Aggregate 113+ gift tax rate in india latest

Details images of gift tax rate in india by website toyotabienhoa.edu.vn compilation. When are gifts received by NRIs subject to tax, TDS in India? – The Economic Times. Income Tax Exemption On Gifts | Are The Gifts Above Rs 50,000 Taxable? | Personal Finance – YouTube. tax on gift money Archives – TaxHelpdesk. Jash Kriplani, CFPᶜᵐ on X: “Wedding season is here. Record 3.5 million weddings are expected this year. Gifts received by newlywed couples are tax-exempt on occasion of marriage. Is this only for. Worcester’s tax-rate gift for business: a positive step | Worcester Business Journal

Pay Zero Tax for 12 Lakhs Income Tax Slab in FY 2023-24 – #1

Pay Zero Tax for 12 Lakhs Income Tax Slab in FY 2023-24 – #1

GIFT City: How PM Modi’s pet project is fast becoming India’s capital gateway – #2

GIFT City: How PM Modi’s pet project is fast becoming India’s capital gateway – #2

- short term capital gains tax 2023

- interest tax

- lineal ascendant

-Gifts.jpg) USA – INDIA F-1 & J-1 Tax Treaty (Students & Business Apprentice) – O&G Tax and Accounting – #4

USA – INDIA F-1 & J-1 Tax Treaty (Students & Business Apprentice) – O&G Tax and Accounting – #4

Foreign Remittance: Sending Gift Money To The USA From India In 2024 – #5

Foreign Remittance: Sending Gift Money To The USA From India In 2024 – #5

What Is Taxable Income and How to Calculate It – Forbes Advisor – #6

What Is Taxable Income and How to Calculate It – Forbes Advisor – #6

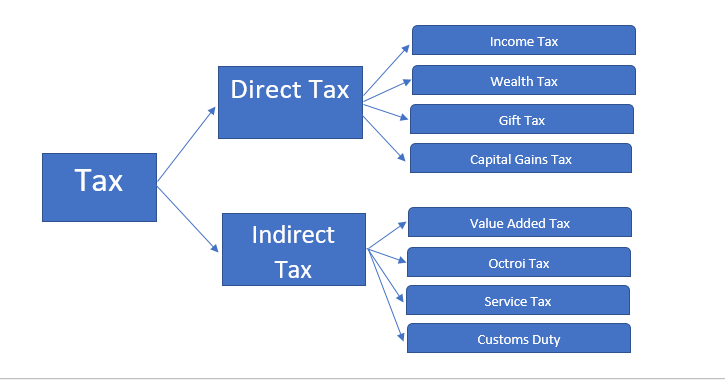

Tax | What is Tax | Taxation in India : Tax Calculation – #7

Tax | What is Tax | Taxation in India : Tax Calculation – #7

Taxation of Gifts received in Cash or Kind – #8

Taxation of Gifts received in Cash or Kind – #8

- long term capital gains tax 2023

- gift tax rate in india 2020

- sales tax by state

- types of income tax

- city taxes usa

- gift tax

Application Money in IPO and its Tax Implications in India – #10

Application Money in IPO and its Tax Implications in India – #10

- gift from relative exempt from income tax

- section 56(2) of income tax act

- family member gift letter gift deed format father to son

What is a gift deed and tax implications | Tax Hack – #11

What is a gift deed and tax implications | Tax Hack – #11

Taxation aspects for NRIs, PIOs, Foreigners for buying immovable property in India | PDF – #12

Taxation aspects for NRIs, PIOs, Foreigners for buying immovable property in India | PDF – #12

Outstanding Tax Demands Up To Rs 1 lakh Waived; Wealth, Gift Tax Exempted; Know Full Details – #13

Outstanding Tax Demands Up To Rs 1 lakh Waived; Wealth, Gift Tax Exempted; Know Full Details – #13

