Details more than 151 gift from relative taxability

Top images of gift from relative taxability by website toyotabienhoa.edu.vn compilation. gift tax payment by donar/donee???? – Income Tax | Tax queries. Gift Tax in India and its Effect on NRIs – Immihelp. Annual Gift Tax Exclusion: A Complete Guide To Gifting. Here’s All You Must Know About Gift Tax & Tax On Donations, That Includes Gifts From A Spouse!. Gifts to Employees – Taxable Income or Nontaxable Gift

Gift from USA to India: Taxation and Exemptions – SBNRI – #1

Gift from USA to India: Taxation and Exemptions – SBNRI – #1

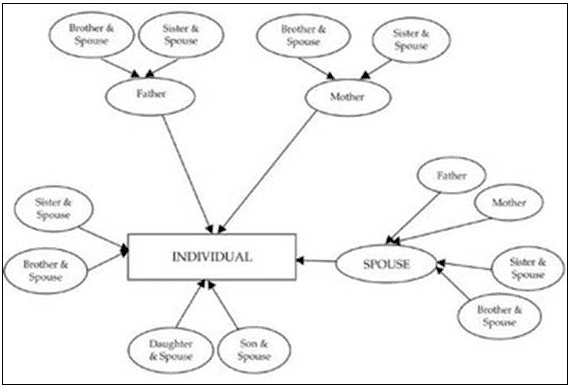

TAX ON SALE OF PROPERTY RECEIVED AS GIFT – TOP CHARTERED ACCOUNTANT IN AHMEDABAD,GUJARAT,INDIA|TAX FILING|INCOME TAX|GST REGISTRATION|COMPANY FORMATION|AUDIT SERVICES|ACCOUNTING|TAX CONSULTANCY|BEST CA IN AHMEDABAD – #2

TAX ON SALE OF PROPERTY RECEIVED AS GIFT – TOP CHARTERED ACCOUNTANT IN AHMEDABAD,GUJARAT,INDIA|TAX FILING|INCOME TAX|GST REGISTRATION|COMPANY FORMATION|AUDIT SERVICES|ACCOUNTING|TAX CONSULTANCY|BEST CA IN AHMEDABAD – #2

Taxability of gift received in cash or in kind by HUF without consideration – #4

Taxability of gift received in cash or in kind by HUF without consideration – #4

Sending gifts to children, relatives abroad? You may have to pay tax – Income Tax News | The Financial Express – #5

Sending gifts to children, relatives abroad? You may have to pay tax – Income Tax News | The Financial Express – #5

How to Avoid the Gift Tax – SmartAsset | SmartAsset – #6

How to Avoid the Gift Tax – SmartAsset | SmartAsset – #6

Repatriation of Funds of Gifts and Inheritance Abroad – ppt download – #7

Repatriation of Funds of Gifts and Inheritance Abroad – ppt download – #7

Gift Tax Rules – A Simple Guide to Claiming Gifts | www.GkaplanCPA.com – #8

Gift Tax Rules – A Simple Guide to Claiming Gifts | www.GkaplanCPA.com – #8

Gift of ‘Brand’ to family trust not taxable | India Tax Law – #10

Gift of ‘Brand’ to family trust not taxable | India Tax Law – #10

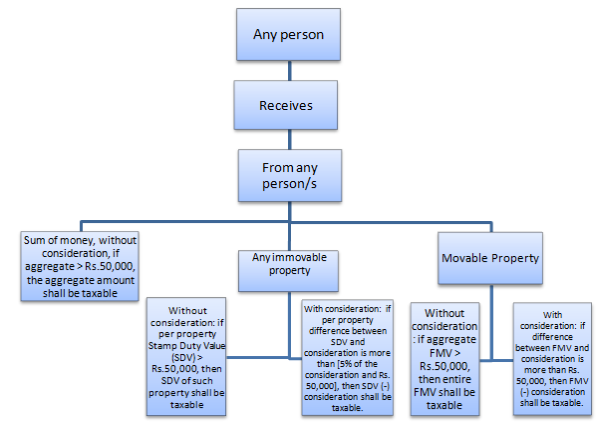

Understanding Section 56(2)(x) of Income Tax Act 1961: Taxation of Gifts Received – Marg ERP Blog – #11

Understanding Section 56(2)(x) of Income Tax Act 1961: Taxation of Gifts Received – Marg ERP Blog – #11

Is there a limit in income tax laws up to which a father can gift to his son – #12

Is there a limit in income tax laws up to which a father can gift to his son – #12

Taxes | What is the relative value of the tax-free gift compared to the value of a bequest in 20 years? | SSEI QForum – #13

Taxes | What is the relative value of the tax-free gift compared to the value of a bequest in 20 years? | SSEI QForum – #13

