Aggregate more than 112 annual federal gift tax exclusion

Details images of annual federal gift tax exclusion by website toyotabienhoa.edu.vn compilation. IRS Form 706: Who Must File It and Related Forms. max gift amount 2024 – bak.una.edu.ar. Personal Planning Strategies – Lexology. FAQ: Is Tuition Exempt From The Gift Tax? – Estate and Probate Legal Group. Memento Law – The federal annual gift exclusion is the… | Facebook

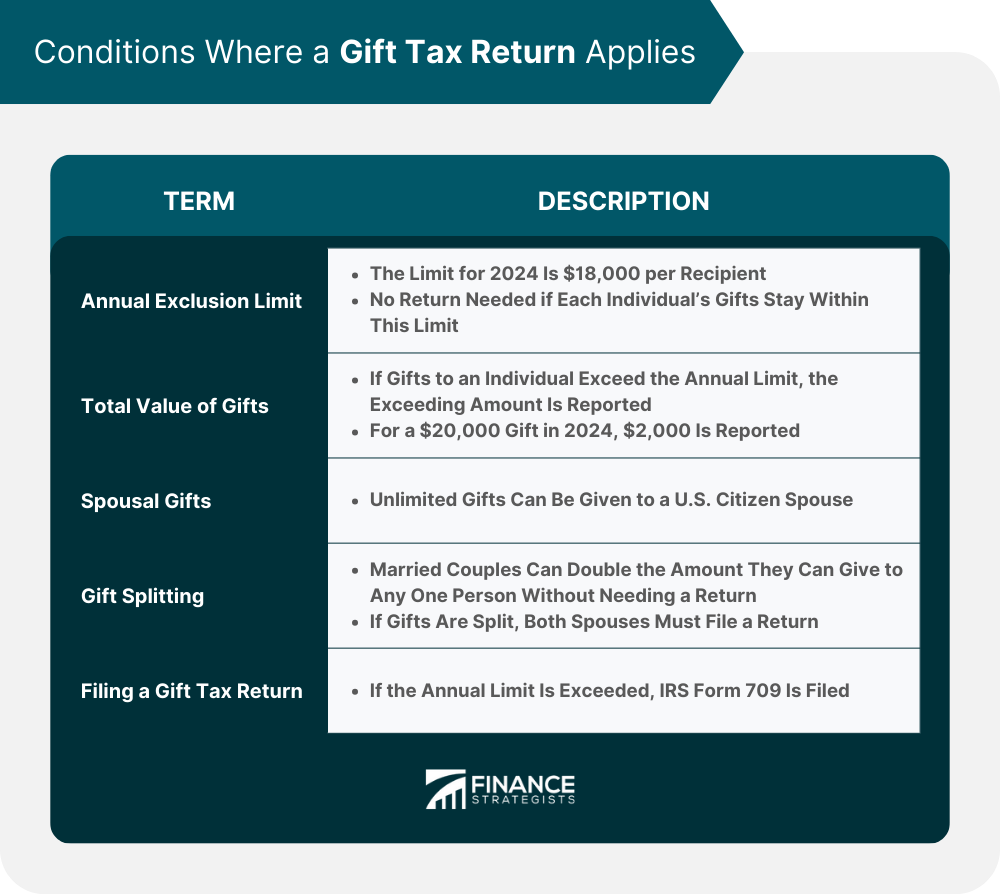

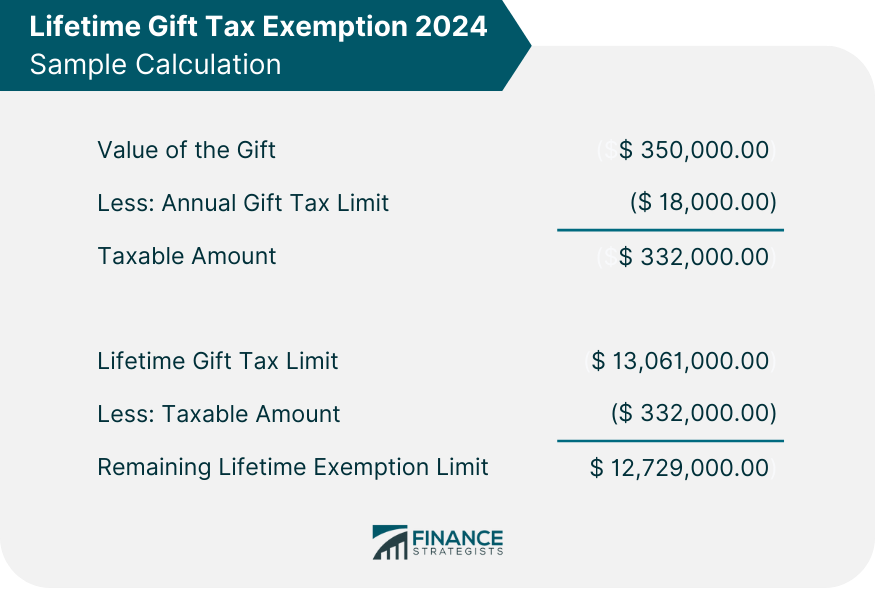

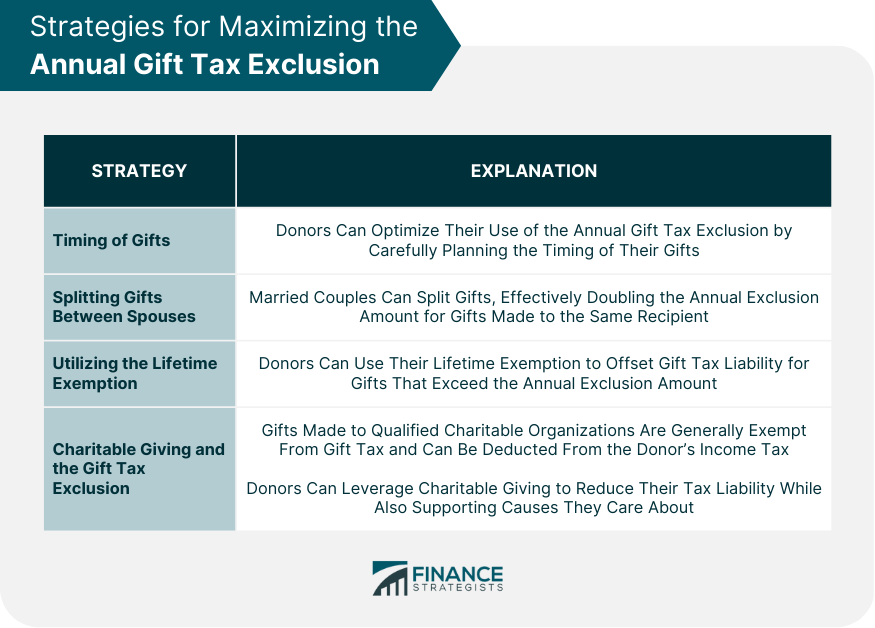

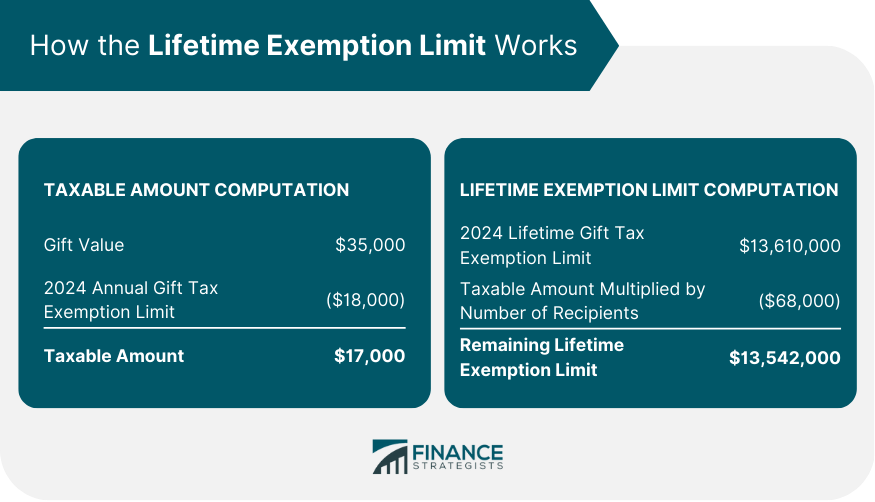

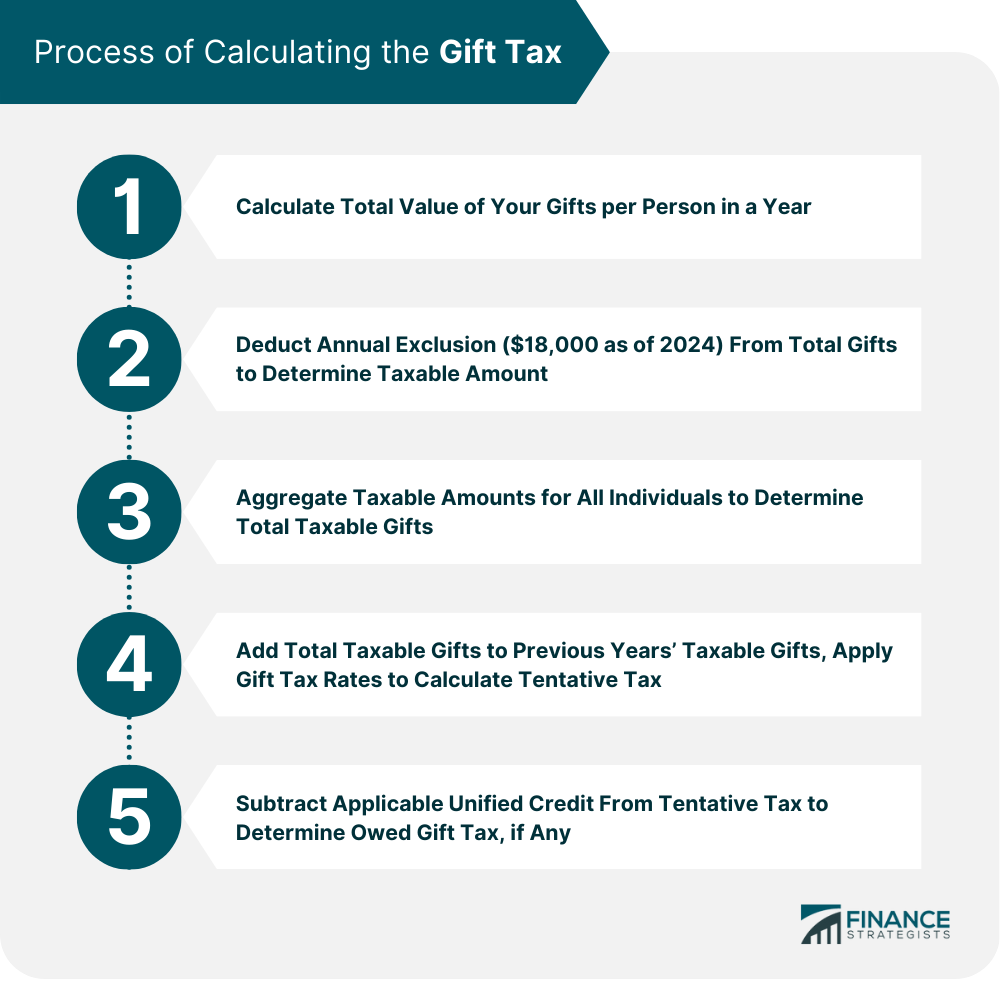

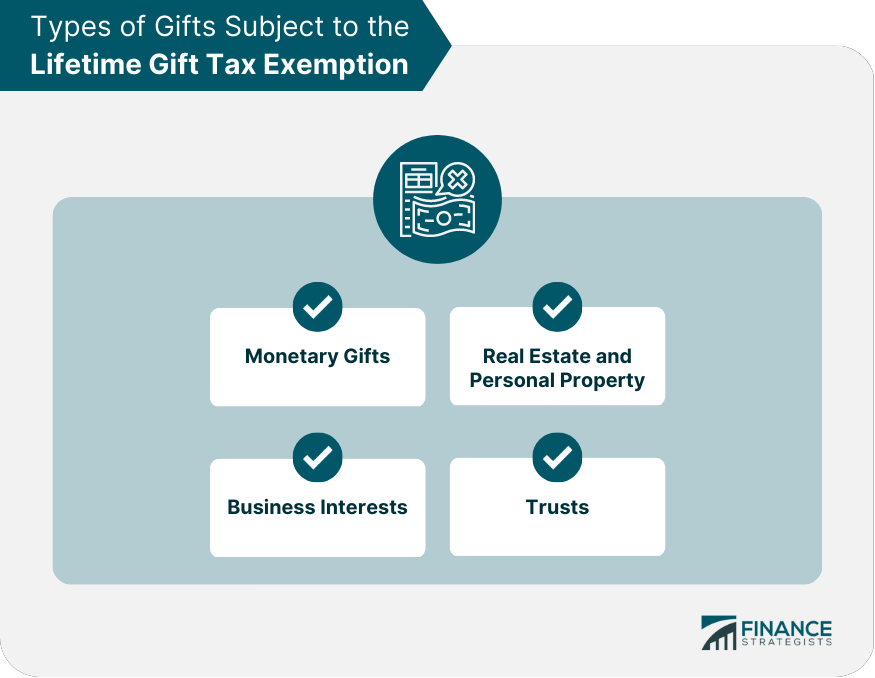

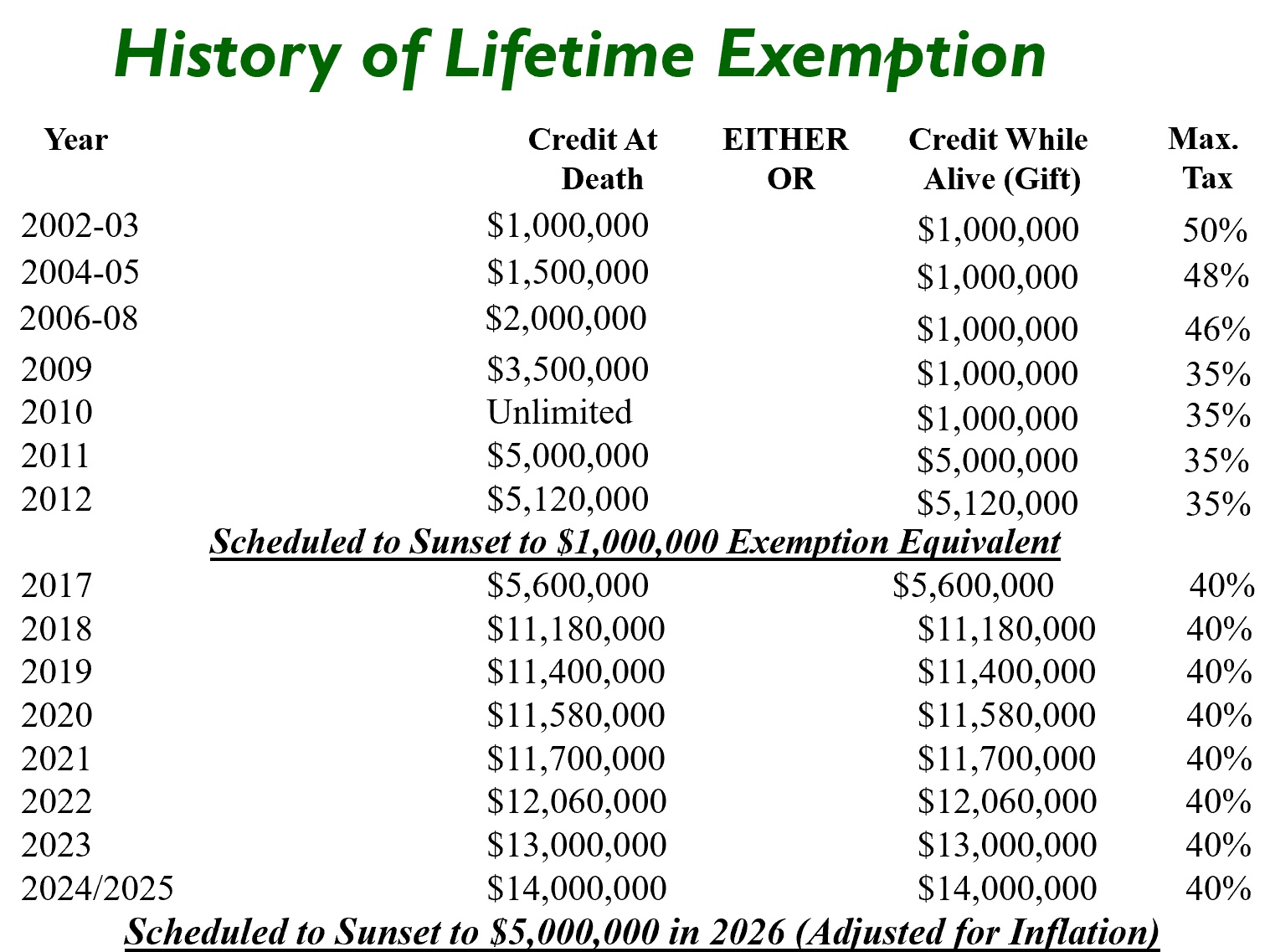

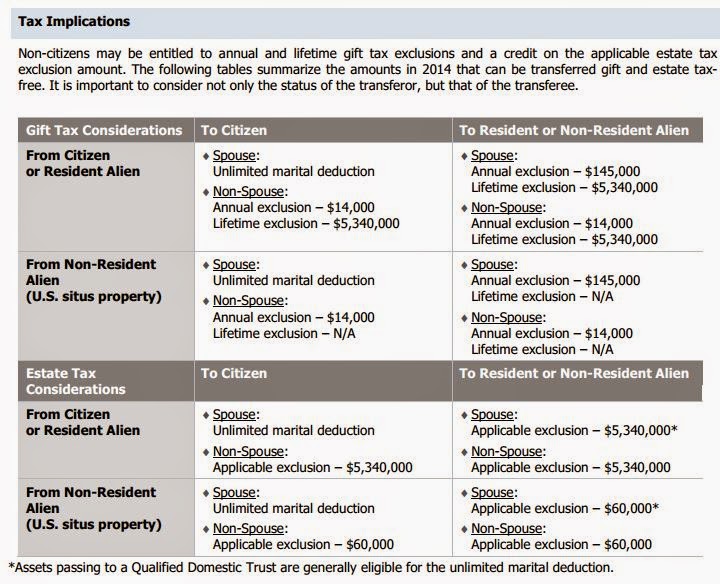

Lifetime Gift Tax Exemption | Definition, Amounts, & Impact – #1

Lifetime Gift Tax Exemption | Definition, Amounts, & Impact – #1

- estate tax exemption history

- gift tax exemption

- gift tax rate 2023

What is the Tax Free Gift Limit for 2022? – #2

