Share more than 120 employee gifts tax treatment best

Share images of employee gifts tax treatment by website toyotabienhoa.edu.vn compilation. Can a company gift a vehicle to an employee in India without tax? – Quora. What is a gift deed and tax implications | Tax Hack. Understanding Income Tax on Gifts Received in India: Rules, Exceptions, and Valuation”. Using gift cards as a tax-free trivial benefit | Blackhawk Network. 6 ways GST may impact salaries – Work cut out for your HR!

Guidelines for Gift Giving to Employees and Volunteers | Church HR Network – #1

Guidelines for Gift Giving to Employees and Volunteers | Church HR Network – #1

Can I Give My Employee a Gift Card Without Being Taxed? – #2

Can I Give My Employee a Gift Card Without Being Taxed? – #2

Wrapping Up the Tax Rules for Business Gifts – #4

Wrapping Up the Tax Rules for Business Gifts – #4

Gift And Gift Card Taxation in Germany Simplified – #5

Gift And Gift Card Taxation in Germany Simplified – #5

- gift deed stamp paper

- gift tax rate in india 2022-23

BASE PAY INCREASES, BONUS PAYMENTS, COLAS, EMPLOYEE TAX IMPLICATIONS & SYSTEMIC REWARDS – #6

BASE PAY INCREASES, BONUS PAYMENTS, COLAS, EMPLOYEE TAX IMPLICATIONS & SYSTEMIC REWARDS – #6

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #7

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #7

Great time for a GRAT – Journal of Accountancy – #8

Great time for a GRAT – Journal of Accountancy – #8

- expenditure tax act

- gift tax exemption relatives list

- staff appreciation gifts under $5

11 Surprising Things That Are Taxable | Kiplinger – #10

11 Surprising Things That Are Taxable | Kiplinger – #10

Taxability of Gift received by an individual or HUF with FAQs – #11

Taxability of Gift received by an individual or HUF with FAQs – #11

How Are Stock Options Taxed? – #12

How Are Stock Options Taxed? – #12

Tax treatment of employer-provided meals and lodging – #13

Tax treatment of employer-provided meals and lodging – #13

Are Cash Gifts to Employees Taxable in Canada – LedgerLogic – #14

Are Cash Gifts to Employees Taxable in Canada – LedgerLogic – #14

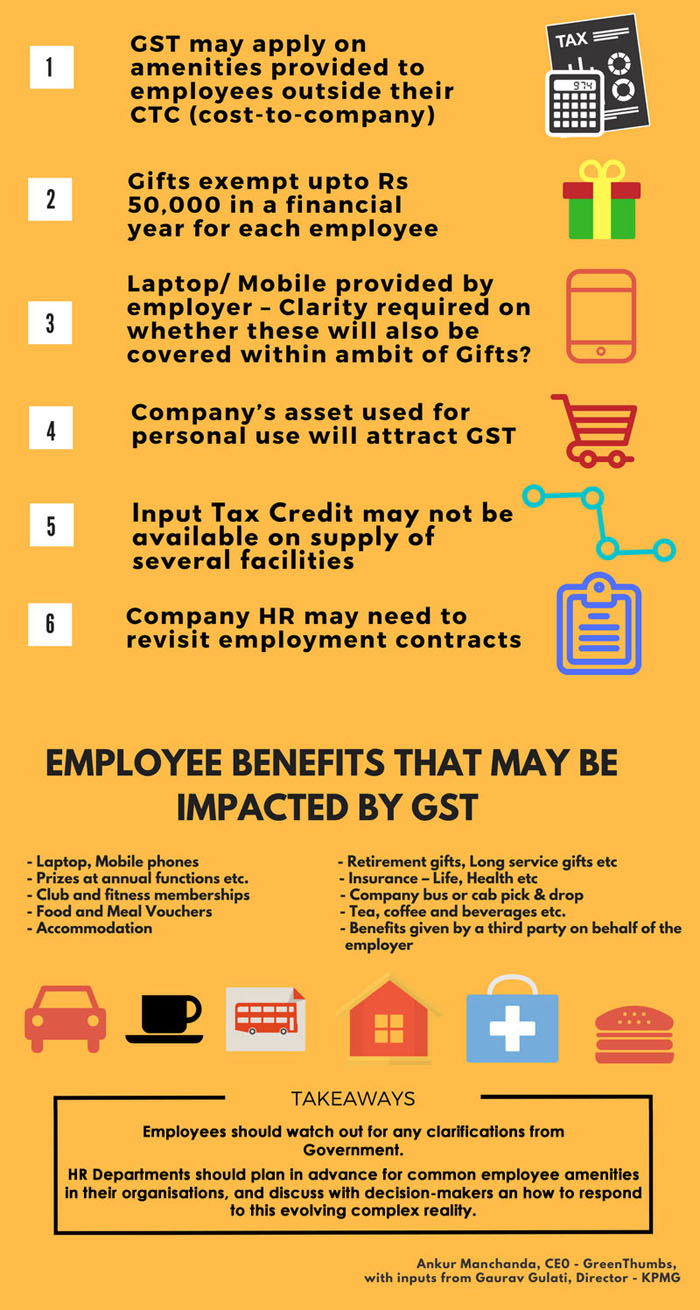

Gift Under GST: What Is And Isn’t Taxable – #15

Gift Under GST: What Is And Isn’t Taxable – #15

