Details more than 201 gift to wife income tax best

Top images of gift to wife income tax by website toyotabienhoa.edu.vn compilation. Gifts Treated as Income. Tax Implications of NRI Spouse Transferring Money to Indian Savings Account – Review Center India. Gift are taxable income or exempted income & how are gift taxed? – Tax Knowledges. Received gold jewellery in a gift? Will it be taxable | Business News

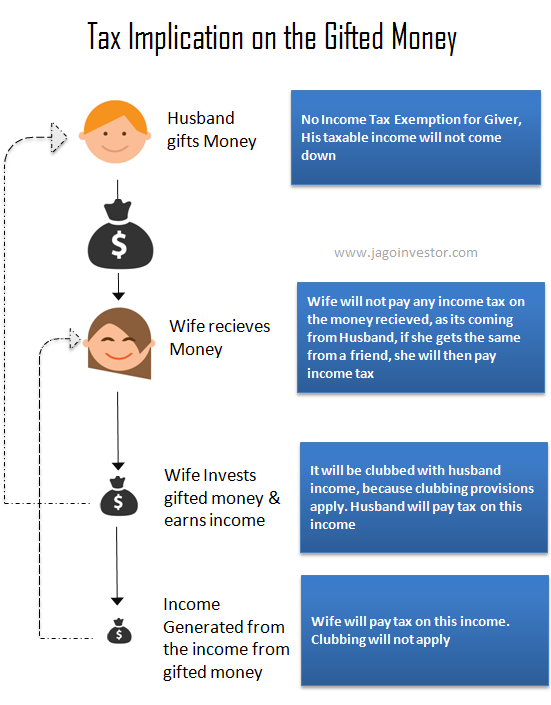

GIFT TAX -TAX ON GIFT BUDGET 2010 | SIMPLE TAX INDIA – #1

GIFT TAX -TAX ON GIFT BUDGET 2010 | SIMPLE TAX INDIA – #1

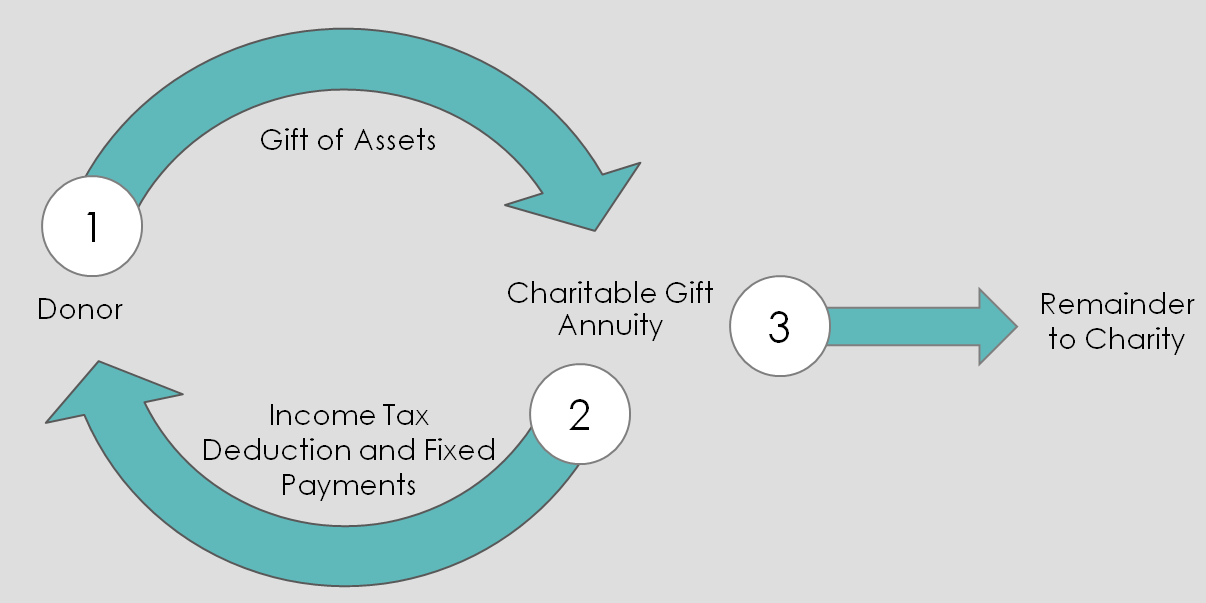

How to Donate to Charity, Get a Tax Break and Have Income for Life – WSJ – #2

How to Donate to Charity, Get a Tax Break and Have Income for Life – WSJ – #2

- 709 gift splitting irs completed sample form 709 sample

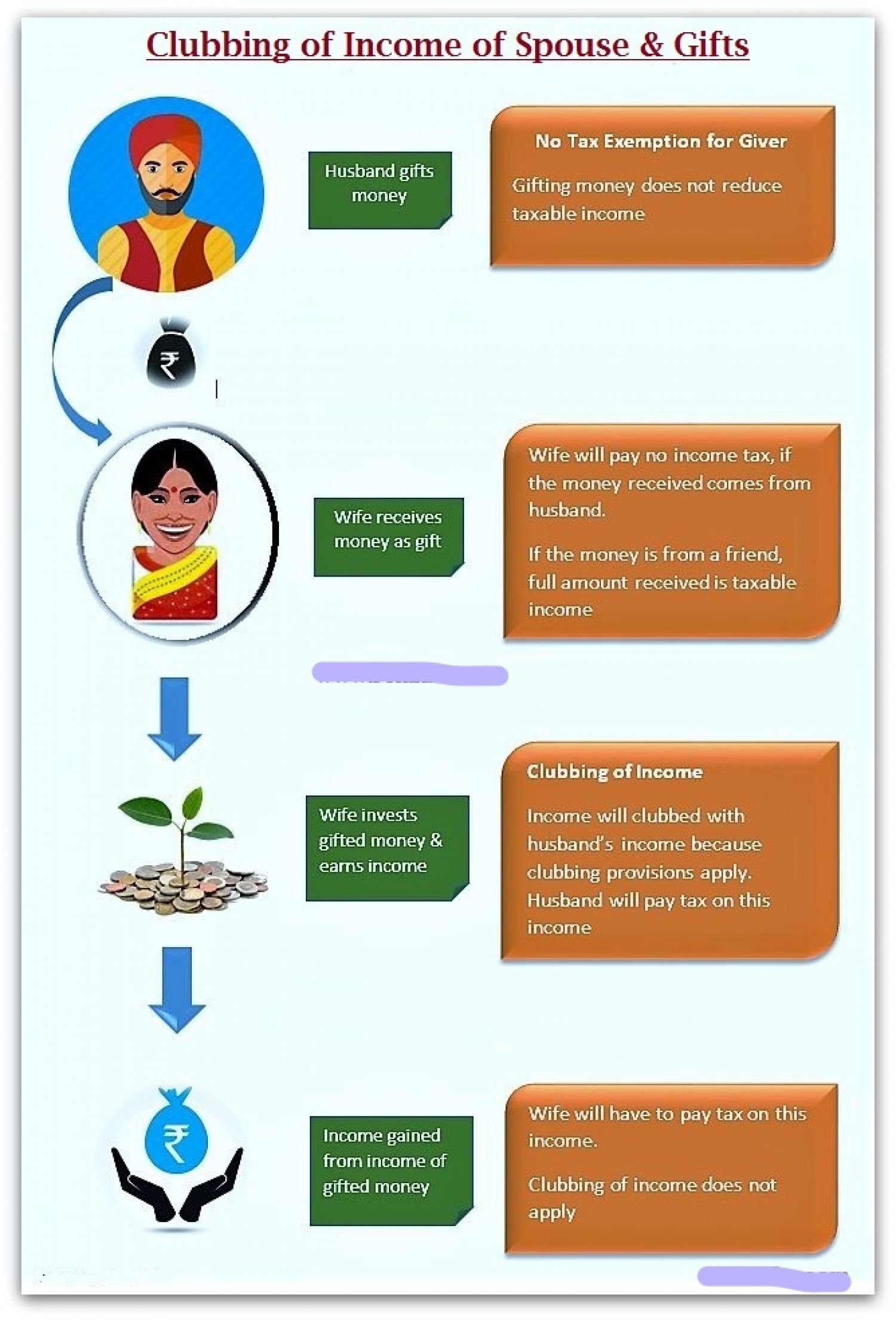

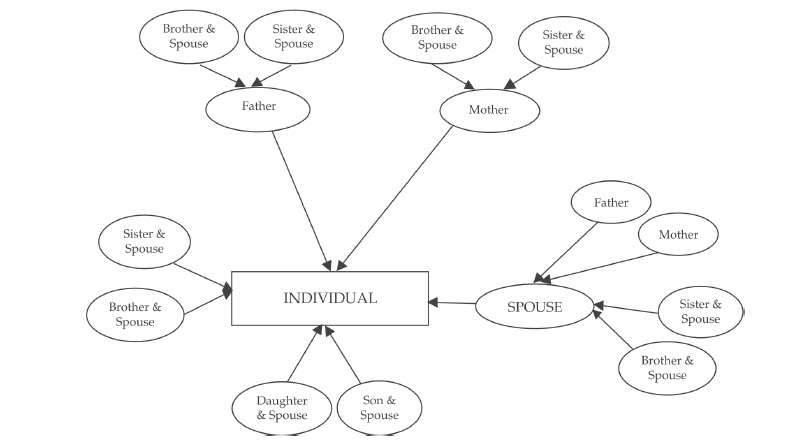

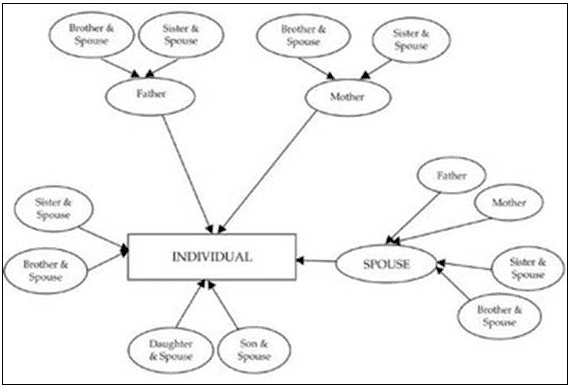

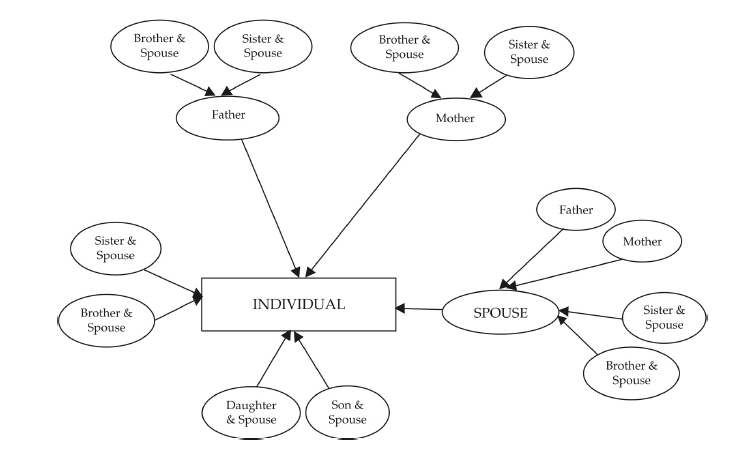

- clubbing of income diagram

- clubbing of income

Gift Tax Rate : r/tax – #4

Gift Tax Rate : r/tax – #4

Step by Step Guide to File ITR 2 Online AY 2024-25 (Full Procedure) – #5

Step by Step Guide to File ITR 2 Online AY 2024-25 (Full Procedure) – #5

