Aggregate 207+ exempt gifts under income tax best

Top images of exempt gifts under income tax by website toyotabienhoa.edu.vn compilation. Careful with Those Gifts – Simple Gifting Principles | MONTAG Wealth Management. Create HUF to save tax and Other Important Aspects of HUF Under Income Tax, 1961 – Income Tax News, Judgments, Act, Analysis, Tax Planning, Advisory, E filing of returns, CA Students. Taxation on gifts: Everything you need to know | Tax Hacks

A Comprehensive guide on gift tax in India – How are gifts taxed? – #1

A Comprehensive guide on gift tax in India – How are gifts taxed? – #1

Indian Taxes Explained: Income Tax, GST, TDS, and More. Ask Us – #2

Indian Taxes Explained: Income Tax, GST, TDS, and More. Ask Us – #2

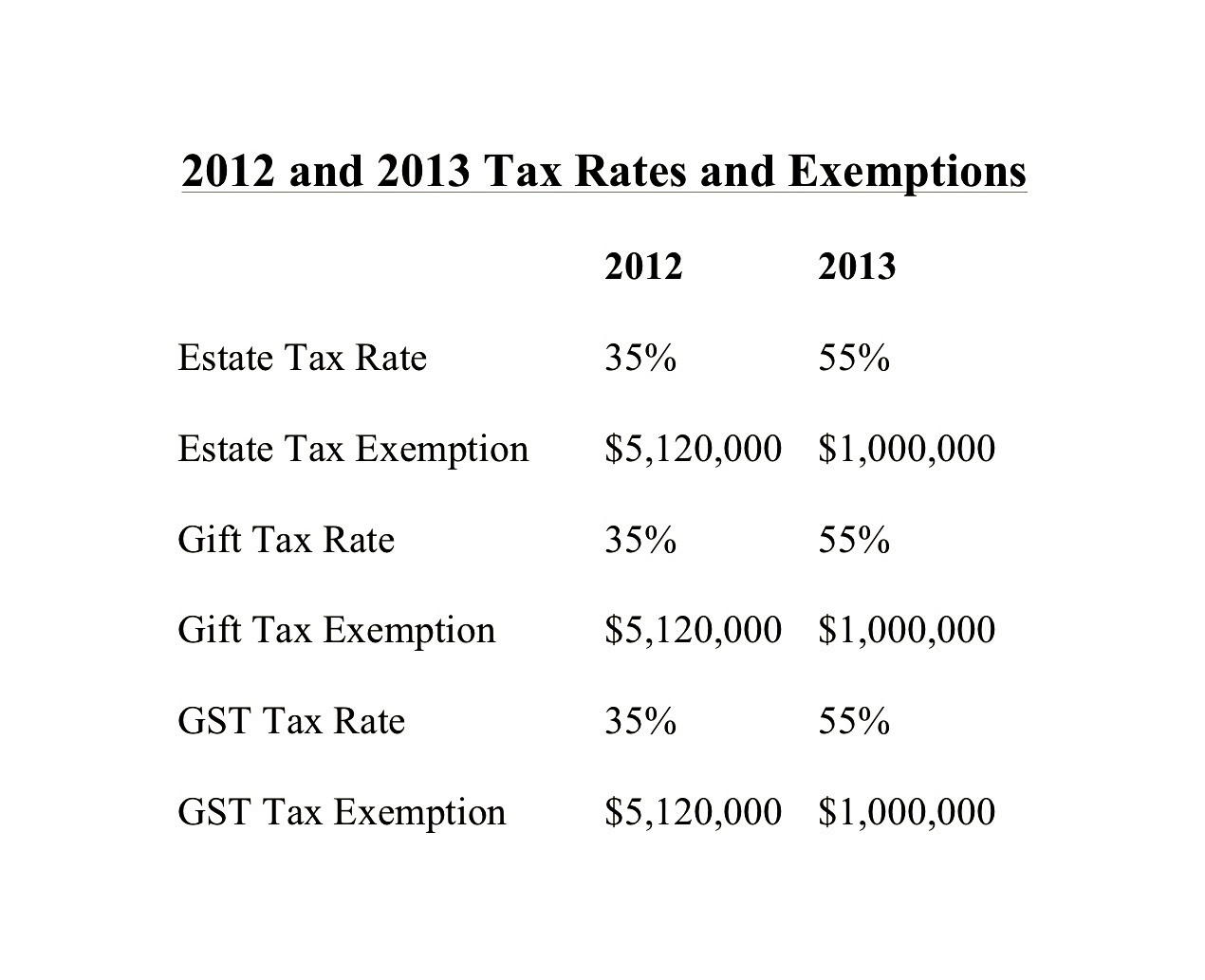

Good News for the Rich: No Clawback on the Recent Doubled Tax Exemption for Estates and Gifts – Certified Tax Coach – #4

Good News for the Rich: No Clawback on the Recent Doubled Tax Exemption for Estates and Gifts – Certified Tax Coach – #4

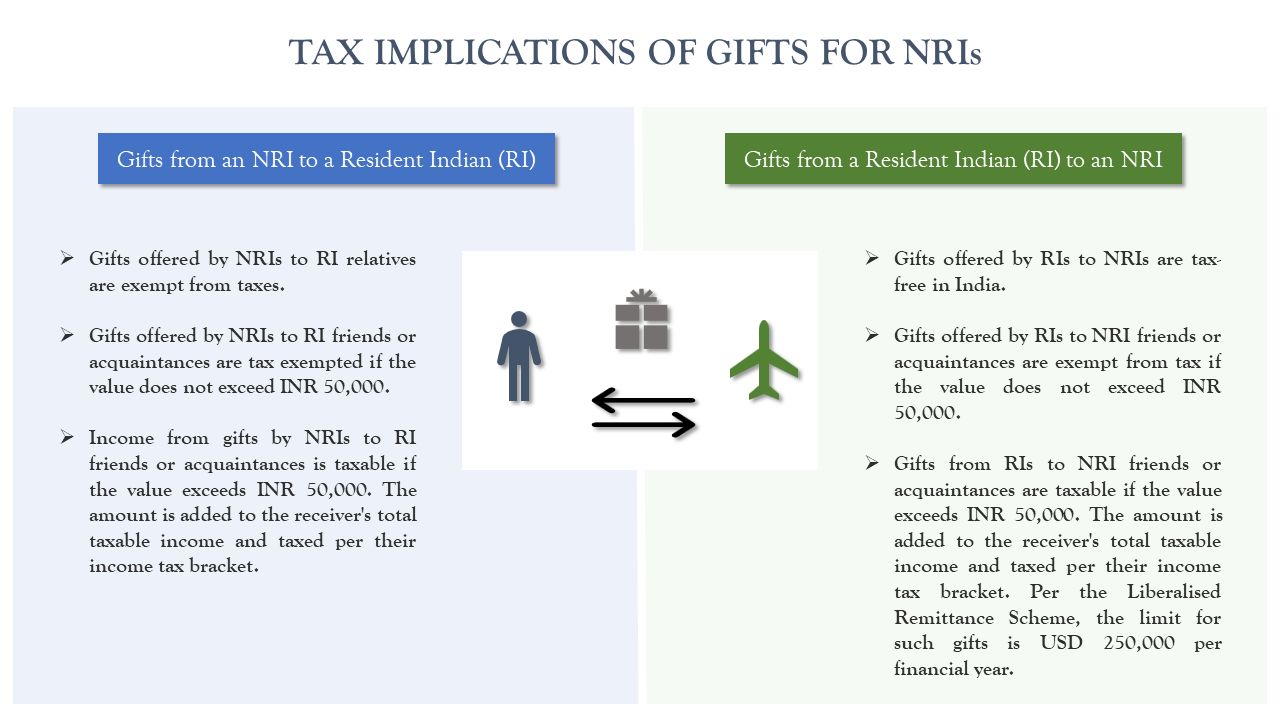

Taxation of gifts to NRIs and changes in Budget 2023-24 – #5

Taxation of gifts to NRIs and changes in Budget 2023-24 – #5

- exempted incomes

- lineal ascendant gift from relative exempt from income tax

- estate tax exemption 2022

The Ultimate Guide to Form 709: An Intro – #6

The Ultimate Guide to Form 709: An Intro – #6

Income Tax for NRI’s: How to File Income Tax Return for NRI’s – #7

Income Tax for NRI’s: How to File Income Tax Return for NRI’s – #7

Taxability on gifts, rewards and rewards given to Sportsperson / Olympic Participants – #8

Taxability on gifts, rewards and rewards given to Sportsperson / Olympic Participants – #8

- gift tax act 1958

- gift tax example

- gift tax return

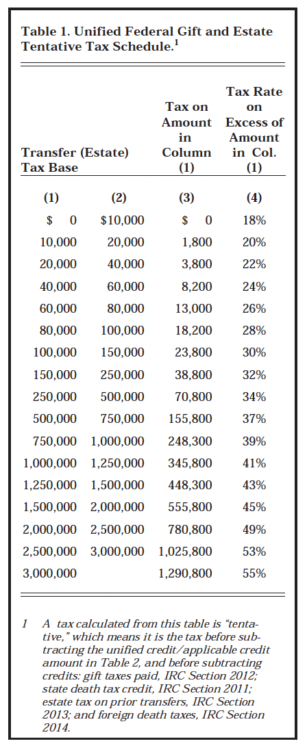

Understanding Federal Estate and Gift Taxes | Congressional Budget Office – #10

Understanding Federal Estate and Gift Taxes | Congressional Budget Office – #10

What it Means to Make a Gift Under the Federal Gift Tax System – Agency One – #11

