Top more than 200 annual tax free gift allowance latest

Details images of annual tax free gift allowance by website toyotabienhoa.edu.vn compilation. Diwali gifts: Taxable or tax-free? Decoding the rules for a hassle-free festival | Mint. Using trusts to shift income to children. You Take a Friend on Your Yacht. Is It a Taxable Gift? – WSJ. What is Portability for Estate and Gift Tax?. What Are Taxable Gifts – FasterCapital

What Is the 2023 and 2024 Gift Tax Limit? – Ramsey – #1

What Is the 2023 and 2024 Gift Tax Limit? – Ramsey – #1

IRS Announces 2023 Estate & Gift Tax Exemption Amounts – Texas Agriculture Law – #2

IRS Announces 2023 Estate & Gift Tax Exemption Amounts – Texas Agriculture Law – #2

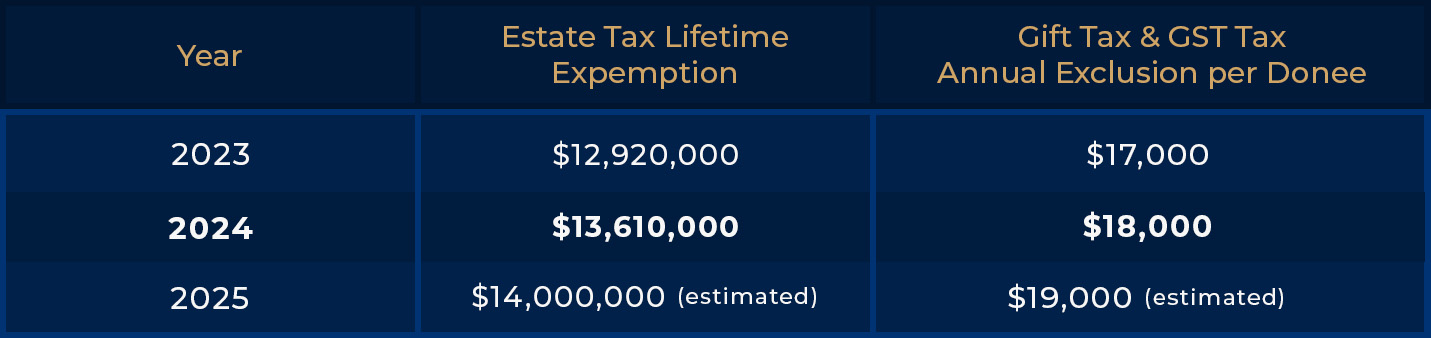

What will the estate and gift tax exclusions be in 2024, 2025? – #4

What will the estate and gift tax exclusions be in 2024, 2025? – #4

Is Money Received From Children Living Abroad Taxable? – #5

Is Money Received From Children Living Abroad Taxable? – #5

Gift Tax, the Annual Exclusion and Estate Planning – #6

Gift Tax, the Annual Exclusion and Estate Planning – #6

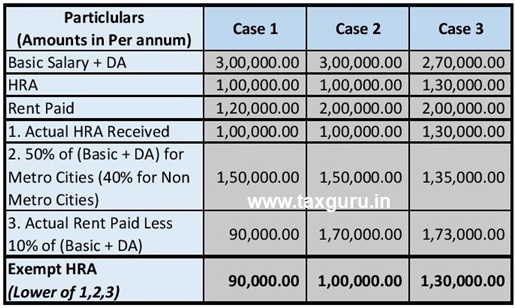

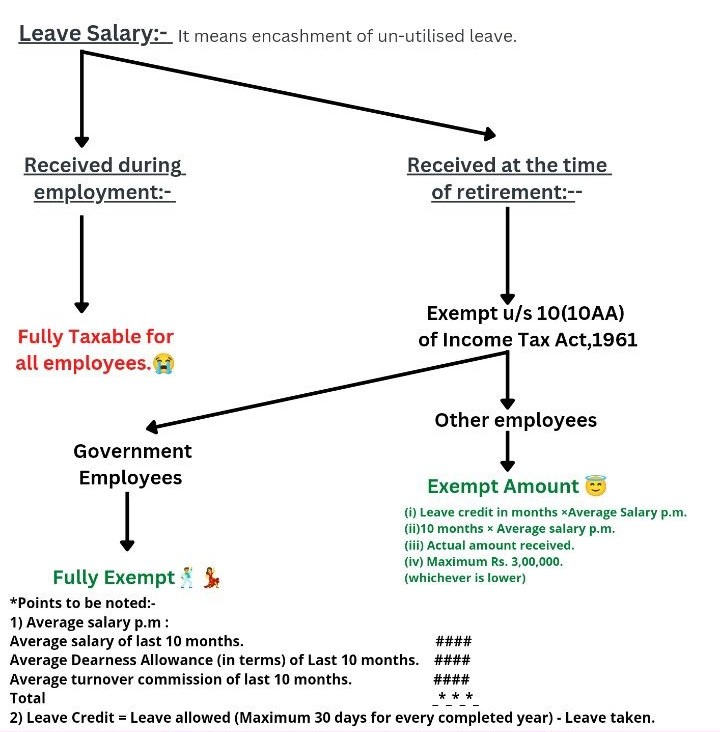

Income Tax Allowances & Deductions Applicable to Salaried Individuals – #7

Income Tax Allowances & Deductions Applicable to Salaried Individuals – #7

Gift from Non-Relatives – A tool for tax planning – TaxReturnWala – #8

Gift from Non-Relatives – A tool for tax planning – TaxReturnWala – #8

Gift Tax: शादी में मिले गिफ्ट टैक्स फ्री, पर जन्मदिन व ऑफिस से मिले तोहफे पर लगता है कर, जानिए ऐसा क्यों? – What is gift tax which gifts are non taxable and which is not know details – News18 हिंदी – #10

Gift Tax: शादी में मिले गिफ्ट टैक्स फ्री, पर जन्मदिन व ऑफिस से मिले तोहफे पर लगता है कर, जानिए ऐसा क्यों? – What is gift tax which gifts are non taxable and which is not know details – News18 हिंदी – #10

