Discover more than 201 cash gift tax super hot

Update images of cash gift tax by website toyotabienhoa.edu.vn compilation. Gift of Immovable property under Income Tax Act. To file or not to file a gift tax return, that is the question | Union Bank & Trust. Greece Increases Gift Tax-exempt Bracket From October 1, 2021 – Inheritance Tax – Greece. The 2021 Gift Tax Return Deadline is Almost Here, Too — Samuel Goldstein & Company

) Do Influencers Pay Tax On Gifts? – FreeCashFlow.io – #1

Do Influencers Pay Tax On Gifts? – FreeCashFlow.io – #1

The Tax Consequences of a Down Payment Gift for a Mortgage – #2

The Tax Consequences of a Down Payment Gift for a Mortgage – #2

Will your ‘gift’ be taxed? – The Economic Times – #4

Will your ‘gift’ be taxed? – The Economic Times – #4

5 gift tax exemptions you need to know | Fox Business – #5

5 gift tax exemptions you need to know | Fox Business – #5

Financial gifts explained | Bestinvest – #6

Financial gifts explained | Bestinvest – #6

Are Gift Cards Taxable to Employees? – #7

Are Gift Cards Taxable to Employees? – #7

Why a DAF Tax Deduction Is Better Than a Cash Gift – YouTube – #8

Why a DAF Tax Deduction Is Better Than a Cash Gift – YouTube – #8

- form 709

- gift from relative exempt from income tax

- estate/gift tax

Gift Tax in India | Save tax on Gift | Income Tax on property gift | will vs gift deed – YouTube – #10

Gift Tax in India | Save tax on Gift | Income Tax on property gift | will vs gift deed – YouTube – #10

- gift chart as per income tax

- gift tax 2023

- gift tax in india

Gift Tax in 2020: How Much Can I Give Tax-Free? | The Motley Fool – #11

Gift Tax in 2020: How Much Can I Give Tax-Free? | The Motley Fool – #11

Gift up to `50,000 by parents tax exempt for NRIs | Mint – #12

Gift up to `50,000 by parents tax exempt for NRIs | Mint – #12

How to Take Advantage of the Gift Tax Exclusion – EKS Associates – #13

How to Take Advantage of the Gift Tax Exclusion – EKS Associates – #13

Optotax on X: “Optotax Income Tax Update: Acceptance of Gift by NRI under Income-tax Act (Refer to the image below to know more) Tap on the link given below to Follow up – #14

Optotax on X: “Optotax Income Tax Update: Acceptance of Gift by NRI under Income-tax Act (Refer to the image below to know more) Tap on the link given below to Follow up – #14

Birthday cash hi-res stock photography and images – Alamy – #15

Birthday cash hi-res stock photography and images – Alamy – #15

Five sources of income other than EPF, PPF that are exempt from income tax | Business News – #16

Five sources of income other than EPF, PPF that are exempt from income tax | Business News – #16

US Gift Tax on Nonresident Noncitizens | James Moore & Co. – #17

US Gift Tax on Nonresident Noncitizens | James Moore & Co. – #17

Kiddie Tax & Other Pitfalls When Gifting Assets To Your Kids | Greenbush Financial Group – #18

Kiddie Tax & Other Pitfalls When Gifting Assets To Your Kids | Greenbush Financial Group – #18

Phew! IRS Announces No Clawback of the Lifetime Gift Tax Exemption | Sand Hill Global Advisors – #19

Phew! IRS Announces No Clawback of the Lifetime Gift Tax Exemption | Sand Hill Global Advisors – #19

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #20

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #20

Party Background Ribbon, Gift Card, Tax, Money, Christmas Gift, Gift Tax, 401k, Income transparent background PNG clipart | HiClipart – #21

Party Background Ribbon, Gift Card, Tax, Money, Christmas Gift, Gift Tax, 401k, Income transparent background PNG clipart | HiClipart – #21

- section 56(2) of income tax act

- gift tax rate in india 2022-23

- gift tax exemption

![Business Succession Management Business Tax... - Stock Photo [48216241] - PIXTA Business Succession Management Business Tax... - Stock Photo [48216241] - PIXTA](https://i.ytimg.com/vi/poiiLhFa5Fw/sddefault.jpg) Business Succession Management Business Tax… – Stock Photo [48216241] – PIXTA – #22

Business Succession Management Business Tax… – Stock Photo [48216241] – PIXTA – #22

Gift Splitting: Definition, Example, and Tax Rules – #23

Gift Splitting: Definition, Example, and Tax Rules – #23

Annual Gift Tax Exclusion Will Increase to $18,000 to Any Person in 2024 – #24

Annual Gift Tax Exclusion Will Increase to $18,000 to Any Person in 2024 – #24

The Time for Gifting | Trust Company of Oklahoma – #25

The Time for Gifting | Trust Company of Oklahoma – #25

Gift-Tax Act Archives | SCC Blog – #26

Gift-Tax Act Archives | SCC Blog – #26

Close Relatives” include Uncle and Aunt: ITAT deletes Addition for Cash Gift from Close Relatives during Emergency – #27

Close Relatives” include Uncle and Aunt: ITAT deletes Addition for Cash Gift from Close Relatives during Emergency – #27

