Top 167+ gift from parents taxable super hot

Details images of gift from parents taxable by website toyotabienhoa.edu.vn compilation. What is French Gift Tax (“Droits de Donation”)? – The Good Life France. What Is The Gift Tax Rate? – Forbes Advisor. 5 rules about Income Tax on Gifts received in India & Exemptions. Tax Strategies for Parents of Kids with Special Needs – The Autism Community in Action. NRI Gift Tax India: Rules for Tax On Gift Money In India | DBS Treasures

One simple (and unknown) trick that will increase your tax savings by more than 50% on your charitable contributions – A Place Of Possibility – #1

One simple (and unknown) trick that will increase your tax savings by more than 50% on your charitable contributions – A Place Of Possibility – #1

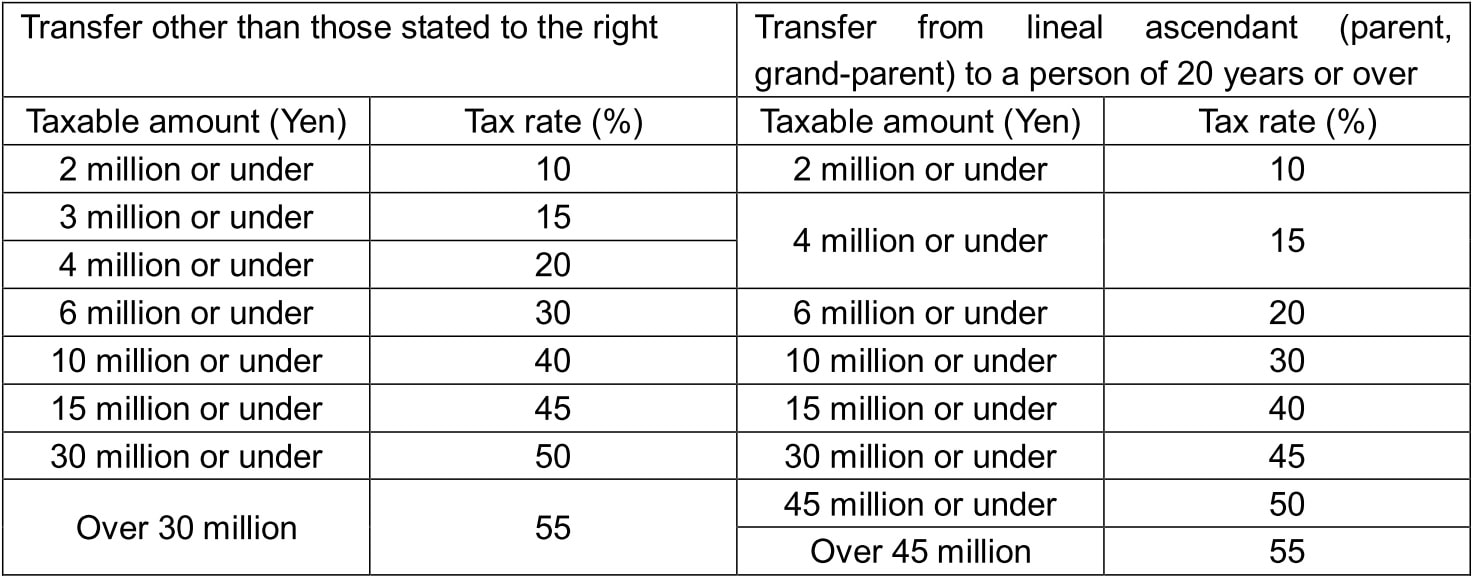

Can I Gift Money Or Investments To My Children In Japan? – #2

Can I Gift Money Or Investments To My Children In Japan? – #2

- expenditure tax act

- wealth tax

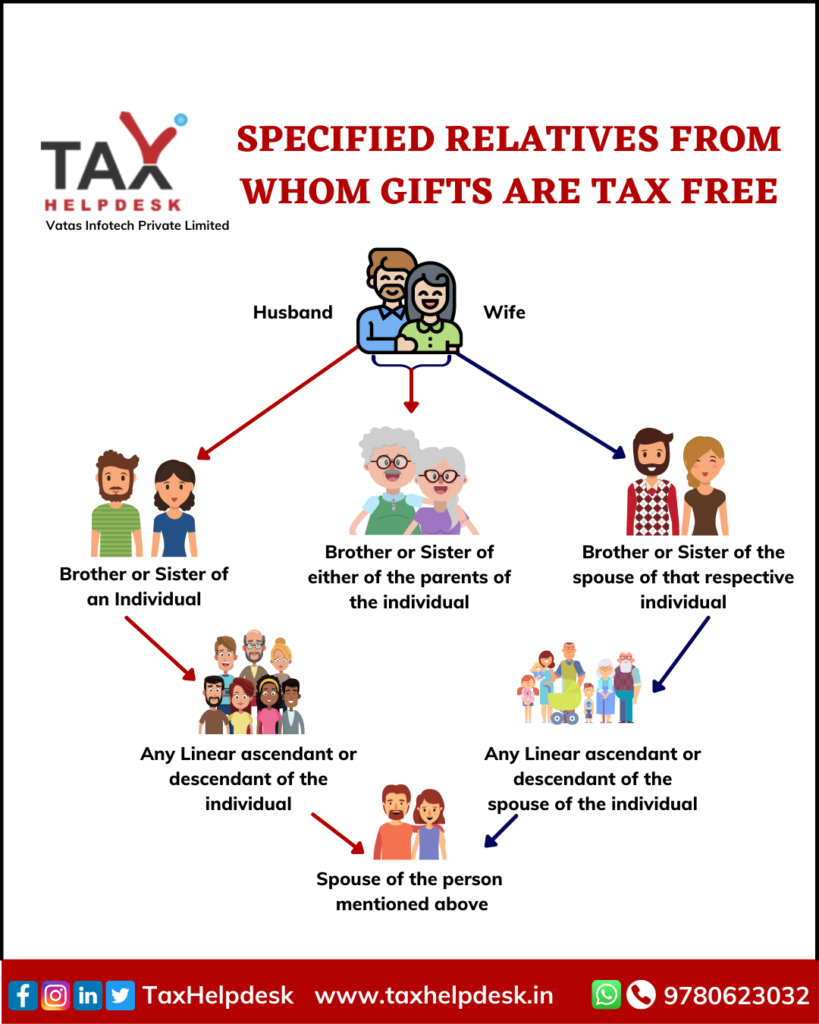

- lineal ascendant gift from relative exempt from income tax

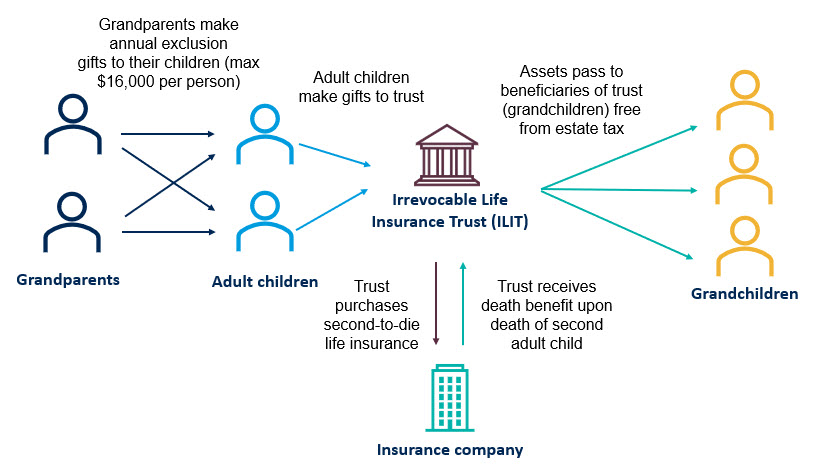

How to Give Tax-Free Gifts to Children – #4

How to Give Tax-Free Gifts to Children – #4

