Update more than 215 are gifts taxable latest

Top images of are gifts taxable by website toyotabienhoa.edu.vn compilation. No tax on shares received as gift but sale proceedings taxable | Mint. Tax on Diwali gifts: How various sources of gifts are taxed – YouTube. Gift Cards as Employee Gifts – Are They Taxable? | Canon Capital Management Group, LLC. Relative से पैसा लेने से पहले यह video ज़रूर देखना, Gift Rule 2022,आपके गिफ्ट पर इनकम टैक्स की नज़र – YouTube

What Is the Maximum Gift You Can Give Without Being Taxed? | Law Office of Janet L. Brewer – #1

What Is the Maximum Gift You Can Give Without Being Taxed? | Law Office of Janet L. Brewer – #1

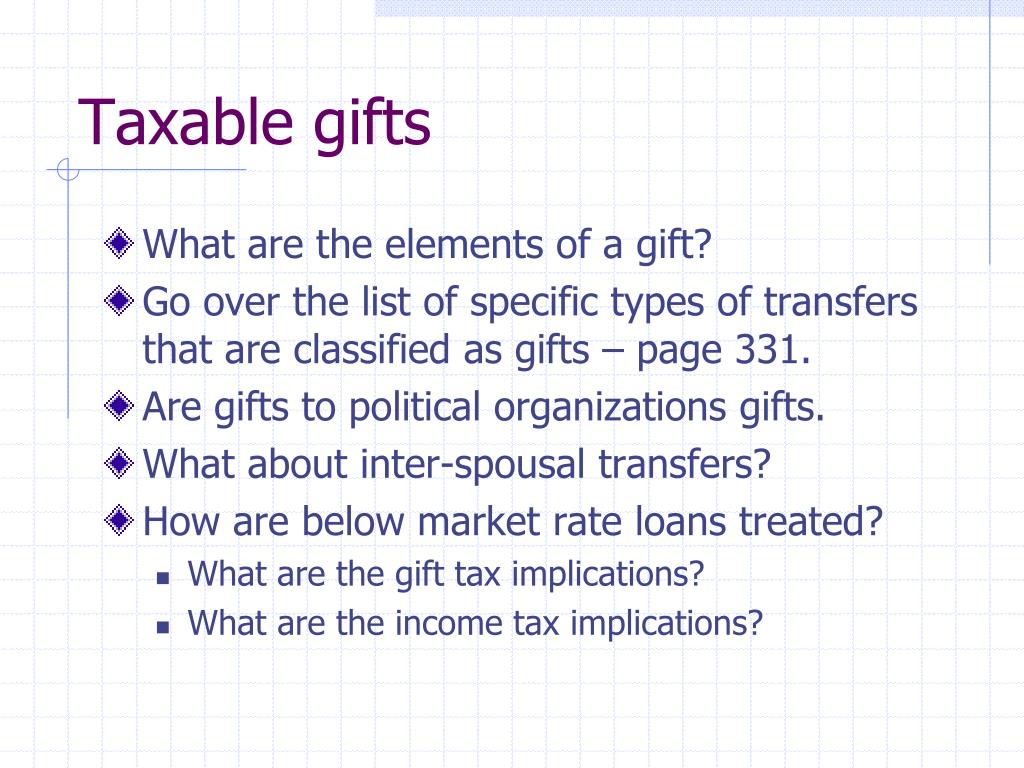

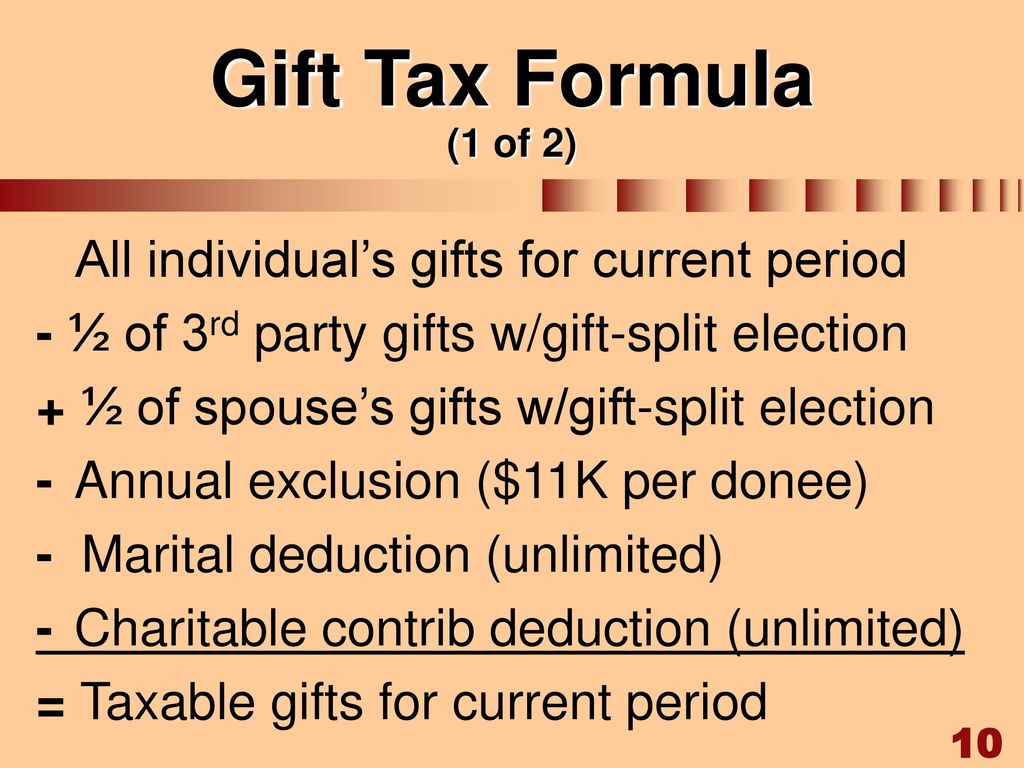

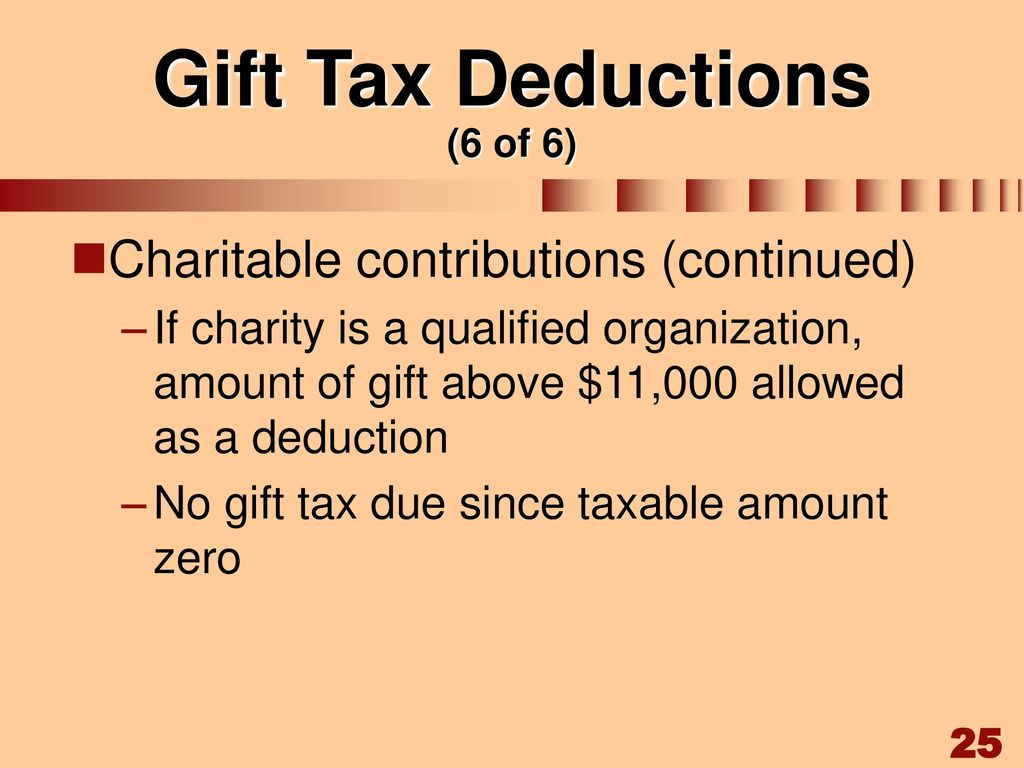

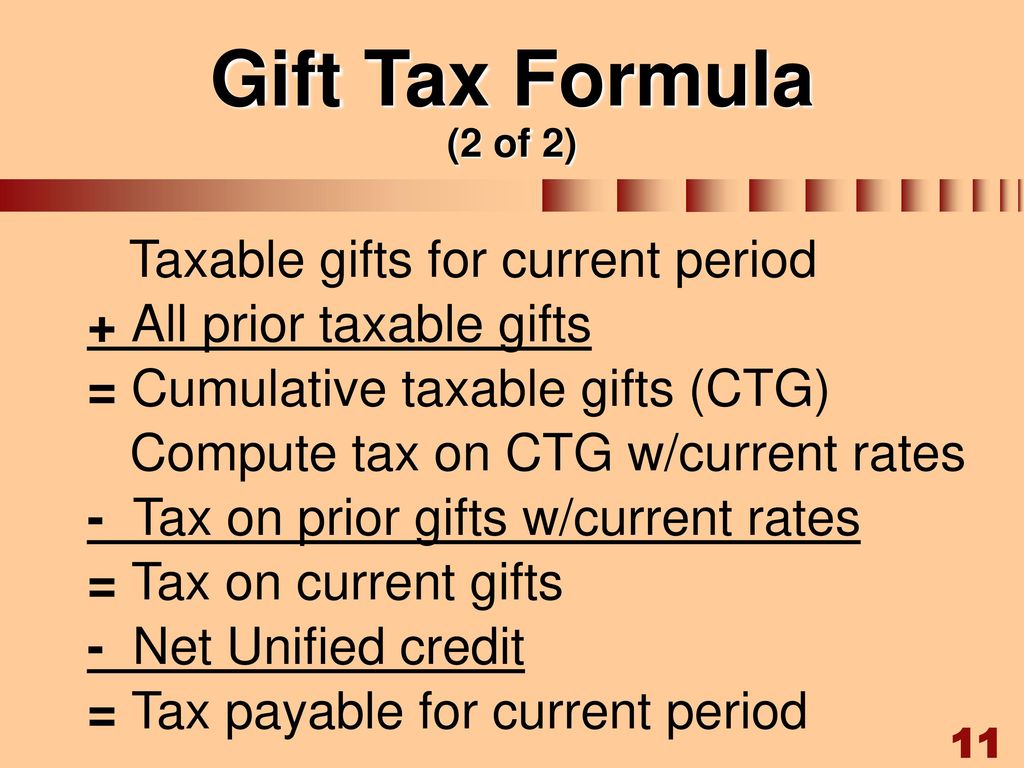

Oppenheimer’s Spencer Nurse – Estate Tax – #2

Oppenheimer’s Spencer Nurse – Estate Tax – #2

Gift Tax Explained 5 min | जानिए Gift लेने पर कितना टैक्स लगता है? Relative से Gift taxable या नहीं? – YouTube – #4

