Discover more than 177 exempted gift income best

Update images of exempted gift income by website toyotabienhoa.edu.vn compilation. IRS Addresses Estate and Gift Tax Exemption “Claw-back” – ESA Law. Taxation in the United States – Wikipedia. Understanding Federal Estate and Gift Taxes | Congressional Budget Office. ITR filing: Are you liable to pay tax on money received as gift?

Gifts from Foreign Corporations Included as Gross Income – #1

Gifts from Foreign Corporations Included as Gross Income – #1

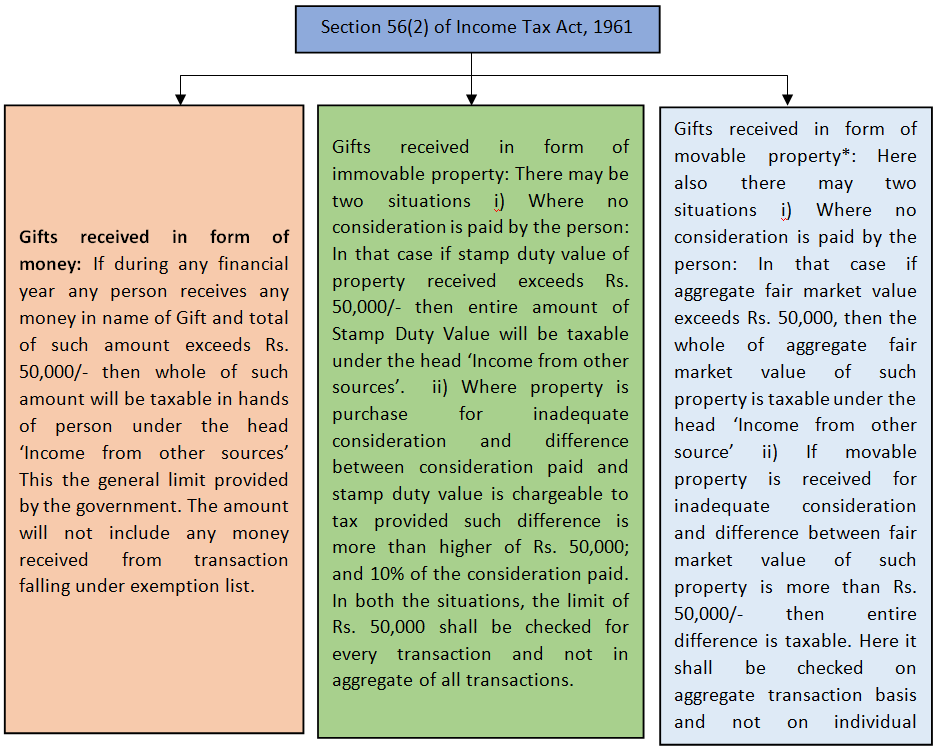

Taxbaility of GIFT – FIBOTA – #2

Taxbaility of GIFT – FIBOTA – #2

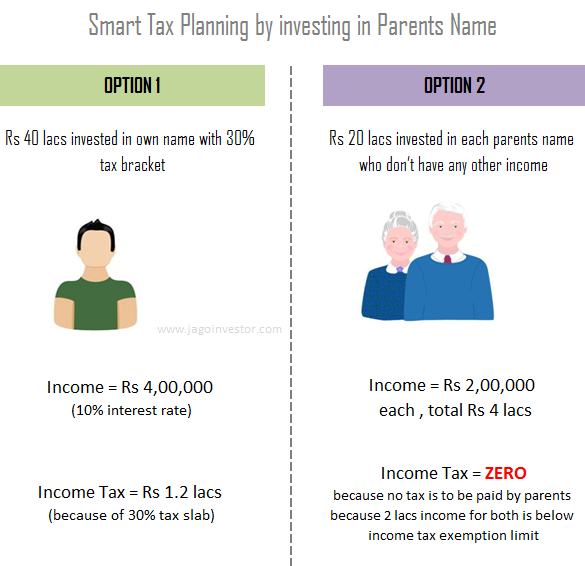

Kritesh Abhishek on X: “How to Save Taxes with your family? – Health Insurance for Parents – Gift Money to Senior Citizen Parents – Pay rent to parents – Transfer money to – #4

Kritesh Abhishek on X: “How to Save Taxes with your family? – Health Insurance for Parents – Gift Money to Senior Citizen Parents – Pay rent to parents – Transfer money to – #4

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #5

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #5

Tax queries: What is the tax liability of gifting a flat to your son? – The Economic Times – #6

Tax queries: What is the tax liability of gifting a flat to your son? – The Economic Times – #6

How Do You Value a Gift of Stock? It Depends on Whether You’re the Giver or the Receiver. | Retirement Plan Services – #7

How Do You Value a Gift of Stock? It Depends on Whether You’re the Giver or the Receiver. | Retirement Plan Services – #7

Gift tax: Gift Tax Explained: Insights from the Internal Revenue Code – FasterCapital – #8

Gift tax: Gift Tax Explained: Insights from the Internal Revenue Code – FasterCapital – #8