25 Small Business Tax Deductions (2024) – #16

25 Small Business Tax Deductions (2024) – #16

Are gift cards tax deductible? I iChoose New Zealand – #17

Are gift cards tax deductible? I iChoose New Zealand – #17

How is a gift perquisite amount taxed in India? If it is more than 5000, is the entire amount taxed or just the amount that exceeds 5000? – Quora – #18

How is a gift perquisite amount taxed in India? If it is more than 5000, is the entire amount taxed or just the amount that exceeds 5000? – Quora – #18

In-Kind Donations and Tax Deductions 101 | DonationMatch — DonationMatch – #19

In-Kind Donations and Tax Deductions 101 | DonationMatch — DonationMatch – #19

Can I treat my employee to a gift? • Vantage Accounting – #20

Can I treat my employee to a gift? • Vantage Accounting – #20

- employee appreciation gifts under $10

- pinterest employee appreciation ideas

- personalized gifts for employees

Employee Holiday Gifts May Be Taxable – Henssler Financial – #21

Employee Holiday Gifts May Be Taxable – Henssler Financial – #21

Taxes On Gifts From Overseas – #22

Taxes On Gifts From Overseas – #22

The Tax Life Cycle — From Birth to Death | EZTax® – #23

The Tax Life Cycle — From Birth to Death | EZTax® – #23

What is the Gift Tax in India and How Does it Affect NRIs? – #24

What is the Gift Tax in India and How Does it Affect NRIs? – #24

- gift tax meaning

- gift ideas for employees on a budget

- inexpensive employee appreciation gifts

The Season for Business Gifts | Pennsylvania Fiduciary Litigation – #25

The Season for Business Gifts | Pennsylvania Fiduciary Litigation – #25

Fringe Benefits, Rules for 2% S Corp Shareholders & Cares Act Changes – #26

Fringe Benefits, Rules for 2% S Corp Shareholders & Cares Act Changes – #26

I received gifts during my wedding, are they taxable? – #27

I received gifts during my wedding, are they taxable? – #27

Employees to pay tax on gifts worth more than Rs.50,000 – The Hindu – #28

Employees to pay tax on gifts worth more than Rs.50,000 – The Hindu – #28

Taxes you have to pay when you get a gift – The Economic Times – #29

Taxes you have to pay when you get a gift – The Economic Times – #29

Short on Cash? Gift-in-Kind Donations Can Also Help Support Charities | Carr, Riggs & Ingram CPAs and Advisors – #30