Income tax on gifts: Know when your gift is tax-free – BusinessToday – #14

Income tax on gifts: Know when your gift is tax-free – BusinessToday – #14

Make Christmas the Season of Stock-Gifting! – Blog by Tickertape – #15

Make Christmas the Season of Stock-Gifting! – Blog by Tickertape – #15

The Gift Tax Made Simple – TurboTax Tax Tips & Videos – #16

The Gift Tax Made Simple – TurboTax Tax Tips & Videos – #16

Form 709 – Guide 2023 | US Expat Tax Service – #17

Form 709 – Guide 2023 | US Expat Tax Service – #17

- service tax

- gift tax definition

- gift tax exemption relatives list

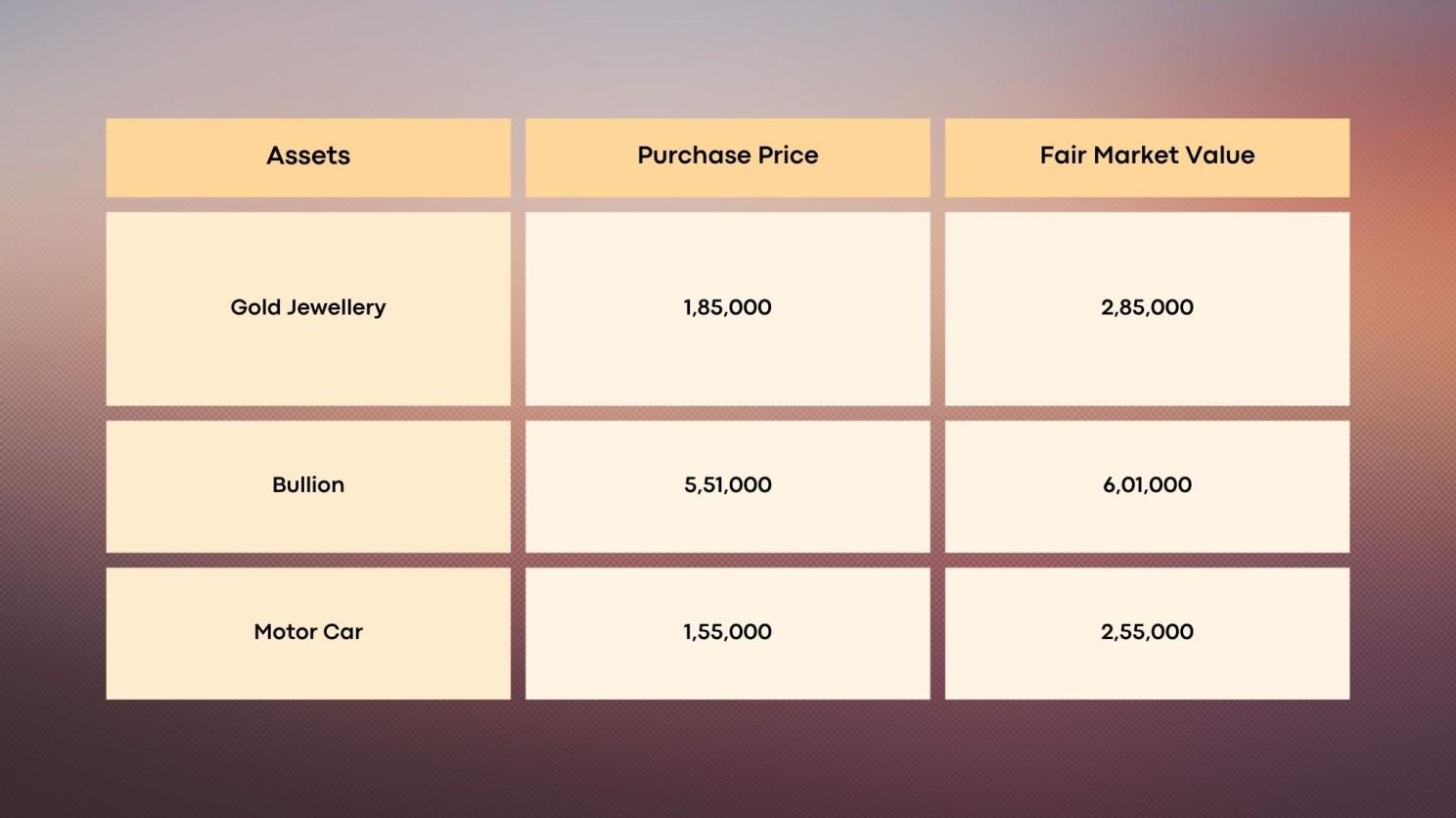

What are different Types of Gold Investment and How are they Taxed – #18

What are different Types of Gold Investment and How are they Taxed – #18

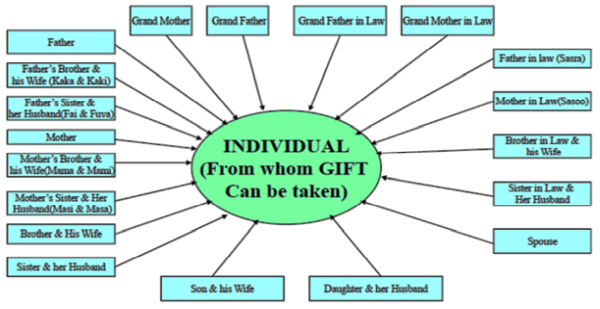

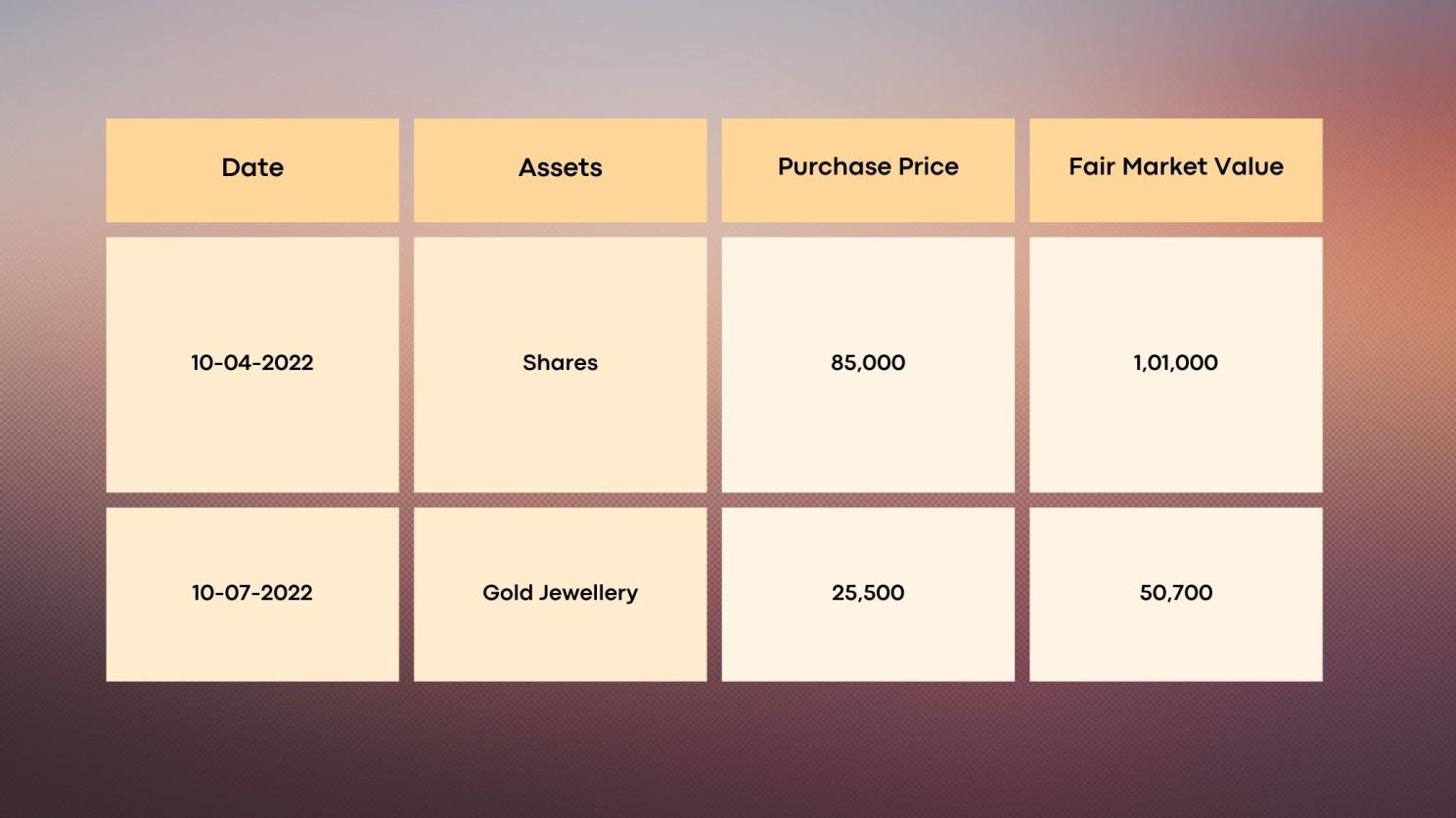

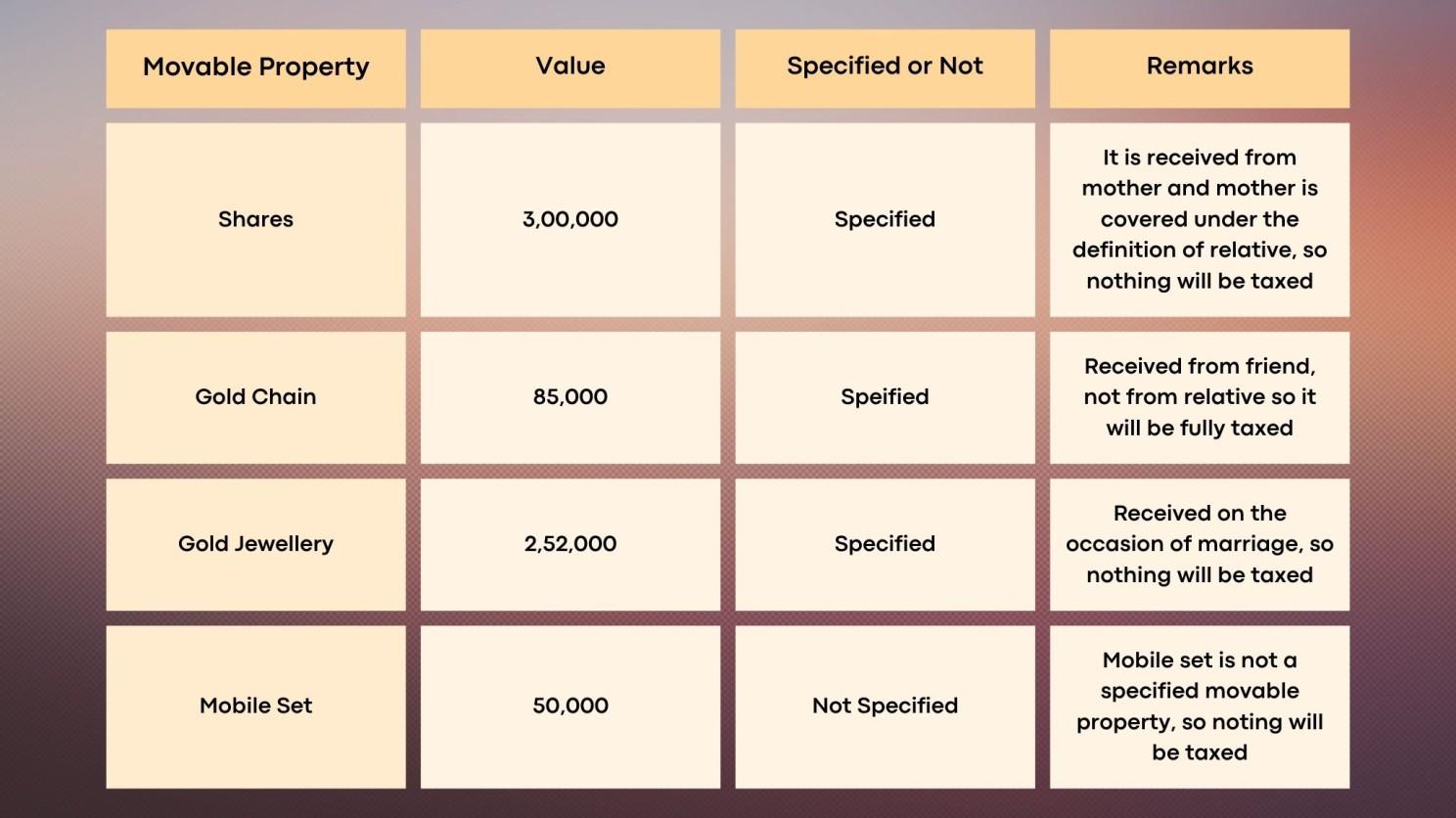

) Taxability of Gifts in hands of Individuals – #19

Taxability of Gifts in hands of Individuals – #19

Tax for NRIs on gifts of money and property from resident Indians received through gift deeds – Property lawyers in India – #20

Tax for NRIs on gifts of money and property from resident Indians received through gift deeds – Property lawyers in India – #20

Documentation of the Gifts Received is Important for Tax Purpose – #21

Documentation of the Gifts Received is Important for Tax Purpose – #21

Understanding Income Tax on Gifts Received in India: Rules, Exceptions, and Valuation” – #22

Understanding Income Tax on Gifts Received in India: Rules, Exceptions, and Valuation” – #22

The Gift Tax Rate Schedule | Download Table – #23

The Gift Tax Rate Schedule | Download Table – #23

Taxellent Associates – #24

Taxellent Associates – #24

How do Gift Taxes and Annual Exclusion Gifts Work? – Anderson O’Brien Law Firm – #25

How do Gift Taxes and Annual Exclusion Gifts Work? – Anderson O’Brien Law Firm – #25

Can I be Taxed for Gifting My Business? – #26

Can I be Taxed for Gifting My Business? – #26

Want To Gift Ancestral Gold To Your Kin Or Sell It For Cash? Know The Taxation – #27

Want To Gift Ancestral Gold To Your Kin Or Sell It For Cash? Know The Taxation – #27

How can I lower the ‘gift’ tax on a present to a relative? – #28

How can I lower the ‘gift’ tax on a present to a relative? – #28

The Ins and Outs of Giving or Receiving Down Payment Gifts — The Agency Texas – #29

