Update more than 129 gift money tax limit super hot

Details images of gift money tax limit by website toyotabienhoa.edu.vn compilation. Using trusts to shift income to children. IRS Gift Limit 2023: How much can a parent gift a child in 2023? | Marca. GIFT DEED REGISTRATION » Shreeyansh Legal

Your queries: Income Tax: Show gift from relative in Schedule EI of ITR – Money News | The Financial Express – #1

Your queries: Income Tax: Show gift from relative in Schedule EI of ITR – Money News | The Financial Express – #1

- gift tax return

- gift tax 2023

- gift tax exemption 2022

2023 Taxes: 8 Things to Know Now | Charles Schwab – #2

2023 Taxes: 8 Things to Know Now | Charles Schwab – #2

Considerations for Gifting Money to Grandchildren | Thrivent – #4

Considerations for Gifting Money to Grandchildren | Thrivent – #4

IRS Form 706: Who Must File It and Related Forms – #5

IRS Form 706: Who Must File It and Related Forms – #5

IRS Gift Limit 2023: What happens if you give more than the limit and some other FAQ | Marca – #6

IRS Gift Limit 2023: What happens if you give more than the limit and some other FAQ | Marca – #6

ITR filing: Are gifts taxable in India? Salient clauses all income taxpayers must know | Zee Business – #7

ITR filing: Are gifts taxable in India? Salient clauses all income taxpayers must know | Zee Business – #7

Narayana Murthy gifts Infosys shares worth Rs 240 cr to his 4-month-old grandson: How are gifts taxed in India? – #8

Narayana Murthy gifts Infosys shares worth Rs 240 cr to his 4-month-old grandson: How are gifts taxed in India? – #8

- gift tax definition

- gift tax exemption relatives list

- gift tax returns irs completed sample form 709 sample

IRS Stimulus Checks Get My Payment – Check for January 2024! – #10

IRS Stimulus Checks Get My Payment – Check for January 2024! – #10

Employee Gifts – Tax Implications of Giving Gifts to Staff | Blog | Avalon Accounting – #11

Employee Gifts – Tax Implications of Giving Gifts to Staff | Blog | Avalon Accounting – #11

