Update more than 186 gift tax foreign recipient super hot

Details images of gift tax foreign recipient by website toyotabienhoa.edu.vn compilation. Form 3520: What is it and How to Report Foreign Gift, Trust and Inheritance Transactions to IRS. – YouTube. Foreign Stocks and Taxation – Varsity by Zerodha. Reporting Trust and Estate Distributions to Foreign Beneficiaries (Part II). Get Ready for the 2023 Gift Tax Return Deadline – Linkenheimer LLP CPAs & Advisors. Understanding The Rules of Gifting — Brooklyn Fi

Interplay of Will, Gift and Relinquishment Deed in the Indian context – COMMERCIAL LAW BLOG – #1

Interplay of Will, Gift and Relinquishment Deed in the Indian context – COMMERCIAL LAW BLOG – #1

eCFR :: 26 CFR Part 25 — Gift Tax; Gifts Made After December 31, 1954 – #2

eCFR :: 26 CFR Part 25 — Gift Tax; Gifts Made After December 31, 1954 – #2

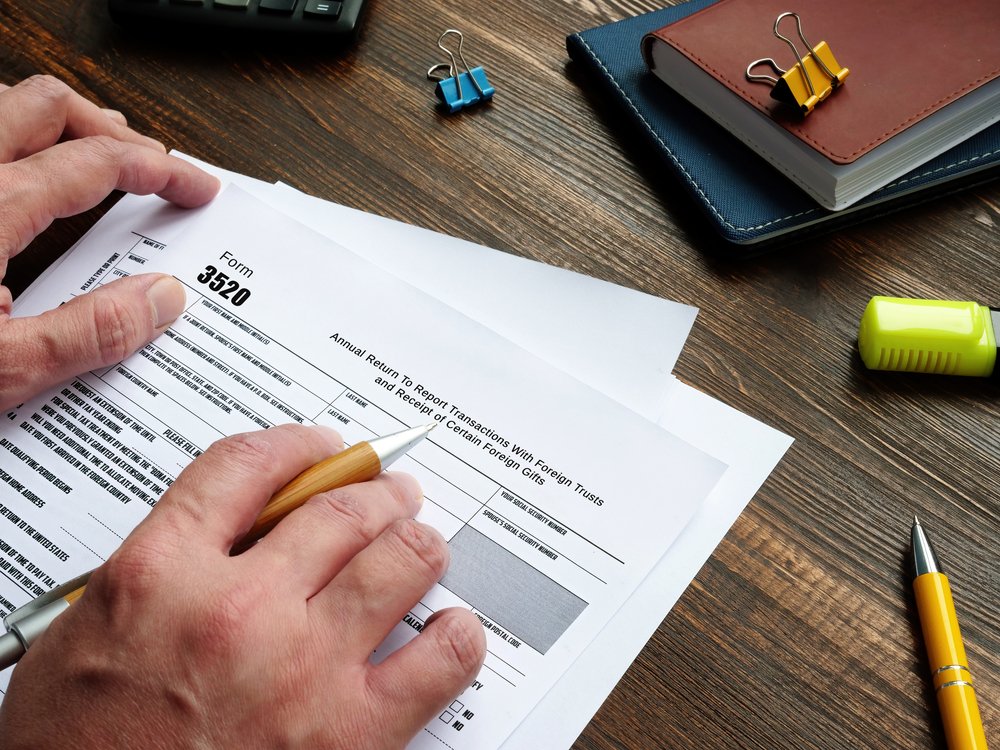

Filing Form 3520: A Guide to Foreign Gift Tax – #4

Filing Form 3520: A Guide to Foreign Gift Tax – #4

2018 Michael J. Stegman United States Wealth Transfer Taxation: An Overview and Comparative Law Analysis The U.S. taxes the g – #5

2018 Michael J. Stegman United States Wealth Transfer Taxation: An Overview and Comparative Law Analysis The U.S. taxes the g – #5

How Are Foreign Inward Remittance Taxed In India – #6

How Are Foreign Inward Remittance Taxed In India – #6

Gift Tax : How Does it Work? – #7

Gift Tax : How Does it Work? – #7

Gift Tax 101: What You Need to Know — Connecticut Estate Planning Attorneys Blog – #8

Gift Tax 101: What You Need to Know — Connecticut Estate Planning Attorneys Blog – #8

Gifts to U.S. Persons | Marcum LLP | Accountants and Advisors – #10

Gifts to U.S. Persons | Marcum LLP | Accountants and Advisors – #10

Get Ready for the 2023 Gift Tax Return Deadline – Linkenheimer LLP CPAs & Advisors – #11

Get Ready for the 2023 Gift Tax Return Deadline – Linkenheimer LLP CPAs & Advisors – #11

