Update more than 56 gift tax percentage in india best

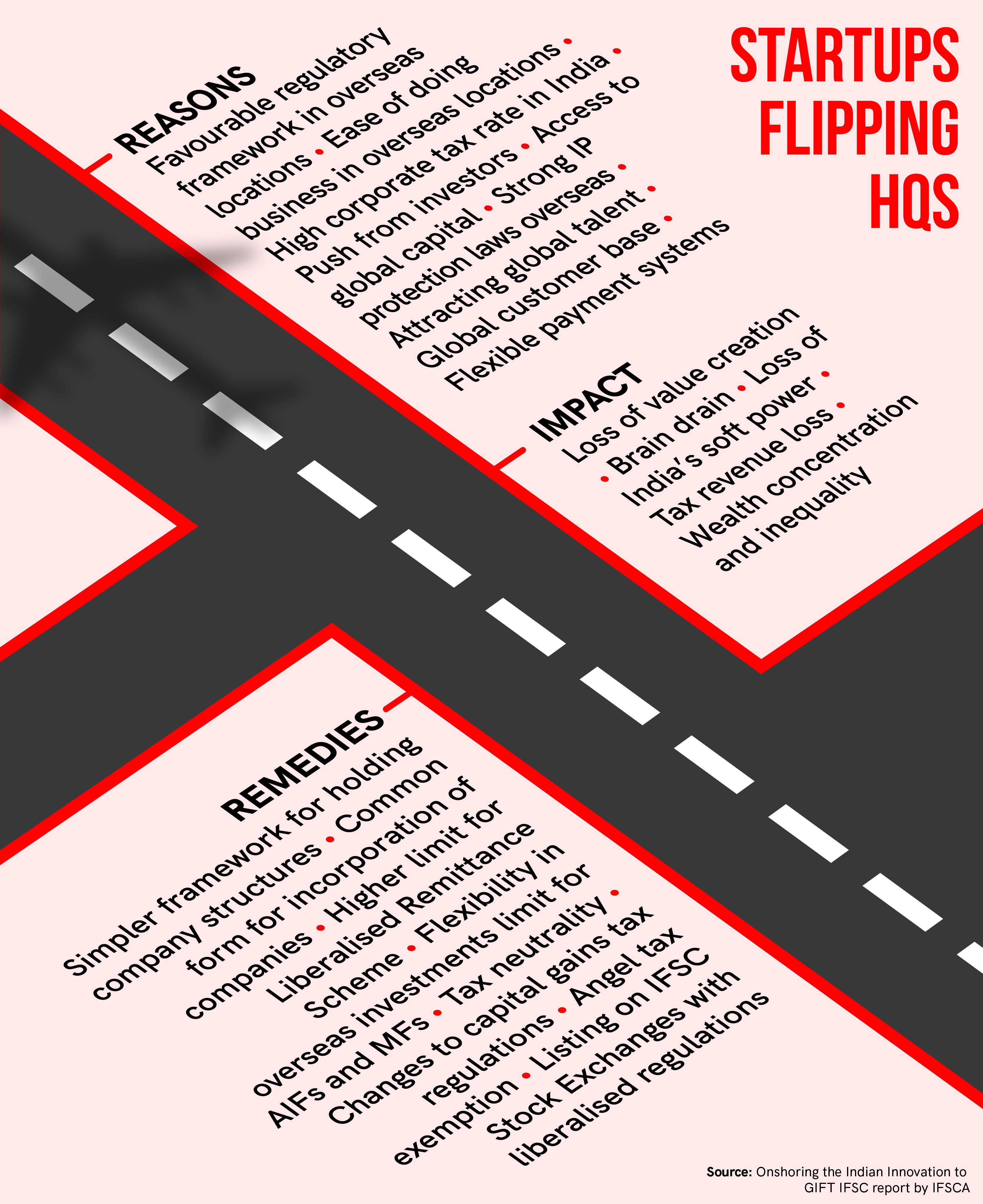

Details images of gift tax percentage in india by website toyotabienhoa.edu.vn compilation. How GIFT IFSC can encourage Indian startups to shift HQs back home. Tax Guidelines for Foreign Nationals & NRIs in India. GIFT TAX – UPSC Current Affairs – IAS GYAN