The Ins and Outs of Giving or Receiving Down Payment Gifts — The Agency Texas – #29

What is the Gift Tax – How Does the Gift Tax Work – #30

What is the Gift Tax – How Does the Gift Tax Work – #30

Understanding the Tax Implications of Gold Gifts in India | My Gold Guide – #31

Understanding the Tax Implications of Gold Gifts in India | My Gold Guide – #31

- gift for boys

- gift tax rate in india 2022-23

Your Diwali gift and bonus can be taxable: Know ways to avoid it – #32

Your Diwali gift and bonus can be taxable: Know ways to avoid it – #32

Do You Need to File a Gift or Estate Tax Return? – Yeo and Yeo – #33

Do You Need to File a Gift or Estate Tax Return? – Yeo and Yeo – #33

The Tax Consequences of a Down Payment Gift for a Mortgage – #34

The Tax Consequences of a Down Payment Gift for a Mortgage – #34

The Lifetime Gift Tax Exemption: Everything You Need to Know – #35

The Lifetime Gift Tax Exemption: Everything You Need to Know – #35

- income tax gif

- gift tax act 1958

- gift tax example

Greece Increases Gift Tax-exempt Bracket From October 1, 2021 – Inheritance Tax – Greece – #36

Greece Increases Gift Tax-exempt Bracket From October 1, 2021 – Inheritance Tax – Greece – #36

NRI Gift Tax in India – Gift from NRI to Resident Indian or Vice Versa – myMoneySage Blog – #37

NRI Gift Tax in India – Gift from NRI to Resident Indian or Vice Versa – myMoneySage Blog – #37

Diwali gifts and taxation: Unwrapping the legal insights | Angel One – #38

Diwali gifts and taxation: Unwrapping the legal insights | Angel One – #38

Expecting an NFT, crypto, or VDA gift this Diwali? Here are the tax implications – #39

Expecting an NFT, crypto, or VDA gift this Diwali? Here are the tax implications – #39

Diwali season: Do you have to pay tax on gifts received ? | Personal Finance – Business Standard – #40

Diwali season: Do you have to pay tax on gifts received ? | Personal Finance – Business Standard – #40

Know how Gifts to NRI is Taxable – Legal Suvidha Providers – #41

Know how Gifts to NRI is Taxable – Legal Suvidha Providers – #41

How To Avoid The Gift Tax In Real Estate | Rocket Mortgage – #42

How To Avoid The Gift Tax In Real Estate | Rocket Mortgage – #42

Income Tax on Diwali, Dhanteras 2021 festival gifts: Here’s all you need to know – Income Tax News | The Financial Express – #43

Income Tax on Diwali, Dhanteras 2021 festival gifts: Here’s all you need to know – Income Tax News | The Financial Express – #43