Short on Cash? Gift-in-Kind Donations Can Also Help Support Charities | Carr, Riggs & Ingram CPAs and Advisors – #30

Get Involved: Fundraising for Childhood Cancer – #31

Get Involved: Fundraising for Childhood Cancer – #31

What are the legal implications of an employer giving their employees gifts with their own money, but not company funds? Would this be considered taxable income? If so, how much would be – #32

What are the legal implications of an employer giving their employees gifts with their own money, but not company funds? Would this be considered taxable income? If so, how much would be – #32

Using gift cards as a tax-free trivial benefit | Blackhawk Network – #33

Using gift cards as a tax-free trivial benefit | Blackhawk Network – #33

Trivial Benefits and Tax – A Guide for Employers – #34

Trivial Benefits and Tax – A Guide for Employers – #34

Kemper CPA Group LLP – #35

Kemper CPA Group LLP – #35

Tax Tips for Incentive Programs | Northstar Meetings Group – #36

Tax Tips for Incentive Programs | Northstar Meetings Group – #36

Recruitment Costs: FAR Allowability and Tax Implications : Cherry Bekaert – #37

Recruitment Costs: FAR Allowability and Tax Implications : Cherry Bekaert – #37

15 Tax Saving Options Other Than Section 80C – #38

15 Tax Saving Options Other Than Section 80C – #38