Awarded Money In Lawsuit Only Tax-free In Certain Instances – #6

Awarded Money In Lawsuit Only Tax-free In Certain Instances – #6

Income Tax Return Filing Tax liability of Gifts Know Rules, मिला है कोई गिफ्ट तो ITR भरने से पहले जान लें ये बात, वरना आ जाएगा नोटिस | यूटिलिटी News, Times Now – #7

Income Tax Return Filing Tax liability of Gifts Know Rules, मिला है कोई गिफ्ट तो ITR भरने से पहले जान लें ये बात, वरना आ जाएगा नोटिस | यूटिलिटी News, Times Now – #7

Buy Taxation Of Gifts Under The Income Tax Act & Law On Gifts Book Online at Low Prices in India | Taxation Of Gifts Under The Income Tax Act & Law On – #8

Buy Taxation Of Gifts Under The Income Tax Act & Law On Gifts Book Online at Low Prices in India | Taxation Of Gifts Under The Income Tax Act & Law On – #8

- gift chart as per income tax

- gift from relative exempt from income tax

- transfer income example

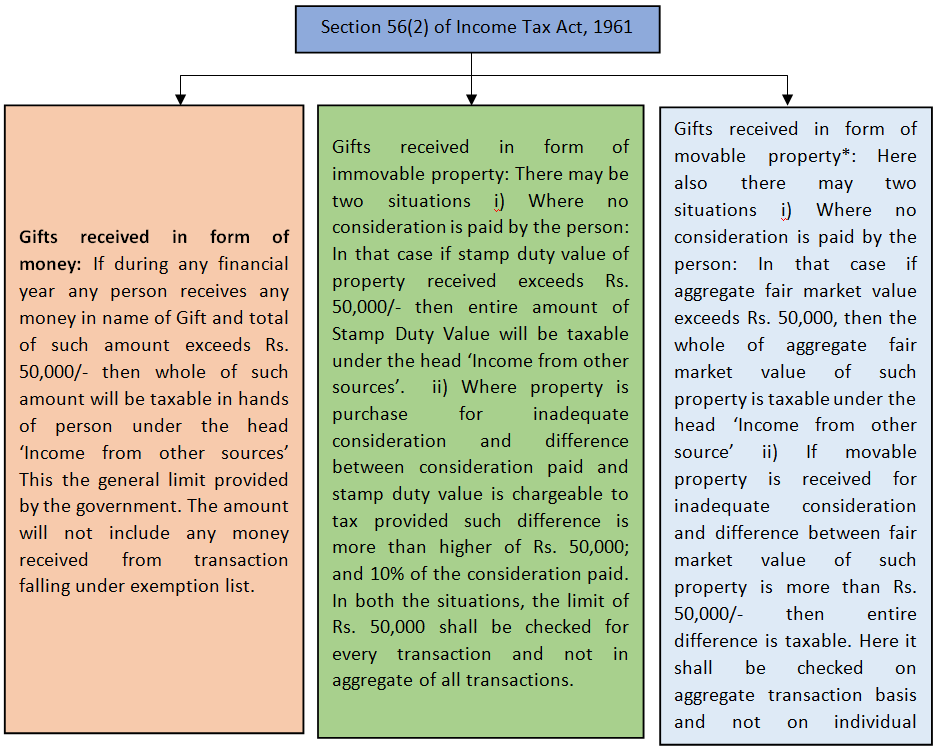

Understanding Section 56(2)(x) of Income Tax Act, 1961: Tax Implications of Gifts Received Without Consideration – Marg ERP Blog – #10

Understanding Section 56(2)(x) of Income Tax Act, 1961: Tax Implications of Gifts Received Without Consideration – Marg ERP Blog – #10

