Discover more than 103 gift section in income tax super hot

Top images of gift section in income tax by website toyotabienhoa.edu.vn compilation. Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver. The Gift Tax Made Simple – TurboTax Tax Tips & Videos. Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will

NRI Gift Tax India: Rules for Tax On Gift Money In India | DBS Treasures – #1

NRI Gift Tax India: Rules for Tax On Gift Money In India | DBS Treasures – #1

Gifts Tax: Know which gifts are taxable this festive season | TAX SAVING | Zee Business – #2

Gifts Tax: Know which gifts are taxable this festive season | TAX SAVING | Zee Business – #2

It just keeps getting better: Why charitable gift annuities are having a moment | Community Foundation Tampa Bay – #4

It just keeps getting better: Why charitable gift annuities are having a moment | Community Foundation Tampa Bay – #4

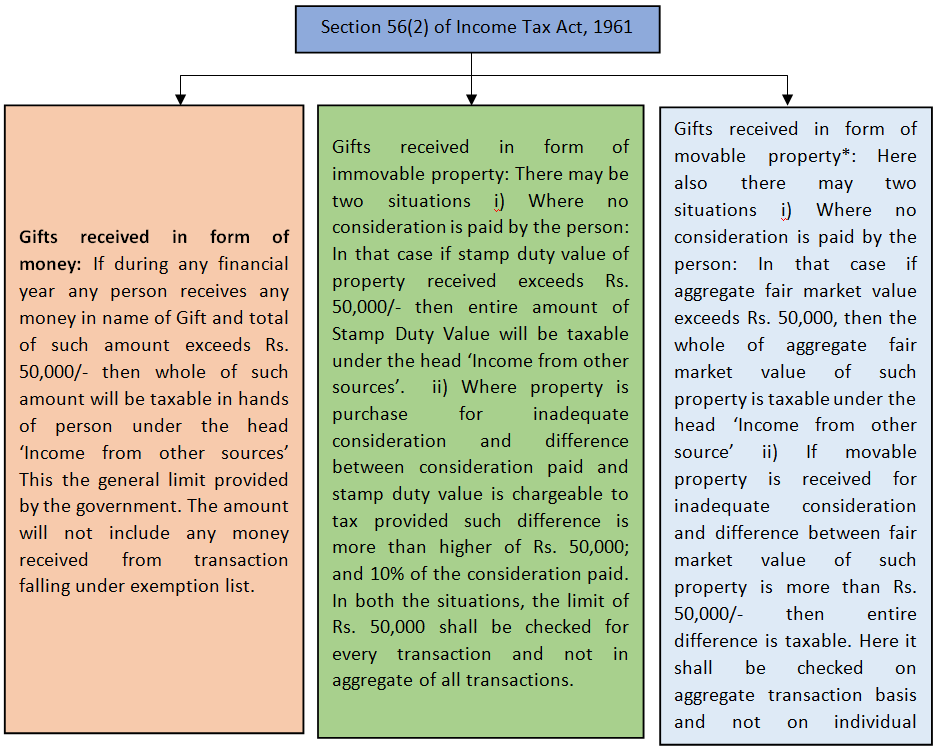

-Gifts.jpg) Taxability of Gift | PDF | Public Finance | Taxes – #5

Taxability of Gift | PDF | Public Finance | Taxes – #5

Government presents bill to redefine Wedding gifts in the Income Tax Act. – Maldives News Network – #6

Government presents bill to redefine Wedding gifts in the Income Tax Act. – Maldives News Network – #6

To File a Gift Tax Return or Not to – CPA Practice Advisor – #7

To File a Gift Tax Return or Not to – CPA Practice Advisor – #7

Gift of Immovable property under Income Tax Act – #8

Gift of Immovable property under Income Tax Act – #8

GMS Flash Alert 2015-121 United States – Proposed Regs on Taxing Gifts, Bequests from Covered Expatriates (October 8, 2015) – #10

GMS Flash Alert 2015-121 United States – Proposed Regs on Taxing Gifts, Bequests from Covered Expatriates (October 8, 2015) – #10

Gifts of Partnership Interests – #11

Gifts of Partnership Interests – #11

Donating Equity Compensation Awards | Schwab Charitable Donor-Advised Fund | Schwab Charitable – #12

Donating Equity Compensation Awards | Schwab Charitable Donor-Advised Fund | Schwab Charitable – #12