Tax on gifts to employees & directors – #39

Tax on gifts to employees & directors – #39

Are Gift Cards Taxable? | Taxation, Examples, & More – #40

Are Gift Cards Taxable? | Taxation, Examples, & More – #40

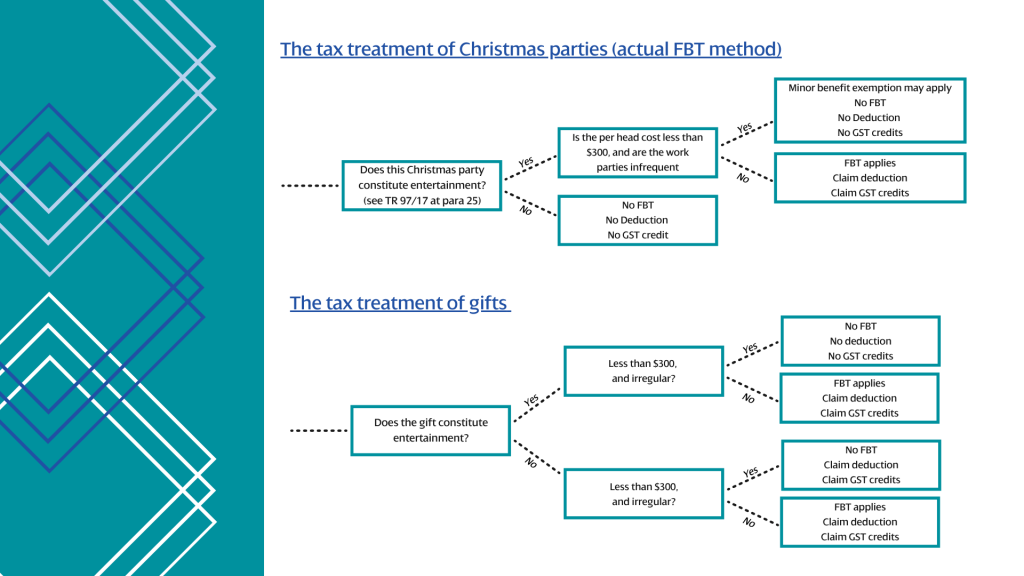

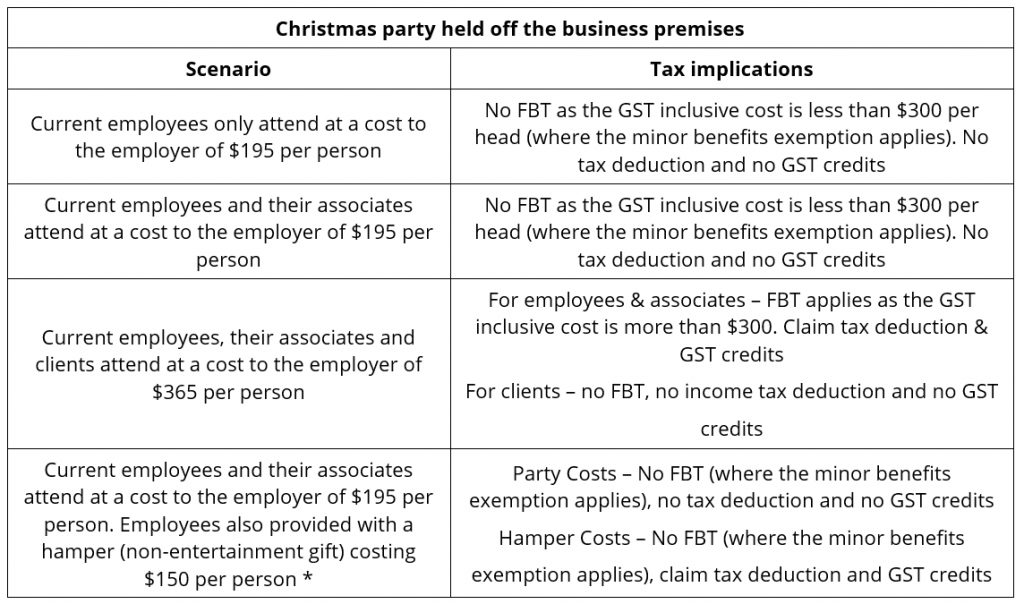

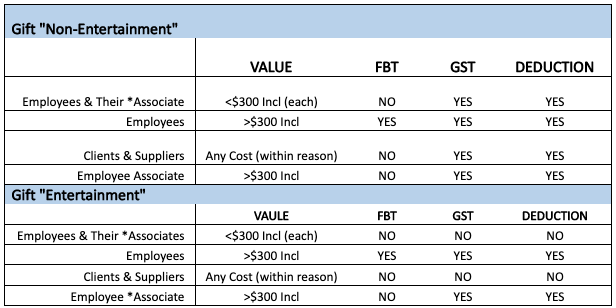

Christmas Expenses: A Tax Treatment Guide for Business – Hoffman Kelly | Accounting Service | Brisbane | Stones Corner – #41

Christmas Expenses: A Tax Treatment Guide for Business – Hoffman Kelly | Accounting Service | Brisbane | Stones Corner – #41

- office diy employee appreciation gifts

- corporate gift ideas for employees

- gift tax exemption 2022

Can a company gift a vehicle to an employee in India without tax? – Quora – #42

Can a company gift a vehicle to an employee in India without tax? – Quora – #42

) Tax Rules for Holiday Parties and Gifts – GRF CPAs & Advisors – #43

Tax Rules for Holiday Parties and Gifts – GRF CPAs & Advisors – #43

Are Employee Gifts Tax Deductible? – Swag Bar – #44

Are Employee Gifts Tax Deductible? – Swag Bar – #44

Missouri Tax Credits – Good Shepherd – #45

Missouri Tax Credits – Good Shepherd – #45

The Tax Implications of Employee Gifts: An Easy Guide for U.S. Employers | Goody – #46

The Tax Implications of Employee Gifts: An Easy Guide for U.S. Employers | Goody – #46