Tax | Types of Tax | Direct & Indirect Taxation in India 2023-24 – #1

Tax | Types of Tax | Direct & Indirect Taxation in India 2023-24 – #1

Tax | What is Tax | Taxation in India : Tax Calculation – #2

Tax | What is Tax | Taxation in India : Tax Calculation – #2

Tax Newsletter, Issue no. 1/2016 – #4

Tax Newsletter, Issue no. 1/2016 – #4

Federal Tax Reform is Official – The Lynch Law Group, Cranberry Twp. – #5

Federal Tax Reform is Official – The Lynch Law Group, Cranberry Twp. – #5

- gift tax rate in india 2020

- gift tax exemption 2022

- section 56(2) of income tax act

Income Tax Slab – All About the Tax Structure in India | HDFC ERGO – #6

Income Tax Slab – All About the Tax Structure in India | HDFC ERGO – #6

Tax on Wedding Gifts in India: Know Rule On Marriage Presents – #7

Tax on Wedding Gifts in India: Know Rule On Marriage Presents – #7

What Is The Gift Tax Rate? – Forbes Advisor – #8

What Is The Gift Tax Rate? – Forbes Advisor – #8

What is a gift deed and tax implications | Tax Hack – #10

What is a gift deed and tax implications | Tax Hack – #10

- gift tax exemption relatives list

- gift tax definition

) How the world taxes capital gains on equity | Mint – #11

How the world taxes capital gains on equity | Mint – #11

New Jersey Gift Tax: All You Need to Know | SmartAsset – #12

New Jersey Gift Tax: All You Need to Know | SmartAsset – #12

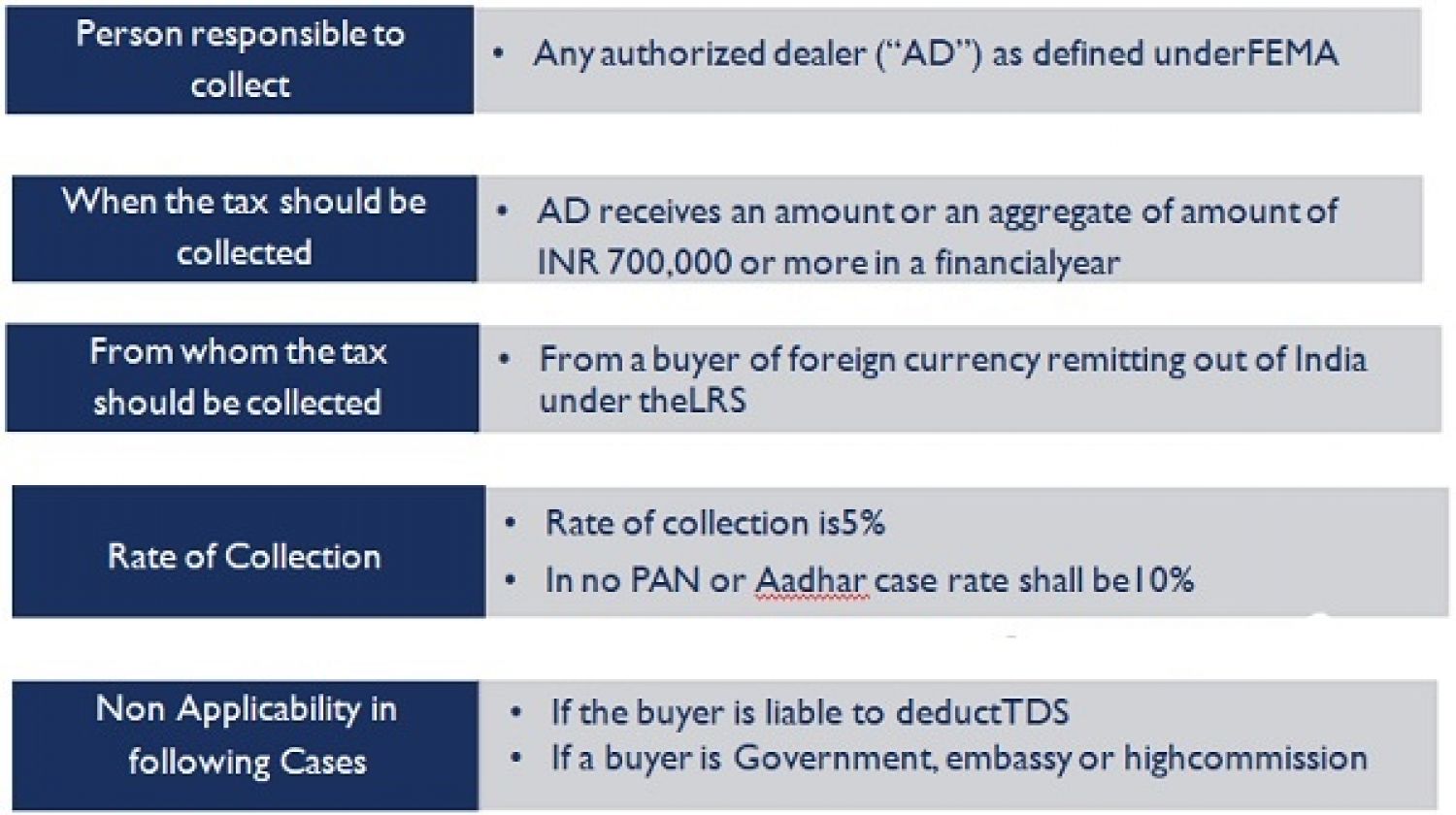

A new tax makes it more expensive to move money out of India – #13

A new tax makes it more expensive to move money out of India – #13

Foreign Gift Tax – Ultimate Insider Info You Need To Know – #14

Foreign Gift Tax – Ultimate Insider Info You Need To Know – #14

gift taxation: Which gifts are taxable for the recipient and which ones can increase tax liability of giver – The Economic Times – #15

gift taxation: Which gifts are taxable for the recipient and which ones can increase tax liability of giver – The Economic Times – #15

