Update more than 177 gift tax exemption relatives india latest

Share images of gift tax exemption relatives india by website toyotabienhoa.edu.vn compilation. Gift tax rules to spread Income and investments to Save Tax. Do I Pay PA Inheritance Tax if My Relative Lives Out of State?. Income Tax on Gifts Received | Monetary Gifts from Relatives & Friends | Taxpundit – YouTube. Akshit Bansal on LinkedIn: #marriage #gifts #taxation

Are Cash Gifts from relatives exempt from Income tax? – #1

Are Cash Gifts from relatives exempt from Income tax? – #1

Income Tax on Gift Rules in Hindi | Income Tax on Gift Received from Parents Reletives Property Gift – YouTube – #2

Income Tax on Gift Rules in Hindi | Income Tax on Gift Received from Parents Reletives Property Gift – YouTube – #2

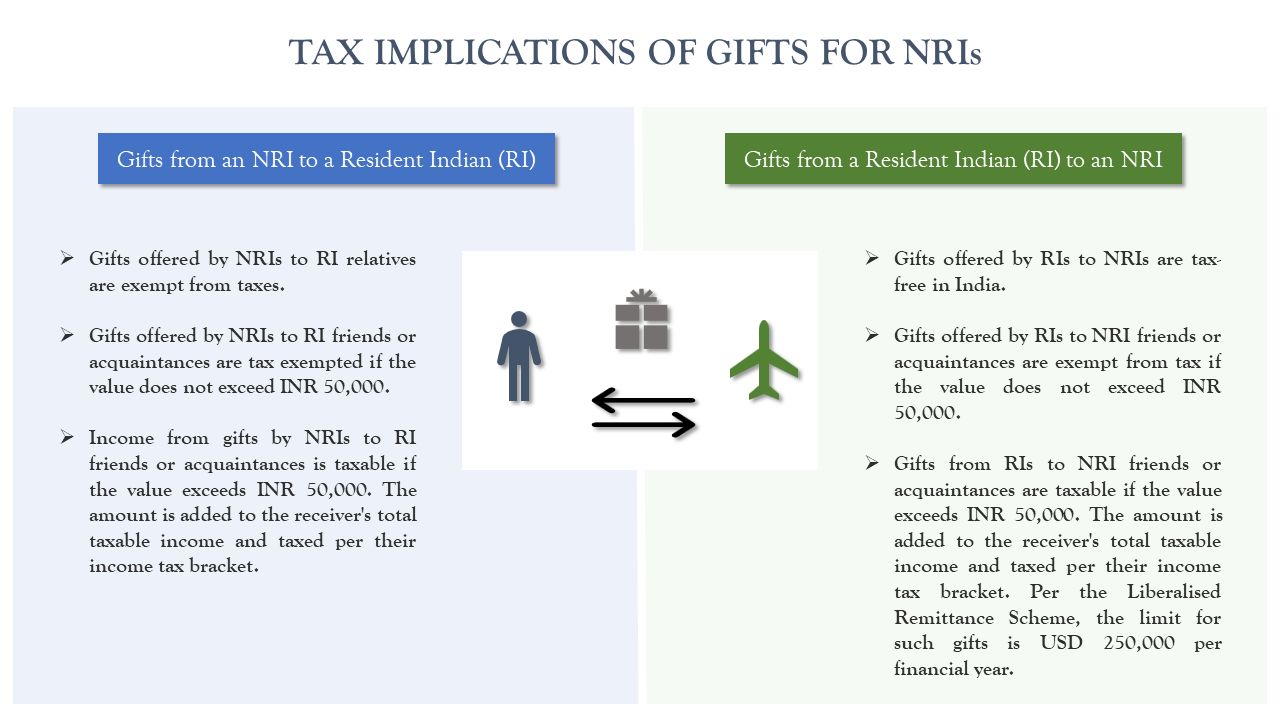

Gifts by NRIs to Relatives and Friends can be made fully Exempt from Gift Tax – #4

Gifts by NRIs to Relatives and Friends can be made fully Exempt from Gift Tax – #4

Unwrapping Gift Taxation: What Is Important For You to Know – #5

Unwrapping Gift Taxation: What Is Important For You to Know – #5

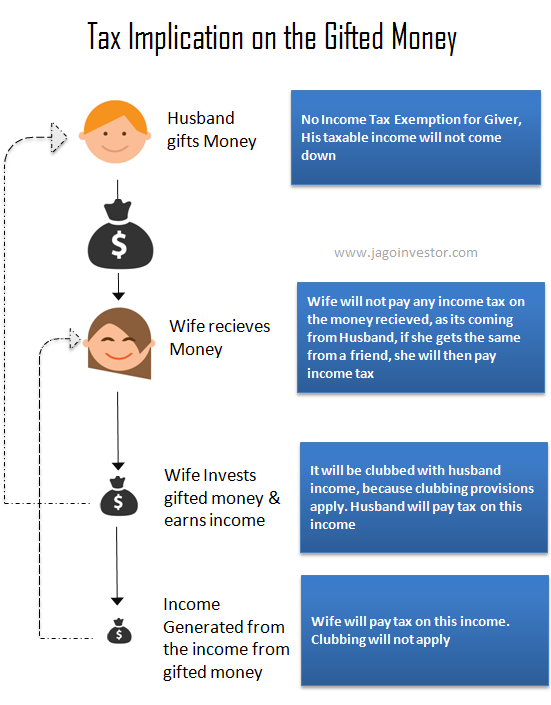

Gifts Received From Spouse Is Not Treated As Income Under Income Tax Laws – #6

Gifts Received From Spouse Is Not Treated As Income Under Income Tax Laws – #6

What is the Gift Tax in India and How Does it Affect NRIs? – #7

What is the Gift Tax in India and How Does it Affect NRIs? – #7

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #8

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #8

Affidavits from Family members sufficient to prove genuineness of cash gift – #10

Affidavits from Family members sufficient to prove genuineness of cash gift – #10

