Update 226+ gift tax exemption relatives list

Update images of gift tax exemption relatives list by website toyotabienhoa.edu.vn compilation. Income Tax on Gifts Received from Relatives & Friends – YouTube. Taxation of gifts to NRIs and changes in Budget 2023-24. These 2 Expenses Don’t Count Against Your Gift Tax Exclusion | Northwestern Mutual

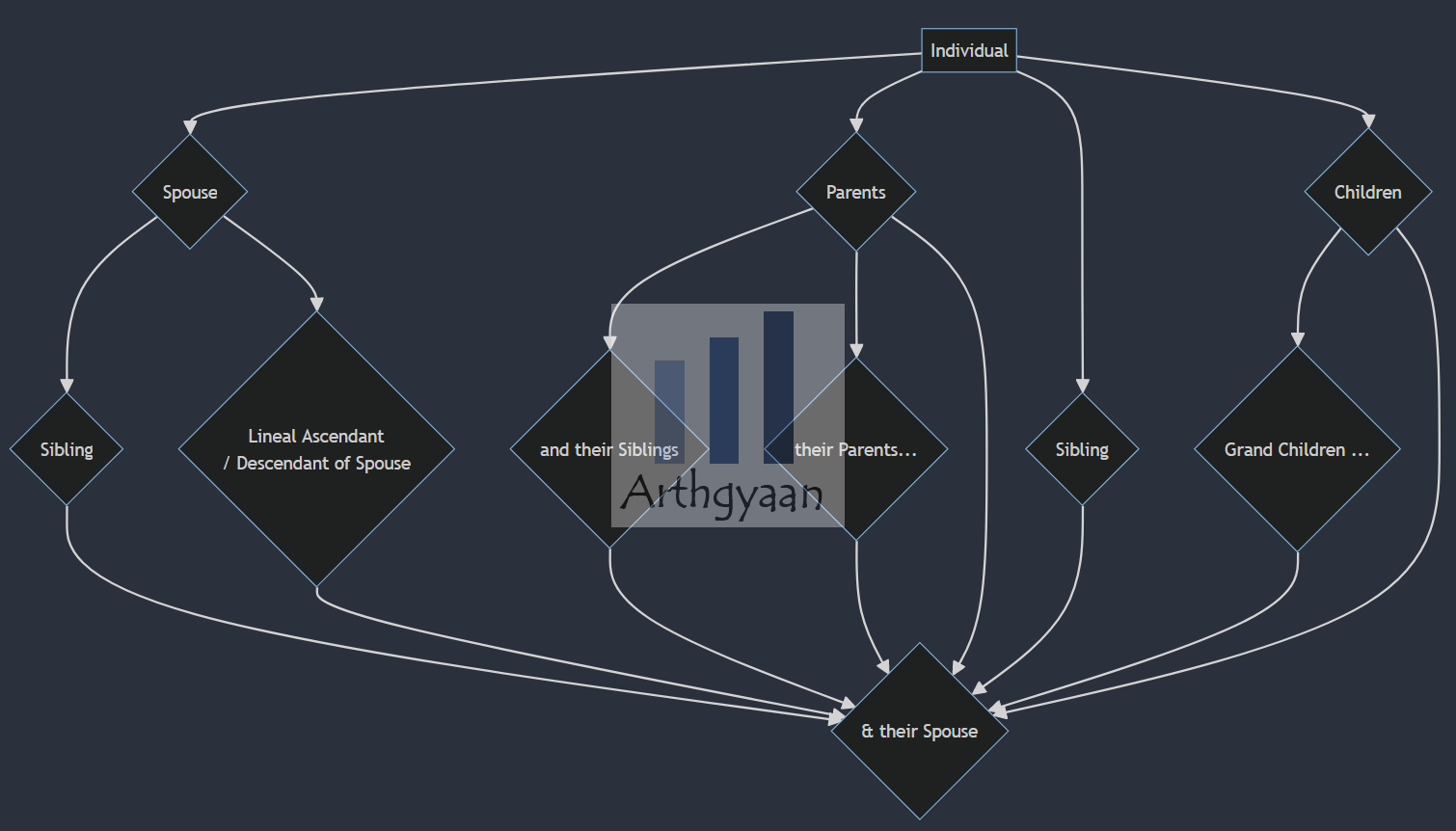

Gift tax exemption rules: who can receive gifts that are tax-free? | Arthgyaan – #1

Gift tax exemption rules: who can receive gifts that are tax-free? | Arthgyaan – #1

