Discover more than 180 employee gifts taxable latest

Top images of employee gifts taxable by website toyotabienhoa.edu.vn compilation. Taxability of Gift received by an individual or HUF with FAQs. 5 rules about Income Tax on Gifts received in India & Exemptions. Are Christmas gifts taxable? It depends.. Gift Cards become Taxable Income when gifted to an Employee {Be Compliant + How to run the payroll} – YouTube. Are Employee Gifts Tax-Deductible?

Great Employee Appreciation Gifts – The Best Gifts for Employees | Crestline – #1

Great Employee Appreciation Gifts – The Best Gifts for Employees | Crestline – #1

Awards, Gifts, and Prizes Policy : University of Dayton, Ohio – #2

Awards, Gifts, and Prizes Policy : University of Dayton, Ohio – #2

Gifts Archives – Robert P. Russo CPA – #4

Gifts Archives – Robert P. Russo CPA – #4

Can I Give My Employee a Gift Card Without Being Taxed? – #5

Can I Give My Employee a Gift Card Without Being Taxed? – #5

De Minimis or Not Di Minimis: Which Employee Benefits are Taxable? – #6

De Minimis or Not Di Minimis: Which Employee Benefits are Taxable? – #6

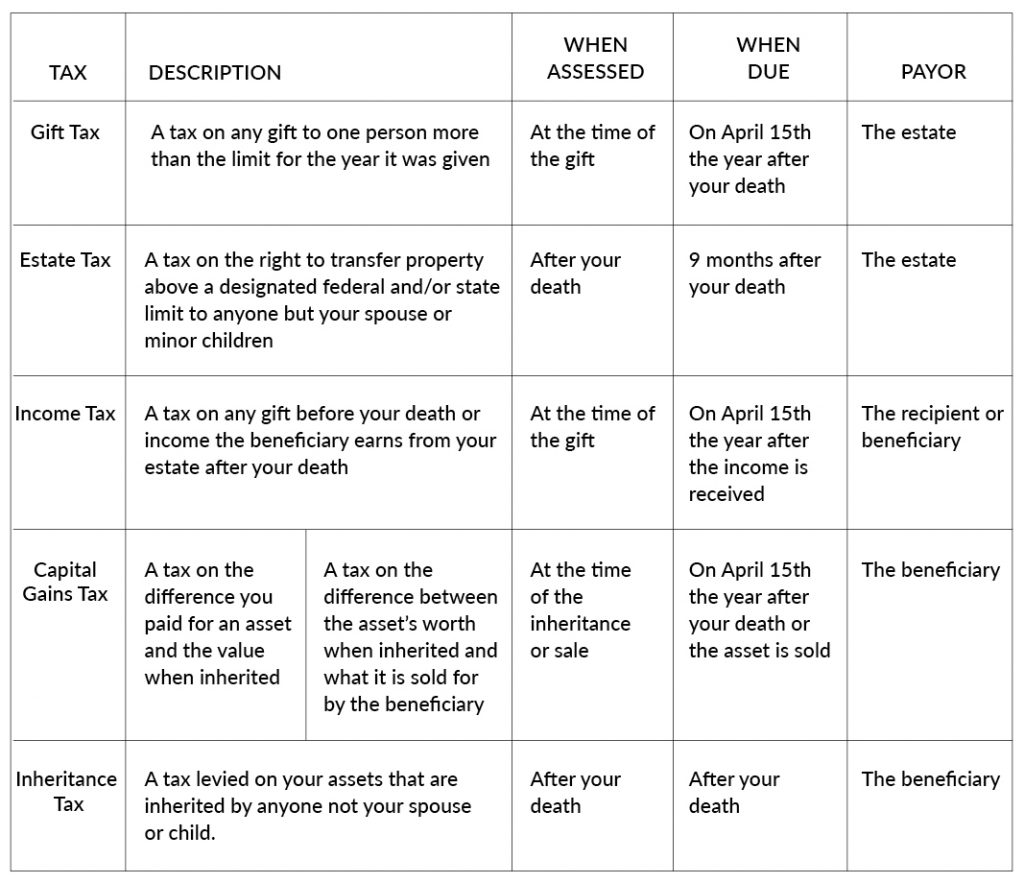

How Do Gifts Work Under The New Massachusetts Estate Tax Law? | Margolis Bloom & D’Agostino – #7

How Do Gifts Work Under The New Massachusetts Estate Tax Law? | Margolis Bloom & D’Agostino – #7

Received Your Diwali Gift As Bonus, Cashback, Or Gift Coupon? Know The Tax Implications – #8

Received Your Diwali Gift As Bonus, Cashback, Or Gift Coupon? Know The Tax Implications – #8

Taxes you have to pay when you get a gift – The Economic Times – #10

Taxes you have to pay when you get a gift – The Economic Times – #10

Form 12BA – #11

Form 12BA – #11

Is a gift from your cousin taxable? – #12

Is a gift from your cousin taxable? – #12

Claiming tax deductions on client gifts | Small Business Development Corporation – #13

Claiming tax deductions on client gifts | Small Business Development Corporation – #13

![Canada] Tax on Christmas bonuses – GPA Canada] Tax on Christmas bonuses – GPA](https://marketbusinessnews.com/wp-content/uploads/2022/11/gifts.jpeg) Canada] Tax on Christmas bonuses – GPA – #14

Canada] Tax on Christmas bonuses – GPA – #14

Kind employers may offer gifts, but onus lies on employees to pay tax on it | News on Markets – Business Standard – #15

Kind employers may offer gifts, but onus lies on employees to pay tax on it | News on Markets – Business Standard – #15

