Aggregate 159+ cash gift limit from relatives latest

Top images of cash gift limit from relatives by website toyotabienhoa.edu.vn compilation. Gift Tax 2023: Understanding Taxation Rules on Receiving Money from Relatives – Video Summarizer – Glarity. Section 56(2)(vii) : Cash / Non-Cash Gifts. Gifts to and from HUF – MN & Associates CS-India

What are the legal implications of an employer giving their employees gifts with their own money, but not company funds? Would this be considered taxable income? If so, how much would be – #1

What are the legal implications of an employer giving their employees gifts with their own money, but not company funds? Would this be considered taxable income? If so, how much would be – #1

Latest NRI Gift Tax Rules 2019-20 | Are Gifts received by NRIs Taxable? – #2

Latest NRI Gift Tax Rules 2019-20 | Are Gifts received by NRIs Taxable? – #2

Gift Tax Limits and Exceptions: Advice From an Expert | Money – #4

Gift Tax Limits and Exceptions: Advice From an Expert | Money – #4

Rules for Overseas Money Transfer to Family Members Abroad | Unimoni.in – #5

Rules for Overseas Money Transfer to Family Members Abroad | Unimoni.in – #5

My relative sends me money every month. How income tax is calculated? | Mint – #6

My relative sends me money every month. How income tax is calculated? | Mint – #6

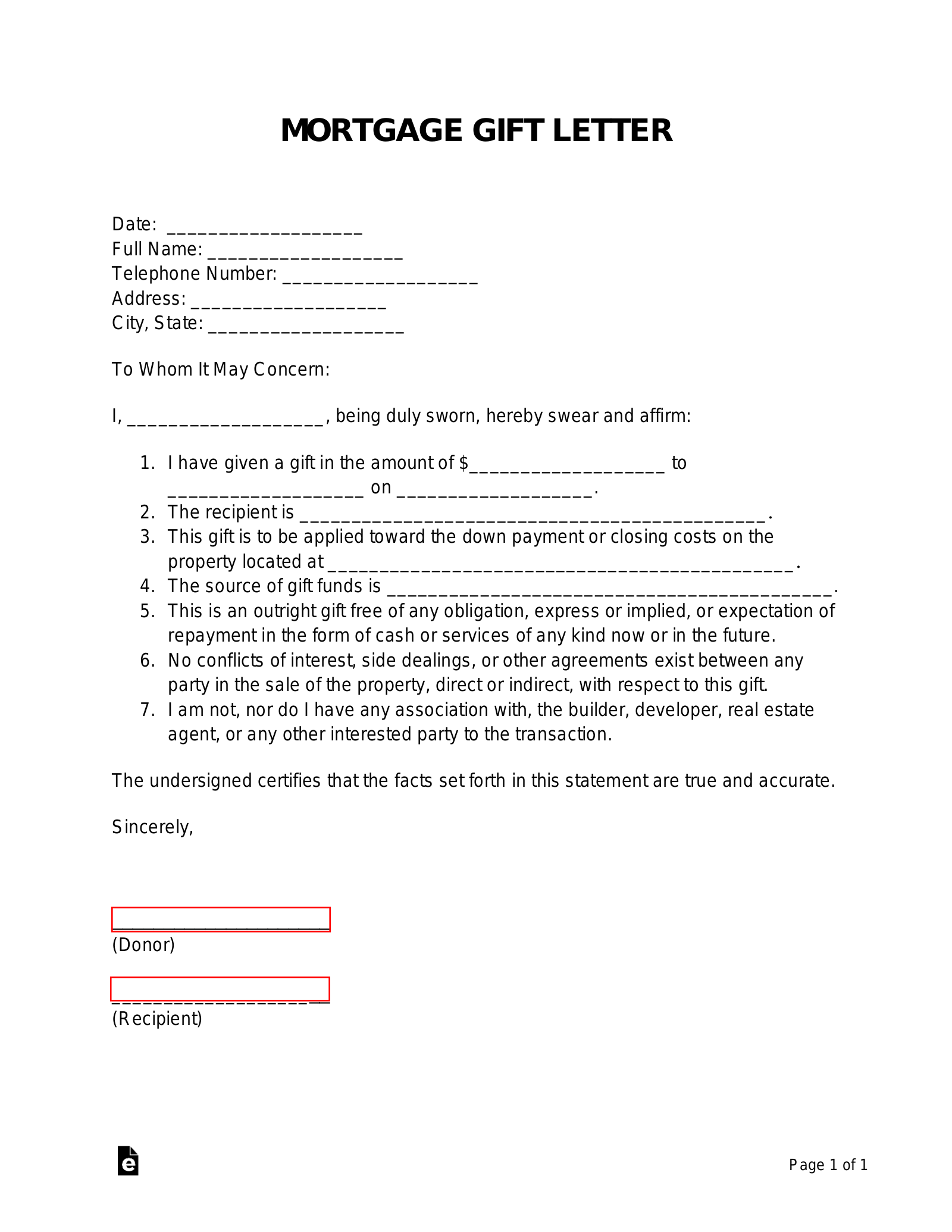

Free Gift Affidavit Form | PDF & Word – #7

Free Gift Affidavit Form | PDF & Word – #7

Taxability of Gift received by an individual or HUF – #8

Taxability of Gift received by an individual or HUF – #8

Central Government employees can accept gifts worth up to Rs 5000 – #10

Central Government employees can accept gifts worth up to Rs 5000 – #10

Gifting Assets could Affect your Medicaid Eligibility for Long-Term Care Benefits – Generation Law – #11