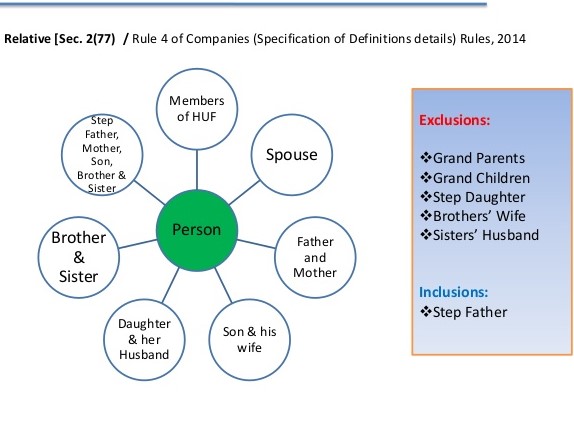

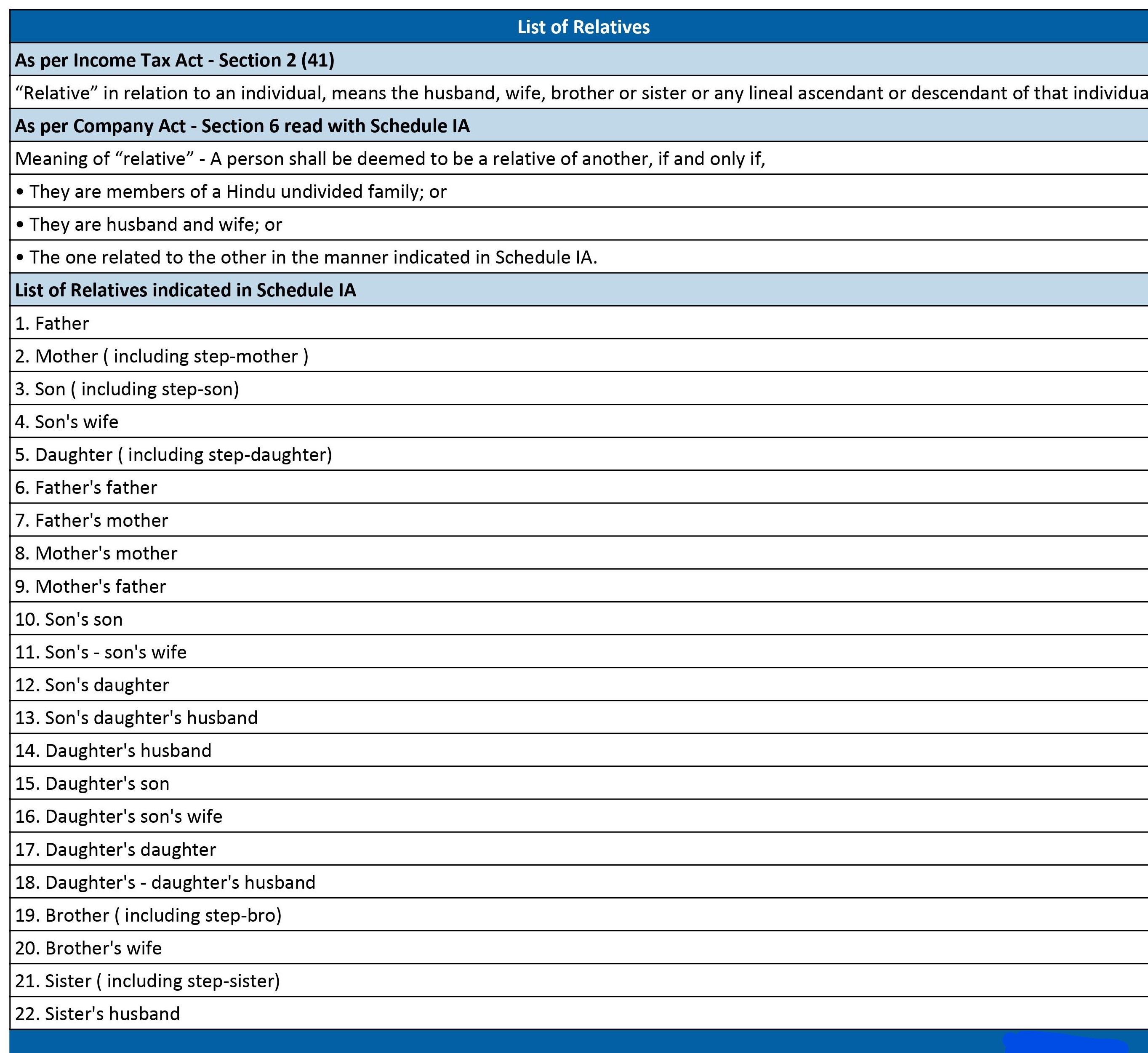

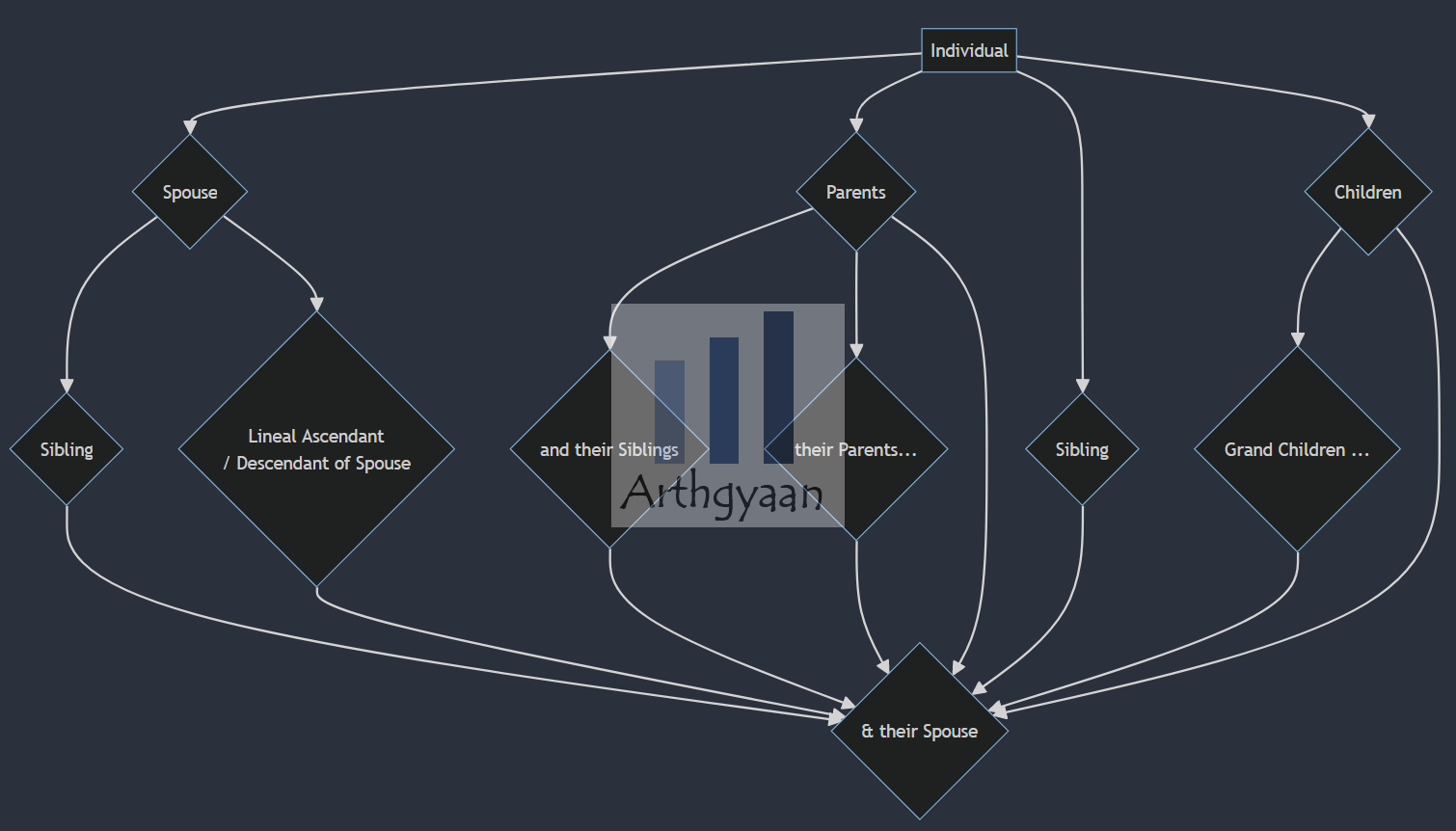

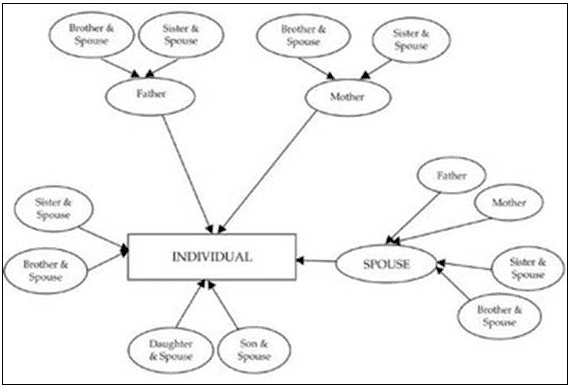

Relatives u/s 56(2)(vii) from whom Gift is permissible…… – Income Tax | Tax planning – #11

Relatives u/s 56(2)(vii) from whom Gift is permissible…… – Income Tax | Tax planning – #11

What is taxation on Gifts | Investyadnya eBook – #12

What is taxation on Gifts | Investyadnya eBook – #12

Gift by NRI to Resident Indian or Vice-Versa — NRI Gift Tax In India – Wisenri – Medium – #13

Gift by NRI to Resident Indian or Vice-Versa — NRI Gift Tax In India – Wisenri – Medium – #13

![How to gift money to parents in India: Tax, Limits [2020] - Wise How to gift money to parents in India: Tax, Limits [2020] - Wise](https://www.caclubindia.com/editor_upload/472400438relatives.jpg) How to gift money to parents in India: Tax, Limits [2020] – Wise – #14

How to gift money to parents in India: Tax, Limits [2020] – Wise – #14

Know when the income tax exemption applies for gifts received as crypto assets – #15

Know when the income tax exemption applies for gifts received as crypto assets – #15

Tax queries: Gifts received from relatives are not taxable – The Economic Times – #16

Tax queries: Gifts received from relatives are not taxable – The Economic Times – #16

The Implication of Income tax on the Gift – Enterslice – #17

The Implication of Income tax on the Gift – Enterslice – #17

Relatives from whom Gift is permissible |TAXVANI – #18

Relatives from whom Gift is permissible |TAXVANI – #18

Draft Tax Free Gift Deed from relative and Get Income Tax exemption | create gift deed – YouTube – #19

Draft Tax Free Gift Deed from relative and Get Income Tax exemption | create gift deed – YouTube – #19

Jash Kriplani, CFPᶜᵐ on X: “Wedding season is here. Record 3.5 million weddings are expected this year. Gifts received by newlywed couples are tax- exempt on occasion of marriage. Is this only for – #20

Jash Kriplani, CFPᶜᵐ on X: “Wedding season is here. Record 3.5 million weddings are expected this year. Gifts received by newlywed couples are tax- exempt on occasion of marriage. Is this only for – #20

Gift Deed: Drafting, Registration, Stamp duty, Tax Implication, FAQ – #21