Holiday Employee Gift Giving and Tax Deductions – Intuit TurboTax Blog – #47

Holiday Employee Gift Giving and Tax Deductions – Intuit TurboTax Blog – #47

Employee Matching Gifts | Leukemia and Lymphoma Society – #48

Employee Matching Gifts | Leukemia and Lymphoma Society – #48

- christmas giving gifts

- gift tax rate

- staff appreciation employee appreciation gifts

Are Business Gifts Tax Deductible? 7 Rules for Clients and Employees Gifts – #49

Are Business Gifts Tax Deductible? 7 Rules for Clients and Employees Gifts – #49

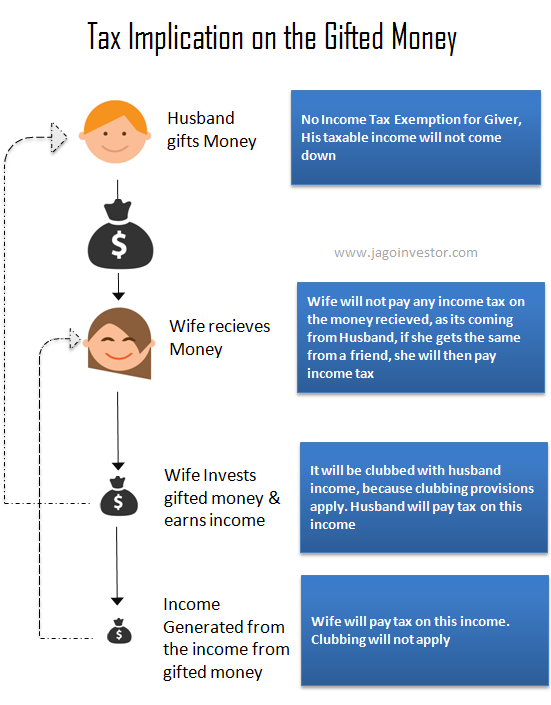

Gifts & Income Tax Implications : Scenarios & Examples – #50

Gifts & Income Tax Implications : Scenarios & Examples – #50

Income Tax Return Filing: Are wedding gifts really tax free? All hidden clauses, conditions explained | Zee Business – #51

Income Tax Return Filing: Are wedding gifts really tax free? All hidden clauses, conditions explained | Zee Business – #51

- person giving gifts

- lineal ascendant gift from relative exempt from income tax

- gifts for employees appreciation

Are gift cards taxable employee benefits? – #52

Are gift cards taxable employee benefits? – #52

What is imputed income? – #53

What is imputed income? – #53

Deducting Meals as a Business Expense – #54

Deducting Meals as a Business Expense – #54

Are Gifts Tax-Deductible? – #55

Are Gifts Tax-Deductible? – #55

4. The tax treatment of giving | Taxation and Philanthropy | OECD iLibrary – #56

4. The tax treatment of giving | Taxation and Philanthropy | OECD iLibrary – #56

Taxation of Gifts to Ministers and Church Employees – Provident Lawyers – #57

Taxation of Gifts to Ministers and Church Employees – Provident Lawyers – #57

Understanding Gift Card Taxation in Spain: A Comprehensive Guide – #58

Understanding Gift Card Taxation in Spain: A Comprehensive Guide – #58

- section 56(2) of income tax act

- money gift deed format

- inexpensive employee appreciation ideas

tax treatment of gifts | PDF – #59

tax treatment of gifts | PDF – #59

Gift Tax In India – All about Gift Tax – Digiaccounto – #60

Gift Tax In India – All about Gift Tax – Digiaccounto – #60

Accountable Plan: Definition and Taxation on Reimbursements – #61

Accountable Plan: Definition and Taxation on Reimbursements – #61

- staff gift ideas

- gift tax act 1958

- diy employee appreciation gifts

Tax Impact of sale of Fixed Assets by Company to its employees – #62

Tax Impact of sale of Fixed Assets by Company to its employees – #62

Employee Benevolence – If Our Church Gives a Gift to One of Our Employees Is It Taxable? – MinistryWorks – #63

Employee Benevolence – If Our Church Gives a Gift to One of Our Employees Is It Taxable? – MinistryWorks – #63

How To Deduct Client Gifts – The $25 Rule — Bastian Accounting for Photographers – #64