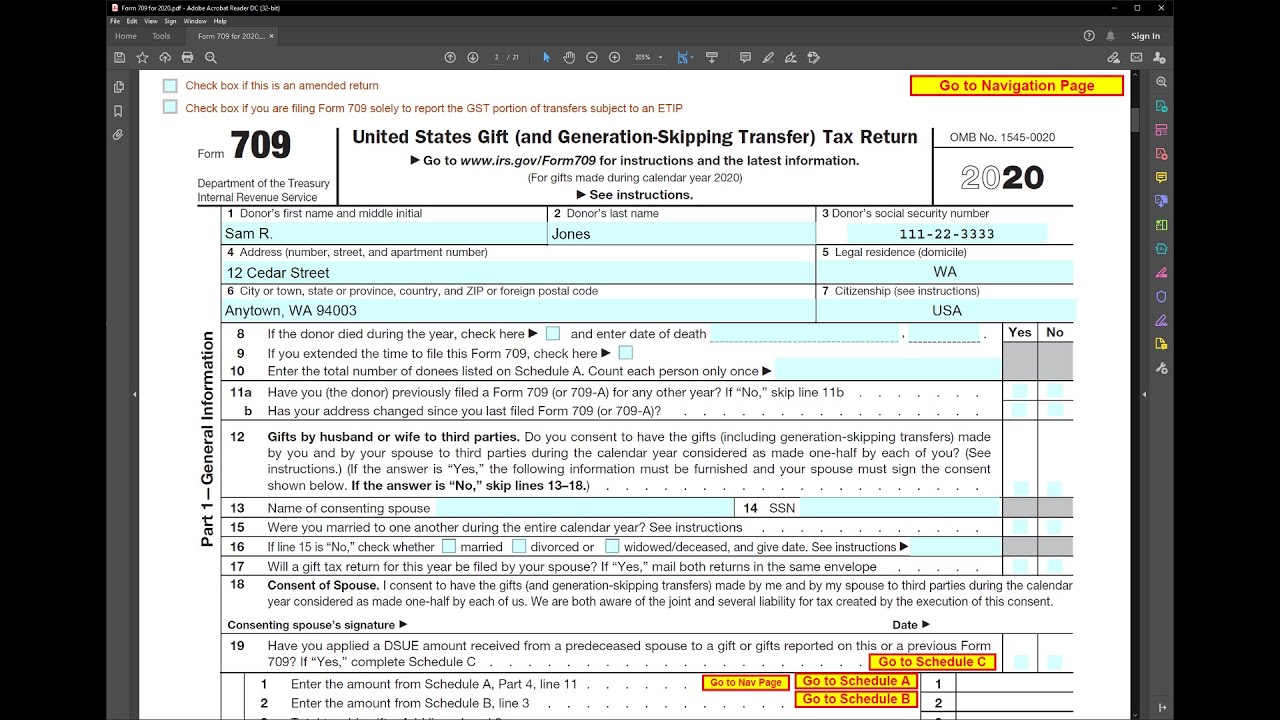

![Solved] Need the Form 709 to it.. GIFT TAX RETURN PROBLEM Lamar Grabowski... | Course Hero Solved] Need the Form 709 to it.. GIFT TAX RETURN PROBLEM Lamar Grabowski... | Course Hero](https://taxguru.in/wp-content/uploads/2021/06/Individual.jpg) Solved] Need the Form 709 to it.. GIFT TAX RETURN PROBLEM Lamar Grabowski… | Course Hero – #28

Solved] Need the Form 709 to it.. GIFT TAX RETURN PROBLEM Lamar Grabowski… | Course Hero – #28

A Tax-Smart Tip to Maximize Charitable Impact Using Your Traditional IRA | The Farther Outlook – #29

A Tax-Smart Tip to Maximize Charitable Impact Using Your Traditional IRA | The Farther Outlook – #29

Anti-Defamation League | Tax-Wise Gifts for 2021 | Mountain States – #30

Anti-Defamation League | Tax-Wise Gifts for 2021 | Mountain States – #30

Buy Online: Elegant Wedding Accessories – Welcome Ribbon – #31

Buy Online: Elegant Wedding Accessories – Welcome Ribbon – #31

Format of Gift Deed PDF | PDF | Government Finances | Taxes – #32

Format of Gift Deed PDF | PDF | Government Finances | Taxes – #32

NEW 2023 Estate and Gift Tax Rules | When Will Taxes Apply? – YouTube – #33

NEW 2023 Estate and Gift Tax Rules | When Will Taxes Apply? – YouTube – #33

INCOME TAX ON CASH GIFT TO WIFE I CA SATBIR SINGH – YouTube – #34

INCOME TAX ON CASH GIFT TO WIFE I CA SATBIR SINGH – YouTube – #34

Free Gift Affidavit Form | PDF & Word – #35

Free Gift Affidavit Form | PDF & Word – #35

Tax Queries: What are the tax implications on a gift deed? – The Economic Times – #36

Tax Queries: What are the tax implications on a gift deed? – The Economic Times – #36

Tax relief! You don’t have to pay income tax on this money gift | Zee Business – #37

Tax relief! You don’t have to pay income tax on this money gift | Zee Business – #37

What it Means to Make a Gift Under the Federal Gift Tax System – Agency One – #38

What it Means to Make a Gift Under the Federal Gift Tax System – Agency One – #38

How to gift stocks, bonds and ETFs and the tax implications – Z-Connect by Zerodha – #39

How to gift stocks, bonds and ETFs and the tax implications – Z-Connect by Zerodha – #39

Transferring Large Sums of Money Internationally | Bright!Tax Expat Tax Services – #40

Transferring Large Sums of Money Internationally | Bright!Tax Expat Tax Services – #40