Gift Deed: Drafting, Registration, Stamp duty, Tax Implication, FAQ – #21

Money received as gift from certain relatives is tax exempt | Mint – #22

Money received as gift from certain relatives is tax exempt | Mint – #22

My grandmother wants to gift cash to me. What are the income tax implications? | Mint – #23

My grandmother wants to gift cash to me. What are the income tax implications? | Mint – #23

Income Tax: Will Gifting Of Shares To Spouse Be Taxable? – News18 – #24

Income Tax: Will Gifting Of Shares To Spouse Be Taxable? – News18 – #24

Interplay of Will, Gift and Relinquishment Deed in the Indian context – COMMERCIAL LAW BLOG – #25

Interplay of Will, Gift and Relinquishment Deed in the Indian context – COMMERCIAL LAW BLOG – #25

How much money can NRIs gift to parents in India? | Arthgyaan – #26

How much money can NRIs gift to parents in India? | Arthgyaan – #26

Income Tax on Gift – #27

Income Tax on Gift – #27

GIFT TAX – UPSC Current Affairs – IAS GYAN – #28

GIFT TAX – UPSC Current Affairs – IAS GYAN – #28

Income Tax On gift Money | How much money is tax free in gift | Section 56 of income tax act 2023 – YouTube – #29

Income Tax On gift Money | How much money is tax free in gift | Section 56 of income tax act 2023 – YouTube – #29

Section 56 – Exemption from Taxation on Wedding Gifts | Fincash – #30

Section 56 – Exemption from Taxation on Wedding Gifts | Fincash – #30

When is money gifted not taxable? All your tax queries on gifts answered | Personal Finance – Business Standard – #31

When is money gifted not taxable? All your tax queries on gifts answered | Personal Finance – Business Standard – #31

Gift Tax: What it is and How Gifts are taxed in India – #32

Gift Tax: What it is and How Gifts are taxed in India – #32

Definition of Relatives for the purpose of Income Tax Act, 1961- Taxwink – #33

Definition of Relatives for the purpose of Income Tax Act, 1961- Taxwink – #33

Tax Planning with Mukesh Patel – #34

Tax Planning with Mukesh Patel – #34

Gift tax rules to spread Income and investments to Save Tax – #35

Gift tax rules to spread Income and investments to Save Tax – #35

Indian Budget 2019 Forces New Regulations on NRIs from Gift Tax to Residential Status – #36

