Top 198+ gift provision in income tax latest

Update images of gift provision in income tax by website toyotabienhoa.edu.vn compilation. Income from other sources | Part 1 in Tamil || Format for Computation of income from other sources – YouTube. EXPLANATION OF PROPOSED ESTATE AND GIFT TAX TREATY BETWEEN THE UNITED STATES AND THE REPUBLIC OF AUSTRIA COMMITTEE ON FOREIGN RE. Is there a limit in income tax laws up to which a father can gift to his son. Procedure for Gift deed registration: A Step By Step Guide – Corpbiz

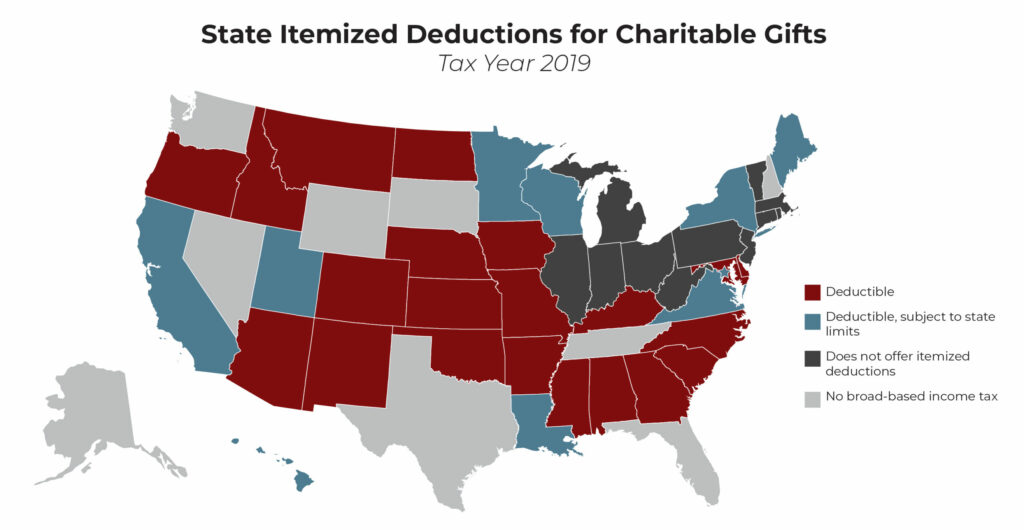

State Itemized Deductions: Surveying the Landscape, Exploring Reforms – ITEP – #1

State Itemized Deductions: Surveying the Landscape, Exploring Reforms – ITEP – #1

Increased Estate Tax Exemption Sunsets the end of 2025 – #2

Increased Estate Tax Exemption Sunsets the end of 2025 – #2

Tax implications on Gifting Shares – Enterslice Pvt Ltd – #4

Tax implications on Gifting Shares – Enterslice Pvt Ltd – #4

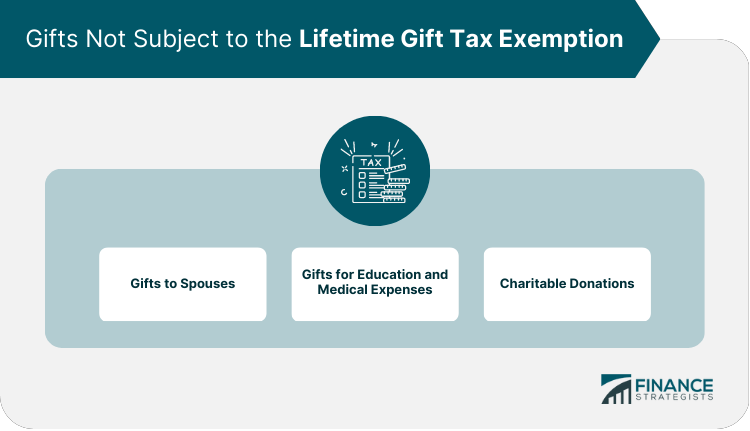

Gifting money in the US: all you need to know | WorldRemit – #5

Gifting money in the US: all you need to know | WorldRemit – #5

- deemed income

- gift tax example

- gift tax return

Is a gift to NRI by a resident Indian who is a relative taxable? – Quora – #6

Is a gift to NRI by a resident Indian who is a relative taxable? – Quora – #6

PPT – Income from other sources. PowerPoint Presentation, free download – ID:3090965 – #7

PPT – Income from other sources. PowerPoint Presentation, free download – ID:3090965 – #7

Income Tax Act, 1961 : a comprehensive overview – iPleaders – #8

Income Tax Act, 1961 : a comprehensive overview – iPleaders – #8

Know this rule of TDS on gifts and incentives, it will be applicable from July 1 TAXCONCEPT – #10

Know this rule of TDS on gifts and incentives, it will be applicable from July 1 TAXCONCEPT – #10

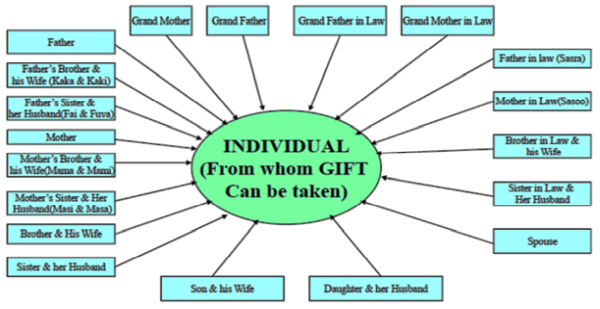

Gift Tax: Relative Transactions – #11

Gift Tax: Relative Transactions – #11

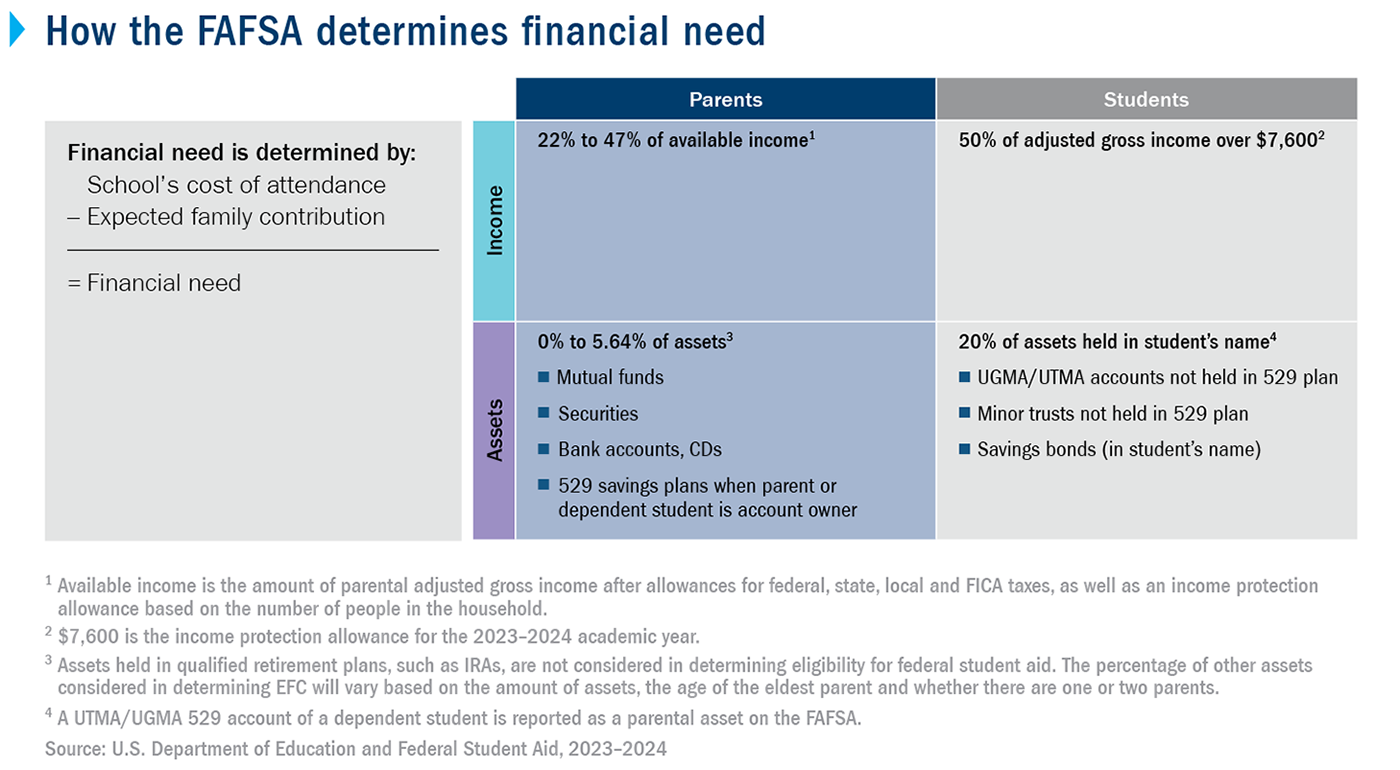

Why grandparents have greater incentive to own 529 accounts | Columbia Threadneedle Blog – #12

Why grandparents have greater incentive to own 529 accounts | Columbia Threadneedle Blog – #12

How is a gift perquisite amount taxed in India? If it is more than 5000, is the entire amount taxed or just the amount that exceeds 5000? – Quora – #13

How is a gift perquisite amount taxed in India? If it is more than 5000, is the entire amount taxed or just the amount that exceeds 5000? – Quora – #13

Gift Deed Format in India » Legal Window – #14

Gift Deed Format in India » Legal Window – #14

Exploring the estate tax: Part 2 – Journal of Accountancy – #15

Exploring the estate tax: Part 2 – Journal of Accountancy – #15

Union Budget 2023: What Is Gift Tax And When Is It Exempted? – News18 – #16

Union Budget 2023: What Is Gift Tax And When Is It Exempted? – News18 – #16

Gift from Non-Relatives – A tool for tax planning – TaxReturnWala – #17

Gift from Non-Relatives – A tool for tax planning – TaxReturnWala – #17

Taxability of Gift under Income Tax| What are situation when gifts are exempt from tax| – YouTube – #18

Taxability of Gift under Income Tax| What are situation when gifts are exempt from tax| – YouTube – #18

Preparing for the Tax Cuts and Jobs Act Sunset at the End of 2025 | Bailey Wealth Advisors – #19

Preparing for the Tax Cuts and Jobs Act Sunset at the End of 2025 | Bailey Wealth Advisors – #19

Gift tax presentation | PPT – #20

Gift tax presentation | PPT – #20

Proposed Impactful Tax Law Changes and What You Can Do Now – Johnson Pope Bokor Ruppel & Burns, LLP. – #21

Proposed Impactful Tax Law Changes and What You Can Do Now – Johnson Pope Bokor Ruppel & Burns, LLP. – #21

Solved Noah and Sophia want to make a maximum contribution | Chegg.com – #22

Solved Noah and Sophia want to make a maximum contribution | Chegg.com – #22

New Higher Estate And Gift Tax Limits For 2022: Couples Can Pass On $720,000 More Tax Free – #23

New Higher Estate And Gift Tax Limits For 2022: Couples Can Pass On $720,000 More Tax Free – #23

What is the Stepped-Up Basis, and Why Does the Biden Administration Want to Eliminate It? – #24

What is the Stepped-Up Basis, and Why Does the Biden Administration Want to Eliminate It? – #24