Taxation System in India MCQ for competitive examinations in India – #14

Taxation System in India MCQ for competitive examinations in India – #14

What is a gift tax in India? – Quora – #15

What is a gift tax in India? – Quora – #15

What are the 5 Heads of Income? – #16

What are the 5 Heads of Income? – #16

- gift deed format in hindi pdf

- gift tax definition

- gift tax upsc

- property capital gains tax

.jpeg) All You Need To Know About Gifting Property And Gift Deed Rules – #17

All You Need To Know About Gifting Property And Gift Deed Rules – #17

The Gift-Tax Benefits of ‘529’ Plans – WSJ – #18

The Gift-Tax Benefits of ‘529’ Plans – WSJ – #18

GST: Ice cream, tobacco, pan masala to be excluded from higher threshold limit – The Hindu BusinessLine – #19

GST: Ice cream, tobacco, pan masala to be excluded from higher threshold limit – The Hindu BusinessLine – #19

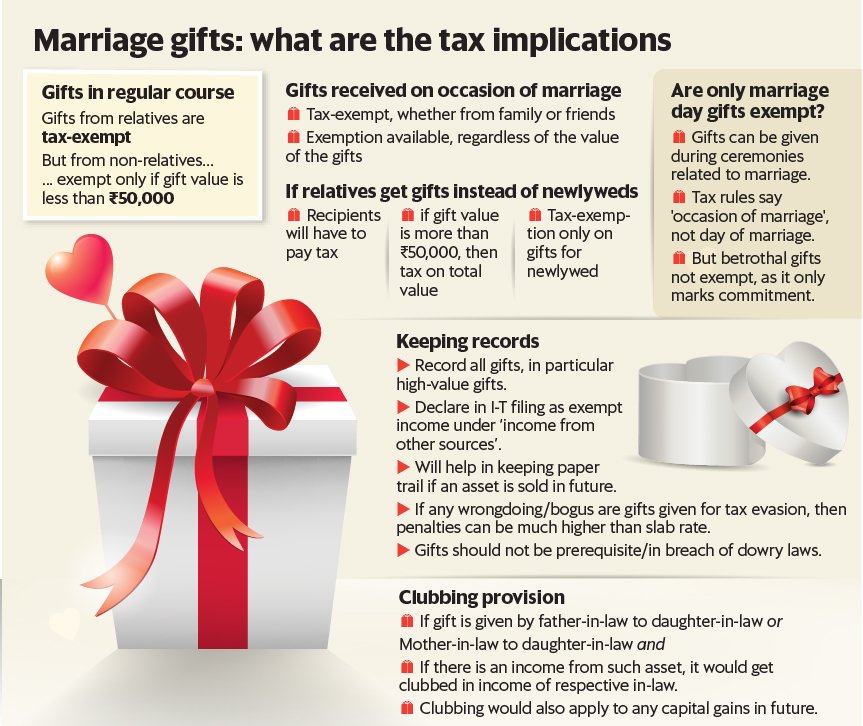

Will your ‘gift’ be taxed? – The Economic Times – #20

Will your ‘gift’ be taxed? – The Economic Times – #20

Planned Giving – Feed My People – #21

Planned Giving – Feed My People – #21

Receiving cryptocurrency gift or inheritance in Japan could ruin your life | by Lerian | Medium – #22

Receiving cryptocurrency gift or inheritance in Japan could ruin your life | by Lerian | Medium – #22

NRI Selling Inherited Property in India: Tax Implications 2023 – SBNRI – #23

NRI Selling Inherited Property in India: Tax Implications 2023 – SBNRI – #23

- gift chart as per income tax

- property tax by state

- gst rates

Sources of Revenue for Government of India – #24

Sources of Revenue for Government of India – #24

Capital Gains Tax Brackets For 2024 – #25

Capital Gains Tax Brackets For 2024 – #25

This month in indirect tax: Indian finance minister hails GST impact | International Tax Review – #26

This month in indirect tax: Indian finance minister hails GST impact | International Tax Review – #26

Food Coupons, Meal Vouchers Income Tax Savings – India – #27

Food Coupons, Meal Vouchers Income Tax Savings – India – #27

Sales taxes in the United States – Wikipedia – #28

Sales taxes in the United States – Wikipedia – #28

Understanding Gift Tax in India: Rules, Rates, and Regulations – Marg ERP Blog – #29

Understanding Gift Tax in India: Rules, Rates, and Regulations – Marg ERP Blog – #29