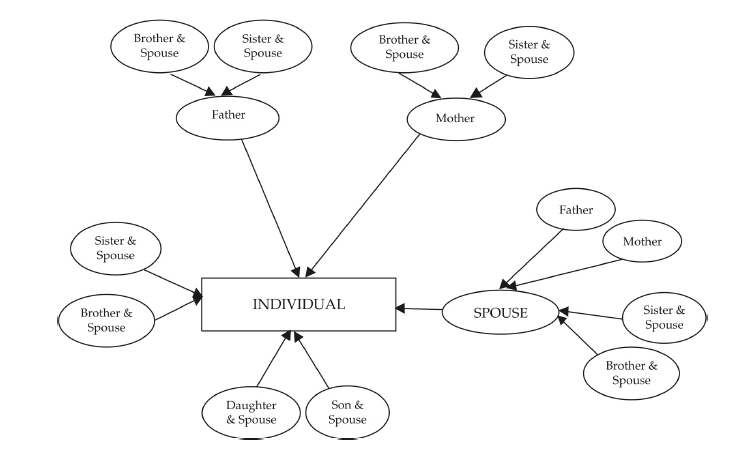

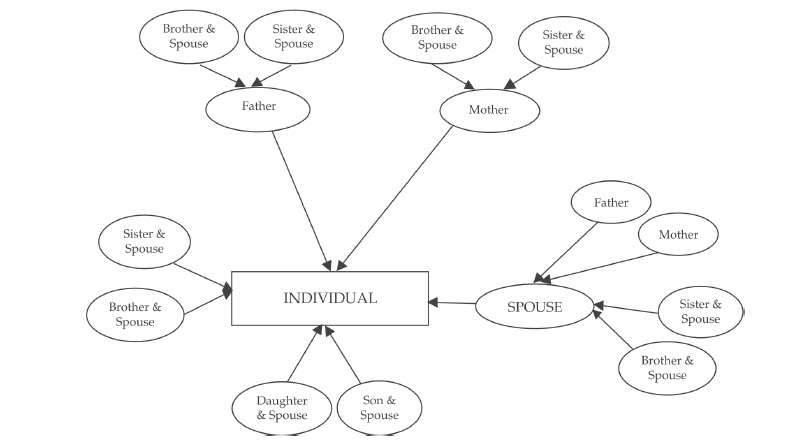

Income tax on gifts: Gift received from relatives is tax free | Mint – #13

Income tax on gifts: Gift received from relatives is tax free | Mint – #13

Introduction to QPRTs: Estate, Gift, & Income Tax Effects | FORVIS – #14

Introduction to QPRTs: Estate, Gift, & Income Tax Effects | FORVIS – #14

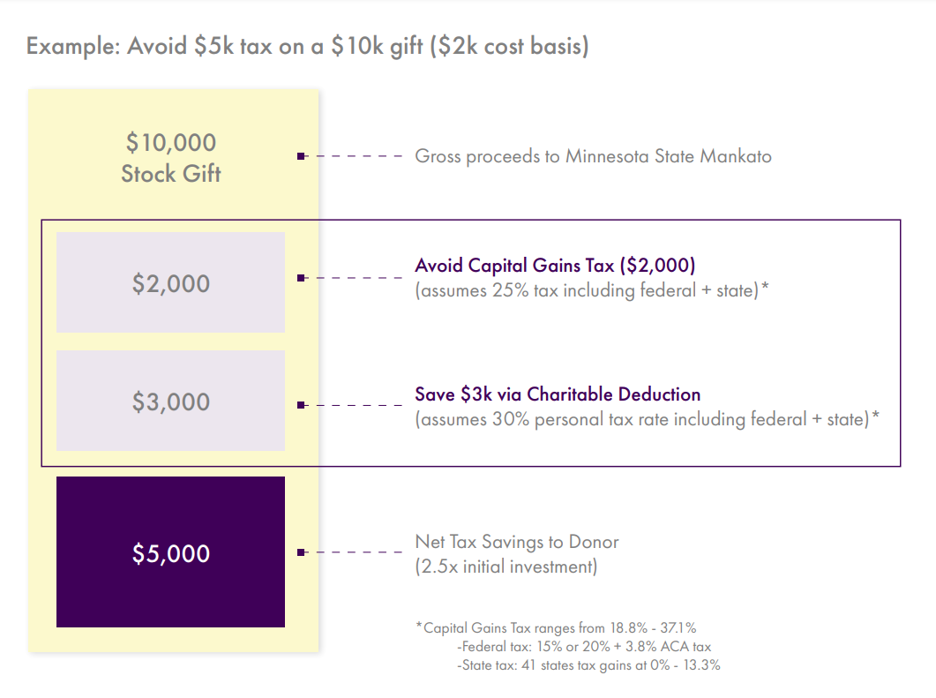

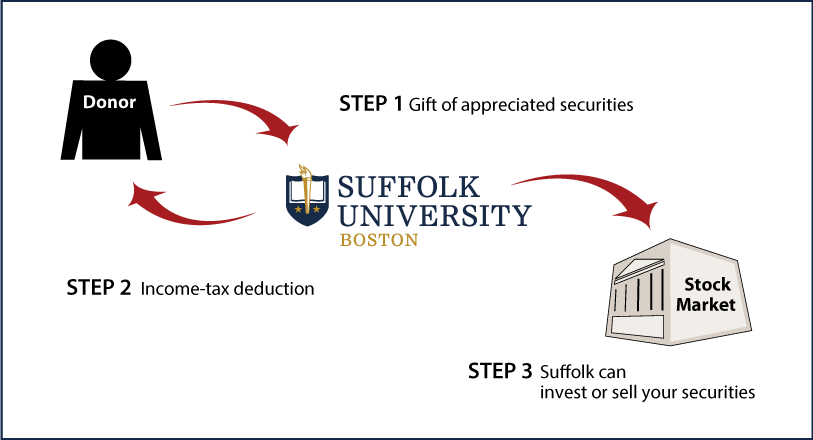

Stock Gifts — St. Francis DeSales High School – #15

Stock Gifts — St. Francis DeSales High School – #15

How Does New York State Gift Tax Work? -Updated Nov 2023 – #16

How Does New York State Gift Tax Work? -Updated Nov 2023 – #16

Crypto Taxes India: Expert Guide 2024 | CPA Reviewed | Koinly – #17

Crypto Taxes India: Expert Guide 2024 | CPA Reviewed | Koinly – #17

Gifts that Provide Income | Maine Organic Farmers and Gardeners – #18

Gifts that Provide Income | Maine Organic Farmers and Gardeners – #18

Solved Question Section 2(1) of the Income Tax Act (ITA) | Chegg.com – #19

Solved Question Section 2(1) of the Income Tax Act (ITA) | Chegg.com – #19

- gift chart as per income tax

- gift tax in india

- estate tax

Business Valuations for Estate and Gift Tax Purposes – #20

Business Valuations for Estate and Gift Tax Purposes – #20

Estate, Inheritance, and Gift Taxes in Europe, 2023 – #21

Estate, Inheritance, and Gift Taxes in Europe, 2023 – #21

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #22

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #22

The Gift Tax – TurboTax Tax Tips & Videos – #23

The Gift Tax – TurboTax Tax Tips & Videos – #23

Amazon.com : Income Tax Sign, TOPKING Signage, LED Neon Open, Store, Window, Shop, Business, Display, Grand Opening Gift : Office Products – #24

Amazon.com : Income Tax Sign, TOPKING Signage, LED Neon Open, Store, Window, Shop, Business, Display, Grand Opening Gift : Office Products – #24