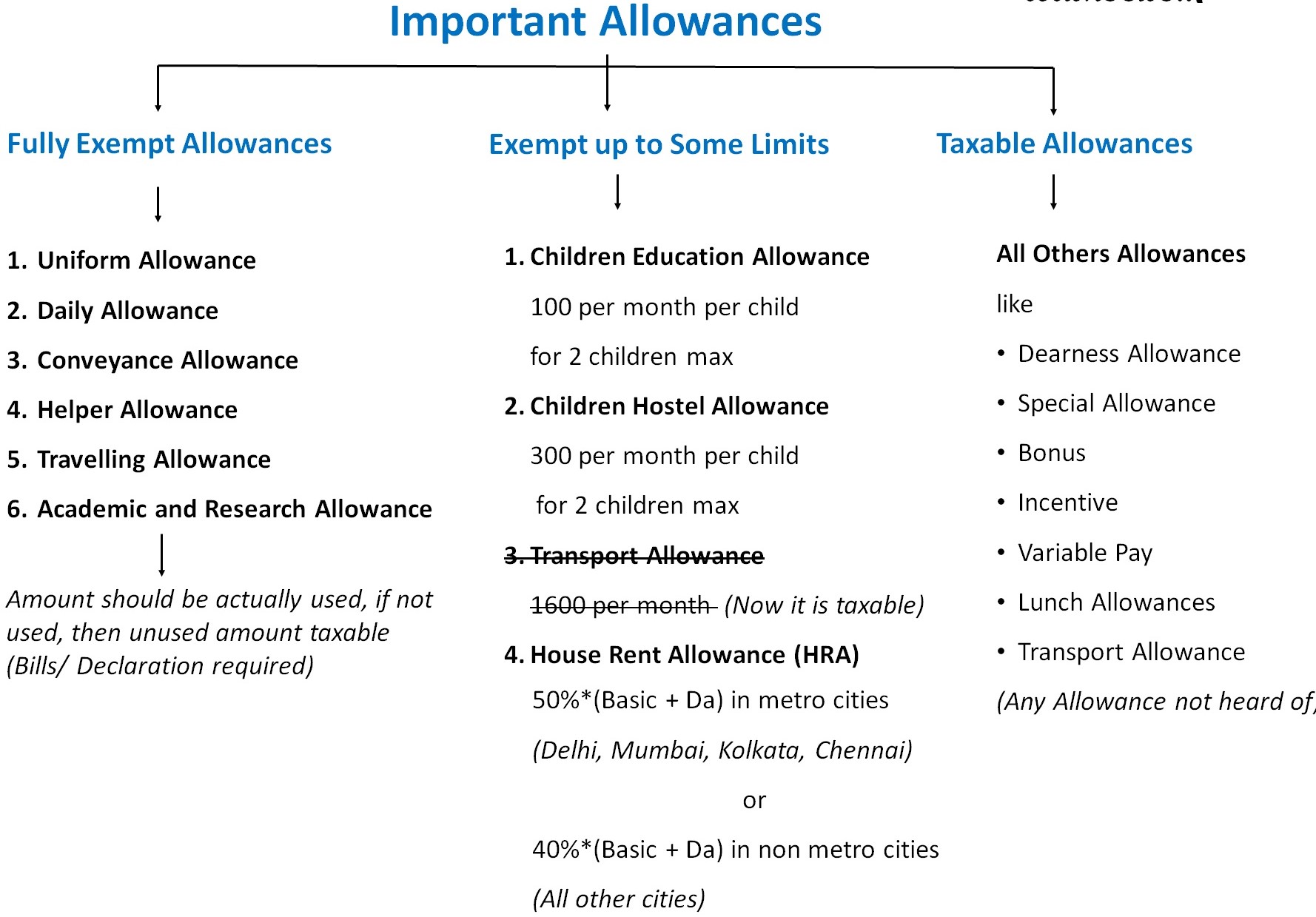

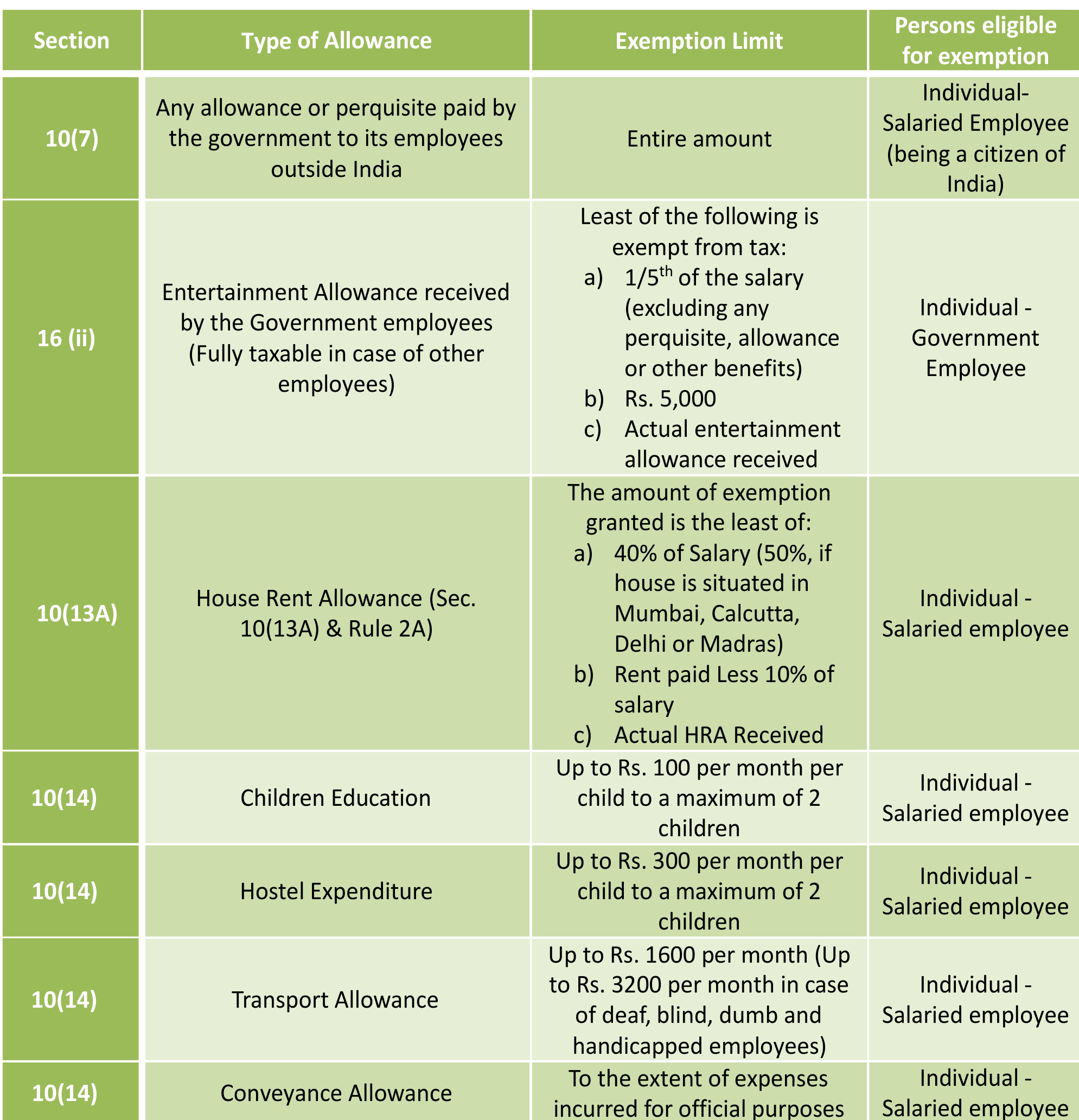

Types of Allowances in India: Taxable and Non Taxable Allowance 2022-23 – #11

Types of Allowances in India: Taxable and Non Taxable Allowance 2022-23 – #11

- gift tax meaning

- gift tax return

- gift from relative exempt from income tax

All about Income Tax on Gift Received From Parents. – #12

All about Income Tax on Gift Received From Parents. – #12

Pay Zero Tax for 12 Lakhs Income Tax Slab in FY 2023-24 – #13

Pay Zero Tax for 12 Lakhs Income Tax Slab in FY 2023-24 – #13

The Hierarchy Of Tax-Preferenced Savings Vehicles – #14

The Hierarchy Of Tax-Preferenced Savings Vehicles – #14

-Gifts.jpg) Income Tax Implications of Wedding Gifts in India – #15

Income Tax Implications of Wedding Gifts in India – #15

How to Gift Educational Expenses: Tax Advantages and Pitfalls – #16

How to Gift Educational Expenses: Tax Advantages and Pitfalls – #16

Tax-free allowances can be availed under new income tax regime too: Avinash Godkhindi, CEO, Zaggle Prepaid – The Economic Times – #17

Tax-free allowances can be availed under new income tax regime too: Avinash Godkhindi, CEO, Zaggle Prepaid – The Economic Times – #17

- list of relatives

- gift tax rate in india 2022-23

- gift tax exemption

Current Income Tax Return Filing Due Dates for FY 2023-24 – #18

Current Income Tax Return Filing Due Dates for FY 2023-24 – #18

How to balance your in-hand salary and savings – BusinessToday – Issue Date: Feb 28, 2013 – #19

How to balance your in-hand salary and savings – BusinessToday – Issue Date: Feb 28, 2013 – #19

Gift taxation | ITR: Gifts have to be declared in ITR: Here’s how they are taxed – #20

Gift taxation | ITR: Gifts have to be declared in ITR: Here’s how they are taxed – #20

Reminder: Holiday Gifts, Prizes or Parties Can Be Taxable Wages – #21

Reminder: Holiday Gifts, Prizes or Parties Can Be Taxable Wages – #21

IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More – #22

IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More – #22

Taxbaility of GIFT – FIBOTA – #23

Taxbaility of GIFT – FIBOTA – #23

Gift and Estate Tax Exemption Limits Increase for 2024 – Texas Trust Law – #24

Gift and Estate Tax Exemption Limits Increase for 2024 – Texas Trust Law – #24

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #25

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #25

What Is The Gift Tax Rate? – Forbes Advisor – #26

What Is The Gift Tax Rate? – Forbes Advisor – #26

IRS Announces 2024 Tax Brackets, Standard Deductions And Other Inflation Adjustments – #27

IRS Announces 2024 Tax Brackets, Standard Deductions And Other Inflation Adjustments – #27

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #28

How gifts by relatives and friends are taxed – Income Tax News | The Financial Express – #28