Gift Tax Explained 5 min | जानिए Gift लेने पर कितना टैक्स लगता है? Relative से Gift taxable या नहीं? – YouTube – #4

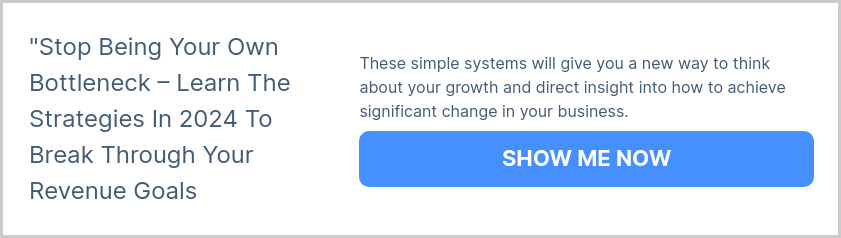

Holiday Gifts May Be Taxable – #5

Holiday Gifts May Be Taxable – #5

8 Tips For Tax-Free Gifting In 2023 – #6

8 Tips For Tax-Free Gifting In 2023 – #6

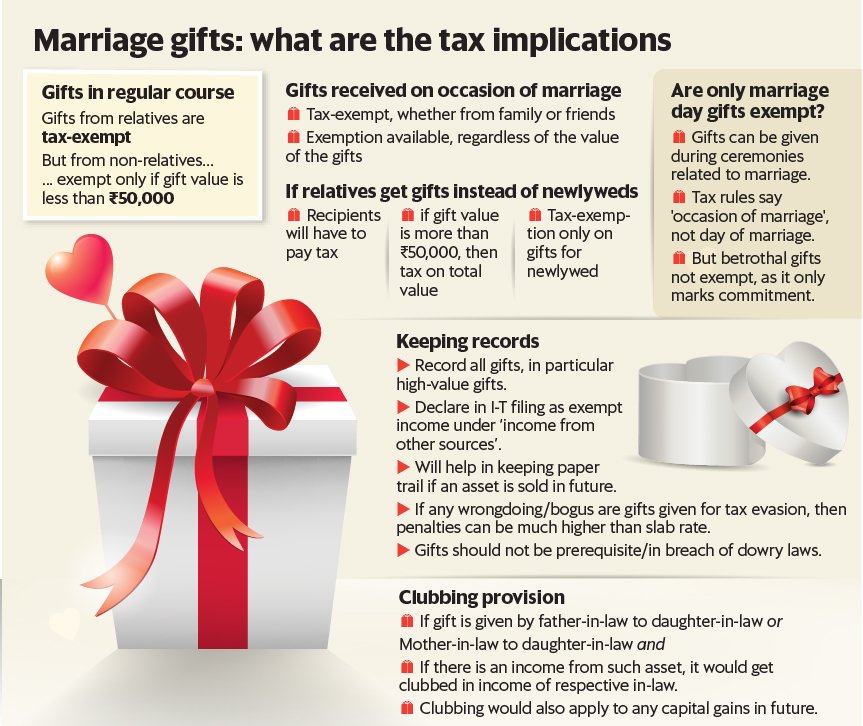

LawStreet Journal – The gifts received by newly-wed couples from their immediate family are not taxable in India. Be it cash, stock, jewelry, house, or property, regardless of its value such wedding – #7

LawStreet Journal – The gifts received by newly-wed couples from their immediate family are not taxable in India. Be it cash, stock, jewelry, house, or property, regardless of its value such wedding – #7

Diwali Gifts Can Be Taxed Under Income Tax Act Know The Exemptions and Calculation of Tax Liability | Diwali Gifts: दिवाली पर अपनों से मिले उपहारों और बोनस पर भी देना पड़ – #8

Diwali Gifts Can Be Taxed Under Income Tax Act Know The Exemptions and Calculation of Tax Liability | Diwali Gifts: दिवाली पर अपनों से मिले उपहारों और बोनस पर भी देना पड़ – #8

Estate Planning Myth #7: Gift Taxes?! I don’t make taxable gifts. – Epilawg – #10

Estate Planning Myth #7: Gift Taxes?! I don’t make taxable gifts. – Epilawg – #10

The Gift Tax Made Simple – TurboTax Tax Tips & Videos | PDF | Gift Tax In The United States | Estate Tax In The United States – #11

The Gift Tax Made Simple – TurboTax Tax Tips & Videos | PDF | Gift Tax In The United States | Estate Tax In The United States – #11

Gift Cards are Taxable! – #12

Gift Cards are Taxable! – #12

Gift Wrap – Swashaa – #13

Gift Wrap – Swashaa – #13

Crypto Taxes India: Expert Guide 2024 | CPA Reviewed | Koinly – #14

Crypto Taxes India: Expert Guide 2024 | CPA Reviewed | Koinly – #14

Income tax on gifts: Know when your gift is tax-free – BusinessToday – #15

Income tax on gifts: Know when your gift is tax-free – BusinessToday – #15

![]() Income Tax on Diwali Gifts Know If Employers Bonus and Gifts from Relatives Are Taxable; दिवाळी भेटवस्तूंवरही फुटतो टॅक्सचा बॉम्ब, नातेवाईकांनी दिलेल्या गिफ्ट्सवरील आयकर नियम … – #16

Income Tax on Diwali Gifts Know If Employers Bonus and Gifts from Relatives Are Taxable; दिवाळी भेटवस्तूंवरही फुटतो टॅक्सचा बॉम्ब, नातेवाईकांनी दिलेल्या गिफ्ट्सवरील आयकर नियम … – #16

Gifting vs. Inheritance – Heritage Investment Group – #17

Gifting vs. Inheritance – Heritage Investment Group – #17

Are gifts given to family members taxable to them? – Tax Tip Weekly – YouTube – #18

Are gifts given to family members taxable to them? – Tax Tip Weekly – YouTube – #18

Give the gift of crypto? Here’s what to expect from your next tax return | Coinbase – #19

Give the gift of crypto? Here’s what to expect from your next tax return | Coinbase – #19

- gift tax exclusion 2023

- gift chart as per income tax

- gift tax act 1958

Solved Elizabeth made taxable gifts of $6,550,000 in 2019 | Chegg.com – #20

Solved Elizabeth made taxable gifts of $6,550,000 in 2019 | Chegg.com – #20

MEMORANDUM ON GIFTING – #21

MEMORANDUM ON GIFTING – #21

Are Employee Gift Cards Taxable? – #22

Are Employee Gift Cards Taxable? – #22

SOLVED: Exercise 18-19 (LO. 3) Elizabeth made taxable gifts of $ 3,000,000 in 2020 and $ 14,000,000 in 2022 . She paid no gift tax on the 2020 transfer. On what amount – #23

SOLVED: Exercise 18-19 (LO. 3) Elizabeth made taxable gifts of $ 3,000,000 in 2020 and $ 14,000,000 in 2022 . She paid no gift tax on the 2020 transfer. On what amount – #23

What kind of gifts does the company give to employees that must withhold personal income tax in Vietnam? Are the gifts exceeding VND 10,000,000 VND taxable income? – #24

What kind of gifts does the company give to employees that must withhold personal income tax in Vietnam? Are the gifts exceeding VND 10,000,000 VND taxable income? – #24

