Top more than 103 gift from grandparents taxable best

Share images of gift from grandparents taxable by website toyotabienhoa.edu.vn compilation. NRI Gift Tax India: Rules for Tax On Gift Money In India | DBS Treasures. Gift Tax: How Much Is It and Who Pays It?. A Gifting Strategy That Avoids Inheritance Tax And More – YouTube

Federal Gift Tax Considerations – The Wright Firm – #1

Federal Gift Tax Considerations – The Wright Firm – #1

How Grandparents Can Use Charitable Income Gifts to Finance College Education | Wealth Management – #2

How Grandparents Can Use Charitable Income Gifts to Finance College Education | Wealth Management – #2

How Much Money Can I Gift Without Owing Taxes? – #4

How Much Money Can I Gift Without Owing Taxes? – #4

Grandparent Owned 529 Accounts Just Got Better | Greenbush Financial Group – #5

Grandparent Owned 529 Accounts Just Got Better | Greenbush Financial Group – #5

6 Tips for Tax-Free Gifting | Mariner Wealth Advisors – #6

6 Tips for Tax-Free Gifting | Mariner Wealth Advisors – #6

Gift Tax and Medicaid in Indiana – #7

Gift Tax and Medicaid in Indiana – #7

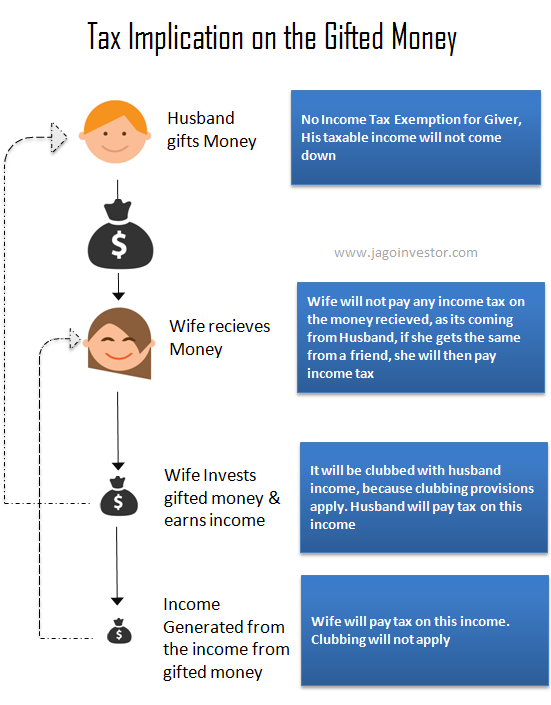

- generation skipping tax example

- clubbing of income in income tax

- gift tax example

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #8

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #8

- inheritance tax example

- form 709 gift splitting example

- grandchildren quotes

Who Pays The Tax On A Cash Gift? | Greenbush Financial Group – #10

Who Pays The Tax On A Cash Gift? | Greenbush Financial Group – #10

Tips to Help You Figure Out if Your Gift is Taxable – Caras Shulman – #11

Tips to Help You Figure Out if Your Gift is Taxable – Caras Shulman – #11

Helping Grandchildren With College Costs | Mission Wealth – #12

Helping Grandchildren With College Costs | Mission Wealth – #12

- generation skipping transfer tax

- gift tax exemption

- clubbing of income ppt

Gift Tax in India and its Effect on NRIs – Immihelp – #13

Gift Tax in India and its Effect on NRIs – Immihelp – #13

Happy Grandparents Day – Grandma & Grandpa Gift Favor Bags – Party Goodie Boxes – Set of 12 | BigDotOfHappiness.com – Big Dot of Happiness LLC – #14

Happy Grandparents Day – Grandma & Grandpa Gift Favor Bags – Party Goodie Boxes – Set of 12 | BigDotOfHappiness.com – Big Dot of Happiness LLC – #14

How much money can I gift to my children and grandchildren tax-free? | Standard Life – #15

How much money can I gift to my children and grandchildren tax-free? | Standard Life – #15

The Hidden Costs of Generosity – The New York Times – #16

The Hidden Costs of Generosity – The New York Times – #16

Gifting from Surplus Income | The Private Office – #17

Gifting from Surplus Income | The Private Office – #17

- clubbing of income

- clubbing of income images

- clubbing of income pdf

Estate Tax | Inheritance Tax | Death Tax | Planning | MA – #18

Estate Tax | Inheritance Tax | Death Tax | Planning | MA – #18

- gift tax in india

- grandparents giving money to grandchildren meme

- grandparents who don’t see their grandchildren

Treatment Of Gift In Income Tax In Pakistan | Gift Conditions in Income Tax | Errors in dec. of Gift – YouTube – #19