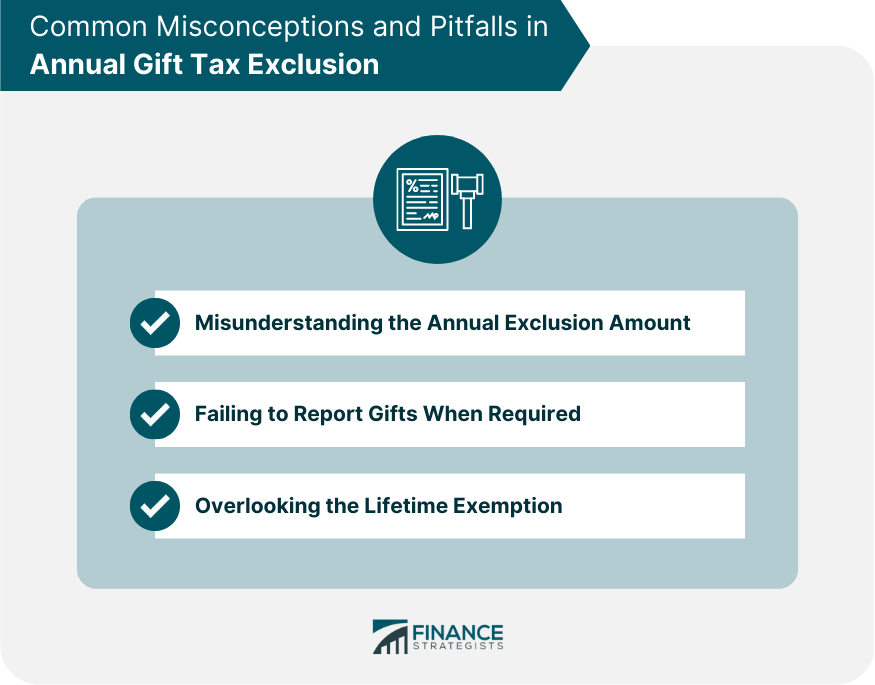

Annual Gift Tax Exclusion Explained | PNC Insights – #10

Annual Gift Tax Exclusion Explained | PNC Insights – #10

Will You Owe a Gift Tax This Year? – #11

Will You Owe a Gift Tax This Year? – #11

Gift tax presentation | PPT – #12

Gift tax presentation | PPT – #12

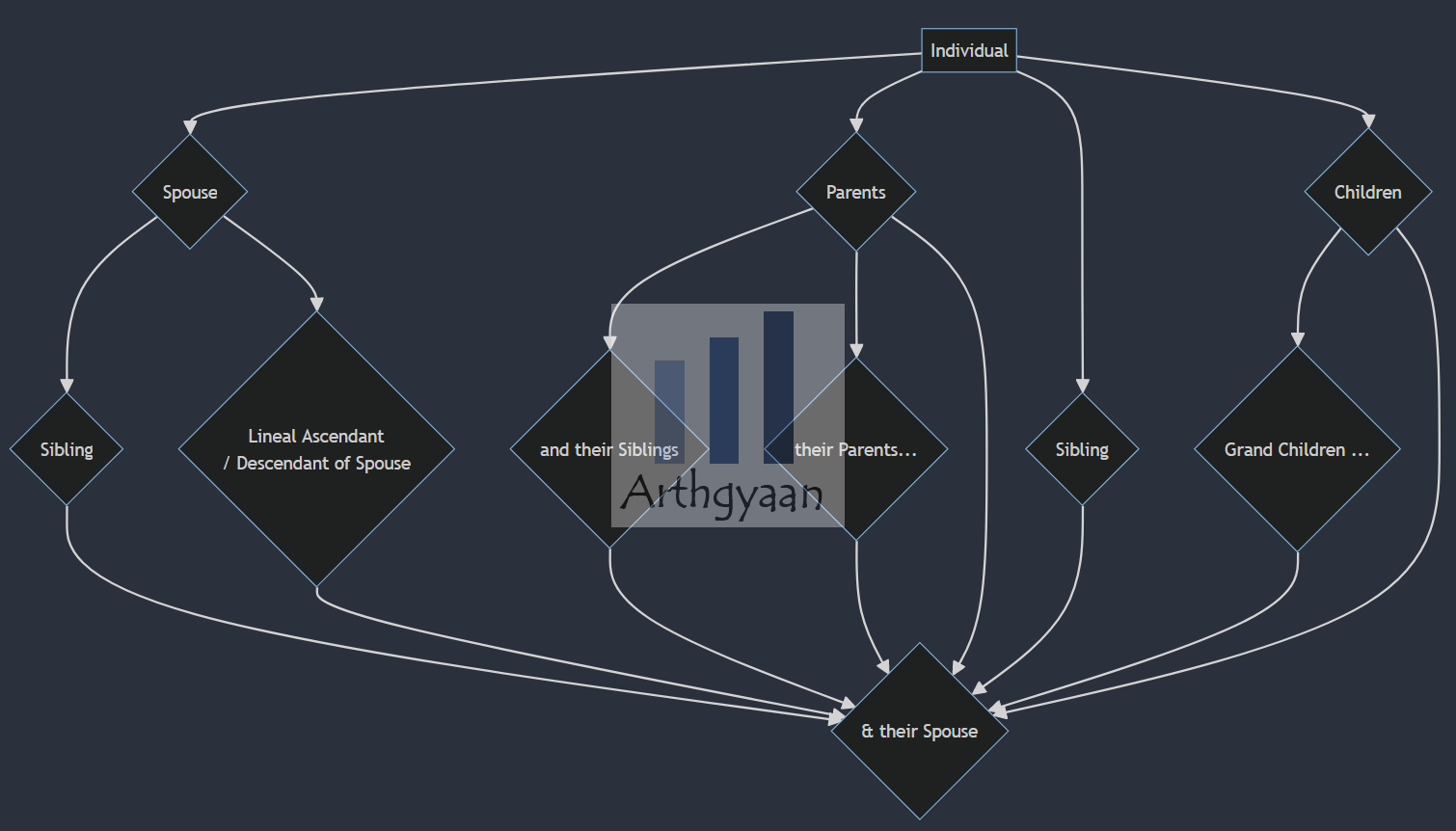

Analysis of definition of “Relative” under different Act – #13

Analysis of definition of “Relative” under different Act – #13

Gifts Tax: Know which gifts are taxable this festive season | TAX SAVING | Zee Business – #14

Gifts Tax: Know which gifts are taxable this festive season | TAX SAVING | Zee Business – #14

Investing in AIFs in Gift City: What You Need to Know – #15

Investing in AIFs in Gift City: What You Need to Know – #15

Taxation of Gifts to Ministers and Church Employees – Provident Lawyers – #16

Taxation of Gifts to Ministers and Church Employees – Provident Lawyers – #16

Gift taxation | ITR: Gifts have to be declared in ITR: Here’s how they are taxed – #17

Gift taxation | ITR: Gifts have to be declared in ITR: Here’s how they are taxed – #17

Mysteries of the IRS Gift Tax: Who Foots the Bill and At What Rate? – #18

Mysteries of the IRS Gift Tax: Who Foots the Bill and At What Rate? – #18

Federal Gift Tax vs. California Inheritance Tax – #19

Federal Gift Tax vs. California Inheritance Tax – #19

- gift tax rate in india 2022-23

- gift tax exemption

- gift tax rate

Lifetime Estate And Gift Tax Exemption Will Hit $12.92 Million In 2023 – #20

Lifetime Estate And Gift Tax Exemption Will Hit $12.92 Million In 2023 – #20

Gifts with Tax Benefits: Guide to Employer Gift Tax Laws – #21

Gifts with Tax Benefits: Guide to Employer Gift Tax Laws – #21

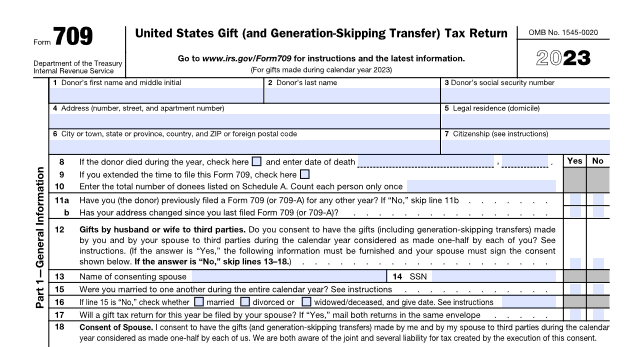

April 15 Is The Deadline To File A Gift Tax Return – #22

April 15 Is The Deadline To File A Gift Tax Return – #22

Guide to Small Benefit Exemptions in Europe | Xoxoday – #23

Guide to Small Benefit Exemptions in Europe | Xoxoday – #23

Justin Haugen on LinkedIn: IRS Announces Increased Gift and Estate Tax Exemption Amounts for 2024 – #24

Justin Haugen on LinkedIn: IRS Announces Increased Gift and Estate Tax Exemption Amounts for 2024 – #24

Gift Remittance: Features, Process & Costs Involved – #25

Gift Remittance: Features, Process & Costs Involved – #25

Nil ITR: What is a Nil ITR? Check out who is eligible for it and the benefits of filing a Nil ITR – The Economic Times – #26

Nil ITR: What is a Nil ITR? Check out who is eligible for it and the benefits of filing a Nil ITR – The Economic Times – #26

Taxability of Gifts under Income Tax Act – Taxmann Blog – #27

Taxability of Gifts under Income Tax Act – Taxmann Blog – #27

Taxability of Gifts – Some Interesting Issues – #28

Taxability of Gifts – Some Interesting Issues – #28

Gifting movable, immovable properties or cash through Gift Deed this Diwali? Know how they will be taxed – Money News | The Financial Express – #29

Gifting movable, immovable properties or cash through Gift Deed this Diwali? Know how they will be taxed – Money News | The Financial Express – #29

gift tax Archives – Milliken, Perkins & Brunelle – #30

gift tax Archives – Milliken, Perkins & Brunelle – #30

Estate Planning: Increased Transfer Limits for Gift and Estate Tax for 2023 – Young Moore Attorneys – #31

Estate Planning: Increased Transfer Limits for Gift and Estate Tax for 2023 – Young Moore Attorneys – #31

How money received via Will or Inheritance from abroad is taxed in India – Income Tax News | The Financial Express – #32

How money received via Will or Inheritance from abroad is taxed in India – Income Tax News | The Financial Express – #32

Gift tax inclusion amount: What You Need to Know – FasterCapital – #33

Gift tax inclusion amount: What You Need to Know – FasterCapital – #33

Housewives with no income should also file IT return; here’s why – BusinessToday – #34

