Update more than 106 gift tax calculator india best

Details images of gift tax calculator india by website toyotabienhoa.edu.vn compilation. Windfall Tax: Meaning, Impact & How Does It Work | 5paisa. 2023 Instructions for Schedule A (2023) | Internal Revenue Service. What is Wealth Tax in India?. What to Know About 2024 Tax Withholding and Paying Estimated Taxes – WSJ. Should I switch to the New Tax Regime from 1st April 2023?

Gift Tax Calculator | EZTax® – #1

Gift Tax Calculator | EZTax® – #1

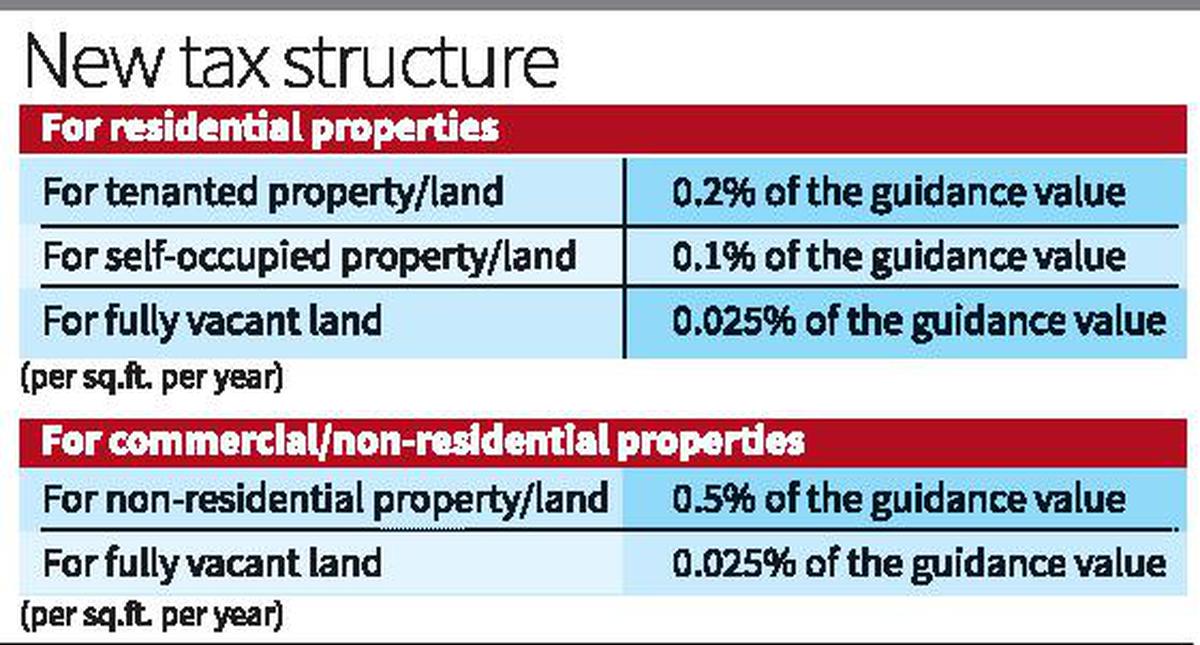

Property Tax Guide 2023 – Calculation, Types & Online Payment | Homebazaar – #2

Property Tax Guide 2023 – Calculation, Types & Online Payment | Homebazaar – #2

Capital Acquisition Tax (Gift Tax) Calculator – National Pension Helpline – #4

Capital Acquisition Tax (Gift Tax) Calculator – National Pension Helpline – #4

Casio Calculators India – New Year! New Calculator? Swtich to Casio MJ-120GST calculator and make your GST Invoicing process Easy and Fast. #CasioGSTCalculator with 5 GST Keys! | Facebook – #5

Casio Calculators India – New Year! New Calculator? Swtich to Casio MJ-120GST calculator and make your GST Invoicing process Easy and Fast. #CasioGSTCalculator with 5 GST Keys! | Facebook – #5

- expenditure tax

Is a gift from your cousin taxable? – #6

Is a gift from your cousin taxable? – #6

Lottery Tax in India: Tax Levied on Winning Game Shows & Lottery – #7

Lottery Tax in India: Tax Levied on Winning Game Shows & Lottery – #7

E-Nivaran is Modi’s gift to tax payers: How does the scheme work? | Economy & Policy News – Business Standard – #8

E-Nivaran is Modi’s gift to tax payers: How does the scheme work? | Economy & Policy News – Business Standard – #8

