Aggregate 154+ gift tax parent to child super hot

Top images of gift tax parent to child by website toyotabienhoa.edu.vn compilation. How much money can NRIs gift to parents in India? | Arthgyaan. Understand the Kiddie tax | Fidelity. Rules for Claiming Dependents on Taxes – TurboTax Tax Tips & Videos

When You Make Cash Gifts To Your Children, Who Pays The Tax? | Greenbush Financial Group – #1

When You Make Cash Gifts To Your Children, Who Pays The Tax? | Greenbush Financial Group – #1

- form 709 gift splitting example

Excise Tax gift Exemption Form | Pdf Fpdf Doc Docx | District Of Columbia – #2

Excise Tax gift Exemption Form | Pdf Fpdf Doc Docx | District Of Columbia – #2

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #4

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #4

When do minors have to pay tax on their income? | Mint – #5

When do minors have to pay tax on their income? | Mint – #5

Gift Tax Limit 2024: How Much Money Can You Gift? | SmartAsset – #6

Gift Tax Limit 2024: How Much Money Can You Gift? | SmartAsset – #6

Gift Deed Registration: Stamp Duty, Registry Fee, Tax, Procedure – #7

Gift Deed Registration: Stamp Duty, Registry Fee, Tax, Procedure – #7

Will a joint savings account be considered a gift? – nj.com – #8

Will a joint savings account be considered a gift? – nj.com – #8

What You Need to Know Before Gifting Money to Family | Savant Wealth Management – #10

What You Need to Know Before Gifting Money to Family | Savant Wealth Management – #10

Can I Be Taxed For Gifting My Business? — Thienel Law – #11

Can I Be Taxed For Gifting My Business? — Thienel Law – #11

Stay at Home Parents Tax Credit Guide for 2023 – TaxSlayer® – #12

Stay at Home Parents Tax Credit Guide for 2023 – TaxSlayer® – #12

Generation-Skipping Transfer Taxes – #13

Generation-Skipping Transfer Taxes – #13

What You Need to Know Before Gifting a 529 Plan – #14

What You Need to Know Before Gifting a 529 Plan – #14

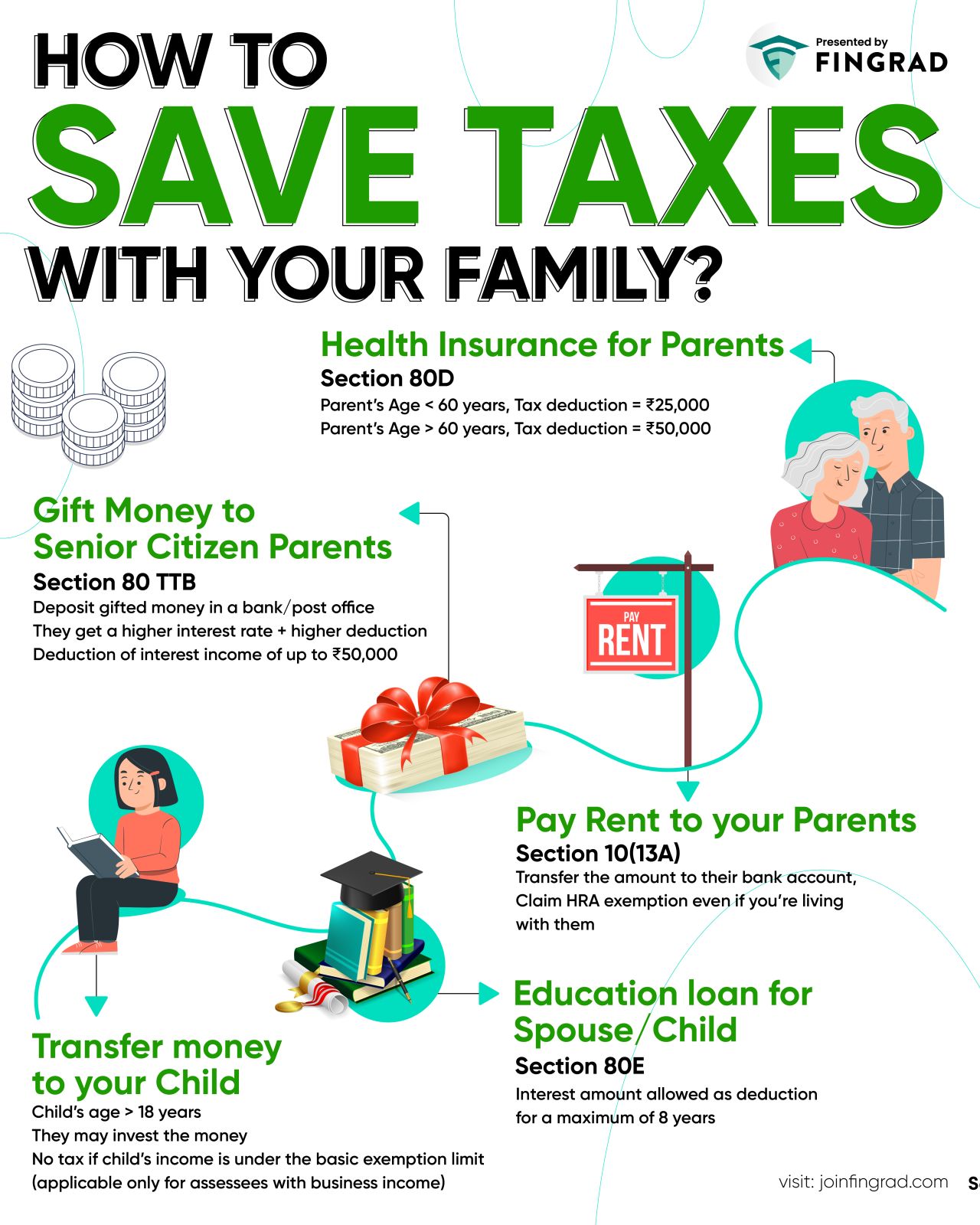

CA Pragya Gupta on LinkedIn: #savetax #taxplanning #incometaxindia – #15

CA Pragya Gupta on LinkedIn: #savetax #taxplanning #incometaxindia – #15

3 ways to give your godchild (or niece or nephew) a financial gift | MassMutual – #16

3 ways to give your godchild (or niece or nephew) a financial gift | MassMutual – #16

