Update 124+ gift tax act

Update images of gift tax act by website toyotabienhoa.edu.vn compilation. Possible Changes to Estate and Gift Tax Law. Thom discusses the impact the Reconciliation Act will likely have on estate and gift taxes in. UGMA & UTMA accounts | Tips for custodial accounts | Fidelity

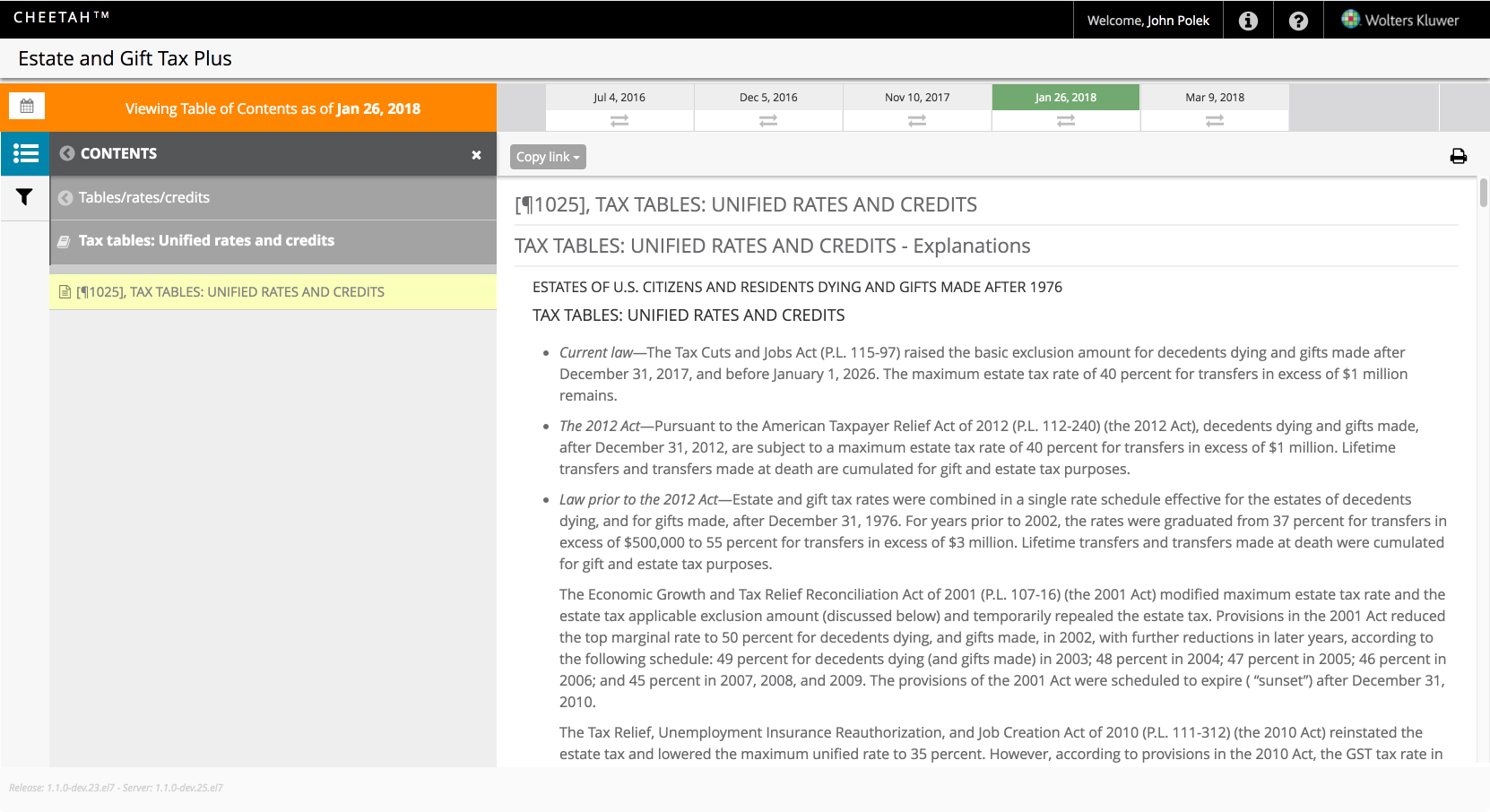

The Change in Administration Makes Estate and Gift Planning a Top Priority – Sikich LLP – #1

The Change in Administration Makes Estate and Gift Planning a Top Priority – Sikich LLP – #1

