Share more than 94 gift from relative income tax best

Update images of gift from relative income tax by website toyotabienhoa.edu.vn compilation. Taxation in the Republic of Ireland – Wikipedia. Taxation of Gifts: An In Depth Analysis. When You Make Cash Gifts To Your Children, Who Pays The Tax? | Greenbush Financial Group

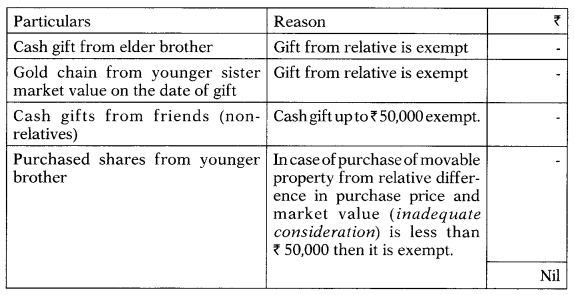

TAX TREATMENT OF GIFTS RECEIVED BY AN INDIVIDUAL OR HUF Source @IncomeTaxIndia Thread 🧵 – Thread from Taxation Updates (Mayur J Sondagar) @TaxationUpdates – Rattibha – #1

TAX TREATMENT OF GIFTS RECEIVED BY AN INDIVIDUAL OR HUF Source @IncomeTaxIndia Thread 🧵 – Thread from Taxation Updates (Mayur J Sondagar) @TaxationUpdates – Rattibha – #1

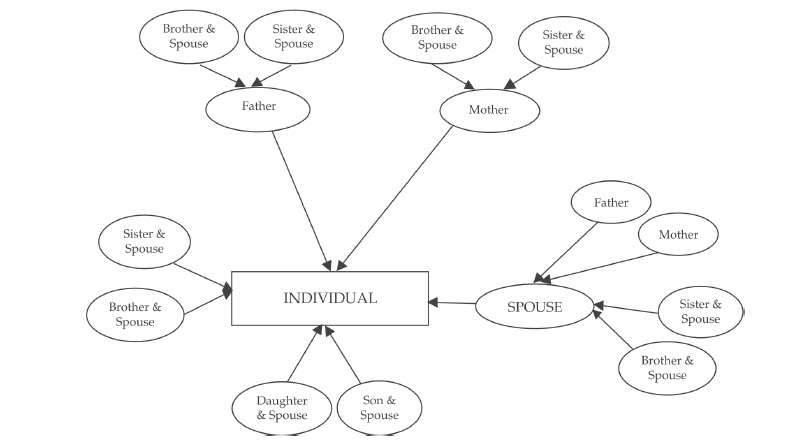

Income Tax on Gift and Definition of Relative – YouTube – #2

Income Tax on Gift and Definition of Relative – YouTube – #2

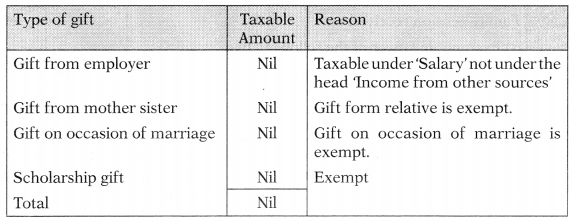

Q & a income from other sources | PDF – #4

Q & a income from other sources | PDF – #4

ITR filing — gifts need to be declared and here you see how they are taxed – #5

ITR filing — gifts need to be declared and here you see how they are taxed – #5

Tax Resident Status and 3 Things to Know Before Moving to US – #6

Tax Resident Status and 3 Things to Know Before Moving to US – #6

Taxability of Gifts – Some Interesting Issues – #7

Taxability of Gifts – Some Interesting Issues – #7

Tax Audit | Detailed Analysis of Clause 32 to Clause 34 | As per the Guidance Note issued by the ICAI – #8

Tax Audit | Detailed Analysis of Clause 32 to Clause 34 | As per the Guidance Note issued by the ICAI – #8

Taxation of Gifts received in Cash or Kind – #10

Taxation of Gifts received in Cash or Kind – #10

Will your ‘gift’ be taxed? – The Economic Times – #11

Will your ‘gift’ be taxed? – The Economic Times – #11

There is bad news for you if your boss showered you with expensive gifts – #12

There is bad news for you if your boss showered you with expensive gifts – #12

Behavioral responses to inheritance and gift taxation: Evidence from Germany – ScienceDirect – #13