What it Means to Make a Gift Under the Federal Gift Tax System – Agency One – #11

ITR filing — gifts need to be declared and here you see how they are taxed – #12

ITR filing — gifts need to be declared and here you see how they are taxed – #12

-Gifts.jpg) Tax on Other Sources of Income: Dividend, Lottery, Bank Interest – #13

Tax on Other Sources of Income: Dividend, Lottery, Bank Interest – #13

![Gifting Strategies in Florida [An Important Estate Planning Consideration] - Estate Planning Attorney | Gibbs Law - Fort Myers, FL Gifting Strategies in Florida [An Important Estate Planning Consideration] - Estate Planning Attorney | Gibbs Law - Fort Myers, FL](https://www.wealthmanagement.com/sites/wealthmanagement.com/files/styles/article_featured_retina/public/dollar-bow.jpg?itok\u003d9bMsWBwD) Gifting Strategies in Florida [An Important Estate Planning Consideration] – Estate Planning Attorney | Gibbs Law – Fort Myers, FL – #14

Gifting Strategies in Florida [An Important Estate Planning Consideration] – Estate Planning Attorney | Gibbs Law – Fort Myers, FL – #14

Tax Free Income: Big News! There is no tax on this income, know why exemption is available under Income Tax Act – informalnewz – #15

Tax Free Income: Big News! There is no tax on this income, know why exemption is available under Income Tax Act – informalnewz – #15

Exemptions Under Section 10 ! Check here to know further – #16

Exemptions Under Section 10 ! Check here to know further – #16

Income Tax Returns (ITR) filing top hack: How you can gift and still save tax on top of HRA, tuition fee, more | Zee Business – #17

Income Tax Returns (ITR) filing top hack: How you can gift and still save tax on top of HRA, tuition fee, more | Zee Business – #17

- gift tax

- estate tax exemption history

- gift tax definition

- gift tax exemption relatives list

- inheritance estate tax

- gift tax returns irs completed sample form 709 sample

Taxability of Gifts in India – #18

Taxability of Gifts in India – #18

Amendments in Income Tax Act: IPOs, bonus issue, share gifts exempted from capital gains tax – BusinessToday – #19

Amendments in Income Tax Act: IPOs, bonus issue, share gifts exempted from capital gains tax – BusinessToday – #19

Gift Tax: How Much Is It and Who Pays It? – #20

Gift Tax: How Much Is It and Who Pays It? – #20

Stridhan: Income Tax Laws For Wedding Gifts That Every Indian Woman Must Know | HerZindagi – #21

Stridhan: Income Tax Laws For Wedding Gifts That Every Indian Woman Must Know | HerZindagi – #21

How is the gifting of money or property to a relative taxed? | Mint – #22

How is the gifting of money or property to a relative taxed? | Mint – #22

In India, is sending money to sister as a gift taxable or not? How much money can be sent? – Quora – #23

In India, is sending money to sister as a gift taxable or not? How much money can be sent? – Quora – #23

Tax On Gifts: As Festive Season Nears, Know Tax Implications On Gifts You Receive – News18 – #24

Tax On Gifts: As Festive Season Nears, Know Tax Implications On Gifts You Receive – News18 – #24

- gift tax rate in india 2020

- lineal ascendant

- wealth tax

Practical Tax Planning – #25

Practical Tax Planning – #25

Taxation of Gifts received in Cash or Kind – #26

Taxation of Gifts received in Cash or Kind – #26

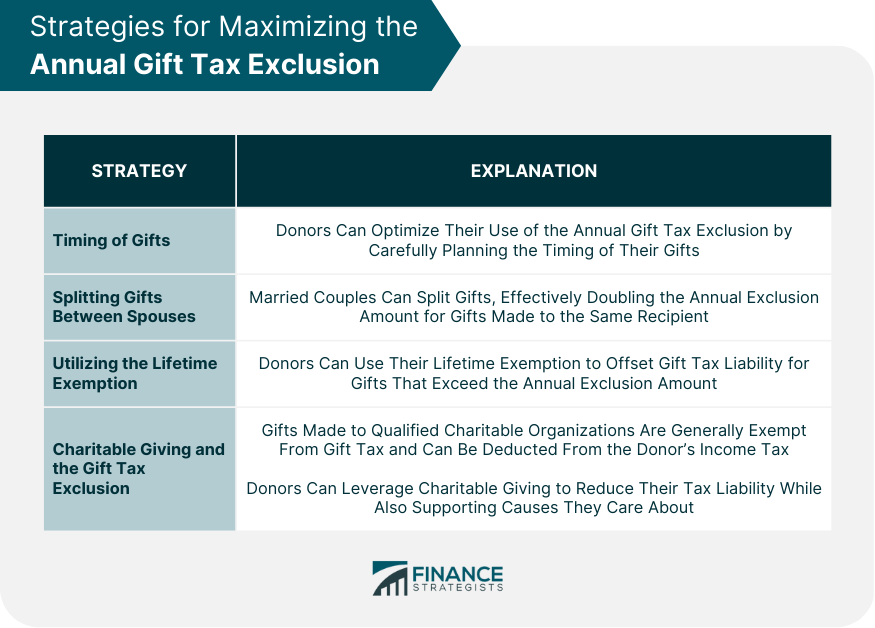

The Benefits of Gifting: A Tool for Estate Planning and Tax Savings – #27

The Benefits of Gifting: A Tool for Estate Planning and Tax Savings – #27

A Simple Solution to the Estate & Gift Tax Quandary – Agency One – #28

A Simple Solution to the Estate & Gift Tax Quandary – Agency One – #28

TaxManntri Consultancy Private Limited – Tax-free! In India, gifts received during a wedding are generally exempt from income tax. Visit our website: www.taxmanntri.com Contact Us: 9519533133 | 9890358772 #TaxMantri #Indiantax #taxconsultant #taxation # – #29

TaxManntri Consultancy Private Limited – Tax-free! In India, gifts received during a wedding are generally exempt from income tax. Visit our website: www.taxmanntri.com Contact Us: 9519533133 | 9890358772 #TaxMantri #Indiantax #taxconsultant #taxation # – #29

taxes – How gifting money to Parents helps in Tax saving in India? – Personal Finance & Money Stack Exchange – #30

taxes – How gifting money to Parents helps in Tax saving in India? – Personal Finance & Money Stack Exchange – #30

Historic Estate Tax Window Closing: Guide to Leveraging Your Exemption | Northwestern Mutual – #31

Historic Estate Tax Window Closing: Guide to Leveraging Your Exemption | Northwestern Mutual – #31

Will You Owe a Gift Tax This Year? – #32

Will You Owe a Gift Tax This Year? – #32

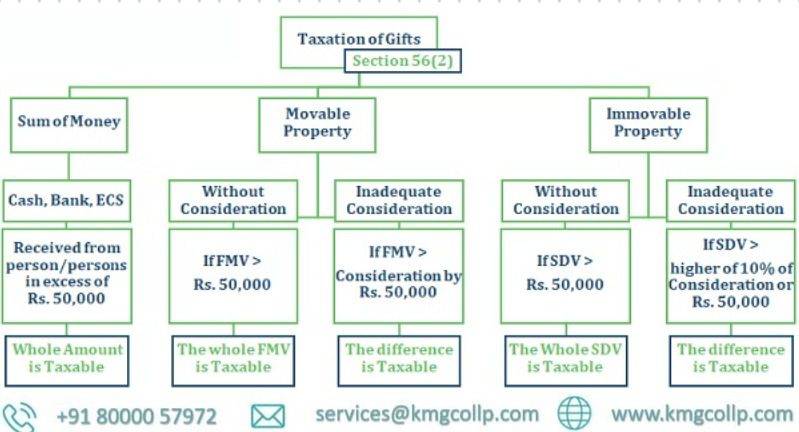

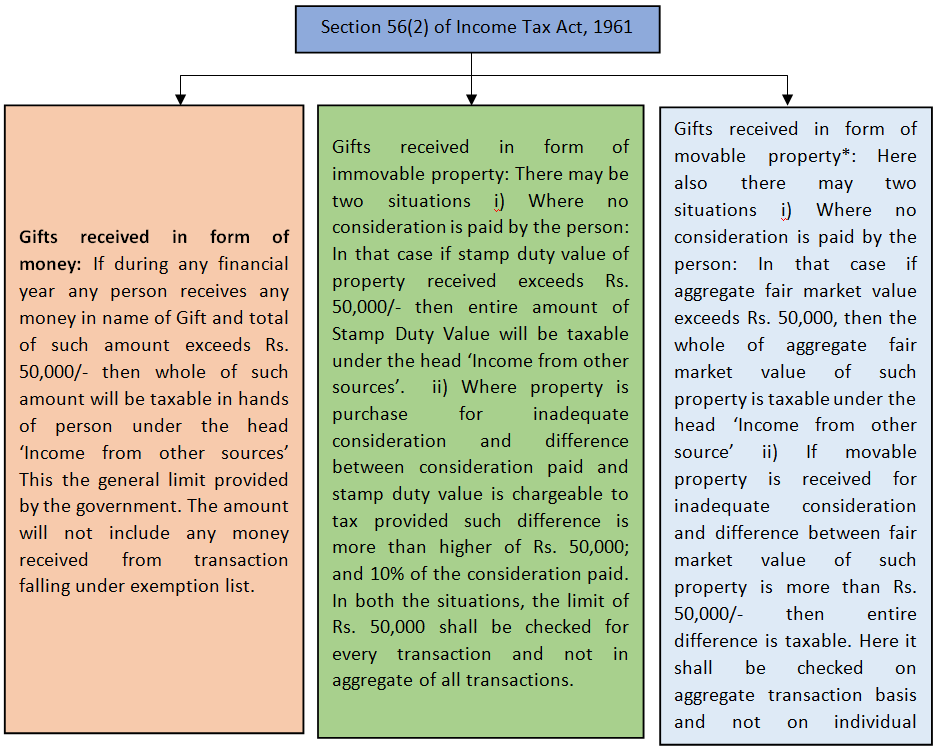

Gift Tax Under Section 56(2)x – #33

Gift Tax Under Section 56(2)x – #33

Section 112A of Income Tax Act – What is Form 10A and How to File It Online? – Tax2win – #34