Gifts to Employees – #16

Gifts to Employees – #16

Tax and Christmas presents – Do you know the rules? – #17

Tax and Christmas presents – Do you know the rules? – #17

What You Should Know About Tax Treatment of Gifts to Employee? – #18

What You Should Know About Tax Treatment of Gifts to Employee? – #18

Reminder: Holiday Gifts, Prizes or Parties Can Be Taxable Wages – #19

Reminder: Holiday Gifts, Prizes or Parties Can Be Taxable Wages – #19

TAXATION OF GIFTS, PRIZES AND AWARDS TO EMPLOYEES … – #20

TAXATION OF GIFTS, PRIZES AND AWARDS TO EMPLOYEES … – #20

CRA may tax company gifts to employees, depending on what it is and how much it’s worth – #21

CRA may tax company gifts to employees, depending on what it is and how much it’s worth – #21

Payroll tax – Wikipedia – #22

Payroll tax – Wikipedia – #22

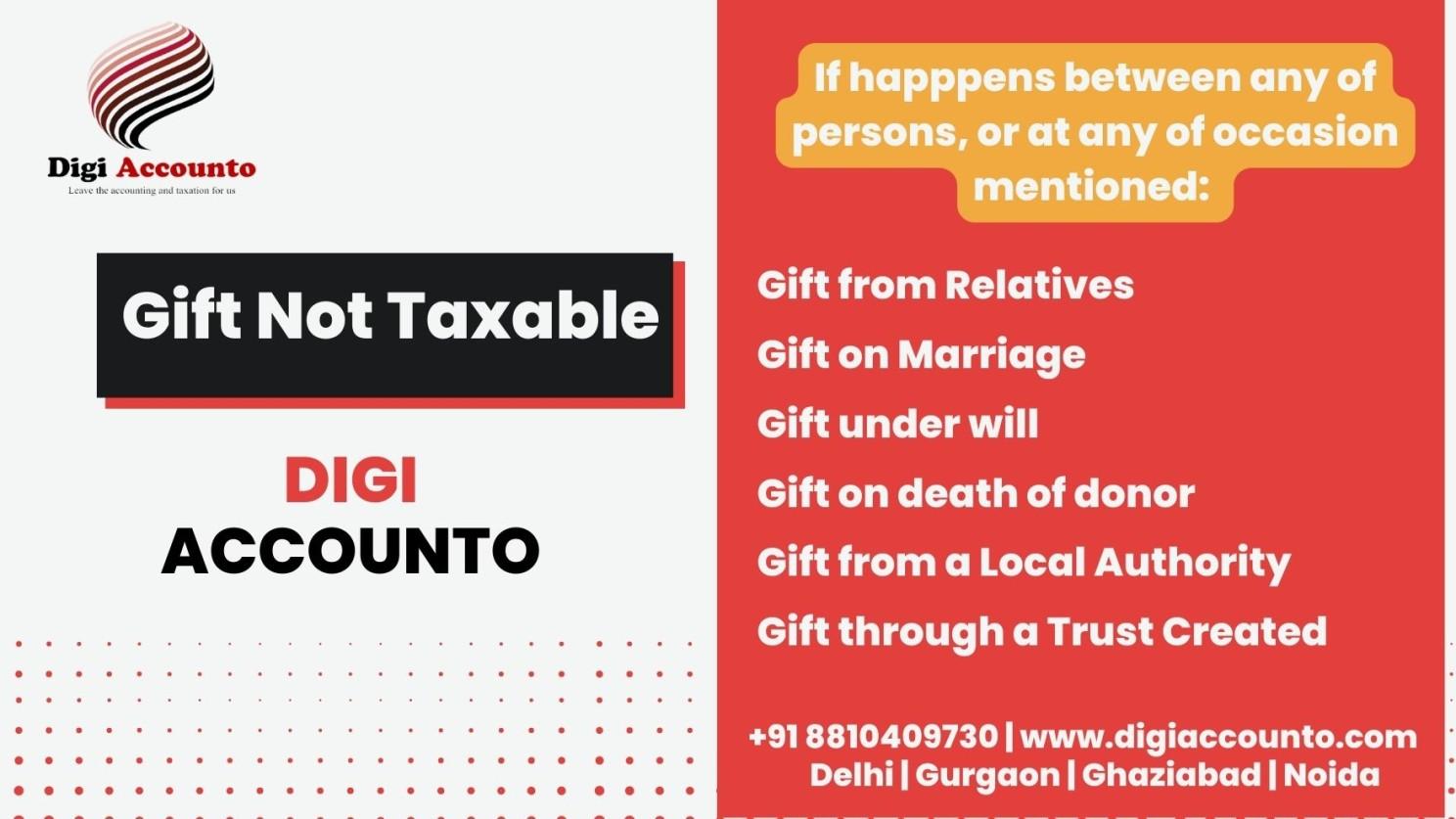

Did you receive Gift? Tax Implications on Gifts | Examples, Limits & Rules – #23

Did you receive Gift? Tax Implications on Gifts | Examples, Limits & Rules – #23

Are Gifts to Employees Taxable or Deductible? | MARCO Promos™ – #24

Are Gifts to Employees Taxable or Deductible? | MARCO Promos™ – #24

What Is The Tax Liability On Gifts Received? – #25

What Is The Tax Liability On Gifts Received? – #25

Do you need to pay taxes on your gifts? #tax #taxes #taxtok #gifttax #… | TikTok – #26

Do you need to pay taxes on your gifts? #tax #taxes #taxtok #gifttax #… | TikTok – #26

