Share 97+ federal gift tax best

Top images of federal gift tax by website toyotabienhoa.edu.vn compilation. 2019 Tax Guides | Sharpe Group. Federal Gift Tax Considerations – The Wright Firm. Now is the Time to Plan: Major Changes to the Federal Estate and Gift Tax Laws Could be in our Future | Lamb McErlane PC. Gift Tax Limit 2024: How Much Can You Give Tax-Free? | Kiplinger. Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES

Estate Taxes During Estate Planning in Kansas | Irigonegaray, Turney, & Revenaugh LLP – #1

Estate Taxes During Estate Planning in Kansas | Irigonegaray, Turney, & Revenaugh LLP – #1

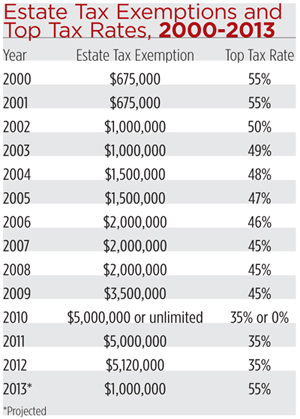

Estate Tax Planning | Law Offices of ARTHUR S. BROWN | Carlsbad, Caliornia – #2

Estate Tax Planning | Law Offices of ARTHUR S. BROWN | Carlsbad, Caliornia – #2

Gifting Basics: What Counts As A Gift And Gift Tax Reporting – Homrich Berg – #4

Gifting Basics: What Counts As A Gift And Gift Tax Reporting – Homrich Berg – #4

Did You Know? “Federal Estate Tax and Gift Tax Exclusion” – WilkinGuttenplan – #5

Did You Know? “Federal Estate Tax and Gift Tax Exclusion” – WilkinGuttenplan – #5

- gift tax exemption 2022

- inheritance tax document

- gift tax definition economics

Free Report: What is the Annual Gift Tax Exclusion in California? – #6

Free Report: What is the Annual Gift Tax Exclusion in California? – #6

- property tax

- gift tax example

- gift tax rate table

A little-known tax secret: Learn the benefits of the annual gift tax exclusion | Institutional Real Estate, Inc. – #7

A little-known tax secret: Learn the benefits of the annual gift tax exclusion | Institutional Real Estate, Inc. – #7

What Is the 2023 and 2024 Gift Tax Limit? – Ramsey – #8

What Is the 2023 and 2024 Gift Tax Limit? – Ramsey – #8

A Guide for Understanding the U.S. Federal Gift Tax Rules – Sprouse Shrader Smith – #10

A Guide for Understanding the U.S. Federal Gift Tax Rules – Sprouse Shrader Smith – #10

Understanding Federal Gift and Estate Tax | RBFCU Credit Union – #11

Understanding Federal Gift and Estate Tax | RBFCU Credit Union – #11

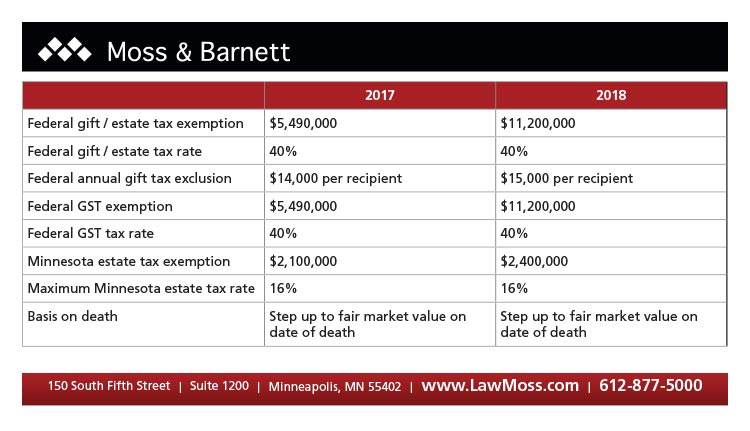

Are You Looking Forward To 2018? We Are! – Lexology – #12

Are You Looking Forward To 2018? We Are! – Lexology – #12

The $10M Gift Tax Exemption Rules | JMV Law – #13

The $10M Gift Tax Exemption Rules | JMV Law – #13

What Should I Know About the Gift Tax in Florida? – #14

What Should I Know About the Gift Tax in Florida? – #14

Gift Tax Limits for 2024: Annual and Lifetime – MagnifyMoney – #15

Gift Tax Limits for 2024: Annual and Lifetime – MagnifyMoney – #15

Gross McGinley 2020 Gift Tax Rate Increase – #16

Gross McGinley 2020 Gift Tax Rate Increase – #16

How to Gradually Lower the Federal Debt, Part I: Increase Tax Revenue — HOME – #17