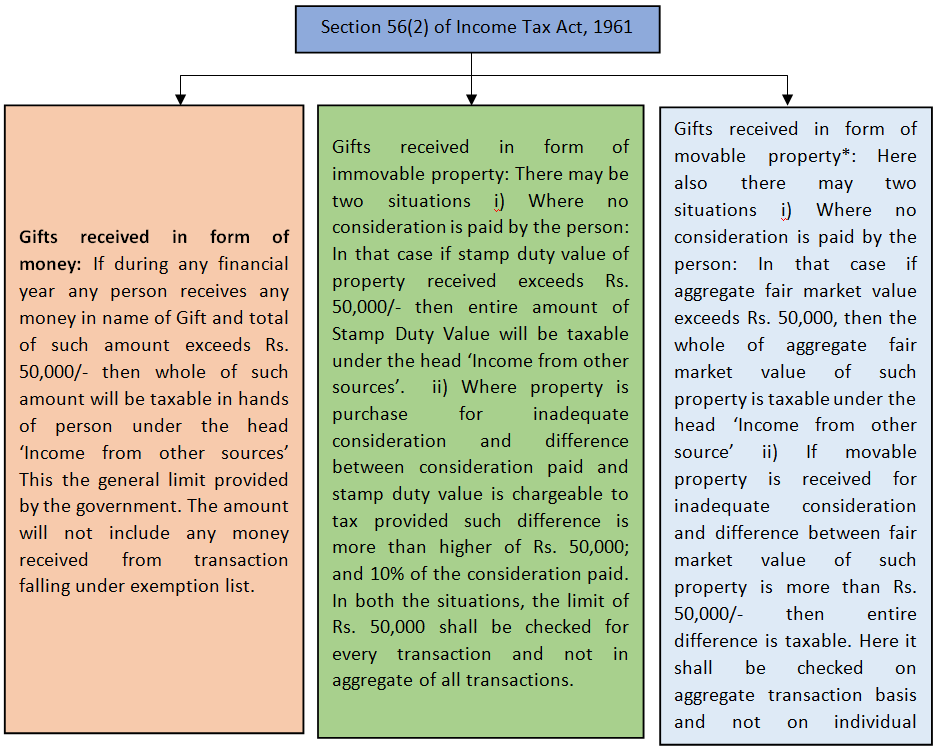

Taxability of Gifts under Income Tax Act 1961 – Adv Adityanarayan – Medium – #2

Taxability of Gifts under Income Tax Act 1961 – Adv Adityanarayan – Medium – #2

1,300+ Gift Tax Stock Illustrations, Royalty-Free Vector Graphics & Clip Art – iStock | Gift tax law, Charitable gift tax – #4

1,300+ Gift Tax Stock Illustrations, Royalty-Free Vector Graphics & Clip Art – iStock | Gift tax law, Charitable gift tax – #4

Understanding Section 50B of the Income Tax Act: Simplifying Capital Gains Tax Calculation in Business Reorganization – Marg ERP Blog – #5

Understanding Section 50B of the Income Tax Act: Simplifying Capital Gains Tax Calculation in Business Reorganization – Marg ERP Blog – #5

State Bar of Texas on X: “Liz Nielsen, founder of Nielsen Law, shares what every lawyer needs to know about the estate and gift tax ahead of the scheduled sunsetting of the – #6

State Bar of Texas on X: “Liz Nielsen, founder of Nielsen Law, shares what every lawyer needs to know about the estate and gift tax ahead of the scheduled sunsetting of the – #6

Estate Planning: Increased Transfer Limits for Gift and Estate Tax for 2023 – Young Moore Attorneys – #7

Estate Planning: Increased Transfer Limits for Gift and Estate Tax for 2023 – Young Moore Attorneys – #7

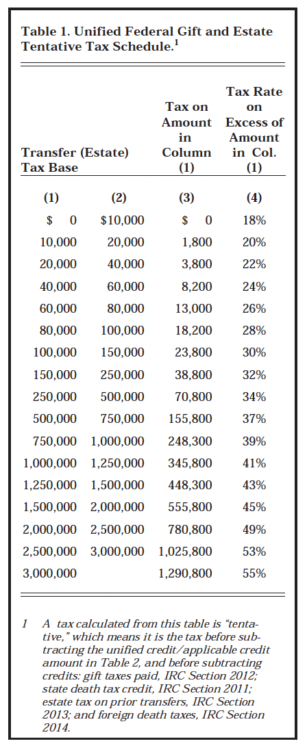

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #8

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #8

- gift tax definition

- gift tax exemption relatives list

- inheritance estate tax

![]() Provisions of Deemed Gift u/s 56(2)(vii)(b) of Income Tax Act cannot be Applied Retrospectively: ITAT – #10

Provisions of Deemed Gift u/s 56(2)(vii)(b) of Income Tax Act cannot be Applied Retrospectively: ITAT – #10

