Discover 144+ gift income tax act super hot

Details images of gift income tax act by website toyotabienhoa.edu.vn compilation. Do You Pay Taxes on Gifts From Parents? (2023 and 2024) | SmartAsset. Taxation of Gift under Income Tax Act 1961. Tax Implications of Supporting Adult Children | TaxAct Blog. Section 56(2)(vii) : Cash / Non-Cash Gifts

What will the estate and gift tax exclusions be in 2024, 2025? – #1

What will the estate and gift tax exclusions be in 2024, 2025? – #1

Federal Estate and Gift Taxation (American Casebook Series) – Grayson McCouch: 9780314161260 – AbeBooks – #2

Federal Estate and Gift Taxation (American Casebook Series) – Grayson McCouch: 9780314161260 – AbeBooks – #2

Did you know? Employers’ gifts over Rs 5000 are taxable – Rediff.com – #4

Did you know? Employers’ gifts over Rs 5000 are taxable – Rediff.com – #4

Gift Planning | Central Piedmont Community College Foundation | Central Piedmont Community College Foundation – #5

Gift Planning | Central Piedmont Community College Foundation | Central Piedmont Community College Foundation – #5

2023 tax law Archives – The National Law Forum – #6

2023 tax law Archives – The National Law Forum – #6

Tax Benefits of Corporate Matching Gifts: The Basics – #7

Tax Benefits of Corporate Matching Gifts: The Basics – #7

Solved Question Section 2(1) of the Income Tax Act (ITA) | Chegg.com – #8

Solved Question Section 2(1) of the Income Tax Act (ITA) | Chegg.com – #8

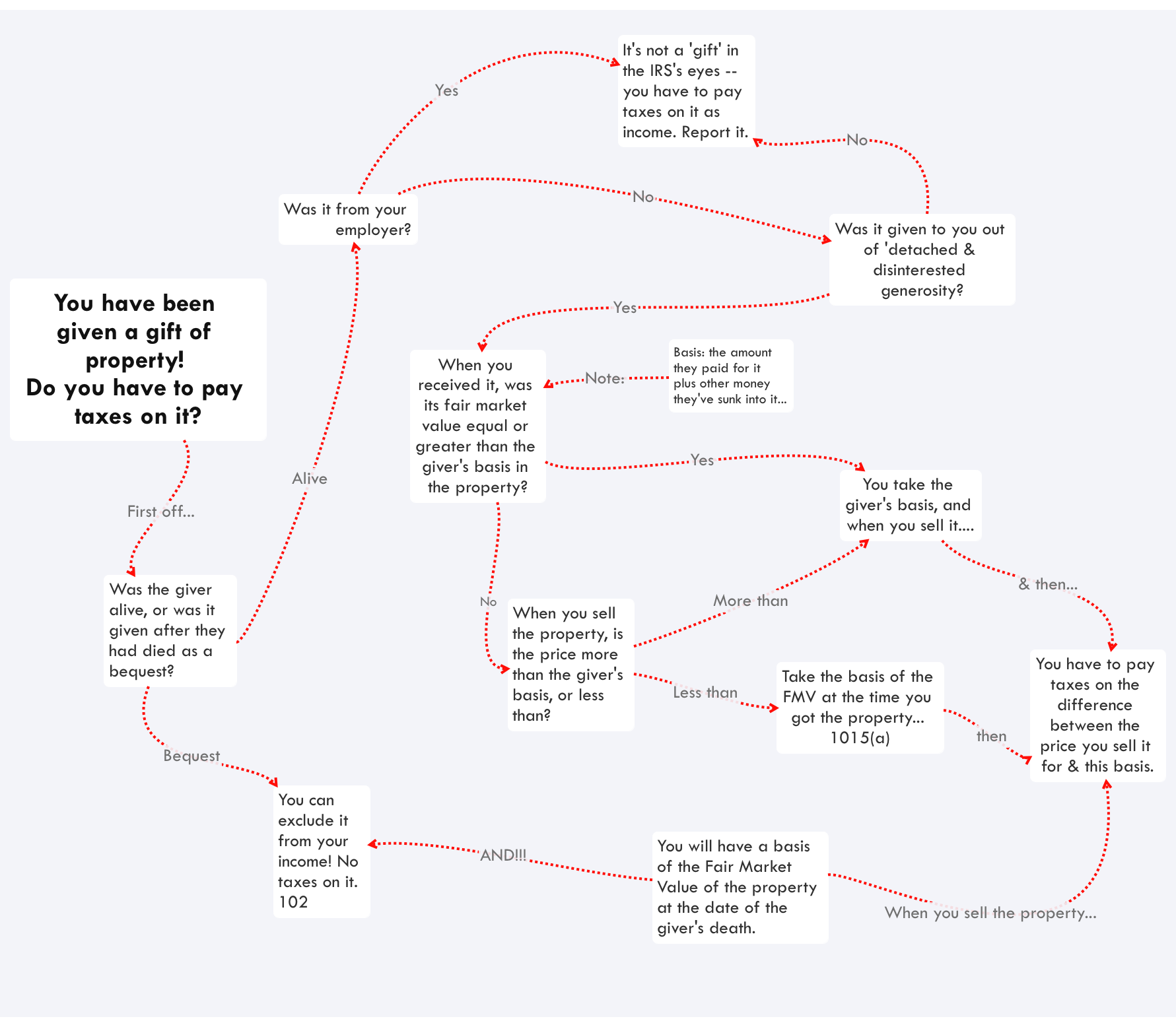

Taft v. Bowers: The Foundation for Non-Recognition Provisions in the Income Tax – #10