709 gift tax software from Thomson Reuters ONESOURCE | Thomson Reuters – #10

709 gift tax software from Thomson Reuters ONESOURCE | Thomson Reuters – #10

Gift received or given to relatives. How income tax is calculated? | Mint – #11

Gift received or given to relatives. How income tax is calculated? | Mint – #11

Giving Or Receiving A Down Payment Gift? Here’s What You Need To Know – #12

Giving Or Receiving A Down Payment Gift? Here’s What You Need To Know – #12

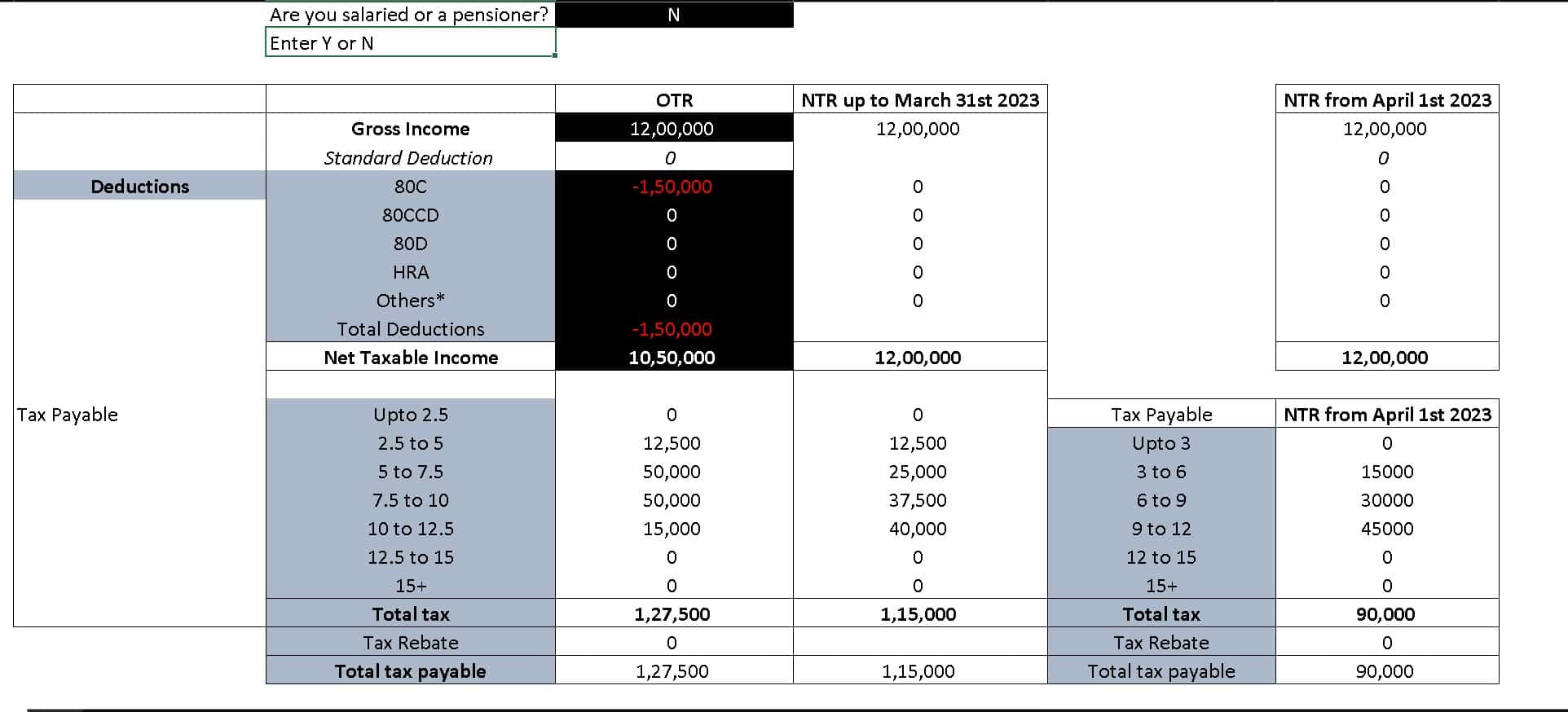

Income Tax Calculator FY 2024-25, 2023-24 – FinCalC Blog – #13

Income Tax Calculator FY 2024-25, 2023-24 – FinCalC Blog – #13

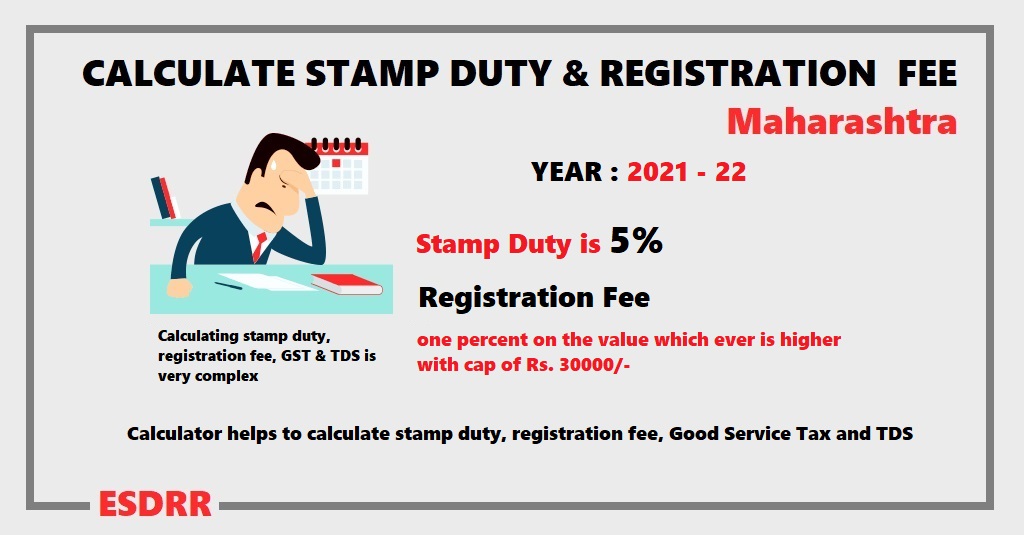

Online Stamp Duty Calculator: Check latest rates (January 2024) – #14

Online Stamp Duty Calculator: Check latest rates (January 2024) – #14

Scheme of Taxation of Undisclosed Income | Taxmann – #15

Scheme of Taxation of Undisclosed Income | Taxmann – #15

ITR filing — gifts need to be declared and here you see how they are taxed – #16

ITR filing — gifts need to be declared and here you see how they are taxed – #16

How much money can NRIs gift to parents in India? | Arthgyaan – #17

How much money can NRIs gift to parents in India? | Arthgyaan – #17

Top 10 Benefits Of Paying Taxes In India | 5paisa – #18

Top 10 Benefits Of Paying Taxes In India | 5paisa – #18