Add a tax break to your holiday gift list – KraftCPAs – #11

Add a tax break to your holiday gift list – KraftCPAs – #11

New Estate and Gift Tax Laws for 2022 – Fee Based Guardians of Wealth – #12

New Estate and Gift Tax Laws for 2022 – Fee Based Guardians of Wealth – #12

These Tax Cuts and Jobs Act Provisions May Sunset Soon – CPA Practice Advisor – #13

These Tax Cuts and Jobs Act Provisions May Sunset Soon – CPA Practice Advisor – #13

![PDF] The Federal Estate Tax: History, Law, and Economics | Semantic Scholar PDF] The Federal Estate Tax: History, Law, and Economics | Semantic Scholar](https://i.ytimg.com/vi/iFJUtpdROUk/sddefault.jpg) PDF] The Federal Estate Tax: History, Law, and Economics | Semantic Scholar – #14

PDF] The Federal Estate Tax: History, Law, and Economics | Semantic Scholar – #14

- gift tax exclusion 2023

- gift tax

- estate tax exemption history

Bill of amendments to the Mexican federal income tax law inheritance, bequest and gift tax – #15

Bill of amendments to the Mexican federal income tax law inheritance, bequest and gift tax – #15

Gift Tax Exemption – FasterCapital – #16

Gift Tax Exemption – FasterCapital – #16

An $80 Billion Estate & Gift Tax Valuation Update – #17

An $80 Billion Estate & Gift Tax Valuation Update – #17

Irrevocable Trusts for Estate Tax Planning, Gift Tax and Gifting Strategies Explained – #18

Irrevocable Trusts for Estate Tax Planning, Gift Tax and Gifting Strategies Explained – #18

Image 1 of Law and regulations relating to the estate tax. | Library of Congress – #19

Image 1 of Law and regulations relating to the estate tax. | Library of Congress – #19

U.S. Master Estate and Gift Tax Guide by Cch Tax Law Editors 9780808022213 | eBay – #20

U.S. Master Estate and Gift Tax Guide by Cch Tax Law Editors 9780808022213 | eBay – #20

Tax Cuts and Jobs Act takeaways – InvestmentNews – #21

Tax Cuts and Jobs Act takeaways – InvestmentNews – #21

Estate Tax Planning: Act Now, Before It’s Too Late – Evercore – #22

Estate Tax Planning: Act Now, Before It’s Too Late – Evercore – #22

What is Portability for Estate and Gift Tax? – My-Estate Plans℠ – #23

What is Portability for Estate and Gift Tax? – My-Estate Plans℠ – #23

2023 Tax Act Texas Bowl Champions Oklahoma State Cowboys Team T Shirt – #24

2023 Tax Act Texas Bowl Champions Oklahoma State Cowboys Team T Shirt – #24

Understanding How the 99.5% Act Affects You – Lowthorp Richards – #25

Understanding How the 99.5% Act Affects You – Lowthorp Richards – #25

Preparing for tax law changes | Baptist Messenger of Oklahoma – #26

Preparing for tax law changes | Baptist Messenger of Oklahoma – #26

2023 tax law Archives – The National Law Forum – #27

2023 tax law Archives – The National Law Forum – #27

Taxability of Gifts – #28

Taxability of Gifts – #28

PPT – BY CA NAVEEN KHARIWAL .G Email id: h.c.khincha@gmail PowerPoint Presentation – ID:3225085 – #29

PPT – BY CA NAVEEN KHARIWAL .G Email id: h.c.khincha@gmail PowerPoint Presentation – ID:3225085 – #29