5 gift tax exemptions you need to know | Fox Business – #2

5 gift tax exemptions you need to know | Fox Business – #2

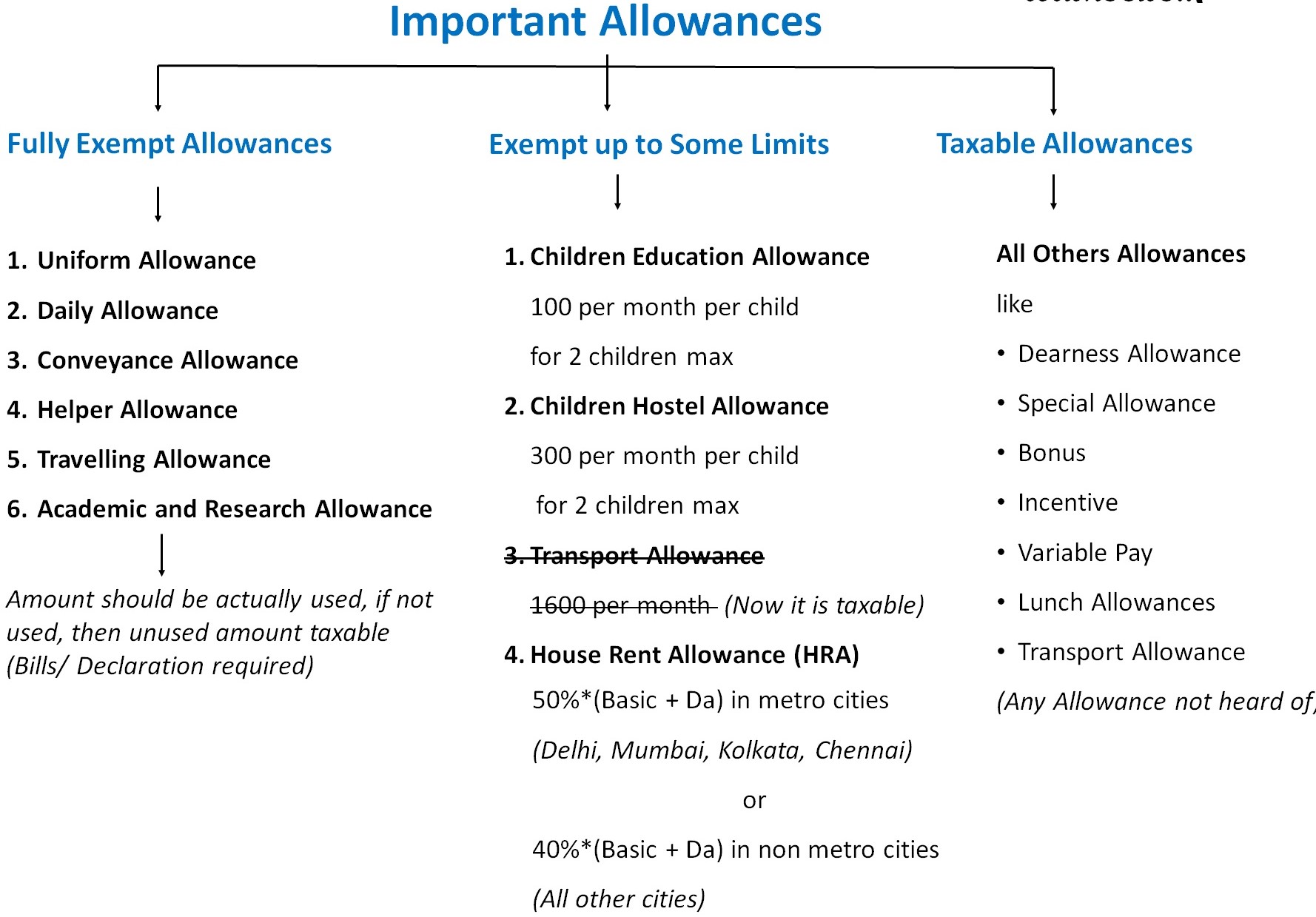

![Opinion] Gifts | A Comprehensive Analysis of an Everlasting Tax Planning Tool Opinion] Gifts | A Comprehensive Analysis of an Everlasting Tax Planning Tool](https://carajput.com/blog/wp-content/uploads/2020/10/Salary-allowances-1.png) Opinion] Gifts | A Comprehensive Analysis of an Everlasting Tax Planning Tool – #4

Opinion] Gifts | A Comprehensive Analysis of an Everlasting Tax Planning Tool – #4

Direct Payment of Medical Expenses and Tuition as an Exception to the Gift Tax – #5

Direct Payment of Medical Expenses and Tuition as an Exception to the Gift Tax – #5