) How to integrate complex assets into your giving strategy – #25

How to integrate complex assets into your giving strategy – #25

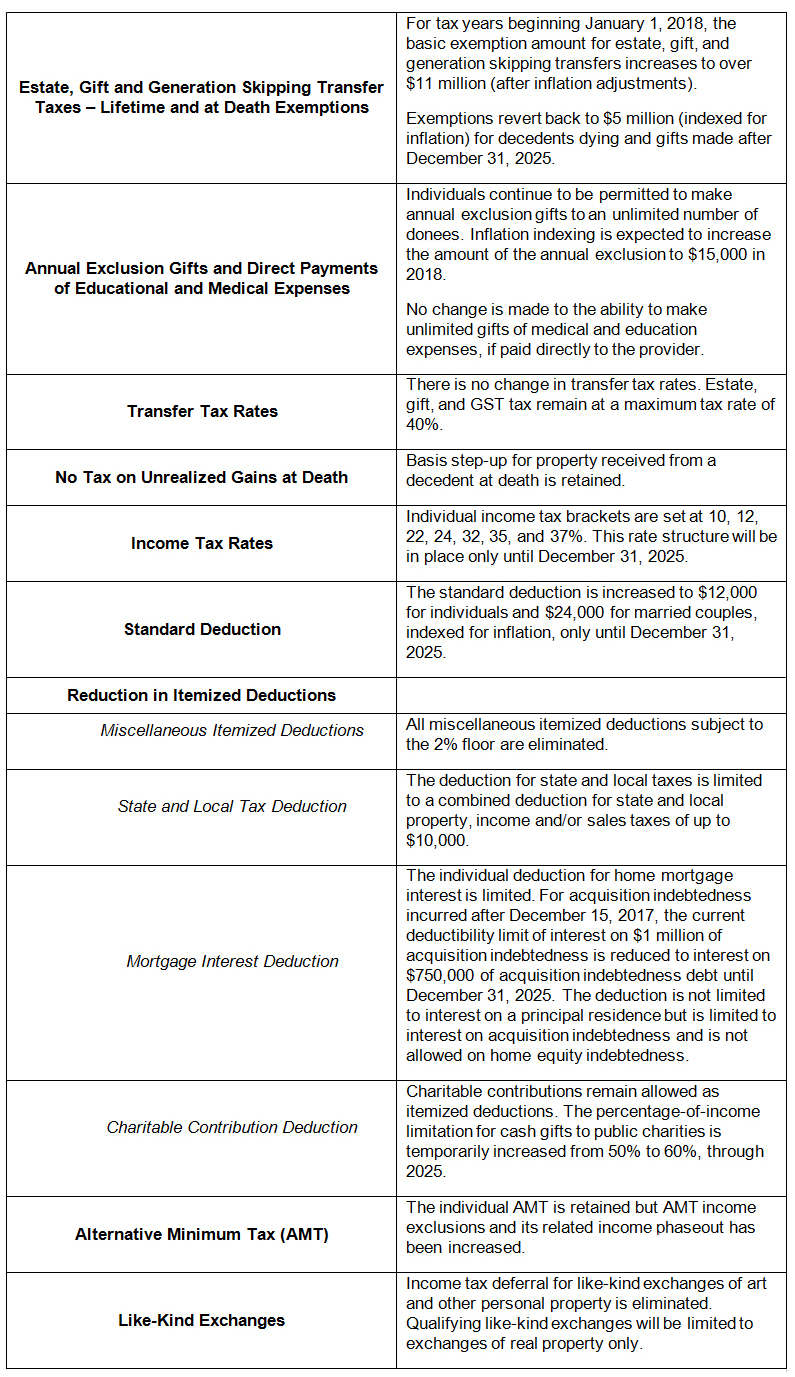

The Gift That Keeps on Giving: Tax Breaks Renewed for 2021 – Context | AB – #26

The Gift That Keeps on Giving: Tax Breaks Renewed for 2021 – Context | AB – #26

Change on the Horizon: Preparing for the Estate and Gift Lifetime Tax Exemption Sunset | Hugh Lau – #27

Change on the Horizon: Preparing for the Estate and Gift Lifetime Tax Exemption Sunset | Hugh Lau – #27

- gift tax rate in india 2020

- wealth tax

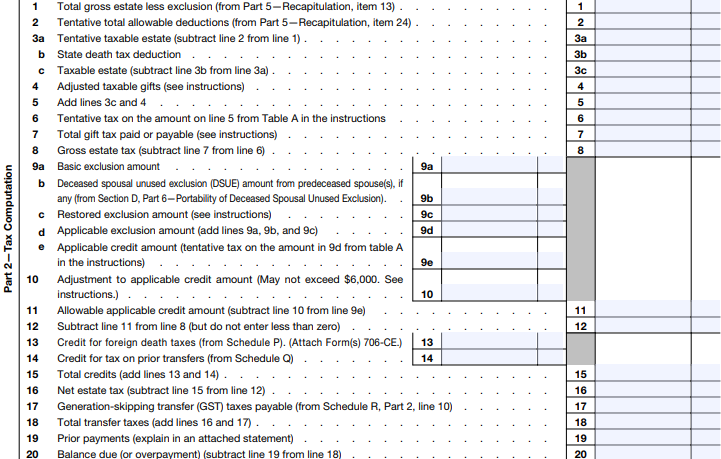

- irs form 709 examples of completed 709s

Alabama State Income Tax Credit – John Carroll Catholic High School – #28

Alabama State Income Tax Credit – John Carroll Catholic High School – #28

8 types of planned gifts your nonprofit should know | Blog | Resources | FreeWill – #29

