Top more than 133 gift income tax super hot

Share images of gift income tax by website toyotabienhoa.edu.vn compilation. What is a Gift Tax?. Income Tax on Digital, Physical, and Paper Gold in India | IIFL Finance. Tax Accountant Mug Income Tax Gag Gift There’s No Crying During Tax Se – Cute But Rude. Gift: Meaning, Tax Considerations, Example

Now What? Congress Considers Another Revamp of Estate and Gift Taxes – Lowenhaupt & Chasnoff – #1

Now What? Congress Considers Another Revamp of Estate and Gift Taxes – Lowenhaupt & Chasnoff – #1

What is a charitable gift annuity|Thrivent – #2

What is a charitable gift annuity|Thrivent – #2

- form 709 gift splitting example

- gift tax return form 709 example

- gift tax rate table

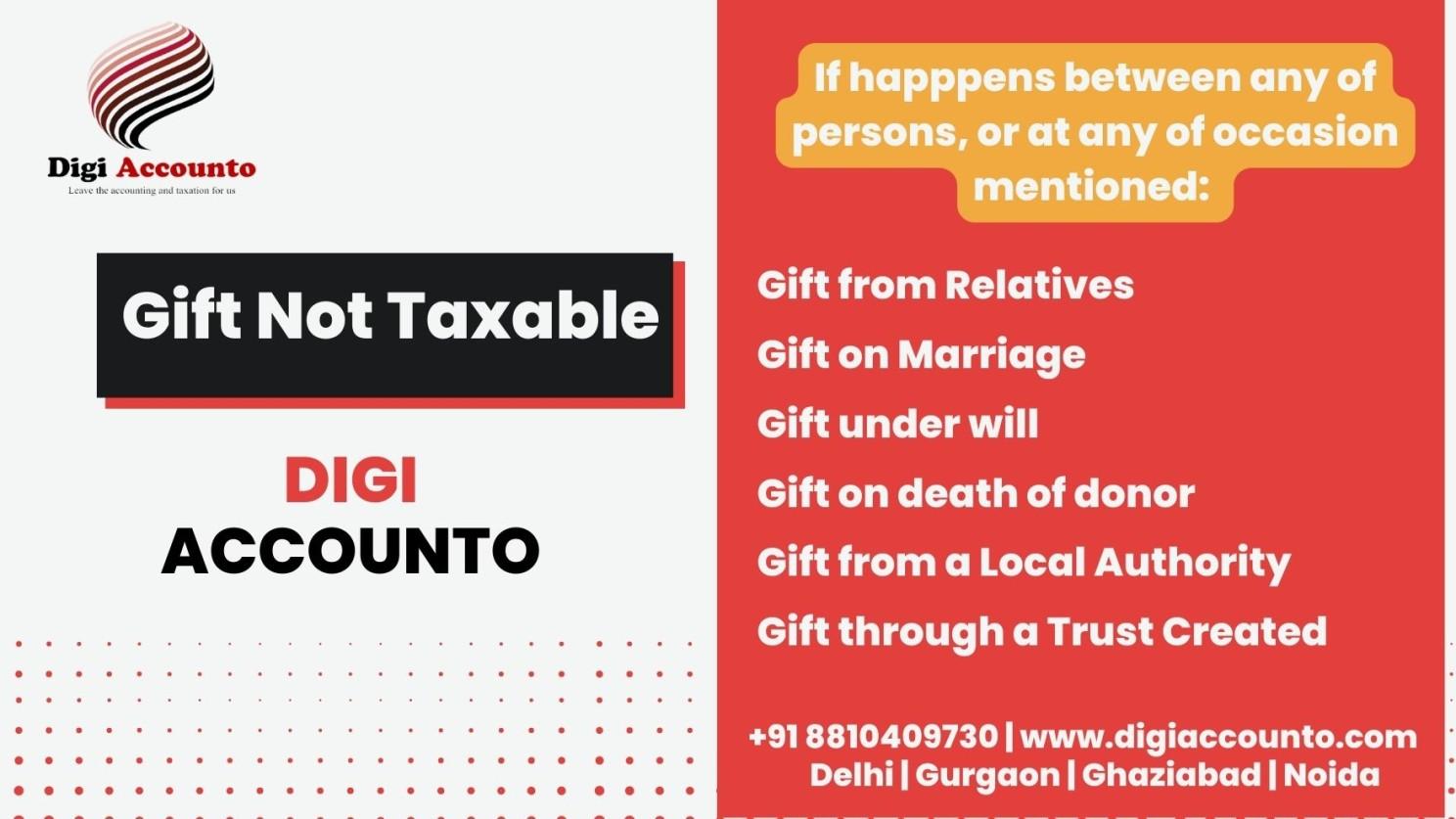

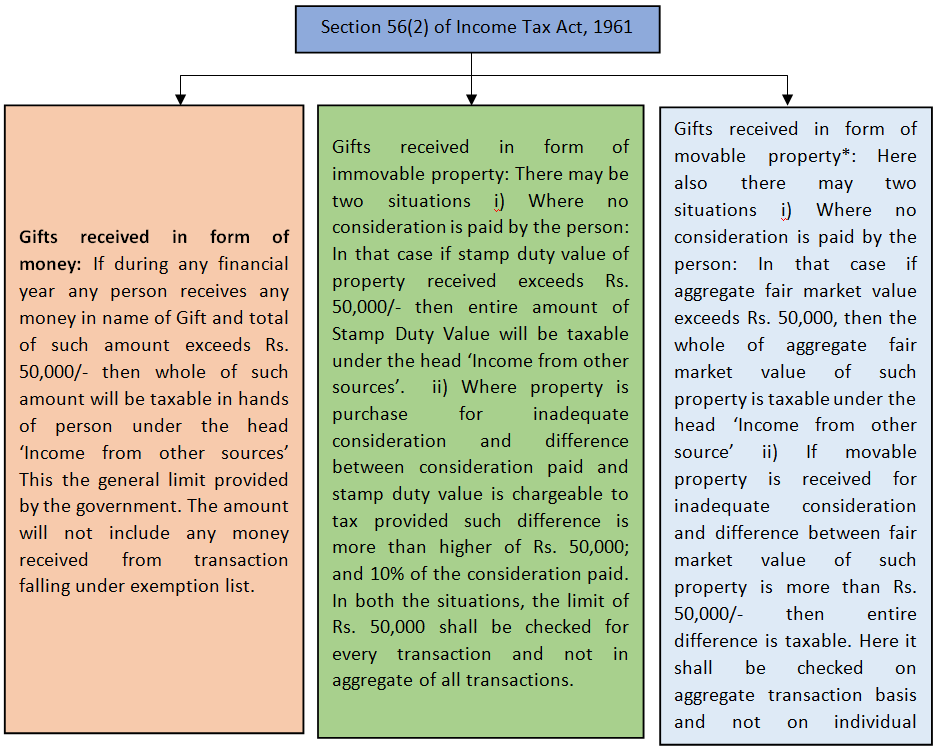

Taxability of Gifts in India – #4

Taxability of Gifts in India – #4

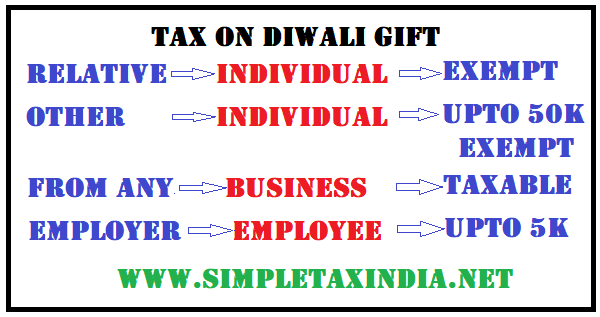

How Diwali Gifts May or May Not Attract Income Tax? – #5

How Diwali Gifts May or May Not Attract Income Tax? – #5

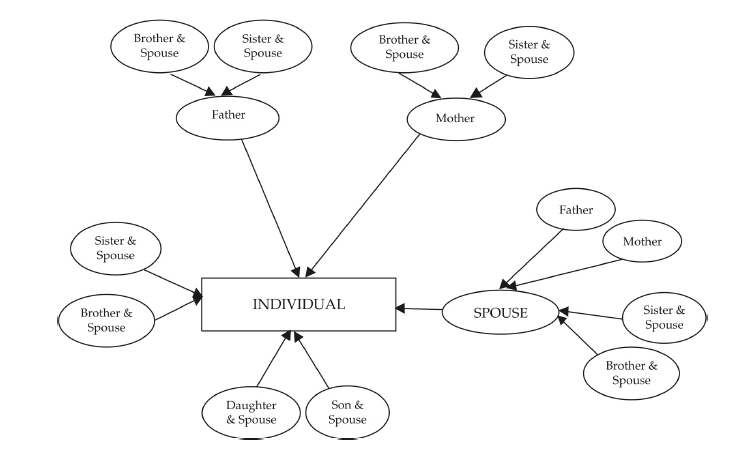

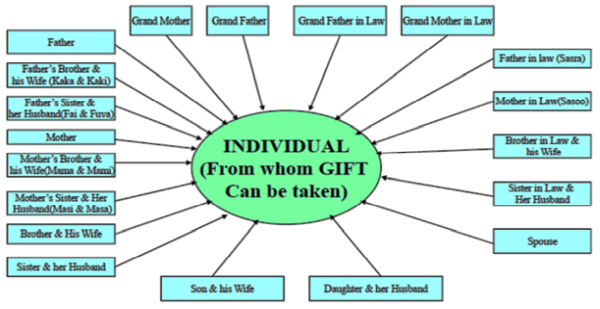

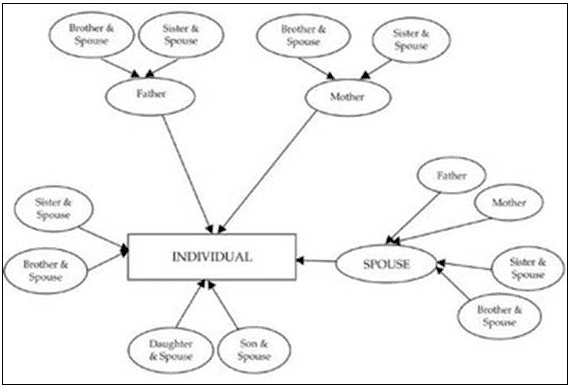

What is gift, is it taxable, who are relatives, which gift to be shown in Income Tax Return and what is clubbing of income. – upload form-16 – #6

What is gift, is it taxable, who are relatives, which gift to be shown in Income Tax Return and what is clubbing of income. – upload form-16 – #6

- service tax

- list of relatives

- expenditure tax

साली गिफ्ट दे तो नहीं लगता टैक्स, फिर दोस्त से मिले उपहार पर क्यों? ऐसे हैं Gift पर Tax के रूल – income tax on gift received which gifts are exempted from – #7

साली गिफ्ट दे तो नहीं लगता टैक्स, फिर दोस्त से मिले उपहार पर क्यों? ऐसे हैं Gift पर Tax के रूल – income tax on gift received which gifts are exempted from – #7

Unravel The Red Ribbon On Spouse Property Transfers – Gift Tax | US Expat Tax Service – #8