Elder Law: How Gifts Can Affect Medicaid Eligibility – #12

Elder Law: How Gifts Can Affect Medicaid Eligibility – #12

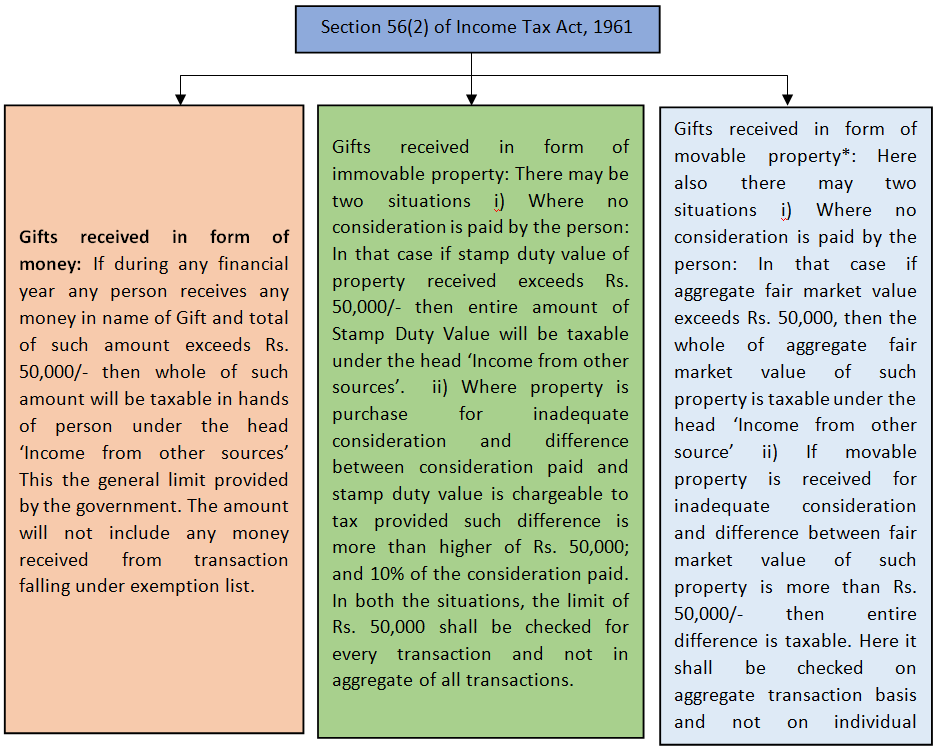

Taxability of gifts under Income Tax Act | PDF – #13

Taxability of gifts under Income Tax Act | PDF – #13

- gift chart as per income tax

- gift from relative exempt from income tax

- gift tax in india

40 Years Ago… and now: From 70% to 30% peak I-T rate | Markets and Investing – Business Standard – #14

40 Years Ago… and now: From 70% to 30% peak I-T rate | Markets and Investing – Business Standard – #14

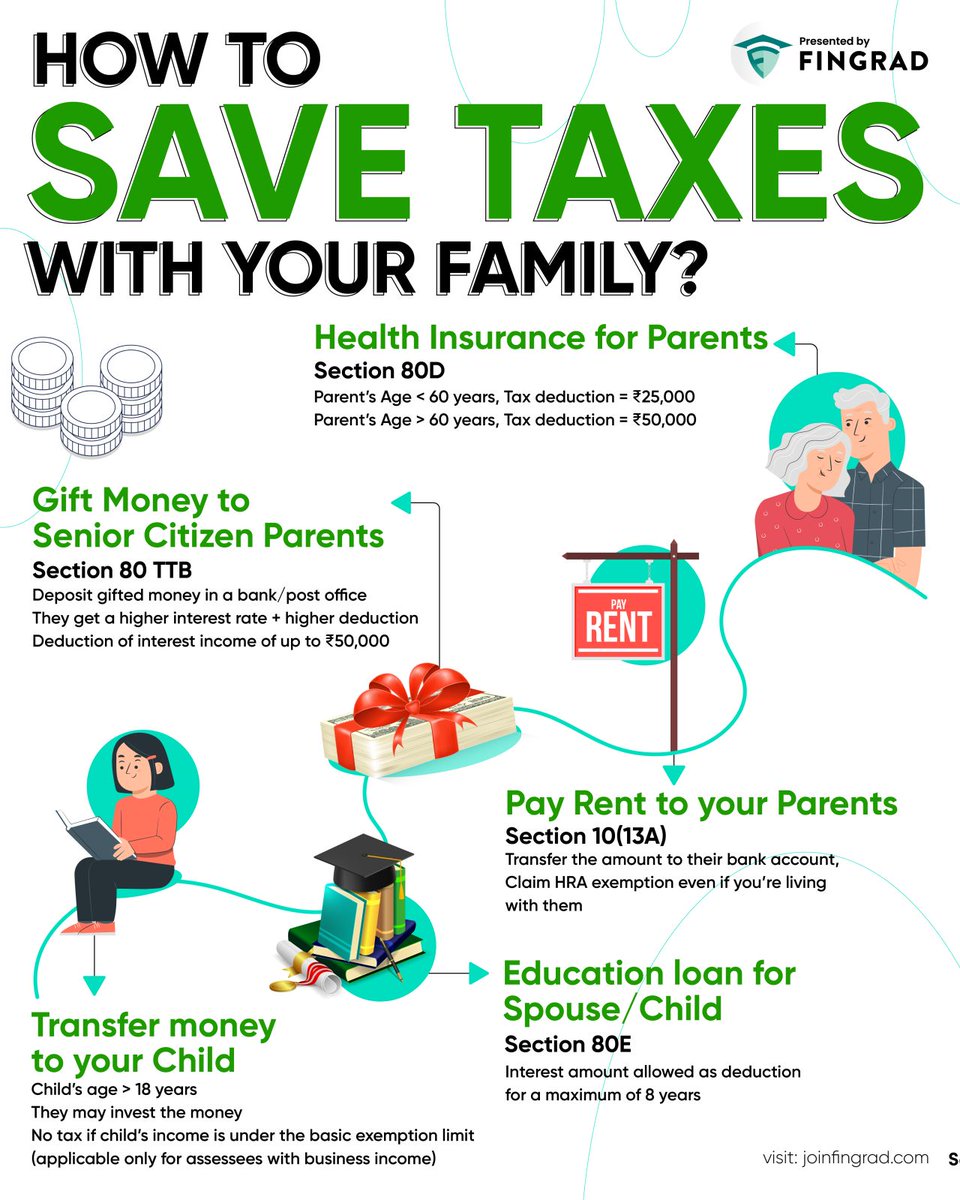

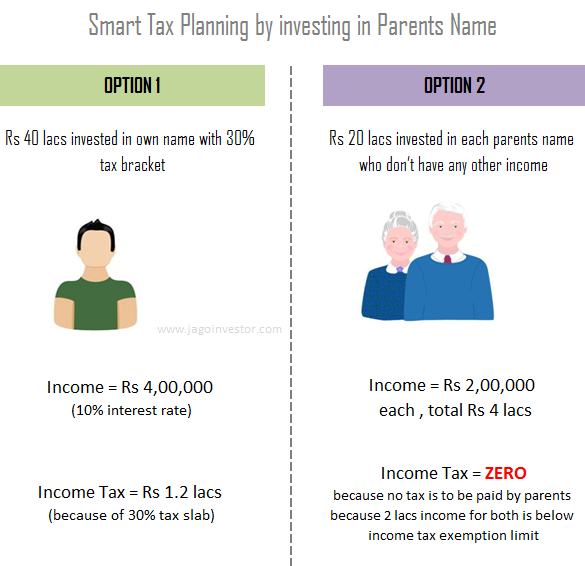

What are some unusual ways of saving income tax in India? – Quora – #15

What are some unusual ways of saving income tax in India? – Quora – #15

Understanding Section 56(2)(x) of Income Tax Act, 1961: Tax Implications of Gifts Received Without Consideration – Marg ERP Blog – #16

Understanding Section 56(2)(x) of Income Tax Act, 1961: Tax Implications of Gifts Received Without Consideration – Marg ERP Blog – #16

Foreign Remittance: Sending Gift Money To The USA From India In 2024 – #17

Foreign Remittance: Sending Gift Money To The USA From India In 2024 – #17

Need to file I-T Returns? Know the steps, benefits of doing it online | Economy & Policy News – Business Standard – #18

