Details more than 117 capital gains on gifted property

Top images of capital gains on gifted property by website toyotabienhoa.edu.vn compilation. A Detailed Guide to Tax on Inheritance in India | HDFC Life. Solved 3. Holding Period. (Obj. 2) State the time when the | Chegg.com. The (Double) Tax Benefits of Donating Appreciated Stock – PKF Texas. Exploring the estate tax: Part 2 – Journal of Accountancy. How is the sale of gifted property taxed? | Mint

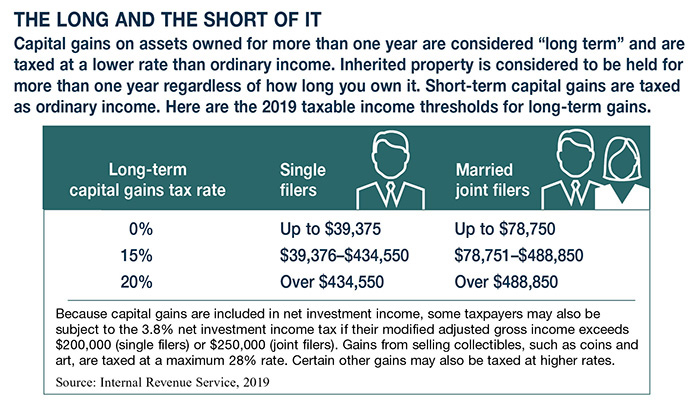

I’m a Collector. Do I Need to Pay Capital Gains Taxes? – #1

I’m a Collector. Do I Need to Pay Capital Gains Taxes? – #1

Gift Deed बनाकर Income Tax कैसे बचाएँ | Relative से Gift लेने वाले जरूर देखे | Expert CA Sachin – YouTube – #2

Gift Deed बनाकर Income Tax कैसे बचाएँ | Relative से Gift लेने वाले जरूर देखे | Expert CA Sachin – YouTube – #2

Would a gifted house deposit be liable for tax? | Property | The Guardian – #4

Would a gifted house deposit be liable for tax? | Property | The Guardian – #4

Capital Gain Tax for NRI Investments in India: Rates & Implications – #5

Capital Gain Tax for NRI Investments in India: Rates & Implications – #5

What Is Gift Deed: Tax Liabilities, Formalities, Format – #6

What Is Gift Deed: Tax Liabilities, Formalities, Format – #6

What’s the best way to minimize taxes when gifting rental properties? | Financial Post – #7

What’s the best way to minimize taxes when gifting rental properties? | Financial Post – #7

Stamp Duty Paid By Recipient On Property Received As Gift Will Make Gift Void – #8

Stamp Duty Paid By Recipient On Property Received As Gift Will Make Gift Void – #8

Gift of Immovable property under Income Tax Act – #10

Gift of Immovable property under Income Tax Act – #10

Intra Family Sale and/or Gifting of Real Estate in California (Propositions 13, 58, 193, 60 and 90 and new Proposition 19) – Lucas Real Estate – #11

Intra Family Sale and/or Gifting of Real Estate in California (Propositions 13, 58, 193, 60 and 90 and new Proposition 19) – Lucas Real Estate – #11