Unravel The Red Ribbon On Spouse Property Transfers – Gift Tax | US Expat Tax Service – #8

It’s The Gift Tax Exemption, Stupid – #10

It’s The Gift Tax Exemption, Stupid – #10

Tax – Articles, Insights of Income Tax Act in India – #11

Tax – Articles, Insights of Income Tax Act in India – #11

en examined and it has been deci – #12

en examined and it has been deci – #12

The Implication of Income tax on the Gift – Enterslice – #13

The Implication of Income tax on the Gift – Enterslice – #13

Non-Cash Gift Agreement (AG-103) Instructions The Non-Cash Gift Agreement is a formal agreement document for acknowledgment of n – #14

Non-Cash Gift Agreement (AG-103) Instructions The Non-Cash Gift Agreement is a formal agreement document for acknowledgment of n – #14

Forums | Holding period of asset acquired without consideration – #15

Forums | Holding period of asset acquired without consideration – #15

Government keeps vouchers, gift, loyalty cards out of crypto tax ambit – #16

Government keeps vouchers, gift, loyalty cards out of crypto tax ambit – #16

Holiday Gift Tax Planning Suggestions for Federal Employees and Retirees – #17

Holiday Gift Tax Planning Suggestions for Federal Employees and Retirees – #17

Developing and Using Global Tax Transparency Principles – #18

Developing and Using Global Tax Transparency Principles – #18

-Gifts.jpg) Present Law Individual Income, Estate, Gift, and Excise Tax Rates: Prepared by the Staff of the Joint Committee on Internal Revenue Taxation (Classic Reprint): Committee on Internal Revenue Taxation: 9780365856221: Amazon.com: Books – #19

Present Law Individual Income, Estate, Gift, and Excise Tax Rates: Prepared by the Staff of the Joint Committee on Internal Revenue Taxation (Classic Reprint): Committee on Internal Revenue Taxation: 9780365856221: Amazon.com: Books – #19