Taft v. Bowers: The Foundation for Non-Recognition Provisions in the Income Tax – #10

House Committee proposal includes widespread changes to current estate, gift and income tax law – #11

House Committee proposal includes widespread changes to current estate, gift and income tax law – #11

Solved In 2022 , Angela gifted shares of a public | Chegg.com – #12

Solved In 2022 , Angela gifted shares of a public | Chegg.com – #12

Gifts to Business Associates and Executives are “Business Promotion Expenses”, Deductible u/s 37 of Income Tax Act: ITAT – #13

Gifts to Business Associates and Executives are “Business Promotion Expenses”, Deductible u/s 37 of Income Tax Act: ITAT – #13

The Estate Tax is Irrelevant to More Than 99 Percent of Americans – ITEP – #14

The Estate Tax is Irrelevant to More Than 99 Percent of Americans – ITEP – #14

The Estate Tax and Lifetime Gifting | Charles Schwab – #15

The Estate Tax and Lifetime Gifting | Charles Schwab – #15

- money gift deed format

- gift deed format father to son

- property gift deed

The IRS’s Christmas Gift to Airbnb and PayPal Is a Loss for Law-Abiding Taxpayers | Tax Policy Center – #16

The IRS’s Christmas Gift to Airbnb and PayPal Is a Loss for Law-Abiding Taxpayers | Tax Policy Center – #16

The 2022 gift tax return deadline is coming up soon – April 18 – Encore Partners – #17

The 2022 gift tax return deadline is coming up soon – April 18 – Encore Partners – #17

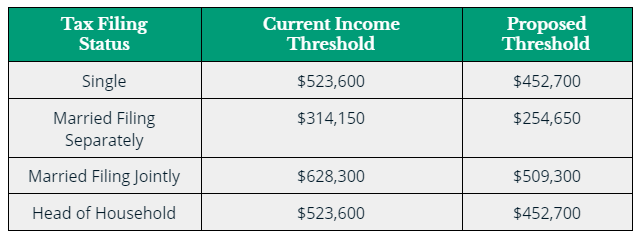

Proposed Tax Law Changes: Where We Are Focused – Relative Value Partners – #18

Proposed Tax Law Changes: Where We Are Focused – Relative Value Partners – #18

Property Gift Deed Registration – Sample Format, Charges & Rules – #19

Property Gift Deed Registration – Sample Format, Charges & Rules – #19

IRS Form 706: Who Must File It and Related Forms – #20

IRS Form 706: Who Must File It and Related Forms – #20

Gifts of Partnership Interests – #21

Gifts of Partnership Interests – #21

Holiday Employee Gift Giving and Tax Deductions – Intuit TurboTax Blog – #22

Holiday Employee Gift Giving and Tax Deductions – Intuit TurboTax Blog – #22

Estate and Tax Planning 2023 Update: Act While You Can – #23

Estate and Tax Planning 2023 Update: Act While You Can – #23

Crypto Taxes India: Expert Guide 2024 | CPA Reviewed | Koinly – #24

Crypto Taxes India: Expert Guide 2024 | CPA Reviewed | Koinly – #24

How to gift stocks, bonds and ETFs and the tax implications – Z-Connect by Zerodha – #25

How to gift stocks, bonds and ETFs and the tax implications – Z-Connect by Zerodha – #25

Inheritance Tax: What It Is, How It’s Calculated, and Who Pays It – #26

Inheritance Tax: What It Is, How It’s Calculated, and Who Pays It – #26

CA Shilpi Goyal on LinkedIn: Gifts Received By Individual/HUF- Taxation & Exemption Under Income Tax… – #27

CA Shilpi Goyal on LinkedIn: Gifts Received By Individual/HUF- Taxation & Exemption Under Income Tax… – #27

Gift Tax: When receiving a gift becomes taxing… – MarketExpress – #28

Gift Tax: When receiving a gift becomes taxing… – MarketExpress – #28

Practical Tax Planning – #29

Practical Tax Planning – #29

Gift Tax: 3 Easy Ways to Avoid Paying the Gift Tax | TaxAct – #30

Gift Tax: 3 Easy Ways to Avoid Paying the Gift Tax | TaxAct – #30

IRS announces tax year 2023 changes to the standard deduction, EITC, and more – Tax Pro Center | Intuit – #31

IRS announces tax year 2023 changes to the standard deduction, EITC, and more – Tax Pro Center | Intuit – #31

Amazon.com: Internal Revenue Code: INC, EST, Gift, Employment & Excise Taxes, (Summer 2022): 9780808057291: CCH Tax Law Editors: Books – #32

Amazon.com: Internal Revenue Code: INC, EST, Gift, Employment & Excise Taxes, (Summer 2022): 9780808057291: CCH Tax Law Editors: Books – #32

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #33

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #33

Taxation of Gifts to Ministers and Church Employees – Provident Lawyers – #34

Taxation of Gifts to Ministers and Church Employees – Provident Lawyers – #34

Helping Entrepreneurs Slash Their Tax Bills – #35

Helping Entrepreneurs Slash Their Tax Bills – #35

-Gifts.jpg) FairTax Act Proposed | C-SPAN.org – #36

FairTax Act Proposed | C-SPAN.org – #36

Taxes at Death Insurance Concepts. Tax on What you Own at Death When a taxpayer dies, they are subjected to paragraph 70(5) of the Income Tax Act which. – ppt download – #37