Section 112A of Income Tax Act – What is Form 10A and How to File It Online? – Tax2win – #34

Gift Tax | Gift Tax In India | Gift Tax under Income Tax | Tax on Gift – #35

Gift Tax | Gift Tax In India | Gift Tax under Income Tax | Tax on Gift – #35

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #36

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #36

Income Tax Return Filing: Are wedding gifts really tax free? All hidden clauses, conditions explained | Zee Business – #37

Income Tax Return Filing: Are wedding gifts really tax free? All hidden clauses, conditions explained | Zee Business – #37

ITR filing: Are gifts taxable in India? Salient clauses all income taxpayers must know | Zee Business – #38

ITR filing: Are gifts taxable in India? Salient clauses all income taxpayers must know | Zee Business – #38

About Income Tax | PDF – #39

About Income Tax | PDF – #39

Scheme of Taxation of Undisclosed Income | Taxmann – #40

Scheme of Taxation of Undisclosed Income | Taxmann – #40

Income Tax Basic Concepts: A Comprehensive Guide – Tax2win – #41

Income Tax Basic Concepts: A Comprehensive Guide – Tax2win – #41

Gift Tax Limit 2024: How Much Can You Give Tax-Free? | Kiplinger – #42

Gift Tax Limit 2024: How Much Can You Give Tax-Free? | Kiplinger – #42

Tax Cuts and Jobs Act Impact | U.S. Bank – #43

Tax Cuts and Jobs Act Impact | U.S. Bank – #43

A Guide for Understanding the U.S. Federal Gift Tax Rules – Sprouse Shrader Smith – #44

A Guide for Understanding the U.S. Federal Gift Tax Rules – Sprouse Shrader Smith – #44

HEADS OF INCOME AND ITS JUSTIFICATION – Legal Vidhiya – #45

HEADS OF INCOME AND ITS JUSTIFICATION – Legal Vidhiya – #45

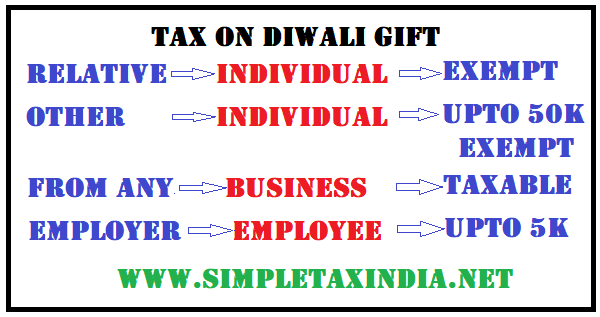

Income Tax on Diwali Gifts: All You Need to Know – #46

Income Tax on Diwali Gifts: All You Need to Know – #46

Know the Income Tax Slabs for 2023-24: Maximize Your Savings – #47

Know the Income Tax Slabs for 2023-24: Maximize Your Savings – #47

The Importance of Filing Gift Tax Returns – #48

The Importance of Filing Gift Tax Returns – #48

2024 Tax Year Estate Planning Related Tax Exemption Figures as Adjusted for Inflation – Morgan and DiSalvo, P.C. – #49

2024 Tax Year Estate Planning Related Tax Exemption Figures as Adjusted for Inflation – Morgan and DiSalvo, P.C. – #49

Tax On Diwali Gifts: Tax Rate, Exemption, Limit; Here’s Everything You Need To Know – News18 – #50

Tax On Diwali Gifts: Tax Rate, Exemption, Limit; Here’s Everything You Need To Know – News18 – #50