How To Deduct Client Gifts – The $25 Rule — Bastian Accounting for Photographers – #64

- fun recognition gifts for employees

- gift tax rate in india 2020

- gift deed format father to son

Donating Equity Compensation Awards | Schwab Charitable Donor-Advised Fund | Schwab Charitable – #65

Donating Equity Compensation Awards | Schwab Charitable Donor-Advised Fund | Schwab Charitable – #65

Here are the Top 9 Tax-Free Investments Everybody Should Consider – #66

Here are the Top 9 Tax-Free Investments Everybody Should Consider – #66

Q&A: Gift card instead of a cash bonus – #67

Q&A: Gift card instead of a cash bonus – #67

Tax Planning for Stock Options – #68

Tax Planning for Stock Options – #68

Goods and Services Tax Applicability on Employees Structure | SAG Infotech – #69

Goods and Services Tax Applicability on Employees Structure | SAG Infotech – #69

Restricted Stock Units – RSU Taxation, Vesting, Calculator & More – #70

Restricted Stock Units – RSU Taxation, Vesting, Calculator & More – #70

Employee Gifts – CPA Shows You How to Avoid Costly Tax Mistakes – YouTube – #71

Employee Gifts – CPA Shows You How to Avoid Costly Tax Mistakes – YouTube – #71

Is Company Swag Taxable? | Stitchi – #72

Is Company Swag Taxable? | Stitchi – #72

Charitable Gifting at Nike – Maximizing the Nike Donation Match & Lowering Taxes — Human Investing – #73

Charitable Gifting at Nike – Maximizing the Nike Donation Match & Lowering Taxes — Human Investing – #73