Increased Estate Tax Exemption Sunsets the end of 2025 – #30

Increased Estate Tax Exemption Sunsets the end of 2025 – #30

Income Tax Slabs for Senior Citizens (FY 2022-23, AY 2023-24) – #31

Income Tax Slabs for Senior Citizens (FY 2022-23, AY 2023-24) – #31

Tax collected at source on foreign remittances: One step forward, two steps back – #32

Tax collected at source on foreign remittances: One step forward, two steps back – #32

Guide: Best Gift Options For Friends & Family This Diwali – #33

Guide: Best Gift Options For Friends & Family This Diwali – #33

Tax Incentives – #34

Tax Incentives – #34

India’s Tax Windfall Gives Modi Scope to Spend More on Welfare – Bloomberg – #35

India’s Tax Windfall Gives Modi Scope to Spend More on Welfare – Bloomberg – #35

From 97% to 42%: How tax rates for individuals changed | Mint – #36

From 97% to 42%: How tax rates for individuals changed | Mint – #36

What is Gift Tax? – Exemption and Limits on Gifts for FY 2023-24 – #37

What is Gift Tax? – Exemption and Limits on Gifts for FY 2023-24 – #37

Decentralised finance under taxman’s lens: Government set to levy additional taxes – #38

Decentralised finance under taxman’s lens: Government set to levy additional taxes – #38

Tax on Gifts in India | Exemption and Rules | EZTax® – #39

Tax on Gifts in India | Exemption and Rules | EZTax® – #39

- state taxes usa

- value added tax example

- service tax

10 taxes we pay in India – The common man’s guide – #40

10 taxes we pay in India – The common man’s guide – #40

) Your gift and cash back vouchers will now attract 18% GST – Daijiworld.com – #41

Your gift and cash back vouchers will now attract 18% GST – Daijiworld.com – #41

Exclusive: UAE wealth fund plans $4-5 billion in investments via India’s new finance hub – sources | Reuters – #42

Exclusive: UAE wealth fund plans $4-5 billion in investments via India’s new finance hub – sources | Reuters – #42

Gift Tax: Tax on gifts: Documents that you should have while filing ITR – The Economic Times – #43

Gift Tax: Tax on gifts: Documents that you should have while filing ITR – The Economic Times – #43

Let Us Know… TAXES in India 2018-19 : C.A. Arun Kumar Chandak & Vinay Malani: Amazon.in: Books – #44

Let Us Know… TAXES in India 2018-19 : C.A. Arun Kumar Chandak & Vinay Malani: Amazon.in: Books – #44

