Share more than 148 gift received from relative super hot

Update images of gift received from relative by website toyotabienhoa.edu.vn compilation. Solved 1. Future and present values Suppose a relative has | Chegg.com. TAXATION OF GIFTS RECEIVED – Here Are The Things You Need To Know – YouTube. Namastey Consultancy – Accounting & Taxation Service. Gift Received From Relatives Entry In Tally Erp9 6.5.4 – YouTube. ITR filing: Are gifts taxable in India? Salient clauses all income taxpayers must know | Zee Business

GIFT TAX ON SHARES & SECURITIES – Consult CA Online – #1

GIFT TAX ON SHARES & SECURITIES – Consult CA Online – #1

Know the tax impact on the gifts you receive – Goal Bridge – #2

Know the tax impact on the gifts you receive – Goal Bridge – #2

Christmas and New Year gifts could be taxable | Mint – #4

Christmas and New Year gifts could be taxable | Mint – #4

Understanding Section 56(2)(x) of Income Tax Act 1961: Taxation of Gifts Received – Marg ERP Blog – #5

Understanding Section 56(2)(x) of Income Tax Act 1961: Taxation of Gifts Received – Marg ERP Blog – #5

Income Tax on Diwali Gift: How Cash, Gold, Car and Property Gifts are Taxed – Income Tax News | The Financial Express – #6

Income Tax on Diwali Gift: How Cash, Gold, Car and Property Gifts are Taxed – Income Tax News | The Financial Express – #6

What You Need to Know Before Gifting Money to Family | Savant Wealth Management – #7

What You Need to Know Before Gifting Money to Family | Savant Wealth Management – #7

Monetary gift tax: Income tax on gift received from parents | Value Research – #8

Monetary gift tax: Income tax on gift received from parents | Value Research – #8

Decoding wedding gift taxation in India: Know ways to exempt it – #10

Decoding wedding gift taxation in India: Know ways to exempt it – #10

How Tax Authority Levy Tax on Diwali Gifts – Corpbiz – #11

How Tax Authority Levy Tax on Diwali Gifts – Corpbiz – #11

Receive A Gift From Relati | PDF | Charitable Organization | Tax Exemption – #12

Receive A Gift From Relati | PDF | Charitable Organization | Tax Exemption – #12

How to Graciously Let Others Know You Won’t Be Buying Them a Gift This Year – Gift Giving & Receiving, Teach By Example – Etiquette School of America | Maralee McKee – – #13

How to Graciously Let Others Know You Won’t Be Buying Them a Gift This Year – Gift Giving & Receiving, Teach By Example – Etiquette School of America | Maralee McKee – – #13

M.K. GUPTA CA EDUCATION INCOME TAX – #14

M.K. GUPTA CA EDUCATION INCOME TAX – #14

Vivek kochar & associates – chartered accountants – #15

Vivek kochar & associates – chartered accountants – #15

) Budget 2023: What is Gift Tax and why govt should abolish this? | Zee Business – #16

Budget 2023: What is Gift Tax and why govt should abolish this? | Zee Business – #16

Gift from USA to India: Taxation and Exemptions – SBNRI – #17

Gift from USA to India: Taxation and Exemptions – SBNRI – #17

GIFT DEED REGISTRATION » Shreeyansh Legal – #18

GIFT DEED REGISTRATION » Shreeyansh Legal – #18

Money gifted by relative in bank account is not liable to tax – Chirag Nangia – Nangia Andersen India Pvt. Ltd. – #19

Money gifted by relative in bank account is not liable to tax – Chirag Nangia – Nangia Andersen India Pvt. Ltd. – #19

) Section 56(2)(x): Taxability of Gifts – Pioneer One Consulting LLP – #20

Section 56(2)(x): Taxability of Gifts – Pioneer One Consulting LLP – #20

Taxes On Gifts From Overseas – #21

Taxes On Gifts From Overseas – #21

A relative is asking me to send them a signed W-9 form after sending me a cash wedding gift. Is this normal? : r/tax – #22

A relative is asking me to send them a signed W-9 form after sending me a cash wedding gift. Is this normal? : r/tax – #22

Property Gift Deed Registration – Sample Format, Charges & Rules – #23

Property Gift Deed Registration – Sample Format, Charges & Rules – #23

Office of Shree Tax Chambers on X: “Hot Off the Press!! May check today’s Deccan Herald’s National Edition Pg 9 | Shree’s ‘Got Deepavali Gifts? Know their tax implications’ appeared. Truly a – #24

Office of Shree Tax Chambers on X: “Hot Off the Press!! May check today’s Deccan Herald’s National Edition Pg 9 | Shree’s ‘Got Deepavali Gifts? Know their tax implications’ appeared. Truly a – #24