Income Tax on Diwali Gift: How Cash, Gold, Car and Property Gifts are Taxed – Income Tax News | The Financial Express – #5

Income Tax on Diwali Gift: How Cash, Gold, Car and Property Gifts are Taxed – Income Tax News | The Financial Express – #5

The unique benefits of 529 college savings plans – #6

The unique benefits of 529 college savings plans – #6

Income Tax on Gift Rules in Hindi | Income Tax on Gift Received from Parents Reletives Property Gift – YouTube – #7

Income Tax on Gift Rules in Hindi | Income Tax on Gift Received from Parents Reletives Property Gift – YouTube – #7

ITR filing: 5 things Gen Z taxpayers should know on saving taxes – Hindustan Times – #8

ITR filing: 5 things Gen Z taxpayers should know on saving taxes – Hindustan Times – #8

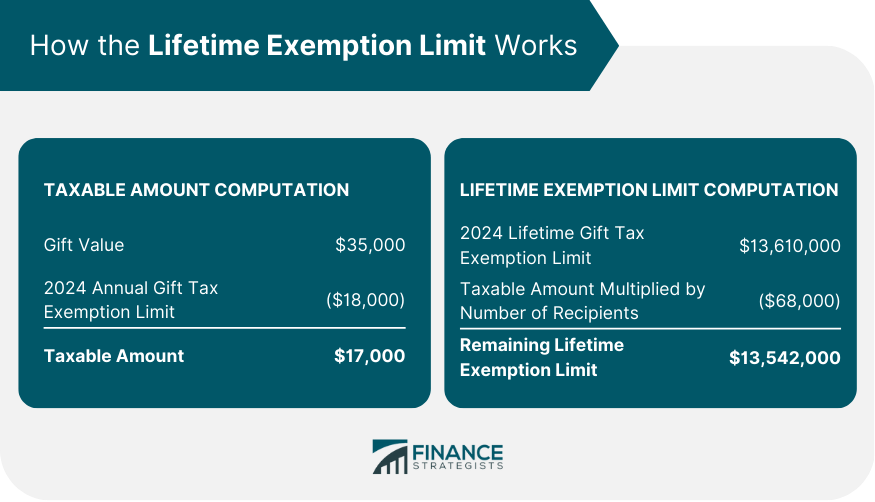

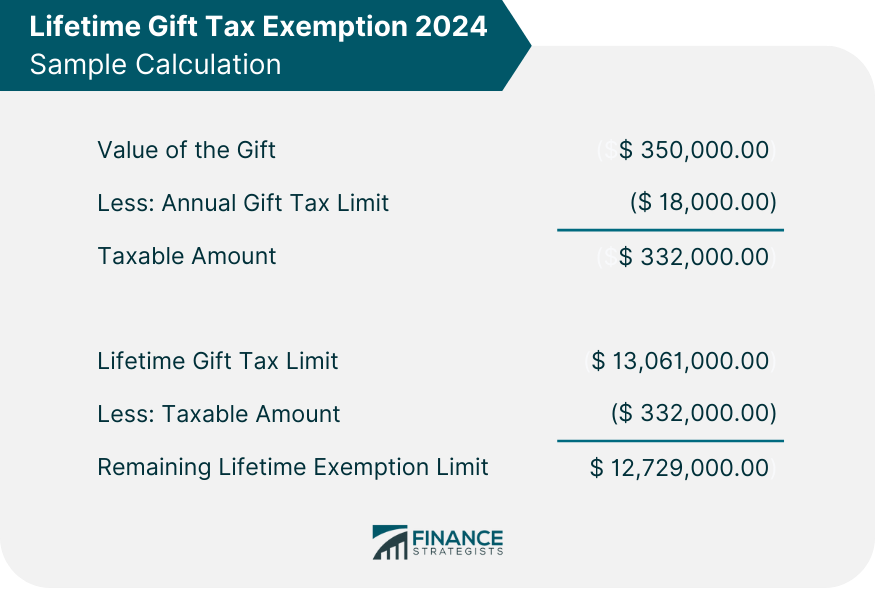

Lifetime Gifts Tax Exemption: Is Now the Time to Act? | PNC Insights – #10

Lifetime Gifts Tax Exemption: Is Now the Time to Act? | PNC Insights – #10

Foreign Gift Tax – Ultimate Insider Info You Need To Know – #11

Foreign Gift Tax – Ultimate Insider Info You Need To Know – #11

![Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will](https://www.cbo.gov/sites/default/files/2021-06/57129-home-estatetax.png) Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will – #12

Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will – #12

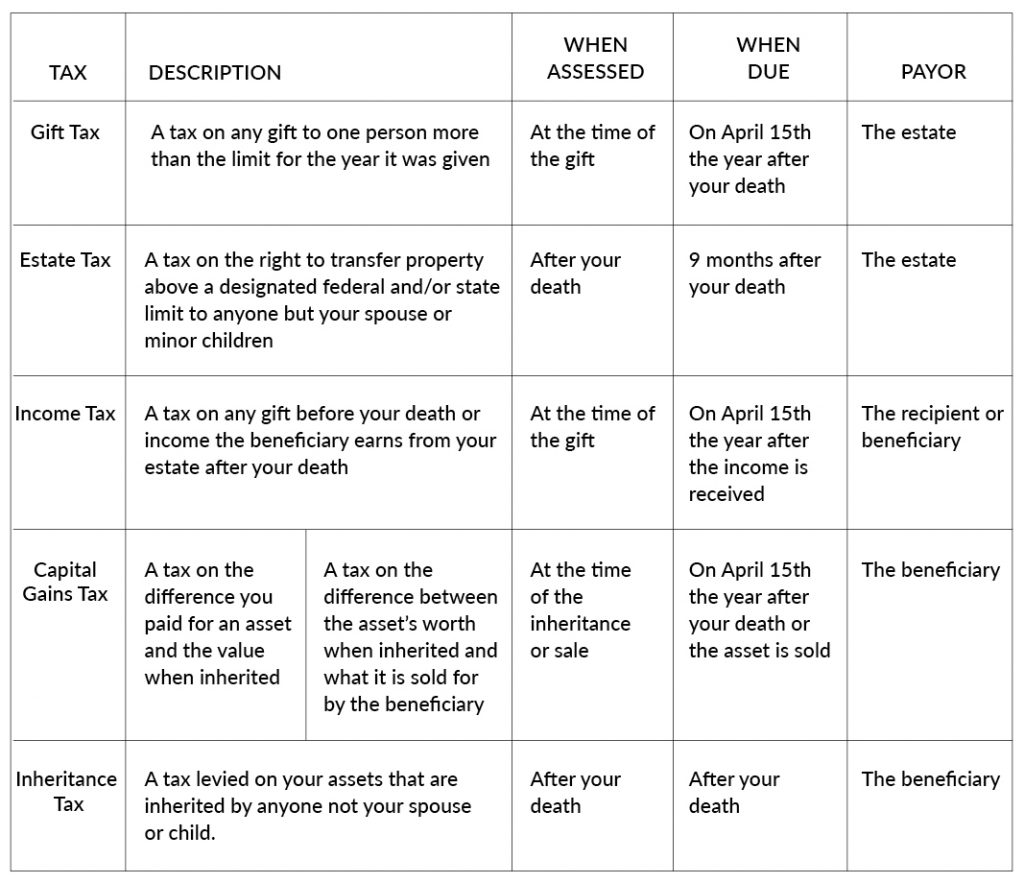

Gift Tax vs. Inheritance Tax: How They Impact Beneficiaries | Thrivent – #13

Gift Tax vs. Inheritance Tax: How They Impact Beneficiaries | Thrivent – #13

Four Important Facts About the Gift Tax Limit | Indianapolis Estate Planning Attorneys – #14

Four Important Facts About the Gift Tax Limit | Indianapolis Estate Planning Attorneys – #14

2024 Gift Tax Rate: What It Is And How It Works | Bankrate – #15

2024 Gift Tax Rate: What It Is And How It Works | Bankrate – #15

How to Gift Money for Weddings, Christmas, Birthdays or Any Occasion – Buy Side from WSJ – #16

How to Gift Money for Weddings, Christmas, Birthdays or Any Occasion – Buy Side from WSJ – #16

Diwali gifts and taxation: Unwrapping the legal insights | Angel One – #17

Diwali gifts and taxation: Unwrapping the legal insights | Angel One – #17

- gift tax exclusion 2023

- form 709

- gift chart as per income tax

What is a gift deed and tax implications | Tax Hack – #18

What is a gift deed and tax implications | Tax Hack – #18

Holiday Gifting with a Tax Twist – Isler Northwest, LLC – #19

Holiday Gifting with a Tax Twist – Isler Northwest, LLC – #19

Tax Credit Gifts (EITC) – Bala House Montessori | Preschool & Kindergarten in the greater Philadelphia area – #20

Tax Credit Gifts (EITC) – Bala House Montessori | Preschool & Kindergarten in the greater Philadelphia area – #20