- 709 2020 gift tax sample completed irs form 709

- gift tax return form 709 example

- simple deed of gift template

Annual Gift Tax Exclusion Explained | PNC Insights – #17

Annual Gift Tax Exclusion Explained | PNC Insights – #17

If a car is sold between family members (not a gift), is there still sales tax (in California)? – Quora – #18

If a car is sold between family members (not a gift), is there still sales tax (in California)? – Quora – #18

Annual Gift Tax Exclusion vs. Medicaid Look Back Period | Cornetet, Meyer, Rush & Stapleton – #19

Annual Gift Tax Exclusion vs. Medicaid Look Back Period | Cornetet, Meyer, Rush & Stapleton – #19

Protecting the Gift: Keeping Children and Teenagers Safe (and Parents Sane): de Becker, Gavin: 9780440509004: Amazon.com: Books – #20

Protecting the Gift: Keeping Children and Teenagers Safe (and Parents Sane): de Becker, Gavin: 9780440509004: Amazon.com: Books – #20

Solved B. Parent gives the rent-free use of the family beach | Chegg.com – #21

Solved B. Parent gives the rent-free use of the family beach | Chegg.com – #21

Smart Ways to Gift Money to Children | Family Finance | U.S. News – #22

Smart Ways to Gift Money to Children | Family Finance | U.S. News – #22

How to Gift Your House to Your Children During Your Lifetime | City National Bank – #23

How to Gift Your House to Your Children During Your Lifetime | City National Bank – #23

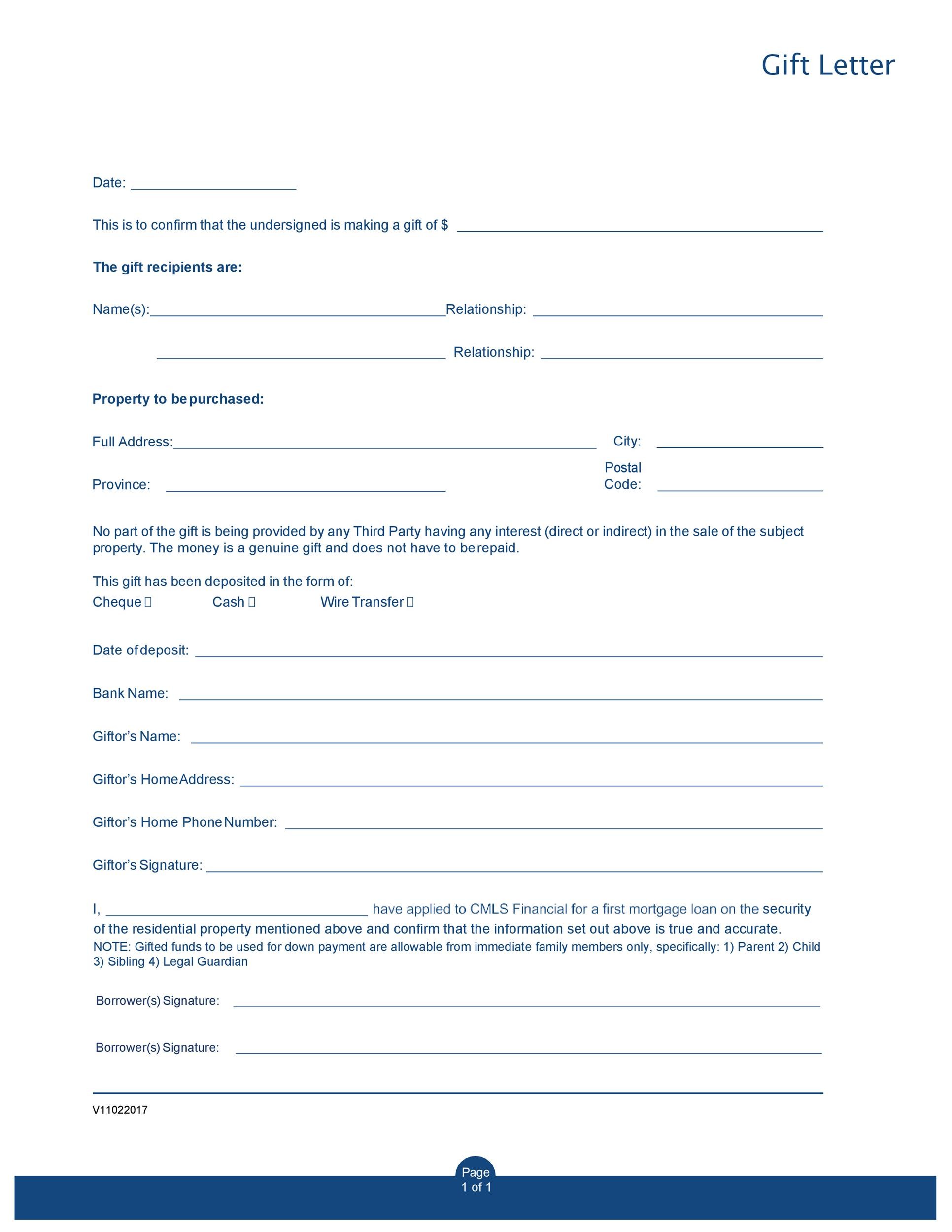

More parents want to help children buy homes in todays tight market | J.P. Morgan Private Bank U.S. – #24

More parents want to help children buy homes in todays tight market | J.P. Morgan Private Bank U.S. – #24

Major Things that Every Person Must Know About Tax on Gift in India | Tax & Investment Consultants – #25

Major Things that Every Person Must Know About Tax on Gift in India | Tax & Investment Consultants – #25

A Complete Guide for Gifting Money to Children – #26

A Complete Guide for Gifting Money to Children – #26

Question #12 of 85 Which of the following is a | Chegg.com – #27

Question #12 of 85 Which of the following is a | Chegg.com – #27

Dinesh Joshi on X: “On a lighter note , my wife has become like China . Charging me interest over interest .. 😂” / X – #28

Dinesh Joshi on X: “On a lighter note , my wife has become like China . Charging me interest over interest .. 😂” / X – #28