8 types of planned gifts your nonprofit should know | Blog | Resources | FreeWill – #29

To File Or Not To File A Gift Tax Return, That Is The Question – #30

To File Or Not To File A Gift Tax Return, That Is The Question – #30

Pros and Cons of the “Kiddie Tax” – CPA Practice Advisor – #31

Pros and Cons of the “Kiddie Tax” – CPA Practice Advisor – #31

- gift tax 2023

- gift tax exemption 2022

- form 706

Tax Protester Leaves Server ‘Personal Gift’ Instead of a Tip – #32

Tax Protester Leaves Server ‘Personal Gift’ Instead of a Tip – #32

A guide to Gift tax for US Expats — Bambridge | Accountants – #33

A guide to Gift tax for US Expats — Bambridge | Accountants – #33

Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation – #34

Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation – #34

- form 709 example

- form 709 schedule a example

- gift tax rate

Gift Annuities – Wheaton College, IL – #35

Gift Annuities – Wheaton College, IL – #35

Gift Tax Archives – Future Wealth Navigator – #36

Gift Tax Archives – Future Wealth Navigator – #36

Gifts That Pay You Income – #37

Gifts That Pay You Income – #37

Income Tax on Gifts: Exemptions and computation – #38

Income Tax on Gifts: Exemptions and computation – #38

Gifts of Stocks Bonds and Other Securities | NRA Foundation – #39

Gifts of Stocks Bonds and Other Securities | NRA Foundation – #39

Give Today – Giving – Foundation – UW-Green Bay – #40

Give Today – Giving – Foundation – UW-Green Bay – #40

![Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will](https://www.taxreturnwala.com/wp-content/uploads/2020/03/Gift-Corel.dr_.0.025.png) Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will – #41

Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will – #41

SOLUTION: Income tax sections – Studypool – #42

SOLUTION: Income tax sections – Studypool – #42

Life income gifts | March of Dimes – #43

Life income gifts | March of Dimes – #43

New Jersey Gift Tax: All You Need to Know | SmartAsset – #44

New Jersey Gift Tax: All You Need to Know | SmartAsset – #44

Gift Tax, Explained: 2024 Exemptions and Rates | SmartAsset – #45

Gift Tax, Explained: 2024 Exemptions and Rates | SmartAsset – #45

Tax On Diwali Gifts: Tax Rate, Exemption, Limit; Here’s Everything You Need To Know – News18 – #46

Tax On Diwali Gifts: Tax Rate, Exemption, Limit; Here’s Everything You Need To Know – News18 – #46

Gift tax: Gift Tax Explained: Insights from the Internal Revenue Code – FasterCapital – #47

Gift tax: Gift Tax Explained: Insights from the Internal Revenue Code – FasterCapital – #47

Tax-favored gifts exemptions that give back — in any administration | Financial Planning – #48

Tax-favored gifts exemptions that give back — in any administration | Financial Planning – #48

Retirement Plan — Lifetime Gifts | Harper College Educational Foundation – #49

Retirement Plan — Lifetime Gifts | Harper College Educational Foundation – #49

Gifts That Pay You Income – Brigham and Women’s Hospital – #50

Gifts That Pay You Income – Brigham and Women’s Hospital – #50

when Gift is taxable ? when gift is Exempted ? | SIMPLE TAX INDIA – #51

when Gift is taxable ? when gift is Exempted ? | SIMPLE TAX INDIA – #51

State Law & State Taxation Corner – #52

State Law & State Taxation Corner – #52

Gifts Archives – Robert P. Russo CPA – #53

Gifts Archives – Robert P. Russo CPA – #53

- income tax gif

- what is gift tax

- gift tax example

Gift of Shares: Income Tax – #54

Gift of Shares: Income Tax – #54

Tax Implications (and Rewards) of Grandparents Taking Care of Grandchildren – The CPA Journal – #55

Tax Implications (and Rewards) of Grandparents Taking Care of Grandchildren – The CPA Journal – #55