NMS Certified Public Accountants – #21

NMS Certified Public Accountants – #21

Top 10 Benefits of 529 Plans – Tax Advantages, Qualified Expenses + More – #22

Top 10 Benefits of 529 Plans – Tax Advantages, Qualified Expenses + More – #22

Federal Taxation of Individuals in 2023 | LBMC – #23

Federal Taxation of Individuals in 2023 | LBMC – #23

How to Avoid the Gift Tax – SmartAsset | SmartAsset – #24

How to Avoid the Gift Tax – SmartAsset | SmartAsset – #24

Gift Appreciated Assets to Family in Lower Tax Brackets – Year End Tax Tip – #25

Gift Appreciated Assets to Family in Lower Tax Brackets – Year End Tax Tip – #25

Gift Tax Limit 2023 & Other Year End Strategies | ML&RPC – #26

Gift Tax Limit 2023 & Other Year End Strategies | ML&RPC – #26

HSA Tax Benefits For Parents With Adult Children Under 26 – #27

HSA Tax Benefits For Parents With Adult Children Under 26 – #27

The Power of Early: The Annual Gift Tax Exclusion – #28

The Power of Early: The Annual Gift Tax Exclusion – #28

Gift letter Template in Word – FREE Download | Template.net – #29

Gift letter Template in Word – FREE Download | Template.net – #29

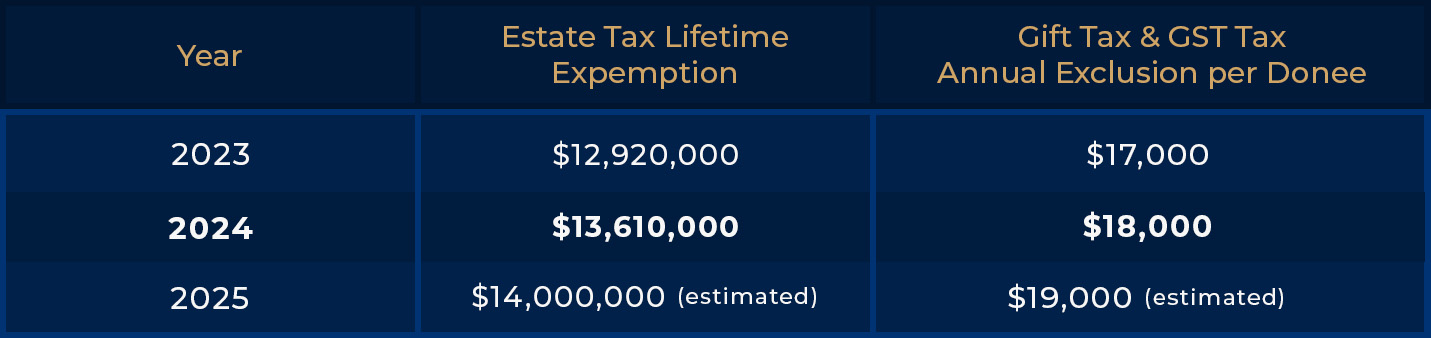

IRS Announced New Lifetime and Gift Tax Exemptions – Texas Trust Law – #30

IRS Announced New Lifetime and Gift Tax Exemptions – Texas Trust Law – #30

Tips To Help You Figure Out if Your Gift Is Taxable – #31

Tips To Help You Figure Out if Your Gift Is Taxable – #31

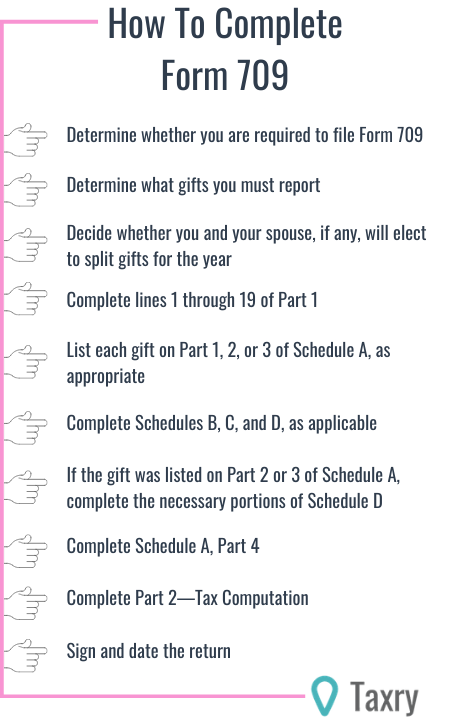

Form 709 – Guide 2023 | US Expat Tax Service – #32

Form 709 – Guide 2023 | US Expat Tax Service – #32

To File Or Not To File A Gift Tax Return, That Is The Question – #33

To File Or Not To File A Gift Tax Return, That Is The Question – #33

Received a Foreign Gift in 2023? Learn About Taxes on Gifts and IRS Form 3520 — – #34

Received a Foreign Gift in 2023? Learn About Taxes on Gifts and IRS Form 3520 — – #34

How to calculate income tax on gifts from relatives? – #35

How to calculate income tax on gifts from relatives? – #35

Gift from USA to India: Taxation and Exemptions – SBNRI – #36

Gift from USA to India: Taxation and Exemptions – SBNRI – #36

What You Need to Know About the Gift Tax – TheStreet – #37

What You Need to Know About the Gift Tax – TheStreet – #37

Gifting stocks? Points to remember if you want to save tax | Mint Primer – YouTube – #38

Gifting stocks? Points to remember if you want to save tax | Mint Primer – YouTube – #38

How to Gift MORE than the Gift Limit in 2022 | TAX FREE – YouTube – #39

How to Gift MORE than the Gift Limit in 2022 | TAX FREE – YouTube – #39

If My Parents Gift Their Home to Me, Do I Have a Tax Liability? – #40

If My Parents Gift Their Home to Me, Do I Have a Tax Liability? – #40

Now, Gift Received by NRI Non-Relative will be Taxable in India – #41

Now, Gift Received by NRI Non-Relative will be Taxable in India – #41

8 Tips For Tax-Free Gifting In 2023 – #42

8 Tips For Tax-Free Gifting In 2023 – #42

When is a Cash Gift Tax Charged & Who Pays? | Oklahoma Estate Planning Attorneys – #43

When is a Cash Gift Tax Charged & Who Pays? | Oklahoma Estate Planning Attorneys – #43

- sample form 709 completed 2019

- gift tax exemption 2022

- gift tax rate in india 2020

How effective use of a ‘defective’ trust reduces taxes on property transfers | Silicon Valley Bank – #44

How effective use of a ‘defective’ trust reduces taxes on property transfers | Silicon Valley Bank – #44