How Are Gifts Taxed in India? – Kanakkupillai – #25

How Are Gifts Taxed in India? – Kanakkupillai – #25

Tax Saving: गिफ्ट्स पर भी लगता है टैक्स, लेकिन यह नियम दिलाता है छूट – #26

Tax Saving: गिफ्ट्स पर भी लगता है टैक्स, लेकिन यह नियम दिलाता है छूट – #26

Solved Exercise 18-19 (Algorithmic) (LO, 3) Elizabeth made | Chegg.com – #27

Solved Exercise 18-19 (Algorithmic) (LO, 3) Elizabeth made | Chegg.com – #27

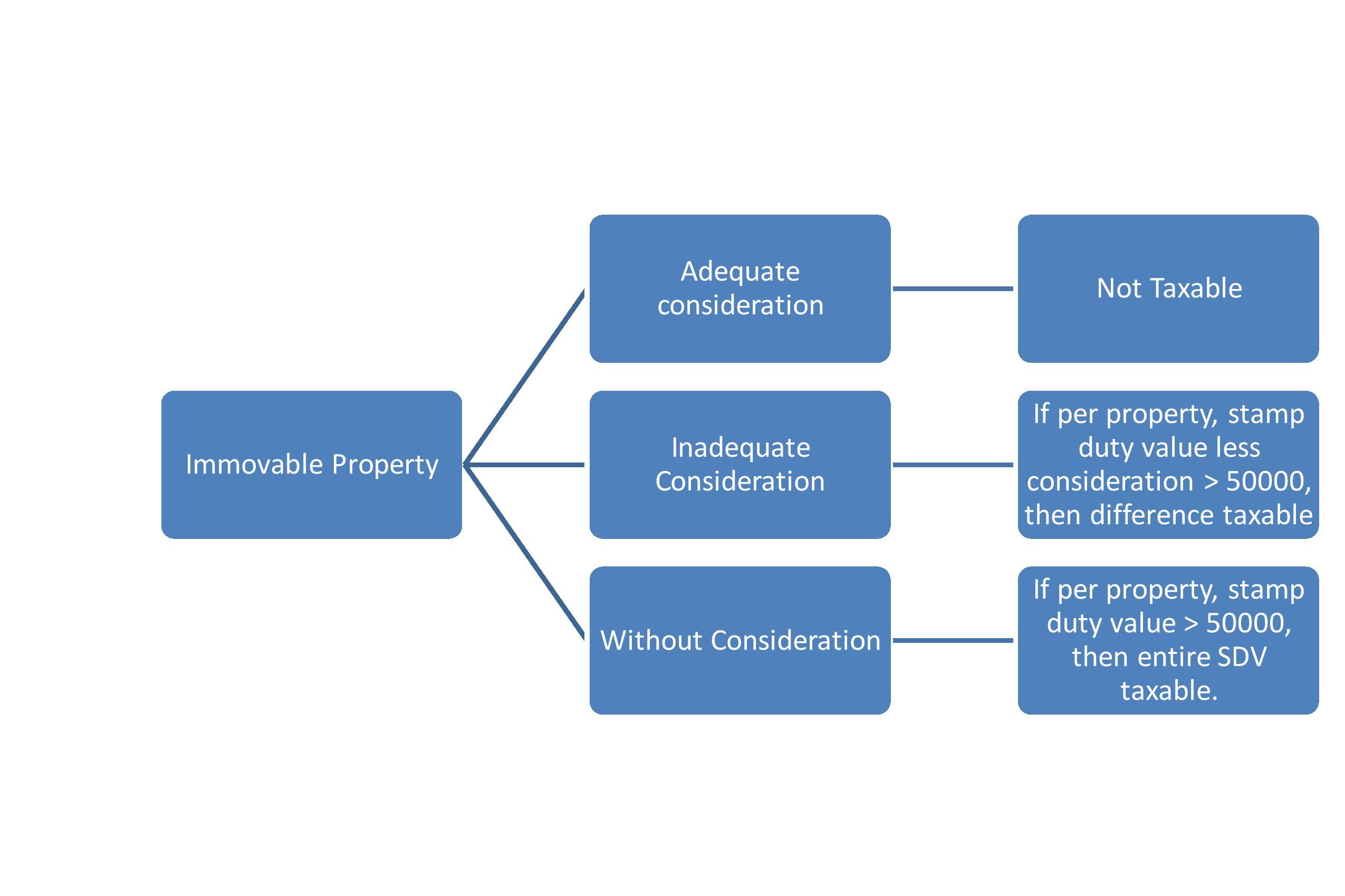

Gift of Property & Tax Obligation: A Comprehensive Guide – #28

Gift of Property & Tax Obligation: A Comprehensive Guide – #28

Are Christmas Gifts To Pastors Taxable? – The Pastor’s Wallet – #29

Are Christmas Gifts To Pastors Taxable? – The Pastor’s Wallet – #29

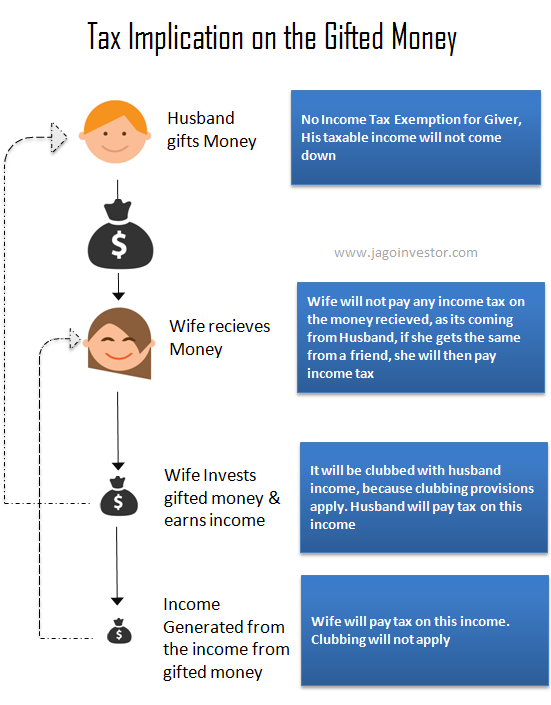

Income Tax on Cash Gift to Wife: How Much You Can Gift on Women’s Day Without Tax Implications – Income Tax News | The Financial Express – #30

Income Tax on Cash Gift to Wife: How Much You Can Gift on Women’s Day Without Tax Implications – Income Tax News | The Financial Express – #30

6 Tips for Tax-Free Gifting | Mariner Wealth Advisors – #31

6 Tips for Tax-Free Gifting | Mariner Wealth Advisors – #31

Understanding Gift Tax – Daytona Beach Attorneys | Family Law, Personal Injury, Estate Planning – #32

Understanding Gift Tax – Daytona Beach Attorneys | Family Law, Personal Injury, Estate Planning – #32

Gift taxes concept icon taxable goods idea thin Vector Image – #33

Gift taxes concept icon taxable goods idea thin Vector Image – #33

Is there a limit in income tax laws up to which a father can gift to his son – #34

Is there a limit in income tax laws up to which a father can gift to his son – #34

GST | Income Tax | Investment on Instagram: “Diwali Gift by employer to employees 👆👆 If you are a Tax Professional, you can become Member of Tax Solution Group✓ (Message inbox) Get – #35

GST | Income Tax | Investment on Instagram: “Diwali Gift by employer to employees 👆👆 If you are a Tax Professional, you can become Member of Tax Solution Group✓ (Message inbox) Get – #35

What You Need to Know About Stock Gift Tax – #36

What You Need to Know About Stock Gift Tax – #36

Gifts above Rs 50,000 given to employees in a year to be taxed under GST: Govt – Hindustan Times – #37

Gifts above Rs 50,000 given to employees in a year to be taxed under GST: Govt – Hindustan Times – #37

Income Tax on Diwali Gifts Received – #38

Income Tax on Diwali Gifts Received – #38

Solved Using property she inherited, Lei makes a 2022 gift | Chegg.com – #39

Solved Using property she inherited, Lei makes a 2022 gift | Chegg.com – #39

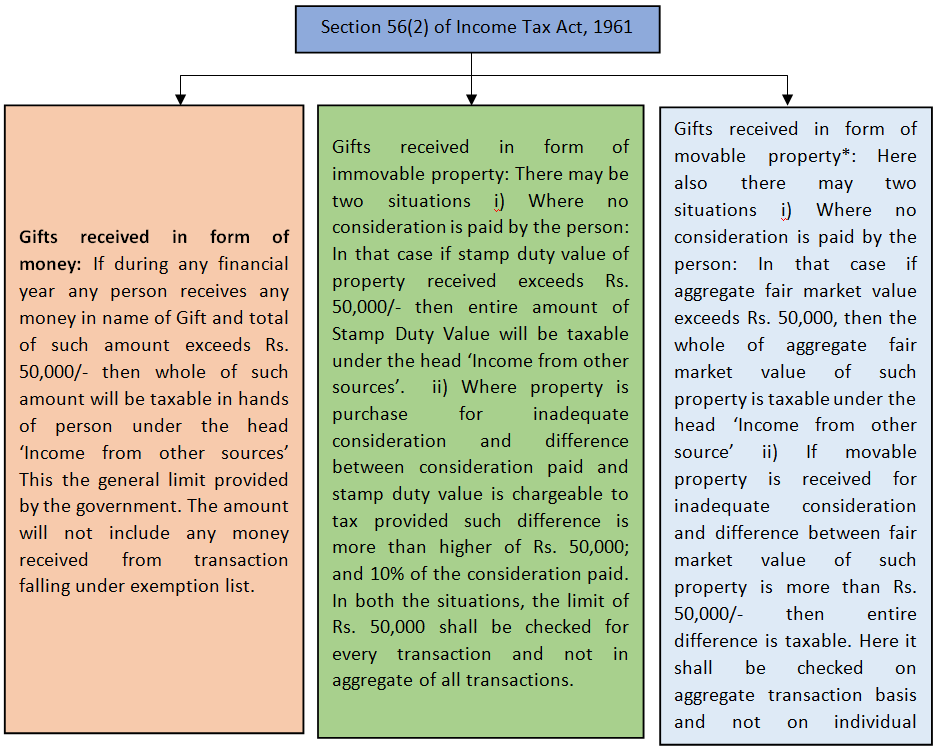

- section 56(2) of income tax act

- annual gift tax exclusion 2021

- gift tax rate

Employee Gifts: What You Need to Know From a Tax Perspective – #40

Employee Gifts: What You Need to Know From a Tax Perspective – #40

If I buy a gift card for myself, is it included in income tax in India? – Quora – #41

If I buy a gift card for myself, is it included in income tax in India? – Quora – #41

What Qualifies as a Business Gift? | Accounting Freedom, Ltd. – #42

What Qualifies as a Business Gift? | Accounting Freedom, Ltd. – #42

How Crypto Gifts and Donations are Taxed | CoinTracker – #43

How Crypto Gifts and Donations are Taxed | CoinTracker – #43

Annual Exclusion: Meaning, Special Cases, FAQs – #44

Annual Exclusion: Meaning, Special Cases, FAQs – #44

![Solved] I need help with this question EXI-HBIT 25-1 Unified Transfer Tax... | Course Hero Solved] I need help with this question EXI-HBIT 25-1 Unified Transfer Tax... | Course Hero](https://akm-img-a-in.tosshub.com/businesstoday/images/story/201911/gift_pack_660_281119014338.jpg?size\u003d948:533) Solved] I need help with this question EXI-HBIT 25-1 Unified Transfer Tax… | Course Hero – #45