Behavioral responses to inheritance and gift taxation: Evidence from Germany – ScienceDirect – #13

Taxes 101: The Gift Tax – Intuit TurboTax Blog – #14

Taxes 101: The Gift Tax – Intuit TurboTax Blog – #14

How to Show Gift in Income Tax Return 2023 – #15

How to Show Gift in Income Tax Return 2023 – #15

Detailed Analysis- Gifts Taxation under Income Tax Act, 1961 – #16

Detailed Analysis- Gifts Taxation under Income Tax Act, 1961 – #16

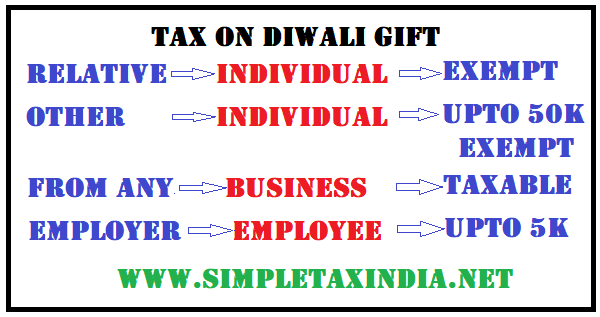

GIFT TAX -TAX ON GIFT BUDGET 2010 | SIMPLE TAX INDIA – #17

GIFT TAX -TAX ON GIFT BUDGET 2010 | SIMPLE TAX INDIA – #17

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #18

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #18

List of Exempted Incomes (Tax-Free) Under Section-10 – #19

List of Exempted Incomes (Tax-Free) Under Section-10 – #19

A Closer Look at the U.S.- Germany Estate and Gift Tax Treaty | SF Tax Counsel – #20

A Closer Look at the U.S.- Germany Estate and Gift Tax Treaty | SF Tax Counsel – #20

chirag-nangia – Page 2 – Nangia Andersen India Pvt. Ltd. – #21

chirag-nangia – Page 2 – Nangia Andersen India Pvt. Ltd. – #21

- gift tax exemption

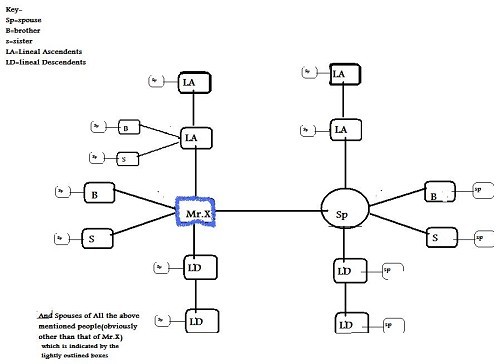

- lineal ascendant gift from relative exempt from income tax

- types of income tax

Gift from USA to India: Taxation and Exemptions – SBNRI – #22

Gift from USA to India: Taxation and Exemptions – SBNRI – #22

If my brother transfers money in my account, say 50 lakhs, will it be taxable in India? – Quora – #23

If my brother transfers money in my account, say 50 lakhs, will it be taxable in India? – Quora – #23

Gift taxation | ITR: Gifts have to be declared in ITR: Here’s how they are taxed – #24

Gift taxation | ITR: Gifts have to be declared in ITR: Here’s how they are taxed – #24

Income Tax on Gift: टैक्स के मामले में मायने रखते हैं रिश्ते, पत्नी की बहन का गिफ्ट Tax Free, लेकिन दोस्त का नहीं | Zee Business Hindi – #25

Income Tax on Gift: टैक्स के मामले में मायने रखते हैं रिश्ते, पत्नी की बहन का गिफ्ट Tax Free, लेकिन दोस्त का नहीं | Zee Business Hindi – #25

- list of relatives for gift

- lineal ascendant

- gift tax exemption relatives list

Avoiding IRS Tax Issues: Renting to Family and Friends – #26

Avoiding IRS Tax Issues: Renting to Family and Friends – #26

Income tax filing: Are gifts taxable? Frequently asked questions on gift taxes | Zee Business – #27

Income tax filing: Are gifts taxable? Frequently asked questions on gift taxes | Zee Business – #27