IRAS | Tax savings for married couples and families – #29

IRAS | Tax savings for married couples and families – #29

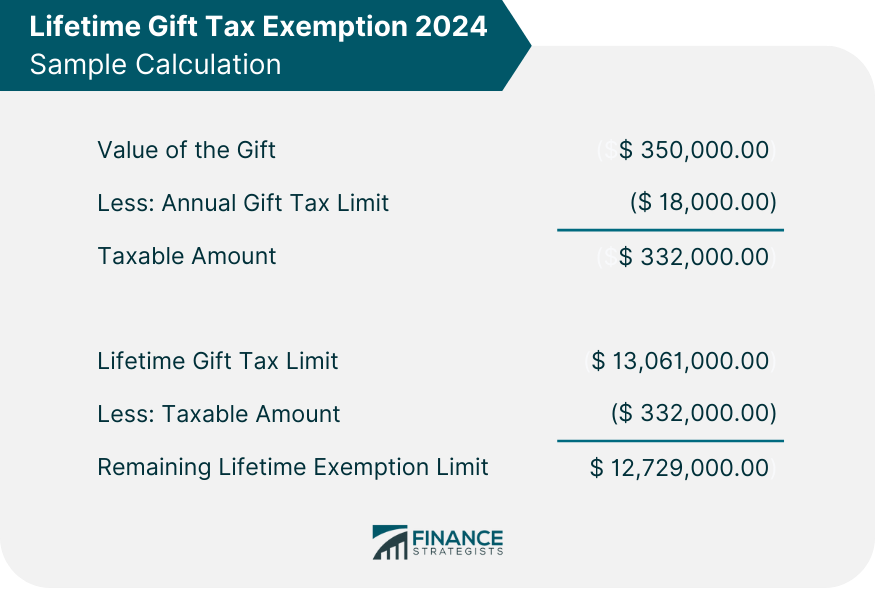

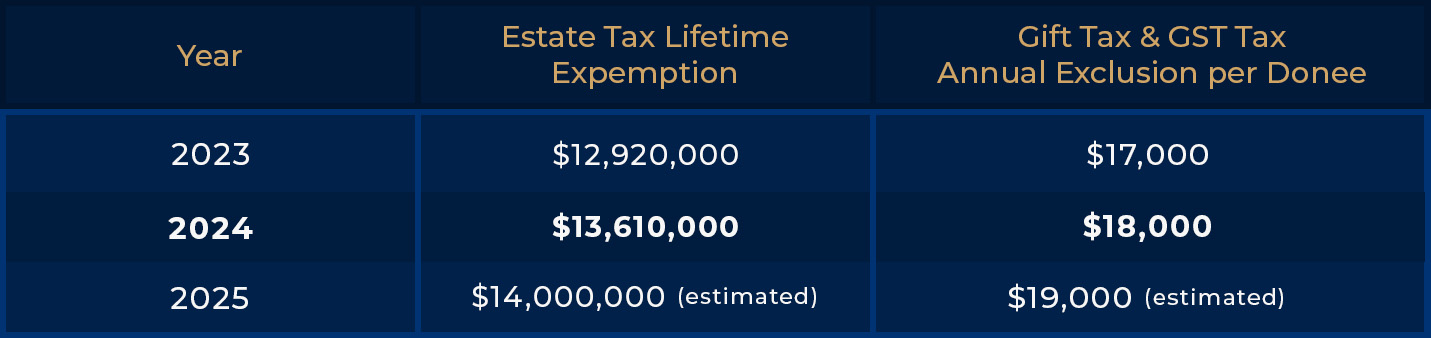

IRS Announced New Lifetime and Gift Tax Exemptions – Texas Trust Law – #30

IRS Announced New Lifetime and Gift Tax Exemptions – Texas Trust Law – #30

Tax Strategies for Parents of Kids with Special Needs – The Autism Community in Action – #31

Tax Strategies for Parents of Kids with Special Needs – The Autism Community in Action – #31