PIB in Goa on X: “Tax Benefits to IFSC, GIFT City! Section 47 (viiad) of the Income-tax Act, 1961 amended to extend the date of transfer of assets of the original fund – #20

PIB in Goa on X: “Tax Benefits to IFSC, GIFT City! Section 47 (viiad) of the Income-tax Act, 1961 amended to extend the date of transfer of assets of the original fund – #20

University of Illinois Foundation Gift Planning :: Gift of Securities – #21

University of Illinois Foundation Gift Planning :: Gift of Securities – #21

- charitable gift annuity

- gift chart as per income tax

- gift tax rate in india 2020

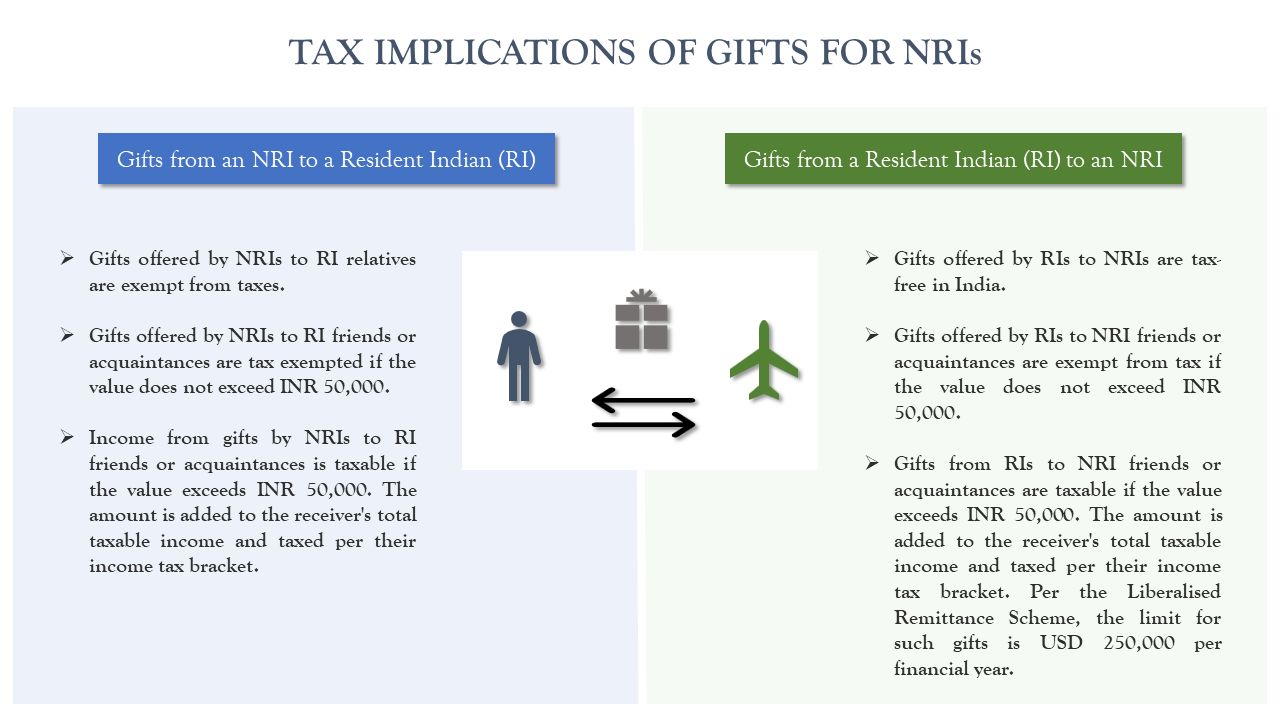

Gifts by NRIs to Relatives and Friends can be made fully Exempt from Gift Tax – #22

Gifts by NRIs to Relatives and Friends can be made fully Exempt from Gift Tax – #22

GIFT TAX -TAX ON GIFT BUDGET 2010 | SIMPLE TAX INDIA – #23

GIFT TAX -TAX ON GIFT BUDGET 2010 | SIMPLE TAX INDIA – #23

Detailed Analysis- Gifts Taxation under Income Tax Act, 1961 – #24

Detailed Analysis- Gifts Taxation under Income Tax Act, 1961 – #24

Do taxes. Save lives. – Gift of Life Michigan – #25

Do taxes. Save lives. – Gift of Life Michigan – #25

Income tax Blogs & Updates – #26

Income tax Blogs & Updates – #26

Income Tax Deduction allowable on Expenses Incurred in Oversea Workshops for Doctors as it can’t be treated as Gift, Freebies: ITAT – #27

Income Tax Deduction allowable on Expenses Incurred in Oversea Workshops for Doctors as it can’t be treated as Gift, Freebies: ITAT – #27