Capital Gains Tax In 2017-18, Ahmed has capital | Chegg.com – #12

Capital Gains Tax In 2017-18, Ahmed has capital | Chegg.com – #12

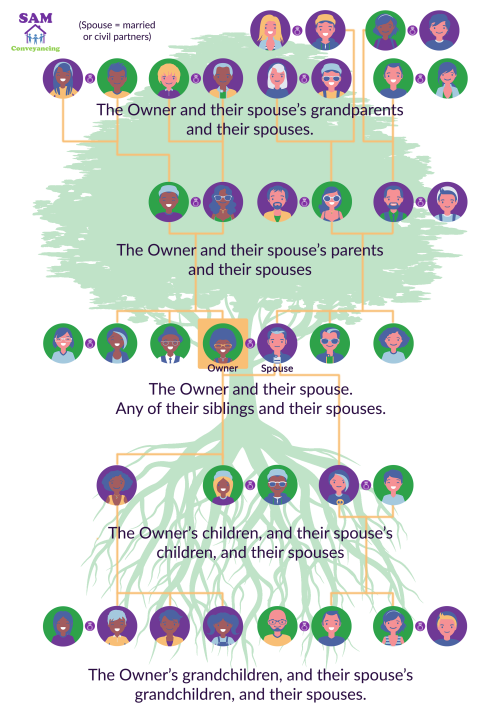

Capital Gains Tax on Gifted Property | SAM Conveyancing – #13

Capital Gains Tax on Gifted Property | SAM Conveyancing – #13

A Guide To Gifts Of Equity | Rocket Mortgage – #14

A Guide To Gifts Of Equity | Rocket Mortgage – #14

What Is the 2023 and 2024 Gift Tax Limit? – Ramsey – #15

What Is the 2023 and 2024 Gift Tax Limit? – Ramsey – #15

Tax implications on Gifting Shares – Enterslice Pvt Ltd – #16

Tax implications on Gifting Shares – Enterslice Pvt Ltd – #16

Federal Gift Tax vs. California Inheritance Tax – #17

Federal Gift Tax vs. California Inheritance Tax – #17

Texas Quitclaim Deed Costs and Fees | LegalTemplates – #18

Texas Quitclaim Deed Costs and Fees | LegalTemplates – #18

What are the tax implications of gifting a property to your spouse in India? – Quora – #19

What are the tax implications of gifting a property to your spouse in India? – Quora – #19

5 rules about Income Tax on Gifts received in India & Exemptions – #20

5 rules about Income Tax on Gifts received in India & Exemptions – #20

Capital Assets, Capital Gain & Transfer of Capital Assets for Taxing ‘Capital Gain’ – #21

Capital Assets, Capital Gain & Transfer of Capital Assets for Taxing ‘Capital Gain’ – #21