What Is Gift Tax Liability – FasterCapital – #45

What Is Gift Tax Liability – FasterCapital – #45

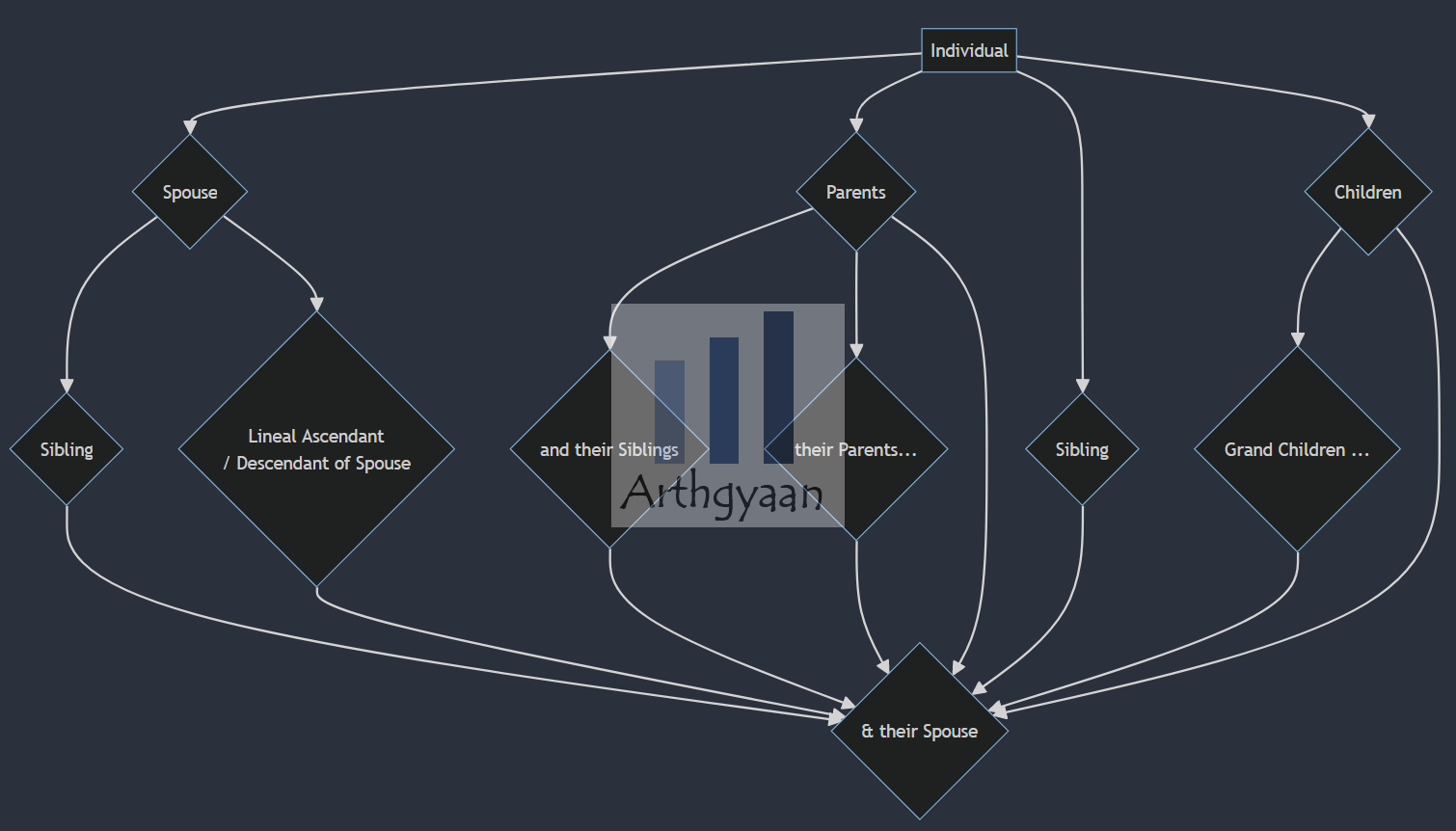

- gift tax act 1958

- list of relatives

- excise tax

The Tax Consequences of a Down Payment Gift for a Mortgage – #46

The Tax Consequences of a Down Payment Gift for a Mortgage – #46

Rules for Gifting Money to Family for a Down Payment in 2024 – #47

Rules for Gifting Money to Family for a Down Payment in 2024 – #47

How do i transfer money from usa to my parents bank account in India and what are the tax implications of it? – Quora – #48

How do i transfer money from usa to my parents bank account in India and what are the tax implications of it? – Quora – #48

Fortune India: Business News, Strategy, Finance and Corporate Insight – #49

Fortune India: Business News, Strategy, Finance and Corporate Insight – #49

Can I Be Taxed For Gifting My Business? — Thienel Law – #50

Can I Be Taxed For Gifting My Business? — Thienel Law – #50

Here’s How To Reduce Your Tax Liability With Health Insurance – The Hindu – #51

Here’s How To Reduce Your Tax Liability With Health Insurance – The Hindu – #51

Property Tax Savings: Transfers In Family | CCSF Office of Assessor-Recorder – #52

Property Tax Savings: Transfers In Family | CCSF Office of Assessor-Recorder – #52

Year-End Gift Giving with Tax Benefits – Squire and Company, PC – #53

Year-End Gift Giving with Tax Benefits – Squire and Company, PC – #53

How Can I Avoid Paying Capital Gains Tax on Gifted Property? – #54

How Can I Avoid Paying Capital Gains Tax on Gifted Property? – #54

What Are Gift Tax Rates and When Do You Have To Pay? | GOBankingRates – #55

What Are Gift Tax Rates and When Do You Have To Pay? | GOBankingRates – #55

List of 6 Arizona Tax Credits | Christian Family Care – #56

List of 6 Arizona Tax Credits | Christian Family Care – #56

Estate Tax Exemption for 2023 | Kiplinger – #57

Estate Tax Exemption for 2023 | Kiplinger – #57

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #58

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #58

Gift Cards are Taxable • Southwestern University – #59

Gift Cards are Taxable • Southwestern University – #59

7 Tax Rules to Know if You Give or Receive Cash | Taxes | U.S. News – #60

7 Tax Rules to Know if You Give or Receive Cash | Taxes | U.S. News – #60

- form 709 schedule a example

- gift tax rate table

- gift tax definition economics

Stamp Duty, Registration fee on Gif Deed Among Blood Relatives – #61

Stamp Duty, Registration fee on Gif Deed Among Blood Relatives – #61

Everything You Wanted To Know About Estate & Gift Taxes | Postic & Bates, P.C. – #62

Everything You Wanted To Know About Estate & Gift Taxes | Postic & Bates, P.C. – #62

Taxability on Gifts from Spouse in India – #63

Taxability on Gifts from Spouse in India – #63

How Grandparents Can Help Grandchildren with College Costs | IAG Wealth Partners – #64

How Grandparents Can Help Grandchildren with College Costs | IAG Wealth Partners – #64

Reminder: Holiday Gifts, Prizes or Parties Can Be Taxable Wages – #65

Reminder: Holiday Gifts, Prizes or Parties Can Be Taxable Wages – #65

Solved Your parents gave you $39,000 worth of Apple stock in | Chegg.com – #66

Solved Your parents gave you $39,000 worth of Apple stock in | Chegg.com – #66

- gift tax returns irs completed sample form 709 sample

- section 56(2) of income tax act

- gift tax rate

Slide19.png – #67

Slide19.png – #67

Gift received from HUF is not taxable – #68

Gift received from HUF is not taxable – #68

Gift Reporting Requirements: Three Things To Keep In Mind – #69

Gift Reporting Requirements: Three Things To Keep In Mind – #69

A Brief Guide to the IRS Gift Tax | Small Business CPA – #70

A Brief Guide to the IRS Gift Tax | Small Business CPA – #70

Using trusts to shift income to children – #71

Using trusts to shift income to children – #71

Tax on the gift from father to daughter – #72

Tax on the gift from father to daughter – #72

Taxes you have to pay when you get a gift – The Economic Times – #73

Taxes you have to pay when you get a gift – The Economic Times – #73

Tax implications on gifts and how your family can help you save tax – #74

Tax implications on gifts and how your family can help you save tax – #74

Do minors need to pay taxes? Here’s all you need to know – #75

Do minors need to pay taxes? Here’s all you need to know – #75

What are the Income tax rules on clubbing of income? – GoodMoneying – #76

What are the Income tax rules on clubbing of income? – GoodMoneying – #76

Should a parent’s financial help to children come in the form of a loan or a gift? | Pittsburgh Post-Gazette – #77

Should a parent’s financial help to children come in the form of a loan or a gift? | Pittsburgh Post-Gazette – #77

- sample completed irs form 709

- federal estate tax

- gift tax exemption

How are Cryptocurrency Gifts Taxed? | CoinLedger – #78

How are Cryptocurrency Gifts Taxed? | CoinLedger – #78

All about Income Tax on Gift Received From Parents. – #79

All about Income Tax on Gift Received From Parents. – #79

When Generosity Bumps Into Gift Tax – The New York Times – #80

When Generosity Bumps Into Gift Tax – The New York Times – #80

Family Matters: How To Transfer Your Business To A Family Member | Comerica – #81

Family Matters: How To Transfer Your Business To A Family Member | Comerica – #81

Gift Card Hoarders, Ultimate Retirement Accounts, & Millennials Selling Out 🤦♀️ – How to Money – #82

Gift Card Hoarders, Ultimate Retirement Accounts, & Millennials Selling Out 🤦♀️ – How to Money – #82

Foreign Nationals and U.S. Gift Tax Consequences of Executing Certain Real Property Deeds · Kerkering, Barberio & Co., Certified Public Accountants Sarasota, FL – #83

Foreign Nationals and U.S. Gift Tax Consequences of Executing Certain Real Property Deeds · Kerkering, Barberio & Co., Certified Public Accountants Sarasota, FL – #83