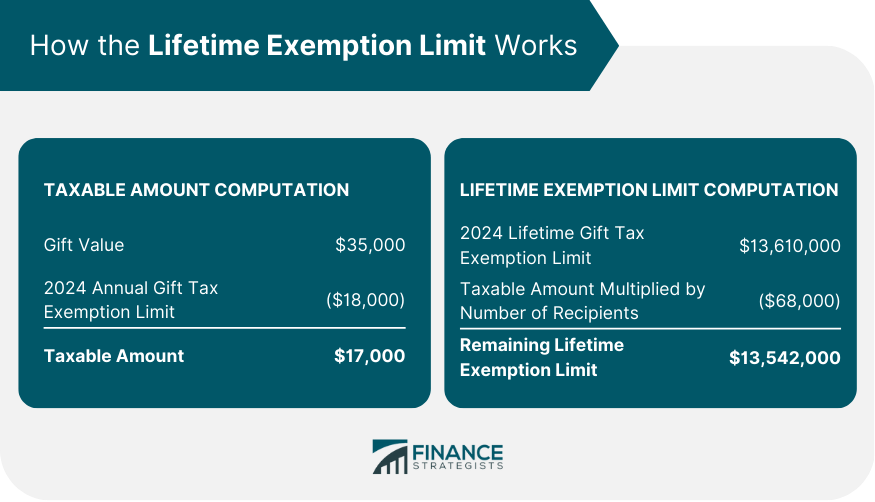

Lifetime Gifts Tax Exemption: Is Now the Time to Act? | PNC Insights – #29

Lifetime Gifts Tax Exemption: Is Now the Time to Act? | PNC Insights – #29

Have a Current/Savings Bank Account? Know the Cash Deposit Limits under Income Tax Act to avoid Penalties and Notices – #30

Have a Current/Savings Bank Account? Know the Cash Deposit Limits under Income Tax Act to avoid Penalties and Notices – #30

IRS Gift Limit 2023: How much can a parent gift a child in 2023? | Marca – #31

IRS Gift Limit 2023: How much can a parent gift a child in 2023? | Marca – #31

What Is the Lifetime Gift Tax Exemption for 2024? | SmartAsset – #32

What Is the Lifetime Gift Tax Exemption for 2024? | SmartAsset – #32

11 Sources Of Tax-Free Income – PKF Mueller – #33

11 Sources Of Tax-Free Income – PKF Mueller – #33

Gift Deed Registration: Stamp Duty, Registry Fee, Tax, Procedure – #34

Gift Deed Registration: Stamp Duty, Registry Fee, Tax, Procedure – #34

All About Allowances & Income Tax Exemption| CA Rajput Jain – #35

All About Allowances & Income Tax Exemption| CA Rajput Jain – #35

Complete Guide to Crypto Taxes: March 2024 Update | Koinly – #36

Complete Guide to Crypto Taxes: March 2024 Update | Koinly – #36

Income tax filing: Are gifts taxable? Frequently asked questions on gift taxes | Zee Business – #37

Income tax filing: Are gifts taxable? Frequently asked questions on gift taxes | Zee Business – #37

Withholding Tax Explained: Types and How It’s Calculated – #38

Withholding Tax Explained: Types and How It’s Calculated – #38

Gifting Money to Family Members: 5 Strategies to Understand – Kindness Financial Planning – #39

Gifting Money to Family Members: 5 Strategies to Understand – Kindness Financial Planning – #39

List of Exempted Incomes (Tax-Free) Under Section-10 – #40

List of Exempted Incomes (Tax-Free) Under Section-10 – #40

How to Gift MORE than the Gift Limit in 2022 | TAX FREE – YouTube – #41

How to Gift MORE than the Gift Limit in 2022 | TAX FREE – YouTube – #41

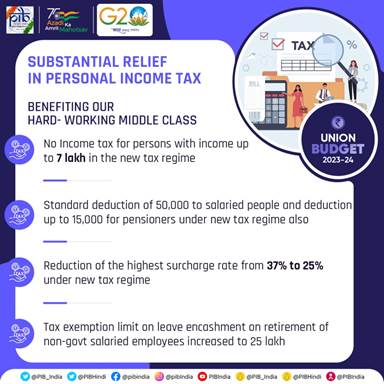

Press Information Bureau – #42

Press Information Bureau – #42

My father wants to gift cash to me. Should I pay income tax on money received from my father? | Mint – #43

My father wants to gift cash to me. Should I pay income tax on money received from my father? | Mint – #43

Form 709: What It Is and Who Must File It – #44

Form 709: What It Is and Who Must File It – #44

Goodall-Smith Wealth Management Ltd – #45

Goodall-Smith Wealth Management Ltd – #45

Annual Exclusion: Meaning, Special Cases, FAQs – #46

Annual Exclusion: Meaning, Special Cases, FAQs – #46

IRS Tax Form 709 Guide: Gift Tax Demystified – #47

IRS Tax Form 709 Guide: Gift Tax Demystified – #47

New Tax Regime – Complete list of exemptions and deductions disallowed – BasuNivesh – #48

New Tax Regime – Complete list of exemptions and deductions disallowed – BasuNivesh – #48

Diwali season: Do you have to pay tax on gifts received ? | Personal Finance – Business Standard – #49

Diwali season: Do you have to pay tax on gifts received ? | Personal Finance – Business Standard – #49

IRS Form 709 | H&R Block – #50

IRS Form 709 | H&R Block – #50

Who benefits from the deduction for charitable contributions? | Tax Policy Center – #51

Who benefits from the deduction for charitable contributions? | Tax Policy Center – #51

Are Cash Gifts from relatives exempt from Income tax? – #52

Are Cash Gifts from relatives exempt from Income tax? – #52

Taxable Income: What It Is, What Counts, and How To Calculate – #53

Taxable Income: What It Is, What Counts, and How To Calculate – #53

Do I Need to Worry About the Gift Tax If I Pay $30,000 Toward My Child’s Wedding? – #54

Do I Need to Worry About the Gift Tax If I Pay $30,000 Toward My Child’s Wedding? – #54

What You Need to Know Before Gifting a 529 Plan – #55

What You Need to Know Before Gifting a 529 Plan – #55

Allowance From Employer, Allowance Exempt From Taxation, tax on undisclosed income – #56

Allowance From Employer, Allowance Exempt From Taxation, tax on undisclosed income – #56

We have over $3 million and 5 adult children: Should we start giving them tax-free gifts each year? – #57

We have over $3 million and 5 adult children: Should we start giving them tax-free gifts each year? – #57

Gift Tax Limits and Exceptions: Advice From an Expert | Money – #58

Gift Tax Limits and Exceptions: Advice From an Expert | Money – #58

IRS Increases Gift and Estate Tax Thresholds for 2023 – #59

IRS Increases Gift and Estate Tax Thresholds for 2023 – #59

EFFECTIVELY MANAGING YOUR ESTATE – #60

EFFECTIVELY MANAGING YOUR ESTATE – #60

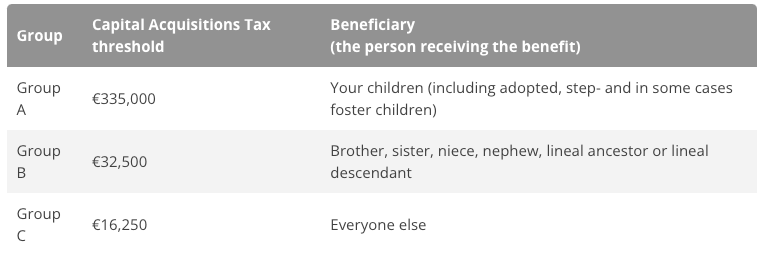

Gifting money in Ireland explained | Raisin Bank – #61

Gifting money in Ireland explained | Raisin Bank – #61

- gift tax in india

- gift tax rate in india 2020

- gift tax exemption 2022

Tax Credit: What It Is, How It Works, What Qualifies, 3 Types – #62

Tax Credit: What It Is, How It Works, What Qualifies, 3 Types – #62

Discover The Latest Federal Estate Tax Exemption Increase For 2024 – Are You Ready? | Opelon LLP- A Trust, Estate Planning And Probate Law Firm – #63

Discover The Latest Federal Estate Tax Exemption Increase For 2024 – Are You Ready? | Opelon LLP- A Trust, Estate Planning And Probate Law Firm – #63

Federal implications of passthrough entity tax elections – #64

Federal implications of passthrough entity tax elections – #64

Gift Tax 101: What You Need to Know — Connecticut Estate Planning Attorneys Blog – #65