How to Gradually Lower the Federal Debt, Part I: Increase Tax Revenue — HOME – #17

The Estate Tax Provides Less than One Percent of Federal Revenue – #18

The Estate Tax Provides Less than One Percent of Federal Revenue – #18

What it Means to Make a Gift Under the Federal Gift Tax System – Agency One – #19

What it Means to Make a Gift Under the Federal Gift Tax System – Agency One – #19

2018 Changes for Federal Gift and Estate Tax Exemption – #20

2018 Changes for Federal Gift and Estate Tax Exemption – #20

Federal Income Tax Videos: Gifts and Bequests | Quimbee – #21

Federal Income Tax Videos: Gifts and Bequests | Quimbee – #21

The 2021 Gift Tax Return Deadline is Almost Here, Too — Samuel Goldstein & Company – #22

The 2021 Gift Tax Return Deadline is Almost Here, Too — Samuel Goldstein & Company – #22

The Clock Is Ticking For Estate & Gift Tax Planning For The Family Business – #23

The Clock Is Ticking For Estate & Gift Tax Planning For The Family Business – #23

6 Facts You Need to Know About the Gift Tax – #24

6 Facts You Need to Know About the Gift Tax – #24

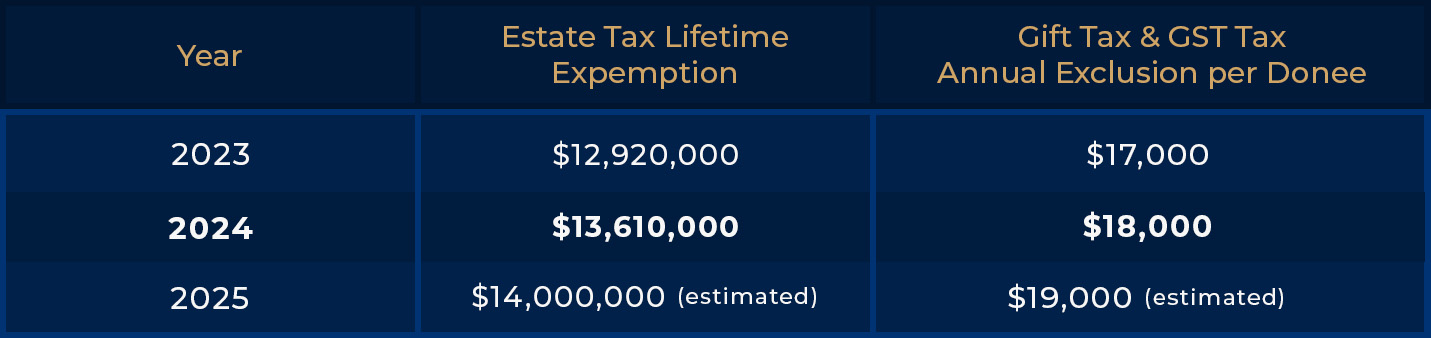

Increased Estate Tax Exemption Sunsets the end of 2025 – #25

Increased Estate Tax Exemption Sunsets the end of 2025 – #25

Estate and Gift Tax Exemption Sunset 2025: How to Prepare : Cherry Bekaert – #26

Estate and Gift Tax Exemption Sunset 2025: How to Prepare : Cherry Bekaert – #26

2023 Applicable State Estate Tax Exemption Amounts Summary – #27

2023 Applicable State Estate Tax Exemption Amounts Summary – #27

Chairman’s News | Newsroom | The United States Senate Committee on Finance – #28

Chairman’s News | Newsroom | The United States Senate Committee on Finance – #28

Dramatic Change to Federal Estate, Gift and Generation-Skipping Tax Exemptions | Akin Gump Strauss Hauer & Feld LLP – #29