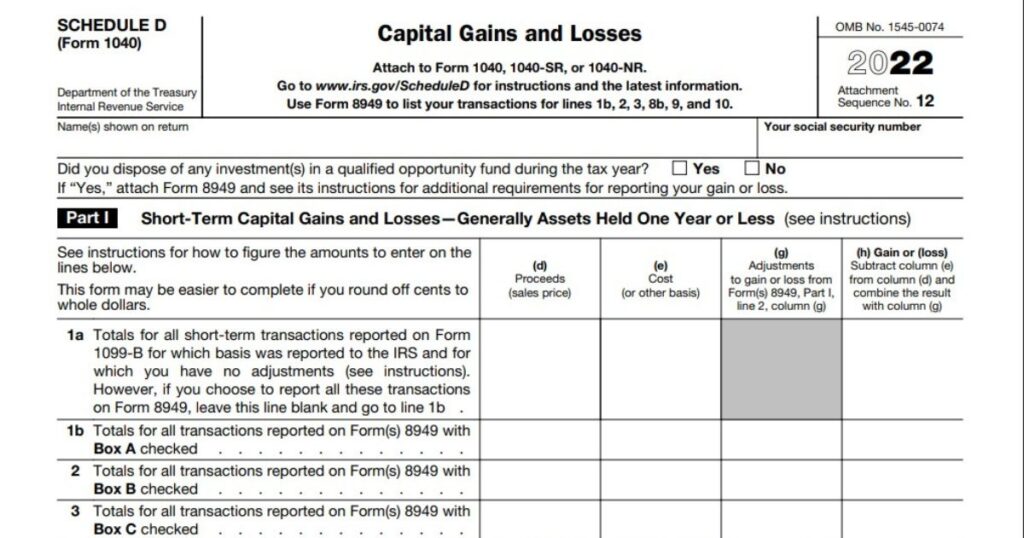

- short term capital gains tax 2022

- property capital gains tax

- tax basis formula

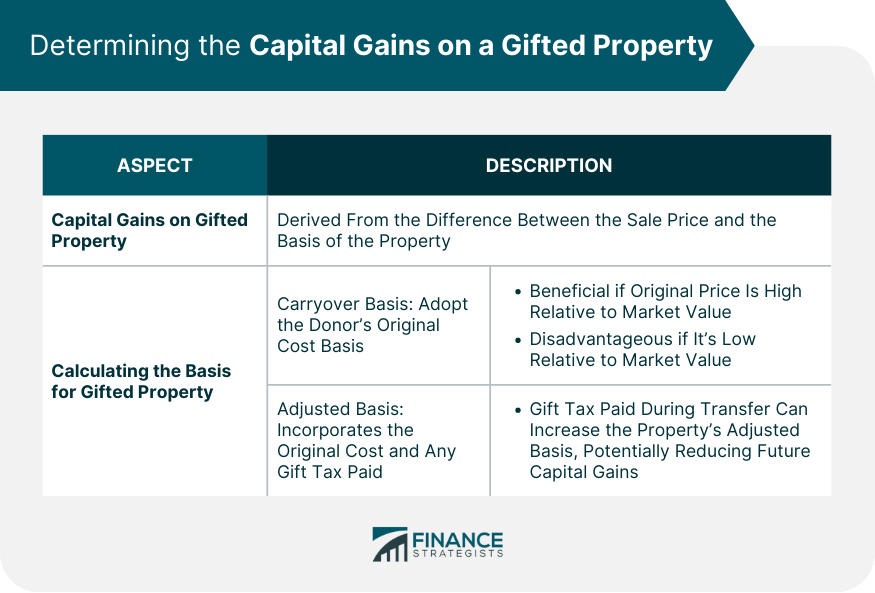

What Are The Gift Tax Implications When Gifting Property? – #22

What Are The Gift Tax Implications When Gifting Property? – #22

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #23

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #23

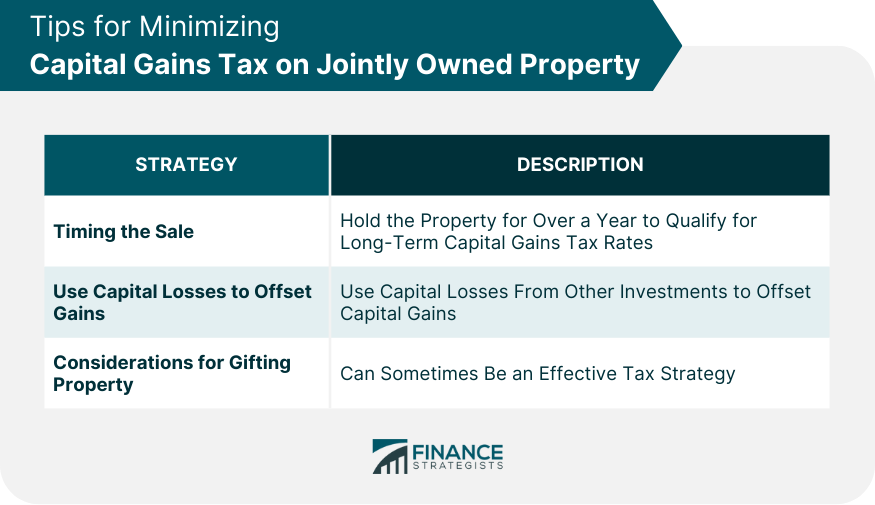

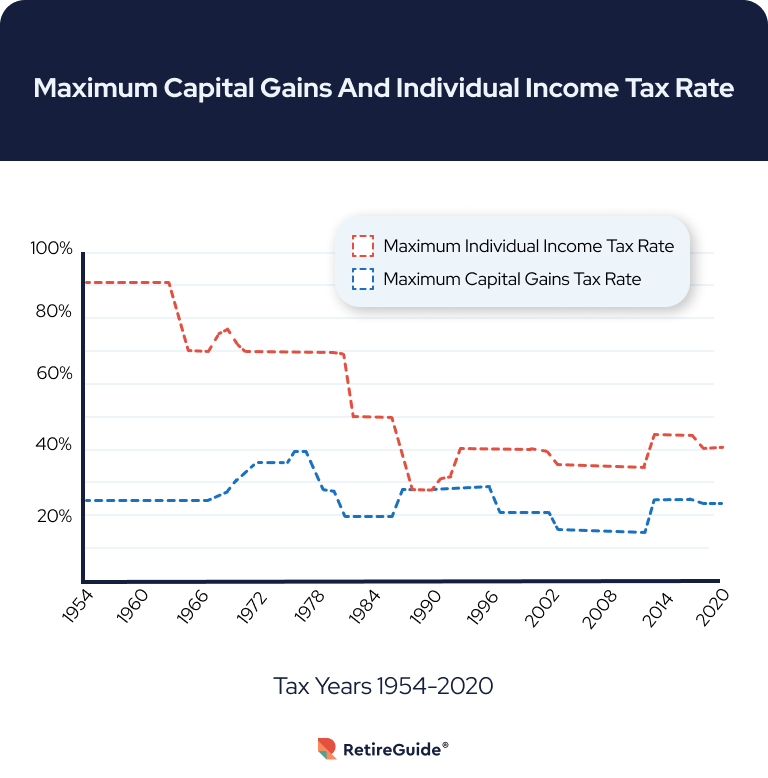

Understanding Capital Gains Tax in Texas | Avidian Wealth Solutions – #24

Understanding Capital Gains Tax in Texas | Avidian Wealth Solutions – #24

Gifted Property Basis vs Gift Tax Value? : r/CPA – #25

Gifted Property Basis vs Gift Tax Value? : r/CPA – #25

Tax on Gifts in India | Exemption and Rules | EZTax® – #26

Tax on Gifts in India | Exemption and Rules | EZTax® – #26

- capital gains taxes

Apex Management Consulting | Islamabad – #27

Apex Management Consulting | Islamabad – #27

Optimise – Avoid Capital Gains Tax (CGT) on inherited/gifted property – #28

Optimise – Avoid Capital Gains Tax (CGT) on inherited/gifted property – #28

Bargain Sale Gifts 3: Special Tax Benefits – YouTube – #29

Bargain Sale Gifts 3: Special Tax Benefits – YouTube – #29

![How to Calculate Capital Gains Tax on Property + [How to SAVE Capital Gain Tax?] How to Calculate Capital Gains Tax on Property + [How to SAVE Capital Gain Tax?]](https://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GTI/Capital-Gain/Capital-Gain.jpg) How to Calculate Capital Gains Tax on Property + [How to SAVE Capital Gain Tax?] – #30