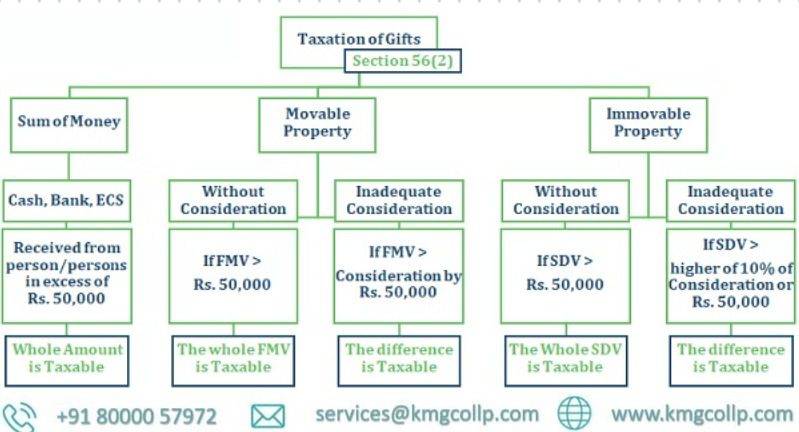

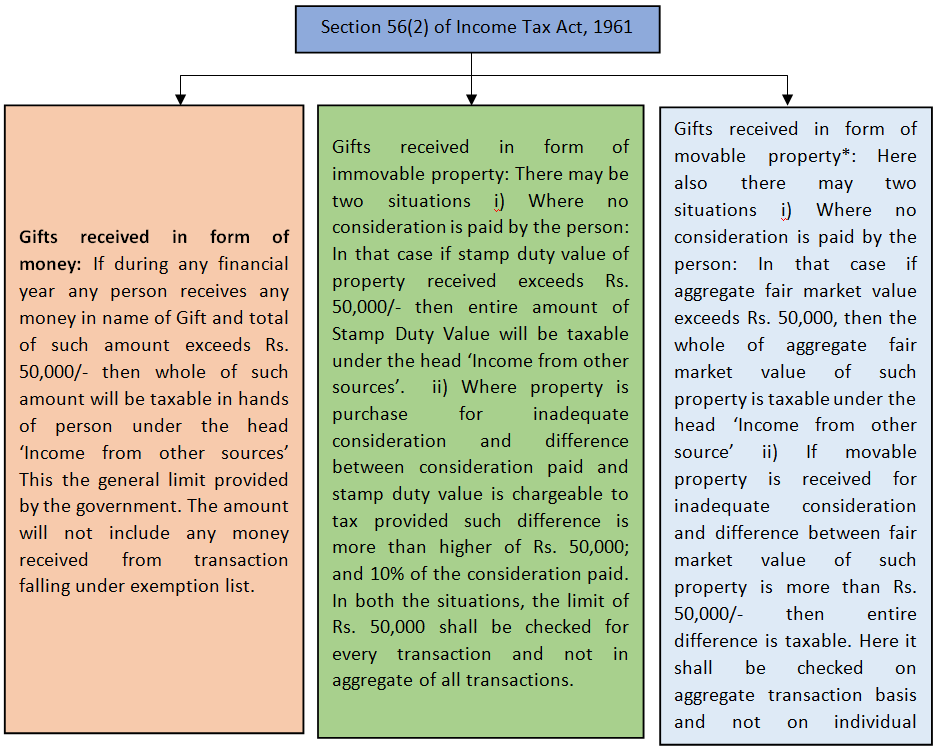

- section 56(2) of income tax act

- gift tax rate

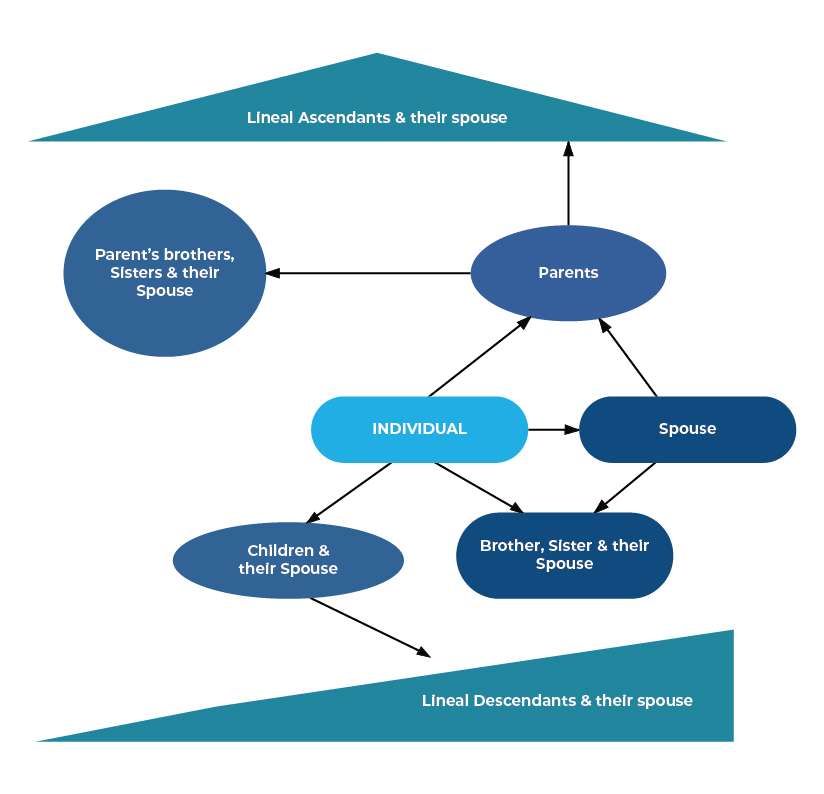

- lineal ascendant gift from relative exempt from income tax

Ask me anything about Advance Tax – AMA (Ask Me Anything) – Trading Q&A by Zerodha – All your queries on trading and markets answered – #44

Ask me anything about Advance Tax – AMA (Ask Me Anything) – Trading Q&A by Zerodha – All your queries on trading and markets answered – #44

Office of Shree Tax Chambers on X: “Hot Off the Press!! May check today’s Deccan Herald’s National Edition Pg 9 | Shree’s ‘Got Deepavali Gifts? Know their tax implications’ appeared. Truly a – #45

Office of Shree Tax Chambers on X: “Hot Off the Press!! May check today’s Deccan Herald’s National Edition Pg 9 | Shree’s ‘Got Deepavali Gifts? Know their tax implications’ appeared. Truly a – #45

How to gift stocks, bonds and ETFs and the tax implications – Z-Connect by Zerodha – #46

How to gift stocks, bonds and ETFs and the tax implications – Z-Connect by Zerodha – #46

Gift Tax 101: Gift Tax Limits (+ Rules for Gifting Stocks) – #47

Gift Tax 101: Gift Tax Limits (+ Rules for Gifting Stocks) – #47

Year End Tasks: RMDs and Gift Tax Exclusions | Alliant Retirement and Investment Services – #48

Year End Tasks: RMDs and Gift Tax Exclusions | Alliant Retirement and Investment Services – #48

Taxability of Gifts – Some Interesting Issues – #49

Taxability of Gifts – Some Interesting Issues – #49

Tax filing: Don’t forget to declare income from ‘other sources’ when filing tax returns – #50

Tax filing: Don’t forget to declare income from ‘other sources’ when filing tax returns – #50

When Generosity Bumps Into Gift Tax – The New York Times – #51

When Generosity Bumps Into Gift Tax – The New York Times – #51

Income Tax for AY 2019-20: Got an expensive gift? Keep a documentary proof; here’s why | Zee Business – #52

Income Tax for AY 2019-20: Got an expensive gift? Keep a documentary proof; here’s why | Zee Business – #52

The Gift Tax And Special Needs Trusts | Rubin Law – #53

The Gift Tax And Special Needs Trusts | Rubin Law – #53

How IRS Can Tax ‘Gifts’ and Impose Big Penalties – #54

How IRS Can Tax ‘Gifts’ and Impose Big Penalties – #54

- gift tax rate in india 2020

- lineal ascendant

- wealth tax

Tax queries: Gifts received from a relative are tax-exempt – The Economic Times – #55

Tax queries: Gifts received from a relative are tax-exempt – The Economic Times – #55