Use the net gift technique to reduce your gift tax rate – RRBB – #41

Use the net gift technique to reduce your gift tax rate – RRBB – #41

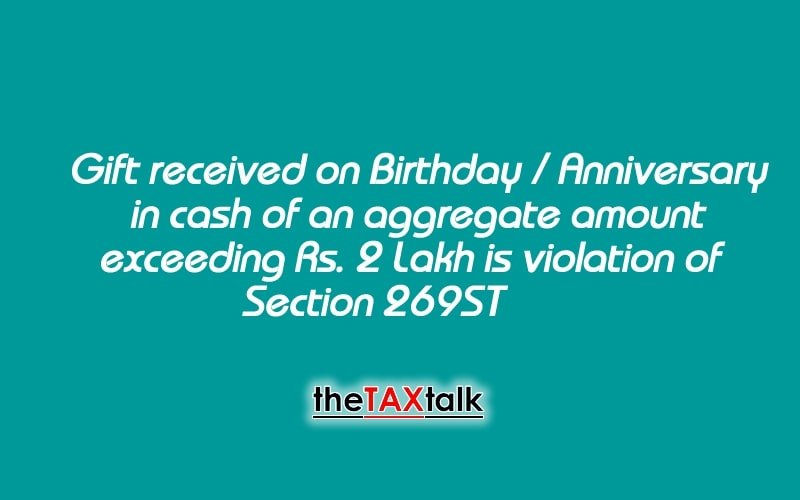

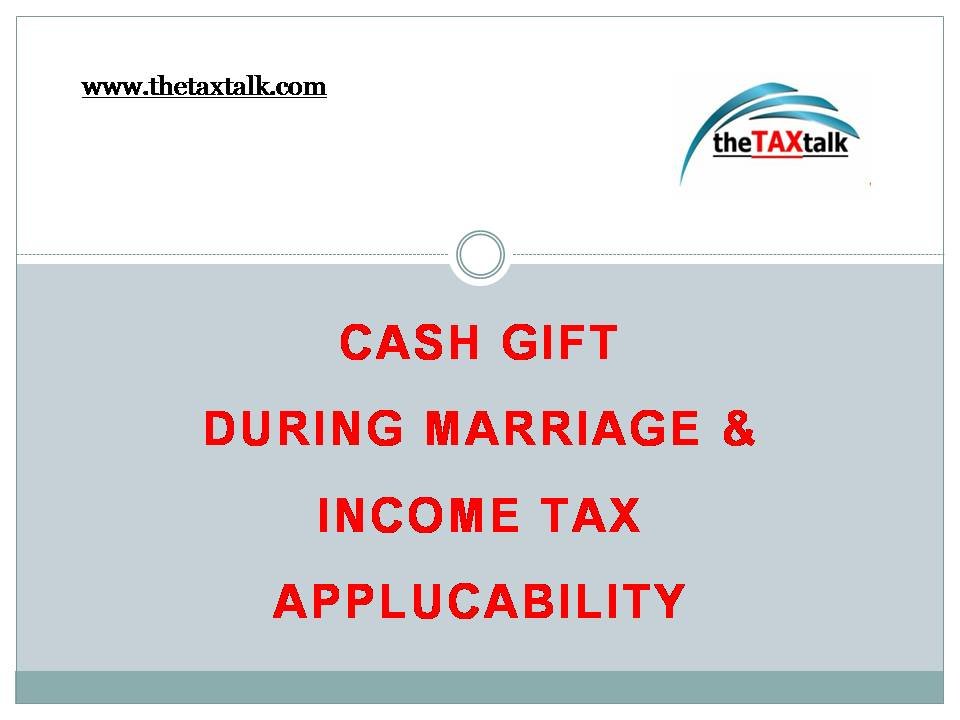

Weddings And Tax Implications of Cash Gifts – #42

Weddings And Tax Implications of Cash Gifts – #42

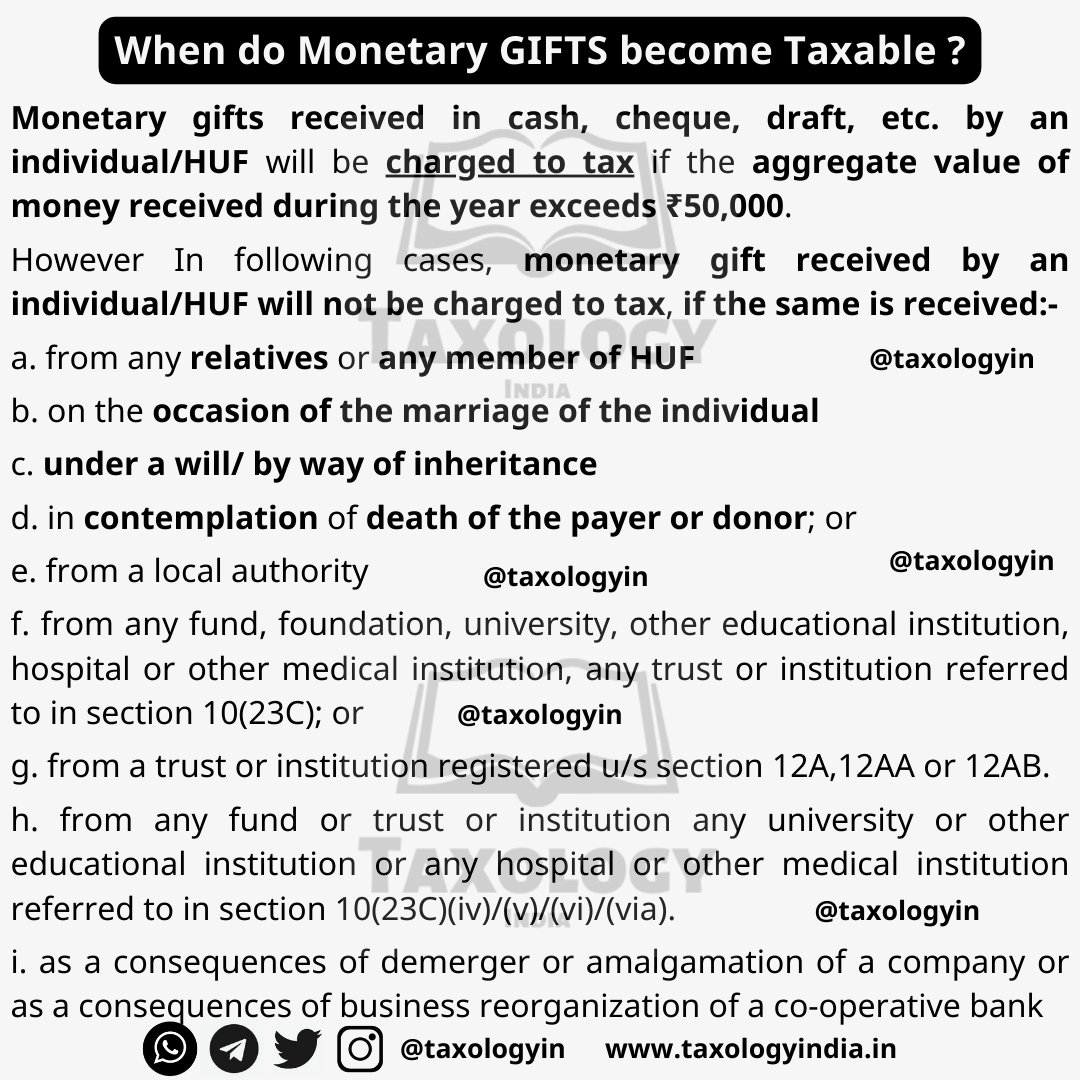

Gift are taxable income or exempted income & how are gift taxed? – Tax Knowledges – #43

Gift are taxable income or exempted income & how are gift taxed? – Tax Knowledges – #43

Tax Revenue: What It Is, How It Works, Types – #44

Tax Revenue: What It Is, How It Works, Types – #44

![Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will](https://etstatic.tnn.in/photo/msid-106566685/106566685.jpg) Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will – #45

Gift Tax: 5 Tips to Avoid Paying Tax on Gifts [Updated 2023] | Trust & Will – #45

- wedding cash gift

- gift tax example

- money gift ideas for birthdays

Gift Tax: शादी में मिले गिफ्ट टैक्स फ्री, पर जन्मदिन व ऑफिस से मिले तोहफे पर लगता है कर, जानिए ऐसा क्यों? – What is gift tax which gifts are non taxable – #46

Gift Tax: शादी में मिले गिफ्ट टैक्स फ्री, पर जन्मदिन व ऑफिस से मिले तोहफे पर लगता है कर, जानिए ऐसा क्यों? – What is gift tax which gifts are non taxable – #46

Unwrapping the Secrets of Gift Tax | Fascinating World of Gift Tax! | CA Sanjeev S Thakur – YouTube – #47

Unwrapping the Secrets of Gift Tax | Fascinating World of Gift Tax! | CA Sanjeev S Thakur – YouTube – #47

Gift Tax, the Annual Exclusion and Estate Planning – #48

Gift Tax, the Annual Exclusion and Estate Planning – #48

Tax On Gifts: How Does It Impact You? | by BeVik | Medium – #49

Tax On Gifts: How Does It Impact You? | by BeVik | Medium – #49

Cash Voucher | Format | Benefits of Using Cash Vouchers – #50

Cash Voucher | Format | Benefits of Using Cash Vouchers – #50

Bajaj Capital Limited – Money received by any relative, is NOT taxable in their hands. The definition of the term ‘relative’ under the Income-tax Act, 1961, includes various family members but does – #51

Bajaj Capital Limited – Money received by any relative, is NOT taxable in their hands. The definition of the term ‘relative’ under the Income-tax Act, 1961, includes various family members but does – #51

