Details 183+ gift tax in india 2021 best

Top images of gift tax in india 2021 by website toyotabienhoa.edu.vn compilation. Kerala tax revenue grows 22% in FY23, third highest among states. 2023 Deloitte holiday retail survey | Deloitte Insights. Understand the Taxation of Virtual Digital Assets – Taxmann. Income Tax Law and Practice Hons Question Paper’ 2021 (Held in 2022), Dibrugarh University B.Com 3rd Sem Question Papers. Tax Exemption FAQS | Tax Benefit on Section 80G

India’s Import-Export Trends in FY 2020-21 – India Briefing News – #1

India’s Import-Export Trends in FY 2020-21 – India Briefing News – #1

- gift for boys

- income from other sources format

- gift tax rate

How to Fill W-8BEN Form India – Including Tax Treaty Details (In The Correct Way) – YouTube – #2

How to Fill W-8BEN Form India – Including Tax Treaty Details (In The Correct Way) – YouTube – #2

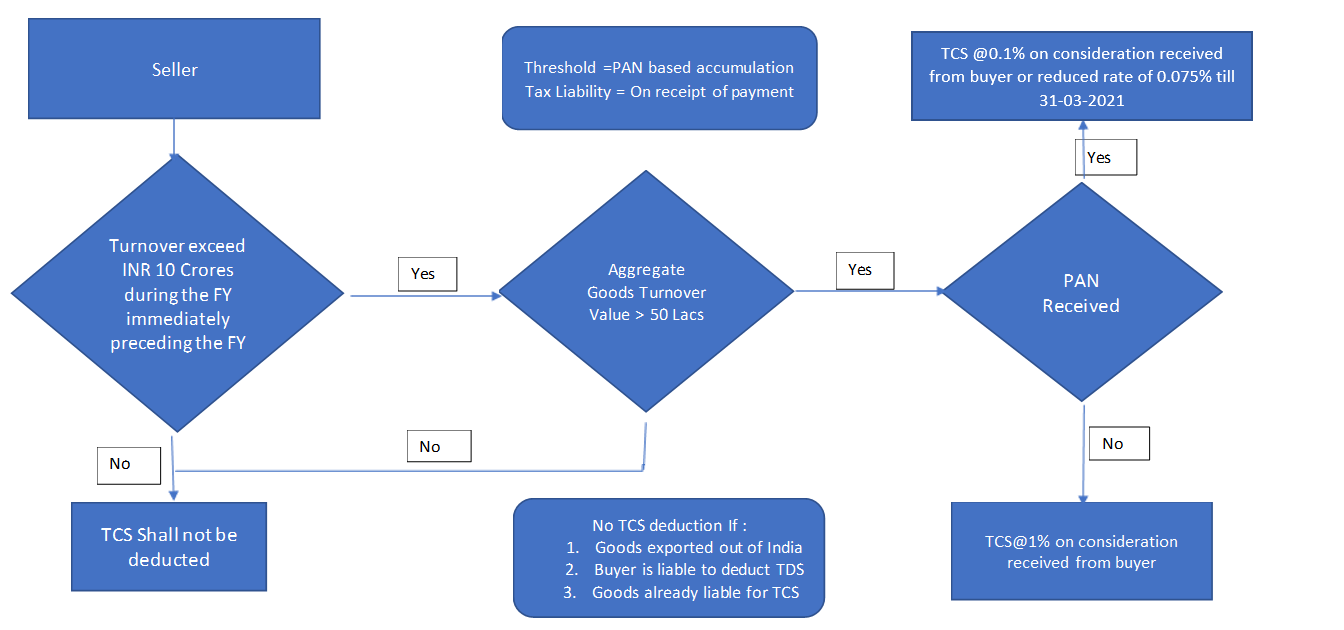

Tax collection at Source” (TCS) on sale of goods for India in Dynamics 365 – Microsoft Support – #4

Tax collection at Source” (TCS) on sale of goods for India in Dynamics 365 – Microsoft Support – #4

Outstanding Tax Demands Up To Rs 1 lakh Waived; Wealth, Gift Tax Exempted; Know Full Details – #5

Outstanding Tax Demands Up To Rs 1 lakh Waived; Wealth, Gift Tax Exempted; Know Full Details – #5

Money received from children is not taxable | Mint – #6

Money received from children is not taxable | Mint – #6

My relative sends me money every month. How income tax is calculated? | Mint – #7

My relative sends me money every month. How income tax is calculated? | Mint – #7

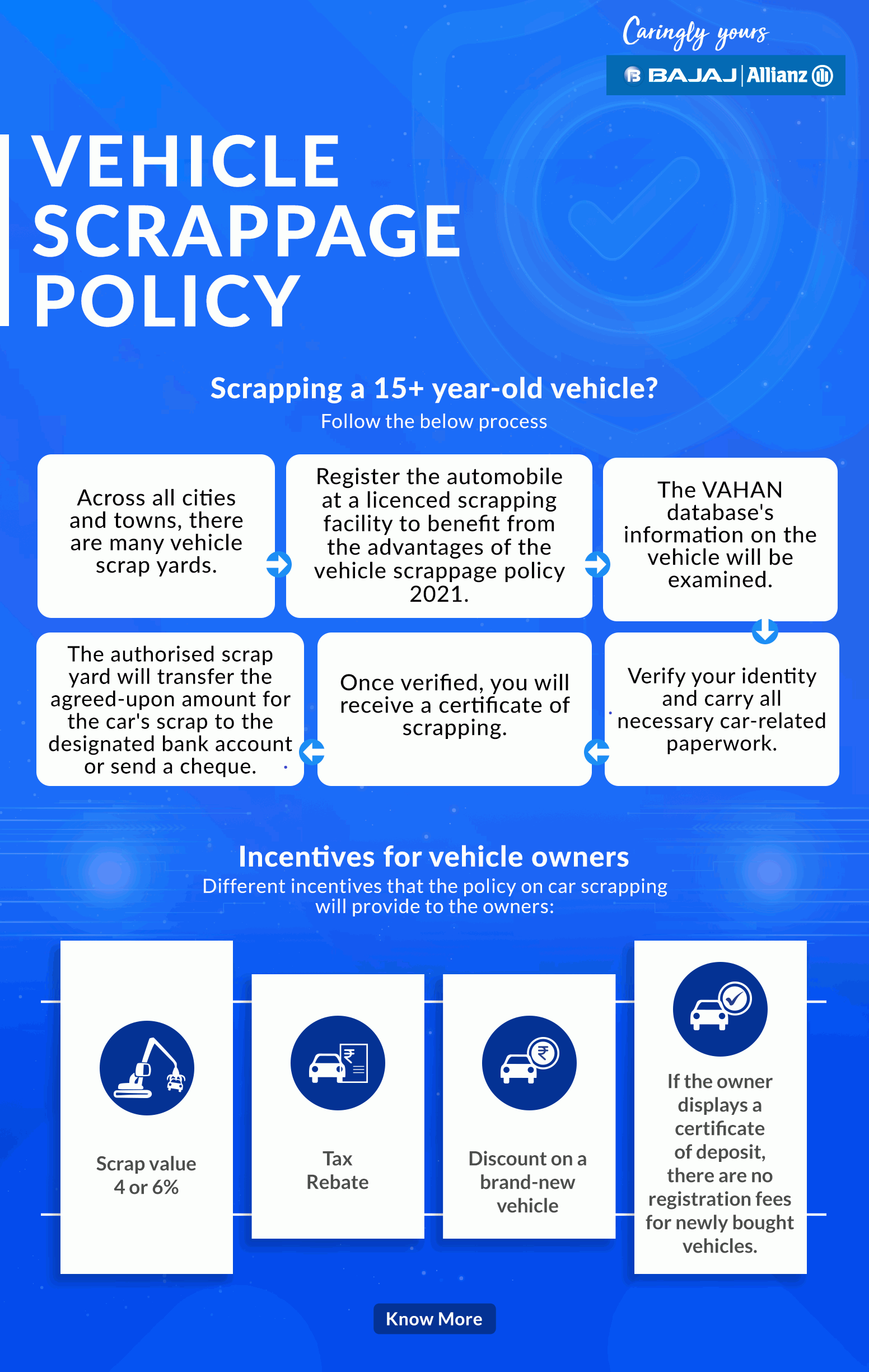

Vehicle Scrappage Policy in India | RTO Rules & Car Scrap Policy – #8

Vehicle Scrappage Policy in India | RTO Rules & Car Scrap Policy – #8

Taxation of Minor Children in India: How Does It Work? – #10

Taxation of Minor Children in India: How Does It Work? – #10

Vouchers – GST Implication – #11

Vouchers – GST Implication – #11

MASD & Co on X: “Gifts are usually capital receipts by nature. The Income Tax Act, 1961 which is levies tax on incomes, that is revenue receipts, carves out certain exceptions and – #12

MASD & Co on X: “Gifts are usually capital receipts by nature. The Income Tax Act, 1961 which is levies tax on incomes, that is revenue receipts, carves out certain exceptions and – #12