Indirect tax has increased by more than 50 percent.. ? – #16

Indirect tax has increased by more than 50 percent.. ? – #16

TransPrice Tax (@TransPrice) / X – #17

TransPrice Tax (@TransPrice) / X – #17

Things an NRI must know about gift tax rules in India | IDFC FIRST Bank – #18

Things an NRI must know about gift tax rules in India | IDFC FIRST Bank – #18

CA Vivek Jha – Investing in USA stock from India Direct vs Gift City taxation comparison | Facebook – #19

CA Vivek Jha – Investing in USA stock from India Direct vs Gift City taxation comparison | Facebook – #19

Form 709: What It Is and Who Must File It – #20

Form 709: What It Is and Who Must File It – #20

Tax – Wikipedia – #21

Tax – Wikipedia – #21

Interplay of Will, Gift and Relinquishment Deed in the Indian context – COMMERCIAL LAW BLOG – #22

Interplay of Will, Gift and Relinquishment Deed in the Indian context – COMMERCIAL LAW BLOG – #22

Do dividend payments from stocks affect your tax return? – Quora – #23

Do dividend payments from stocks affect your tax return? – Quora – #23

Planned Giving – Feed My People – #24

Planned Giving – Feed My People – #24

6 Crypto Tax Loopholes in 2024 (Save Thousands) | CoinLedger – #25

6 Crypto Tax Loopholes in 2024 (Save Thousands) | CoinLedger – #25

Everything you need to know about gift tax on property. – #26

Everything you need to know about gift tax on property. – #26

- lineal ascendant gift from relative exempt from income tax

- types of income tax

- gift tax rate in india 2022-23

TaxMode: income tax calculator & planner for USA:Amazon.com:Appstore for Android – #27

TaxMode: income tax calculator & planner for USA:Amazon.com:Appstore for Android – #27

Is there any gift tax to be paid in USA on the amounts received from sale of my house and jewellery in India and sent to our daughter in USA? – Quora – #28

Is there any gift tax to be paid in USA on the amounts received from sale of my house and jewellery in India and sent to our daughter in USA? – Quora – #28