Understanding Gift Taxes | Georgia Estate Plan: Worrall Law LLC – #52

Understanding Gift Taxes | Georgia Estate Plan: Worrall Law LLC – #52

Using Your IRA For Tax-Efficient Charitable Giving | Prairiewood Wealth Management – #53

Using Your IRA For Tax-Efficient Charitable Giving | Prairiewood Wealth Management – #53

Tax-free amounts for 2024 — Karisch Jonas Law • Texas Probate – #54

Tax-free amounts for 2024 — Karisch Jonas Law • Texas Probate – #54

Income Tax on Gifts: Exemptions and computation – #55

Income Tax on Gifts: Exemptions and computation – #55

Estate Tax Planning and Compliance – #56

Estate Tax Planning and Compliance – #56

i.ytimg.com/vi/WDfGFSeDGvg/maxresdefault.jpg – #57

i.ytimg.com/vi/WDfGFSeDGvg/maxresdefault.jpg – #57

A Guide to Gifting Money to Your Children | City National Bank – #58

A Guide to Gifting Money to Your Children | City National Bank – #58

Can I Pay My Kid’s Tuition Without Triggering the Gift Tax? | Money – #59

Can I Pay My Kid’s Tuition Without Triggering the Gift Tax? | Money – #59

Countdown for Gift and Estate Tax Exemptions | Charles Schwab – #60

Countdown for Gift and Estate Tax Exemptions | Charles Schwab – #60

Gifts that Pay You Income | Archdiocese of New York – #61

Gifts that Pay You Income | Archdiocese of New York – #61

Perquisites: Meaning, Types, Calculation & Examples – Razorpay Payroll – #62

Perquisites: Meaning, Types, Calculation & Examples – Razorpay Payroll – #62

The Federal Gift and Estate Taxes – ppt download – #63

The Federal Gift and Estate Taxes – ppt download – #63

The U.S. Estate and Gift Tax and the Non-Citizen (2nd Edition) by ForsterBoughman – Issuu – #64

The U.S. Estate and Gift Tax and the Non-Citizen (2nd Edition) by ForsterBoughman – Issuu – #64

Add a tax break to your holiday gift list – KraftCPAs – #65

Add a tax break to your holiday gift list – KraftCPAs – #65

PPF: How you can double your income through clubbing your life partner’s PPF account; know the trick | Zee Business – #66

PPF: How you can double your income through clubbing your life partner’s PPF account; know the trick | Zee Business – #66