Gift Taxes and Annual Exclusion Gifts – Russo Law Group – #28

Gift Taxes and Annual Exclusion Gifts – Russo Law Group – #28

totallychocolate.com/wp-content/uploads/2018/07/re… – #29

totallychocolate.com/wp-content/uploads/2018/07/re… – #29

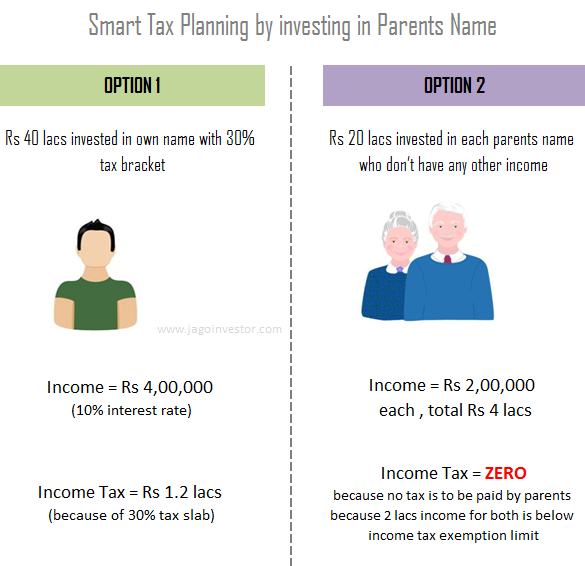

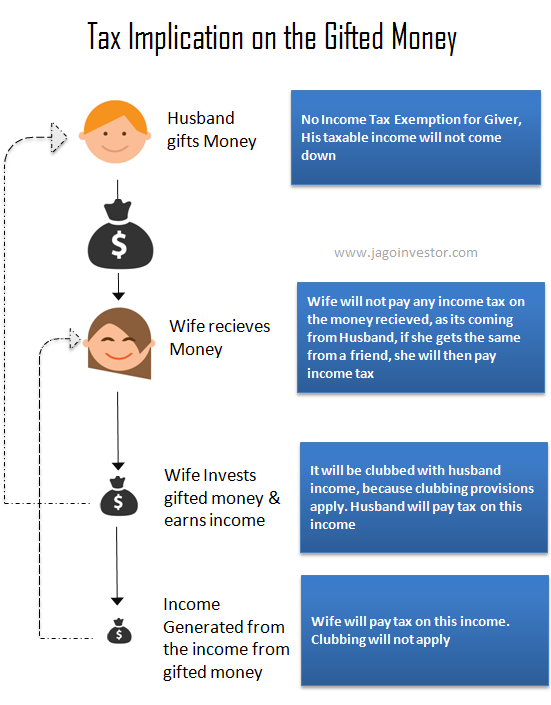

Gift, loan, house rent: How your family can help in saving taxes | TAX – Business Standard – #30

Gift, loan, house rent: How your family can help in saving taxes | TAX – Business Standard – #30

Gift Tax. Why are gifts taxed? o Gifts were made to avoid estate taxes o Gifts were made to avoid income taxes o Taxes in general are for social welfare. – – #31

Gift Tax. Why are gifts taxed? o Gifts were made to avoid estate taxes o Gifts were made to avoid income taxes o Taxes in general are for social welfare. – – #31

Can I give total income from my business as gift to my parents. (in India)? – Quora – #32

Can I give total income from my business as gift to my parents. (in India)? – Quora – #32

Gifts Everyone Can Afford | American Heart Association – #33

Gifts Everyone Can Afford | American Heart Association – #33

Attention: Gift of Love Sponsors! Signed Tax Donation Forms Available for Pick Up — St. Francis de Sales Catholic Parish – #34

Attention: Gift of Love Sponsors! Signed Tax Donation Forms Available for Pick Up — St. Francis de Sales Catholic Parish – #34

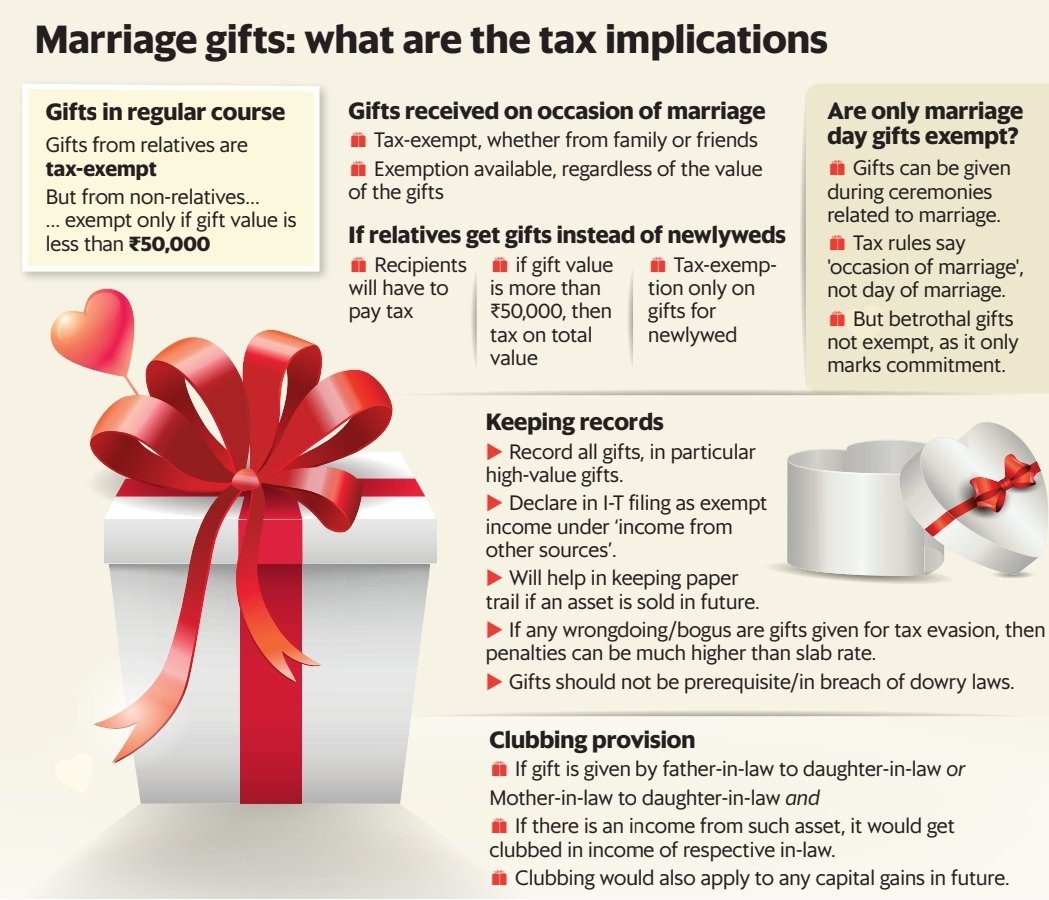

Income Tax Provisions related to Marriage Gifts – #35

Income Tax Provisions related to Marriage Gifts – #35

Gift Appreciated Assets to Family in Lower Tax Brackets – Year End Tax Tip – #36

Gift Appreciated Assets to Family in Lower Tax Brackets – Year End Tax Tip – #36

Gift tax in India – Income tax rules on gifts and exemption available – #37

Gift tax in India – Income tax rules on gifts and exemption available – #37

Personal Tax Return – Pastor, Minister, and Staff Gift — Wisdom Over Wealth – #38

Personal Tax Return – Pastor, Minister, and Staff Gift — Wisdom Over Wealth – #38

- estate duty tax

- federal gift tax

- gift tax exclusion 2023

Life Income Gifts – Fast Facts | David’s House Ministries – #39

Life Income Gifts – Fast Facts | David’s House Ministries – #39

Gift of Giving – Foster Kinship – #40

Gift of Giving – Foster Kinship – #40

- gift tax exemption relatives list

- excise tax

- gift tag

Income Tax: अगर ऑफिस से मिला है दिवाली का बोनस तो टैक्स देने के लिए हो जाएं तैयार, जानें क्या हैं इसके नियम – Diwali bonus or cash gifts, are they taxable – #41

Income Tax: अगर ऑफिस से मिला है दिवाली का बोनस तो टैक्स देने के लिए हो जाएं तैयार, जानें क्या हैं इसके नियम – Diwali bonus or cash gifts, are they taxable – #41