2023 Estate Planning Update | Helsell Fetterman – #51

2023 Estate Planning Update | Helsell Fetterman – #51

Tax on Gifting Crypto, NFT, VDA in India – #52

Tax on Gifting Crypto, NFT, VDA in India – #52

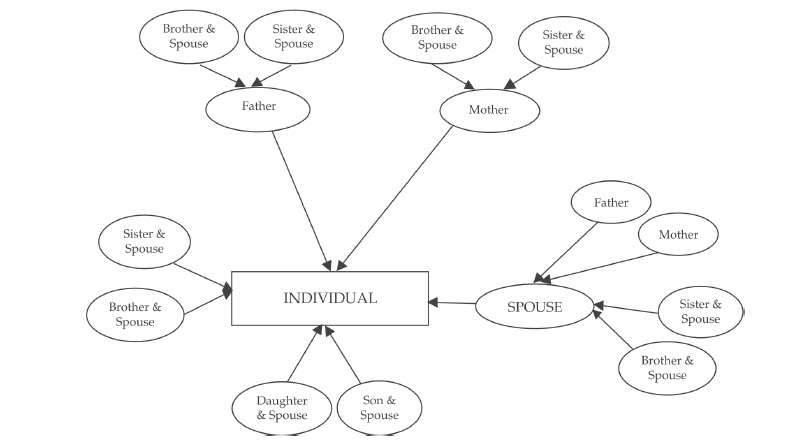

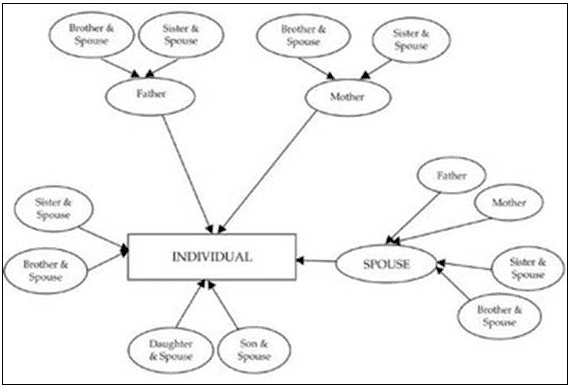

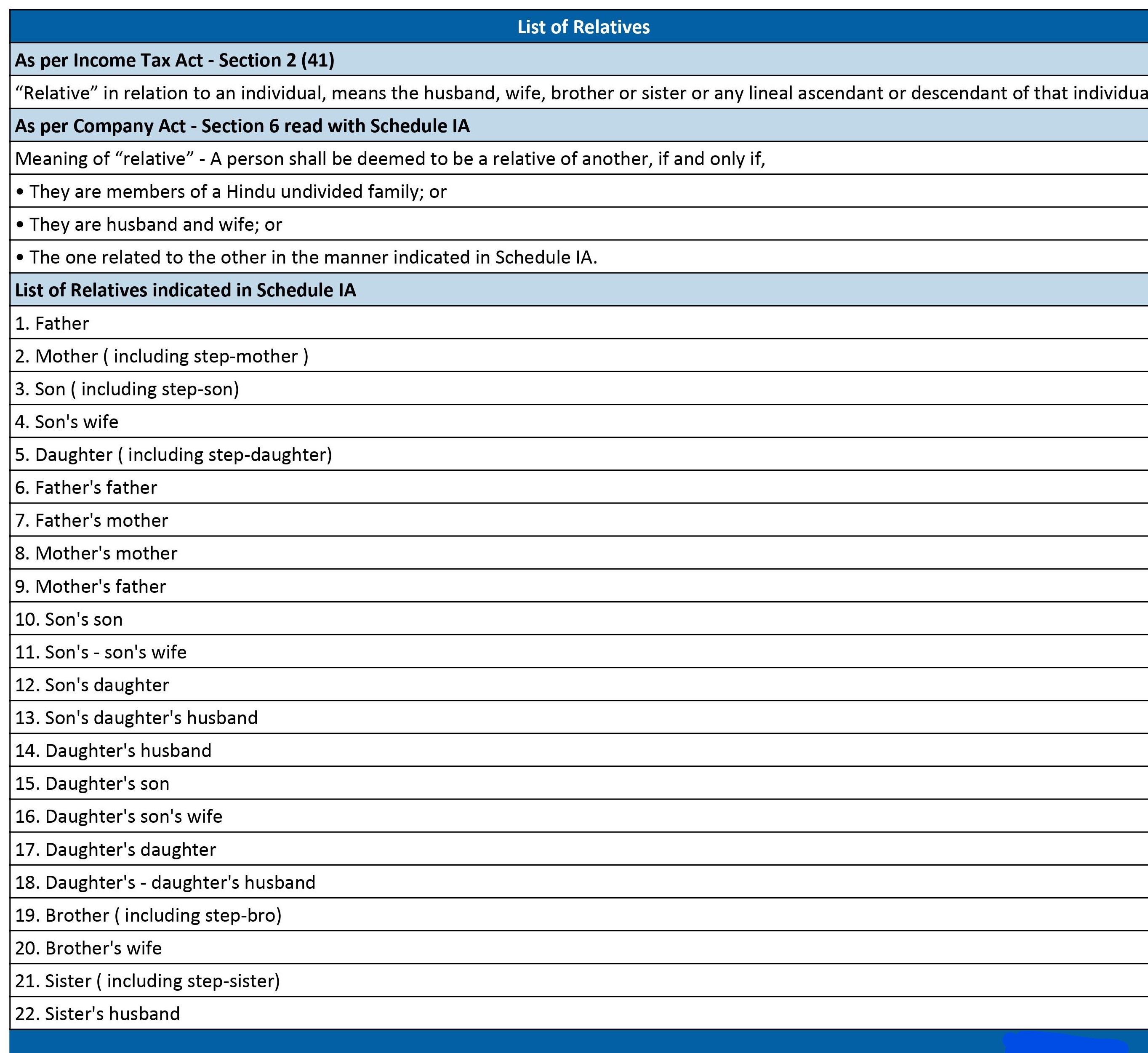

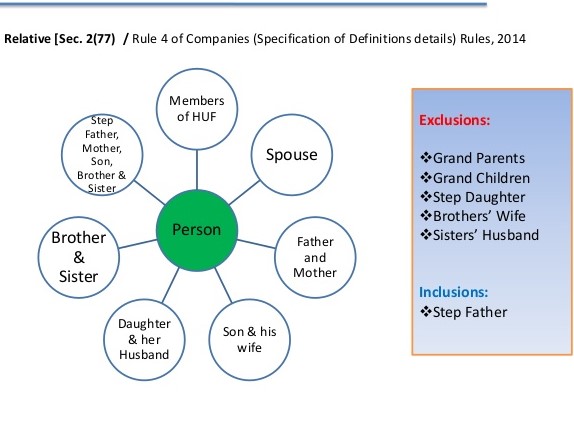

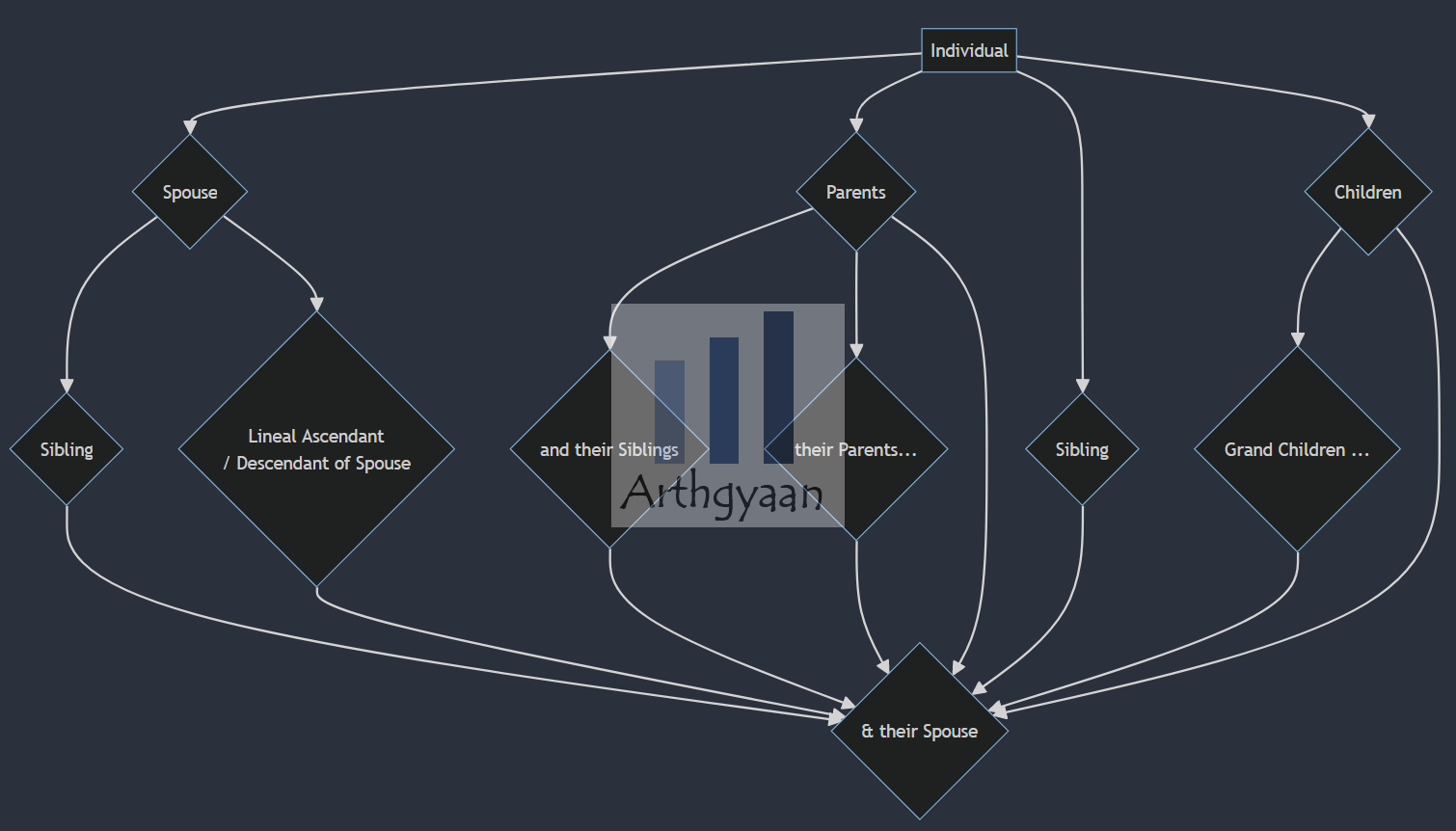

Analysis of definition of “Relative” under different Act – #53

Analysis of definition of “Relative” under different Act – #53

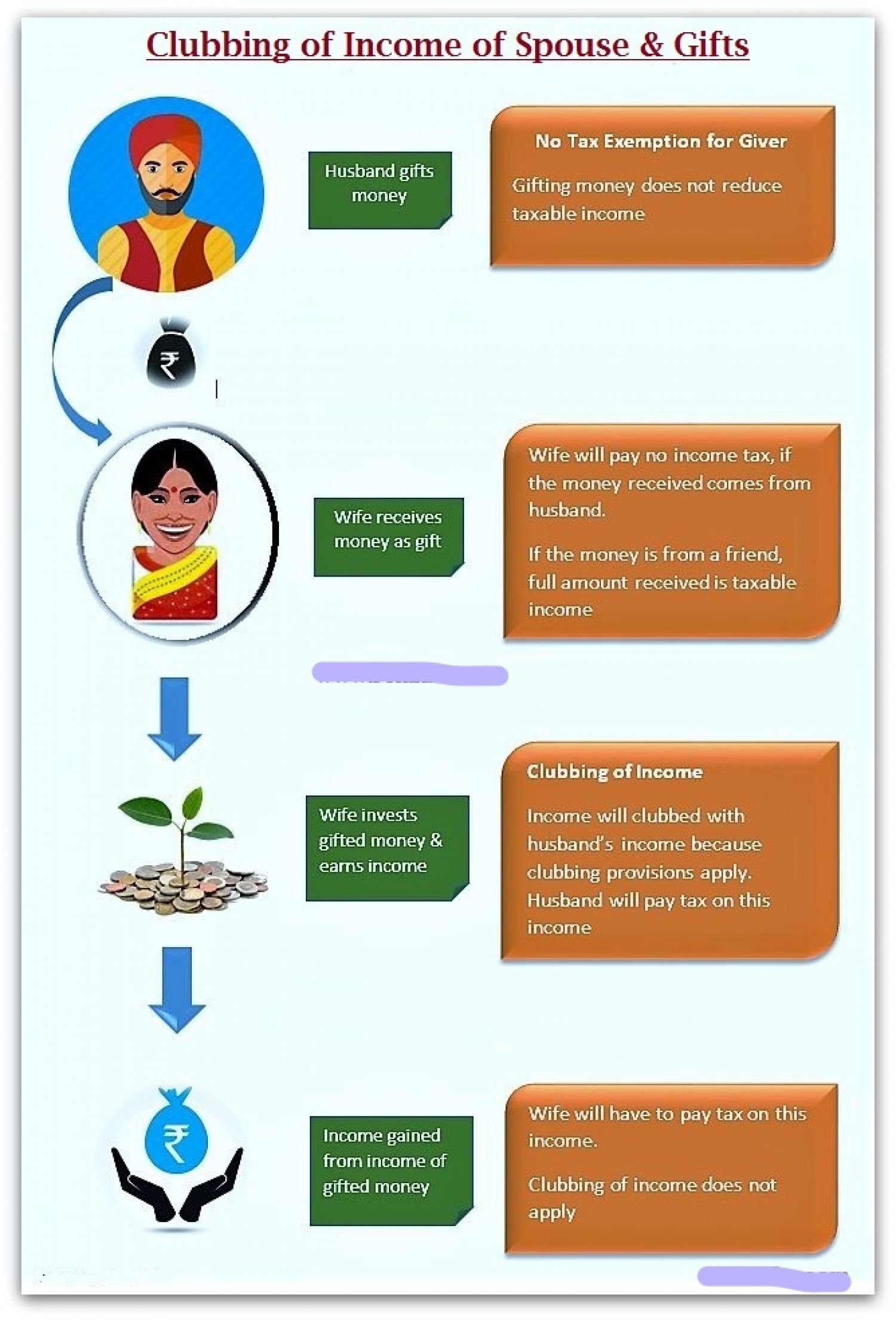

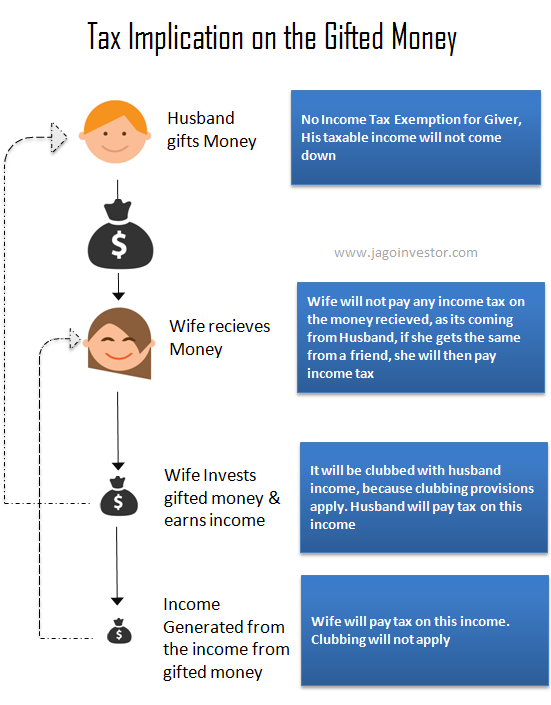

Clubbing of Income under Section 64 & 27- TaxHelpdesk – #54

Clubbing of Income under Section 64 & 27- TaxHelpdesk – #54

The $10M Gift Tax Exemption Rules | JMV Law – #55

The $10M Gift Tax Exemption Rules | JMV Law – #55

Gift Tax Exclusion Increases for 2024: How to Get the Most Benefit – CPA Practice Advisor – #56

Gift Tax Exclusion Increases for 2024: How to Get the Most Benefit – CPA Practice Advisor – #56

Gift, Estate and Income Tax Planning Opportunities | Marcum LLP | Accountants and Advisors – #57

Gift, Estate and Income Tax Planning Opportunities | Marcum LLP | Accountants and Advisors – #57

Gifts received by a newly-wed couple as wedding presents are tax-exempt. Follow @mylegalaid.in for regular law updates Follow @lawspeaks… | Instagram – #58

Gifts received by a newly-wed couple as wedding presents are tax-exempt. Follow @mylegalaid.in for regular law updates Follow @lawspeaks… | Instagram – #58