Solved] I need help with this question EXI-HBIT 25-1 Unified Transfer Tax… | Course Hero – #45

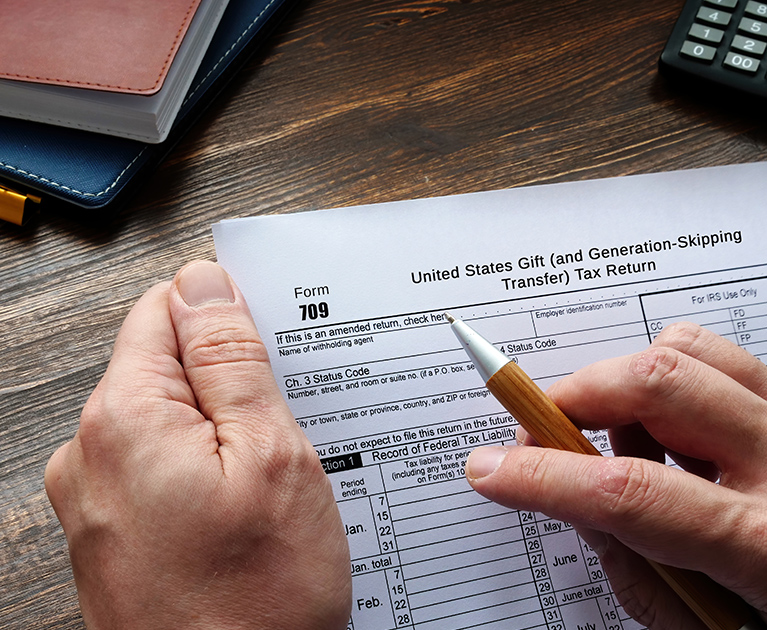

Form 709: Guide to US Gift Taxes for Expats – #46

Form 709: Guide to US Gift Taxes for Expats – #46

Substantial Compliance Reporting Taxable Gift Sufficient to Start SoL | Wealth Management – #47

Substantial Compliance Reporting Taxable Gift Sufficient to Start SoL | Wealth Management – #47

Will you be taxed if you get Diwali gifts? – The Economic Times – #48

Will you be taxed if you get Diwali gifts? – The Economic Times – #48

Receiving a Foreign Gift? You May Need to Tell the IRS – The Wolf Group – #49

Receiving a Foreign Gift? You May Need to Tell the IRS – The Wolf Group – #49

Considerations When Making Gifts to Children – Community First Credit Union – #50

Considerations When Making Gifts to Children – Community First Credit Union – #50

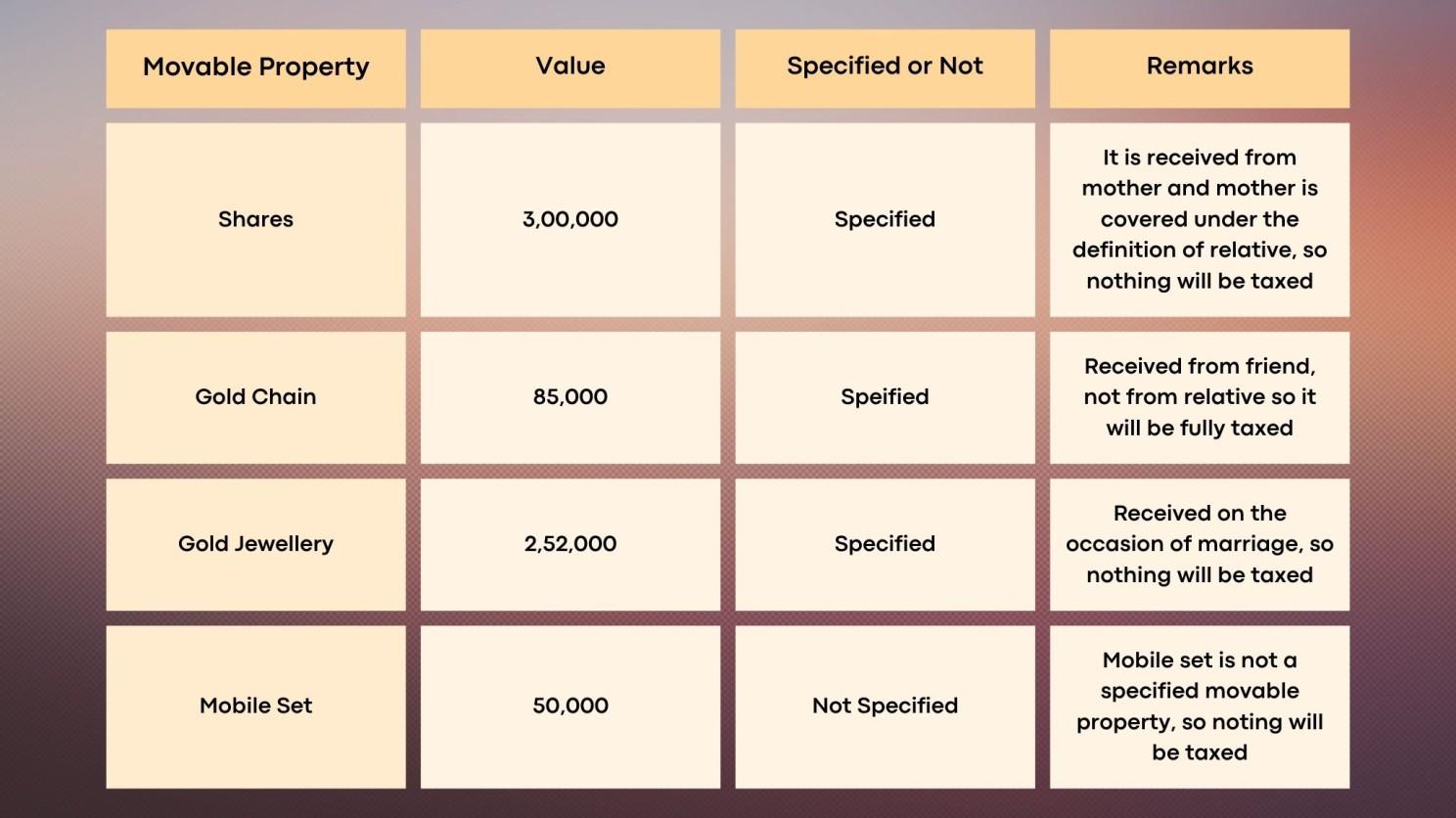

Gifts & Income Tax Implications : Scenarios & Examples – #51

Gifts & Income Tax Implications : Scenarios & Examples – #51

Gift and Estate Tax Basic Exclusion Amount vs. Generation-Skipping Transfer Tax Exemption Amount – Online CFP Program – #52

Gift and Estate Tax Basic Exclusion Amount vs. Generation-Skipping Transfer Tax Exemption Amount – Online CFP Program – #52

Taxation — Interrelation of Income and Gift Taxes — Gift Tax Status of Income of Trust Which Is Taxable to Donor – #53

Taxation — Interrelation of Income and Gift Taxes — Gift Tax Status of Income of Trust Which Is Taxable to Donor – #53

$14,000 Tax-Free Gifts: A Good Way to Reduce Your Taxable Estate – #54

$14,000 Tax-Free Gifts: A Good Way to Reduce Your Taxable Estate – #54

Blog: Tips to Help You Figure Out if Your Gift is Taxable – Montgomery Community Media – #55

Blog: Tips to Help You Figure Out if Your Gift is Taxable – Montgomery Community Media – #55

How to Gift Educational Expenses: Tax Advantages and Pitfalls – #56

How to Gift Educational Expenses: Tax Advantages and Pitfalls – #56

Reminder: You don’t have to pay sales tax on gift cards – #57

Reminder: You don’t have to pay sales tax on gift cards – #57

taxes – How gifting money to Parents helps in Tax saving in India? – Personal Finance & Money Stack Exchange – #58

taxes – How gifting money to Parents helps in Tax saving in India? – Personal Finance & Money Stack Exchange – #58