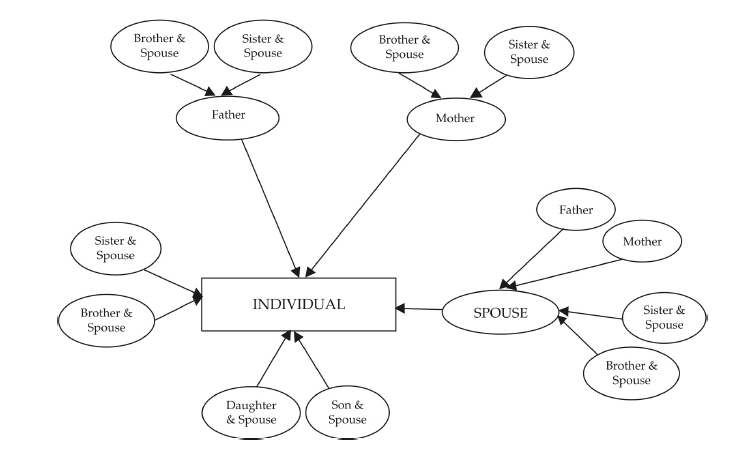

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #56

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #56

Capital Gains on a Gifted Property | Impact, Tax Considerations – #57

Capital Gains on a Gifted Property | Impact, Tax Considerations – #57

TAX TREATMENT OF GIFTS RECEIVED IN DEEPAWALI ? – Kanoon For All – #58

TAX TREATMENT OF GIFTS RECEIVED IN DEEPAWALI ? – Kanoon For All – #58

Gift Tax: 3 Easy Ways to Avoid Paying the Gift Tax | TaxAct – #59

Gift Tax: 3 Easy Ways to Avoid Paying the Gift Tax | TaxAct – #59

Do Cash Gifts Count as Income? • 1040.com Blog – #60

Do Cash Gifts Count as Income? • 1040.com Blog – #60

Solved b. Gifts of up to $15,000 per year from any person | Chegg.com – #61

Solved b. Gifts of up to $15,000 per year from any person | Chegg.com – #61

What You Need to Know About Stock Gift Tax – #62

What You Need to Know About Stock Gift Tax – #62

Monetary gift tax: Income tax on gift received from parents | Value Research – #63

Monetary gift tax: Income tax on gift received from parents | Value Research – #63

Know the tax impact on the gifts you receive – Goal Bridge – #64

Know the tax impact on the gifts you receive – Goal Bridge – #64

How to calculate income tax on gifts from relatives? – #65

How to calculate income tax on gifts from relatives? – #65

Are Diwali gifts from employer, relatives, friends taxable? Here’s a look at the norms | Mint – #66

Are Diwali gifts from employer, relatives, friends taxable? Here’s a look at the norms | Mint – #66

Save Tax Through Gifts Se Tax Planning Income Tax Rules, Gift Deed Create # gift #gifttax #taxongift – YouTube – #67

Save Tax Through Gifts Se Tax Planning Income Tax Rules, Gift Deed Create # gift #gifttax #taxongift – YouTube – #67