Treatment Of Gift In Income Tax In Pakistan | Gift Conditions in Income Tax | Errors in dec. of Gift – YouTube – #19

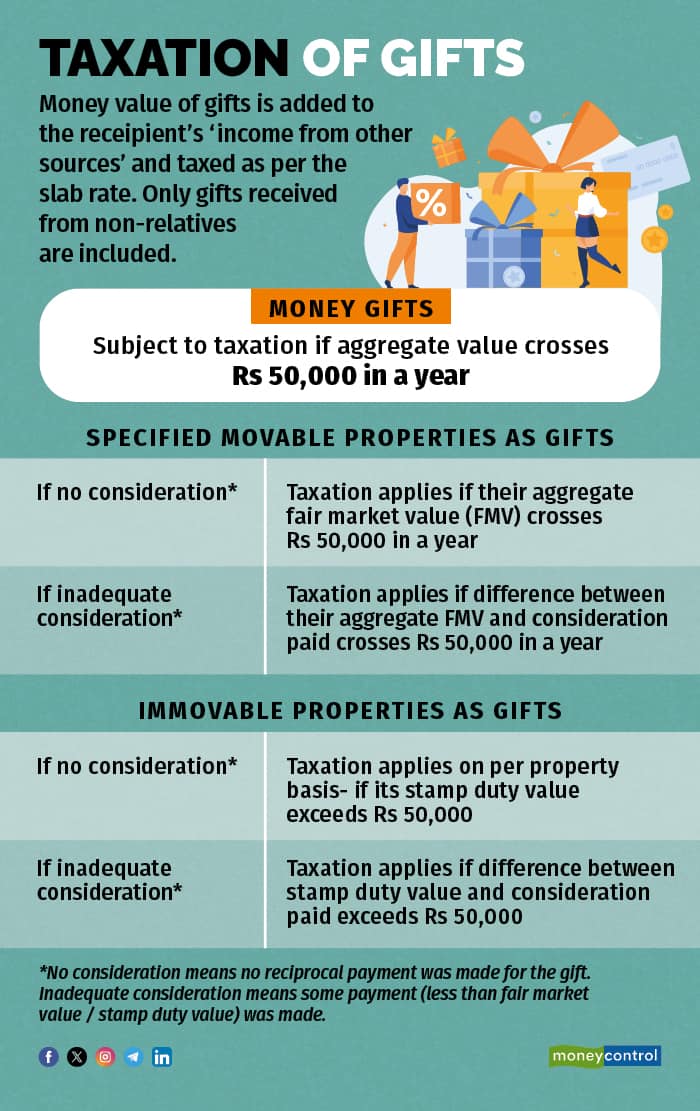

Understanding Section 56 of the Income Tax Act – Marg ERP Blog – #20

Understanding Section 56 of the Income Tax Act – Marg ERP Blog – #20

How Grandparents Can Help With (and Not Hurt) College Funding | TGS Financial Advisors – #21

How Grandparents Can Help With (and Not Hurt) College Funding | TGS Financial Advisors – #21

How Much Money Can I Give to My Children and Grandchildren as Tax-Free Gifts ? – #22

How Much Money Can I Give to My Children and Grandchildren as Tax-Free Gifts ? – #22

- 709 2020 gift tax sample completed irs form 709

- grandchild cartoon

- gift tax

Minimizing Gift Taxes on Your Estate Through a GRAT – #23

Minimizing Gift Taxes on Your Estate Through a GRAT – #23

How Grandparents Can Help Grandchildren with College Costs | Farm Bureau Financial Services – #24

How Grandparents Can Help Grandchildren with College Costs | Farm Bureau Financial Services – #24

- gift tax definition

- gift tax exemption relatives list

- inheritance estate tax

- types of clubbing of income

- estate tax example

Planning to open a 529 for a grandchild? Here’s what you need to know | NY 529 – #25

Planning to open a 529 for a grandchild? Here’s what you need to know | NY 529 – #25

Child Tax Credit: Grandparents and Other Relatives of Dependents Can Collect Money — Are You Eligible? – #26