What is the Tax Free Gift Limit for 2022? – #2

The federal annual gift… – Norris & Golubovic, PLLC | Facebook – #4

The federal annual gift… – Norris & Golubovic, PLLC | Facebook – #4

Higher Estate And Gift Tax Limits for 2019 – #5

Higher Estate And Gift Tax Limits for 2019 – #5

Life Insurance HQ The Podcast : Hosted By: Jason Mericle: Amazon.in: Books – #6

Life Insurance HQ The Podcast : Hosted By: Jason Mericle: Amazon.in: Books – #6

Stretch the Gift Tax Limit with Education or Health Care – #7

Stretch the Gift Tax Limit with Education or Health Care – #7

Solved 18. The gift tax annual exclusion is claimed by the | Chegg.com – #8

Solved 18. The gift tax annual exclusion is claimed by the | Chegg.com – #8

Gift Tax Exclusion Increases for 2024: How to Get the Most Benefit – CPA Practice Advisor – #10

Gift Tax Exclusion Increases for 2024: How to Get the Most Benefit – CPA Practice Advisor – #10

- annual gift tax exclusion 2021

Annual Gift Tax Exclusions | First Republic now part of JPMorgan Chase – #11

Annual Gift Tax Exclusions | First Republic now part of JPMorgan Chase – #11

New Jersey Gift Tax: All You Need to Know – #12

New Jersey Gift Tax: All You Need to Know – #12

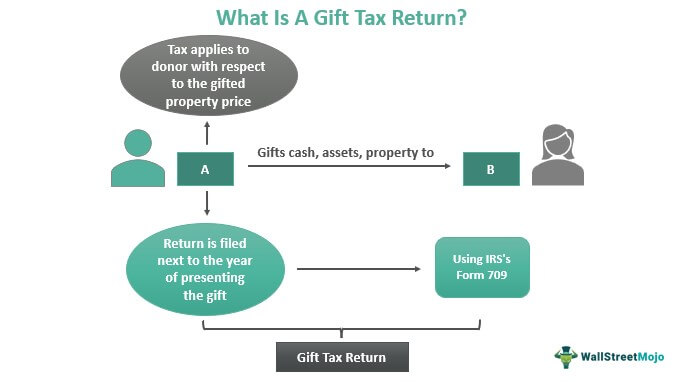

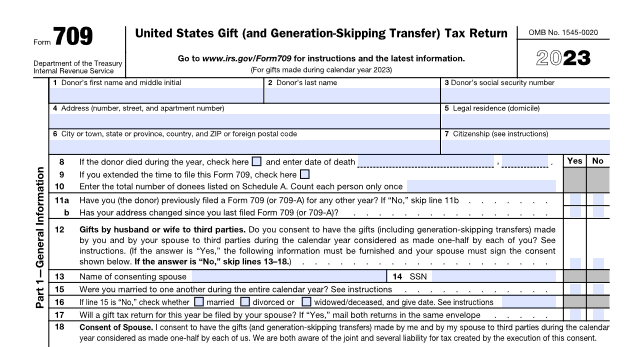

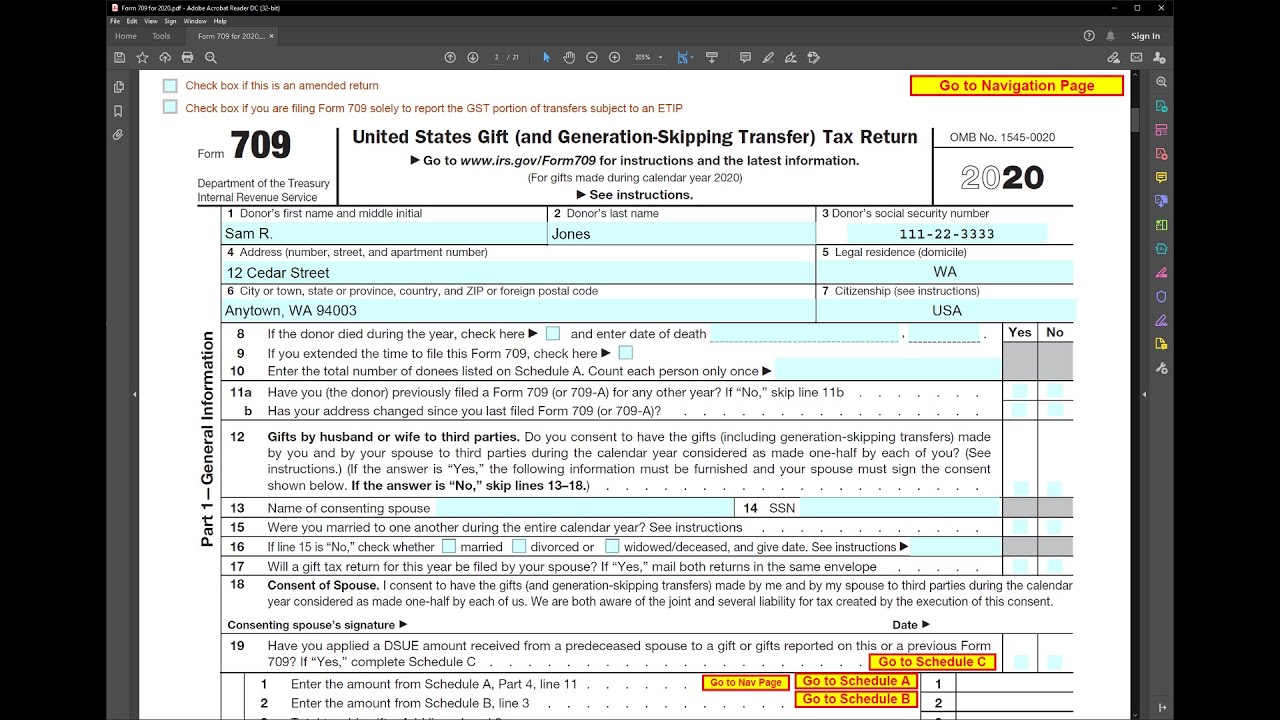

Gifts to 529 Plans: The Ultimate Guide to Form 709 – #13

Gifts to 529 Plans: The Ultimate Guide to Form 709 – #13

The Federal Gift Tax And People With Special Needs | Rubin Law – #14

The Federal Gift Tax And People With Special Needs | Rubin Law – #14

December 2023 Newsletter – Trust Company of North Carolina – #15

December 2023 Newsletter – Trust Company of North Carolina – #15

Lifetime Gifts Tax Exemption: Is Now the Time to Act? | PNC Insights – #16

Lifetime Gifts Tax Exemption: Is Now the Time to Act? | PNC Insights – #16

Alan Gassman & Kenneth Crotty on Form 709 – The 10 Biggest Mistakes Made on Gift Tax Returns – YouTube – #17