Dramatic Change to Federal Estate, Gift and Generation-Skipping Tax Exemptions | Akin Gump Strauss Hauer & Feld LLP – #29

Inflation Adjustments for Tax Year 2022 | Southwest Portland Law Group – #30

Inflation Adjustments for Tax Year 2022 | Southwest Portland Law Group – #30

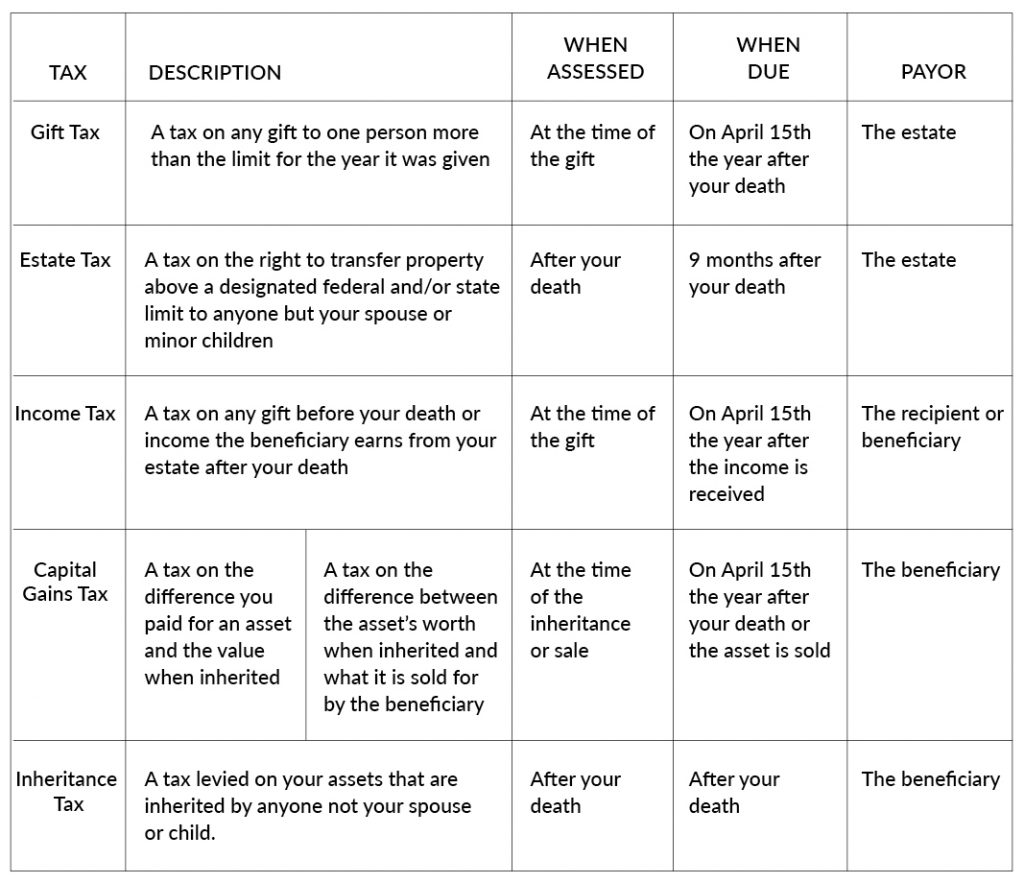

Who pays the IRS tax on a “gift”? – Shawn J. Roberts – #31

Who pays the IRS tax on a “gift”? – Shawn J. Roberts – #31

Federal Estate & Gift Tax Exclusion 2024-2025 – Shannon CPAs – #32

Federal Estate & Gift Tax Exclusion 2024-2025 – Shannon CPAs – #32

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #33

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #33

Understanding Estate, Gift, and Generation-Skipping Transfer Tax Rules for U.S. and Non-U.S. Residents: A must-attend webinar for attorneys – Federal Bar Association – #34

Understanding Estate, Gift, and Generation-Skipping Transfer Tax Rules for U.S. and Non-U.S. Residents: A must-attend webinar for attorneys – Federal Bar Association – #34