What is the tax treatment for share transfers? | Value Research – #28

What is the tax treatment for share transfers? | Value Research – #28

Income tax on gifts: Know when your gift is tax-free – BusinessToday – #29

Income tax on gifts: Know when your gift is tax-free – BusinessToday – #29

Taxation of Gifts: An In Depth Analysis – #30

Taxation of Gifts: An In Depth Analysis – #30

Gift Tax in India and USA – #31

Gift Tax in India and USA – #31

Gifts from relatives are always tax-free – The Economic Times – #32

Gifts from relatives are always tax-free – The Economic Times – #32

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #33

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #33

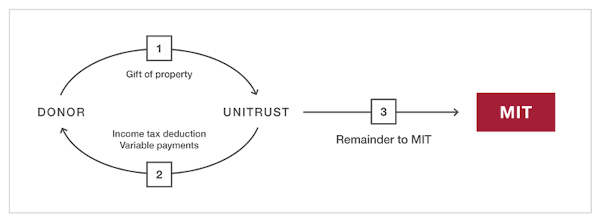

ABCs of CGAs: Basics of Charitable Gift Annuities – Gordon Fischer Law Firm – #34

ABCs of CGAs: Basics of Charitable Gift Annuities – Gordon Fischer Law Firm – #34

IRA Rollover (Qualified Charitable Distribution) – Denver Jewish Day School – #35

IRA Rollover (Qualified Charitable Distribution) – Denver Jewish Day School – #35

ITR : Disclosure and taxation of gifts received from brother? | Mint – #36

ITR : Disclosure and taxation of gifts received from brother? | Mint – #36

Income from Other Sources – CS Executive Tax Laws MCQs – GST Guntur – #37

Income from Other Sources – CS Executive Tax Laws MCQs – GST Guntur – #37

Tax on Gifts in India | Exemption and Rules | EZTax® – #38

Tax on Gifts in India | Exemption and Rules | EZTax® – #38

- gift chart as per income tax

- list of relatives

- income tax sections list in pdf

Gifts Treated as Income – #39

Gifts Treated as Income – #39

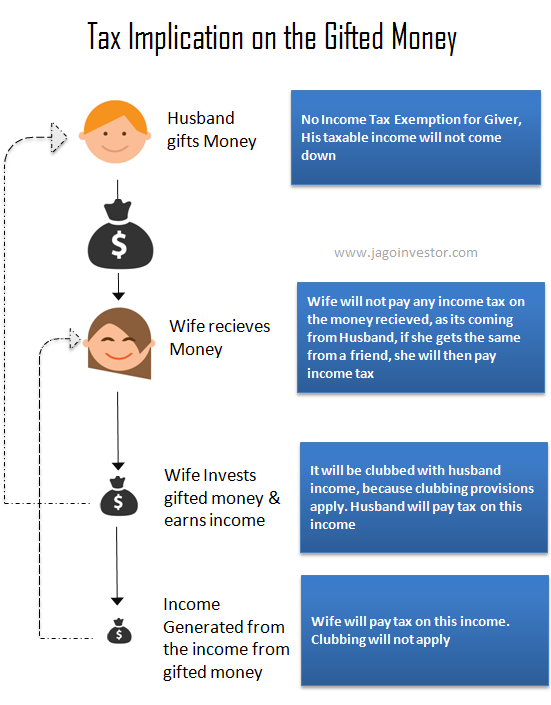

Money received as gift from relative is not taxed | Mint – #40

Money received as gift from relative is not taxed | Mint – #40

- income tax flowchart

- english relative meaning

- paternal relatives

Understanding Taxes – Assessment: Why Pay Taxes – #41

Understanding Taxes – Assessment: Why Pay Taxes – #41

Can a company gift a vehicle to an employee in India without tax? – Quora – #42

Can a company gift a vehicle to an employee in India without tax? – Quora – #42

Can I be Taxed for Gifting My Business? – #43

Can I be Taxed for Gifting My Business? – #43

- gift from relative exempt from income tax

- gift tax example

- lineal ascendant meaning

- gift tax in india

- income tax deductions chart

- gift tax meaning

Whether gift received from HUF to any member of HUF is exempt from taxable income? ITAT Explains | SCC Times – #44

Whether gift received from HUF to any member of HUF is exempt from taxable income? ITAT Explains | SCC Times – #44