Estate Tax Exemption Increased for 2024 – Anchin, Block & Anchin LLP – #59

Estate Tax Exemption Increased for 2024 – Anchin, Block & Anchin LLP – #59

Is it possible to save tax in India under new regime of income tax act? – Quora – #60

Is it possible to save tax in India under new regime of income tax act? – Quora – #60

Gift Tax 2024: How much can a parent give their child in a year? | verifythis.com – #61

Gift Tax 2024: How much can a parent give their child in a year? | verifythis.com – #61

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #62

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #62

Do I Need to File a Gift Tax Return? – Retirement Daily on TheStreet: Finance and Retirement Advice, Analysis, and More – #63

Do I Need to File a Gift Tax Return? – Retirement Daily on TheStreet: Finance and Retirement Advice, Analysis, and More – #63

Taxability of gifts under Income Tax Act | PDF – #64

Taxability of gifts under Income Tax Act | PDF – #64

What You Need to Know About NRI Gift Tax in India | Personal Finance News | Zee News – #65

What You Need to Know About NRI Gift Tax in India | Personal Finance News | Zee News – #65

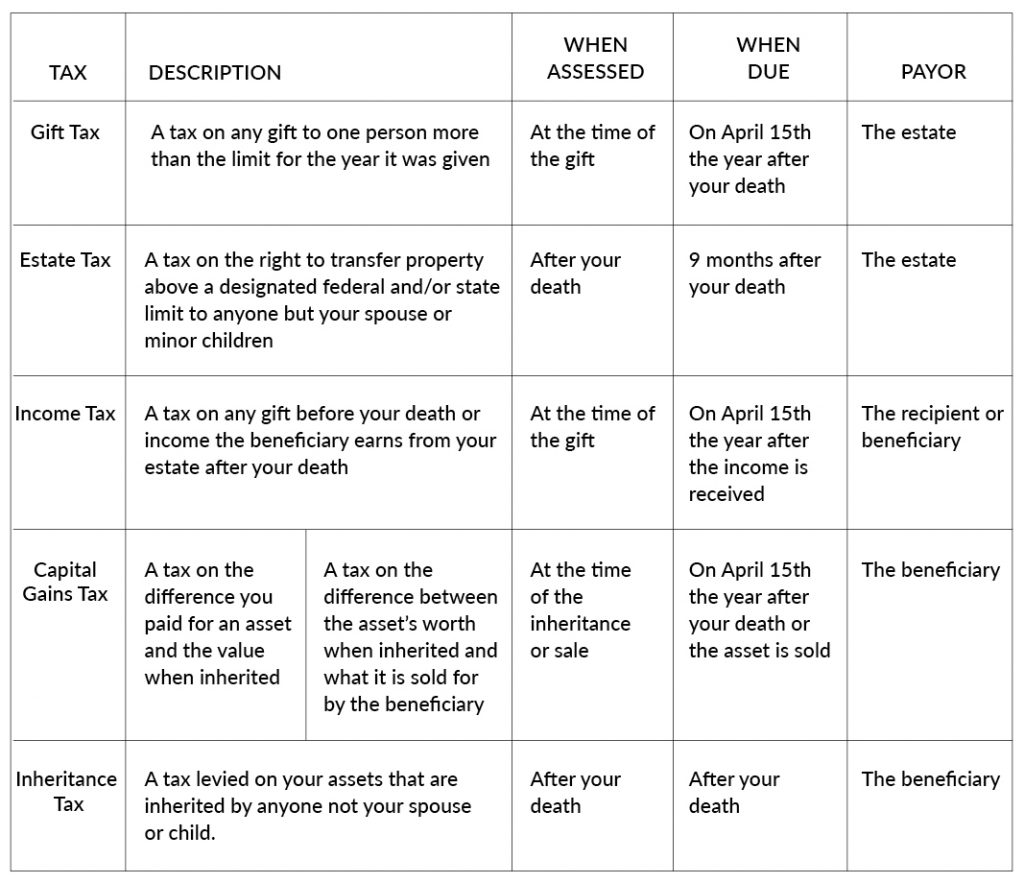

Types of Tax – Exemptions, Due Dates & Penalties – #66

Types of Tax – Exemptions, Due Dates & Penalties – #66

Interplay of Will, Gift and Relinquishment Deed in the Indian context – COMMERCIAL LAW BLOG – #67

Interplay of Will, Gift and Relinquishment Deed in the Indian context – COMMERCIAL LAW BLOG – #67