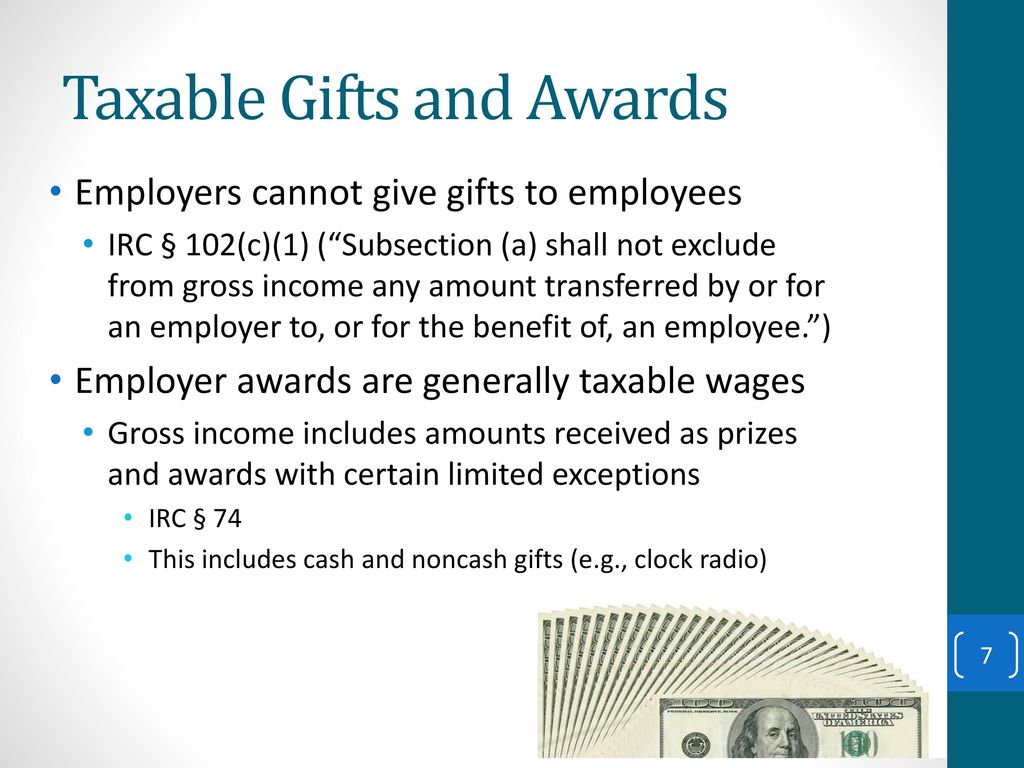

An Employer’s Guide to Paying Fringe Benefits to Employees – ppt video online download – #27

An Employer’s Guide to Paying Fringe Benefits to Employees – ppt video online download – #27

Section: Business and Support Operations Section Number: 3.7.20 Subject: De Minimis Benefit Policy Date of Present issue: 09/01/ – #28

Section: Business and Support Operations Section Number: 3.7.20 Subject: De Minimis Benefit Policy Date of Present issue: 09/01/ – #28

Gifting shares to employees and HMRC valuation | DNS Accountants – #29

Gifting shares to employees and HMRC valuation | DNS Accountants – #29

Employee Tax Benefits | Corporate Solutions :: Zaggle Save – #30

Employee Tax Benefits | Corporate Solutions :: Zaggle Save – #30

Guide to Small Benefit Exemptions in Europe | Xoxoday – #31

Guide to Small Benefit Exemptions in Europe | Xoxoday – #31

Tax on Christmas Gifts for Employees – Cronin & Co – #32

Tax on Christmas Gifts for Employees – Cronin & Co – #32

Income Tax Calculator: Calculate Income Tax Online for FY 2023-24 and FY 2024-25 | Max Life Insurance – #33

Income Tax Calculator: Calculate Income Tax Online for FY 2023-24 and FY 2024-25 | Max Life Insurance – #33

Income tax filing: Are gifts taxable? Frequently asked questions on gift taxes | Zee Business – #34

Income tax filing: Are gifts taxable? Frequently asked questions on gift taxes | Zee Business – #34

Section 194R of the Income-tax Act | TDS on Benefit or Perquisite – #35

Section 194R of the Income-tax Act | TDS on Benefit or Perquisite – #35

What is the treatment of GST on employee notice pay recovery? – #36

What is the treatment of GST on employee notice pay recovery? – #36

Know incomes free from taxes in India – #37

Know incomes free from taxes in India – #37

Tax implications on Christmas gifts | Lovewell Blake – #38

Tax implications on Christmas gifts | Lovewell Blake – #38

Gifts Tax: A Canadian Tax Lawyer Analysis | Toronto Tax Lawyer – #39

Gifts Tax: A Canadian Tax Lawyer Analysis | Toronto Tax Lawyer – #39

What is covered under Income from other sources? – #40

What is covered under Income from other sources? – #40

Receipt of Gifts and Inheritance by an NRI under FEMA – Enterslice – #41

Receipt of Gifts and Inheritance by an NRI under FEMA – Enterslice – #41

Transfer of moveable assets by Employer to Employee – Taxability of Pe – #42

Transfer of moveable assets by Employer to Employee – Taxability of Pe – #42

Sugar boss’ employers are showing appreciation to staff by giving lavish gifts | Fortune – #43

Sugar boss’ employers are showing appreciation to staff by giving lavish gifts | Fortune – #43

Complete Guide to Crypto Taxes: March 2024 Update | Koinly – #44

Complete Guide to Crypto Taxes: March 2024 Update | Koinly – #44

Is it necessary to pay taxes on Diwali gifts received from employers, relatives, and friends? – #45