A Quick Guide On China’s Customs Import Tax & Duty Rates | DHL Express MY – #45

A Quick Guide On China’s Customs Import Tax & Duty Rates | DHL Express MY – #45

Investing in AIFs in Gift City: What You Need to Know – #46

Investing in AIFs in Gift City: What You Need to Know – #46

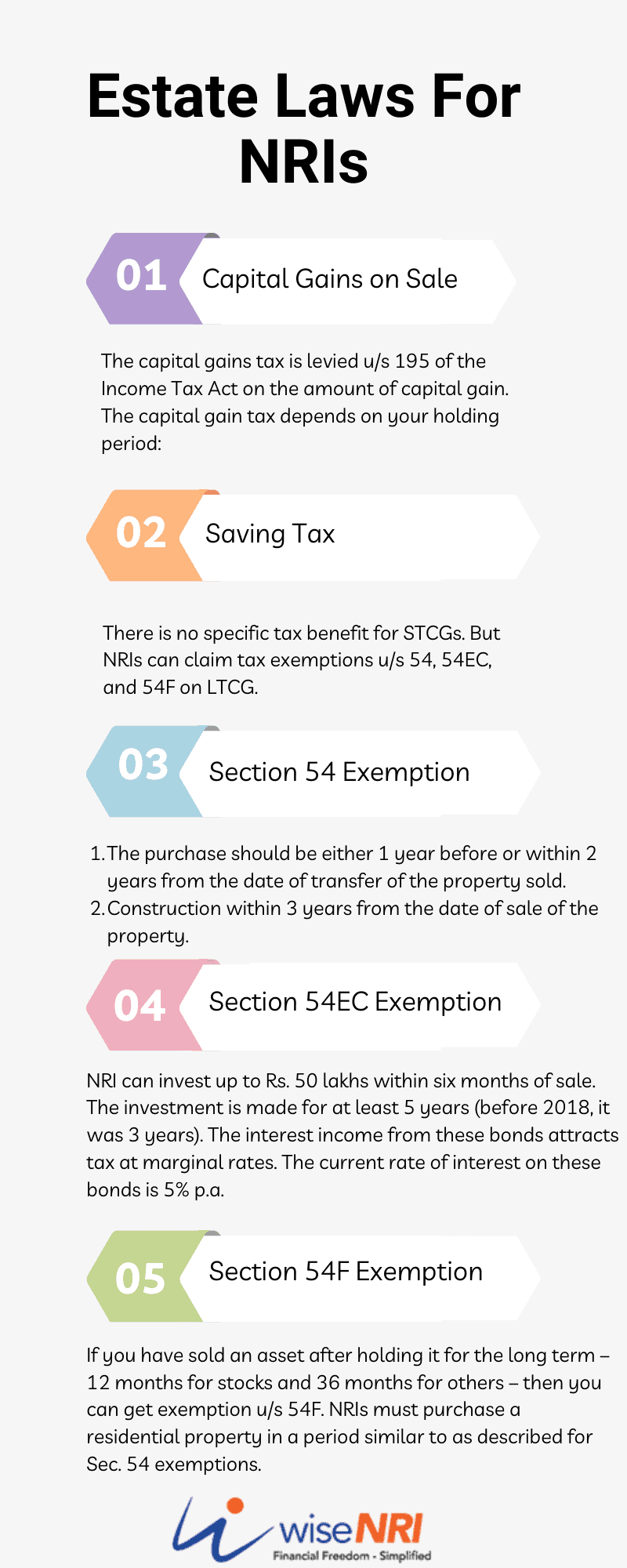

Estate Laws For NRIs In India – #47

Estate Laws For NRIs In India – #47

Taxes Definition: Types, Who Pays, and Why – #48

Taxes Definition: Types, Who Pays, and Why – #48

What is Wealth Tax in India? – #49

What is Wealth Tax in India? – #49

Is there any way to gift money to a non-resident Indian friend? | Mint – #50

Is there any way to gift money to a non-resident Indian friend? | Mint – #50

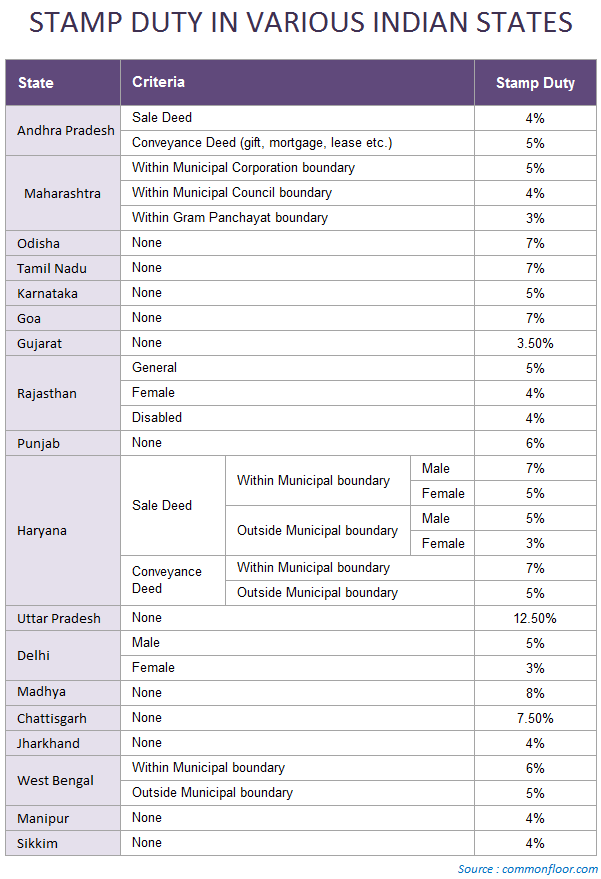

Gift Deed: Registration, property gift deed format, stamp duty – #51

Gift Deed: Registration, property gift deed format, stamp duty – #51

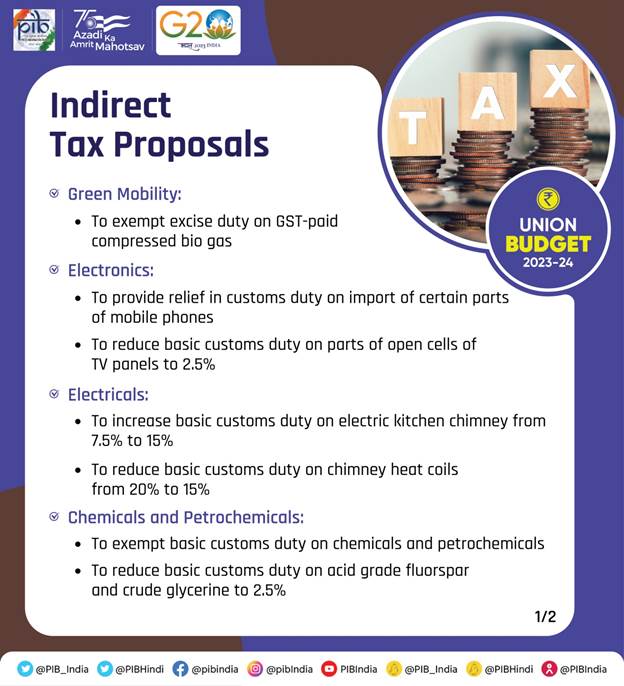

Press Information Bureau – #52

Press Information Bureau – #52

) Rs 11,000 Crore Retroactive Tax Demand May Hit MNCs After SC Ruling; The Myriad Complexity Of Retroactive Taxation – Inventiva – #53

Rs 11,000 Crore Retroactive Tax Demand May Hit MNCs After SC Ruling; The Myriad Complexity Of Retroactive Taxation – Inventiva – #53

Tax Structure in India – Apna Gyaan – #54

Tax Structure in India – Apna Gyaan – #54

Key takeaways from six years of Donald Trump’s federal tax returns | CNN Politics – #55

Key takeaways from six years of Donald Trump’s federal tax returns | CNN Politics – #55

Types of Taxes in India – ClearIAS – #56

Types of Taxes in India – ClearIAS – #56