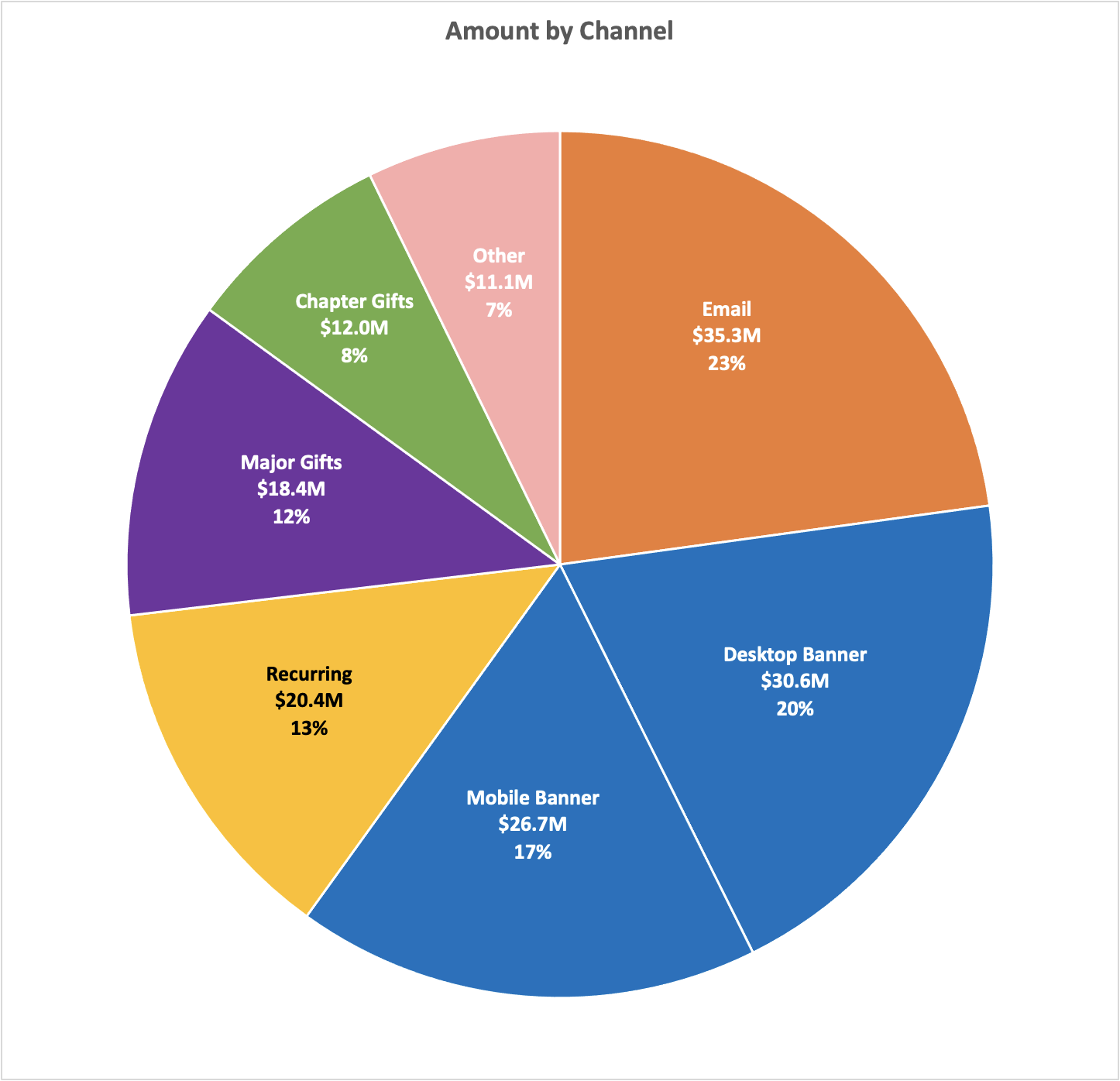

2023 Deloitte holiday retail survey | Deloitte Insights – #13

2023 Deloitte holiday retail survey | Deloitte Insights – #13

Income Tax Implications of Transactions in Crypto Currency – #14

Income Tax Implications of Transactions in Crypto Currency – #14

Press Information Bureau – #15

Press Information Bureau – #15

Lottery Tax in India: Tax Levied on Winning Game Shows & Lottery – #16

Lottery Tax in India: Tax Levied on Winning Game Shows & Lottery – #16

Introduction and Basic Concepts of Income Tax – #17

Introduction and Basic Concepts of Income Tax – #17

Union Budget 2021’s GIFT To The Payments Industry And Overcoming Zero MDR Issues – Cashfree Payments Blog – #18

Union Budget 2021’s GIFT To The Payments Industry And Overcoming Zero MDR Issues – Cashfree Payments Blog – #18

Income tax: 5 sources beyond PF, PPF, NPS that are tax exempted | Mint – #19

Income tax: 5 sources beyond PF, PPF, NPS that are tax exempted | Mint – #19

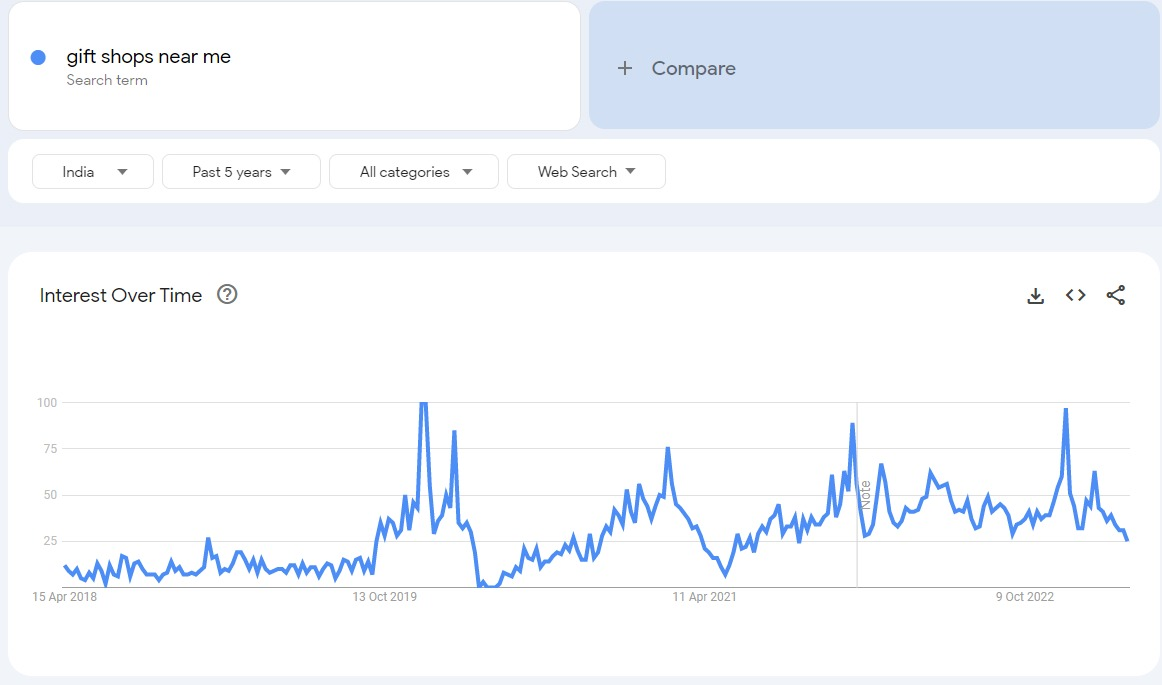

![How to Start a Gift Shop Business In India [2024] - KeeVurds How to Start a Gift Shop Business In India [2024] - KeeVurds](https://www.livemint.com/lm-img/img/2023/05/26/1600x900/income_tax_rule_changes_under_Modi_govt_1685078164942_1685078165077.jpg) How to Start a Gift Shop Business In India [2024] – KeeVurds – #20