Housewives with no income should also file IT return; here’s why – BusinessToday – #34

tax treatment of gifts | PDF – #35

tax treatment of gifts | PDF – #35

) How Much Money Can I Gift Without Owing Taxes? – #36

How Much Money Can I Gift Without Owing Taxes? – #36

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #37

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #37

Get Ahead: Gift & Estate Tax Exemptions Sunset | Huntington Private Bank – #38

Get Ahead: Gift & Estate Tax Exemptions Sunset | Huntington Private Bank – #38

- lineal ascendant gift from relative exempt from income tax

- expenditure tax act

Pushpendra Singh on X: “When cutting edge technology like #blockchain will exempt from tax ? https://t.co/FRhrlmTetg” / X – #39

Pushpendra Singh on X: “When cutting edge technology like #blockchain will exempt from tax ? https://t.co/FRhrlmTetg” / X – #39

2024 TAX LAW CHANGES: BLOG SERIES 5 – PPL CPA – #40

2024 TAX LAW CHANGES: BLOG SERIES 5 – PPL CPA – #40

Budget 2024: Common Taxpayer’s Expectations; Will Nirmala Sitharaman Open Gift Box Before Elections? – #41

Budget 2024: Common Taxpayer’s Expectations; Will Nirmala Sitharaman Open Gift Box Before Elections? – #41

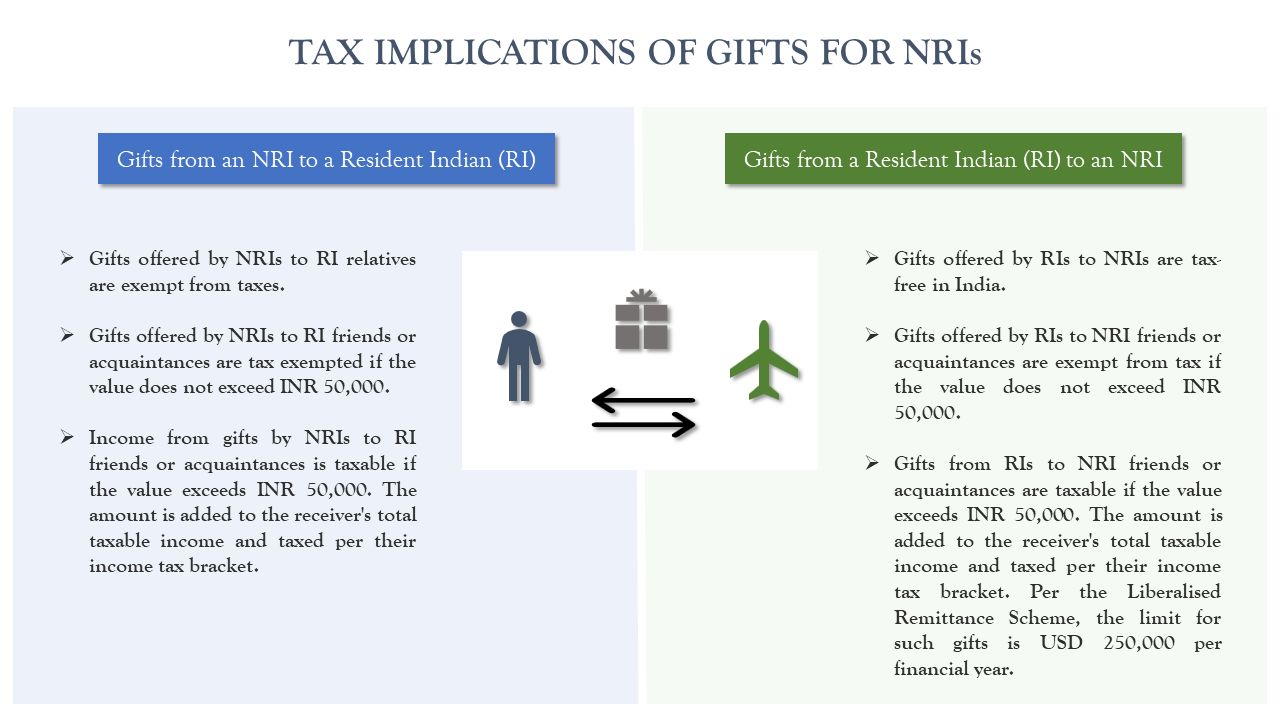

Gift by NRI to Resident Indian or Vice-Versa – NRI Gift Tax In India – #42

Gift by NRI to Resident Indian or Vice-Versa – NRI Gift Tax In India – #42

What Are Estate and Gift Taxes and How Do They Work? – #43

What Are Estate and Gift Taxes and How Do They Work? – #43

- gift tax exemption 2022

- 2023 gift

- gift tax exemption relatives list

Taxability of Gifts | Income Tax | CA PRITISH BURTON – YouTube – #44

Taxability of Gifts | Income Tax | CA PRITISH BURTON – YouTube – #44

Invest India on X: “#IndiaResurgent Here are the tax incentives announced in #Budget2021 for the companies located at the International Financial Services Centre (IFSC) in Gujarat’s @GIFTCity_! #TheLionRoarsAgain #UnionBudget2021 @CMOGuj https://t.co … – #45

Invest India on X: “#IndiaResurgent Here are the tax incentives announced in #Budget2021 for the companies located at the International Financial Services Centre (IFSC) in Gujarat’s @GIFTCity_! #TheLionRoarsAgain #UnionBudget2021 @CMOGuj https://t.co … – #45

Things an NRI must know about gift tax rules in India | IDFC FIRST Bank – #46

Things an NRI must know about gift tax rules in India | IDFC FIRST Bank – #46

- estate tax

- gift tax definition

- gift tax act 1958

LiveMint on LinkedIn: #personalfinance – #47

LiveMint on LinkedIn: #personalfinance – #47

How Much is the Gift Tax? | What is a Gift Tax? | Gift Tax Limit 2020 – #48

How Much is the Gift Tax? | What is a Gift Tax? | Gift Tax Limit 2020 – #48

A Note for Gift Tax Return Preparers: Make Sure Remaining GST Tax Exemption is Accurate – YouTube – #49

A Note for Gift Tax Return Preparers: Make Sure Remaining GST Tax Exemption is Accurate – YouTube – #49

Vivek kochar & associates – chartered accountants | Kanker – #50

Vivek kochar & associates – chartered accountants | Kanker – #50

Charitable deduction rules for trusts, estates, and lifetime transfers – #51

Charitable deduction rules for trusts, estates, and lifetime transfers – #51

Frequently Asked Questions on Gift Taxes | Internal Revenue Service – #52

Frequently Asked Questions on Gift Taxes | Internal Revenue Service – #52

Gift Deed Registration: Stamp Duty, Registry Fee, Tax, Procedure – #53

Gift Deed Registration: Stamp Duty, Registry Fee, Tax, Procedure – #53

Gift are taxable income or exempted income & how are gift taxed? – Tax Knowledges – #54

Gift are taxable income or exempted income & how are gift taxed? – Tax Knowledges – #54