Gifting Assets could Affect your Medicaid Eligibility for Long-Term Care Benefits – Generation Law – #11

Gift Tax in India: Implications & Exemptions – myMoneySage Blog – #12

Gift Tax in India: Implications & Exemptions – myMoneySage Blog – #12

6 Ways To Give Money As A Gift | Bankrate – #13

6 Ways To Give Money As A Gift | Bankrate – #13

Income tax on gifts: Know when your gift is tax-free – BusinessToday – #14

Income tax on gifts: Know when your gift is tax-free – BusinessToday – #14

The Best Ways to Give Money for the Holidays, at Any Age – WSJ – #15

The Best Ways to Give Money for the Holidays, at Any Age – WSJ – #15

Can I be Taxed for Gifting My Business? – #16

Can I be Taxed for Gifting My Business? – #16

Are Cash Gifts from relatives exempt from Income tax? – #17

Are Cash Gifts from relatives exempt from Income tax? – #17

What is Gift Tax? – Exemption and Limits on Gifts for FY 2023-24 – #18

What is Gift Tax? – Exemption and Limits on Gifts for FY 2023-24 – #18

ITR filing: Are gifts taxable in India? Salient clauses all income taxpayers must know | Zee Business – #19

ITR filing: Are gifts taxable in India? Salient clauses all income taxpayers must know | Zee Business – #19

Taxation of Gifts received in Cash or Kind – #20

Taxation of Gifts received in Cash or Kind – #20

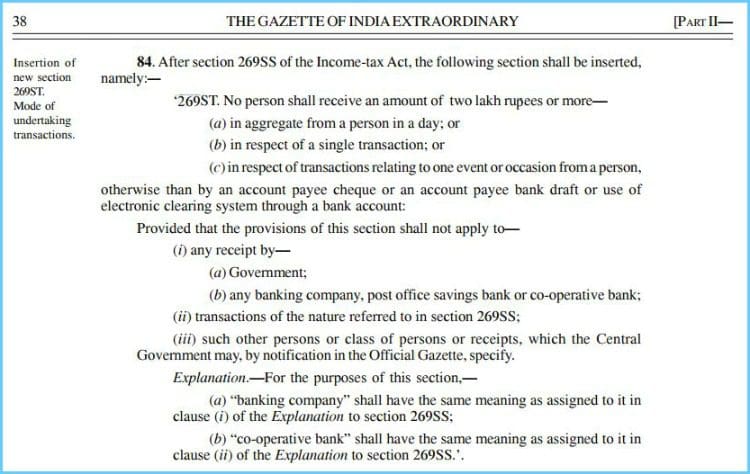

Rs 2 Lakh Cash Transaction Limit | Penalty Details & Examples – #21

Rs 2 Lakh Cash Transaction Limit | Penalty Details & Examples – #21

Gift tax: Tax rules to know if you give or receive cash – WTOP News – #22

Gift tax: Tax rules to know if you give or receive cash – WTOP News – #22

How to Max Out the Gift Tax Exclusion – CPA Practice Advisor – #23

How to Max Out the Gift Tax Exclusion – CPA Practice Advisor – #23

What’s The Limit On Cash Gifts From A Nonresident Alien? – #24

What’s The Limit On Cash Gifts From A Nonresident Alien? – #24

Income Tax on Gifts Received | Monetary Gifts from Relatives & Friends | Taxpundit – YouTube – #25

Income Tax on Gifts Received | Monetary Gifts from Relatives & Friends | Taxpundit – YouTube – #25

Gift Tax 101: Gift Tax Limits (+ Rules for Gifting Stocks) – #26

Gift Tax 101: Gift Tax Limits (+ Rules for Gifting Stocks) – #26

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #27

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #27

Gifts received from non-relatives of above Rs 50,000 a year are taxable – #28

Gifts received from non-relatives of above Rs 50,000 a year are taxable – #28

Any Income On Assets Gifted By You To Spouse Will Be Added To Your Income – #29

Any Income On Assets Gifted By You To Spouse Will Be Added To Your Income – #29

Budget 2023: What is Gift Tax and why govt should abolish this? | Zee Business – #30

Budget 2023: What is Gift Tax and why govt should abolish this? | Zee Business – #30

My grandmother wants to gift cash to me. What are the income tax implications? | Mint – #31

My grandmother wants to gift cash to me. What are the income tax implications? | Mint – #31

Sabalier Law – Understanding Gift Taxes | Sabalier Law – #32

Sabalier Law – Understanding Gift Taxes | Sabalier Law – #32

Is there any gift tax to be paid in USA on the amounts received from sale of my house and jewellery in India and sent to our daughter in USA? – Quora – #33