Gift Tax 101: What You Need to Know — Connecticut Estate Planning Attorneys Blog – #65

What is Gift Tax? – Exemption and Limits on Gifts for FY 2023-24 – #66

What is Gift Tax? – Exemption and Limits on Gifts for FY 2023-24 – #66

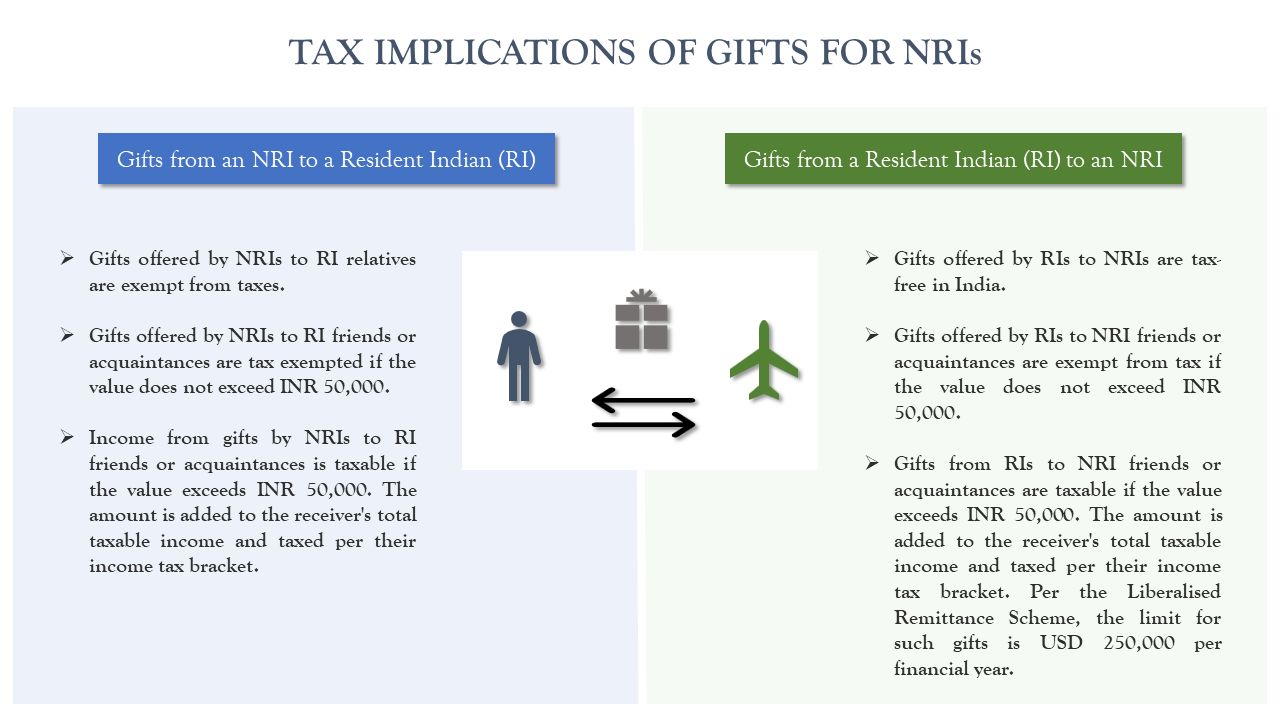

NRI Gift Tax Guide: Understanding Tax Implications in India – #67

NRI Gift Tax Guide: Understanding Tax Implications in India – #67

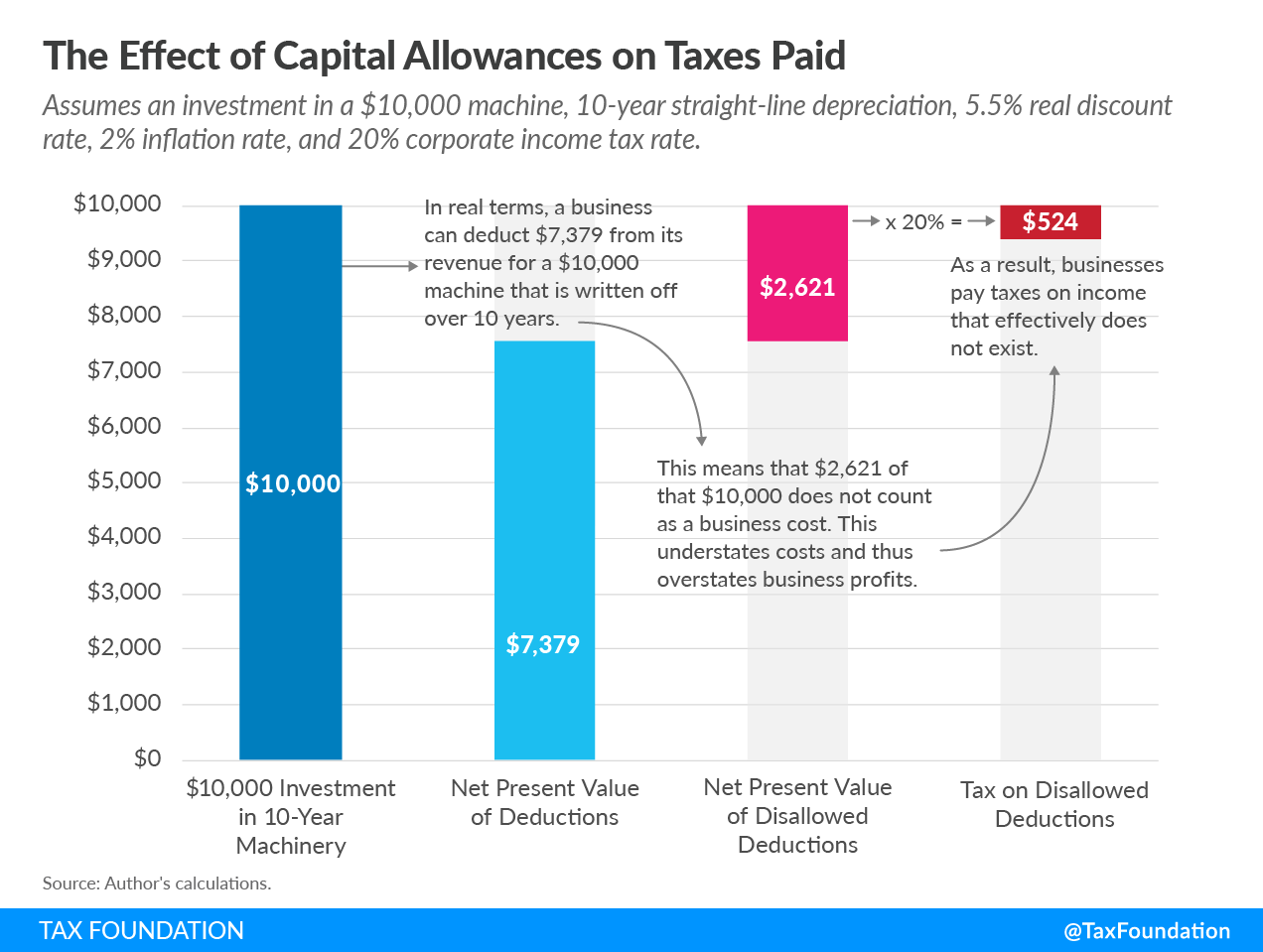

Super-Deduction | TaxEDU Glossary – #68

Super-Deduction | TaxEDU Glossary – #68

2023 Taxes: 8 Things to Know Now | Charles Schwab – #69

2023 Taxes: 8 Things to Know Now | Charles Schwab – #69

The unique benefits of 529 college savings plans – #70

The unique benefits of 529 college savings plans – #70

The Gift Tax – TurboTax Tax Tips & Videos – #71

The Gift Tax – TurboTax Tax Tips & Videos – #71

Crypto Gift Tax | Your Guide | Koinly – #72

Crypto Gift Tax | Your Guide | Koinly – #72

Can You Save Tax by Transferring Money to Wife’s Account? – Enterslice – #73

Can You Save Tax by Transferring Money to Wife’s Account? – Enterslice – #73

Historical Estate Tax Exemption Amounts And Tax Rates – #74

Historical Estate Tax Exemption Amounts And Tax Rates – #74

River Valley Law Firm – 2022 estate and gift tax numbers to know. | Facebook – #75

River Valley Law Firm – 2022 estate and gift tax numbers to know. | Facebook – #75