How to Start a Gift Shop Business In India [2024] – KeeVurds – #20

Taxation and Accounting – India Guide | Doing Business in India – #21

Taxation and Accounting – India Guide | Doing Business in India – #21

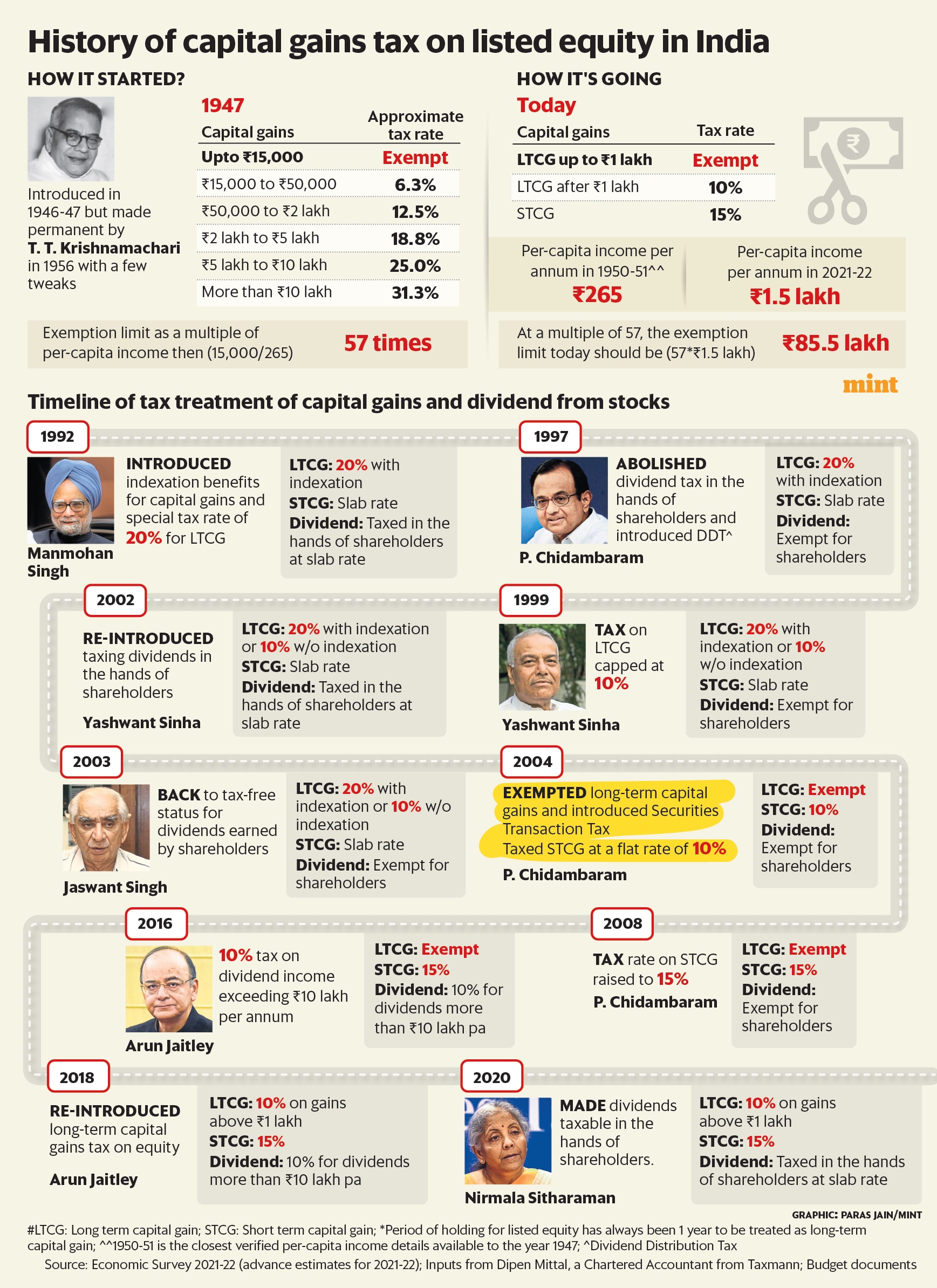

- capital gains tax

- gift tax exemption 2022

- income tax

India Inc pitches for more reforms and tax stability in Budget 2022-23 | Company News – Business Standard – #22

India Inc pitches for more reforms and tax stability in Budget 2022-23 | Company News – Business Standard – #22

Tax Audit | Detailed Analysis of Clause 26 to Clause 29 – #23

Tax Audit | Detailed Analysis of Clause 26 to Clause 29 – #23

Corporate Gifts Association seeks amendment in Income Tax Act that adversely impacts the industry – The Economic Times – #24

Corporate Gifts Association seeks amendment in Income Tax Act that adversely impacts the industry – The Economic Times – #24

GST council’s deferment of proposed hike in tax for textiles is a gift for the industry, says Piyush Goyal | A2Z Taxcorp LLP – #25

GST council’s deferment of proposed hike in tax for textiles is a gift for the industry, says Piyush Goyal | A2Z Taxcorp LLP – #25

How Much Do Americans Spend On Christmas? (Latest Data) – #26

How Much Do Americans Spend On Christmas? (Latest Data) – #26

Offline Income Tax Return e-Filing Software, in Pan India, For Windows at best price in New Delhi – #27

Offline Income Tax Return e-Filing Software, in Pan India, For Windows at best price in New Delhi – #27

Is there a limit in income tax laws up to which a father can gift to his son – #28

Is there a limit in income tax laws up to which a father can gift to his son – #28

Inter-co managerial/leadership services to attract 18% GST | Company News – Business Standard – #29

Inter-co managerial/leadership services to attract 18% GST | Company News – Business Standard – #29

Call for papers for the International Seminar on “GST in India: Promises, Performance and Prospects” to be held during 12-13 November 2021. News & Notifications | GIFT – #30

Call for papers for the International Seminar on “GST in India: Promises, Performance and Prospects” to be held during 12-13 November 2021. News & Notifications | GIFT – #30

Current Income Tax Return Filing Due Dates for FY 2023-24 – #31

Current Income Tax Return Filing Due Dates for FY 2023-24 – #31

Nri Gift Tax In India – #32

Nri Gift Tax In India – #32

When is money gifted not taxable? All your tax queries on gifts answered | Personal Finance – Business Standard – #33

When is money gifted not taxable? All your tax queries on gifts answered | Personal Finance – Business Standard – #33

Income from House Property – Exemption, Relief and Practice Questions – #34

Income from House Property – Exemption, Relief and Practice Questions – #34

Complete Guide to Crypto Taxes: March 2024 Update | Koinly – #35

Complete Guide to Crypto Taxes: March 2024 Update | Koinly – #35

- tax structure in india

- indirect tax

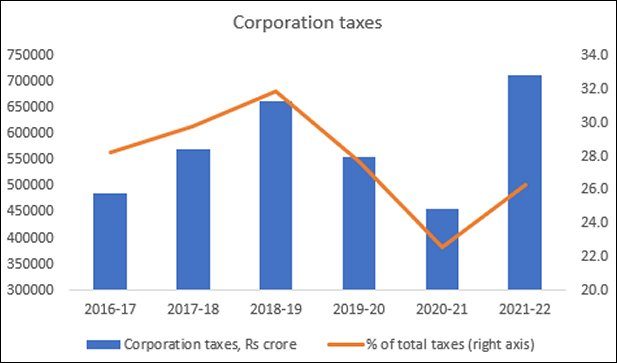

- corporate tax

My wife is into share trading. Money was given by me. Income tax rules explained | Mint – #36

My wife is into share trading. Money was given by me. Income tax rules explained | Mint – #36