Budget 2024 Income Tax Expectations: Top 10 Things FM Sitharaman Should Do | Business – Times of India – #25

Budget 2024 Income Tax Expectations: Top 10 Things FM Sitharaman Should Do | Business – Times of India – #25

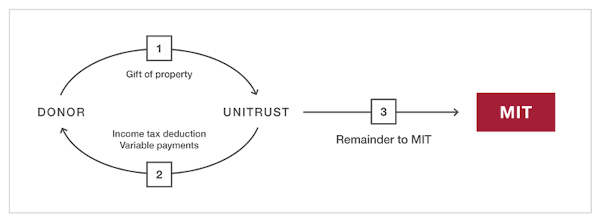

Charitable Remainder Unitrust and NIMCRUT: Tax-Savvy Giving – #26

Charitable Remainder Unitrust and NIMCRUT: Tax-Savvy Giving – #26

Provisions Related to Advance Tax under Income Tax Act, 1961 by Munimji Training and Placement Academy – Issuu – #27

Provisions Related to Advance Tax under Income Tax Act, 1961 by Munimji Training and Placement Academy – Issuu – #27

![Capital Gain Exemption u/s 54B not allowed if land is purchased in name of wife [Read Judgement] Capital Gain Exemption u/s 54B not allowed if land is purchased in name of wife [Read Judgement]](https://www.legalraasta.com/blog/wp-content/uploads/2021/11/Role-of-fund-manager-in-mutual-funds-16-1280x720.png) Capital Gain Exemption u/s 54B not allowed if land is purchased in name of wife [Read Judgement] – #28

Capital Gain Exemption u/s 54B not allowed if land is purchased in name of wife [Read Judgement] – #28

Countdown for Gift and Estate Tax Exemptions | Charles Schwab – #29

Countdown for Gift and Estate Tax Exemptions | Charles Schwab – #29

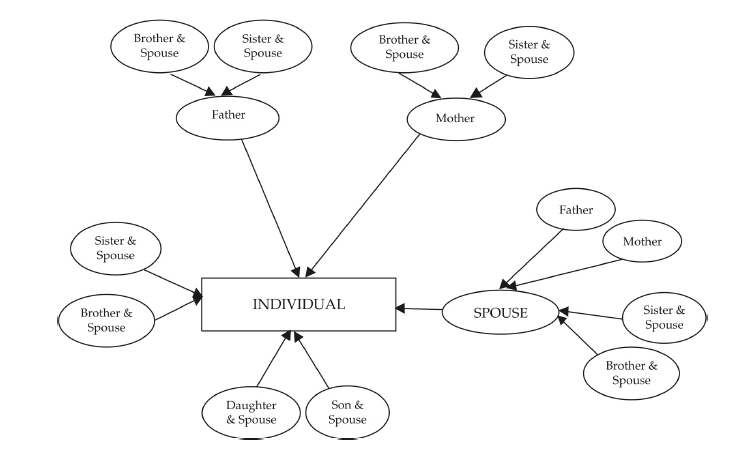

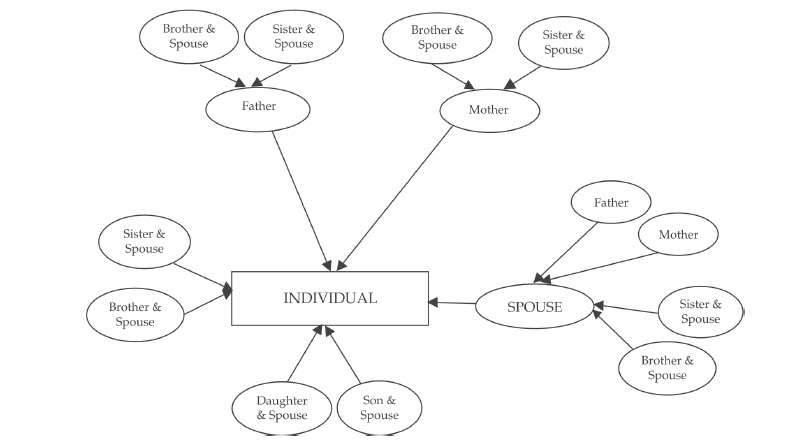

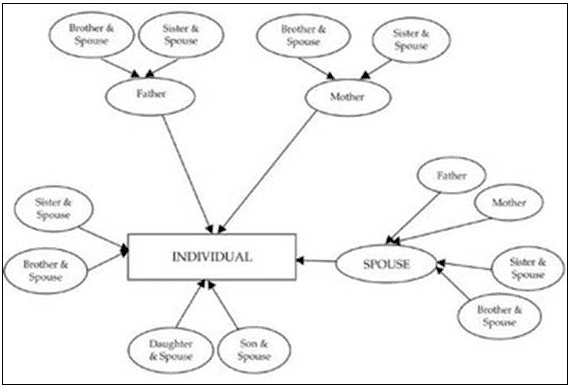

Definition of Relatives for the purpose of Income Tax Act, 1961- Taxwink – #30

Definition of Relatives for the purpose of Income Tax Act, 1961- Taxwink – #30

Business Tax Tips – Are staff and client gifts tax-deductible and when does FBT apply? – #31

Business Tax Tips – Are staff and client gifts tax-deductible and when does FBT apply? – #31

Minnesota Gift Tax: All You Need to Know | SmartAsset – #32

Minnesota Gift Tax: All You Need to Know | SmartAsset – #32

What it Means to Make a Gift Under the Federal Gift Tax System – Agency One – #33

What it Means to Make a Gift Under the Federal Gift Tax System – Agency One – #33

When You Make Cash Gifts To Your Children, Who Pays The Tax? | Greenbush Financial Group – #34

When You Make Cash Gifts To Your Children, Who Pays The Tax? | Greenbush Financial Group – #34

Income Tax Provisions For A Teenager In India – #35

Income Tax Provisions For A Teenager In India – #35

11 Big Tax Changes on the Horizon | Northwestern Mutual – #36

11 Big Tax Changes on the Horizon | Northwestern Mutual – #36

![Updated] Income Tax Changes in the New FY 2022-23 (AY 2023-24) - Online Demat, Trading, and Mutual Fund Investment in India - Fisdom Updated] Income Tax Changes in the New FY 2022-23 (AY 2023-24) - Online Demat, Trading, and Mutual Fund Investment in India - Fisdom](https://images.livemint.com/img/2023/02/14/original/gift_1676358107458.jpg) Updated] Income Tax Changes in the New FY 2022-23 (AY 2023-24) – Online Demat, Trading, and Mutual Fund Investment in India – Fisdom – #37

Updated] Income Tax Changes in the New FY 2022-23 (AY 2023-24) – Online Demat, Trading, and Mutual Fund Investment in India – Fisdom – #37

Reporting Considerations Approaching Tax Provision Season – #38

Reporting Considerations Approaching Tax Provision Season – #38

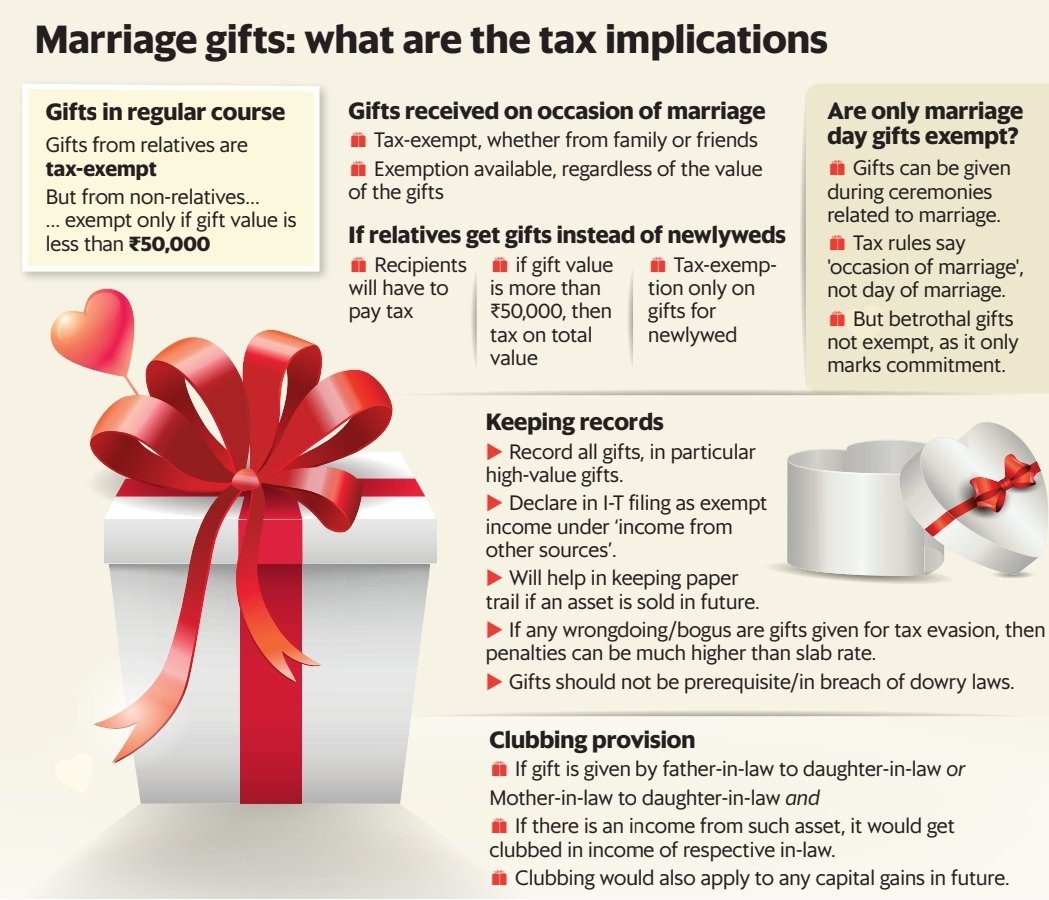

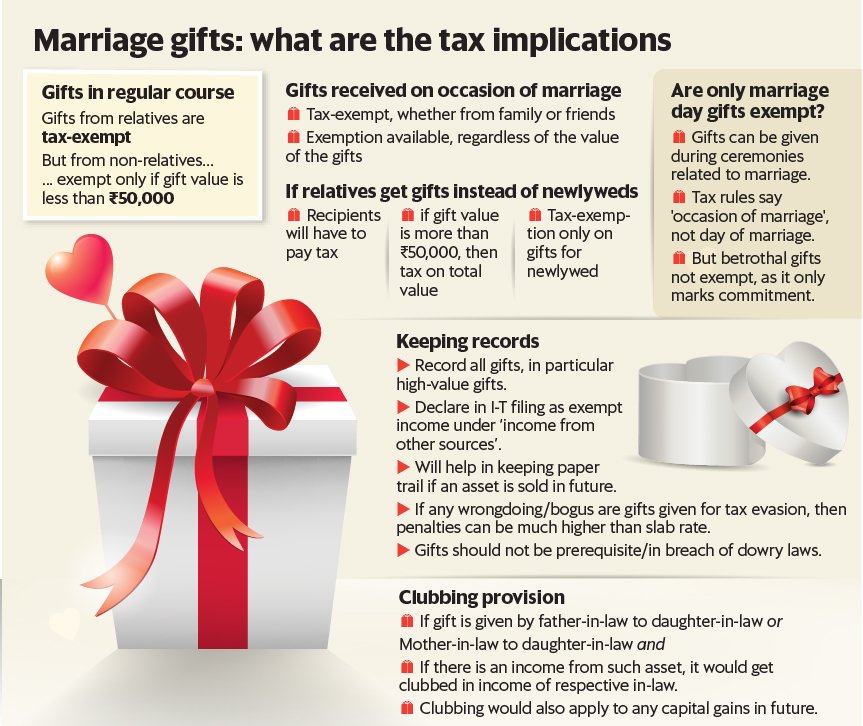

Decoding wedding gift taxation in India: Know ways to exempt it – #39

Decoding wedding gift taxation in India: Know ways to exempt it – #39

Estate Tax Exemption: How Much It Is and How to Calculate It – #40

Estate Tax Exemption: How Much It Is and How to Calculate It – #40

Income tax returns (ITR) filing: Marriage to divorce, this is how spouses can be impacted | Zee Business – #41