Gift Tax 101: Gift Tax Limits (+ Rules for Gifting Stocks) – #59

Gift Tax 101: Gift Tax Limits (+ Rules for Gifting Stocks) – #59

Gifts to and from HUF – MN & Associates CS-India – #60

Gifts to and from HUF – MN & Associates CS-India – #60

Annual Reminder: Are Gifts to Clergy Taxable or Nontaxable? – #61

Annual Reminder: Are Gifts to Clergy Taxable or Nontaxable? – #61

Gift Tax – #62

Gift Tax – #62

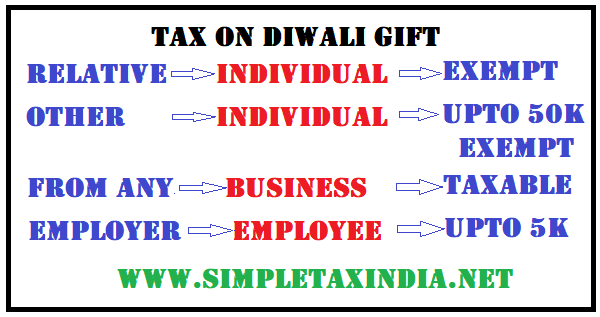

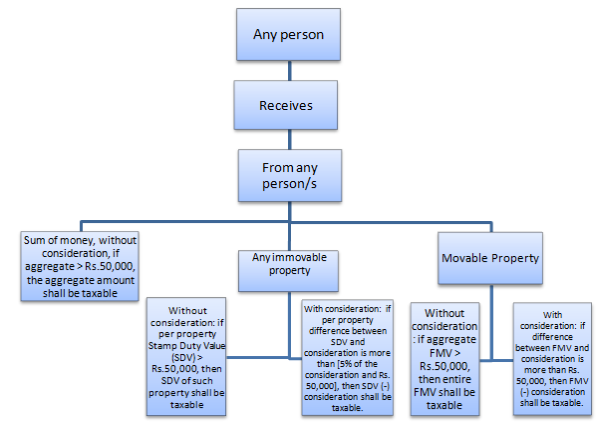

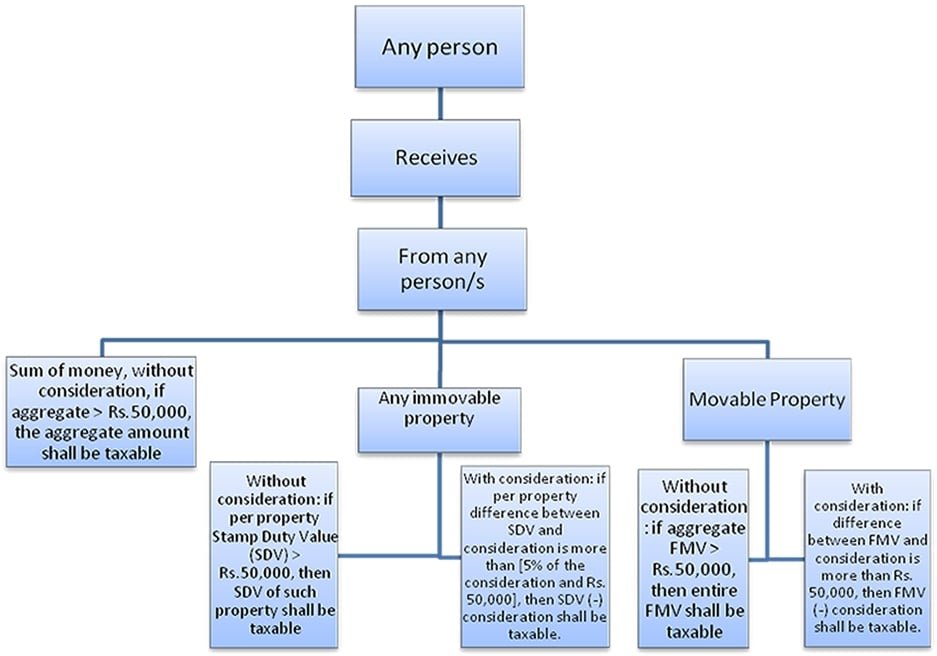

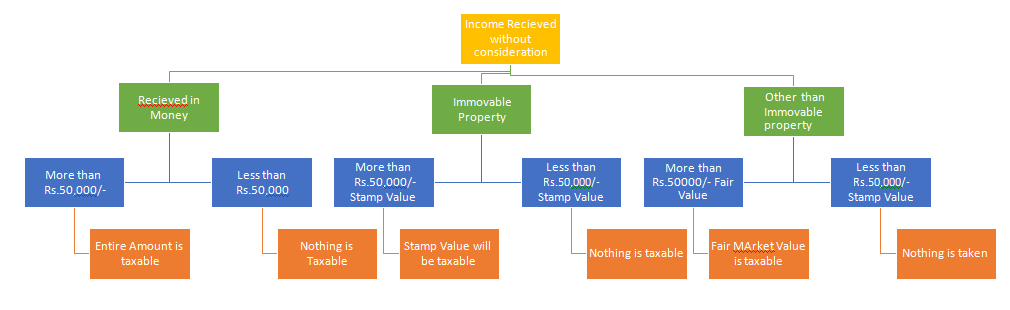

when Gift is taxable ? when gift is Exempted ? | SIMPLE TAX INDIA – #63

when Gift is taxable ? when gift is Exempted ? | SIMPLE TAX INDIA – #63

Bosses Bearing Year-End Gifts – Echelon Business Development Network – #64

Bosses Bearing Year-End Gifts – Echelon Business Development Network – #64

Ch 1 notes – Thomas Moschetti – 00 Ch 1 notes. Gift Tax. The value of tax is based on the value of – Studocu – #65

Ch 1 notes – Thomas Moschetti – 00 Ch 1 notes. Gift Tax. The value of tax is based on the value of – Studocu – #65

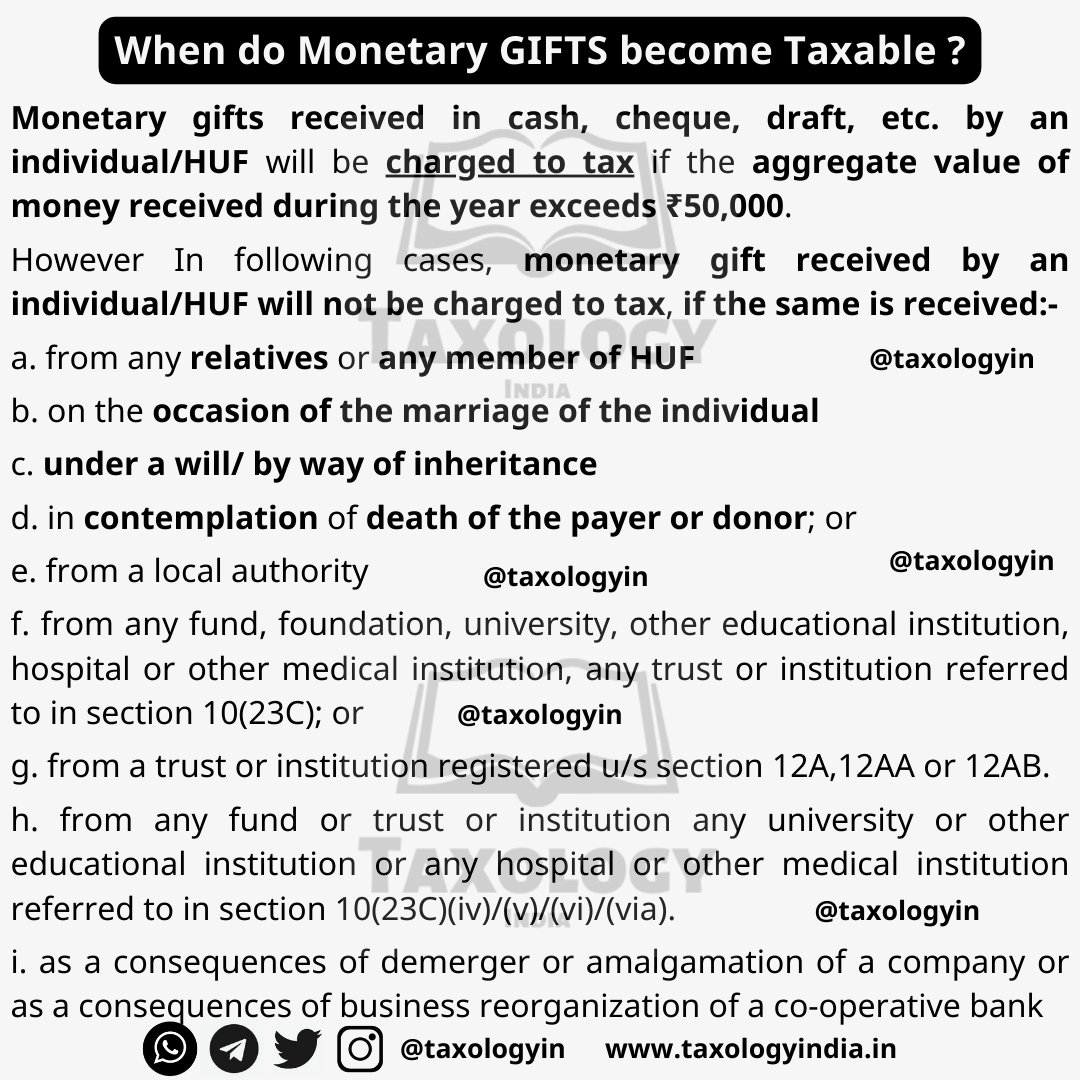

Taxology India on X: “Did you know cash gifts received from friends (other than in wedding) is taxable? Lets learn about Monetary Gifts & its taxability in a simple way. https://t.co/yZFVP17Qu4” / – #66

Taxology India on X: “Did you know cash gifts received from friends (other than in wedding) is taxable? Lets learn about Monetary Gifts & its taxability in a simple way. https://t.co/yZFVP17Qu4” / – #66

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #67

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #67

Did you know that gifts you receive are also taxed? | Zee Business – #68

Did you know that gifts you receive are also taxed? | Zee Business – #68

Gift are taxable income or exempted income & how are gift taxed? – Tax Knowledges – #69

Gift are taxable income or exempted income & how are gift taxed? – Tax Knowledges – #69

Solved b. Gifts of up to $15,000 per year from any person | Chegg.com – #70

Solved b. Gifts of up to $15,000 per year from any person | Chegg.com – #70

- excise tax

- gift tax return

- capital gains tax

The Gift Tax – TurboTax Tax Tips & Videos – #71

The Gift Tax – TurboTax Tax Tips & Videos – #71

Are Gifts Taxable? How Much To Gift & Who Pays It | Trust & Will – #72

Are Gifts Taxable? How Much To Gift & Who Pays It | Trust & Will – #72

Gift Tax: What it is and How Gifts are taxed in India – #73

Gift Tax: What it is and How Gifts are taxed in India – #73

Complete Guide on Whether Employee Gift Cards Are Taxable Or Not – #74

Complete Guide on Whether Employee Gift Cards Are Taxable Or Not – #74

-Gifts.jpg) Are Gifts Taxable? | Gift Tax Exclusion Explained | Ask a CPA – YouTube – #75