Is it necessary to pay taxes on Diwali gifts received from employers, relatives, and friends? – #45

Examples of Inadmissible Expenses and Admissible Expenses | PDF | Expense | Taxes – #46

Examples of Inadmissible Expenses and Admissible Expenses | PDF | Expense | Taxes – #46

Christmas parties and staff gifts – a tax guide | Hawsons – #47

Christmas parties and staff gifts – a tax guide | Hawsons – #47

Is compensation paid by employer taxable? The devil is in the detail | News on Markets – Business Standard – #48

Is compensation paid by employer taxable? The devil is in the detail | News on Markets – Business Standard – #48

Are gifts to clients tax-deductible? – Oldfield Advisory – #49

Are gifts to clients tax-deductible? – Oldfield Advisory – #49

Form 12BA – What is it, Uses & Format – Tax2win – #50

Form 12BA – What is it, Uses & Format – Tax2win – #50

Reg. Section 1.274-3(c) – #51

Reg. Section 1.274-3(c) – #51

Are Client Gifts Tax Deductible? Your Official Guide To Business Gift Write-Offs – Confetë Gifts + Party Boxes – #52

Are Client Gifts Tax Deductible? Your Official Guide To Business Gift Write-Offs – Confetë Gifts + Party Boxes – #52

Complete Guide on Whether Employee Gift Cards Are Taxable Or Not – #53

Complete Guide on Whether Employee Gift Cards Are Taxable Or Not – #53

Are Gifts Given to Employees and Non-Employees Claimable? – #54

Are Gifts Given to Employees and Non-Employees Claimable? – #54

Received Diwali Bonus via cash, gift card, e-voucher, prepaid cards? Know how much income tax you will have to pay – The Economic Times – #55

Received Diwali Bonus via cash, gift card, e-voucher, prepaid cards? Know how much income tax you will have to pay – The Economic Times – #55