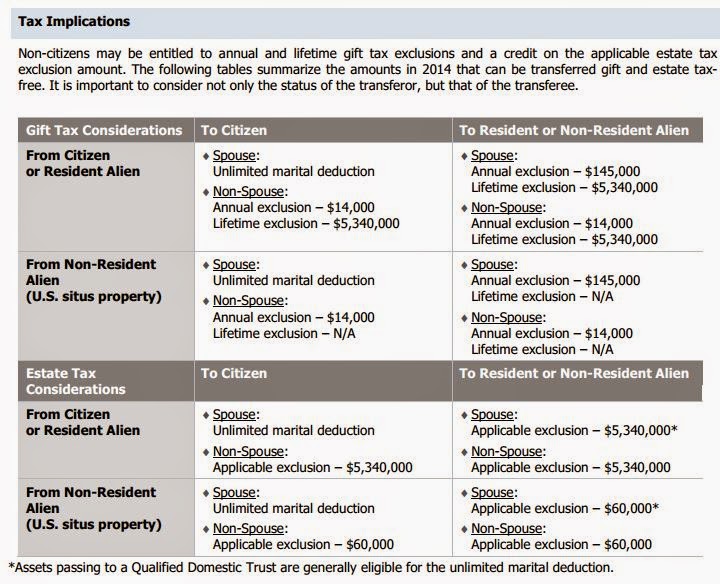

Nonresidents, Think You Are Safe from U.S. Gift and Estate Taxes? Think Again. – The Wolf Group – #11

Nonresidents, Think You Are Safe from U.S. Gift and Estate Taxes? Think Again. – The Wolf Group – #11

ITAT: Property Transferred To Mother

Though Sale Deed Is A Sale And Not Gift,

Taxable As Capital – TheDailyGuardian – #12

Click here to know about Income tax implications on Diwali gifts and bonuses! – #13

Click here to know about Income tax implications on Diwali gifts and bonuses! – #13

5 rules about Income Tax on Gifts received in India & Exemptions – #14

5 rules about Income Tax on Gifts received in India & Exemptions – #14

Buy Luxury Sign India Income Tax Neon Signs for Wall Decor Neon Lights for Bedroom Led Business Signs Suitable for IncomeTax Shop Store Gift Led Art Wall Hanging Decorative Lights Unique Gift – #15

Buy Luxury Sign India Income Tax Neon Signs for Wall Decor Neon Lights for Bedroom Led Business Signs Suitable for IncomeTax Shop Store Gift Led Art Wall Hanging Decorative Lights Unique Gift – #15

Blog – KKC Law – #16

Blog – KKC Law – #16

Cash gift during marriage & income Tax Applucability – #17

Cash gift during marriage & income Tax Applucability – #17

-originalImg-5d9c05bd-fef7-468b-a79a-7b00245b1da1.png) Know about the Income Tax Laws in India Regarding gifts in Cash | Income Tax Laws: पिता की ओर से बेटे को दिए गए गिफ्ट पर क्या है IT नियम, जानिए कितना – #18

Know about the Income Tax Laws in India Regarding gifts in Cash | Income Tax Laws: पिता की ओर से बेटे को दिए गए गिफ्ट पर क्या है IT नियम, जानिए कितना – #18

ECO-11 Elements of Income Tax Solved Assignment 2017-2018 – KHOJINET | IGNOU Solved Assignments 2023-2024 at Discounted Price – #19

ECO-11 Elements of Income Tax Solved Assignment 2017-2018 – KHOJINET | IGNOU Solved Assignments 2023-2024 at Discounted Price – #19

when Gift is taxable ? when gift is Exempted ? | SIMPLE TAX INDIA – #20

when Gift is taxable ? when gift is Exempted ? | SIMPLE TAX INDIA – #20

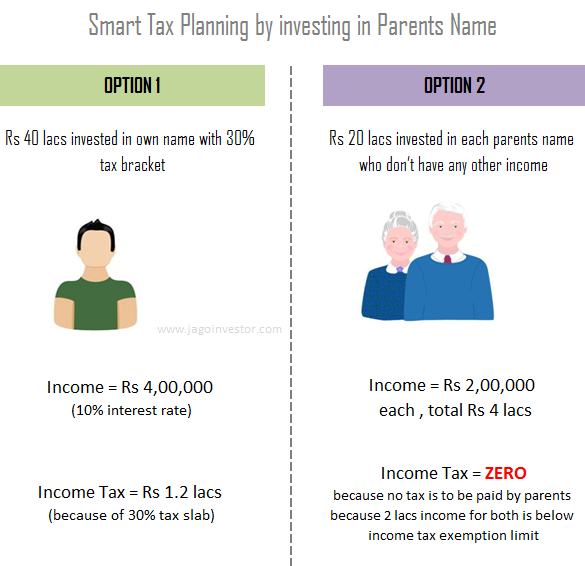

Gift, loan, house rent: How your family can help in saving taxes | TAX – Business Standard – #21

Gift, loan, house rent: How your family can help in saving taxes | TAX – Business Standard – #21

) Edible Gift Ideas for Tax Preparer & Accounting Clients – Totally Chocolate – #22

Edible Gift Ideas for Tax Preparer & Accounting Clients – Totally Chocolate – #22

Tax Planning with the Annual Gift Tax Exclusion – Alloy Silverstein – #23

Tax Planning with the Annual Gift Tax Exclusion – Alloy Silverstein – #23

Gift tax rules to spread Income and investments to Save Tax – #24

Gift tax rules to spread Income and investments to Save Tax – #24

Scan tax documents: Easy online tax preparation | Adobe Acrobat – #25

Scan tax documents: Easy online tax preparation | Adobe Acrobat – #25

What is the purpose of estate and gift taxation – #26

What is the purpose of estate and gift taxation – #26

Tax on gifts received on Diwali : Diwali 2022 – #27

Tax on gifts received on Diwali : Diwali 2022 – #27

GIFT DEED I – PARY & Co. – #28

GIFT DEED I – PARY & Co. – #28

Tejaswini Avhad on LinkedIn: Taxability of gifts under Income Tax act – #29

Tejaswini Avhad on LinkedIn: Taxability of gifts under Income Tax act – #29

Budget 2019: Income tax changes can you expect on July 5 – India Today – #30

Budget 2019: Income tax changes can you expect on July 5 – India Today – #30

All about Income tax on Gifts received in India ! | Fintrakk – #31

All about Income tax on Gifts received in India ! | Fintrakk – #31

- transfer income images

- gift tax example

- gift deed format on stamp paper

गिफ्ट पर टैक्स छूट के नियम 2023 | Income tax on Gift rules in Hindi » PlanMoneyTax – #32

गिफ्ट पर टैक्स छूट के नियम 2023 | Income tax on Gift rules in Hindi » PlanMoneyTax – #32

New Jersey Gift Tax: All You Need to Know | SmartAsset – #33

New Jersey Gift Tax: All You Need to Know | SmartAsset – #33

Personal Tax Tips | CloudBook Online Accountants Ltd – #34

Personal Tax Tips | CloudBook Online Accountants Ltd – #34

📒Tax Waala📒 on Instagram: “Join our Youtube Channel (Link in Bio) . . Gifts from relatives are not taxable under Incometax, however income of gifts in some cases (Limited scenorios) are clubbed – #35

📒Tax Waala📒 on Instagram: “Join our Youtube Channel (Link in Bio) . . Gifts from relatives are not taxable under Incometax, however income of gifts in some cases (Limited scenorios) are clubbed – #35