Taxes at Death Insurance Concepts. Tax on What you Own at Death When a taxpayer dies, they are subjected to paragraph 70(5) of the Income Tax Act which. – ppt download – #37

Will your ‘gift’ be taxed? – The Economic Times – #38

Will your ‘gift’ be taxed? – The Economic Times – #38

Taxscan on LinkedIn: Advance received for Sale of Property is taxable under ‘Income from other… – #39

Taxscan on LinkedIn: Advance received for Sale of Property is taxable under ‘Income from other… – #39

Irrevocable Trusts for Estate Tax Planning, Gift Tax and Gifting Strategies Explained – #40

Irrevocable Trusts for Estate Tax Planning, Gift Tax and Gifting Strategies Explained – #40

The Benefits of Gifting: A Tool for Estate Planning and Tax Savings – #41

The Benefits of Gifting: A Tool for Estate Planning and Tax Savings – #41

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #42

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #42

Got laid off? This is how your severance pay will be taxed | Mint – #43

Got laid off? This is how your severance pay will be taxed | Mint – #43

Page 1 of 2 – #44

Page 1 of 2 – #44

How much can you gift a family member in 2022? | Law Offices of DuPont and Blumenstiel – #45

How much can you gift a family member in 2022? | Law Offices of DuPont and Blumenstiel – #45

Union Budget 2021’s GIFT To The Payments Industry And Overcoming Zero MDR Issues – Cashfree Payments Blog – #46

Union Budget 2021’s GIFT To The Payments Industry And Overcoming Zero MDR Issues – Cashfree Payments Blog – #46

How is inherited property to be declared in ITR? | Mint – #47

How is inherited property to be declared in ITR? | Mint – #47

Reminder: Holiday Gifts, Prizes or Parties Can Be Taxable Wages – #48

Reminder: Holiday Gifts, Prizes or Parties Can Be Taxable Wages – #48

What are the tax laws on gifts? – Quora – #49

What are the tax laws on gifts? – Quora – #49

Federal Income, Gift and Estate Taxation | LexisNexis Store – #50

Federal Income, Gift and Estate Taxation | LexisNexis Store – #50

Solved 1. What are the taxes? Check all that apply Income | Chegg.com – #51

Solved 1. What are the taxes? Check all that apply Income | Chegg.com – #51

Tejaswini Avhad on LinkedIn: Taxability of gifts under Income Tax act – #52

Tejaswini Avhad on LinkedIn: Taxability of gifts under Income Tax act – #52

Decoding wedding gift taxation in India: Know ways to exempt it – #53

Decoding wedding gift taxation in India: Know ways to exempt it – #53

Florida Gift Tax: All You Need to Know | SmartAsset – #54

Florida Gift Tax: All You Need to Know | SmartAsset – #54

Build Back Better Act: Trusts and Estates – #55

Build Back Better Act: Trusts and Estates – #55

Income Tax Exemption On Gifts | Are The Gifts Above Rs 50,000 Taxable? | Personal Finance – YouTube – #56

Income Tax Exemption On Gifts | Are The Gifts Above Rs 50,000 Taxable? | Personal Finance – YouTube – #56

Understanding Federal Estate and Gift Taxes | Congressional Budget Office – #57

Understanding Federal Estate and Gift Taxes | Congressional Budget Office – #57

A Guide To Gifts Of Equity | Rocket Mortgage – #58

A Guide To Gifts Of Equity | Rocket Mortgage – #58

How Does a Uniform Gifts to Minors Act (UGMA) Account Work? – #59

How Does a Uniform Gifts to Minors Act (UGMA) Account Work? – #59

Amazon.com: Internal Revenue Code Winter 2020: Income Taxes SS1-860G / Income, Estate, Gift, Employment and Excise Taxes S861-End – As of November 21, 2019: 9780808047858: Cch Tax Law Editors: Books – #60

Amazon.com: Internal Revenue Code Winter 2020: Income Taxes SS1-860G / Income, Estate, Gift, Employment and Excise Taxes S861-End – As of November 21, 2019: 9780808047858: Cch Tax Law Editors: Books – #60

Estate and Gift Taxes Brochure – Item: #72-8121 – #61

Estate and Gift Taxes Brochure – Item: #72-8121 – #61

My grandmother wants to gift cash to me. What are the income tax implications? | Mint – #62

My grandmother wants to gift cash to me. What are the income tax implications? | Mint – #62