Income tax returns (ITR) filing: Marriage to divorce, this is how spouses can be impacted | Zee Business – #41

Union Budget 2022 – Tax Proposals – Blog by Tickertape – #42

Union Budget 2022 – Tax Proposals – Blog by Tickertape – #42

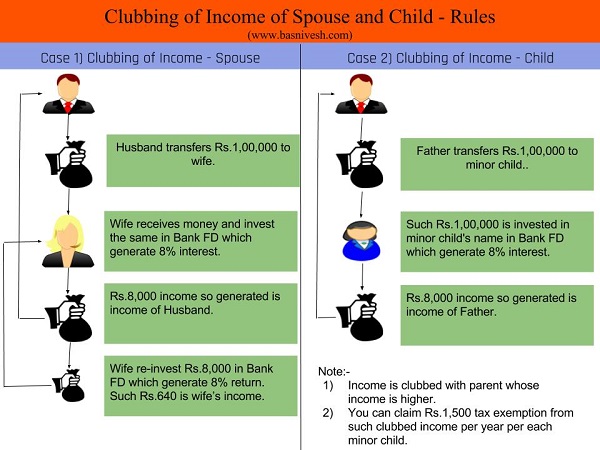

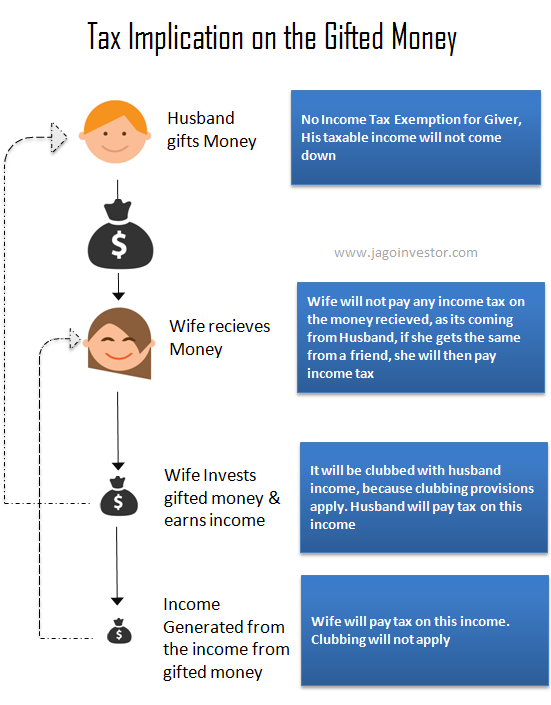

Clubbing of Income under Section 64 & 27- TaxHelpdesk – #43

Clubbing of Income under Section 64 & 27- TaxHelpdesk – #43

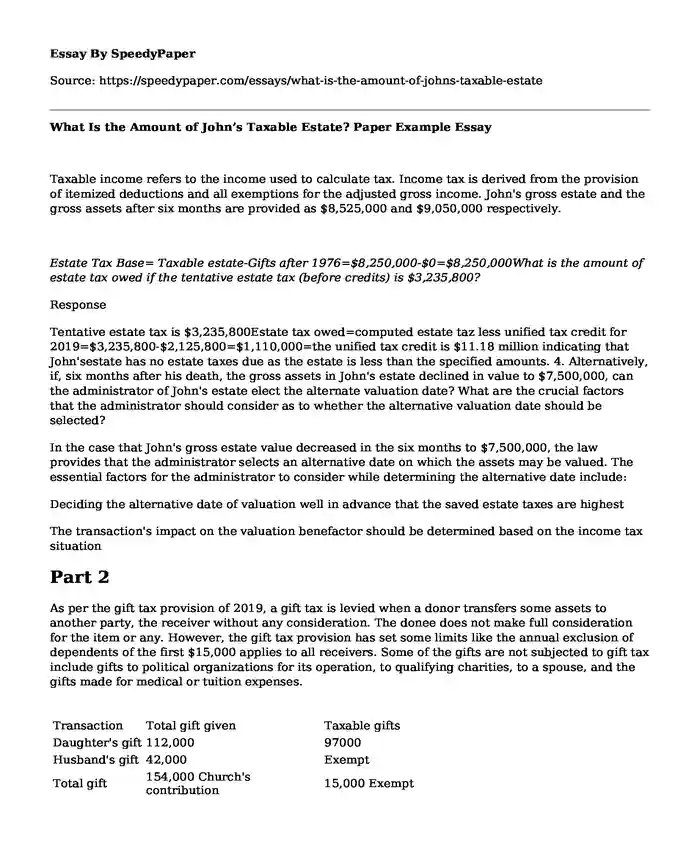

📗 What Is the Amount of John’s Taxable Estate? Paper Example | SpeedyPaper.com – #44

📗 What Is the Amount of John’s Taxable Estate? Paper Example | SpeedyPaper.com – #44

Budget 22-23 : Tax | Handwritten notes, Tax deductions, Budgeting – #45

Budget 22-23 : Tax | Handwritten notes, Tax deductions, Budgeting – #45

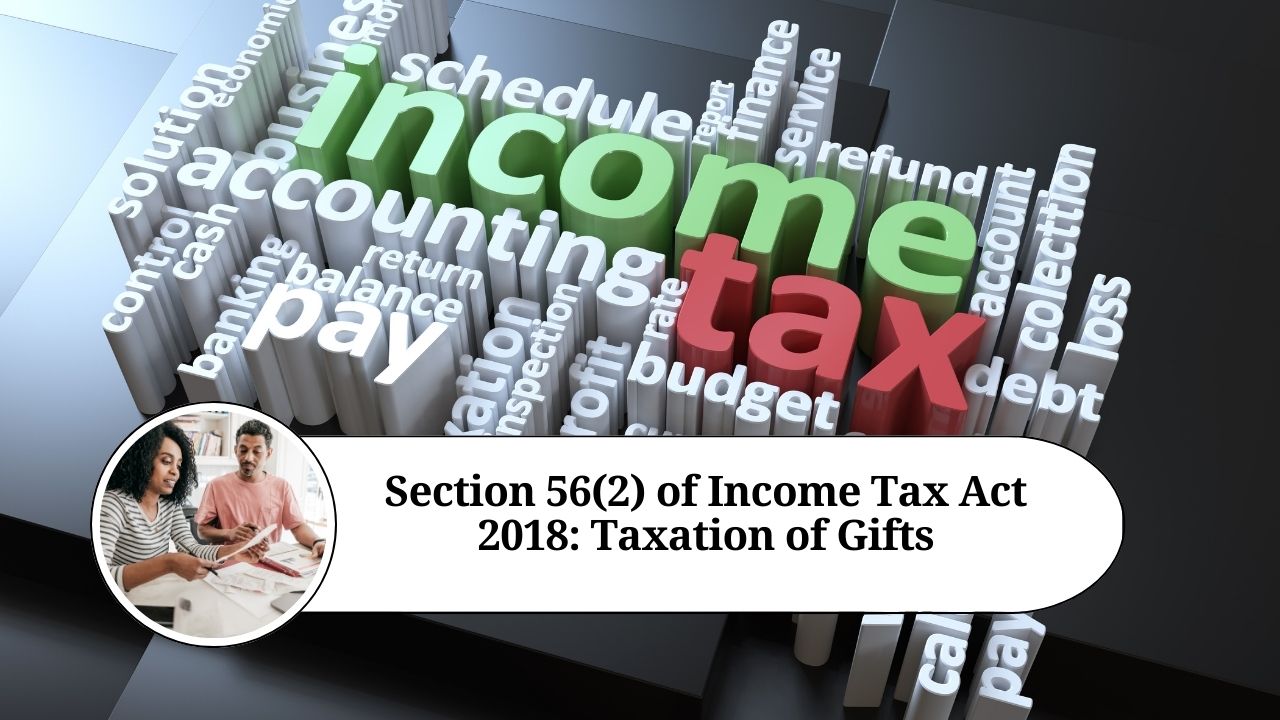

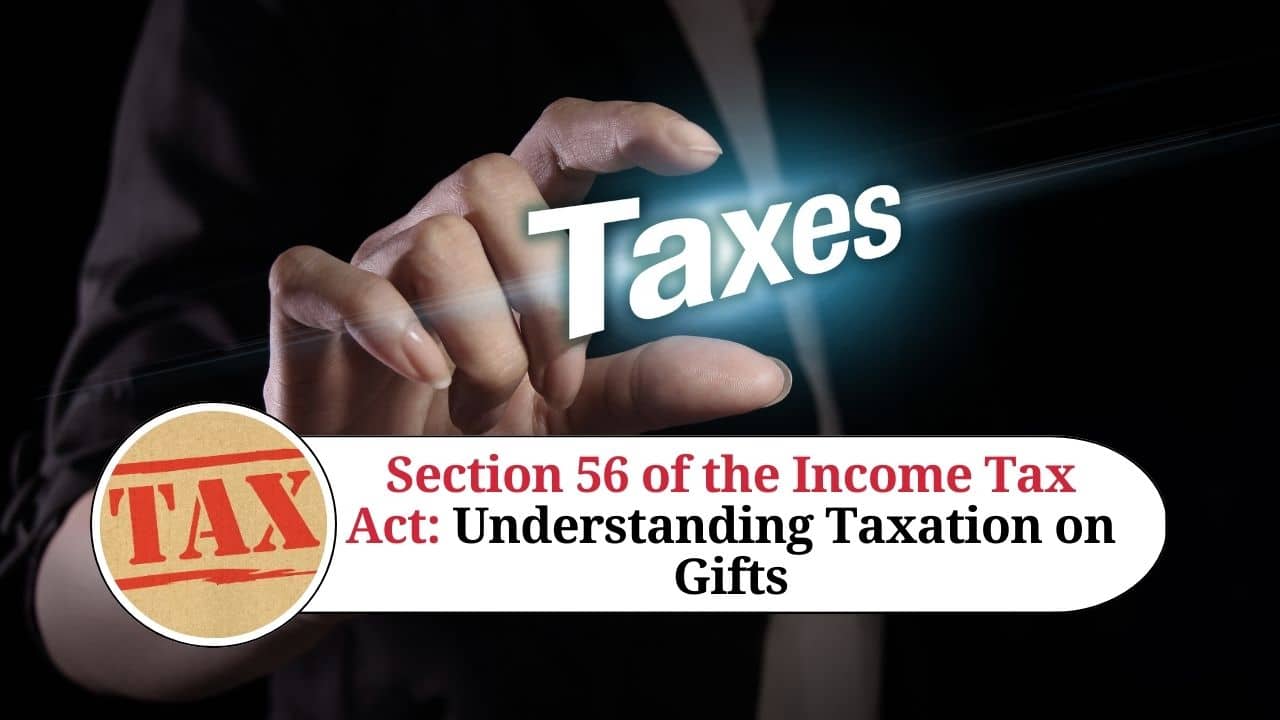

Section 56(ii) of Income Tax Act: Understanding the Taxation of Gifts – Marg ERP Blog – #46