Types of Tax – Exemptions, Due Dates & Penalties – #37

Types of Tax – Exemptions, Due Dates & Penalties – #37

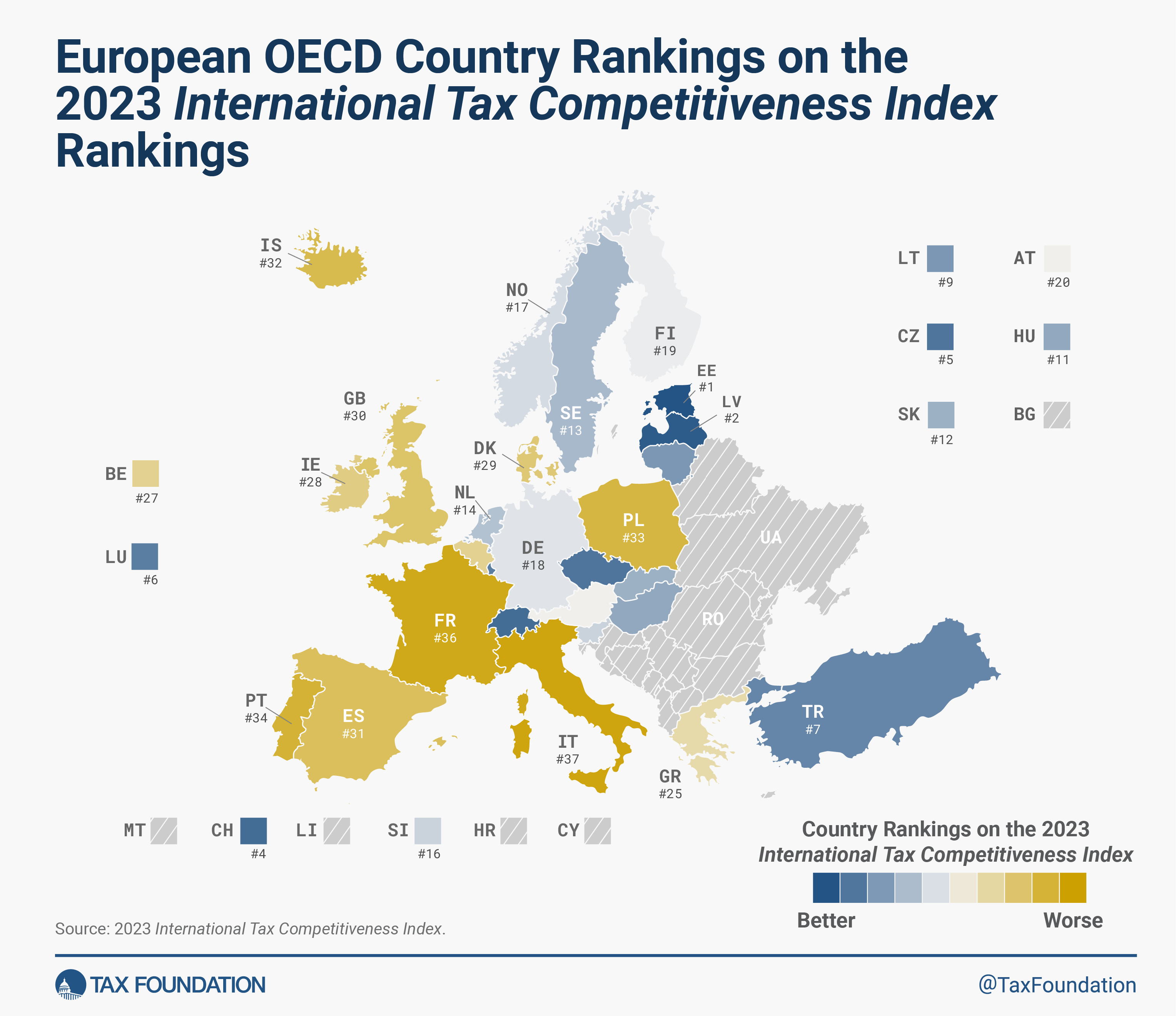

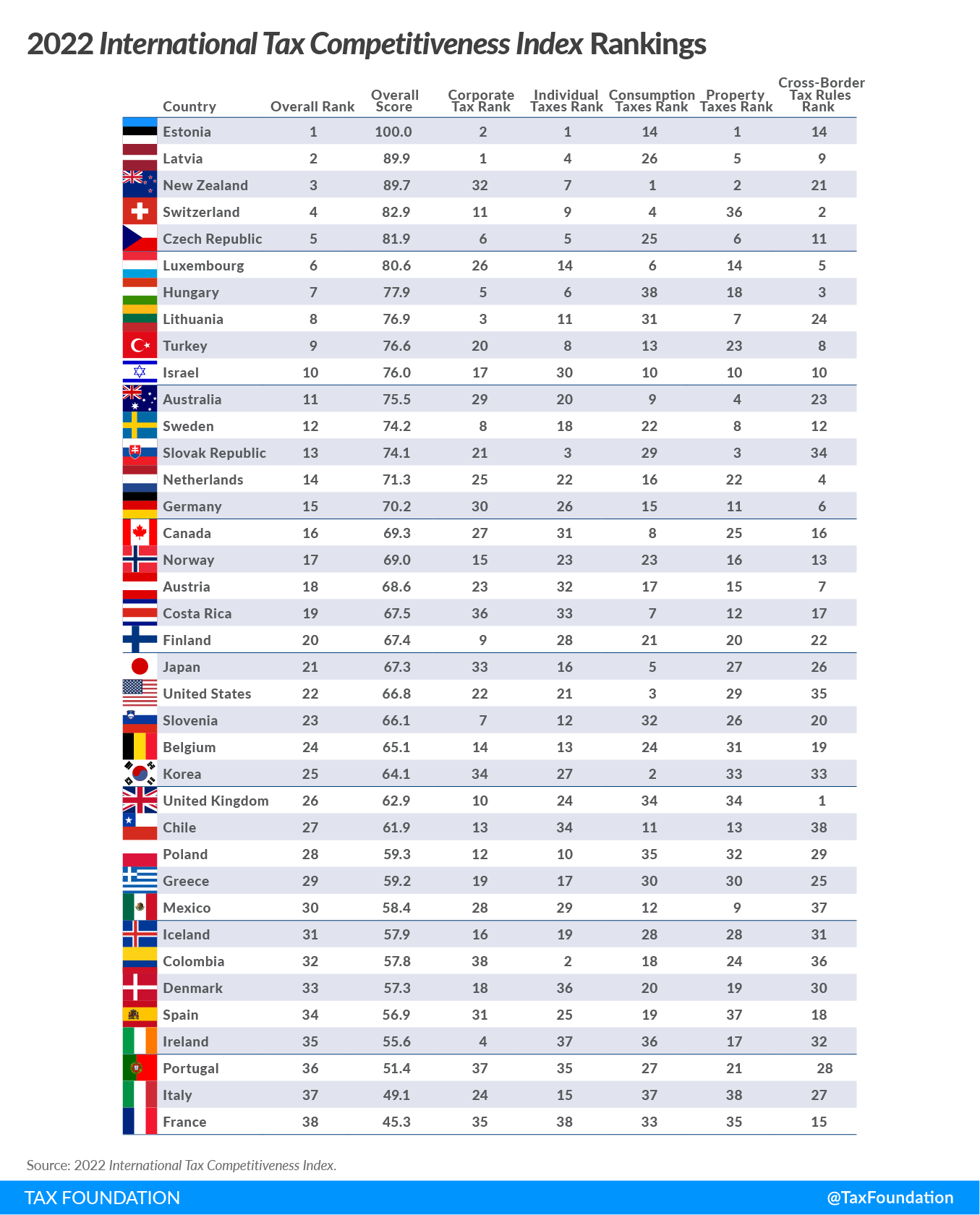

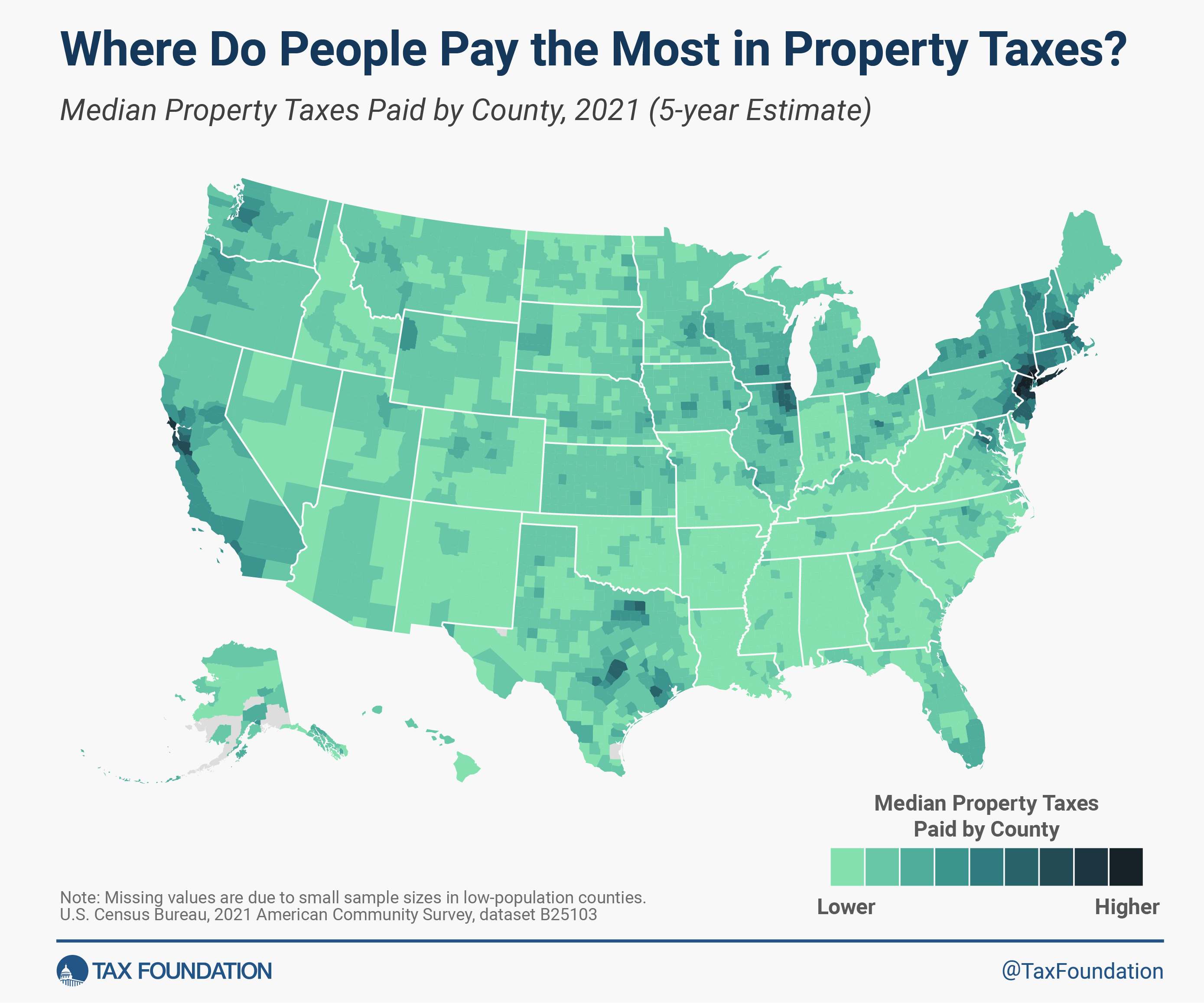

2022 International Tax Competitiveness Index | Tax Foundation – #38

2022 International Tax Competitiveness Index | Tax Foundation – #38

A Practical Guide To Capital Gains Tax, Securities Transaction Tax And Gift Tax 17th Edition 2021, P L Subramanian, 9789390740321 – #39

A Practical Guide To Capital Gains Tax, Securities Transaction Tax And Gift Tax 17th Edition 2021, P L Subramanian, 9789390740321 – #39

2024 State Business Tax Climate Index | Tax Foundation – #40

2024 State Business Tax Climate Index | Tax Foundation – #40

Different types of taxes in mauryan periord Taxes in mauryan period #tax #maurya #period #mauryan #gk #gs #news #india #knowledge… | Instagram – #41

Different types of taxes in mauryan periord Taxes in mauryan period #tax #maurya #period #mauryan #gk #gs #news #india #knowledge… | Instagram – #41

Ved Jain on LinkedIn: UP Government exempts stamp duty on Gift of property to family members. As… | 14 comments – #42