Let Us Know Taxes In India 2018 – 2019 | Money laundering, Let it be, Tax – #57

Let Us Know Taxes In India 2018 – 2019 | Money laundering, Let it be, Tax – #57

Is transferring crypto between wallets taxable? | CoinLedger – #58

Is transferring crypto between wallets taxable? | CoinLedger – #58

East India Trading Tea Box Replica – Relic Wood – #59

East India Trading Tea Box Replica – Relic Wood – #59

Gift Deed in Maharashtra: A Comprehensive Guide – #60

Gift Deed in Maharashtra: A Comprehensive Guide – #60

Long Term Capital Gain Tax on Shares in India – #61

Long Term Capital Gain Tax on Shares in India – #61

How much money can NRIs gift to parents in India? | Arthgyaan – #62

How much money can NRIs gift to parents in India? | Arthgyaan – #62

tax on gift money Archives – TaxHelpdesk – #63

tax on gift money Archives – TaxHelpdesk – #63

Vested on X: “Investing in US stocks from India through Direct platforms like @Vested_finance vs IFSC GIFT city route – a quick comparison #vestedfinance #taxation #investing https://t.co/elpZObePKE” / X – #64

Vested on X: “Investing in US stocks from India through Direct platforms like @Vested_finance vs IFSC GIFT city route – a quick comparison #vestedfinance #taxation #investing https://t.co/elpZObePKE” / X – #64

Budget 2023 Explained: In FM Nirmala Sitharaman’s Budget, focus on capex, fiscal consolidation, income tax relief | Explained News – The Indian Express – #65

Budget 2023 Explained: In FM Nirmala Sitharaman’s Budget, focus on capex, fiscal consolidation, income tax relief | Explained News – The Indian Express – #65