Gift Tax: 3 Easy Ways to Avoid Paying the Gift Tax | TaxAct – #19

Gift Tax: 3 Easy Ways to Avoid Paying the Gift Tax | TaxAct – #19

- gift deed format father to son

- gift deed format on stamp paper

- gift tax exemption relatives list

) Nri Gift Tax In India – #20

Nri Gift Tax In India – #20

From 97% to 42%: How tax rates for individuals changed | Mint – #21

From 97% to 42%: How tax rates for individuals changed | Mint – #21

A Comprehensive Guide to Calculating Crypto Taxes – WazirX Blog – #22

A Comprehensive Guide to Calculating Crypto Taxes – WazirX Blog – #22

Gift Nifty Live: Gift (SGX) Nifty Index Today | 5paisa – #23

Gift Nifty Live: Gift (SGX) Nifty Index Today | 5paisa – #23

Indirect Tax | What is Indirect Tax Meaning & Types – #24

Indirect Tax | What is Indirect Tax Meaning & Types – #24

Income Tax Return: Do You Have Pay Tax For Diwali Gifts? Here’s What Rules Say – #25

Income Tax Return: Do You Have Pay Tax For Diwali Gifts? Here’s What Rules Say – #25

Guide to Crypto & Bitcoin taxes (2024) | CoinTracker – #26

Guide to Crypto & Bitcoin taxes (2024) | CoinTracker – #26

- property tax

- gift tax rate

- service tax

What is Advance Tax? How to Calculate It? – Due Date is 15th March 2024 – Tax2win – #27

What is Advance Tax? How to Calculate It? – Due Date is 15th March 2024 – Tax2win – #27