Rules For Giving And Receiving Home Down Payment Gifts – Experian – #68

Rules For Giving And Receiving Home Down Payment Gifts – Experian – #68

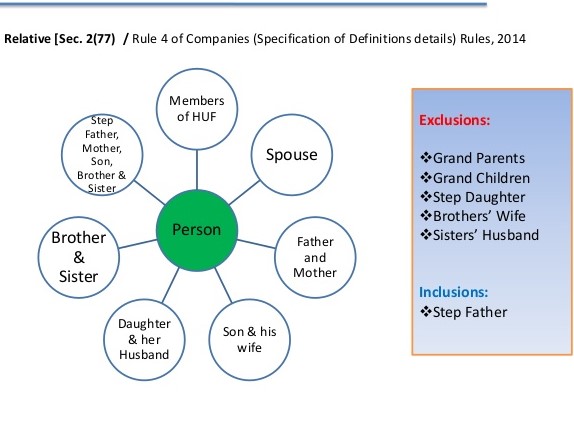

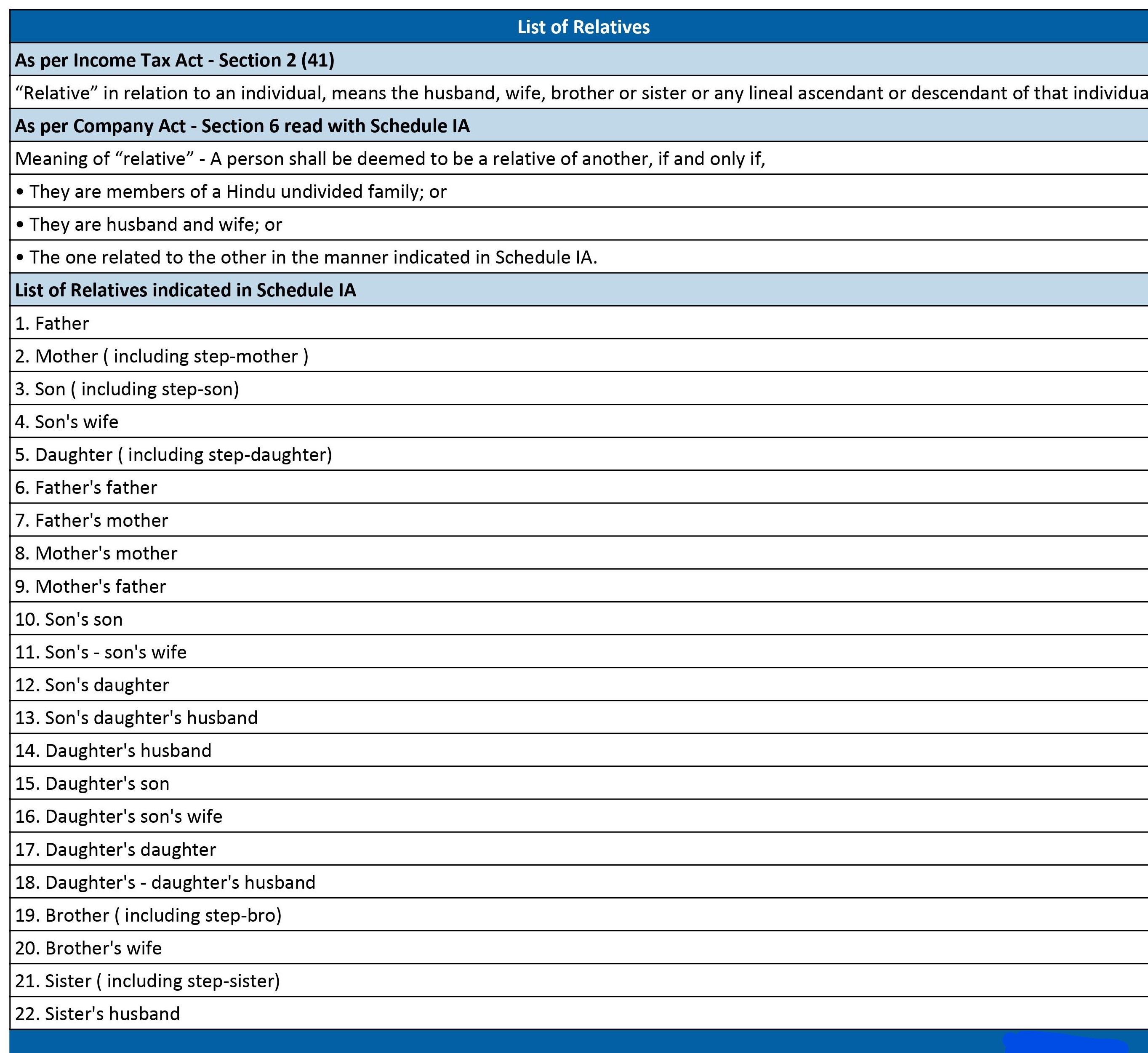

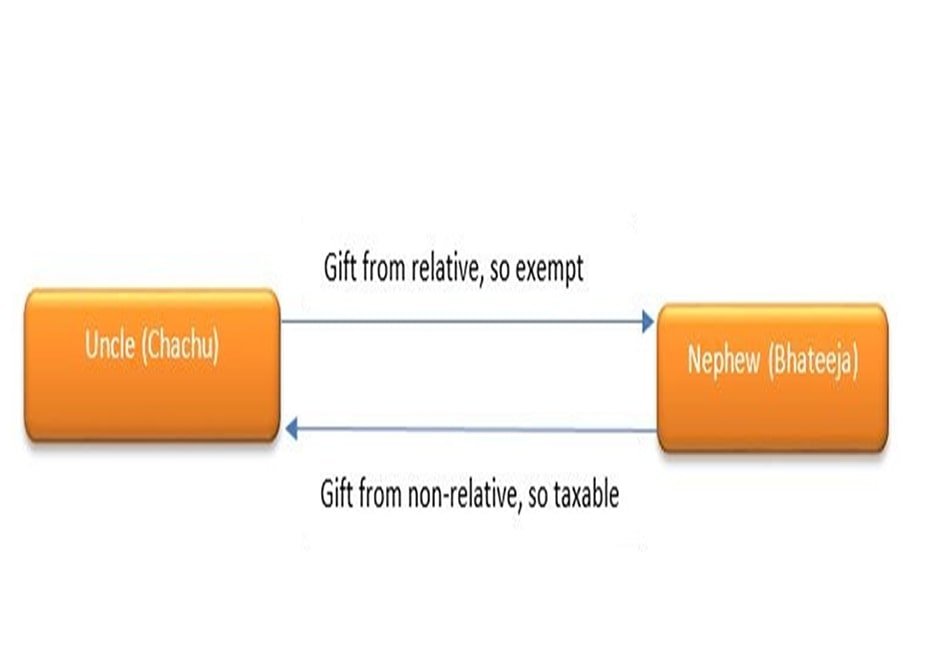

Nephew and Niece are not “Relative” under Income Tax act 1961 – #69

Nephew and Niece are not “Relative” under Income Tax act 1961 – #69

Section 56(2)(vii) Gift Tax – #70

Section 56(2)(vii) Gift Tax – #70

Tax implications on Gifting Shares – Enterslice Pvt Ltd – #71

Tax implications on Gifting Shares – Enterslice Pvt Ltd – #71

Gift Tax planning – 3 awesome tips to save income tax legally – #72

Gift Tax planning – 3 awesome tips to save income tax legally – #72

Managing and shifting wealth – CFA, FRM, and Actuarial Exams Study Notes – #73

Managing and shifting wealth – CFA, FRM, and Actuarial Exams Study Notes – #73

Legal Alert | Common Gift Tax Return Mistakes and Ways to Avoid Them | Husch Blackwell – #74

Legal Alert | Common Gift Tax Return Mistakes and Ways to Avoid Them | Husch Blackwell – #74

Taxes On Gifts From Overseas – #75

Taxes On Gifts From Overseas – #75

Everything you need to know about gift tax on property. – #76

Everything you need to know about gift tax on property. – #76

Hedge Your Knowledge – #77

Hedge Your Knowledge – #77

Income Tax on Gift Rules in Hindi | Income Tax on Gift Received from Parents Reletives Property Gift – YouTube – #78

Income Tax on Gift Rules in Hindi | Income Tax on Gift Received from Parents Reletives Property Gift – YouTube – #78

A Comprehensive guide on gift tax in India – How are gifts taxed? – #79

A Comprehensive guide on gift tax in India – How are gifts taxed? – #79

How are stocks gifted to your spouse taxed? | Mint – #80

How are stocks gifted to your spouse taxed? | Mint – #80

gift tax payment by donar/donee???? – Income Tax | Tax queries – #81

gift tax payment by donar/donee???? – Income Tax | Tax queries – #81

when Gift is taxable ? when gift is Exempted ? | SIMPLE TAX INDIA – #82

when Gift is taxable ? when gift is Exempted ? | SIMPLE TAX INDIA – #82

Business Tax Tips – Are staff and client gifts tax-deductible and when does FBT apply? – #83

Business Tax Tips – Are staff and client gifts tax-deductible and when does FBT apply? – #83

Gift To Huf By Member – File Taxes Online | Online Tax Services in India | Online E-tax Filing – #84

Gift To Huf By Member – File Taxes Online | Online Tax Services in India | Online E-tax Filing – #84

Tax matters: Uncle’s gift is tax free | Tax matters: Uncle’s gift is tax free – #85

Tax matters: Uncle’s gift is tax free | Tax matters: Uncle’s gift is tax free – #85

A Guide To Gifts Of Equity | Rocket Mortgage – #86

A Guide To Gifts Of Equity | Rocket Mortgage – #86

Estate and Gift Taxes 2021-2022: What’s New This Year and What You Need to Know – WSJ – #87

Estate and Gift Taxes 2021-2022: What’s New This Year and What You Need to Know – WSJ – #87

The Charles Schwab Guide To Finances After Fifty – #88

The Charles Schwab Guide To Finances After Fifty – #88

All about Income Tax on Gift Received From Parents. – #89

All about Income Tax on Gift Received From Parents. – #89

Income Tax: Will Gifting Of Shares To Spouse Be Taxable? – News18 – #90

Income Tax: Will Gifting Of Shares To Spouse Be Taxable? – News18 – #90

The New Tax Law: Estate and Gift Tax – WSJ – #91

The New Tax Law: Estate and Gift Tax – WSJ – #91

Gifts received in professional capacity are taxable – #92

Gifts received in professional capacity are taxable – #92

Taxability of Gift received by an individual or HUF with FAQs – #93

Taxability of Gift received by an individual or HUF with FAQs – #93

Paisa Wasool 2.0: Are wedding gifts really tax free? All hidden clauses explained | Zee Business – #94

Paisa Wasool 2.0: Are wedding gifts really tax free? All hidden clauses explained | Zee Business – #94

Your Queries: No tax on gift from relative but show it in ITR under exempt income – Income Tax News | The Financial Express – #95

Your Queries: No tax on gift from relative but show it in ITR under exempt income – Income Tax News | The Financial Express – #95

Marriage Gifts And Its Taxation in India: Understanding – Legal Window – #96

Marriage Gifts And Its Taxation in India: Understanding – Legal Window – #96

Income Tax on Gifts Received | Monetary Gifts from Relatives & Friends | Taxpundit – YouTube – #97

Income Tax on Gifts Received | Monetary Gifts from Relatives & Friends | Taxpundit – YouTube – #97

Income Tax on Gift in India – Rules and tips to save tax – BasuNivesh – #98

Income Tax on Gift in India – Rules and tips to save tax – BasuNivesh – #98

Estate and Gift Tax Update for 2023 – #99

Estate and Gift Tax Update for 2023 – #99

6 ways to avoid tax on your Diwali Gifts – #100

6 ways to avoid tax on your Diwali Gifts – #100

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #101

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #101

Income Tax Rules | Tax Saving Plan | WealthDirect Portfolio Pvt Ltd – #102

Income Tax Rules | Tax Saving Plan | WealthDirect Portfolio Pvt Ltd – #102

Gift Deed | Procedure | Fee | Expert lawyer and advocate in Delhi NCR | Litem – #103

Gift Deed | Procedure | Fee | Expert lawyer and advocate in Delhi NCR | Litem – #103