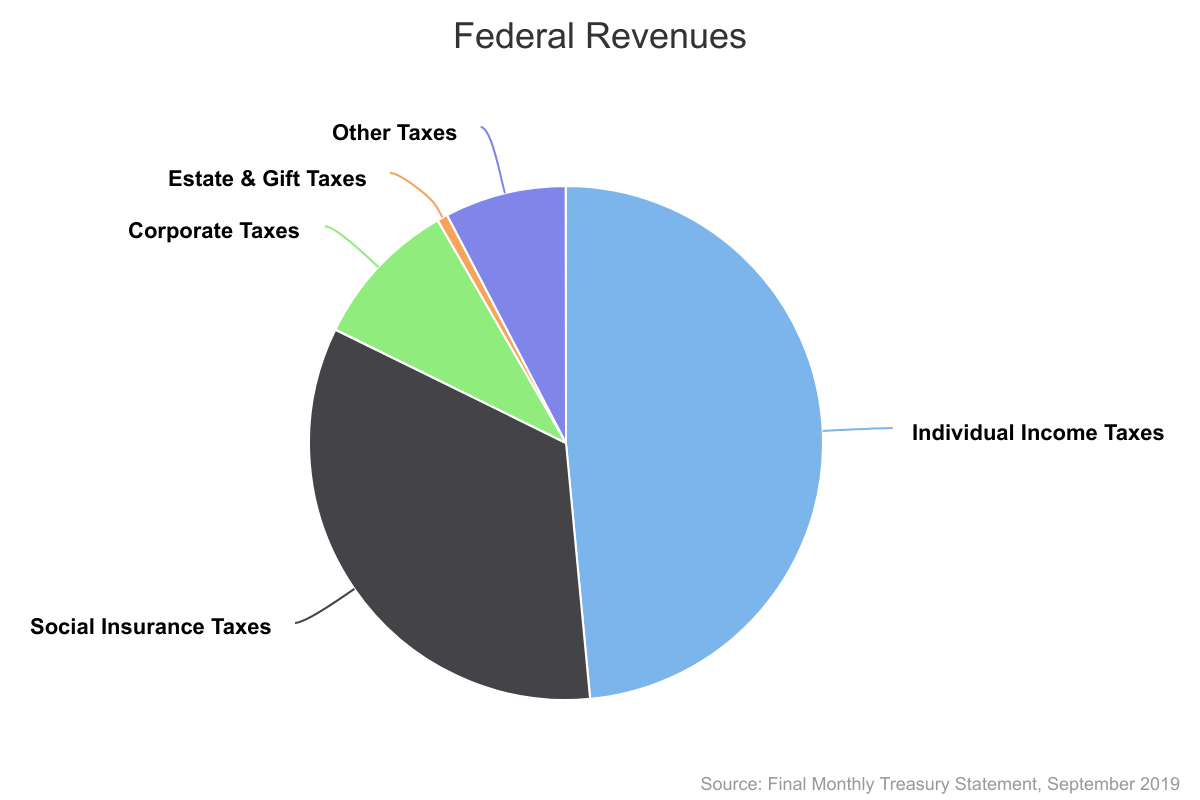

Taxes Primer – The Concord Coalition – #63

Taxes Primer – The Concord Coalition – #63

The New Tax Reform: Not Quite a Lavish Gift, But Largely Favorable to Commercial Real Estate – Counselors of Real Estate – #64

The New Tax Reform: Not Quite a Lavish Gift, But Largely Favorable to Commercial Real Estate – Counselors of Real Estate – #64

Are Diwali gifts from employer, relatives, friends taxable? Here’s a look at the norms | Mint – #65

Are Diwali gifts from employer, relatives, friends taxable? Here’s a look at the norms | Mint – #65

How To Avoid The Gift Tax In Real Estate | Rocket Mortgage – #66

How To Avoid The Gift Tax In Real Estate | Rocket Mortgage – #66

2017 Estates And Trusts Tax Law And Planning Update (43-Page Book) – #67

2017 Estates And Trusts Tax Law And Planning Update (43-Page Book) – #67

The New Tax Law and Charitable Giving | The ALS Association – #68

The New Tax Law and Charitable Giving | The ALS Association – #68

Can I Be Taxed For Gifting My Business? — Thienel Law – #69

Can I Be Taxed For Gifting My Business? — Thienel Law – #69

Tax Changes Likely to Fuel More M&A Tax Cuts and Jobs Act – #70

Tax Changes Likely to Fuel More M&A Tax Cuts and Jobs Act – #70

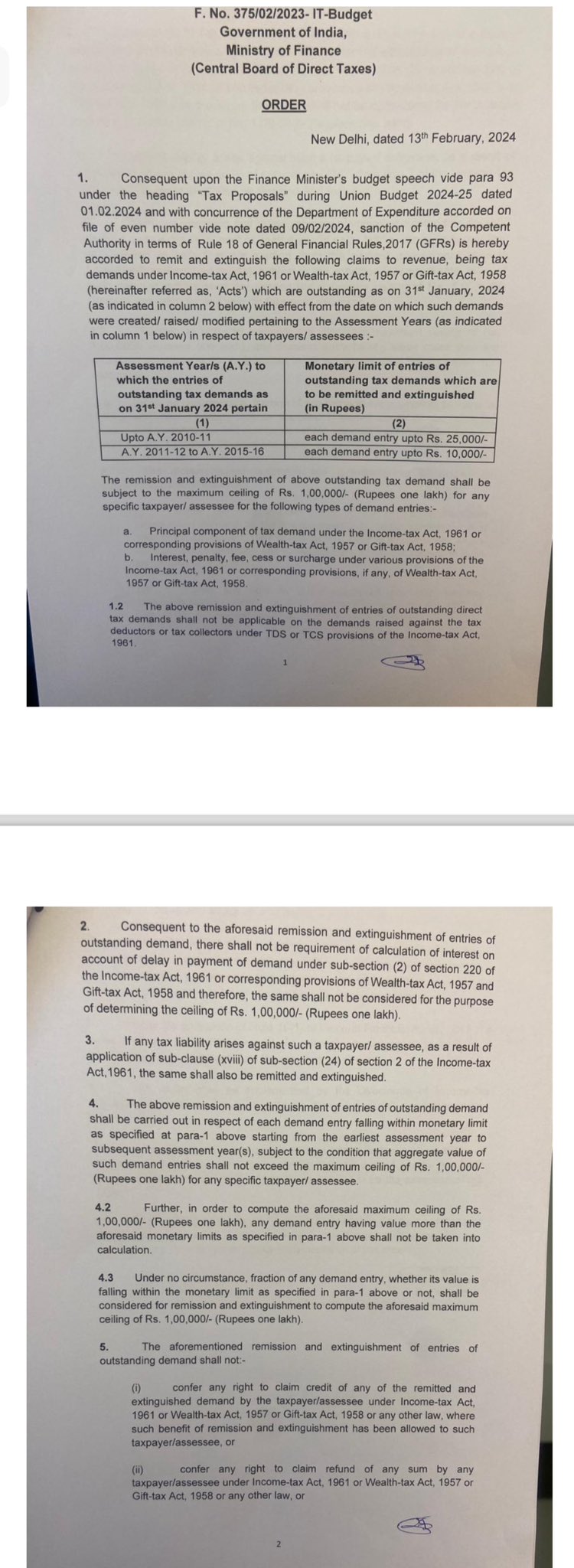

Understanding the Concept of “Remission and Extinguishment of Demands” under Income Tax Act – #71