Section 10 of Income Tax Act – Deductions and Allowances – #30

Section 10 of Income Tax Act – Deductions and Allowances – #30

- gift tax example

- gift tax return

- federal estate tax

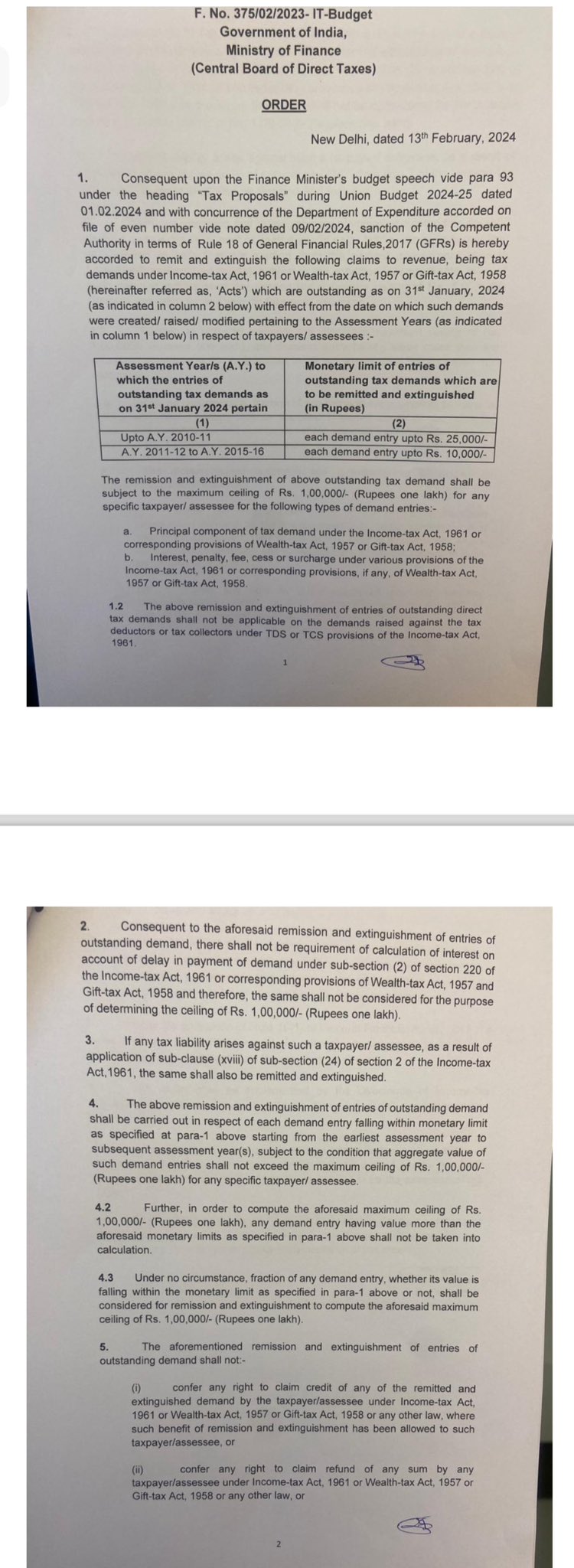

New Tool from Wolters Kluwer Tracks Changes to Estate and Gift Tax Laws | LawSites – #31

New Tool from Wolters Kluwer Tracks Changes to Estate and Gift Tax Laws | LawSites – #31

How to Avoid a Possible Increase in Federal Estate Taxes – #32

How to Avoid a Possible Increase in Federal Estate Taxes – #32

Gift- Income Tax on Gift- Exempt Gift- Taxable Gift- Tax Planning with Gifts under Income Tax Act – YouTube – #33

Gift- Income Tax on Gift- Exempt Gift- Taxable Gift- Tax Planning with Gifts under Income Tax Act – YouTube – #33

Estate, Gift, and Generation Skipping Taxes for 2023 – Holland Law Offices, LLC. – #34

Estate, Gift, and Generation Skipping Taxes for 2023 – Holland Law Offices, LLC. – #34

Marietta Estate Tax Lawyer Answers, “What Is Portability in an Estate Plan?” | Georgia Estate Plan: Worrall Law LLC – #35

Marietta Estate Tax Lawyer Answers, “What Is Portability in an Estate Plan?” | Georgia Estate Plan: Worrall Law LLC – #35

Economic Recovery Tax Act of 1981 (ERTA) | Finance Strategists – #36

Economic Recovery Tax Act of 1981 (ERTA) | Finance Strategists – #36

estate and gift tax planning – #37

estate and gift tax planning – #37

Crystal Ball Gazing for the Federal Estate and Gift Tax After 2020 – Should I Act Now? – #38

Crystal Ball Gazing for the Federal Estate and Gift Tax After 2020 – Should I Act Now? – #38

Long-term tax planning | Advisor education | Nuveen – #39

Long-term tax planning | Advisor education | Nuveen – #39

DATRI Blood Stem Cell Donors Registry on Instagram: “Your donation can SAVE TAX & GIFT LIVES. Donate now to DATRI and get 50% tax exemption under Section 80G of Income Tax Act – #40

DATRI Blood Stem Cell Donors Registry on Instagram: “Your donation can SAVE TAX & GIFT LIVES. Donate now to DATRI and get 50% tax exemption under Section 80G of Income Tax Act – #40

Mitigating the Impacts: Sunsetting the Tax Cuts and Jobs Act | Moonan | Stratton – #41

Mitigating the Impacts: Sunsetting the Tax Cuts and Jobs Act | Moonan | Stratton – #41

Income Tax Return Filing: Are wedding gifts really tax free? All hidden clauses, conditions explained | Zee Business – #42

Income Tax Return Filing: Are wedding gifts really tax free? All hidden clauses, conditions explained | Zee Business – #42