Section 56(ii) of Income Tax Act: Understanding the Taxation of Gifts – Marg ERP Blog – #46

When are gifts received by NRIs subject to tax, TDS in India? – The Economic Times – #47

When are gifts received by NRIs subject to tax, TDS in India? – The Economic Times – #47

Income tax returns filing: Is gift from cousin taxable? Find out here – Money News | The Financial Express – #48

Income tax returns filing: Is gift from cousin taxable? Find out here – Money News | The Financial Express – #48

- gift deed stamp paper

- inheritance tax document

- provision for income tax journal entry

Section 10 of Income Tax Act – Deductions and Allowances – #49

Section 10 of Income Tax Act – Deductions and Allowances – #49

TDS on Purchase of Goods” – All Questions Answered! – #50

TDS on Purchase of Goods” – All Questions Answered! – #50

Income Tax Implications of Wedding Gifts in India – #51

Income Tax Implications of Wedding Gifts in India – #51

What are the Stamp Duty Provisions Applicable on Gift Deed? – #52

What are the Stamp Duty Provisions Applicable on Gift Deed? – #52

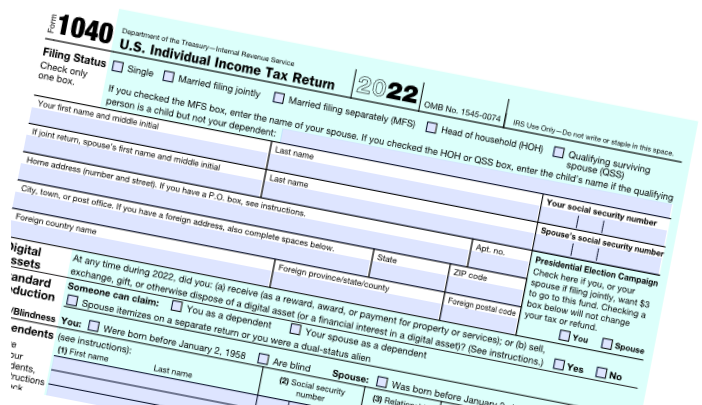

How to Split Gifts on a Tax Return – #53

How to Split Gifts on a Tax Return – #53

How Tax Reform Will Affect Nonprofits – Smith and Howard – #54

How Tax Reform Will Affect Nonprofits – Smith and Howard – #54

- estate tax exemption history

- gift tax definition

- gift tax exemption relatives list

Our three points: – #55

Our three points: – #55

Check TDS on Sale of Property and TDS on Purchase of Property – #56

Check TDS on Sale of Property and TDS on Purchase of Property – #56

Section 68 & section 69 of Income Tax Act Unexplained money, Deposits & Investments – #57

Section 68 & section 69 of Income Tax Act Unexplained money, Deposits & Investments – #57