Understanding the Concept of “Remission and Extinguishment of Demands” under Income Tax Act – #71

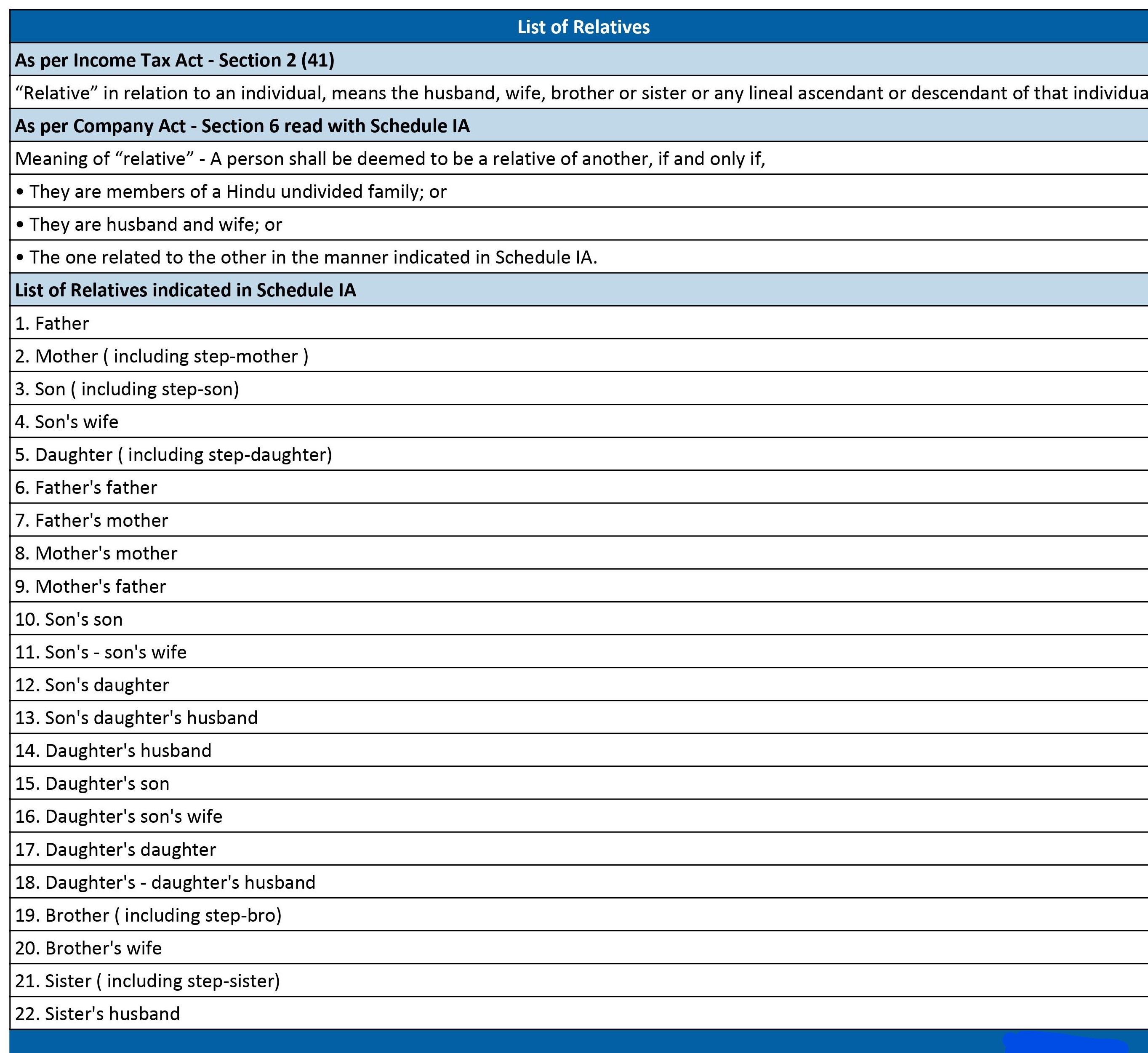

Meaning of relative under different act | CA Rajput Jain – #72

Meaning of relative under different act | CA Rajput Jain – #72

Taxability of gifts under Income Tax Act | PDF – #73

Taxability of gifts under Income Tax Act | PDF – #73

Three Gifts That Pay You | Texas A&M Foundation – #74

Three Gifts That Pay You | Texas A&M Foundation – #74

DATRI Blood Stem Cell Donors Registry on Instagram: “Your donation can SAVE TAX & GIFT LIVES. Donate now to DATRI and get 50% tax exemption under Section 80G of Income Tax Act – #75

DATRI Blood Stem Cell Donors Registry on Instagram: “Your donation can SAVE TAX & GIFT LIVES. Donate now to DATRI and get 50% tax exemption under Section 80G of Income Tax Act – #75