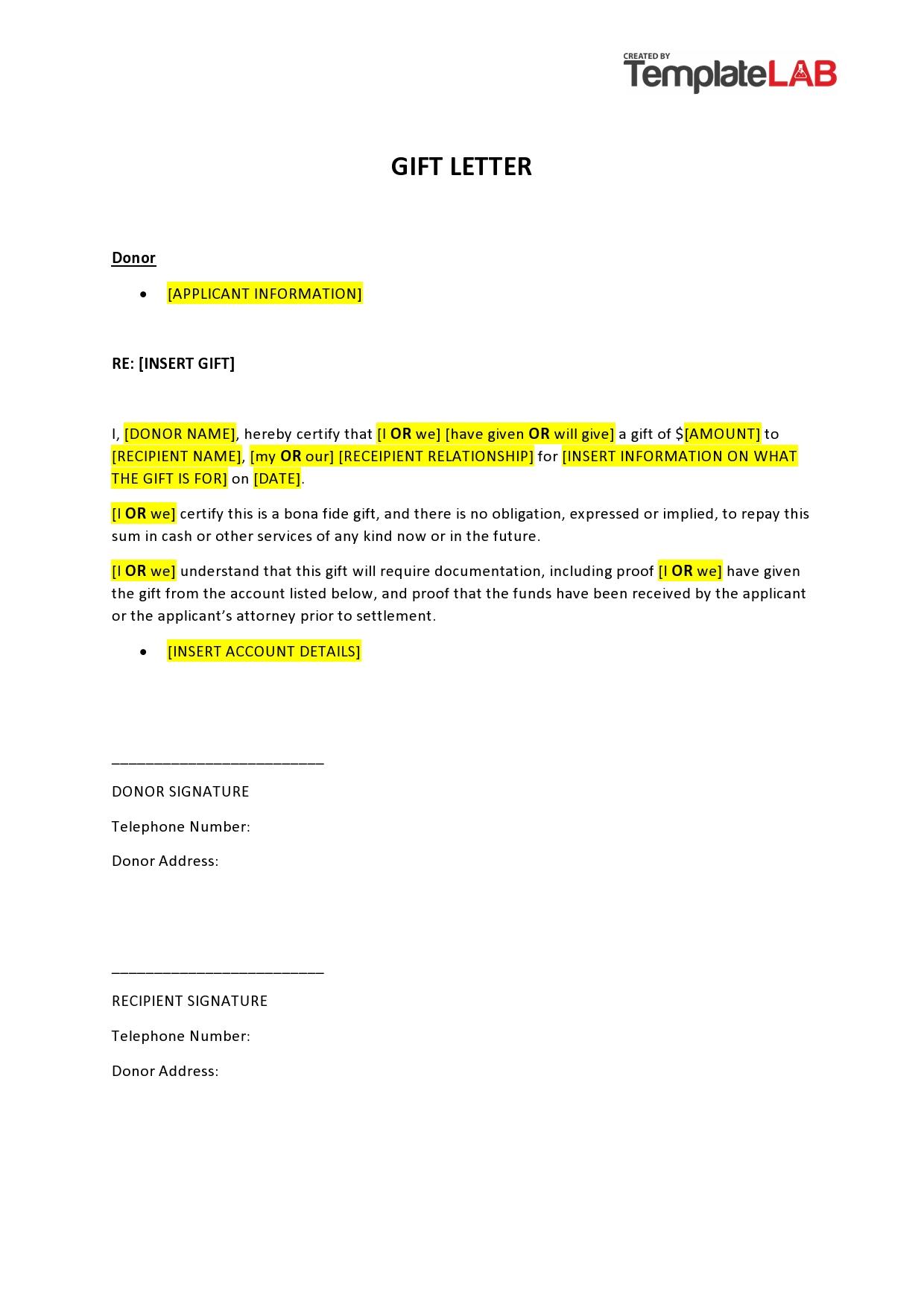

![Free Printable Gift Letter Templates / Car, Boat, Mortgage [PDF, Word] Free Printable Gift Letter Templates / Car, Boat, Mortgage [PDF, Word]](https://i.ytimg.com/vi/MgZEn1SO86k/hq720.jpg?sqp\u003d-oaymwEhCK4FEIIDSFryq4qpAxMIARUAAAAAGAElAADIQj0AgKJD\u0026rs\u003dAOn4CLAOgkC5ElTV14jmk2l5mmzWw-0r0Q) Free Printable Gift Letter Templates / Car, Boat, Mortgage [PDF, Word] – #32

Free Printable Gift Letter Templates / Car, Boat, Mortgage [PDF, Word] – #32

Using trusts to shift income to children – #33

Using trusts to shift income to children – #33

Will You Owe a Gift Tax This Year? – #34

Will You Owe a Gift Tax This Year? – #34

Do gifts of property to children trigger taxes? – Courtney Elder Law Associates – #35

Do gifts of property to children trigger taxes? – Courtney Elder Law Associates – #35

- gift deed format father to son

- irs form 709 examples of completed 709s

- property gift deed

The Misunderstood Gift Tax: What You Should Know – Wealthy Mom MD® – #36

The Misunderstood Gift Tax: What You Should Know – Wealthy Mom MD® – #36

Thinking About Giving Money to Adult Children? Think Again – The New York Times – #37

Thinking About Giving Money to Adult Children? Think Again – The New York Times – #37

New parent gift to child tax Quotes, Status, Photo, Video | Nojoto – #38

New parent gift to child tax Quotes, Status, Photo, Video | Nojoto – #38

Tax-Smart Ways to Help Your Kids or Grandkids Pay for College – #39

Tax-Smart Ways to Help Your Kids or Grandkids Pay for College – #39

Section 56(2)(vii) : Cash / Non-Cash Gifts – #40

Section 56(2)(vii) : Cash / Non-Cash Gifts – #40

IRS Gift Limit 2023: How much can a parent gift a child in 2023? | Marca – #41

IRS Gift Limit 2023: How much can a parent gift a child in 2023? | Marca – #41

Inheritance Tax: What It Is, 3 Ways to Avoid It – NerdWallet – #42

Inheritance Tax: What It Is, 3 Ways to Avoid It – NerdWallet – #42

Infographic – The Ramifications Of Giving Your Children Financial Gifts | Symmetry Financial Management – #43

Infographic – The Ramifications Of Giving Your Children Financial Gifts | Symmetry Financial Management – #43

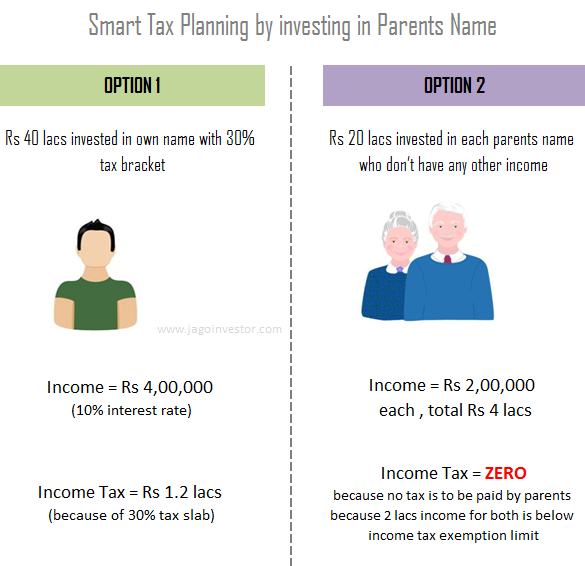

Gift Tax planning – 3 awesome tips to save income tax legally – #44

Gift Tax planning – 3 awesome tips to save income tax legally – #44

Do Gifts Count Toward Child Support? – #45

Do Gifts Count Toward Child Support? – #45

Do I Need to Worry About the Gift Tax If I Pay $30,000 Toward My Child’s Wedding? – #46

Do I Need to Worry About the Gift Tax If I Pay $30,000 Toward My Child’s Wedding? – #46

What You Need to Know About Stock Gift Tax – #47

What You Need to Know About Stock Gift Tax – #47

Taxation of gifts to NRIs and changes in Budget 2023-24 – #48

Taxation of gifts to NRIs and changes in Budget 2023-24 – #48

Gifting a House Deposit to Your Child in Ireland: What You Need to Know – Paul O’Donovan & Associates – #49

Gifting a House Deposit to Your Child in Ireland: What You Need to Know – Paul O’Donovan & Associates – #49