Solved In 2021 , you gave a $15,000 cash gift to your best | Chegg.com – #67

Solved In 2021 , you gave a $15,000 cash gift to your best | Chegg.com – #67

Gift Tax Explained – Do You Pay Taxes On Gifted Money? – YouTube – #68

Gift Tax Explained – Do You Pay Taxes On Gifted Money? – YouTube – #68

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #69

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #69

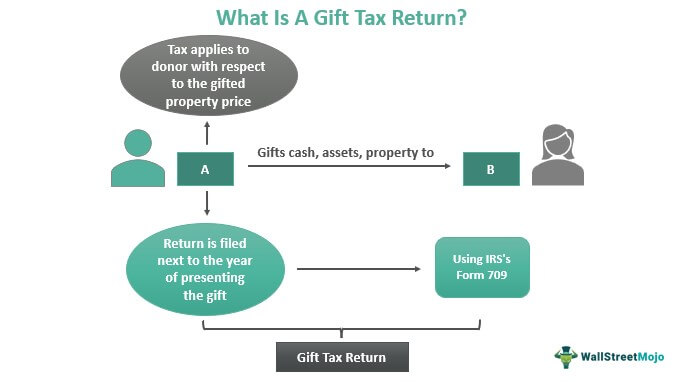

Gift Tax Return Preparation and Planning – #70

Gift Tax Return Preparation and Planning – #70

Income tax Money Gift tax, Received stamp, text, public Relations, logo png | PNGWing – #71

Income tax Money Gift tax, Received stamp, text, public Relations, logo png | PNGWing – #71

Changes for estate and gift tax under the new Tax Cuts and Jobs Act – Tarleton Law Firm – #72

Changes for estate and gift tax under the new Tax Cuts and Jobs Act – Tarleton Law Firm – #72

Two tax-smart strategies for charitable giving with an IRA | Schwab Charitable Donor-Advised Fund | Schwab Charitable – #73

Two tax-smart strategies for charitable giving with an IRA | Schwab Charitable Donor-Advised Fund | Schwab Charitable – #73

The Continuing Tax Gift To India Inc : Daily Current Affairs | Dhyeya IAS® – Best UPSC IAS CSE Online Coaching | Best UPSC Coaching | Top IAS Coaching in Delhi | Top CSE Coaching – #74

The Continuing Tax Gift To India Inc : Daily Current Affairs | Dhyeya IAS® – Best UPSC IAS CSE Online Coaching | Best UPSC Coaching | Top IAS Coaching in Delhi | Top CSE Coaching – #74

Gifting Opportunities Under the New Tax Law | Wealth Management – #75

Gifting Opportunities Under the New Tax Law | Wealth Management – #75

Understanding Section 56(2)(vii) of the Income Tax Act: Taxation on Gifts and its Implications – Marg ERP Blog – #76

Understanding Section 56(2)(vii) of the Income Tax Act: Taxation on Gifts and its Implications – Marg ERP Blog – #76

Word Gift Tax Composed Wooden Letters Stock Photo 1072390610 | Shutterstock – #77

Word Gift Tax Composed Wooden Letters Stock Photo 1072390610 | Shutterstock – #77

13 tax-free income in India – every investor should know – #78

13 tax-free income in India – every investor should know – #78

Federal Estate and Gift Tax Rates, Exemptions, and Exclusions, 1916-2014 – #79

Federal Estate and Gift Tax Rates, Exemptions, and Exclusions, 1916-2014 – #79

A Simple Solution to the Estate & Gift Tax Quandary – Agency One – #80

A Simple Solution to the Estate & Gift Tax Quandary – Agency One – #80

12 Tax-Smart Charitable Giving Tips for 2023 | Charles Schwab – #81

12 Tax-Smart Charitable Giving Tips for 2023 | Charles Schwab – #81

IRS’s Ability to Collect from Recipients of Gifts – IRS Tax Trouble – #82

IRS’s Ability to Collect from Recipients of Gifts – IRS Tax Trouble – #82

IRS Announces Higher 2019 Estate And Gift Tax Limits – #83

IRS Announces Higher 2019 Estate And Gift Tax Limits – #83

Gift Tax Limit: How to Gift More Than $16,000 in a Year | Divergent Planning – #84

Gift Tax Limit: How to Gift More Than $16,000 in a Year | Divergent Planning – #84

Tax Relief – Just for Them Gift Baskets – #85

Tax Relief – Just for Them Gift Baskets – #85

What Is The Gift Tax Rate? – Forbes Advisor – #86

What Is The Gift Tax Rate? – Forbes Advisor – #86

The Gift That Increases Your retirement Income :: Diocese of Sioux City :: Sioux City, IA – #87

The Gift That Increases Your retirement Income :: Diocese of Sioux City :: Sioux City, IA – #87

When Gifts Become Taxing – #88

When Gifts Become Taxing – #88

Does joint account rule out tax exempt small gift for son-in-law? – The Irish Times – #89

Does joint account rule out tax exempt small gift for son-in-law? – The Irish Times – #89

Gift Taxes from Real Estate and New IRS Rules on CashApp and more – #90

Gift Taxes from Real Estate and New IRS Rules on CashApp and more – #90

How much Cash is Tax Free, Sec. 56 of income tax, Relative से पैसा लेने से पहले यह video ज़रूर देखना – YouTube – #91

How much Cash is Tax Free, Sec. 56 of income tax, Relative से पैसा लेने से पहले यह video ज़रूर देखना – YouTube – #91

Test Client – Test Client – #92

Test Client – Test Client – #92

Income tax department launches TIN 2.0: Simplified tax payments for same-day credit or refund – BusinessToday – #93

Income tax department launches TIN 2.0: Simplified tax payments for same-day credit or refund – BusinessToday – #93

How To Legally Gift Money To A Family Member In The UK? – #94

How To Legally Gift Money To A Family Member In The UK? – #94

Cash and Cash Equivalents Chapter 1 Tools & Techniques of Investment Planning Life Insurance and the Generation-Skipping Transfer Tax Chapter 25 Tools. – ppt download – #95

Cash and Cash Equivalents Chapter 1 Tools & Techniques of Investment Planning Life Insurance and the Generation-Skipping Transfer Tax Chapter 25 Tools. – ppt download – #95

MASD & Co on X: “Gifts are usually capital receipts by nature. The Income Tax Act, 1961 which is levies tax on incomes, that is revenue receipts, carves out certain exceptions and – #96