What is the taxation on any gift via cash transfer to a relative? | Mint – #104

What is the taxation on any gift via cash transfer to a relative? | Mint – #104

gift taxation: Which gifts are taxable for the recipient and which ones can increase tax liability of giver – The Economic Times – #105

gift taxation: Which gifts are taxable for the recipient and which ones can increase tax liability of giver – The Economic Times – #105

) Scenarios of Exemption of Capital Gains Tax | Nimit Consultancy – #106

Scenarios of Exemption of Capital Gains Tax | Nimit Consultancy – #106

Taxation on Gifts – by Jia – JJ Tax Blog – #107

Taxation on Gifts – by Jia – JJ Tax Blog – #107

- gift tax exemption 2022

- gift tax meaning

- gift tax exemption

I received gifts during my wedding, are they taxable? – #108

I received gifts during my wedding, are they taxable? – #108

THE LOWDOWN ON GIFT GIVING – Blair & Associates – #109

THE LOWDOWN ON GIFT GIVING – Blair & Associates – #109

What Is the Lifetime Gift Tax Exemption for 2024? | SmartAsset – #110

What Is the Lifetime Gift Tax Exemption for 2024? | SmartAsset – #110

Gifts of Partnership Interests – #111

Gifts of Partnership Interests – #111

We’re Paying for Our Daughter’s Wedding. Is It a Taxable Gift? – WSJ – #112

We’re Paying for Our Daughter’s Wedding. Is It a Taxable Gift? – WSJ – #112

Types of Tax – Exemptions, Due Dates & Penalties – #113

Types of Tax – Exemptions, Due Dates & Penalties – #113

CFA L3 NOTES: 4 – ESTATE PLANNING IN A GLOBAL CONTEXT – RELATIVE AFTER-TAX VALUES OF GIFTS – #114

CFA L3 NOTES: 4 – ESTATE PLANNING IN A GLOBAL CONTEXT – RELATIVE AFTER-TAX VALUES OF GIFTS – #114

Gifts Tax: Know which gifts are taxable this festive season | TAX SAVING | Zee Business – #115

Gifts Tax: Know which gifts are taxable this festive season | TAX SAVING | Zee Business – #115

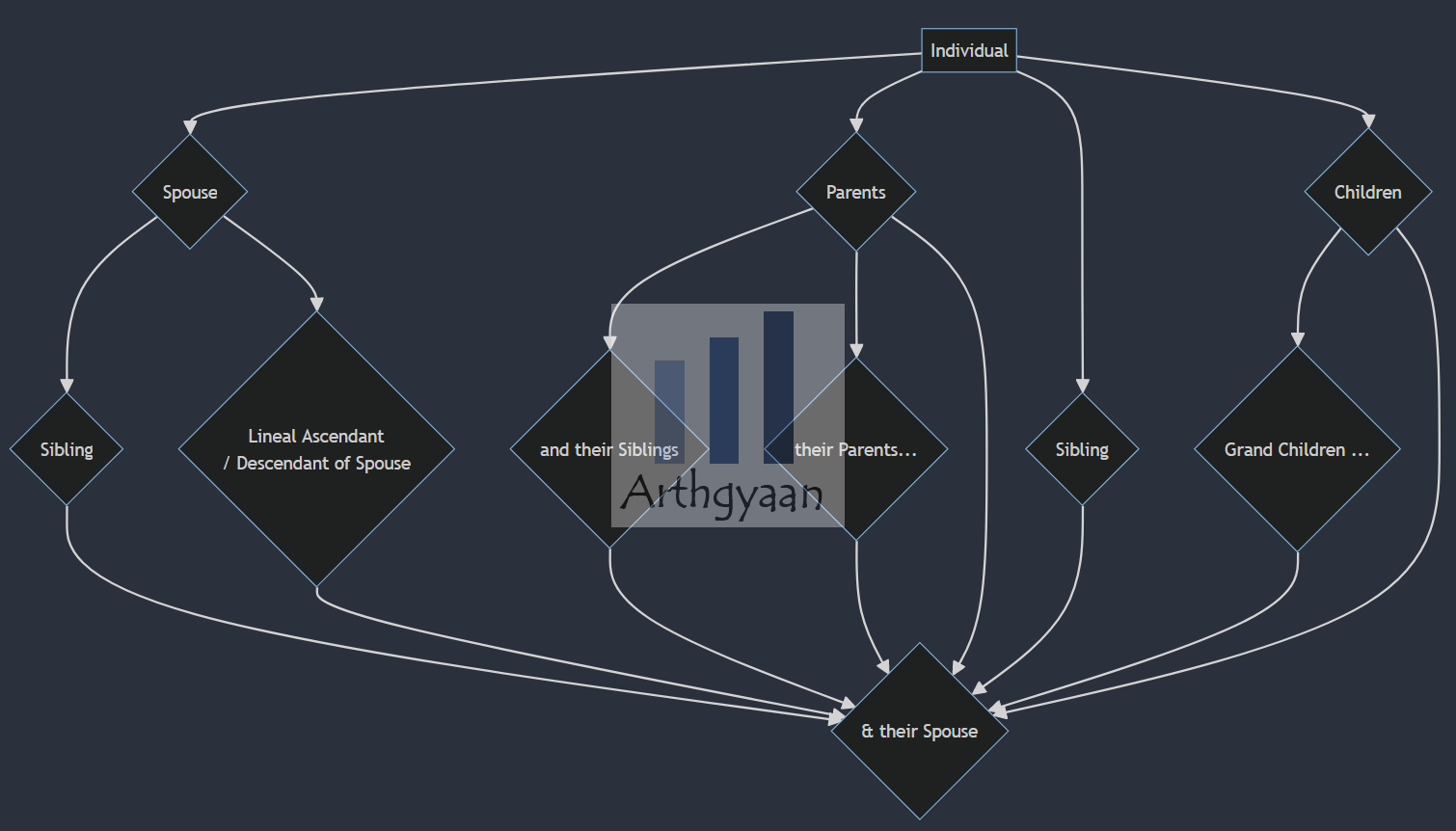

Section 56(2)(X): Taxation of Gift – #116

Section 56(2)(X): Taxation of Gift – #116

Understanding Section 56(2)(viib) of the Income Tax Act – Marg ERP Blog – #117

Understanding Section 56(2)(viib) of the Income Tax Act – Marg ERP Blog – #117

Income Tax Liabilities on Marriage Gift & for Divorced Couples – #118

Income Tax Liabilities on Marriage Gift & for Divorced Couples – #118

Maximize Tax Savings: Business Gift Deductions Explained – #119

Maximize Tax Savings: Business Gift Deductions Explained – #119

Gift Tax – गिफ्ट लेन – देन के 8 इम्पोर्टेन्ट टैक्स रूल्स – #120

Gift Tax – गिफ्ट लेन – देन के 8 इम्पोर्टेन्ट टैक्स रूल्स – #120

What’s the difference between a gift and taxable income for tax purposes? For example, I received a gift card from my friend after I helped him with homework. Is this considered to – #121

What’s the difference between a gift and taxable income for tax purposes? For example, I received a gift card from my friend after I helped him with homework. Is this considered to – #121

Tax Implications When Making an International Money Transfer – #122

Tax Implications When Making an International Money Transfer – #122

Tax On Diwali Gifts: Tax Rate, Exemption, Limit; Here’s Everything You Need To Know – News18 – #123

Tax On Diwali Gifts: Tax Rate, Exemption, Limit; Here’s Everything You Need To Know – News18 – #123

How Much of a Gift Can You Give to Someone to Buy a House? – #124

How Much of a Gift Can You Give to Someone to Buy a House? – #124

Annual Gift Tax Exclusion: A Complete Guide To Gifting – #125

Annual Gift Tax Exclusion: A Complete Guide To Gifting – #125

Amount received as gift by any blood relative living in US is not taxable in India – Scripbox – #126