Are Gifts Taxable? | Gift Tax Exclusion Explained | Ask a CPA – YouTube – #75

Estate and Gift Tax Alert – #76

Estate and Gift Tax Alert – #76

Taxation of Gifts to Ministers and Church Employees – Provident Lawyers – #77

Taxation of Gifts to Ministers and Church Employees – Provident Lawyers – #77

Don’t gift your sister tax on Raksha Bandhan – #78

Don’t gift your sister tax on Raksha Bandhan – #78

Awards (Gifts) from Employers – Are they Taxable? – #79

Awards (Gifts) from Employers – Are they Taxable? – #79

Tax Credits | St. Francis Community Services – #80

Tax Credits | St. Francis Community Services – #80

- 2024 gift

- list of relatives

- gift tax rate 2023

Are Cash Gifts to Employees Taxable in Canada – LedgerLogic – #81

Are Cash Gifts to Employees Taxable in Canada – LedgerLogic – #81

CRA may tax company gifts to employees: How to know if it’s tax free | Financial Post – #82

CRA may tax company gifts to employees: How to know if it’s tax free | Financial Post – #82

Are Gifts Tax-Deductible? – #83

Are Gifts Tax-Deductible? – #83

What Counts as Taxable and Non-Taxable Income for 2023 | The Official Blog of TaxSlayer – #84

What Counts as Taxable and Non-Taxable Income for 2023 | The Official Blog of TaxSlayer – #84

Are Gifts Taxable? – Tax Defense Partners – #85

Are Gifts Taxable? – Tax Defense Partners – #85

Gift tax: Gift Tax 101: How It Fits into the Picture of Total Taxation – FasterCapital – #86

Gift tax: Gift Tax 101: How It Fits into the Picture of Total Taxation – FasterCapital – #86

3.12.263 Estate and Gift Tax Returns | Internal Revenue Service – #87

3.12.263 Estate and Gift Tax Returns | Internal Revenue Service – #87

Estate & Gift Tax Strategies – Milton Law Group – #88

Estate & Gift Tax Strategies – Milton Law Group – #88

Taxability of Gifts in the Hands of Recipients Simplified – #89

Taxability of Gifts in the Hands of Recipients Simplified – #89

- gift tax

- gift tax in india

- interest tax

ITR filing — gifts need to be declared and here you see how they are taxed – #90

ITR filing — gifts need to be declared and here you see how they are taxed – #90

Do Beneficiaries Pay Taxes on Life Insurance? – #91

Do Beneficiaries Pay Taxes on Life Insurance? – #91

Tax Free Weekends | Did you know that gifts up to Rs. 50,000 per year are not taxable for the receiver? Plan for similar investments well in advance by visiting our website… | – #92

Tax Free Weekends | Did you know that gifts up to Rs. 50,000 per year are not taxable for the receiver? Plan for similar investments well in advance by visiting our website… | – #92

Tax on gifts and inheritances | ATO Community – #93

Tax on gifts and inheritances | ATO Community – #93

Form TP-400:10/99, New York State Gift Tax Return, TP400 – #94

Form TP-400:10/99, New York State Gift Tax Return, TP400 – #94

Overview of Estate/Gift Tax Unified Rate Schedule Single unified transfer tax applies to estates/gifts (post 12/76) why? Rates range from 18% to 40% – – ppt download – #95

Overview of Estate/Gift Tax Unified Rate Schedule Single unified transfer tax applies to estates/gifts (post 12/76) why? Rates range from 18% to 40% – – ppt download – #95

Are Wedding Gifts Taxable? (Explanation + Examples) – #96

Are Wedding Gifts Taxable? (Explanation + Examples) – #96

Gifts to Employees – Taxable Income or Nontaxable Gift – #97

Gifts to Employees – Taxable Income or Nontaxable Gift – #97

Taxes on Gifts and Inheritances – Arrows International Realty – #98

Taxes on Gifts and Inheritances – Arrows International Realty – #98

Gift Tax | Gift Tax In India | Gift Tax under Income Tax | Tax on Gift – #99

Gift Tax | Gift Tax In India | Gift Tax under Income Tax | Tax on Gift – #99

- federal gift tax

- gift tax exemption relatives list

- estate tax

Taxability on Gifts from Spouse in India – #100

Taxability on Gifts from Spouse in India – #100

What are the tax laws on gifts? – Quora – #101

What are the tax laws on gifts? – Quora – #101

Income Tax on Gifts Received | Monetary Gifts from Relatives & Friends | Taxpundit – YouTube – #102

Income Tax on Gifts Received | Monetary Gifts from Relatives & Friends | Taxpundit – YouTube – #102

Adler & Adler | Lifetime Gifts to Reduce NY Estate Tax – #103

Adler & Adler | Lifetime Gifts to Reduce NY Estate Tax – #103

Are Gift Cards Taxable? IRS Rules Explained – #104

Are Gift Cards Taxable? IRS Rules Explained – #104

Legacy IRA Rollover To Charitable Gift Annuity – #105

Legacy IRA Rollover To Charitable Gift Annuity – #105

Prosper CPAs on LinkedIn: Did you know that gifts are taxable to the giver? Actually, yes! But there… – #106

Prosper CPAs on LinkedIn: Did you know that gifts are taxable to the giver? Actually, yes! But there… – #106

Alloy Silverstein – What are the tax implications of gifting money or property to family or friends? Gifting can be a key part of tax and estate planning strategies, but it’s recommended – #107

Alloy Silverstein – What are the tax implications of gifting money or property to family or friends? Gifting can be a key part of tax and estate planning strategies, but it’s recommended – #107

Which Gifts from relatives are exempted from Income Tax? – #108

Which Gifts from relatives are exempted from Income Tax? – #108

Annual Gift Tax Exclusion Explained | PNC Insights – #109

Annual Gift Tax Exclusion Explained | PNC Insights – #109

Gift Card Hoarders, Ultimate Retirement Accounts, & Millennials Selling Out 🤦♀️ – How to Money – #110

Gift Card Hoarders, Ultimate Retirement Accounts, & Millennials Selling Out 🤦♀️ – How to Money – #110

![]() Leo Anzoleaga Group – #111

Leo Anzoleaga Group – #111

- gift tax png

- lineal ascendant gift from relative exempt from income tax

- gift tag

How to Avoid Paying Gift Tax: 13 Steps (with Pictures) – wikiHow Life – #112

How to Avoid Paying Gift Tax: 13 Steps (with Pictures) – wikiHow Life – #112

Taxes On Gifts From Overseas – #113

Taxes On Gifts From Overseas – #113

Are wedding gifts taxable? How Gift Tax applies to your wedding – Beem – #114

Are wedding gifts taxable? How Gift Tax applies to your wedding – Beem – #114

Taxation of Gifts, Prizes and Awards to Employees Policy/Procedure – #115

Taxation of Gifts, Prizes and Awards to Employees Policy/Procedure – #115

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #116

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #116

Is cashback on mobile wallets taxable? – #117

Is cashback on mobile wallets taxable? – #117

What You Need to Know about Employee Gifts and Taxable Income — Blog | Casey Peterson, Ltd. – #118

What You Need to Know about Employee Gifts and Taxable Income — Blog | Casey Peterson, Ltd. – #118

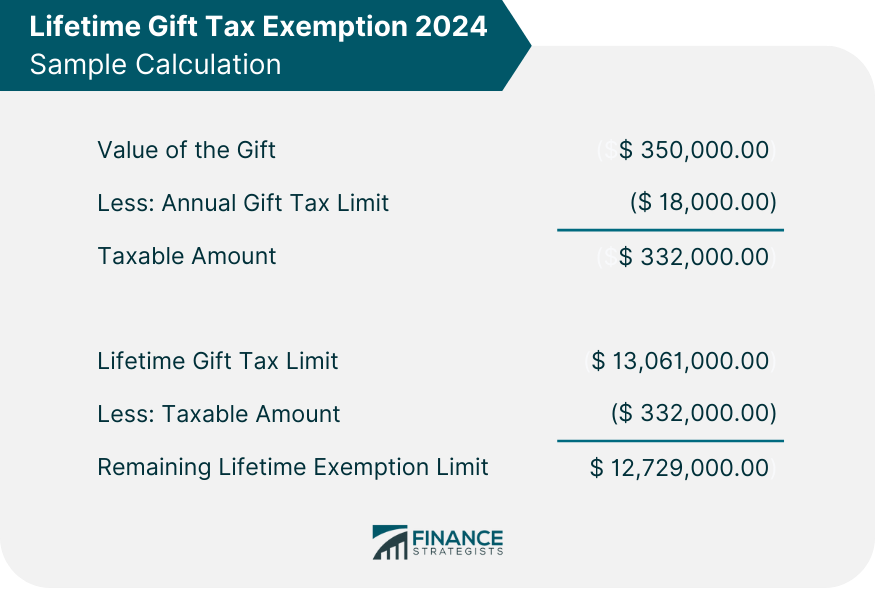

What Is the Lifetime Gift Tax Exemption for 2024? | SmartAsset – #119

What Is the Lifetime Gift Tax Exemption for 2024? | SmartAsset – #119

Gifts and Taxes: how much does it cost to make someone happy? – #120

Gifts and Taxes: how much does it cost to make someone happy? – #120

Are Gifts Received During Diwali Taxable? – Goodreturns – #121

Are Gifts Received During Diwali Taxable? – Goodreturns – #121

Expecting an NFT, crypto, or VDA gift this Diwali? Here are the tax implications – #122

Expecting an NFT, crypto, or VDA gift this Diwali? Here are the tax implications – #122