How to Calculate Capital Gains Tax on Property + [How to SAVE Capital Gain Tax?] – #30

Inherited Property FAQ – – #31

Inherited Property FAQ – – #31

Adding Someone to Your Real Estate Deed? Know the Risks. – Deeds.com – #32

Adding Someone to Your Real Estate Deed? Know the Risks. – Deeds.com – #32

For Calculating Capital Gains, Sale Will Be Considered When Sale Deed Is Executed – #33

For Calculating Capital Gains, Sale Will Be Considered When Sale Deed Is Executed – #33

How Capital Gains Tax Rules Work for Different Investments in India – #34

How Capital Gains Tax Rules Work for Different Investments in India – #34

How is the sale of gifted property taxed? | Mint – #35

How is the sale of gifted property taxed? | Mint – #35

Giving Your Home to Your Children Can Have Tax Consequences – #36

Giving Your Home to Your Children Can Have Tax Consequences – #36

My father bought a plot and gifted me. I sold it. How income tax is calculated? | Mint – #37

My father bought a plot and gifted me. I sold it. How income tax is calculated? | Mint – #37

Capital gains tax on second homes | TaxAssist Accountants | TaxAssist Accountants – #38

Capital gains tax on second homes | TaxAssist Accountants | TaxAssist Accountants – #38

![Gifting Property to Your Children [Tax Smart Daily 014] - YouTube Gifting Property to Your Children [Tax Smart Daily 014] - YouTube](https://hackyourwealth.com/wp-content/uploads/2016/01/avoid-capital-gains-taxes-on-home-sale-graphic.jpg) Gifting Property to Your Children [Tax Smart Daily 014] – YouTube – #39