MASD & Co on X: “Gifts are usually capital receipts by nature. The Income Tax Act, 1961 which is levies tax on incomes, that is revenue receipts, carves out certain exceptions and – #96

Income Tax – #97

Income Tax – #97

How To Leverage Your Marriage To Avoid Paying Gift Tax | GOBankingRates – #98

How To Leverage Your Marriage To Avoid Paying Gift Tax | GOBankingRates – #98

Will my wedding gift be taxed?’ – Rediff.com – #99

Will my wedding gift be taxed?’ – Rediff.com – #99

-Gifts.jpg) Daisy Does Taxes | Are gifts taxable?🎁 Cash gifts definitely are! They’re counted as income and have to be recorded 🪷 #accountant #spicyaccountant… | Instagram – #100

Daisy Does Taxes | Are gifts taxable?🎁 Cash gifts definitely are! They’re counted as income and have to be recorded 🪷 #accountant #spicyaccountant… | Instagram – #100

Tuesday Tax Tidbit: Planning to Make a Large Cash Gift for High School Graduation? | Weaver – #101

Tuesday Tax Tidbit: Planning to Make a Large Cash Gift for High School Graduation? | Weaver – #101

What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #102

What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #102

Tax Implications When Sending Money to the Philippines – #103

Tax Implications When Sending Money to the Philippines – #103

Charitable deduction rules for trusts, estates, and lifetime transfers – #104

Charitable deduction rules for trusts, estates, and lifetime transfers – #104

3,500+ Gift Tax Photos Stock Photos, Pictures & Royalty-Free Images – iStock – #105

3,500+ Gift Tax Photos Stock Photos, Pictures & Royalty-Free Images – iStock – #105

Is the New Tax Act a Gift to Parents? – #106

Is the New Tax Act a Gift to Parents? – #106

Misunderstanding Gifting Rules – Allaire Elder Law – #107

Misunderstanding Gifting Rules – Allaire Elder Law – #107

How much money can you gift tax free? How the inheritance tax threshold works and the 7-year rule explained – #108

How much money can you gift tax free? How the inheritance tax threshold works and the 7-year rule explained – #108

Cash and Non-Cash Gifts – National Boy Scouts of America Foundation – #109

Cash and Non-Cash Gifts – National Boy Scouts of America Foundation – #109

Non-taxable income: 5 different types of non-taxable income that can help you to save income tax | Zee Business – #110

Non-taxable income: 5 different types of non-taxable income that can help you to save income tax | Zee Business – #110

NS Global » India tax – #111

NS Global » India tax – #111

The Gift That Keeps on Giving: Tax Breaks Renewed for 2021 – Context | AB – #112

The Gift That Keeps on Giving: Tax Breaks Renewed for 2021 – Context | AB – #112

Appreciated Securities | Christian Union – #113

Appreciated Securities | Christian Union – #113

Drake Tax Services | Tax Season Tips For Holiday Gifts And Bonuses – #114

Drake Tax Services | Tax Season Tips For Holiday Gifts And Bonuses – #114

The Legalities of Cash Gifts: How Much Money Can I Gift Tax Free? – #115

The Legalities of Cash Gifts: How Much Money Can I Gift Tax Free? – #115

How are Diwali bonus and cash gifts taxed? | Times Now – #116

How are Diwali bonus and cash gifts taxed? | Times Now – #116

How To Write a Donor Acknowledgement Letter — Altruic Advisors – #117

How To Write a Donor Acknowledgement Letter — Altruic Advisors – #117

Take advantage of the gift tax exclusion rules – KraftCPAs – #118

Take advantage of the gift tax exclusion rules – KraftCPAs – #118

Gift by NRI to Resident Indian or Vice-Versa — NRI Gift Tax In India – Wisenri – Medium – #119

Gift by NRI to Resident Indian or Vice-Versa — NRI Gift Tax In India – Wisenri – Medium – #119

- gift tax upsc

- money cash gift

- gift money

How To Avoid The Gift Tax In Real Estate | Rocket Mortgage – #120

How To Avoid The Gift Tax In Real Estate | Rocket Mortgage – #120

Addition u/s 69A deleted as receipt of gifts in cash on various occasions is common – #121

Addition u/s 69A deleted as receipt of gifts in cash on various occasions is common – #121

Charitable donation hi-res stock photography and images – Alamy – #122

Charitable donation hi-res stock photography and images – Alamy – #122

New Limits on Estate Taxes & Gift Tax exemptions | Ashok Sanghavi – #123

New Limits on Estate Taxes & Gift Tax exemptions | Ashok Sanghavi – #123

Last Call” for Current Estate and Gift Exclusion? | Windes – #124

Last Call” for Current Estate and Gift Exclusion? | Windes – #124

U.S. Gift Tax Application – YouTube – #125

U.S. Gift Tax Application – YouTube – #125

Gift tax | PDF – #126

Gift tax | PDF – #126

Is There a New York Gift Tax? | Long Island Estate Planning – #127

Is There a New York Gift Tax? | Long Island Estate Planning – #127

Do cash gifts count as income? | Mozo – #128

Do cash gifts count as income? | Mozo – #128

Gift-Tax Exemptions are Treated Differently by IRS and Medicaid – – #129

Gift-Tax Exemptions are Treated Differently by IRS and Medicaid – – #129

Gift and Estate Tax Changes | LBMC – #130

Gift and Estate Tax Changes | LBMC – #130

Poll-Year's Budget Has A Tax Gift For Middle Class, Cash Transfer For Farmers – #131

Poll-Year's Budget Has A Tax Gift For Middle Class, Cash Transfer For Farmers – #131

Japanese Bank Note In The Darkness Background, Banknote Banknote 10, 000 Yen Bill Money Banknote Big Money Cash Inheritance Tax Lifetime Gift, Hd Photography Photo Background Image And Wallpaper for Free Download – #132