Is there any gift tax to be paid in USA on the amounts received from sale of my house and jewellery in India and sent to our daughter in USA? – Quora – #33

7 Tax Rules to Know if You Give or Receive Cash | Taxes | U.S. News – #34

7 Tax Rules to Know if You Give or Receive Cash | Taxes | U.S. News – #34

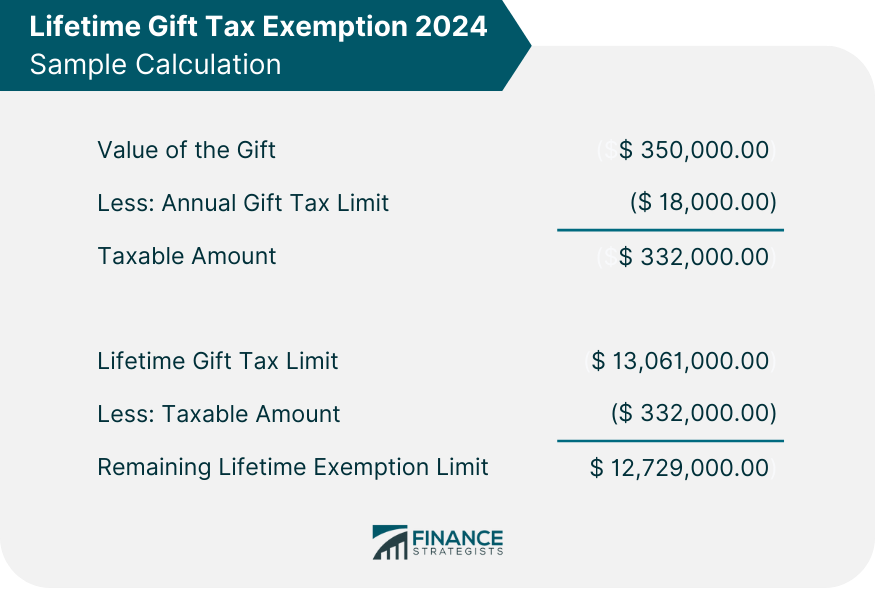

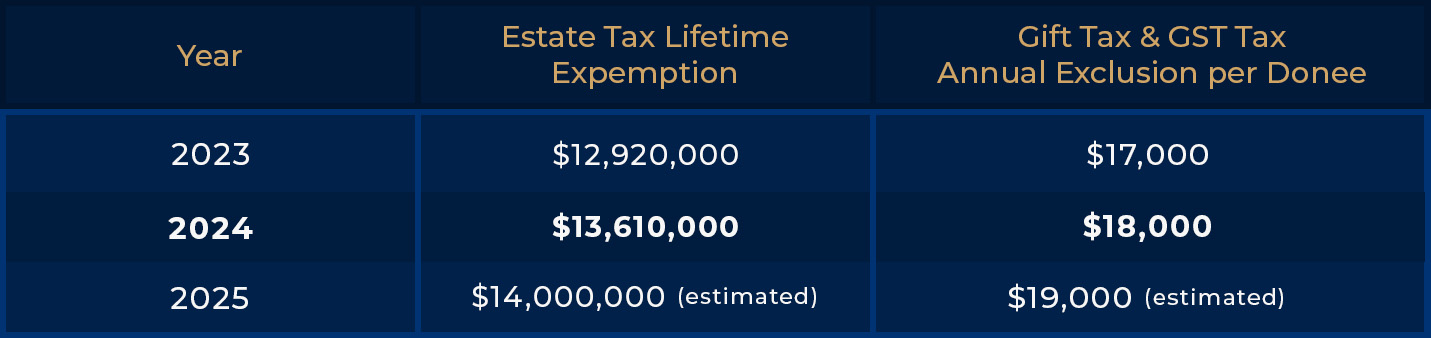

Gift Tax Limit 2024 | Calculation, Filing, and How to Avoid Gift Tax – #35

Gift Tax Limit 2024 | Calculation, Filing, and How to Avoid Gift Tax – #35

What is the IRS Gift Tax Limit? – #36

What is the IRS Gift Tax Limit? – #36

CASH PAYMENT LIMIT REDUCED TO Rs 10000/- FROM Rs 20000/- EARLIER .RULES ALSO APPLICABLE ON CAPITAL EXPENSES | SIMPLE TAX INDIA – #37

CASH PAYMENT LIMIT REDUCED TO Rs 10000/- FROM Rs 20000/- EARLIER .RULES ALSO APPLICABLE ON CAPITAL EXPENSES | SIMPLE TAX INDIA – #37