Need to file I-T Returns? Know the steps, benefits of doing it online | Economy & Policy News – Business Standard – #18

Gift tax limit 2022: What is it and who can benefit? | Marca – #19

Gift tax limit 2022: What is it and who can benefit? | Marca – #19

Income Tax on Cash Gift to Wife: How Much You Can Gift on Women’s Day Without Tax Implications – Income Tax News | The Financial Express – #20

Income Tax on Cash Gift to Wife: How Much You Can Gift on Women’s Day Without Tax Implications – Income Tax News | The Financial Express – #20

- money cash gift

- gift tax rate table

- gift tax

Tax on Gifts to Children: What You Need to Know – #21

Tax on Gifts to Children: What You Need to Know – #21

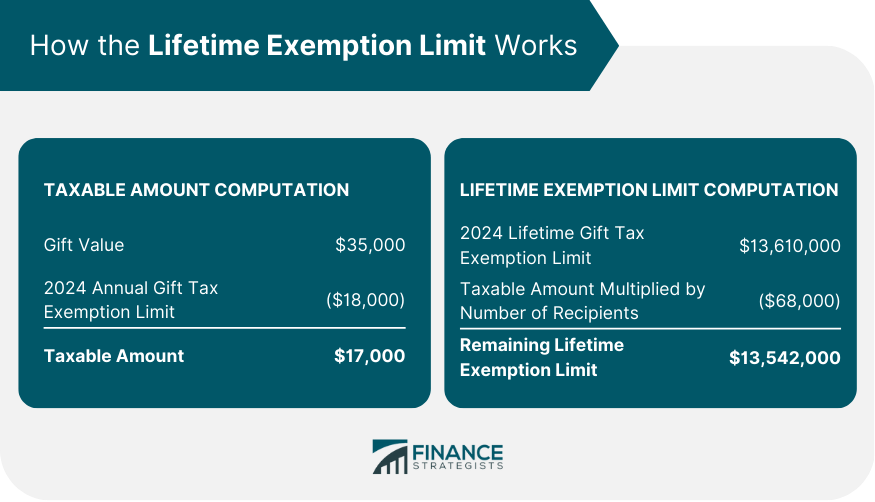

What Is Unified Tax Credit & How Does It Work? – #22

What Is Unified Tax Credit & How Does It Work? – #22

Which Gifts from relatives are exempted from Income Tax? – #23

Which Gifts from relatives are exempted from Income Tax? – #23

5 Guidelines for Homebuyers Using Gift Money for Down Payments – #24

5 Guidelines for Homebuyers Using Gift Money for Down Payments – #24

EbixCash -Get Corporate Gift Cards & Prepaid Cards | Meal Cards – #25

EbixCash -Get Corporate Gift Cards & Prepaid Cards | Meal Cards – #25

Gift Tax: Tax on gifts: Documents that you should have while filing ITR – The Economic Times – #26