List of Advantages of Gift Deed Registration That You Must Know – Corpbiz – #6

List of Advantages of Gift Deed Registration That You Must Know – Corpbiz – #6

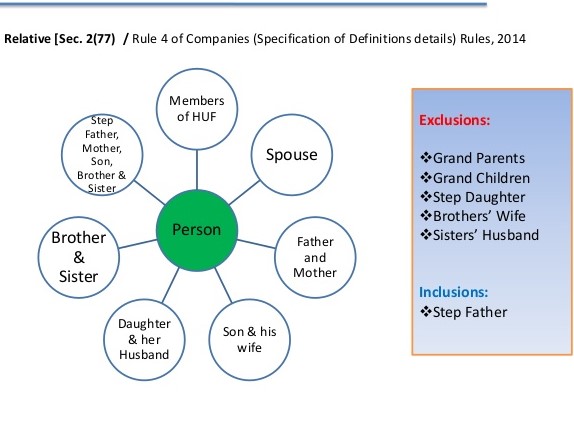

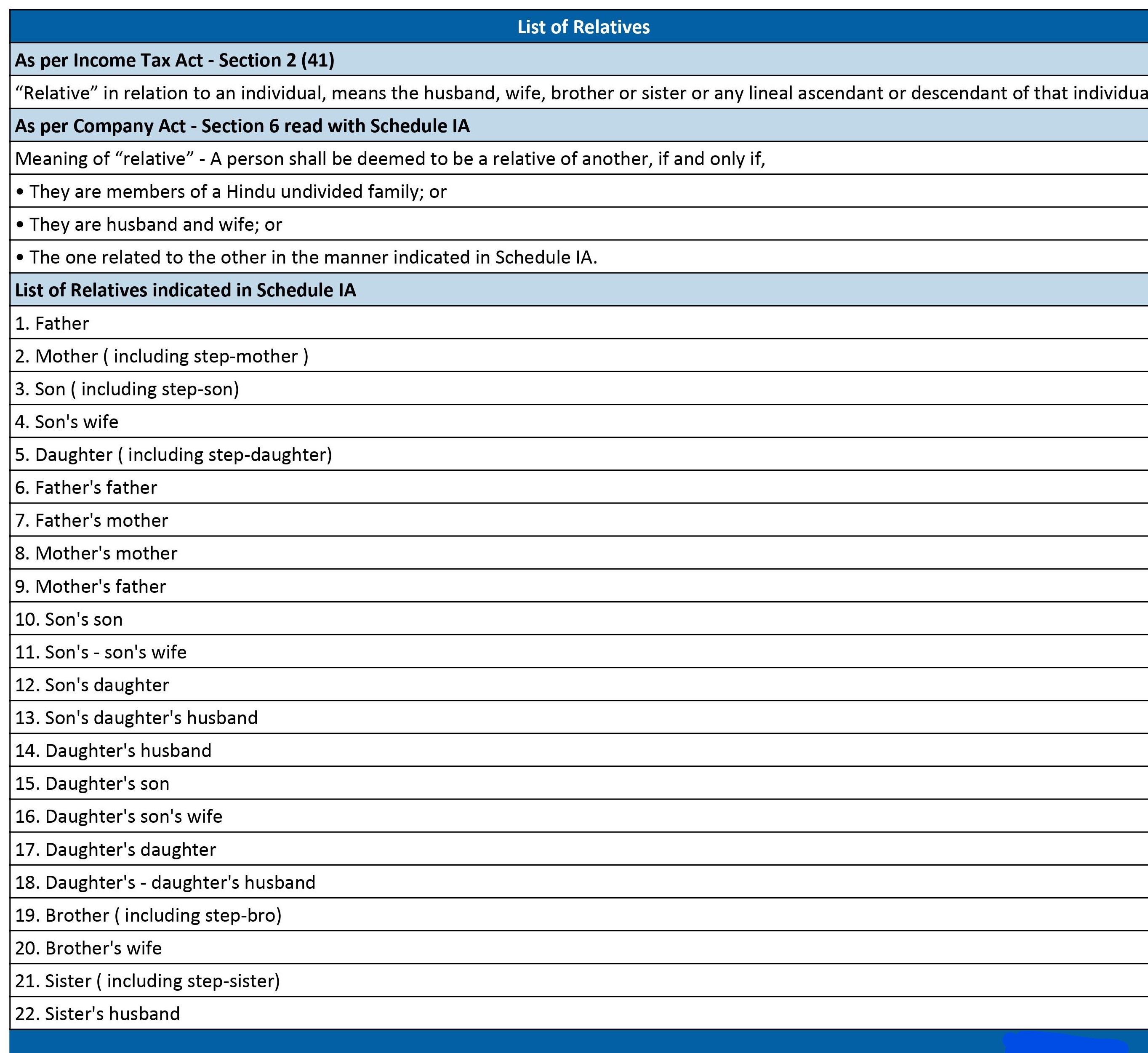

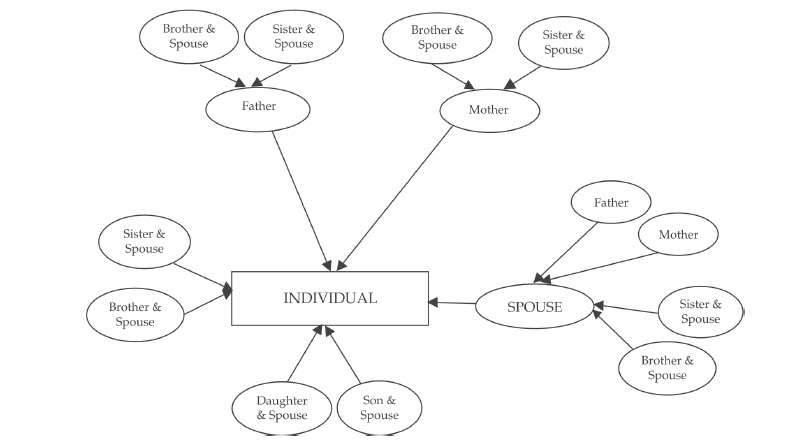

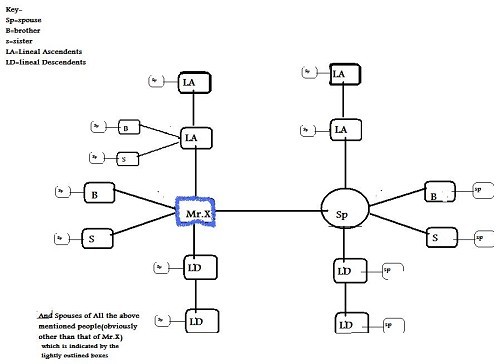

Analysis of definition of “Relative” under different Act – #7

Analysis of definition of “Relative” under different Act – #7

How Are Gifts Taxed in India? – Kanakkupillai – #8

How Are Gifts Taxed in India? – Kanakkupillai – #8

Tax queries: Gifts received from relatives are not taxable – The Economic Times – #10

Tax queries: Gifts received from relatives are not taxable – The Economic Times – #10

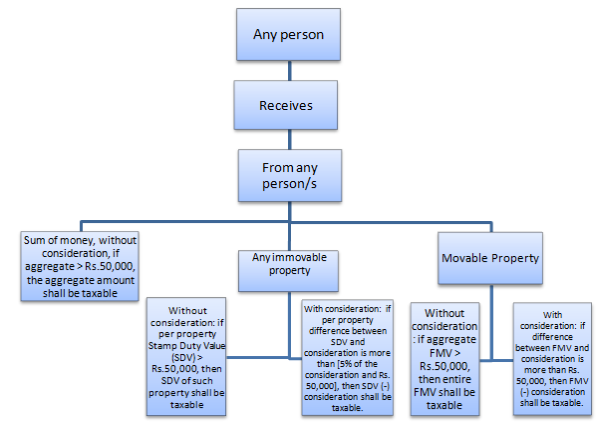

Gift tax under section 56(2)x – #11

Gift tax under section 56(2)x – #11

Tax queries: Gifts received from a relative are tax-exempt – The Economic Times – #12

Tax queries: Gifts received from a relative are tax-exempt – The Economic Times – #12

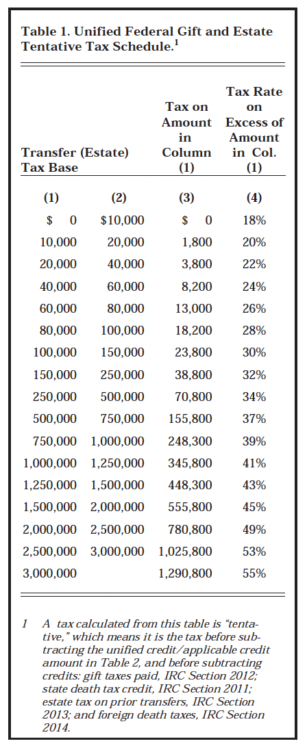

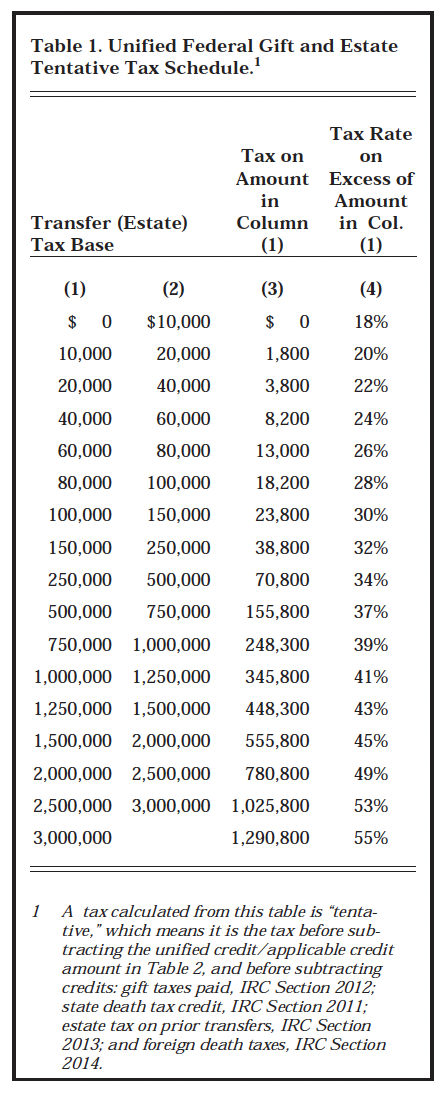

Use the 2016 Gift Tax Exclusion to Beat the Estate Tax | The Motley Fool – #13

Use the 2016 Gift Tax Exclusion to Beat the Estate Tax | The Motley Fool – #13

Publication 17 (2023), Your Federal Income Tax | Internal Revenue Service – #14

Publication 17 (2023), Your Federal Income Tax | Internal Revenue Service – #14

Will your ‘gift’ be taxed? – The Economic Times – #15

Will your ‘gift’ be taxed? – The Economic Times – #15

) Gift Tax planning – 3 awesome tips to save income tax legally – #16

Gift Tax planning – 3 awesome tips to save income tax legally – #16

Gift Tax Return Lessons: Common Mistakes And Tips For Your Gift Tax Return – #17

Gift Tax Return Lessons: Common Mistakes And Tips For Your Gift Tax Return – #17

Diwali gifts: Taxable or tax-free? Decoding the rules for a hassle-free festival | Mint – #18