Gift by NRI to Resident Indian or Vice-Versa – NRI Gift Tax In India – #25

Gift by NRI to Resident Indian or Vice-Versa – NRI Gift Tax In India – #25

Gift received or given to relatives. How income tax is calculated? | Mint – #26

Gift received or given to relatives. How income tax is calculated? | Mint – #26

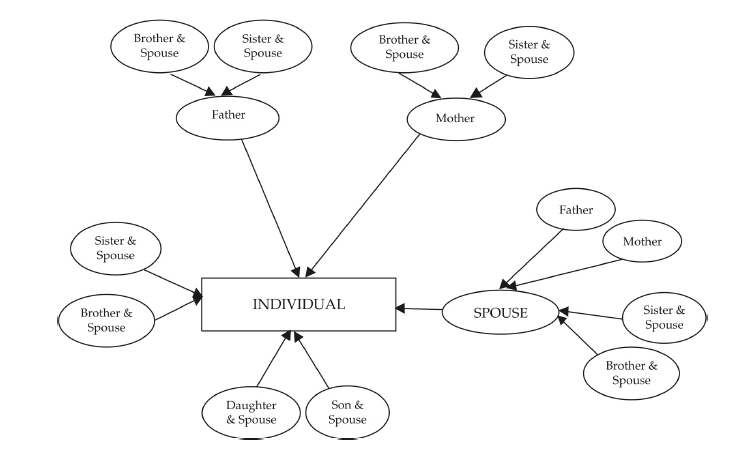

Article on the definition of Relatives… – CA Arjit Agarwal | Facebook – #27

Article on the definition of Relatives… – CA Arjit Agarwal | Facebook – #27

- income tax gif

- gift tax exemption relatives list

- gift tax definition

Gift Tax | Gift Tax In India | Gift Tax under Income Tax | Tax on Gift – #28

Gift Tax | Gift Tax In India | Gift Tax under Income Tax | Tax on Gift – #28

Income Tax Exemption On Gifts | Are The Gifts Above Rs 50,000 Taxable? | Personal Finance – YouTube – #29

Income Tax Exemption On Gifts | Are The Gifts Above Rs 50,000 Taxable? | Personal Finance – YouTube – #29

How to ensure the cash gift from parents doesn’t land you in tax trouble – Money News | The Financial Express – #30

How to ensure the cash gift from parents doesn’t land you in tax trouble – Money News | The Financial Express – #30

Gift Tax in India: Implications & Exemptions – myMoneySage Blog – #31

Gift Tax in India: Implications & Exemptions – myMoneySage Blog – #31

Taxation of Gifts received in Cash or Kind – #32

Taxation of Gifts received in Cash or Kind – #32

Tax queries: Gifts received from a relative are tax-exempt – The Economic Times – #33

Tax queries: Gifts received from a relative are tax-exempt – The Economic Times – #33