Gift Tax: Tax on gifts: Documents that you should have while filing ITR – The Economic Times – #26

Charitable deduction rules for trusts, estates, and lifetime transfers – #27

Charitable deduction rules for trusts, estates, and lifetime transfers – #27

Generation-Skipping Trust (GST): What It Is and How It Works – #28

Generation-Skipping Trust (GST): What It Is and How It Works – #28

Using Gift Funds for Investment Property: What You Need to Know – Trustworthy: The Family Operating System® – #29

Using Gift Funds for Investment Property: What You Need to Know – Trustworthy: The Family Operating System® – #29

Tony DuBose, AIF® on LinkedIn: #legacywealth #legacywealthmanagement #estateplan #estateplanning… – #30

Tony DuBose, AIF® on LinkedIn: #legacywealth #legacywealthmanagement #estateplan #estateplanning… – #30

TDS and Income Tax rates on winnings from Lottery and Game Shows – myMoneySage Blog – #31

TDS and Income Tax rates on winnings from Lottery and Game Shows – myMoneySage Blog – #31

What is HUF (Hindu Undivided Family)? and HUF Tax Benefits | HDFC Life – #32

What is HUF (Hindu Undivided Family)? and HUF Tax Benefits | HDFC Life – #32

Have a Current/Savings Bank Account? Know the Cash Deposit Limits under Income Tax Act to avoid Penalties and Notices – #33

Have a Current/Savings Bank Account? Know the Cash Deposit Limits under Income Tax Act to avoid Penalties and Notices – #33

Top 10 Benefits Of Paying Taxes In India | 5paisa – #34

Top 10 Benefits Of Paying Taxes In India | 5paisa – #34

- gift tax meaning

- gift tax exemption

- family member money gift letter from parents

Whether gift received from HUF to any member of HUF is exempt from taxable income? ITAT Explains | SCC Times – #35

Whether gift received from HUF to any member of HUF is exempt from taxable income? ITAT Explains | SCC Times – #35

Income Tax Slabs FY 2023-24 & AY 2024-25 (New & Old Tax Slab) – #36

Income Tax Slabs FY 2023-24 & AY 2024-25 (New & Old Tax Slab) – #36

Irrevocable Trusts for Estate Tax Planning, Gift Tax and Gifting Strategies Explained – #37

Irrevocable Trusts for Estate Tax Planning, Gift Tax and Gifting Strategies Explained – #37

My grandmother wants to gift cash to me. What are the income tax implications? | Mint – #38

My grandmother wants to gift cash to me. What are the income tax implications? | Mint – #38

Taxability of Gifts under Income Tax Act – Taxmann Blog – #39

Taxability of Gifts under Income Tax Act – Taxmann Blog – #39

Using trusts to shift income to children – #40

Using trusts to shift income to children – #40

Gift Tax Limits and Exceptions: Advice From an Expert | Money – #41

Gift Tax Limits and Exceptions: Advice From an Expert | Money – #41

The Estate Tax and Lifetime Gifting | Charles Schwab – #42

The Estate Tax and Lifetime Gifting | Charles Schwab – #42

Are Your Holiday Employee Gifts Tax Deductible? – #43

Are Your Holiday Employee Gifts Tax Deductible? – #43

Will your ‘gift’ be taxed? – The Economic Times – #44

Will your ‘gift’ be taxed? – The Economic Times – #44

Tax Advantages for Donor-Advised Funds | NPTrust – #45

Tax Advantages for Donor-Advised Funds | NPTrust – #45

Section 80G Deduction Eligibility, Benefits – Tax Exemption – #46

Section 80G Deduction Eligibility, Benefits – Tax Exemption – #46

Spread the Wealth, Carefully, with Tax-Free Gifts – TurboTax Tax Tips & Videos – #47

Spread the Wealth, Carefully, with Tax-Free Gifts – TurboTax Tax Tips & Videos – #47