Child Tax Credit: Grandparents and Other Relatives of Dependents Can Collect Money — Are You Eligible? – #26

Annual Exclusion: Meaning, Special Cases, FAQs – #27

Annual Exclusion: Meaning, Special Cases, FAQs – #27

Gift Tax Rules – FasterCapital – #28

Gift Tax Rules – FasterCapital – #28

Better gift: Stocks or Cash? – Arvest Share – #29

Better gift: Stocks or Cash? – Arvest Share – #29

What Will Happen When the Gift and Estate Tax Exemption Gets Cut in Half? – #30

What Will Happen When the Gift and Estate Tax Exemption Gets Cut in Half? – #30

- federal estate tax

- clipart grandchild

- clubbing of income flow chart

Gifting To Grandchildren? Use a Trust! – Fendrick Morgan – #31

Gifting To Grandchildren? Use a Trust! – Fendrick Morgan – #31

FAFSA FORM CHANGE: GREAT NEWS FOR GRANDPARENTS – #32

FAFSA FORM CHANGE: GREAT NEWS FOR GRANDPARENTS – #32

- inheritance tax document

- gift chart as per income tax

- gift from relative exempt from income tax

Grandparents’ options for college costs | Voorhees, NJ | Timothy Rice Estate & Elder Law – #33

Grandparents’ options for college costs | Voorhees, NJ | Timothy Rice Estate & Elder Law – #33

Gift Tax In Denmark – When And How Much? | Family Matters On Line – #34

Gift Tax In Denmark – When And How Much? | Family Matters On Line – #34

Tax Benefits for Grandchildren – KEB – #35

Tax Benefits for Grandchildren – KEB – #35

Gift Tax planning – 3 awesome tips to save income tax legally – #36

Gift Tax planning – 3 awesome tips to save income tax legally – #36

Understanding Gift Tax in India: Rules, Rates, and Regulations – Marg ERP Blog – #37

Understanding Gift Tax in India: Rules, Rates, and Regulations – Marg ERP Blog – #37

8 Tips on How to Help Your Grandchildren Financially – #38

8 Tips on How to Help Your Grandchildren Financially – #38

Taxes on gifts: Is It Necessary? | SCL Tax Services – #39

Taxes on gifts: Is It Necessary? | SCL Tax Services – #39

Parents Living With You? You May Be Eligible for Tax Breaks – #40

Parents Living With You? You May Be Eligible for Tax Breaks – #40

- child and dependent care credit form

- form 709 example

- inheritance tax usa

Tax Tips: Determining Whether Your Gift is Taxable – #41

Tax Tips: Determining Whether Your Gift is Taxable – #41

New Gift Tax Rule Will Apply For 2023 | Bring your Finances to LIFE – #42

New Gift Tax Rule Will Apply For 2023 | Bring your Finances to LIFE – #42

The scope of the rules | Tax Adviser – #43

The scope of the rules | Tax Adviser – #43

What Is A Generation-Skipping Transfer Tax (GSTT) And Is There A Way To Avoid It? | First Class Counsel – #44

What Is A Generation-Skipping Transfer Tax (GSTT) And Is There A Way To Avoid It? | First Class Counsel – #44

Are You Liable To Pay Income Tax On Gift Received ??? – Accovet Insight – #45

Are You Liable To Pay Income Tax On Gift Received ??? – Accovet Insight – #45

How — and Why — to Give to Your Grandkids | Kiplinger – #46

How — and Why — to Give to Your Grandkids | Kiplinger – #46

Taxation of Gifts in Pakistan | How to treat gain arising from the sale of Gift in Pakistan? | FBR – YouTube – #47

Taxation of Gifts in Pakistan | How to treat gain arising from the sale of Gift in Pakistan? | FBR – YouTube – #47

Considerations for Gifting Money to Grandchildren | Thrivent – #48

Considerations for Gifting Money to Grandchildren | Thrivent – #48

- child and dependent care credit 2021

- clubbing of income chart

- bank inheritance tax document

What Is the Lifetime Gift Tax Exemption for 2024? | SmartAsset – #49

What Is the Lifetime Gift Tax Exemption for 2024? | SmartAsset – #49

Promoted To Grandparents Pregnancy Announcement Gift Set | The Milk Moustache – #50