Some Holiday Parties and Gifts are Tax Deductible – Landmark CPAs – #76

Some Holiday Parties and Gifts are Tax Deductible – Landmark CPAs – #76

The Estate Tax is Irrelevant to More Than 99 Percent of Americans – ITEP – #77

The Estate Tax is Irrelevant to More Than 99 Percent of Americans – ITEP – #77

Annual Gift Tax Exclusion vs. Medicaid Look Back Period | Cornetet, Meyer, Rush & Stapleton – #78

Annual Gift Tax Exclusion vs. Medicaid Look Back Period | Cornetet, Meyer, Rush & Stapleton – #78

Gift Tax: How Much Is It and Who Pays It? – #79

Gift Tax: How Much Is It and Who Pays It? – #79

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation – #80

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation – #80

12 Tax-Smart Charitable Giving Tips for 2023 | Charles Schwab – #81

12 Tax-Smart Charitable Giving Tips for 2023 | Charles Schwab – #81

How to calculate income tax on gifts from relatives? – #82

How to calculate income tax on gifts from relatives? – #82

Zero Tax on Salary Income INR 20+ Lakhs? Legal Way Here… – #83

Zero Tax on Salary Income INR 20+ Lakhs? Legal Way Here… – #83

Gifting Money to Children Without Paying Tax (Annual Gift Tax Exclusion 2023) – YouTube – #84

Gifting Money to Children Without Paying Tax (Annual Gift Tax Exclusion 2023) – YouTube – #84

Taxability of Gifts in India – #85

Taxability of Gifts in India – #85

Your Diwali gift and bonus can be taxable: Know ways to avoid it – #86

Your Diwali gift and bonus can be taxable: Know ways to avoid it – #86

List of relatives covered under Section 56(2) of Income Tax Act,1961 – #87

List of relatives covered under Section 56(2) of Income Tax Act,1961 – #87

Are gifts to clients and employees tax-deductible? – Financial Solution Advisors – #88

Are gifts to clients and employees tax-deductible? – Financial Solution Advisors – #88

- gift tax rate

- gift tax 2023

- gift chart as per income tax

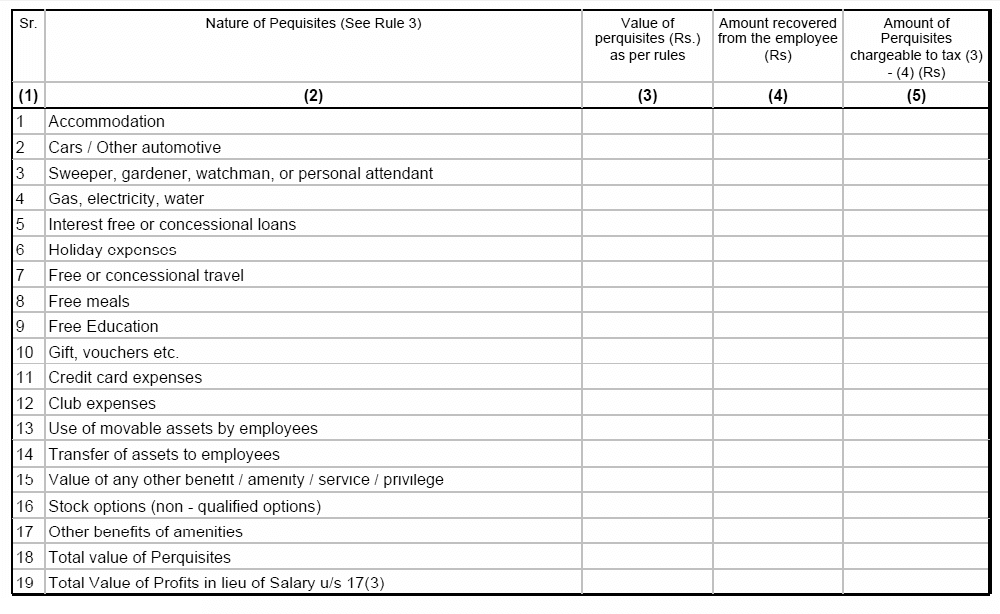

Form 12BA – #89

Form 12BA – #89

Major Gift Planning Opportunities for 2024 | Akin Gump Strauss Hauer & Feld LLP – #90

Major Gift Planning Opportunities for 2024 | Akin Gump Strauss Hauer & Feld LLP – #90

Income Tax Return Filing: Are wedding gifts really tax free? All hidden clauses, conditions explained | Zee Business – #91

Income Tax Return Filing: Are wedding gifts really tax free? All hidden clauses, conditions explained | Zee Business – #91

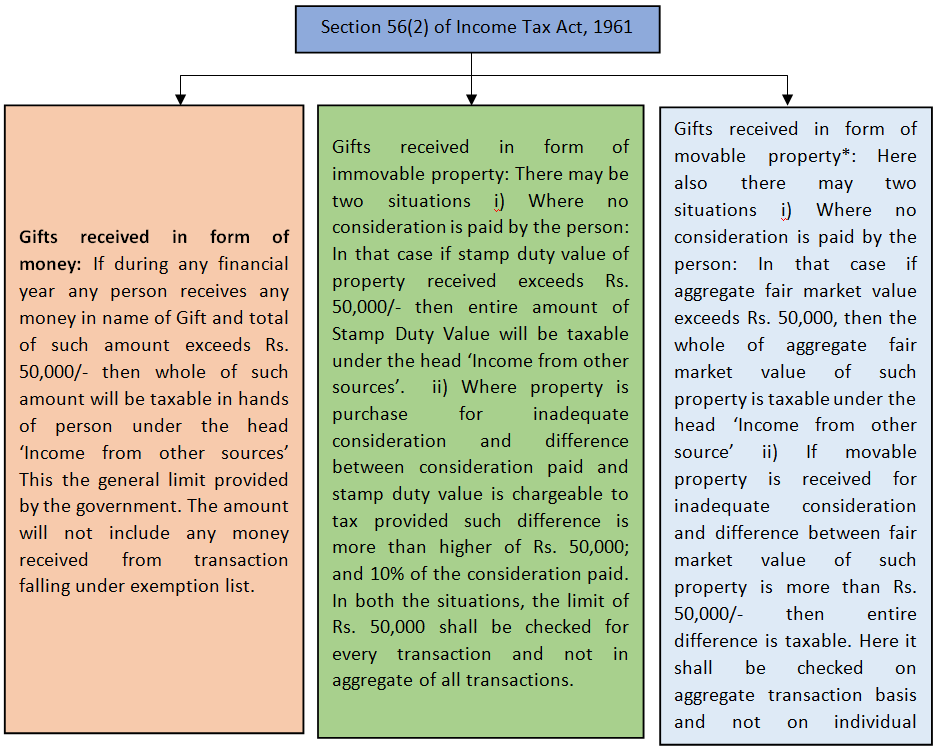

Tax Implication on Gifts Under Section 56(2)(x)(b) of Income Tax Act, 1961 – #92

Tax Implication on Gifts Under Section 56(2)(x)(b) of Income Tax Act, 1961 – #92

Section 10 – Exemptions under Section 10 of Income Tax Act – #93

Section 10 – Exemptions under Section 10 of Income Tax Act – #93

New 2024 Gift and Estate Tax Limits – YouTube – #94

New 2024 Gift and Estate Tax Limits – YouTube – #94

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #95

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #95

Gift Tax 2023 | What It Is, Annual Limit, Lifetime Exemption, & Gift Tax Rate – #96

Gift Tax 2023 | What It Is, Annual Limit, Lifetime Exemption, & Gift Tax Rate – #96