Stamp duty on gift deed in blood relatives – #50

Stamp duty on gift deed in blood relatives – #50

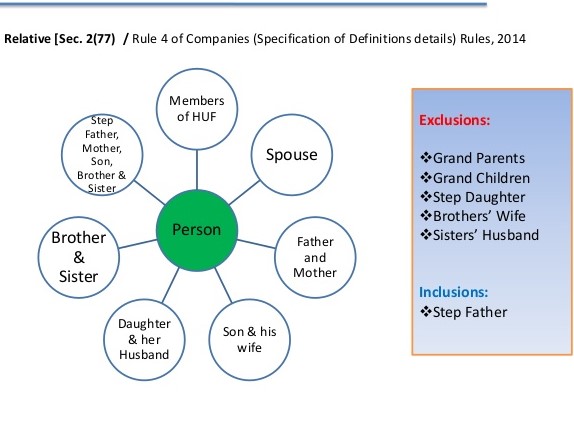

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #51

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #51

Gifting Money to Your Kids for College Tuition | SoFi – #52

Gifting Money to Your Kids for College Tuition | SoFi – #52

How much money can I gift to my children and grandchildren tax-free? | Standard Life – #53

How much money can I gift to my children and grandchildren tax-free? | Standard Life – #53

- form 709 example

- gift tax rate

- sample form 709 completed 2019

All You Need To Know About Gifting Property And Gift Deed Rules – #54

All You Need To Know About Gifting Property And Gift Deed Rules – #54

Taxation on gifts: Everything you need to know | Tax Hacks – #55

Taxation on gifts: Everything you need to know | Tax Hacks – #55

What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #56

What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #56

How to Calculate the Federal Gift Tax? – YouTube – #57

How to Calculate the Federal Gift Tax? – YouTube – #57

Making tax-efficient gifts to grandchildren | RBC Brewin Dolphin – #58

Making tax-efficient gifts to grandchildren | RBC Brewin Dolphin – #58

What is the Generation-Skipping Transfer Tax? – TurboTax Tax Tips & Videos – #59

What is the Generation-Skipping Transfer Tax? – TurboTax Tax Tips & Videos – #59

Why Married Couples Should Probably Do Nothing in Light of Proposition 19 Passing | BB&L – #60

Why Married Couples Should Probably Do Nothing in Light of Proposition 19 Passing | BB&L – #60

What Happens When Both Parents Claim a Child on a Tax Return? – TurboTax Tax Tips & Videos – #61

What Happens When Both Parents Claim a Child on a Tax Return? – TurboTax Tax Tips & Videos – #61

Child insurance plan best gift for children(news pdf) by Gaurav06 – Issuu – #62

Child insurance plan best gift for children(news pdf) by Gaurav06 – Issuu – #62

Tax Breaks for Generous Grandparents | NEA Member Benefits – #63

Tax Breaks for Generous Grandparents | NEA Member Benefits – #63

IRS Announces 2017 Estate And Gift Tax Limits: The $11 Million Tax Break – #64

IRS Announces 2017 Estate And Gift Tax Limits: The $11 Million Tax Break – #64

6 Rules for Gifting Money to Family | First Citizens Bank – #65

6 Rules for Gifting Money to Family | First Citizens Bank – #65

- 709 gift splitting irs completed sample form 709 sample

- gift deed stamp paper

- form 709 example 2022

This is a great way to help out a family member to get in a home today, especially if they’re going to inherit it in the future anyway. … | Instagram – #66

This is a great way to help out a family member to get in a home today, especially if they’re going to inherit it in the future anyway. … | Instagram – #66

Income clubbing: Are you trying to save tax by investing in the name of your parents or wife? | Arthgyaan – #67

Income clubbing: Are you trying to save tax by investing in the name of your parents or wife? | Arthgyaan – #67

Should You Give Children Money as a Gift? | Truist – #68

Should You Give Children Money as a Gift? | Truist – #68

Gifting Your House To Your Children – YouTube – #69

Gifting Your House To Your Children – YouTube – #69

-Gifts.jpg) Jeanne on X: “A misleading headline. The “annual exclusion” ($18,000 for 2024) is the amount you can gift to someone without using any of your lifetime gift & estate exclusion or filing – #70

Jeanne on X: “A misleading headline. The “annual exclusion” ($18,000 for 2024) is the amount you can gift to someone without using any of your lifetime gift & estate exclusion or filing – #70

Estate & Gift Tax Considerations – #71

Estate & Gift Tax Considerations – #71

All you need to know about taxes on gifts and the exceptions | Mint – #72

All you need to know about taxes on gifts and the exceptions | Mint – #72

Form 709: What It Is and Who Must File It – #73

Form 709: What It Is and Who Must File It – #73

Gifting Money to Family Members: Everything You Need to Know – #74

Gifting Money to Family Members: Everything You Need to Know – #74

- gift tax in india

- generation-skipping trust diagram

- money gift deed format

5 tips for picking gifts for your child – #75

5 tips for picking gifts for your child – #75

What is a gift deed and tax implications | Tax Hack – #76

What is a gift deed and tax implications | Tax Hack – #76

Four Ways to Pass Your Home to Your Children Tax-Free – #77

Four Ways to Pass Your Home to Your Children Tax-Free – #77

In season of giving, parental gifts carry tax, legal concerns with them – #78

In season of giving, parental gifts carry tax, legal concerns with them – #78

How can NRIs in the US gift money to their parents in India in 2023? | Arthgyaan – #79

How can NRIs in the US gift money to their parents in India in 2023? | Arthgyaan – #79

What will the estate and gift tax exclusions be in 2024, 2025? – #80

What will the estate and gift tax exclusions be in 2024, 2025? – #80

- gift tax definition

- gift tax exemption relatives list

- gift tax returns irs completed sample form 709 sample

How To Make (Or Ask For) A 529 Plan Gift Contribution – Forbes Advisor – #81

How To Make (Or Ask For) A 529 Plan Gift Contribution – Forbes Advisor – #81

Parent to/from Child (on/or prior to 2/15/21 – Prop 58) – #82

Parent to/from Child (on/or prior to 2/15/21 – Prop 58) – #82

Helping a Child Purchase a Home | PNC Insights – #83

Helping a Child Purchase a Home | PNC Insights – #83

Sweet Child of Mine: Tax Credits for Parents – TurboTax Tax Tips & Videos – #84

Sweet Child of Mine: Tax Credits for Parents – TurboTax Tax Tips & Videos – #84

Gift Tax, the Annual Exclusion and Estate Planning – #85

Gift Tax, the Annual Exclusion and Estate Planning – #85

- gift tax meaning

- gift tax exemption

- generation skipping transfer tax

Children Educational Allowance Exemption: 4 Ways to Save Taxes! – #86

Children Educational Allowance Exemption: 4 Ways to Save Taxes! – #86

8 Ways to Creatively and Thoughtfully Gift Cash and Money – #87

8 Ways to Creatively and Thoughtfully Gift Cash and Money – #87

gift deed: Is gift deed a tax-efficient way to transfer assets to legal heirs? – The Economic Times – #88

gift deed: Is gift deed a tax-efficient way to transfer assets to legal heirs? – The Economic Times – #88