MVB Audit and Advisory – #56

MVB Audit and Advisory – #56

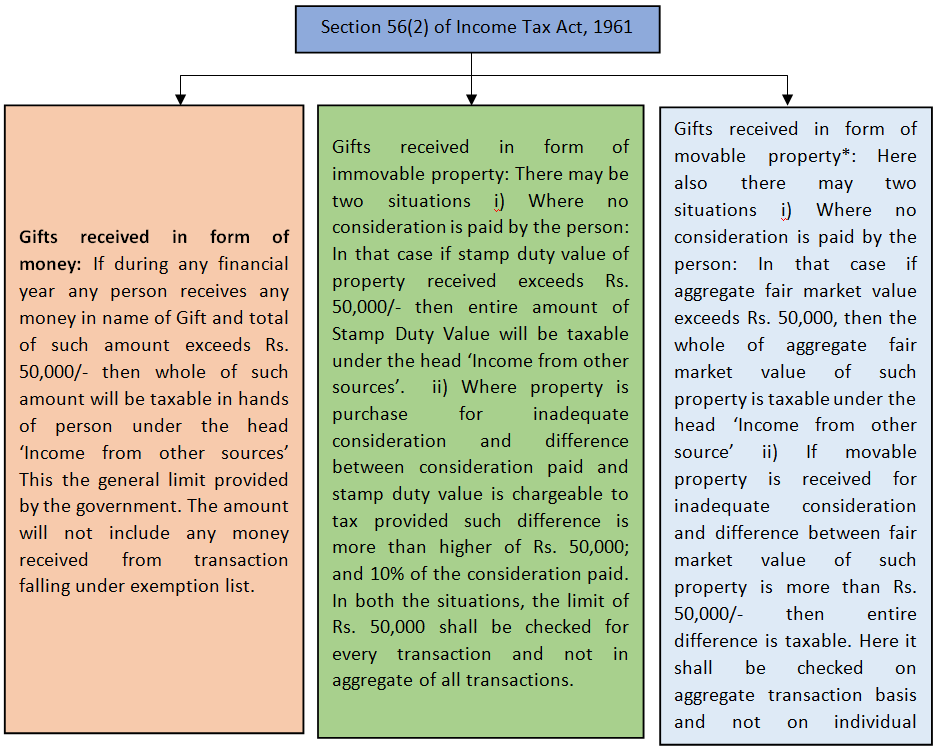

Taxability of gifts Section 56 2 x of Income Tax Act 1961 – #57

Taxability of gifts Section 56 2 x of Income Tax Act 1961 – #57

- gift tax example

- gift tax return

- corporate gift ideas for employees

Business Gifts 2024: Discover Limited Company Business Gifts – #58

Business Gifts 2024: Discover Limited Company Business Gifts – #58

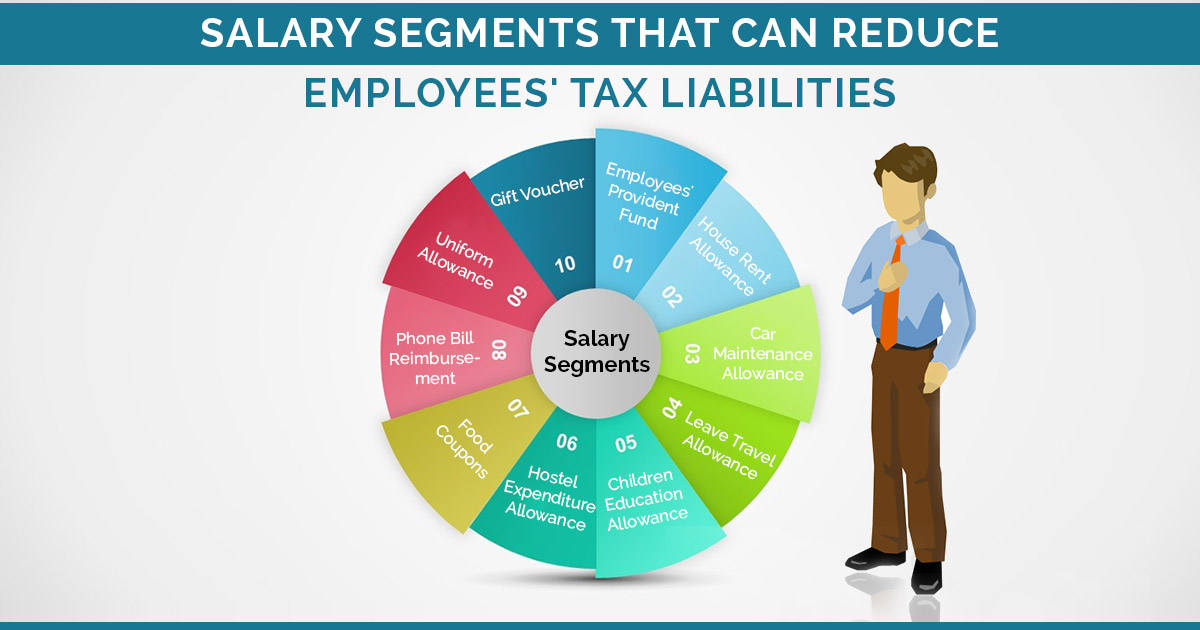

Salary Segments That Can Reduce Employees’ Tax Liabilities – #59

Salary Segments That Can Reduce Employees’ Tax Liabilities – #59

Gifts are tax exempt in the hands of relatives | Mint – #60

Gifts are tax exempt in the hands of relatives | Mint – #60

NEW:Income from salary-Problems,theory and solutions – ppt download – #61

NEW:Income from salary-Problems,theory and solutions – ppt download – #61

Do You Need to File Gift Tax Returns? Avoid These Common Mistakes | Bennett Thrasher – #62

Do You Need to File Gift Tax Returns? Avoid These Common Mistakes | Bennett Thrasher – #62

Are Employee Christmas Gifts Tax Deductible? -2023 | Stitchi – #63

Are Employee Christmas Gifts Tax Deductible? -2023 | Stitchi – #63

Perquisites Meaning in Income tax: Benefits & Examples – #64

Perquisites Meaning in Income tax: Benefits & Examples – #64

Income Tax on Diwali Gift: How Cash, Gold, Car and Property Gifts are Taxed – Income Tax News | The Financial Express – #65

Income Tax on Diwali Gift: How Cash, Gold, Car and Property Gifts are Taxed – Income Tax News | The Financial Express – #65

Are gifts to clients and employees tax-deductible? – Financial Solution Advisors – #66

Are gifts to clients and employees tax-deductible? – Financial Solution Advisors – #66

Gifts to U.S. Persons | Marcum LLP | Accountants and Advisors – #67

Gifts to U.S. Persons | Marcum LLP | Accountants and Advisors – #67

Locking In The $12 Million Gift Tax Exclusion | Margolis Bloom & D’Agostino – #68

Locking In The $12 Million Gift Tax Exclusion | Margolis Bloom & D’Agostino – #68

New Canada Revenue Agency (CRA) policy on Taxable Benefits regarding gifts, awards, social events, parking, etc.: A Tax Alert by an Expert Canadian Tax Lawyer – TaxPage.com – #69

New Canada Revenue Agency (CRA) policy on Taxable Benefits regarding gifts, awards, social events, parking, etc.: A Tax Alert by an Expert Canadian Tax Lawyer – TaxPage.com – #69

Gift Tax: शादी में मिले गिफ्ट टैक्स फ्री, पर जन्मदिन व ऑफिस से मिले तोहफे पर लगता है कर, जानिए ऐसा क्यों? – What is gift tax which gifts are non taxable – #70

Gift Tax: शादी में मिले गिफ्ट टैक्स फ्री, पर जन्मदिन व ऑफिस से मिले तोहफे पर लगता है कर, जानिए ऐसा क्यों? – What is gift tax which gifts are non taxable – #70

Are the gifts received on Diwali tax-free in your hands? | Business News – #71

Are the gifts received on Diwali tax-free in your hands? | Business News – #71

What are the taxes on gifts on Onlyfans? – FreeCashFlow.io 2024 – #72

What are the taxes on gifts on Onlyfans? – FreeCashFlow.io 2024 – #72

7 Employee Benefits You Didn’t Know Were Taxable Income | Inc.com – #73

7 Employee Benefits You Didn’t Know Were Taxable Income | Inc.com – #73

Gifting Company Stock: A Step-by-Step Guide | Eqvista – #74

Gifting Company Stock: A Step-by-Step Guide | Eqvista – #74

Tax-free rewarding of employees | Delicard – #75

Tax-free rewarding of employees | Delicard – #75

) Gift Cards as Employee Gifts – Are They Taxable? | Canon Capital Management Group, LLC – #76

Gift Cards as Employee Gifts – Are They Taxable? | Canon Capital Management Group, LLC – #76