Tax liability on gifts from family abroad? : r/tax – #12

Tax liability on gifts from family abroad? : r/tax – #12

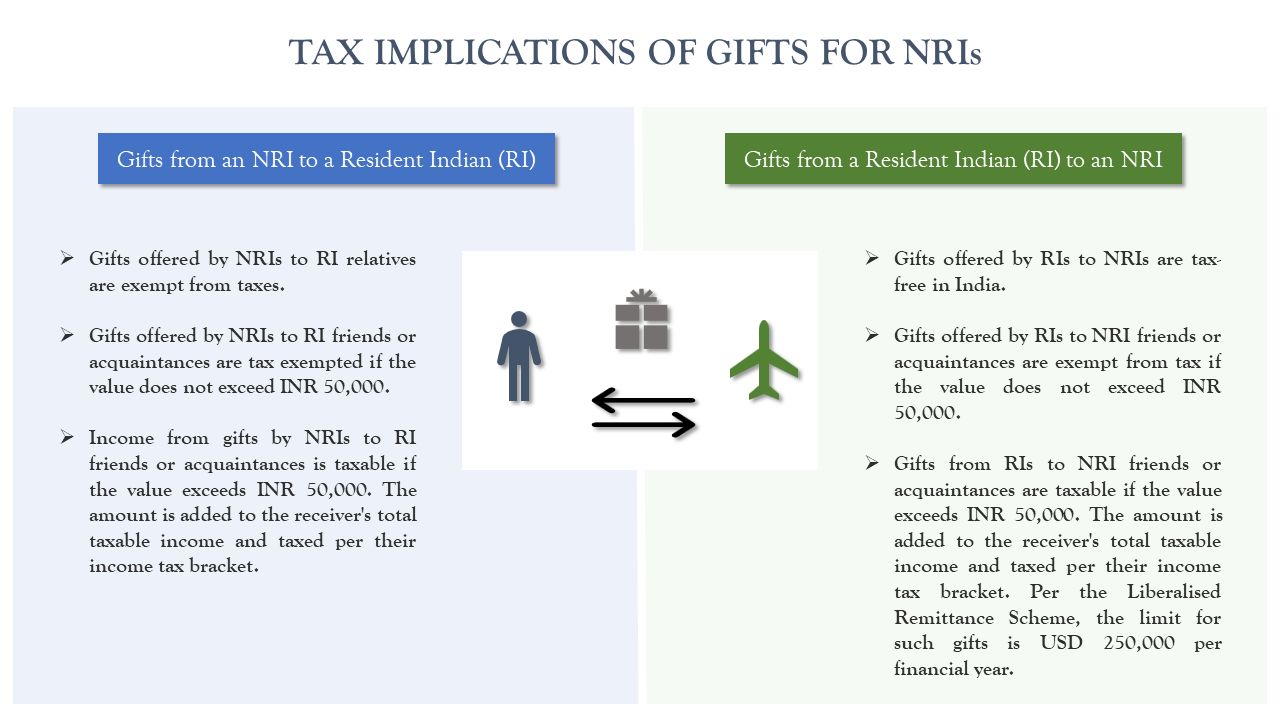

NRI Gift Tax India: Rules for Tax On Gift Money In India | DBS Treasures – #13

NRI Gift Tax India: Rules for Tax On Gift Money In India | DBS Treasures – #13

Tax Implications of Loans from a Foreign Person to a US Person | Sciarabba Walker Blog – #14

Tax Implications of Loans from a Foreign Person to a US Person | Sciarabba Walker Blog – #14

Received a Foreign Gift in 2023? Learn About Taxes on Gifts and IRS Form 3520 — – #15

Received a Foreign Gift in 2023? Learn About Taxes on Gifts and IRS Form 3520 — – #15

Foreign Clients: Watch out for U.S. Gift Tax Traps this Holiday Season – #16

Foreign Clients: Watch out for U.S. Gift Tax Traps this Holiday Season – #16

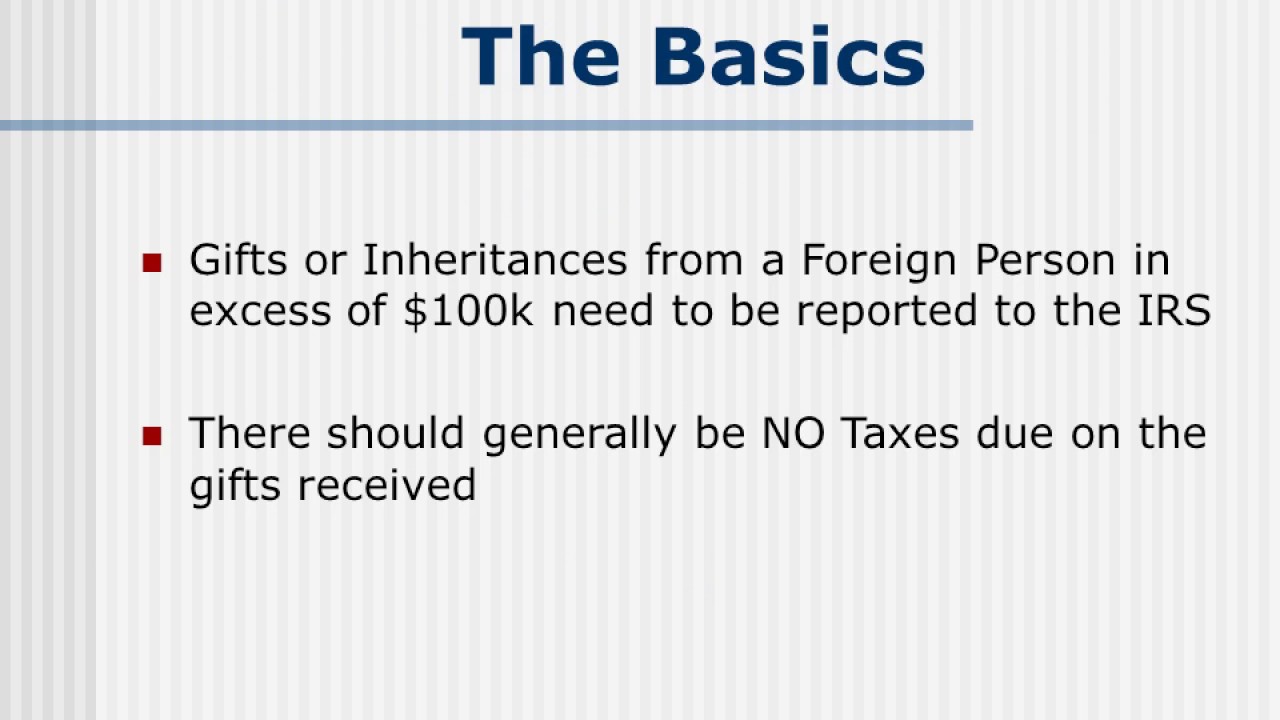

How A US Citizen Reports gifts from a foreign person and distributions from a foreign trust – YouTube – #17

How A US Citizen Reports gifts from a foreign person and distributions from a foreign trust – YouTube – #17

Gifting money in the US: all you need to know | WorldRemit – #18

Gifting money in the US: all you need to know | WorldRemit – #18

IRS Guides Taxation of Foreign Trust Distributions – Sol Schwartz – #19

IRS Guides Taxation of Foreign Trust Distributions – Sol Schwartz – #19

Reporting foreign trust and estate distributions to U.S. beneficiaries | HTJ Tax – #20

Reporting foreign trust and estate distributions to U.S. beneficiaries | HTJ Tax – #20

Northern Trust | Wealth Management, Asset Management & Asset Servicing – #21

Northern Trust | Wealth Management, Asset Management & Asset Servicing – #21

GIFT TAX – UPSC Current Affairs – IAS GYAN – #22

GIFT TAX – UPSC Current Affairs – IAS GYAN – #22

When are gifts received by NRIs subject to tax, TDS in India? – The Economic Times – #23

When are gifts received by NRIs subject to tax, TDS in India? – The Economic Times – #23

The Gift Tax (2022): US Expat Exclusions & Exemptions Explained! – #24

The Gift Tax (2022): US Expat Exclusions & Exemptions Explained! – #24

Unravel The Red Ribbon On Spouse Property Transfers – Gift Tax | US Expat Tax Service – #25

Unravel The Red Ribbon On Spouse Property Transfers – Gift Tax | US Expat Tax Service – #25

Taxability of Gifts to NRIs from Resident Indians – TaxReturnWala – #26

Taxability of Gifts to NRIs from Resident Indians – TaxReturnWala – #26

Untitled – #27

Untitled – #27

Receiving an Inheritance From Abroad: Special Considerations for U.S. Taxpayers | Cerity Partners – #28