Amount received as gift by any blood relative living in US is not taxable in India – Scripbox – #126

PPT – DONOR’S TAX PowerPoint Presentation, free download – ID:9569434 – #127

PPT – DONOR’S TAX PowerPoint Presentation, free download – ID:9569434 – #127

- lineal ascendant meaning

- list of relatives

- expenditure tax act

In India, is sending money to sister as a gift taxable or not? How much money can be sent? – Quora – #128

In India, is sending money to sister as a gift taxable or not? How much money can be sent? – Quora – #128

Received gifts? Don’t forget to declare in Income Tax Return – PANORAMA BusinessToday – #129

Received gifts? Don’t forget to declare in Income Tax Return – PANORAMA BusinessToday – #129

Gift tax exemption | Tax on gift money | Value Research – #130

Gift tax exemption | Tax on gift money | Value Research – #130

Gift Deed in India – Registration Process, Documents & Tax Exemption – #131

Gift Deed in India – Registration Process, Documents & Tax Exemption – #131

What Gifts Are Subject to the Gift Tax? – #132

What Gifts Are Subject to the Gift Tax? – #132

Is Money Received From Children Living Abroad Taxable? – #133

Is Money Received From Children Living Abroad Taxable? – #133

- gift chart as per income tax

- gift from relative exempt from income tax

- gift tax in india

gift-tax – upload form-16 – #134

gift-tax – upload form-16 – #134

Income Tax on Diwali Gift: How Cash, Gold, Car and Property Gifts are Taxed – Income Tax News | The Financial Express – #135

Income Tax on Diwali Gift: How Cash, Gold, Car and Property Gifts are Taxed – Income Tax News | The Financial Express – #135

Are there any income tax implications on the gifting of shares? – #136

Are there any income tax implications on the gifting of shares? – #136

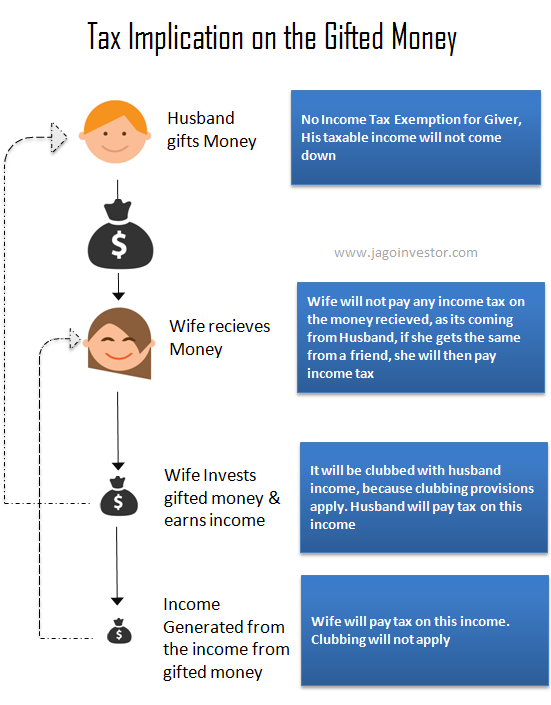

Gifted money to wife? Know the applicable tax rules | Business News – #137

Gifted money to wife? Know the applicable tax rules | Business News – #137

IRS Announced New Lifetime and Gift Tax Exemptions – Texas Trust Law – #138

IRS Announced New Lifetime and Gift Tax Exemptions – Texas Trust Law – #138

WSJ Tax Guide 2019: Estate and Gift Taxes – WSJ – #139

WSJ Tax Guide 2019: Estate and Gift Taxes – WSJ – #139

Gift Tax | Gift Tax In India | Gift Tax under Income Tax | Tax on – #140

Gift Tax | Gift Tax In India | Gift Tax under Income Tax | Tax on – #140

Gift Under The Income Tax Act In India – Especia – #141

Gift Under The Income Tax Act In India – Especia – #141

Income Tax on Cash Gift to Wife: How Much You Can Gift on Women’s Day Without Tax Implications – Income Tax News | The Financial Express – #142

Income Tax on Cash Gift to Wife: How Much You Can Gift on Women’s Day Without Tax Implications – Income Tax News | The Financial Express – #142

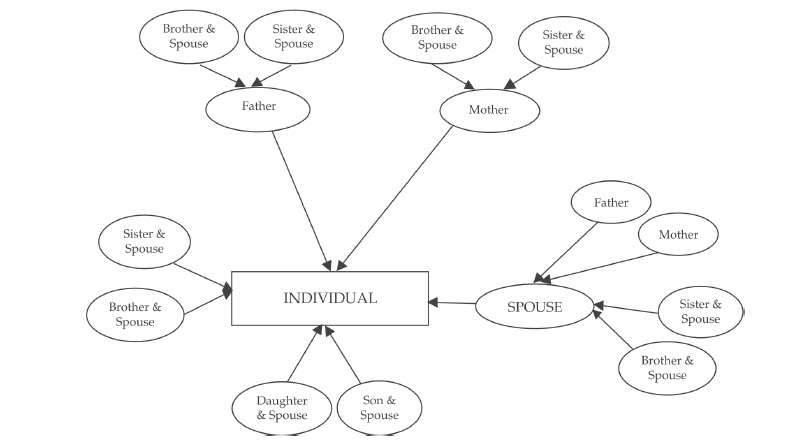

x may be relative of y but y may not be: interesting income tax – #143

x may be relative of y but y may not be: interesting income tax – #143

Is There Any Way To Avoid The Gift Tax In Illinois? – #144

Is There Any Way To Avoid The Gift Tax In Illinois? – #144

Tax Planning with the Annual Gift Tax Exclusion – Alloy Silverstein – #145

Tax Planning with the Annual Gift Tax Exclusion – Alloy Silverstein – #145

-Gifts.jpg) Gifting NFTs, Crypto, VDAs This Diwali? Recipients Can Be Taxed On Certain Items. Know More – #146

Gifting NFTs, Crypto, VDAs This Diwali? Recipients Can Be Taxed On Certain Items. Know More – #146

![No Income Tax on Gift made by HUF to its Member: ITAT Mumbai [Read Order] | Taxscan No Income Tax on Gift made by HUF to its Member: ITAT Mumbai [Read Order] | Taxscan](https://www.financestrategists.com/uploads/featured/Gift-Tax-Rates-for-2024.png) No Income Tax on Gift made by HUF to its Member: ITAT Mumbai [Read Order] | Taxscan – #147

No Income Tax on Gift made by HUF to its Member: ITAT Mumbai [Read Order] | Taxscan – #147

Can Your Diwali Gifts Be Taxed? Check Here For More Details – #148

Can Your Diwali Gifts Be Taxed? Check Here For More Details – #148

Major Things that Every Person Must Know About Tax on Gift in India | Tax & Investment Consultants – #149

Major Things that Every Person Must Know About Tax on Gift in India | Tax & Investment Consultants – #149

Gift Tax Explained 5 min | जानिए Gift लेने पर कितना टैक्स लगता है? Relative से Gift taxable या नहीं? – YouTube – #150

Gift Tax Explained 5 min | जानिए Gift लेने पर कितना टैक्स लगता है? Relative से Gift taxable या नहीं? – YouTube – #150

Taxability on gifts, rewards and rewards given to Sportsperson / Olympic Participants – #151

Taxability on gifts, rewards and rewards given to Sportsperson / Olympic Participants – #151

Posts: gift from relative taxability

Categories: Gifts

Author: toyotabienhoa.edu.vn