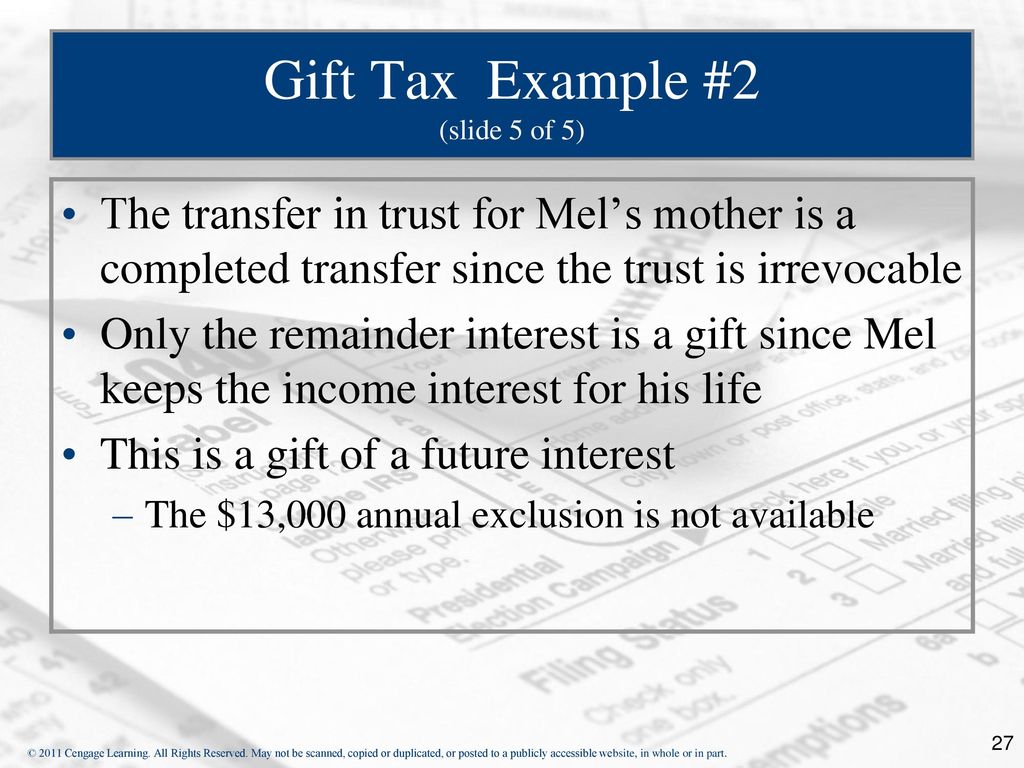

Incomplete and Completed Gift Non-Grantor Trusts – #42

Incomplete and Completed Gift Non-Grantor Trusts – #42

Taxes on Gift – #43

Taxes on Gift – #43

Want To Send Rakhi Gifts To Your Siblings? Here Is A Guide For NRIs To Understand Tax Imposed On Presents | HerZindagi – #44

Want To Send Rakhi Gifts To Your Siblings? Here Is A Guide For NRIs To Understand Tax Imposed On Presents | HerZindagi – #44

Income Tax Status of Gifts – #45

Income Tax Status of Gifts – #45

2026 Estate Tax Changes: Impact on Your Estate Planning – Atlanta Estate Planning, Wills & Probate | Siedentopf Law – #46

2026 Estate Tax Changes: Impact on Your Estate Planning – Atlanta Estate Planning, Wills & Probate | Siedentopf Law – #46

Taxes you have to pay when you get a gift – The Economic Times – #47

Taxes you have to pay when you get a gift – The Economic Times – #47

India’s budget proposes reduction of top rates of income tax and restriction of gift tax relief | STEP – #48

India’s budget proposes reduction of top rates of income tax and restriction of gift tax relief | STEP – #48

Estate & Gift Tax: Basics & A View of IRS Practice – YouTube – #49

Estate & Gift Tax: Basics & A View of IRS Practice – YouTube – #49

- gift tax meaning

- estate/gift tax

- 709 2020 gift tax sample completed irs form 709

Gift Gift – FasterCapital – #50

Gift Gift – FasterCapital – #50

Gift: Meaning, Tax Considerations, Example – #51

Gift: Meaning, Tax Considerations, Example – #51

Information about gifts received on Diwali not given in income tax return Then there heavy fine – इनकम टैक्स रिटर्न में नहीं दी दिवाली पर मिले गिफ्ट्स की जानकारी तो लगेगा तगड़ा – #52

Information about gifts received on Diwali not given in income tax return Then there heavy fine – इनकम टैक्स रिटर्न में नहीं दी दिवाली पर मिले गिफ्ट्स की जानकारी तो लगेगा तगड़ा – #52

Taxation of Gifts received in Cash or Kind – #53

Taxation of Gifts received in Cash or Kind – #53

8 types of planned gifts your nonprofit should know | Blog | Resources | FreeWill – #54

8 types of planned gifts your nonprofit should know | Blog | Resources | FreeWill – #54

Received a Foreign Gift in 2023? Learn About Taxes on Gifts and IRS Form 3520 — – #55

Received a Foreign Gift in 2023? Learn About Taxes on Gifts and IRS Form 3520 — – #55

My grandmother wants to gift cash to me. What are the income tax implications? | Mint – #56

My grandmother wants to gift cash to me. What are the income tax implications? | Mint – #56