Alan Gassman & Kenneth Crotty on Form 709 – The 10 Biggest Mistakes Made on Gift Tax Returns – YouTube – #17

3 Transfer Taxes to Avoid in Your Houston Estate Plan – #18

3 Transfer Taxes to Avoid in Your Houston Estate Plan – #18

Tax Update: Trust 1041 & Gift Tax | Marcum LLP | Accountants and Advisors – #19

Tax Update: Trust 1041 & Gift Tax | Marcum LLP | Accountants and Advisors – #19

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #20

How do the estate, gift, and generation-skipping transfer taxes work? | Tax Policy Center – #20

Timmoney Ng on LinkedIn: #tax #gift #chatgbt #chatgpt4 #internationaltax – #21

Timmoney Ng on LinkedIn: #tax #gift #chatgbt #chatgpt4 #internationaltax – #21

- gift tax definition

- federal estate tax

- estate tax exemption

Estate Tax Planning in Maryland – Annapolis Estate Tax Lawyers – #22

Estate Tax Planning in Maryland – Annapolis Estate Tax Lawyers – #22

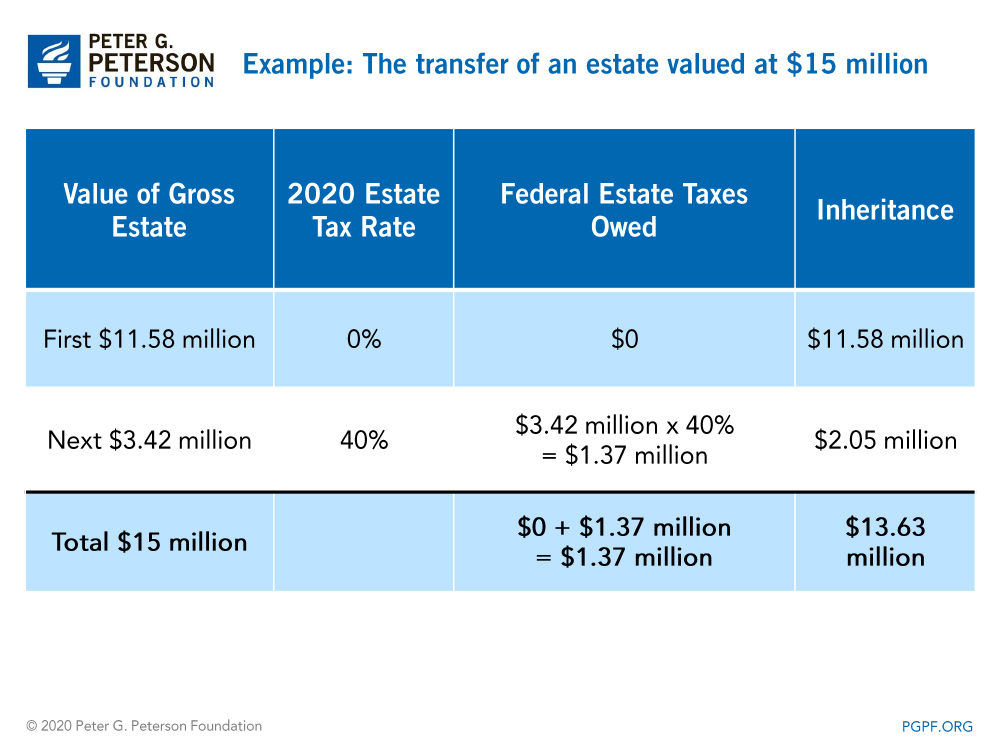

IRS Announces Higher Estate And Gift Tax Limits For 2020 – #23

IRS Announces Higher Estate And Gift Tax Limits For 2020 – #23

Gift tax: Gift Tax 101: How It Fits into the Picture of Total Taxation – FasterCapital – #24

Gift tax: Gift Tax 101: How It Fits into the Picture of Total Taxation – FasterCapital – #24