GIFTS, DONATIONS,GRANTS – TAXABLE OR NOT? Let’s find out… – #55

GIFTS, DONATIONS,GRANTS – TAXABLE OR NOT? Let’s find out… – #55

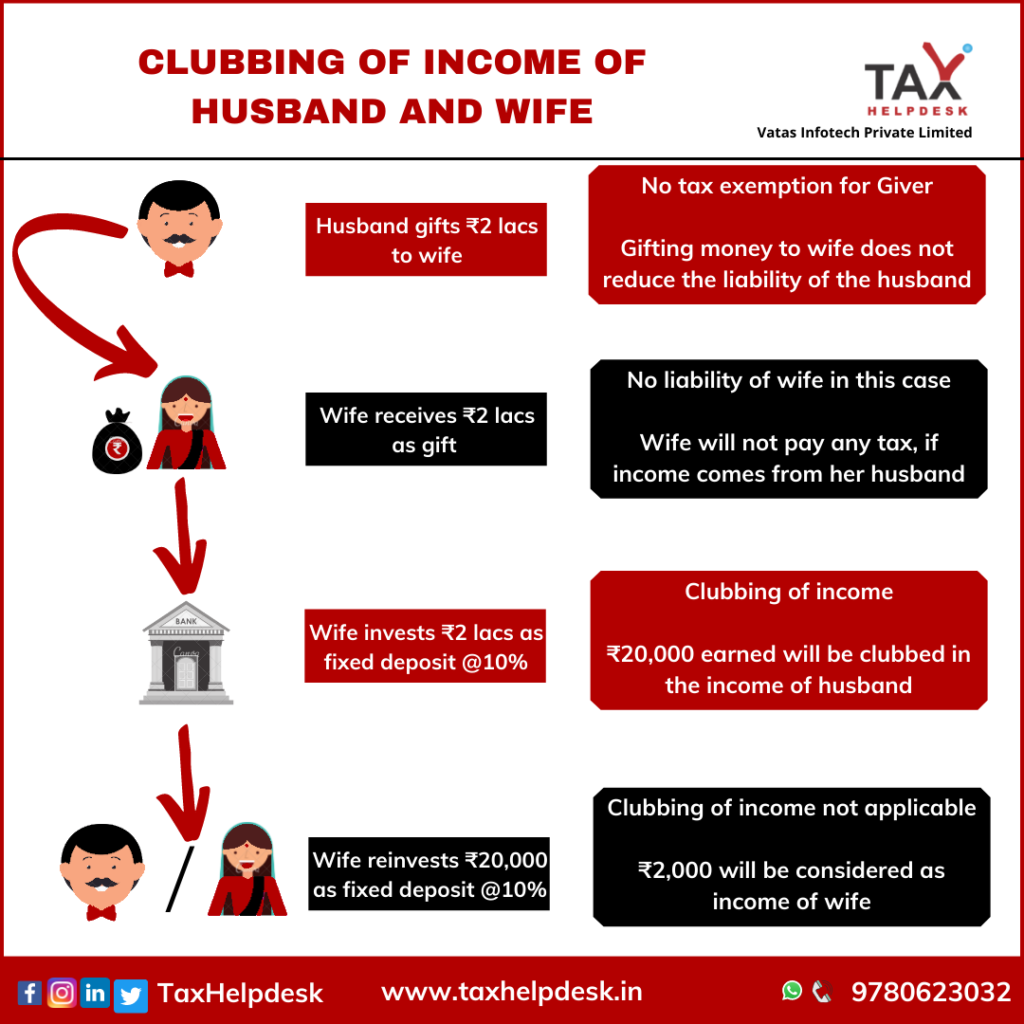

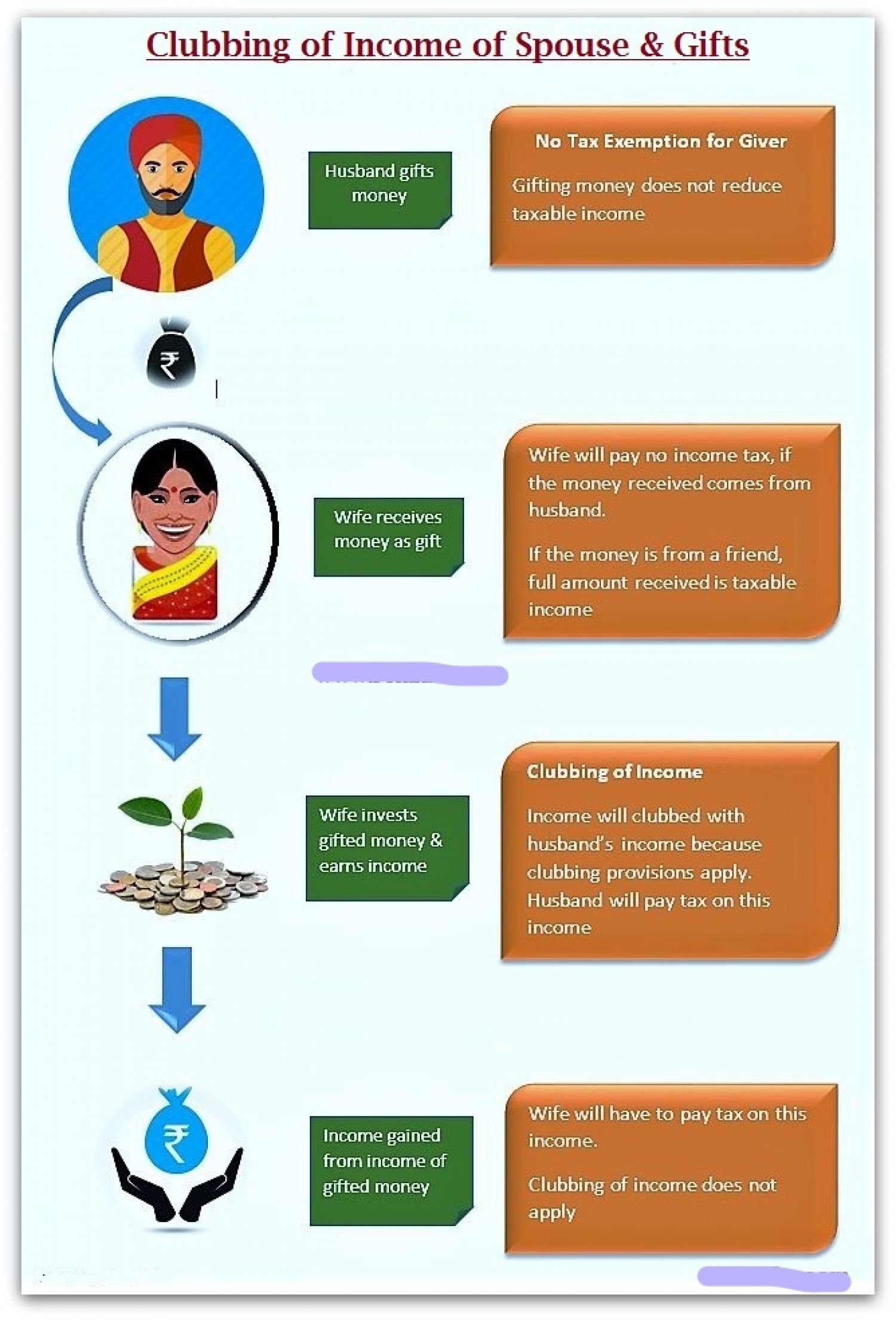

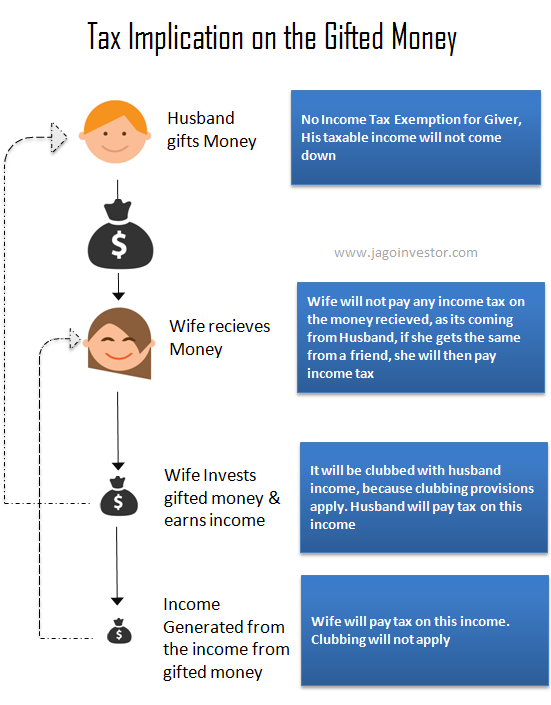

Clubbing of Income under Section 64 & 27- TaxHelpdesk – #56

Clubbing of Income under Section 64 & 27- TaxHelpdesk – #56

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #57

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #57

Navigating the Estate Tax Horizon – Mercer Capital – #58

Navigating the Estate Tax Horizon – Mercer Capital – #58

Definition of Relatives for the purpose of Income Tax Act, 1961- Taxwink – #59

Definition of Relatives for the purpose of Income Tax Act, 1961- Taxwink – #59

Regulations Related to Gift Tax in India – #60

Regulations Related to Gift Tax in India – #60

Where to Show Gratuity Exemption in Income Tax Return? – #61

Where to Show Gratuity Exemption in Income Tax Return? – #61

![FAQs] on Personal Tax Planning FAQs] on Personal Tax Planning](https://www.financestrategists.com/uploads/Strategies_for_Maximizing_the_Annual_Gift_Tax_Exclusion.png) FAQs] on Personal Tax Planning – #62