Lifetime Estate And Gift Tax Exemption Will Hit $12.92 Million In 2023 – #58

Lifetime Estate And Gift Tax Exemption Will Hit $12.92 Million In 2023 – #58

Guide to Profits and Gains of Business or Profession under Income Tax Act – #59

Guide to Profits and Gains of Business or Profession under Income Tax Act – #59

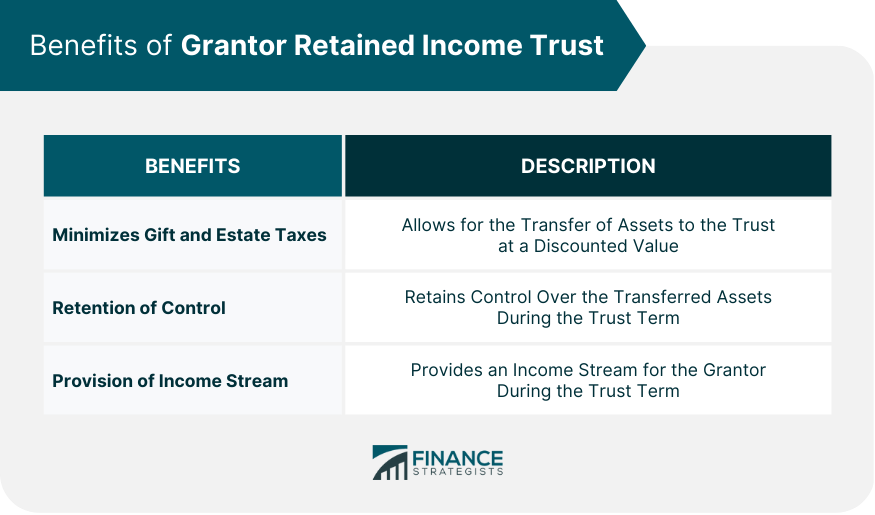

Split Interest Gifts – Durfee Law Group – #60

Split Interest Gifts – Durfee Law Group – #60

Income Tax on Gift – #61

Income Tax on Gift – #61

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #62

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #62

- gift tax exemption

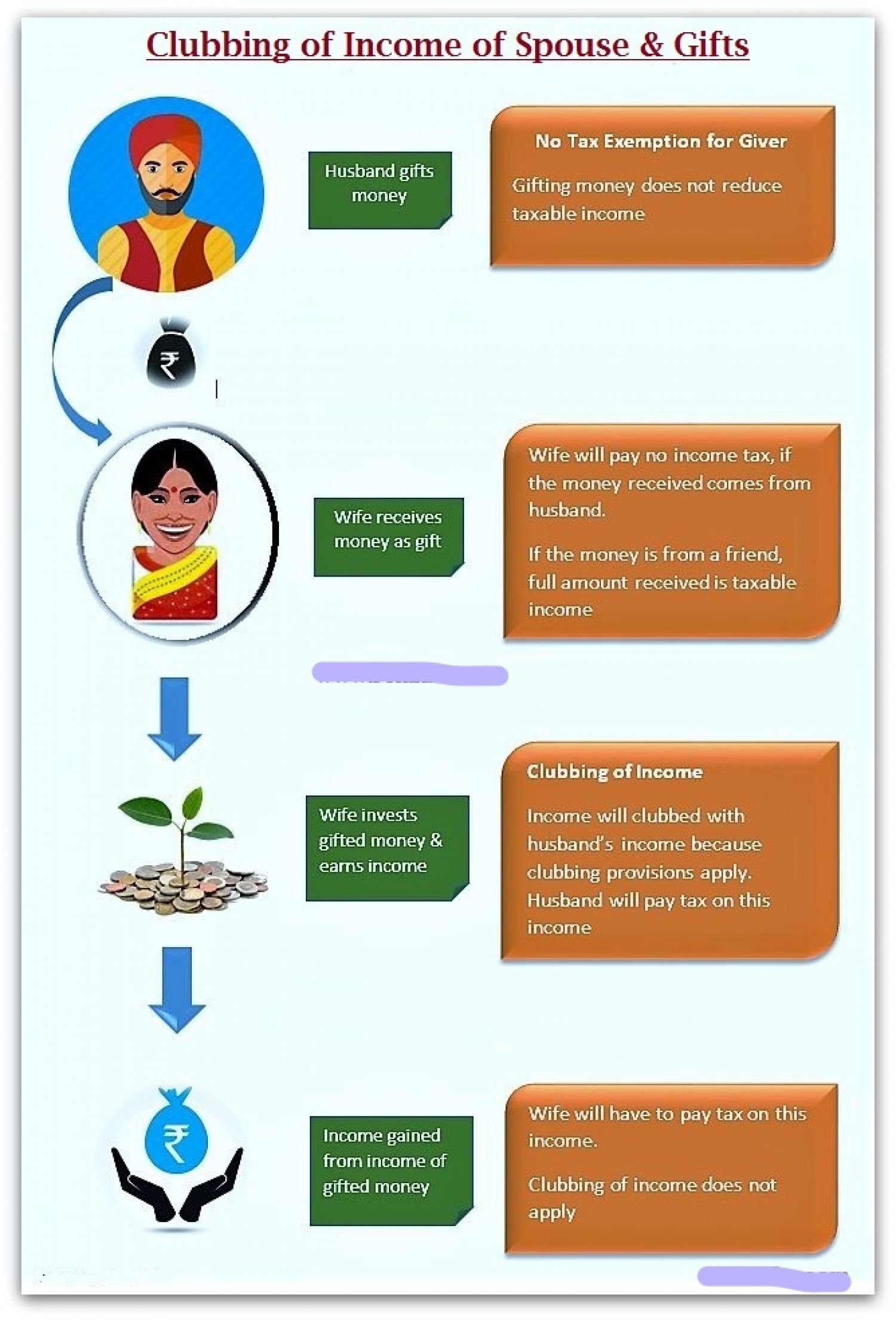

- clubbing of income ppt

- clubbing of income diagram

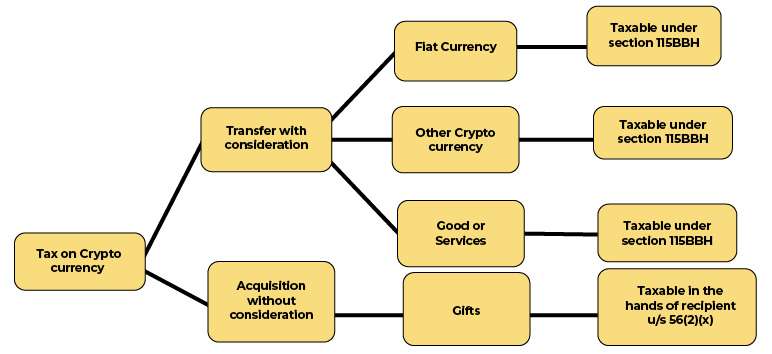

Tax on Gifted Shares & Securities – – #63

Tax on Gifted Shares & Securities – – #63

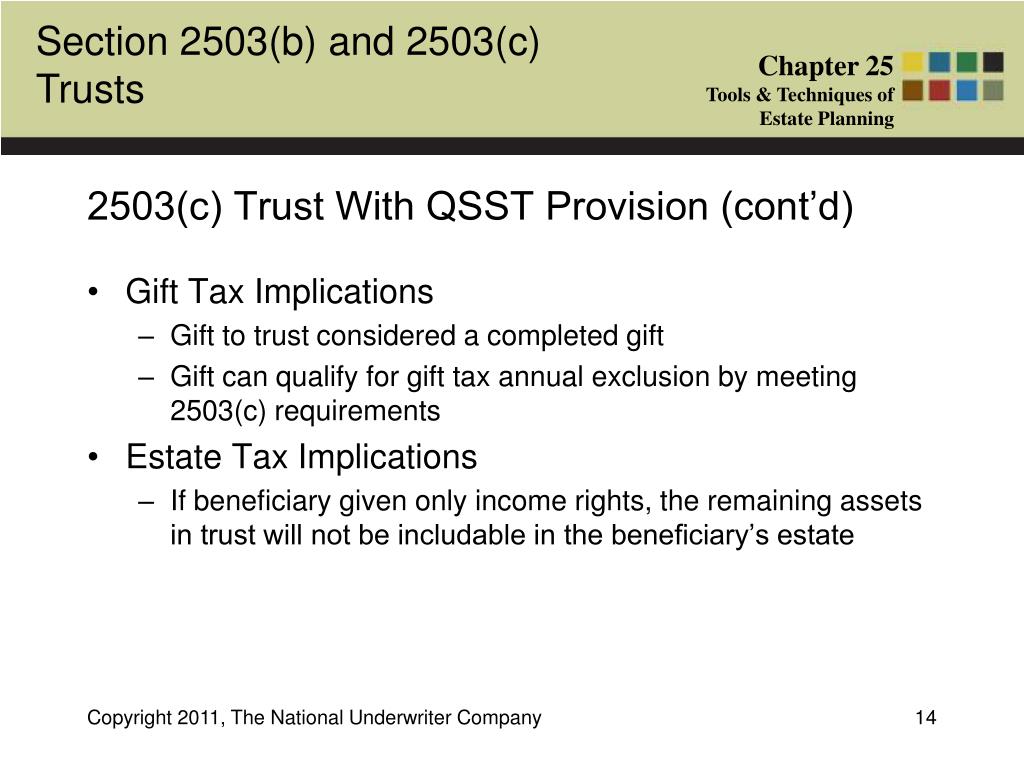

Incomplete and Completed Gift Non-Grantor Trusts – #64

Incomplete and Completed Gift Non-Grantor Trusts – #64

Income tax on initial gift to HUF | Mint – #65

Income tax on initial gift to HUF | Mint – #65

IRS Reverses Position Previously Taken in 2016 Letter Ruling Regarding Gift Tax Treatment of Adding a Tax Reimbursement Clause to an IDGT — Current Federal Tax Developments – #66

IRS Reverses Position Previously Taken in 2016 Letter Ruling Regarding Gift Tax Treatment of Adding a Tax Reimbursement Clause to an IDGT — Current Federal Tax Developments – #66

Gift Tax: Details, Exemptions and Avoidance | Chase – #67

Gift Tax: Details, Exemptions and Avoidance | Chase – #67

- gift chart as per income tax

- gift from relative exempt from income tax

- gift tax in india

Examples of Inadmissible Expenses and Admissible Expenses | PDF | Expense | Taxes – #68

Examples of Inadmissible Expenses and Admissible Expenses | PDF | Expense | Taxes – #68

Tax on Farm Estates and Inherited Gains – farmdoc daily – #69

Tax on Farm Estates and Inherited Gains – farmdoc daily – #69

Step-Up in Basis: Definition, How It Works for Inherited Property – #70

Step-Up in Basis: Definition, How It Works for Inherited Property – #70

What will the estate and gift tax exclusions be in 2024, 2025? – #71

What will the estate and gift tax exclusions be in 2024, 2025? – #71

www.skyheight.in/wp-content/uploads/2021/03/Employ… – #72

www.skyheight.in/wp-content/uploads/2021/03/Employ… – #72

Section 281 of Income Tax Act: Guidelines and Details – #73

Section 281 of Income Tax Act: Guidelines and Details – #73

Understanding the Scope of Income under Section 11 of the Income-tax Act – #74

Understanding the Scope of Income under Section 11 of the Income-tax Act – #74

- money gift deed format

- property gift deed

- income tax provision

Start Planning Now For A Higher Tax Environment | Pay Taxes Later – #75

Start Planning Now For A Higher Tax Environment | Pay Taxes Later – #75

Gifts That Provide Income | Giving to MIT – #76

Gifts That Provide Income | Giving to MIT – #76

INTERMEDIAT EXAMINATION DIRECT AND INDIRECT TAXATION – #77

INTERMEDIAT EXAMINATION DIRECT AND INDIRECT TAXATION – #77

Assessment of Hindu Undivided Family – ppt download – #78

Assessment of Hindu Undivided Family – ppt download – #78

How Do Gifts Work Under The New Massachusetts Estate Tax Law? | Margolis Bloom & D’Agostino – #79

How Do Gifts Work Under The New Massachusetts Estate Tax Law? | Margolis Bloom & D’Agostino – #79

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #80

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #80

Section 185 & 186 of Companies Act r.w Section 2(22)(e) of Income Tax – #81

Section 185 & 186 of Companies Act r.w Section 2(22)(e) of Income Tax – #81

Income tax filing: Are gifts taxable? Frequently asked questions on gift taxes | Zee Business – #82

Income tax filing: Are gifts taxable? Frequently asked questions on gift taxes | Zee Business – #82

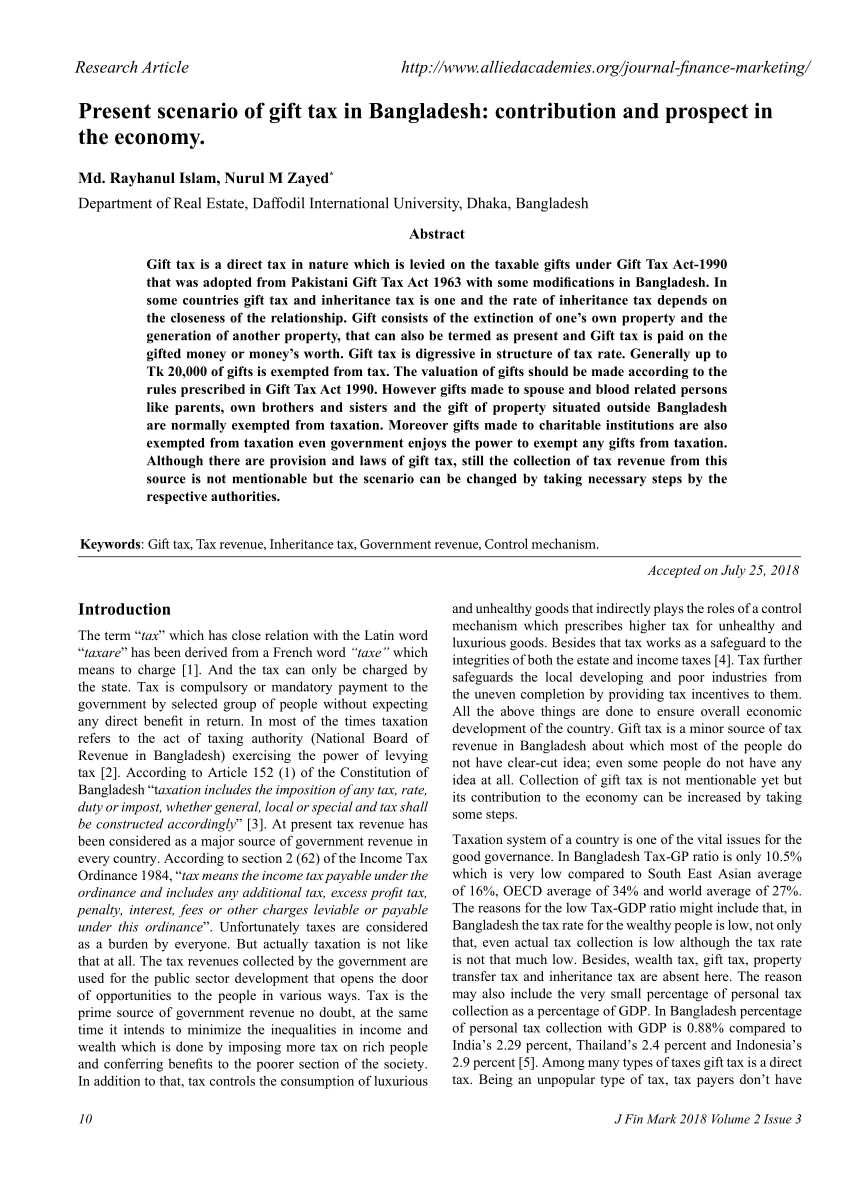

PDF) Present Scenario of Gift tax in Bangladesh: Contribution and Prospect in the Economy – #83

PDF) Present Scenario of Gift tax in Bangladesh: Contribution and Prospect in the Economy – #83

Income tax on a gift from father to daughter – #84

Income tax on a gift from father to daughter – #84

Maximizing Tax Efficiency: The Power of Beneficiary Deemed Owner Trust Provisions – #85

Maximizing Tax Efficiency: The Power of Beneficiary Deemed Owner Trust Provisions – #85

Federal implications of passthrough entity tax elections – #86

Federal implications of passthrough entity tax elections – #86

Taxation of Gifts received in Cash or Kind – #87

Taxation of Gifts received in Cash or Kind – #87

Income-tax implications of issues of shares at a discount | Lakshmikumaran & Sridharan Attorneys – #88

Income-tax implications of issues of shares at a discount | Lakshmikumaran & Sridharan Attorneys – #88

Gift Deed Registration: Stamp Duty, Registry Fee, Tax, Procedure – #89

Gift Deed Registration: Stamp Duty, Registry Fee, Tax, Procedure – #89

Gifts by NRIs to Relatives and Friends can be made fully Exempt from Gift Tax – #90

Gifts by NRIs to Relatives and Friends can be made fully Exempt from Gift Tax – #90

Income Tax: CBDT sets outstanding tax waiver limit at Rs 1 lakh. How to check status? – BusinessToday – #91

Income Tax: CBDT sets outstanding tax waiver limit at Rs 1 lakh. How to check status? – BusinessToday – #91

How to Show Gift in Income Tax Return 2023 – #92

How to Show Gift in Income Tax Return 2023 – #92

What Is The Tax Liability On Gifts Received? – #93

What Is The Tax Liability On Gifts Received? – #93

- gift tax rate

- estate tax exemption 2022

- lineal ascendant gift from relative exempt from income tax

Gift To Huf By Member – File Taxes Online | Online Tax Services in India | Online E-tax Filing – #94

Gift To Huf By Member – File Taxes Online | Online Tax Services in India | Online E-tax Filing – #94

How to Make Unlimited Tax-Free Gifts | Retirement Watch – #95

How to Make Unlimited Tax-Free Gifts | Retirement Watch – #95

Section 54 of Income Tax Act – Purpose, Benefits, Exemption, Provision – #96

Section 54 of Income Tax Act – Purpose, Benefits, Exemption, Provision – #96

Gifts to Employees – Taxable Income or Nontaxable Gift – #97

Gifts to Employees – Taxable Income or Nontaxable Gift – #97

How to Make a Gift Deed – A Complete guide | Law House – #98

How to Make a Gift Deed – A Complete guide | Law House – #98

A Comprehensive Guide on Tax for Freelancers – #99

A Comprehensive Guide on Tax for Freelancers – #99

Income Tax Slab – All About the Tax Structure in India | HDFC ERGO – #100

Income Tax Slab – All About the Tax Structure in India | HDFC ERGO – #100

Tax provisions relating to receipt and forfeiture of earnest money – #101

Tax provisions relating to receipt and forfeiture of earnest money – #101

Section 48 of Income Tax Act, 1961 – Sorting Tax – #102

Section 48 of Income Tax Act, 1961 – Sorting Tax – #102

3. Inheritance, estate, and gift tax design in OECD countries | Inheritance Taxation in OECD Countries | OECD iLibrary – #103