Will your ‘gift’ be taxed? – The Economic Times – #34

Will your ‘gift’ be taxed? – The Economic Times – #34

Free Gift Affidavit: Make & Download – Rocket Lawyer – #35

Free Gift Affidavit: Make & Download – Rocket Lawyer – #35

Gift SGB This Festive Season – ICICI Direct- ICICI Direct – #36

Gift SGB This Festive Season – ICICI Direct- ICICI Direct – #36

All about Income Tax on Gift Received From Parents. – #37

All about Income Tax on Gift Received From Parents. – #37

Gift Policy – #38

Gift Policy – #38

Tax exemption available if money is received from relative | Mint – #39

Tax exemption available if money is received from relative | Mint – #39

Are Cash Gifts from relatives exempt from Income tax? – #40

Are Cash Gifts from relatives exempt from Income tax? – #40

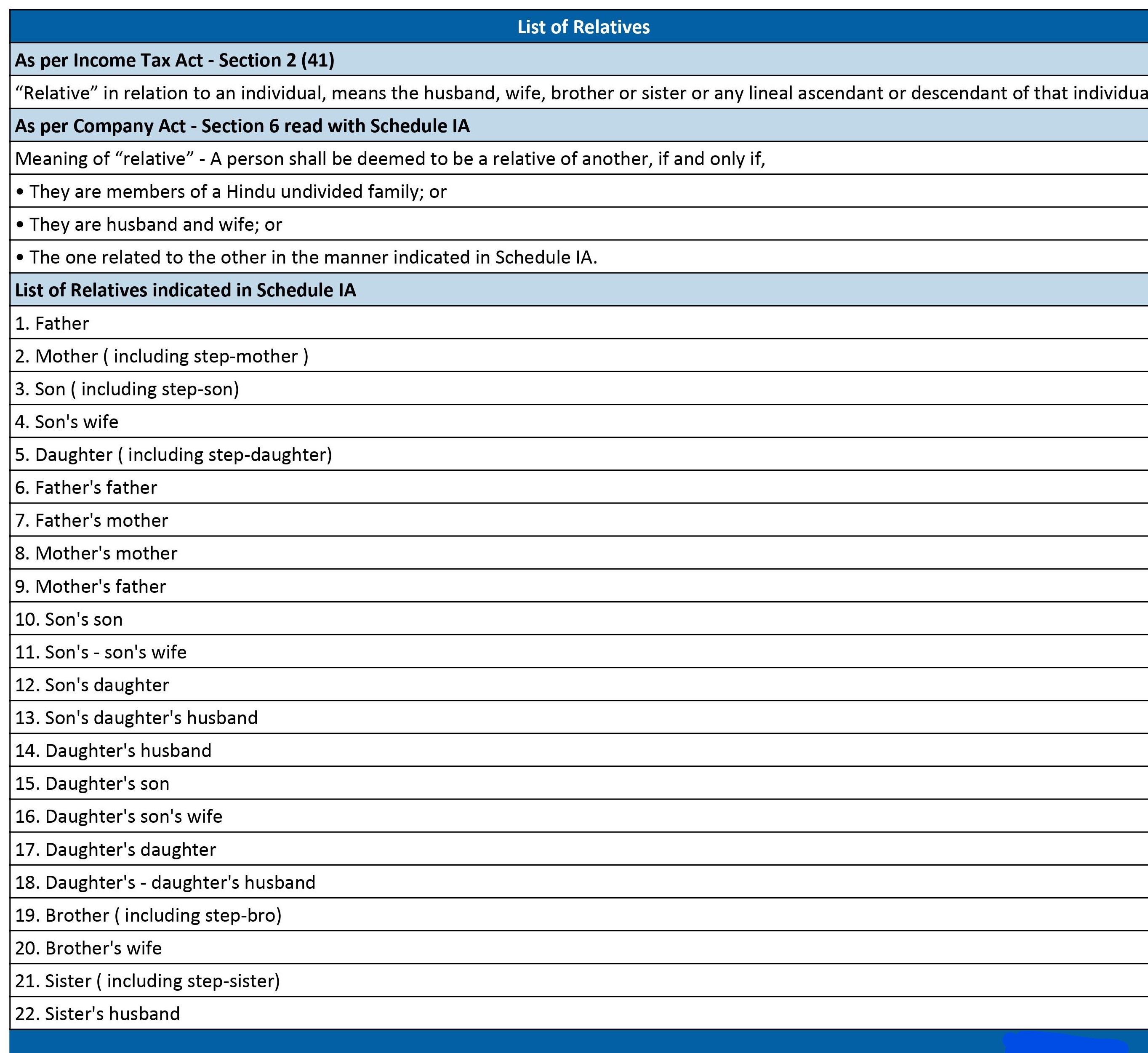

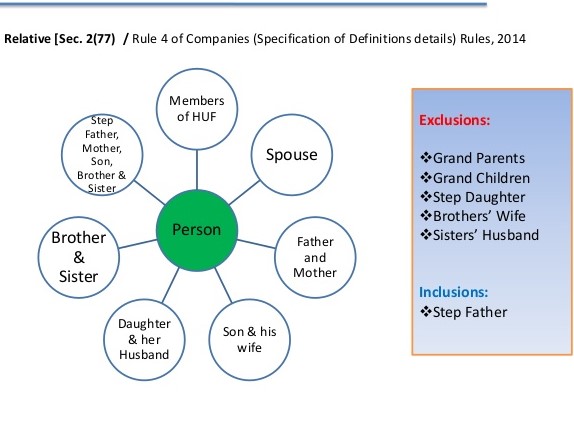

Analysis of definition of “Relative” under different Act – #41

Analysis of definition of “Relative” under different Act – #41

Income tax – “GIFT” Taxability under Income Tax Act,… | Facebook – #42

Income tax – “GIFT” Taxability under Income Tax Act,… | Facebook – #42

- gift from relative exempt from income tax

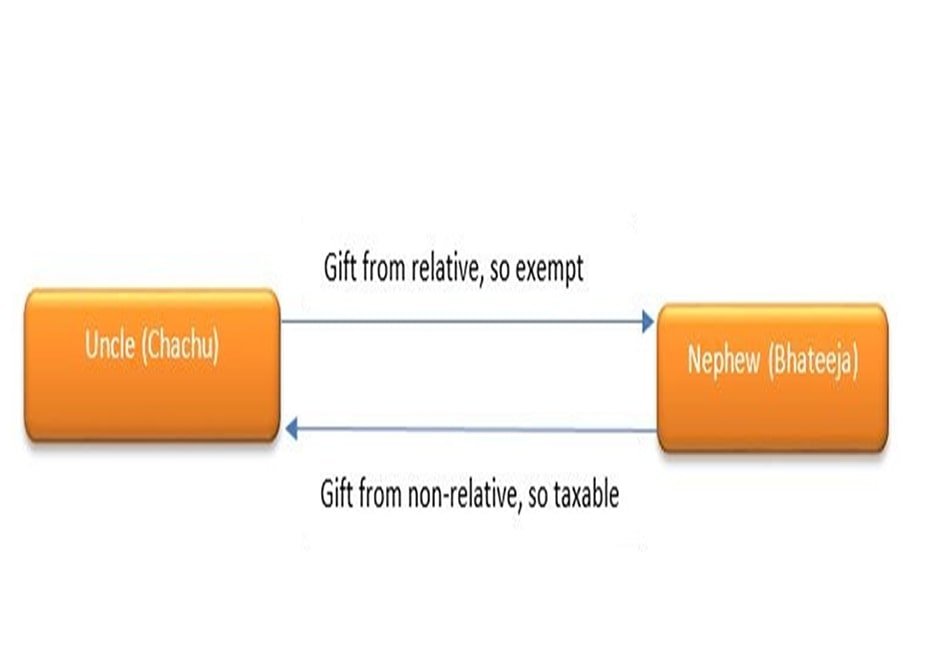

- gift tax example

- lineal ascendant meaning

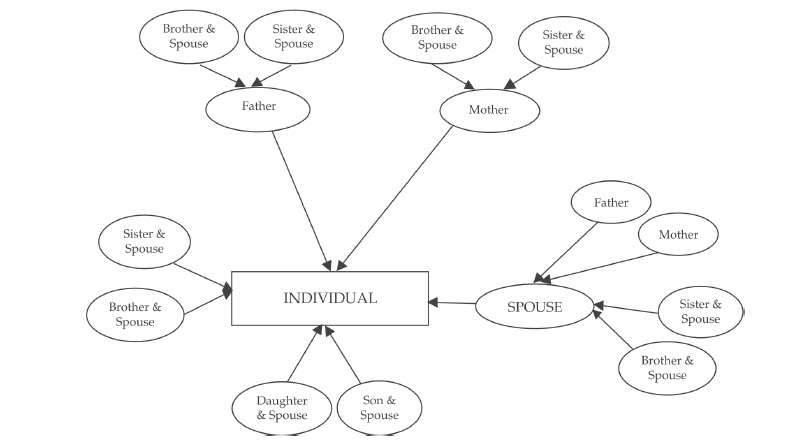

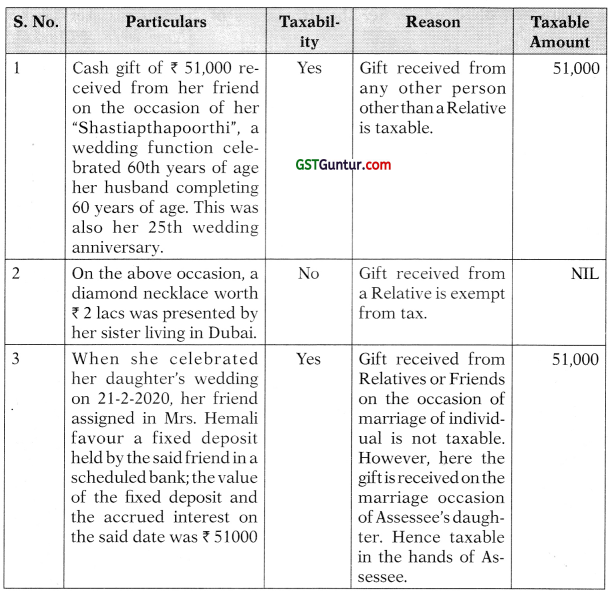

Meaning of Relative for Section 56(2) – GST Guntur – #43

Meaning of Relative for Section 56(2) – GST Guntur – #43

Income Tax: You do not have to pay tax on gift received on marriage or by will – Nangia Andersen India Pvt. Ltd. – #44