Gifting Property to Your Children [Tax Smart Daily 014] – YouTube – #39

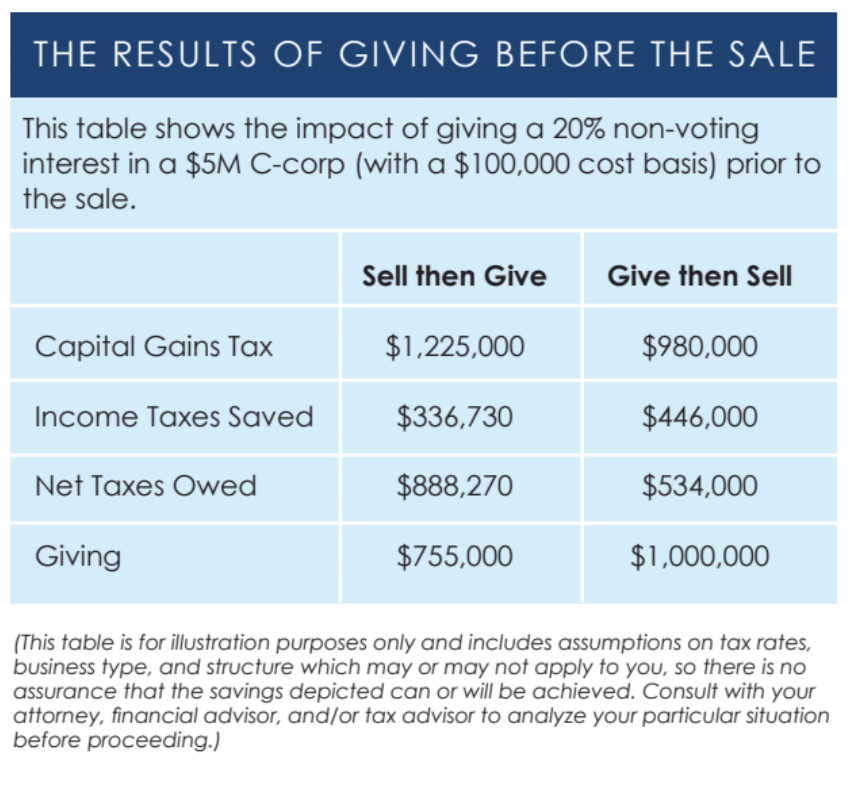

DonateEquity – Home – #40

DonateEquity – Home – #40

Tax on Capital gain on sale of Assets by Charitable Trust/NGO – #41

Tax on Capital gain on sale of Assets by Charitable Trust/NGO – #41

) Parents’ gift of house has some tax implications – #42

Parents’ gift of house has some tax implications – #42

WAYS OF GIVING – #43

WAYS OF GIVING – #43

How to Avoid Capital Gains Tax on Sale Of Gold? | IIFL Finance – #44

How to Avoid Capital Gains Tax on Sale Of Gold? | IIFL Finance – #44

Does moving to Scotland from England affect capital gains tax on properties? | Capital gains tax | The Guardian – #45

Does moving to Scotland from England affect capital gains tax on properties? | Capital gains tax | The Guardian – #45

When is money gifted not taxable? All your tax queries on gifts answered | Personal Finance – Business Standard – #46

When is money gifted not taxable? All your tax queries on gifts answered | Personal Finance – Business Standard – #46

- long term capital gains tax rate

- federal estate tax

- long term capital gains tax

How Capital Gains Taxes Work for People Over 65 – #47

How Capital Gains Taxes Work for People Over 65 – #47

) No Good Deed Goes Unpunished – #48

No Good Deed Goes Unpunished – #48

How to calculate capital gains tax on inherited property? | Value Research – #49

How to calculate capital gains tax on inherited property? | Value Research – #49

A $500,000 Gift from Uncle Sam? Maybe. Capital Gains, You and San Francisco Real Estate with Kevin and Jonathan, Vanguard Properties – #50