Gifts to and from HUF – MN & Associates CS-India – #66

Gifts to and from HUF – MN & Associates CS-India – #66

- simple deed of gift template

- gift tax exemption relatives list

- sales tax

Gift City route to foreign equities promises security – Indian Income Tax – Quora – #67

Gift City route to foreign equities promises security – Indian Income Tax – Quora – #67

TDS RATE CHART FY 19-20 AY 20-21 | SIMPLE TAX INDIA – #68

TDS RATE CHART FY 19-20 AY 20-21 | SIMPLE TAX INDIA – #68

A new tax makes it more expensive to move money out of India – #69

A new tax makes it more expensive to move money out of India – #69

Most awaited and must required Gift by Indian Government to Companies” – ProfZilla – #70

Most awaited and must required Gift by Indian Government to Companies” – ProfZilla – #70

Taxation of Minor Children in India: How Does It Work? – #71

Taxation of Minor Children in India: How Does It Work? – #71

- short term capital gains tax 2022

- gift deed format on stamp paper

- types of taxes in india

- gift tax meaning

- sales tax chart

- sales tax receipt

Section 56(2)(vii) : Cash / Non-Cash Gifts – #72

Section 56(2)(vii) : Cash / Non-Cash Gifts – #72

Tax and Returns for a Restaurant – The Complete Guide for 2024 – Treelife – #73

Tax and Returns for a Restaurant – The Complete Guide for 2024 – Treelife – #73

Japan Gift Tax; All Expats Need to Know – #74

Japan Gift Tax; All Expats Need to Know – #74

- list of relatives

- income tax by state

- expenditure tax

How to file taxes in 2024 | CNN Underscored Money – #75

How to file taxes in 2024 | CNN Underscored Money – #75

Zero Tax on Salary Income INR 20+ Lakhs? Legal Way Here… – #76

Zero Tax on Salary Income INR 20+ Lakhs? Legal Way Here… – #76

A Detailed Guide to Tax on Inheritance in India | HDFC Life – #77

A Detailed Guide to Tax on Inheritance in India | HDFC Life – #77

- direct tax examples

- gift tax example

- corporate tax

Can I Pay My Kid’s Tuition Without Triggering the Gift Tax? | Money – #78

Can I Pay My Kid’s Tuition Without Triggering the Gift Tax? | Money – #78

Banking & Finance units in IFSC- A regulatory overview – Vinod Kothari Consultants – #79

Banking & Finance units in IFSC- A regulatory overview – Vinod Kothari Consultants – #79

How To Make (Or Ask For) A 529 Plan Gift Contribution – Forbes Advisor – #80

How To Make (Or Ask For) A 529 Plan Gift Contribution – Forbes Advisor – #80

- gift deed stamp paper

- gift tax in india

- lineal ascendant gift from relative exempt from income tax

Federal Estate and Gift Tax Exemption to Sunset in 2025: Are You Ready? | AdvicePeriod – #81

Federal Estate and Gift Tax Exemption to Sunset in 2025: Are You Ready? | AdvicePeriod – #81

2024 Guide to the Unified Tax Credit – #82

2024 Guide to the Unified Tax Credit – #82

- tax system in india

- gift deed format father to son

- indirect tax

New Tax Regime – Complete list of exemptions and deductions disallowed – BasuNivesh – #83

New Tax Regime – Complete list of exemptions and deductions disallowed – BasuNivesh – #83

Rich foreigners will now get tax-free access to Indian MFs : r/nri – #84

Rich foreigners will now get tax-free access to Indian MFs : r/nri – #84

Gift from employer, exceeding Rs5,000, is taxable and tax is to be withheld from salary | Mint – #85

Gift from employer, exceeding Rs5,000, is taxable and tax is to be withheld from salary | Mint – #85

Historical Look at Estate and Gift Tax Rates | Wolters Kluwer – #86

Historical Look at Estate and Gift Tax Rates | Wolters Kluwer – #86

Perquisites under Income Tax Act – #87

Perquisites under Income Tax Act – #87

GIFT City: A Game-changer for Indian Startup Ecosystem – #88

GIFT City: A Game-changer for Indian Startup Ecosystem – #88

Tax policy of India @ 75 | Expert Views – Business Standard – #89

Tax policy of India @ 75 | Expert Views – Business Standard – #89

Amazon Commission Rates In India (2024) – Shiprocket – #90

Amazon Commission Rates In India (2024) – Shiprocket – #90

Gift Deed Registration Charges and Stamp Duty in Telangana – #91

Gift Deed Registration Charges and Stamp Duty in Telangana – #91

- gift tax exemption 2022

- gift tax act 1958

- wealth tax

How to gift stocks, bonds and ETFs and the tax implications – Z-Connect by Zerodha – #92