Old personal tax regime vs new tax regime: Choosing made easy here | Mint – #97

Old personal tax regime vs new tax regime: Choosing made easy here | Mint – #97

What is a gift deed and tax implications | Tax Hack – #98

What is a gift deed and tax implications | Tax Hack – #98

Gift Tax in India: Implications & Exemptions – myMoneySage Blog – #99

Gift Tax in India: Implications & Exemptions – myMoneySage Blog – #99

) The Generation-Skipping Transfer Tax: A Quick Guide – #100

The Generation-Skipping Transfer Tax: A Quick Guide – #100

Income Tax on Gift – #101

Income Tax on Gift – #101

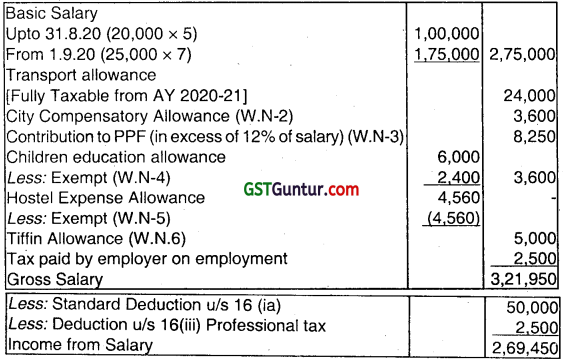

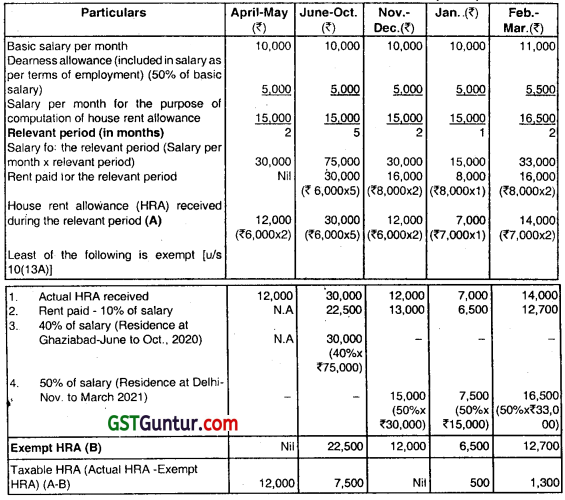

Income from Salaries – CA Inter Tax Question Bank – GST Guntur – #102

Income from Salaries – CA Inter Tax Question Bank – GST Guntur – #102

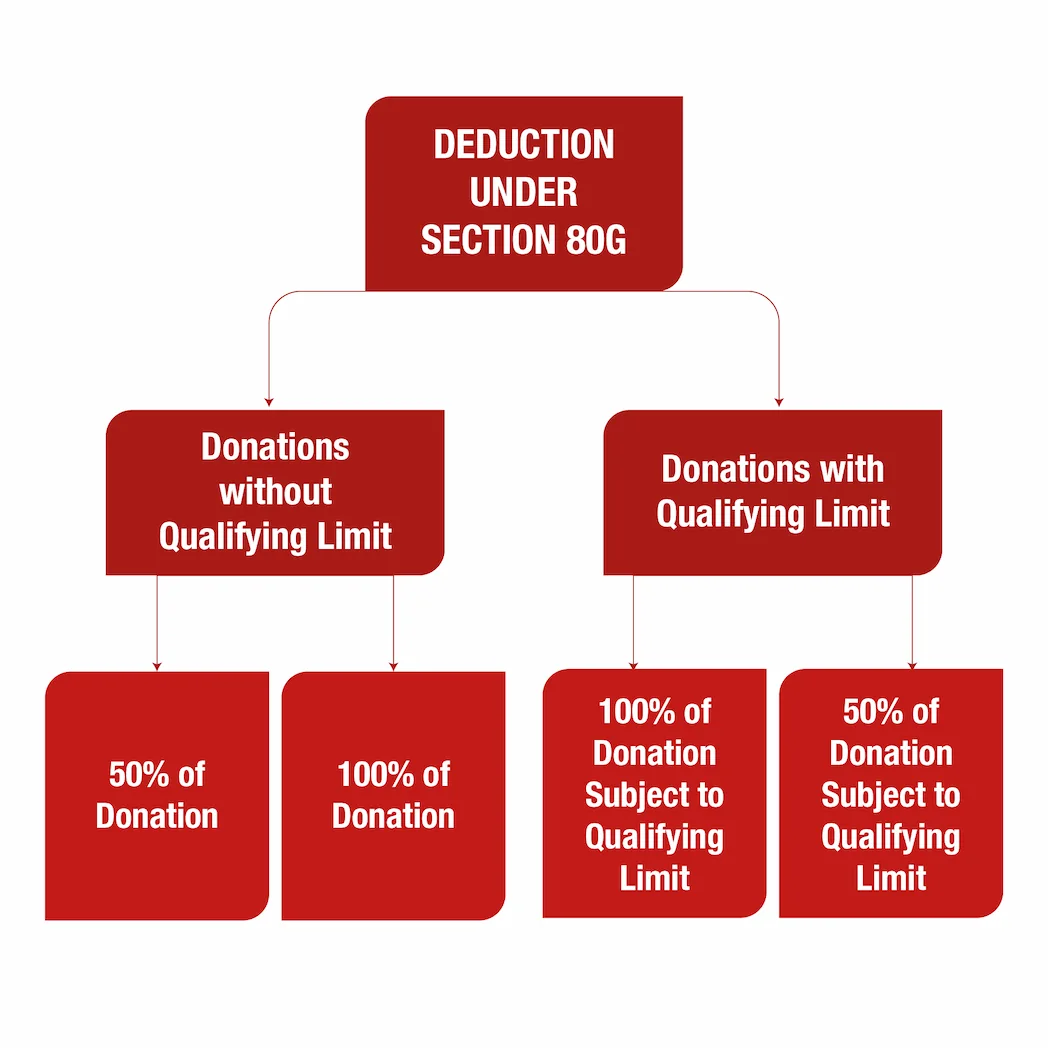

Section 80G Deduction: Tax Benefits on Donation Made to NGO – #103

Section 80G Deduction: Tax Benefits on Donation Made to NGO – #103

Taxation of gifts to NRIs and changes in Budget 2023-24 – #104

Taxation of gifts to NRIs and changes in Budget 2023-24 – #104

What are the 5 Heads of Income? – #105

What are the 5 Heads of Income? – #105

ITR filing: Are gifts taxable in India? Salient clauses all income taxpayers must know | Zee Business – #106

ITR filing: Are gifts taxable in India? Salient clauses all income taxpayers must know | Zee Business – #106

How salaried employee save income tax legally on CTC ₹ “14 Lakhs” : financialcontrol – #107

How salaried employee save income tax legally on CTC ₹ “14 Lakhs” : financialcontrol – #107

Gift Tax In India – All about Gift Tax – Digiaccounto – #108

Gift Tax In India – All about Gift Tax – Digiaccounto – #108

IRS Gift Limit 2024, Spousе & Minors, Tax Free Gift, Tax Rates – NCBlpc – #109

IRS Gift Limit 2024, Spousе & Minors, Tax Free Gift, Tax Rates – NCBlpc – #109

Problems On Taxable Salary Income-Additional | PDF | Tax Deduction | Employee Benefits – #110

Problems On Taxable Salary Income-Additional | PDF | Tax Deduction | Employee Benefits – #110

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #111

Estate and Gift Taxes 2020-2021: Here’s What You Need to Know – WSJ – #111

Gift of Immovable property under Income Tax Act – #112

Gift of Immovable property under Income Tax Act – #112

Income tax exemption limit: What are the tax exemption limits for allowances, reimbursements paid to employees? Find out – #113

Income tax exemption limit: What are the tax exemption limits for allowances, reimbursements paid to employees? Find out – #113

![Guide to Crypto Tax in India [Updated 2024] Guide to Crypto Tax in India [Updated 2024]](https://img.etimg.com/thumb/width-1200,height-900,imgsize-285290,resizemode-75,msid-66117072/wealth/tax/gifts-from-relatives-are-always-tax-free.jpg) Guide to Crypto Tax in India [Updated 2024] – #114

Guide to Crypto Tax in India [Updated 2024] – #114

Know the tax impact on the gifts you receive – Goal Bridge – #115

Know the tax impact on the gifts you receive – Goal Bridge – #115

Decoding GST: Impact of Free Gifts on Input Tax Credit – #116

Decoding GST: Impact of Free Gifts on Input Tax Credit – #116

What is the limit up to which a father can gift to his son under income tax laws | Mint – #117

What is the limit up to which a father can gift to his son under income tax laws | Mint – #117

Diwali gifts: Taxable or tax-free? Decoding the rules for a hassle-free festival | Mint – #118

Diwali gifts: Taxable or tax-free? Decoding the rules for a hassle-free festival | Mint – #118

What Is Form 709? – #119

What Is Form 709? – #119

Crypto Taxes India: Expert Guide 2024 | CPA Reviewed | Koinly – #120

Crypto Taxes India: Expert Guide 2024 | CPA Reviewed | Koinly – #120

Monetary gift tax: Income tax on gift received from parents | Value Research – #121