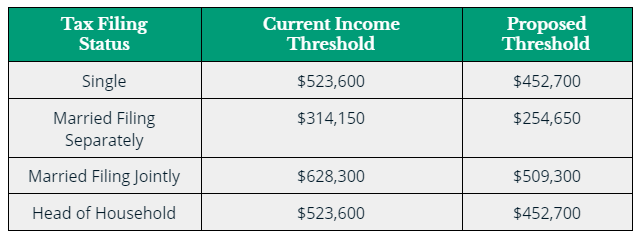

Senate estate and gift tax proposals hint possible changes | Crowe LLP – #43

Senate estate and gift tax proposals hint possible changes | Crowe LLP – #43

Estate, Gift and Trust Flashcards | Quizlet – #44

Estate, Gift and Trust Flashcards | Quizlet – #44

Now gift stocks and ETFs to your friends and loved ones – Stocks – Trading Q&A by Zerodha – All your queries on trading and markets answered – #45

Now gift stocks and ETFs to your friends and loved ones – Stocks – Trading Q&A by Zerodha – All your queries on trading and markets answered – #45

Gift Tax: When receiving a gift becomes taxing… – MarketExpress – #46

Gift Tax: When receiving a gift becomes taxing… – MarketExpress – #46

The Best Gifts Under the New Tax Law – Context | AB – #47

The Best Gifts Under the New Tax Law – Context | AB – #47

शादी से पहले जान लें टैक्स का नियम, नहीं तो घर आ सकता है नोटिस – #48

शादी से पहले जान लें टैक्स का नियम, नहीं तो घर आ सकता है नोटिस – #48

GST on Gifts, Discounts, Credits | SBS and Co LLP – #49

GST on Gifts, Discounts, Credits | SBS and Co LLP – #49

Media – Ram Law – #50

Media – Ram Law – #50

Tax on Gifts in India: know taxation rules on gifts according to Income Tax Act 1961 | Business – #51

Tax on Gifts in India: know taxation rules on gifts according to Income Tax Act 1961 | Business – #51

What is a gift deed and tax implications | Tax Hack – #52

What is a gift deed and tax implications | Tax Hack – #52

How Does a Uniform Gifts to Minors Act (UGMA) Account Work? – #53

How Does a Uniform Gifts to Minors Act (UGMA) Account Work? – #53

What Is The Gift Tax Law In PA? – Bononi and Company PC – #54

What Is The Gift Tax Law In PA? – Bononi and Company PC – #54

FED.ESTATE+GIFT TAX.-STUDY PROBS. Hardcover: Richard B. Stephens, Stephen A. Lind, & Dennis A. Calfee: 9780791386491: Amazon.com: Books – #55

FED.ESTATE+GIFT TAX.-STUDY PROBS. Hardcover: Richard B. Stephens, Stephen A. Lind, & Dennis A. Calfee: 9780791386491: Amazon.com: Books – #55

Solved 1. What are the taxes? Check all that apply Income | Chegg.com – #56

Solved 1. What are the taxes? Check all that apply Income | Chegg.com – #56

Estate and Gift Tax Planning Archives – Trusts, Estates, and Tax – #57

Estate and Gift Tax Planning Archives – Trusts, Estates, and Tax – #57

- lineal ascendant gift from relative exempt from income tax

- gift tax rate table

- expenditure tax act

Italian Tax Administration Issued Its Final Guidance on Taxation of Trusts, Discusses Italian Gift Tax On Distributions From Foreign Trusts | European Union and Italian International Tax Law Blog – #58

Italian Tax Administration Issued Its Final Guidance on Taxation of Trusts, Discusses Italian Gift Tax On Distributions From Foreign Trusts | European Union and Italian International Tax Law Blog – #58

Tax Changes Likely to Fuel More M&A Tax Cuts and Jobs Act – #59

Tax Changes Likely to Fuel More M&A Tax Cuts and Jobs Act – #59

The Tax Cuts and Jobs Act (TCJA) Makes Significant Estate and Gift Tax Changes | Louisiana Law Blog – #60

The Tax Cuts and Jobs Act (TCJA) Makes Significant Estate and Gift Tax Changes | Louisiana Law Blog – #60

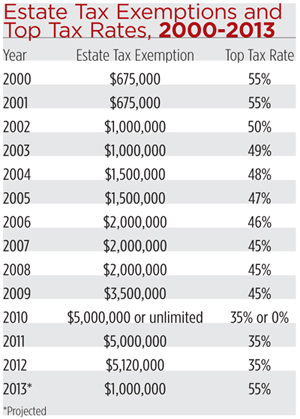

Estate and Gift Tax Changes in the Taxpayer relief Act of 1997 – #61

Estate and Gift Tax Changes in the Taxpayer relief Act of 1997 – #61

Tax Cuts and Jobs Act Changing Gift and GST Tax Laws – #62

Tax Cuts and Jobs Act Changing Gift and GST Tax Laws – #62

The New Tax Law: Estate and Gift Tax – WSJ – #63

The New Tax Law: Estate and Gift Tax – WSJ – #63

Annual Gift Tax Exclusions | First Republic now part of JPMorgan Chase – #64

Annual Gift Tax Exclusions | First Republic now part of JPMorgan Chase – #64

Build Back Better Act: Proposed estate and gift tax changes | Our Insights | Plante Moran – #65