Gift Tax A gift is… – Ghana Revenue Authority – Official | Facebook – #123

Gift Tax A gift is… – Ghana Revenue Authority – Official | Facebook – #123

Tips To Help You Figure Out if Your Gift Is Taxable – #124

Tips To Help You Figure Out if Your Gift Is Taxable – #124

) Are Gift Cards Taxable? | Tremendous – #125

Are Gift Cards Taxable? | Tremendous – #125

Award, Gift and Tax – 10082015 | PDF – #126

Award, Gift and Tax – 10082015 | PDF – #126

Five Best Financial Gifts for Grandkids | Kiplinger – #127

Five Best Financial Gifts for Grandkids | Kiplinger – #127

Will your ‘gift’ be taxed? – The Economic Times – #128

Will your ‘gift’ be taxed? – The Economic Times – #128

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #129

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #129

Unwrapping Gift Taxation: What Is Important For You to Know – #130

Unwrapping Gift Taxation: What Is Important For You to Know – #130

Gift Tax planning – 3 awesome tips to save income tax legally – #131

Gift Tax planning – 3 awesome tips to save income tax legally – #131

Tamil Nadu AAAR: Now Gift Vouchers Also Taxable as Per GST – #132

Tamil Nadu AAAR: Now Gift Vouchers Also Taxable as Per GST – #132

Income Tax: Will Gifting Of Shares To Spouse Be Taxable? – News18 – #133

Income Tax: Will Gifting Of Shares To Spouse Be Taxable? – News18 – #133

Year-end holiday parties & gifts: what’s taxable? – PKF Mueller – #134

Year-end holiday parties & gifts: what’s taxable? – PKF Mueller – #134

New Canada Revenue Agency (CRA) policy on Taxable Benefits regarding gifts, awards, social events, parking, etc.: A Tax Alert by an Expert Canadian Tax Lawyer – TaxPage.com – #135

New Canada Revenue Agency (CRA) policy on Taxable Benefits regarding gifts, awards, social events, parking, etc.: A Tax Alert by an Expert Canadian Tax Lawyer – TaxPage.com – #135

Estate and Gift Taxes Brochure – Item: #72-8121 – #136

Estate and Gift Taxes Brochure – Item: #72-8121 – #136

- gift tax rate in india 2022-23

- gift tax exemption 2022

- gift tax rate in india 2020

Taxable Gift Reporting on Form 709 | New York Law Journal – #137

Taxable Gift Reporting on Form 709 | New York Law Journal – #137

- gift from relative exempt from income tax

- gift tax example

- gift tax 2023

Gift में मिली प्रॉपर्टी बेचने पर भरना पड़ता है टैक्स? जानिए क्या कहता है नियम – How Gifted property taxed in india know the rules long term capital gain tax – #138

Gift में मिली प्रॉपर्टी बेचने पर भरना पड़ता है टैक्स? जानिए क्या कहता है नियम – How Gifted property taxed in india know the rules long term capital gain tax – #138

CRA Changes Policy on Taxable Gifts and Awards Given to Employees – #139

CRA Changes Policy on Taxable Gifts and Awards Given to Employees – #139

Are Employee Gifts Taxable Or Not? – Market Business News – #140

Are Employee Gifts Taxable Or Not? – Market Business News – #140

Looking the Gift Horse in the Mouth | Sharpe Group blog – #141

Looking the Gift Horse in the Mouth | Sharpe Group blog – #141

Ultimate Bitcoin Tax Guide 2024 | Koinly – #142

Ultimate Bitcoin Tax Guide 2024 | Koinly – #142

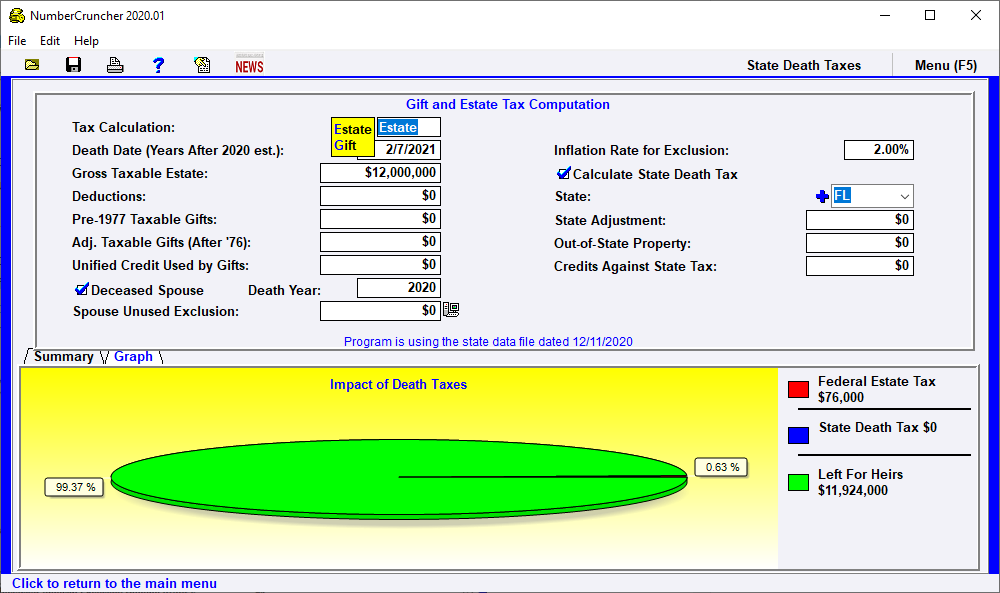

Estate Tax: Gift and Estate Tax Computation – Leimberg, LeClair, & Lackner, Inc. – #143

Estate Tax: Gift and Estate Tax Computation – Leimberg, LeClair, & Lackner, Inc. – #143

Qualified Charitable Distributions: Tax-savvy gifts for older donors | Blog | Resources | FreeWill – #144

Qualified Charitable Distributions: Tax-savvy gifts for older donors | Blog | Resources | FreeWill – #144

Are gifts received on your wedding taxable and some other … | Flickr – #145

Are gifts received on your wedding taxable and some other … | Flickr – #145

Are Gifts To Retired Ministers Taxable? – The Pastor’s Wallet – #146

Are Gifts To Retired Ministers Taxable? – The Pastor’s Wallet – #146

Solved Elizabeth made taxable gifts of $6,550,000 in 2020 | Chegg.com – #147

Solved Elizabeth made taxable gifts of $6,550,000 in 2020 | Chegg.com – #147

- gift tax meaning

- gift tax exemption

- customs duty

Gift taxes neon light concept icon taxable goods Vector Image – #148

Gift taxes neon light concept icon taxable goods Vector Image – #148

Gift Tax | Galactic Advisors – #149

Gift Tax | Galactic Advisors – #149

Income Tax on Marriage Gift: Taxation of Wedding Gifts Received – Section 56 – Tax2win – #150

Income Tax on Marriage Gift: Taxation of Wedding Gifts Received – Section 56 – Tax2win – #150

Must-Know Tax Rules for Employee Gift Cards – #151

Must-Know Tax Rules for Employee Gift Cards – #151

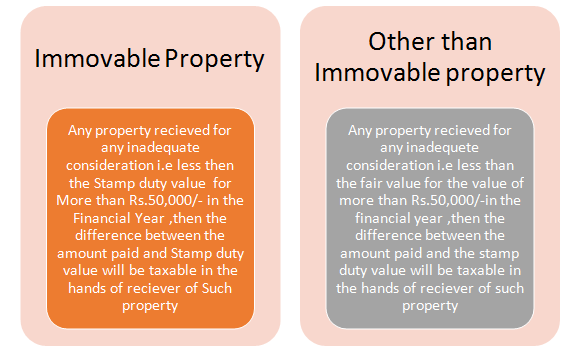

Section 56(2)(vii) : Cash / Non-Cash Gifts – #152

Section 56(2)(vii) : Cash / Non-Cash Gifts – #152

Property transferred to Mother for Rs. 5 Lakhs not ‘Gift’, Taxable as ‘Capital Gain’: ITAT Orders to Apply S. 50C – #153

Property transferred to Mother for Rs. 5 Lakhs not ‘Gift’, Taxable as ‘Capital Gain’: ITAT Orders to Apply S. 50C – #153

The Ultimate Guide to Form 709: An Intro – #154

The Ultimate Guide to Form 709: An Intro – #154

- estate/gift tax

Gift Tax In India – All about Gift Tax – Digiaccounto – #155

Gift Tax In India – All about Gift Tax – Digiaccounto – #155

To be claimed as a dependent – #156

To be claimed as a dependent – #156

What Employers Should Know about Giving Gifts to Employees – Rincker Law – #157

What Employers Should Know about Giving Gifts to Employees – Rincker Law – #157

) Taxability of Gifts in India – #158

Taxability of Gifts in India – #158

How are Diwali bonus and cash gifts taxed? | Times Now – #159

How are Diwali bonus and cash gifts taxed? | Times Now – #159

Reminder: Holiday Gifts, Prizes or Parties Can Be Taxable Wages – #160

Reminder: Holiday Gifts, Prizes or Parties Can Be Taxable Wages – #160

How do U.S. Gift Taxes Work? IRS Form 709 Example – #161

How do U.S. Gift Taxes Work? IRS Form 709 Example – #161

Crypto Taxable Events – BitcoinTaxes – #162

Crypto Taxable Events – BitcoinTaxes – #162

tax on diwali gifts: Will you be taxed on Diwali gifts received? Check how various sources of gifts will be taxed – The Economic Times – #163

tax on diwali gifts: Will you be taxed on Diwali gifts received? Check how various sources of gifts will be taxed – The Economic Times – #163

Gift taxable – TAXCONCEPT – #164

Gift taxable – TAXCONCEPT – #164

![Guide to Crypto Tax in India [Updated 2024] Guide to Crypto Tax in India [Updated 2024]](https://www.dineshaarjav.com/images/03f3690f9c58a843973a7bf9410fca5f.jpg) Guide to Crypto Tax in India [Updated 2024] – #165

Guide to Crypto Tax in India [Updated 2024] – #165

Are Gifts to Employees Taxable? | Perfect Feast Corporate Gifts – #166

Are Gifts to Employees Taxable? | Perfect Feast Corporate Gifts – #166

Tax issues for the newly unemployed | MileIQ – #167

Tax issues for the newly unemployed | MileIQ – #167

Is A Gift Taxable? – Cash, Stocks, Real Estate? – YouTube – #168

Is A Gift Taxable? – Cash, Stocks, Real Estate? – YouTube – #168

Client Alert: Increases of Estate and Gift Exemption and Exclusion Amounts – #169

Client Alert: Increases of Estate and Gift Exemption and Exclusion Amounts – #169

Income Tax on Diwali Gift: How Cash, Gold, Car and Property Gifts are Taxed – Income Tax News | The Financial Express – #170