Long Term Capital Gain Tax on Shares in India – #28

Long Term Capital Gain Tax on Shares in India – #28

GIFT City: A Game-changer for Indian Startup Ecosystem – #29

GIFT City: A Game-changer for Indian Startup Ecosystem – #29

2024 State Business Tax Climate Index | Tax Foundation – #30

2024 State Business Tax Climate Index | Tax Foundation – #30

New Jersey Gift Tax: All You Need to Know | SmartAsset – #31

New Jersey Gift Tax: All You Need to Know | SmartAsset – #31

Income Tax: Will Gifting Of Shares To Spouse Be Taxable? – News18 – #32

Income Tax: Will Gifting Of Shares To Spouse Be Taxable? – News18 – #32

Taxable Income: What It Is, What Counts, and How To Calculate – #33

Taxable Income: What It Is, What Counts, and How To Calculate – #33

Stamp Duty on Gift Deed: Rates and Regulations – #34

Stamp Duty on Gift Deed: Rates and Regulations – #34

Buy Chromebook Super Shortcuts Mug tiktok: Coworker Coffee Mug, Office Mug, Nerd Gift, CPA Gift, Tax Prep Mug, Excel Mug Online in India – Etsy – #35

Buy Chromebook Super Shortcuts Mug tiktok: Coworker Coffee Mug, Office Mug, Nerd Gift, CPA Gift, Tax Prep Mug, Excel Mug Online in India – Etsy – #35

Send iPhone USA to India, Custom Duty, GST Tax Calculator – USA – #36

Send iPhone USA to India, Custom Duty, GST Tax Calculator – USA – #36

How are Cryptocurrency Gifts Taxed? | CoinLedger – #37

How are Cryptocurrency Gifts Taxed? | CoinLedger – #37

- gift from relative exempt from income tax

- gift tax example

- property gift deed

Tax Calculator – Calculate Taxes for FY 2023-24 | Income Tax – #38

Tax Calculator – Calculate Taxes for FY 2023-24 | Income Tax – #38

Taxability of Gift received by an individual or HUF with FAQs – #39

Taxability of Gift received by an individual or HUF with FAQs – #39

How to Calculate Taxable Income on Salary? – #40

How to Calculate Taxable Income on Salary? – #40

Tax | What is Tax | Taxation in India : Tax Calculation – #41

Tax | What is Tax | Taxation in India : Tax Calculation – #41

Income Tax Calculator-FinCalC – Apps on Google Play – #42

Income Tax Calculator-FinCalC – Apps on Google Play – #42

Tax Structure in India, Explained | AEGONLIFE – #43

Tax Structure in India, Explained | AEGONLIFE – #43

TDS on Salary Calculation | Tax Deduction on Salary – FinCalC – #44

TDS on Salary Calculation | Tax Deduction on Salary – FinCalC – #44

) What is a Gift Tax and What are its Rates and Exemptions? | Fi Money – #45

What is a Gift Tax and What are its Rates and Exemptions? | Fi Money – #45

Income From Other Sources: Get the Notes, List and Tax Rates in 2024 – #46

Income From Other Sources: Get the Notes, List and Tax Rates in 2024 – #46

Taxation in the United States – Wikipedia – #47

Taxation in the United States – Wikipedia – #47

2023 Gift Tax Exclusions Archives – The National Law Forum – #48

2023 Gift Tax Exclusions Archives – The National Law Forum – #48

Taxation of Minor Children in India: How Does It Work? – #49

Taxation of Minor Children in India: How Does It Work? – #49

Crypto Taxes India: Expert Guide 2024 | CPA Reviewed | Koinly – #50

Crypto Taxes India: Expert Guide 2024 | CPA Reviewed | Koinly – #50

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #51

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #51

Casio Calculator FX-300MS Plus – RightStart™ Mathematics by Activities for Learning – #52

Casio Calculator FX-300MS Plus – RightStart™ Mathematics by Activities for Learning – #52

How to calculate income tax on gifts from relatives? – #53

How to calculate income tax on gifts from relatives? – #53

Capital Gains Tax Brackets For 2024 – #54

Capital Gains Tax Brackets For 2024 – #54

Income Tax – Guide With Examples & Tax Calculator – #55

Income Tax – Guide With Examples & Tax Calculator – #55

Stamp Duty and Registration Charges in West Bengal 2024 – #56

Stamp Duty and Registration Charges in West Bengal 2024 – #56

Bitcoin Tax Calculator | Cryptocurrency Tax Calculator | TaxAct – #57

Bitcoin Tax Calculator | Cryptocurrency Tax Calculator | TaxAct – #57

For Calculating Capital Gains, Sale Will Be Considered When Sale Deed Is Executed – #58

For Calculating Capital Gains, Sale Will Be Considered When Sale Deed Is Executed – #58