Build Back Better Act: Proposed estate and gift tax changes | Our Insights | Plante Moran – #65

UHNW Investors Enjoy Ongoing Tax Savings | Bernstein – #66

UHNW Investors Enjoy Ongoing Tax Savings | Bernstein – #66

Gift Tax: 3 Easy Ways to Avoid Paying the Gift Tax | TaxAct – #67

Gift Tax: 3 Easy Ways to Avoid Paying the Gift Tax | TaxAct – #67

Favorable Gift Tax Rules Set To Expire at the End of This Year | Wealth Management – #68

Favorable Gift Tax Rules Set To Expire at the End of This Year | Wealth Management – #68

1 Gifts n Generosity / personal motives n estate reduction n income shifting (’86 Act) n income tax deduction (charity) n issue of control. – ppt download – #69

1 Gifts n Generosity / personal motives n estate reduction n income shifting (’86 Act) n income tax deduction (charity) n issue of control. – ppt download – #69

Estate and Gift Tax—Are You Prepared for Changes? — Thienel Law – #70

Estate and Gift Tax—Are You Prepared for Changes? — Thienel Law – #70

Amazon.com: Internal Revenue Code: INC, EST, Gift, Employment & Excise Taxes, (Summer 2022): 9780808057291: CCH Tax Law Editors: Books – #71

Amazon.com: Internal Revenue Code: INC, EST, Gift, Employment & Excise Taxes, (Summer 2022): 9780808057291: CCH Tax Law Editors: Books – #71

Estate and Gift Tax Law: Changes Under the Economic Growth and Tax Relief Reconciliation Act of 2001 – EveryCRSReport.com – #72

Estate and Gift Tax Law: Changes Under the Economic Growth and Tax Relief Reconciliation Act of 2001 – EveryCRSReport.com – #72

Three Gifts That Pay You | Texas A&M Foundation – #73

Three Gifts That Pay You | Texas A&M Foundation – #73

- federal gift tax

- gift chart as per income tax

- gift from relative exempt from income tax

Wealth Transfer Tax Planning Implications of the 2017 Tax Act | Williams Mullen – JDSupra – #74

Wealth Transfer Tax Planning Implications of the 2017 Tax Act | Williams Mullen – JDSupra – #74

GIFT TAX ON SHARES & SECURITIES – Consult CA Online – #75

GIFT TAX ON SHARES & SECURITIES – Consult CA Online – #75

Charitable Giving Options Under the New Tax Law – #76

Charitable Giving Options Under the New Tax Law – #76

- gift tax exemption

- estate tax exemption 2026

- estate tax example

FCS DEEPAK P. SINGH PROCEDURE OF TRANSFER OF SHARES BY GIFT & TAX IMPLICATIONS – #77

FCS DEEPAK P. SINGH PROCEDURE OF TRANSFER OF SHARES BY GIFT & TAX IMPLICATIONS – #77

Gift Under The Income Tax Act In India – Especia – #78

Gift Under The Income Tax Act In India – Especia – #78

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation – #79

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation – #79

Section 80EEB of Income Tax Act: Deduction on purchase of electric vehicle – #80

Section 80EEB of Income Tax Act: Deduction on purchase of electric vehicle – #80

UGMA & UTMA accounts | Tips for custodial accounts | Fidelity – #81

UGMA & UTMA accounts | Tips for custodial accounts | Fidelity – #81

Year-end charitable gift strategies that give a tax deduction in return – Press Enterprise – #82

Year-end charitable gift strategies that give a tax deduction in return – Press Enterprise – #82

How to calculate income tax on gifts from relatives? – #83

How to calculate income tax on gifts from relatives? – #83

How much can you gift a family member in 2022? | Law Offices of DuPont and Blumenstiel – #84

How much can you gift a family member in 2022? | Law Offices of DuPont and Blumenstiel – #84

New Tax Act Doubles Gift and Estate Tax Exemption: Now What? – #85

New Tax Act Doubles Gift and Estate Tax Exemption: Now What? – #85

-Gifts.jpg) What are the tax laws on gifts? – Quora – #86

What are the tax laws on gifts? – Quora – #86

Who pays the IRS tax on a “gift”? – Shawn J. Roberts – #87

Who pays the IRS tax on a “gift”? – Shawn J. Roberts – #87

Current Estate and Gift Tax Environment – YouTube – #88

Current Estate and Gift Tax Environment – YouTube – #88

Section 56(2)(vii) of the Income Tax Act-1961 considers Archives – The Tax Talk – #89