Ved Jain on LinkedIn: UP Government exempts stamp duty on Gift of property to family members. As… | 14 comments – #42

Gift Tax Malayalam – YouTube – #43

Gift Tax Malayalam – YouTube – #43

5 rules about Income Tax on Gifts received in India & Exemptions – #44

5 rules about Income Tax on Gifts received in India & Exemptions – #44

P-notes to make a return via Gift City | Mint – #45

P-notes to make a return via Gift City | Mint – #45

Gift Deed Archives – Property lawyers in India – #46

Gift Deed Archives – Property lawyers in India – #46

IRS Budget and Workforce | Internal Revenue Service – #47

IRS Budget and Workforce | Internal Revenue Service – #47

Invest India on X: “#IndiaResurgent Here are the tax incentives announced in #Budget2021 for the companies located at the International Financial Services Centre (IFSC) in Gujarat’s @GIFTCity_! #TheLionRoarsAgain #UnionBudget2021 @CMOGuj https://t.co … – #48

Invest India on X: “#IndiaResurgent Here are the tax incentives announced in #Budget2021 for the companies located at the International Financial Services Centre (IFSC) in Gujarat’s @GIFTCity_! #TheLionRoarsAgain #UnionBudget2021 @CMOGuj https://t.co … – #48

Gift Tax – #49

Gift Tax – #49

Delhi High Court reserves order in an 85 year old’s plea challenging Levy of 12% GST on Import of Oxygen Generators as Gift for Personal use to India – #50

Delhi High Court reserves order in an 85 year old’s plea challenging Levy of 12% GST on Import of Oxygen Generators as Gift for Personal use to India – #50

How To Make (Or Ask For) A 529 Plan Gift Contribution – Forbes Advisor – #51

How To Make (Or Ask For) A 529 Plan Gift Contribution – Forbes Advisor – #51

Know about the Income Tax Laws in India Regarding gifts in Cash | Income Tax Laws: पिता की ओर से बेटे को दिए गए गिफ्ट पर क्या है IT नियम, जानिए कितना – #52

Know about the Income Tax Laws in India Regarding gifts in Cash | Income Tax Laws: पिता की ओर से बेटे को दिए गए गिफ्ट पर क्या है IT नियम, जानिए कितना – #52

Does an NRO account attract more tax? | Mint – #53

Does an NRO account attract more tax? | Mint – #53

Vertex Financial and Investment Services on X: “A bird’s eye view on the benefits offered to Business Startups under Income Tax Act !! #Tax #IncomeTax #GST https://t.co/AI16OeMZZq” / X – #54

Vertex Financial and Investment Services on X: “A bird’s eye view on the benefits offered to Business Startups under Income Tax Act !! #Tax #IncomeTax #GST https://t.co/AI16OeMZZq” / X – #54

Rules For Taxation Of Gift In India – Labour Law Advisor – #55

Rules For Taxation Of Gift In India – Labour Law Advisor – #55

Section 281 of Income Tax Act: Guidelines and Details – #56

Section 281 of Income Tax Act: Guidelines and Details – #56

Rs 11,000 Crore Retroactive Tax Demand May Hit MNCs After SC Ruling; The Myriad Complexity Of Retroactive Taxation – Inventiva – #57

Rs 11,000 Crore Retroactive Tax Demand May Hit MNCs After SC Ruling; The Myriad Complexity Of Retroactive Taxation – Inventiva – #57

Will outstanding tax demand waiver help you get pending income tax refund? – The Economic Times – #58

Will outstanding tax demand waiver help you get pending income tax refund? – The Economic Times – #58

Tax Incentives for Businesses in India – India Guide | Doing Business in India – #59

Tax Incentives for Businesses in India – India Guide | Doing Business in India – #59

New Foreign Trade Policy 2021-2026: Expect Amidst Covid-19 Pandemic – #60

New Foreign Trade Policy 2021-2026: Expect Amidst Covid-19 Pandemic – #60

Now you can claim tax benefits on your purchases from Amazon: Here’s how | HT Tech – #61

Now you can claim tax benefits on your purchases from Amazon: Here’s how | HT Tech – #61

India Goods and Services Tax (GST) – India Guide | Doing Business in India – #62

India Goods and Services Tax (GST) – India Guide | Doing Business in India – #62

Receipt of Gifts and Inheritance by an NRI under FEMA – Enterslice – #63

Receipt of Gifts and Inheritance by an NRI under FEMA – Enterslice – #63

Key takeaways from six years of Donald Trump’s federal tax returns | CNN Politics – #64

Key takeaways from six years of Donald Trump’s federal tax returns | CNN Politics – #64

income tax: How your parents, spouse and children can help you save tax – The Economic Times – #65

income tax: How your parents, spouse and children can help you save tax – The Economic Times – #65

- wealth tax

- new tax regime exemption list

E Way GST Tax Consultancy – #66

E Way GST Tax Consultancy – #66

New income tax rules for GPF from 1st April 2022 that you should know | Mint – #67

New income tax rules for GPF from 1st April 2022 that you should know | Mint – #67

Taxmann Virtual Books – #68

Taxmann Virtual Books – #68

Buy Federal Estate & Gift Taxes: Code & Regs Including Related Income Tax Provisions, As of March 2021 Book Online at Low Prices in India | Federal Estate & Gift Taxes: Code – #69

Buy Federal Estate & Gift Taxes: Code & Regs Including Related Income Tax Provisions, As of March 2021 Book Online at Low Prices in India | Federal Estate & Gift Taxes: Code – #69

Income Tax Return Services at Rs 499/na in Pune | ID: 23248118230 – #70

Income Tax Return Services at Rs 499/na in Pune | ID: 23248118230 – #70

Latest Official Updates Under GST by the Indian Government – #71

Latest Official Updates Under GST by the Indian Government – #71

International Financial Services Centre, an idea whose time has come – Part I: Banking Sector | India Tax Law – #72

International Financial Services Centre, an idea whose time has come – Part I: Banking Sector | India Tax Law – #72

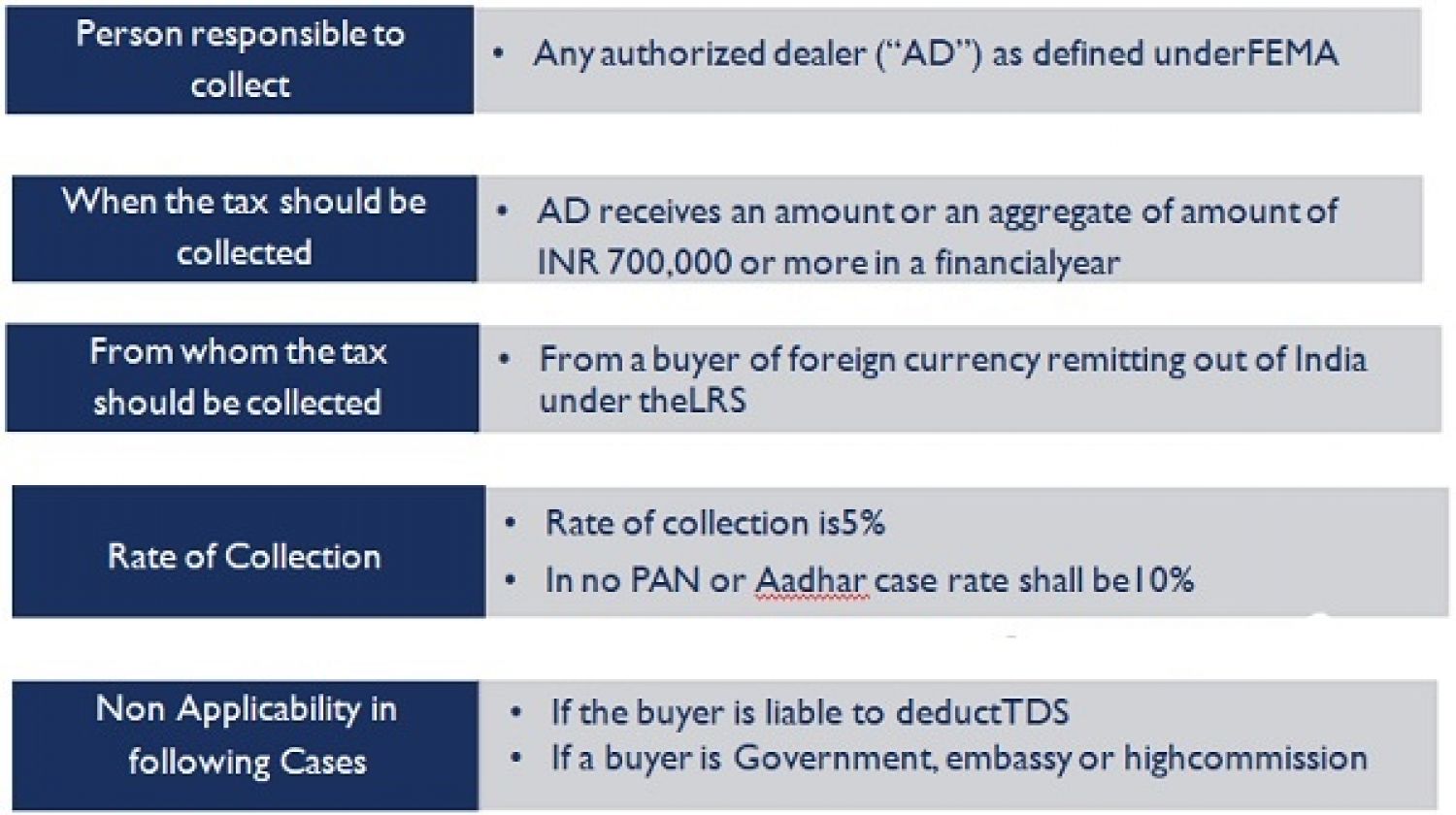

TCS on Tax Foreign Remittance Transactions under LRS – #73

TCS on Tax Foreign Remittance Transactions under LRS – #73

Gift Tax Calculator | EZTax® – #74

Gift Tax Calculator | EZTax® – #74

Can You Save Tax by Transferring Money to Wife’s Account? – Enterslice – #75

Can You Save Tax by Transferring Money to Wife’s Account? – Enterslice – #75

Kerala tax revenue grows 22% in FY23, third highest among states – #76

Kerala tax revenue grows 22% in FY23, third highest among states – #76

Taxation on gifts in India | Example of Clubbing | Saving Taxes – – #77

Taxation on gifts in India | Example of Clubbing | Saving Taxes – – #77

GST Rates in India 2024 – List of Goods and Service Tax Rates, Slab and Revision – #78