- gift tax upsc

- list of relatives

- capital gains tax

Sales taxes in the United States – Wikipedia – #29

Sales taxes in the United States – Wikipedia – #29

.jpeg) Gift Tax: Details, Exemptions and Avoidance | Chase – #30

Gift Tax: Details, Exemptions and Avoidance | Chase – #30

Gifting Stock: 4 Ways to Gift Stocks to Friends, Family, and Charities – #31

Gifting Stock: 4 Ways to Gift Stocks to Friends, Family, and Charities – #31

What the IFSC at GIFT City has for non-resident Indian investors | Mint – #32

What the IFSC at GIFT City has for non-resident Indian investors | Mint – #32

- gift tax meaning

- expenditure tax act

- wealth tax

2024 Tax Brackets: Everything You Need to Know | CNN Underscored Money – #33

2024 Tax Brackets: Everything You Need to Know | CNN Underscored Money – #33

Gift from USA to India: Taxation and Exemptions – SBNRI – #34

Gift from USA to India: Taxation and Exemptions – SBNRI – #34

5 rules about Income Tax on Gifts received in India & Exemptions – #35

5 rules about Income Tax on Gifts received in India & Exemptions – #35

Gifts & Income Tax Implications : Scenarios & Examples – #36

Gifts & Income Tax Implications : Scenarios & Examples – #36

amazon india: Income tax payable on winnings from online, offline games of chance – The Economic Times – #37

amazon india: Income tax payable on winnings from online, offline games of chance – The Economic Times – #37

What is the Gift Tax in India and How Does it Affect NRIs? – #38

What is the Gift Tax in India and How Does it Affect NRIs? – #38

The Gift Tax Rate Schedule | Download Table – #39

The Gift Tax Rate Schedule | Download Table – #39

Investing in AIFs in Gift City: What You Need to Know – #40

Investing in AIFs in Gift City: What You Need to Know – #40

Outstanding Tax Demands Up To Rs 1 lakh Waived; Wealth, Gift Tax Exempted; Know Full Details – #41

Outstanding Tax Demands Up To Rs 1 lakh Waived; Wealth, Gift Tax Exempted; Know Full Details – #41

Fest gift as def pension revised from July 2019 – #42

Fest gift as def pension revised from July 2019 – #42

What the Income Tax rate was 40 years ago – Rediff.com – #43

What the Income Tax rate was 40 years ago – Rediff.com – #43

How to pay tax in Spain and what is the tax free allowance? – #44

How to pay tax in Spain and what is the tax free allowance? – #44

Gift by NRI to Resident Indian or Vice-Versa: Taxation and more – SBNRI – #45

Gift by NRI to Resident Indian or Vice-Versa: Taxation and more – SBNRI – #45

Taxation of Gifts received in Cash or Kind – #46

Taxation of Gifts received in Cash or Kind – #46

For every Rs 100 paid in direct tax, how much each state gets back : r/india – #47

For every Rs 100 paid in direct tax, how much each state gets back : r/india – #47

How are Cryptocurrency Gifts Taxed? | CoinLedger – #48

How are Cryptocurrency Gifts Taxed? | CoinLedger – #48

Where does India stand in the world in comparison of individual tax rates? | Mint – #49

Where does India stand in the world in comparison of individual tax rates? | Mint – #49

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #50

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #50

Lottery Tax in India: Tax Levied on Winning Game Shows & Lottery – #51

Lottery Tax in India: Tax Levied on Winning Game Shows & Lottery – #51

- gift from relative exempt from income tax

- gift tax example

- gift tax in india

Wealth Tax India: Who needs to pay and its history – #52

Wealth Tax India: Who needs to pay and its history – #52

Taxes On Gifts From Overseas – #53

Taxes On Gifts From Overseas – #53

- gift tax rate

- gift tax act 1958

- gift chart as per income tax

How money received via Will or Inheritance from abroad is taxed in India – Income Tax News | The Financial Express – #54

How money received via Will or Inheritance from abroad is taxed in India – Income Tax News | The Financial Express – #54

RSU Taxes Explained + 4 Tax Strategies for 2023 – #55

RSU Taxes Explained + 4 Tax Strategies for 2023 – #55

Tax queries: What is the tax liability of gifting a flat to your son? – The Economic Times – #56

Tax queries: What is the tax liability of gifting a flat to your son? – The Economic Times – #56

Posts: gift tax percentage in india

Categories: Gifts

Author: toyotabienhoa.edu.vn