Receiving an Inheritance From Abroad: Special Considerations for U.S. Taxpayers | Cerity Partners – #28

IRS Form 3520 Foreign Trust and Major Foreign Gift and Foreign Inheritance Report | International Tax Attorney Andrew L. Jones – Offices in San Francisco, Palo Alto, Walnut Creek, Santa Barbara, Irvine, – #29

IRS Form 3520 Foreign Trust and Major Foreign Gift and Foreign Inheritance Report | International Tax Attorney Andrew L. Jones – Offices in San Francisco, Palo Alto, Walnut Creek, Santa Barbara, Irvine, – #29

Tax Deductibility On Gifts To Clients On Birthdays And Festive Occasions – iPleaders – #30

Tax Deductibility On Gifts To Clients On Birthdays And Festive Occasions – iPleaders – #30

Covered US Expatriate Directives On Gift Tax | US Expat Tax Service – #31

Covered US Expatriate Directives On Gift Tax | US Expat Tax Service – #31

Do you Report your Foreign Gift to the IRS? — John Schachter + Associates – #32

Do you Report your Foreign Gift to the IRS? — John Schachter + Associates – #32

Foreign Remittance: Sending Gift Money To The USA From India In 2024 – #33

Foreign Remittance: Sending Gift Money To The USA From India In 2024 – #33

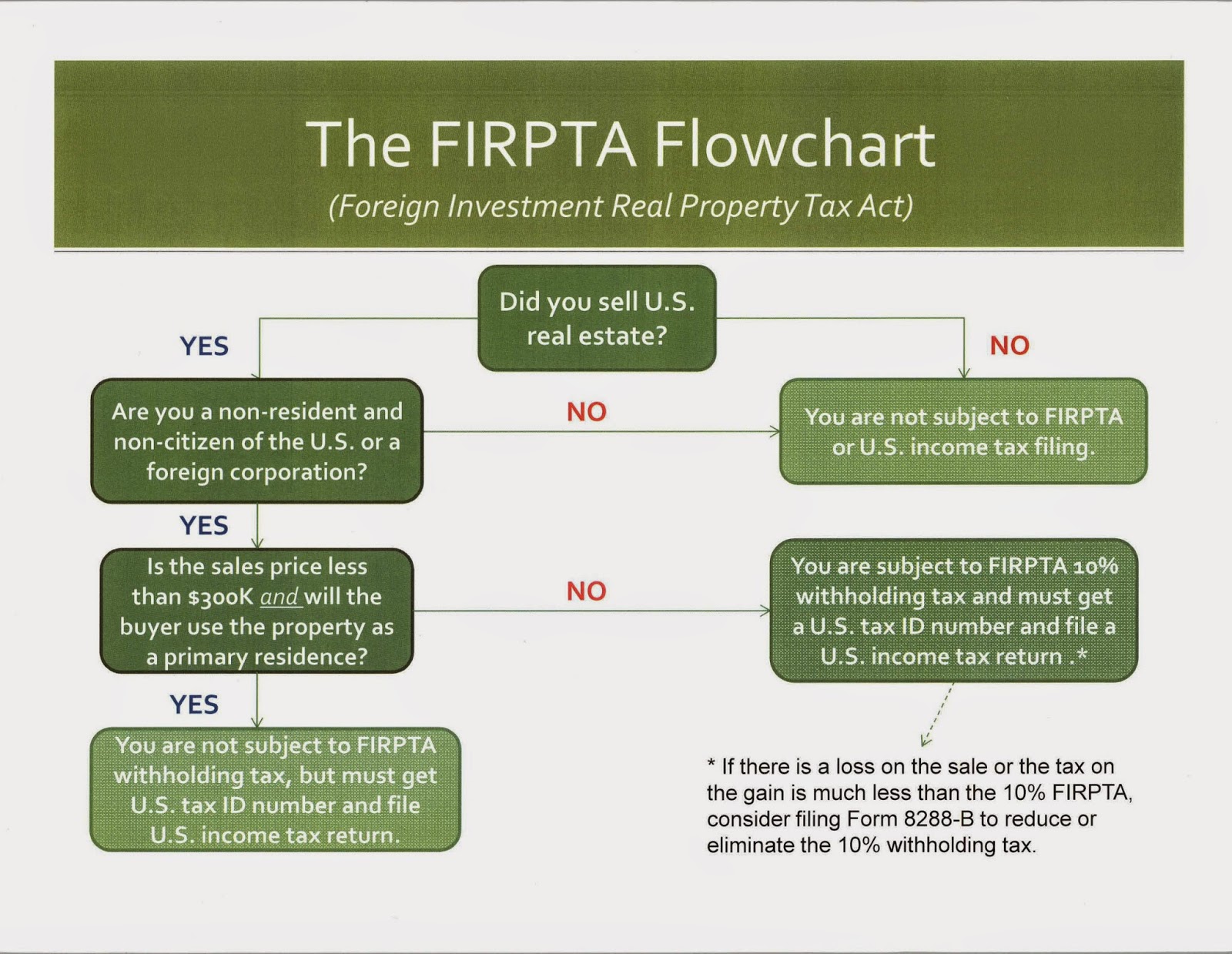

Are you purchasing Real Property from a Foreign Person? – #34

Are you purchasing Real Property from a Foreign Person? – #34

US Taxation: How To Report Inheritance Received On Your Tax returns – #35

US Taxation: How To Report Inheritance Received On Your Tax returns – #35

Foreign Gift Tax: A Guide To Understanding Your US Tax and Reporting Requirements For Those That Receive Cash Gifts From A Foreign Person eBook : Brody, Randall: Amazon.in: Kindle Store – #36

Foreign Gift Tax: A Guide To Understanding Your US Tax and Reporting Requirements For Those That Receive Cash Gifts From A Foreign Person eBook : Brody, Randall: Amazon.in: Kindle Store – #36

3. Inheritance, estate, and gift tax design in OECD countries | Inheritance Taxation in OECD Countries | OECD iLibrary – #37

3. Inheritance, estate, and gift tax design in OECD countries | Inheritance Taxation in OECD Countries | OECD iLibrary – #37