- gift tax meaning

- gift tax return

- estate/gift tax

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #35

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #35

Top Estate Planning Law Changes for 2022 • Law Offices of Daniel Hunt – #36

Top Estate Planning Law Changes for 2022 • Law Offices of Daniel Hunt – #36

2023 Winter GPB | American Cancer Society – #37

2023 Winter GPB | American Cancer Society – #37

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™ – #38

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™ – #38

Anticipating Changes in the Federal Estate and Gift Tax Exemption – Magee & Adler, Estate & Trust Planning, Administration & Litigation – #39

Anticipating Changes in the Federal Estate and Gift Tax Exemption – Magee & Adler, Estate & Trust Planning, Administration & Litigation – #39

What is a Qualified Personal Residence Trust in Indianapolis? | PDF – #40

What is a Qualified Personal Residence Trust in Indianapolis? | PDF – #40

Prepare for an uncertain federal gift and estate tax exemption amount with a SLAT | Cordasco & Company – #41

Prepare for an uncertain federal gift and estate tax exemption amount with a SLAT | Cordasco & Company – #41

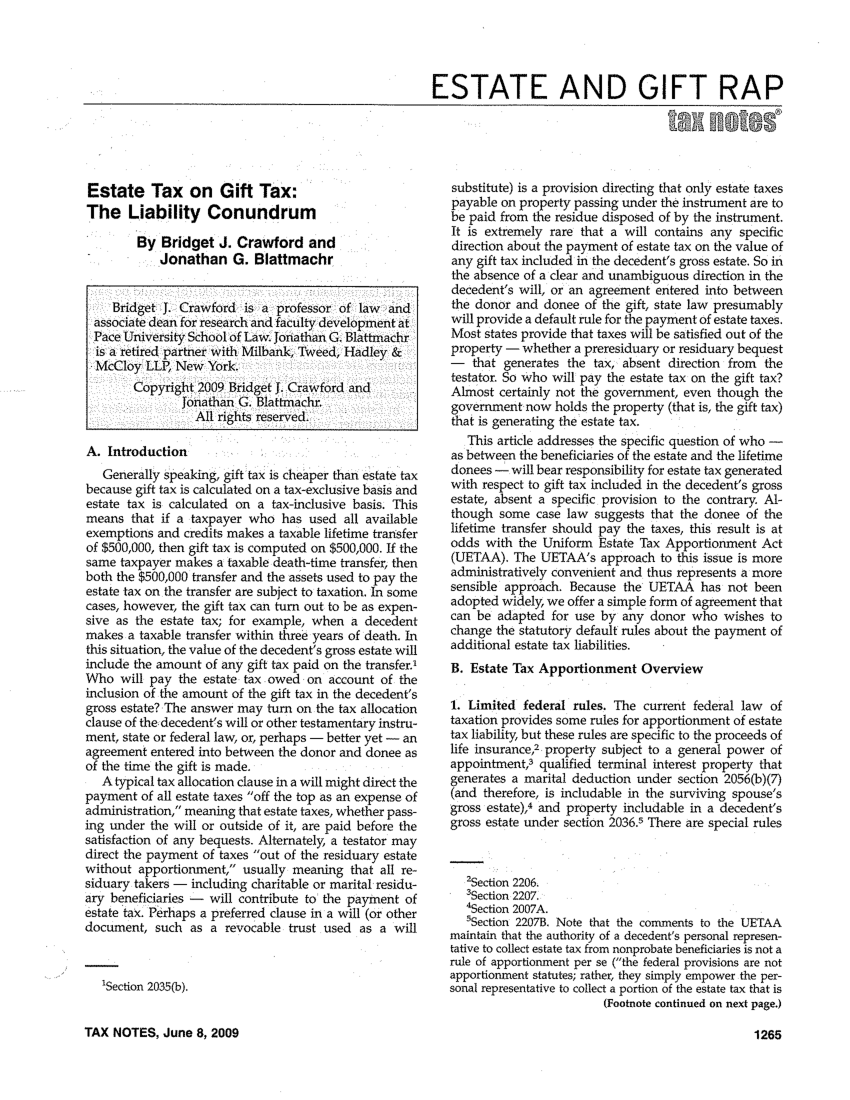

Federal Gift Tax | Tax Controversy & Financial Crimes Report – #42

Federal Gift Tax | Tax Controversy & Financial Crimes Report – #42

The Federal Gift Tax: History, Law, and Economics: Joulfaian, David: 9781505389678: Amazon.com: Books – #43