14-317 Affidavit of Motor Vehicle Gift Transfer – #89

14-317 Affidavit of Motor Vehicle Gift Transfer – #89

Gift Tax – Do I Have to Pay Taxes on a Gift | Gift Tax Calculator – #90

Gift Tax – Do I Have to Pay Taxes on a Gift | Gift Tax Calculator – #90

Transfer of Property From Parent to Child Canada (2024) | Onyx Law Group – #91

Transfer of Property From Parent to Child Canada (2024) | Onyx Law Group – #91

Gifting Money to Your Grandchildren | Progressive – #92

Gifting Money to Your Grandchildren | Progressive – #92

Want To Gift Ancestral Gold To Your Kin Or Sell It For Cash? Know The Taxation – #93

Want To Gift Ancestral Gold To Your Kin Or Sell It For Cash? Know The Taxation – #93

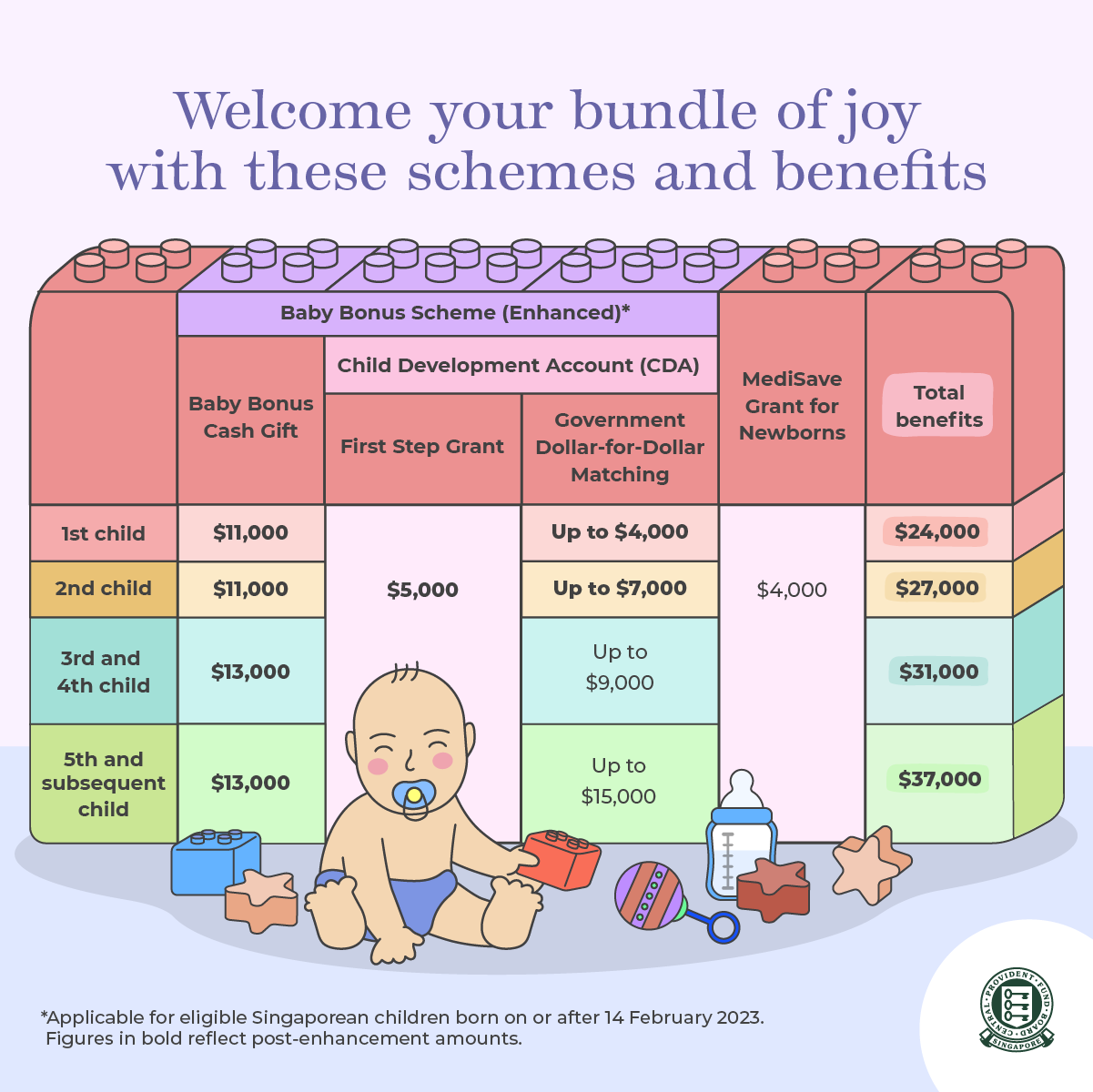

CPFB | Baby Bonus benefits and support for new parents – #94

CPFB | Baby Bonus benefits and support for new parents – #94

VERIFY on X: “In 2024, a parent is allowed to give their child this much without having to report it to the IRS: https://t.co/tINyQbCDTF https://t.co/WRKCj874Vo” / X – #95

VERIFY on X: “In 2024, a parent is allowed to give their child this much without having to report it to the IRS: https://t.co/tINyQbCDTF https://t.co/WRKCj874Vo” / X – #95

What is Gift Tax? – Exemption and Limits on Gifts for FY 2023-24 – #96

What is Gift Tax? – Exemption and Limits on Gifts for FY 2023-24 – #96

Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver – #97

Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver – #97

Gifts for the grandchildren: 7 things to keep in mind while investing for grandkids – The Economic Times – #98

Gifts for the grandchildren: 7 things to keep in mind while investing for grandkids – The Economic Times – #98

Generation-Skipping Transfer Tax: How It Can Affect Your Estate Plan | U.S. Bank – #99

Generation-Skipping Transfer Tax: How It Can Affect Your Estate Plan | U.S. Bank – #99