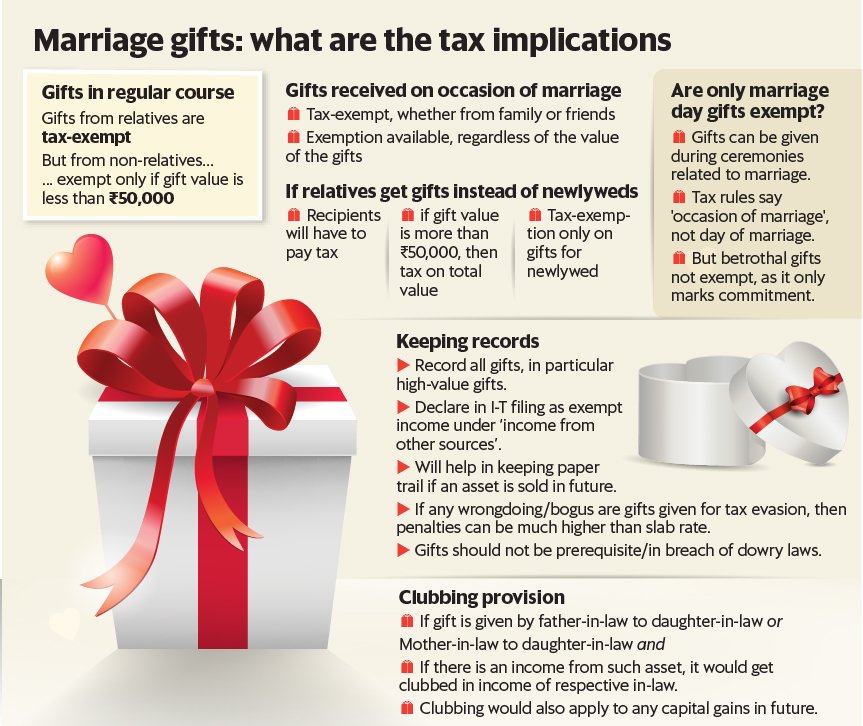

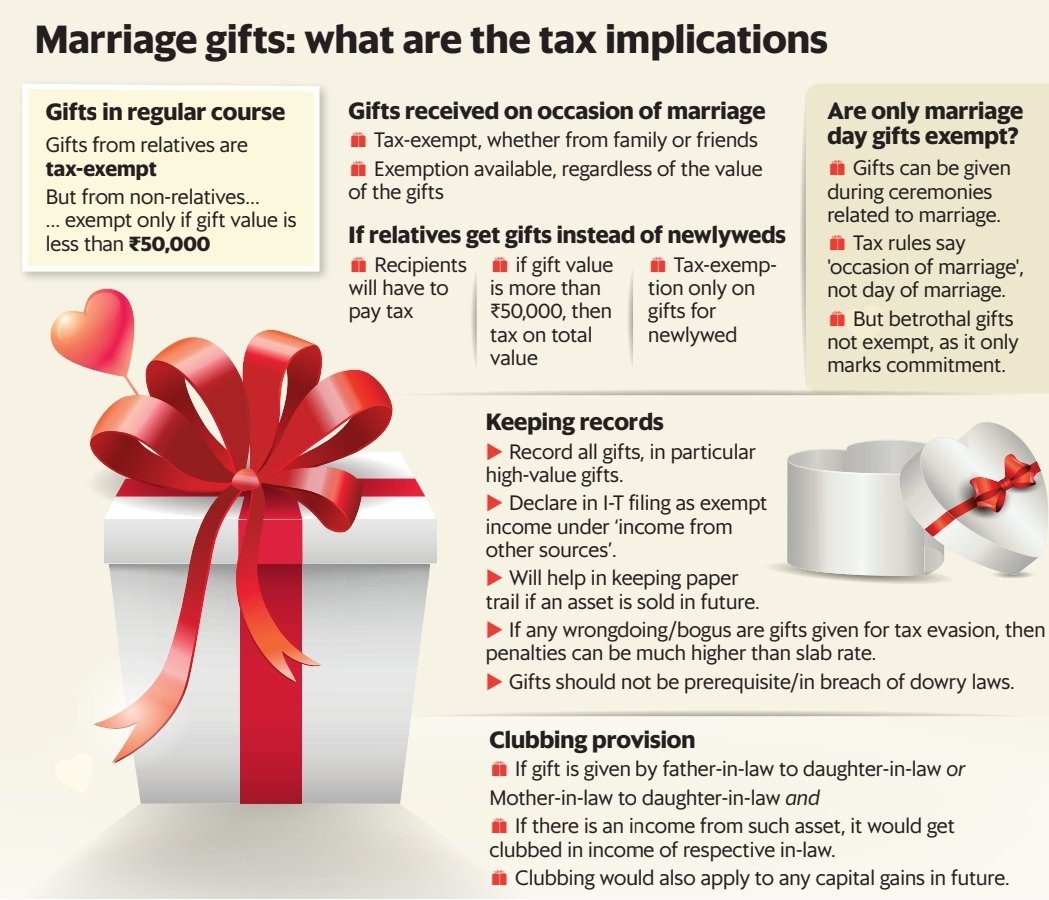

Marriage Gifts: Tax implications | Sudha Jhunjhunwala posted on the topic | LinkedIn – #68

Marriage Gifts: Tax implications | Sudha Jhunjhunwala posted on the topic | LinkedIn – #68

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #69

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #69

Frequently asked questions on Section 54F: the complete guide | Arthgyaan – #70

Frequently asked questions on Section 54F: the complete guide | Arthgyaan – #70

Sources of Revenue: Contributions, Gifts and Grants Received for Scientific Research and Development Services, Establishments Exempt from Federal Income Tax Employer Firms (REVCGGEF5417TAXEPT) | FRED | St. Louis Fed – #71

Sources of Revenue: Contributions, Gifts and Grants Received for Scientific Research and Development Services, Establishments Exempt from Federal Income Tax Employer Firms (REVCGGEF5417TAXEPT) | FRED | St. Louis Fed – #71

) Annual Exclusion Amount For Gift Tax Increases For 2023 – #72

Annual Exclusion Amount For Gift Tax Increases For 2023 – #72

What you need to know about generation-skipping gifts (and their tax implications) — Vanilla – #73

What you need to know about generation-skipping gifts (and their tax implications) — Vanilla – #73

Latest NRI Gift Tax Rules 2019-20 | Are Gifts received by NRIs Taxable? – #74

Latest NRI Gift Tax Rules 2019-20 | Are Gifts received by NRIs Taxable? – #74

Gift Taxes Explained | Expat US Tax – #75

Gift Taxes Explained | Expat US Tax – #75

Gift from USA to India: Taxation and Exemptions – SBNRI – #76

Gift from USA to India: Taxation and Exemptions – SBNRI – #76

The 2022 gift tax return deadline is coming up soon | Cordasco & Company – #77

The 2022 gift tax return deadline is coming up soon | Cordasco & Company – #77

Is There Any Way To Avoid The Gift Tax In Illinois? – #78

Is There Any Way To Avoid The Gift Tax In Illinois? – #78

Income tax on gift received | Gift deed | Gift tax | CA Neha Gupta – YouTube – #79

Income tax on gift received | Gift deed | Gift tax | CA Neha Gupta – YouTube – #79

Capital Gain Tax on sale of House Property & Eligible Exemptions by tax guru – Issuu – #80

Capital Gain Tax on sale of House Property & Eligible Exemptions by tax guru – Issuu – #80

List of relatives covered under Section 56(2) of Income Tax Act,1961 – #81

List of relatives covered under Section 56(2) of Income Tax Act,1961 – #81

How Much Money Can I Gift Without Owing Taxes? – #82

How Much Money Can I Gift Without Owing Taxes? – #82

What Is the Gift Tax Exclusion for 2017? | Cipparone & Zaccaro – #83

What Is the Gift Tax Exclusion for 2017? | Cipparone & Zaccaro – #83

How is a gift perquisite amount taxed in India? If it is more than 5000, is the entire amount taxed or just the amount that exceeds 5000? – Quora – #84

How is a gift perquisite amount taxed in India? If it is more than 5000, is the entire amount taxed or just the amount that exceeds 5000? – Quora – #84

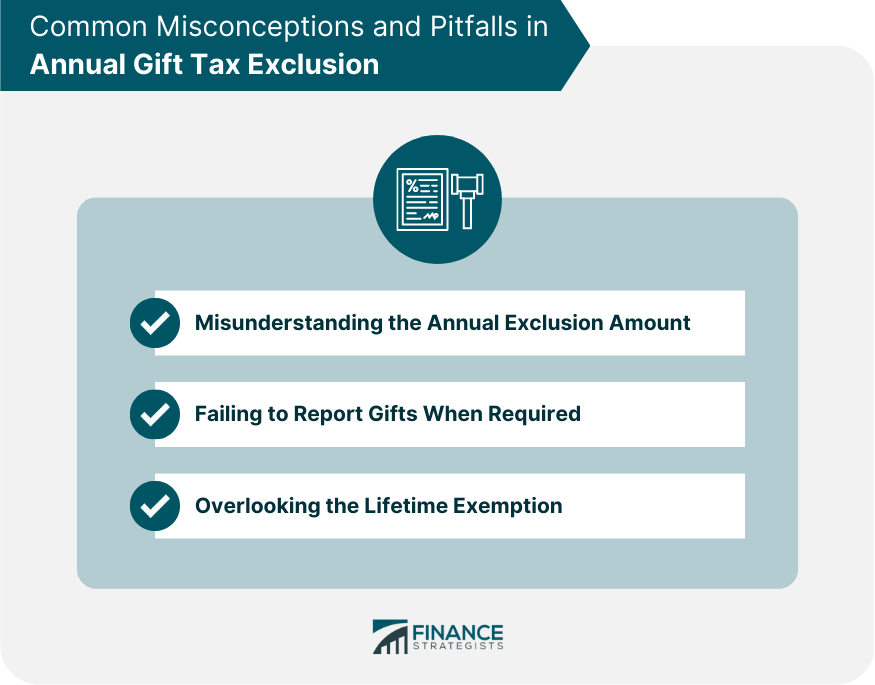

Do You Need to File Gift Tax Returns? Avoid These Common Mistakes | Bennett Thrasher – #85

Do You Need to File Gift Tax Returns? Avoid These Common Mistakes | Bennett Thrasher – #85

Taxation Of Gifts – Income Tax Act, 1961 – #86

Taxation Of Gifts – Income Tax Act, 1961 – #86

Detailed Analysis- Gifts Taxation under Income Tax Act, 1961 – #87

Detailed Analysis- Gifts Taxation under Income Tax Act, 1961 – #87

The Generation-Skipping Transfer Tax: A Quick Guide – #88

The Generation-Skipping Transfer Tax: A Quick Guide – #88

Gift Tax | AnnuityAdvantage – #89

Gift Tax | AnnuityAdvantage – #89

- form 709

- estate tax exemption

- gift tax rate table

Solved Chapter 27 and Chapter 28 1. Briefly describe the | Chegg.com – #90

Solved Chapter 27 and Chapter 28 1. Briefly describe the | Chegg.com – #90

Gift Deed in India – Registration Process, Documents & Tax Exemption – #91

Gift Deed in India – Registration Process, Documents & Tax Exemption – #91

Getting married? Ask for blessings in presents only and save taxes – #92

Getting married? Ask for blessings in presents only and save taxes – #92

Gift of Immovable property under Income Tax Act – #93

Gift of Immovable property under Income Tax Act – #93

What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #94

What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #94

11 Tax-Free Income Sources In India (2023 Update) – #95

11 Tax-Free Income Sources In India (2023 Update) – #95

No income tax till Rs 7.27 lakh, FM Nirmala Sitharaman clarifies | A2Z Taxcorp LLP – #96