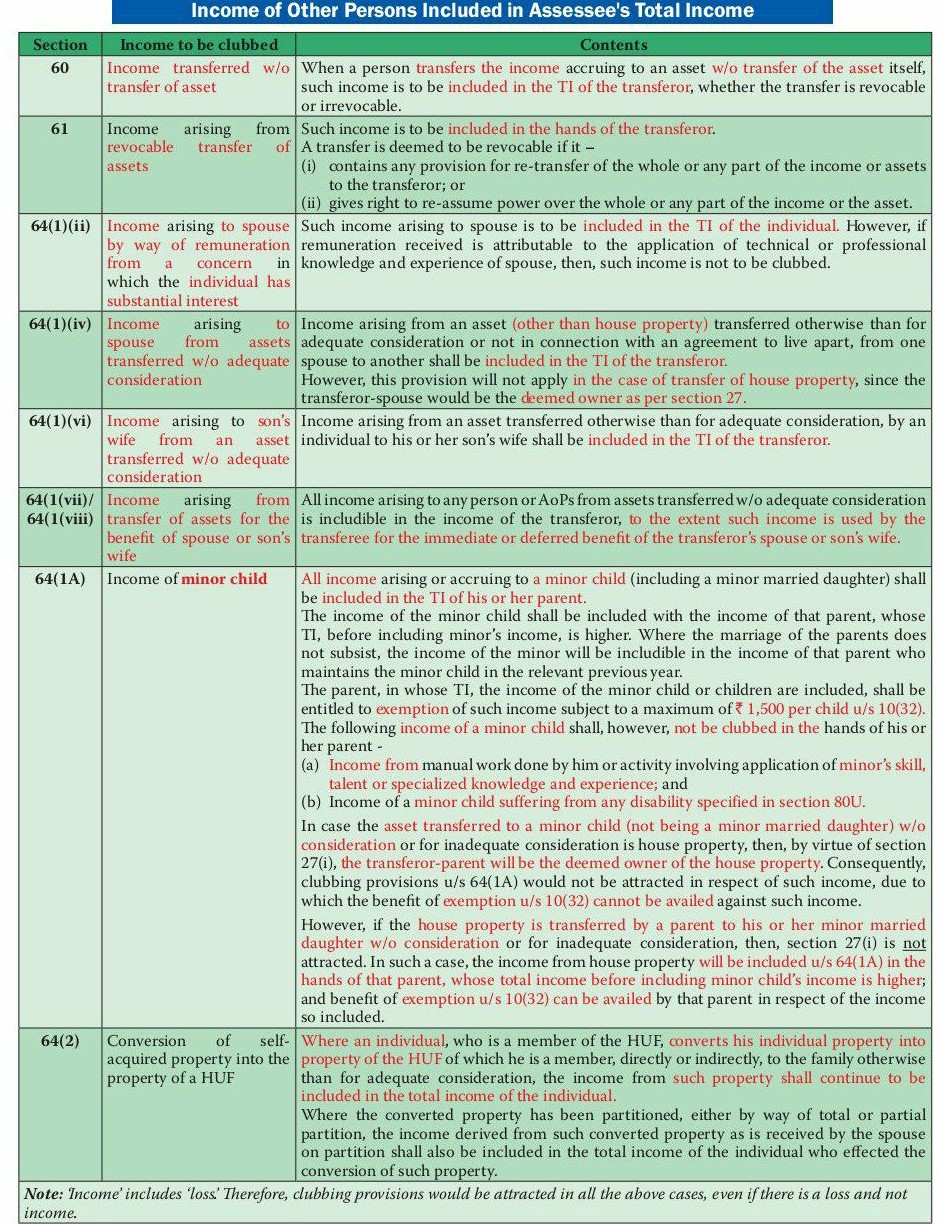

- clubbing of income pdf

- world gif

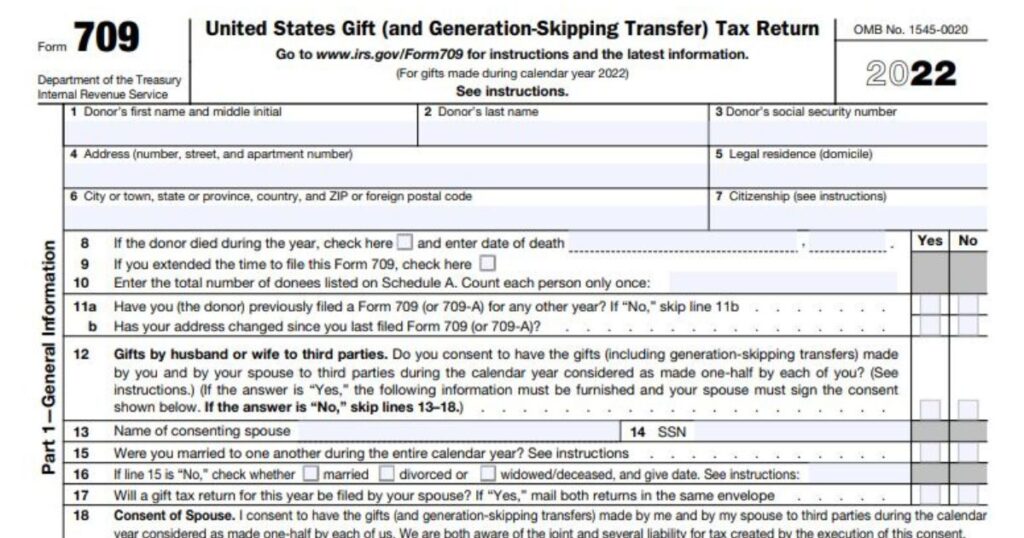

Form 709: Guide to US Gift Taxes for Expats – #38

Form 709: Guide to US Gift Taxes for Expats – #38

Receive Money in India from Abroad | Process | Requirement – #39

Receive Money in India from Abroad | Process | Requirement – #39

The Clements & Wallace Ultimate Gift Guide – #40

The Clements & Wallace Ultimate Gift Guide – #40

California Gift Taxes Explained – Snyder Law – #41

California Gift Taxes Explained – Snyder Law – #41

What is a gift deed and tax implications | Tax Hack – #42

What is a gift deed and tax implications | Tax Hack – #42

Passthrough-entity treatment of foreign subsidiary income – #43

Passthrough-entity treatment of foreign subsidiary income – #43

Virginia Tax Attorney – #44

Virginia Tax Attorney – #44

Money & relationships: What are the tax implications if my daughter sends me money from abroad? – The Economic Times – #45

Money & relationships: What are the tax implications if my daughter sends me money from abroad? – The Economic Times – #45

Things an NRI must know about gift tax rules in India | IDFC FIRST Bank – #46

Things an NRI must know about gift tax rules in India | IDFC FIRST Bank – #46

Considerations for making charitable gifts abroad | Withersworldwide – #47

Considerations for making charitable gifts abroad | Withersworldwide – #47

Connecticut Gift Tax: All You Need to Know | SmartAsset – #48

Connecticut Gift Tax: All You Need to Know | SmartAsset – #48

Foreign Gifts | When Do You Have to Report Them? | Freeman Law – #49

Foreign Gifts | When Do You Have to Report Them? | Freeman Law – #49

Gift Tax In 2024: What Is It And How Does It Work? – #50

Gift Tax In 2024: What Is It And How Does It Work? – #50

Purported Gifts” from a Foreign Corporation or Partnership- Exceptions & Application of PFIC Rules – Virginia – US TAX TALK – #51