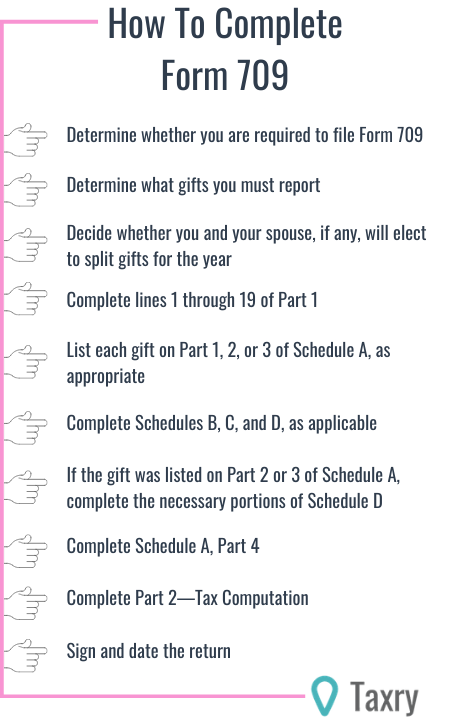

How to Fill Out Gift Tax Form 709 | SoFi – #45

How to Fill Out Gift Tax Form 709 | SoFi – #45

Gift Tax: Tax on gifts: Documents that you should have while filing ITR – The Economic Times – #46

Gift Tax: Tax on gifts: Documents that you should have while filing ITR – The Economic Times – #46

Income Tax on Gift | Relative से पैसा लेने से पहले यह video ज़रूर देखना | Cash Gift Tax Rule 2023 | – YouTube – #47

Income Tax on Gift | Relative से पैसा लेने से पहले यह video ज़रूर देखना | Cash Gift Tax Rule 2023 | – YouTube – #47

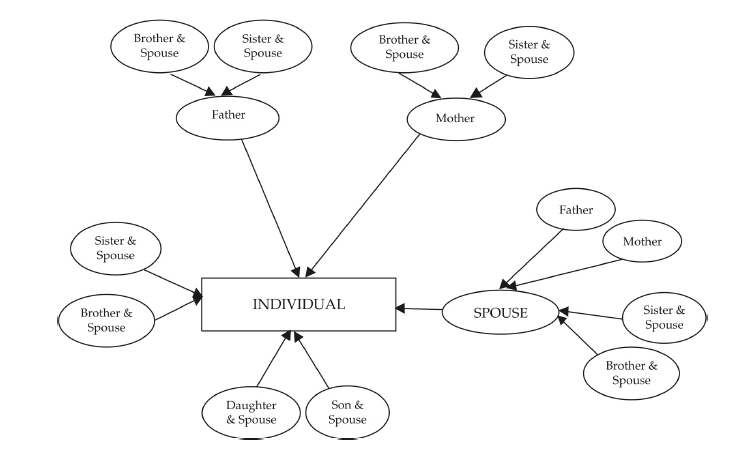

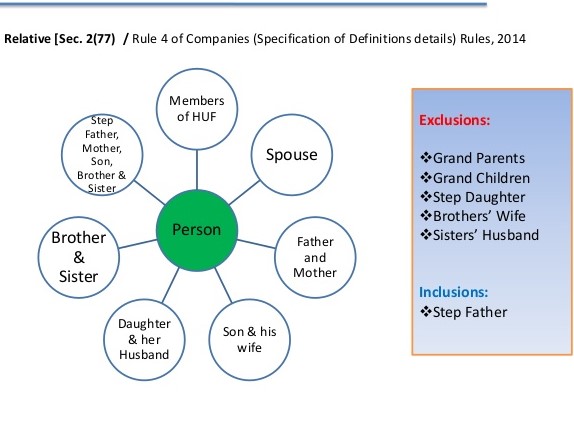

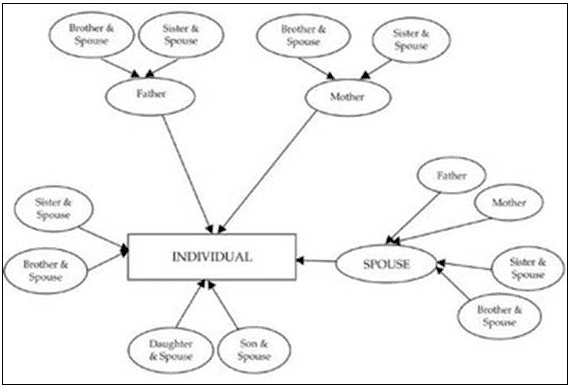

Bajaj Capital Limited – Money received by any relative, is NOT taxable in their hands. The definition of the term ‘relative’ under the Income-tax Act, 1961, includes various family members but does – #48