Gift of Immovable property under Income Tax Act – #77

Gift of Immovable property under Income Tax Act – #77

Gift Tax – YouTube – #78

Gift Tax – YouTube – #78

Are Gift Cards Taxable? IRS Rules Explained – #79

Are Gift Cards Taxable? IRS Rules Explained – #79

31 Employee Appreciation Gifts: The Ultimate Recognition Guide – #80

31 Employee Appreciation Gifts: The Ultimate Recognition Guide – #80

Are Diwali gifts really tax-free in your hands | SIMPLE TAX INDIA – #81

Are Diwali gifts really tax-free in your hands | SIMPLE TAX INDIA – #81

Ways to Make Good Gift Vouchers for Employees | Xoxoday – #82

Ways to Make Good Gift Vouchers for Employees | Xoxoday – #82

- gift tax rate table

- expenditure tax act

- service tax

US Gift Tax on Nonresident Noncitizens | James Moore & Co. – #83

US Gift Tax on Nonresident Noncitizens | James Moore & Co. – #83

Tax Planning with the Annual Gift Tax Exclusion – Alloy Silverstein – #84

Tax Planning with the Annual Gift Tax Exclusion – Alloy Silverstein – #84

What is Gross Income? Definition, Formula, Calculation, and Example – #85

What is Gross Income? Definition, Formula, Calculation, and Example – #85

April 15 Is The Deadline To File A Gift Tax Return – #86

April 15 Is The Deadline To File A Gift Tax Return – #86

Are your Diwali gifts taxable? Know what income tax rules say | Personal Finance News, Times Now – #87

Are your Diwali gifts taxable? Know what income tax rules say | Personal Finance News, Times Now – #87

Taxability of Gifts, Awards, and Long-service Awards given to Employees | – #88

Taxability of Gifts, Awards, and Long-service Awards given to Employees | – #88

A Comprehensive guide on gift tax in India – How are gifts taxed? – #89

A Comprehensive guide on gift tax in India – How are gifts taxed? – #89

Gifts to Employees – A Taxing Topic – A Better Way To Blog – PayMaster – #90

Gifts to Employees – A Taxing Topic – A Better Way To Blog – PayMaster – #90

Are Employee Gift Cards Taxable? – #91

Are Employee Gift Cards Taxable? – #91

) Navigating the Tax Code: Your Guide to Gift Cards and Corporate Gifting – #92

Navigating the Tax Code: Your Guide to Gift Cards and Corporate Gifting – #92

Annual Reminder: Are Gifts to Clergy Taxable or Nontaxable? – #93

Annual Reminder: Are Gifts to Clergy Taxable or Nontaxable? – #93

Employee Holiday Gifts May Be Taxable | Heintzelman Accounting Services – #94

Employee Holiday Gifts May Be Taxable | Heintzelman Accounting Services – #94

Taxability of gifts under Income Tax Act | PDF – #95

Taxability of gifts under Income Tax Act | PDF – #95

Determining What Constitutes Taxable Compensation | Wolters Kluwer – #96

Determining What Constitutes Taxable Compensation | Wolters Kluwer – #96

Income From Other Sources – Notes | PDF | Dividend | Tax Deduction – #97

Income From Other Sources – Notes | PDF | Dividend | Tax Deduction – #97

What Are Fringe Benefits? How They Work and Types – #98

What Are Fringe Benefits? How They Work and Types – #98

- gift tax in india

- estate/gift tax

- estate tax

Gift Under GST: What Is And Isn’t Taxable – #99

Gift Under GST: What Is And Isn’t Taxable – #99

A Happl Guide to Employee Gifting in the UK – #100

A Happl Guide to Employee Gifting in the UK – #100

Travel and Business Expense Reimbursements – ppt download – #101

Travel and Business Expense Reimbursements – ppt download – #101

Got lots of gifts on Diwali? Know tax implications – Income Tax News | The Financial Express – #102

Got lots of gifts on Diwali? Know tax implications – Income Tax News | The Financial Express – #102

CRA may tax company gifts to employees: How to know if it’s tax free | Financial Post – #103

CRA may tax company gifts to employees: How to know if it’s tax free | Financial Post – #103

tax on diwali gifts: Will you be taxed on Diwali gifts received? Check how various sources of gifts will be taxed – The Economic Times – #104

tax on diwali gifts: Will you be taxed on Diwali gifts received? Check how various sources of gifts will be taxed – The Economic Times – #104

Taxability of Gifts – Some Interesting Issues – #105

Taxability of Gifts – Some Interesting Issues – #105

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #106

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #106

- gift tax rate in india 2020

- wealth tax

- section 56(2) of income tax act

Giving Bonuses and Gifts for your Employees — Savvy Bird Consulting – #107

Giving Bonuses and Gifts for your Employees — Savvy Bird Consulting – #107

The Tax Implications of Employee Gifts – Hourly, Inc. – #108

The Tax Implications of Employee Gifts – Hourly, Inc. – #108

- gift tax rate

- lineal ascendant gift from relative exempt from income tax

- gifts for employees appreciation

Year-End Holiday Parties and Gifts: What’s Taxable? – #109

Year-End Holiday Parties and Gifts: What’s Taxable? – #109

- gift tax exemption relatives list

- gift tax act 1958

- diy employee appreciation gifts

) Taxability for Specified Employees – GST Guntur – #110

Taxability for Specified Employees – GST Guntur – #110

Gifts Distinguished From Exchange | PDF | Employment | Tax Exemption – #111

Gifts Distinguished From Exchange | PDF | Employment | Tax Exemption – #111

Workplace Holiday Gift Giving & Year-End Bonuses – YouTube – #112

Workplace Holiday Gift Giving & Year-End Bonuses – YouTube – #112

Gifts for employees – a tax guide – Relative Accountancy – #113

Gifts for employees – a tax guide – Relative Accountancy – #113

Use the net gift technique to reduce your gift tax rate – Miller Kaplan – #114

Use the net gift technique to reduce your gift tax rate – Miller Kaplan – #114

Do you know the tax implications on Diwali gifts? – #115

Do you know the tax implications on Diwali gifts? – #115

Capital Gain on Sale of Property: Meaning & Tax Implications – #116

Capital Gain on Sale of Property: Meaning & Tax Implications – #116

Taxation of Wellness Program Gift Cards – #117

Taxation of Wellness Program Gift Cards – #117

Understanding the Tax Treatment of Gifts: A Comprehensive Guide for Em – Table Matters – #118