Purported Gifts” from a Foreign Corporation or Partnership- Exceptions & Application of PFIC Rules – Virginia – US TAX TALK – #51

The (Foreign) Gift That Keeps On Giving – IRS Penalties – #52

The (Foreign) Gift That Keeps On Giving – IRS Penalties – #52

3 Timely Reasons to Give Monetary Gifts this Holiday Season | Merit Financial Advisors – #53

3 Timely Reasons to Give Monetary Gifts this Holiday Season | Merit Financial Advisors – #53

FEMA aspects of private trusts – #54

FEMA aspects of private trusts – #54

Tax Tips and Traps Related to Foreign Gifts | Gift from Foreign Person – YouTube – #55

Tax Tips and Traps Related to Foreign Gifts | Gift from Foreign Person – YouTube – #55

What is Gift Tax? – Exemption and Limits on Gifts for FY 2023-24 – #56

What is Gift Tax? – Exemption and Limits on Gifts for FY 2023-24 – #56

Gifts from a Foreign Person/Non-Resident Alien – O&G Tax and Accounting – #57

Gifts from a Foreign Person/Non-Resident Alien – O&G Tax and Accounting – #57

Tax for NRIs on gifts of money and property from resident Indians received through gift deeds – Property lawyers in India – #58

Tax for NRIs on gifts of money and property from resident Indians received through gift deeds – Property lawyers in India – #58

According to the income tax laws of India, who can be gifted property without incurring tax? – Quora – #59

According to the income tax laws of India, who can be gifted property without incurring tax? – Quora – #59

Gift Tax, the Annual Exclusion and Estate Planning – #60

Gift Tax, the Annual Exclusion and Estate Planning – #60

Money Remitted As Gift To Parent In India Not Taxable As Income – #61

Money Remitted As Gift To Parent In India Not Taxable As Income – #61

Is a gift from your cousin taxable? – #62

Is a gift from your cousin taxable? – #62

Gift Tax: Tax on gifts: Documents that you should have while filing ITR – The Economic Times – #63

Gift Tax: Tax on gifts: Documents that you should have while filing ITR – The Economic Times – #63

Annual Gift Tax Exclusions | First Republic now part of JPMorgan Chase – #64

Annual Gift Tax Exclusions | First Republic now part of JPMorgan Chase – #64

Form 3520: Reporting Foreign Trusts and Gifts for US Citizens – #65

Form 3520: Reporting Foreign Trusts and Gifts for US Citizens – #65

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #66

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #66

Generation-Skipping Transfer Taxes – #67

Generation-Skipping Transfer Taxes – #67

Form 3520 Penalties – 2020 Late Filed Penalties for Gifts or Inheritance from Foreign Persons – YouTube – #68

Form 3520 Penalties – 2020 Late Filed Penalties for Gifts or Inheritance from Foreign Persons – YouTube – #68

How to Report a Foreign Gift or Inheritance to the IRS – #69

How to Report a Foreign Gift or Inheritance to the IRS – #69

2023 Tax Information – Ascendant LLP – #70

2023 Tax Information – Ascendant LLP – #70

A Guide to Understanding the U.S. Tax Consequences of Foreign Person Investing in U.S. Real Property – #71

A Guide to Understanding the U.S. Tax Consequences of Foreign Person Investing in U.S. Real Property – #71

Gift Tax: A Trap during Valentine’s Day – #72

Gift Tax: A Trap during Valentine’s Day – #72

Money received from daughter-in-law based abroad is not taxable. | Mint – #73

Money received from daughter-in-law based abroad is not taxable. | Mint – #73

.jpeg) Do I have to pay taxes on foreign inheritance to the IRS? | International Tax Attorney – #74

Do I have to pay taxes on foreign inheritance to the IRS? | International Tax Attorney – #74

IRS’s Ability to Collect from Recipients of Gifts – IRS Tax Trouble – #75

IRS’s Ability to Collect from Recipients of Gifts – IRS Tax Trouble – #75

Tax Reporting Requirements for Gifts – Weisberg Kainen Mark, PL – #76

Tax Reporting Requirements for Gifts – Weisberg Kainen Mark, PL – #76

Taxation of GIFTS from NRIs and inheritances from India – #77

Taxation of GIFTS from NRIs and inheritances from India – #77

2001 Client Letter – #78

2001 Client Letter – #78

What Expats Need to Know about Foreign Inheritance Tax – #79

What Expats Need to Know about Foreign Inheritance Tax – #79

How to Challenge IRS Foreign Gifts Received Penalties (3520) – #80

How to Challenge IRS Foreign Gifts Received Penalties (3520) – #80

For the Record : Newsletter from Andersen : Q4 2019 Newsletter : Foreigners Still Don’t Get an Estate and Gift Tax Break – #81

For the Record : Newsletter from Andersen : Q4 2019 Newsletter : Foreigners Still Don’t Get an Estate and Gift Tax Break – #81

- gift tax in india

- clubbing of income chart

- gift tax example

How to Fill Form 3520: Reporting Foreign Trust Transactions and Gifts – #82

How to Fill Form 3520: Reporting Foreign Trust Transactions and Gifts – #82

Gift Tax Reporting for US Citizens (Guidelines) – #83

Gift Tax Reporting for US Citizens (Guidelines) – #83

What’s the Gift Tax Exclusion? – MyExpatTaxes – #84

What’s the Gift Tax Exclusion? – MyExpatTaxes – #84

Trust Agreement Gift Tax For Foreign Person | US Legal Forms – #85

Trust Agreement Gift Tax For Foreign Person | US Legal Forms – #85

It’s The Gift Tax Exemption, Stupid – #86

It’s The Gift Tax Exemption, Stupid – #86

Rules for Overseas Money Transfer to Family Members Abroad | Unimoni.in – #87

Rules for Overseas Money Transfer to Family Members Abroad | Unimoni.in – #87

- gift tax meaning

- gift chart as per income tax

- gift from relative exempt from income tax

Latest NRI Gift Tax Rules 2019-20 | Are Gifts received by NRIs Taxable? – #88

Latest NRI Gift Tax Rules 2019-20 | Are Gifts received by NRIs Taxable? – #88

Business Gifts: Understanding Tax Rules in IRS Pub 463 – FasterCapital – #89

Business Gifts: Understanding Tax Rules in IRS Pub 463 – FasterCapital – #89

Gift Remittance: Features, Process & Costs Involved – #90

Gift Remittance: Features, Process & Costs Involved – #90

How are gifts taxed in India? | Mint – #91

How are gifts taxed in India? | Mint – #91

Amazon.com: Foreign Gift Tax: A Guide To Understanding Your US Tax and Reporting Requirements For Those That Receive Cash Gifts From A Foreign Person eBook : Brody, Randall: Kindle Store – #92