3. Inheritance, estate, and gift tax design in OECD countries | Inheritance Taxation in OECD Countries | OECD iLibrary – #103

Taxability of Gifts under Income Tax Act – Taxmann Blog – #104

Taxability of Gifts under Income Tax Act – Taxmann Blog – #104

Tax on Foreign Remittance in India: Sending & Receiving Money – #105

Tax on Foreign Remittance in India: Sending & Receiving Money – #105

Benefits of Spousal Lifetime Access Trusts (SLATs) – AMG National Trust – #106

Benefits of Spousal Lifetime Access Trusts (SLATs) – AMG National Trust – #106

Gift Tax Calculator | EZTax® – #107

Gift Tax Calculator | EZTax® – #107

IRS Releases Annual Inflation Adjustments for Tax Year 2022 – #108

IRS Releases Annual Inflation Adjustments for Tax Year 2022 – #108

- clubbing of income chart

- federal estate tax exemption 2023

- list of relatives

GIFT City IFSC at Gujarat, India: A Brief Profile for Investors – #109

GIFT City IFSC at Gujarat, India: A Brief Profile for Investors – #109

Are your Diwali gifts taxable? Know what income tax rules say | Personal Finance News, Times Now – #110

Are your Diwali gifts taxable? Know what income tax rules say | Personal Finance News, Times Now – #110

Section 54F of Income Tax Act | Tax Benefits On Capital Gains – #111

Section 54F of Income Tax Act | Tax Benefits On Capital Gains – #111

Solved Exercise 27-24 (Algorithmic) ( LO, 5 ) Noah and | Chegg.com – #112

Solved Exercise 27-24 (Algorithmic) ( LO, 5 ) Noah and | Chegg.com – #112

Sunil Sir Paper Final | PDF | Equity (Finance) | Stocks – #113

Sunil Sir Paper Final | PDF | Equity (Finance) | Stocks – #113

Stamp Duty on Gift of Shares – #114

Stamp Duty on Gift of Shares – #114

Income Tax Act 1961: Establishing taxation rules in the country – Getlegal India – #115

Income Tax Act 1961: Establishing taxation rules in the country – Getlegal India – #115

Nephew and Niece are not “Relative” under Income Tax act 1961 – #116

Nephew and Niece are not “Relative” under Income Tax act 1961 – #116

- federal estate tax

- gift deed format on stamp paper

- family member gift letter gift deed format father to son

- simple deed of gift template

- provision for income tax in income statement

- gift tax

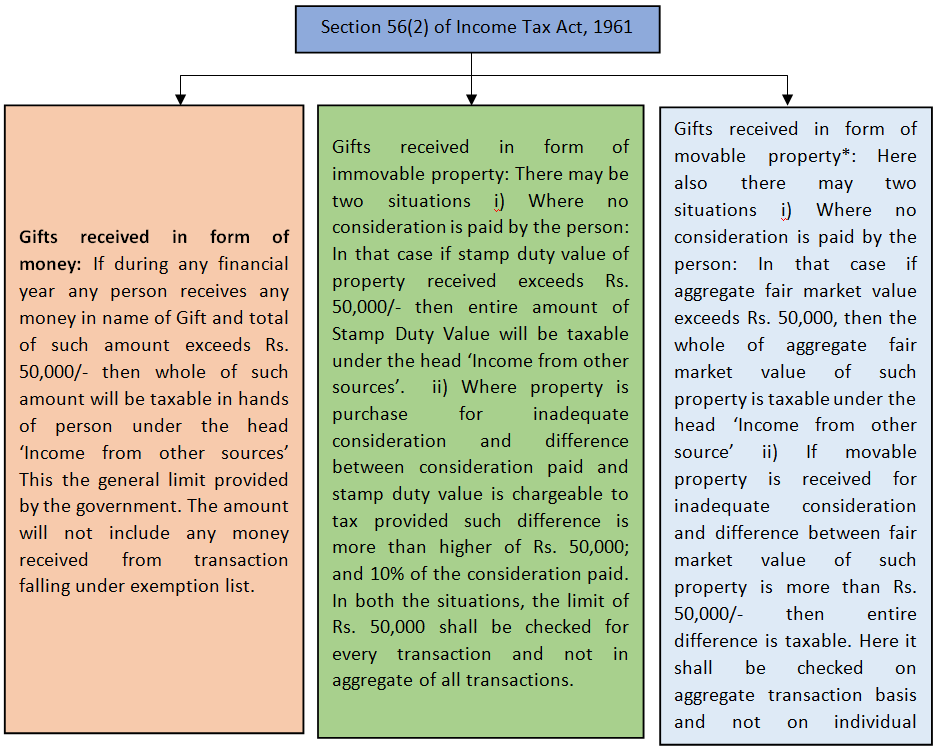

Tax Insights: Exploring Section 56(2)(x) of Income Tax – #117

Tax Insights: Exploring Section 56(2)(x) of Income Tax – #117

All you need to know about taxes on gifts and the exceptions | Mint – #118

All you need to know about taxes on gifts and the exceptions | Mint – #118

Taxation on Film Production – #119

Taxation on Film Production – #119

Senate and House agree on final tax bill – Putnam Investments – #120

Senate and House agree on final tax bill – Putnam Investments – #120

When Should I Use My Estate and Gift Tax Exemption? – #121

When Should I Use My Estate and Gift Tax Exemption? – #121

U.S. Gift Taxation of Nonresident Aliens · Kerkering, Barberio & Co., Certified Public Accountants Sarasota, FL – #122

U.S. Gift Taxation of Nonresident Aliens · Kerkering, Barberio & Co., Certified Public Accountants Sarasota, FL – #122

Taxbaility of GIFT – FIBOTA – #123

Taxbaility of GIFT – FIBOTA – #123

CLUBBING OF INCOME UNDER INCOME TAX ACT, 1961. – Kanoon For All – #124

CLUBBING OF INCOME UNDER INCOME TAX ACT, 1961. – Kanoon For All – #124

If I Gift 1cr to my mother is it exempt or taxable? – Quora – #125

If I Gift 1cr to my mother is it exempt or taxable? – Quora – #125

What Is a Crummey Trust and How Does It Work? – #126

What Is a Crummey Trust and How Does It Work? – #126

Planpaisa on X: “There are many changes in the income tax rules effective from this financial year. #incometax #taxregime #financialplanning #taxplanning #inflation #taxchanges #indiantaxlaw #tax #financialyear #financialplanner #financialeducation … – #127

Planpaisa on X: “There are many changes in the income tax rules effective from this financial year. #incometax #taxregime #financialplanning #taxplanning #inflation #taxchanges #indiantaxlaw #tax #financialyear #financialplanner #financialeducation … – #127