Solved Description Annual exclusion This is the amount that | Chegg.com – #25

Solved Description Annual exclusion This is the amount that | Chegg.com – #25

IRS Announces Higher 2019 Estate And Gift Tax Limits – #26

IRS Announces Higher 2019 Estate And Gift Tax Limits – #26

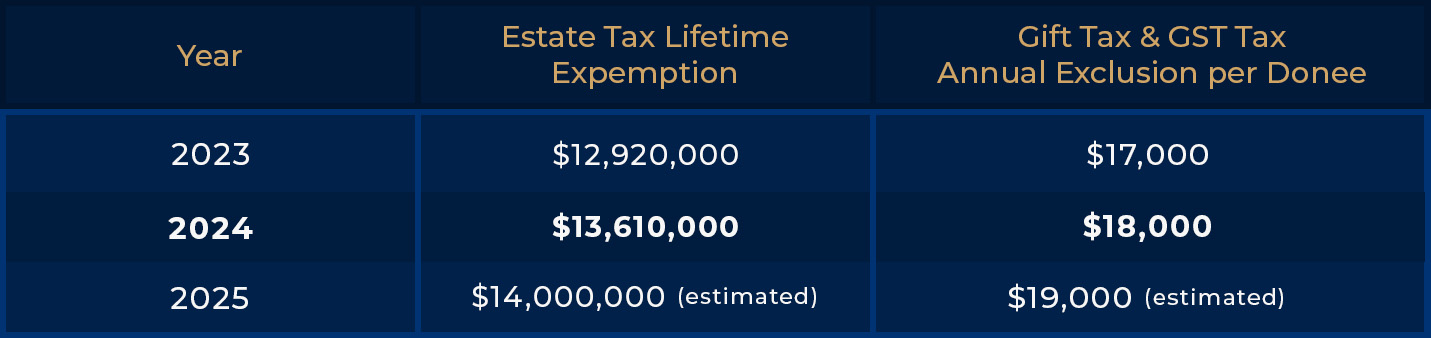

Estate and Gift Tax Update for 2023 – #27

Estate and Gift Tax Update for 2023 – #27

Gift Tax In 2024: What Is It And How Does It Work? – #28

Gift Tax In 2024: What Is It And How Does It Work? – #28

The Generation-Skipping Transfer Tax: A Quick Guide – #29

The Generation-Skipping Transfer Tax: A Quick Guide – #29

Federal Gift Tax vs. California Inheritance Tax – #30

Federal Gift Tax vs. California Inheritance Tax – #30

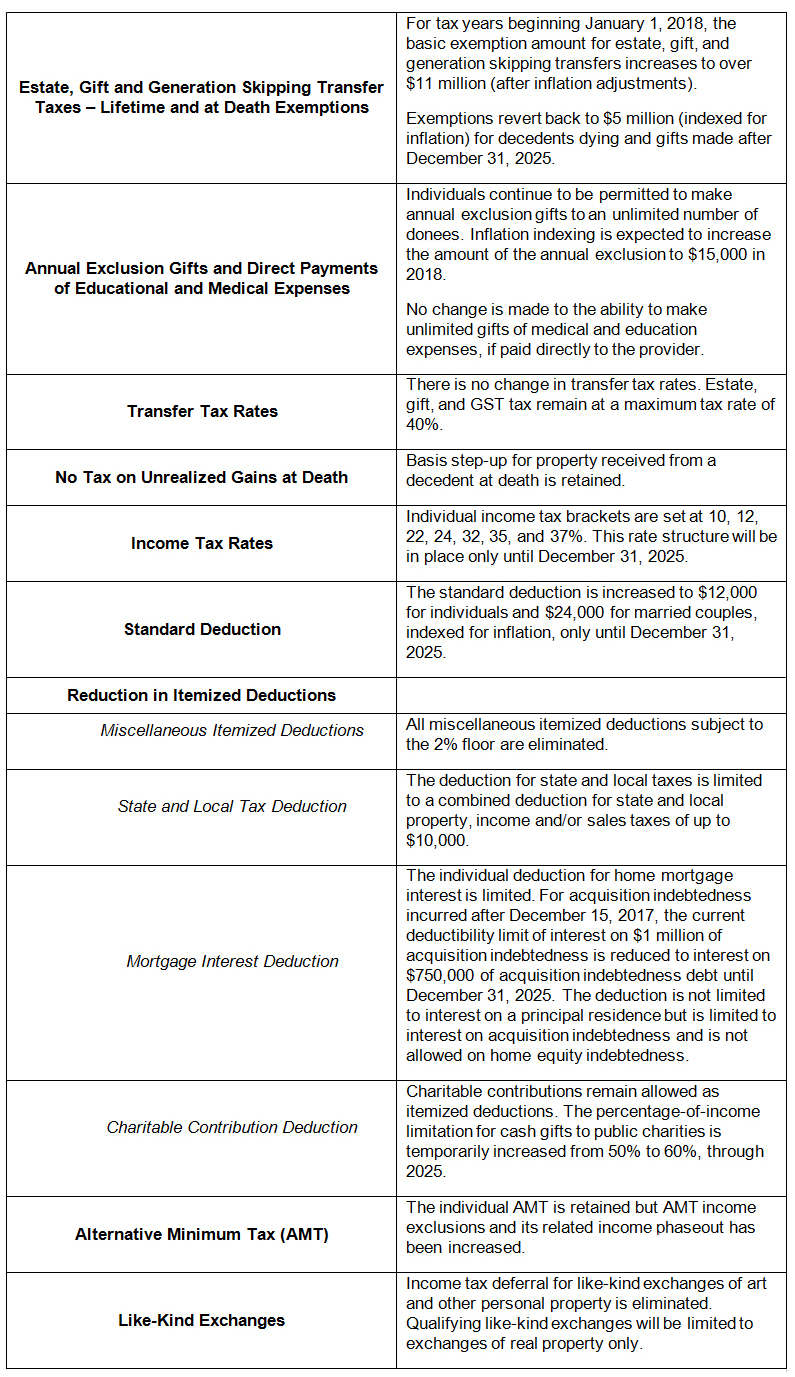

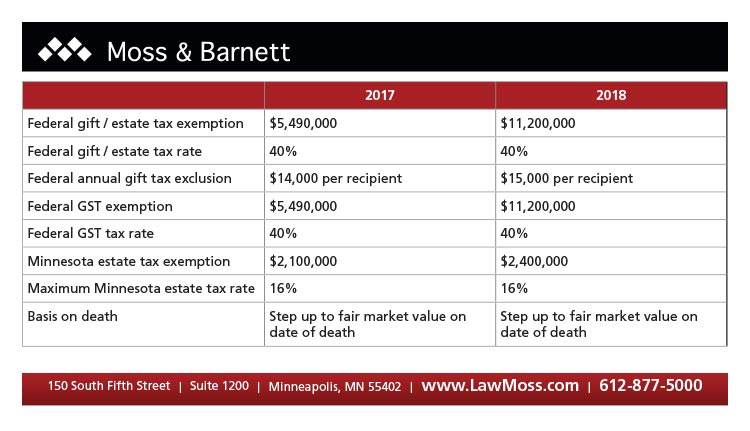

estate-tax-alert-tax-cuts-and-jobs-act: Moss & Barnett – Minneapolis, Law Firm – Attorneys – #31

estate-tax-alert-tax-cuts-and-jobs-act: Moss & Barnett – Minneapolis, Law Firm – Attorneys – #31

IRS Gift Limit 2023: What happens if you give more than the limit and some other FAQ | Marca – #32

IRS Gift Limit 2023: What happens if you give more than the limit and some other FAQ | Marca – #32

Annual Estate and Gift Tax Limits in Ohio – #33

Annual Estate and Gift Tax Limits in Ohio – #33

Updated Federal Estate and Gift Tax Exemptions for 2024 – #34

Updated Federal Estate and Gift Tax Exemptions for 2024 – #34

Year end is gift-giving time: Use the annual gift tax exclusion to the max | Union Bank & Trust – #35

Year end is gift-giving time: Use the annual gift tax exclusion to the max | Union Bank & Trust – #35

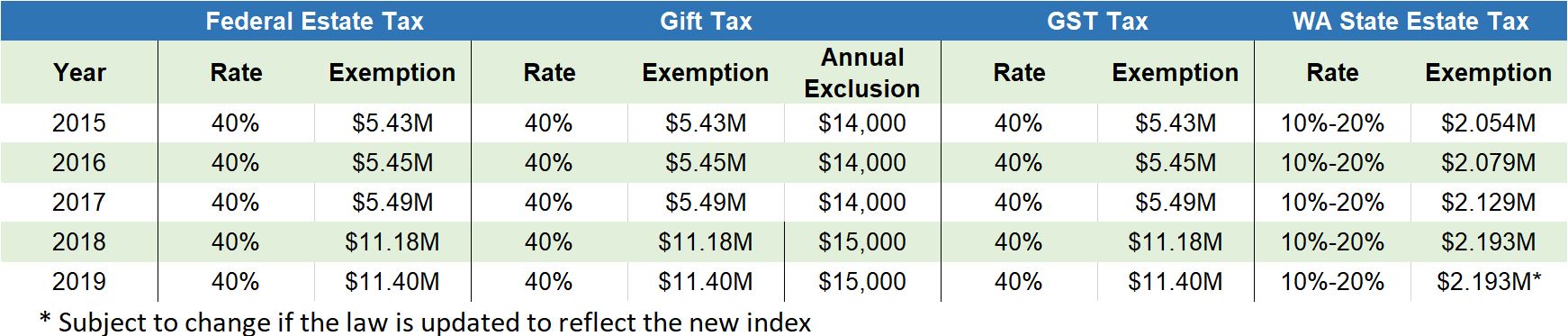

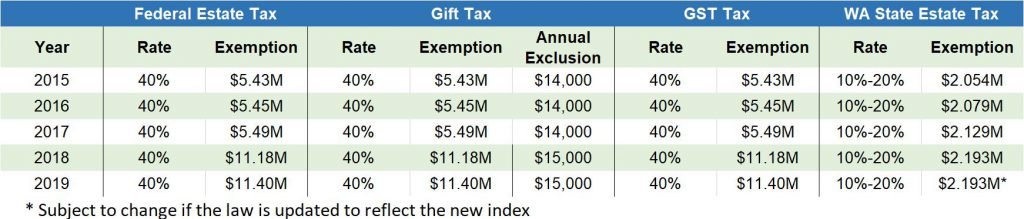

Inflation Adjustment for GST, Gift, and Estate Tax – #36

Inflation Adjustment for GST, Gift, and Estate Tax – #36

Historical Estate Tax Exemption Amounts And Tax Rates – #37

Historical Estate Tax Exemption Amounts And Tax Rates – #37

- federal estate tax exemption 2023

- gift tax rate

- personal exemption

Pre-Sunset Planning Opportunity – Get Ahead of the Massive Increase in Federal Estate & Gift Tax Exemption – Agency One – #38

Pre-Sunset Planning Opportunity – Get Ahead of the Massive Increase in Federal Estate & Gift Tax Exemption – Agency One – #38