Promoted To Grandparents Pregnancy Announcement Gift Set | The Milk Moustache – #50

Making Gifts to Children: Best Practices in 2021 — HCM Wealth Advisors – #51

Making Gifts to Children: Best Practices in 2021 — HCM Wealth Advisors – #51

How grandparents can contribute to college funds instead of buying gifts – #52

How grandparents can contribute to college funds instead of buying gifts – #52

How Grandparents Can Help Grandchildren with College Costs | Stein Wealth Advisors, Canonsburg, PA – #53

How Grandparents Can Help Grandchildren with College Costs | Stein Wealth Advisors, Canonsburg, PA – #53

Understanding Section 56(2)(x) of Income Tax Act, 1961: Tax Implications of Gifts Received Without Consideration – Marg ERP Blog – #54

Understanding Section 56(2)(x) of Income Tax Act, 1961: Tax Implications of Gifts Received Without Consideration – Marg ERP Blog – #54

- grandchildren

- child and dependent care credit 2023

- grandparents giving money to grandchildren cartoon

What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #55

What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #55

Taxation of Minor Children in India: How Does It Work? – #56

Taxation of Minor Children in India: How Does It Work? – #56

4 Types Of Tax-Exempt Gifts | Kotak Securities – #57

4 Types Of Tax-Exempt Gifts | Kotak Securities – #57

Tax-smart Year-end Giving – #58

Tax-smart Year-end Giving – #58

How Grandparents Can Contribute to 529 Plans – #59

How Grandparents Can Contribute to 529 Plans – #59

Gifting with Knowledge – Fiduciary Trust – #60

Gifting with Knowledge – Fiduciary Trust – #60

![Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will](https://images.livemint.com/img/2021/10/16/1600x900/diwali_gifts-kBsF--621x414@LiveMint_1634362040423.jpg) Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will – #61

Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will – #61

Understanding Section 56(2)(viib) of the Income Tax Act – Marg ERP Blog – #62

Understanding Section 56(2)(viib) of the Income Tax Act – Marg ERP Blog – #62

How to Show Gift in Income Tax Return 2023 – #63

How to Show Gift in Income Tax Return 2023 – #63

Diwali 2019: No escape! You have to pay tax on gifts; check full list here | Zee Business – #64

Diwali 2019: No escape! You have to pay tax on gifts; check full list here | Zee Business – #64

Taxation of gifts to NRIs and changes in Budget 2023-24 – #65

Taxation of gifts to NRIs and changes in Budget 2023-24 – #65

Income Tax Exemption On Gifts | Are The Gifts Above Rs 50,000 Taxable? | Personal Finance – YouTube – #66

Income Tax Exemption On Gifts | Are The Gifts Above Rs 50,000 Taxable? | Personal Finance – YouTube – #66

What is a Monetary Gift? – Greatest Gift – #67

What is a Monetary Gift? – Greatest Gift – #67

2021: NRI Taxation on Gifts Received | SBNRI – YouTube – #68

2021: NRI Taxation on Gifts Received | SBNRI – YouTube – #68

How Grandparents Can Help Grandchildren with College – Coastal Wealth Management – #69

How Grandparents Can Help Grandchildren with College – Coastal Wealth Management – #69