The Federal Gift Tax: History, Law, and Economics: Joulfaian, David: 9781505389678: Amazon.com: Books – #43

What Makes a Gift Taxable? – News – Fisher – Houston & The Woodlands Tx – #44

What Makes a Gift Taxable? – News – Fisher – Houston & The Woodlands Tx – #44

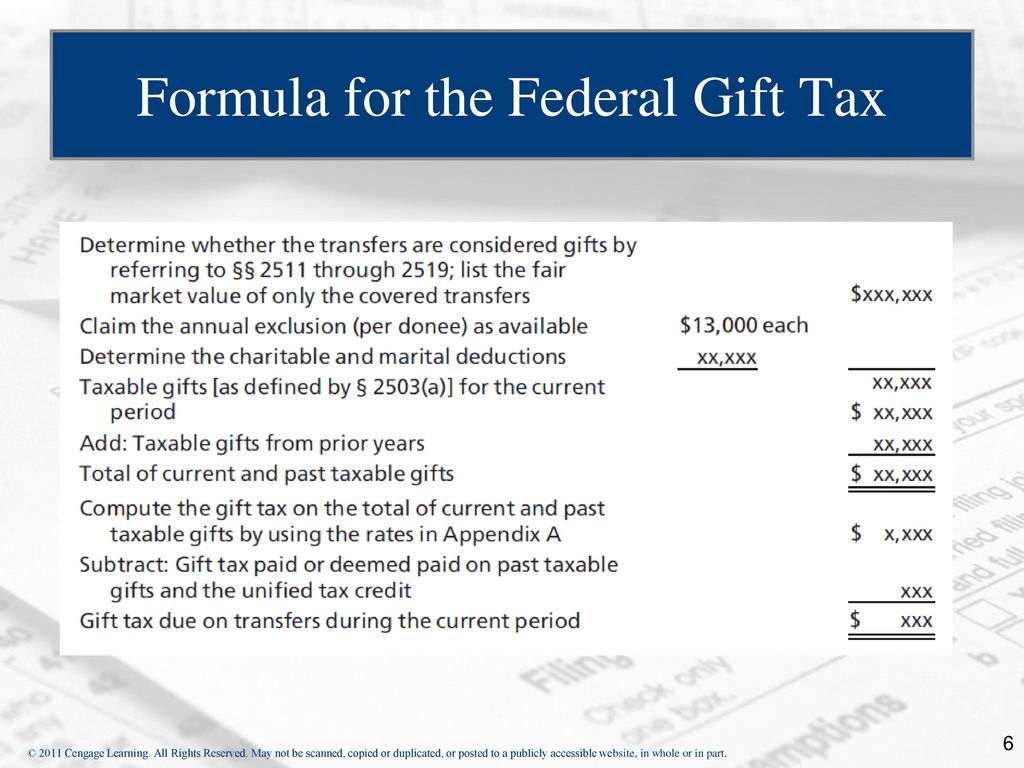

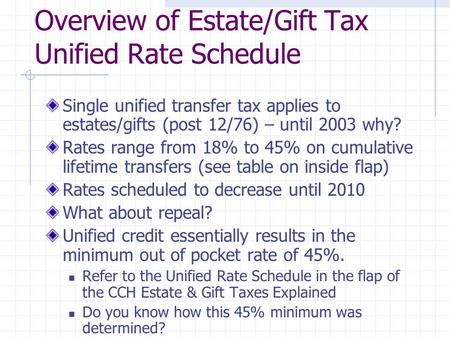

The Federal Gift and Estate Taxes – ppt download – #45

The Federal Gift and Estate Taxes – ppt download – #45

Are Changes Coming to the Estate and Gift Tax? | Heritage Financial Services – #46

Are Changes Coming to the Estate and Gift Tax? | Heritage Financial Services – #46

Alert—2020 Federal Gift and Estate Tax Planning, Part I | New York Law Journal – #47

Alert—2020 Federal Gift and Estate Tax Planning, Part I | New York Law Journal – #47