No income tax till Rs 7.27 lakh, FM Nirmala Sitharaman clarifies | A2Z Taxcorp LLP – #96

BT Insight: How Kaun Banega Crorepati, Dream11 winners get taxed – BusinessToday – #97

BT Insight: How Kaun Banega Crorepati, Dream11 winners get taxed – BusinessToday – #97

What is a gift deed and tax implications | Tax Hack – #98

What is a gift deed and tax implications | Tax Hack – #98

Gift Tax: What it is and How Gifts are taxed in India – #99

Gift Tax: What it is and How Gifts are taxed in India – #99

Tax queries: Gifts received from a relative are tax-exempt – The Economic Times – #100

Tax queries: Gifts received from a relative are tax-exempt – The Economic Times – #100

What Is Form 709? – #101

What Is Form 709? – #101

What is the gift tax? | AP Buyline Personal Finance – #102

What is the gift tax? | AP Buyline Personal Finance – #102

3. Inheritance, estate, and gift tax design in OECD countries | Inheritance Taxation in OECD Countries | OECD iLibrary – #103

3. Inheritance, estate, and gift tax design in OECD countries | Inheritance Taxation in OECD Countries | OECD iLibrary – #103

State Regulations – #104

State Regulations – #104

Cash gifts are tax exempt but interest from them is taxable | Mint – #105

Cash gifts are tax exempt but interest from them is taxable | Mint – #105

Tejaswini Avhad on LinkedIn: Taxability of gifts under Income Tax act – #106

Tejaswini Avhad on LinkedIn: Taxability of gifts under Income Tax act – #106

Income Tax Slabs FY 2023-24 and AY 2024-25 (New & Old Regime Tax Rates) – #107

Income Tax Slabs FY 2023-24 and AY 2024-25 (New & Old Regime Tax Rates) – #107

How to Ensure Cash Gifts from Parents and Relatives Won’t Land you in Tax Trouble – #108

How to Ensure Cash Gifts from Parents and Relatives Won’t Land you in Tax Trouble – #108

- federal estate tax

- gift tax 2023

- personal exemption

Estate and Gift Taxes Brochure – Item: #72-8121 – #109

Estate and Gift Taxes Brochure – Item: #72-8121 – #109

What Is a Tax Exemption? – Ramsey – #110

What Is a Tax Exemption? – Ramsey – #110

Other Sources of Income in Saral Income Tax software – #111

Other Sources of Income in Saral Income Tax software – #111

Can I be Taxed for Gifting My Business? – #112

Can I be Taxed for Gifting My Business? – #112

Consider all the tax consequences before making gifts to loved ones – Gosling & Company Certified Public Accountants – #113

Consider all the tax consequences before making gifts to loved ones – Gosling & Company Certified Public Accountants – #113

Major Changes in Income Tax Rules FY 2023-24, 21-22 & 20-21 – #114

Major Changes in Income Tax Rules FY 2023-24, 21-22 & 20-21 – #114

- section 56(2) of income tax act

- gift tax rate

- excise tax

Start Your Business Succession Planning Early with 415 Group – #115

Start Your Business Succession Planning Early with 415 Group – #115

- exempted income exempt from tax

- estate tax exemption 2026

- clubbing of income

What is exempt Income | Tax free bonds, Filing taxes, Income – #116

What is exempt Income | Tax free bonds, Filing taxes, Income – #116

Generation-Skipping Transfer Taxes – #117

Generation-Skipping Transfer Taxes – #117

Gift from Non-Relatives – A tool for tax planning – TaxReturnWala – #118

Gift from Non-Relatives – A tool for tax planning – TaxReturnWala – #118

Set-off and Carry Forward Provision of Losses Under Income Tax | SIMPLE TAX INDIA – #119

Set-off and Carry Forward Provision of Losses Under Income Tax | SIMPLE TAX INDIA – #119

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #120

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #120

SuperCA – #121

SuperCA – #121

To File Or Not To File A Gift Tax Return, That Is The Question – #122

To File Or Not To File A Gift Tax Return, That Is The Question – #122

I received gifts during my wedding, are they taxable? – #123

I received gifts during my wedding, are they taxable? – #123

Income Tax: How To Save Income Tax Deductions Under New Tax Regime? | FAQs News, Times Now – #124

Income Tax: How To Save Income Tax Deductions Under New Tax Regime? | FAQs News, Times Now – #124

Income From Other Sources: Meaning, Exemptions, Deductions & Examples – Tax2win – #125

Income From Other Sources: Meaning, Exemptions, Deductions & Examples – Tax2win – #125

Donate and Save Tax Deduction Under Section 80g – ISKCON Dwarka – #126

Donate and Save Tax Deduction Under Section 80g – ISKCON Dwarka – #126

Tax Effects on X: “All About Taxation of Gifts [Section 56(2)(x)] https://t.co/Uepayz5jFf” / X – #127

Tax Effects on X: “All About Taxation of Gifts [Section 56(2)(x)] https://t.co/Uepayz5jFf” / X – #127

Income Tax books – Shopscan – #128

Income Tax books – Shopscan – #128

Taxation of gifts in Tamil | Under Income tax | Exemption for gifts | #gifts #incometax – YouTube – #129

Taxation of gifts in Tamil | Under Income tax | Exemption for gifts | #gifts #incometax – YouTube – #129

Income Tax on Digital, Physical, and Paper Gold in India | IIFL Finance – #130

Income Tax on Digital, Physical, and Paper Gold in India | IIFL Finance – #130

LiveMint on LinkedIn: #personalfinance – #131

LiveMint on LinkedIn: #personalfinance – #131

Income tax exemptions to individuals and extent of their use 2007 -2009 | Download Scientific Diagram – #132

Income tax exemptions to individuals and extent of their use 2007 -2009 | Download Scientific Diagram – #132

Lifetime Estate And Gift Tax Exemption Will Hit $12.92 Million In 2023 – #133

Lifetime Estate And Gift Tax Exemption Will Hit $12.92 Million In 2023 – #133

Estate Tax Exemption Increased for 2023 – Anchin, Block & Anchin LLP – #134

Estate Tax Exemption Increased for 2023 – Anchin, Block & Anchin LLP – #134

All you need to know about tax on gifts – #135

All you need to know about tax on gifts – #135

Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation – #136

Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation – #136

Gift Received From Husband Not Taxable As Income For Wife Under Income Tax Laws – #137

Gift Received From Husband Not Taxable As Income For Wife Under Income Tax Laws – #137

Is Your Nonprofit in Jeopardy of Losing its Tax-Exempt Status? — Jonathan Grissom, Nonprofit Attorney – #138

Is Your Nonprofit in Jeopardy of Losing its Tax-Exempt Status? — Jonathan Grissom, Nonprofit Attorney – #138

Taxation of Minor Children in India: How Does It Work? – #139

Taxation of Minor Children in India: How Does It Work? – #139

IRS Gift Limit 2024, Spousе & Minors, Tax Free Gift, Tax Rates – NCBlpc – #140

IRS Gift Limit 2024, Spousе & Minors, Tax Free Gift, Tax Rates – NCBlpc – #140

IRS Form 709 ≡ Fill Out Printable PDF Forms Online – #141

IRS Form 709 ≡ Fill Out Printable PDF Forms Online – #141

Section 10 of Income Tax Act – Allowance and Deductions – #142

Section 10 of Income Tax Act – Allowance and Deductions – #142

How Does the Unified Credit Work for My Estates Taxes? – #143

How Does the Unified Credit Work for My Estates Taxes? – #143

Outstanding Tax Demands Up To Rs 1 lakh Waived; Wealth, Gift Tax Exempted; Know Full Details – #144

Outstanding Tax Demands Up To Rs 1 lakh Waived; Wealth, Gift Tax Exempted; Know Full Details – #144

It’s The Gift Tax Exemption, Stupid – #145

It’s The Gift Tax Exemption, Stupid – #145

Lifetime Gift Tax Exemption | Definition, Amounts, & Impact – #146

Lifetime Gift Tax Exemption | Definition, Amounts, & Impact – #146

Holiday gift tax planning for IRAs – #147

Holiday gift tax planning for IRAs – #147

A valuable inheritance tax exemption: gifts out of income by Howard Kennedy LLP – Issuu – #148

A valuable inheritance tax exemption: gifts out of income by Howard Kennedy LLP – Issuu – #148

New Jersey Gift Tax: All You Need to Know | SmartAsset – #149

New Jersey Gift Tax: All You Need to Know | SmartAsset – #149

Tax-favored gifts exemptions that give back — in any administration | Financial Planning – #150

Tax-favored gifts exemptions that give back — in any administration | Financial Planning – #150