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #36

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #36

Solved 1. Briefly describe the principal characteristics of | Chegg.com – #37

Solved 1. Briefly describe the principal characteristics of | Chegg.com – #37

Charitable gift annuity helps nonprofits and pays you lifetime income – #38

Charitable gift annuity helps nonprofits and pays you lifetime income – #38

Taxbaility of GIFT – FIBOTA – #39

Taxbaility of GIFT – FIBOTA – #39

What is taxation on Gifts | Investyadnya eBook – #40

What is taxation on Gifts | Investyadnya eBook – #40

Frequently asked questions on Section 54F: the complete guide | Arthgyaan – #41

Frequently asked questions on Section 54F: the complete guide | Arthgyaan – #41

Rules For Taxation Of Gift In India – Labour Law Advisor – #42

Rules For Taxation Of Gift In India – Labour Law Advisor – #42

GIFT TAX UNDER INCOME TAX – Taxmuneem – #43

GIFT TAX UNDER INCOME TAX – Taxmuneem – #43

) Want To Gift Stocks To Your Spouse? Know How They Are Taxed Under The Gift Tax Act (GTA) Of The Income Tax Act. – #44

Want To Gift Stocks To Your Spouse? Know How They Are Taxed Under The Gift Tax Act (GTA) Of The Income Tax Act. – #44

Received gold jewellery in a gift? Will it be taxable | Business News – #45

Received gold jewellery in a gift? Will it be taxable | Business News – #45

- property gift deed

- form 709 example

- gift tax rate

Section 115BAC of Income Tax Act: What is 115bac? Eligibility, Deduction & Calculation – #46

Section 115BAC of Income Tax Act: What is 115bac? Eligibility, Deduction & Calculation – #46

Tax matters: Uncle’s gift is tax free | Tax matters: Uncle’s gift is tax free – #47

Tax matters: Uncle’s gift is tax free | Tax matters: Uncle’s gift is tax free – #47

दोस्तों और रिश्तेदारों से मिलने वाले गिफ्ट पर लगता है टैक्स, जानें आयकर विभाग के नियम – Gifts received from friends and relatives are taxed know the rules of income tax department – #48

दोस्तों और रिश्तेदारों से मिलने वाले गिफ्ट पर लगता है टैक्स, जानें आयकर विभाग के नियम – Gifts received from friends and relatives are taxed know the rules of income tax department – #48

Government presents bill to redefine Wedding gifts in the Income Tax Act. – Maldives News Network – #49

Government presents bill to redefine Wedding gifts in the Income Tax Act. – Maldives News Network – #49

Income Tax On gift Money | How much money is tax free in gift | Section 56 of income tax act 2023 – YouTube – #50

Income Tax On gift Money | How much money is tax free in gift | Section 56 of income tax act 2023 – YouTube – #50

Income Tax: Increased gift for taxpayers, now 0% tax will be levied on this income – informalnewz – #51

Income Tax: Increased gift for taxpayers, now 0% tax will be levied on this income – informalnewz – #51

दिवाली में मिलने वाले इन Gifts और Bonus पर लगेगा Tax, जारी हुआ नया नियम – These gifts and bonuses received in Diwali will be taxed, new rule issued – #52

दिवाली में मिलने वाले इन Gifts और Bonus पर लगेगा Tax, जारी हुआ नया नियम – These gifts and bonuses received in Diwali will be taxed, new rule issued – #52

Five Taxes your Heirs May Pay (or not) After your Death | SSB LLC | Samuel, Sayward, & Baler LLC | Dedham, MA lawyers – #53

Five Taxes your Heirs May Pay (or not) After your Death | SSB LLC | Samuel, Sayward, & Baler LLC | Dedham, MA lawyers – #53

5 Ways to Gift Yourself Tax Savings This Holiday Season – CPA Practice Advisor – #54

5 Ways to Gift Yourself Tax Savings This Holiday Season – CPA Practice Advisor – #54

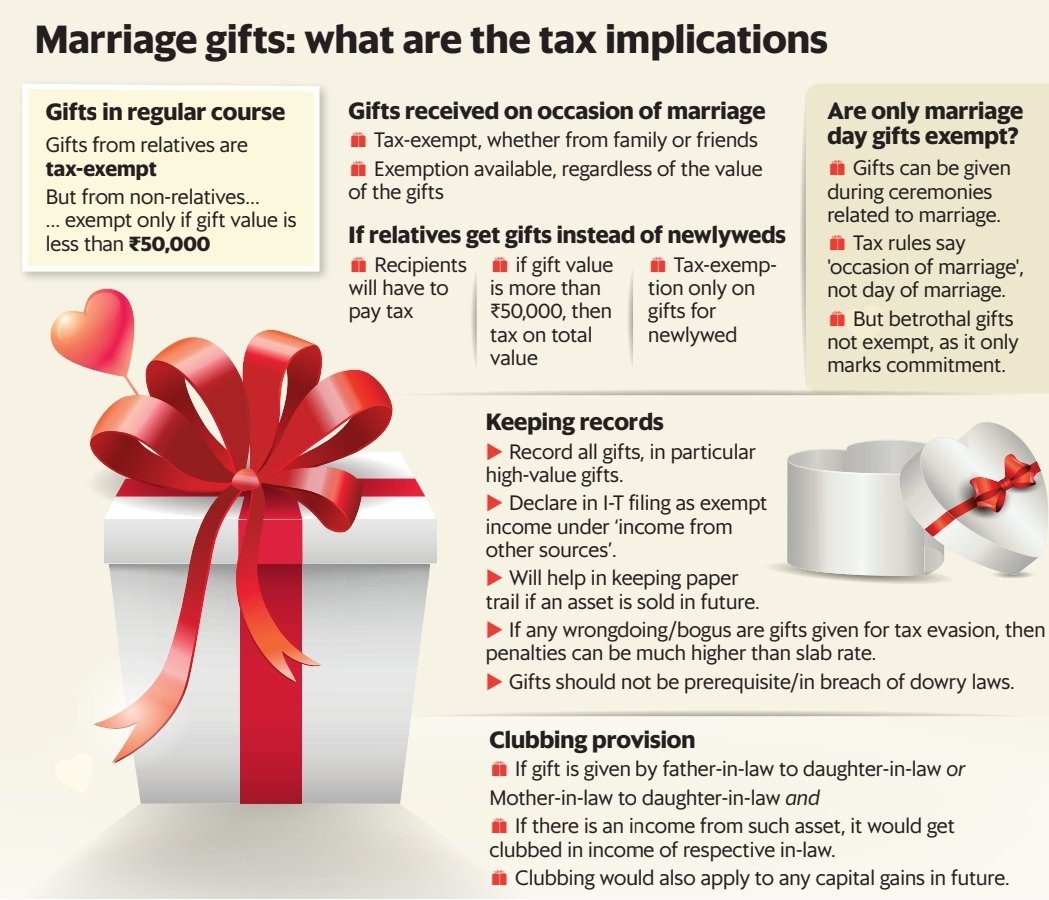

Will my wedding gift be taxed?’ – Rediff.com – #55

Will my wedding gift be taxed?’ – Rediff.com – #55

- 709 2020 gift tax sample completed irs form 709

- gift tax return form 709 example

- gift tax definition

Income tax: Can a member make gift to the HUF without any tax liability? | Mint – #56

Income tax: Can a member make gift to the HUF without any tax liability? | Mint – #56

Gift Tax – Do I Have to Pay Taxes on a Gift | Gift Tax Calculator – #57

Gift Tax – Do I Have to Pay Taxes on a Gift | Gift Tax Calculator – #57

Getting Paid in Crypto? Know Your Tax Rules | Koinly – #58

Getting Paid in Crypto? Know Your Tax Rules | Koinly – #58

Gift में मिलने वाली राशि और संपत्ति पर कितना देना होता है Income Tax, केवल इन्हीं मौकों पर मिलती है छूट – Income Tax on Gift Rules and Benefits rebate on marriage – #59

Gift में मिलने वाली राशि और संपत्ति पर कितना देना होता है Income Tax, केवल इन्हीं मौकों पर मिलती है छूट – Income Tax on Gift Rules and Benefits rebate on marriage – #59

Income Tax payers got a big gift on the new year Income Tax भरने वालों को नए साल पर मिला बड़ा तोहफा, अब नहीं भरना होगा टैक्स, वित्तमंत्री ने दी खुशख़बरी – – #60