Employing Family Members: Tax Implications in 2023 – Rosenberg Chesnov – #84

Employing Family Members: Tax Implications in 2023 – Rosenberg Chesnov – #84

Taxes On Gifts From Overseas – #85

Taxes On Gifts From Overseas – #85

eCFR :: 26 CFR Part 25 — Gift Tax; Gifts Made After December 31, 1954 – #86

eCFR :: 26 CFR Part 25 — Gift Tax; Gifts Made After December 31, 1954 – #86

Crypto Gift Tax | Your Guide | Koinly – #87

Crypto Gift Tax | Your Guide | Koinly – #87

Gift Tax Return – FasterCapital – #88

Gift Tax Return – FasterCapital – #88

Kentucky’s Inheritance Tax | Brackney Law – #89

Kentucky’s Inheritance Tax | Brackney Law – #89

How to gift assets to family members while cutting tax rates | Financial Planning – #90

How to gift assets to family members while cutting tax rates | Financial Planning – #90

Is Foster Income Taxable? What Foster Parents Should Know About Income Tax – – #91

Is Foster Income Taxable? What Foster Parents Should Know About Income Tax – – #91

- gift tax

- gift tax in india

- gift tax meaning

Gifts & Income Tax Implications : Scenarios & Examples – #92

Gifts & Income Tax Implications : Scenarios & Examples – #92

New Gift Tax Rule Will Apply For 2023 | Bring your Finances to LIFE – #93

New Gift Tax Rule Will Apply For 2023 | Bring your Finances to LIFE – #93

Gift Tax Explained – Do You Pay Taxes On Gifted Money? – YouTube – #94

Gift Tax Explained – Do You Pay Taxes On Gifted Money? – YouTube – #94

Gifting equity in a home – #95

Gifting equity in a home – #95

What You Need to Know Before Gifting Money to Family | Savant Wealth Management – #96

What You Need to Know Before Gifting Money to Family | Savant Wealth Management – #96

Meaning of relative under different act | CA Rajput Jain – #97

Meaning of relative under different act | CA Rajput Jain – #97

Charitable lead trust | Gift Planning | Bucknell University – #98

Charitable lead trust | Gift Planning | Bucknell University – #98

Receiving these gifts this Diwali may increase your tax liability | Business News – #99

Receiving these gifts this Diwali may increase your tax liability | Business News – #99

Sabalier Law – Understanding Gift Taxes | Sabalier Law – #100

Sabalier Law – Understanding Gift Taxes | Sabalier Law – #100

HUF (Hindu Undivided Family) – A Tax Saving Tool! – #101

HUF (Hindu Undivided Family) – A Tax Saving Tool! – #101

Gift Tax in India, Income Tax On Gift, Exemption from Gift Tax – YouTube – #102

Gift Tax in India, Income Tax On Gift, Exemption from Gift Tax – YouTube – #102

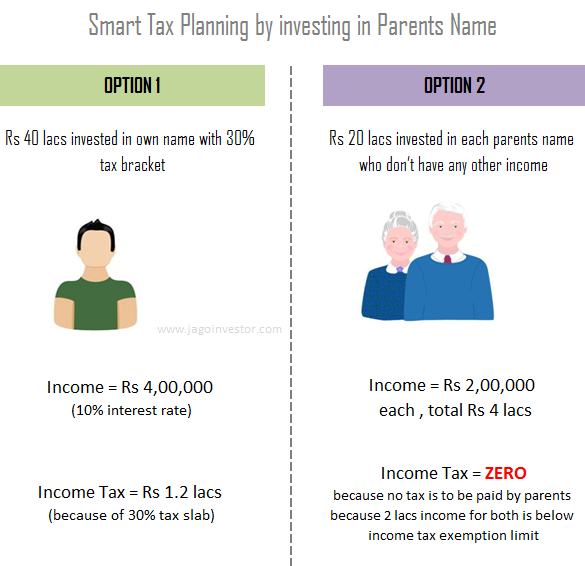

Trim your tax bill by doing this: Gift money, pay rent to your parents | Personal Finance – Business Standard – #103

Trim your tax bill by doing this: Gift money, pay rent to your parents | Personal Finance – Business Standard – #103

Annual Gift Tax Exclusion Explained | PNC Insights – #104

Annual Gift Tax Exclusion Explained | PNC Insights – #104

-originalImg-5d9c05bd-fef7-468b-a79a-7b00245b1da1.png) How to get tax exemption on the cash gift which I will receive for my marriage from bride’s side ? If so, what could be the procedure? Are there any limitations on – #105

How to get tax exemption on the cash gift which I will receive for my marriage from bride’s side ? If so, what could be the procedure? Are there any limitations on – #105

Navigating Income Tax & Taxation on Gifts Received in India – 1 Finance Blog – #106

Navigating Income Tax & Taxation on Gifts Received in India – 1 Finance Blog – #106

Get Taxation Planning Assignment Help from BookMyEssay | Income tax, Audit services, Finance blog – #107

Get Taxation Planning Assignment Help from BookMyEssay | Income tax, Audit services, Finance blog – #107

How To Avoid The Gift Tax In Real Estate | Rocket Mortgage – #108

How To Avoid The Gift Tax In Real Estate | Rocket Mortgage – #108

Understand the Kiddie tax | Fidelity – #109

Understand the Kiddie tax | Fidelity – #109

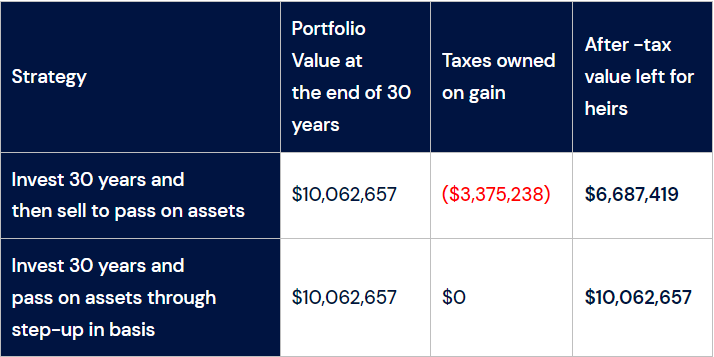

The Estate Tax and Lifetime Gifting | Retirement Plan Services – #110

The Estate Tax and Lifetime Gifting | Retirement Plan Services – #110

Is a Quitclaim Deed Subject to Tax? – Deeds.com – #111

Is a Quitclaim Deed Subject to Tax? – Deeds.com – #111

Seven Smart Tax Saving Tips – Fort Pitt Capital Group – #112

Seven Smart Tax Saving Tips – Fort Pitt Capital Group – #112

Cash gift received from parents do not have any tax implications for children | Mint – #113