GST Rates in India 2024 – List of Goods and Service Tax Rates, Slab and Revision – #78

Scheme of Taxation of Undisclosed Income | Taxmann – #79

Scheme of Taxation of Undisclosed Income | Taxmann – #79

Efiletax – #80

Efiletax – #80

Know what Budget 2021 means for your retirement and investment planning | Mint – #81

Know what Budget 2021 means for your retirement and investment planning | Mint – #81

It isn’t mandatory to execute gift deed for transferring shares | Mint – #82

It isn’t mandatory to execute gift deed for transferring shares | Mint – #82

TransPrice Tax (@TransPrice) / X – #83

TransPrice Tax (@TransPrice) / X – #83

Tax Audit | Detailed Analysis of Clause 17 to Clause 19 | As per the Guidance Note issued by the ICAI – #84

Tax Audit | Detailed Analysis of Clause 17 to Clause 19 | As per the Guidance Note issued by the ICAI – #84

Nine years of Narendra Modi government: How income tax rules changed in this period | Mint – #85

Nine years of Narendra Modi government: How income tax rules changed in this period | Mint – #85

Deloitte India on X: “Don’t miss the “GIFT IFSC: An evolving landscape” webinar, scheduled today at 1:30 p.m. India time, for insights on the ground realities and what’s in store for the – #86

Deloitte India on X: “Don’t miss the “GIFT IFSC: An evolving landscape” webinar, scheduled today at 1:30 p.m. India time, for insights on the ground realities and what’s in store for the – #86

MASD & Co on X: “While crypto-currency has become the talk of the town since few months, we are here to present an article on the Taxability of transactions in crypto-currency under – #87

MASD & Co on X: “While crypto-currency has become the talk of the town since few months, we are here to present an article on the Taxability of transactions in crypto-currency under – #87

What is the limit up to which a father can gift to his son under income tax laws | Mint – #88

What is the limit up to which a father can gift to his son under income tax laws | Mint – #88

Giving to India? Compliance with the Newly Amended FCRA – CAF America – #89

Giving to India? Compliance with the Newly Amended FCRA – CAF America – #89

Value-Added Tax (VAT) – #90

Value-Added Tax (VAT) – #90

TOP LUMP-SUM TAXATION COUNTRIES: – #91

TOP LUMP-SUM TAXATION COUNTRIES: – #91

Gift and income tax rules is know tax rules on marriage gifts | शादी के समय मिलने वाले गिफ्ट और रिलेटिव से मिलने वाले Gift को लेकर जानिए क्या है टैक्स संबंधी – #92

Gift and income tax rules is know tax rules on marriage gifts | शादी के समय मिलने वाले गिफ्ट और रिलेटिव से मिलने वाले Gift को लेकर जानिए क्या है टैक्स संबंधी – #92

What Is Taxable Income and How to Calculate It – Forbes Advisor – #93

What Is Taxable Income and How to Calculate It – Forbes Advisor – #93

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #94

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #94

ITAT judgments – #95

ITAT judgments – #95

Income Tax on Digital, Physical, and Paper Gold in India | IIFL Finance – #96

Income Tax on Digital, Physical, and Paper Gold in India | IIFL Finance – #96

The Gift-Tax Benefits of ‘529’ Plans – WSJ – #97

The Gift-Tax Benefits of ‘529’ Plans – WSJ – #97

Returns Filed Taxes Collected and Refunds Issued | Internal Revenue Service – #98

Returns Filed Taxes Collected and Refunds Issued | Internal Revenue Service – #98

) Cryptocurrency Taxation in India: Rules and Implications – #99

Cryptocurrency Taxation in India: Rules and Implications – #99

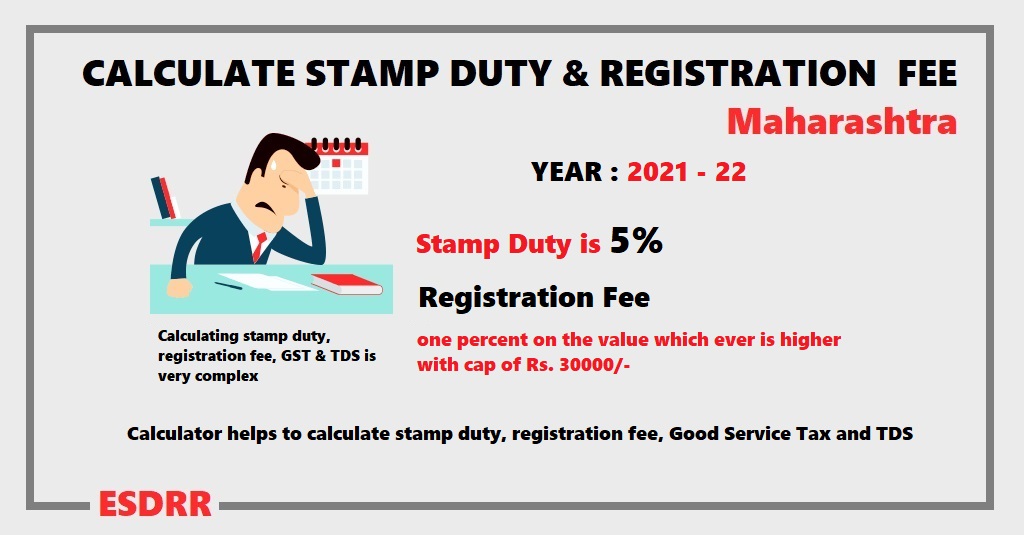

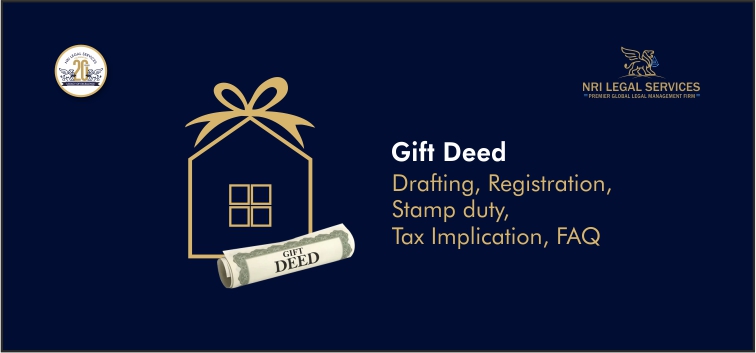

Gift Deed: Drafting, Registration, Stamp duty, Tax Implication, FAQ – #100

Gift Deed: Drafting, Registration, Stamp duty, Tax Implication, FAQ – #100

India’s Export Import Trends in FY 2021-22 – India Briefing News – #101

India’s Export Import Trends in FY 2021-22 – India Briefing News – #101

How Are Gains On Foreign Stock Investments Taxed? – Forbes Advisor INDIA – #102

How Are Gains On Foreign Stock Investments Taxed? – Forbes Advisor INDIA – #102

Income Tax Volume 1: Buy Income Tax Volume 1 by M K GUPTA SIR at Low Price in India | Flipkart.com – #103

Income Tax Volume 1: Buy Income Tax Volume 1 by M K GUPTA SIR at Low Price in India | Flipkart.com – #103

Deutsche Bank gets nod to set up IFSC banking unit at GIFT City | Banking News – Business Standard – #104

Deutsche Bank gets nod to set up IFSC banking unit at GIFT City | Banking News – Business Standard – #104

एक पिता अपने बेटे को किस सीमा तक दे सकता है उपहार? जानें क्या कहता है कानून – income tax news can a father gift his property to son or flat what – #105

एक पिता अपने बेटे को किस सीमा तक दे सकता है उपहार? जानें क्या कहता है कानून – income tax news can a father gift his property to son or flat what – #105