Gift Tax: What it is and How Gifts are taxed in India – #128

Gift Tax: What it is and How Gifts are taxed in India – #128

CBDT NOTIFIES RELAXATION IN FAIR VALUATION NORMS- ARE THEY ENOUGH? | India Tax Law – #129

CBDT NOTIFIES RELAXATION IN FAIR VALUATION NORMS- ARE THEY ENOUGH? | India Tax Law – #129

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #130

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #130

Gift by NRI to Resident Indian or Vice-Versa – NRI Gift Tax In India – #131

Gift by NRI to Resident Indian or Vice-Versa – NRI Gift Tax In India – #131

Decoding GST: Impact of Free Gifts on Input Tax Credit – #132

Decoding GST: Impact of Free Gifts on Input Tax Credit – #132

What Will Happen When the Gift and Estate Tax Exemption Gets Cut in Half? – #133

What Will Happen When the Gift and Estate Tax Exemption Gets Cut in Half? – #133

Income Tax for NRIs in India – Rules, Exemptions & Deductions – Tax2win – #134

Income Tax for NRIs in India – Rules, Exemptions & Deductions – Tax2win – #134

Can You Save Tax by Transferring Money to Wife’s Account? – Enterslice – #135

Can You Save Tax by Transferring Money to Wife’s Account? – Enterslice – #135

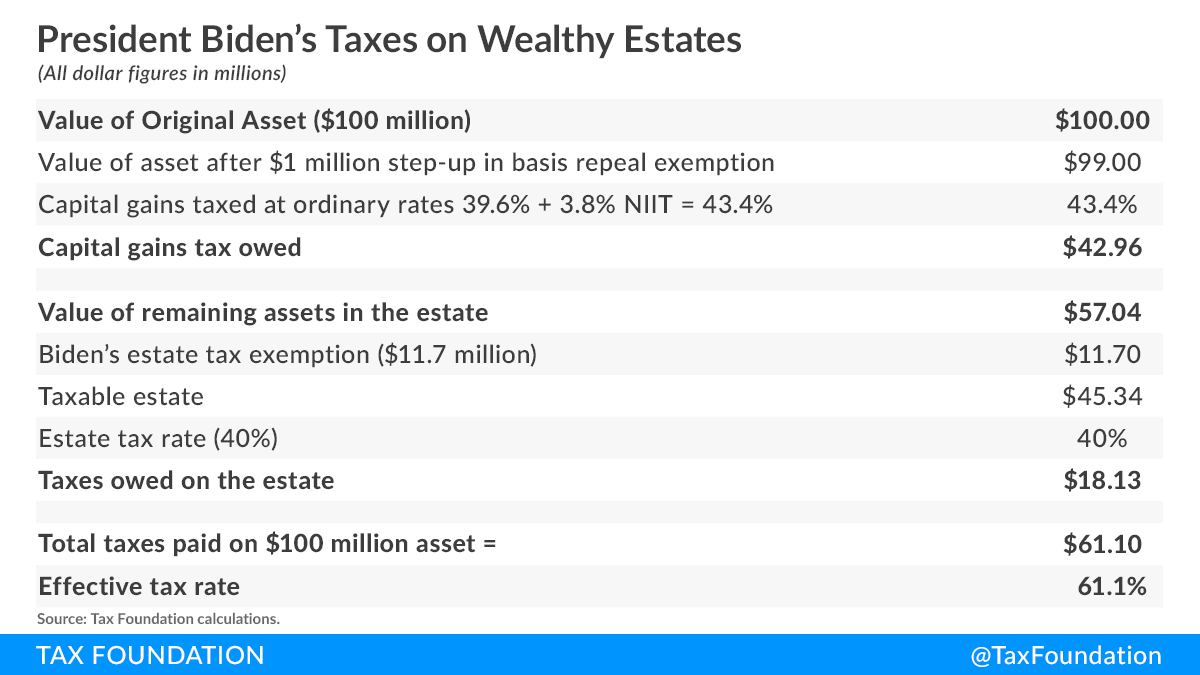

Biden Estate Tax? 61 Percent Tax on Wealth | Tax Foundation – #136

Biden Estate Tax? 61 Percent Tax on Wealth | Tax Foundation – #136

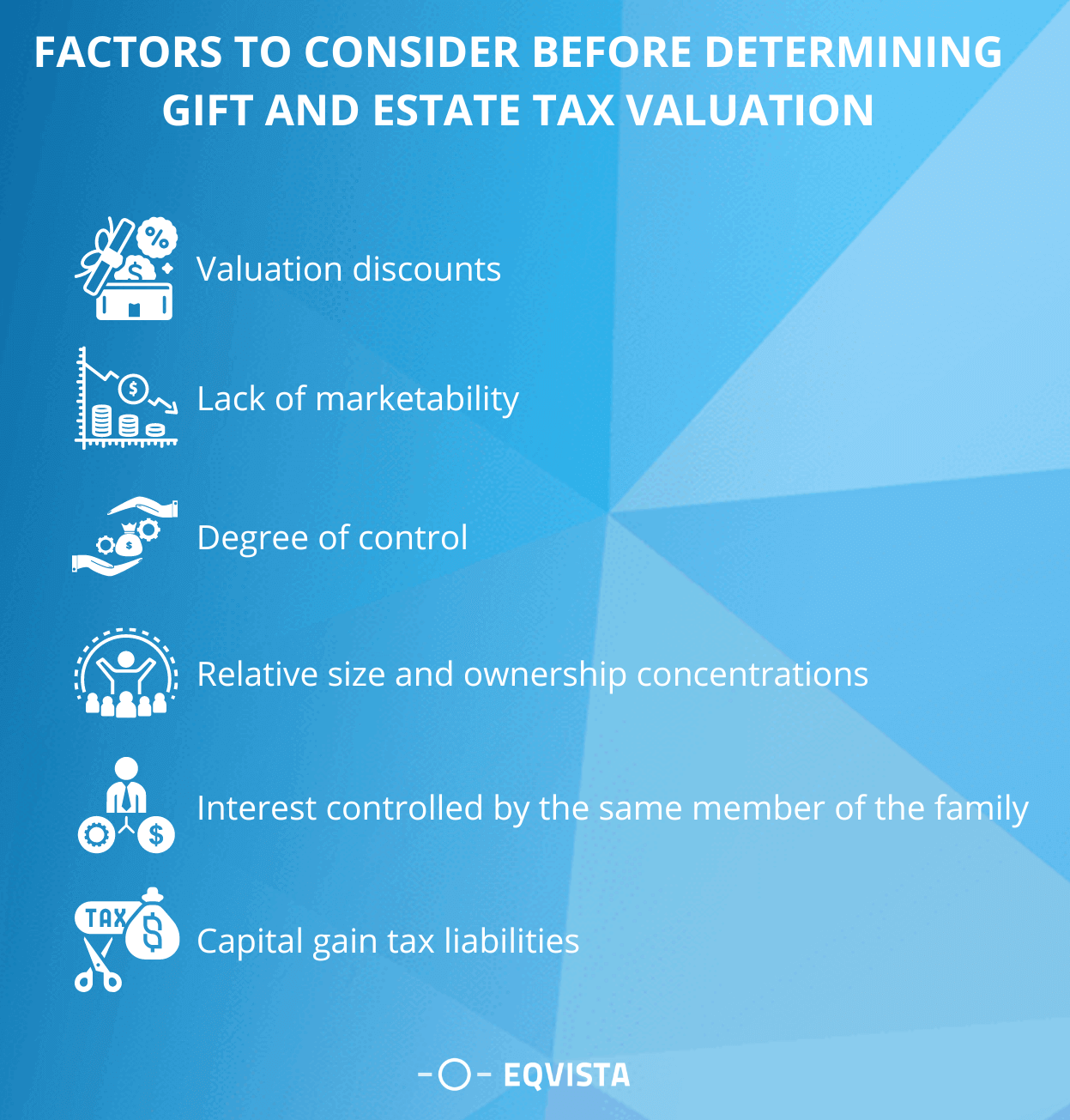

Gift & Estate Tax Valuation – Everything you should know | Eqvista – #137

Gift & Estate Tax Valuation – Everything you should know | Eqvista – #137

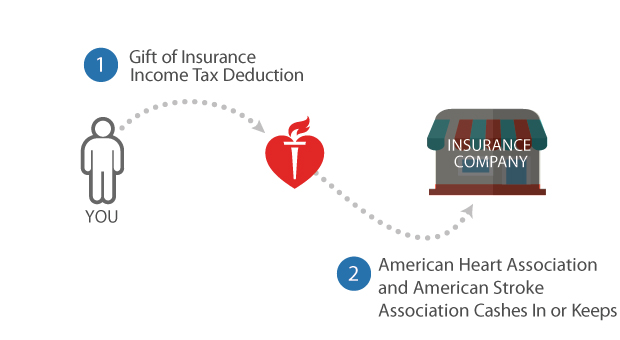

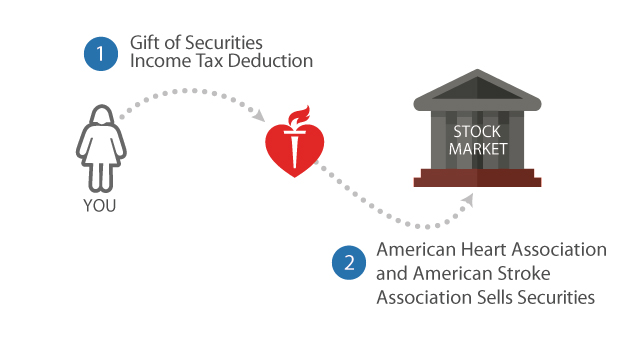

Gifts Everyone Can Afford | American Heart Association – #138

Gifts Everyone Can Afford | American Heart Association – #138

Generation-Skipping Trust (GST): What It Is and How It Works – #139

Generation-Skipping Trust (GST): What It Is and How It Works – #139

-Gifts.jpg) Irrevocable Trusts – #140

Irrevocable Trusts – #140

Annual Gift Tax Exclusion: A Complete Guide To Gifting – #141

Annual Gift Tax Exclusion: A Complete Guide To Gifting – #141

Holiday gift tax planning for IRAs – #142

Holiday gift tax planning for IRAs – #142

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #143

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #143

Provisions of Clubbing of Income under Section 64 | Ebizfiling – #144

Provisions of Clubbing of Income under Section 64 | Ebizfiling – #144

Perquisites under Income Tax Act – #145

Perquisites under Income Tax Act – #145

Help Your Charitable IRA Donors Report Their Gifts | Sharpe Group – #146

Help Your Charitable IRA Donors Report Their Gifts | Sharpe Group – #146

NRI Gift Tax Guide: Understanding Tax Implications in India – #147

NRI Gift Tax Guide: Understanding Tax Implications in India – #147

Planned Giving – #148

Planned Giving – #148

) Annual Gift Tax Exclusion Explained | PNC Insights – #149

Annual Gift Tax Exclusion Explained | PNC Insights – #149

What is the limit up to which a father can gift to his son under income tax laws | Mint – #150

What is the limit up to which a father can gift to his son under income tax laws | Mint – #150

What is a gift tax in India? – Quora – #151

What is a gift tax in India? – Quora – #151

Everything You Need to Know About Section 43C of Income Tax Act 1961 – Special Provisions for Computation of Cost of Acquisition of Certain Assets | CA B K Goyal & Co LLP – #152

Everything You Need to Know About Section 43C of Income Tax Act 1961 – Special Provisions for Computation of Cost of Acquisition of Certain Assets | CA B K Goyal & Co LLP – #152