Bajaj Capital Limited – Money received by any relative, is NOT taxable in their hands. The definition of the term ‘relative’ under the Income-tax Act, 1961, includes various family members but does – #48

Cash Of Over Rs. 50,000 As Gift From Relative Is Non-Taxable For Receiver – Goodreturns – #49

Cash Of Over Rs. 50,000 As Gift From Relative Is Non-Taxable For Receiver – Goodreturns – #49

Gift Tax 101: Gift Tax Limits (+ Rules for Gifting Stocks) – #50

Gift Tax 101: Gift Tax Limits (+ Rules for Gifting Stocks) – #50

-Gifts.jpg) A Gift amount can’t be doubted just because donor’s returned income is insufficient to justify it: ITAT – #51

A Gift amount can’t be doubted just because donor’s returned income is insufficient to justify it: ITAT – #51

NRI Gift Tax in India – Gift from NRI to Resident Indian or Vice Versa – myMoneySage Blog – #52

NRI Gift Tax in India – Gift from NRI to Resident Indian or Vice Versa – myMoneySage Blog – #52

Income Tax on Gifts: Exemptions and computation – #53

Income Tax on Gifts: Exemptions and computation – #53

Tax on Gifting Crypto, NFT, VDA in India – #54

Tax on Gifting Crypto, NFT, VDA in India – #54

How to gift stocks, bonds and ETFs and the tax implications – Z-Connect by Zerodha – #55

How to gift stocks, bonds and ETFs and the tax implications – Z-Connect by Zerodha – #55

- gift tax definition

- family relative meaning

ATO scrutinising gifts or loans from relatives overseas | Walsh Accountants – #56

ATO scrutinising gifts or loans from relatives overseas | Walsh Accountants – #56

Required Documents to Transfer the Property Through a Gift Deed – #57

Required Documents to Transfer the Property Through a Gift Deed – #57

Things an NRI must know about gift tax rules in India | IDFC FIRST Bank – #58

Things an NRI must know about gift tax rules in India | IDFC FIRST Bank – #58

What Is The Tax Liability On Gifts Received? – #59

What Is The Tax Liability On Gifts Received? – #59

Gift Deed Vs Will: Which is a better option for property transfer – #60

Gift Deed Vs Will: Which is a better option for property transfer – #60

Transfer of Shares Through Gift – Income Tax and FEMA Regulations – #61

Transfer of Shares Through Gift – Income Tax and FEMA Regulations – #61

11 Tax-Free Income Sources In India (2023 Update) – #62

11 Tax-Free Income Sources In India (2023 Update) – #62

How To Save Tax On Gold in India – Blog by Tickertape – #63

How To Save Tax On Gold in India – Blog by Tickertape – #63

Taxability of Gifts in the Hands of Recipients Simplified – #64

Taxability of Gifts in the Hands of Recipients Simplified – #64

Design and implementation of art teaching system based on B/S structure – #65

Design and implementation of art teaching system based on B/S structure – #65

Connecticut Gift Tax: All You Need to Know | SmartAsset – #66

Connecticut Gift Tax: All You Need to Know | SmartAsset – #66

Gift Tax rules for US citizens (Guidelines) | Expat US Tax – #67

Gift Tax rules for US citizens (Guidelines) | Expat US Tax – #67

What Is the 2023 and 2024 Gift Tax Limit? – Ramsey – #68

What Is the 2023 and 2024 Gift Tax Limit? – Ramsey – #68

Gift by NRI to Resident Indian or Vice-Versa – NRI Gift Tax In India – #69

Gift by NRI to Resident Indian or Vice-Versa – NRI Gift Tax In India – #69

Taxes On Gifts From Overseas – #70

Taxes On Gifts From Overseas – #70

Tax Implications of Loans to Family Members – #71

Tax Implications of Loans to Family Members – #71

Income tax – “GIFT” Taxability under Income Tax Act, 1961-In Very Short | Facebook – #72