A $500,000 Gift from Uncle Sam? Maybe. Capital Gains, You and San Francisco Real Estate with Kevin and Jonathan, Vanguard Properties – #50

Long-term capital gains: Can you save taxes by buying multiple properties? | Mint – #51

Long-term capital gains: Can you save taxes by buying multiple properties? | Mint – #51

How to Gift Your House to Your Children During Your Lifetime | City National Bank – #52

How to Gift Your House to Your Children During Your Lifetime | City National Bank – #52

How buying a new home can save you capital gains tax on shares, mutual funds | Mint – #53

How buying a new home can save you capital gains tax on shares, mutual funds | Mint – #53

Juliana purchased land three years ago for $50,000. She gave the land to Tom, her brother, in the current – brainly.com – #54

Juliana purchased land three years ago for $50,000. She gave the land to Tom, her brother, in the current – brainly.com – #54

Do You Pay Capital Gains Tax on Divorce Settlements? – #55

Do You Pay Capital Gains Tax on Divorce Settlements? – #55

Gifting to Family Members: What You Need to Know | First Republic now part of JPMorgan Chase – #56

Gifting to Family Members: What You Need to Know | First Republic now part of JPMorgan Chase – #56

Should My Parents Give Me Their Home?https://static.wixstatic.com/media/267f0e_b686291ed37649eda4b683ce140b715f~mv2.jpg/v1/fill/w_353,h_409,al_c,lg_1,q_80/267f0e_b686291ed37649eda4b683ce140b715f~mv2.jpg – #57

Should My Parents Give Me Their Home?https://static.wixstatic.com/media/267f0e_b686291ed37649eda4b683ce140b715f~mv2.jpg/v1/fill/w_353,h_409,al_c,lg_1,q_80/267f0e_b686291ed37649eda4b683ce140b715f~mv2.jpg – #57

The basic ways the gov steals your money: -if you earn it, income tax -if you live somewhere, property tax -if you spend it, sales tax -if you save it, inflation tax – – #58

The basic ways the gov steals your money: -if you earn it, income tax -if you live somewhere, property tax -if you spend it, sales tax -if you save it, inflation tax – – #58

Capital Gain or Loss Pub 4012 – Tab D Pub 4491 – Lesson ppt download – #59

Capital Gain or Loss Pub 4012 – Tab D Pub 4491 – Lesson ppt download – #59

Easy guide to capital gains tax on sale of residential property – Times of India – #60

Easy guide to capital gains tax on sale of residential property – Times of India – #60

- capital gains tax rate

- capital gain exemption chart

- capital gain tax on property

Long Term Capital Gain Tax on Shares in India – #61

Long Term Capital Gain Tax on Shares in India – #61

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #62

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #62

Detailed Guide on Capital Gains Taxation | Section 45 to Section 55A | Case Laws – #63

Detailed Guide on Capital Gains Taxation | Section 45 to Section 55A | Case Laws – #63

Long-term capital gains tax: Rates & calculation guide | CNN Underscored Money – #64

Long-term capital gains tax: Rates & calculation guide | CNN Underscored Money – #64

Naeem din, FCMA, ACCA on LinkedIn: Capital Gain Tax on immovable properties #TY2023#Naeem & Co, CMA’s – #65

Naeem din, FCMA, ACCA on LinkedIn: Capital Gain Tax on immovable properties #TY2023#Naeem & Co, CMA’s – #65

Estate Tax, Capital Gains & Gifting – Mistakes to Avoid – #66

Estate Tax, Capital Gains & Gifting – Mistakes to Avoid – #66

How Can Senior Citizens Avoid Capital Gains Tax? – #67

How Can Senior Citizens Avoid Capital Gains Tax? – #67

Gift of Property & Tax Obligation: A Comprehensive Guide – #68

Gift of Property & Tax Obligation: A Comprehensive Guide – #68

Understanding Federal Estate and Gift Taxes | Congressional Budget Office – #69

Understanding Federal Estate and Gift Taxes | Congressional Budget Office – #69

Solved 5. This time Denise makes a gift of capital gain | Chegg.com – #70

Solved 5. This time Denise makes a gift of capital gain | Chegg.com – #70

What are the tax implications of gifting proceeds from sale of land? – The Economic Times – #71