How to gift stocks, bonds and ETFs and the tax implications – Z-Connect by Zerodha – #92

FTC Report: Gift Card Scams Increased This Year – Forbes Advisor – #93

FTC Report: Gift Card Scams Increased This Year – Forbes Advisor – #93

Definition of Relatives for the purpose of Income Tax Act, 1961- Taxwink – #94

Definition of Relatives for the purpose of Income Tax Act, 1961- Taxwink – #94

Turkey Tax Rate in 2024: Complete Taxation Guide – #95

IRS Raises Estate-Tax Threshold to $12.92 Million for 2023 – WSJ – #96

IRS Raises Estate-Tax Threshold to $12.92 Million for 2023 – WSJ – #96

- income tax

- estate tax

- capital gains tax rate

![Tax on money received from abroad to India [Oct 2020] - Wise Tax on money received from abroad to India [Oct 2020] - Wise](https://www.natlawreview.com/sites/default/files/styles/article_image/public/article/aux/17444/India%20Rupees%20Tax%20Finance%20Cash_0.jpg?itok\u003d-Xp3sNqY) Tax on money received from abroad to India [Oct 2020] – Wise – #97

Tax on money received from abroad to India [Oct 2020] – Wise – #97

New Year, Different Rules: Estate Tax, Gift Tax, & GST Tax Rules For 2011 – #98

New Year, Different Rules: Estate Tax, Gift Tax, & GST Tax Rules For 2011 – #98

When are gifts received by NRIs subject to tax, TDS in India? – The Economic Times – #99

When are gifts received by NRIs subject to tax, TDS in India? – The Economic Times – #99