Income tax – “GIFT” Taxability under Income Tax Act, 1961-In Very Short | Facebook – #72

Latest NRI Gift Tax Rules 2019-20 | Are Gifts received by NRIs Taxable? – #73

Latest NRI Gift Tax Rules 2019-20 | Are Gifts received by NRIs Taxable? – #73

Gift by NRI to Resident Indian or Vice-Versa: Taxation and more – SBNRI – #74

Gift by NRI to Resident Indian or Vice-Versa: Taxation and more – SBNRI – #74

What You Need to Know About Stock Gift Tax – #75

What You Need to Know About Stock Gift Tax – #75

Gift Deed: Meaning, Registration, Charges, Documents, and More – #76

Gift Deed: Meaning, Registration, Charges, Documents, and More – #76

Weddings and tax implications of cash gifts | Mint – #77

Weddings and tax implications of cash gifts | Mint – #77

- gift tax exemption 2022

- section 56(2) of income tax act

- gift tax rate

What Is the Process to Gift a House to My Blood Relative? – #78

What Is the Process to Gift a House to My Blood Relative? – #78

Where does the government get the money it spends? | Mercatus Center – #79

Where does the government get the money it spends? | Mercatus Center – #79

Whether a father can make a gift to his son’s HUF. – #80

Whether a father can make a gift to his son’s HUF. – #80

Monetary gift tax: Income tax on gift received from parents | Value Research – #81

Monetary gift tax: Income tax on gift received from parents | Value Research – #81

All About Allowances & Income Tax Exemption| CA Rajput Jain – #82

All About Allowances & Income Tax Exemption| CA Rajput Jain – #82

How Does the IRS Know If You Give a Gift? — Taxry – #83

How Does the IRS Know If You Give a Gift? — Taxry – #83

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #84

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #84

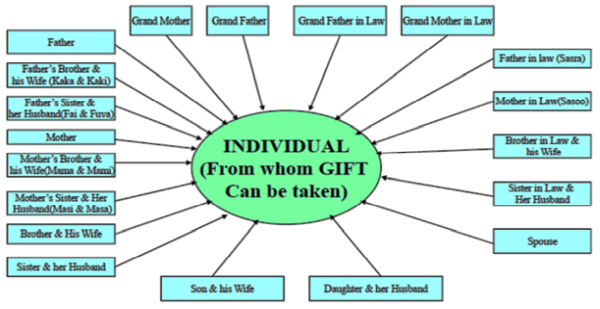

List of relatives covered under Section 56(2) of Income Tax Act,1961 – #85

List of relatives covered under Section 56(2) of Income Tax Act,1961 – #85

Avoiding Taxes on Gifts By Foreigners | MEG International Counsel – #86

Avoiding Taxes on Gifts By Foreigners | MEG International Counsel – #86

Income tax and other related financial information 2019-20 INDIA uploaded by T james joseph Adhikarathil | PDF – #87

Income tax and other related financial information 2019-20 INDIA uploaded by T james joseph Adhikarathil | PDF – #87

ITR filing: Are gifts taxable in India? Salient clauses all income taxpayers must know | Zee Business – #88

ITR filing: Are gifts taxable in India? Salient clauses all income taxpayers must know | Zee Business – #88

Know the tax impact on the gifts you receive – Goal Bridge – #89

Know the tax impact on the gifts you receive – Goal Bridge – #89

Solved For each of the following questions, assume you are | Chegg.com – #90

Solved For each of the following questions, assume you are | Chegg.com – #90

Stamp Duty, Registration fee on Gif Deed Among Blood Relatives – #91

Stamp Duty, Registration fee on Gif Deed Among Blood Relatives – #91

Taxation of gifts to NRIs and changes in Budget 2023-24 – #92

Taxation of gifts to NRIs and changes in Budget 2023-24 – #92

Taxability of Gift received by an individual or HUF – #93

Taxability of Gift received by an individual or HUF – #93

List of Advantages of Gift Deed Registration That You Must Know – Corpbiz – #94

List of Advantages of Gift Deed Registration That You Must Know – Corpbiz – #94

Posts: gift from relative income tax

Categories: Gifts

Author: toyotabienhoa.edu.vn