Diwali gifts: Taxable or tax-free? Decoding the rules for a hassle-free festival | Mint – #18

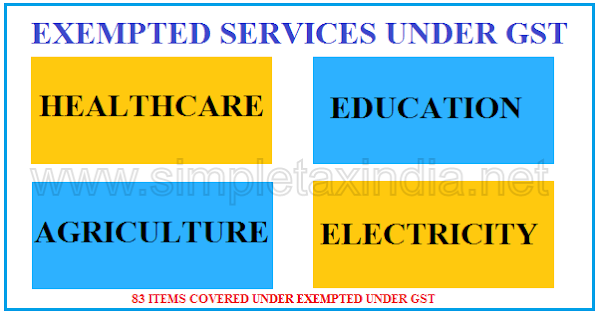

when Gift is taxable ? when gift is Exempted ? | SIMPLE TAX INDIA – #19

when Gift is taxable ? when gift is Exempted ? | SIMPLE TAX INDIA – #19

What is the Gift Tax in India and How Does it Affect NRIs? – #20

What is the Gift Tax in India and How Does it Affect NRIs? – #20

Taxability of Gifts – Some Interesting Issues – #21

Taxability of Gifts – Some Interesting Issues – #21

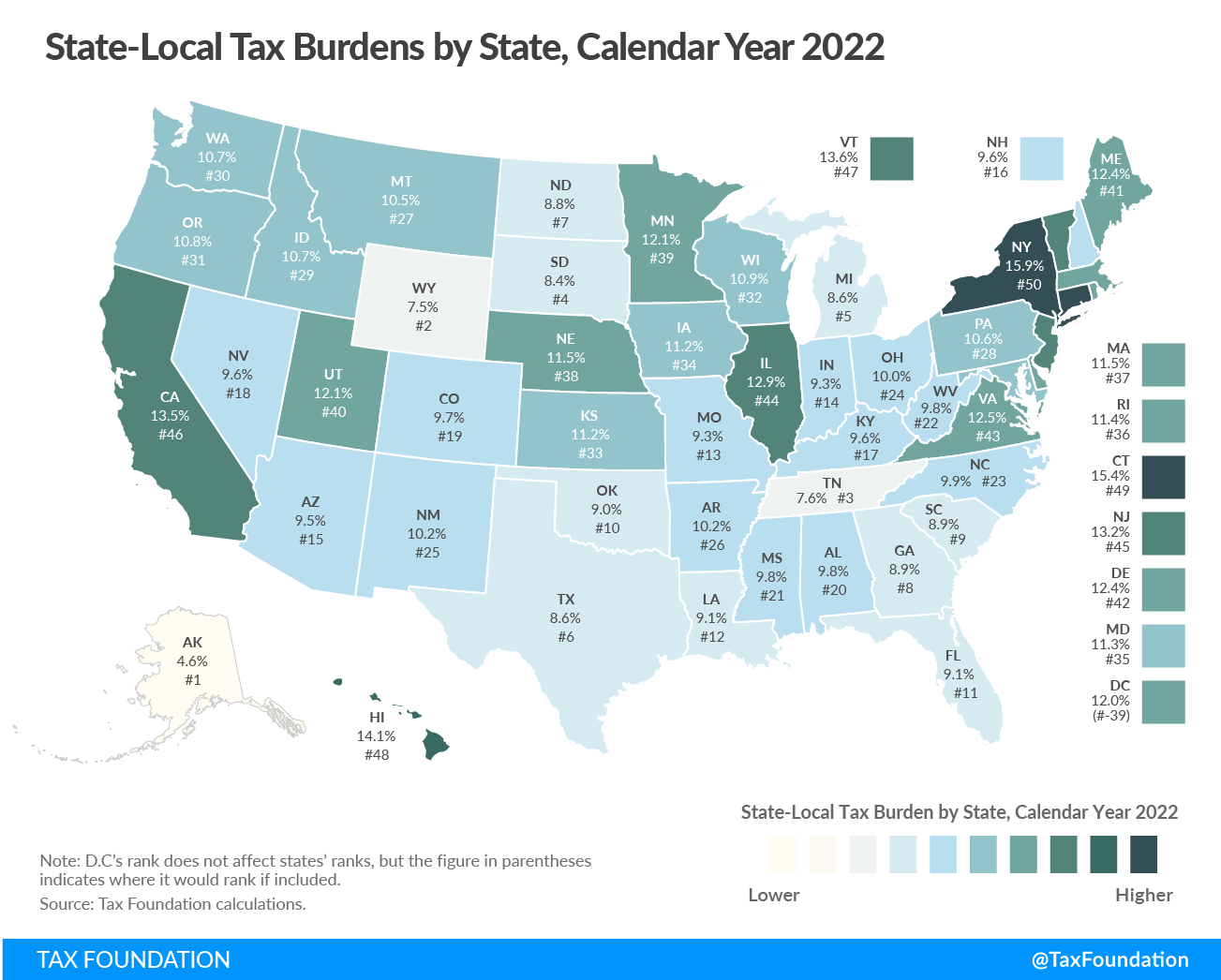

Tax Burden by State: 2022 State and Local Taxes | Tax Foundation – #22

Tax Burden by State: 2022 State and Local Taxes | Tax Foundation – #22

Income Tax on Gifts| All About Gift Tax Rules & Exemptions| List of relatives – YouTube – #23

Income Tax on Gifts| All About Gift Tax Rules & Exemptions| List of relatives – YouTube – #23

Gift Tax in India – Learn Gift Tax Meaning & How to Calculate the Gift Income Tax – #24

Gift Tax in India – Learn Gift Tax Meaning & How to Calculate the Gift Income Tax – #24

Did you receive Gift? Tax Implications on Gifts | Examples, Limits & Rules – #25

Did you receive Gift? Tax Implications on Gifts | Examples, Limits & Rules – #25

Tax on gift from Non Relative & Friends| कितना पैसा ले सकते है एक साल में की नोटिस ना आए | CA Sachin – YouTube – #26

Tax on gift from Non Relative & Friends| कितना पैसा ले सकते है एक साल में की नोटिस ना आए | CA Sachin – YouTube – #26