Understanding the Tax Treatment of Gifts: A Comprehensive Guide for Em – Table Matters – #118

GST Implications on Gift by Employer to Employee (Taxability & ITC) – #119

GST Implications on Gift by Employer to Employee (Taxability & ITC) – #119

Gift Cards become Taxable Income when gifted to an Employee {Be Compliant + How to run the payroll} – YouTube – #120

Gift Cards become Taxable Income when gifted to an Employee {Be Compliant + How to run the payroll} – YouTube – #120

Are Diwali Bonuses, Monetary Gifts From Company Subject To Income Tax? Explained – #121

Are Diwali Bonuses, Monetary Gifts From Company Subject To Income Tax? Explained – #121

The Tax of Gift Giving: Are Employee Gifts Tax Deductible? – LiveCA LLP – #122

The Tax of Gift Giving: Are Employee Gifts Tax Deductible? – LiveCA LLP – #122

SOLVED: The company is looking at possible employee benefit options and would like you to write a memo explaining whether each of the following would be considered taxable benefits for the employees: – #123

SOLVED: The company is looking at possible employee benefit options and would like you to write a memo explaining whether each of the following would be considered taxable benefits for the employees: – #123

Christmas and New Year gifts could be taxable | Mint – #124

Christmas and New Year gifts could be taxable | Mint – #124

🎁 Employee Holiday Gifts May Be Taxable – #125

🎁 Employee Holiday Gifts May Be Taxable – #125

- federal gift tax

- gift chart as per income tax

- gift from relative exempt from income tax

35 Best Gift Letter Templates (Word & PDF) ᐅ TemplateLab – #126

35 Best Gift Letter Templates (Word & PDF) ᐅ TemplateLab – #126

Potential tax consequences of holiday gifts and celebrations – Akler Browning LLP – #127

Potential tax consequences of holiday gifts and celebrations – Akler Browning LLP – #127

The Best Corporate Employee Gifts They Won’t Forget – Swag.com – #128

The Best Corporate Employee Gifts They Won’t Forget – Swag.com – #128

- gift tax exemption 2022

- gift tax meaning

- gift tax exemption

Did you know? Employers’ gifts over Rs 5000 are taxable – Rediff.com – #129

Did you know? Employers’ gifts over Rs 5000 are taxable – Rediff.com – #129

Income Tax on Gift – #130

Income Tax on Gift – #130

Solved 11. Which of the following benefits would be taxable | Chegg.com – #131

Solved 11. Which of the following benefits would be taxable | Chegg.com – #131

Bonuses, Gifts & Fringe Benefits: Taxable and Deductible – #132

Bonuses, Gifts & Fringe Benefits: Taxable and Deductible – #132

GIFTS FOR EMPLOYEES – Leinonen Norway – #133

GIFTS FOR EMPLOYEES – Leinonen Norway – #133

A Guide to Gift Card Taxation in Sweden for Businesses – #134

A Guide to Gift Card Taxation in Sweden for Businesses – #134

Non-discretionary vs discretionary bonuses: Do you know the difference? | Homebase – #135

Non-discretionary vs discretionary bonuses: Do you know the difference? | Homebase – #135

Types of Taxable & Tax-Free Fringe Benefits | Points North – #136

Types of Taxable & Tax-Free Fringe Benefits | Points North – #136

Are gifts to employees considered income? – Feb 17, 2022, Johor Bahru (JB), Malaysia, Taman Molek Service | THK Management Advisory Sdn Bhd – #137

Are gifts to employees considered income? – Feb 17, 2022, Johor Bahru (JB), Malaysia, Taman Molek Service | THK Management Advisory Sdn Bhd – #137

Gifts to Employees – Are They Taxable Benefits? – Pinnacle Accountants & Advisors – #138

Gifts to Employees – Are They Taxable Benefits? – Pinnacle Accountants & Advisors – #138

Navigating tax-free employee gifts Part 2 – Oldfield Advisory – #139

Navigating tax-free employee gifts Part 2 – Oldfield Advisory – #139

Tax implications for company gatherings | Pit & Quarry – #140

Tax implications for company gatherings | Pit & Quarry – #140

Solved Q3: (a) Ahmed received the following gifts/awards | Chegg.com – #141

Solved Q3: (a) Ahmed received the following gifts/awards | Chegg.com – #141

Are Business and Client Gifts Tax Deductible? – Formations – #142

Are Business and Client Gifts Tax Deductible? – Formations – #142

Taxability of Gifts – #143

Taxability of Gifts – #143

Amount received as gift by any blood relative living in US is not taxable in India – Scripbox – #144

Amount received as gift by any blood relative living in US is not taxable in India – Scripbox – #144

Are Employee Gifts Taxable? – Virtual CFO Blog – #145

Are Employee Gifts Taxable? – Virtual CFO Blog – #145

Enjoying Diwali gifts? Beware of tax implications – Income Tax News | The Financial Express – #146

Enjoying Diwali gifts? Beware of tax implications – Income Tax News | The Financial Express – #146

- gift tax rate in india 2022-23

Guidelines for Gift Giving to Employees and Volunteers | Church HR Network – #147