Japanese Bank Note In The Darkness Background, Banknote Banknote 10, 000 Yen Bill Money Banknote Big Money Cash Inheritance Tax Lifetime Gift, Hd Photography Photo Background Image And Wallpaper for Free Download – #132

IRS Increases Tax Breaks for Gifts, Estates and Capital Gains – #133

IRS Increases Tax Breaks for Gifts, Estates and Capital Gains – #133

दिवाली पर पत्नी को दे रहे हैं कैश गिफ्ट तो क्या भरना पड़ेगा इनकम टैक्स? नियम जान लेने में है भलाई | Zee Business Hindi – #134

दिवाली पर पत्नी को दे रहे हैं कैश गिफ्ट तो क्या भरना पड़ेगा इनकम टैक्स? नियम जान लेने में है भलाई | Zee Business Hindi – #134

Gift Letter: What it Means, How it Works – #135

Gift Letter: What it Means, How it Works – #135

Gift tax: what is it & how does it work? | Empower – #136

Gift tax: what is it & how does it work? | Empower – #136

) The Gift Tax Made Simple – TurboTax Tax Tips & Videos – #137

The Gift Tax Made Simple – TurboTax Tax Tips & Videos – #137

Gift Clearing Account | The Church Foundation – #138

Gift Clearing Account | The Church Foundation – #138

Estate Planning: Increased Transfer Limits for Gift and Estate Tax for 2023 – Young Moore Attorneys – #139

Estate Planning: Increased Transfer Limits for Gift and Estate Tax for 2023 – Young Moore Attorneys – #139

![Guide to Crypto Tax in India [Updated 2024] Guide to Crypto Tax in India [Updated 2024]](https://i.ytimg.com/vi/QWLzbnDcEjQ/sddefault.jpg) Guide to Crypto Tax in India [Updated 2024] – #140

Guide to Crypto Tax in India [Updated 2024] – #140

7 Tax Rules to Know if You Give or Receive Cash | Taxes | U.S. News – #141

7 Tax Rules to Know if You Give or Receive Cash | Taxes | U.S. News – #141

Why you should make annual exclusion gifts before year end – Whalen & Company, CPAs – #142

Why you should make annual exclusion gifts before year end – Whalen & Company, CPAs – #142

Received a gift from India? You now have to pay tax on it – News | Khaleej Times – #143

Received a gift from India? You now have to pay tax on it – News | Khaleej Times – #143

- money gift deed format

- gift tax rate

- cash gift

gifts and income tax | ReLakhs – #144

gifts and income tax | ReLakhs – #144

The 2024 Estate & Gift Tax Exemption: What You Need to Know – AmeriEstate – #145

The 2024 Estate & Gift Tax Exemption: What You Need to Know – AmeriEstate – #145

Gifting vs. Inheritance – Heritage Investment Group – #146

Gifting vs. Inheritance – Heritage Investment Group – #146

Federal and Minnesota Estate and Gift Tax: Knowing the Difference and 2018 Limit Changes – Schromen Law LLC – #147

Federal and Minnesota Estate and Gift Tax: Knowing the Difference and 2018 Limit Changes – Schromen Law LLC – #147

How To Pay Income Tax Online? | Consultaxx™ – #148

How To Pay Income Tax Online? | Consultaxx™ – #148

Tax-Free Income Sources in India 2024 – #149

Tax-Free Income Sources in India 2024 – #149

What is the tax on gifts in India? – #150

What is the tax on gifts in India? – #150

What is gift tax? – Universal CPA Review – #151

What is gift tax? – Universal CPA Review – #151

How Much Cash Can You Gift Tax Free to Your Spouse or Children in Canada? – Bloom Investment Counsel, Inc. – #152

How Much Cash Can You Gift Tax Free to Your Spouse or Children in Canada? – Bloom Investment Counsel, Inc. – #152

Favorable Gift Tax Rules Set To Expire at the End of This Year | Wealth Management – #153

Favorable Gift Tax Rules Set To Expire at the End of This Year | Wealth Management – #153

) Chartered Accountant Consultancy Service | Bhopal – #154

Chartered Accountant Consultancy Service | Bhopal – #154

A Gift for Generations | Ash Brokerage – #155

A Gift for Generations | Ash Brokerage – #155

Calculating Your Gift Tax Liability – FasterCapital – #156

Calculating Your Gift Tax Liability – FasterCapital – #156

Michael Cohen Dallas Elder Lawyer | IRS Announces Increase In Amount That Can Be Given In Life And At Death Without Taxation – #157

Michael Cohen Dallas Elder Lawyer | IRS Announces Increase In Amount That Can Be Given In Life And At Death Without Taxation – #157

Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation – #158

Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation – #158

Stamp Duty Charges in Haryana: Calculation & Payments – #159

Stamp Duty Charges in Haryana: Calculation & Payments – #159

Appreciated Stock | Jewish Community Foundation | Overland Park, KS – #160

Appreciated Stock | Jewish Community Foundation | Overland Park, KS – #160

How to Calculate the Federal Gift Tax? – YouTube – #161

How to Calculate the Federal Gift Tax? – YouTube – #161

Gift Tax Stock Illustrations – 2,954 Gift Tax Stock Illustrations, Vectors & Clipart – Dreamstime – #162

Gift Tax Stock Illustrations – 2,954 Gift Tax Stock Illustrations, Vectors & Clipart – Dreamstime – #162

Year-End Gifts and the Gift Tax Annual Exclusion – #163

Year-End Gifts and the Gift Tax Annual Exclusion – #163

Income Tax Declared Cash Deposit Limit in Saving & Current Bank Accounts – AWBI – #164

Income Tax Declared Cash Deposit Limit in Saving & Current Bank Accounts – AWBI – #164

5,600+ Gift Tax Stock Photos, Pictures & Royalty-Free Images – iStock | Gift tax law, Charitable gift tax – #165

5,600+ Gift Tax Stock Photos, Pictures & Royalty-Free Images – iStock | Gift tax law, Charitable gift tax – #165