Section 10 of Income Tax Act – Deductions and Allowances – #76

Section 10 of Income Tax Act – Deductions and Allowances – #76

What’s the Gift Tax Limit in California? | The Werner Law Firm, PC – #77

What’s the Gift Tax Limit in California? | The Werner Law Firm, PC – #77

Tax Guidelines for Foreign Nationals & NRIs in India – #78

Tax Guidelines for Foreign Nationals & NRIs in India – #78

Annual Gift Tax Exclusion Explained | PNC Insights – #79

Annual Gift Tax Exclusion Explained | PNC Insights – #79

Income tax and GST implication for Perquisites or benefit under section 194R of Income tax Act – Tax Today – #80

Income tax and GST implication for Perquisites or benefit under section 194R of Income tax Act – Tax Today – #80

Do I Need to Worry About the Gift Tax If I Pay $30,000 Toward My Child’s Wedding? | SmartAsset – #81

Do I Need to Worry About the Gift Tax If I Pay $30,000 Toward My Child’s Wedding? | SmartAsset – #81

- gift tax exemption relatives list

- gift tax act 1958

- gift tax example

Create HUF to save tax and Other Important Aspects of HUF Under Income Tax, 1961 – Income Tax News, Judgments, Act, Analysis, Tax Planning, Advisory, E filing of returns, CA Students – #82

Create HUF to save tax and Other Important Aspects of HUF Under Income Tax, 1961 – Income Tax News, Judgments, Act, Analysis, Tax Planning, Advisory, E filing of returns, CA Students – #82

Tax queries: Gifts received from a relative are tax-exempt – The Economic Times – #83

Tax queries: Gifts received from a relative are tax-exempt – The Economic Times – #83

Are Employee Gifts Tax Deductible? – Swag Bar – #84

Are Employee Gifts Tax Deductible? – Swag Bar – #84

![AY 23-24 Income Tax - 5.5.9 Income From Other Sources - Gift [Section 56(2)(x)] - YouTube AY 23-24 Income Tax - 5.5.9 Income From Other Sources - Gift [Section 56(2)(x)] - YouTube](https://digitalasset.intuit.com/content/dam/intuit/cg/en_us/turbotax/tax-tips/images/general/the-gift-tax-made-simple_l5tgwvc8n.jpg) AY 23-24 Income Tax – 5.5.9 Income From Other Sources – Gift [Section 56(2)(x)] – YouTube – #85

AY 23-24 Income Tax – 5.5.9 Income From Other Sources – Gift [Section 56(2)(x)] – YouTube – #85

How to calculate income tax on gifts from relatives? – #86

How to calculate income tax on gifts from relatives? – #86

federal estate gift taxes – AbeBooks – #87

federal estate gift taxes – AbeBooks – #87

when Gift is taxable ? when gift is Exempted ? | SIMPLE TAX INDIA – #88

when Gift is taxable ? when gift is Exempted ? | SIMPLE TAX INDIA – #88

Monetary gift tax: Income tax on gift received from parents | Value Research – #89

Monetary gift tax: Income tax on gift received from parents | Value Research – #89

Donating Publicly Traded Securities | Schwab Charitable Donor-Advised Fund | Schwab Charitable – #90

Donating Publicly Traded Securities | Schwab Charitable Donor-Advised Fund | Schwab Charitable – #90

What Is The Gift Tax Rate? – Forbes Advisor – #91

What Is The Gift Tax Rate? – Forbes Advisor – #91

- federal gift tax

- gift chart as per income tax

- gift from relative exempt from income tax

- import tax

- gift tax rate

- excise tax

TAXATION ON GIFTS UNDER INCOME TAX ACT, 1961 | Income tax, Taxact, Income – #92

TAXATION ON GIFTS UNDER INCOME TAX ACT, 1961 | Income tax, Taxact, Income – #92

How a QPRT Can Help Reduce Estate Tax | Charles Schwab – #93

How a QPRT Can Help Reduce Estate Tax | Charles Schwab – #93

Tax On Gifts: As Festive Season Nears, Know Tax Implications On Gifts You Receive – News18 – #94

Tax On Gifts: As Festive Season Nears, Know Tax Implications On Gifts You Receive – News18 – #94

126 Donation Receipt Template page 7 – Free to Edit, Download & Print | CocoDoc – #95

126 Donation Receipt Template page 7 – Free to Edit, Download & Print | CocoDoc – #95

- gift tax exclusion 2023

- gift tax

- gift tax definition

Tax Scan – https://www.taxscan.in/advance-received-by-assessee-constitutes-a-gift -and-therefore-exempt-from-penalty-u-s-271d-of-the-income-tax-act-itat-dismisses-appeal/329654/ #advance #assessee #gift #penalty #incometaxact #appeal #taxscan #taxnews … – #96

Tax Scan – https://www.taxscan.in/advance-received-by-assessee-constitutes-a-gift -and-therefore-exempt-from-penalty-u-s-271d-of-the-income-tax-act-itat-dismisses-appeal/329654/ #advance #assessee #gift #penalty #incometaxact #appeal #taxscan #taxnews … – #96

Income Tax Implications of Wedding Gifts in India – #97

Income Tax Implications of Wedding Gifts in India – #97

In-Kind Donation Letter by TopContentCreator – Issuu – #98

In-Kind Donation Letter by TopContentCreator – Issuu – #98

81 gift certificate templates page 6 – Free to Edit, Download & Print | CocoDoc – #99

81 gift certificate templates page 6 – Free to Edit, Download & Print | CocoDoc – #99