How to calculate income tax on gifts from relatives? – #56

How to calculate income tax on gifts from relatives? – #56

- list of relatives

- service tax

- gift tax

- gift tax meaning

- gift tax exemption

- 709 gift splitting irs completed sample form 709 sample

Gift And Gift Card Taxation in Germany Simplified – #57

Gift And Gift Card Taxation in Germany Simplified – #57

You may get expensive gifts during the festive season: Are they taxable? – #58

You may get expensive gifts during the festive season: Are they taxable? – #58

Gifts from Foreign Corporations Included as Gross Income – #59

Gifts from Foreign Corporations Included as Gross Income – #59

A Brief Guide to the IRS Gift Tax | Small Business CPA – #60

A Brief Guide to the IRS Gift Tax | Small Business CPA – #60

How to gift assets to family members while cutting tax rates | Financial Planning – #61

How to gift assets to family members while cutting tax rates | Financial Planning – #61

Gift tax: what is it & how does it work? | Empower – #62

Gift tax: what is it & how does it work? | Empower – #62

What Non-residents need to learn about gift tax in Canada? – #63

What Non-residents need to learn about gift tax in Canada? – #63

How to Avoid Paying Gift Tax: 13 Steps (with Pictures) – wikiHow Life – #64

How to Avoid Paying Gift Tax: 13 Steps (with Pictures) – wikiHow Life – #64

A Tax-Smart Tip to Maximize Charitable Impact Using Your Traditional IRA | The Farther Outlook – #65

A Tax-Smart Tip to Maximize Charitable Impact Using Your Traditional IRA | The Farther Outlook – #65

Andrew College | Planned Giving | Giving Opportunities | College Donations – #66

Andrew College | Planned Giving | Giving Opportunities | College Donations – #66

Taxation of Gift under Income Tax Act 1961 – #67

Taxation of Gift under Income Tax Act 1961 – #67

Tax On Gifts: As Festive Season Nears, Know Tax Implications On Gifts You Receive – News18 – #68

Tax On Gifts: As Festive Season Nears, Know Tax Implications On Gifts You Receive – News18 – #68