Gift Tax Limit 2024: How Much Can You Give Tax-Free? | Kiplinger – #38

Gift Tax Limit 2024: How Much Can You Give Tax-Free? | Kiplinger – #38

Gift from Non-Relatives – A tool for tax planning – TaxReturnWala – #39

Gift from Non-Relatives – A tool for tax planning – TaxReturnWala – #39

Gift Tax: How Much Is It and Who Pays It? – #40

Gift Tax: How Much Is It and Who Pays It? – #40

How to Avoid the Gift Tax – SmartAsset | SmartAsset – #41

How to Avoid the Gift Tax – SmartAsset | SmartAsset – #41

Detailed Analysis- Gifts Taxation under Income Tax Act, 1961 – #42

Detailed Analysis- Gifts Taxation under Income Tax Act, 1961 – #42

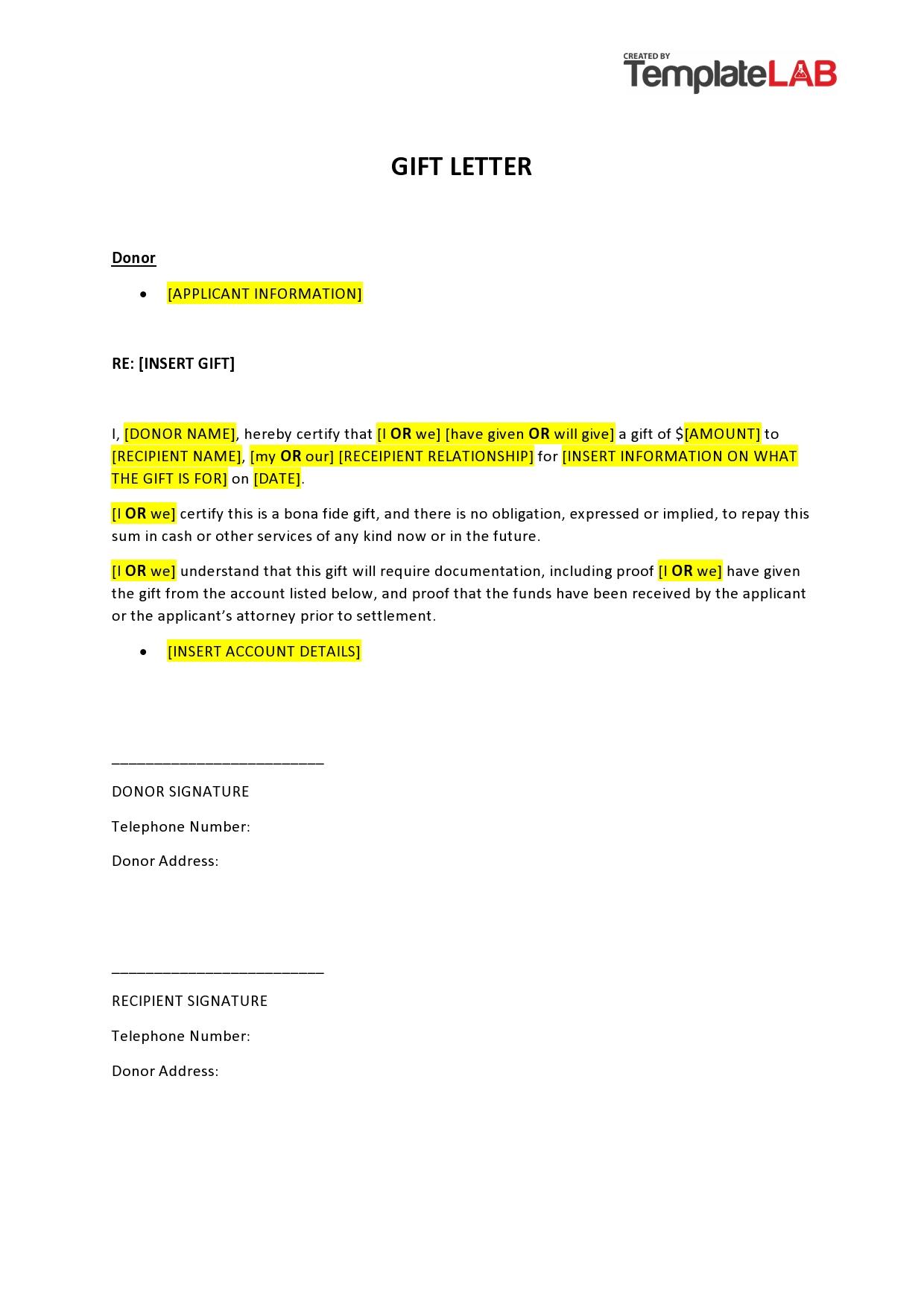

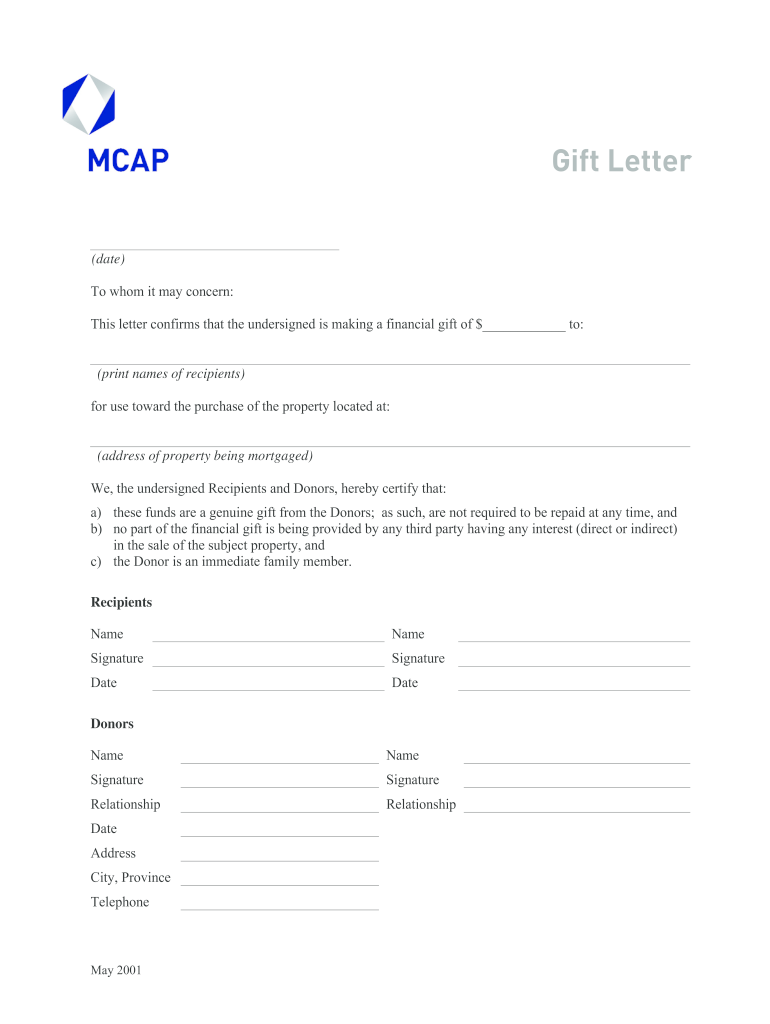

Down Payment Gift Rules from a Friend or Relative – – #43

Down Payment Gift Rules from a Friend or Relative – – #43

3 Ways to Make Sure Your Cash Gifting Is Legal – wikiHow – #44

3 Ways to Make Sure Your Cash Gifting Is Legal – wikiHow – #44

The Gift Tax Made Simple – TurboTax Tax Tips & Videos – #45

The Gift Tax Made Simple – TurboTax Tax Tips & Videos – #45

Gift Tax Calculator | EZTax® – #46

Gift Tax Calculator | EZTax® – #46

Form 709: What It Is and Who Must File It – #47

Form 709: What It Is and Who Must File It – #47

Know the tax impact on the gifts you receive – Goal Bridge – #48

Know the tax impact on the gifts you receive – Goal Bridge – #48

Gift Tax In 2024: What Is It And How Does It Work? – #49

Gift Tax In 2024: What Is It And How Does It Work? – #49