Home Loan Tax Benefits: Save Income Tax on Home Loan (FY 2023-24) – #48

Home Loan Tax Benefits: Save Income Tax on Home Loan (FY 2023-24) – #48

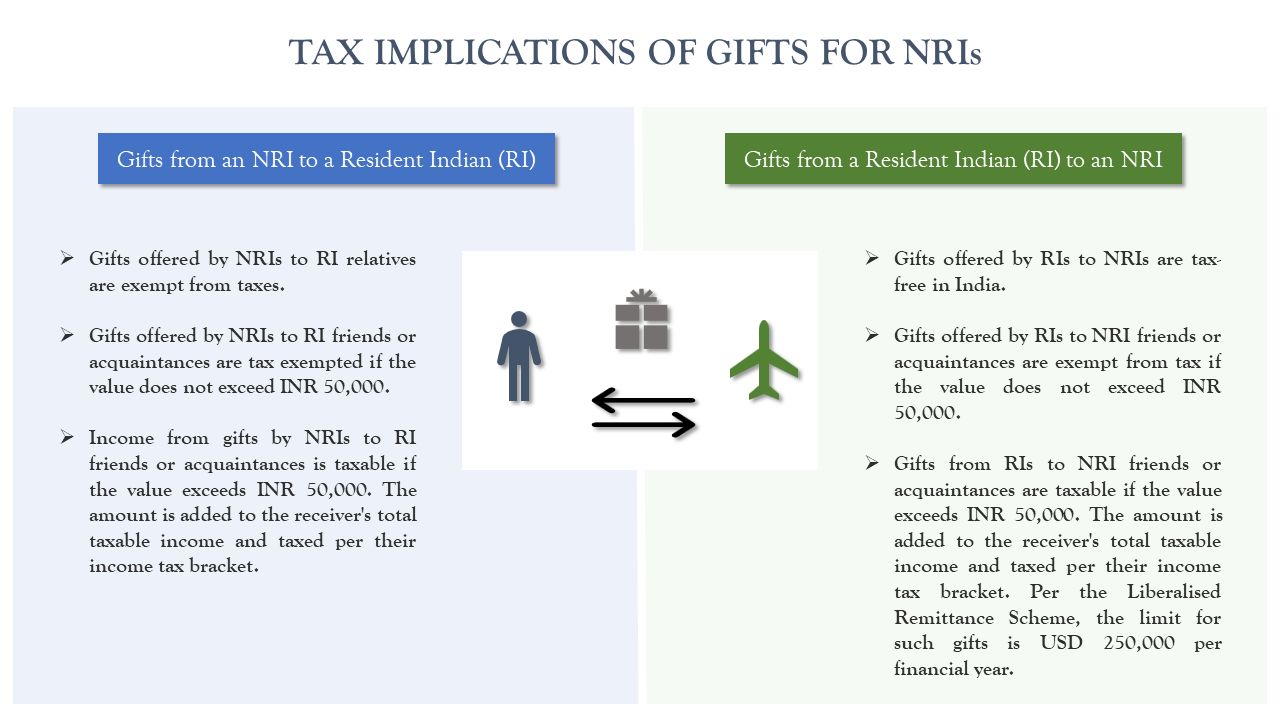

Taxation of gifts to NRIs and changes in Budget 2023-24 – #49

Taxation of gifts to NRIs and changes in Budget 2023-24 – #49

- gift tax rate

- lineal ascendant gift from relative exempt from income tax

- gift money

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Using Gift Money for a Down Payment in Kentucky For A Mortgage Loan – #50

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Using Gift Money for a Down Payment in Kentucky For A Mortgage Loan – #50

Gifts to and from HUF – MN & Associates CS-India – #51

Gifts to and from HUF – MN & Associates CS-India – #51

Income Tax Calculator FY 2024-25, 2023-24 – FinCalC Blog – #52

Income Tax Calculator FY 2024-25, 2023-24 – FinCalC Blog – #52

Decoding wedding gift taxation in India: Know ways to exempt it – #53

Decoding wedding gift taxation in India: Know ways to exempt it – #53

- cash money gift

- gift tax act 1958

- gift tax example

Gift and Estate Tax Exemption Limits Increase for 2024 – Texas Trust Law – #54

Gift and Estate Tax Exemption Limits Increase for 2024 – Texas Trust Law – #54

Gift Tax in India | Save tax on Gift | Income Tax on property gift | will vs gift deed – YouTube – #55