How Does the Gift Tax Work? – Opsahl Dawson – #48

How Does the Gift Tax Work? – Opsahl Dawson – #48

Are Gifts Tax-Deductible? – #49

Are Gifts Tax-Deductible? – #49

Cincinnati Estate Tax Planning Lawyer | Shaw & Nelson, PLLC – #50

Cincinnati Estate Tax Planning Lawyer | Shaw & Nelson, PLLC – #50

2024 Federal Estate and Gift Tax Update (VIDEO) – Litherland, Kennedy & Associates, APC, Attorneys at Law – #51

2024 Federal Estate and Gift Tax Update (VIDEO) – Litherland, Kennedy & Associates, APC, Attorneys at Law – #51

2016 Estate Tax Update – Fairview Law Group – #52

2016 Estate Tax Update – Fairview Law Group – #52

- estate tax formula

- estate tax exemption

Federal Estate Tax and Gift Tax Limits Announced For 2022 – #53

Federal Estate Tax and Gift Tax Limits Announced For 2022 – #53

Elevate Your Expertise with Estate, Tax, and Financial Planning Webinars – #54

Elevate Your Expertise with Estate, Tax, and Financial Planning Webinars – #54

Memento Law – The federal annual gift exclusion is the… | Facebook – #55

Memento Law – The federal annual gift exclusion is the… | Facebook – #55

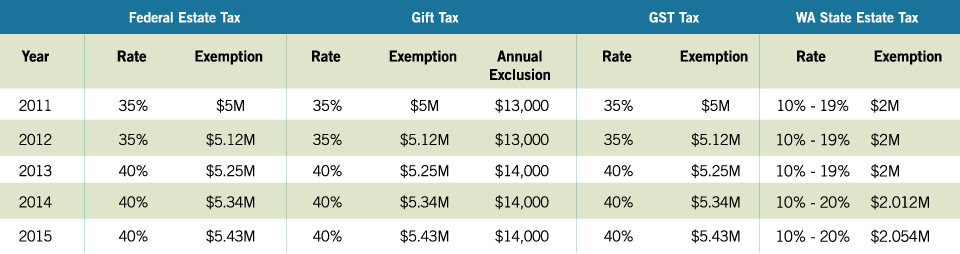

2015 Estate Planning Update | Helsell Fetterman – #56

2015 Estate Planning Update | Helsell Fetterman – #56

Pre-Owned U.S. Master Estate and Gift Tax Guide (Paperback) 0808022210 9780808022213 – Walmart.com – #57

Pre-Owned U.S. Master Estate and Gift Tax Guide (Paperback) 0808022210 9780808022213 – Walmart.com – #57

Alternatives to the Gift and Estate Tax – LIRA@BC Law – #58

Alternatives to the Gift and Estate Tax – LIRA@BC Law – #58

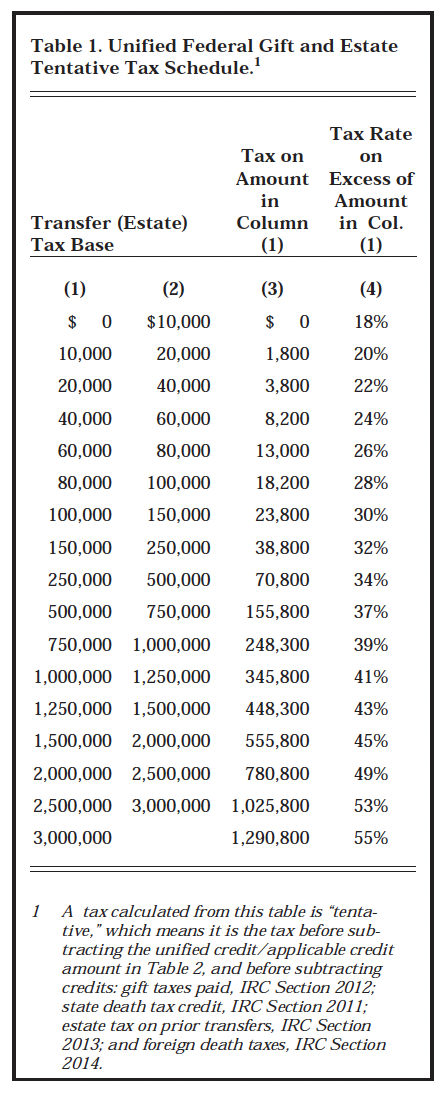

Table 1 from SPECIAL REPORT May 2006 No . 142 Death and Taxes : The Economics of the Federal Estate Tax | Semantic Scholar – #59