- wealth tax

- lineal ascendant gift from relative exempt from income tax

- indirect tax

Three ways in which you can save tax through your parents | Mint – #59

Three ways in which you can save tax through your parents | Mint – #59

Income from Other Sources (IFOS) – – #60

Income from Other Sources (IFOS) – – #60

Income Tax Calculator: Know your post-Budget 2020 tax liability as per new income tax slabs – #61

Income Tax Calculator: Know your post-Budget 2020 tax liability as per new income tax slabs – #61

SGX Nifty Renamed as GIFT Nifty From July 3 – #62

SGX Nifty Renamed as GIFT Nifty From July 3 – #62

6 Ways To Give Money As A Gift | Bankrate – #63

6 Ways To Give Money As A Gift | Bankrate – #63

Income Tax Calculator: Calculate your Income Tax Online in India – #64

Income Tax Calculator: Calculate your Income Tax Online in India – #64

Tax Guidelines About Gifting – TurboTax Tax Tips & Videos – #65

Tax Guidelines About Gifting – TurboTax Tax Tips & Videos – #65

Tax queries: Gifts received from a relative are tax-exempt – The Economic Times – #66

Tax queries: Gifts received from a relative are tax-exempt – The Economic Times – #66

What is Property Tax and How it is Calculated? – #67

What is Property Tax and How it is Calculated? – #67

How are stocks gifted to your spouse taxed? | Mint – #68

How are stocks gifted to your spouse taxed? | Mint – #68

Crypto Tax Calculator India – FinCalC Blog – #69

Crypto Tax Calculator India – FinCalC Blog – #69

14 లక్షల Income వరకు 0% Tax | Calculation with Free Excel Calculator | 0 tax on income of ₹14 lakhs – YouTube – #70

14 లక్షల Income వరకు 0% Tax | Calculation with Free Excel Calculator | 0 tax on income of ₹14 lakhs – YouTube – #70

Alerts | Tax & Regulatory Services | Grant Thornton Bharat – #71

Alerts | Tax & Regulatory Services | Grant Thornton Bharat – #71

Income Tax: What is Gift Tax? Exemption and limits explained | Economy News – News9live – #72

Income Tax: What is Gift Tax? Exemption and limits explained | Economy News – News9live – #72

Income Tax Exemption On Gifts | Are The Gifts Above Rs 50,000 Taxable? | Personal Finance – YouTube – #73

Income Tax Exemption On Gifts | Are The Gifts Above Rs 50,000 Taxable? | Personal Finance – YouTube – #73

Calculating & Declaring Gift Tax In Thailand | Acclime Thailand – #74

Calculating & Declaring Gift Tax In Thailand | Acclime Thailand – #74

Crypto Tax in India: The Ultimate Guide (2024) – #75

Crypto Tax in India: The Ultimate Guide (2024) – #75

Top 5 Income Tax Calculator Apps in India 2023 – #76

Top 5 Income Tax Calculator Apps in India 2023 – #76

- estate tax

- salary income tax calculator

- gift tax definition

GST Rates in India 2024 – List of Goods and Service Tax Rates, Slab and Revision – #77

GST Rates in India 2024 – List of Goods and Service Tax Rates, Slab and Revision – #77

How to Calculate Stamp Duty for Gift Deeds? – #78

How to Calculate Stamp Duty for Gift Deeds? – #78

Exposed New Income Tax Calculation 2023 | Old vs New Tax Calculation |New Tax Slab 2023 | Full Guide – YouTube – #79

Exposed New Income Tax Calculation 2023 | Old vs New Tax Calculation |New Tax Slab 2023 | Full Guide – YouTube – #79

A Mini-Guide for Handling Holiday Bonuses and Gifts | SPARK Blog | ADP – #80

A Mini-Guide for Handling Holiday Bonuses and Gifts | SPARK Blog | ADP – #80

Gift Tax: What it is and How Gifts are taxed in India – #81

Gift Tax: What it is and How Gifts are taxed in India – #81

- gift tax in india

- gift tax meaning

- gift deed format in hindi pdf

Old vs New Regime Income Tax Calculator – Calculate Income Tax For FY 2023-2024 – #82

Old vs New Regime Income Tax Calculator – Calculate Income Tax For FY 2023-2024 – #82

Casio MJ-120GST GST Calculator (Black) : Amazon.in: Office Products – #83

Casio MJ-120GST GST Calculator (Black) : Amazon.in: Office Products – #83

Gift Tax: Tax on gifts: Documents that you should have while filing ITR – The Economic Times – #84