What Is the Lifetime Gift Tax Exemption for 2024? | SmartAsset – #100

What Is the Lifetime Gift Tax Exemption for 2024? | SmartAsset – #100

Bittker, Clark, and McCouch’s Federal Estate and Gift Taxation, 12th – #101

Bittker, Clark, and McCouch’s Federal Estate and Gift Taxation, 12th – #101

- gift tax return

- federal estate tax

- gift tax 2023

2023 State Estate Taxes and State Inheritance Taxes – #102

2023 State Estate Taxes and State Inheritance Taxes – #102

Keyword:estate gift tax laws – FasterCapital – #103

Keyword:estate gift tax laws – FasterCapital – #103

A Guide to Gifting Money to Your Children | City National Bank – #104

A Guide to Gifting Money to Your Children | City National Bank – #104

- lineal ascendant gift from relative exempt from income tax

- gift tax rate table

- list of relatives

8 Tips For Tax-Free Gifting In 2023 – #105

8 Tips For Tax-Free Gifting In 2023 – #105

CAP – Estate and Gift Taxation, Fourth Edition (9781531026424). Authors: Brant J. Hellwig. Carolina Academic Press – #106

CAP – Estate and Gift Taxation, Fourth Edition (9781531026424). Authors: Brant J. Hellwig. Carolina Academic Press – #106

Using trusts to shift income to children – #107

Using trusts to shift income to children – #107

WisBar News: Statute of Limitations May Bar Special Tax Refund Claims Against Milwaukee: – #108

WisBar News: Statute of Limitations May Bar Special Tax Refund Claims Against Milwaukee: – #108

![Income Tax Deductions under Section 10 [2024] Income Tax Deductions under Section 10 [2024]](https://www.taxmanagementindia.com/file_folder/folder_6/2023_8_TMI_371_ITAT_MUMBAI.jpg) Income Tax Deductions under Section 10 [2024] – #109

Income Tax Deductions under Section 10 [2024] – #109

Solution CA Inter Taxation | PDF | Money | Business – #110

Solution CA Inter Taxation | PDF | Money | Business – #110

Gift of Immovable property under Income Tax Act – #111

Gift of Immovable property under Income Tax Act – #111

Article on the definition of Relatives… – CA Arjit Agarwal | Facebook – #112

Article on the definition of Relatives… – CA Arjit Agarwal | Facebook – #112

1 Gifts n Generosity / personal motives n estate reduction n income shifting (’86 Act) n income tax deduction (charity) n issue of control. – ppt download – #113

1 Gifts n Generosity / personal motives n estate reduction n income shifting (’86 Act) n income tax deduction (charity) n issue of control. – ppt download – #113

Do I Need to Worry About the Gift Tax If I Pay $60,000 Toward My Daughter’s Wedding? – #114

Do I Need to Worry About the Gift Tax If I Pay $60,000 Toward My Daughter’s Wedding? – #114

Income tax demand of up to Rs 1 lakh/person to be withdrawn – Times of India – #115

Income tax demand of up to Rs 1 lakh/person to be withdrawn – Times of India – #115

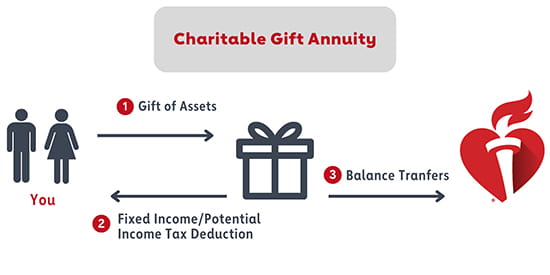

Legacy IRA Rollover To Charitable Gift Annuity – #116

Legacy IRA Rollover To Charitable Gift Annuity – #116

Opportunity Tax Credits – SB1080 | usef – #117

Opportunity Tax Credits – SB1080 | usef – #117

No ‘Occasion’ required for ‘Gift’ under Income Tax Law: ITAT deletes Addition towards Gift from NRI Brother – #118

No ‘Occasion’ required for ‘Gift’ under Income Tax Law: ITAT deletes Addition towards Gift from NRI Brother – #118

Tax on Gift| Gift Tax in Malayalam | Taxability of Gift| Gift income tax – YouTube – #119

Tax on Gift| Gift Tax in Malayalam | Taxability of Gift| Gift income tax – YouTube – #119

