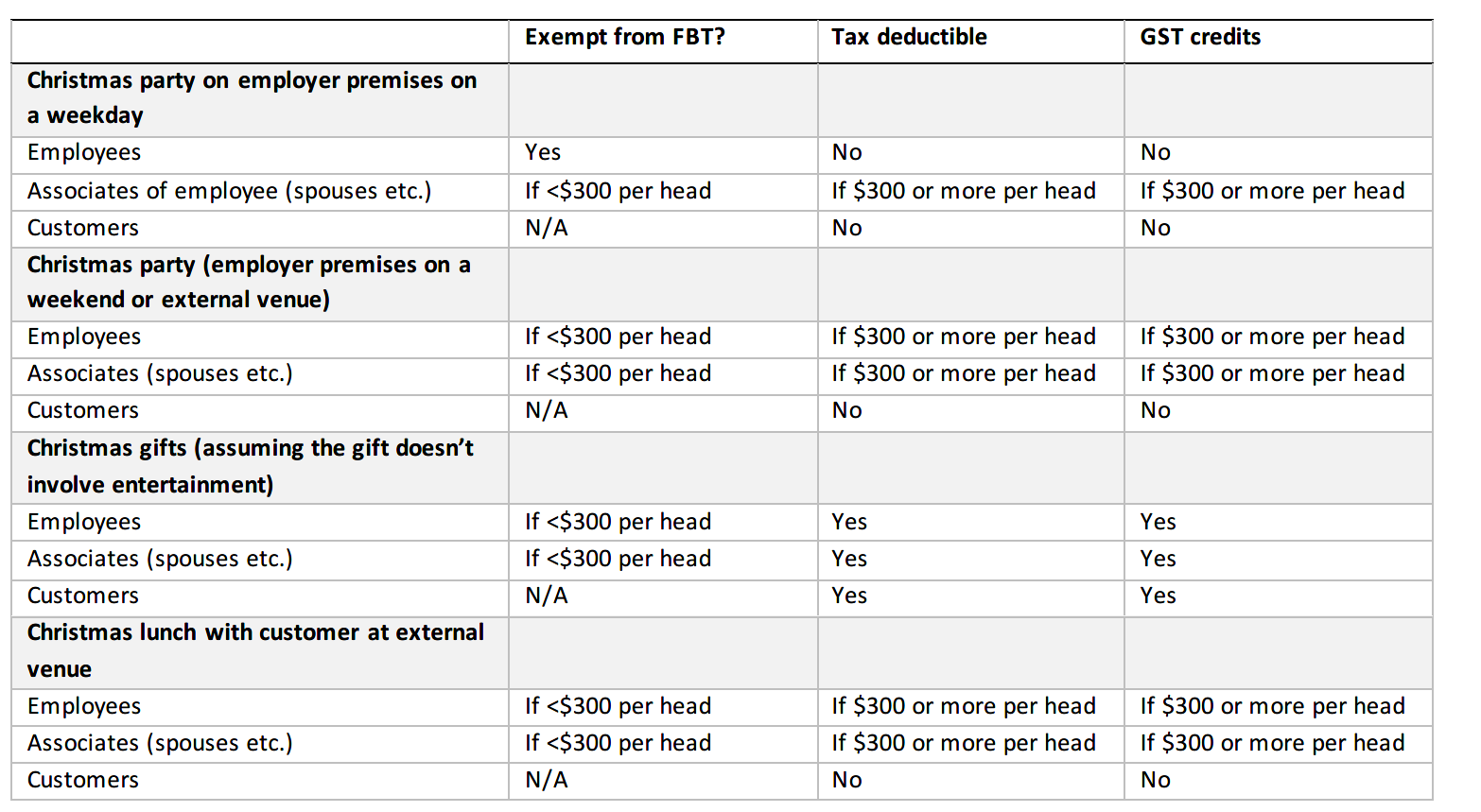

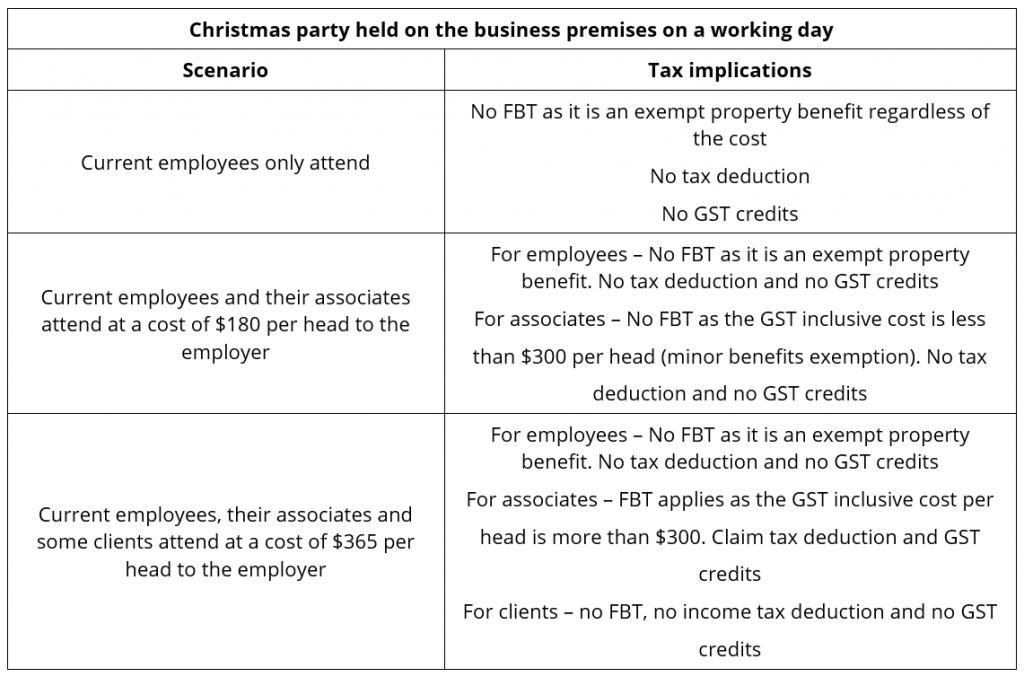

Tax implications of Christmas party – KMT Partners – #137

Tax implications of Christmas party – KMT Partners – #137

Taxability of Gifts – #138

Taxability of Gifts – #138

Madras high court clarifies on gift voucher GST – Times of India – #139

Madras high court clarifies on gift voucher GST – Times of India – #139

14 Cases where Input Tax Credit cannot be availed under GST – #140

14 Cases where Input Tax Credit cannot be availed under GST – #140

Personalized Office Gift Set , Employee Appreciation , Customized Accessories at Rs 2299/box | Customized Corporate Gift in Delhi | ID: 2852739098088 – #141

Personalized Office Gift Set , Employee Appreciation , Customized Accessories at Rs 2299/box | Customized Corporate Gift in Delhi | ID: 2852739098088 – #141

Types of GST in India: SGST, CGST, IGST & UTGST | 5paisa – #142

Types of GST in India: SGST, CGST, IGST & UTGST | 5paisa – #142

![Tax Deduction for Christmas Gifts & Parties in Australia [2023] - Key Administration Solutions Tax Deduction for Christmas Gifts & Parties in Australia [2023] - Key Administration Solutions](https://cdn-dkool.nitrocdn.com/ADVowcMiwfTySERahlERRMCCKIkCeGEH/assets/images/optimized/rev-ac91af3/gsthero.com/wp-content/uploads/2021/01/Ineligible-ITC-under-GST.png) Tax Deduction for Christmas Gifts & Parties in Australia [2023] – Key Administration Solutions – #143

Tax Deduction for Christmas Gifts & Parties in Australia [2023] – Key Administration Solutions – #143

Gifts to U.S. Persons | Marcum LLP | Accountants and Advisors – #144

Gifts to U.S. Persons | Marcum LLP | Accountants and Advisors – #144

First Bud Organics Diwali Gift Hamper |4 Varities of Honey with Dia and Card | – #145

First Bud Organics Diwali Gift Hamper |4 Varities of Honey with Dia and Card | – #145

GST on Advertising Services – ITC, Rates, HSN Code & Benefits – #146

GST on Advertising Services – ITC, Rates, HSN Code & Benefits – #146