Gift Tax: Tax on gifts: Documents that you should have while filing ITR – The Economic Times – #84

- gift tax rate in india 2022-23

- gift tax exemption 2022

- gift tax rate in india 2020

How To Make (Or Ask For) A 529 Plan Gift Contribution – Forbes Advisor – #85

How To Make (Or Ask For) A 529 Plan Gift Contribution – Forbes Advisor – #85

The Computation and Calculation of Adhoc Tax – #86

The Computation and Calculation of Adhoc Tax – #86

Gift Deed: Registration, Format and All You Need to Know – #87

Gift Deed: Registration, Format and All You Need to Know – #87

Tax Laws on Cash Gifts: Is Gifted Money Taxable? | Axis Bank – #88

Tax Laws on Cash Gifts: Is Gifted Money Taxable? | Axis Bank – #88

%20relief%20calculator%20FY%202023-24%20AY%202024-25.png) 2023 Instructions for Schedule A (2023) | Internal Revenue Service – #89

2023 Instructions for Schedule A (2023) | Internal Revenue Service – #89

- gift chart as per income tax

- income tax calculation sheet

- corporate tax

How to Avoid Capital Gains Tax on Sale Of Gold? | IIFL Finance – #90

How to Avoid Capital Gains Tax on Sale Of Gold? | IIFL Finance – #90

Quintet Solutions – #91

Quintet Solutions – #91

Optimizing Long & Short Term Capital Gains Tax for NRIs – #92

Optimizing Long & Short Term Capital Gains Tax for NRIs – #92

Buy Casio MJ-120D 150 Steps Check and Correct Desktop Calculator with Tax Keys Online at Best Prices in India – JioMart. – #93

Buy Casio MJ-120D 150 Steps Check and Correct Desktop Calculator with Tax Keys Online at Best Prices in India – JioMart. – #93

Training Videos – Winman Software – #94

Training Videos – Winman Software – #94

- money gift deed format

- estate duty

- types of taxes in india

Types of Taxes in India 2024 – Fincash – #95

Types of Taxes in India 2024 – Fincash – #95

Crypto Tax Calculator – Taxation on Cryptocurrency, Bitcoin, Ethereum – Tax2win – #96

Crypto Tax Calculator – Taxation on Cryptocurrency, Bitcoin, Ethereum – Tax2win – #96

Gifts from relatives are always tax-free – The Economic Times – #97

Gifts from relatives are always tax-free – The Economic Times – #97

How money received via Will or Inheritance from abroad is taxed in India – Income Tax News | The Financial Express – #98

How money received via Will or Inheritance from abroad is taxed in India – Income Tax News | The Financial Express – #98

BA-II Plus Advance Financial Calculator, Dark Gray – Walmart.com – #99

BA-II Plus Advance Financial Calculator, Dark Gray – Walmart.com – #99

The continuing tax gift to India Inc – The Hindu BusinessLine – #100

The continuing tax gift to India Inc – The Hindu BusinessLine – #100

Stamp Duty and Registration Fee Calculator – Mahrashtra – #101

Stamp Duty and Registration Fee Calculator – Mahrashtra – #101

Will your ‘gift’ be taxed? – The Economic Times – #102

Will your ‘gift’ be taxed? – The Economic Times – #102

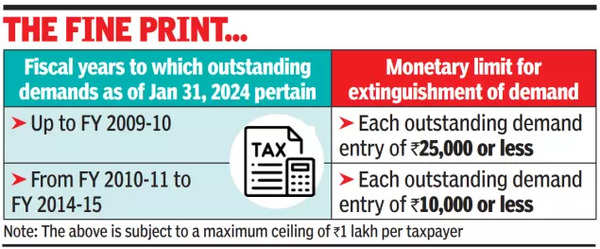

Small tax demands up to ₹1 lakh waived, bringing relief for income tax payers | Mint – #103

Small tax demands up to ₹1 lakh waived, bringing relief for income tax payers | Mint – #103

Tax on gifts and inheritances | ATO Community – #104

Tax on gifts and inheritances | ATO Community – #104

All you need to know about taxes on gifts and the exceptions | Mint – #105

All you need to know about taxes on gifts and the exceptions | Mint – #105

How scientists are subtracting race from medical risk calculators | Science | AAAS – #106

How scientists are subtracting race from medical risk calculators | Science | AAAS – #106

Posts: gift tax calculator india

Categories: Gifts

Author: toyotabienhoa.edu.vn