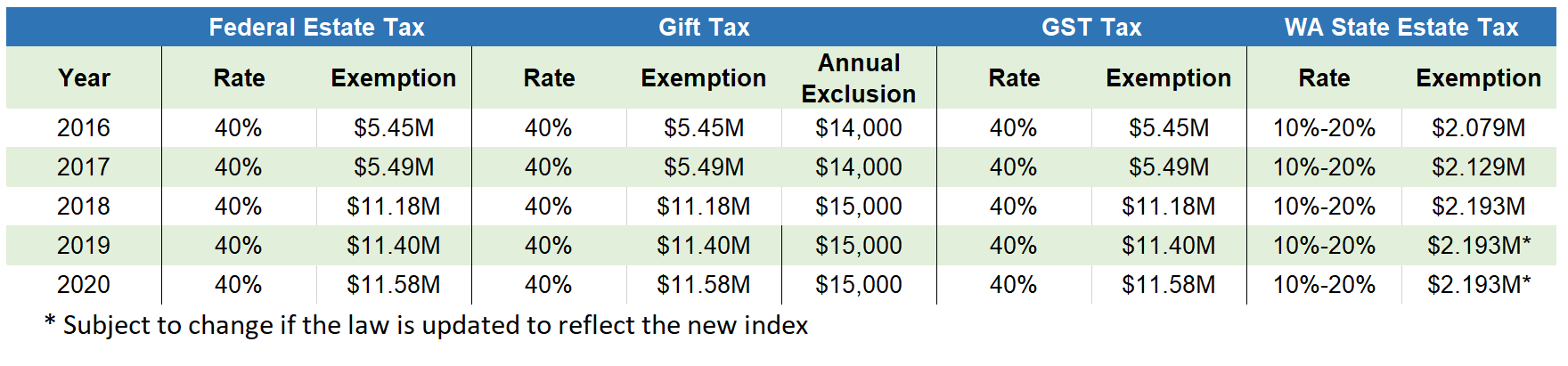

2019 Estate Planning Update | Helsell Fetterman – #39

2019 Estate Planning Update | Helsell Fetterman – #39

How to give to family and friends — and avoid gift taxes – WTOP News – #40

How to give to family and friends — and avoid gift taxes – WTOP News – #40

Form 709 – Guide 2023 | US Expat Tax Service – #41

Form 709 – Guide 2023 | US Expat Tax Service – #41

- gift tax 2023

- gift tax in india

- estate tax example

Unlocking NY State Gift Tax – Updated Mar 2024 – #42

Unlocking NY State Gift Tax – Updated Mar 2024 – #42

Legal Alert | Common Gift Tax Return Mistakes and Ways to Avoid Them | Husch Blackwell – #43

Legal Alert | Common Gift Tax Return Mistakes and Ways to Avoid Them | Husch Blackwell – #43

How Much Is Gift Tax? Rates Range From 18% to 40% – #44

How Much Is Gift Tax? Rates Range From 18% to 40% – #44

Plan now for year-end gifts with the gift tax annual exclusion – Miller Kaplan – #45

Plan now for year-end gifts with the gift tax annual exclusion – Miller Kaplan – #45

8 Tips For Tax-Free Gifting In 2023 – #46

8 Tips For Tax-Free Gifting In 2023 – #46

The Gift Tax Made Simple – TurboTax Tax Tips & Videos – #47

The Gift Tax Made Simple – TurboTax Tax Tips & Videos – #47

Estate and Gift Tax – Estate Planning Now and for the 2026 “Double Exemption” Sunset – #48

Estate and Gift Tax – Estate Planning Now and for the 2026 “Double Exemption” Sunset – #48

ESTATE, INHERITANCE, AND GIFT TAXES IN CONNECTICUT AND OTHER STATES – #49

ESTATE, INHERITANCE, AND GIFT TAXES IN CONNECTICUT AND OTHER STATES – #49

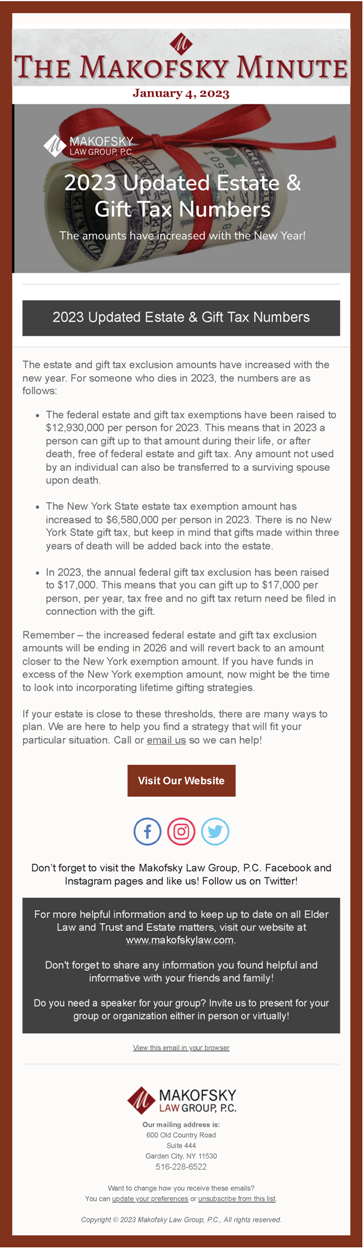

2023 Updated Estate & Gift Tax Numbers – Makofsky Valente Law Group, P.C. – #50

2023 Updated Estate & Gift Tax Numbers – Makofsky Valente Law Group, P.C. – #50

Gift Tax 709 Form : r/tax – #51

Gift Tax 709 Form : r/tax – #51

2024 Revisions to annual gift and estate tax – Elville – #52

2024 Revisions to annual gift and estate tax – Elville – #52

Gift Tax Exemption 2022 & 2023 | How It Works, Calculation, & Strategies – #53

Gift Tax Exemption 2022 & 2023 | How It Works, Calculation, & Strategies – #53

- gift tax exclusion 2023

- estate tax exemption 2026

- estate tax exemption 2022

IRS Tax Form 709 Guide: Gift Tax Demystified – #54

IRS Tax Form 709 Guide: Gift Tax Demystified – #54

2023 Inflation Adjustments and FEC Contribution Limits – Harmon Curran – #55

2023 Inflation Adjustments and FEC Contribution Limits – Harmon Curran – #55

Annual Exclusion Amount For Gift Tax Increases For 2023 – #56

Annual Exclusion Amount For Gift Tax Increases For 2023 – #56

Plan Now with the Gift Tax Annual Exclusion – PKF Texas – #57

Plan Now with the Gift Tax Annual Exclusion – PKF Texas – #57

What it Means to Make a Gift Under the Federal Gift Tax System – Agency One – #58

What it Means to Make a Gift Under the Federal Gift Tax System – Agency One – #58

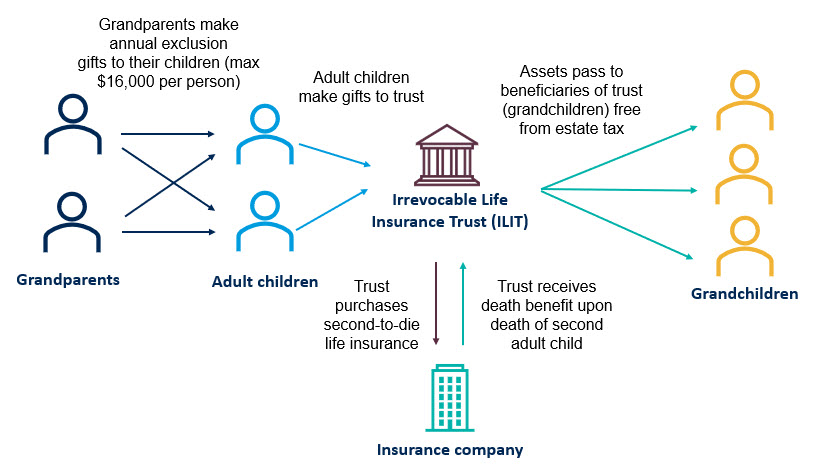

Generation-Skipping Transfer Taxes – #59

Generation-Skipping Transfer Taxes – #59

IRS unveils new brackets and other tax changes for 2024 – #60

IRS unveils new brackets and other tax changes for 2024 – #60

The Benefits of Gifting: A Tool for Estate Planning and Tax Savings – #61

The Benefits of Gifting: A Tool for Estate Planning and Tax Savings – #61

Inflation Boosts Federal Gift and Estate Tax Breaks | Hantzmon Wiebel CPA and Advisory Services – #62