Gift Tax in India | Save tax on Gift | Income Tax on property gift | will vs gift deed – YouTube – #55

NEW IRS changes for tax year 2022 and 2023 due to inflation levels. – US Tax Shield – #56

NEW IRS changes for tax year 2022 and 2023 due to inflation levels. – US Tax Shield – #56

Florida Gift Tax: All You Need to Know | SmartAsset – #57

Florida Gift Tax: All You Need to Know | SmartAsset – #57

Do you have to pay tax on gifts received? – #58

Do you have to pay tax on gifts received? – #58

![529 Tax Deductions by State [2024]: Rules on Tax Benefits 529 Tax Deductions by State [2024]: Rules on Tax Benefits](https://i.ytimg.com/vi/Uf5gs1ln2B0/maxresdefault.jpg) 529 Tax Deductions by State [2024]: Rules on Tax Benefits – #59

529 Tax Deductions by State [2024]: Rules on Tax Benefits – #59

Income tax demand of up to Rs 1 lakh/person to be withdrawn – Times of India – #60

Income tax demand of up to Rs 1 lakh/person to be withdrawn – Times of India – #60

Does Illinois Have A Gift Tax? | Pasquesi Sheppard LLC – #61

Does Illinois Have A Gift Tax? | Pasquesi Sheppard LLC – #61

) Section 10 – Exemptions under Section 10 of Income Tax Act – #62

Section 10 – Exemptions under Section 10 of Income Tax Act – #62

Are Gift Cards Taxable: Employee Gift Card Rules – #63

Are Gift Cards Taxable: Employee Gift Card Rules – #63

Income Tax Slab 2023 24 & AY 2024 25 – #64

Income Tax Slab 2023 24 & AY 2024 25 – #64

Is there any way to gift money to a non-resident Indian friend? | Mint – #65

Is there any way to gift money to a non-resident Indian friend? | Mint – #65

Maximizing Section 1202’s Gain Exclusion – Frost Brown Todd | Full-Service Law Firm – #66

Maximizing Section 1202’s Gain Exclusion – Frost Brown Todd | Full-Service Law Firm – #66

These 13 Tax Breaks Can Save You Money — Even If You File Last Minute – CNET – #67

These 13 Tax Breaks Can Save You Money — Even If You File Last Minute – CNET – #67

6 Ways To Give Money As A Gift | Bankrate – #68

6 Ways To Give Money As A Gift | Bankrate – #68

Claiming A Charitable Donation Without A Receipt | H&R Block – #69

Claiming A Charitable Donation Without A Receipt | H&R Block – #69

tax liability: Money & relationships: 7 ways children can help us reduce our tax liability – The Economic Times – #70

tax liability: Money & relationships: 7 ways children can help us reduce our tax liability – The Economic Times – #70

RMS ACCOUNTING | Fort Lauderdale FL – #71

RMS ACCOUNTING | Fort Lauderdale FL – #71

How is the gifting of money or property to a relative taxed? | Mint – #72

How is the gifting of money or property to a relative taxed? | Mint – #72

Gift Tax – #73

Gift Tax – #73

Gifting Stock: 4 Ways to Gift Stocks to Friends, Family, and Charities – #74

Gifting Stock: 4 Ways to Gift Stocks to Friends, Family, and Charities – #74

What Is the Gift Tax? | City National Bank – #75

What Is the Gift Tax? | City National Bank – #75

How to Gift Money – Experian – #76

How to Gift Money – Experian – #76

Revisit the History of I-T Slab Rates (1944-45 to 2021-22) – #77

Revisit the History of I-T Slab Rates (1944-45 to 2021-22) – #77

What Are the Implications of a Loan Versus a Financial Gift to a Family Member – #78

What Are the Implications of a Loan Versus a Financial Gift to a Family Member – #78

We’re Paying for Our Daughter’s Wedding. Is It a Taxable Gift? – WSJ – #79

We’re Paying for Our Daughter’s Wedding. Is It a Taxable Gift? – WSJ – #79

![How to gift money to parents in India: Tax, Limits [2020] - Wise How to gift money to parents in India: Tax, Limits [2020] - Wise](https://life.futuregenerali.in/media/ozqbo2iq/taxes-on-gift-deed.webp) How to gift money to parents in India: Tax, Limits [2020] – Wise – #80