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #27

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #27

Gifts & Income Tax Implications : Scenarios & Examples – #28

Gifts & Income Tax Implications : Scenarios & Examples – #28

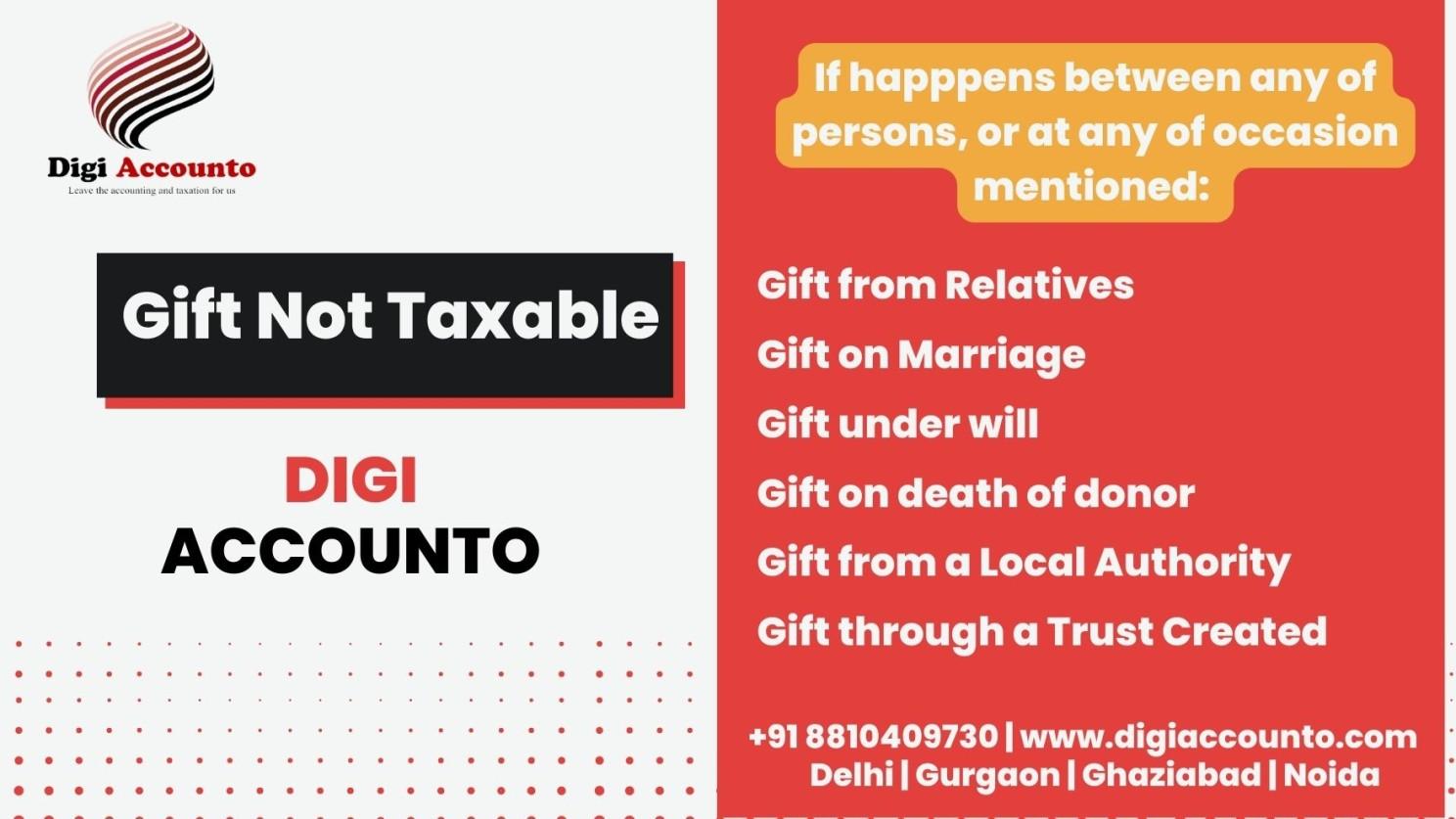

Gift Tax In India – All about Gift Tax – Digiaccounto – #29

Gift Tax In India – All about Gift Tax – Digiaccounto – #29

Relatives from whom Gift is permissible |TAXVANI – #30

Relatives from whom Gift is permissible |TAXVANI – #30

Gift from USA to India: Taxation and Exemptions – SBNRI – #31

Gift from USA to India: Taxation and Exemptions – SBNRI – #31

The unique benefits of 529 college savings plans – #32

The unique benefits of 529 college savings plans – #32

Gift Deed Registration: Stamp Duty, Registry Fee, Tax, Procedure – #33

Gift Deed Registration: Stamp Duty, Registry Fee, Tax, Procedure – #33

Gift tax in India – Income tax rules on gifts and exemption available – #34

Gift tax in India – Income tax rules on gifts and exemption available – #34

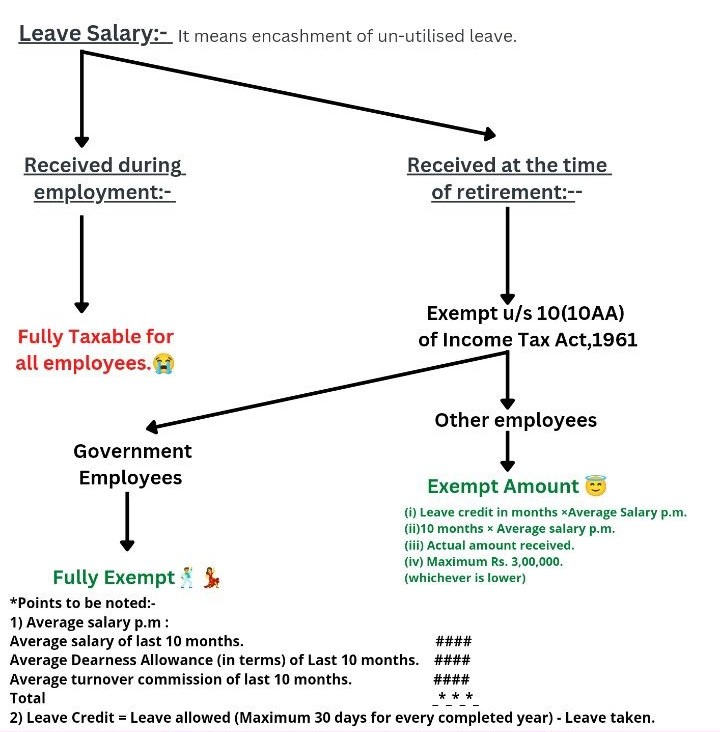

List of Exempted Incomes (Tax-Free) Under Section-10 – #35

List of Exempted Incomes (Tax-Free) Under Section-10 – #35

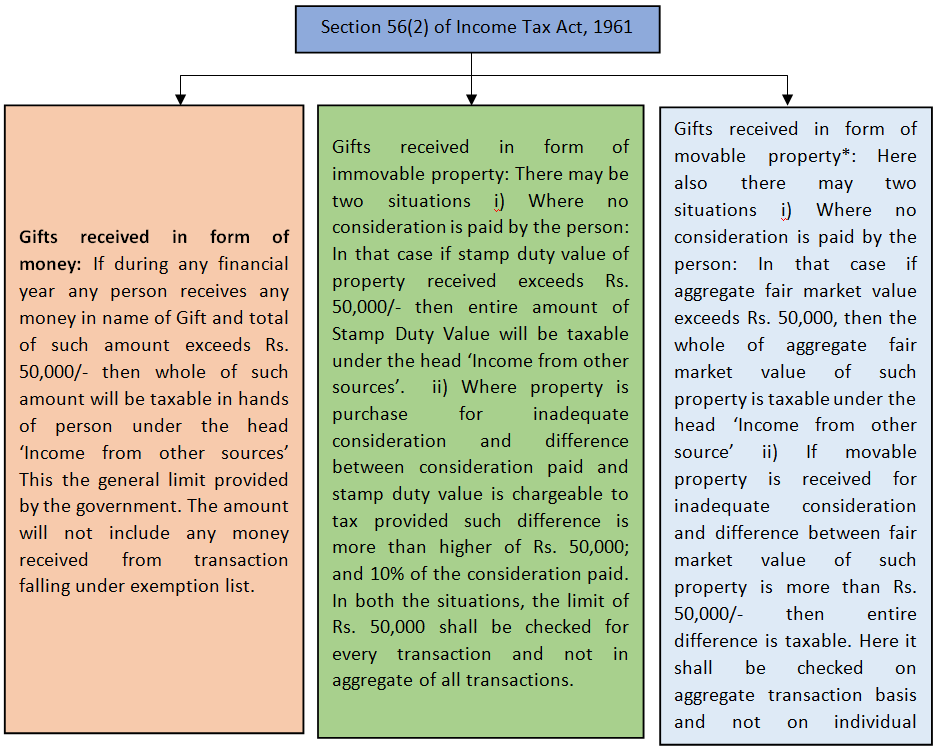

Section 56(2)(x): Taxability of Gifts – Pioneer One Consulting LLP – #36

Section 56(2)(x): Taxability of Gifts – Pioneer One Consulting LLP – #36

The Gift Tax Made Simple – TurboTax Tax Tips & Videos – #37

The Gift Tax Made Simple – TurboTax Tax Tips & Videos – #37

Taxability on gifts, rewards and rewards given to Sportsperson / Olympic Participants – #38

Taxability on gifts, rewards and rewards given to Sportsperson / Olympic Participants – #38

These 2 Expenses Don’t Count Against Your Gift Tax Exclusion | Northwestern Mutual – #39

These 2 Expenses Don’t Count Against Your Gift Tax Exclusion | Northwestern Mutual – #39

Wealth Planning: Updates for Year-End 2023 and 2024 – Evercore – #40

Wealth Planning: Updates for Year-End 2023 and 2024 – Evercore – #40

List of relatives covered under Section 56(2) of Income Tax Act,1961 – #41

List of relatives covered under Section 56(2) of Income Tax Act,1961 – #41

Does Your State Have an Estate or Inheritance Tax? – #42

Does Your State Have an Estate or Inheritance Tax? – #42

Taxability of Gifts – Some Interesting Issues – #43

Taxability of Gifts – Some Interesting Issues – #43

Gift by NRI to Resident Indian or Vice-Versa – NRI Gift Tax In India – #44