FAQs] on Personal Tax Planning – #62

Income Tax Saving: Wedding gift and investment in the name of parents, know the ways to save income tax.. – #63

Income Tax Saving: Wedding gift and investment in the name of parents, know the ways to save income tax.. – #63

Budget 2024 highlights: Income tax exemption extended by one year for three key areas – #64

Budget 2024 highlights: Income tax exemption extended by one year for three key areas – #64

Consider all the tax consequences before making gifts to loved ones – Gosling & Company Certified Public Accountants – #65

Consider all the tax consequences before making gifts to loved ones – Gosling & Company Certified Public Accountants – #65

Income tax on gifts: Gift received from relatives is tax free | Mint – #66

Income tax on gifts: Gift received from relatives is tax free | Mint – #66

Income of Minor Child – Different types of Clubbing – #67

Income of Minor Child – Different types of Clubbing – #67

Income tax filing: Are gifts taxable? Frequently asked questions on gift taxes | Zee Business – #68

Income tax filing: Are gifts taxable? Frequently asked questions on gift taxes | Zee Business – #68

Your Queries: No tax on gift from relative but show it in ITR under exempt income – Income Tax News | The Financial Express – #69

Your Queries: No tax on gift from relative but show it in ITR under exempt income – Income Tax News | The Financial Express – #69

Gift Deed बनाकर Income Tax कैसे बचाएँ | Relative से Gift लेने वाले जरूर देखे | Expert CA Sachin – YouTube – #70

Gift Deed बनाकर Income Tax कैसे बचाएँ | Relative से Gift लेने वाले जरूर देखे | Expert CA Sachin – YouTube – #70

Income from Other Sources – CS Executive Tax Laws MCQs – GST Guntur – #71

Income from Other Sources – CS Executive Tax Laws MCQs – GST Guntur – #71

Income Tax Slab: Modi govt may increase tax exemption in Interim Budget 2024; may increase limit by Rs 50,000 | Zee Business – #72

Income Tax Slab: Modi govt may increase tax exemption in Interim Budget 2024; may increase limit by Rs 50,000 | Zee Business – #72

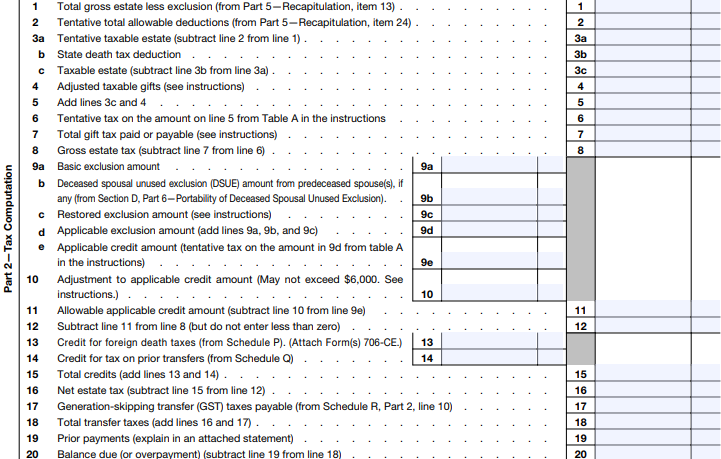

IRS Addresses Estate and Gift Tax Exemption “Claw-back” – ESA Law – #73

IRS Addresses Estate and Gift Tax Exemption “Claw-back” – ESA Law – #73

Income tax returns filing: Is gift from cousin taxable? Find out here – Money News | The Financial Express – #74

Income tax returns filing: Is gift from cousin taxable? Find out here – Money News | The Financial Express – #74

A Gift of Financial Security: Why Bonds Are a Smart Choice – #75

A Gift of Financial Security: Why Bonds Are a Smart Choice – #75

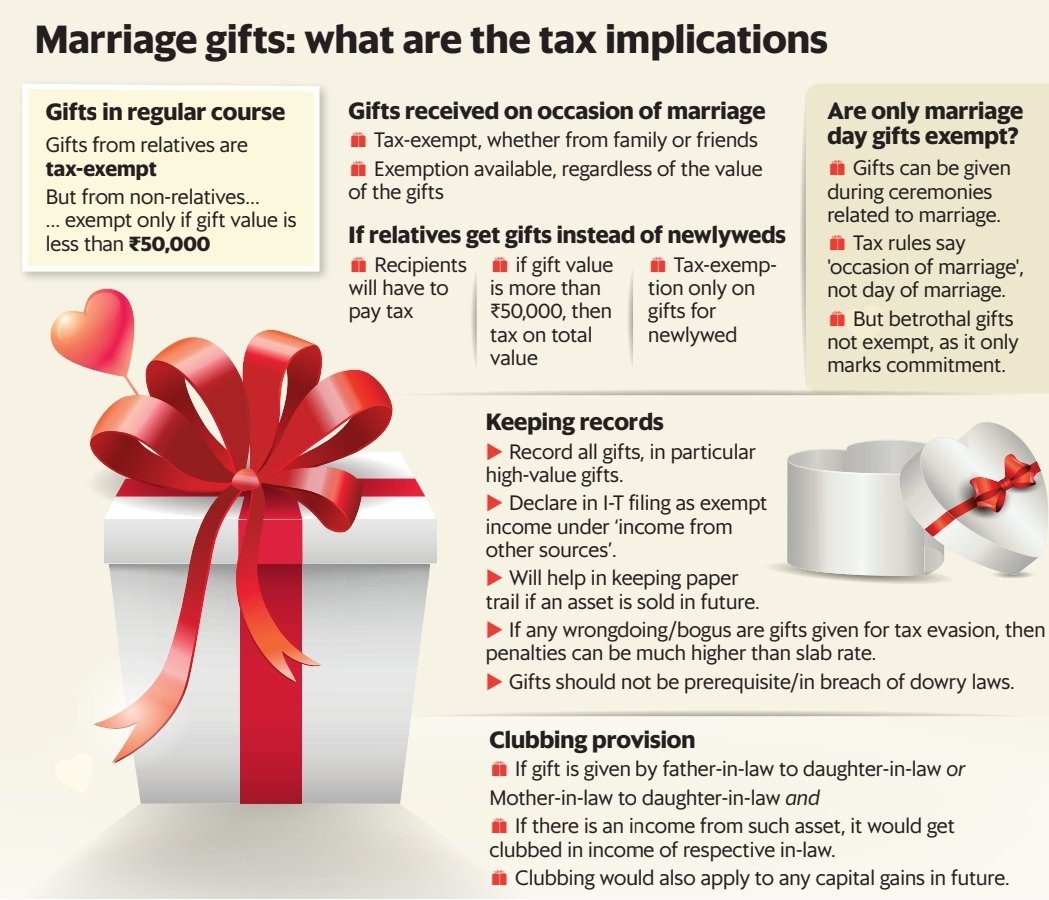

Trade Brains on X: “Wedding season is here – from November 23 to December 12! And this time the Indian wedding season will boost the country’s economy by Rs. 4.5 lakh crores – #76

Trade Brains on X: “Wedding season is here – from November 23 to December 12! And this time the Indian wedding season will boost the country’s economy by Rs. 4.5 lakh crores – #76

Estate and Gift Tax Exemption Sunset 2025: How to Prepare : Cherry Bekaert – #77

Estate and Gift Tax Exemption Sunset 2025: How to Prepare : Cherry Bekaert – #77

Lifetime Gift Tax Exemption 2023: All you need to know about it is here! | SarkariResult – #78