What are the tax implications of gifting proceeds from sale of land? – The Economic Times – #71

How Is Crypto Taxed? (2024) IRS Rules and How to File | Gordon Law Group – #72

How Is Crypto Taxed? (2024) IRS Rules and How to File | Gordon Law Group – #72

) Mistakes in Deeding Property to Children – #73

Mistakes in Deeding Property to Children – #73

Step-Up In Basis: How Does It Work? | Quicken Loans – #74

Step-Up In Basis: How Does It Work? | Quicken Loans – #74

Ways to Give – Cobb Foundation – #75

Ways to Give – Cobb Foundation – #75

Capital Gains Tax In Kentucky: What You Need To Know – #76

Capital Gains Tax In Kentucky: What You Need To Know – #76

How to Transfer Stock to a Family Member Guide – #77

How to Transfer Stock to a Family Member Guide – #77

The Right Property Show: How Indexation Can Help In Saving Capital Gains Tax While Transferring Property | Zee Business – #78

The Right Property Show: How Indexation Can Help In Saving Capital Gains Tax While Transferring Property | Zee Business – #78

Gift Tax: 3 Easy Ways to Avoid Paying the Gift Tax | TaxAct – #79

Gift Tax: 3 Easy Ways to Avoid Paying the Gift Tax | TaxAct – #79

Gifts of Real Estate | ASU Foundation – #80

Gifts of Real Estate | ASU Foundation – #80

Income Tax & RBI Rules for NRIs Buying Indian Properties – #81

Income Tax & RBI Rules for NRIs Buying Indian Properties – #81

Capital Gain Income Tax: Types, Rates, and Calculation – #82

Capital Gain Income Tax: Types, Rates, and Calculation – #82

- capital gain example

- capital gains tax formula

- capital gains tax example

At What Age Can You Sell Your Home and Not Pay Capital Gains | ASAP Cash Offer – #83

At What Age Can You Sell Your Home and Not Pay Capital Gains | ASAP Cash Offer – #83

- capital gains tax calculator

- capital gain formula

- what is capital gain in income tax

Indexed cost of acquisition | Cost of acquisition of property for capital gain | Value Research – #84

Indexed cost of acquisition | Cost of acquisition of property for capital gain | Value Research – #84

Using Debt to Transfer Wealth | PNC Insights – #85

Using Debt to Transfer Wealth | PNC Insights – #85

Property Tax Service (@Propertytax_UK) / X – #86

Property Tax Service (@Propertytax_UK) / X – #86

Recent News: A Step-up in Basis and Irrevocable Trusts – The Heritage Law Center, LLC – #87

Recent News: A Step-up in Basis and Irrevocable Trusts – The Heritage Law Center, LLC – #87

Gifting Property to Children – Saffery – #88

Gifting Property to Children – Saffery – #88

Exploring the estate tax: Part 2 – Journal of Accountancy – #89

Exploring the estate tax: Part 2 – Journal of Accountancy – #89

- capital gains tax 2022

- capital gains tax 2023

- real estate house gift

Do I need to pay Capital Gains Tax if I gift property? – TaxScouts – #90

Do I need to pay Capital Gains Tax if I gift property? – TaxScouts – #90

- inheritance tax document

- inheritance/estate tax

- capital gain format

Taxation in the United States – Wikipedia – #91

Taxation in the United States – Wikipedia – #91

Do You Pay Capital Gains Taxes on Property You Inherit? – #92

Do You Pay Capital Gains Taxes on Property You Inherit? – #92

- capital gains tax 2021

- types of capital gain

- long term capital gain tax

Tax Implications Of Gifting Inherited Property To Spouse | Capital Tax If Selling Gifted Property – #93

Tax Implications Of Gifting Inherited Property To Spouse | Capital Tax If Selling Gifted Property – #93