Taxation of Gifts received in Cash or Kind – #106

Taxation of Gifts received in Cash or Kind – #106

Definition of Relatives for the purpose of Income Tax Act, 1961- Taxwink – #107

Definition of Relatives for the purpose of Income Tax Act, 1961- Taxwink – #107

The Moves Wealthy Families Are Making to Skirt Estate Taxes – WSJ – #108

The Moves Wealthy Families Are Making to Skirt Estate Taxes – WSJ – #108

Tax – Webinars & webcasts – KPMG India – #109

Tax – Webinars & webcasts – KPMG India – #109

NRI Selling Inherited Property in India: Tax Implications 2023 – SBNRI – #110

NRI Selling Inherited Property in India: Tax Implications 2023 – SBNRI – #110

- gift tax example

- gift from relative exempt from income tax

- gift tax definition

First india jaipur edition-02 february 2021 | PDF – #111

First india jaipur edition-02 february 2021 | PDF – #111

Banking & Finance units in IFSC- A regulatory overview – Vinod Kothari Consultants – #112

Banking & Finance units in IFSC- A regulatory overview – Vinod Kothari Consultants – #112

Tax Exemption FAQS | Tax Benefit on Section 80G – #113

Tax Exemption FAQS | Tax Benefit on Section 80G – #113

Taxation on Cryptocurrency: Guide To Crypto Taxes in India 2024 – #114

Taxation on Cryptocurrency: Guide To Crypto Taxes in India 2024 – #114

What is GST in India? Tax Rates, Key Terms, and Concepts Explained – India Briefing News – #115

What is GST in India? Tax Rates, Key Terms, and Concepts Explained – India Briefing News – #115

GST Rates 2020 – Complete List of Goods and Services Tax Slabs – #116

GST Rates 2020 – Complete List of Goods and Services Tax Slabs – #116

Funds in GIFT City – FAQs & Structuring Insights | India Corporate Law – #117

Funds in GIFT City – FAQs & Structuring Insights | India Corporate Law – #117

Gifts from specified relatives are not taxed | Mint – #118

Gifts from specified relatives are not taxed | Mint – #118

15 Tax Saving Options Other Than Section 80C – #119

15 Tax Saving Options Other Than Section 80C – #119

బహుమతులు తీసుకుంటున్నారా.. అయితే మీ మీద ఐటీ కన్నుంటుంది.. ఎందుకో తెలుసుకోండి | Gift tax rules and exemptions of gift tax in india know when your gift is tax free | TV9 Telugu – #120

బహుమతులు తీసుకుంటున్నారా.. అయితే మీ మీద ఐటీ కన్నుంటుంది.. ఎందుకో తెలుసుకోండి | Gift tax rules and exemptions of gift tax in india know when your gift is tax free | TV9 Telugu – #120

What is Wealth Tax in India? – #121

What is Wealth Tax in India? – #121

Understanding Capital Gains | A Comprehensive Guide and FAQs – #122

Understanding Capital Gains | A Comprehensive Guide and FAQs – #122

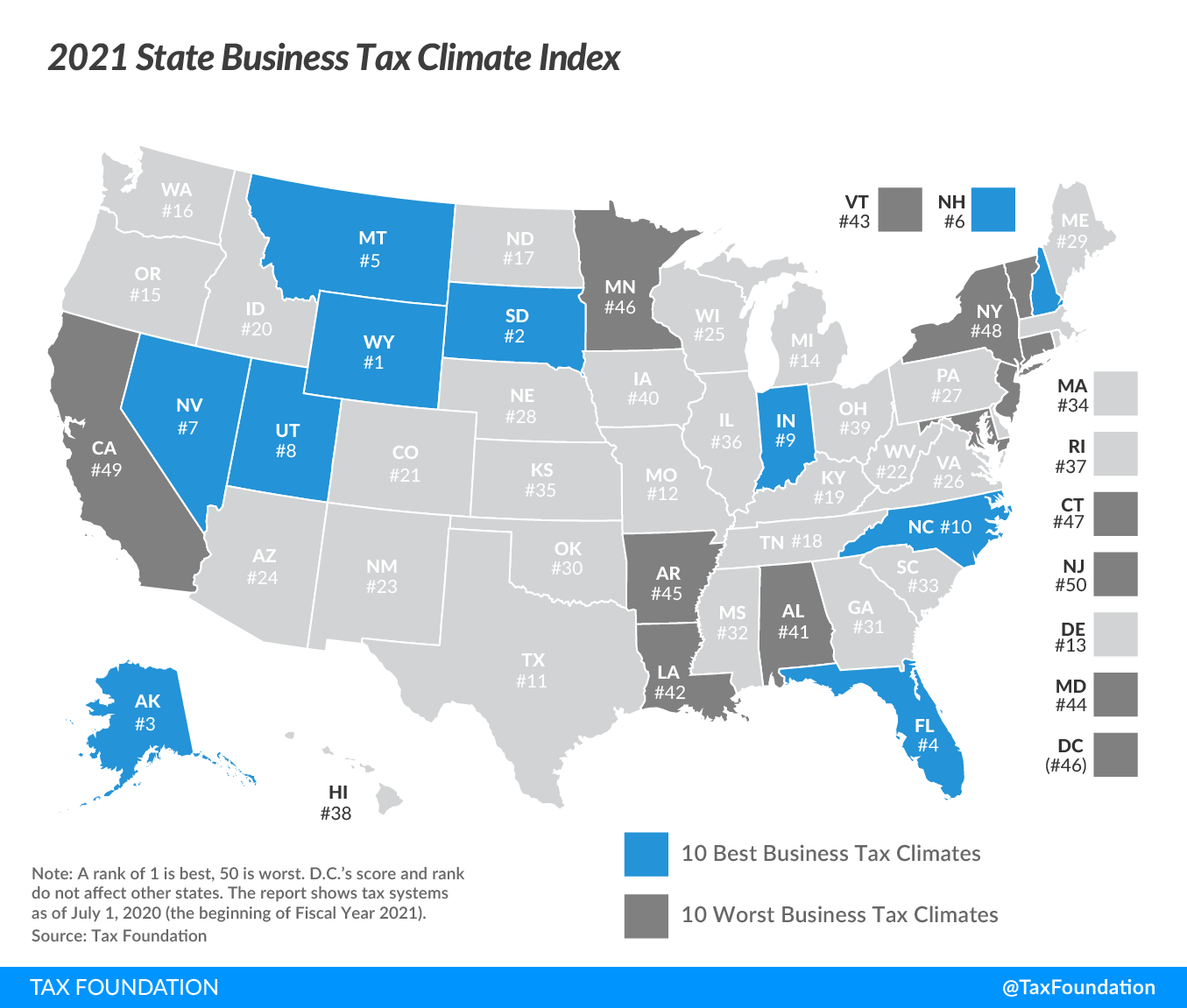

2021 State Business Tax Climate Index | Tax Foundation – #123

2021 State Business Tax Climate Index | Tax Foundation – #123

- section 56(2) of income tax act

- gift tax exemption

- property tax

Taxability of Gift in India under head Other Sources – Deep Gyan® – #124

Taxability of Gift in India under head Other Sources – Deep Gyan® – #124

Bhagyashree Financial Services | Indore | Facebook – #125

Bhagyashree Financial Services | Indore | Facebook – #125

Wealth Planning – FLSV | Frankel Loughran Starr & Vallone LLP – #126

Wealth Planning – FLSV | Frankel Loughran Starr & Vallone LLP – #126

Income Tax Implications of Wedding Gifts in India – #127

Income Tax Implications of Wedding Gifts in India – #127

- excise tax

- gift tax meaning

- list of relatives

Sending money overseas: tax implications – Wise – #128

Sending money overseas: tax implications – Wise – #128

Taxability of Gift received by an individual or HUF with FAQs – #129

Taxability of Gift received by an individual or HUF with FAQs – #129

💎 Can GIFT City become India’s next financial capital? – #130

💎 Can GIFT City become India’s next financial capital? – #130

Permanent Establishment: Taxation of Permanent Establishment (PE) in India: When it’s applicable and its impact – The Economic Times – #131

Permanent Establishment: Taxation of Permanent Establishment (PE) in India: When it’s applicable and its impact – The Economic Times – #131

Individual Income Tax in India – India Guide | Doing Business in India – #132

Individual Income Tax in India – India Guide | Doing Business in India – #132

No additions towards gifts if assessee duly produced declarations of donors confirming gifts: ITAT – #133

No additions towards gifts if assessee duly produced declarations of donors confirming gifts: ITAT – #133

Income Tax for NRIs in India – Rules, Exemptions & Deductions – Tax2win – #134

Income Tax for NRIs in India – Rules, Exemptions & Deductions – Tax2win – #134

ApnaPlan.com – Personal Finance Investment Ideas – #135

ApnaPlan.com – Personal Finance Investment Ideas – #135

GST to be levied on goods, services in gift vouchers- The New Indian Express – #136

GST to be levied on goods, services in gift vouchers- The New Indian Express – #136

Gifting Stock to Family Members: What to Know | ThinkAdvisor – #137

Gifting Stock to Family Members: What to Know | ThinkAdvisor – #137

5 Best Tea Clubs and Subscriptions for 2024, Tested and Reviewed – CNET – #138

5 Best Tea Clubs and Subscriptions for 2024, Tested and Reviewed – CNET – #138

GST to be levied on underlying goods & services in gift vouchers: rules AAAR – Navjeevan Express – #139

GST to be levied on underlying goods & services in gift vouchers: rules AAAR – Navjeevan Express – #139