Section 56(2)(vii) of the Income Tax Act-1961 considers Archives – The Tax Talk – #89

The Gift Tax Introduction and Its Benefits – Essay Example – YouTube – #90

The Gift Tax Introduction and Its Benefits – Essay Example – YouTube – #90

Gift, Estate, and Generation-Skipping Transfer Tax Update: Estate Planning in 2022 and Beyond – Rudman Winchell – #91

Gift, Estate, and Generation-Skipping Transfer Tax Update: Estate Planning in 2022 and Beyond – Rudman Winchell – #91

Gift Tax Law Closes Window of Opportunity | Indianapolis Estate Planning Attorneys – #92

Gift Tax Law Closes Window of Opportunity | Indianapolis Estate Planning Attorneys – #92

) Estate and Gift Tax Amendments of the Revenue Act of 1948 – #93

Estate and Gift Tax Amendments of the Revenue Act of 1948 – #93

Understanding Section 56 of the Income Tax Act – Marg ERP Blog – #94

Understanding Section 56 of the Income Tax Act – Marg ERP Blog – #94

What is the income tax liability on a gift in India? – Quora – #95

What is the income tax liability on a gift in India? – Quora – #95

Is the New Tax Act a Gift to Parents? – #96

Is the New Tax Act a Gift to Parents? – #96

Estate and Gift Tax Law: Changes Under the Economic Growth and Tax Relief Reconciliation Act of 2001 – UNT Digital Library – #97

Estate and Gift Tax Law: Changes Under the Economic Growth and Tax Relief Reconciliation Act of 2001 – UNT Digital Library – #97

Tax Law Symposia – College of Law – St. Thomas University – #98

Tax Law Symposia – College of Law – St. Thomas University – #98

Estate and Gift Planning for 2015 and Beyond – #99

Estate and Gift Planning for 2015 and Beyond – #99

2024 Estate, Gift and GST Tax Changes | Shipman & Goodwin LLP™ – #100

2024 Estate, Gift and GST Tax Changes | Shipman & Goodwin LLP™ – #100

4 Ways to Pay off Someone Else’s Mortgage – wikiHow – #101

4 Ways to Pay off Someone Else’s Mortgage – wikiHow – #101

Proactive Year-end Tax Planning for 2020 and Beyond | Capital Income Advisors – #102

Proactive Year-end Tax Planning for 2020 and Beyond | Capital Income Advisors – #102

PDF) Valuation, Values, Norms: Proposals for Estate and Gift Tax Reform | Bridget Crawford – Academia.edu – #103

PDF) Valuation, Values, Norms: Proposals for Estate and Gift Tax Reform | Bridget Crawford – Academia.edu – #103

Norton Rose Fulbright – Philip Michaels, Celeste Lawton, Nancy Montmarquet and Natasha A. Robertson provide an overview of the increased US #estate and gift #tax limits for 2020. http://ow.ly/S5Tw50BH8jD | Facebook – #104

Norton Rose Fulbright – Philip Michaels, Celeste Lawton, Nancy Montmarquet and Natasha A. Robertson provide an overview of the increased US #estate and gift #tax limits for 2020. http://ow.ly/S5Tw50BH8jD | Facebook – #104

Transfer Tax Changes Under Tax Cuts and Jobs Act – #105

Transfer Tax Changes Under Tax Cuts and Jobs Act – #105

An Act to Establish the Framework and Provisions for Levying Gift Tax in Bangladesh | PDF | Income Tax In India | Income Tax – #106

An Act to Establish the Framework and Provisions for Levying Gift Tax in Bangladesh | PDF | Income Tax In India | Income Tax – #106

Senate and House agree on final tax bill – Putnam Investments – #107

Senate and House agree on final tax bill – Putnam Investments – #107

The 2022 gift tax return deadline is coming up soon – April 18 – Encore Partners – #108

The 2022 gift tax return deadline is coming up soon – April 18 – Encore Partners – #108

What Is a Grantor Retained Annuity Trust (GRAT)? – #109

What Is a Grantor Retained Annuity Trust (GRAT)? – #109

- gift tax in india

- estate/gift tax

- wealth tax

Estate and Gift Tax Alert – #110

Estate and Gift Tax Alert – #110

Tax Planning with a $5,000,000 Gift Tax Exemption Presented by: Robert S. Keebler, CPA, MST, AEP Keebler & Associates, LLP Phone: (920) ppt download – #111

Tax Planning with a $5,000,000 Gift Tax Exemption Presented by: Robert S. Keebler, CPA, MST, AEP Keebler & Associates, LLP Phone: (920) ppt download – #111