- gift tax in india

- gift tax rate

- family member money gift letter from parents

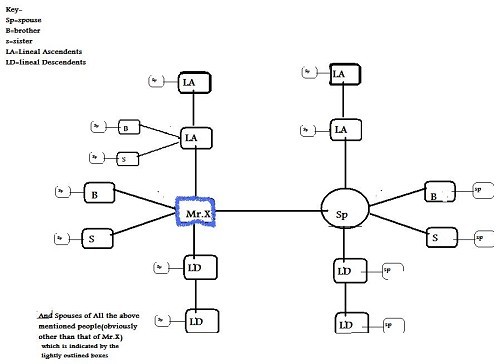

Definition of Relatives for the purpose of Income Tax Act, 1961- Taxwink – #50

Definition of Relatives for the purpose of Income Tax Act, 1961- Taxwink – #50

- gift tax meaning

- gift chart as per income tax

- gift from relative exempt from income tax

How To Use Gift Money for a Down Payment on a Home – #51

How To Use Gift Money for a Down Payment on a Home – #51

Paying the College Directly to Avoid Gift Taxes | Fastweb – #52

Paying the College Directly to Avoid Gift Taxes | Fastweb – #52

Gift Money for Down Payment | Free Gift Letter Template – #53

Gift Money for Down Payment | Free Gift Letter Template – #53

Taxability of Gifts – #54

Taxability of Gifts – #54

Gift by NRI to Resident Indian or Vice-Versa — NRI Gift Tax In India – Wisenri – Medium – #55

Gift by NRI to Resident Indian or Vice-Versa — NRI Gift Tax In India – Wisenri – Medium – #55

How to Ensure Cash Gifts from Parents and Relatives Won’t Land you in Tax Trouble – #56

How to Ensure Cash Gifts from Parents and Relatives Won’t Land you in Tax Trouble – #56

Newly-weds, read carefully: How to make the most of tax relief on gifts – #57

Newly-weds, read carefully: How to make the most of tax relief on gifts – #57

How to gift stocks, bonds and ETFs and the tax implications – Z-Connect by Zerodha – #58

How to gift stocks, bonds and ETFs and the tax implications – Z-Connect by Zerodha – #58