Table 1 from SPECIAL REPORT May 2006 No . 142 Death and Taxes : The Economics of the Federal Estate Tax | Semantic Scholar – #59

Proposed Changes to the Federal Estate & Gift Tax Exemption | BRMM – #60

Proposed Changes to the Federal Estate & Gift Tax Exemption | BRMM – #60

Federal Estate & Gift Taxation: GUY B. MAXFIELD DENNIS A. CALFEE RICHARD B. STEPHENS, Guy Maxfield, Stephen Lind, Dennis Calfee: 9780791389737: Amazon.com: Books – #61

Federal Estate & Gift Taxation: GUY B. MAXFIELD DENNIS A. CALFEE RICHARD B. STEPHENS, Guy Maxfield, Stephen Lind, Dennis Calfee: 9780791389737: Amazon.com: Books – #61

Federal Gift Tax Exclusion for Direct Payment of Medical Expenses … – #62

Federal Gift Tax Exclusion for Direct Payment of Medical Expenses … – #62

Texas Estate and Gift Tax Figures – Slaton Schauer Law Firm – #63

Texas Estate and Gift Tax Figures – Slaton Schauer Law Firm – #63

- gift tax exemption relatives list

- gift tax definition

- federal estate tax

Back to the Future Interest: The Origin and Questionable Legal Basis of the Use of Crummey Withdrawal Powers to Obtain the Federal Gift Tax Annual Exclusion | Florida Tax Review – #64

Back to the Future Interest: The Origin and Questionable Legal Basis of the Use of Crummey Withdrawal Powers to Obtain the Federal Gift Tax Annual Exclusion | Florida Tax Review – #64

Lathrope’s Selected Federal Taxation Statutes and Regulations, 2024 with Motro Tax Map – #65

Lathrope’s Selected Federal Taxation Statutes and Regulations, 2024 with Motro Tax Map – #65

The federal gift tax exclusion has… – Capstone Financial | Facebook – #66

The federal gift tax exclusion has… – Capstone Financial | Facebook – #66

River Valley Law Firm – 2022 estate and gift tax numbers to know. | Facebook – #67

River Valley Law Firm – 2022 estate and gift tax numbers to know. | Facebook – #67

- gift tax exemption

- gift tax rate 2023

- gift tax rate

A History of Federal Estate, Gift, and Generation-Skipping Taxes – EveryCRSReport.com – #68

A History of Federal Estate, Gift, and Generation-Skipping Taxes – EveryCRSReport.com – #68

Plan Now for Year-end Gifts with the Gift Tax Annual Exclusion – #69

Plan Now for Year-end Gifts with the Gift Tax Annual Exclusion – #69

How does the gift tax work? – Personal Finance Club – #70

How does the gift tax work? – Personal Finance Club – #70

Gift Tax Exemption – Buckley Fine – #71

Gift Tax Exemption – Buckley Fine – #71

2015 Federal Income Tax Rates, Retirement Contribution Limits, Kiddie Tax, Gift Tax Exclusion And More – #72

2015 Federal Income Tax Rates, Retirement Contribution Limits, Kiddie Tax, Gift Tax Exclusion And More – #72

Solved Exercise 18-19 (Algorithmic) (LO, 3) Elizabeth made | Chegg.com – #73

Solved Exercise 18-19 (Algorithmic) (LO, 3) Elizabeth made | Chegg.com – #73

Federal Estate and Gift Taxes: Code &… by: CCH Tax Law Editors – 9780808053927 | RedShelf – #74

Federal Estate and Gift Taxes: Code &… by: CCH Tax Law Editors – 9780808053927 | RedShelf – #74