Tax Guidelines About Gifting – TurboTax Tax Tips & Videos – #100

Tax Guidelines About Gifting – TurboTax Tax Tips & Videos – #100

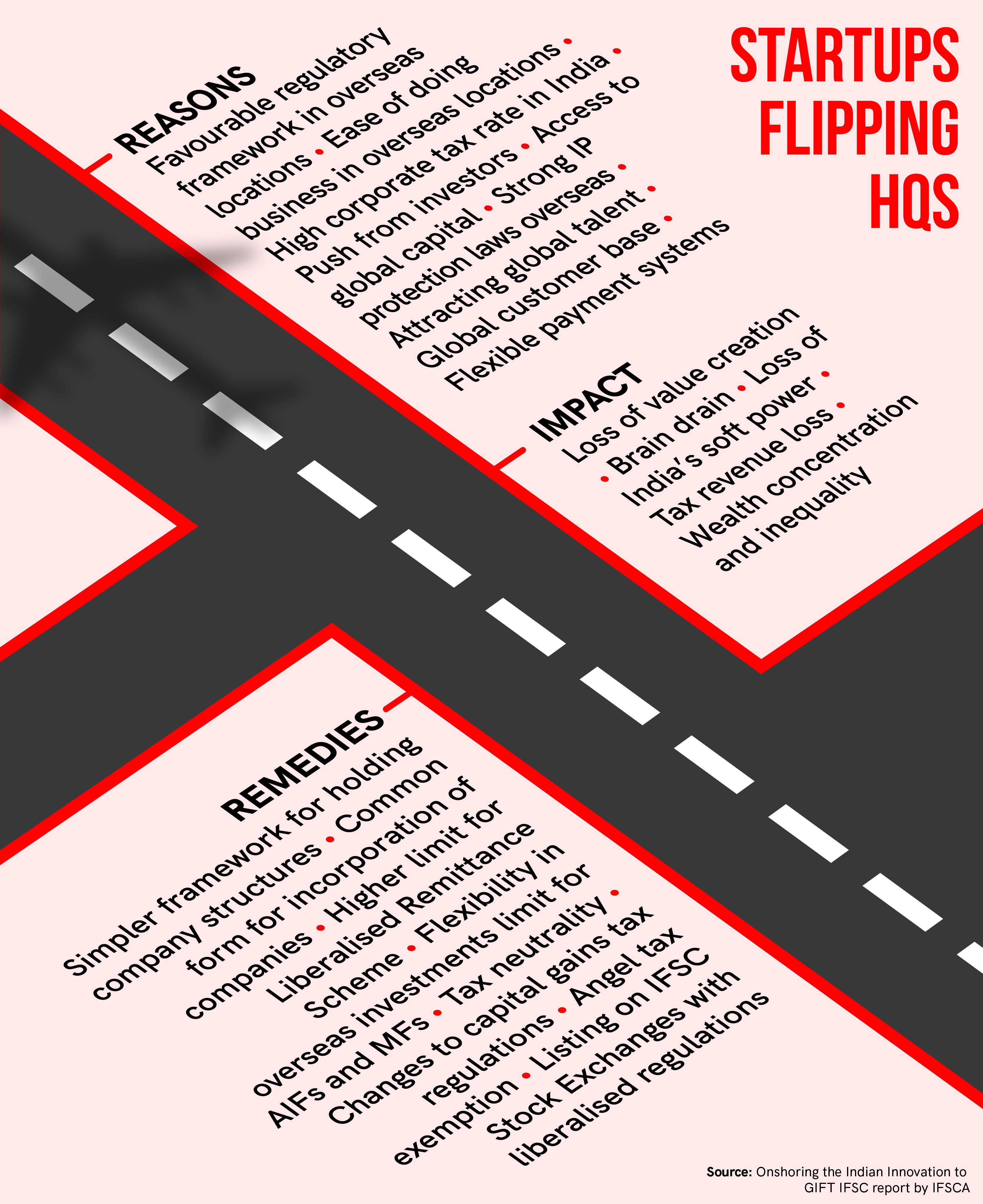

How The GIFT IFSC 10-Member Panel Wants To Clip The Startup Flip – #101

How The GIFT IFSC 10-Member Panel Wants To Clip The Startup Flip – #101

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #102

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #102

Income Tax Slabs FY 2023-24 & AY 2024-25 (New & Old Tax Slab) – #103

Income Tax Slabs FY 2023-24 & AY 2024-25 (New & Old Tax Slab) – #103

US Tax Revenue: % of GDP, 1968 – 2024 | CEIC Data – #104

US Tax Revenue: % of GDP, 1968 – 2024 | CEIC Data – #104

SW India – #105

SW India – #105

23 tax breaks for small businesses in 2024 | QuickBooks – #106

23 tax breaks for small businesses in 2024 | QuickBooks – #106

Valuation Discounts for Gift and Estate Tax Savings | Wealth Management | CAPTRUST – #107

Valuation Discounts for Gift and Estate Tax Savings | Wealth Management | CAPTRUST – #107

Jash Kriplani, CFPᶜᵐ on X: “Wedding season is here. Record 3.5 million weddings are expected this year. Gifts received by newlywed couples are tax-exempt on occasion of marriage. Is this only for – #108

Jash Kriplani, CFPᶜᵐ on X: “Wedding season is here. Record 3.5 million weddings are expected this year. Gifts received by newlywed couples are tax-exempt on occasion of marriage. Is this only for – #108

2023 International Tax Competitiveness Index | Tax Foundation – #109

2023 International Tax Competitiveness Index | Tax Foundation – #109

Taxation on gifts: Everything you need to know | Tax Hacks – #110

Taxation on gifts: Everything you need to know | Tax Hacks – #110

Understanding Gift Deeds and Stamp Duties in India – #111

Understanding Gift Deeds and Stamp Duties in India – #111

10 Ways America’s Rich Save Big on Estate Taxes – #112

10 Ways America’s Rich Save Big on Estate Taxes – #112

For every Rs 100 paid in direct tax, how much each state gets back : r/india – #113

For every Rs 100 paid in direct tax, how much each state gets back : r/india – #113

Posts: gift tax rate in india

Categories: Gifts

Author: toyotabienhoa.edu.vn