How to gift money to parents in India: Tax, Limits [2020] – Wise – #80

Gift Tax Limit Cartoons and Comics – funny pictures from CartoonStock – #81

Gift Tax Limit Cartoons and Comics – funny pictures from CartoonStock – #81

What is the Annual Gift Tax Limit? | Long Island Estate Planning – #82

What is the Annual Gift Tax Limit? | Long Island Estate Planning – #82

Jeanne on X: “A misleading headline. The “annual exclusion” ($18,000 for 2024) is the amount you can gift to someone without using any of your lifetime gift & estate exclusion or filing – #83

Jeanne on X: “A misleading headline. The “annual exclusion” ($18,000 for 2024) is the amount you can gift to someone without using any of your lifetime gift & estate exclusion or filing – #83

How to Maximize OPC Savings before Filing Income Tax? – #84

How to Maximize OPC Savings before Filing Income Tax? – #84

The best ways of gifting money to grandchildren – #85

The best ways of gifting money to grandchildren – #85

Gift of Immovable property under Income Tax Act – #86

Gift of Immovable property under Income Tax Act – #86

Japan Gift Tax; All Expats Need to Know – #87

Japan Gift Tax; All Expats Need to Know – #87

Tax collection at Source” (TCS) on sale of goods for India in Dynamics 365 – Microsoft Support – #88

Tax collection at Source” (TCS) on sale of goods for India in Dynamics 365 – Microsoft Support – #88

Gift taxation | ITR: Gifts have to be declared in ITR: Here’s how they are taxed – #89

Gift taxation | ITR: Gifts have to be declared in ITR: Here’s how they are taxed – #89

UGMA & UTMA accounts | Tips for custodial accounts | Fidelity – #90

UGMA & UTMA accounts | Tips for custodial accounts | Fidelity – #90

- estate tax

- gift tax rate in india 2020

- section 56(2) of income tax act

How can NRIs in the US gift money to their parents in India in 2023? | Arthgyaan – #91

How can NRIs in the US gift money to their parents in India in 2023? | Arthgyaan – #91

Lottery Tax in India: Tax Levied on Winning Game Shows & Lottery – #92

Lottery Tax in India: Tax Levied on Winning Game Shows & Lottery – #92

How to Donate to Charity, Get a Tax Break and Have Income for Life – WSJ – #93

How to Donate to Charity, Get a Tax Break and Have Income for Life – WSJ – #93

7th pay commission latest news today: Big Modi government gift for 18 lakh central government employees | Zee Business – #94

7th pay commission latest news today: Big Modi government gift for 18 lakh central government employees | Zee Business – #94

New Income Tax Slab FY 2023-24, AY 2024-25 Old, New Regime – #95

New Income Tax Slab FY 2023-24, AY 2024-25 Old, New Regime – #95

Cash Deposit Limit in Saving Account as Per Income Tax (2024) – Forbes Advisor INDIA – #96

Cash Deposit Limit in Saving Account as Per Income Tax (2024) – Forbes Advisor INDIA – #96

Annual Exclusion: Meaning, Special Cases, FAQs – #97

Annual Exclusion: Meaning, Special Cases, FAQs – #97

Bonuses, Gifts & Fringe Benefits: Taxable and Deductible – #98

Bonuses, Gifts & Fringe Benefits: Taxable and Deductible – #98

It’s Not Just Income Taxes. Billionaires Don’t Pay Inheritance Taxes Either. – Mother Jones – #99

It’s Not Just Income Taxes. Billionaires Don’t Pay Inheritance Taxes Either. – Mother Jones – #99

Are Gift Cards Taxable to Employees? – #100

Are Gift Cards Taxable to Employees? – #100

The Tax Implications of Employee Gifts – Hourly, Inc. – #101

The Tax Implications of Employee Gifts – Hourly, Inc. – #101

Long Term Capital Gain Tax on Shares in India – #102

Long Term Capital Gain Tax on Shares in India – #102

Income tax rules: What if HUF’s Karta transfers money personal account to HUF? | Mint – #103

Income tax rules: What if HUF’s Karta transfers money personal account to HUF? | Mint – #103