2023 Updates to Federal Estate and Gift Tax Exemptions – Smith Barid – #75

2023 Updates to Federal Estate and Gift Tax Exemptions – Smith Barid – #75

2019 Tax Guides | Sharpe Group – #76

2019 Tax Guides | Sharpe Group – #76

Download efficient Form 709 software – #77

Download efficient Form 709 software – #77

- gift tax 2023

- gift tax in india

- estate tax example

Gift Tax Rate : r/tax – #78

Gift Tax Rate : r/tax – #78

Marietta Estate Tax Lawyer Answers, “What Is Portability in an Estate Plan?” | Georgia Estate Plan: Worrall Law LLC – #79

Marietta Estate Tax Lawyer Answers, “What Is Portability in an Estate Plan?” | Georgia Estate Plan: Worrall Law LLC – #79

Federal Gift Tax Law – TurboTax Tax Tip Video – YouTube – #80

Federal Gift Tax Law – TurboTax Tax Tip Video – YouTube – #80

Gift tax: what is it & how does it work? | Empower – #81

Gift tax: what is it & how does it work? | Empower – #81

Estate Planning Estate and Gift Tax – Finance and Economics – Lecture Notes | Study notes Finance | Docsity – #82

Estate Planning Estate and Gift Tax – Finance and Economics – Lecture Notes | Study notes Finance | Docsity – #82

SOLVED: Which of the following is a CORRECT statement concerning whether a transfer is a gift for federal gift tax purposes? A) The gift tax does not apply to the forgiveness of – #83

SOLVED: Which of the following is a CORRECT statement concerning whether a transfer is a gift for federal gift tax purposes? A) The gift tax does not apply to the forgiveness of – #83

When to File a Gift Tax Return – Capaldi Reynolds & Pelosi, P. A. – #84

When to File a Gift Tax Return – Capaldi Reynolds & Pelosi, P. A. – #84

Eight Tips from the IRS to Help you Determine if your Gift is Taxable | Northeast Financial Strategies, Inc. – #85

Eight Tips from the IRS to Help you Determine if your Gift is Taxable | Northeast Financial Strategies, Inc. – #85

Gift Tax: 3 Easy Ways to Avoid Paying the Gift Tax | TaxAct – #86

Gift Tax: 3 Easy Ways to Avoid Paying the Gift Tax | TaxAct – #86

Explaining The Federal Estate Tax Exemption 2023-24 – #87

Explaining The Federal Estate Tax Exemption 2023-24 – #87

Federal Gift and Estate Tax Breaks Boosted by Inflation – #88

Federal Gift and Estate Tax Breaks Boosted by Inflation – #88

Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver – #89

Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver – #89

IRS Reverses Position Previously Taken in 2016 Letter Ruling Regarding Gift Tax Treatment of Adding a Tax Reimbursement Clause to an IDGT — Current Federal Tax Developments – #90

IRS Reverses Position Previously Taken in 2016 Letter Ruling Regarding Gift Tax Treatment of Adding a Tax Reimbursement Clause to an IDGT — Current Federal Tax Developments – #90

The Gift Tax Made Simple – TurboTax Tax Tips & Videos | PDF | Gift Tax In The United States | Estate Tax In The United States – #91

The Gift Tax Made Simple – TurboTax Tax Tips & Videos | PDF | Gift Tax In The United States | Estate Tax In The United States – #91

Countdown for Gift and Estate Tax Exemptions | Charles Schwab – #92

Countdown for Gift and Estate Tax Exemptions | Charles Schwab – #92

Does a Trust Have a Federal Gift Tax Exemption? – #93

Does a Trust Have a Federal Gift Tax Exemption? – #93

2018 Estate and Gift Tax Exemptions: — Provenance Law PLLC – #94

2018 Estate and Gift Tax Exemptions: — Provenance Law PLLC – #94

ES402: Introduction to Estate & Gift Tax – #95

ES402: Introduction to Estate & Gift Tax – #95

Not a Big Fan of the Federal Estate and Gift Tax Exemption Rules – Ultimate Estate Planner – #96

Not a Big Fan of the Federal Estate and Gift Tax Exemption Rules – Ultimate Estate Planner – #96

What Is the Federal Gift Tax? – Marshall Jones – #97

What Is the Federal Gift Tax? – Marshall Jones – #97

Posts: federal gift tax

Categories: Gifts

Author: toyotabienhoa.edu.vn