Revisit the History of I-T Slab Rates (1944-45 to 2021-22) – #140

Revisit the History of I-T Slab Rates (1944-45 to 2021-22) – #140

HUF (Hindu Undivided Family) – A Tax Saving Tool! – #141

HUF (Hindu Undivided Family) – A Tax Saving Tool! – #141

Zero Tax on Salary Income INR 20+ Lakhs? Legal Way Here… – #142

Zero Tax on Salary Income INR 20+ Lakhs? Legal Way Here… – #142

Income Tax Law and Practice Hons Question Paper’ 2021 (Held in 2022), Dibrugarh University B.Com 3rd Sem Question Papers – #143

Income Tax Law and Practice Hons Question Paper’ 2021 (Held in 2022), Dibrugarh University B.Com 3rd Sem Question Papers – #143

How to File ITR 1 Sahaj Form Online for AY 2024-25 (Easily) – #144

How to File ITR 1 Sahaj Form Online for AY 2024-25 (Easily) – #144

Indirect Tax | What is Indirect Tax Meaning & Types – #145

Indirect Tax | What is Indirect Tax Meaning & Types – #145

New Tax Regime – Complete list of exemptions and deductions disallowed – BasuNivesh – #146

New Tax Regime – Complete list of exemptions and deductions disallowed – BasuNivesh – #146

Taxation | PDF – #147

Taxation | PDF – #147

Solution CA Inter Taxation | PDF | Money | Business – #148

Solution CA Inter Taxation | PDF | Money | Business – #148

Taxation on Film Production – #149

Taxation on Film Production – #149

What is Gift Tax? – Exemption and Limits on Gifts for FY 2023-24 – #150

What is Gift Tax? – Exemption and Limits on Gifts for FY 2023-24 – #150

Amount received as gift by any blood relative living in US is not taxable in India – Scripbox – #151

Amount received as gift by any blood relative living in US is not taxable in India – Scripbox – #151

Are College Scholarships and Grants Taxable? – Forbes Advisor – #152

Are College Scholarships and Grants Taxable? – Forbes Advisor – #152

Income Tax Return Filing For Trust In India – #153

Income Tax Return Filing For Trust In India – #153

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #154

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #154

World Vision Unveils 2021 Holiday Gift Catalog Featuring Handcrafted Gifts Inspired By A Historic Lineup Of Celebrity Supporters – #155

World Vision Unveils 2021 Holiday Gift Catalog Featuring Handcrafted Gifts Inspired By A Historic Lineup Of Celebrity Supporters – #155

IRS Zaps Nearly $1 Billion in Penalties for Taxpayers – WSJ – #156

IRS Zaps Nearly $1 Billion in Penalties for Taxpayers – WSJ – #156

Gift from USA to India: Taxation and Exemptions – SBNRI – #157

Gift from USA to India: Taxation and Exemptions – SBNRI – #157

Tax Structure In India: Learn Indian Tax System, Taxation in India – #158

Tax Structure In India: Learn Indian Tax System, Taxation in India – #158

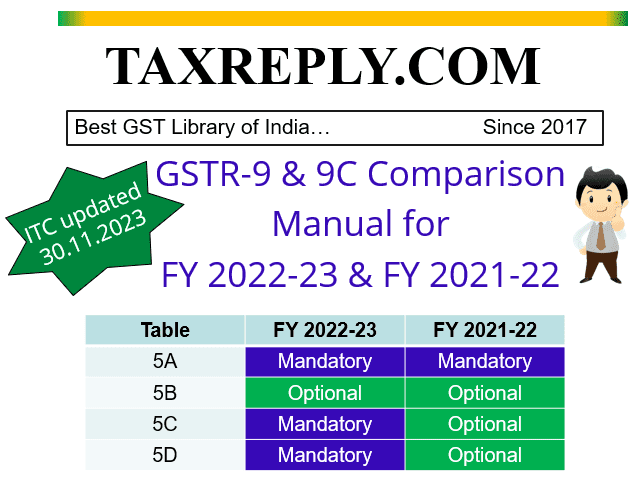

Free Gift for all readers) GSTR-9 & 9C Comparison Manual for FY 2022-23 – #159

Free Gift for all readers) GSTR-9 & 9C Comparison Manual for FY 2022-23 – #159

What is Direct Tax – Meaning, Types & Examples in India – #160

What is Direct Tax – Meaning, Types & Examples in India – #160

Sales taxes in the United States – Wikipedia – #161

Sales taxes in the United States – Wikipedia – #161

Central Bank of India on X: “The Sukanya Samriddhi Account offers a high interest rate of 7.6% and tax benefits under 80c. To know more, visit: https://t.co/lXBl4EWd12 https://t.co/D90xGRpZWg” / X – #162

Central Bank of India on X: “The Sukanya Samriddhi Account offers a high interest rate of 7.6% and tax benefits under 80c. To know more, visit: https://t.co/lXBl4EWd12 https://t.co/D90xGRpZWg” / X – #162

Now gift and cashback vouchers will attract 18% GST – The Statesman – #163

Now gift and cashback vouchers will attract 18% GST – The Statesman – #163

How much money can NRIs gift to parents in India? | Arthgyaan – #164

How much money can NRIs gift to parents in India? | Arthgyaan – #164

Motor fuel tax revenue U.S. 2021 | Statista – #165

Motor fuel tax revenue U.S. 2021 | Statista – #165

- gift tax exemption relatives list

- tax residency certificate india

- lineal ascendant gift from relative exempt from income tax

![Analysis] Changes in New ITR Forms for Assessment Year 2024-25 Analysis] Changes in New ITR Forms for Assessment Year 2024-25](https://images.livemint.com/img/2021/08/08/600x338/incometax-kctF--621x414@LiveMint_1628400954005.jpg) Analysis] Changes in New ITR Forms for Assessment Year 2024-25 – #166

Analysis] Changes in New ITR Forms for Assessment Year 2024-25 – #166

Union Budget 2021-22 | Bharatiya Janata Party – #167

Union Budget 2021-22 | Bharatiya Janata Party – #167

GIFT to Gujarat: Can the state become the next Ireland of aircraft leasing? | Budget 2021 News – Business Standard – #168

GIFT to Gujarat: Can the state become the next Ireland of aircraft leasing? | Budget 2021 News – Business Standard – #168

India Incentivizes Foreign Financial Institutions – #169

India Incentivizes Foreign Financial Institutions – #169

Deloitte India Cyber Risk – Video Presentation about Cyber Threat In India | Deloitte India | Tax – #170

Deloitte India Cyber Risk – Video Presentation about Cyber Threat In India | Deloitte India | Tax – #170

![Guide to Crypto Tax in India [Updated 2024] Guide to Crypto Tax in India [Updated 2024]](https://taxfoundation.org/wp-content/uploads/2023/12/2023-International-Tax-Competitiveness-Index-Rankings.png) Guide to Crypto Tax in India [Updated 2024] – #171

Guide to Crypto Tax in India [Updated 2024] – #171

What is a gift deed and tax implications | Tax Hack – #172

What is a gift deed and tax implications | Tax Hack – #172

TDS on Payment for Purchase of Goods | Section 194Q | Taxmann – #173

TDS on Payment for Purchase of Goods | Section 194Q | Taxmann – #173

TAXABILITY OF GIFTS IN INDIA – Manthan Experts – #174

TAXABILITY OF GIFTS IN INDIA – Manthan Experts – #174

.jpg) Income Tax Calculator: Calculate Income Tax Online for FY 2023-24 and FY 2024-25 | Max Life Insurance – #175

Income Tax Calculator: Calculate Income Tax Online for FY 2023-24 and FY 2024-25 | Max Life Insurance – #175

Buy Tax Facts on Insurance & Employee Benefits 2021 (Tax Facts on Insurance and Employee Benefits) Book Online at Low Prices in India | Tax Facts on Insurance & Employee Benefits 2021 ( – #176

Buy Tax Facts on Insurance & Employee Benefits 2021 (Tax Facts on Insurance and Employee Benefits) Book Online at Low Prices in India | Tax Facts on Insurance & Employee Benefits 2021 ( – #176

- gift chart as per income tax

- income from other sources notes

- estate tax

Know Income tax rules on gifts received on marriage | Mint – #177

Know Income tax rules on gifts received on marriage | Mint – #177

Direct Taxation in India : the Income Tax Act, 1961 and the Direct Tax Vivad se Vishwas Act, 2020 – iPleaders – #178

Direct Taxation in India : the Income Tax Act, 1961 and the Direct Tax Vivad se Vishwas Act, 2020 – iPleaders – #178

2023 International Tax Competitiveness Index | Tax Foundation – #179

2023 International Tax Competitiveness Index | Tax Foundation – #179

YOUR QUERIES: INCOME TAX : No income tax on money received as gift from your grandmother – Income Tax News | The Financial Express – #180

YOUR QUERIES: INCOME TAX : No income tax on money received as gift from your grandmother – Income Tax News | The Financial Express – #180

) What is Assessment year (AY) ? | Meaning & Definition – #181

What is Assessment year (AY) ? | Meaning & Definition – #181

Meaning of relative under different act | CA Rajput Jain – #182

Meaning of relative under different act | CA Rajput Jain – #182

What is the new income tax slab of 2021-22? – Quora – #183

What is the new income tax slab of 2021-22? – Quora – #183

Posts: gift tax in india 2021

Categories: Gifts

Author: toyotabienhoa.edu.vn