Income Tax: You do not have to pay tax on gift received on marriage or by will – Nangia Andersen India Pvt. Ltd. – #44

Gift of Immovable property under Income Tax Act – #45

Gift of Immovable property under Income Tax Act – #45

What’s the Right Way To Ask If Someone Has Received a Gift? – #46

What’s the Right Way To Ask If Someone Has Received a Gift? – #46

Gift Deed Registration: Stamp Duty, Registry Fee, Tax, Procedure – #47

Gift Deed Registration: Stamp Duty, Registry Fee, Tax, Procedure – #47

) Q & a income from other sources | PDF – #48

Q & a income from other sources | PDF – #48

Income tax filing: Are gifts taxable? Frequently asked questions on gift taxes | Zee Business – #49

Income tax filing: Are gifts taxable? Frequently asked questions on gift taxes | Zee Business – #49

Understanding Section 56(2)(x) of the Income Tax Act: Taxation of Gifts Received Without Consideration or for Inadequate Consideration – Marg ERP Blog – #50

Understanding Section 56(2)(x) of the Income Tax Act: Taxation of Gifts Received Without Consideration or for Inadequate Consideration – Marg ERP Blog – #50

Tax on Foreign Remittance in India: Sending & Receiving Money – #51

Tax on Foreign Remittance in India: Sending & Receiving Money – #51

Income Tax on Gift | Relative से पैसा लेने से पहले यह video ज़रूर देखना | Cash Gift Tax Rule 2023 | – YouTube – #52

Income Tax on Gift | Relative से पैसा लेने से पहले यह video ज़रूर देखना | Cash Gift Tax Rule 2023 | – YouTube – #52