Amazon.com: Foreign Gift Tax: A Guide To Understanding Your US Tax and Reporting Requirements For Those That Receive Cash Gifts From A Foreign Person eBook : Brody, Randall: Kindle Store – #92

Foreign Stocks and Taxation – Varsity by Zerodha – #93

Foreign Stocks and Taxation – Varsity by Zerodha – #93

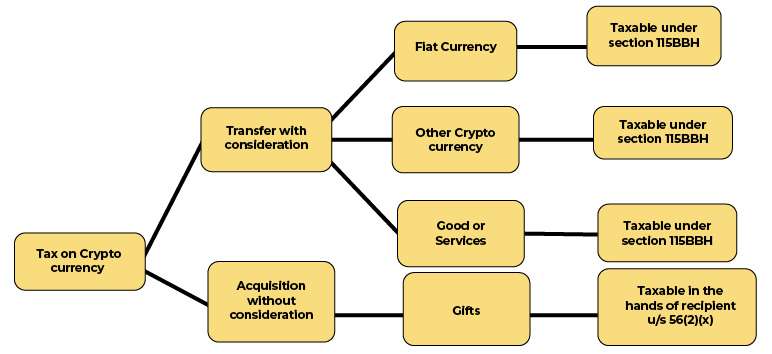

Tax on Gifting Crypto, NFT, VDA in India – #94

Tax on Gifting Crypto, NFT, VDA in India – #94

Foreign Gift Tax: Do I Have To Pay? | Cerebral Tax Advisors – #95

Foreign Gift Tax: Do I Have To Pay? | Cerebral Tax Advisors – #95

Reynolds + Rowella | Ridgefield CT – #96

Reynolds + Rowella | Ridgefield CT – #96

Form 709 – Guide 2023 | US Expat Tax Service – #97

Form 709 – Guide 2023 | US Expat Tax Service – #97

Can I Be Taxed on Money Gifts From Abroad? – #98

Can I Be Taxed on Money Gifts From Abroad? – #98

Sending money overseas: tax implications – Wise – #99

Sending money overseas: tax implications – Wise – #99

The Non-Citizen and the U.S. Estate and Gift Tax – An Introduction – #100

The Non-Citizen and the U.S. Estate and Gift Tax – An Introduction – #100

Taxation of gifts to NRIs and changes in Budget 2023-24 – #101

Taxation of gifts to NRIs and changes in Budget 2023-24 – #101

Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to Avoid It – #102

Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to Avoid It – #102

What Is the Gift Tax? | City National Bank – #103

What Is the Gift Tax? | City National Bank – #103

Cross-border gift tax issues for Canadians | Advisor.ca – #104

Cross-border gift tax issues for Canadians | Advisor.ca – #104

How is a gift perquisite amount taxed in India? If it is more than 5000, is the entire amount taxed or just the amount that exceeds 5000? – Quora – #105

How is a gift perquisite amount taxed in India? If it is more than 5000, is the entire amount taxed or just the amount that exceeds 5000? – Quora – #105

Gifts from Foreign Persons | Marcum LLP | Accountants and Advisors – #106

Gifts from Foreign Persons | Marcum LLP | Accountants and Advisors – #106

Can a Gift of Cash from Abroad Trigger a Gift Tax Obligation to the U.S. Recipient? | SF Tax Counsel – #107

Can a Gift of Cash from Abroad Trigger a Gift Tax Obligation to the U.S. Recipient? | SF Tax Counsel – #107

Gifts from Foreign Corporations Included as Gross Income – #108

Gifts from Foreign Corporations Included as Gross Income – #108

What Are the Tax Consequences of Giving a Gift to a Foreign Person? – EPGD Business Law – #109

What Are the Tax Consequences of Giving a Gift to a Foreign Person? – EPGD Business Law – #109

Guide to Unraveling Foreign Inheritance From an Estate and Tax Attorney – #110

Guide to Unraveling Foreign Inheritance From an Estate and Tax Attorney – #110

Form 3520 | H&R Block® – #111

Form 3520 | H&R Block® – #111

When Do You Need to Report Foreign Transfers to the IRS? – #112

When Do You Need to Report Foreign Transfers to the IRS? – #112

Inheritance and gift tax laws of Sweden ; prepared in the Office of the General Counsel for the Department of the Treasury – #113

Inheritance and gift tax laws of Sweden ; prepared in the Office of the General Counsel for the Department of the Treasury – #113

Foreign Gift Tax – Ultimate Insider Info You Need To Know – #114

Foreign Gift Tax – Ultimate Insider Info You Need To Know – #114

The Tax Implications of Opening a Foreign Bank Account – #115

The Tax Implications of Opening a Foreign Bank Account – #115

Tax on Foreign Remittance in India: Sending & Receiving Money – #116

Tax on Foreign Remittance in India: Sending & Receiving Money – #116

IRS Reporting Requirements for Gifts from a Foreign Person – #117

IRS Reporting Requirements for Gifts from a Foreign Person – #117

Taxes On Gifts From Overseas – #118

Taxes On Gifts From Overseas – #118

In India, is sending money to sister as a gift taxable or not? How much money can be sent? – Quora – #119

In India, is sending money to sister as a gift taxable or not? How much money can be sent? – Quora – #119

Sending Gift Money To Dubai From India – All You Need To Know – #120

Sending Gift Money To Dubai From India – All You Need To Know – #120

Gift from USA to India: Taxation and Exemptions – SBNRI – #121

Gift from USA to India: Taxation and Exemptions – SBNRI – #121

Sending gifts to children, relatives abroad? You may have to pay tax – Income Tax News | The Financial Express – #122

Sending gifts to children, relatives abroad? You may have to pay tax – Income Tax News | The Financial Express – #122

Foreigners Can Avoid U.S. Gift Tax With Proper Planning | MEG International Counsel – #123

Foreigners Can Avoid U.S. Gift Tax With Proper Planning | MEG International Counsel – #123

Instructions for IRS Form 3520 – #124

Instructions for IRS Form 3520 – #124

Income tax implications of sending funds abroad for daughter’s study— explained | Mint – #125

Income tax implications of sending funds abroad for daughter’s study— explained | Mint – #125