Indian Budget 2019 Forces New Regulations on NRIs from Gift Tax to Residential Status – #36

Taxability of Monetary Gifts, Immovable Property & Prescribed Movable Property received for adequate or inadequate consideration – Tax Effects – #37

Taxability of Monetary Gifts, Immovable Property & Prescribed Movable Property received for adequate or inadequate consideration – Tax Effects – #37

Tying the Knot and Taxes: Unraveling the Wedding Gift Dilemma💑🌏🤵👸⭐ – #38

Tying the Knot and Taxes: Unraveling the Wedding Gift Dilemma💑🌏🤵👸⭐ – #38

Amount received as gift by any blood relative living in US is not taxable in India – Scripbox – #39

Amount received as gift by any blood relative living in US is not taxable in India – Scripbox – #39

Gift Tax in India: Rules and Exceptions Under Income Tax apply; here is how you can keep taxman happy – Money News | The Financial Express – #40

Gift Tax in India: Rules and Exceptions Under Income Tax apply; here is how you can keep taxman happy – Money News | The Financial Express – #40

Tax exemptions for non resident indians | PDF – #41

Tax exemptions for non resident indians | PDF – #41

Gifts & Income Tax Implications : Scenarios & Examples – #42

Gifts & Income Tax Implications : Scenarios & Examples – #42

Gift Tax Implications – FasterCapital – #43

Gift Tax Implications – FasterCapital – #43

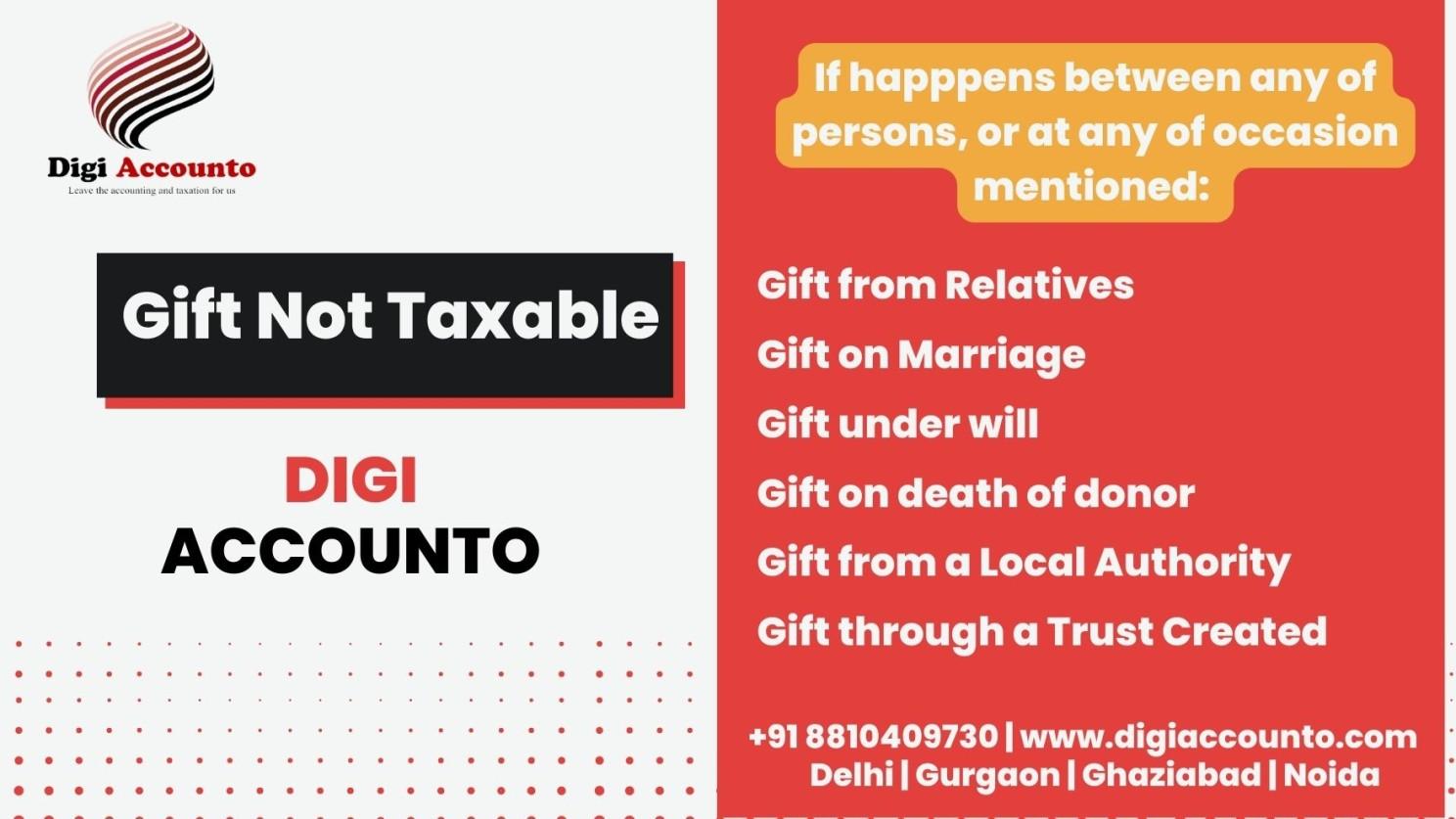

![Opinion] Gifts | A Comprehensive Analysis of an Everlasting Tax Planning Tool Opinion] Gifts | A Comprehensive Analysis of an Everlasting Tax Planning Tool](https://digiaccounto.com/wp-content/uploads/2023/03/gt5.jpg) Opinion] Gifts | A Comprehensive Analysis of an Everlasting Tax Planning Tool – #44

Opinion] Gifts | A Comprehensive Analysis of an Everlasting Tax Planning Tool – #44

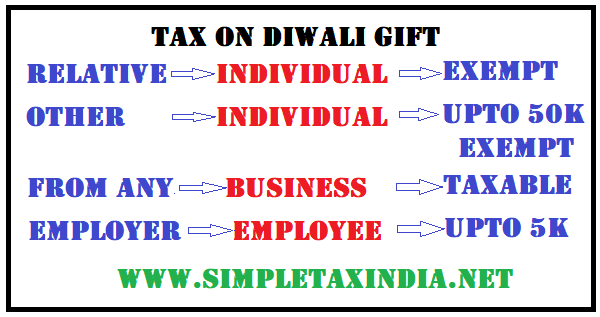

Received cash, gold as Diwali gifts? Check income tax implications | Business News – #45