Annual Gift Tax Exclusion Explained | PNC Insights – #70

Annual Gift Tax Exclusion Explained | PNC Insights – #70

- personalized gifts for grandparents

- estate tax exemption

- estate tax definition

Holiday gift tax planning for IRAs – #71

Holiday gift tax planning for IRAs – #71

How to include grandchildren in your plan – #72

How to include grandchildren in your plan – #72

Inheritance Tax and Estate Planning | Mercian Accountants – #73

Inheritance Tax and Estate Planning | Mercian Accountants – #73

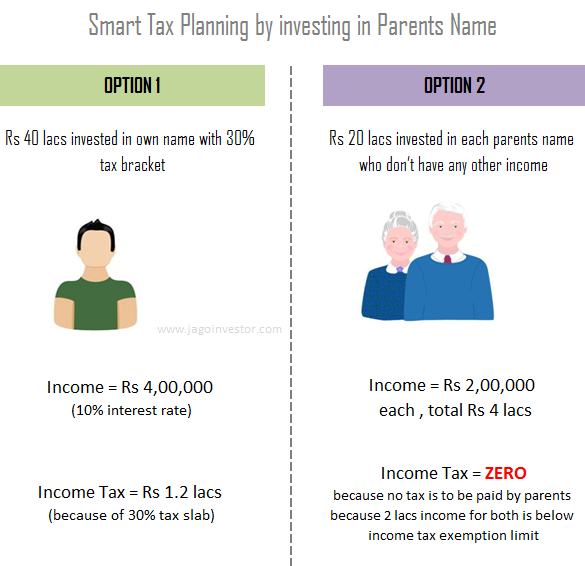

Gift tax rules to spread Income and investments to Save Tax – #74

Gift tax rules to spread Income and investments to Save Tax – #74

Gifting Money: How to Create a Tax Savvy Plan for Larger Sums – #75

Gifting Money: How to Create a Tax Savvy Plan for Larger Sums – #75

Taxes on Gifts and Inheritances – Arrows International Realty – #76

Taxes on Gifts and Inheritances – Arrows International Realty – #76

) A grandparents’ guide to 529 plan gifting | John Hancock Investment Management – #77

A grandparents’ guide to 529 plan gifting | John Hancock Investment Management – #77

Are your Diwali gifts and bonuses taxable? – #78

Are your Diwali gifts and bonuses taxable? – #78

Tax Saving through Gifting: A Smart Way to Minimize Your Tax Burden – #79

Tax Saving through Gifting: A Smart Way to Minimize Your Tax Burden – #79

Blog: Tips to Help You Figure Out if Your Gift is Taxable – Montgomery Community Media – #80

Blog: Tips to Help You Figure Out if Your Gift is Taxable – Montgomery Community Media – #80

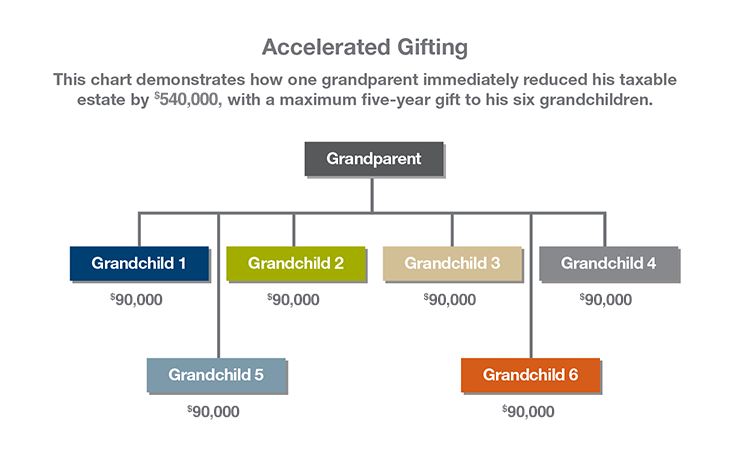

Avoiding Taxes When Giving Assets to Grandchildren – #81

Avoiding Taxes When Giving Assets to Grandchildren – #81

ITR filing rules for children 2023: When is it mandatory to pay taxes and file returns? – Income Tax News | The Financial Express – #82

ITR filing rules for children 2023: When is it mandatory to pay taxes and file returns? – Income Tax News | The Financial Express – #82

Column: Smart steps to take when helping your grandchildren financially – #83

Column: Smart steps to take when helping your grandchildren financially – #83

Gift Tax in India | PDF | Gift Tax In The United States | Capital Gains Tax – #84

Gift Tax in India | PDF | Gift Tax In The United States | Capital Gains Tax – #84

11 Simple Ways to Calculate How Much Grandparents Can Gift in the UK – #85

11 Simple Ways to Calculate How Much Grandparents Can Gift in the UK – #85

Best Way for Grandparents to Give Money to Grandchildren – Hella Wealth – #86

Best Way for Grandparents to Give Money to Grandchildren – Hella Wealth – #86

D-mas | Gifts and Inheritance – #87

D-mas | Gifts and Inheritance – #87

Gifts for the grandchildren: 7 things to keep in mind while investing for grandkids – The Economic Times – #88

Gifts for the grandchildren: 7 things to keep in mind while investing for grandkids – The Economic Times – #88

What will be the tax implications if I make cash gift to my minor granddaughter? – #89

What will be the tax implications if I make cash gift to my minor granddaughter? – #89

Mothers Day Gift for Grandparents, Custom Family Portrait Illustration – Lovekoki – #90