Received Gift – Whether it is Taxable or Not? – #166

Received Gift – Whether it is Taxable or Not? – #166

Income Tax Guidelines & Mini Ready Reckoner 2022-23 & 2023-24 – #167

Income Tax Guidelines & Mini Ready Reckoner 2022-23 & 2023-24 – #167

A look at the tax consequences of charitable bequests – #168

A look at the tax consequences of charitable bequests – #168

The Fundamentals of Gift Tax Return — White Paper | Lorman Education Services – #169

The Fundamentals of Gift Tax Return — White Paper | Lorman Education Services – #169

Budget2019: Time for Indian Start-ups to Rejoice | Entrepreneur – #170

Budget2019: Time for Indian Start-ups to Rejoice | Entrepreneur – #170

Gifting Money to Family Members: 5 Strategies to Understand – Kindness Financial Planning – #171

Gifting Money to Family Members: 5 Strategies to Understand – Kindness Financial Planning – #171

Tax implications on a gifted property – Property lawyers in India – #172

Tax implications on a gifted property – Property lawyers in India – #172

Giving Gifts? Understand the Tax Consequences – #173

Giving Gifts? Understand the Tax Consequences – #173

Is Your Gift Taxable? | TaxConnections – #174

Is Your Gift Taxable? | TaxConnections – #174

Gifts of Appreciated Securities | Harvard Alumni – #175

Gifts of Appreciated Securities | Harvard Alumni – #175

Gift Tax Exclusion Rules | Appreciated Assets Gifts | Phoenix Tucson AZ – #176

Gift Tax Exclusion Rules | Appreciated Assets Gifts | Phoenix Tucson AZ – #176

Foreign Gift Reporting & Penalties | Thresholds for Purposes of Reporting a Foreign Gift | Form 3520 – #177

Foreign Gift Reporting & Penalties | Thresholds for Purposes of Reporting a Foreign Gift | Form 3520 – #177

Security or Stock Gifts – Giving – BLS-BLSA: Boston Latin School – Boston Latin School Association – #178

Security or Stock Gifts – Giving – BLS-BLSA: Boston Latin School – Boston Latin School Association – #178

) 1099-K IRS Delay: What PayPal, Venmo and Cash App Users Need to Know This Tax Season – CNET – #179

1099-K IRS Delay: What PayPal, Venmo and Cash App Users Need to Know This Tax Season – CNET – #179

Steps For Advance Tax Payment – Adlakha Kukreja Group – #180

Steps For Advance Tax Payment – Adlakha Kukreja Group – #180

Understanding the Gift Tax Rules and Why They Are Important – Part I – #181

Understanding the Gift Tax Rules and Why They Are Important – Part I – #181

Tax queries: Pay tax on cash gift from nephew in excess of Rs 50,000 – The Economic Times – #182

Tax queries: Pay tax on cash gift from nephew in excess of Rs 50,000 – The Economic Times – #182

- gift tax rate in india 2020

- gift tax exemption 2022

- gift tax exemption relatives list

Narayana Murthy’s Rs 240-crore gift of Infosys shares to 4-month-old grandson: Find out the tax implications here – #183

Narayana Murthy’s Rs 240-crore gift of Infosys shares to 4-month-old grandson: Find out the tax implications here – #183

Sanjeev Kavish and Associates, Chartered Accountants – #184

Sanjeev Kavish and Associates, Chartered Accountants – #184

Gift of Equity – What Is It, How Does It Work, Template & Tax – #185

Gift of Equity – What Is It, How Does It Work, Template & Tax – #185

IRS Announces Higher Estate And Gift Tax Limits For 2021 – #186

IRS Announces Higher Estate And Gift Tax Limits For 2021 – #186

Income Tax on Gift – #187

Income Tax on Gift – #187

Gift Tax Deadline Postponed – SGR Law – #188

Gift Tax Deadline Postponed – SGR Law – #188

What Charitable Givers Need to Know about Taxes | Miller Cooper – #189

What Charitable Givers Need to Know about Taxes | Miller Cooper – #189

- money gift box

- gift tax definition

- gift tax act 1958

- federal gift tax

- lineal ascendant gift from relative exempt from income tax

- cash gift gif

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #190

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #190

INCOME TAX ACT– RECENT AMENDMENTS APPLICABLE FOR THE FY – ppt download – #191

INCOME TAX ACT– RECENT AMENDMENTS APPLICABLE FOR THE FY – ppt download – #191

The Misunderstood Gift Tax: What You Should Know – Wealthy Mom MD® – #192

The Misunderstood Gift Tax: What You Should Know – Wealthy Mom MD® – #192

- money gift ideas

- gift tax meaning

- gift tax return

French Gift Tax | Beacon Global Wealth Management – #193

French Gift Tax | Beacon Global Wealth Management – #193

Tax Advantages for Donor-Advised Funds | NPTrust – #194

Tax Advantages for Donor-Advised Funds | NPTrust – #194

Newly-weds, read carefully: How to make the most of tax relief on gifts – #195

Newly-weds, read carefully: How to make the most of tax relief on gifts – #195

IRS Form 709, Gift and GST Tax – YouTube – #196

IRS Form 709, Gift and GST Tax – YouTube – #196

Taxation of Gifts received in Cash or Kind – #197

Taxation of Gifts received in Cash or Kind – #197

The Tax Implications of Employee Gifts – Hourly, Inc. – #198

The Tax Implications of Employee Gifts – Hourly, Inc. – #198

We have over $3 million and 5 adult children: Should we start giving them tax-free gifts each year? – #199

We have over $3 million and 5 adult children: Should we start giving them tax-free gifts each year? – #199

Giving Away Money? Know the Tax Laws – #200

Giving Away Money? Know the Tax Laws – #200

How much can I give as a cash gift? – #201

How much can I give as a cash gift? – #201

Posts: cash gift tax

Categories: Gifts

Author: toyotabienhoa.edu.vn