Gift by NRI to Resident Indian or Vice-Versa – NRI Gift Tax In India – #44

GIFT TAX – UPSC Current Affairs – IAS GYAN – #45

GIFT TAX – UPSC Current Affairs – IAS GYAN – #45

How to ensure your Gifts are exempted from Gift Tax in India? – #46

How to ensure your Gifts are exempted from Gift Tax in India? – #46

Taxation Of Gifts – Income Tax Act, 1961 – #47

Taxation Of Gifts – Income Tax Act, 1961 – #47

Taxation in the United States – Wikipedia – #48

Taxation in the United States – Wikipedia – #48

Taxability of Gift received by an individual or HUF – #49

Taxability of Gift received by an individual or HUF – #49

Income tax on gifts: Know when your gift is tax-free – BusinessToday – #50

Income tax on gifts: Know when your gift is tax-free – BusinessToday – #50

Legal Alert | Common Gift Tax Return Mistakes and Ways to Avoid Them | Husch Blackwell – #51

Legal Alert | Common Gift Tax Return Mistakes and Ways to Avoid Them | Husch Blackwell – #51

Income Tax on Gift in India – Rules and tips to save tax – BasuNivesh – #52

Income Tax on Gift in India – Rules and tips to save tax – BasuNivesh – #52

Is a gift given by a nephew to an uncle taxable under the Income-tax Act, 1961? – Quora – #53

Is a gift given by a nephew to an uncle taxable under the Income-tax Act, 1961? – Quora – #53

Tax Implications of Loans to Family Members – #54

Tax Implications of Loans to Family Members – #54

State Estate and Inheritance Taxes: Does Your State Have Them, What Are They, and How Should You Plan for Them | Georgia Estate Plan: Worrall Law LLC – #55

State Estate and Inheritance Taxes: Does Your State Have Them, What Are They, and How Should You Plan for Them | Georgia Estate Plan: Worrall Law LLC – #55

What is a gift deed and tax implications | Tax Hack – #56

What is a gift deed and tax implications | Tax Hack – #56

Gifts Tax: Know which gifts are taxable this festive season | TAX SAVING | Zee Business – #57

Gifts Tax: Know which gifts are taxable this festive season | TAX SAVING | Zee Business – #57

Getting Ahead: Estate & Inheritance Taxes – Snow-Redfern Foundation – #58

Getting Ahead: Estate & Inheritance Taxes – Snow-Redfern Foundation – #58

Tax Resident Status and 3 Things to Know Before Moving to US – #59

Tax Resident Status and 3 Things to Know Before Moving to US – #59

When is money gifted not taxable? All your tax queries on gifts answered | Personal Finance – Business Standard – #60

When is money gifted not taxable? All your tax queries on gifts answered | Personal Finance – Business Standard – #60