GIFT TAX – UPSC Current Affairs – IAS GYAN – #53

GIFT TAX – UPSC Current Affairs – IAS GYAN – #53

Tax Treatment for gifts received from relatives – MN & Associates – #54

Tax Treatment for gifts received from relatives – MN & Associates – #54

How Are Foreign Inward Remittance Taxed In India – #55

How Are Foreign Inward Remittance Taxed In India – #55

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #56

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #56

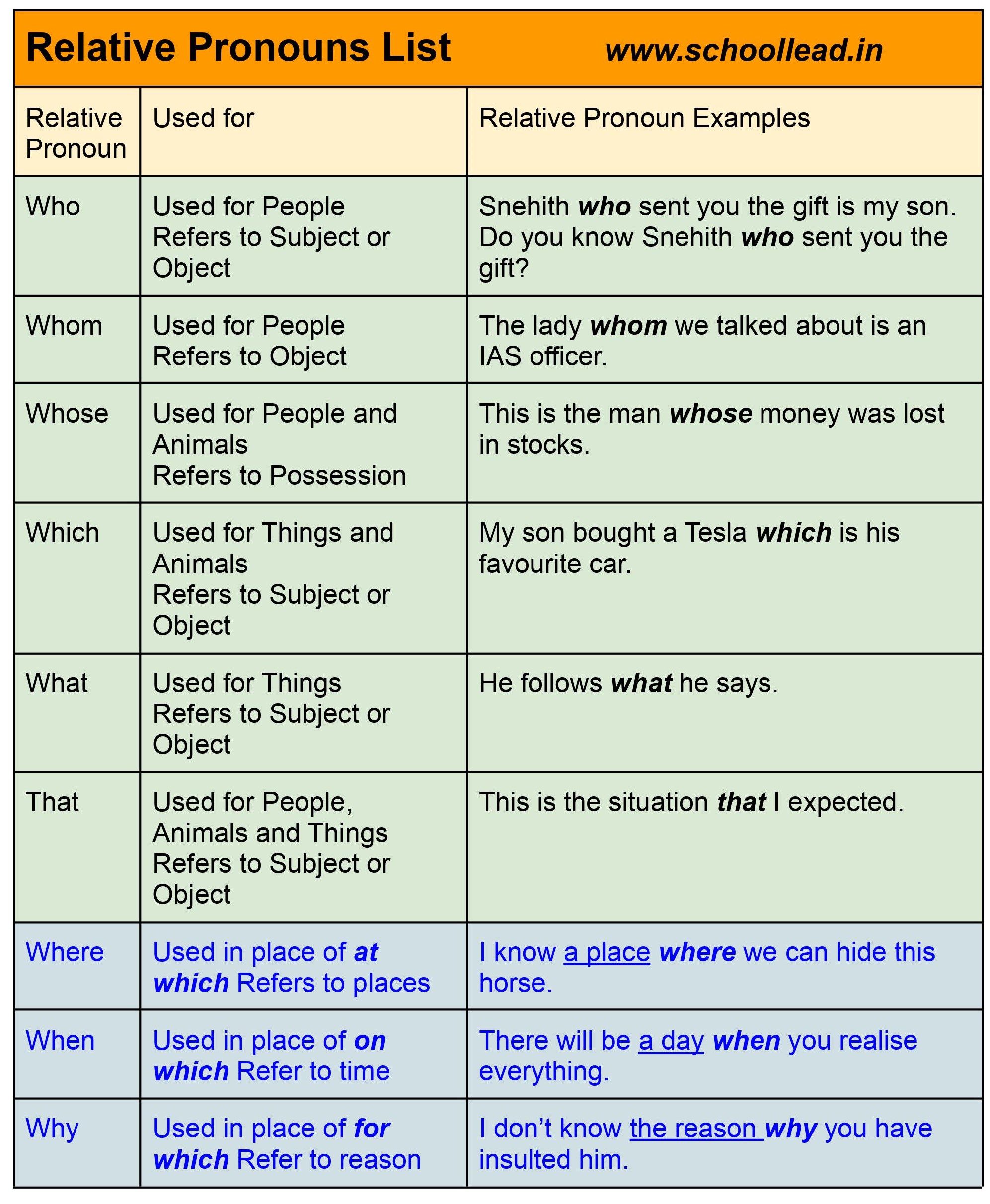

Relative Pronouns – School Lead – #57

Relative Pronouns – School Lead – #57

FREE Gift letter Template – Download in Word, Google Docs, PDF, Apple Pages, Outlook | Template.net – #58

FREE Gift letter Template – Download in Word, Google Docs, PDF, Apple Pages, Outlook | Template.net – #58

Down payment: gift or loan U.S. 2000-2019 | Statista – #59

Down payment: gift or loan U.S. 2000-2019 | Statista – #59

Cash gift received from a non-relative is regarded as income, but the exempt amount is _ p.a. A Rs. – Brainly.in – #60

Cash gift received from a non-relative is regarded as income, but the exempt amount is _ p.a. A Rs. – Brainly.in – #60

tax on diwali gifts: Will you be taxed on Diwali gifts received? Check how various sources of gifts will be taxed – The Economic Times – #61

tax on diwali gifts: Will you be taxed on Diwali gifts received? Check how various sources of gifts will be taxed – The Economic Times – #61

SOLVED: Gift received by Mr. Mohan from his friend amounts to R80,000, shall be OPTIONS exempt up to R 25,000 Or fully taxable Or fully exempt from tax Or exempt up to – #62

SOLVED: Gift received by Mr. Mohan from his friend amounts to R80,000, shall be OPTIONS exempt up to R 25,000 Or fully taxable Or fully exempt from tax Or exempt up to – #62

3 Ways to Deal with Not Being Thanked for a Gift – wikiHow – #63

3 Ways to Deal with Not Being Thanked for a Gift – wikiHow – #63

9 Bad Employee Gifts from Bosses | Client Giant – #64

9 Bad Employee Gifts from Bosses | Client Giant – #64

Best Bengali Wedding Gift Ideas For Couples – #65

Best Bengali Wedding Gift Ideas For Couples – #65

Down payment: gift or loan of first-time buyers U.S.2019 | Statista – #66

Down payment: gift or loan of first-time buyers U.S.2019 | Statista – #66

Do Cash Gifts Count as Income? • 1040.com Blog – #67

Do Cash Gifts Count as Income? • 1040.com Blog – #67

I received gifts during my wedding, are they taxable? – #68

I received gifts during my wedding, are they taxable? – #68

If my brother transfers money in my account, say 50 lakhs, will it be taxable in India? – Quora – #69

If my brother transfers money in my account, say 50 lakhs, will it be taxable in India? – Quora – #69

Now, Gift Received by NRI Non-Relative will be Taxable in India – #70

Now, Gift Received by NRI Non-Relative will be Taxable in India – #70

How Much to Spend on a Wedding Gift, According to Experts | Vogue – #71

How Much to Spend on a Wedding Gift, According to Experts | Vogue – #71

35 Best Gift Letter Templates (Word & PDF) ᐅ TemplateLab – #72

35 Best Gift Letter Templates (Word & PDF) ᐅ TemplateLab – #72

Gifting Money to Family Members: 5 Strategies to Understand – Kindness Financial Planning – #73

Gifting Money to Family Members: 5 Strategies to Understand – Kindness Financial Planning – #73

Income Tax on Cash Gift to Wife: How Much You Can Gift on Women’s Day Without Tax Implications – Income Tax News | The Financial Express – #74

Income Tax on Cash Gift to Wife: How Much You Can Gift on Women’s Day Without Tax Implications – Income Tax News | The Financial Express – #74

Income From Other Sources | PDF | Capital Gains Tax | Payments – #75

Income From Other Sources | PDF | Capital Gains Tax | Payments – #75

Things an NRI must know about gift tax rules in India | IDFC FIRST Bank – #76

Things an NRI must know about gift tax rules in India | IDFC FIRST Bank – #76

Amount received as gift by any blood relative living in US is not taxable in India | Mint – #77