InvestorZclub: Gift Tax in India: Rules, Rates, Exclusion & Limit – #59

InvestorZclub: Gift Tax in India: Rules, Rates, Exclusion & Limit – #59

5 Ways to Give a Monetary Gift: What You Need to Know – #60

5 Ways to Give a Monetary Gift: What You Need to Know – #60

When You Make Cash Gifts To Your Children, Who Pays The Tax? | Greenbush Financial Group – #61

When You Make Cash Gifts To Your Children, Who Pays The Tax? | Greenbush Financial Group – #61

What You Need to Know Before Gifting Money to Family | Savant Wealth Management – #62

What You Need to Know Before Gifting Money to Family | Savant Wealth Management – #62

What is the taxation on any gift via cash transfer to a relative? | Mint – #63

What is the taxation on any gift via cash transfer to a relative? | Mint – #63

- lineal ascendant gift from relative exempt from income tax

- gift tax example

- section 56(2) of income tax act

Gift Deed Registration: Stamp Duty, Registry Fee, Tax, Procedure – #64

Gift Deed Registration: Stamp Duty, Registry Fee, Tax, Procedure – #64

Your Diwali gift and bonus can be taxable: Know ways to avoid it – #65

Your Diwali gift and bonus can be taxable: Know ways to avoid it – #65

A Guide To Gifts Of Equity | Rocket Mortgage – #66

A Guide To Gifts Of Equity | Rocket Mortgage – #66

In India, is sending money to sister as a gift taxable or not? How much money can be sent? – Quora – #67

In India, is sending money to sister as a gift taxable or not? How much money can be sent? – Quora – #67

Things an NRI must know about gift tax rules in India | IDFC FIRST Bank – #68

Things an NRI must know about gift tax rules in India | IDFC FIRST Bank – #68

Gift Tax & The Holiday Season – Limits, Exceptions, & More – Aldridge Borden and Company – #69

Gift Tax & The Holiday Season – Limits, Exceptions, & More – Aldridge Borden and Company – #69

Gifts from relatives are always tax-free – The Economic Times – #70

Gifts from relatives are always tax-free – The Economic Times – #70

Optimise Your Taxes by Gifting Money to Your Parents and Children – #71

Optimise Your Taxes by Gifting Money to Your Parents and Children – #71

Taxability of Gifts – Some Interesting Issues – #72

Taxability of Gifts – Some Interesting Issues – #72

A relative wants to gift cash to me. What are the income tax implications? | Mint – #73

A relative wants to gift cash to me. What are the income tax implications? | Mint – #73

Gift by NRI to Resident Indian or Vice-Versa – NRI Gift Tax In India – #74

Gift by NRI to Resident Indian or Vice-Versa – NRI Gift Tax In India – #74

-Gifts.jpg) Gifting Money to Family Members: Everything You Need to Know – #75

Gifting Money to Family Members: Everything You Need to Know – #75

Diwali season: Do you have to pay tax on gifts received ? | Personal Finance – Business Standard – #76

Diwali season: Do you have to pay tax on gifts received ? | Personal Finance – Business Standard – #76

Important Cash Transaction Limits and Penalties Under Income Tax That You Need to Know About – #77

Important Cash Transaction Limits and Penalties Under Income Tax That You Need to Know About – #77

Income Tax on Gift | Relative से पैसा लेने से पहले यह video ज़रूर देखना | Cash Gift Tax Rule 2023 | – YouTube – #78

Income Tax on Gift | Relative से पैसा लेने से पहले यह video ज़रूर देखना | Cash Gift Tax Rule 2023 | – YouTube – #78

Gift by NRI to Resident Indian or Vice-Versa: Taxation and more – SBNRI – #79

Gift by NRI to Resident Indian or Vice-Versa: Taxation and more – SBNRI – #79

Use a Gift of Equity When Buying A Home From A Relative – #80

Use a Gift of Equity When Buying A Home From A Relative – #80

Gifting Money to Family Members: 5 Strategies to Understand – Kindness Financial Planning – #81

Gifting Money to Family Members: 5 Strategies to Understand – Kindness Financial Planning – #81

Income Tax on Gift | Relative से पैसा लेने से पहले यह video ज़रूर देखना | Cash Gift Tax Rule 2023 – YouTube – #82

Income Tax on Gift | Relative से पैसा लेने से पहले यह video ज़रूर देखना | Cash Gift Tax Rule 2023 – YouTube – #82

Getting a Gift from Relatives When Buying a Home – #83

Getting a Gift from Relatives When Buying a Home – #83

Cash Limit at home: Big News! Now only this much cash can be kept at home, new limit for keeping cash fixed – informalnewz – #84

Cash Limit at home: Big News! Now only this much cash can be kept at home, new limit for keeping cash fixed – informalnewz – #84

Will your ‘gift’ be taxed? – The Economic Times – #85

Will your ‘gift’ be taxed? – The Economic Times – #85

Now gift stocks and ETFs to your friends and loved ones – Z-Connect by Zerodha – #86

Now gift stocks and ETFs to your friends and loved ones – Z-Connect by Zerodha – #86