Lifetime Gift Tax Exemption 2023: All you need to know about it is here! | SarkariResult – #78

2021 Federal Tax Changes That You Should Know Today – Estate and Probate Legal Group – #79

2021 Federal Tax Changes That You Should Know Today – Estate and Probate Legal Group – #79

- gift tax 2023

- gift tax in india

- gift tax rate in india 2020

Section 54 of Income Tax Act – Purpose, Benefits, Exemption, Provision – #80

Section 54 of Income Tax Act – Purpose, Benefits, Exemption, Provision – #80

Gift Tax in India – Learn Gift Tax Meaning & How to Calculate the Gift Income Tax – #81

Gift Tax in India – Learn Gift Tax Meaning & How to Calculate the Gift Income Tax – #81

- gift tax meaning

- gift tax return

- lineal ascendant

Optimise Your Taxes by Gifting Money to Your Parents and Children – #82

Optimise Your Taxes by Gifting Money to Your Parents and Children – #82

How to show LIC maturity amount in ITR-Exempt lic maturity in itr || How to show exempt gift on itr – YouTube – #83

How to show LIC maturity amount in ITR-Exempt lic maturity in itr || How to show exempt gift on itr – YouTube – #83

New Jersey Gift Tax: All You Need to Know | SmartAsset – #84

New Jersey Gift Tax: All You Need to Know | SmartAsset – #84

Gift and Estate Tax Changes Coming in 2023, What You Need to Know to Prepare – Anders CPA – #85

Gift and Estate Tax Changes Coming in 2023, What You Need to Know to Prepare – Anders CPA – #85

Tax-Free Income Sources in India 2024 – #86

Tax-Free Income Sources in India 2024 – #86

CA Shilpi Goyal on LinkedIn: Gifts Received By Individual/HUF- Taxation & Exemption Under Income Tax… – #87

CA Shilpi Goyal on LinkedIn: Gifts Received By Individual/HUF- Taxation & Exemption Under Income Tax… – #87

What Is the Gift Tax? | City National Bank – #88

What Is the Gift Tax? | City National Bank – #88

Tax exemption notified for non-residents’ investments in offerings by IFSC – The Economic Times – #89

Tax exemption notified for non-residents’ investments in offerings by IFSC – The Economic Times – #89

IRS Announces 2017 Estate And Gift Tax Limits: The $11 Million Tax Break – #90

IRS Announces 2017 Estate And Gift Tax Limits: The $11 Million Tax Break – #90

NRI Gift Tax in India – Gift from NRI to Resident Indian or Vice Versa – myMoneySage Blog – #91

NRI Gift Tax in India – Gift from NRI to Resident Indian or Vice Versa – myMoneySage Blog – #91

6 Tips for Tax-Free Gifting | Mariner Wealth Advisors – #92

6 Tips for Tax-Free Gifting | Mariner Wealth Advisors – #92

Luxury Tax Newsletter by Jemimah Astrid Tayag – Issuu – #93

Luxury Tax Newsletter by Jemimah Astrid Tayag – Issuu – #93

Budget 2023 | Those earning up to ₹7 lakh a year need not pay income tax – The Hindu – #94

Budget 2023 | Those earning up to ₹7 lakh a year need not pay income tax – The Hindu – #94

Gift Received From Nephew Is Not Exempt From Taxation Under Section 56 (2) – #95

Gift Received From Nephew Is Not Exempt From Taxation Under Section 56 (2) – #95

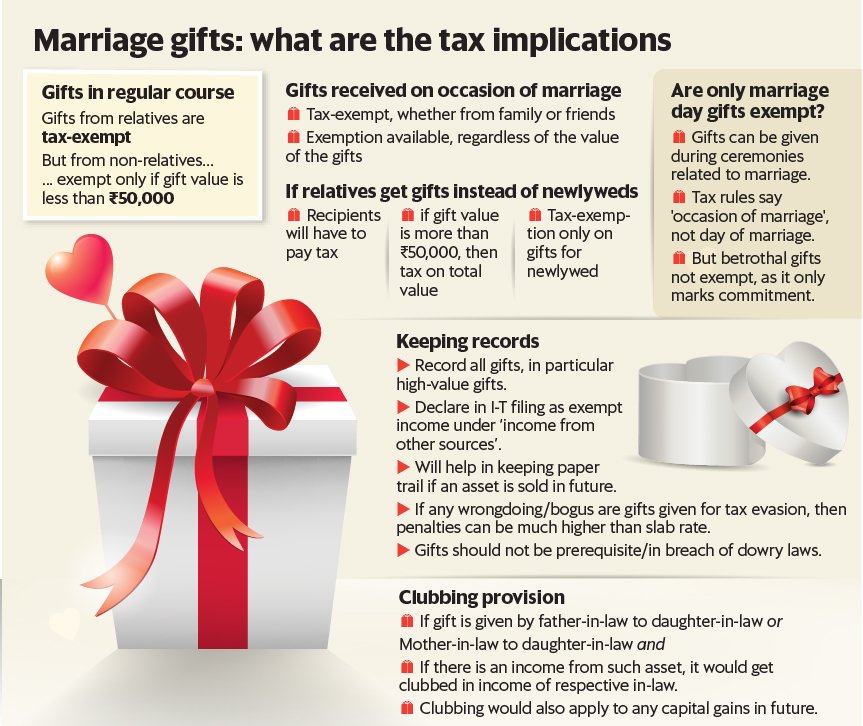

I received gifts during my wedding, are they taxable? – #96

I received gifts during my wedding, are they taxable? – #96

Understanding California Federal Estate And Gift Tax Rates – #97

Understanding California Federal Estate And Gift Tax Rates – #97

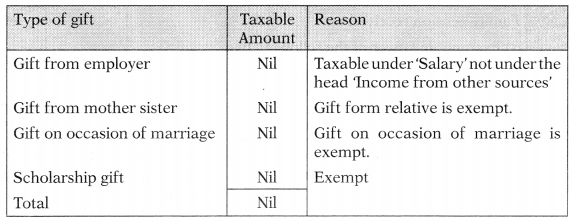

Problems On Taxable Salary Income-Additional | PDF | Tax Deduction | Employee Benefits – #98

Problems On Taxable Salary Income-Additional | PDF | Tax Deduction | Employee Benefits – #98

Tax-Related Estate Planning | Lee Kiefer & Park – #99

Tax-Related Estate Planning | Lee Kiefer & Park – #99

Section 56(2)(vii) : Cash / Non-Cash Gifts – #100

Section 56(2)(vii) : Cash / Non-Cash Gifts – #100

Gift from USA to India: Taxation and Exemptions – SBNRI – #101

Gift from USA to India: Taxation and Exemptions – SBNRI – #101

Section 281 of Income Tax Act: Guidelines and Details – #102

Section 281 of Income Tax Act: Guidelines and Details – #102

INFORMATION NOTE – MODIFICATION OF TAX EXEMPTION FOR INHERITANCE AND GIFT TAX – EBF Consulting – #103

INFORMATION NOTE – MODIFICATION OF TAX EXEMPTION FOR INHERITANCE AND GIFT TAX – EBF Consulting – #103

- gift from relative exempt from income tax

- gift tax example

- consumption tax

-Gifts.jpg) Gifts Distinguished From Exchange | PDF | Employment | Tax Exemption – #104

Gifts Distinguished From Exchange | PDF | Employment | Tax Exemption – #104

Gifting a Property in India- Everything You Need to Know – #105

Gifting a Property in India- Everything You Need to Know – #105

What is a Gift Tax and What are its Rates and Exemptions? | Fi Money – #106

What is a Gift Tax and What are its Rates and Exemptions? | Fi Money – #106

How to file ITR Income Tax Return If Gift Received | How to show Gift Received in ITR – YouTube – #107

How to file ITR Income Tax Return If Gift Received | How to show Gift Received in ITR – YouTube – #107

Will I Be Taxed When Gifting Money? – #108

Will I Be Taxed When Gifting Money? – #108

The Future Consulties – #109

The Future Consulties – #109

CBDT Exempts TDS for IFSC Units under Income Tax Act: Know Exempted Receipts – #110