Amount received as gift by any blood relative living in US is not taxable in India | Mint – #77

Your queries: Income Tax; You have to pay tax when you sell a gift received from a relative – Income Tax News | The Financial Express – #78

Your queries: Income Tax; You have to pay tax when you sell a gift received from a relative – Income Tax News | The Financial Express – #78

Section 56(2)(vii) : Cash / Non-Cash Gifts – #79

Section 56(2)(vii) : Cash / Non-Cash Gifts – #79

SOLVED: A single individual earned wages of 50,000 working at a bank. The individual received a6,000 gift from a parent to go to Europe, inherited 10,000 from a relative, and received500 interest – #80

SOLVED: A single individual earned wages of 50,000 working at a bank. The individual received a6,000 gift from a parent to go to Europe, inherited 10,000 from a relative, and received500 interest – #80

CA Harshil sheth on X: “Day 6 #IncometaxseriesbyHarshil Topic 9-Income From Other Source Topic 10-Taxability of GIFTS Topic 11-Tax on Unexplained Income Topic 12-Income from House Property (If Any mistake, Please let – #81

CA Harshil sheth on X: “Day 6 #IncometaxseriesbyHarshil Topic 9-Income From Other Source Topic 10-Taxability of GIFTS Topic 11-Tax on Unexplained Income Topic 12-Income from House Property (If Any mistake, Please let – #81

A relative wants to gift cash to me. What are the income tax implications? | Mint – #82

A relative wants to gift cash to me. What are the income tax implications? | Mint – #82

Nri Gift Tax In India – #83

Nri Gift Tax In India – #83

Gift I received from a relative from Mongolia. It’s an indigo coloured sweater made out of cashmere. Anyone know this brand? Would like to learn about it a bit more 🙂 : – #84

Gift I received from a relative from Mongolia. It’s an indigo coloured sweater made out of cashmere. Anyone know this brand? Would like to learn about it a bit more 🙂 : – #84

-Gifts.jpg) InvestorZclub: Gift Tax in India: Rules, Rates, Exclusion & Limit – #85

InvestorZclub: Gift Tax in India: Rules, Rates, Exclusion & Limit – #85

Solved 1. Future and present values Suppose a relative has | Chegg.com – #86

Solved 1. Future and present values Suppose a relative has | Chegg.com – #86

Tax – Articles, Insights of Income Tax Act in India – #87

Tax – Articles, Insights of Income Tax Act in India – #87

Gift by NRI to Resident Indian or Vice-Versa — NRI Gift Tax In India – Wisenri – Medium – #88

Gift by NRI to Resident Indian or Vice-Versa — NRI Gift Tax In India – Wisenri – Medium – #88

50+ SAMPLE Gift Letters in PDF – #89

50+ SAMPLE Gift Letters in PDF – #89

What’s the difference between a gift and taxable income for tax purposes? For example, I received a gift card from my friend after I helped him with homework. Is this considered to – #90

What’s the difference between a gift and taxable income for tax purposes? For example, I received a gift card from my friend after I helped him with homework. Is this considered to – #90

HP to GOT Printed Kitchen Tea Towel-fun Gift-friend-relative-neighbor-birthday-kitchen-chef-fandom-lotr-hp-got-fall-sw-geeky-nerd-st Patrick – Etsy – #91

HP to GOT Printed Kitchen Tea Towel-fun Gift-friend-relative-neighbor-birthday-kitchen-chef-fandom-lotr-hp-got-fall-sw-geeky-nerd-st Patrick – Etsy – #91

NRI Gift Tax India: Rules for Tax On Gift Money In India | DBS Treasures – #92

NRI Gift Tax India: Rules for Tax On Gift Money In India | DBS Treasures – #92

Money received from relative is gift and exempt from tax – #93

Money received from relative is gift and exempt from tax – #93

Income tax and other related financial information 2019-20 INDIA uploaded by T james joseph Adhikarathil | PDF – #94

Income tax and other related financial information 2019-20 INDIA uploaded by T james joseph Adhikarathil | PDF – #94

Income tax on gifts: Gift received from relatives is tax free | Mint – #95

Income tax on gifts: Gift received from relatives is tax free | Mint – #95

Contacted about a long-lost relative’s inheritance? Hold on a minute | Consumer Advice – #96

Contacted about a long-lost relative’s inheritance? Hold on a minute | Consumer Advice – #96

Gift Deed in India – Registration Process, Documents & Tax Exemption – #97

Gift Deed in India – Registration Process, Documents & Tax Exemption – #97

2,033 Birthday Money Stock Photos, High-Res Pictures, and Images – Getty Images – #98

2,033 Birthday Money Stock Photos, High-Res Pictures, and Images – Getty Images – #98

Income Tax Return Filing: Are wedding gifts really tax free? All hidden clauses, conditions explained | Zee Business – #99

Income Tax Return Filing: Are wedding gifts really tax free? All hidden clauses, conditions explained | Zee Business – #99

- gift tax rate in india 2020

- section 56(2) of income tax act

- gift tax rate

- gift tax in india

- gift tax meaning

- money gift deed format

ITR : Disclosure and taxation of gifts received from brother? | Mint – #100

ITR : Disclosure and taxation of gifts received from brother? | Mint – #100

![Tax on money received from abroad to India [Oct 2020] - Wise Tax on money received from abroad to India [Oct 2020] - Wise](https://cms.ezylegal.in/wp-content/uploads/2022/11/Gift-from-Father-to-Daughter.jpg) Tax on money received from abroad to India [Oct 2020] – Wise – #101