5 Ways to Gift Yourself Tax Savings This Holiday Season – CPA Practice Advisor – #69

5 Ways to Gift Yourself Tax Savings This Holiday Season – CPA Practice Advisor – #69

The unique benefits of 529 college savings plans – #70

The unique benefits of 529 college savings plans – #70

Solved Gifts received are not subject to income taxation. | Chegg.com – #71

Solved Gifts received are not subject to income taxation. | Chegg.com – #71

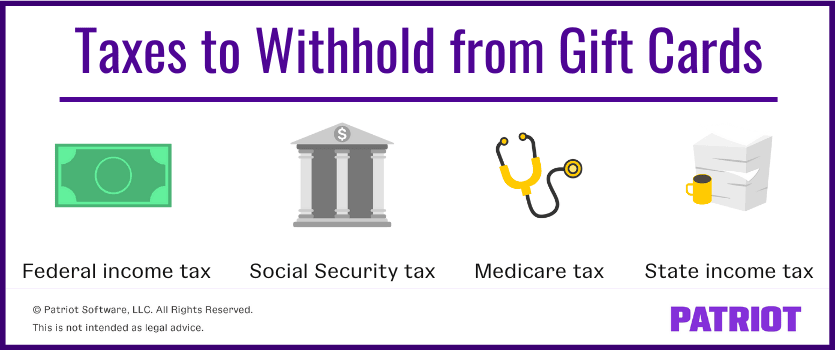

Gift Card Accounting, Part 2: The Rules for Tax – #72

Gift Card Accounting, Part 2: The Rules for Tax – #72

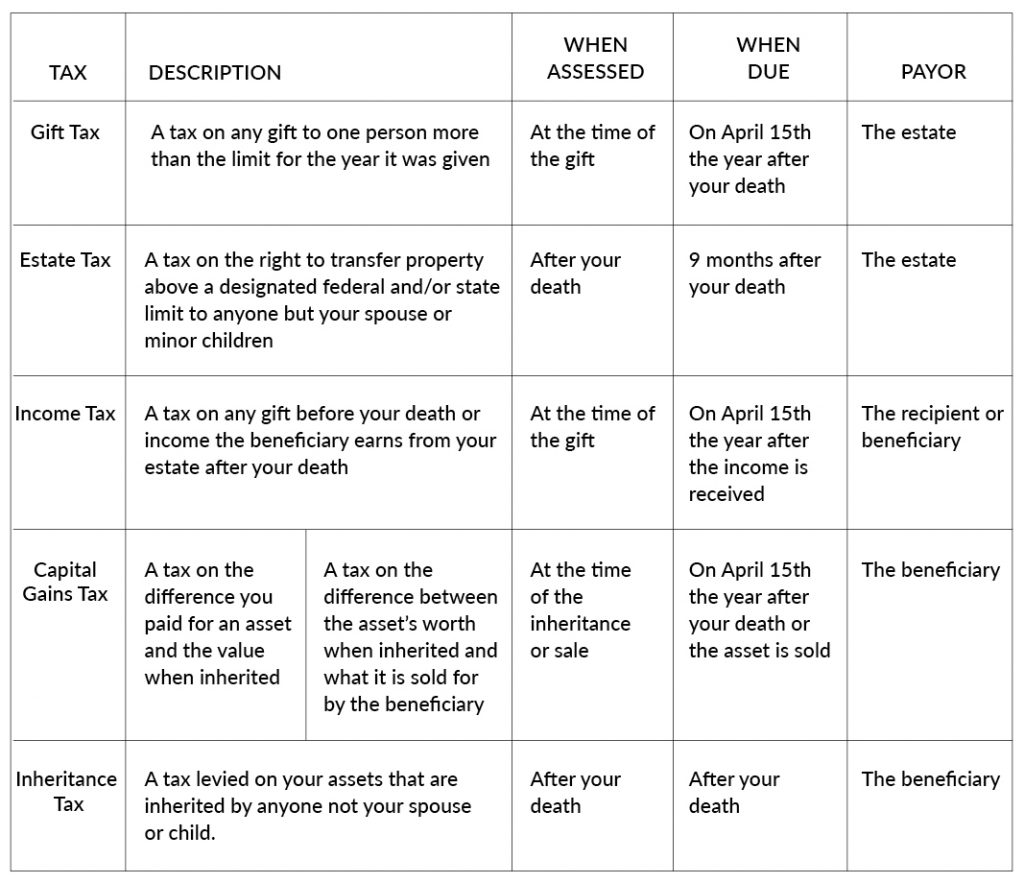

Five Taxes your Heirs May Pay (or not) After your Death | SSB LLC | Samuel, Sayward, & Baler LLC | Dedham, MA lawyers – #73

Five Taxes your Heirs May Pay (or not) After your Death | SSB LLC | Samuel, Sayward, & Baler LLC | Dedham, MA lawyers – #73

Date: APR “‘J / f”‘()”l5 – #74

Date: APR “‘J / f”‘()”l5 – #74

Income tax on gifts – US Tax Filing – #75

Income tax on gifts – US Tax Filing – #75

Gifts of Appreciated Securities Can Mean Tax Savings – Mass General Giving – #76

Gifts of Appreciated Securities Can Mean Tax Savings – Mass General Giving – #76

Know the tax impact on the gifts you receive – Goal Bridge – #77

Know the tax impact on the gifts you receive – Goal Bridge – #77

Taxation of gifts to NRIs and changes in Budget 2023-24 – #78

Taxation of gifts to NRIs and changes in Budget 2023-24 – #78

Tips to Avoid a Stressful 2023 Tax Season – Robbins LLP – #79

Tips to Avoid a Stressful 2023 Tax Season – Robbins LLP – #79

What is a Gift Tax? – #80

What is a Gift Tax? – #80

What is a gift deed and tax implications | Tax Hack – #81

What is a gift deed and tax implications | Tax Hack – #81

- income from other sources

- form 709 gift splitting example

- form 709

- lineal ascendant gift from relative exempt from income tax

- sample completed irs form 709 schedule a

Tax-Wise Options For Investing In Wyoming Public Media | Wyoming Public Media – #82

Tax-Wise Options For Investing In Wyoming Public Media | Wyoming Public Media – #82

How to Donate to Charity, Get a Tax Break and Have Income for Life – WSJ – #83

How to Donate to Charity, Get a Tax Break and Have Income for Life – WSJ – #83

Tax Answers – Chapter 3 | PDF | Gross Income | Internal Revenue Code – #84

Tax Answers – Chapter 3 | PDF | Gross Income | Internal Revenue Code – #84

How to Fill Out Form 709 | SmartAsset – #85

How to Fill Out Form 709 | SmartAsset – #85

Gifts of Grain in Mills County | Methodist Jennie Edmundson Foundation – #86

Gifts of Grain in Mills County | Methodist Jennie Edmundson Foundation – #86

federal estate gift taxes – AbeBooks – #87

federal estate gift taxes – AbeBooks – #87

Jordan Porco Foundation Planned Giving | Jordan Porco Foundation – #88

Jordan Porco Foundation Planned Giving | Jordan Porco Foundation – #88

Now What? Congress Considers Another Revamp of Estate and Gift Taxes – Lowenhaupt & Chasnoff – #89