5 rules about Income Tax on Gifts received in India & Exemptions – #61

5 rules about Income Tax on Gifts received in India & Exemptions – #61

Taxability of Gifts – #62

Taxability of Gifts – #62

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #63

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #63

29 Tax free income sources in India – #64

29 Tax free income sources in India – #64

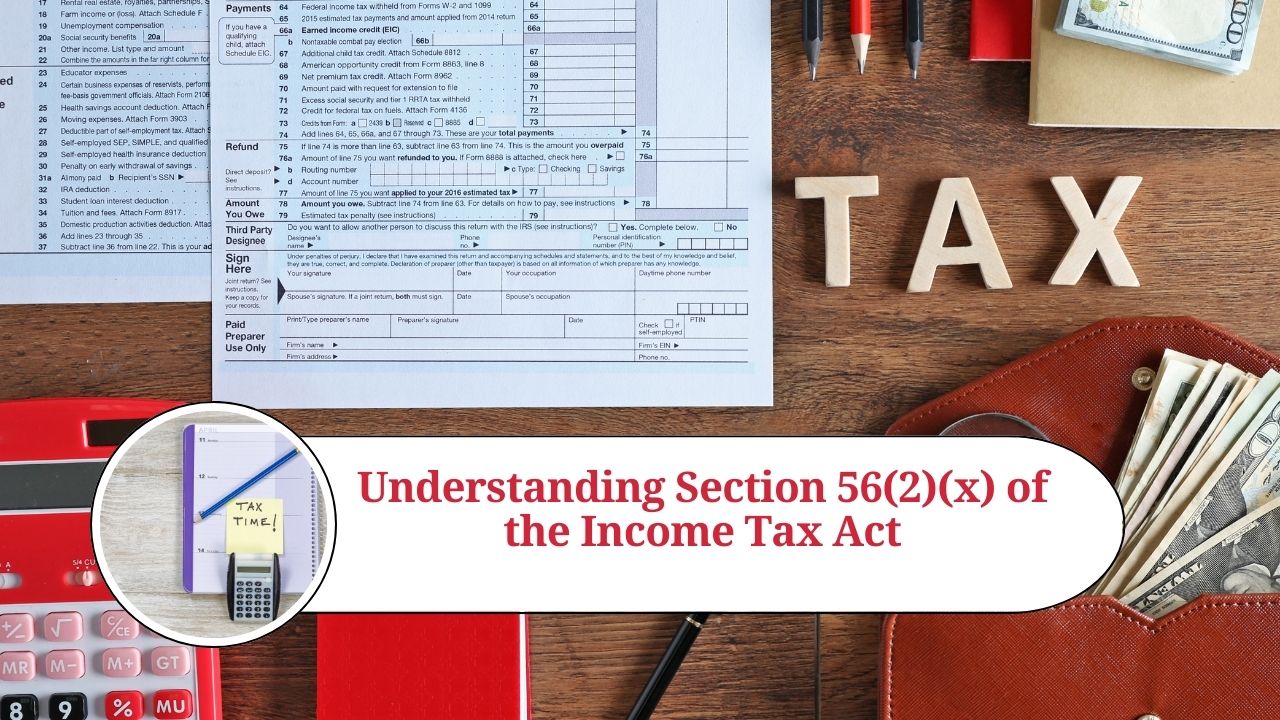

Understanding Section 56(2)(x) of Income Tax Act, 1961: Tax Implications of Gifts Received Without Consideration – Marg ERP Blog – #65

Understanding Section 56(2)(x) of Income Tax Act, 1961: Tax Implications of Gifts Received Without Consideration – Marg ERP Blog – #65

1040 (2023) | Internal Revenue Service – #66

1040 (2023) | Internal Revenue Service – #66

Form 709: What It Is and Who Must File It – #67

Form 709: What It Is and Who Must File It – #67

Tax Query: Taxation Aspects on Gifts Received – The Hindu BusinessLine – #68

Tax Query: Taxation Aspects on Gifts Received – The Hindu BusinessLine – #68

Ten Facts You Should Know About the Federal Estate Tax | Center on Budget and Policy Priorities – #69

Ten Facts You Should Know About the Federal Estate Tax | Center on Budget and Policy Priorities – #69

Can NRI gift money to parents? In India for purchase property – Quora – #70

Can NRI gift money to parents? In India for purchase property – Quora – #70

Income Tax on Gift – #71

Income Tax on Gift – #71

Taxation of Gifts received in Cash or Kind – #72

Taxation of Gifts received in Cash or Kind – #72

I received gifts during my wedding, are they taxable? – #73

I received gifts during my wedding, are they taxable? – #73

2023 State Estate Taxes and State Inheritance Taxes – #74

2023 State Estate Taxes and State Inheritance Taxes – #74

Tax Tips and Deductions for Family Caregivers – #75

Tax Tips and Deductions for Family Caregivers – #75

How to Fill Out Form 709 | SmartAsset – #76

How to Fill Out Form 709 | SmartAsset – #76

2024 Estate and Gift Tax Exemptions – Littman Krooks LLP – #77

2024 Estate and Gift Tax Exemptions – Littman Krooks LLP – #77

Taxation of gifts to NRIs and changes in Budget 2023-24 – #78

Taxation of gifts to NRIs and changes in Budget 2023-24 – #78

All you need to know about taxes on gifts and the exceptions | Mint – #79

All you need to know about taxes on gifts and the exceptions | Mint – #79

What is Gift Tax? – Exemption and Limits on Gifts for FY 2023-24 – #80

What is Gift Tax? – Exemption and Limits on Gifts for FY 2023-24 – #80

Definition of Relatives for the purpose of Income Tax Act, 1961- Taxwink – #81

Definition of Relatives for the purpose of Income Tax Act, 1961- Taxwink – #81

Taxation in the Republic of Ireland – Wikipedia – #82

Taxation in the Republic of Ireland – Wikipedia – #82

Solved b. Gifts of up to $15,000 per year from any person | Chegg.com – #83

Solved b. Gifts of up to $15,000 per year from any person | Chegg.com – #83

Gifts received from non-relatives of above Rs 50,000 a year are taxable – #84

Gifts received from non-relatives of above Rs 50,000 a year are taxable – #84

Gifts Treated as Income – #85

Gifts Treated as Income – #85

Section 56 – Exemption from Taxation on Wedding Gifts | Fincash – #86

Section 56 – Exemption from Taxation on Wedding Gifts | Fincash – #86

Income Tax on Gifts Received from Relatives & Friends – YouTube – #87

Income Tax on Gifts Received from Relatives & Friends – YouTube – #87

Relative से पैसा लेने से पहले यह video ज़रूर देखना, Gift Rule 2022,आपके गिफ्ट पर इनकम टैक्स की नज़र – YouTube – #88

Relative से पैसा लेने से पहले यह video ज़रूर देखना, Gift Rule 2022,आपके गिफ्ट पर इनकम टैक्स की नज़र – YouTube – #88

Taxability of Monetary Gifts, Immovable Property & Prescribed Movable Property received for adequate or inadequate consideration – Tax Effects – #89