Taxation of gifts to NRIs and changes in Budget 2023-24 – #87

Taxation of gifts to NRIs and changes in Budget 2023-24 – #87

What You Need to Know About the Gift Tax – TheStreet – #88

What You Need to Know About the Gift Tax – TheStreet – #88

- gift tax exemption 2022

When are gifts received by NRIs subject to tax, TDS in India? – The Economic Times – #89

When are gifts received by NRIs subject to tax, TDS in India? – The Economic Times – #89

IRS Form 709 | H&R Block – #90

IRS Form 709 | H&R Block – #90

The Tax Consequences of a Down Payment Gift for a Mortgage – #91

The Tax Consequences of a Down Payment Gift for a Mortgage – #91

Tax on Foreign Remittance in India: Sending & Receiving Money – #92

Tax on Foreign Remittance in India: Sending & Receiving Money – #92

How To Make (Or Ask For) A 529 Plan Gift Contribution – Forbes Advisor – #93

How To Make (Or Ask For) A 529 Plan Gift Contribution – Forbes Advisor – #93

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #94

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #94

Weddings and tax implications of cash gifts | Mint – #95

Weddings and tax implications of cash gifts | Mint – #95

What Are the Legal and Tax Implications of Using Gift Cards in India? – #96

What Are the Legal and Tax Implications of Using Gift Cards in India? – #96

What Is a Gift Letter & Why Do I need One? | Money.com – #97

What Is a Gift Letter & Why Do I need One? | Money.com – #97

The Lifetime Gift Tax Exemption: Everything You Need to Know – #98

The Lifetime Gift Tax Exemption: Everything You Need to Know – #98

Foreign Remittance: Sending Gift Money To The USA From India In 2024 – #99

Foreign Remittance: Sending Gift Money To The USA From India In 2024 – #99

Elder Law: How Gifts Can Affect Medicaid Eligibility – #100

Elder Law: How Gifts Can Affect Medicaid Eligibility – #100

Wedding gift spending: How much is too much? How much is not enough? | Fox Business – #101

Wedding gift spending: How much is too much? How much is not enough? | Fox Business – #101

How to Gift Educational Expenses: Tax Advantages and Pitfalls – #102

How to Gift Educational Expenses: Tax Advantages and Pitfalls – #102

What You Need to Know Before Gifting a 529 Plan – #103

What You Need to Know Before Gifting a 529 Plan – #103

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #104

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #104

Monetary gift tax: Income tax on gift received from parents | Value Research – #105

Monetary gift tax: Income tax on gift received from parents | Value Research – #105

Gifting Money to Children in 2023: Everything Retirements Savers Ought to Know! – #106

Gifting Money to Children in 2023: Everything Retirements Savers Ought to Know! – #106

IRS Gift Limit 2023: How much can a parent gift a child in 2023? | Marca – #107

IRS Gift Limit 2023: How much can a parent gift a child in 2023? | Marca – #107

Section 56(2)(x): Taxability of Gifts – Pioneer One Consulting LLP – #108

Section 56(2)(x): Taxability of Gifts – Pioneer One Consulting LLP – #108

How to Show Gift in Income Tax Return 2023 – #109

How to Show Gift in Income Tax Return 2023 – #109

Parenting, makeup advice: Our relatives gave our daughter a makeup gift card. She’s 11. – #110

Parenting, makeup advice: Our relatives gave our daughter a makeup gift card. She’s 11. – #110

Section 56 – Exemption from Taxation on Wedding Gifts | Fincash – #111

Section 56 – Exemption from Taxation on Wedding Gifts | Fincash – #111

The Ins and Outs of Giving or Receiving Down Payment Gifts — The Agency Texas – #112

The Ins and Outs of Giving or Receiving Down Payment Gifts — The Agency Texas – #112

Gift Tax: Relative Transactions – #113

Gift Tax: Relative Transactions – #113

My father wants to gift cash to me. Should I pay income tax on money received from my father? | Mint – #114

My father wants to gift cash to me. Should I pay income tax on money received from my father? | Mint – #114

What Is The Tax Liability On Gifts Received? – #115

What Is The Tax Liability On Gifts Received? – #115

Relatives u/s 56(2)(vii) from whom Gift is permissible…… – Income Tax | Tax planning – #116

Relatives u/s 56(2)(vii) from whom Gift is permissible…… – Income Tax | Tax planning – #116

Tax Implications on Gifting of Shares – #117

Tax Implications on Gifting of Shares – #117

Do I have to pay taxes if I receive money from my parents to pay rent? All money I get from them I put in bank then write check – Quora – #118

Do I have to pay taxes if I receive money from my parents to pay rent? All money I get from them I put in bank then write check – Quora – #118

Gift received or given to relatives. How income tax is calculated? | Mint – #119

Gift received or given to relatives. How income tax is calculated? | Mint – #119

) IRS Gift Limit 2023: What happens if you give more than the limit and some other FAQ | Marca – #120

IRS Gift Limit 2023: What happens if you give more than the limit and some other FAQ | Marca – #120