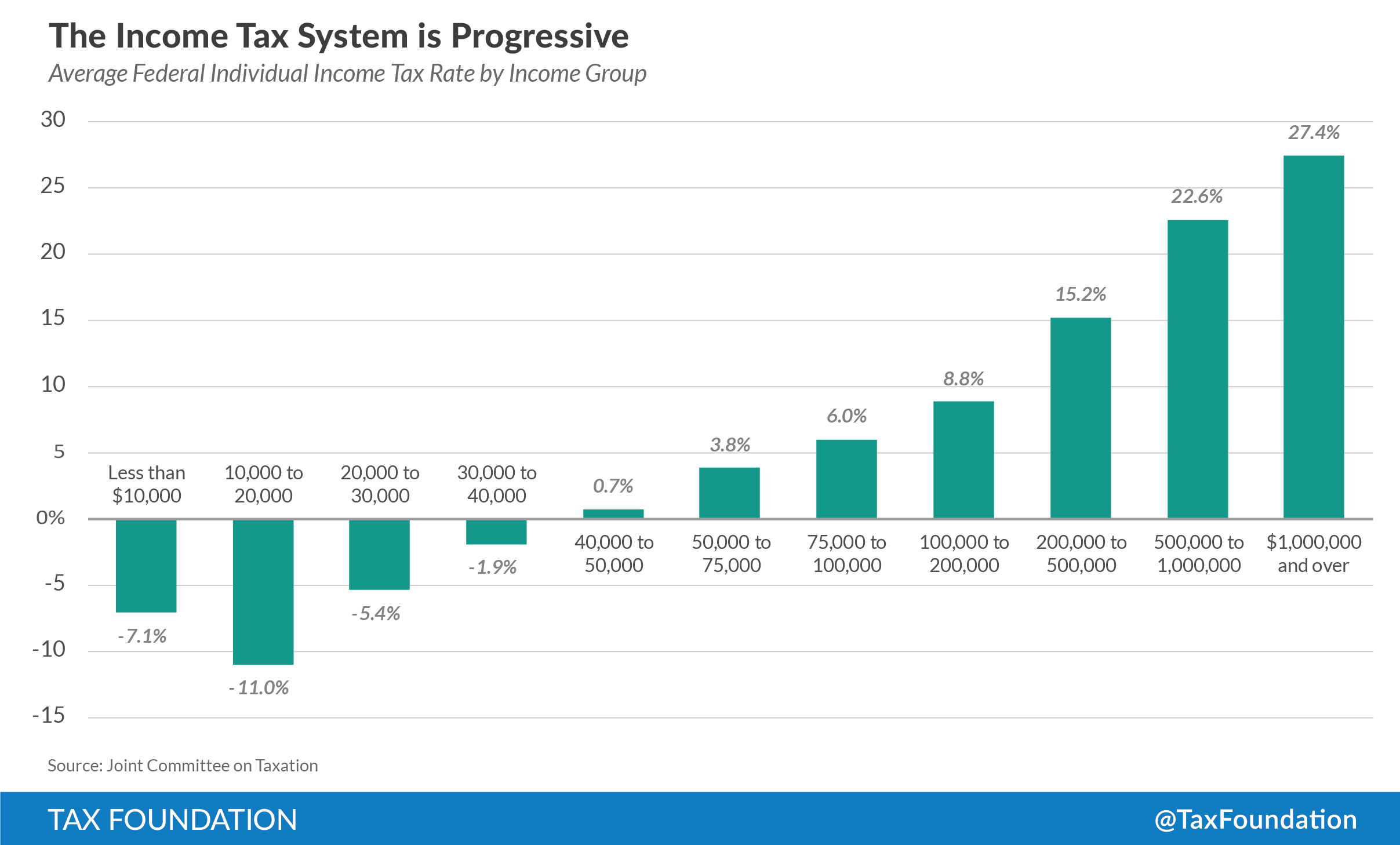

How Much Do People Pay in Taxes? – #153

How Much Do People Pay in Taxes? – #153

Section 56(2)(vii) : Cash / Non-Cash Gifts – #154

Section 56(2)(vii) : Cash / Non-Cash Gifts – #154

Section 194R of Income Tax Act 1961 – Benefits & Doubts – #155

Section 194R of Income Tax Act 1961 – Benefits & Doubts – #155

Federal Taxation of Individuals in 2023 | LBMC – #156

Federal Taxation of Individuals in 2023 | LBMC – #156

Procedure for Gift deed registration: A Step By Step Guide – Corpbiz – #157

Procedure for Gift deed registration: A Step By Step Guide – Corpbiz – #157

- gift tax 2023

- gift tax exemption 2022

- gift tax meaning

Income Tax on Bitcoin in India – PKC Management Consulting – #158

Income Tax on Bitcoin in India – PKC Management Consulting – #158

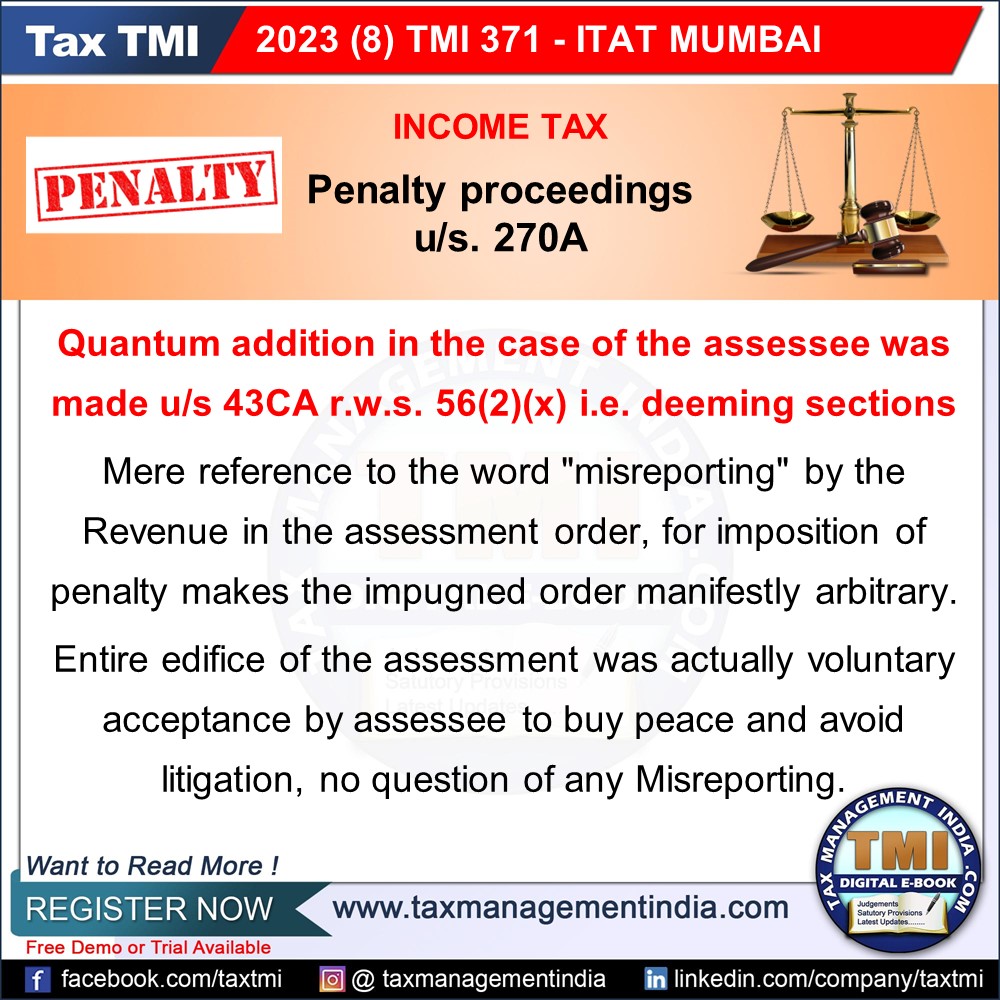

Income Tax – Penalty proceedings u/s. 270A – Additions made u/s 43CA r.w.s. 56 (2) (x) i.e. deeming sections – There is not even a whisper as to which limb of… – #159

Income Tax – Penalty proceedings u/s. 270A – Additions made u/s 43CA r.w.s. 56 (2) (x) i.e. deeming sections – There is not even a whisper as to which limb of… – #159

Maximise your CTC: 12 tax-free components every salaried employee can include – BusinessToday – #160

Maximise your CTC: 12 tax-free components every salaried employee can include – BusinessToday – #160

Direct Tax | PDF – #161

Direct Tax | PDF – #161

List of relatives covered under Section 56(2) of Income Tax Act,1961 – #162

List of relatives covered under Section 56(2) of Income Tax Act,1961 – #162

9100 Relief: Jumping Through the Hoops When You Learn You have an “Oops!” – #163

9100 Relief: Jumping Through the Hoops When You Learn You have an “Oops!” – #163

A Summary of President Biden’s Proposed 2024 Tax Provisions – #164

A Summary of President Biden’s Proposed 2024 Tax Provisions – #164

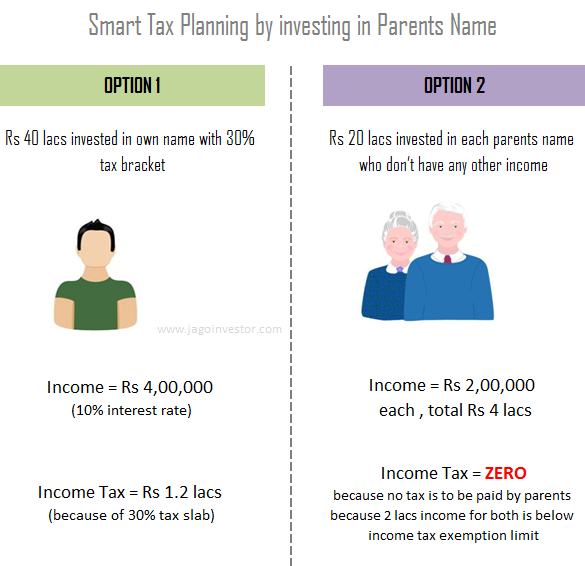

Saving income tax (interest from FD) by transferring to Father-in-law and to my wife (details in comment) : r/IndiaInvestments – #165

Saving income tax (interest from FD) by transferring to Father-in-law and to my wife (details in comment) : r/IndiaInvestments – #165

Section 10 – Exemptions under Section 10 of Income Tax Act – #166

Section 10 – Exemptions under Section 10 of Income Tax Act – #166

Clubbing provision under the Income Tax Act-1961 – thetaxtalk – #167

Clubbing provision under the Income Tax Act-1961 – thetaxtalk – #167

LiveMint on LinkedIn: #personalfinance – #168

LiveMint on LinkedIn: #personalfinance – #168

Budget 2024: Common Taxpayer’s Expectations; Will Nirmala Sitharaman Open Gift Box Before Elections? – #169

Budget 2024: Common Taxpayer’s Expectations; Will Nirmala Sitharaman Open Gift Box Before Elections? – #169

- lineal ascendant

- gift deed format father to son

- section 56(2) of income tax act

What is the tax expenditure budget? | Tax Policy Center – #170

What is the tax expenditure budget? | Tax Policy Center – #170

Taxability of Gift received by an individual or HUF with FAQs – #171

Taxability of Gift received by an individual or HUF with FAQs – #171

Is there a limit in income tax laws up to which a father can gift to his son – #172

Is there a limit in income tax laws up to which a father can gift to his son – #172

Giving Your Home to Your Children Can Have Tax Consequences – #173

Giving Your Home to Your Children Can Have Tax Consequences – #173

What is Income Tax Act 1961? Types and Heads of Income Tax – #174

What is Income Tax Act 1961? Types and Heads of Income Tax – #174

Charitable Remainder Trusts (CRTs) – Wealthspire – #175

Charitable Remainder Trusts (CRTs) – Wealthspire – #175

Gift Tax planning – 3 awesome tips to save income tax legally – #176

Gift Tax planning – 3 awesome tips to save income tax legally – #176

What is the taxation on any gift via cash transfer to a relative? | Mint – #177

What is the taxation on any gift via cash transfer to a relative? | Mint – #177

Optotax (@optotax_gst) / X – #178

Optotax (@optotax_gst) / X – #178

Untitled – #179

Untitled – #179

Unabsorbed Depreciation Set Off & Carry Forward – Section 32(2) – #180

Unabsorbed Depreciation Set Off & Carry Forward – Section 32(2) – #180

eCFR :: 26 CFR Part 25 — Gift Tax; Gifts Made After December 31, 1954 – #181

eCFR :: 26 CFR Part 25 — Gift Tax; Gifts Made After December 31, 1954 – #181

How to Ensure Cash Gifts from Parents and Relatives Won’t Land you in Tax Trouble – #182

How to Ensure Cash Gifts from Parents and Relatives Won’t Land you in Tax Trouble – #182

Section 56(2)(X): Taxation of Gift – #183

Section 56(2)(X): Taxation of Gift – #183

Section 64 Of The Income Tax Act: Clubbing Of Income And Eligibility – #184

Section 64 Of The Income Tax Act: Clubbing Of Income And Eligibility – #184

- tax provision example

- gift deed format in hindi pdf

- gift tax returns irs completed sample form 709 sample

Are Business Gifts Tax Deductible? All You Need to Know – #185

Are Business Gifts Tax Deductible? All You Need to Know – #185

Addressing Tax – FasterCapital – #186

Addressing Tax – FasterCapital – #186

Provisions of Deemed Gift u/s 56(2)(vii)(b) of Income Tax Act cannot be Applied Retrospectively: ITAT – #187

Provisions of Deemed Gift u/s 56(2)(vii)(b) of Income Tax Act cannot be Applied Retrospectively: ITAT – #187

Budget updates FY 2022-23- Direct Tax by tax guru – Issuu – #188

Budget updates FY 2022-23- Direct Tax by tax guru – Issuu – #188

Crummey Trust: Maximizing Gift Tax Exclusion Benefits – #189

Crummey Trust: Maximizing Gift Tax Exclusion Benefits – #189

Clubbing of Income of spouse and child -Tips to save tax – BasuNivesh – #190

Clubbing of Income of spouse and child -Tips to save tax – BasuNivesh – #190

Tax-Smart Giving: Gifting Stock & QCDs | U.S. Bank – #191

Tax-Smart Giving: Gifting Stock & QCDs | U.S. Bank – #191

Marriage Gifts And Its Taxation – #192

Marriage Gifts And Its Taxation – #192

When is money gifted not taxable? All your tax queries on gifts answered | Personal Finance – Business Standard – #193

When is money gifted not taxable? All your tax queries on gifts answered | Personal Finance – Business Standard – #193

What is a gift deed and tax implications | Tax Hack – #194

What is a gift deed and tax implications | Tax Hack – #194

IRA Rollover Gifts Have Been Extended to Cover … – Mama’s Kitchen – #195

IRA Rollover Gifts Have Been Extended to Cover … – Mama’s Kitchen – #195

How Is the Value of an Estate Determined for Tax Purposes? – #196

How Is the Value of an Estate Determined for Tax Purposes? – #196

The Secure 2.0 Act and Charitable Gift Annuity | Charles Schwab – #197

The Secure 2.0 Act and Charitable Gift Annuity | Charles Schwab – #197

What is the Gift Tax in India and How Does it Affect NRIs? – #198

What is the Gift Tax in India and How Does it Affect NRIs? – #198

Posts: gift provision in income tax

Categories: Gifts

Author: toyotabienhoa.edu.vn