) Gift Tax – Do I Have to Pay Taxes on a Gift | Gift Tax Calculator – #104

Gift Tax – Do I Have to Pay Taxes on a Gift | Gift Tax Calculator – #104

You Take a Friend on Your Yacht. Is It a Taxable Gift? – WSJ – #105

You Take a Friend on Your Yacht. Is It a Taxable Gift? – WSJ – #105

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #106

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #106

Tax Reduction Strategies for High-Income Earners (2023) – #107

Tax Reduction Strategies for High-Income Earners (2023) – #107

Cody Garrett, CFP® on LinkedIn: Common misconception: “You can only gift up to $17k each year without… | 14 comments – #108

Cody Garrett, CFP® on LinkedIn: Common misconception: “You can only gift up to $17k each year without… | 14 comments – #108

Gift Deed Registration: Stamp Duty, Registry Fee, Tax, Procedure – #109

Gift Deed Registration: Stamp Duty, Registry Fee, Tax, Procedure – #109

Do I have to pay taxes on foreign inheritance to the IRS? | International Tax Attorney – #110

Do I have to pay taxes on foreign inheritance to the IRS? | International Tax Attorney – #110

Gift Cards vs Cash: Which is the Better Gift Option? – #111

Gift Cards vs Cash: Which is the Better Gift Option? – #111

3 Ways to Make Sure Your Cash Gifting Is Legal – wikiHow – #112

3 Ways to Make Sure Your Cash Gifting Is Legal – wikiHow – #112

Your acts of generosity could unintentionally use your gift tax exemption – #113

Your acts of generosity could unintentionally use your gift tax exemption – #113

Pending income tax demand of up to Rs 1 lakh per individual waived. All the details – BusinessToday – #114

Pending income tax demand of up to Rs 1 lakh per individual waived. All the details – BusinessToday – #114

Taxation of Minor Children in India: How Does It Work? – #115

Taxation of Minor Children in India: How Does It Work? – #115

-Gifts.jpg) Gifting Money to Family Members: 5 Strategies to Understand – Kindness Financial Planning – #116

Gifting Money to Family Members: 5 Strategies to Understand – Kindness Financial Planning – #116

Home Loan Tax Benefit Calculator – Tax Saving on Home Loan | Kotak Bank – #117

Home Loan Tax Benefit Calculator – Tax Saving on Home Loan | Kotak Bank – #117

Rules for Gifting Money to Family for a Down Payment in 2024 – #118

Rules for Gifting Money to Family for a Down Payment in 2024 – #118

The Generation-Skipping Transfer Tax: A Quick Guide – #119

The Generation-Skipping Transfer Tax: A Quick Guide – #119

Taxability of Gift received by an individual or HUF with FAQs – #120

Taxability of Gift received by an individual or HUF with FAQs – #120

NRI Gift Tax India: Rules for Tax On Gift Money In India | DBS Treasures – #121

NRI Gift Tax India: Rules for Tax On Gift Money In India | DBS Treasures – #121

Gift tax: Gift Tax 101: How It Fits into the Picture of Total Taxation – FasterCapital – #122

Gift tax: Gift Tax 101: How It Fits into the Picture of Total Taxation – FasterCapital – #122

Navigating Indian Tax Rules for NRI Gift Money: Key Considerations and Compliance Guidelines – #123

Navigating Indian Tax Rules for NRI Gift Money: Key Considerations and Compliance Guidelines – #123

- gift tax upsc

- gift tax rate in india 2022-23

Gift Tax, the Annual Exclusion and Estate Planning – #124

Gift Tax, the Annual Exclusion and Estate Planning – #124

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #125

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #125

Is there a limit in income tax laws up to which a father can gift to his son – #126

Is there a limit in income tax laws up to which a father can gift to his son – #126

Money Transfer Rules: Want to send money abroad? Here are the rules, limitations, tax implications, charges, ways to transfer – The Economic Times – #127

Money Transfer Rules: Want to send money abroad? Here are the rules, limitations, tax implications, charges, ways to transfer – The Economic Times – #127

When You Make Cash Gifts To Your Children, Who Pays The Tax? – YouTube – #128

When You Make Cash Gifts To Your Children, Who Pays The Tax? – YouTube – #128

Giving Or Receiving A Down Payment Gift? Here’s What You Need To Know – #129

Giving Or Receiving A Down Payment Gift? Here’s What You Need To Know – #129

Posts: gift money tax limit

Categories: Gifts

Author: toyotabienhoa.edu.vn