How much money can NRIs gift to parents in India? | Arthgyaan – #100

How much money can NRIs gift to parents in India? | Arthgyaan – #100

Employing Your Child TWC – #101

Employing Your Child TWC – #101

6 Ways To Give Money As A Gift | Bankrate – #102

6 Ways To Give Money As A Gift | Bankrate – #102

Gift Tax 2023 | What It Is, Annual Limit, Lifetime Exemption, & Gift Tax Rate – #103

Gift Tax 2023 | What It Is, Annual Limit, Lifetime Exemption, & Gift Tax Rate – #103

A Guide to Gifting Money to Your Children | City National Bank – #104

A Guide to Gifting Money to Your Children | City National Bank – #104

What is the IRS Gift Tax Limit? – #105

What is the IRS Gift Tax Limit? – #105

What to Know About the Child Tax Credit Being Debated in Congress – The New York Times – #106

What to Know About the Child Tax Credit Being Debated in Congress – The New York Times – #106

Should I Include a Dependent’s Income on My Tax Return? – TurboTax Tax Tips & Videos – #107

Should I Include a Dependent’s Income on My Tax Return? – TurboTax Tax Tips & Videos – #107

Do You Have to Pay Tax on Gifts? – #108

Do You Have to Pay Tax on Gifts? – #108

What Is a Custodial Account? – #109

What Is a Custodial Account? – #109

16 holiday gifts for expecting parents and new parents – #110

16 holiday gifts for expecting parents and new parents – #110

Wealth Planning Resources: Funding for Education – The Haverford Trust Company – #111

Wealth Planning Resources: Funding for Education – The Haverford Trust Company – #111

Income tax on a gift from father to daughter – #112

Income tax on a gift from father to daughter – #112

Making Gifts to Minors – #113

Making Gifts to Minors – #113

Gift Tax Limit 2024 | Calculation, Filing, and How to Avoid Gift Tax – #114

Gift Tax Limit 2024 | Calculation, Filing, and How to Avoid Gift Tax – #114

What Is the 2023 and 2024 Gift Tax Limit? – Ramsey – #115

What Is the 2023 and 2024 Gift Tax Limit? – Ramsey – #115

All about Gift of Immovable property from father to son – #116

All about Gift of Immovable property from father to son – #116

What is the limit up to which a father can gift to his son under income tax laws | Mint – #117

What is the limit up to which a father can gift to his son under income tax laws | Mint – #117

UGMA & UTMA accounts | Tips for custodial accounts | Fidelity – #118

UGMA & UTMA accounts | Tips for custodial accounts | Fidelity – #118

Can I Pay My Kid’s Tuition Without Triggering the Gift Tax? | Money – #119

Can I Pay My Kid’s Tuition Without Triggering the Gift Tax? | Money – #119

Do I Have to Worry About the Gift Tax if I Give My Son $75,000 Toward a Down Payment? | SmartAsset – #120

Do I Have to Worry About the Gift Tax if I Give My Son $75,000 Toward a Down Payment? | SmartAsset – #120