Capital Gains Tax in Texas: What You Need to Know in 2024 – #94

Capital Gains Tax in Texas: What You Need to Know in 2024 – #94

Capital Gains Tax Calculator – #95

Capital Gains Tax Calculator – #95

Trusts and Taxes: Transfer, Income and Property Tax Implications of Trusts – #96

Trusts and Taxes: Transfer, Income and Property Tax Implications of Trusts – #96

Avoid Capital Gains Tax on Inherited Property • Law Offices of Daniel Hunt – #97

Avoid Capital Gains Tax on Inherited Property • Law Offices of Daniel Hunt – #97

Tax Implications for NRIs Who Want to Sell Property in India – #98

Tax Implications for NRIs Who Want to Sell Property in India – #98

Gift Tax In 2024: What Is It And How Does It Work? – #99

Gift Tax In 2024: What Is It And How Does It Work? – #99

How to Calculate Capital Gains Tax on Real Estate Investment Property – #100

How to Calculate Capital Gains Tax on Real Estate Investment Property – #100

How To Calculate Cost Basis For Real Estate | Rocket Mortgage – #101

How To Calculate Cost Basis For Real Estate | Rocket Mortgage – #101

Sale of Life Estate Property Before Death | Step Up In Basis – #102

Sale of Life Estate Property Before Death | Step Up In Basis – #102

Selling Gifted Property VS Selling Inherited Property – an Expat Guide | Bright!Tax Expat Tax Services – #103

Selling Gifted Property VS Selling Inherited Property – an Expat Guide | Bright!Tax Expat Tax Services – #103

What Is The Gift Tax Rate? – Forbes Advisor – #104

What Is The Gift Tax Rate? – Forbes Advisor – #104

Tax on Wedding Gifts – Explained | EZTax® – #105

Tax on Wedding Gifts – Explained | EZTax® – #105

Gift of Property & Tax Obligation: A Comprehensive Guide | Property tax, Tax, Tax exemption – #106

Gift of Property & Tax Obligation: A Comprehensive Guide | Property tax, Tax, Tax exemption – #106

tax implication: Gift or will: Which is a better way to inherit property? – The Economic Times – #107

tax implication: Gift or will: Which is a better way to inherit property? – The Economic Times – #107

How to Avoid Capital Gains Tax on Real Estate | SmartAsset – #108

How to Avoid Capital Gains Tax on Real Estate | SmartAsset – #108

Gifting equity in a home – #109

Gifting equity in a home – #109

Frequently Asked Questions (FAQs) on Capital Gains – Definitions | Rules | Exemptions – #110

Frequently Asked Questions (FAQs) on Capital Gains – Definitions | Rules | Exemptions – #110

Gift Tax Explained – Do You Pay Taxes On Gifted Money? – YouTube – #111

Gift Tax Explained – Do You Pay Taxes On Gifted Money? – YouTube – #111

Using Gift Funds for Investment Property: What You Need to Know – Trustworthy: The Family Operating System® – #112

Using Gift Funds for Investment Property: What You Need to Know – Trustworthy: The Family Operating System® – #112

Gift Planning – Wendell Foster – Owensboro Kentucky – #113

Gift Planning – Wendell Foster – Owensboro Kentucky – #113

How Capital Gains Affect Your Taxes | H&R Block® – #114

How Capital Gains Affect Your Taxes | H&R Block® – #114

Transferring Property Ownership: Pros, Cons, & Other Options – #115

Transferring Property Ownership: Pros, Cons, & Other Options – #115

Selling inherited, gifted gold? Know taxation rules | Business News – #116

Selling inherited, gifted gold? Know taxation rules | Business News – #116

Cost of indexation while computing capital gain from transfer of assets received as gift etc. | SIMPLE TAX INDIA – #117

Cost of indexation while computing capital gain from transfer of assets received as gift etc. | SIMPLE TAX INDIA – #117

Posts: capital gains on gifted property

Categories: Gifts

Author: toyotabienhoa.edu.vn