Mothers Day Gift for Grandparents, Custom Family Portrait Illustration – Lovekoki – #90

- child and dependent care credit 2022

- clubbing of income section 60-65

- clubbing of income diagram

Give a Gift That Lasts – Good Times – #91

Give a Gift That Lasts – Good Times – #91

A Gifting Strategy That Avoids Inheritance Tax And More – YouTube – #92

A Gifting Strategy That Avoids Inheritance Tax And More – YouTube – #92

Gifting Stock to Family Members: What to Know | ThinkAdvisor – #93

Gifting Stock to Family Members: What to Know | ThinkAdvisor – #93

How Can I Save For My Grandchild’s Education? 4 FAQs – #94

How Can I Save For My Grandchild’s Education? 4 FAQs – #94

Dynasty Trusts- the Most Powerful Planning Available to Combat the Estate, Gift, and the Generation Skipping Tax | SF Tax Counsel – #95

Dynasty Trusts- the Most Powerful Planning Available to Combat the Estate, Gift, and the Generation Skipping Tax | SF Tax Counsel – #95

KLR | Grandparents: Annual Tax-Free Gifts to Grandchildren Increases… – #96

KLR | Grandparents: Annual Tax-Free Gifts to Grandchildren Increases… – #96

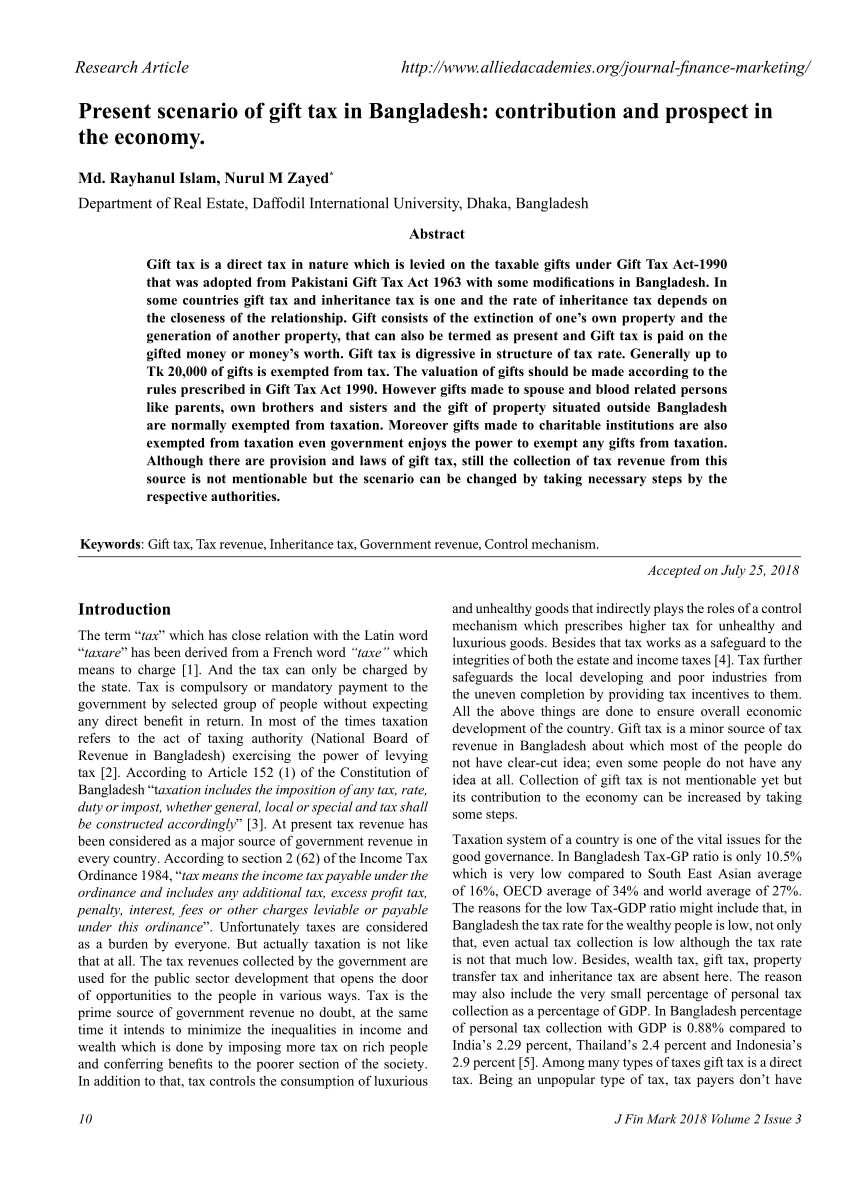

PDF) Present Scenario of Gift tax in Bangladesh: Contribution and Prospect in the Economy – #97