Tax Benefits | College Savings Iowa 529 Plan – #121

Tax Benefits | College Savings Iowa 529 Plan – #121

Tax Implications of Supporting Adult Children | TaxAct Blog – #122

Tax Implications of Supporting Adult Children | TaxAct Blog – #122

Free Gift Affidavit Form | PDF & Word – #123

Free Gift Affidavit Form | PDF & Word – #123

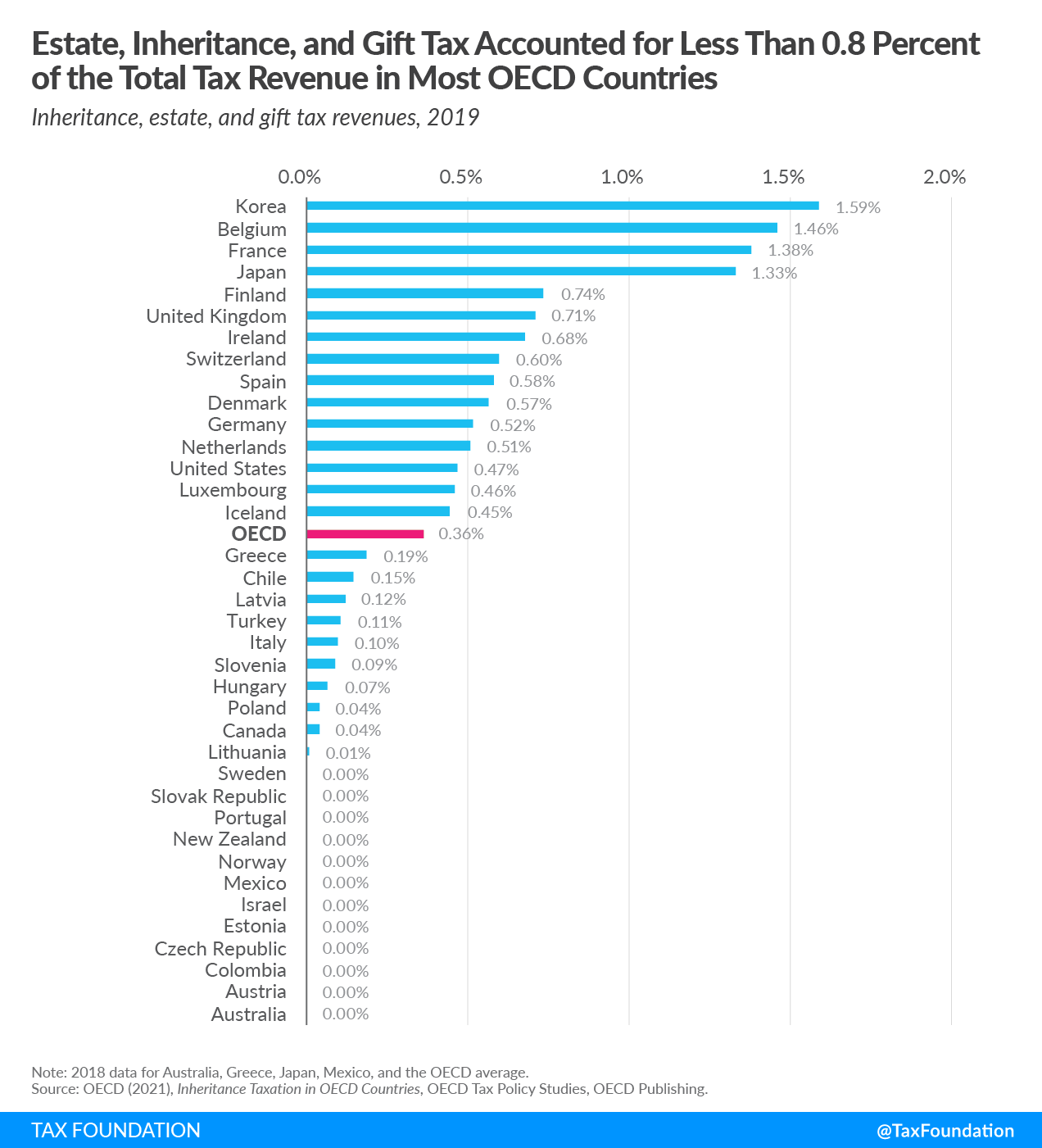

Inheritance, Estate, and Gift Taxes in OECD Countries | Tax Foundation – #124

Inheritance, Estate, and Gift Taxes in OECD Countries | Tax Foundation – #124

7 Tax Advantages For Parents | Child Care Tax Benefits – #125

7 Tax Advantages For Parents | Child Care Tax Benefits – #125

What is gift splitting and how does it work? | Fidelity – #126

What is gift splitting and how does it work? | Fidelity – #126

Tax implications of gifting bank account, demat account and PPF to 18-year-old son – The Economic Times – #127

Tax implications of gifting bank account, demat account and PPF to 18-year-old son – The Economic Times – #127

Understanding the Gift Tax in New York – Littman Krooks LLP – #128

Understanding the Gift Tax in New York – Littman Krooks LLP – #128

Who Pays The Tax On A Cash Gift? | Greenbush Financial Group – #129

Who Pays The Tax On A Cash Gift? | Greenbush Financial Group – #129

Can an Adult Child Gift Parents Money and Use It as a Tax Deduction? – #130

Can an Adult Child Gift Parents Money and Use It as a Tax Deduction? – #130

Amazon.com : 97 Decor Will You Be My Godparents Proposal Gift – God Parents Presents Proposal Ideas, Godparent Gifts from Godchild for Baptism, Godparents Proposal Card, Asking Godmother Godfather Invitation : Baby – #131

Amazon.com : 97 Decor Will You Be My Godparents Proposal Gift – God Parents Presents Proposal Ideas, Godparent Gifts from Godchild for Baptism, Godparents Proposal Card, Asking Godmother Godfather Invitation : Baby – #131

Ways to Give Money to Children | Kiplinger – #132

Ways to Give Money to Children | Kiplinger – #132

How Much is the Gift Tax? | What is a Gift Tax? | Gift Tax Limit 2020 – #133

How Much is the Gift Tax? | What is a Gift Tax? | Gift Tax Limit 2020 – #133

4 Ways You Can Gift Money to Children | T. Rowe Price – #134

4 Ways You Can Gift Money to Children | T. Rowe Price – #134

A Guide To Helping Your Kids Own A Home | Rocket Mortgage – #135

A Guide To Helping Your Kids Own A Home | Rocket Mortgage – #135

Gift Tax Exclusion – FasterCapital – #136

Gift Tax Exclusion – FasterCapital – #136

Gifting a Car & Tax Write Offs : r/texas – #137

Gifting a Car & Tax Write Offs : r/texas – #137

2024 Gift Tax Rate: What It Is And How It Works | Bankrate – #138

2024 Gift Tax Rate: What It Is And How It Works | Bankrate – #138

About Proposition 19 (2020) | CCSF Office of Assessor-Recorder – #139

About Proposition 19 (2020) | CCSF Office of Assessor-Recorder – #139

How to gift money to children, family, and loved ones | Fidelity – #140

How to gift money to children, family, and loved ones | Fidelity – #140

- generation skipping tax example

- gift tax example

- gift deed format on stamp paper

California’s new tobacco ban putting family services at risk – Los Angeles Times – #141

California’s new tobacco ban putting family services at risk – Los Angeles Times – #141

How to Protect Your Child Benefit : Braun, Nick: Amazon.in: Books – #142

How to Protect Your Child Benefit : Braun, Nick: Amazon.in: Books – #142

I Want To Help My Son Buy A House — If I Give Him $30,000 For The Down Payment, Will I Pay A Gift Tax? Do I Need To Report This To – #143

I Want To Help My Son Buy A House — If I Give Him $30,000 For The Down Payment, Will I Pay A Gift Tax? Do I Need To Report This To – #143

HSA Tax Benefits For Parents With Adult Children Under 26 – #144

HSA Tax Benefits For Parents With Adult Children Under 26 – #144

The 10 Greatest Gifts I Give My Children: Parenting from the Heart: Vannoy, Steven W.: 9781476762975: Amazon.com: Books – #145

The 10 Greatest Gifts I Give My Children: Parenting from the Heart: Vannoy, Steven W.: 9781476762975: Amazon.com: Books – #145

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #146

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #146

Gift Tax: Why Giving Away $15,000 Is a Trap For the Unwary – #147

Gift Tax: Why Giving Away $15,000 Is a Trap For the Unwary – #147

The Generation-Skipping Transfer Tax: A Quick Guide – #148

The Generation-Skipping Transfer Tax: A Quick Guide – #148

Meaning of relative under different act | CA Rajput Jain – #149

Meaning of relative under different act | CA Rajput Jain – #149

IRS Form 709 | H&R Block – #150

IRS Form 709 | H&R Block – #150

How to Gift Educational Expenses: Tax Advantages and Pitfalls – #151

How to Gift Educational Expenses: Tax Advantages and Pitfalls – #151

How to pass on inheritance to your children – Los Angeles Times – #152

How to pass on inheritance to your children – Los Angeles Times – #152

5 Ways To Transfer Ownership of Property From Parents to Child – #153

5 Ways To Transfer Ownership of Property From Parents to Child – #153

Nannies and sitters: Do you give kids presents? – Care.com Resources – #154

Nannies and sitters: Do you give kids presents? – Care.com Resources – #154

Posts: gift tax parent to child

Categories: Gifts

Author: toyotabienhoa.edu.vn