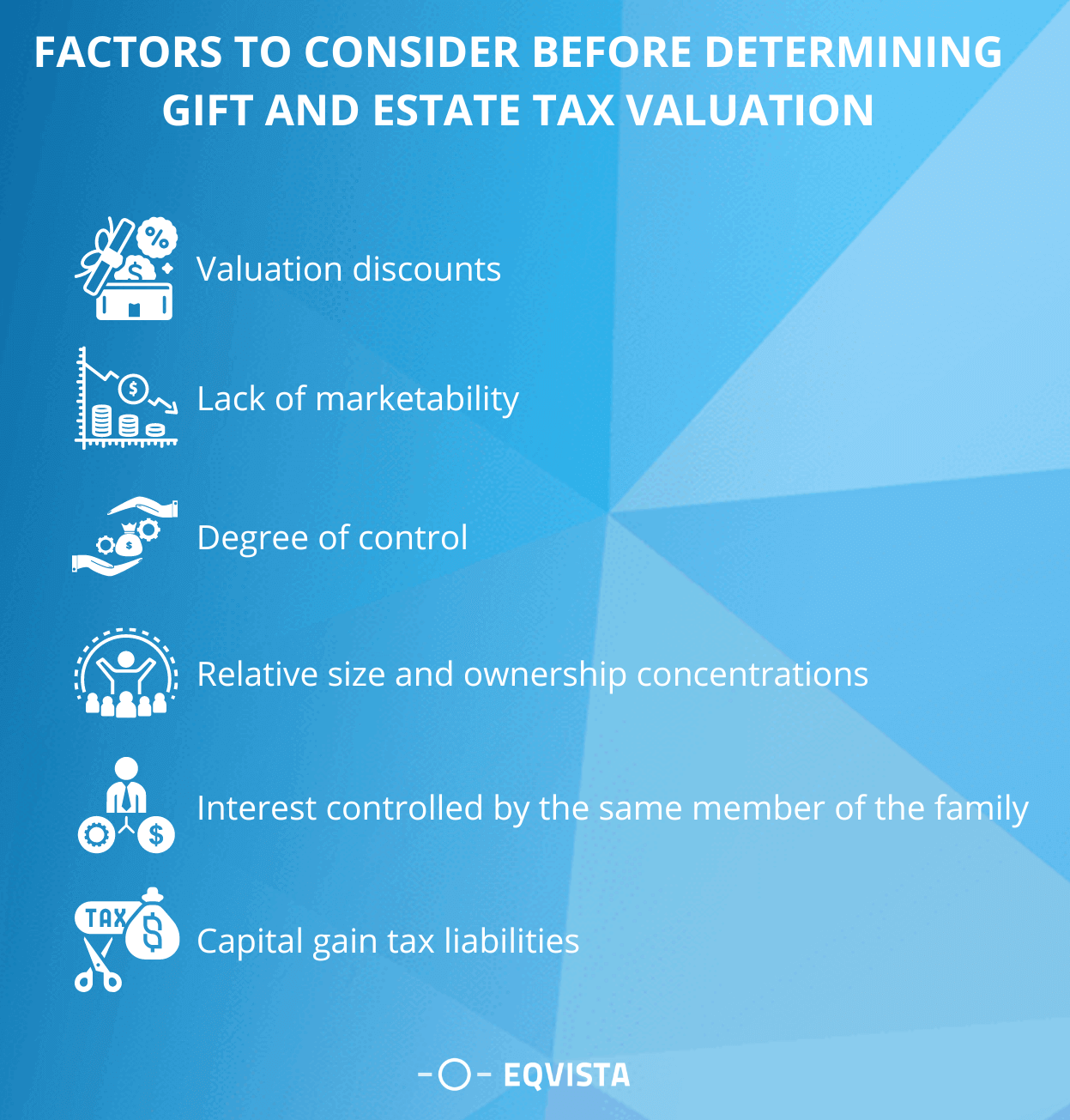

Gift and Estate Tax Computational Problem – #57

Gift and Estate Tax Computational Problem – #57

Give — Camp Mitchell – #58

Give — Camp Mitchell – #58

Gift Tax Imposed In India | Dialabank – #59

Gift Tax Imposed In India | Dialabank – #59

Relatives u/s 56(2)(vii) from whom Gift is permissible…… – Income Tax | Tax planning – #60

Relatives u/s 56(2)(vii) from whom Gift is permissible…… – Income Tax | Tax planning – #60

Tax on Gift in India – Income Tax on Gift of money, property – Exemptions – #61

Tax on Gift in India – Income Tax on Gift of money, property – Exemptions – #61

Gifts of Securities | Tower Health – #62

Gifts of Securities | Tower Health – #62

Gifts of Stock | Minnesota State University, Mankato – #63

Gifts of Stock | Minnesota State University, Mankato – #63

MoneyTalkWithL on X: “Not many know this. Wedding gifts are tax exempt. So be lavish with people you love. I know someone who made a hefty wedding gift to a friend and – #64

MoneyTalkWithL on X: “Not many know this. Wedding gifts are tax exempt. So be lavish with people you love. I know someone who made a hefty wedding gift to a friend and – #64

Tax secrets of the philanthropist next door | Vanguard – #65

Tax secrets of the philanthropist next door | Vanguard – #65

Tax efficient giving: A guide for UK donors · Giving What We Can – #66

Tax efficient giving: A guide for UK donors · Giving What We Can – #66

How to Avoid the Gift Tax – #67

How to Avoid the Gift Tax – #67

Anyone Can Make – #68

Anyone Can Make – #68

Are Gifts From Relatives Taxable? Understanding Income Tax Rules – #69

Are Gifts From Relatives Taxable? Understanding Income Tax Rules – #69

9 Ways to Reduce Your Taxable Income | Fidelity Charitable – #70

9 Ways to Reduce Your Taxable Income | Fidelity Charitable – #70

- gift tax rate

- gift tax in india

- lineal ascendant gift from relative exempt from income tax

The Top 10 Tax Court Cases Of 2018: When Is A Gift Not A Gift? – #71

The Top 10 Tax Court Cases Of 2018: When Is A Gift Not A Gift? – #71

Amazing gift by income tax deptt – #72

Amazing gift by income tax deptt – #72

![Guide to Crypto Tax in India [Updated 2024] Guide to Crypto Tax in India [Updated 2024]](https://www.bcasonline.org/Referencer2015-16/Taxation/Income%20Tax/IT-GiftsTreatedasIncome1.jpg) Guide to Crypto Tax in India [Updated 2024] – #73

Guide to Crypto Tax in India [Updated 2024] – #73

How Are Gifts Taxed in India? – Kanakkupillai – #74

How Are Gifts Taxed in India? – Kanakkupillai – #74

Check out the limit up to which a father can gift cash to his son as per income tax laws – www.lokmattimes.com – #75

Check out the limit up to which a father can gift cash to his son as per income tax laws – www.lokmattimes.com – #75

Stock Gift — CFNEK – #76

Stock Gift — CFNEK – #76

This Holiday Season, Give Children the Gift of Education and Get Tax Exemption – #77

This Holiday Season, Give Children the Gift of Education and Get Tax Exemption – #77

What Income Tax Rules Says On Gifts Received From Family Members And Relatives Know Details | Income Tax: సొంత కుటుంబ సభ్యుల నుంచి బహుమతి తీసుకున్నా పన్ను కట్టాలా, రూల్స్ ఏం … – #78

What Income Tax Rules Says On Gifts Received From Family Members And Relatives Know Details | Income Tax: సొంత కుటుంబ సభ్యుల నుంచి బహుమతి తీసుకున్నా పన్ను కట్టాలా, రూల్స్ ఏం … – #78

Planning to take a gift from relatives? Here’s how you can take it from their bank account directly – #79