Inflation Boosts Federal Gift and Estate Tax Breaks | Hantzmon Wiebel CPA and Advisory Services – #62

Projecting the Year-by-Year Estate and Gift Tax Exemption Amount – Ultimate Estate Planner – #63

Projecting the Year-by-Year Estate and Gift Tax Exemption Amount – Ultimate Estate Planner – #63

2023 Estate and Gift Tax Number Updates. | Peach State Wills and Trusts, a Division of The Beck Law Firm, LLC – #64

2023 Estate and Gift Tax Number Updates. | Peach State Wills and Trusts, a Division of The Beck Law Firm, LLC – #64

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #65

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #65

Annual Gift Tax and Estate Tax Exclusions Are Increasing in 2022 – TESFAYE LAW – #66

Annual Gift Tax and Estate Tax Exclusions Are Increasing in 2022 – TESFAYE LAW – #66

Estate Planning: Increased Transfer Limits for Gift and Estate Tax for 2023 – Young Moore Attorneys – #67

Estate Planning: Increased Transfer Limits for Gift and Estate Tax for 2023 – Young Moore Attorneys – #67

When Should I Use My Estate and Gift Tax Exemption | Lifetime Gift Tax Exemption | ACTEC – YouTube – #68

When Should I Use My Estate and Gift Tax Exemption | Lifetime Gift Tax Exemption | ACTEC – YouTube – #68

DOC) Annual Gift Tax Exclusion | Evans Sternau CPA – Academia.edu – #69

DOC) Annual Gift Tax Exclusion | Evans Sternau CPA – Academia.edu – #69

Annual Gift Tax Exclusion vs. Medicaid Look Back Period | Cornetet, Meyer, Rush & Stapleton – #70

Annual Gift Tax Exclusion vs. Medicaid Look Back Period | Cornetet, Meyer, Rush & Stapleton – #70

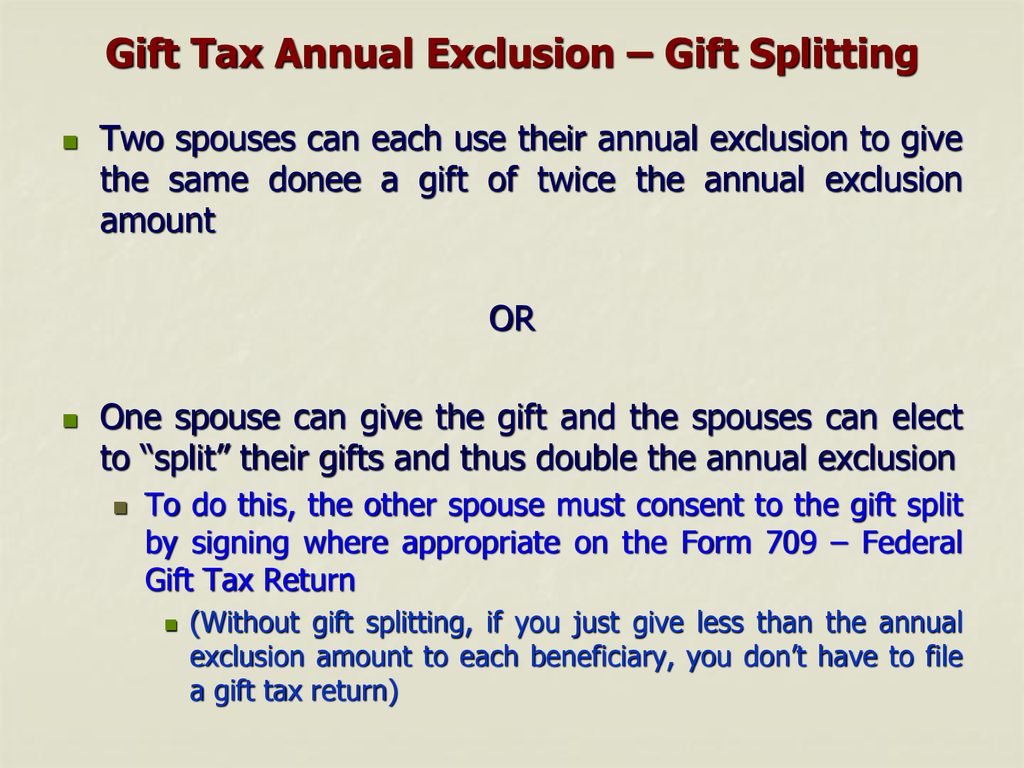

How to Split Gifts on a Tax Return – #71

How to Split Gifts on a Tax Return – #71

IRS Announced New Lifetime and Gift Tax Exemptions – Texas Trust Law – #72

IRS Announced New Lifetime and Gift Tax Exemptions – Texas Trust Law – #72

2023 Estate Planning Update | Helsell Fetterman – #73

2023 Estate Planning Update | Helsell Fetterman – #73

Plan now to make tax-smart year-end gifts to loved ones – JCCS Certified Public Accountants – #74

Plan now to make tax-smart year-end gifts to loved ones – JCCS Certified Public Accountants – #74

2021 Year-End Tax Gifts: What You Need To Know | CCHA Law – #75

2021 Year-End Tax Gifts: What You Need To Know | CCHA Law – #75

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #76

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #76

Gift and Estate Tax Changes Coming in 2023, What You Need to Know to Prepare – Anders CPA – #77

Gift and Estate Tax Changes Coming in 2023, What You Need to Know to Prepare – Anders CPA – #77

What is a Crummey Trust? – Rania Combs Law, PLLC – #78

What is a Crummey Trust? – Rania Combs Law, PLLC – #78

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™ – #79

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™ – #79

Summary of Estate and Gift Tax Law Changes for 2015 – #80

Summary of Estate and Gift Tax Law Changes for 2015 – #80

- gift tax exemption 2022

- 2023 gift

- gift tax exemption relatives list

What You Need to Know Before Gifting Money to Family | Savant Wealth Management – #81

What You Need to Know Before Gifting Money to Family | Savant Wealth Management – #81

Video: Federal Gift Tax Law – TurboTax Tax Tips & Videos – #82

Video: Federal Gift Tax Law – TurboTax Tax Tips & Videos – #82

Gift Tax 101: What You Need to Know — Connecticut Estate Planning Attorneys Blog – #83

Gift Tax 101: What You Need to Know — Connecticut Estate Planning Attorneys Blog – #83