Now What? Congress Considers Another Revamp of Estate and Gift Taxes – Lowenhaupt & Chasnoff – #89

Gifts of Appreciated Securities | Archdiocese of New York – #90

Gifts of Appreciated Securities | Archdiocese of New York – #90

- sample form 709 completed 2019

- 709 2020 gift tax sample completed irs form 709

- gift tax return form 709 example

Free tax preparation services available now in Washtenaw County – mlive.com – #91

Free tax preparation services available now in Washtenaw County – mlive.com – #91

ITR filing: Are you liable to pay tax on money received as gift? – #92

ITR filing: Are you liable to pay tax on money received as gift? – #92

Trust Agreement for Minor Qualifying for Annual Gift-Tax Exclusion; Beneficiary has Option to Continue Trust Past Age 21 – Gift Tax Income | US Legal Forms – #93

Trust Agreement for Minor Qualifying for Annual Gift-Tax Exclusion; Beneficiary has Option to Continue Trust Past Age 21 – Gift Tax Income | US Legal Forms – #93

Gifts of Real Estate – End of Life Choices New York – #94

Gifts of Real Estate – End of Life Choices New York – #94

Gifts received on marriage are not income and need not to be reported in the tax return | Mint – #95

Gifts received on marriage are not income and need not to be reported in the tax return | Mint – #95

Gifts Treated as Income – #96

Gifts Treated as Income – #96

Three Gifts That Pay You | Texas A&M Foundation – #97

Three Gifts That Pay You | Texas A&M Foundation – #97

Charitable Gift Annuity – George Snow Scholarship Fund – #98

Charitable Gift Annuity – George Snow Scholarship Fund – #98

- form 709 example 2021

- gift tax definition

- gift tax returns irs completed sample form 709 sample

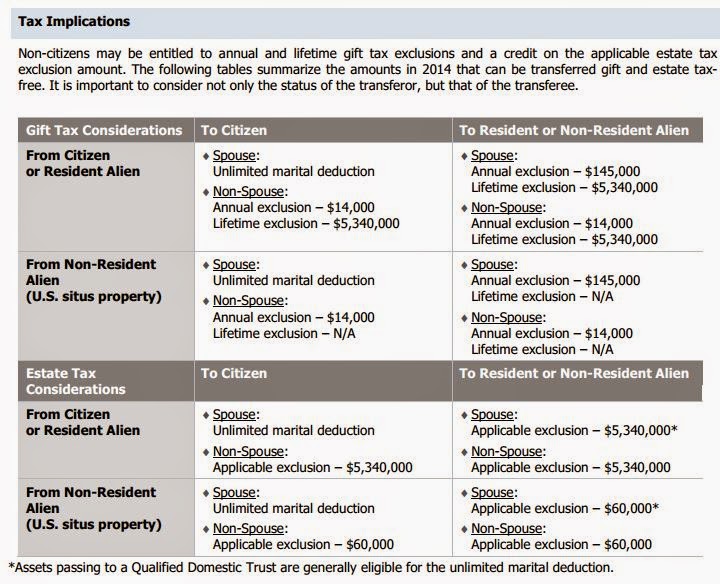

What You Need to Know About Gift & Estate Taxation – KEB – #99

What You Need to Know About Gift & Estate Taxation – KEB – #99

Ask the Expert: Are Employee Recognition ‘Gifts’ Taxable Income? – HR Daily Advisor – #100

Ask the Expert: Are Employee Recognition ‘Gifts’ Taxable Income? – HR Daily Advisor – #100

APPLICATION OF FEDERAL INCOME, ESTATE AND GIFT TAX LAWS TO COMMUNITY PROPERTY – #101

APPLICATION OF FEDERAL INCOME, ESTATE AND GIFT TAX LAWS TO COMMUNITY PROPERTY – #101

Income, Gift and Estate Tax Exemptions Updates for 2024 – Members Trust Company – #102

Income, Gift and Estate Tax Exemptions Updates for 2024 – Members Trust Company – #102

Historical Look at Estate and Gift Tax Rates | Wolters Kluwer – #103

Historical Look at Estate and Gift Tax Rates | Wolters Kluwer – #103

Posts: gift section in income tax

Categories: Gifts

Author: toyotabienhoa.edu.vn