Tax on money received from abroad to India [Oct 2020] – Wise – #101

- gift chart as per income tax

- gift tax act 1958

- list of relatives

When Gifts Become Taxing – #102

When Gifts Become Taxing – #102

How to calculate income tax on gifts from relatives? – #103

How to calculate income tax on gifts from relatives? – #103

Income tax on a gift from father to daughter – #104

Income tax on a gift from father to daughter – #104

Taxation on gifts: Everything you need to know | Tax Hacks – #105

Taxation on gifts: Everything you need to know | Tax Hacks – #105

Income tax on gifts: Know when your gift is tax-free – BusinessToday – #106

Income tax on gifts: Know when your gift is tax-free – BusinessToday – #106

Thank You Messages Examples and Wording Ideas – Best Advice – SimplyNoted – #107

Thank You Messages Examples and Wording Ideas – Best Advice – SimplyNoted – #107

Stamp duty on gift deed in blood relatives – #108

Stamp duty on gift deed in blood relatives – #108

Guide: Best Gift Options For Friends & Family This Diwali – #109

Guide: Best Gift Options For Friends & Family This Diwali – #109

If I Gift 1cr to my mother is it exempt or taxable? – Quora – #110

If I Gift 1cr to my mother is it exempt or taxable? – Quora – #110

How to gift stocks, bonds and ETFs and the tax implications – Z-Connect by Zerodha – #111

How to gift stocks, bonds and ETFs and the tax implications – Z-Connect by Zerodha – #111

Tax on Gifts in India | Exemption and Rules | EZTax® – #112

Tax on Gifts in India | Exemption and Rules | EZTax® – #112

Income Tax: Will Gifting Of Shares To Spouse Be Taxable? – News18 – #113

Income Tax: Will Gifting Of Shares To Spouse Be Taxable? – News18 – #113

This Is By Far The Rudest Thing Newlyweds Could Ask Of A Guest | HuffPost Life – #114

This Is By Far The Rudest Thing Newlyweds Could Ask Of A Guest | HuffPost Life – #114