Monetary gift tax: Income tax on gift received from parents | Value Research – #121

7 Tax Rules to Know if You Give or Receive Cash | Taxes | U.S. News – #122

7 Tax Rules to Know if You Give or Receive Cash | Taxes | U.S. News – #122

IRS Announces Higher Estate and Gift Tax Limits for 2020 | Senior Law – #123

IRS Announces Higher Estate and Gift Tax Limits for 2020 | Senior Law – #123

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #124

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #124

How the wealthy avoid inheritance tax | The Private Office – #125

How the wealthy avoid inheritance tax | The Private Office – #125

Tax-free Meals For Your Employees With EnKash Meal Cards – #126

Tax-free Meals For Your Employees With EnKash Meal Cards – #126

Will your ‘gift’ be taxed? – The Economic Times – #127

Will your ‘gift’ be taxed? – The Economic Times – #127

Estate Tax Exemption for 2023 | Kiplinger – #128

Estate Tax Exemption for 2023 | Kiplinger – #128

Section 194B of Income Tax – TDS on Lottery, Betting, and Games – #129

Section 194B of Income Tax – TDS on Lottery, Betting, and Games – #129

Which Gifts from relatives are exempted from Income Tax? – #130

Which Gifts from relatives are exempted from Income Tax? – #130

How To Avoid The Gift Tax In Real Estate | Rocket Mortgage – #131

How To Avoid The Gift Tax In Real Estate | Rocket Mortgage – #131

- federal estate tax

- lineal ascendant gift from relative exempt from income tax

- estate tax exemption

New Income Tax Slabs 2023 – 2024 Highlights: Full list of new tax slabs for new income tax regime, comparison & FAQs answered – Times of India – #132

New Income Tax Slabs 2023 – 2024 Highlights: Full list of new tax slabs for new income tax regime, comparison & FAQs answered – Times of India – #132

How are Cryptocurrency Gifts Taxed? | CoinLedger – #133

How are Cryptocurrency Gifts Taxed? | CoinLedger – #133

Income Tax on Cash Gift to Wife: How Much You Can Gift on Women’s Day Without Tax Implications – Income Tax News | The Financial Express – #134

Income Tax on Cash Gift to Wife: How Much You Can Gift on Women’s Day Without Tax Implications – Income Tax News | The Financial Express – #134

) When is money gifted not taxable? All your tax queries on gifts answered | Personal Finance – Business Standard – #135

When is money gifted not taxable? All your tax queries on gifts answered | Personal Finance – Business Standard – #135

If you want to offer financial… – The Strain Practice | Facebook – #136

If you want to offer financial… – The Strain Practice | Facebook – #136

What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #137

What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #137

Taxation of Gifts received in Cash or Kind – #138

Taxation of Gifts received in Cash or Kind – #138

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #139

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #139

Types of Income Exempted from Income Tax in India – #140

Types of Income Exempted from Income Tax in India – #140

Budget 2023 | Those earning up to ₹7 lakh a year need not pay income tax – The Hindu – #141

Budget 2023 | Those earning up to ₹7 lakh a year need not pay income tax – The Hindu – #141

- gift tax exemption relatives list

- gift tax definition

- gift tax act 1958

Legal Alert | Common Gift Tax Return Mistakes and Ways to Avoid Them | Husch Blackwell – #142

Legal Alert | Common Gift Tax Return Mistakes and Ways to Avoid Them | Husch Blackwell – #142

Budget 2014-15: Don’t expect too much – #143

Budget 2014-15: Don’t expect too much – #143

) Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver – #144

Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver – #144

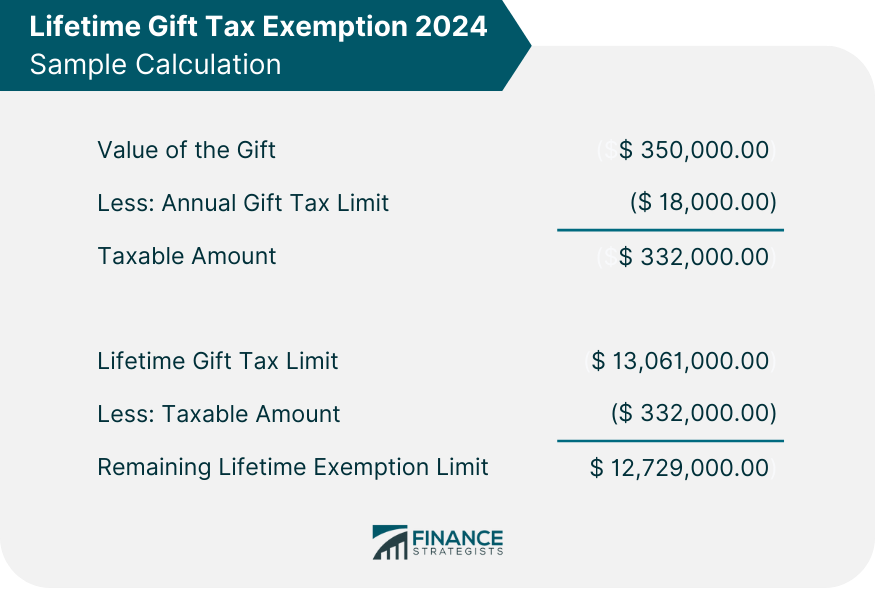

Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation – #145

Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation – #145

Irrevocable Trusts for Estate Tax Planning, Gift Tax and Gifting Strategies Explained – #146

Irrevocable Trusts for Estate Tax Planning, Gift Tax and Gifting Strategies Explained – #146

Income Tax on Marriage Gift: Taxation of Wedding Gifts Received – Section 56 – Tax2win – #147

Income Tax on Marriage Gift: Taxation of Wedding Gifts Received – Section 56 – Tax2win – #147

What is the taxation on any gift via cash transfer to a relative? | Mint – #148

What is the taxation on any gift via cash transfer to a relative? | Mint – #148

Taxability of Gifts under Income Tax Act – Taxmann Blog – #149

Taxability of Gifts under Income Tax Act – Taxmann Blog – #149

Gift Taxes Explained | Expat US Tax – #150

Gift Taxes Explained | Expat US Tax – #150

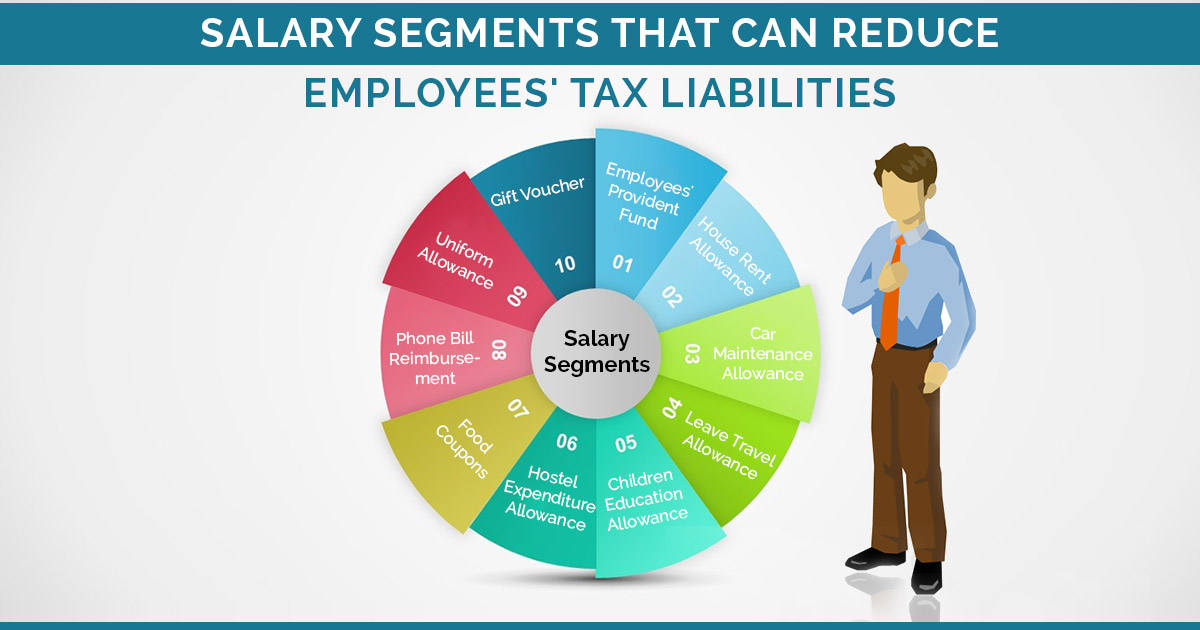

Salary Segments That Can Reduce Employees’ Tax Liabilities – #151

Salary Segments That Can Reduce Employees’ Tax Liabilities – #151

Are Gift Cards Taxable? | Taxation, Examples, & More – #152

Are Gift Cards Taxable? | Taxation, Examples, & More – #152

Section 10 of Income Tax Act – Deductions and Allowances – #153

Section 10 of Income Tax Act – Deductions and Allowances – #153

Are Wedding Gifts Taxable? (Explanation + Examples) – #154

Are Wedding Gifts Taxable? (Explanation + Examples) – #154

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™ – #155

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™ – #155

Income Tax: CBDT sets outstanding tax waiver limit at Rs 1 lakh. How to check status? – BusinessToday – #156