How to give to family and friends — and avoid gift taxes – WTOP News – #121

How to give to family and friends — and avoid gift taxes – WTOP News – #121

Gifts & Income Tax Implications : Scenarios & Examples – #122

Gifts & Income Tax Implications : Scenarios & Examples – #122

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #123

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #123

Giving Or Receiving A Down Payment Gift? Here’s What You Need To Know – #124

Giving Or Receiving A Down Payment Gift? Here’s What You Need To Know – #124

Nri Gift Tax In India – #125

Nri Gift Tax In India – #125

Video: Is Inheritance Money Counted as Income by the IRS? – TurboTax Tax Tips & Videos – #126

Video: Is Inheritance Money Counted as Income by the IRS? – TurboTax Tax Tips & Videos – #126

Property Gift Deed in India – A detailed guide with FAQs – #127

Property Gift Deed in India – A detailed guide with FAQs – #127

Tax Laws on Cash Gifts: Is Gifted Money Taxable? | Axis Bank – #128

Tax Laws on Cash Gifts: Is Gifted Money Taxable? | Axis Bank – #128

Tax on gifts and inheritances | ATO Community – #129

Tax on gifts and inheritances | ATO Community – #129

Gifts to and from HUF – MN & Associates CS-India – #130

Gifts to and from HUF – MN & Associates CS-India – #130

Understanding Income Tax on Gifts Received in India: Rules, Exceptions, and Valuation” – #131

Understanding Income Tax on Gifts Received in India: Rules, Exceptions, and Valuation” – #131

Tax collected at source on foreign remittances: One step forward, two steps back – #132

Tax collected at source on foreign remittances: One step forward, two steps back – #132

Income tax on a gift from father to daughter – #133

Income tax on a gift from father to daughter – #133

Gift Tax: Tax on gifts: Documents that you should have while filing ITR – The Economic Times – #134

Gift Tax: Tax on gifts: Documents that you should have while filing ITR – The Economic Times – #134

What Is the 2023 and 2024 Gift Tax Limit? – Ramsey – #135

What Is the 2023 and 2024 Gift Tax Limit? – Ramsey – #135

Gift Tax Limit 2024: How Much Money Can You Gift? | SmartAsset – #136

Gift Tax Limit 2024: How Much Money Can You Gift? | SmartAsset – #136

Gift Deed बनाकर Income Tax कैसे बचाएँ | Relative से Gift लेने वाले जरूर देखे | Expert CA Sachin – YouTube – #137

Gift Deed बनाकर Income Tax कैसे बचाएँ | Relative से Gift लेने वाले जरूर देखे | Expert CA Sachin – YouTube – #137

5 rules about Income Tax on Gifts received in India & Exemptions – #138

5 rules about Income Tax on Gifts received in India & Exemptions – #138

Section 56(2)(vii) : Cash / Non-Cash Gifts – #139

Section 56(2)(vii) : Cash / Non-Cash Gifts – #139

) All You Need To Know About Gifting Property And Gift Deed Rules – #140

All You Need To Know About Gifting Property And Gift Deed Rules – #140

Gift from USA to India: Taxation and Exemptions – SBNRI – #141

Gift from USA to India: Taxation and Exemptions – SBNRI – #141

Tax Implications of Gifting Funds for Real Estate Purchases – #142

Tax Implications of Gifting Funds for Real Estate Purchases – #142

Gift Tax rules for US citizens (Guidelines) | Expat US Tax – #143

Gift Tax rules for US citizens (Guidelines) | Expat US Tax – #143

Make A Mark With These Financial Gift Ideas – #144

Make A Mark With These Financial Gift Ideas – #144

When Generosity Bumps Into Gift Tax – The New York Times – #145

When Generosity Bumps Into Gift Tax – The New York Times – #145

Income Tax on Gift – #146

Income Tax on Gift – #146

Gift Tax 2023: Understanding Taxation Rules on Receiving Money from Relatives – Video Summarizer – Glarity – #147

Gift Tax 2023: Understanding Taxation Rules on Receiving Money from Relatives – Video Summarizer – Glarity – #147

What Are the Implications of a Loan Versus a Financial Gift to a Family Member – #148

What Are the Implications of a Loan Versus a Financial Gift to a Family Member – #148

Careful with Those Gifts – Simple Gifting Principles | MONTAG Wealth Management – #149

Careful with Those Gifts – Simple Gifting Principles | MONTAG Wealth Management – #149

Gift letter for mortgage: Give or receive a down payment gift – #150

Gift letter for mortgage: Give or receive a down payment gift – #150

What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #151

What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #151

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #152

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #152

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Using Gift Money for a Down Payment in Kentucky For A Mortgage Loan – #153

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Using Gift Money for a Down Payment in Kentucky For A Mortgage Loan – #153

- gift tax exemption

- list of relatives

- gift tax definition

– #154

– #154

– #155

– #155

– #156

– #156

– #157

– #157

– #158

– #158

– #159

– #159

Posts: cash gift limit from relatives

Categories: Gifts

Author: toyotabienhoa.edu.vn