Planning to take a gift from relatives? Here’s how you can take it from their bank account directly – #79

![Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will](https://i.ytimg.com/vi/jCwPVCfBrLQ/maxresdefault.jpg) Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will – #80

Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will – #80

Free Gift Affidavit: Make & Download – Rocket Lawyer – #81

Free Gift Affidavit: Make & Download – Rocket Lawyer – #81

What is taxation on Gifts | Investyadnya eBook – #82

What is taxation on Gifts | Investyadnya eBook – #82

Gifting Appreciated Assets | Definition, Types, & Strategies – #83

Gifting Appreciated Assets | Definition, Types, & Strategies – #83

- interest tax

- gift tax returns irs completed sample form 709 sample

- estate tax

Whether any non-resident individual/ Company is required to obtain the mandatory approval of RBI for any sale or gift of a property in India? | Law Firm in Ahmedabad – #84

Whether any non-resident individual/ Company is required to obtain the mandatory approval of RBI for any sale or gift of a property in India? | Law Firm in Ahmedabad – #84

If I Gift 1cr to my mother is it exempt or taxable? – Quora – #85

If I Gift 1cr to my mother is it exempt or taxable? – Quora – #85

income tax: गिफ्ट में मिली इन चीजों पर लगता है टैक्स, जान लें इनकम टैक्स के नियम – #86

income tax: गिफ्ट में मिली इन चीजों पर लगता है टैक्स, जान लें इनकम टैक्स के नियम – #86

- gift tax exemption 2022

- gift tax act 1958

- wealth tax

![Addition u/s 68 can't be made in respect of receipt of Gift evident through Credit Entries in Bank Passbook: ITAT [Read Order] | Taxscan Addition u/s 68 can't be made in respect of receipt of Gift evident through Credit Entries in Bank Passbook: ITAT [Read Order] | Taxscan](https://cdn.zeebiz.com/sites/default/files/styles/zeebiz_850x478/public/2022/10/12/204993-266979-2119x1413-gift-1.jpg?itok\u003dlWxP9QGI) Addition u/s 68 can’t be made in respect of receipt of Gift evident through Credit Entries in Bank Passbook: ITAT [Read Order] | Taxscan – #87

Addition u/s 68 can’t be made in respect of receipt of Gift evident through Credit Entries in Bank Passbook: ITAT [Read Order] | Taxscan – #87

Income Tax Troubles For Priyanka Chopra As She Didn’t Pay Taxes On Luxury Gifts Worth Rs 67 Lakhs – RVCJ Media – #88

Income Tax Troubles For Priyanka Chopra As She Didn’t Pay Taxes On Luxury Gifts Worth Rs 67 Lakhs – RVCJ Media – #88

Section 56(2)(vii) : Cash / Non-Cash Gifts – #89

Section 56(2)(vii) : Cash / Non-Cash Gifts – #89

Tax2win – Gifts received on your marriage is not your income hence you are not required to disclose it while filing Income Tax Return. https://tax2win.in/ #Incometax #Efiling #ITR #Gift #Wedding #Win #Tax2win | – #90

Tax2win – Gifts received on your marriage is not your income hence you are not required to disclose it while filing Income Tax Return. https://tax2win.in/ #Incometax #Efiling #ITR #Gift #Wedding #Win #Tax2win | – #90

Edible Gift Ideas for Tax Preparer & Accounting Clients – Totally Chocolate – #91

Edible Gift Ideas for Tax Preparer & Accounting Clients – Totally Chocolate – #91

t p radhakrishnan v assistant commissioner – #92

t p radhakrishnan v assistant commissioner – #92

TIT BITS on Taxation – Gift Tax…. – Maame Birago Yeboah | Facebook – #93

TIT BITS on Taxation – Gift Tax…. – Maame Birago Yeboah | Facebook – #93

![No Income Tax on Gift made by HUF to its Member: ITAT Mumbai [Read Order] | Taxscan No Income Tax on Gift made by HUF to its Member: ITAT Mumbai [Read Order] | Taxscan](https://i.ytimg.com/vi/s0hw5o9_QF0/maxresdefault.jpg) No Income Tax on Gift made by HUF to its Member: ITAT Mumbai [Read Order] | Taxscan – #94

No Income Tax on Gift made by HUF to its Member: ITAT Mumbai [Read Order] | Taxscan – #94

Gift Tax Stock Photos and Pictures – 22,050 Images | Shutterstock – #95

Gift Tax Stock Photos and Pictures – 22,050 Images | Shutterstock – #95

Received gold jewellery in a gift? Will it be taxable | Business News – #96

Received gold jewellery in a gift? Will it be taxable | Business News – #96

Solved Chapter 27 and Chapter 28 1. Briefly describe the | Chegg.com – #97

Solved Chapter 27 and Chapter 28 1. Briefly describe the | Chegg.com – #97

Tax queries: Pay tax on cash gift from nephew in excess of Rs 50,000 – The Economic Times – #98

Tax queries: Pay tax on cash gift from nephew in excess of Rs 50,000 – The Economic Times – #98

Blog – KKC Law – #99

Blog – KKC Law – #99

Income Tax News: Are Wedding Presents Really Tax-Free? Unveiling the Gift Exemption Details – #100

Income Tax News: Are Wedding Presents Really Tax-Free? Unveiling the Gift Exemption Details – #100

Gifts of Stock and Appreciated Assets – Board of Child CareBoard of Child Care – #101

Gifts of Stock and Appreciated Assets – Board of Child CareBoard of Child Care – #101

Tax Consequences for Gifting Properties – Gift Tax and Income Tax | Your Personal Finance and Tax – #102

Tax Consequences for Gifting Properties – Gift Tax and Income Tax | Your Personal Finance and Tax – #102

California Gift Tax: All You Need to Know | SmartAsset – #103

California Gift Tax: All You Need to Know | SmartAsset – #103

TAXATION – FEDERAL GIFT TAX – INTEGRATION WITH INCOME TAX – #104

TAXATION – FEDERAL GIFT TAX – INTEGRATION WITH INCOME TAX – #104

Clarence Thomas’s Luxury Travel and the Gift Tax | Tax Notes – #105

Clarence Thomas’s Luxury Travel and the Gift Tax | Tax Notes – #105

- gift tax rate in india 2022-23

- form 709

- gift tax example

Amazon.com: Income Tax Advisor mug, income tax advisor gifts, gift for income tax advisor gift idea, income tax advisor 11 oz mug – Coffee Mug gift for coworker birthday, friend graduation christmas : – #106