Income Tax payers got a big gift on the new year Income Tax भरने वालों को नए साल पर मिला बड़ा तोहफा, अब नहीं भरना होगा टैक्स, वित्तमंत्री ने दी खुशख़बरी – – #60

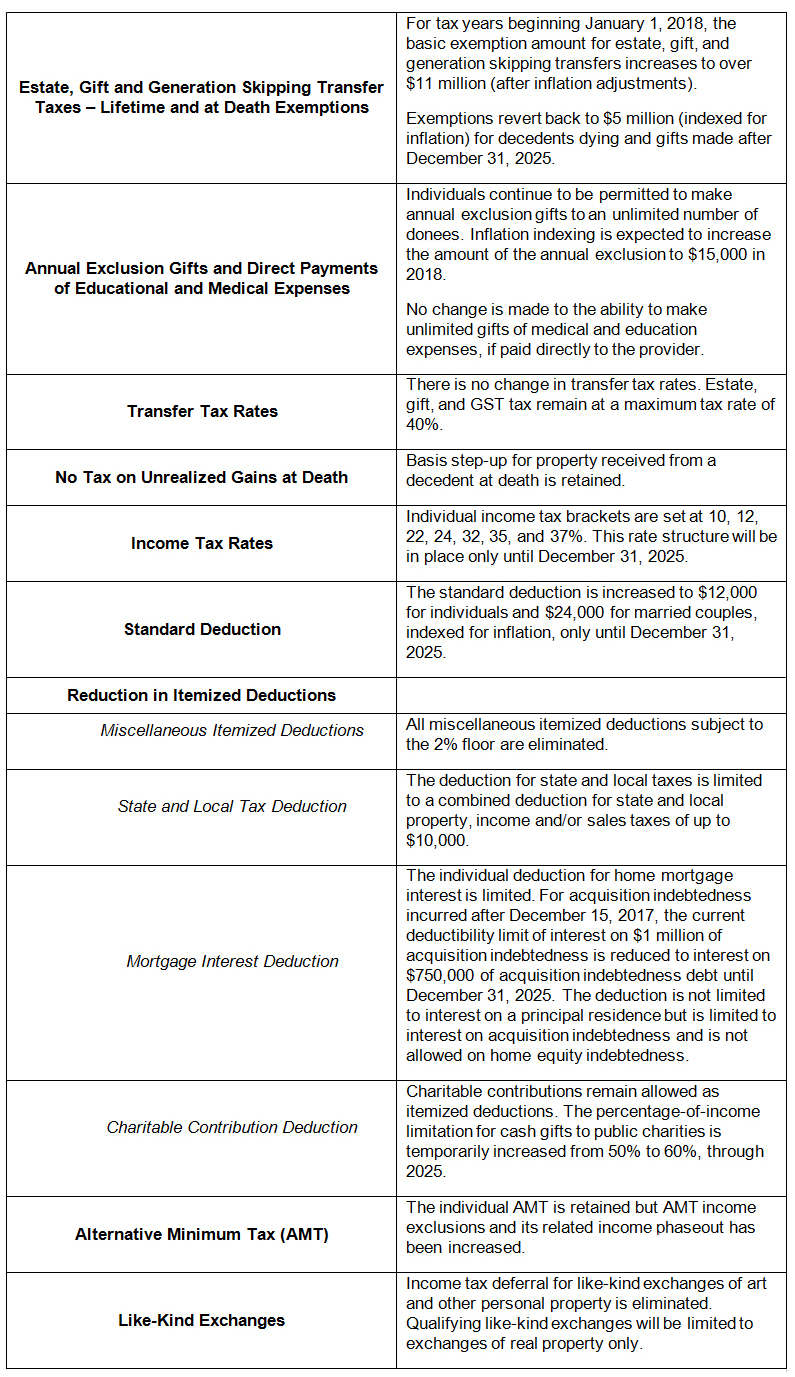

US Gift & Estate Taxes 2022 – Gifts, Transfer Taxes | HTJ Tax – #61

US Gift & Estate Taxes 2022 – Gifts, Transfer Taxes | HTJ Tax – #61

gift deed: Is gift deed a tax-efficient way to transfer assets to legal heirs? – The Economic Times – #62

gift deed: Is gift deed a tax-efficient way to transfer assets to legal heirs? – The Economic Times – #62

How much money can NRIs gift to parents in India? | Arthgyaan – #63

How much money can NRIs gift to parents in India? | Arthgyaan – #63

Amazon.com | muggable Gift For Income Tax Preparer Mom From Son, Daughter – Mother’s Day, Birthday, Or Christmas Gift 11oz, 15oz White Ceramic Mug: Glassware & Drinkware – #64

Amazon.com | muggable Gift For Income Tax Preparer Mom From Son, Daughter – Mother’s Day, Birthday, Or Christmas Gift 11oz, 15oz White Ceramic Mug: Glassware & Drinkware – #64

शादी से पहले जान लें टैक्स का नियम, नहीं तो घर आ सकता है नोटिस – #65

शादी से पहले जान लें टैक्स का नियम, नहीं तो घर आ सकता है नोटिस – #65

Crypto Gift Tax | Your Guide | Koinly – #66

Crypto Gift Tax | Your Guide | Koinly – #66

Inheritance Tax: What It Is, How It’s Calculated, and Who Pays It – #67

Inheritance Tax: What It Is, How It’s Calculated, and Who Pays It – #67

What Is Estate, Gift and Inheritance Tax – Kotak Bank – #68

What Is Estate, Gift and Inheritance Tax – Kotak Bank – #68

Understanding Income Tax on Marriage Gifts: Important Facts You Need to Know | Ebizfiling – #69

Understanding Income Tax on Marriage Gifts: Important Facts You Need to Know | Ebizfiling – #69

Tax Saving: गिफ्ट्स पर भी लगता है टैक्स, लेकिन यह नियम दिलाता है छूट – #70

Tax Saving: गिफ्ट्स पर भी लगता है टैक्स, लेकिन यह नियम दिलाता है छूट – #70

) Any Income On Assets Gifted By You To Spouse Will Be Added To Your Income – #71

Any Income On Assets Gifted By You To Spouse Will Be Added To Your Income – #71

Know About Income Tax on Intraday Trading | 5paisa – #72

Know About Income Tax on Intraday Trading | 5paisa – #72

Income Tax on Gifts: Exemptions and computation – #73

Income Tax on Gifts: Exemptions and computation – #73

Income Taxes Gifts – CartoonStock – #74

Income Taxes Gifts – CartoonStock – #74

Taxancy – Gifts from Relatives is fully tax Free Who is… | Facebook – #75

Taxancy – Gifts from Relatives is fully tax Free Who is… | Facebook – #75

Unearned income: Exploring Unearned Income: A Diverse Range of Earnings – FasterCapital – #76

Unearned income: Exploring Unearned Income: A Diverse Range of Earnings – FasterCapital – #76

- gift tax exemption relatives list

- gift tax returns irs completed sample form 709 sample

- deemed income

Marriage Gifts: Tax implications | Sudha Jhunjhunwala posted on the topic | LinkedIn – #77

Marriage Gifts: Tax implications | Sudha Jhunjhunwala posted on the topic | LinkedIn – #77

Save Tax Through Gifts Se Tax Planning Income Tax Rules, Gift Deed Create # gift #gifttax #taxongift – YouTube – #78

Save Tax Through Gifts Se Tax Planning Income Tax Rules, Gift Deed Create # gift #gifttax #taxongift – YouTube – #78

Gifts by NRIs to Relatives and Friends can be made fully Exempt from Gift Tax – #79

Gifts by NRIs to Relatives and Friends can be made fully Exempt from Gift Tax – #79