CBDT Exempts TDS for IFSC Units under Income Tax Act: Know Exempted Receipts – #110

Detailed Analysis- Gifts Taxation under Income Tax Act, 1961 – #111

Detailed Analysis- Gifts Taxation under Income Tax Act, 1961 – #111

Gift Tax 2024: How much can a parent give their child in a year? | verifythis.com – #112

Gift Tax 2024: How much can a parent give their child in a year? | verifythis.com – #112

Gift Tax & The Holiday Season – Limits, Exceptions, & More – Aldridge Borden and Company – #113

Gift Tax & The Holiday Season – Limits, Exceptions, & More – Aldridge Borden and Company – #113

Section 56(2) of Income Tax Act: All You Need to Know – Marg ERP Blog – #114

Section 56(2) of Income Tax Act: All You Need to Know – Marg ERP Blog – #114

Stridhan: Income Tax Laws For Wedding Gifts That Every Indian Woman Must Know | HerZindagi – #115

Stridhan: Income Tax Laws For Wedding Gifts That Every Indian Woman Must Know | HerZindagi – #115

Income from assets transferred to spouse| clubbing of income – #116

Income from assets transferred to spouse| clubbing of income – #116

Gift Tax: Tax on gifts: Documents that you should have while filing ITR – The Economic Times – #117

Gift Tax: Tax on gifts: Documents that you should have while filing ITR – The Economic Times – #117

Section 56(2)(vii) Gift Tax – #118

Section 56(2)(vii) Gift Tax – #118

Reader’s corner: Are you liable to pay tax on property received as gift? – #119

Reader’s corner: Are you liable to pay tax on property received as gift? – #119

Types of Allowances in India: Taxable and Non Taxable Allowance 2022-23 – #120

Types of Allowances in India: Taxable and Non Taxable Allowance 2022-23 – #120

Holiday gift tax planning for IRAs – #121

Holiday gift tax planning for IRAs – #121

Gift Deed: Drafting, Registration, Stamp duty, Tax Implication, FAQ – #122

Gift Deed: Drafting, Registration, Stamp duty, Tax Implication, FAQ – #122

How to Show Gift in Income Tax Return 2023 – #123

How to Show Gift in Income Tax Return 2023 – #123

Gift Splitting: Definition, Example, and Tax Rules – #124

Gift Splitting: Definition, Example, and Tax Rules – #124

Gift Under The Income Tax Act In India – Especia – #125

Gift Under The Income Tax Act In India – Especia – #125

Tax Implications Of Gifting Inherited Property To Spouse | Capital Tax If Selling Gifted Property – #126

Tax Implications Of Gifting Inherited Property To Spouse | Capital Tax If Selling Gifted Property – #126

- section 56(2) of income tax act

- list of relatives

- import taxes

![Gift from Brother-in-Law Exempted from Tax: ITAT Deletes Addition against Narotam Sekhsariya's Relative [Read Order] | Taxscan Gift from Brother-in-Law Exempted from Tax: ITAT Deletes Addition against Narotam Sekhsariya's Relative [Read Order] | Taxscan](https://images.news18.com/ibnlive/uploads/2023/01/budgetvisuals-01-1-16746355274x3.png?impolicy\u003dwebsite\u0026width\u003d640\u0026height\u003d480) Gift from Brother-in-Law Exempted from Tax: ITAT Deletes Addition against Narotam Sekhsariya’s Relative [Read Order] | Taxscan – #127

Gift from Brother-in-Law Exempted from Tax: ITAT Deletes Addition against Narotam Sekhsariya’s Relative [Read Order] | Taxscan – #127

Gifts & Income Tax Implications : Scenarios & Examples – #128

Gifts & Income Tax Implications : Scenarios & Examples – #128

Tax sops for middle class, I-T exemption limit hiked to Rs 5 lakh | Union Budget 2019 | Manorama English – #129

Tax sops for middle class, I-T exemption limit hiked to Rs 5 lakh | Union Budget 2019 | Manorama English – #129

Gift of Property & Tax Obligation: A Comprehensive Guide | Property tax, Tax, Tax exemption – #130

Gift of Property & Tax Obligation: A Comprehensive Guide | Property tax, Tax, Tax exemption – #130

When Can We claim Exemption Under Section 54F Of Income Tax Act and When You Cant – #131

When Can We claim Exemption Under Section 54F Of Income Tax Act and When You Cant – #131

TaxHelpdesk – 👉👉Swipe left to clear all your taxation… | Facebook – #132

TaxHelpdesk – 👉👉Swipe left to clear all your taxation… | Facebook – #132

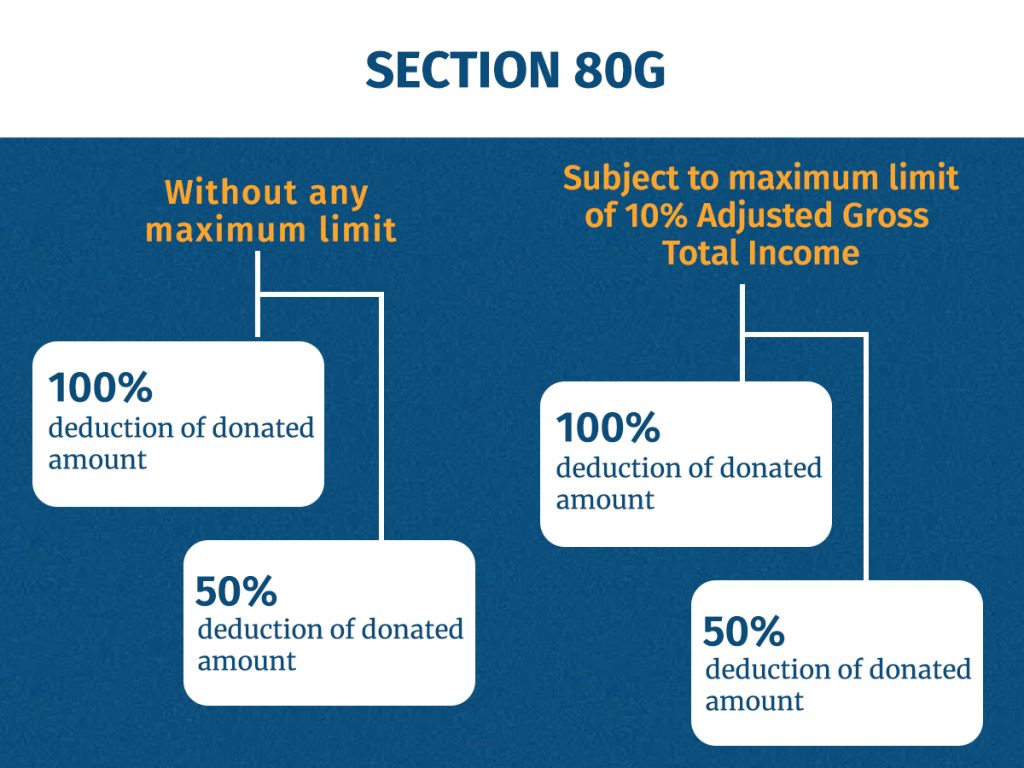

Section 80G of Income Tax Act – Complete guide to Eligibility & Deductions – #133

Section 80G of Income Tax Act – Complete guide to Eligibility & Deductions – #133

When You Make Cash Gifts To Your Children, Who Pays The Tax? | Greenbush Financial Group – #134

When You Make Cash Gifts To Your Children, Who Pays The Tax? | Greenbush Financial Group – #134

Gift Tax Reporting for US Citizens (Guidelines) – #135

Gift Tax Reporting for US Citizens (Guidelines) – #135

Section 56 – Exemption from Taxation on Wedding Gifts | Fincash – #136

Section 56 – Exemption from Taxation on Wedding Gifts | Fincash – #136

Taxation of gifts in Tamil | Under Income tax | Exemption for gifts | #gifts #incometax – YouTube – #137