Received cash, gold as Diwali gifts? Check income tax implications | Business News – #45

Gifting Using Your Annual Gift Exclusion – #46

Gifting Using Your Annual Gift Exclusion – #46

Gifts received from non-relatives of above Rs 50,000 a year are taxable – #47

Gifts received from non-relatives of above Rs 50,000 a year are taxable – #47

wiseNRI.com on X: “Gifts from NRI Relative are exempted from tax – When an NRI gives gifts in the form of cash, cheque, items, or property to a Resident Indian who is – #48

wiseNRI.com on X: “Gifts from NRI Relative are exempted from tax – When an NRI gives gifts in the form of cash, cheque, items, or property to a Resident Indian who is – #48

Taxability of Gifts – #49

Taxability of Gifts – #49

Income tax: How are gifts taxed in India? We explain – #50

Income tax: How are gifts taxed in India? We explain – #50

Gifted money to wife? Know the applicable tax rules | Business News – #51

Gifted money to wife? Know the applicable tax rules | Business News – #51

How to ensure your Gifts are exempted from Gift Tax in India? – #52

How to ensure your Gifts are exempted from Gift Tax in India? – #52

Are gifts from parents tax bound? – #53

Are gifts from parents tax bound? – #53

Tax on Gifted Shares & Securities – – #54

Tax on Gifted Shares & Securities – – #54

Your Diwali gift and bonus can be taxable: Know ways to avoid it – #55

Your Diwali gift and bonus can be taxable: Know ways to avoid it – #55

- gift tax rate in india 2022-23

All you need to know about tax on gifts – #56

All you need to know about tax on gifts – #56

Gift Tax in India, Income Tax On Gift, Exemption from Gift Tax – YouTube – #57

Gift Tax in India, Income Tax On Gift, Exemption from Gift Tax – YouTube – #57

) Which Gifts from relatives are exempted from Income Tax? – #58

Which Gifts from relatives are exempted from Income Tax? – #58

Income Tax on Digital, Physical, and Paper Gold in India | IIFL Finance – #59

Income Tax on Digital, Physical, and Paper Gold in India | IIFL Finance – #59

Gift Deed in India – Registration Process, Documents & Tax Exemption – #60

Gift Deed in India – Registration Process, Documents & Tax Exemption – #60

- gift tax definition

- gift tax exemption relatives list

- gift tax act 1958

Income Tax on Gifts Received | Monetary Gifts from Relatives & Friends | Taxpundit – YouTube – #61

Income Tax on Gifts Received | Monetary Gifts from Relatives & Friends | Taxpundit – YouTube – #61

NRI Gift Tax India: Rules for Tax On Gift Money In India | DBS Treasures – #62

NRI Gift Tax India: Rules for Tax On Gift Money In India | DBS Treasures – #62

Federal Judge Green Lights IRS Search For California Gift Tax Cheats – #63

Federal Judge Green Lights IRS Search For California Gift Tax Cheats – #63

How gifts are taxed in India? | Gift tax explained – YouTube – #64

How gifts are taxed in India? | Gift tax explained – YouTube – #64

Gifts to and from HUF – MN & Associates CS-India – #65

Gifts to and from HUF – MN & Associates CS-India – #65

Money received from relative is gift and exempt from tax – #66

Money received from relative is gift and exempt from tax – #66

Is it necessary to pay taxes on Diwali gifts received from employers – #67

Is it necessary to pay taxes on Diwali gifts received from employers – #67

Income Tax on Bitcoin in India – PKC Management Consulting – #68

Income Tax on Bitcoin in India – PKC Management Consulting – #68

Is it necessary to pay taxes on Diwali gifts received from employers, relatives, and friends? – #69

Is it necessary to pay taxes on Diwali gifts received from employers, relatives, and friends? – #69

- gift tax example

- gift tax exemption 2022

- gift tax meaning

- capital gains tax

- lineal ascendant meaning

- list of relatives

Tax On Diwali Gifts: Tax Rate, Exemption, Limit; Here’s Everything You Need To Know – News18 – #70

Tax On Diwali Gifts: Tax Rate, Exemption, Limit; Here’s Everything You Need To Know – News18 – #70

Gift of Immovable property under Income Tax Act – #71

Gift of Immovable property under Income Tax Act – #71

5 rules about Income Tax on Gifts received in India & Exemptions – #72

5 rules about Income Tax on Gifts received in India & Exemptions – #72

) Crypto Taxes India: Expert Guide 2024 | CPA Reviewed | Koinly – #73

Crypto Taxes India: Expert Guide 2024 | CPA Reviewed | Koinly – #73

Latest NRI Gift Tax Rules 2019-20 | Are Gifts received by NRIs Taxable? – #74

Latest NRI Gift Tax Rules 2019-20 | Are Gifts received by NRIs Taxable? – #74

You Take a Friend on Your Yacht. Is It a Taxable Gift? – WSJ – #75

You Take a Friend on Your Yacht. Is It a Taxable Gift? – WSJ – #75

ITR filing: Are gifts taxable in India? Salient clauses all income taxpayers must know | Zee Business – #76

ITR filing: Are gifts taxable in India? Salient clauses all income taxpayers must know | Zee Business – #76

Section 56(ii) of Income Tax Act: Understanding the Taxation of Gifts – Marg ERP Blog – #77

Section 56(ii) of Income Tax Act: Understanding the Taxation of Gifts – Marg ERP Blog – #77

Meaning of relative under different act | CA Rajput Jain – #78

Meaning of relative under different act | CA Rajput Jain – #78

) How to calculate income tax on gifts from relatives? – #79

How to calculate income tax on gifts from relatives? – #79

Save Tax Through Gifts. This is How It Works – #80

Save Tax Through Gifts. This is How It Works – #80

Taxability of Gifts in hands of Individuals – #81

Taxability of Gifts in hands of Individuals – #81

Will your ‘gift’ be taxed? – The Economic Times – #82

Will your ‘gift’ be taxed? – The Economic Times – #82

Gift Under The Income Tax Act In India – Especia – #83

Gift Under The Income Tax Act In India – Especia – #83

ITR : Disclosure and taxation of gifts received from brother? | Mint – #84

ITR : Disclosure and taxation of gifts received from brother? | Mint – #84

Marriage Gifts And Its Taxation in India: Understanding – Legal Window – #85

Marriage Gifts And Its Taxation in India: Understanding – Legal Window – #85

क्या Gift From Relative पर Tax लगता है? | Tax on Gifts from Relatives | – YouTube – #86