Guidelines for Gift Giving to Employees and Volunteers | Church HR Network – #147

Giving gifts and throwing parties can help show gratitude and provide tax breaks – #148

Giving gifts and throwing parties can help show gratitude and provide tax breaks – #148

Employee gifts without the tax! – Evans & Co – #149

Employee gifts without the tax! – Evans & Co – #149

- gift ideas for employees on a budget

- personalized gifts for employees

- gift tax upsc

Are Diwali gifts from employer, relatives, friends taxable? Here’s a look at the norms | Mint – #150

Are Diwali gifts from employer, relatives, friends taxable? Here’s a look at the norms | Mint – #150

Just saw this on Twitter. Sorry if it’s been posted before. It’s so tragic it’s almost funny. Surely this isn’t legal? : r/antiwork – #151

Just saw this on Twitter. Sorry if it’s been posted before. It’s so tragic it’s almost funny. Surely this isn’t legal? : r/antiwork – #151

- gift tax

- gift tax exclusion 2023

- gift tax definition

An In-Depth Analysis of Tax Planning Strategies Related to Employee Remuneration Through the Lens of Key Sections of the Indian Income Tax Act | PDF | Employee Benefits | Tax Deduction – #152

An In-Depth Analysis of Tax Planning Strategies Related to Employee Remuneration Through the Lens of Key Sections of the Indian Income Tax Act | PDF | Employee Benefits | Tax Deduction – #152

Are Gifts for Your Team and Clients Tax Deductible in the U.S.? | FreshBooks Blog – #153

Are Gifts for Your Team and Clients Tax Deductible in the U.S.? | FreshBooks Blog – #153

Which employee gifts are tax exempt? » Stem Rural – #154

Which employee gifts are tax exempt? » Stem Rural – #154

Why Corporate Gifts Are More than Tax Breaks | Perfect Feast – #155

Why Corporate Gifts Are More than Tax Breaks | Perfect Feast – #155

Gift Tax Australia – Employee gifts and parties | DPM – #156

Gift Tax Australia – Employee gifts and parties | DPM – #156

Will you be taxed if you get Diwali gifts? – The Economic Times – #157

Will you be taxed if you get Diwali gifts? – The Economic Times – #157

Tax Declaration on Employer Shares | HTH Accountants – #158

Tax Declaration on Employer Shares | HTH Accountants – #158

What is Previous Year in Income Tax under Section 3? – #159

What is Previous Year in Income Tax under Section 3? – #159

Generation-Skipping Transfer Taxes – #160

Generation-Skipping Transfer Taxes – #160

Taxable and Nontaxable Compensation – ppt download – #161

Taxable and Nontaxable Compensation – ppt download – #161

Gift Tax – GRA – #162

Gift Tax – GRA – #162

What employers need to know about employee gifts – #163

What employers need to know about employee gifts – #163

Are employee Christmas gifts taxable? – TTR Barnes – #164

Are employee Christmas gifts taxable? – TTR Barnes – #164

Kindness Works – #165

Kindness Works – #165

Taxable vs Nontaxable Fringe Benefits – Hourly, Inc. – #166

Taxable vs Nontaxable Fringe Benefits – Hourly, Inc. – #166

Taxbility Of Salary Income – Notes – LearnPick India – #167

Taxbility Of Salary Income – Notes – LearnPick India – #167

Property Gift Deed Registration – Sample Format, Charges & Rules – #168

Property Gift Deed Registration – Sample Format, Charges & Rules – #168

Tax on Gifting Crypto, NFT, VDA in India – #169

Tax on Gifting Crypto, NFT, VDA in India – #169

75 Motivational Gifts for Employees To Raise Team Spirits ✨ – #170

75 Motivational Gifts for Employees To Raise Team Spirits ✨ – #170

Tips to Help You Figure Out if Your Gift is Taxable – Caras Shulman – #171

Tips to Help You Figure Out if Your Gift is Taxable – Caras Shulman – #171

KTP & Company PLT | Audit, Tax, Accountancy in Johor Bahru. – #172

KTP & Company PLT | Audit, Tax, Accountancy in Johor Bahru. – #172

GST on Diwali gifts: Now Companies pay GST if you gift more than Rs.50,000 – – #173

GST on Diwali gifts: Now Companies pay GST if you gift more than Rs.50,000 – – #173

Shift Accounting – Unwrapping Tax Guidelines – #174

Shift Accounting – Unwrapping Tax Guidelines – #174

Are CNY Hongbaos (And Gifts) Taxable In Singapore? | DollarsAndSense Business – #175

Are CNY Hongbaos (And Gifts) Taxable In Singapore? | DollarsAndSense Business – #175

Income from Other Sources – CS Executive Tax Laws MCQs – GST Guntur – #176

Income from Other Sources – CS Executive Tax Laws MCQs – GST Guntur – #176

Is a gift card or voucher from an employer to an employee taxable in India? – Quora – #177

Is a gift card or voucher from an employer to an employee taxable in India? – Quora – #177

How to file ITR-2 Online? | ITR Filing FY 2022-23 (AY 2023-24) – #178

How to file ITR-2 Online? | ITR Filing FY 2022-23 (AY 2023-24) – #178

Everything You Need to Know About Employee Service Awards – #179

Everything You Need to Know About Employee Service Awards – #179

6 perks provided by your employer that can help you save tax – Money News | The Financial Express – #180

6 perks provided by your employer that can help you save tax – Money News | The Financial Express – #180

Posts: employee gifts taxable

Categories: Gifts

Author: toyotabienhoa.edu.vn