What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #80

What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #80

Charitable Gift Annuities – Catholic Community Foundation of Southwest Florida – #81

Charitable Gift Annuities – Catholic Community Foundation of Southwest Florida – #81

Today’s Tax Savings May Not Be Available Tomorrow – Iannuzzi Manetta – #82

Today’s Tax Savings May Not Be Available Tomorrow – Iannuzzi Manetta – #82

What Is Form 709? – #83

What Is Form 709? – #83

The 2022 Gift Tax Return Deadline is Coming Up Soon – News Post – Varney & Associates – #84

The 2022 Gift Tax Return Deadline is Coming Up Soon – News Post – Varney & Associates – #84

A Gift amount can’t be doubted just because donor’s returned income is insufficient to justify it: ITAT – #85

A Gift amount can’t be doubted just because donor’s returned income is insufficient to justify it: ITAT – #85

Do You Need to File a Gift Tax Return? – Nisivoccia – #86

Do You Need to File a Gift Tax Return? – Nisivoccia – #86

Are your Diwali gifts taxable? Know what income tax rules say | Personal Finance News, Times Now – #87

Are your Diwali gifts taxable? Know what income tax rules say | Personal Finance News, Times Now – #87

Income from assets transferred to spouse| clubbing of income – #88

Income from assets transferred to spouse| clubbing of income – #88

Tax | Types of Tax | Direct & Indirect Taxation in India 2023-24 – #89

Tax | Types of Tax | Direct & Indirect Taxation in India 2023-24 – #89

What is the Gift Tax in India and How Does it Affect NRIs? – #90

What is the Gift Tax in India and How Does it Affect NRIs? – #90

1. 2 INVESTMENT & PERSONAL FINANCIAL PLANNING (1 of 2) Business vs. investment activities Investments in financial assets Interest income Tax deferral: – ppt download – #91

1. 2 INVESTMENT & PERSONAL FINANCIAL PLANNING (1 of 2) Business vs. investment activities Investments in financial assets Interest income Tax deferral: – ppt download – #91

2024 Gift Tax Rate: What It Is And How It Works | Bankrate – #92

2024 Gift Tax Rate: What It Is And How It Works | Bankrate – #92

Income Tax Status of Gifts – #93

Income Tax Status of Gifts – #93

IRS Form 709 | H&R Block – #94

IRS Form 709 | H&R Block – #94

Yes, inflation does affect your tax return. Here are 5 things to watch out for. – MarketWatch – #95

Yes, inflation does affect your tax return. Here are 5 things to watch out for. – MarketWatch – #95

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #96

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #96

Income Tax Rules On E-Wallet Or UPI Transactions – Goodreturns – #97

Income Tax Rules On E-Wallet Or UPI Transactions – Goodreturns – #97

GST | Income Tax | Investment on Instagram: “Diwali Gift by employer to employees 👆👆 If you are a Tax Professional, you can become Member of Tax Solution Group✓ (Message inbox) Get – #98

GST | Income Tax | Investment on Instagram: “Diwali Gift by employer to employees 👆👆 If you are a Tax Professional, you can become Member of Tax Solution Group✓ (Message inbox) Get – #98

Gift, Estate and Income Tax Planning Opportunities | Marcum LLP | Accountants and Advisors – #99

Gift, Estate and Income Tax Planning Opportunities | Marcum LLP | Accountants and Advisors – #99

Income Tax Exemption On Gifts | Are The Gifts Above Rs 50,000 Taxable? | Personal Finance – YouTube – #100

Income Tax Exemption On Gifts | Are The Gifts Above Rs 50,000 Taxable? | Personal Finance – YouTube – #100

Tax On Gifts: As Festive Season Nears, Know Tax Implications On Gifts You Receive – News18 – #101

Tax On Gifts: As Festive Season Nears, Know Tax Implications On Gifts You Receive – News18 – #101

Income tax on gifts: Know when your gift is tax-free – BusinessToday – #102

Income tax on gifts: Know when your gift is tax-free – BusinessToday – #102

Close Relatives” include Uncle and Aunt: ITAT deletes Addition for Cash Gift from Close Relatives during Emergency – #103

Close Relatives” include Uncle and Aunt: ITAT deletes Addition for Cash Gift from Close Relatives during Emergency – #103

Income tax for capital gain and using margin – Taxation – Trading Q&A by Zerodha – All your queries on trading and markets answered – #104

Income tax for capital gain and using margin – Taxation – Trading Q&A by Zerodha – All your queries on trading and markets answered – #104

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #105

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #105

Top 10 Benefits Of Paying Taxes In India | 5paisa – #106

Top 10 Benefits Of Paying Taxes In India | 5paisa – #106

Gift tax in India – Income tax rules on gifts and exemption available – #107

Gift tax in India – Income tax rules on gifts and exemption available – #107

Navigating Income Tax & Taxation on Gifts Received in India – 1 Finance Blog – #108

Navigating Income Tax & Taxation on Gifts Received in India – 1 Finance Blog – #108

Itr Filing: ITR Filing, Income Tax: Do you have to pay tax on GIFTS or cash received from someone? Know what rules say – DETAILS | Income Tax News, ET Now – #109

Itr Filing: ITR Filing, Income Tax: Do you have to pay tax on GIFTS or cash received from someone? Know what rules say – DETAILS | Income Tax News, ET Now – #109

Outstanding Tax Demands Up To Rs 1 lakh Waived; Wealth, Gift Tax Exempted; Know Full Details: Edatabook – #110

Outstanding Tax Demands Up To Rs 1 lakh Waived; Wealth, Gift Tax Exempted; Know Full Details: Edatabook – #110

ITAT Delhi: Non-Resident Share Premium Not Governed by Section 56(2) (viib) of Income Tax Act – #111

ITAT Delhi: Non-Resident Share Premium Not Governed by Section 56(2) (viib) of Income Tax Act – #111

- gift tax meaning

- gift tax exemption

- clubbing of income ppt

![Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will](https://imageio.forbes.com/specials-images/dam/imageserve/1067349388/960x0.jpg?height\u003d542\u0026width\u003d711\u0026fit\u003dbounds) Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will – #112

Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will – #112

What is the difference between Gift and Inheritance Tax – #113

What is the difference between Gift and Inheritance Tax – #113

Gift tax: what is it & how does it work? | Empower – #114

Gift tax: what is it & how does it work? | Empower – #114

Holiday Gift Income Tax Implications – Collins Dollies – #115

Holiday Gift Income Tax Implications – Collins Dollies – #115

India’s budget proposes reduction of top rates of income tax and restriction of gift tax relief | STEP – #116

India’s budget proposes reduction of top rates of income tax and restriction of gift tax relief | STEP – #116

Tax on Gifted Stocks know here how tax will be calculated on shares gift to spouse and others | Tax on Gifted Stocks: आपने भी परिजनों को गिफ्ट में दिया है शेयर, – #117

Tax on Gifted Stocks know here how tax will be calculated on shares gift to spouse and others | Tax on Gifted Stocks: आपने भी परिजनों को गिफ्ट में दिया है शेयर, – #117

Top Christmas Gifts for the Tax Preparer in Your Life | The Income Tax School – #118

Top Christmas Gifts for the Tax Preparer in Your Life | The Income Tax School – #118

Your queries: Income Tax: Show gift from relative in Schedule EI of ITR – Money News | The Financial Express – #119

Your queries: Income Tax: Show gift from relative in Schedule EI of ITR – Money News | The Financial Express – #119

Taxation on gifts in India | Example of Clubbing | Saving Taxes – – #120

Taxation on gifts in India | Example of Clubbing | Saving Taxes – – #120

Forums | Clubbing of Income – #121

Forums | Clubbing of Income – #121

) THE LAW ON GIFTS With TAXATION OF GIFTS AND DEEMED GIFTS (UNDER THE INCOME TAX ACT) – Xcess Infostore Private Limited – #122