Cash gift received from parents do not have any tax implications for children | Mint – #113

35 Best Gift Letter Templates (Word & PDF) ᐅ TemplateLab – #114

35 Best Gift Letter Templates (Word & PDF) ᐅ TemplateLab – #114

tax on diwali gifts: Will you be taxed on Diwali gifts received? Check how various sources of gifts will be taxed – The Economic Times – #115

tax on diwali gifts: Will you be taxed on Diwali gifts received? Check how various sources of gifts will be taxed – The Economic Times – #115

How to Ensure Cash Gifts from Parents and Relatives Won’t Land you in Tax Trouble – #116

How to Ensure Cash Gifts from Parents and Relatives Won’t Land you in Tax Trouble – #116

Locking In The $12 Million Gift Tax Exclusion | Margolis Bloom & D’Agostino – #117

Locking In The $12 Million Gift Tax Exclusion | Margolis Bloom & D’Agostino – #117

Green Card Holders Tax Mistakes in Gifting Before Your Exit from the U.S. – CDH – #118

Green Card Holders Tax Mistakes in Gifting Before Your Exit from the U.S. – CDH – #118

How Does the Gift Tax Work? – Opsahl Dawson – #119

How Does the Gift Tax Work? – Opsahl Dawson – #119

- gift tax exemption relatives list

- estate tax

- gift tax definition

Three ways in which you can save tax through your parents | Mint – #120

Three ways in which you can save tax through your parents | Mint – #120

Property Gift Deed Registration – Sample Format, Charges & Rules – #121

Property Gift Deed Registration – Sample Format, Charges & Rules – #121

Taxability of Gifts in India – #122

Taxability of Gifts in India – #122

How to gift a car to a friend, spouse, or anyone else you love | Business Insider India – #123

How to gift a car to a friend, spouse, or anyone else you love | Business Insider India – #123

What employers need to know about employee gifts – #124

What employers need to know about employee gifts – #124

Section 56(ii) of Income Tax Act: Understanding the Taxation of Gifts – Marg ERP Blog – #125

Section 56(ii) of Income Tax Act: Understanding the Taxation of Gifts – Marg ERP Blog – #125

- estate/gift tax

- form 709 gift splitting example

Student Loan Help From Family Could Mean Gift Taxes – #126

Student Loan Help From Family Could Mean Gift Taxes – #126

Paying the College Directly to Avoid Gift Taxes | Fastweb – #127

Paying the College Directly to Avoid Gift Taxes | Fastweb – #127

Taxability of Gifts: Who Pays and How to Avoid Taxes – Picnic Tax – #128

Taxability of Gifts: Who Pays and How to Avoid Taxes – Picnic Tax – #128

Gifting Money to Children in 2023: Everything Retirements Savers Ought to Know! – #129

Gifting Money to Children in 2023: Everything Retirements Savers Ought to Know! – #129

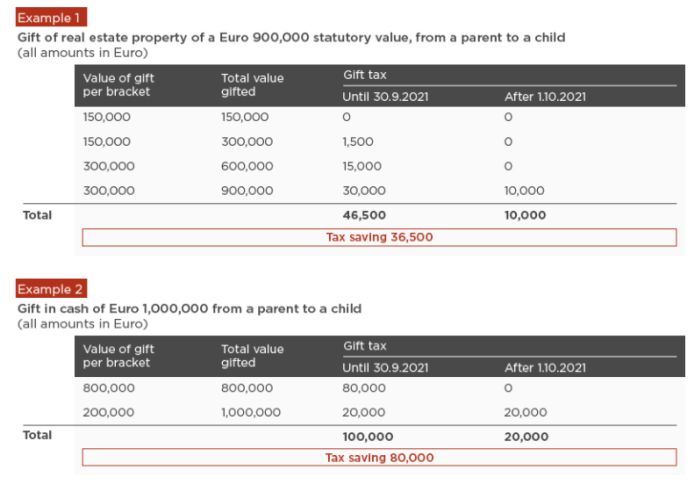

What is French Gift Tax (“Droits de Donation”)? – The Good Life France – #130

What is French Gift Tax (“Droits de Donation”)? – The Good Life France – #130

Gifting a car to family member | Will there be tax liability for recipient? – Page 2 – Team-BHP – #131

Gifting a car to family member | Will there be tax liability for recipient? – Page 2 – Team-BHP – #131

What Types of Income Aren’t Taxable? – #132

What Types of Income Aren’t Taxable? – #132

Nonresident Individual Income and Transfer Taxation in the United States – #133

Nonresident Individual Income and Transfer Taxation in the United States – #133

How Much Can You Gift Before Paying Tax? – #134

How Much Can You Gift Before Paying Tax? – #134

Inheritance and Gift Taxes in Vietnam; Emerging Tax Issues in Asia; The Sixth IMF-Japan High-Level Tax Conference for Asian Cou – #135

Inheritance and Gift Taxes in Vietnam; Emerging Tax Issues in Asia; The Sixth IMF-Japan High-Level Tax Conference for Asian Cou – #135

Want To Send Rakhi Gifts To Your Siblings? Here Is A Guide For NRIs To Understand Tax Imposed On Presents | HerZindagi – #136

Want To Send Rakhi Gifts To Your Siblings? Here Is A Guide For NRIs To Understand Tax Imposed On Presents | HerZindagi – #136

UTMA Tax Rules 2023 & 2024 – Greatest Gift – #137

UTMA Tax Rules 2023 & 2024 – Greatest Gift – #137

- gift tax return

- capital gains tax

- federal gift tax

Tax on vehicle : r/tax – #138

Tax on vehicle : r/tax – #138

Is there a limit in income tax laws up to which a father can gift to his son – #139

Is there a limit in income tax laws up to which a father can gift to his son – #139

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #140

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #140

What’s the Gift Tax Limit in California? | The Werner Law Firm, PC – #141

What’s the Gift Tax Limit in California? | The Werner Law Firm, PC – #141

What Is The Tax Liability On Gifts Received? – #142

What Is The Tax Liability On Gifts Received? – #142

Gift Tax : How Does it Work? – #143

Gift Tax : How Does it Work? – #143

What You Need to Know About NRI Gift Tax in India | Personal Finance News | Zee News – #144

What You Need to Know About NRI Gift Tax in India | Personal Finance News | Zee News – #144

- gift from relative exempt from income tax

- gift tax example

- gift tax 2023

Know incomes free from taxes in India – #145

Know incomes free from taxes in India – #145

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #146

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #146

Gift, loan, house rent: How your family can help in saving taxes | TAX – Business Standard – #147

Gift, loan, house rent: How your family can help in saving taxes | TAX – Business Standard – #147