क्या Gift From Relative पर Tax लगता है? | Tax on Gifts from Relatives | – YouTube – #86

What Are the Legal and Tax Implications of Using Gift Cards in India? – #87

What Are the Legal and Tax Implications of Using Gift Cards in India? – #87

Relative से पैसा लेने से पहले यह video ज़रूर देखना, Gift Rule 2022,आपके गिफ्ट पर इनकम टैक्स की नज़र – YouTube – #88

Relative से पैसा लेने से पहले यह video ज़रूर देखना, Gift Rule 2022,आपके गिफ्ट पर इनकम टैक्स की नज़र – YouTube – #88

Tax Query: Taxation Aspects on Gifts Received – The Hindu BusinessLine – #89

Tax Query: Taxation Aspects on Gifts Received – The Hindu BusinessLine – #89

Taxation of Minor Children in India: How Does It Work? – #90

Taxation of Minor Children in India: How Does It Work? – #90

NRI Gift Tax in India: A Comprehensive Guide – #91

NRI Gift Tax in India: A Comprehensive Guide – #91

- gift chart as per income tax

- gift from relative exempt from income tax

- gift tax in india

Income Tax Exemption On Gifts | Are The Gifts Above Rs 50,000 Taxable? | Personal Finance – YouTube – #92

Income Tax Exemption On Gifts | Are The Gifts Above Rs 50,000 Taxable? | Personal Finance – YouTube – #92

eCFR :: 26 CFR Part 25 — Gift Tax; Gifts Made After December 31, 1954 – #93

eCFR :: 26 CFR Part 25 — Gift Tax; Gifts Made After December 31, 1954 – #93

Understanding Income Tax on Marriage Gifts: Important Facts You Need to Know | Ebizfiling – #94

Understanding Income Tax on Marriage Gifts: Important Facts You Need to Know | Ebizfiling – #94

Tax queries: Gifts received from a relative are tax-exempt – The Economic Times – #95

Tax queries: Gifts received from a relative are tax-exempt – The Economic Times – #95

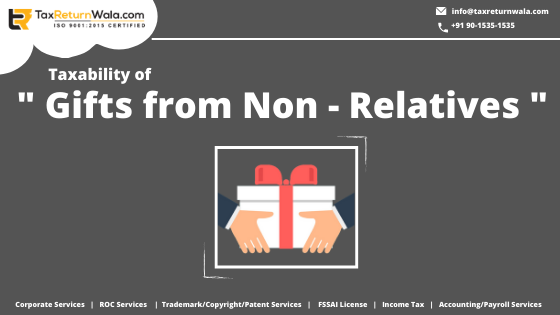

Gift from Non-Relatives – A tool for tax planning – TaxReturnWala – #96

Gift from Non-Relatives – A tool for tax planning – TaxReturnWala – #96

What is a Gift as per the Income Tax Act? TAXCONCEPT – #97

What is a Gift as per the Income Tax Act? TAXCONCEPT – #97

Gifting Property to NRIs – Immihelp – #98

Gifting Property to NRIs – Immihelp – #98

Tax exemptions for non resident Indians | PDF – #99

Tax exemptions for non resident Indians | PDF – #99

Source of Funds for Indian EB-5 Investors: Webinar with Immigration Attorney Anahita George | EB5 Visa Investments – #100

Source of Funds for Indian EB-5 Investors: Webinar with Immigration Attorney Anahita George | EB5 Visa Investments – #100

Outstanding Tax Demands Up To Rs 1 lakh Waived; Wealth, Gift Tax Exempted; Know Full Details – #101

Outstanding Tax Demands Up To Rs 1 lakh Waived; Wealth, Gift Tax Exempted; Know Full Details – #101

TAXABILITY OF GIFTS IN INDIA – Manthan Experts – #102

TAXABILITY OF GIFTS IN INDIA – Manthan Experts – #102

How to Show Gift in Income Tax Return 2023 – #103

How to Show Gift in Income Tax Return 2023 – #103

TAX TREATMENT OF GIFTS RECEIVED IN DEEPAWALI ? – Kanoon For All – #104

TAX TREATMENT OF GIFTS RECEIVED IN DEEPAWALI ? – Kanoon For All – #104

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #105

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #105

Tax On Gifts: As Festive Season Nears, Know Tax Implications On Gifts You Receive – News18 – #106

Tax On Gifts: As Festive Season Nears, Know Tax Implications On Gifts You Receive – News18 – #106

Form 709 – Guide 2023 | US Expat Tax Service – #107

Form 709 – Guide 2023 | US Expat Tax Service – #107

Tax on Gifts in India | Exemption and Rules | EZTax® – #108

Tax on Gifts in India | Exemption and Rules | EZTax® – #108

Gifts Tax: Know which gifts are taxable this festive season | TAX SAVING | Zee Business – #109

Gifts Tax: Know which gifts are taxable this festive season | TAX SAVING | Zee Business – #109

Diwali gifts from relatives are taxable or not? – #110

Diwali gifts from relatives are taxable or not? – #110

Decoding wedding gift taxation in India: Know ways to exempt it – #111

Decoding wedding gift taxation in India: Know ways to exempt it – #111

-originalImg-5d9c05bd-fef7-468b-a79a-7b00245b1da1.png) Tax on the gift from father to daughter – #112

Tax on the gift from father to daughter – #112

According to the income tax laws of India, who can be gifted property without incurring tax? – Quora – #113

According to the income tax laws of India, who can be gifted property without incurring tax? – Quora – #113

Whether gift received from HUF to any member of HUF is exempt from taxable income? ITAT Explains | SCC Times – #114

Whether gift received from HUF to any member of HUF is exempt from taxable income? ITAT Explains | SCC Times – #114

Planning to take a gift from relatives? Here’s how you can take it from their bank account directly – #115

Planning to take a gift from relatives? Here’s how you can take it from their bank account directly – #115

Expecting an NFT, crypto, or VDA gift this Diwali? Here are the tax implications – #116

Expecting an NFT, crypto, or VDA gift this Diwali? Here are the tax implications – #116

Taxability on gifts, rewards and rewards given to Sportsperson / Olympic Participants – #117

Taxability on gifts, rewards and rewards given to Sportsperson / Olympic Participants – #117

Budget 2023: What is Gift Tax and why govt should abolish this? | Zee Business – #118

Budget 2023: What is Gift Tax and why govt should abolish this? | Zee Business – #118

Greece Increases Gift Tax-exempt Bracket From October 1, 2021 – Inheritance Tax – Greece – #119

Greece Increases Gift Tax-exempt Bracket From October 1, 2021 – Inheritance Tax – Greece – #119