THE LAW ON GIFTS With TAXATION OF GIFTS AND DEEMED GIFTS (UNDER THE INCOME TAX ACT) – Xcess Infostore Private Limited – #122

Income tax on gifts – US Tax Filing – #123

Income tax on gifts – US Tax Filing – #123

Aaykar Kaise Bachaye? How To Save Income Tax On Donations, Rules Of Section 80G, 80GGA And Section 80GGC – दान और चंदा देकर कैसे बचा सकते हैं टैक्स? जानें सेक्शन 80G, 80GGA – #124

Aaykar Kaise Bachaye? How To Save Income Tax On Donations, Rules Of Section 80G, 80GGA And Section 80GGC – दान और चंदा देकर कैसे बचा सकते हैं टैक्स? जानें सेक्शन 80G, 80GGA – #124

CREDAI MCHI | Stamp Duty in Thane | Real Estate – #125

CREDAI MCHI | Stamp Duty in Thane | Real Estate – #125

income tax on gifts: What will be the tax implications if I invest the money sent by my NRI son as a gift? – The Economic Times – #126

income tax on gifts: What will be the tax implications if I invest the money sent by my NRI son as a gift? – The Economic Times – #126

Gifting money in the US: all you need to know | WorldRemit – #127

Gifting money in the US: all you need to know | WorldRemit – #127

Income Tax: Will Gifting Of Shares To Spouse Be Taxable? – News18 – #128

Income Tax: Will Gifting Of Shares To Spouse Be Taxable? – News18 – #128

When are gifts received by NRIs subject to tax, TDS in India? – The Economic Times – #129

When are gifts received by NRIs subject to tax, TDS in India? – The Economic Times – #129

What is the limit up to which a father can gift to his son under income tax laws | Mint – #130

What is the limit up to which a father can gift to his son under income tax laws | Mint – #130

Your Guide To Gift Tax Returns In 2023 – #131

Your Guide To Gift Tax Returns In 2023 – #131

Gift Tax, the Annual Exclusion and Estate Planning – #132

Gift Tax, the Annual Exclusion and Estate Planning – #132

How to Save Tax for Salary above 10 Lakhs – #133

How to Save Tax for Salary above 10 Lakhs – #133

Income Tax: Affidavits from Family Members sufficient to prove Genuineness of Cash Gift – #134

Income Tax: Affidavits from Family Members sufficient to prove Genuineness of Cash Gift – #134

11 Tax-Free Income Sources In India (2023 Update) – #135

11 Tax-Free Income Sources In India (2023 Update) – #135

-Gifts.jpg) Tax On Gifts In India: Exemption & Criteria | E-StartupIndia | ITR Filing – #136

Tax On Gifts In India: Exemption & Criteria | E-StartupIndia | ITR Filing – #136

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #137

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #137

Top 10 Tax Deductions For Active Traders – #138

Top 10 Tax Deductions For Active Traders – #138

Navigating the Estate Tax Horizon – Mercer Capital – #139

Navigating the Estate Tax Horizon – Mercer Capital – #139

Are Cash Gifts from relatives exempt from Income tax? – #140

Are Cash Gifts from relatives exempt from Income tax? – #140

All you need to know about taxes on gifts and the exceptions | Mint – #141

All you need to know about taxes on gifts and the exceptions | Mint – #141

ProfZilla – #142

ProfZilla – #142

Taxation of gifts implication under income tax act 1961 – #143

Taxation of gifts implication under income tax act 1961 – #143

Income Tax: What is Gift Tax? Exemption and limits explained | Economy News – News9live – #144

Income Tax: What is Gift Tax? Exemption and limits explained | Economy News – News9live – #144

Dinesh Joshi on X: “On a lighter note , my wife has become like China . Charging me interest over interest .. 😂” / X – #145

Dinesh Joshi on X: “On a lighter note , my wife has become like China . Charging me interest over interest .. 😂” / X – #145

income tax on marriage gift Archives – The Tax Talk – #146

income tax on marriage gift Archives – The Tax Talk – #146

What is the income tax rule on the gift given by the father to the son TAXCONCEPT – #147

What is the income tax rule on the gift given by the father to the son TAXCONCEPT – #147

Gifts from Foreign Corporations Included as Gross Income – #148

Gifts from Foreign Corporations Included as Gross Income – #148

- transfer income examples

- gift tax 2023

- gift tax exemption 2022

Income Tax: You do not have to pay tax on gift received on marriage or by will – Nangia Andersen India Pvt. Ltd. – #149

Income Tax: You do not have to pay tax on gift received on marriage or by will – Nangia Andersen India Pvt. Ltd. – #149

This wedding season, embrace these tax rules along with the gifts – India Today – #150

This wedding season, embrace these tax rules along with the gifts – India Today – #150

Gifting Basics: What Counts As A Gift And Gift Tax Reporting – Homrich Berg – #151

Gifting Basics: What Counts As A Gift And Gift Tax Reporting – Homrich Berg – #151

Income Tax – Penalty proceedings u/s. 270A – Additions made u/s 43CA r.w.s. 56 (2) (x) i.e. deeming sections – There is not even a whisper as to which limb of… – #152

Income Tax – Penalty proceedings u/s. 270A – Additions made u/s 43CA r.w.s. 56 (2) (x) i.e. deeming sections – There is not even a whisper as to which limb of… – #152

Tax-favored gifts exemptions that give back — in any administration | Financial Planning – #153

Tax-favored gifts exemptions that give back — in any administration | Financial Planning – #153

Income Tax on Gifts: Now New Year and Christmas gifts can also be taxed? Know the plan of the government – #154

Income Tax on Gifts: Now New Year and Christmas gifts can also be taxed? Know the plan of the government – #154

Tax on Property Gift to Wife | Tax on Property Transfer to Spouse | Gift Deed | Clubbing of Income – YouTube – #155

Tax on Property Gift to Wife | Tax on Property Transfer to Spouse | Gift Deed | Clubbing of Income – YouTube – #155

दिवाली में मिलने वाले गिफ्ट और बोनस पर भी लगेगा टैक्स, जानें- क्या है नियम? – Income Tax are your Diwali gifts and bonuses taxable know the details and Slabs tutd – AajTak – #156

दिवाली में मिलने वाले गिफ्ट और बोनस पर भी लगेगा टैक्स, जानें- क्या है नियम? – Income Tax are your Diwali gifts and bonuses taxable know the details and Slabs tutd – AajTak – #156

SuperCA – #157

SuperCA – #157

- form 709 gift splitting example

Raksha Bandhan: Sister’s life-saving ‘gift’ last year makes festival special for duo – Hindustan Times – #158

Raksha Bandhan: Sister’s life-saving ‘gift’ last year makes festival special for duo – Hindustan Times – #158

Gift of Property & Tax Obligation: A Comprehensive Guide | Property tax, Tax, Tax exemption – #159

Gift of Property & Tax Obligation: A Comprehensive Guide | Property tax, Tax, Tax exemption – #159

What Is the Last Surviving Spouse Rule? – #160

What Is the Last Surviving Spouse Rule? – #160

- gift deed stamp paper

- clubbing of income images

- clubbing of income pdf

Income Tax on Marriage Gift: Taxation of Wedding Gifts Received – Section 56 – Tax2win – #161

Income Tax on Marriage Gift: Taxation of Wedding Gifts Received – Section 56 – Tax2win – #161

Tax on shares received as a gift – Income from Capital Gains – TaxQ&A by Quicko – Get answers to all tax related queries – #162

Tax on shares received as a gift – Income from Capital Gains – TaxQ&A by Quicko – Get answers to all tax related queries – #162

Weddings & Tax Implications of Cash Gifts | by CA Tanuja Gupta -YourTaxAdvisor& EquityFundManager | Feb, 2024 | Medium – #163