Amazon.com: Income Tax Advisor mug, income tax advisor gifts, gift for income tax advisor gift idea, income tax advisor 11 oz mug – Coffee Mug gift for coworker birthday, friend graduation christmas : – #106

Planned Gifts – Springfield, Illinois | Lincolnland Community College Foundation – #107

Planned Gifts – Springfield, Illinois | Lincolnland Community College Foundation – #107

How to Gift MORE than the Gift Limit in 2022 | TAX FREE – YouTube – #108

How to Gift MORE than the Gift Limit in 2022 | TAX FREE – YouTube – #108

Your Money: New U.S. gift tax strategies could alter giving | Reuters – #109

Your Money: New U.S. gift tax strategies could alter giving | Reuters – #109

Shieldsmore Ceramic Designer INCOME TAX Printed Coffee Cup/Mug For GIFT 325ML Ceramic Coffee Mug Price in India – Buy Shieldsmore Ceramic Designer INCOME TAX Printed Coffee Cup/Mug For GIFT 325ML Ceramic Coffee Mug online at Flipkart … – #110

Shieldsmore Ceramic Designer INCOME TAX Printed Coffee Cup/Mug For GIFT 325ML Ceramic Coffee Mug Price in India – Buy Shieldsmore Ceramic Designer INCOME TAX Printed Coffee Cup/Mug For GIFT 325ML Ceramic Coffee Mug online at Flipkart … – #110

Income Tax Liabilities on Marriage Gift & for Divorced Couples – #111

Income Tax Liabilities on Marriage Gift & for Divorced Couples – #111

Taxancy – Gifts from Relatives is fully tax Free Who is… | Facebook – #112

Taxancy – Gifts from Relatives is fully tax Free Who is… | Facebook – #112

Understanding Income Tax on Marriage Gifts: Important Facts You Need to Know | Ebizfiling – #113

Understanding Income Tax on Marriage Gifts: Important Facts You Need to Know | Ebizfiling – #113

- clubbing of income

- gift tax exemption

- gift tax definition

Income Tax,दिवाळीत मिळणाऱ्या भेटवस्तू आणि बोनसवरही टॅक्स; सोने, मालमत्तेबाबत जाणून घ्या IT विभागाचा नियम – income tax on diwali gift how gold cash and property gifts are taxed … – #114

Income Tax,दिवाळीत मिळणाऱ्या भेटवस्तू आणि बोनसवरही टॅक्स; सोने, मालमत्तेबाबत जाणून घ्या IT विभागाचा नियम – income tax on diwali gift how gold cash and property gifts are taxed … – #114

- gift from relative exempt from income tax

- capital gains tax

- section 56(2) of income tax act

Income Tax Guidelines & Mini Ready Reckoner 2022-23 & 2023-24 – BigBookShop – #115

Income Tax Guidelines & Mini Ready Reckoner 2022-23 & 2023-24 – BigBookShop – #115

Tax Flowchart: Gifts of Property & Income Tax | Visual Law Library – #116

Tax Flowchart: Gifts of Property & Income Tax | Visual Law Library – #116

NO ‘OCCASION’ REQUIRED FOR ‘GIFT’ UNDER INCOME TAX LAW: ITAT DELETES ADDITION TOWARDS GIFT FROM NRI BROTHER – CA Support India – #117

NO ‘OCCASION’ REQUIRED FOR ‘GIFT’ UNDER INCOME TAX LAW: ITAT DELETES ADDITION TOWARDS GIFT FROM NRI BROTHER – CA Support India – #117

11.11.2022: Webinar on “Centre-State Relations in India – Constitutional Provisions and Role of constitutional functionaries” Workshop | GIFT – #118

11.11.2022: Webinar on “Centre-State Relations in India – Constitutional Provisions and Role of constitutional functionaries” Workshop | GIFT – #118

Gifts of Stock and Securities | CAI – #119

Gifts of Stock and Securities | CAI – #119

-originalImg-5d9c05bd-fef7-468b-a79a-7b00245b1da1.png) gifts from non-relatives | Gifts, Income tax, Quick news – #120

gifts from non-relatives | Gifts, Income tax, Quick news – #120

) Liz Weston: Make sure gift doesn’t create a tax problem – oregonlive.com – #121

Liz Weston: Make sure gift doesn’t create a tax problem – oregonlive.com – #121

IRS Gift Limit 2024, Spousе & Minors, Tax Free Gift, Tax Rates – NCBlpc – #122

IRS Gift Limit 2024, Spousе & Minors, Tax Free Gift, Tax Rates – NCBlpc – #122

Decentralised finance under taxman’s lens: Government set to levy additional taxes – #123

Decentralised finance under taxman’s lens: Government set to levy additional taxes – #123

Here’s all you need to know about “Gift Tax” | Zee Business – #124

Here’s all you need to know about “Gift Tax” | Zee Business – #124

The Trustees of Reservations Planned Giving :: Gift of Securities – #125

The Trustees of Reservations Planned Giving :: Gift of Securities – #125

2021 Gift Tax Exclusion – How Much Can You Give Away? – YouTube – #126

2021 Gift Tax Exclusion – How Much Can You Give Away? – YouTube – #126

Change on the Horizon: Preparing for the Estate and Gift Lifetime Tax Exemption Sunset | Hugh Lau – #127

Change on the Horizon: Preparing for the Estate and Gift Lifetime Tax Exemption Sunset | Hugh Lau – #127

Considerations in Making a Gift of a Business Interest to a Public Charity – Policy and Taxation Group – #128

Considerations in Making a Gift of a Business Interest to a Public Charity – Policy and Taxation Group – #128

MASD & Co on X: “Gifts are usually capital receipts by nature. The Income Tax Act, 1961 which is levies tax on incomes, that is revenue receipts, carves out certain exceptions and – #129

MASD & Co on X: “Gifts are usually capital receipts by nature. The Income Tax Act, 1961 which is levies tax on incomes, that is revenue receipts, carves out certain exceptions and – #129

Donating Stock to Charity | Fidelity Charitable – #130

Donating Stock to Charity | Fidelity Charitable – #130

tax saving strategies, tax planning to reduce taxes – #131

tax saving strategies, tax planning to reduce taxes – #131

GIFT IFSC – Destination for Earning Tax Free Income for NRIs – Neuronwealth – #132

GIFT IFSC – Destination for Earning Tax Free Income for NRIs – Neuronwealth – #132

Chocolate Day Gifts & Delivery in Income Tax Building Kolkata – #133

Chocolate Day Gifts & Delivery in Income Tax Building Kolkata – #133

Posts: gift income tax

Categories: Gifts

Author: toyotabienhoa.edu.vn