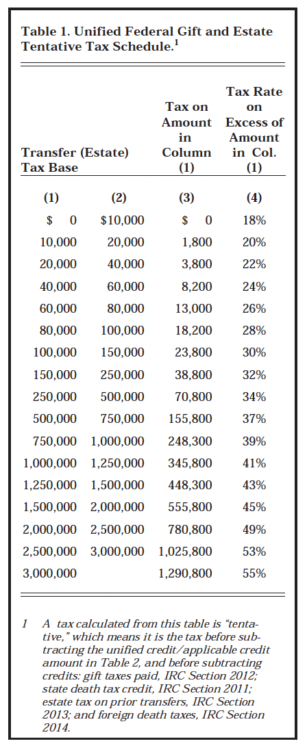

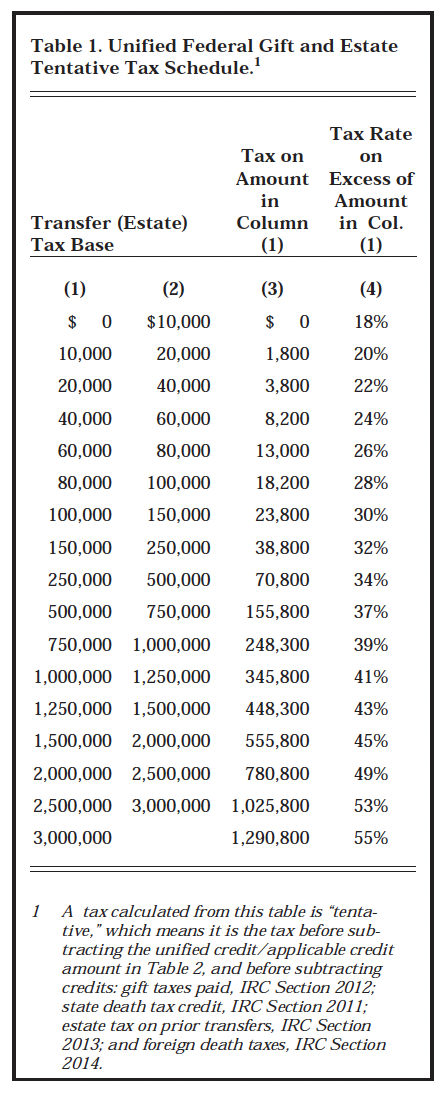

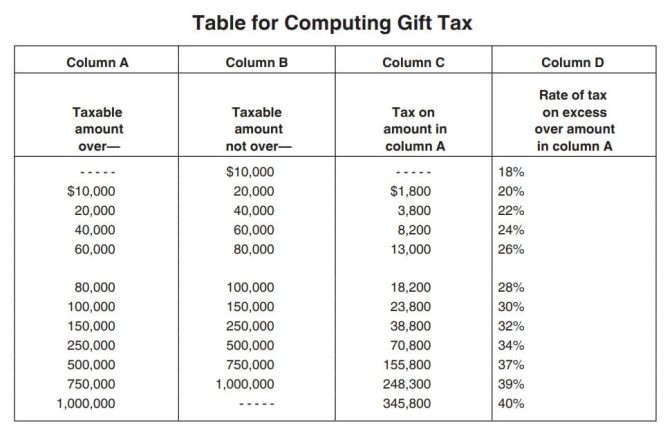

PPT – Overview of Estate/Gift Tax Unified Rate Schedule PowerPoint Presentation – ID:354079 – #148

PPT – Overview of Estate/Gift Tax Unified Rate Schedule PowerPoint Presentation – ID:354079 – #148

Gift Deed: Registration, Format and All You Need to Know – #149

Gift Deed: Registration, Format and All You Need to Know – #149

![Opinion] Gifts And Inheritances – A Brief Analysis Opinion] Gifts And Inheritances – A Brief Analysis](https://images.livemint.com/img/2023/02/14/original/gift_1676358107458.jpg) Opinion] Gifts And Inheritances – A Brief Analysis – #150

Opinion] Gifts And Inheritances – A Brief Analysis – #150

What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #151

What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #151

The Annual Gift Tax Exclusion | H&R Block – #152

The Annual Gift Tax Exclusion | H&R Block – #152

) Will You Owe a Gift Tax This Year? – #153

Will You Owe a Gift Tax This Year? – #153

Pros and Cons of the “Kiddie Tax” – CPA Practice Advisor – #154

Pros and Cons of the “Kiddie Tax” – CPA Practice Advisor – #154

-Gifts.jpg) What is the Gift Tax in India and How Does it Affect NRIs? – #155

What is the Gift Tax in India and How Does it Affect NRIs? – #155

Taxing Teens: Working Children, Family Businesses, and the Kiddie Tax | Baker Institute – #156

Taxing Teens: Working Children, Family Businesses, and the Kiddie Tax | Baker Institute – #156

How to Gift Educational Expenses: Tax Advantages and Pitfalls – #157

How to Gift Educational Expenses: Tax Advantages and Pitfalls – #157

Is a gift from your cousin taxable? – #158

Is a gift from your cousin taxable? – #158

Gifting Stock: 4 Ways to Gift Stocks to Friends, Family, and Charities – #159

Gifting Stock: 4 Ways to Gift Stocks to Friends, Family, and Charities – #159

Tax Implications of Parent Living With You: 7 Things To Know – Trustworthy: The Family Operating System® – #160

Tax Implications of Parent Living With You: 7 Things To Know – Trustworthy: The Family Operating System® – #160

Ten Facts You Should Know About the Federal Estate Tax | Center on Budget and Policy Priorities – #161

Ten Facts You Should Know About the Federal Estate Tax | Center on Budget and Policy Priorities – #161

I received gifts during my wedding, are they taxable? – #162

I received gifts during my wedding, are they taxable? – #162

Is A Gift Taxable? – Cash, Stocks, Real Estate? – YouTube – #163

Is A Gift Taxable? – Cash, Stocks, Real Estate? – YouTube – #163

How much can you gift a family member in 2022? | Law Offices of DuPont and Blumenstiel – #164

How much can you gift a family member in 2022? | Law Offices of DuPont and Blumenstiel – #164

The Generation-Skipping Transfer Tax: A Quick Guide – #165

The Generation-Skipping Transfer Tax: A Quick Guide – #165

Tax Talk: Diwali gift from a business associate could be taxable – Income Tax News | The Financial Express – #166

Tax Talk: Diwali gift from a business associate could be taxable – Income Tax News | The Financial Express – #166

How to file ITR Income Tax Return If Gift Received | How to show Gift Received in ITR – YouTube – #167

How to file ITR Income Tax Return If Gift Received | How to show Gift Received in ITR – YouTube – #167

Posts: gift from parents taxable

Categories: Gifts

Author: toyotabienhoa.edu.vn