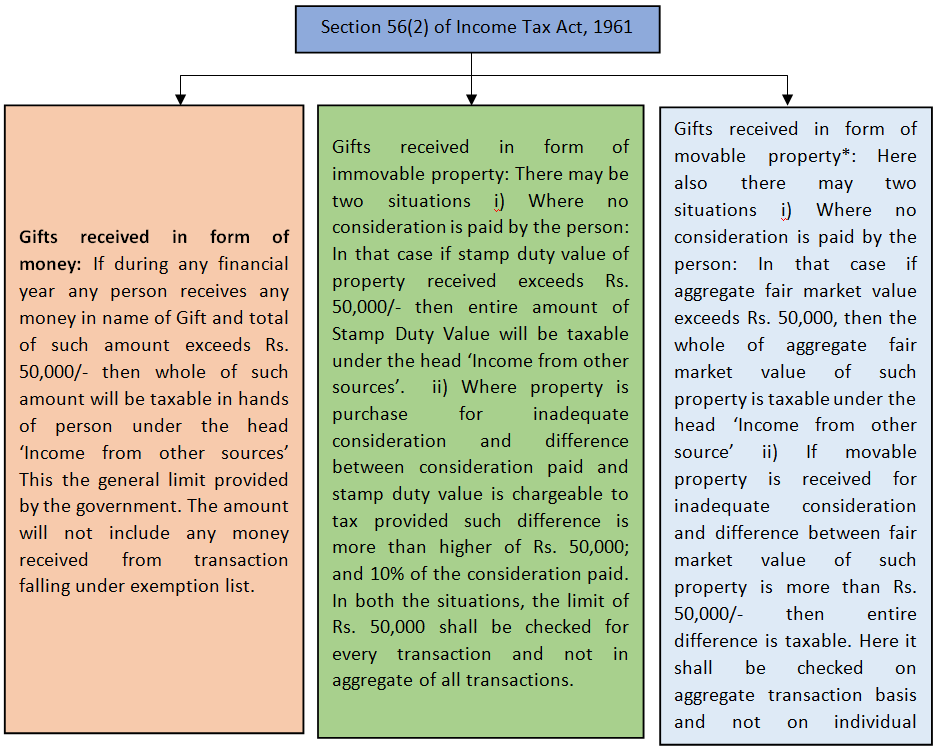

Understanding Section 56(2)(vii) of the Income Tax Act: Taxation on Gifts and its Implications – Marg ERP Blog – #120

Understanding Section 56(2)(vii) of the Income Tax Act: Taxation on Gifts and its Implications – Marg ERP Blog – #120

Section 56 Of Income Tax Act 1961 – SBS AND CO LLP – #121

Section 56 Of Income Tax Act 1961 – SBS AND CO LLP – #121

- gift deed format on stamp paper

- gift tax exemption 2022

- gift tax meaning

Gift Tax: Does this Exist at the State Level in New York? – – #122

Gift Tax: Does this Exist at the State Level in New York? – – #122

Education and medical expenses are exempt from gifting rules | Farm Office – #123

Education and medical expenses are exempt from gifting rules | Farm Office – #123

Income | Meaning and Features or Characteristics | Gift Tax | Law of Taxation – YouTube – #124

Income | Meaning and Features or Characteristics | Gift Tax | Law of Taxation – YouTube – #124

A Gift amount can’t be doubted just because donor’s returned income is insufficient to justify it: ITAT – #125

A Gift amount can’t be doubted just because donor’s returned income is insufficient to justify it: ITAT – #125

Income Tax on Gift – #126

Income Tax on Gift – #126

Gift Tax: How Much Is It and Who Pays It? – #127

Gift Tax: How Much Is It and Who Pays It? – #127

- gift tax exemption

- property tax

What Is the 2023 and 2024 Gift Tax Limit? – Ramsey – #128

What Is the 2023 and 2024 Gift Tax Limit? – Ramsey – #128

How to get tax exemption on the cash gift which I will receive for my marriage from bride’s side ? If so, what could be the procedure? Are there any limitations on – #129

How to get tax exemption on the cash gift which I will receive for my marriage from bride’s side ? If so, what could be the procedure? Are there any limitations on – #129

Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver – #130

Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver – #130

Taxabilty of Gifts under Income-tax Act / कौनसी गिफ्ट पर लगेगा आयकर और कौनसी होंगी कर से मुक्त? – YouTube – #131

Taxabilty of Gifts under Income-tax Act / कौनसी गिफ्ट पर लगेगा आयकर और कौनसी होंगी कर से मुक्त? – YouTube – #131

Section 56(2)(x): Taxability of Gifts – Pioneer One Consulting LLP – #132

Section 56(2)(x): Taxability of Gifts – Pioneer One Consulting LLP – #132

Proposed IRS regs would “claw back” gift exemption for certain taxpayers – Baker Tilly – #133

Proposed IRS regs would “claw back” gift exemption for certain taxpayers – Baker Tilly – #133

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #134

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #134

Minnesota Gift Tax: All You Need to Know | SmartAsset – #135

Minnesota Gift Tax: All You Need to Know | SmartAsset – #135

When You Make Cash Gifts To Your Children, Who Pays The Tax? | Greenbush Financial Group – #136

When You Make Cash Gifts To Your Children, Who Pays The Tax? | Greenbush Financial Group – #136

Types of Tax – Exemptions, Due Dates & Penalties – #137

Types of Tax – Exemptions, Due Dates & Penalties – #137

Taxes On Gifts From Overseas – #138

Taxes On Gifts From Overseas – #138

Definition of Relatives for the purpose of Income Tax Act, 1961- Taxwink – #139

Definition of Relatives for the purpose of Income Tax Act, 1961- Taxwink – #139

What Is an Inter Vivos Gift? – SmartAsset | SmartAsset – #140

What Is an Inter Vivos Gift? – SmartAsset | SmartAsset – #140

- gift tax in india

- estate/gift tax

- estate tax

Sales Tax on Gift Cards and Gift Certificates – AccurateTax.com – #141

Sales Tax on Gift Cards and Gift Certificates – AccurateTax.com – #141

Things you should know about “Gift Tax” before receiving, giving this festive season | Zee Business – #142

Things you should know about “Gift Tax” before receiving, giving this festive season | Zee Business – #142

Are Business Gifts Tax Deductible? 7 Rules for Clients and Employees Gifts – #143

Are Business Gifts Tax Deductible? 7 Rules for Clients and Employees Gifts – #143

No prohibition on NRI from accepting gifts from the relatives under the – #144

No prohibition on NRI from accepting gifts from the relatives under the – #144

Posts: gift income tax act

Categories: Gifts

Author: toyotabienhoa.edu.vn