Taxability of Monetary Gifts, Immovable Property & Prescribed Movable Property received for adequate or inadequate consideration – Tax Effects – #89

Gift Tax Under Section 56(2)x – #90

Gift Tax Under Section 56(2)x – #90

Analyzing Biden’s New “American Families Plan” Tax Proposal – #91

Analyzing Biden’s New “American Families Plan” Tax Proposal – #91

When Should I Use My Estate and Gift Tax Exemption? – #92

When Should I Use My Estate and Gift Tax Exemption? – #92

Tax on Gifts | Income tax on Gifts | list of relatives | Income Tax On gift Money – YouTube – #93

Tax on Gifts | Income tax on Gifts | list of relatives | Income Tax On gift Money – YouTube – #93

Taxbaility of GIFT – FIBOTA – #94

Taxbaility of GIFT – FIBOTA – #94

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #95

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #95

Save Tax Through Gifts Se Tax Planning Income Tax Rules, Gift Deed Create # gift #gifttax #taxongift – YouTube – #96

Save Tax Through Gifts Se Tax Planning Income Tax Rules, Gift Deed Create # gift #gifttax #taxongift – YouTube – #96

If my mother gives me one crore, will this amount be taxable? – Quora – #97

If my mother gives me one crore, will this amount be taxable? – Quora – #97

Gift Tax, the Annual Exclusion and Estate Planning – #98

Gift Tax, the Annual Exclusion and Estate Planning – #98

Tax on Foreign Remittance in India: Sending & Receiving Money – #99

Tax on Foreign Remittance in India: Sending & Receiving Money – #99

) Income Tax efiling: Received gifts during the year? Here is what that means for your ITR – Income Tax News | The Financial Express – #100

Income Tax efiling: Received gifts during the year? Here is what that means for your ITR – Income Tax News | The Financial Express – #100

Gift Tax in India: Implications & Exemptions – myMoneySage Blog – #101

Gift Tax in India: Implications & Exemptions – myMoneySage Blog – #101

Budget 2023: गिफ्ट पर लगने वाले टैक्स को लेकर बजट में हो सकता है बड़ा ऐलान – budget 2023 expectations gift tax exemption relatives list – News18 हिंदी – #102

Budget 2023: गिफ्ट पर लगने वाले टैक्स को लेकर बजट में हो सकता है बड़ा ऐलान – budget 2023 expectations gift tax exemption relatives list – News18 हिंदी – #102

When Generosity Bumps Into Gift Tax – The New York Times – #103

When Generosity Bumps Into Gift Tax – The New York Times – #103

The Generation-Skipping Transfer Tax: A Quick Guide – #104

The Generation-Skipping Transfer Tax: A Quick Guide – #104

Income tax on gifts: Gift received from relatives is tax free | Mint – #105

Income tax on gifts: Gift received from relatives is tax free | Mint – #105

Recent developments in estate planning: Part 2 – #106

Recent developments in estate planning: Part 2 – #106

Latest NRI Gift Tax Rules 2019-20 | Are Gifts received by NRIs Taxable? – #107

Latest NRI Gift Tax Rules 2019-20 | Are Gifts received by NRIs Taxable? – #107

Relatives u/s 56(2)(vii) from whom Gift is permissible…… – Income Tax | Tax planning – #108

Relatives u/s 56(2)(vii) from whom Gift is permissible…… – Income Tax | Tax planning – #108

If a car is sold between family members (not a gift), is there still sales tax (in California)? – Quora – #109

If a car is sold between family members (not a gift), is there still sales tax (in California)? – Quora – #109

Tax on Gifts in India | Exemption and Rules | EZTax® – #110

Tax on Gifts in India | Exemption and Rules | EZTax® – #110

4 Types Of Tax-Exempt Gifts | Kotak Securities – #111

4 Types Of Tax-Exempt Gifts | Kotak Securities – #111

Meaning of relative under different act | CA Rajput Jain – #112

Meaning of relative under different act | CA Rajput Jain – #112

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #113

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #113

- section 56(2) of income tax act

- lineal ascendant gift from relative exempt from income tax

- gift tax in india

Estates and Taxes – Plan for Passing On – #114

Estates and Taxes – Plan for Passing On – #114

Fresher: Gifting Shares – #115

Fresher: Gifting Shares – #115

– #116

– #116

– #117

– #117

– #118

– #118

– #119

– #119

– #120

– #120

– #121

– #121

– #122

– #122

– #123

– #123

– #124

– #124

– #125

– #125

– #126

– #126

.jpeg) – #127

– #127

– #128

– #128

– #129

– #129

– #130

– #130

– #131

– #131

- gift tax example

- gift chart as per income tax

- list of relatives

– #132

– #132

– #133

– #133

– #134

– #134

– #135

– #135

– #136

– #136

– #137

– #137

– #138

– #138

– #139

– #139

– #140

– #140

– #141

– #141

– #142

– #142

– #143

– #143

– #144

– #144

– #145

– #145

– #146

– #146

– #147

– #147

– #148

– #148

– #149

– #149

– #150

– #150

– #151

– #151

– #152

– #152

– #153

– #153

– #154

– #154

– #155

– #155

– #156

– #156

– #157

– #157

– #158

– #158

– #159

– #159

– #160

– #160

– #161

– #161

– #162

– #162

– #163

– #163

– #164

– #164

– #165

– #165

– #166

– #166

– #167

– #167

– #168

– #168

– #169

– #169

) – #170

– #170

– #171

– #171

– #172

– #172

– #173

– #173

– #174

– #174

– #175

– #175

– #176

– #176

– #177

– #177

– #178

– #178

– #179

– #179

– #180

– #180

– #181

– #181

– #182

– #182

– #183

– #183

– #184

– #184

– #185

– #185

– #186

– #186

– #187

– #187

– #188

– #188

– #189

– #189

– #190

– #190

– #191

– #191

– #192

– #192

– #193

– #193

– #194

– #194

– #195

– #195

– #196

– #196

– #197

– #197

– #198

– #198

– #199

– #199

– #200

– #200

– #201

– #201

– #202

– #202

– #203

– #203

– #204

– #204

– #205

– #205

– #206

– #206

– #207

– #207

– #208

– #208

– #209

– #209

– #210

– #210

– #211

– #211

– #212

– #212

– #213

– #213

– #214

– #214

– #215

– #215

– #216

– #216

– #217

– #217

– #218

– #218

– #219

– #219

– #220

– #220

– #221

– #221

– #222

– #222

– #223

– #223

– #224

– #224

– #225

– #225

– #226

– #226

Posts: gift tax exemption relatives list

Categories: Gifts

Author: toyotabienhoa.edu.vn