Income Tax on Diwali Gift: How Cash, Gold, Car and Property Gifts are Taxed – Income Tax News | The Financial Express – #170

Detailed Analysis- Gifts Taxation under Income Tax Act, 1961 – #171

Detailed Analysis- Gifts Taxation under Income Tax Act, 1961 – #171

Federal Gift Tax vs. California Inheritance Tax – #172

Federal Gift Tax vs. California Inheritance Tax – #172

Know the tax impact on the gifts you receive – Goal Bridge – #173

Know the tax impact on the gifts you receive – Goal Bridge – #173

Lesson 2 – Gift and Estate Taxes Flashcards by Adam Farid | Brainscape – #174

Lesson 2 – Gift and Estate Taxes Flashcards by Adam Farid | Brainscape – #174

Will I Be Taxed When Gifting Money? – #175

Will I Be Taxed When Gifting Money? – #175

All You Need To Know About Gifting Property And Gift Deed Rules – #176

All You Need To Know About Gifting Property And Gift Deed Rules – #176

Gift Taxes if You Give or Receive a Large Gift – Rocket Lawyer – #177

Gift Taxes if You Give or Receive a Large Gift – Rocket Lawyer – #177

Tax Deductibility On Gifts To Clients On Birthdays And Festive Occasions – iPleaders – #178

Tax Deductibility On Gifts To Clients On Birthdays And Festive Occasions – iPleaders – #178

Can Your Diwali Gifts Be Taxed? Check Here For More Details – #179

Can Your Diwali Gifts Be Taxed? Check Here For More Details – #179

Taxability of Gifts – #180

Taxability of Gifts – #180

How does the gift tax work? – Personal Finance Club – #181

How does the gift tax work? – Personal Finance Club – #181

Tax on Diwali Gifts: How your Diwali gifts will be taxed | EconomicTimes – #182

Tax on Diwali Gifts: How your Diwali gifts will be taxed | EconomicTimes – #182

gifts and income tax | ReLakhs – #183

gifts and income tax | ReLakhs – #183

Are gifts, prize winnings, and non-cash bonuses taxable? What you need to know. – #184

Are gifts, prize winnings, and non-cash bonuses taxable? What you need to know. – #184

Does Giving an Employee a Gift Card or Other Small Gift Cause a Tax Issue? – Tax Problem Solver – #185

Does Giving an Employee a Gift Card or Other Small Gift Cause a Tax Issue? – Tax Problem Solver – #185

Gift Deed: Registration, Format and All You Need to Know – #186

Gift Deed: Registration, Format and All You Need to Know – #186

Received a gift card? It could be taxable too – Here is what you must know | Zee Business – #187

Received a gift card? It could be taxable too – Here is what you must know | Zee Business – #187

Starter Guide to Crypto Tax and Who Needs to Pay It – #188

Starter Guide to Crypto Tax and Who Needs to Pay It – #188

Income tax – “GIFT” Taxability under Income Tax Act,… | Facebook – #189

Income tax – “GIFT” Taxability under Income Tax Act,… | Facebook – #189

Income tax on a gift from father to daughter – #190

Income tax on a gift from father to daughter – #190

Did you receive gift cash? It is taxable, but not for these individuals | Zee Business – #191

Did you receive gift cash? It is taxable, but not for these individuals | Zee Business – #191

Smart Gifting: Understanding Taxable Gifts and the Unified Tax Credit – FasterCapital – #192

Smart Gifting: Understanding Taxable Gifts and the Unified Tax Credit – FasterCapital – #192

How are gifts taxed in India? Read here – #193

How are gifts taxed in India? Read here – #193

Use the tiktok live gifts you send as advertising expense to lower you… | TikTok – #194

Use the tiktok live gifts you send as advertising expense to lower you… | TikTok – #194

Tax Advantages for Donor-Advised Funds | NPTrust – #195

Tax Advantages for Donor-Advised Funds | NPTrust – #195

CRA Gift Tax Rules for Employers – SRJ Chartered Accountants Professional Corporation – #196

CRA Gift Tax Rules for Employers – SRJ Chartered Accountants Professional Corporation – #196

Connecticut Gift Tax: All You Need to Know | SmartAsset – #197

Connecticut Gift Tax: All You Need to Know | SmartAsset – #197

Are Gifts, Prize Winnings, and Non-Cash Bonuses Taxable? What You Need to Know – Weisberg Kainen Mark, PL – #198

Are Gifts, Prize Winnings, and Non-Cash Bonuses Taxable? What You Need to Know – Weisberg Kainen Mark, PL – #198

- gift tax definition

- gift tax rate table

- gift tax definition economics

Relative से पैसा लेने से पहले यह video ज़रूर देखना, Gift Rule 2022,आपके गिफ्ट पर इनकम टैक्स की नज़र – YouTube – #199

Relative से पैसा लेने से पहले यह video ज़रूर देखना, Gift Rule 2022,आपके गिफ्ट पर इनकम टैक्स की नज़र – YouTube – #199

Are Influencer Gifts Taxable? – SocialStar – #200

Are Influencer Gifts Taxable? – SocialStar – #200

WK ACCOUNTING & TAX CONSULTING” WK Accounting & Tax Consultant has 15 years of experience in Finance, Accounting, and Taxing, we… | Instagram – #201

WK ACCOUNTING & TAX CONSULTING” WK Accounting & Tax Consultant has 15 years of experience in Finance, Accounting, and Taxing, we… | Instagram – #201

Why a gifting strategy still matters | Union Bank & Trust – #202

Why a gifting strategy still matters | Union Bank & Trust – #202

Understanding the Tax Treatment of Gifts: A Comprehensive Guide for Em – Table Matters – #203

Understanding the Tax Treatment of Gifts: A Comprehensive Guide for Em – Table Matters – #203

How much money can NRIs gift to parents in India? | Arthgyaan – #204

How much money can NRIs gift to parents in India? | Arthgyaan – #204

Income tax filing: Are gifts taxable? Frequently asked questions on gift taxes | Zee Business – #205

Income tax filing: Are gifts taxable? Frequently asked questions on gift taxes | Zee Business – #205

Planned Giving : Diocesan Services Appeal : Development : Offices : Ministries/Offices : Diocese of Palm Beach – #206

Planned Giving : Diocesan Services Appeal : Development : Offices : Ministries/Offices : Diocese of Palm Beach – #206

Diwali gifts from relatives are taxable or not? – #207

Diwali gifts from relatives are taxable or not? – #207

Solved Which of the following payments is a taxable gift | Chegg.com – #208

Solved Which of the following payments is a taxable gift | Chegg.com – #208

Invest in the Future with Charitable Lead Trusts | Wintrust Wealth Management – #209

Invest in the Future with Charitable Lead Trusts | Wintrust Wealth Management – #209

ESTATE, INHERITANCE, AND GIFT TAXES IN CONNECTICUT AND OTHER STATES – #210

ESTATE, INHERITANCE, AND GIFT TAXES IN CONNECTICUT AND OTHER STATES – #210

Current State Of The Estate And Gift Tax Laws – Homrich Berg – #211

Current State Of The Estate And Gift Tax Laws – Homrich Berg – #211

) Section 56(2)(X) of Income Tax Act – Tax Implication on Gifts – #212

Section 56(2)(X) of Income Tax Act – Tax Implication on Gifts – #212

What Are de Minimis Fringe Benefits? — SLATE ACCOUNTING + TECHNOLOGY – #213

What Are de Minimis Fringe Benefits? — SLATE ACCOUNTING + TECHNOLOGY – #213

FAQ: Are Gift Cards for Employees a Tax Deduction? – #214

FAQ: Are Gift Cards for Employees a Tax Deduction? – #214

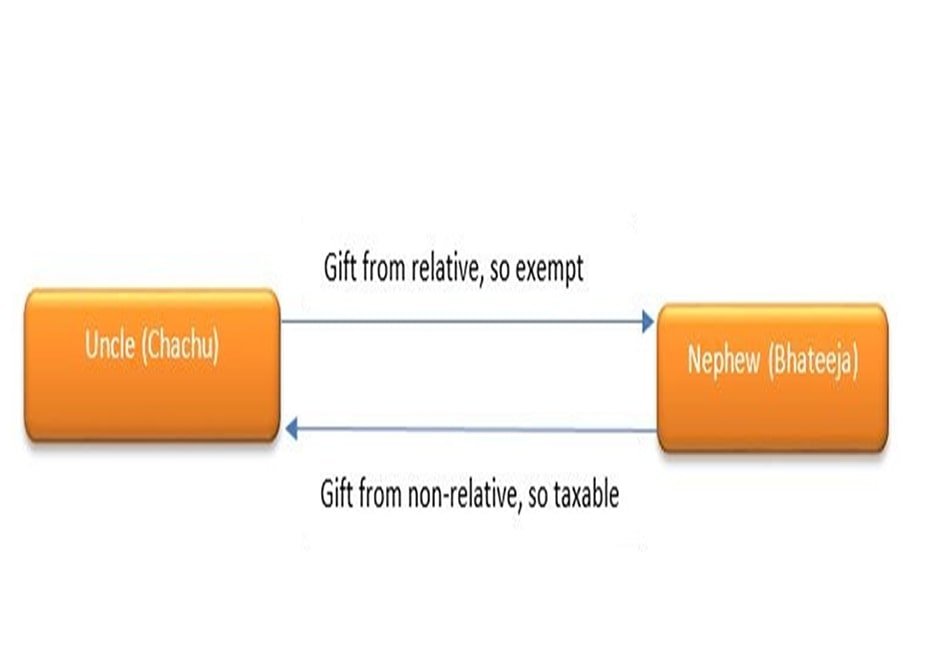

Gift by NRI to Resident Indian or Vice-Versa – NRI Gift Tax In India – #215

Gift by NRI to Resident Indian or Vice-Versa – NRI Gift Tax In India – #215

Posts: are gifts taxable

Categories: Gifts

Author: toyotabienhoa.edu.vn