Different Ways to Say Thank-You — Emily Post – #115

Different Ways to Say Thank-You — Emily Post – #115

- lineal ascendant gift from relative exempt from income tax

- gift tax rate in india 2022-23

- gift tax exemption 2022

Taxability of gifts | PDF – #116

Taxability of gifts | PDF – #116

Tying the Knot and Taxes: Unraveling the Wedding Gift Dilemma💑🌏🤵👸⭐ – #117

Tying the Knot and Taxes: Unraveling the Wedding Gift Dilemma💑🌏🤵👸⭐ – #117

Taxmann Daily – #118

Taxmann Daily – #118

Money received as gift from relative is not taxed | Mint – #119

Money received as gift from relative is not taxed | Mint – #119

Taxation of gifts to NRIs and changes in Budget 2023-24 – #120

Taxation of gifts to NRIs and changes in Budget 2023-24 – #120

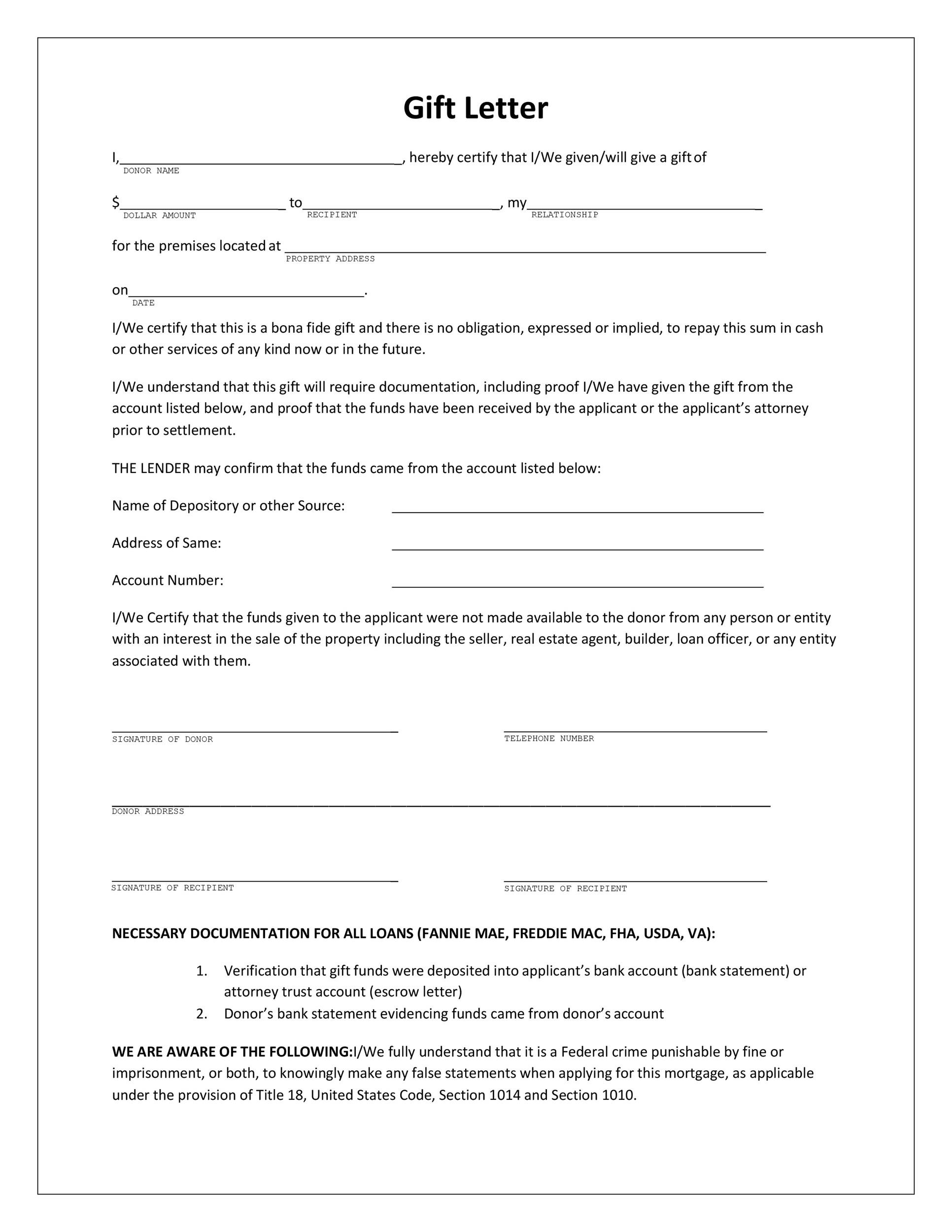

Gift Letter | How to use a gift to buy a home – #121

Gift Letter | How to use a gift to buy a home – #121

Interplay of Will, Gift and Relinquishment Deed in the Indian context – COMMERCIAL LAW BLOG – #122

Interplay of Will, Gift and Relinquishment Deed in the Indian context – COMMERCIAL LAW BLOG – #122

TAXABILITY OF GIFTS—SOME INTERESTING ISSUES – #123

TAXABILITY OF GIFTS—SOME INTERESTING ISSUES – #123

What is a gift deed and tax implications | Tax Hack – #124

What is a gift deed and tax implications | Tax Hack – #124

Weddings & Tax Implications of Cash Gifts | by CA Tanuja Gupta -YourTaxAdvisor& EquityFundManager | Feb, 2024 | Medium – #125

Weddings & Tax Implications of Cash Gifts | by CA Tanuja Gupta -YourTaxAdvisor& EquityFundManager | Feb, 2024 | Medium – #125

- gift for boys

- expenditure tax act

- wealth tax

For Gift Giving, Research Shows It’s the Thought That Counts – #126

For Gift Giving, Research Shows It’s the Thought That Counts – #126

Namastey Consultancy – Accounting & Taxation Service – #127

Namastey Consultancy – Accounting & Taxation Service – #127

Describe the best gift you have ever received – IELTS Cue Card – #128

Describe the best gift you have ever received – IELTS Cue Card – #128

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #129

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #129

Section 56(2)(X) of Income Tax Act – Tax Implication on Gifts – #130

Section 56(2)(X) of Income Tax Act – Tax Implication on Gifts – #130

Income Tax on Gift – #131

Income Tax on Gift – #131

Taxability of Gifts – #132

Taxability of Gifts – #132

Understanding Section 56(2)(x) of Income Tax Act, 1961: Tax Implications of Gifts Received Without Consideration – Marg ERP Blog – #133

Understanding Section 56(2)(x) of Income Tax Act, 1961: Tax Implications of Gifts Received Without Consideration – Marg ERP Blog – #133

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #134

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #134

gift tax payment by donar/donee???? – Income Tax | Tax queries – #135

gift tax payment by donar/donee???? – Income Tax | Tax queries – #135

Definition of Relatives for the purpose of Income Tax Act, 1961- Taxwink – #136

Definition of Relatives for the purpose of Income Tax Act, 1961- Taxwink – #136

Income from Other Sources – CA Inter Tax Study Material – GST Guntur – #137

Income from Other Sources – CA Inter Tax Study Material – GST Guntur – #137

ITR filing — gifts need to be declared and here you see how they are taxed – #138

ITR filing — gifts need to be declared and here you see how they are taxed – #138

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #139

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #139

What Is the Process to Gift a House to My Blood Relative? – #140

What Is the Process to Gift a House to My Blood Relative? – #140

How to Write a Memorial Donation Family Notification Letter – Bloomerang – #141

How to Write a Memorial Donation Family Notification Letter – Bloomerang – #141

Spiritual Gifts Inventory – #142

Spiritual Gifts Inventory – #142

How do big gifts affect rival charities and their donors? – ScienceDirect – #143

How do big gifts affect rival charities and their donors? – ScienceDirect – #143

GIFT POLICY What is gift? A “Gift” means anything of value, including – but not limited to cash, favourable terms or disc – #144

GIFT POLICY What is gift? A “Gift” means anything of value, including – but not limited to cash, favourable terms or disc – #144

All you need to know about taxes on gifts and the exceptions | Mint – #145

All you need to know about taxes on gifts and the exceptions | Mint – #145

Who gives wealth transfers to whom and when? Patterns in the giving and receiving of lifetime gifts and loans | Institute for Fiscal Studies – #146

Who gives wealth transfers to whom and when? Patterns in the giving and receiving of lifetime gifts and loans | Institute for Fiscal Studies – #146

Now gift stocks and ETFs to your friends and loved ones – Stocks – Trading Q&A by Zerodha – All your queries on trading and markets answered – #147

Now gift stocks and ETFs to your friends and loved ones – Stocks – Trading Q&A by Zerodha – All your queries on trading and markets answered – #147

Tax On Gifts: As Festive Season Nears, Know Tax Implications On Gifts You Receive – News18 – #148

Tax On Gifts: As Festive Season Nears, Know Tax Implications On Gifts You Receive – News18 – #148

Posts: gift received from relative

Categories: Gifts

Author: toyotabienhoa.edu.vn