Tax on Gifts Received from Relatives | Tax on Gifts | What to do if Received Money as Gift | – YouTube – #112

Tax on Gifts Received from Relatives | Tax on Gifts | What to do if Received Money as Gift | – YouTube – #112

Direct Taxes Matter – Gift Tax Act 1958 Direct Taxes Matter – Penalties/Prosecution/Settlement Commission – #113

Direct Taxes Matter – Gift Tax Act 1958 Direct Taxes Matter – Penalties/Prosecution/Settlement Commission – #113

Act Now to Leverage the Gift Tax Exclusion Before Year End – The Burns Firm – Advisors of Complex Financial Matters – #114

Act Now to Leverage the Gift Tax Exclusion Before Year End – The Burns Firm – Advisors of Complex Financial Matters – #114

Federal Gift Tax Law – TurboTax Tax Tip Video – YouTube – #115

Federal Gift Tax Law – TurboTax Tax Tip Video – YouTube – #115

- gift tax 2023

- gift tax exemption 2022

- gift tax meaning

- section 56(2) of income tax act

- gift tax rate

- estate tax exemption 2022

70+ Gift Tax Law Stock Illustrations, Royalty-Free Vector Graphics & Clip Art – iStock – #116

70+ Gift Tax Law Stock Illustrations, Royalty-Free Vector Graphics & Clip Art – iStock – #116

Income tax – “GIFT” Taxability under Income Tax Act, 1961-In Very Short | Facebook – #117

Income tax – “GIFT” Taxability under Income Tax Act, 1961-In Very Short | Facebook – #117

Tax Law Changes for 2023 | Estate Planning – #118

Tax Law Changes for 2023 | Estate Planning – #118

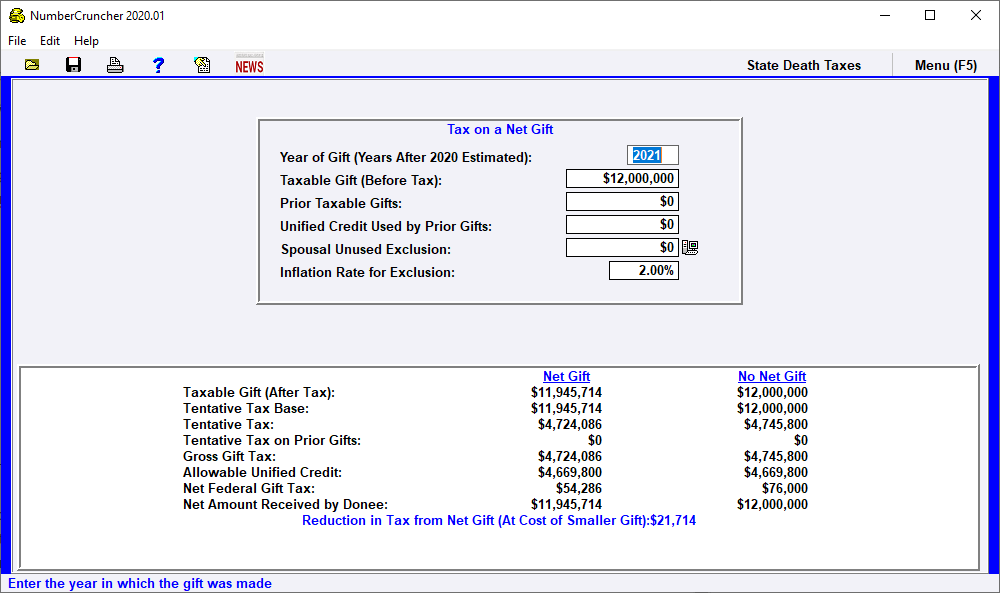

Net Gift: Tax on a Net Gift – Leimberg, LeClair, & Lackner, Inc. – #119

Net Gift: Tax on a Net Gift – Leimberg, LeClair, & Lackner, Inc. – #119

Article on the definition of Relatives… – CA Arjit Agarwal | Facebook – #120

Article on the definition of Relatives… – CA Arjit Agarwal | Facebook – #120

What Beats A Charitable Bequest Under The New Tax Law? – #121

What Beats A Charitable Bequest Under The New Tax Law? – #121

Taxability of Gift under Income Tax Act 1961 – Aristole Consultancy – #122

Taxability of Gift under Income Tax Act 1961 – Aristole Consultancy – #122

Giving Under the New Tax Law: Tax Cuts and Jobs Act of 2017 – #123

Giving Under the New Tax Law: Tax Cuts and Jobs Act of 2017 – #123

Generation-Skipping Transfer Taxes – #124

Generation-Skipping Transfer Taxes – #124

Posts: gift tax act

Categories: Gifts

Author: toyotabienhoa.edu.vn