The Gift Tax Explained – What You Need to Know – YouTube – #126

The Gift Tax Explained – What You Need to Know – YouTube – #126

Form 709 and Gift Tax for Expats: What to Know | Bright!Tax Expat Tax Services – #127

Form 709 and Gift Tax for Expats: What to Know | Bright!Tax Expat Tax Services – #127

A Closer Look at the U.S.-France Estate and Gift Tax Treaty | SF Tax Counsel – #128

A Closer Look at the U.S.-France Estate and Gift Tax Treaty | SF Tax Counsel – #128

- form 3520 gift example

- form 3520 example

- gift tax exemption relatives list

TAXABILITY OF GIFTS IN INDIA – Manthan Experts – #129

TAXABILITY OF GIFTS IN INDIA – Manthan Experts – #129

The Rules on Reporting Foreign Gifts and Inheritances – #130

The Rules on Reporting Foreign Gifts and Inheritances – #130

Form 3520 (2023): Reporting a Foreign Trust, Gift or Inheritance – #131

Form 3520 (2023): Reporting a Foreign Trust, Gift or Inheritance – #131

Form 3520: US Taxes on Gifts and Inheritances – #132

Form 3520: US Taxes on Gifts and Inheritances – #132

Form 3520: What is it and How to Report Foreign Gift, Trust and Inheritance Transactions to IRS. – YouTube – #133

Form 3520: What is it and How to Report Foreign Gift, Trust and Inheritance Transactions to IRS. – YouTube – #133

Gift Tax in India and USA – #134

Gift Tax in India and USA – #134

Receiving a Foreign Gift? You May Need to Tell the IRS – The Wolf Group – #135

Receiving a Foreign Gift? You May Need to Tell the IRS – The Wolf Group – #135

U.S. Gift Tax Implications of Quit Claim Deeds for Foreigners – #136

U.S. Gift Tax Implications of Quit Claim Deeds for Foreigners – #136

- gift tax exemption

- clubbing of income ppt

- form 3520 part iv example

India’s DTAA Regime: A Brief Primer for Foreign Investors – #137

India’s DTAA Regime: A Brief Primer for Foreign Investors – #137

Insights – Prager Metis – #138

Insights – Prager Metis – #138

5 rules about Income Tax on Gifts received in India & Exemptions – #139

5 rules about Income Tax on Gifts received in India & Exemptions – #139

Understanding The Rules of Gifting — Brooklyn Fi – #140

Understanding The Rules of Gifting — Brooklyn Fi – #140

How money received via Will or Inheritance from abroad is taxed in India – Income Tax News | The Financial Express – #141

How money received via Will or Inheritance from abroad is taxed in India – Income Tax News | The Financial Express – #141

Gift Tax rules for US citizens (Guidelines) | Expat US Tax – #142

Gift Tax rules for US citizens (Guidelines) | Expat US Tax – #142

US Gift Tax on Nonresident Noncitizens | James Moore & Co. – #143

US Gift Tax on Nonresident Noncitizens | James Moore & Co. – #143

NRIs: India-US tax impact on gifts received by Indian Americans – The Economic Times – #144

NRIs: India-US tax impact on gifts received by Indian Americans – The Economic Times – #144

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #145

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #145

Tax Guidelines for Foreign Nationals & NRIs in India – #146

Tax Guidelines for Foreign Nationals & NRIs in India – #146

Taxation of Foreign Inheritance or Bequests in India – #147

Taxation of Foreign Inheritance or Bequests in India – #147

The U.S. Gift and Estate Tax | HTJ Tax – #148

The U.S. Gift and Estate Tax | HTJ Tax – #148

IRS Form 3520 ≡ Fill Out Printable PDF Forms Online – #149

IRS Form 3520 ≡ Fill Out Printable PDF Forms Online – #149

KLR | What are the Rules for Receiving Gifts from a Foreign Person,… – #150

KLR | What are the Rules for Receiving Gifts from a Foreign Person,… – #150

How to Avoid the Gift Tax – SmartAsset | SmartAsset – #151

How to Avoid the Gift Tax – SmartAsset | SmartAsset – #151

When FATCA Meets FIRPTA: Some Preliminary Comments | HTJ Tax – #152

When FATCA Meets FIRPTA: Some Preliminary Comments | HTJ Tax – #152

Taxability of Monetary Gifts, Immovable Property & Prescribed Movable Property received for adequate or inadequate consideration – Tax Effects – #153

Taxability of Monetary Gifts, Immovable Property & Prescribed Movable Property received for adequate or inadequate consideration – Tax Effects – #153

Understanding Income Tax on Marriage Gifts: Important Facts You Need to Know | Ebizfiling – #154

Understanding Income Tax on Marriage Gifts: Important Facts You Need to Know | Ebizfiling – #154

US Resident Receives $150k Gift from Pakistani Parent: What to Report to IRS? – O&G Tax and Accounting – #155

US Resident Receives $150k Gift from Pakistani Parent: What to Report to IRS? – O&G Tax and Accounting – #155

Nonresidents, Think You Are Safe from U.S. Gift and Estate Taxes? Think Again. – The Wolf Group – #156

Nonresidents, Think You Are Safe from U.S. Gift and Estate Taxes? Think Again. – The Wolf Group – #156

How much do you have to pay for inheritance and gift tax in Spain – IR Global – #157

How much do you have to pay for inheritance and gift tax in Spain – IR Global – #157

Taxation in the United States – Wikipedia – #158

Taxation in the United States – Wikipedia – #158

Taxability of Gifts: Who Pays and How to Avoid Taxes – Picnic Tax – #159

Taxability of Gifts: Who Pays and How to Avoid Taxes – Picnic Tax – #159

Marriage Gifts And Its Taxation in India: Understanding – Legal Window – #160

Marriage Gifts And Its Taxation in India: Understanding – Legal Window – #160

Taxability of Gifts – Some Interesting Issues – #161

Taxability of Gifts – Some Interesting Issues – #161

Crypto Gift Tax | Your Guide | Koinly – #162

Crypto Gift Tax | Your Guide | Koinly – #162

Buying US Real Estate As a Foreigner | Common Mistakes – #163

Buying US Real Estate As a Foreigner | Common Mistakes – #163

What is ‘Foreign Contribution’ under Foreign Contribution Regulation Act (FCRA)? – #164

What is ‘Foreign Contribution’ under Foreign Contribution Regulation Act (FCRA)? – #164

Gift tax – A guide – Online Demat, Trading, and Mutual Fund Investment in India – Fisdom – #165

Gift tax – A guide – Online Demat, Trading, and Mutual Fund Investment in India – Fisdom – #165

Act Now to Leverage the Gift Tax Exclusion Before Year End | Hantzmon Wiebel CPA and Advisory Services – #166