PDF) Present Scenario of Gift tax in Bangladesh: Contribution and Prospect in the Economy – #97

What Is the Best Investment for a Grandchild? – Experian – #98

What Is the Best Investment for a Grandchild? – Experian – #98

Tax Implications (and Rewards) of Grandparents Taking Care of Grandchildren – The CPA Journal – #99

Tax Implications (and Rewards) of Grandparents Taking Care of Grandchildren – The CPA Journal – #99

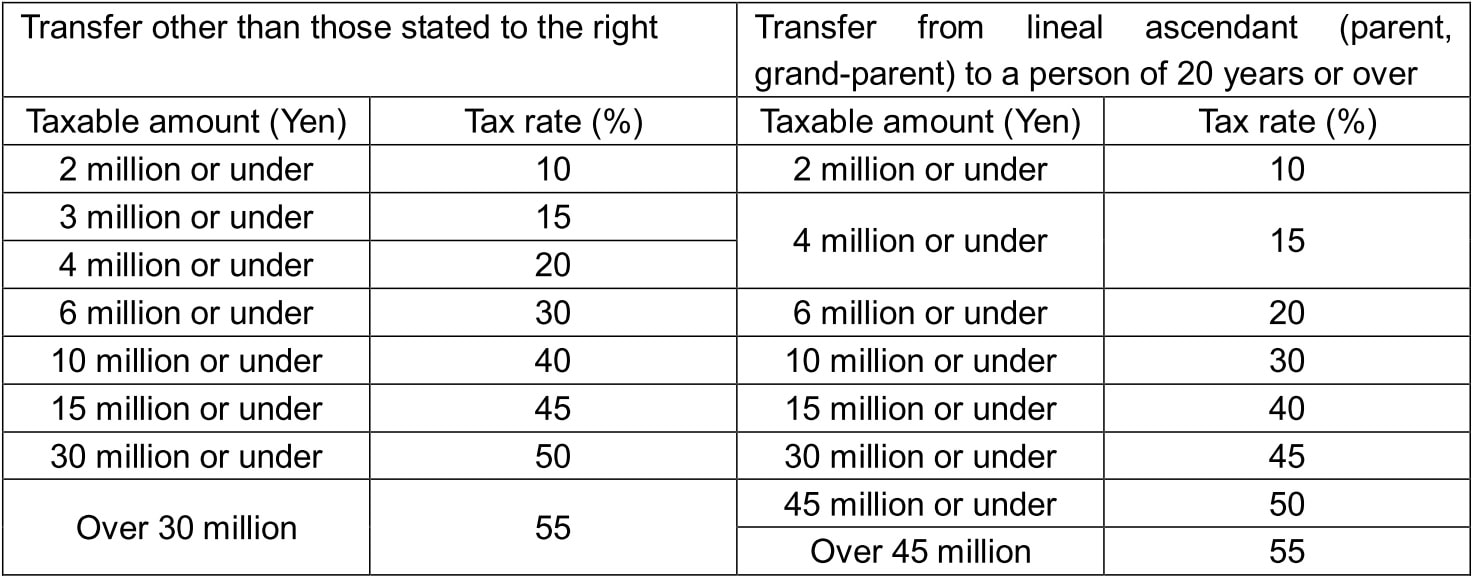

Inheritance Tax and Gift Tax – Business in Japan | SME Japan – #100

Inheritance Tax and Gift Tax – Business in Japan | SME Japan – #100

What is French Gift Tax (“Droits de Donation”)? | Beacon Global Wealth Management – #101

What is French Gift Tax (“Droits de Donation”)? | Beacon Global Wealth Management – #101

Tax Guidelines About Gifting – TurboTax Tax Tips & Videos – #102

Tax Guidelines About Gifting – TurboTax Tax Tips & Videos – #102

Taxation of Gifts received in Cash or Kind – #103

Taxation of Gifts received in Cash or Kind – #103

Posts: gift from grandparents taxable

Categories: Gifts

Author: toyotabienhoa.edu.vn