Taxation of gifts in Tamil | Under Income tax | Exemption for gifts | #gifts #incometax – YouTube – #137

India exempts tax on investments in alternative funds in GIFT City | Asia Asset Management – #138

India exempts tax on investments in alternative funds in GIFT City | Asia Asset Management – #138

What You Need to Know About the Gift Tax – TheStreet – #139

What You Need to Know About the Gift Tax – TheStreet – #139

- personal exemption

- capital gains tax

- gift chart as per income tax

What is a gift deed and tax implications | Tax Hack – #140

What is a gift deed and tax implications | Tax Hack – #140

Expanded Federal Tax Exclusions and Exemptions Mean Greater Opportunities for New Yorkers – Lexology – #141

Expanded Federal Tax Exclusions and Exemptions Mean Greater Opportunities for New Yorkers – Lexology – #141

When Gifts Become Taxing – #142

When Gifts Become Taxing – #142

गिफ्ट लेना तो ठीक, लेकिन देने पर भी बढ़ता जाता है Tax का बोझ, जानें कौन सी स्थिति में भरना होता है टैक्स | Zee Business Hindi – #143

गिफ्ट लेना तो ठीक, लेकिन देने पर भी बढ़ता जाता है Tax का बोझ, जानें कौन सी स्थिति में भरना होता है टैक्स | Zee Business Hindi – #143

Bill of amendments to the Mexican federal income tax law inheritance, bequest and gift tax – #144

Bill of amendments to the Mexican federal income tax law inheritance, bequest and gift tax – #144

Taxbility Of Salary Income – Notes – LearnPick India – #145

Taxbility Of Salary Income – Notes – LearnPick India – #145

How much money can I gift to someone? – #146

How much money can I gift to someone? – #146

3. Inheritance, estate, and gift tax design in OECD countries | Inheritance Taxation in OECD Countries | OECD iLibrary – #147

3. Inheritance, estate, and gift tax design in OECD countries | Inheritance Taxation in OECD Countries | OECD iLibrary – #147

What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #148

What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #148

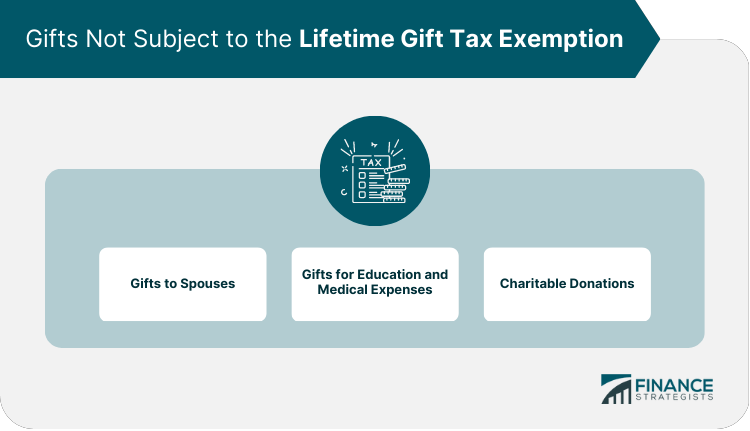

Gifting Strategies for Estate Planning | Finance Strategists – #149

Gifting Strategies for Estate Planning | Finance Strategists – #149

All you need to know about tax on gifts – #150

All you need to know about tax on gifts – #150

CBDT exempts GIFT City aircraft leasing cos from withholding on dividend distributed inter se, but is it enough? | India Tax Law – #151

CBDT exempts GIFT City aircraft leasing cos from withholding on dividend distributed inter se, but is it enough? | India Tax Law – #151

Tax Exempt | Importance of Tax Exempt | Tax Exempt Interest – #152

Tax Exempt | Importance of Tax Exempt | Tax Exempt Interest – #152

Income Tax Laws On Loans, Gifts And Cash Credit | PaySense – #153

Income Tax Laws On Loans, Gifts And Cash Credit | PaySense – #153

Countdown for Gift and Estate Tax Exemptions | Charles Schwab – #154

Countdown for Gift and Estate Tax Exemptions | Charles Schwab – #154

Income Tax on Winning Lottery, Game Shows, Awards, and Prizes – #155

Income Tax on Winning Lottery, Game Shows, Awards, and Prizes – #155

Farewell to the Current Gift and Estate Tax Exemption? – #156

Farewell to the Current Gift and Estate Tax Exemption? – #156

All About Allowances & Income Tax Exemption| CA Rajput Jain – #157

All About Allowances & Income Tax Exemption| CA Rajput Jain – #157

) Gift Tax in India: Implications & Exemptions – myMoneySage Blog – #158

Gift Tax in India: Implications & Exemptions – myMoneySage Blog – #158

Tax on the gift from father to daughter – #159

Tax on the gift from father to daughter – #159

What is Gift Tax? – Exemption and Limits on Gifts for FY 2023-24 – #160

What is Gift Tax? – Exemption and Limits on Gifts for FY 2023-24 – #160

What is the Gift Tax in India and How Does it Affect NRIs? – #161

What is the Gift Tax in India and How Does it Affect NRIs? – #161

Section 54F of Income Tax Act | Tax Benefits On Capital Gains – #162

Section 54F of Income Tax Act | Tax Benefits On Capital Gains – #162

Save tax by Gifting – Gift Tax Part 3 | Can I save tax by giving Gift? – YouTube – #163

Save tax by Gifting – Gift Tax Part 3 | Can I save tax by giving Gift? – YouTube – #163

Projecting the Year-by-Year Estate and Gift Tax Exemption Amount – Ultimate Estate Planner – #164

Projecting the Year-by-Year Estate and Gift Tax Exemption Amount – Ultimate Estate Planner – #164

Tax on Gifts | Income tax on Gifts | list of relatives | Income Tax On gift Money – YouTube – #165

Tax on Gifts | Income tax on Gifts | list of relatives | Income Tax On gift Money – YouTube – #165

Know All About Tax on Inheritance in India – #166

Know All About Tax on Inheritance in India – #166

Taxability of Gifts in India – #167

Taxability of Gifts in India – #167

Gifts received from non-relatives of above Rs 50,000 a year are taxable – #168

Gifts received from non-relatives of above Rs 50,000 a year are taxable – #168

12 Common Types of Non Taxable Income You Write Off – #169

12 Common Types of Non Taxable Income You Write Off – #169

Weddings and tax implications of cash gifts | Mint – #170

Weddings and tax implications of cash gifts | Mint – #170

Not for Profit: Definitions and What It Means for Taxes – #171

Not for Profit: Definitions and What It Means for Taxes – #171

Annual Gift Tax Exclusion vs. Lifetime Gift Tax Exemption – #172

Annual Gift Tax Exclusion vs. Lifetime Gift Tax Exemption – #172

2017 Year-End Individual Tax Planning in Light of New Tax Legislation | Steptoe – #173

2017 Year-End Individual Tax Planning in Light of New Tax Legislation | Steptoe – #173

So You Used Up All of Your Gift and Estate Tax Exemption, Now What? – #174

So You Used Up All of Your Gift and Estate Tax Exemption, Now What? – #174

Income Tax News: Are Wedding Presents Really Tax-Free? Unveiling the Gift Exemption Details – #175

Income Tax News: Are Wedding Presents Really Tax-Free? Unveiling the Gift Exemption Details – #175

Income Tax On gift Money | How much money is tax free in gift | Section 56 of income tax act 2023 – YouTube – #176

Income Tax On gift Money | How much money is tax free in gift | Section 56 of income tax act 2023 – YouTube – #176

![Income Tax Deductions under Section 10 [2024] Income Tax Deductions under Section 10 [2024]](https://arthgyaan.com/assets/images/how-much-money-can-nris-in-the-us-gift-to-their-parents-in-india-in-2024.jpg) Income Tax Deductions under Section 10 [2024] – #177

Income Tax Deductions under Section 10 [2024] – #177

Posts: exempted gift income

Categories: Gifts

Author: toyotabienhoa.edu.vn