Income Tax: CBDT sets outstanding tax waiver limit at Rs 1 lakh. How to check status? – BusinessToday – #156

Gift tax: what is it & how does it work? | Empower – #157

Gift tax: what is it & how does it work? | Empower – #157

Navigating Indian Tax Rules for NRI Gift Money: Key Considerations and Compliance Guidelines – #158

Navigating Indian Tax Rules for NRI Gift Money: Key Considerations and Compliance Guidelines – #158

You Take a Friend on Your Yacht. Is It a Taxable Gift? – WSJ – #159

You Take a Friend on Your Yacht. Is It a Taxable Gift? – WSJ – #159

What’s the Gift Tax Limit in California? | The Werner Law Firm, PC – #160

What’s the Gift Tax Limit in California? | The Werner Law Firm, PC – #160

Understanding Federal Estate and Gift Taxes | Congressional Budget Office – #161

Understanding Federal Estate and Gift Taxes | Congressional Budget Office – #161

What Gifts Are Subject to the Gift Tax? – #162

What Gifts Are Subject to the Gift Tax? – #162

Taxes you have to pay when you get a gift – The Economic Times – #163

Taxes you have to pay when you get a gift – The Economic Times – #163

Gift Tax Limit 2024: How Much Money Can You Gift? | SmartAsset – #164

Gift Tax Limit 2024: How Much Money Can You Gift? | SmartAsset – #164

Raksha Bandhan 2023: Is gifting cash to your sister taxable? Income tax rules explained here | Mint – #165

Raksha Bandhan 2023: Is gifting cash to your sister taxable? Income tax rules explained here | Mint – #165

Yes, there is a limit on how much tax-free money a parent can gift their child each year – #166

Yes, there is a limit on how much tax-free money a parent can gift their child each year – #166

Estate and Gift Tax Exemption Sunset 2025: How to Prepare : Cherry Bekaert – #167

Estate and Gift Tax Exemption Sunset 2025: How to Prepare : Cherry Bekaert – #167

Slide26.png – #168

Slide26.png – #168

Publication 463 (2023), Travel, Gift, and Car Expenses | Internal Revenue Service – #169

Publication 463 (2023), Travel, Gift, and Car Expenses | Internal Revenue Service – #169

Is There Any Way To Avoid The Gift Tax In Illinois? – #170

Is There Any Way To Avoid The Gift Tax In Illinois? – #170

The Estate Tax and Lifetime Gifting | Charles Schwab – #171

The Estate Tax and Lifetime Gifting | Charles Schwab – #171

Section 56(2)(vii) : Cash / Non-Cash Gifts – #172

Section 56(2)(vii) : Cash / Non-Cash Gifts – #172

Estate Tax Exemption: How Much It Is and How to Calculate It – #173

Estate Tax Exemption: How Much It Is and How to Calculate It – #173

How can NRIs in the US gift money to their parents in India in 2023? | Arthgyaan – #174

How can NRIs in the US gift money to their parents in India in 2023? | Arthgyaan – #174

How much money can NRIs gift to parents in India? | Arthgyaan – #175

How much money can NRIs gift to parents in India? | Arthgyaan – #175

Do You Need to File Gift Tax Returns? Avoid These Common Mistakes | Bennett Thrasher – #176

Do You Need to File Gift Tax Returns? Avoid These Common Mistakes | Bennett Thrasher – #176

![How HRA Exemption is Calculated [Excel Examples] | FinCalC Blog How HRA Exemption is Calculated [Excel Examples] | FinCalC Blog](https://zerodha.com/z-connect/wp-content/uploads/2023/11/blog2-taxation-on-gifts.png) How HRA Exemption is Calculated [Excel Examples] | FinCalC Blog – #177

How HRA Exemption is Calculated [Excel Examples] | FinCalC Blog – #177

Cash Deposit Limit in Saving Account as per Income Tax – #178

Cash Deposit Limit in Saving Account as per Income Tax – #178

IRS Raises Gifting Limits: Know How Much You Can Gift Tax-Free – #179

IRS Raises Gifting Limits: Know How Much You Can Gift Tax-Free – #179

Budget 2023: What is Gift Tax and why govt should abolish this? | Zee Business – #180

Budget 2023: What is Gift Tax and why govt should abolish this? | Zee Business – #180

CASH PAYMENT LIMIT REDUCED TO Rs 10000/- FROM Rs 20000/- EARLIER .RULES ALSO APPLICABLE ON CAPITAL EXPENSES | SIMPLE TAX INDIA – #181

CASH PAYMENT LIMIT REDUCED TO Rs 10000/- FROM Rs 20000/- EARLIER .RULES ALSO APPLICABLE ON CAPITAL EXPENSES | SIMPLE TAX INDIA – #181

Tax | What is Tax | Taxation in India : Tax Calculation – #182

Tax | What is Tax | Taxation in India : Tax Calculation – #182

All you need to know about taxes on gifts and the exceptions | Mint – #183

All you need to know about taxes on gifts and the exceptions | Mint – #183

Section 194P – Exemption For ITR Filing For Senior Citizens – #184

Section 194P – Exemption For ITR Filing For Senior Citizens – #184

What You Need to Know About Stock Gift Tax – #185

What You Need to Know About Stock Gift Tax – #185

Who Pays Taxes on a Gift? – #186

Who Pays Taxes on a Gift? – #186

Is there a limit in income tax laws up to which a father can gift to his son – #187

Is there a limit in income tax laws up to which a father can gift to his son – #187

Taxability of Gifts – #188

Taxability of Gifts – #188

2023 Estate Planning Update | Helsell Fetterman – #189

2023 Estate Planning Update | Helsell Fetterman – #189

Estate Tax Exemption Increased for 2024 – Anchin, Block & Anchin LLP – #190

Estate Tax Exemption Increased for 2024 – Anchin, Block & Anchin LLP – #190

Perquisites: Meaning, Types, Calculation & Examples – Razorpay Payroll – #191

Perquisites: Meaning, Types, Calculation & Examples – Razorpay Payroll – #191

2024 Guide to the Unified Tax Credit – #192

2024 Guide to the Unified Tax Credit – #192

- gift tax example

- gift tax rate table

- section 56(2) of income tax act

Gift Tax Explained – Do You Pay Taxes On Gifted Money? – YouTube – #193

Gift Tax Explained – Do You Pay Taxes On Gifted Money? – YouTube – #193

Saving Tax on House Rent Allowance under Old Tax Regime – #194

Saving Tax on House Rent Allowance under Old Tax Regime – #194

Section 10 of Income Tax Act – Allowance and Deductions – #195

Section 10 of Income Tax Act – Allowance and Deductions – #195

I received gifts during my wedding, are they taxable? – #196

I received gifts during my wedding, are they taxable? – #196

12 Common Types of Non Taxable Income You Write Off – #197

12 Common Types of Non Taxable Income You Write Off – #197

Children Educational Allowance Exemption: 4 Ways to Save Taxes! – #198

Children Educational Allowance Exemption: 4 Ways to Save Taxes! – #198

What is Portability for Estate and Gift Tax? – #199

What is Portability for Estate and Gift Tax? – #199

Income Tax Slabs FY 2023-24 & AY 2024-25 (New & Old Tax Slab) – #200

Income Tax Slabs FY 2023-24 & AY 2024-25 (New & Old Tax Slab) – #200

Posts: annual tax free gift allowance

Categories: Gifts

Author: toyotabienhoa.edu.vn