Grantor Trusts: A Path To Employee Ownership | EOT Advisors – #74

Grantor Trusts: A Path To Employee Ownership | EOT Advisors – #74

Untitled – #75

Untitled – #75

The Tax Implications Behind Gifting Capital Assets – #76

The Tax Implications Behind Gifting Capital Assets – #76

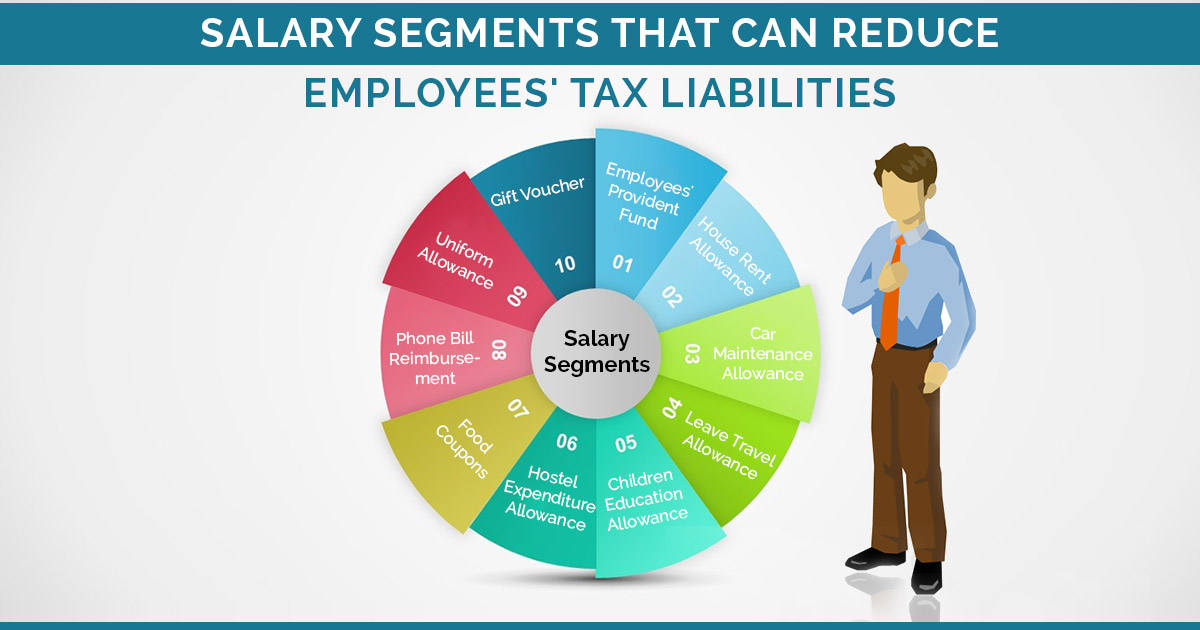

Tax Treatment of Allowances and Perquisites under Head Salary – #77

Tax Treatment of Allowances and Perquisites under Head Salary – #77

Complete Guide on Whether Employee Gift Cards Are Taxable Or Not – #78

Complete Guide on Whether Employee Gift Cards Are Taxable Or Not – #78

FAQ: Are Gift Cards for Employees a Tax Deduction? – #79

FAQ: Are Gift Cards for Employees a Tax Deduction? – #79

What is the limit up to which a father can gift to his son under income tax laws | Mint – #80

What is the limit up to which a father can gift to his son under income tax laws | Mint – #80

Employee Gifts: What You Need to Know From a Tax Perspective – #81

Employee Gifts: What You Need to Know From a Tax Perspective – #81

- employee giving gifts

- lineal ascendant meaning

- cheap diy employee appreciation gifts

TCS on Foreign Remittances towards LRS Foreign Travel Overseas Tour Packages – #82

TCS on Foreign Remittances towards LRS Foreign Travel Overseas Tour Packages – #82

Types of Taxable & Tax-Free Fringe Benefits | Points North – #83

Types of Taxable & Tax-Free Fringe Benefits | Points North – #83

CRA Gift Tax Rules for Employers – #84

CRA Gift Tax Rules for Employers – #84

The receipt and redemption of rewards program points: Tax and reporting implications – #85

The receipt and redemption of rewards program points: Tax and reporting implications – #85

Accounting for gifts – Caseron Cloud Accounting – #86

Accounting for gifts – Caseron Cloud Accounting – #86

- gift chart as per income tax

- gift from relative exempt from income tax

- gift tax in india

Taxation of Gifts: An In Depth Analysis – #87

Taxation of Gifts: An In Depth Analysis – #87

NMS Certified Public Accountants – #88

NMS Certified Public Accountants – #88

Are Business Gifts Tax-Deductible? IN Accountancy Explains – #89

Are Business Gifts Tax-Deductible? IN Accountancy Explains – #89

Top tax write-offs that could get you in trouble with the IRS – #90

Top tax write-offs that could get you in trouble with the IRS – #90

Perquisites Meaning Eplained With Types, Benefits & Examples – #91

Perquisites Meaning Eplained With Types, Benefits & Examples – #91

TDS & Tax on Salary | Section 192 | FY 2021-22 | AY 2022-23 – #92

TDS & Tax on Salary | Section 192 | FY 2021-22 | AY 2022-23 – #92

Empire Accountants – Can I claim it? Christmas Parties and Client Gifts – #93

Empire Accountants – Can I claim it? Christmas Parties and Client Gifts – #93

Fringe Benefit Taxation – Tax Office | The University of Alabama – #94

Fringe Benefit Taxation – Tax Office | The University of Alabama – #94

EMPLOYERS CAN NOW PROVIDE TAX-FREE QUALIFIED DISASTER PAYMENTS TO EMPLOYEES IN CONNECTION WITH COVID-19 – #95

EMPLOYERS CAN NOW PROVIDE TAX-FREE QUALIFIED DISASTER PAYMENTS TO EMPLOYEES IN CONNECTION WITH COVID-19 – #95

What Are the Tax Consequences of Being Added to a Deed? | SmartAsset – #96

What Are the Tax Consequences of Being Added to a Deed? | SmartAsset – #96

A Complete Guide to Employee Gifting | Xoxoday – #97

A Complete Guide to Employee Gifting | Xoxoday – #97

How to treat Gifts and Entertainment expenses in your business – MJJ Accounting and Business Solutions – #98