Act Now to Leverage the Gift Tax Exclusion Before Year End | Hantzmon Wiebel CPA and Advisory Services – #166

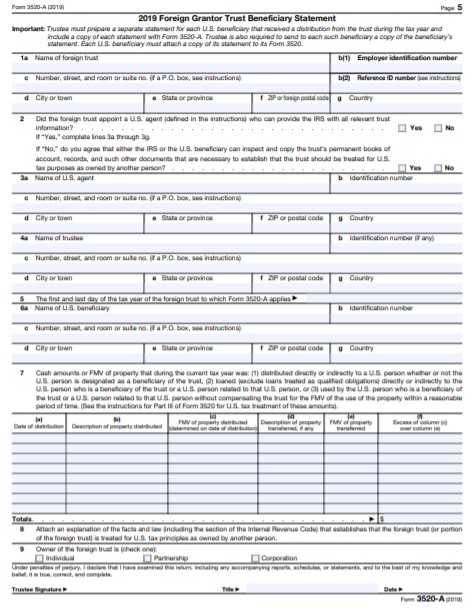

Instructions for Form 3520-A (12/2023) | Internal Revenue Service – #167

Instructions for Form 3520-A (12/2023) | Internal Revenue Service – #167

A silver lining on inflation: Estate & gift tax adjustments – #168

A silver lining on inflation: Estate & gift tax adjustments – #168

Gifts and Taxes in France — Sanderling Expat Advisors – #169

Gifts and Taxes in France — Sanderling Expat Advisors – #169

Navigating Wedding Gifts And Taxes: Here Is A Hitch-Free Guide For The Gifted – Goodreturns – #170

Navigating Wedding Gifts And Taxes: Here Is A Hitch-Free Guide For The Gifted – Goodreturns – #170

Income Tax on Gift – #171

Income Tax on Gift – #171

Foreign Nationals and U.S. Gift Tax Consequences of Executing Certain Real Property Deeds · Kerkering, Barberio & Co., Certified Public Accountants Sarasota, FL – #172

Foreign Nationals and U.S. Gift Tax Consequences of Executing Certain Real Property Deeds · Kerkering, Barberio & Co., Certified Public Accountants Sarasota, FL – #172

Types of Tax – Exemptions, Due Dates & Penalties – #173

Types of Tax – Exemptions, Due Dates & Penalties – #173

What Happens if You Inherit Money from Another Country? – #174

What Happens if You Inherit Money from Another Country? – #174

Do I Have To Pay Taxes On An Inheritance From A Foreign Relative? — – #175

Do I Have To Pay Taxes On An Inheritance From A Foreign Relative? — – #175

Money above `50,000 gifted to friend is taxable | Mint – #176

Money above `50,000 gifted to friend is taxable | Mint – #176

The US-Japan Estate, Inheritance and Gift Tax Treaty – #177

The US-Japan Estate, Inheritance and Gift Tax Treaty – #177

Did you receive Gift? Tax Implications on Gifts | Examples, Limits & Rules – #178

Did you receive Gift? Tax Implications on Gifts | Examples, Limits & Rules – #178

Gifts of Partnership Interests – #179

Gifts of Partnership Interests – #179

Gifts & Income Tax Implications : Scenarios & Examples – #180

Gifts & Income Tax Implications : Scenarios & Examples – #180

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #181

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #181

NRI Gift Tax Guide: Understanding Tax Implications in India – #182

NRI Gift Tax Guide: Understanding Tax Implications in India – #182

Expatriation Plays A Big Role on US Gift Tax | US Expat Tax Service – #183

Expatriation Plays A Big Role on US Gift Tax | US Expat Tax Service – #183

Receipt of Gifts and Inheritance by an NRI under FEMA – Enterslice – #184

Receipt of Gifts and Inheritance by an NRI under FEMA – Enterslice – #184

How can NRIs in the US gift money to their parents in India in 2023? | Arthgyaan – #185

How can NRIs in the US gift money to their parents in India in 2023? | Arthgyaan – #185

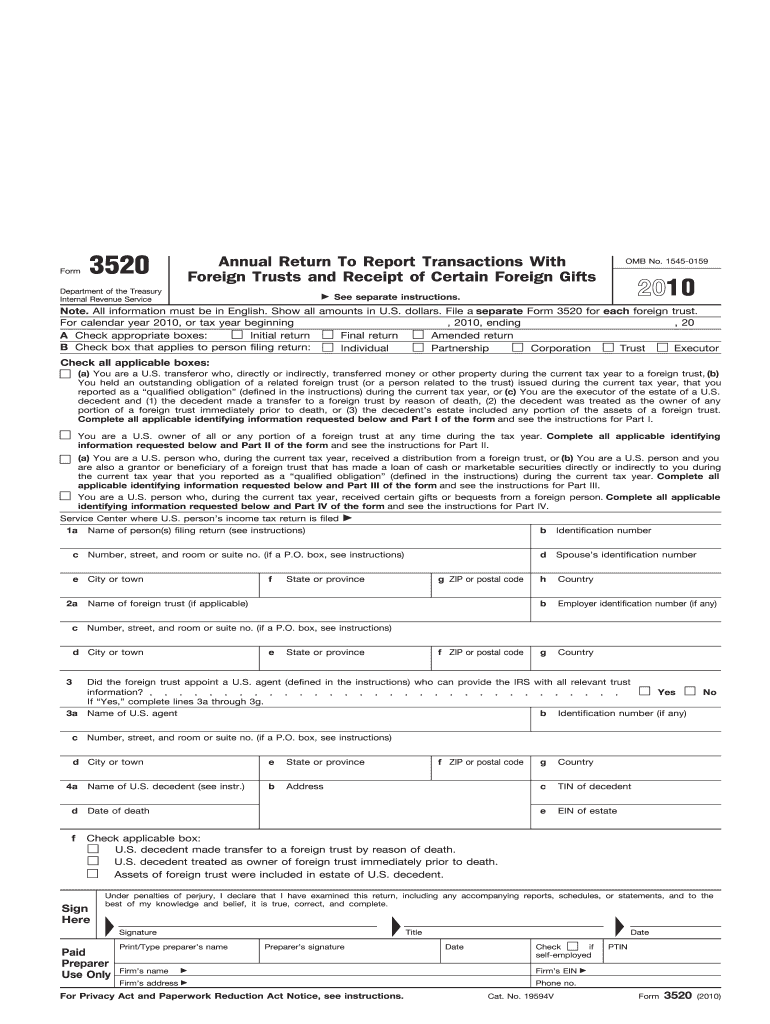

Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts – #186

Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts – #186

Posts: gift tax foreign recipient

Categories: Gifts

Author: toyotabienhoa.edu.vn