gift tax limit 2024 – bak.una.edu.ar – #84

gift tax limit 2024 – bak.una.edu.ar – #84

How Much Money Can You Gift Tax-Free? | The Motley Fool – #85

How Much Money Can You Gift Tax-Free? | The Motley Fool – #85

How Much is the Gift Tax? | What is a Gift Tax? | Gift Tax Limit 2020 – #86

How Much is the Gift Tax? | What is a Gift Tax? | Gift Tax Limit 2020 – #86

What Is the 2023 and 2024 Gift Tax Limit? – Ramsey – #87

What Is the 2023 and 2024 Gift Tax Limit? – Ramsey – #87

Estate Planning Key Numbers | Brian Nydegger – #88

Estate Planning Key Numbers | Brian Nydegger – #88

Understanding California Federal Estate And Gift Tax Rates – #89

Understanding California Federal Estate And Gift Tax Rates – #89

Gift Tax Reporting for US Citizens (Guidelines) – #90

Gift Tax Reporting for US Citizens (Guidelines) – #90

2024 Estate, Gift and GST Tax Changes | Shipman & Goodwin LLP™ – #91

2024 Estate, Gift and GST Tax Changes | Shipman & Goodwin LLP™ – #91

MSU Extension | Montana State University – #92

MSU Extension | Montana State University – #92

6 Facts You Need to Know About the Gift Tax – #93

6 Facts You Need to Know About the Gift Tax – #93

Four More Years for the Heightened Gift and Tax Estate Exclusion – #94

Four More Years for the Heightened Gift and Tax Estate Exclusion – #94

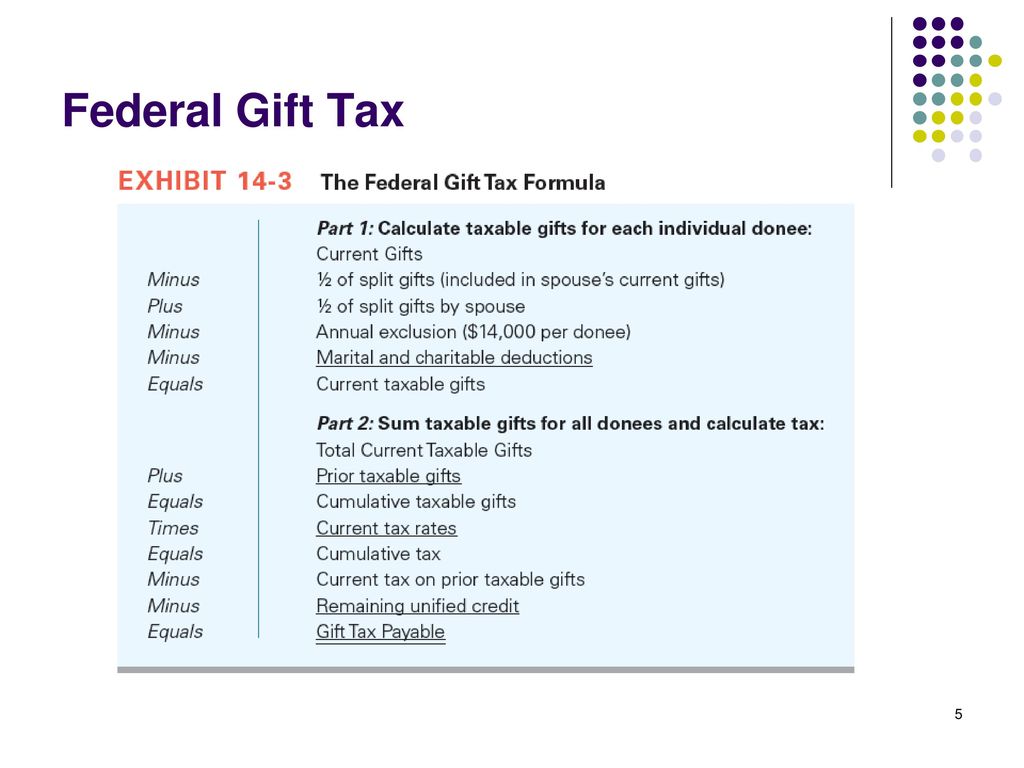

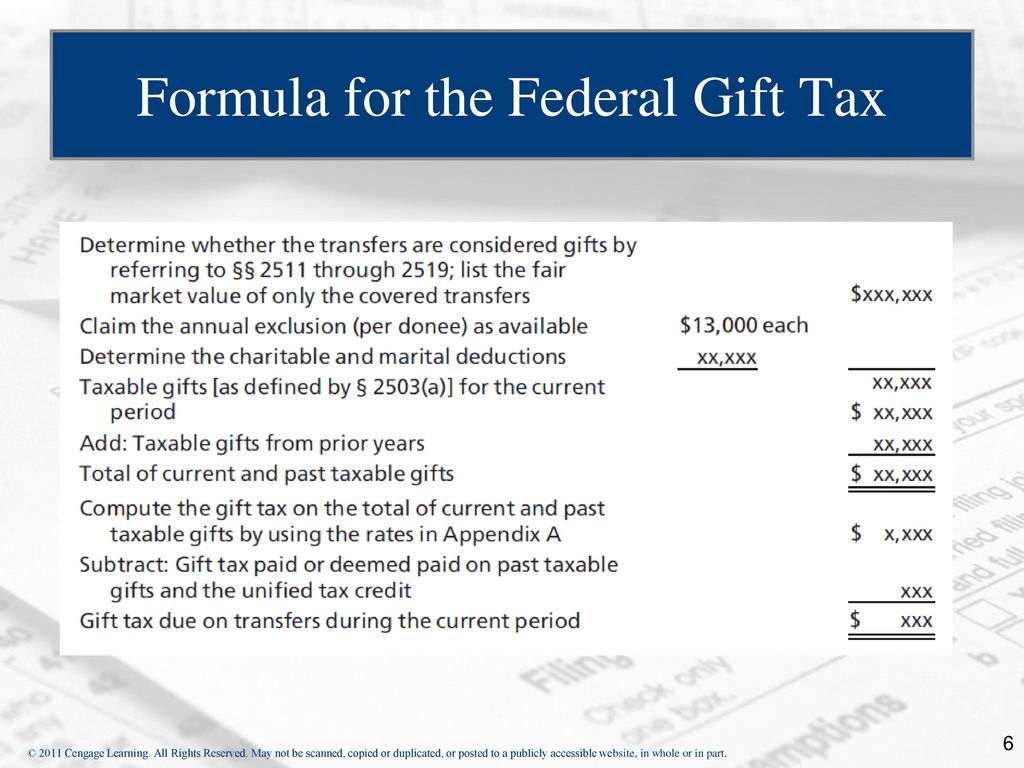

Notes on The Federal Gift and Estate Taxes | ACCT 431 | Apuntes Gestión Tributaria | Docsity – #95

Notes on The Federal Gift and Estate Taxes | ACCT 431 | Apuntes Gestión Tributaria | Docsity – #95

What Is Form 709? – #96

What Is Form 709? – #96

Foreign Gift Taxes: What You Need to Report – #97

Foreign Gift Taxes: What You Need to Report – #97

Gift Taxes Explained | Expat US Tax – #98

Gift Taxes Explained | Expat US Tax – #98

New Gift Tax Rule Will Apply For 2023 | Bring your Finances to LIFE – #99

New Gift Tax Rule Will Apply For 2023 | Bring your Finances to LIFE – #99

2023 Federal Estate and Gift Tax Numbers – The Estate Planner – #100

2023 Federal Estate and Gift Tax Numbers – The Estate Planner – #100

Gift Tax : How Does it Work? – #101

Gift Tax : How Does it Work? – #101

Everything You Wanted To Know About Estate & Gift Taxes | Postic & Bates, P.C. – #102

Everything You Wanted To Know About Estate & Gift Taxes | Postic & Bates, P.C. – #102

- gift tax meaning

- gift tax return

- gift from relative exempt from income tax

- gift tax example

- 2024 gift

- gift tax rate table

The Lifetime Gift Tax Exemption: Everything You Need to Know – #103

The Lifetime Gift Tax Exemption: Everything You Need to Know – #103

FAQ: Is Tuition Exempt From The Gift Tax? – Estate and Probate Legal Group – #104

FAQ: Is Tuition Exempt From The Gift Tax? – Estate and Probate Legal Group – #104

Recent developments in estate planning: Part 2 – #105

Recent developments in estate planning: Part 2 – #105

Estate Tax Planning | Illinois & Federal Estate Taxes | Orland Park Lawyer – #106

Estate Tax Planning | Illinois & Federal Estate Taxes | Orland Park Lawyer – #106

Taxation in the United States – Wikipedia – #107

Taxation in the United States – Wikipedia – #107

Proposed Impactful Tax Law Changes and What You Can Do Now – Johnson Pope Bokor Ruppel & Burns, LLP. – #108

Proposed Impactful Tax Law Changes and What You Can Do Now – Johnson Pope Bokor Ruppel & Burns, LLP. – #108

Tax & Wealth Advisor Alert–IRS Announces Changes to Estate and Gift Tax Exemptions for 2024 – O’Neil, Cannon, Hollman, DeJong & Laing S.C. – #109

Tax & Wealth Advisor Alert–IRS Announces Changes to Estate and Gift Tax Exemptions for 2024 – O’Neil, Cannon, Hollman, DeJong & Laing S.C. – #109

Gift Tax Limit 2024 | Calculation, Filing, and How to Avoid Gift Tax – #110

Gift Tax Limit 2024 | Calculation, Filing, and How to Avoid Gift Tax – #110

Gift Tax: 3 Easy Ways to Avoid Paying the Gift Tax | TaxAct – #111

Gift Tax: 3 Easy Ways to Avoid Paying the Gift Tax | TaxAct – #111

Gift Tax Limit: How to Gift More Than $16,000 in a Year | Divergent Planning – #112

Gift Tax Limit: How to Gift More Than $16,000 in a Year | Divergent Planning – #112

Posts: annual federal gift tax exclusion

Categories: Gifts

Author: toyotabienhoa.edu.vn