Generation-Skipping Transfer Taxes – #147

Generation-Skipping Transfer Taxes – #147

Form 709 – Guide 2023 | US Expat Tax Service – #148

Form 709 – Guide 2023 | US Expat Tax Service – #148

Tax Implications of Christmas Parties and Gifts | MGI Parkinson – #149

Tax Implications of Christmas Parties and Gifts | MGI Parkinson – #149

Madras High Court rules that gift vouchers are ‘actionable claims’ in Kalyan Jewellers’ GST levy case – The Retail Jeweller India – #150

Madras High Court rules that gift vouchers are ‘actionable claims’ in Kalyan Jewellers’ GST levy case – The Retail Jeweller India – #150

Taxability of Voucher under GST (Includes E Voucher) – #151

Taxability of Voucher under GST (Includes E Voucher) – #151

GST Guide for Businesses: What is GST & How Does It Work | Square – #152

GST Guide for Businesses: What is GST & How Does It Work | Square – #152

What is E-Invoicing under GST- Definition & Benefits – #153

What is E-Invoicing under GST- Definition & Benefits – #153

Input Tax Credit (ITC) on Diwali Gifts | Blog – #154

Input Tax Credit (ITC) on Diwali Gifts | Blog – #154

Press Information Bureau Government of India Ministry of Finance It is being reported that gifts and perquisites supplied by com – #155

Press Information Bureau Government of India Ministry of Finance It is being reported that gifts and perquisites supplied by com – #155

Giving away goods for free – #156

Giving away goods for free – #156

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #157

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #157

Boost Your Workforce’s Health: Corporate Wellness Gifts 101 – Burnlab.Co – #158

Boost Your Workforce’s Health: Corporate Wellness Gifts 101 – Burnlab.Co – #158

Insights of Valuation Provisions under GST – #159

Insights of Valuation Provisions under GST – #159

Are you ready for GST Audit? – ppt download – #160

Are you ready for GST Audit? – ppt download – #160

Posts: gst on gift to employees

Categories: Gifts

Author: toyotabienhoa.edu.vn