Income Tax Deductions List FY 2018-19 | How to save Tax for AY ’19-20? – #151

Income Tax Deductions List FY 2018-19 | How to save Tax for AY ’19-20? – #151

Gift Tax: What You Need to Know in 2022 – Rosenberg Chesnov – #152

Gift Tax: What You Need to Know in 2022 – Rosenberg Chesnov – #152

Taxation of Gifts to Ministers and Church Employees – Provident Lawyers – #153

Taxation of Gifts to Ministers and Church Employees – Provident Lawyers – #153

Annual Gift Tax Exclusions | First Republic now part of JPMorgan Chase – #154

Annual Gift Tax Exclusions | First Republic now part of JPMorgan Chase – #154

- federal estate tax exemption 2023

- list of relatives

- expenditure tax act

IRS Exemption Letter – #155

IRS Exemption Letter – #155

- gift tax exemption 2022

- gift tax meaning

- gift tax exemption

Income Tax Slabs Update 2023-24: A Look at the New Income Tax Slab – #156

Income Tax Slabs Update 2023-24: A Look at the New Income Tax Slab – #156

- gift chart as per income tax

- gift from relative exempt from income tax

- gift tax in india

Proposed IRS regs would “claw back” gift exemption for certain taxpayers – Baker Tilly – #157

Proposed IRS regs would “claw back” gift exemption for certain taxpayers – Baker Tilly – #157

MoneyTalkWithL on X: “Not many know this. Wedding gifts are tax exempt. So be lavish with people you love. I know someone who made a hefty wedding gift to a friend and – #158

MoneyTalkWithL on X: “Not many know this. Wedding gifts are tax exempt. So be lavish with people you love. I know someone who made a hefty wedding gift to a friend and – #158

Monetary gift tax: Income tax on gift received from parents | Value Research – #159

Monetary gift tax: Income tax on gift received from parents | Value Research – #159

Taxability of Gift U/s 56(2)(X) – #160

Taxability of Gift U/s 56(2)(X) – #160

Tax-Free Incomes in India: Understanding the Basics – #161

Tax-Free Incomes in India: Understanding the Basics – #161

What Is The Lifetime Gift Tax Exemption? – CountyOffice.org – YouTube – #162

What Is The Lifetime Gift Tax Exemption? – CountyOffice.org – YouTube – #162

6 Tips for Tax-Free Gifting | Mariner Wealth Advisors – #163

6 Tips for Tax-Free Gifting | Mariner Wealth Advisors – #163

Section 54F of the Income Tax Act – #164

Section 54F of the Income Tax Act – #164

Income tax returns filing: Is gift from cousin taxable? Find out here – Money News | The Financial Express – #165

Income tax returns filing: Is gift from cousin taxable? Find out here – Money News | The Financial Express – #165

) SOLVED: Chapter 27 and Chapter 28 1. Briefly describe the principal characteristics of the Estate and Gift taxes and how they differ from the Income tax. 2. List and briefly describe those – #166

SOLVED: Chapter 27 and Chapter 28 1. Briefly describe the principal characteristics of the Estate and Gift taxes and how they differ from the Income tax. 2. List and briefly describe those – #166

Section 80G of Income Tax Act – Complete guide to Eligibility & Deductions – #167

Section 80G of Income Tax Act – Complete guide to Eligibility & Deductions – #167

Nonresident Individual Income and Transfer Taxation in the United States – #168

Nonresident Individual Income and Transfer Taxation in the United States – #168

Gift HSN Code or HS Codes with GST Rate – Enterslice – #169

Gift HSN Code or HS Codes with GST Rate – Enterslice – #169

Did you receive Gift? Tax Implications on Gifts | Examples, Limits & Rules – #170

Did you receive Gift? Tax Implications on Gifts | Examples, Limits & Rules – #170

If I Gift 1cr to my mother is it exempt or taxable? – Quora – #171

If I Gift 1cr to my mother is it exempt or taxable? – Quora – #171

Dramatic Change to Federal Estate, Gift and Generation-Skipping Tax Exemptions – #172

Dramatic Change to Federal Estate, Gift and Generation-Skipping Tax Exemptions – #172

Section 56(2)(X) of Income Tax Act – Tax Implication on Gifts – #173

Section 56(2)(X) of Income Tax Act – Tax Implication on Gifts – #173

Income tax on a gift from father to daughter – #174

Income tax on a gift from father to daughter – #174

Understanding the Changes to Estate and Gift Exemption in 2024 | KROST – #175

Understanding the Changes to Estate and Gift Exemption in 2024 | KROST – #175

Know About The Income Tax Slab Rates For FY 2023-24 – #176

Know About The Income Tax Slab Rates For FY 2023-24 – #176

Estate Planning 101: Making Exempt Gifts – #177

Estate Planning 101: Making Exempt Gifts – #177

Section 115BAC Of Income Tax Act Deductions, Exemptions – #178

Section 115BAC Of Income Tax Act Deductions, Exemptions – #178

What is covered under Income from other sources? – #179

What is covered under Income from other sources? – #179

Gift tax presentation | PPT – #180

Gift tax presentation | PPT – #180

Budget 2024 income tax: Basic exemption limit should be increased to Rs 3.5 lakh – here’s why | Business – Times of India – #181

Budget 2024 income tax: Basic exemption limit should be increased to Rs 3.5 lakh – here’s why | Business – Times of India – #181

2016 Estate Tax Update – Fairview Law Group – #182

2016 Estate Tax Update – Fairview Law Group – #182

Gifts from abroad facing Centre’s ire | Expert Views – Business Standard – #183

Gifts from abroad facing Centre’s ire | Expert Views – Business Standard – #183

Tax | Types of Tax | Direct & Indirect Taxation in India 2023-24 – #184

Tax | Types of Tax | Direct & Indirect Taxation in India 2023-24 – #184

The Lifetime Gift Tax Exemption: Everything You Need to Know – #185

The Lifetime Gift Tax Exemption: Everything You Need to Know – #185

Gift tax: Gift Tax 101: How It Fits into the Picture of Total Taxation – FasterCapital – #186

Gift tax: Gift Tax 101: How It Fits into the Picture of Total Taxation – FasterCapital – #186

Doeren Mayhew | Get Ready for the 2023 Gift Tax Return Deadline – #187

Doeren Mayhew | Get Ready for the 2023 Gift Tax Return Deadline – #187

Gift Tax In 2024: What Is It And How Does It Work? – #188

Gift Tax In 2024: What Is It And How Does It Work? – #188

Gift tax exemption: Exploring the Annual Exclusion for Gift Tax Purposes – FasterCapital – #189

Gift tax exemption: Exploring the Annual Exclusion for Gift Tax Purposes – FasterCapital – #189

What Are the Legal and Tax Implications of Using Gift Cards in India? – #190

What Are the Legal and Tax Implications of Using Gift Cards in India? – #190

Donations Under Section 80G And 80GGA of Income Tax Act – #191

Donations Under Section 80G And 80GGA of Income Tax Act – #191

Before giving Diwali gifts this festive season, know about their tax implications here – BusinessToday – #192

Before giving Diwali gifts this festive season, know about their tax implications here – BusinessToday – #192

- gift tax rate in india 2022-23

- estate tax example

Income Tax efiling: Received gifts during the year? Here is what that means for your ITR – Income Tax News | The Financial Express – #193

Income Tax efiling: Received gifts during the year? Here is what that means for your ITR – Income Tax News | The Financial Express – #193

Income Tax Compliance Hand Book – 2022 Edition.pdf – #194

Income Tax Compliance Hand Book – 2022 Edition.pdf – #194

Tax Exemption for Gifts, Bequests, and Inheritances – #195

Tax Exemption for Gifts, Bequests, and Inheritances – #195

Income Tax on Bitcoin in India – PKC Management Consulting – #196

Income Tax on Bitcoin in India – PKC Management Consulting – #196

Clubbing of Income from gift – Sorting Tax – #197

Clubbing of Income from gift – Sorting Tax – #197

Locking In The $12 Million Gift Tax Exclusion | Margolis Bloom & D’Agostino – #198

Locking In The $12 Million Gift Tax Exclusion | Margolis Bloom & D’Agostino – #198

Gift Under The Income Tax Act In India – Especia – #199

Gift Under The Income Tax Act In India – Especia – #199

IRS Announced New Lifetime and Gift Tax Exemptions – Texas Trust Law – #200

IRS Announced New Lifetime and Gift Tax Exemptions – Texas Trust Law – #200

Income Tax Return Filing: How to save capital gains tax on gold and residential property | Zee Business – #201

Income Tax Return Filing: How to save capital gains tax on gold and residential property | Zee Business – #201

Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to Avoid It – #202

Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to Avoid It – #202

Income Tax Allowances and Deductions Allowed to Salaried Individuals – #203

Income Tax Allowances and Deductions Allowed to Salaried Individuals – #203

Income from Other Sources: Section 56 – 59 of the Income Tax Act – #204

Income from Other Sources: Section 56 – 59 of the Income Tax Act – #204

The Ultimate Guide to Preparing a Gift Deed in India – #205

The Ultimate Guide to Preparing a Gift Deed in India – #205

All about Income Tax on Gift Received From Parents. – #206

All about Income Tax on Gift Received From Parents. – #206

Your Diwali gift and bonus can be taxable: Know ways to avoid it – #207

Your Diwali gift and bonus can be taxable: Know ways to avoid it – #207

Posts: exempt gifts under income tax

Categories: Gifts

Author: toyotabienhoa.edu.vn