Did you receive Gift? Tax Implications on Gifts | Examples, Limits & Rules – #120

Did you receive Gift? Tax Implications on Gifts | Examples, Limits & Rules – #120

Taxbaility of GIFT – FIBOTA – #121

Taxbaility of GIFT – FIBOTA – #121

) How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #122

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #122

Amendment to exemption from gift tax for support, maintenance and exemption of children | Deloitte Ireland | Deloitte Private, tax – #123

Amendment to exemption from gift tax for support, maintenance and exemption of children | Deloitte Ireland | Deloitte Private, tax – #123

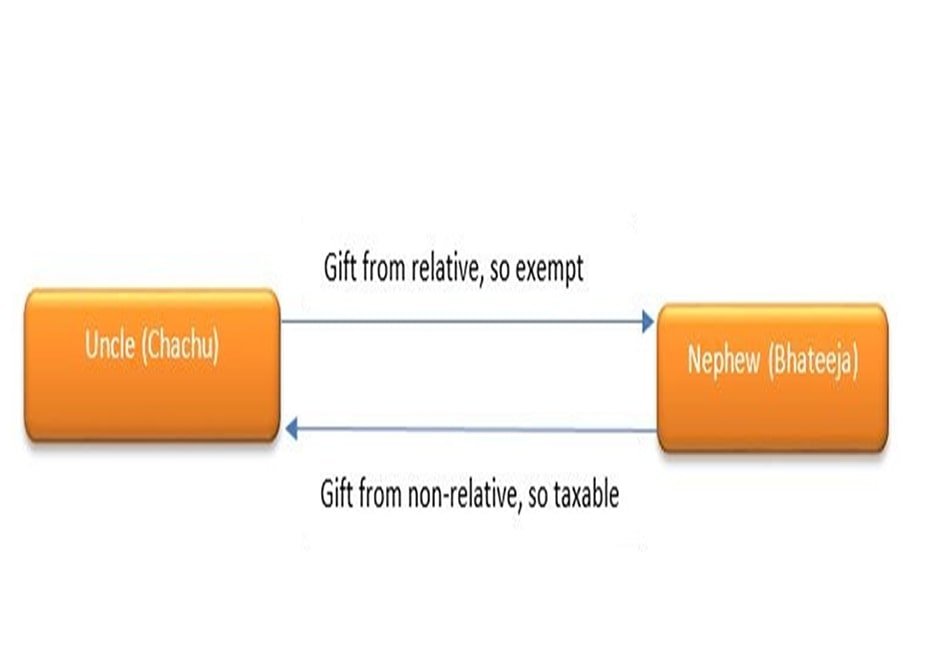

Nephew and Niece are not “Relative” under Income Tax act 1961 – #124

Nephew and Niece are not “Relative” under Income Tax act 1961 – #124

Gifts received from employer – Got Diwali gifts? Know tax implications | The Economic Times – #125

Gifts received from employer – Got Diwali gifts? Know tax implications | The Economic Times – #125

Gift Tax in India – #126

Gift Tax in India – #126

Your queries: Income Tax; You have to pay tax when you sell a gift received from a relative – Income Tax News | The Financial Express – #127

Your queries: Income Tax; You have to pay tax when you sell a gift received from a relative – Income Tax News | The Financial Express – #127

How to give to family and friends — and avoid gift taxes – WTOP News – #128

How to give to family and friends — and avoid gift taxes – WTOP News – #128

- gift tax rate

- lineal ascendant gift from relative exempt from income tax

- family relative meaning

Tax on Gifting Crypto, NFT, VDA in India – #129

Tax on Gifting Crypto, NFT, VDA in India – #129

Know Income tax rules on gifts received on marriage | Mint – #130

Know Income tax rules on gifts received on marriage | Mint – #130

Trade Brains on X: “Wedding season is here – from November 23 to December 12! And this time the Indian wedding season will boost the country’s economy by Rs. 4.5 lakh crores – #131

Trade Brains on X: “Wedding season is here – from November 23 to December 12! And this time the Indian wedding season will boost the country’s economy by Rs. 4.5 lakh crores – #131

When are gifts received by NRIs subject to tax, TDS in India? – The Economic Times – #132

When are gifts received by NRIs subject to tax, TDS in India? – The Economic Times – #132

Are gifts received from relatives on Diwali subject to taxation? – #133

Are gifts received from relatives on Diwali subject to taxation? – #133

-Gifts.jpg) EvoBreyta | Tax-Finance-Technology – #134

EvoBreyta | Tax-Finance-Technology – #134

How to gift stocks, bonds and ETFs and the tax implications – Z-Connect by Zerodha – #135

How to gift stocks, bonds and ETFs and the tax implications – Z-Connect by Zerodha – #135

4 Types Of Tax-Exempt Gifts | Kotak Securities – #136

4 Types Of Tax-Exempt Gifts | Kotak Securities – #136

Zero Tax On Wedding Gifts: A Loophole For The Rich To Amass Wealth? – #137

Zero Tax On Wedding Gifts: A Loophole For The Rich To Amass Wealth? – #137

A relative wants to gift cash to me. What are the income tax implications? | Mint – #138

A relative wants to gift cash to me. What are the income tax implications? | Mint – #138

Gift Tax planning – 3 awesome tips to save income tax legally – #139

Gift Tax planning – 3 awesome tips to save income tax legally – #139

Unwrapping the Secrets of Gift Tax | Fascinating World of Gift Tax! | CA Sanjeev S Thakur – YouTube – #140

Unwrapping the Secrets of Gift Tax | Fascinating World of Gift Tax! | CA Sanjeev S Thakur – YouTube – #140

ITR filing — gifts need to be declared and here you see how they are taxed – #141

ITR filing — gifts need to be declared and here you see how they are taxed – #141

- wealth tax

- section 56(2) of income tax act

- income tax sections list in pdf

Gift Received From Husband Not Taxable As Income For Wife Under Income Tax Laws – #142

Gift Received From Husband Not Taxable As Income For Wife Under Income Tax Laws – #142

Can an NRI gift money to his brother from selling a property in India? Will this be taxed? – Quora – #143

Can an NRI gift money to his brother from selling a property in India? Will this be taxed? – Quora – #143