How to treat Gifts and Entertainment expenses in your business – MJJ Accounting and Business Solutions – #98

Maternity Leave in India 2024: Laws, Eligibility and Benefits – #99

Maternity Leave in India 2024: Laws, Eligibility and Benefits – #99

Are Your Holiday Employee Gifts Tax Deductible? – #100

Are Your Holiday Employee Gifts Tax Deductible? – #100

Tax Implications of Gift Gifting From Your Medical Practice – Bokhaut CPA LLP – #101

Tax Implications of Gift Gifting From Your Medical Practice – Bokhaut CPA LLP – #101

Are Business Gifts Tax Deductible? – #102

Are Business Gifts Tax Deductible? – #102

Rudd Mantell Accountants – #103

Rudd Mantell Accountants – #103

Expanded meals and entertainment expense rules allow for increased deductions | Our Insights | Plante Moran – #104

Expanded meals and entertainment expense rules allow for increased deductions | Our Insights | Plante Moran – #104

US Gift Tax on Nonresident Noncitizens | James Moore & Co. – #105

US Gift Tax on Nonresident Noncitizens | James Moore & Co. – #105

What Qualifies as a Business Gift? | Accounting Freedom, Ltd. – #106

What Qualifies as a Business Gift? | Accounting Freedom, Ltd. – #106

Tax Checklist when buying Corporate Gifts for Employees | Laser Crystal – #107

Tax Checklist when buying Corporate Gifts for Employees | Laser Crystal – #107

Is That Payment Taxable? 5 Key Tax Facts All Employers Should Know – Procopio | Procopio – #108

Is That Payment Taxable? 5 Key Tax Facts All Employers Should Know – Procopio | Procopio – #108

Tax Deductions for Business Gifts – #109

Tax Deductions for Business Gifts – #109

Tax Treatment of Income Under the Head “Income from House Property” – #110

Tax Treatment of Income Under the Head “Income from House Property” – #110

Is Relinquishment Transfer of Property Taxable in India? – #111

Is Relinquishment Transfer of Property Taxable in India? – #111

A Guide To The Tax Benefits of Corporate Donation Matching Gifts | Groundswell – #112

A Guide To The Tax Benefits of Corporate Donation Matching Gifts | Groundswell – #112

Christmas parties and staff gifts – a tax guide | Hawsons – #113

Christmas parties and staff gifts – a tax guide | Hawsons – #113

- gift tax example

- birthday giving gifts

- gift deed format on stamp paper

Types of Allowances in India: Taxable and Non Taxable Allowance 2022-23 – #114

Types of Allowances in India: Taxable and Non Taxable Allowance 2022-23 – #114

Tax Planning For HUF (Hindu Undivided Family) | Business Basics – #115

Tax Planning For HUF (Hindu Undivided Family) | Business Basics – #115

Tax Treatment of Gifts Received By an Individual or HUF – #116

Tax Treatment of Gifts Received By an Individual or HUF – #116

ARE CHRISTMAS PARTIES & GIFTS TAX DEDUCTIBLE? – enterprisegrowth.com.au – #117

ARE CHRISTMAS PARTIES & GIFTS TAX DEDUCTIBLE? – enterprisegrowth.com.au – #117

How to Calculate Bonus Pay & Taxes (2024 Update) – #118

How to Calculate Bonus Pay & Taxes (2024 Update) – #118

18 Awesome Ideas for Employee Gifts – #119

18 Awesome Ideas for Employee Gifts – #119

What is a gift deed and tax implications | Tax Hack – #120

What is a gift deed and tax implications | Tax Hack – #120

Posts: employee gifts tax treatment

Categories: Gifts

Author: toyotabienhoa.edu.vn