Weddings & Tax Implications of Cash Gifts | by CA Tanuja Gupta -YourTaxAdvisor& EquityFundManager | Feb, 2024 | Medium – #163

Planning to take a gift from relatives? Here’s how you can take it from their bank account directly – #164

Planning to take a gift from relatives? Here’s how you can take it from their bank account directly – #164

S Archives – Latest Real Estate News, Articles, Property Insights – #165

S Archives – Latest Real Estate News, Articles, Property Insights – #165

April 15 Is The Deadline To File A Gift Tax Return – #166

April 15 Is The Deadline To File A Gift Tax Return – #166

Income Tax Rules | Tax Saving Plan | WealthDirect Portfolio Pvt Ltd – #167

Income Tax Rules | Tax Saving Plan | WealthDirect Portfolio Pvt Ltd – #167

What Is the 2023 and 2024 Gift Tax Limit? – Ramsey – #168

What Is the 2023 and 2024 Gift Tax Limit? – Ramsey – #168

Now gift stocks and ETFs to your friends and loved ones – Stocks – Trading Q&A by Zerodha – All your queries on trading and markets answered – #169

Now gift stocks and ETFs to your friends and loved ones – Stocks – Trading Q&A by Zerodha – All your queries on trading and markets answered – #169

Gift holdover relief – watch out for the tax trap! – Blog : Torgersens, Chartered Accountants in Sunderland, Newcastle and Jarrow – #170

Gift holdover relief – watch out for the tax trap! – Blog : Torgersens, Chartered Accountants in Sunderland, Newcastle and Jarrow – #170

- lineal ascendant gift from relative exempt from income tax

- clubbing of income chart

- sample form 709 completed 2019

MoneyTalkWithL on X: “Not many know this. Wedding gifts are tax exempt. So be lavish with people you love. I know someone who made a hefty wedding gift to a friend and – #171

MoneyTalkWithL on X: “Not many know this. Wedding gifts are tax exempt. So be lavish with people you love. I know someone who made a hefty wedding gift to a friend and – #171

Estate, Inheritance, and Gift Taxes in Europe | Tax Foundation – #172

Estate, Inheritance, and Gift Taxes in Europe | Tax Foundation – #172

9 Reasons You Might Owe Money to the IRS This Tax Season – CNET – #173

9 Reasons You Might Owe Money to the IRS This Tax Season – CNET – #173

Income-tax- Gifts received from some specified relatives like parents and children are not treated as income of the recipient but… TAXCONCEPT – #174

Income-tax- Gifts received from some specified relatives like parents and children are not treated as income of the recipient but… TAXCONCEPT – #174

Rules you should know pertaining to gift taxation – BusinessToday – Issue Date: Dec 01, 2014 – #175

Rules you should know pertaining to gift taxation – BusinessToday – Issue Date: Dec 01, 2014 – #175

Gift Taxes if You Give or Receive a Large Gift – Rocket Lawyer – #176

Gift Taxes if You Give or Receive a Large Gift – Rocket Lawyer – #176

Income Tax Liabilities on Marriage Gift & for Divorced Couples – #177

Income Tax Liabilities on Marriage Gift & for Divorced Couples – #177

Income Tax Return Filing: Are wedding gifts really tax free? All hidden clauses, conditions explained | Zee Business – #178

Income Tax Return Filing: Are wedding gifts really tax free? All hidden clauses, conditions explained | Zee Business – #178

Gifts Tax: Know which gifts are taxable this festive season | TAX SAVING | Zee Business – #179

Gifts Tax: Know which gifts are taxable this festive season | TAX SAVING | Zee Business – #179

What You Need to Know About Gift & Estate Taxation – KEB – #180

What You Need to Know About Gift & Estate Taxation – KEB – #180

Gifts and Taxes: how much does it cost to make someone happy? – #181

Gifts and Taxes: how much does it cost to make someone happy? – #181

Income Tax Return LTR at Rs 498/na in Pune | ID: 23256476233 – #182

Income Tax Return LTR at Rs 498/na in Pune | ID: 23256476233 – #182

Gift Splitting: Definition, Example, and Tax Rules – #183

Gift Splitting: Definition, Example, and Tax Rules – #183

EvoBreyta | Tax-Finance-Technology – #184

EvoBreyta | Tax-Finance-Technology – #184

) Filing Amended Gift Tax Return | Sapling – #185

Filing Amended Gift Tax Return | Sapling – #185

![No Income Tax on Gift made by HUF to its Member: ITAT Mumbai [Read Order] | Taxscan No Income Tax on Gift made by HUF to its Member: ITAT Mumbai [Read Order] | Taxscan](https://sftaxcounsel.com/wp-content/uploads/2022/08/shutterstock_2135945295-640x427.jpg) No Income Tax on Gift made by HUF to its Member: ITAT Mumbai [Read Order] | Taxscan – #186

No Income Tax on Gift made by HUF to its Member: ITAT Mumbai [Read Order] | Taxscan – #186

Amazon.com: Tax Season Humor Gift Idea For Boyfriend Income Tax Preparers 11oz 15oz Color Changing Mug : Handmade Products – #187

Amazon.com: Tax Season Humor Gift Idea For Boyfriend Income Tax Preparers 11oz 15oz Color Changing Mug : Handmade Products – #187

MASD & Co on X: “Gifts are usually capital receipts by nature. The Income Tax Act, 1961 which is levies tax on incomes, that is revenue receipts, carves out certain exceptions and – #188

MASD & Co on X: “Gifts are usually capital receipts by nature. The Income Tax Act, 1961 which is levies tax on incomes, that is revenue receipts, carves out certain exceptions and – #188

tax treatment of gifts | PDF – #189

tax treatment of gifts | PDF – #189

Cash Deposit Limit in Saving Account as Per Income Tax (2024) – Forbes Advisor INDIA – #190

Cash Deposit Limit in Saving Account as Per Income Tax (2024) – Forbes Advisor INDIA – #190

How to Split Gifts on a Tax Return – #191

How to Split Gifts on a Tax Return – #191

Liz Weston: Make sure gift doesn’t create a tax problem – oregonlive.com – #192

Liz Weston: Make sure gift doesn’t create a tax problem – oregonlive.com – #192

Everything You Need To Know About Tax-Free Family Gifting | Private Wealth Management – #193

Everything You Need To Know About Tax-Free Family Gifting | Private Wealth Management – #193

Gift Tax In India – New 2020 Rules of Income Tax on Gifts – #194

Gift Tax In India – New 2020 Rules of Income Tax on Gifts – #194

Forever Devoted Society :: Familial Dysautonomia Foundation Inc | Fund Research Educate – #195

Forever Devoted Society :: Familial Dysautonomia Foundation Inc | Fund Research Educate – #195

Page 22 | 8,000+ Refundable Pictures – #196

Page 22 | 8,000+ Refundable Pictures – #196

Understanding Income Tax on Gifts Received in India: Rules, Exceptions, and Valuation” – #197

Understanding Income Tax on Gifts Received in India: Rules, Exceptions, and Valuation” – #197

- gift tax in india

- gift deed format father to son

- section 56(2) of income tax act

tax saving strategies, tax planning to reduce taxes – #198

tax saving strategies, tax planning to reduce taxes – #198

ES402: Introduction to Estate & Gift Tax – #199

ES402: Introduction to Estate & Gift Tax – #199

EXPLAINED | What clubbing of income really means in your income tax return (ITR) | Zee Business – #200

EXPLAINED | What clubbing of income really means in your income tax return (ITR) | Zee Business – #200

Tax on Gifts in India: know taxation rules on gifts according to Income Tax Act 1961 | Business – #201

Tax on Gifts in India: know taxation rules on gifts according to Income Tax Act 1961 | Business – #201

Posts: gift to wife income tax

Categories: Gifts

Author: toyotabienhoa.edu.vn