Taxability of Gifts – Some Interesting Issues – #144

Taxability of Gifts – Some Interesting Issues – #144

Tax on Wedding Gifts – Explained | EZTax® – #145

Tax on Wedding Gifts – Explained | EZTax® – #145

SuperCA – #146

SuperCA – #146

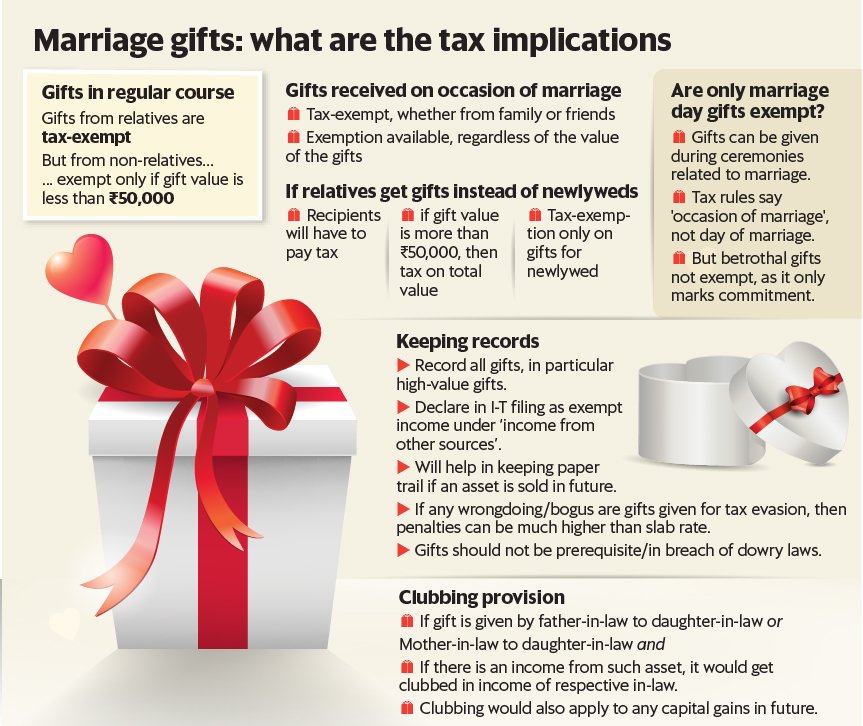

Akshit Bansal on LinkedIn: #marriage #gifts #taxation – #147

Akshit Bansal on LinkedIn: #marriage #gifts #taxation – #147

Getting married? Ask for blessings in presents only and save taxes – #148

Getting married? Ask for blessings in presents only and save taxes – #148

If I Gift 1cr to my mother is it exempt or taxable? – Quora – #149

If I Gift 1cr to my mother is it exempt or taxable? – Quora – #149

Gift Tax In India – New 2020 Rules of Income Tax on Gifts – #150

Gift Tax In India – New 2020 Rules of Income Tax on Gifts – #150

Union Budget 2023: What Is Gift Tax And When Is It Exempted? – News18 – #151

Union Budget 2023: What Is Gift Tax And When Is It Exempted? – News18 – #151

Gift up to `50,000 by parents tax exempt for NRIs | Mint – #152

Gift up to `50,000 by parents tax exempt for NRIs | Mint – #152

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #153

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #153

List of Advantages of Gift Deed Registration That You Must Know – Corpbiz – #154

List of Advantages of Gift Deed Registration That You Must Know – Corpbiz – #154

What you must know when making a gift deed | by Rashimehta | Medium – #155

What you must know when making a gift deed | by Rashimehta | Medium – #155

Taxation of Gifts received in Cash or Kind – #156

Taxation of Gifts received in Cash or Kind – #156

When Should I Use My Estate and Gift Tax Exemption? – #157

When Should I Use My Estate and Gift Tax Exemption? – #157

Gift Tax On Immovable Property in India 2024 – #158

Gift Tax On Immovable Property in India 2024 – #158

Gift by NRI to Resident Indian or Vice-Versa: Taxation and more – SBNRI – #159

Gift by NRI to Resident Indian or Vice-Versa: Taxation and more – SBNRI – #159

Gift tax – A guide – Online Demat, Trading, and Mutual Fund Investment in India – Fisdom – #160

Gift tax – A guide – Online Demat, Trading, and Mutual Fund Investment in India – Fisdom – #160

List of relatives covered under Section 56(2) of Income Tax Act,1961 – #161

List of relatives covered under Section 56(2) of Income Tax Act,1961 – #161

Gifts and Taxes: how much does it cost to make someone happy? – #162

Gifts and Taxes: how much does it cost to make someone happy? – #162

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #163

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #163

WSJ Tax Guide 2019: Estate and Gift Taxes – WSJ – #164

WSJ Tax Guide 2019: Estate and Gift Taxes – WSJ – #164

- gift tax rate in india 2020

- list of relatives for gift

- lineal ascendant

Navigating Income Tax & Taxation on Gifts Received in India – 1 Finance Blog – #165

Navigating Income Tax & Taxation on Gifts Received in India – 1 Finance Blog – #165

In India, is sending money to sister as a gift taxable or not? How much money can be sent? – Quora – #166

In India, is sending money to sister as a gift taxable or not? How much money can be sent? – Quora – #166

Form 709: What It Is and Who Must File It – #167

Form 709: What It Is and Who Must File It – #167

Tax on Gifts | Income tax on Gifts | list of relatives | Income Tax On gift Money – YouTube – #168

Tax on Gifts | Income tax on Gifts | list of relatives | Income Tax On gift Money – YouTube – #168

How Are Foreign Inward Remittance Taxed In India – #169

How Are Foreign Inward Remittance Taxed In India – #169

Explained: How Money Sent From India To Relatives Abroad Is Taxed? – #170

Explained: How Money Sent From India To Relatives Abroad Is Taxed? – #170

Taxation of GIFTS from NRIs and inheritances from India – #171

Taxation of GIFTS from NRIs and inheritances from India – #171

Regulations Related to Gift Tax in India – #172

Regulations Related to Gift Tax in India – #172

Detailed Analysis- Gifts Taxation under Income Tax Act, 1961 – #173

Detailed Analysis- Gifts Taxation under Income Tax Act, 1961 – #173

Monetary gift tax: Income tax on gift received from parents | Value Research – #174

Monetary gift tax: Income tax on gift received from parents | Value Research – #174

NRI Gift Tax in India – Gift from NRI to Resident Indian or Vice Versa – myMoneySage Blog – #175

NRI Gift Tax in India – Gift from NRI to Resident Indian or Vice Versa – myMoneySage Blog – #175

Gifts are tax exempt in the hands of relatives | Mint – #176

Gifts are tax exempt in the hands of relatives | Mint – #176

Make The Most of Tax Exemption on Wedding Gifts – #177

Make The Most of Tax Exemption on Wedding Gifts – #177

Posts: gift tax exemption relatives india

Categories: Gifts

Author: toyotabienhoa.edu.vn